Q1MarketReport &AreaResults

Data Disclaimer: The source of all data contained in this report is

by the Canopy REALTOR® Association, Triad Real Estate MLS, & Paragon MLS (Raleigh).

Data

for Charlotte is comprised of the Charlotte mailing area as reflected in the

Dear Friends, Clients, and Colleagues,

As we usher in the first quarter of 2024, Asheville’s real estate market's momentum continues to reflect the vibrant lifestyle and unique appeal that makes our city and the surrounding areas in Western North Carolina such sought-after destinations. We've witnessed a steady demand for homes driven by a thriving job market, a strong sense of community, and the breathtaking scenery that defines our region.

Asheville's enchanting mix of cultural attractions, outdoor activities, and beautiful neighborhoods has drawn people from all over, creating a robust housing market that shows no signs of slowing down. The cool mountain air, vibrant arts scene, and outdoor recreation opportunities offer a perfect blend of urban amenities and natural beauty. It's no wonder people are eager to call Asheville home.

The Federal Reserve's policies suggest that interest rates will remain steady throughout 2024, with cuts potentially on the horizon early in 2025. This stability is good news for buyers looking to make a move, as it creates a predictable environment for mortgage rates. As we move through the Spring season and into Summer, sellers can take advantage of this demand, with buyers exploring various strategies to secure their dream home before spring.

At Carolina Mountain Sales, we embrace each home's unique story and employ innovative technology and marketing strategies to ensure our sellers' success in this competitive market. We are committed to consistently demonstrating our value and going the extra mile to help buyers and sellers with all their real estate needs.

We're excited about the year ahead and look forward to working with you to make 2024 a year of successful real estate experiences.

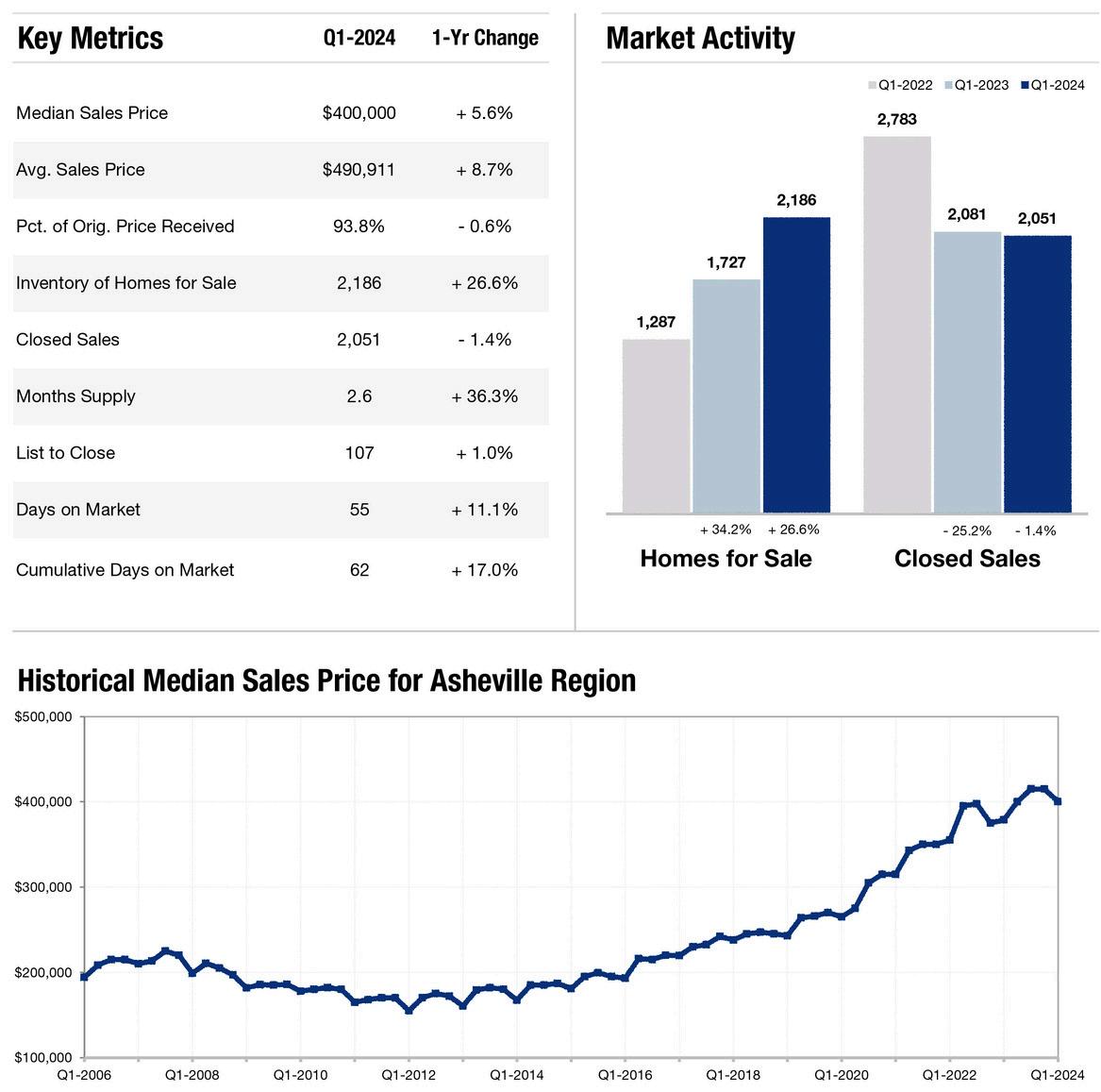

ASHEVILLE RESIDENTIAL SALES SUMMARY

Asheville continues to see Average and Median Sales Prices increase, while Month's Supply rose a considerable 36.3%. Not surprisingly, Asheville’s Closed Sales have dropped more than -1.4% on Q1 2023 figures. Expect prices to continue rising and Days on the Market to decrease during the Q2 selling season, similar to many other popular metros in North Carolina.

Asheville (Region)

In the pastoral setting of Buncombe County, Asheville's home county, the Q1 Average Sales Price for homes was up 4.7% year-on-year. On average, homes in Buncombe County are on the market for 51 days, more than 5.8% slower than this time last year. While Buncombe County offers greater selection and opportunities for first-time buyers, its new developments and luxury communities have put upward pressure on home prices, outpacing Asheville.

CHARLOTTE AREA

RESIDENTIAL SALES SUMMARY

Charlotte Market

The first quarter showed a modest but steady increase in median and average sales prices in the Charlotte market. This steady rise indicates that demand for homes remains consistent even though inventory levels have decreased.

Despite the drop in inventory, closed sales have also slowed, suggesting that the market might be finding balance after a period of rapid growth This could mean that buyers are becoming more selective while sellers are recalibrating their pricing expectations

With the market reaching a state of equilibrium, consistent pricing can lead to a more stable environment for both buyers and sellers This stability might reduce the chances of significant fluctuations in home values, offering a sense of predictability as we move forward

Mecklenburg County

In Mecklenburg County, there's a noticeable year-over-year increase in median and average sales prices. This upward trend indicates an increasingly competitive market with fewer affordable options for buyers.

The decrease in inventory and the slower rate of closed sales mirror trends in the Charlotte market, suggesting that the broader region is experiencing a similar shift. The decline in closed sales could be due to factors like rising interest rates, fewer available homes, or changes in buyer behavior

With Mecklenburg County's average sales price now surpassing that of the Charlotte region, the traditional perception of affordability in this area is being challenged As a result, buyers might need to consider other locations or adjust their budgets On the seller side, patience may be necessary as the market adapts to these new conditions

CHARLOTTE REGION

RESIDENTIAL SALES SUMMARY

Modest or consistent median and Average Sales Price increases, an increase in Inventory, and a slow down in Closed Sales continue to define much of the Charlotte Region and establish a baseline for our other markets.

The Median Sales Price in Q1 2024 for a single family home in Charlotte was $380,410 for a year over year increase of 4.2%

As of March 2024 the Average Month's Rent in Charlotte for a 2 bedroom was $2,113

Charlotte Occupied Housing Units 53% of homes are owner-occupied households and 47% are renter-occupied households

The Median Sales Price in Q1 2024 for a single family home in Mecklenburg County was $425,000 for a year over year increase of 4.4%

MECKLENBURG CO.

RESIDENTIAL SALES SUMMARY

Charlotte's home county shows a Median and Average Sales Price increase, year-on-year, with an increase in inventory and a reduction in Closed Sales that closely tracks with Charlotte. The county, once a respite for buyers seeking affordability, now holds a higher Average Sales Price than the Charlotte Region.

CHARLOTTE-AREA COUNTIES

RESIDENTIAL SALES SUMMARY

Cabarrus County is one of Charlotte's largest neighboring counties and home to the county seat of Concord and the pretty towns of Mt. Pleasant, Midland, & Kannapolis. Union County features the charming and in-demand town of Waxhaw–growing in both popularity and Increasing in Average Sales Price

Cabarrus Co.

Union Co.

CHARLOTTE-AREA COUNTIES,

RESIDENTIAL SALES SUMMARY

The major metro area surrounding Charlotte includes seven different counties, each with its distinctive towns, cities, and townships. Charlotte’s surrounding counties provide greater inventory at various price points with something for everyone- from charming rural communities to vibrant market towns and commercial areas.

York Co.

Lancaster Co.

THE TRIAD | WINSTON SALEM

RESIDENTIAL SALES SUMMARY

In Q1 of 2024, the Median Sales Price in Winston-Salem, NC was $282,000K, trending up 8% year-over-year. This laid-back city poised for continued growth is located in Forsyth County in the north-central part of North Carolina. The metro area lies along the Carolina Core in the heart of North Carolina, a 120+ mile stretch running between Winston-Salem, Fayetteville, Greensboro, & High Point. The Triad's continued big draw? Affordability!

THE TRIAD | GREENSBORO

RESIDENTIAL SALES SUMMARY

U.S. News and World Reports ranked Greensboro #94 in the nation for Best Places to Live and #71 in Best Places to Retire. Part of the Piedmont Triad, with a low cost of living and a Q1 2024 Median Sales Price of $00,000, it's one of North Carolina's more affordable metro areas. Inventory in Greensboro has been on the rise, with an increase in new listings of 12.3% year-overyear.

THE TRIAD | HIGH POINT

RESIDENTIAL SALES SUMMARY

High Point is located alongside Greensboro and Winston-Salem in the Piedmont Triad region of North Carolina, the nation’s 33rd largest metro area with a population exceeding 1 7 million Home of High Point University and the famous annual High Point Market, the world's largest home furnishings trade show High Point offers outstanding value for homebuyers, while sellers can expect to receive 97 6% of List Price

THE TRIAD | WILKES COUNTY

RESIDENTIAL SALES SUMMARY

Wilkes County is widely known for its county seat, Wilkesboro, and its largest town, North Wilkesboro The area is widely known for MerleFest, an annual "traditional plus" music festival held in Wilkesboro each spring Wilkesboro home-buyers enjoy a relatively low sales price compared to larger metro areas in North Carolina and an increase in the number of homes available for buyers seeking value and proximity to Winston Salem

McDowell County RESIDENTIAL

SALES SUMMARY

A predominately rural region, McDowell County boasts a wide array of natural beauty and scenic attractions, drawing tourists to it's waterfalls, hiking trails, mountain biking, and myriad outdoor pursuits Quaint shops can be found from the market town of Marion, to the charming country town of Old Fort Aside from Wilkes County, McDowell and Burke Counties offer some of the most affordable housing in the state!

Burke County

In the foothills of North Carolina's Blue Ridge Mountains sits Burke County and the attractive market town of Morganton Linville Gorge, Fonta Flora State Trail, and a portion of the Pisgah National Forest are just a few of the attractions drawing tourists to the area Laid-back living, smalltown life, and affordable housing, keep families and professionals here, calling Burke County "home "

RALEIGH & TRIANGLE AREA

RESIDENTIAL SALES SUMMARY

If you're looking to buy or sell in Raleigh, you're stepping into a lively market! Raleigh's home values are hitting new highs, with the average sales price now at $516,344. It's an exciting time, with homes appreciating steadily and demand staying strong.

What's Happening Right Now? The number of homes for sale has gone down, making the Raleigh market pretty competitive. For buyers, this means you should be ready to make quick decisions and have your financing in order. For sellers, the low inventory is good news as it keeps your property in high demand.

What to Expect Moving Forward As we continue through the year, expect the market to stay dynamic. Mortgage rates are looking to level off, which helps keep home prices stable. Homes, especially singlefamily and townhomes, are moving quickly, so whether you're buying or selling, opportunity exists!

Recent

Trends to Note

Homes in Raleigh are selling close to their asking prices, at an average of 99 1% It shows that the market is leaning in favor of sellers, with many homes receiving strong offers

The total number of homes available has dropped significantly to about 1,004 homes, a decrease of 16 5% compared to last year

The average time it takes to sell a home has shortened to 20 days a 9 1% decrease from last year indicating homes are moving faster than ever.

Tips for Navigating the Market

For sellers: Your home is likely to attract plenty of interest, so work with a real estate agent to strategize on pricing and marketing to get the best possible offer. For buyers: Be prepared for a brisk pace. Have

THE TRIANGLE AREA | RALEIGH

RESIDENTIAL SALES SUMMARY

Raleigh’s real estate market has continued its forward momentum, with prices at record highs. Home values have been rising marginally, pushing the Average Sales Price of Raleigh homes to $556,318 This marks another month in Raleigh with rising average home prices, slower monthly sales, and a reduced inventory of available homes for sale

THE TRIANGLE AREA | DURHAM

RESIDENTIAL SALES SUMMARY

Triangle Area real estate markets remain active, with Durham and Wake County areas showing particular demand That's still positive news for sellers, for now For buyers, reduced inventory and level days on market will add more balance to this highly competitive market. Sellers will be happy to see Average Sales Prices increased in March by more than 5.2% on 2023's figures.

EMPOWER DREAMS THROUGH REAL ESTATE