Financial Seminar PostEvent Report

Saturday, April 27th 2024

Prepared for April 2024 Sponsors September 2024

Potential Sponsors

Arranged by Nikita Gibson Moné Renata Holder Castalia Consulting Team

Introduction

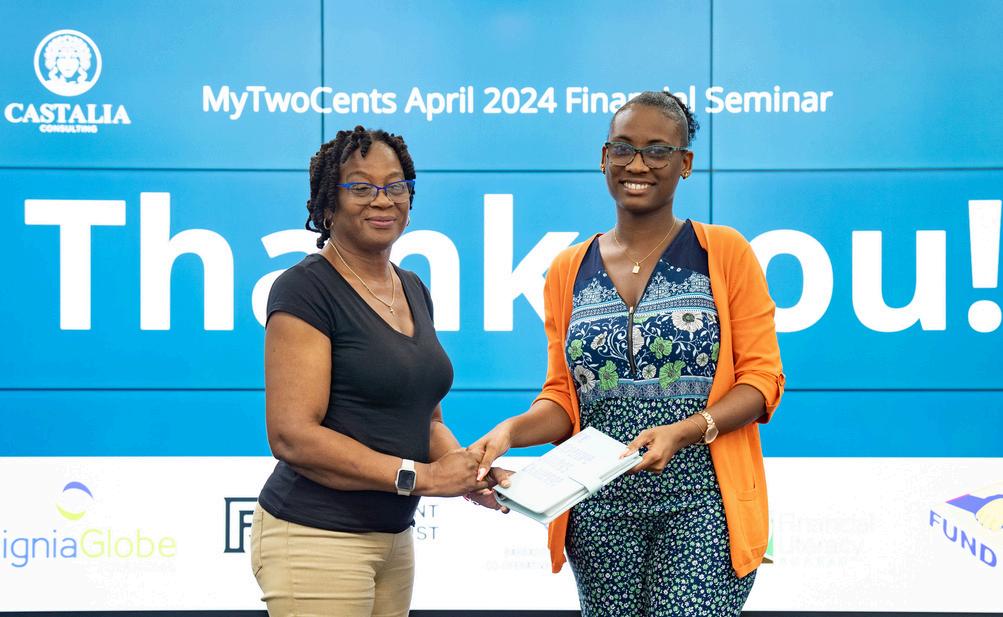

We are pleased to share insights from the MyTwoCents Financial Seminar & Workshop held on April 27th, 2024, at the Sagicor Cavehill School of Business. The event engaged around 100 of the 127 registered participants, filled with enriching content from 9 AM to 5 PM, followed by a productive networking cocktail hour.

This report provides a detailed overview of the seminar, including attendee testimonials, a summary of sessions, our reach through social media, radio segments, and advertising efforts. It also discusses our methods for measuring success and outlines plans for our next seminar scheduled for September 21st, 2024.

Thank you for your ongoing support in fostering financial education in Barbados We look forward to deepening our partnership as we continue to empower individuals financially.

37.k 92 22 Followers +15% 8-month Content Reach per boosted posts Share Save

3,011

288 All Post Average

How did we measure success?

Success for our seminar was quantified through a combination of direct and indirect feedback and actions taken by participants:

Personal Engagement: Over 20 attendees have scheduled one-on-one financial planning sessions with Nikita in June 2024, aiming to integrate our showcased products into their comprehensive financial strategies.

Feedback: We received outstanding feedback from participants, with select insights highlighted on page 6 of this report

Media Reach: Our initiatives were supported by radio segments on SLAM 101.1FM, broadening our impact.

Proactive Steps by Attendees: Several attendees began implementing their financial plans using products discussed in our case studies Examples include utilizing SigniaGlobe Financial as a broker for accessing RF Bank & Trust Mutual Funds and adopting the Barbados Public Workers’ Co-operative Credit Union Premiere Plan

Comprehensive Coverage and Immediate Action: The seminar's extensive curriculum covered Budgeting, Saving, Investing, Risk Management, Insurance, Debt Management, Credit Management, Retirement Planning, and Estate Planning We facilitated immediate sign-ups and information requests for insurance and credit union memberships, focusing on the products demonstrated during the seminar.

These metrics not only reflect the seminar's immediate impact but also its ongoing contribution to the financial empowerment of our attendees

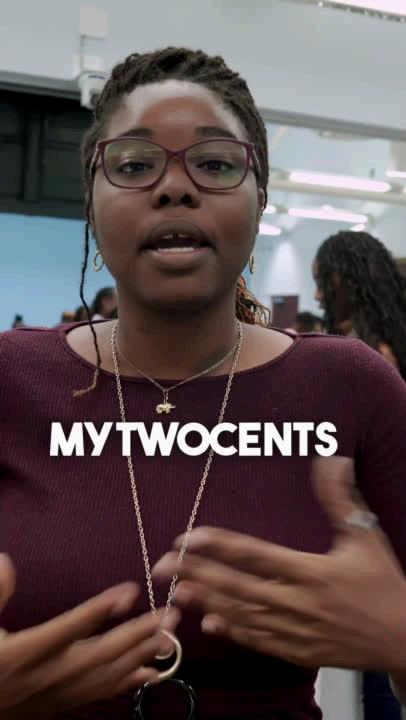

Participant

Listen to what our participants had to say about their experience

Participant Reviews

“It was a awesome event I was very insightful and I learned a lot The material shared was relevant and easy to understand Well done!” - Accountant

“I found Saturday's session very enlightening, although having an understanding of financial management, I definitely learned a lot more regarding investing and retirement planning. The session also demonstrated, especially through the example, how much and what we could achieve with the right guidance ” - Business Development Officer

“I felt like I was given tools and information to make my life and future better ” - Statistician

“Great! A wealth of information to help revamp my finances.”- Medical Doctor

“The event was very informative, fun and interactive. I learned so much and will definitely put a lot of this into practice and share the information so that I can help improve the quality of life of myself, my family, friends and others around me.” - Electrical Technician

April 2024 Event

What's next

Our next event is scheduled for Saturday, September 21st, 2024, running from 9:00 AM to 6:00 PM.

As we continue to evolve and enhance our seminars, the next event will feature several exciting enhancements tailored to enrich our attendees' experience:

Our Plans

Guest Speakers: We will invite renowned guest speakers to provide expert insights and add more depth to our discussions.

Sponsor-Specific Presentations: Our sponsors will have dedicated segments to present their products. More importantly, they will demonstrate the real-world applications of these products, showcasing how they can specifically help attendees achieve their financial goals.

Enhanced Application Sessions: We will expand our application sessions to give attendees more opportunities to practice and apply what they've learned. These sessions will not only involve practical case studies but will also assist attendees in integrating the knowledge into their own financial plans.

Follow-Up Resources: Provide attendees with follow-up resources or access to a digital platform for continued learning and support after the event.

These initiatives are designed to provide more interactive and personalized learning experiences, helping our participants make informed financial decisions based on their personal or family goals.

Sponsorship Opportunities and Levels

Platinum - BBD $6,000 Gold - BBD $4,000 Silver - BBD $2,500 Bronze - BBD $1,500