Q2MarketReport &AreaResults

Dear Friends and Neighbors,

Whether you ’ re exploring your next move or simply keeping an eye on the market, we ’ re glad you ’ re here! At ERA Live Moore, we know that real estate decisions are some of the most important ones you'll make and they’re best made with the right information and a trusted advisor by your side.

This quarterly report is designed to give you just that: a clear, data-driven look at market activity across North Carolina, backed by the perspective of experienced professionals who live and work in the communities we serve.

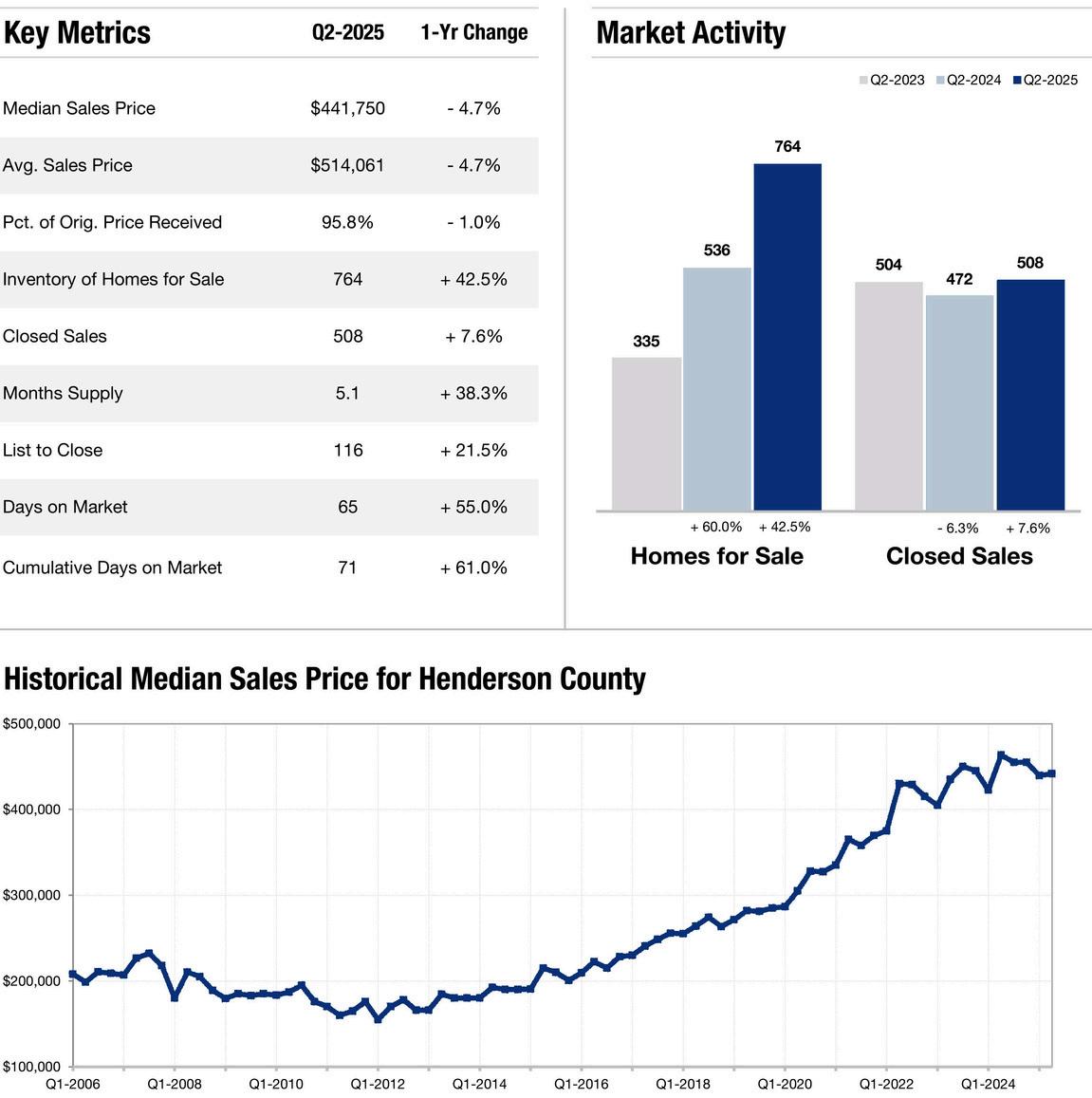

From the energy and growth of Charlotte to the innovation-driven demand in Raleigh and the Triangle, to the steady value of the Triad region, Q2 2025 brought a clearer picture of a market that continues to normalize. Increased inventory across nearly every region has opened the door for buyers who were previously sidelined, while sellers are still seeing success particularly when listings are positioned strategically and priced with precision.

Across the board, we ’ re seeing a return to fundamentals. Homes are taking longer to sell, and pricing has leveled out in many areas after years of rapid growth. Buyers are approaching the market with more options and greater discernment, while sellers are adjusting to meet the moment with better preparation and smarter strategies. It’s a healthier pace and one where experience, local knowledge, and guidance make a real difference.

This report brings you not just numbers, but the story behind them. We’ve analyzed the data across our major markets from Mecklenburg County to Wake County, from Winston-Salem to Durham to give you a comprehensive understanding of what’s shifting, where opportunities lie, and how to move forward with clarity and purpose

At ERA Live Moore, our reach spans across the state but our service is always personal Whether you're buying your first home in the Triad, moving across town in Charlotte, investing in a property near Raleigh, or preparing to sell your longtime home, we are proud to offer the insight, tools, and support you need to make the most of today’s market

Thank you for the opportunity to guide you. We’re honored to serve clients at every stage of life and we look forward to helping you navigate your real estate goals with confidence and care.

Warmest regards,

Brookelynn Cardenas Vice President, Relocation & Business Development ERA Live Moore

“ It’s a healthier pace and one where experience, local knowledge, and guidance make a real difference ”

Charlotte’s U S National Whitewater Center

CHARLOTTE AREA

Q22025CharlotteMarketSnapshot

KeyTakeawaysforBuyers&Sellers

TheCharlotteregioncontinueditsshifttowardamorebalancedmarketthisquarter. Here'swhatyouneedtoknow:

MarketTrends

Homepricesroseacrossthemetroarea,withYorkandLancasterCountiesseeingthe largestgains.

ClosedsalesheldsteadyacrosstheCharlottearea,showingthatdemandisstillpresent— especiallywithwell-positioned,well-prepared,appropriatelypricedhomescontinuingto attractstronginterest.

Inventorysurged,givingbuyersmoreoptionsandsofteningcompetition.

What It Means for Buyers

More listings = more choice and negotiating power.

Outlying counties like Cabarrus, Union, York, and Lancaster offer strong value and lifestyle appeal.

Bottom Line:

What It Means for Sellers

Pricing matters more than ever! Buyers are selective and market-savvy.

Homes that are thoughtfully priced and well-presented continue to perform well.

Charlotte remains a high-opportunity market, but strategy is key. Whether you’re entering or exiting the market, success comes from smart preparation, accurate pricing, and expert local guidance Let us help you make the most of what’s next!

CHARLOTTE REGION

RESIDENTIAL SALES SUMMARY

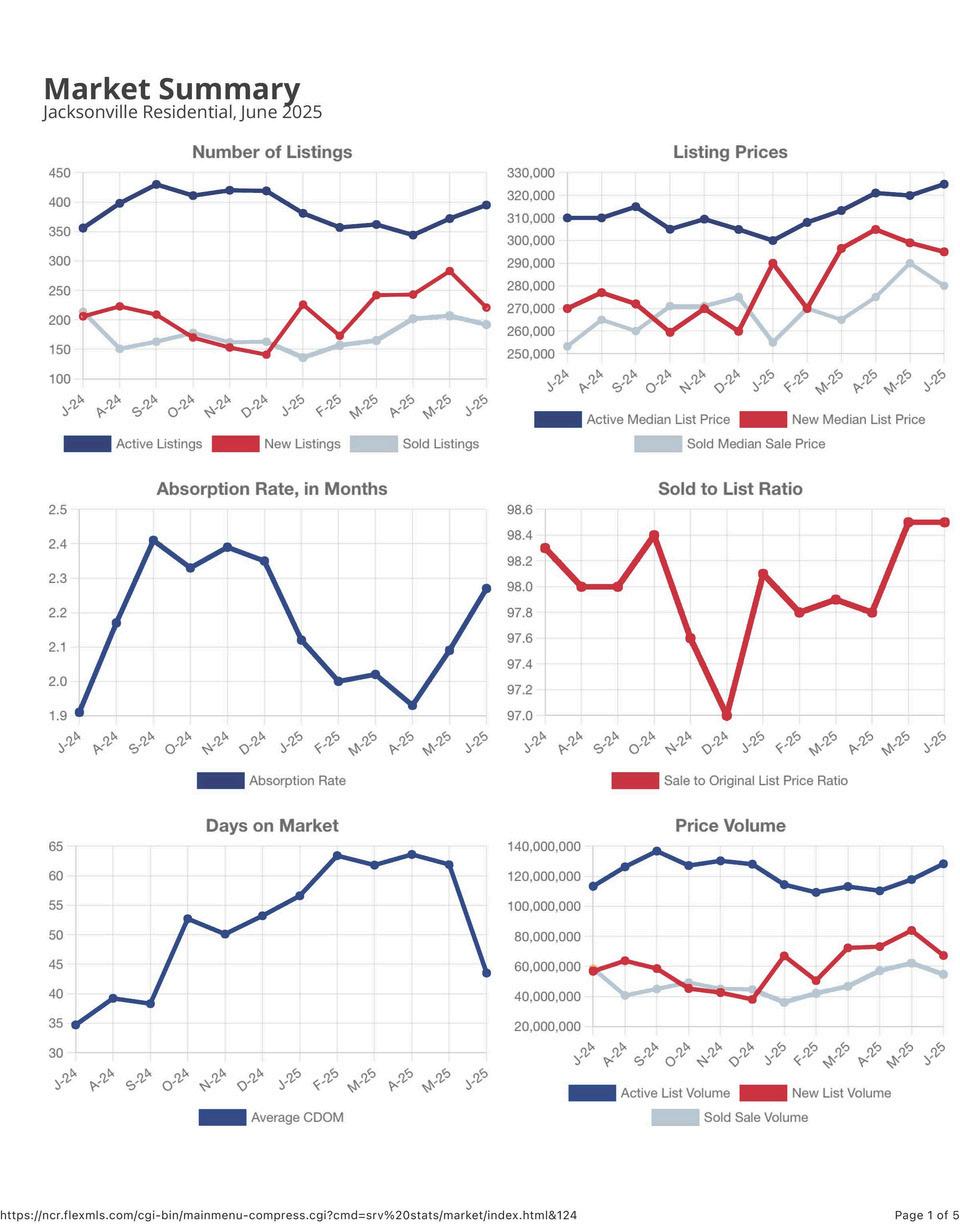

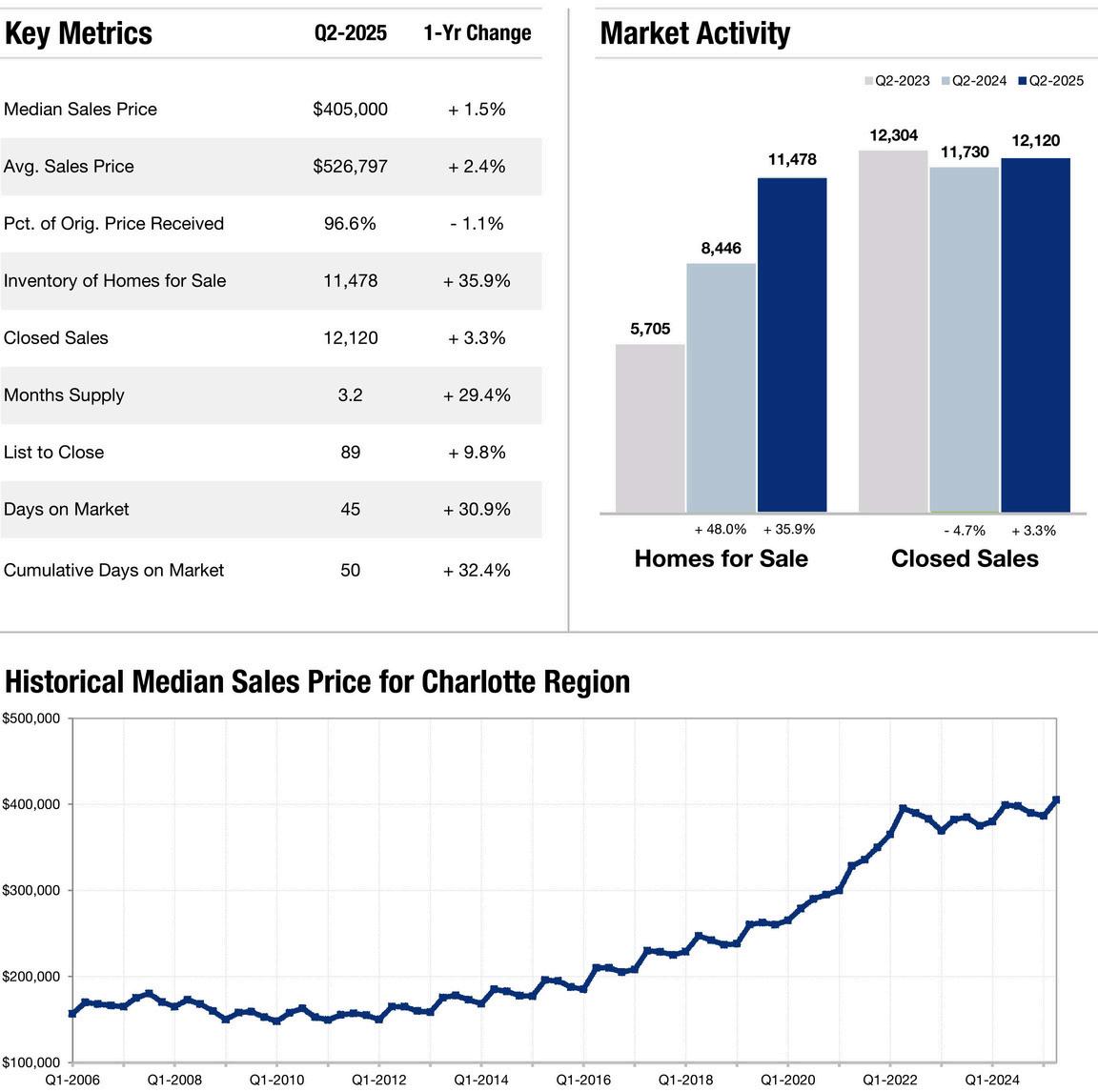

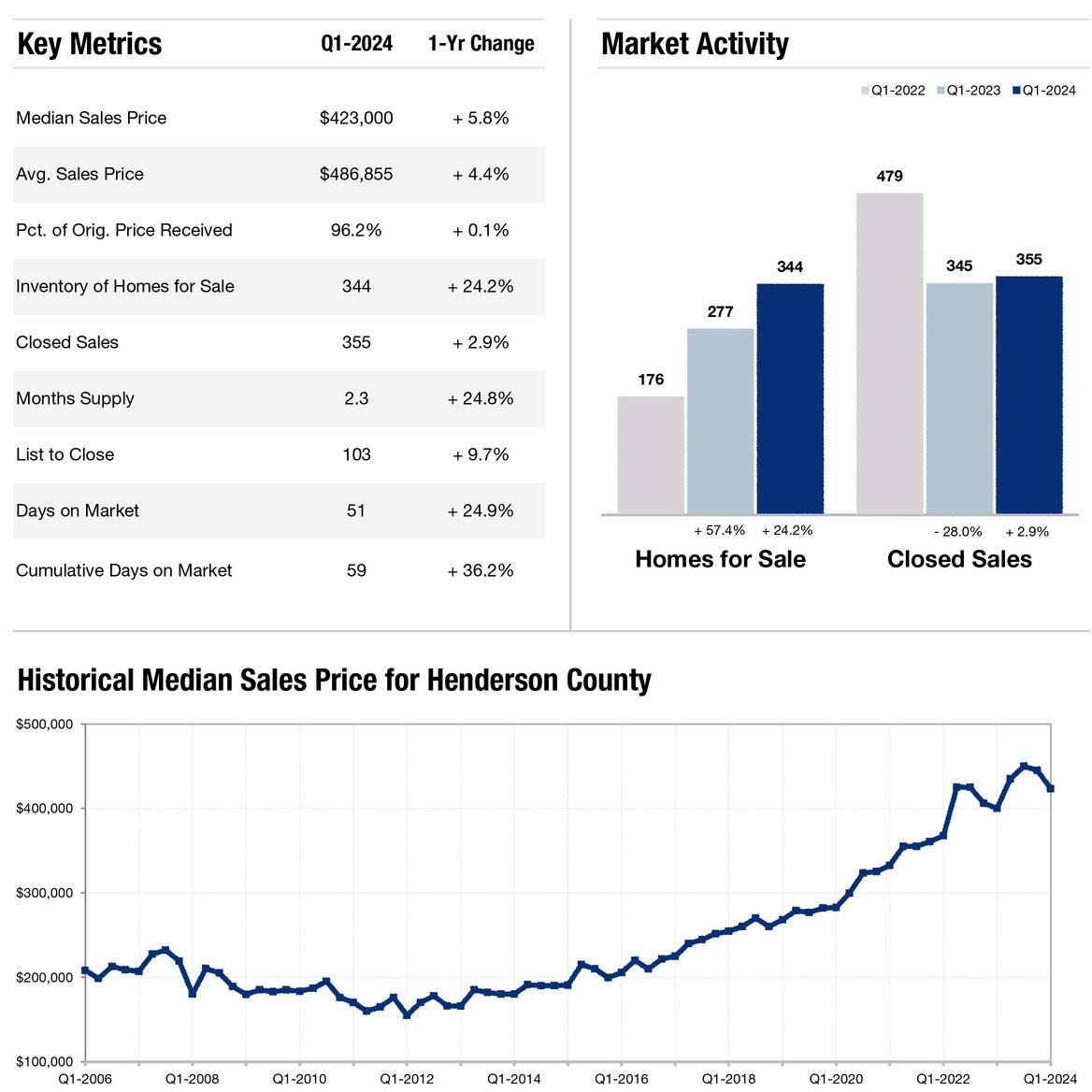

Median and Average Sales Price saw a modest increase, along with surge in Inventory, while Closed Sales hovered just over 3% higher than the previous Q2 in 2024 This activity defined much of the Charlotte Region and continues to establish a baseline for our other markets

The Median Sales Price in Q2 2025 for a single family home in Charlotte was $405,000 for a year over year increase of 1.5%

As of July 2025 the Average Month's Rent in Charlotte for a 2 bedroom was $1,700

Charlotte Occupied Housing Units 53% of homes are owner-occupied households and 47% are renter-occupied households

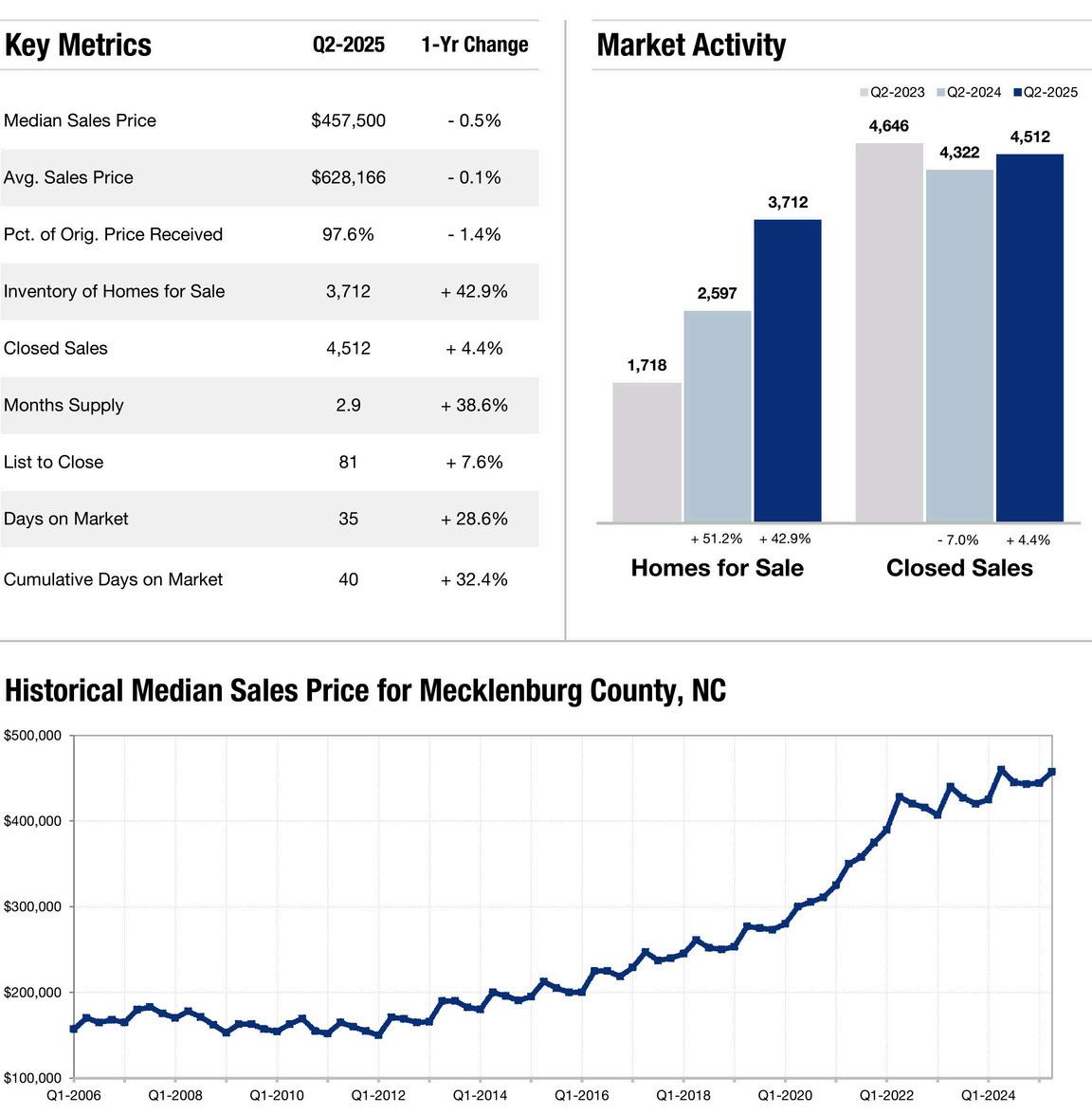

The Median Sales Price in Q2 2025 for a single family home in Mecklenburg County was $457,50000 for a year over year decrease of -0.5%

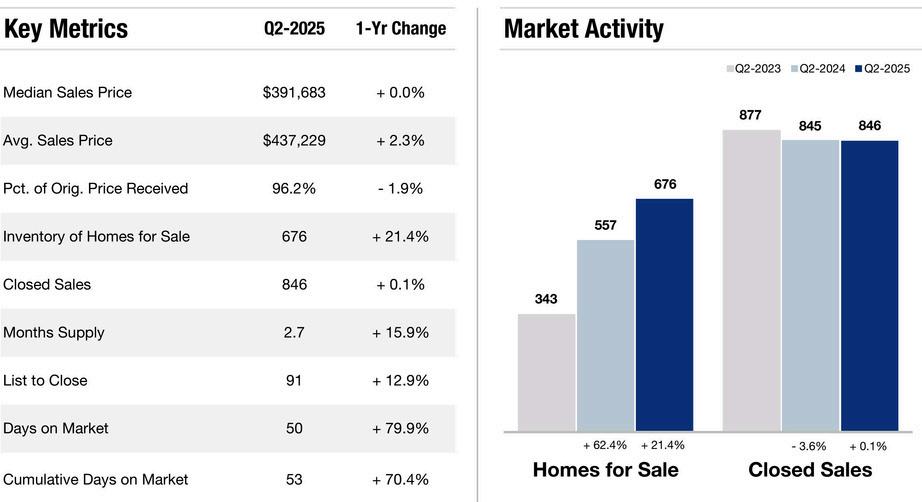

MECKLENBURG CO.

RESIDENTIAL SALES SUMMARY

Charlotte's home county saw relatively stable Median and Average Sales Price year-on-year, with a huge surge in inventory and slight increase in Closed Sales, almost level with Charlotte The county, once a respite for buyers seeking affordability, maintains a considerably higher Average Sales Price than the Charlotte Region

CHARLOTTE-AREA COUNTIES

RESIDENTIAL SALES SUMMARY

Cabarrus County is one of Charlotte's largest neighboring counties and home to the county seat of Concord and the pretty towns of Mt. Pleasant, Midland, & Kannapolis. Union County features the charming and in-demand town of Waxhaw–growing in both popularity and Increasing in Average Sales Price

Cabarrus Co.

Union Co.

CHARLOTTE-AREA COUNTIES,

RESIDENTIAL SALES SUMMARY

The major metro area surrounding Charlotte includes seven different counties, each with its distinctive towns, cities, and townships. Charlotte’s surrounding counties provide greater inventory at various price points with something for everyone- from charming rural communities to vibrant market towns and commercial areas.

York Co.

Lancaster Co.

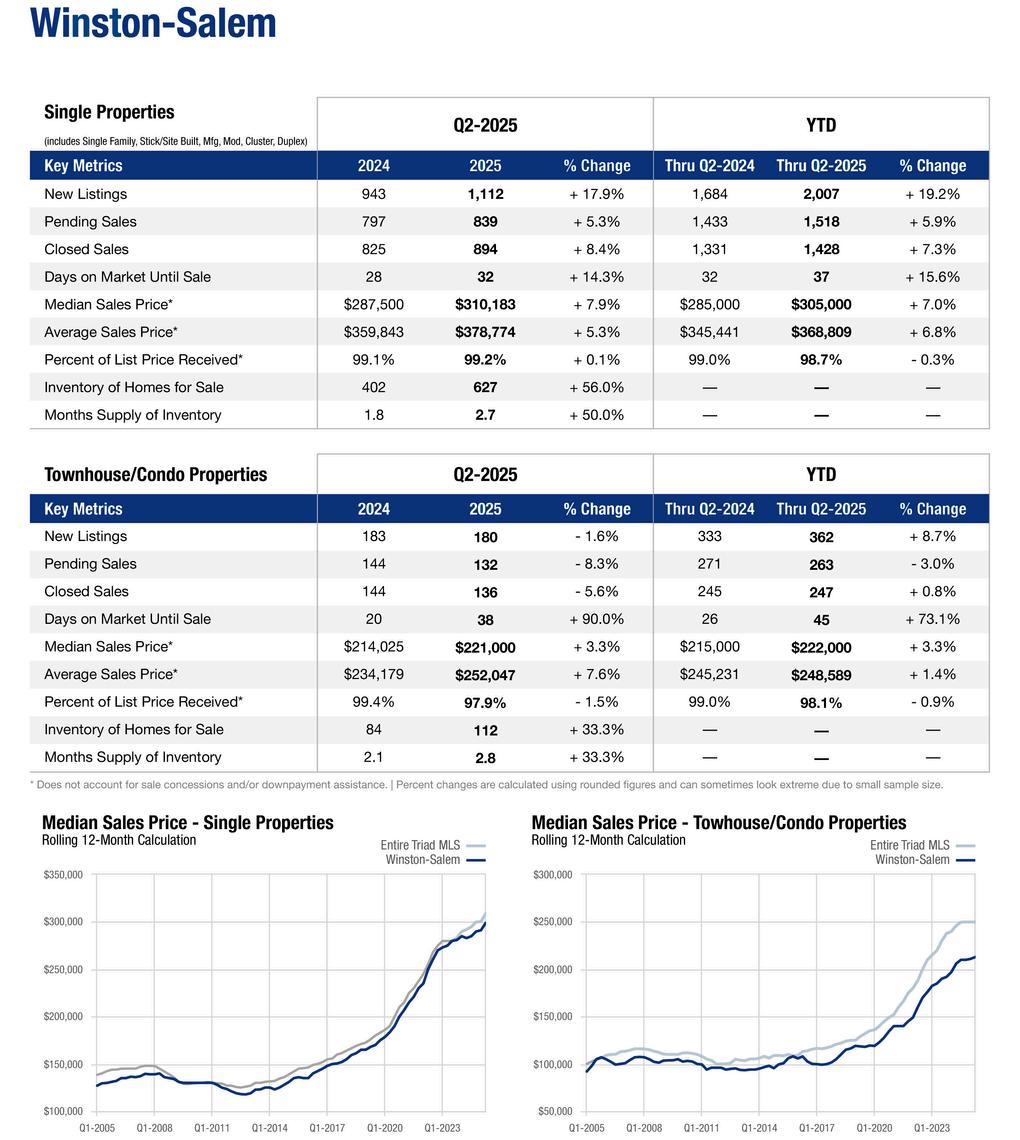

THE TRIAD | WINSTON SALEM

RESIDENTIAL SALES SUMMARY

In Q2 of 2025, the Median Sales Price in Winston-Salem, NC was $310,183, trending up year-over-year by almost 8%. This laid-back city experiencing continued growth is located in Forsyth County in the north-central part of North Carolina. The metro area lies along the Carolina Core in the heart of North Carolina, a 120+ mile stretch running between Winston-Salem, Fayetteville, Greensboro, & High Point. In 2025, the Triad's continued big draw? You guessed it––affordability!

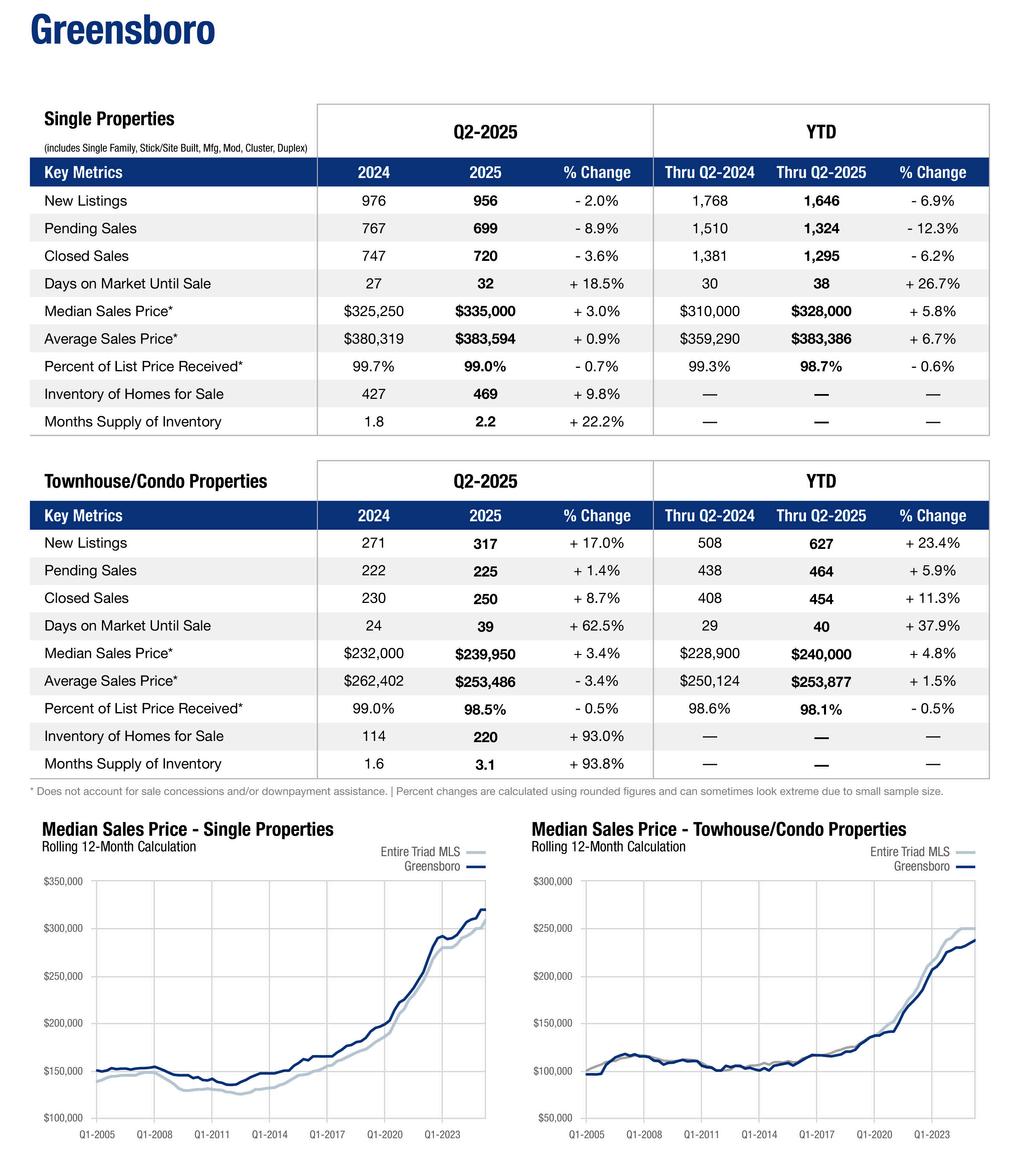

THE TRIAD | GREENSBORO

RESIDENTIAL SALES SUMMARY

U.S. News and World Reports ranked Greensboro #23 in the nation for Best Places to Live in the U.S. 2024-25, and one of Livability’s 2025 Top 100 Best Places to Live. Part of the Piedmont Triad, with a low cost of living and a Q2 2025 Median Sales Price of $335,000, it's one of North Carolina's more affordable metro areas. While Inventory in Greensboro has been on the rise, Days on Market continues to extend, rising 18.5% to 32.

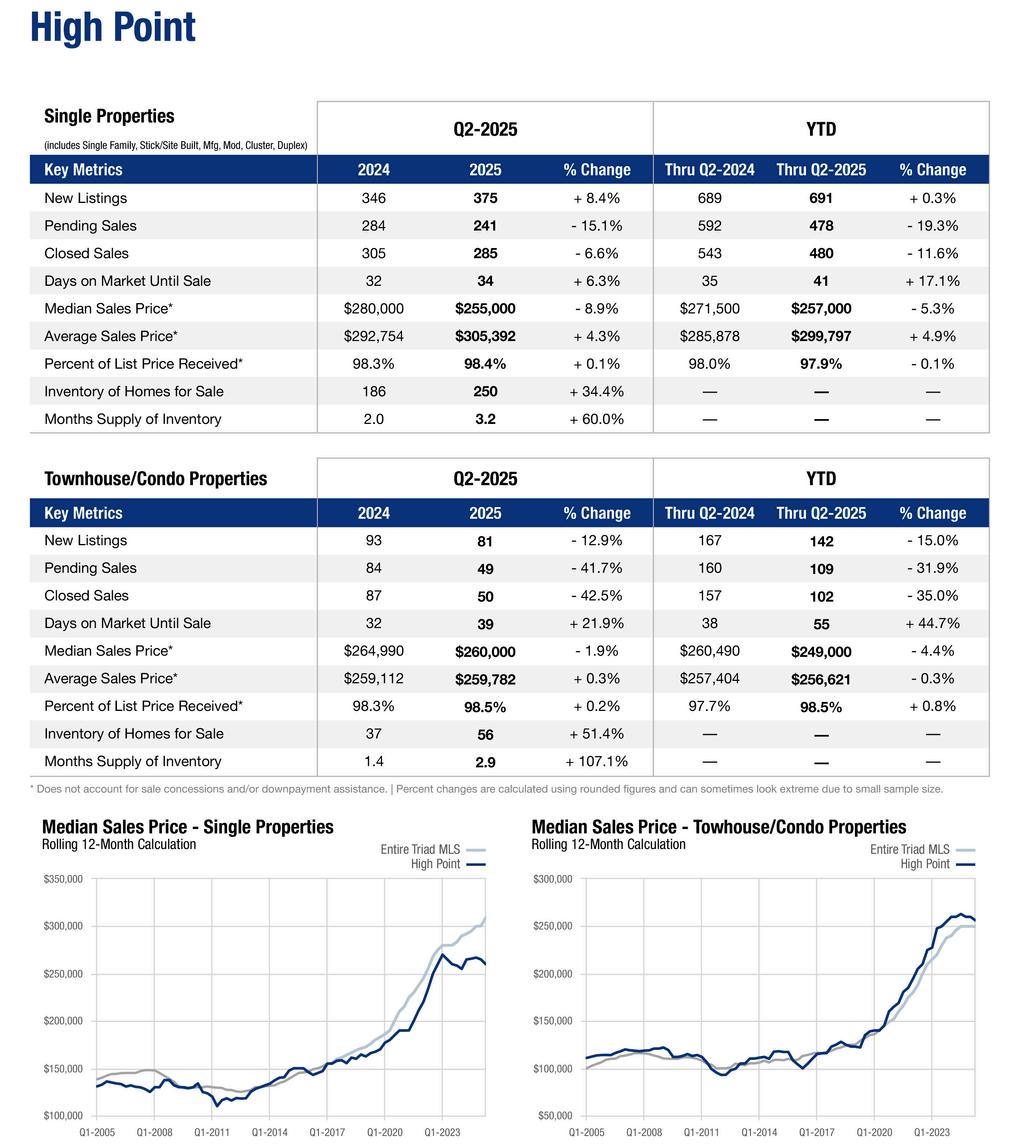

THE TRIAD | HIGH POINT

RESIDENTIAL SALES SUMMARY

High Point is located alongside Greensboro and Winston-Salem in the Piedmont Triad region of North Carolina, the nation’s 33rd largest metro area with a population exceeding 1 7 million Home of High Point University and the famous annual High Point Market, the world's largest home furnishings trade show High Point offers outstanding value for homebuyers, while sellers can expect to receive 98 4% of List Price

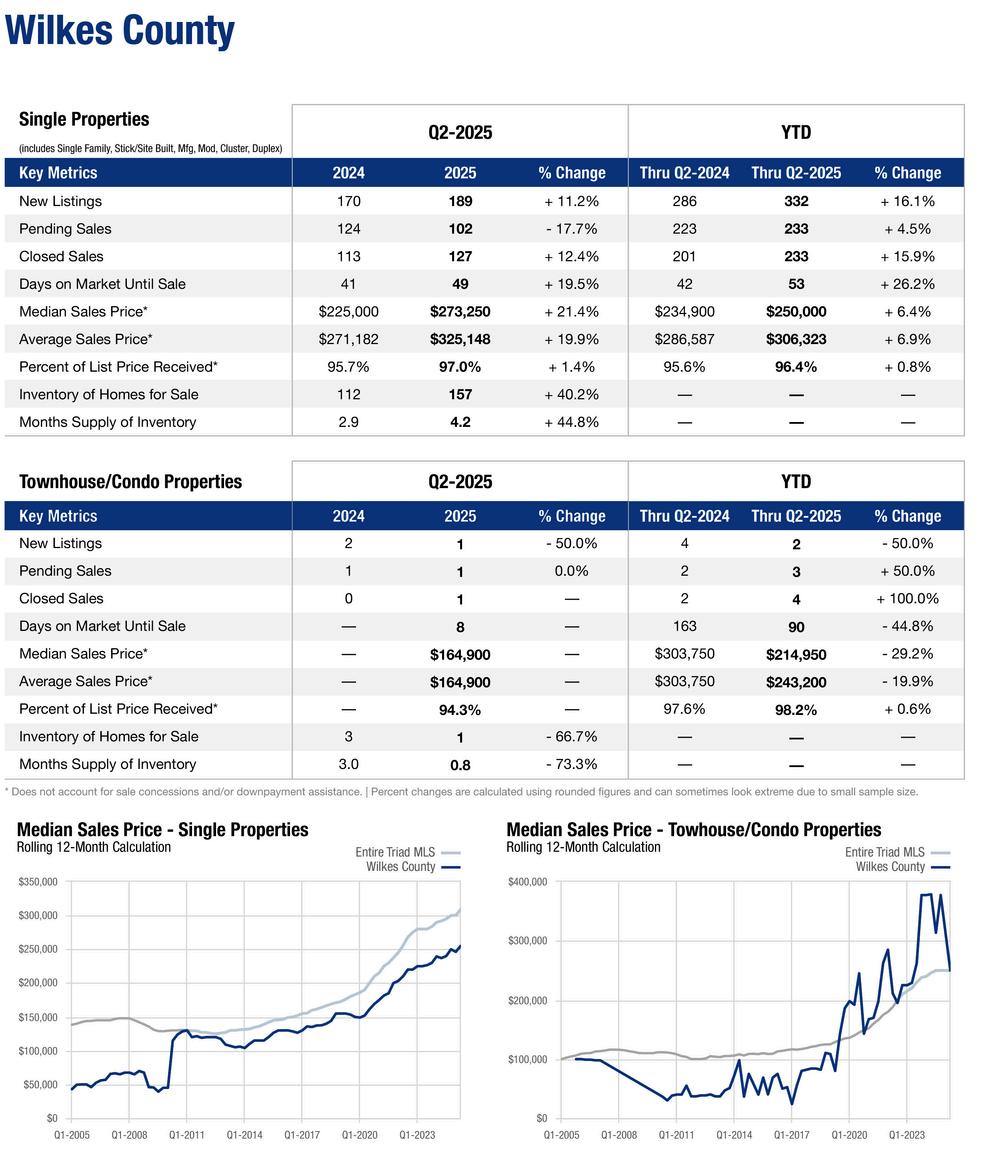

THE TRIAD | WILKES COUNTY

RESIDENTIAL SALES SUMMARY

Wilkes County is widely known for its county seat, Wilkesboro, and its largest town, North Wilkesboro The area is widely known for MerleFest, an annual "traditional plus" music festival held in Wilkesboro each spring. Wilkesboro homebuyers enjoy a relatively low sales price compared to larger metro areas in North Carolina and an increase in the availability of homes on the market for buyers seeking value and proximity to Winston Salem

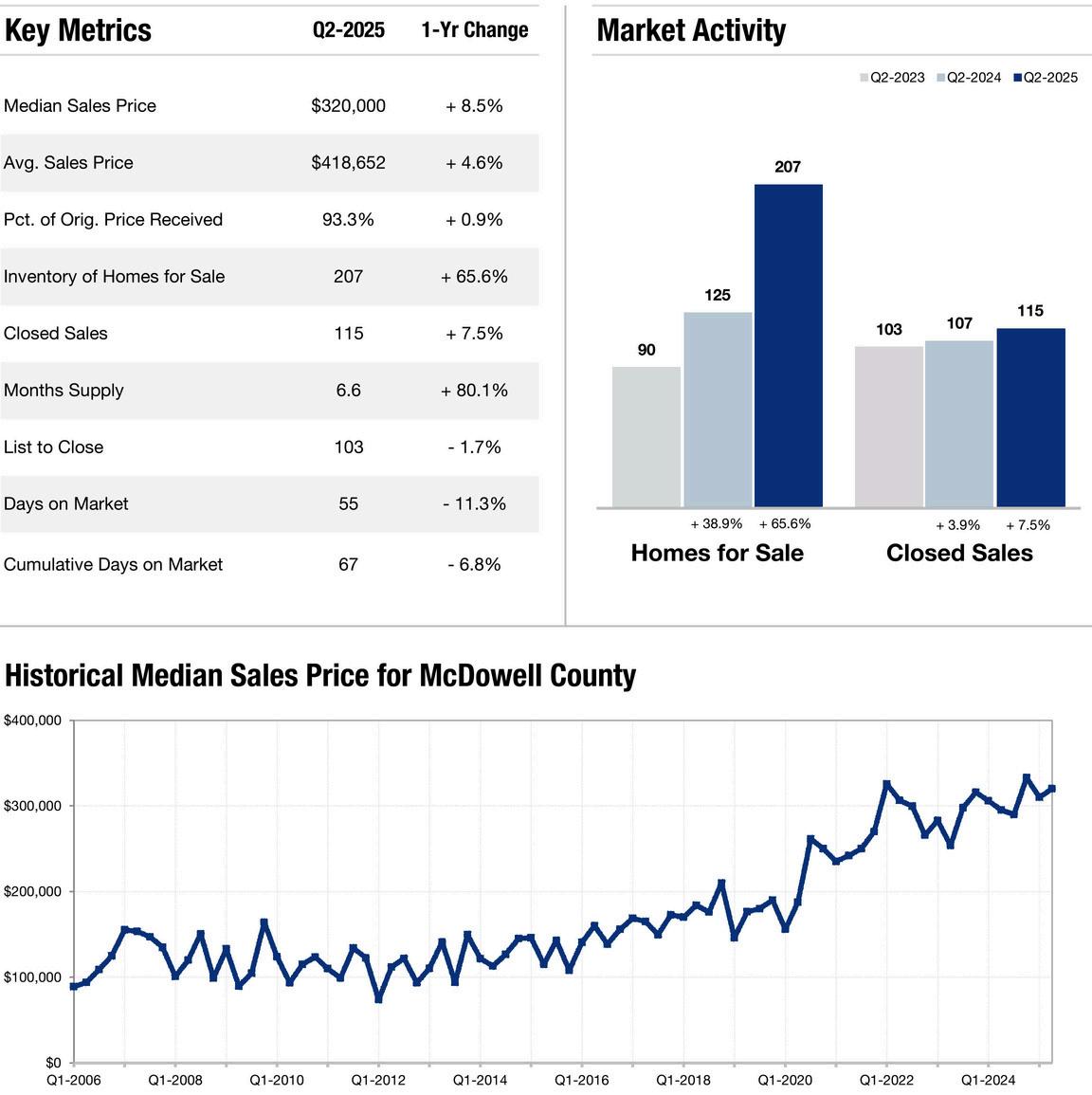

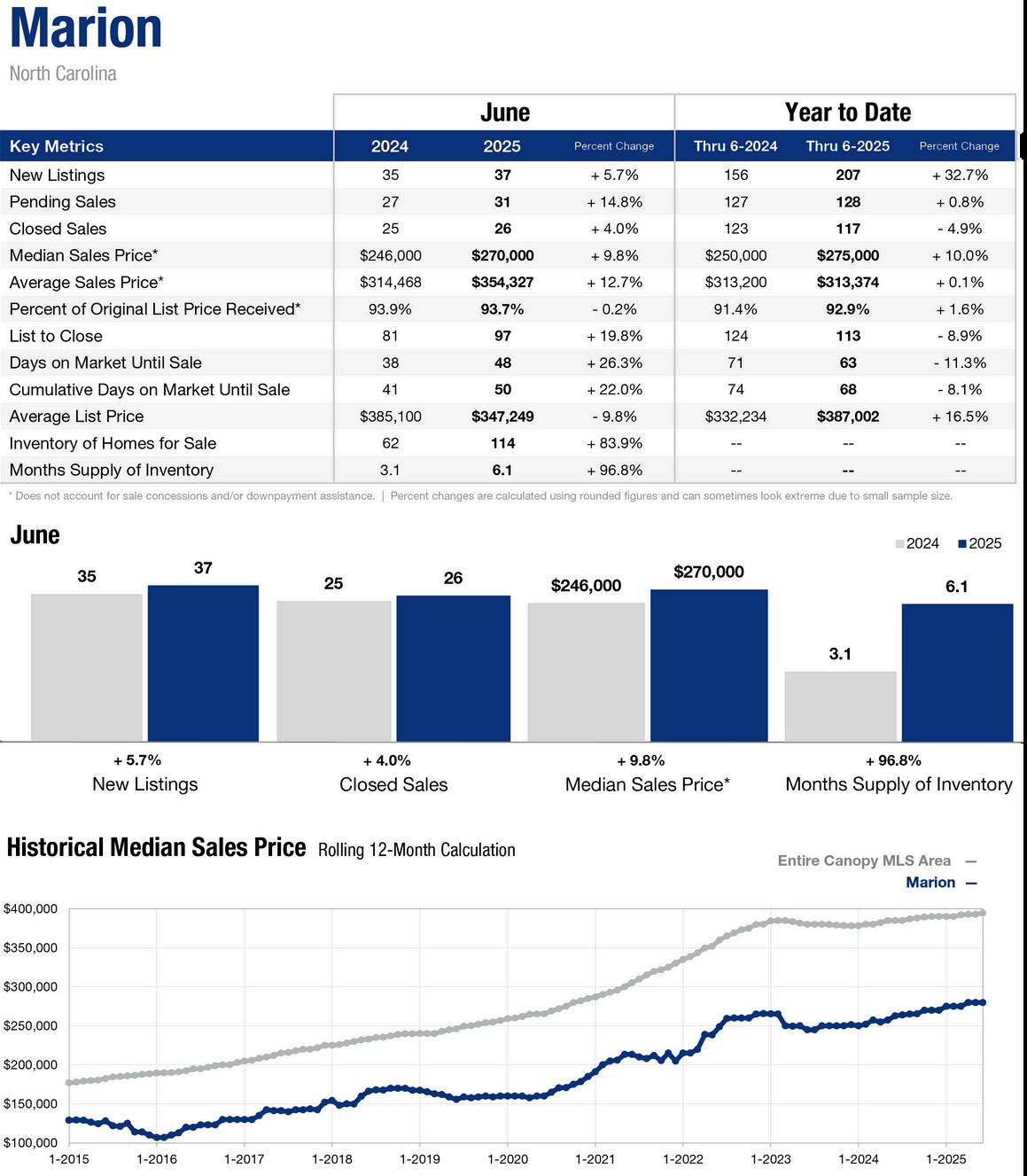

McDowell County RESIDENTIAL

SALES SUMMARY

In Q2 2025, McDowell County continues to showcase its natural beauty and outdoor attractions. Quaint shops line the streets from the market town of Marion to the charming country town of Old Fort. The region is continuing recovery efforts following the impact of Hurricane Helene. Despite these challenges, McDowell and neighboring Burke Counties remain among the most affordable housing markets in the state, second only to Wilkes County, offering opportunities for both residents and investors as recovery progresses

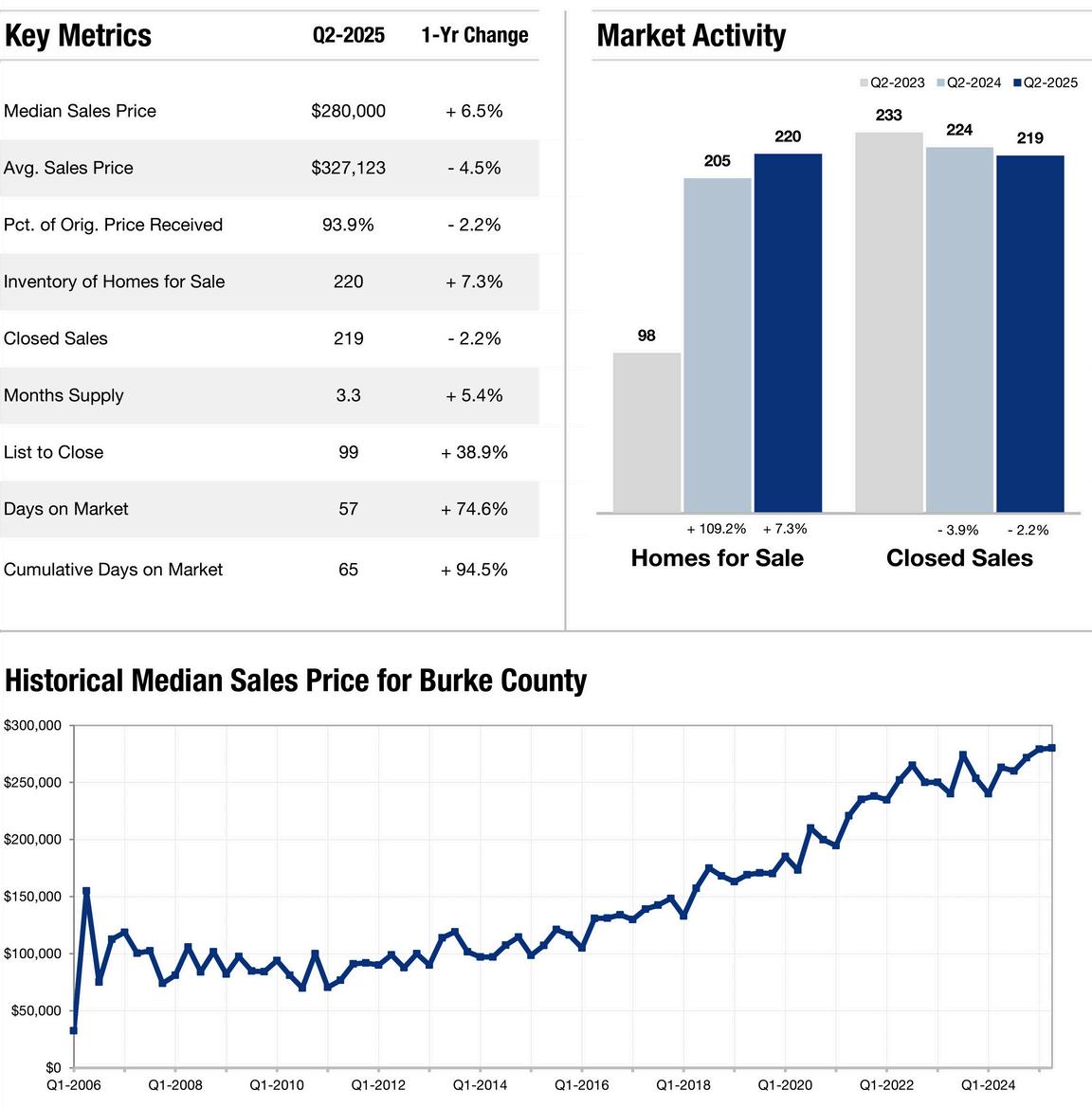

Burke County

Burke County, nestled in the foothills of North Carolina's Blue Ridge Mountains, continues to draw visitors with its scenic attractions, including Linville Gorge, the Fonta Flora State Trail, and portions of the Pisgah National Forest. The attractive market town of Morganton offers a blend of laid-back living and small-town charm. The county is navigating the recovery process in the aftermath of Hurricane Helene, which disrupted local life and tourism. Burke County's housing market continues to attract families and professionals, providing stability and a sense of community in this picturesque region

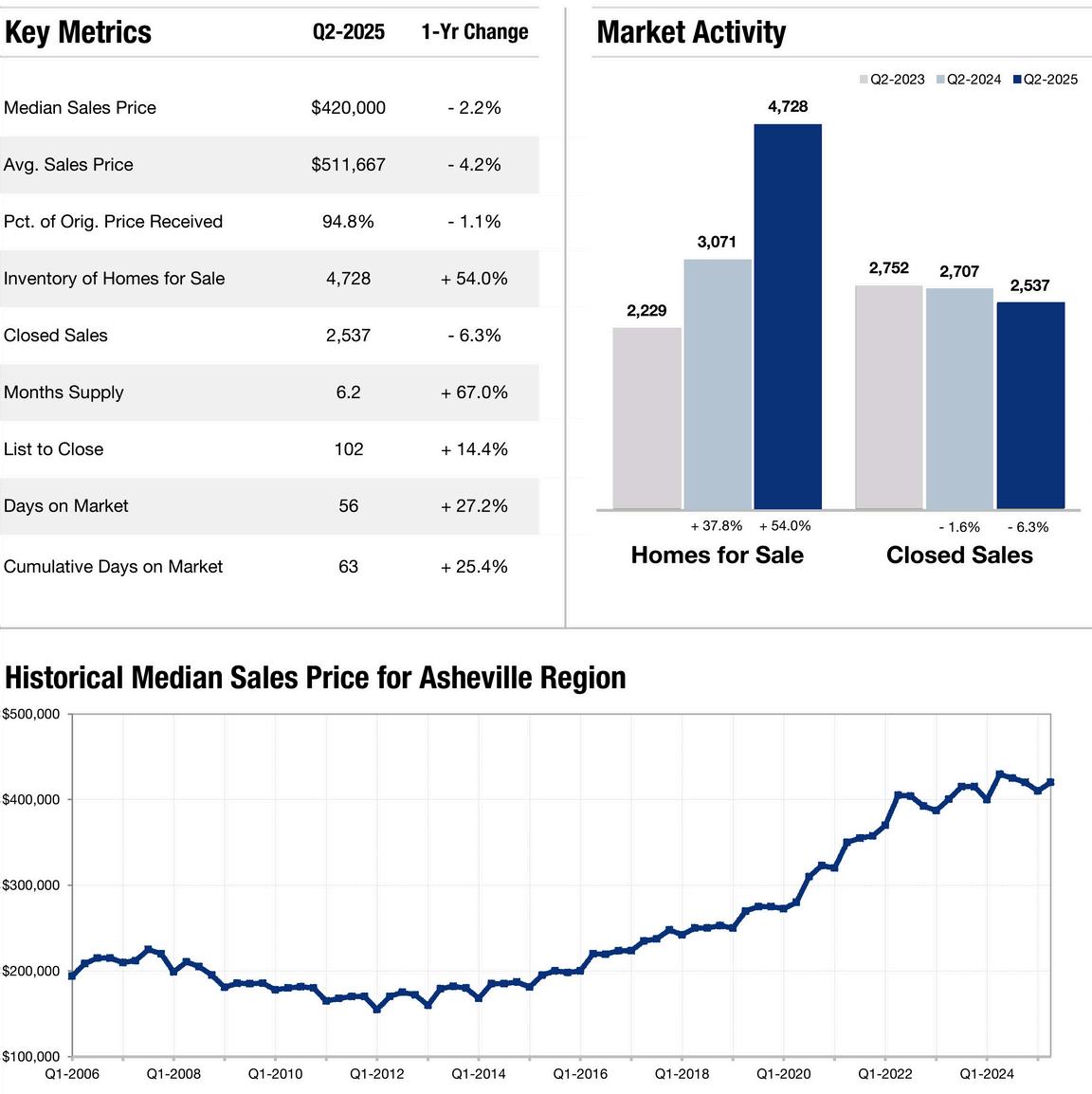

ASHEVILLE RESIDENTIAL SALES SUMMARY

Asheville’s Average and Median Sales Price increases are starting to show more variance, while Month's Supply surged ahead with a considerable 67% increase on 2024's Q2 figures. Closed Sales dropped once again–this quarter, by -6.3%. Expect prices to continue stabilizing through a recoveryfocused 2025

Asheville (Region)

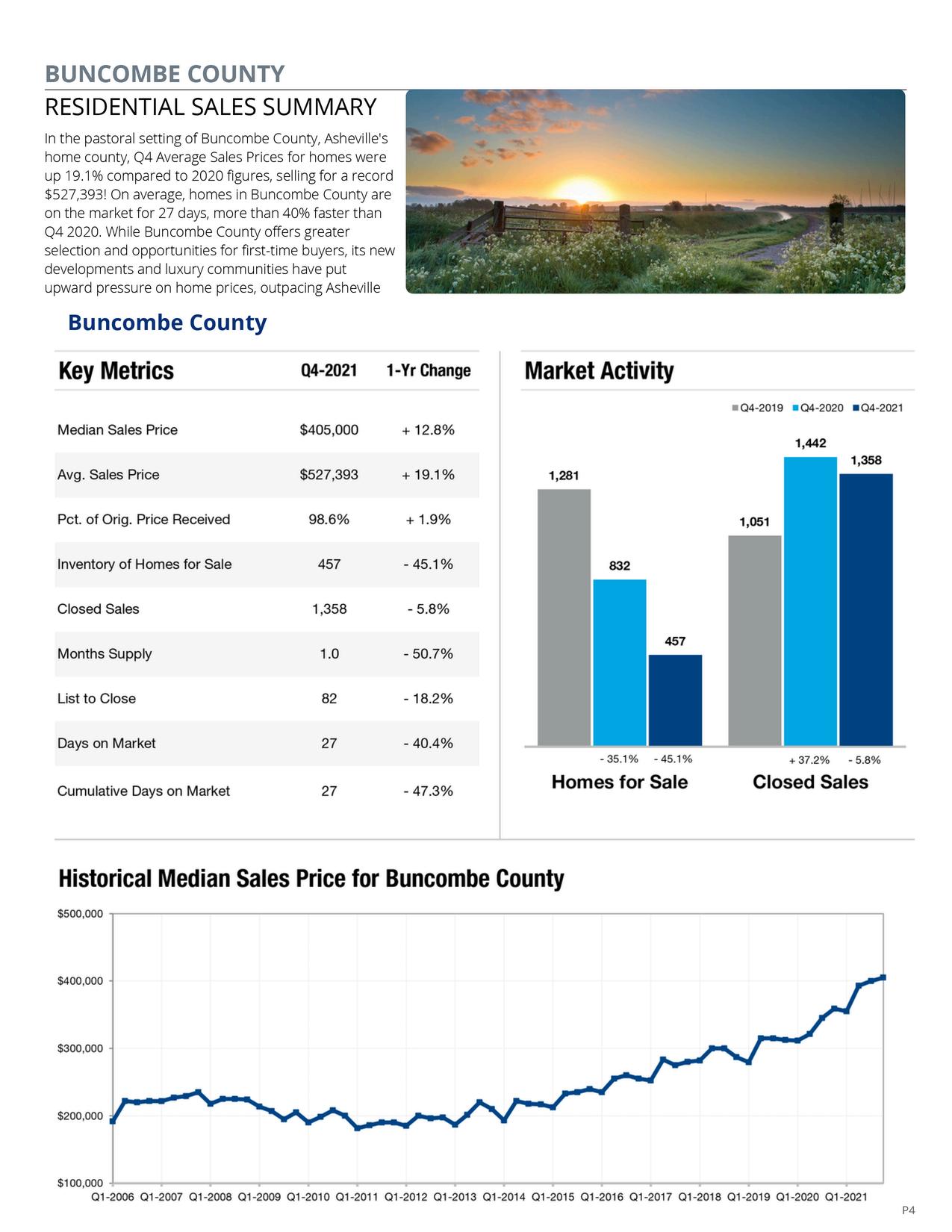

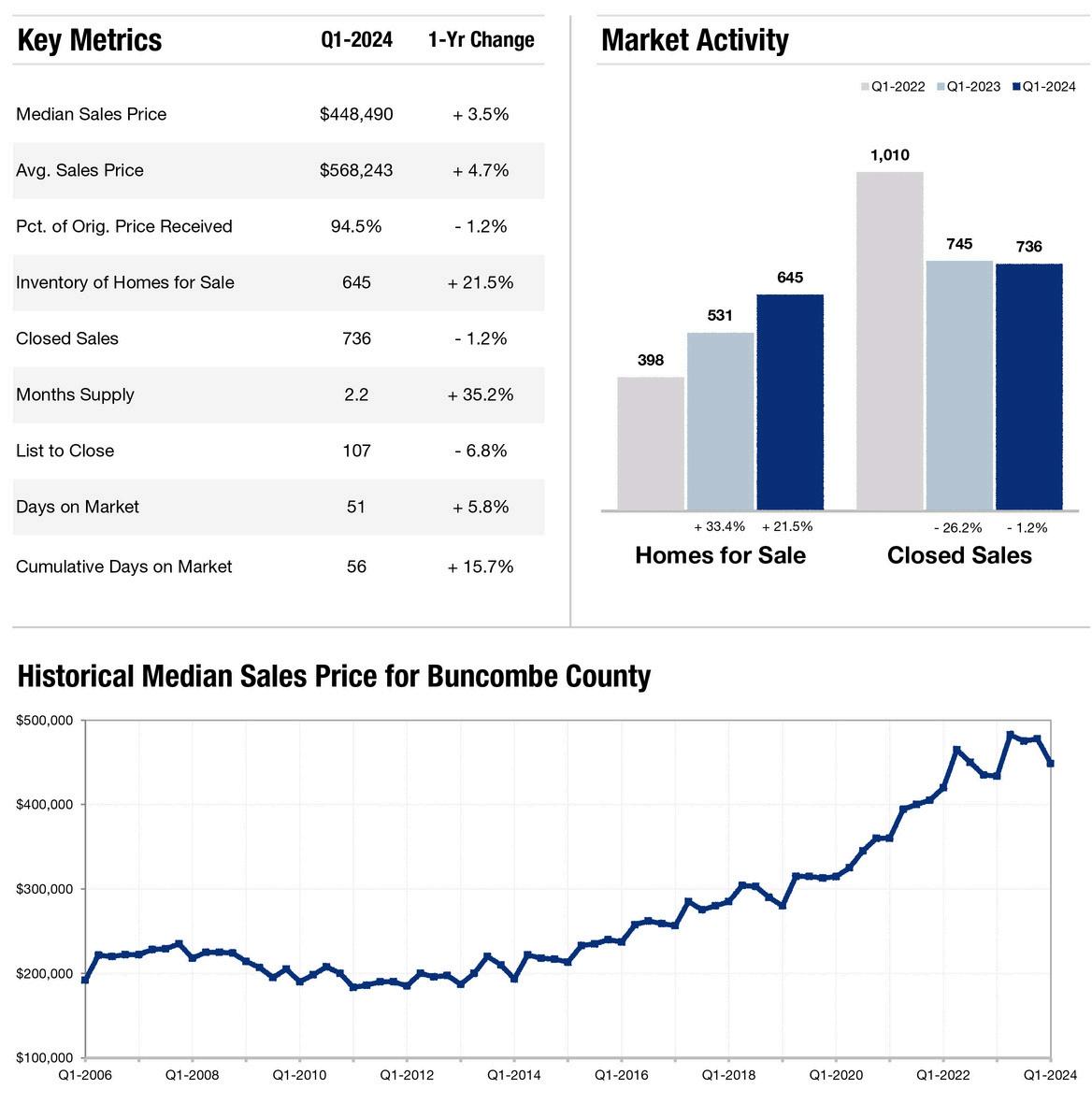

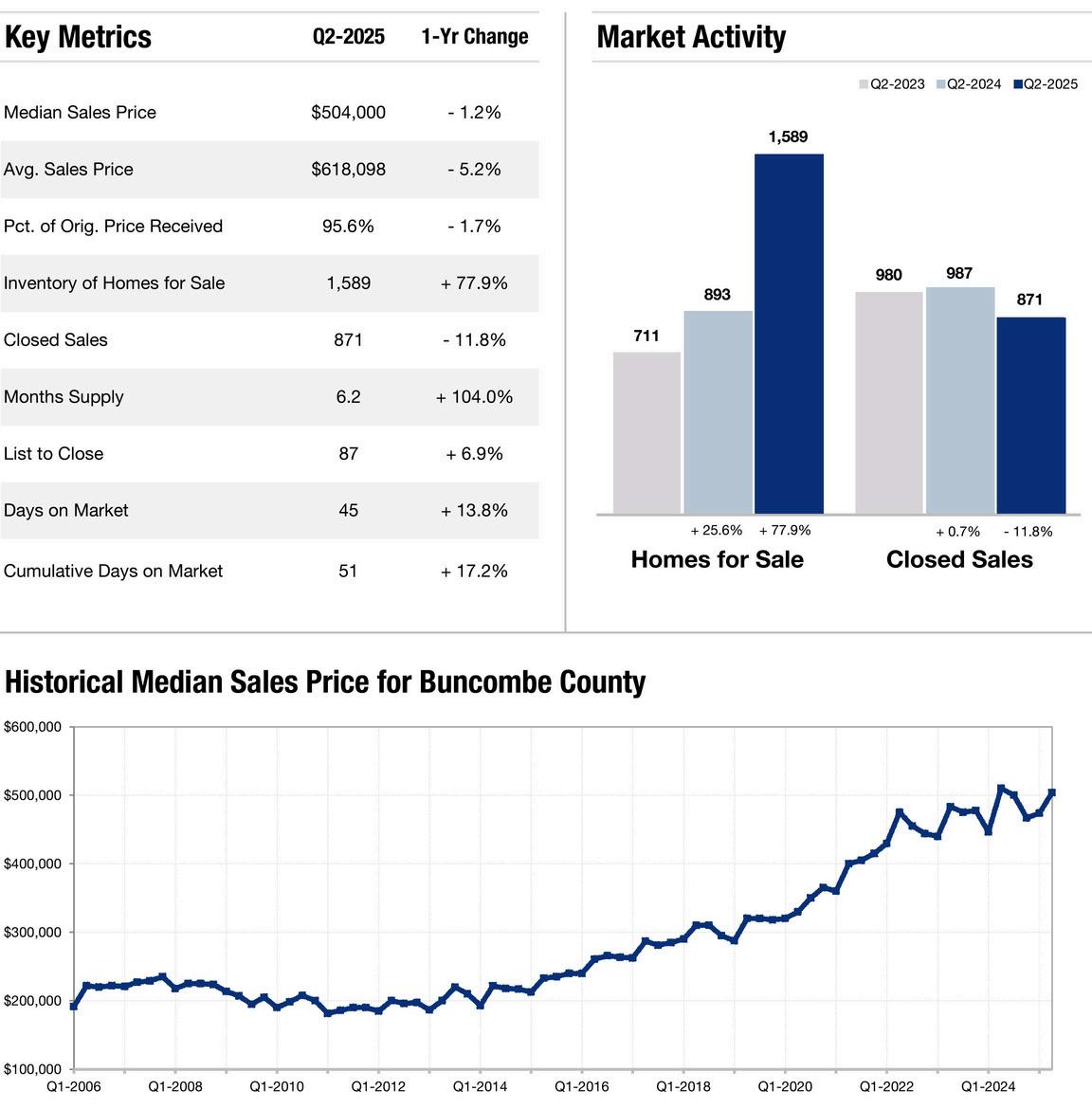

The pastoral setting of Buncombe County, Asheville's home county, saw its Q2 Average Sales drop by more than 11% year over year. On average, homes in Buncombe County are on the market for 45 days. While Buncombe County offers a considerable selection and opportunities for first-time buyers, its new developments and luxury communities have put upward pressure on home prices, often outpacing Asheville.

RALEIGH & TRIANGLE AREA

RESIDENTIAL SALES SUMMARY

Q22025TriangleMarketSnapshot

KeyTakeawaysforBuyers&SellersinRaleigh,Durham&WakeCounty

TheTrianglerealestatemarketcontinueditsupwardtrajectoryinQ2,withrisingprices,expandedinventory, andcompetitivemovementacrossRaleighandDurham Here’swhatstoodout:

MarketMomentumContinues

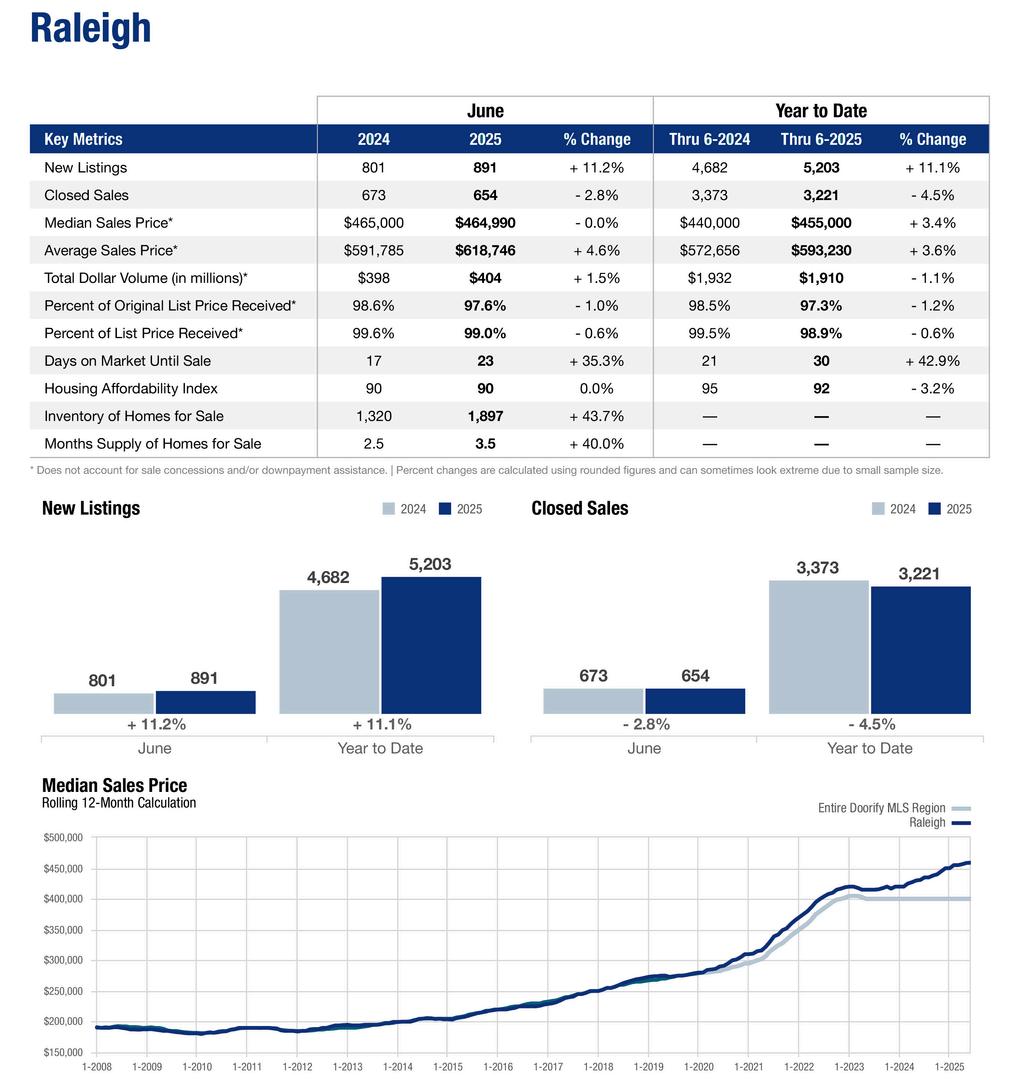

Raleigh’sAverageSalesPricehitanewhighof$618,746inJune,markinga46%increaseoverQ2 2024.

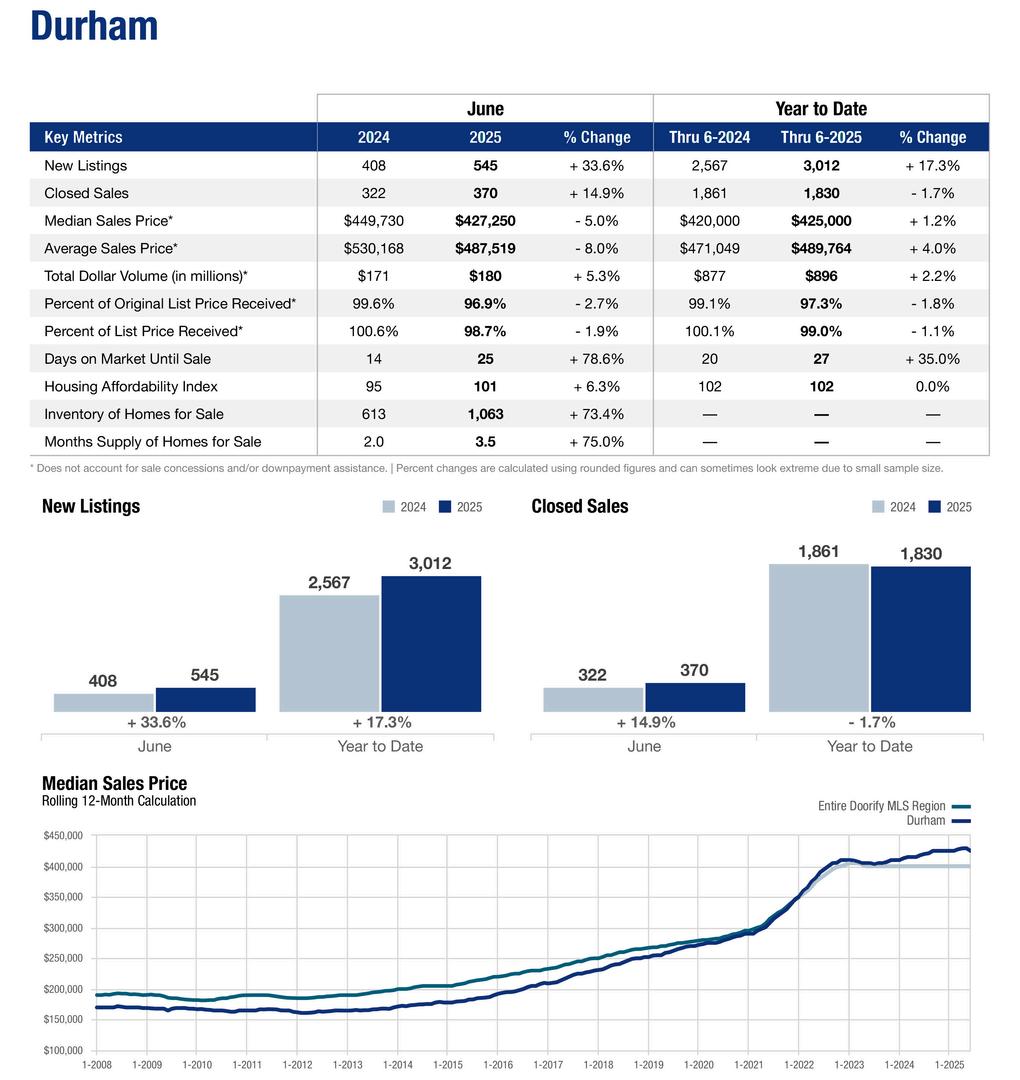

DurhamandWakeCountysawmixedgrowth,withaveragepricesinDurhamdown7%andinWake Co.,up+.8% year-over-year.

Inventorylevelsclimbedbysignificantdouble-digitfigures,helpingtoeasepressureonbuyer demandandrestorebalanceinthishistoricallycompetitivemarket.

What It Means for Buyers

Market Momentum Continues

Raleigh’s Average Sales Price hit a new high of $618,746 in June, marking a 4 6% increase over June, 2024

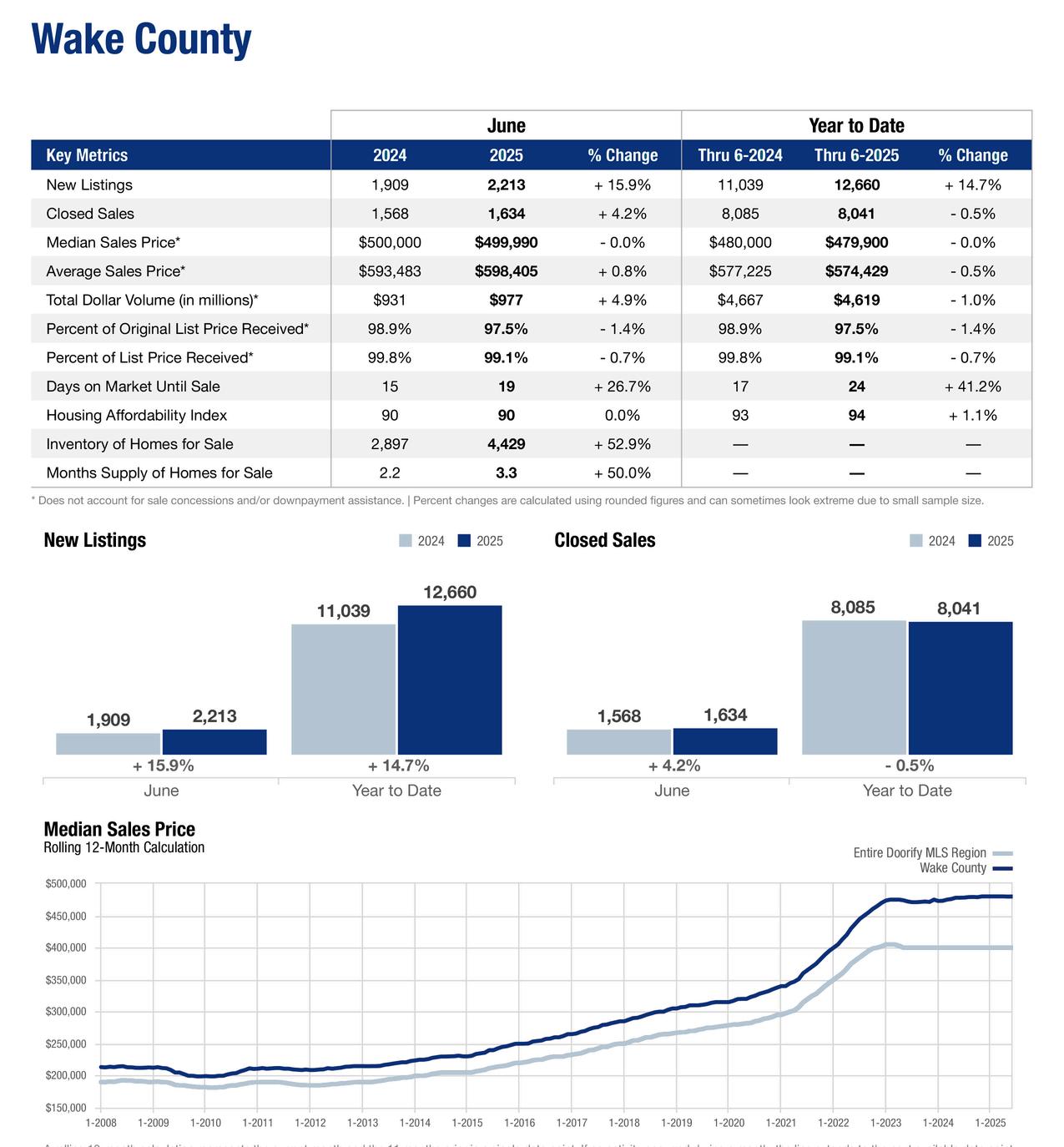

Durham and Wake County saw mixed growth, with average prices in Durham down 7% and up 8% in Wake Co , year-over-year

Inventory levels climbed, helping to ease pressure and restore balance in this historically competitive market.

Bottom Line:

What It Means for Sellers

It’s still a seller’s market, but buyers are more value-driven, with abundant inventory Well-staged, competitively priced homes are commanding attention—and moving quickly Wake Co sellers have the lowest year-overyear increase in Days on Market, at 267%, showing the faster sales

The Triangle remains one of the most in-demand regions in the Southeast Whether you ’ re buying or selling, understanding the data and working with a local expert who can interpret it makes all the difference

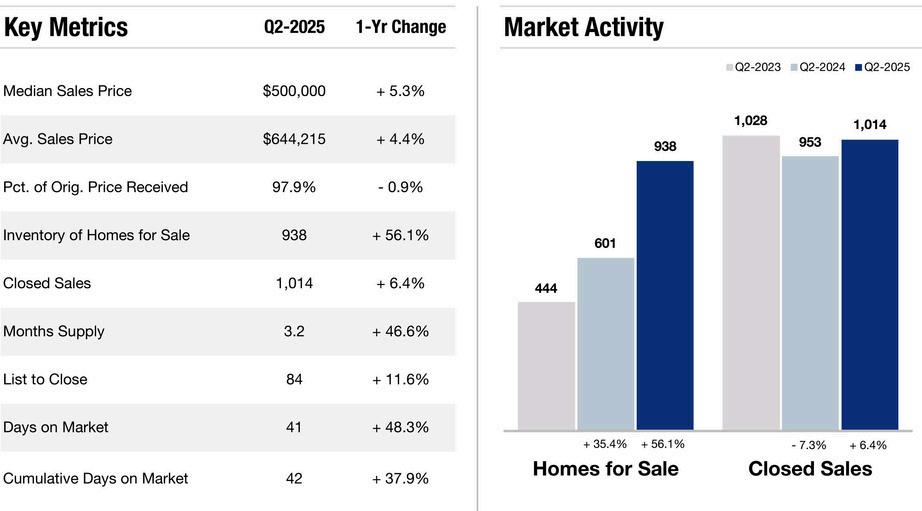

THE TRIANGLE AREA | RALEIGH

RESIDENTIAL SALES SUMMARY

Raleigh’s real estate market continues its forward momentum, with sales prices at record highs. Home values have been rising marginally, pushing the Average Sales Price of Raleigh homes to $618,746, which is an increase of 4.6% on 2024 results. Monthly sales decreased slightly in Raleigh while the number of available homes for sale rose significantly, 43.7% year-over-year.

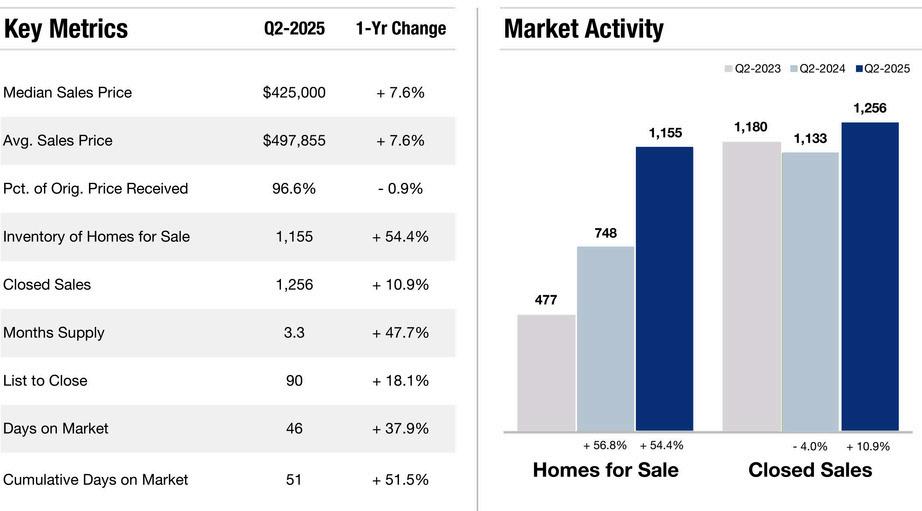

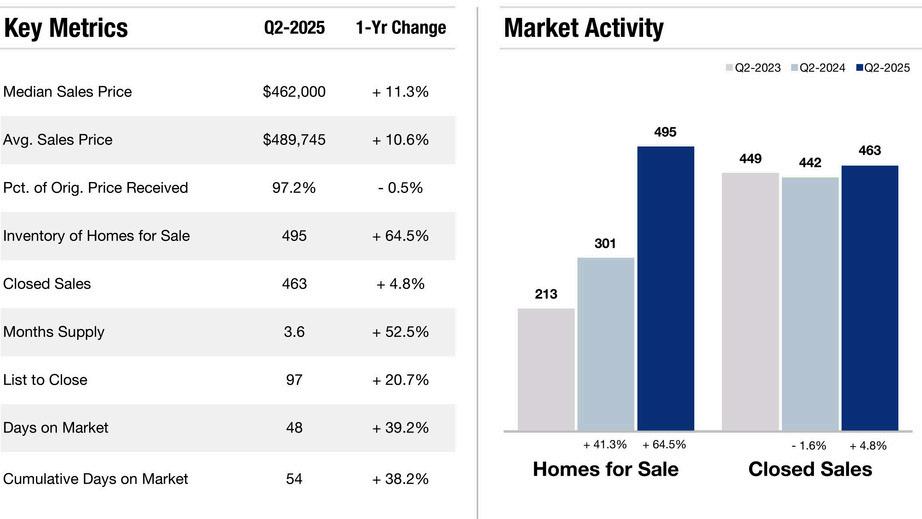

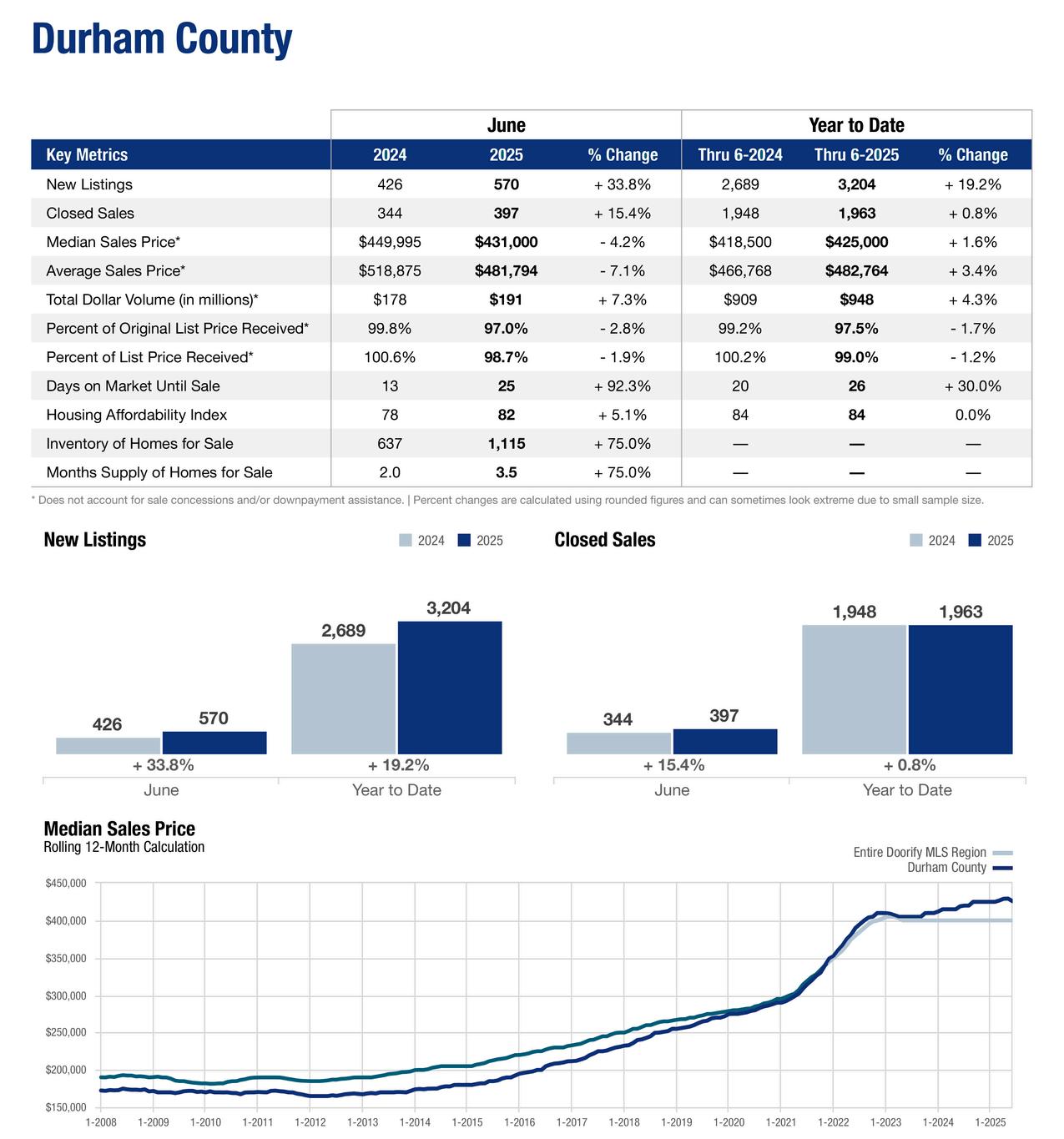

THE TRIANGLE AREA | DURHAM

RESIDENTIAL SALES SUMMARY

Triangle Area real estate markets remain active, with Durham and Wake County areas showing particular demand. That's positive news for sellers, for now. For buyers, a significant rise in inventory will maintain balance in this highly competitive market. Closed Sales increased across both counties, while Days on Market surged, suggesting a buyers are taking more time to make decisions.

THE

Jacksonville

Jacksonville, NC is a vibrant coastal community known for its military roots, natural beauty, and growing neighborhoods. It offers much more than military heritage—it’s a thriving, young skewing community (median age 23) with a growing population (2.2% year over year) and rising household incomes.