The link between preharvest conditions and postharvest quality

The link between preharvest conditions and postharvest quality

The link between preharvest conditions and postharvest quality

The link between preharvest conditions and postharvest quality

• Can be harvested at a green or yellow stage.

• Uniform blocky fruit, with excellent quality.

• Ability to set fruit under various environmental conditions.

• HR: Tobamo viruses (Tm:0-2)

• IR: Tomato Spotted Wilt Virus (TSWV:0)

• Strong dominant indoor pepper.

• Can be harvested at a green or yellow stage.

• Uniform blocky fruit, with excellent quality.

• Ability to set fruit under various environmental conditions.

• HR: Tobamo viruses (Tm:0-3)

• IR: Tomato Spotted Wilt Virus (TSWV:0)

• Can be harvested at a green or yellow stage.

• Uniform blocky fruit, with excellent quality.

• Ability to set fruit under various environmental conditions.

• Keeps shape and size throughout growing cycle.

• HR: Tobamo viruses (Tm:0-3)

• IR: Tomato Spotted Wilt Virus (TSWV:0)

• Strong dominant indoor pepper.

• Can be harvested at a green or red stage.

• Medium to Large high quality uniform blocky fruit.

• Short internodes with continuous fruit set.

• HR: Tobamo viruses (Tm:0-3)

• IR: Tomato Spotted Wilt Virus (TSWV:0), Powdery Mildew (Lt)

• Ideally suited to be harvested at green immature stage

• Large leaves good canopy protecting fruit against sunburn

• Large fruit with thick fruit walls

• Excellent for summer production

• IR: Phytophthora capsici (Pc), Bacterial Leaf Spot (Xcv:1-3)

• Ideally suited to be harvested at green stage

• Large leaves, give a good canopy protecting fruit

• Uniform blocky fruit with thick wall

• HR: Tobamo virus (Tm:0), Bacterial Leaf Spot (Xcv:0-3,7,8)

• IR: Tomato Spotted Wilt Virus (TSWV:0), Powdery Mildew (Lt), Phytophthora capsici (Pc)

• Green to red blocky sweet pepper.

• Uniform blocky fruit, with excellent quality.

• Ability to set fruit under cool conditions.

• HR: Tobamo virus (Tm:0), Bacterial Leaf Spot (Xcv:0-5,7,9), Pepper Mottle Virus (PepMoV), Pepper Virus Y (PVY:1), Tobacco Etch Virus (TEV)

• IR: Cucumber Mosaic Virus (CMV), Phytophthora capsici (Pc)

• High yielding field variety, large fruits with thick fruit walls.

• Dark green fruit, perfect for green harvesting.

• Ability to set fruit under various environmental conditions.

• HR: Potato Virus Y (PVY:1)

• IR: Tomato Spotted Wilt Virus (TSWV:0)

Edition 214 ISSN 1015-85 37

www.vegetablesandfruitmagazine.co.za

COVER

Pears are full of fibre, low in calories, and loaded with antioxidants, including vitamin C. They have been used in anti-inflammatory, diuretic, and anti-hyperglycemic folk remedies in China for more than 2000 years.

Besoek ons webtuiste | Visit our website:

NEWS

4 Agri SA appoints new Chief Executive Officer

4 Natuurlike bemesting herstel die balans vir grond en gewasse

4 Need for loadshedding relief in agri sector

6 Citrus industry faces more challenges

7 Local farm cuts electricity costs and carbon with solar initiative

7 Engen and Fred Junior celebrate success

8 Namibian citrus growers join their CGA neighbours

8 Culdevco appointments new GM

& Vrugte | Vegetables & Fruit

1 Year @ R235.00 (6 issues)

2 Years @ R450.00 (12 issues)

22

Agri SA announced the appointment of Johann Kotzé as its new Chief Executive Officer. Jaco Minnaar, Agri SA President, congratulated Kotzé and expressed his excitement over the new phase ahead.

“Kotzé’s appointment comes at a critical point in South Africa’s trajectory. Leadership is needed across so many spheres of both the larger South African society and the agricultural industry. In the coming years, agriculture will have to navigate the combined impact of challenges such as climate change, deteriorating infrastructure, decaying service delivery, rural safety, shifts in global markets and policy uncertainty.”

Minnaar says Kotzé is a creative leader with a passion for farming and the sustainability of the food system. He brings a wealth of experience as a former agricultural banker and a renowned leader in organised agriculture.

Kotzé started his career as a farmer and thereafter, he became an agricultural banker at Absa Bank. After working as a corporate banker in Mozambique, he became an independent business consultant. Kotzé returned to banking and oversaw Africa agriculture for FNB. Since 2017, he has

Agri SA notes that the latest quarterly labour force survey results demonstrate yet again the outsized contribution of the agricultural sector to the country’s economy and underscore the urgent need to protect the sector from the job-killing impact of loadshedding.

The agricultural sector continues to punch above its weight in terms of job creation. While employment decreased by 0,2% nationally, employment in the sector increased by 3,2%. And though the sector represents 1,5% of nominal gross domestic product (GDP), it makes up 5,4% of the jobs in the country.

Agri SA says these figures highlight the centrality of the agricultural sector to the South African economy and underscore the need to provide targeted relief to the sector from the scourge of loadshedding that threatens both jobs and food security in the country.

“Since Russia’s invasion of Ukraine, the sector has endured substantial increases in the cost of agricultural inputs. This inflationary pressure alone threatens the financial viability of farming operations across the country. Compounding this hardship has been the escalation of loadshedding, which has added an extraordinary increase in the cost of energy for irrigation, cold storage and other agricultural and agro-processing systems.

“As the country continues to battle a protracted crisis of unemployment, the labor-intensive sectors that underpin job creation in South Africa must be supported.”

served as the chief executive officer of the South African Pig Producers Organisation (SAPPO).

“Over the course of my career, I have learned that South African agriculture commands global respect for its efficient farming practices,” Kotzé says. “As an agricultural community, the natural hope that South African farmers embody with pragmatic solutions to the complex challenges faced is needed. Looking ahead, farmers will have to challenge their thinking on what is realistically possible in the current business environment and position agriculture to leverage partnerships in the broader business and international community.

“In the current conditions, the community should not be tempted by frustration but collectively facilitate innovative solutions. The ethos and integrity of our structures need to create the necessary conditions and a culture receptive to change.”

He is confident that that the industry can collaboratively author a new narrative and unlock the growth potential of agriculture in Africa. Future sustainability is fundamentally a question of leadership, says Kotze

ReStore-korrelmisstof is besig om nuwe geleenthede vir landbouers te ontsluit as alternatief vir kunsmis. Hierdie plaaslik vervaardigde produk word gemaak van biokoolstof (biochar) afkomstig van indringerplante en van hoendermisafval van vrylopende hoenders.

Volgens Kobus Stoop, tegniese woordvoerder van die maatskappy Senfore wat ReStore vervaardig, is die belangrikste voordeel van hierdie korrelbemesting dat dit die gesondheid van grond verbeter deur langtermyn-koolstofvaslegging.

Die misstof word volhoubaar vervaardig deur hout van indringerplante, soos portjackson, bloekombome en ander te veras om biokoolstof van te maak. Die biokoolstof word saam met voedingsryke vryloophoendermis tot ’n korrel verwerk. Die samestelling is ryk aan stikstof, fosfor en kalium (NPK) en ontwerp om grond se biologiese balans te optimaliseer om opbrengs te kan verhoog, terwyl dit ook die grond se langtermyngesondheid en veerkragtigheid teen klimaatsverandering bevoordeel.

Ruan Siebert van die plaas Highlands buite Hermanus kon met behulp van die produk suksesvol makadamiabome vestig, ’n gewas wat ongewoon is vir die gebied. Soos ander boere wat die korrels gebruik, meld Siebert dat dit ’n goeie manier is om organiese materiaal in arm sandgrond te kry. In swaarder gronde help dit weer om verdigting te voorkom.

Stoop sê dat die formulering van ReStore ’n ideale oplossing bied vir verbouers wat hulle op herlewingslandbou toespits. “Die voordele van biokoolstof-grondverbetering strek oor 'n leeftyd.”

South Africa’s citrus industry has been a major contributor to the country's agricultural sector, and its overall gross domestic product (GDP), for many years. Despite facing numerous challenges in recent times, the sector has managed to achieve a steady annual compound growth rate of 11% in gross production value over the past five years, allowing it to not only continue to bolster South Africa’s economic recovery but also continue to provide close to 150 000 employment opportunities.

However, despite this success, the industry continues to face several challenges that threaten its sustainability and, as it enters the 2023 export season, these challenges are falling under a very bright spotlight.

That’s according to Paul Makube, senior agricultural economist at FNB, who points to a combination of domestic and global headwinds as presenting something of a perfect storm for the country’s citrus industry.

“The global economy, including declining grow prospects and rapidly rising inflation and interest rates, are starting to bite hard into the profitability of the citrus industry worldwide,” Makube says. “When you couple these fiscal pressures with the sharp rises seen in the costs of logistics, particularly the prices of reefer containers, citrus exporters’ margins have been shrinking rapidly, since 2021.”

Makube also points to a number of other challenges that SA’s citrus producers have faced, and will likely continue to battle in 2023, not least the deterioration of infrastructure, the impact of energy insecurity and loadshedding on farming, storage and cooling processes, increasing competition in many markets and the still slow progress that is being made in terms of expanding global market access.

“In addition to rapidly increasing production costs, which have risen by more than 25% in the past three years, local citrus producers are also having to deal with rising costs associated with getting their produce to global marketplaces,” Makube explains. “The situation has now been exacerbated by changes in the EU’s cooling protocols, combined with the steady increase in the costs of sanitary and phytosanitary (SPS) protocols across the food chain management process.”

Makube says that, while these cost increases are, in themselves, a significant challenge for local citrus producers, they are compounded by a variety of operational problems ranging from ongoing domestic port and logistical crises that raise the risks of delays and consequent quality claims. He also points to cold-chain interruptions due to loadshedding as presenting a massive risk to both the quality of fresh produce and the costs of storage in chilled environments.

“To top it all, while freight rates are showing signs of

normalising, they are largely still higher than pre-pandemic rates,” he says. “Input costs in terms of fertilizers and labour are also still presenting headaches for many farmers.”

Despite these challenges, Makube is positive about the potential that still exists for the country’s citrus industry to grow in the coming years, and even become more sustainable.

“While the challenge of slowing exports is likely to remain in place for some time, the local industry is able to adapt, and there is evidence that it is already doing so,” he explains, “as evidenced by the gradual consolidation of the planted area due to the removal of marginal orchards and more carefully considered orchard expansion.”

Makube emphasises that there is no simple solution or quick fix to the challenges facing the sector, but he believes that a carefully coordinated response by all stakeholders can, and will, lead to long-term positive outcomes, particularly for farms, which are the cornerstone of the sector’s sustainability.

“Although 2023 is likely to be another challenging year for the industry, and it is unlikely to see the record-breaking export prices that were seen over the past five years, from next year it is expected to see a gradual settling of the various factors that are contributing to the volatility and uncertainty in the citrus markets,” he says. “After which, it is hoped that steady improvements will once again take place as all the industry players work together to secure its sustainability and set it firmly back on an expansionary path.”

As SA’s citrus industry faces a challenging 2023, a collaborative approach is needed for long-term sustainability, says an economist.

Fred Junior MacCarthy, a passionate 12-year old farmer from Brits, who dreams of helping feed the children of South Africa, received R20 000 from Engen recently to help him make his dream a reality.

Junior, as Fred is affectionately known, is the founder and CEO of Junior Farm Park which seeks to draw young South Africans into commercial farming. Junior believes that teaching young people about farming will help achieve his vision of ending hunger.

“My ambition is to build a Junior Farm Park where young people can visit and learn all about commercial farming and how they can help sustain the environment,” he says enthusiastically. He has launched a Garden School Project where he plans to visit various schools to teach children about the basics of growing vegetables.

Engen was inspired by Junior’s love for farming and his vision that it pledged to support Junior’s vision with an R20 000 donation. The funds will be used to purchase garden forks, rakes and spades, and watering cans and wheelbarrows.

The project will be made possible by a global community of solar supporters who purchase solar cells through the Sun Exchange platform to fund solar projects for organisations involved in education, health care and agriculture.

The farm, now in its eighth year of operation cultivating delicious table grapes, is on a mission to become more sustainable. Since the implementation of new technology to decrease its dependence on diesel during the busy harvesting season, the farm’s next goal is to become energy sufficient and access environmentally conscious and affordable electricity through solar.

In addition to ensuring food security, the agriculture sector plays a critical part in South Africa’s economy and provides more than 800 000 jobs. It is estimated that in 2022, agriculture lost more than R23 billion ($1,25 billion) between January and September alone due to loadshedding.

“Any person in the agriculture sector will understand the immense stress that farmers are under to stay afloat. Installing solar power means that businesses can continue during an energy crisis and employ locals in the community. Knowing the local community can play a part in making this happen, really instills a sense of hope and pride,” says Marlene Christopher, manager at Rostra Grape Company.

“By providing solar power to a farm like Rostra Grape Company, solar cell buyers in this project will be reducing Rostra’s electricity bills, and ease pressure on the grid, alleviating loadshedding. What’s more, as Rostra Grape Company will pay for all the solar energy provided by the members, solar cell buyers will also secure a modest long-term passive income stream. It’s a real win-win-win,” says Abe Cambridge, founder of Sun Exchange.

Globally, solar energy is growing increasingly popular for its ability to generate clean, reliable electricity by harnessing the power of the sun. However, in South Africa, one of the sunniest continents on the planet, it is reported that only 2% of the country’s energy is generated by solar. According to Cambridge, even though sunshine is one of the farmers’ most valuable resources, financial obstacles continue to hinder solar adoption.

That’s where Sun Exchange comes in. As the world’s first peer-to-peer solar leasing platform, Sun Exchange helps impact-driven institutions like farms, schools and retirement homes in South Africa switch to solar power. “The model allows anyone from anywhere in the world to easily produce and sell solar power to businesses here in sunny South Africa. In turn, they’re earning income while helping keep this country's grid up and energy costs down,” explains Cambridge.

The Citrus Growers’ Association of Southern Africa (CGA) recently announced that citrus growers in Namibia have become members of the organisation. CGA already represents over 1 560 growers from South Africa, Eswatini, Zimbabwe and Botswana.

The burgeoning citrus industry in Namibia has tremendous potential. While the citrus yield is still relatively small, with just under 500 tons delivered in 2022, Namibian growers have mapped out a ten-year plan for expansion with the aim of farming 10 000 hectares of citrus creating 60 000 job opportunities by 2033.

To achieve this, the growers planted just over 100 000 new citrus trees last year alone. Farmers in the north of the country are also excited about export plans.

“Namibia is a country with many opportunities. It is in the best interest to associate with the ‘big elephants’ such as the CGA to further the strategy to become a citrus-growing nation. There is respect for the experience and knowledge of the CGA. We are confident being a member of the organisation will help attain the goals,” says André Neethling from Citrus Namibia and a farmer from the Tsumeb area in Northern Namibia.

The CGA now provides the following services to Namibian growers:

• Assistance with increasing market access for their product

• Research and technical support to help citrus production and export preparation

• Logistics coordination – including road, rail, warehousing, ports and shipping

• Supplying growers with relevant information to make informed decisions.

CEO of the CGA, Justin Chadwick, says the CGA is happy that the Namibian neighbours have become a member, following Botswana joining the CGA towards the end of last year.

“The CGA and its grower development company remain committed to unlocking the potential of all citrus farmers in the region and ensuring we remain one of the top exporters of quality citrus in the world. Through sharing knowledge and assisting one another, the industry can grow together and contribute to the economic health of the region. The CGA also looks forward to enlarging its footprint to other African countries in the near future and contributing towards positioning Africa as an economic competitor globally.”

Fresh energy flourishes in the corridors and offices of Culdevco as Mishkaat Anderson is appointed as the company’s new general manager in Fleurbaix, Stellenbosch.

Anderson follows in the footsteps of Dr Leon von Mollendorff who retired from Culdevco after 16 years. Von Mollendorff founded the company in 2006 and has left behind a strong legacy in the SA fruit sector, plus a highly competent team for Anderson to steer.

Since 2006, Culdevco and the ARC have had an exclusive deciduous fruit license agreement to market and commercialise most of their apple, pear, plum, peach, apricot, table grape, and dried grapes in South Africa, and in other specific countries of the world.

Coming from a 15-year managerial background in

FMCG, Anderson has worked in a variety of industries, including wine, plastics, clothing, construction and chocolates.

Speaking about her motivation for applying for the position, Anderson says: “I was interested in Culdevco due to the scope of my profile as a GM and the opportunity to learn about something new in one of the most dominant sectors in South Africa – the fruit industry.”

Anderson is a true Bolander who was born in Wellington and schooled in Paarl, graduating from Stellenbosch University with a BSc degree. She also holds a postgraduate degree in industrial engineering and since then, has worked in a broad spectrum of consumer goods industries.

BASF fokus daarop om oor die langtermyn waarde en volhoubare oplossings aan produsente, die bedryf en die gemeenskap te bied. BASF is ʼn markleier in innovasie, met talle gevestigde oplossings teen donsskimmel, witroes en botritis.

BASF SE OPLOSSINGS VIR DONSSKIMMEL

Orvego®: Initium® en dimethomorph vorm saam ʼn kragtige kombinasie wat ʼn dubbele slag slaan in die beheer van donsskimmel op wingerd. Die voordeel van Orvego® se kort onthoudingsperiodes stel jou in staat om dit vroeg in die program toe te dien. Sy uitstekende oplosbaarheid maak die produk soveel makliker om te meng en toe te dien. Die nuwe chemiese klas waartoe Initium® behoort (FRAC Grp 45), maak Orvego® die ideale oplossing vir suksesvolle weerstandbeheer. Kruisweerstand is dus nie ʼn probleem nie. Die gunstige toksikologiese profiel van Orvego® teenoor die omgewing, gebruikers en verbruikers maak dit ʼn ideale keuse vir geïntegreerde donsskimmelbeheer. Buitengewone reënvastheid binne een uur na toediening bied beskerming op die blare en trosse, selfs tydens nat toestande. Orvego® van BASF bring ʼn innoverende oplossing vir donsskimmelbeheer in wingerd.

Collis® kombineer kresoxim-methyl en boscalid vir uitmuntende beheer teen witroes in ʼn spuitprogram. Die twee aktiewe bestanddele reageer verskillend op en binne die plantweefsel, wat bydra tot sistemiese voorkomende werking. Dit het ook die gewenste nawerking tot gevolg. Collis® is ʼn betroubare keuse wat goed in ʼn afwisselende spuitprogram teen witroes pas.

Kumulus ® WG , die ou staatmaker, is ʼ n droëswaelswamdoder met goeie vermengingseienskappe. Die uiters betroubare formulasie met drie kenmerkende deeltjie-

groottes wat optimum stabiliteit in suspensie het, dra by tot doeltreffende klewing en nawerking in en op die blaar- en vrugoppervlak. Hierdie eienskappe verseker vinnige werking, volgehoue vrystelling en langdurige beskerming om witroes effektief te beheer.

Vivando® se enkele aktiewe bestanddeel, metrafenone, beweeg vinnig deur die kutikula tot in die onderliggende selle waar dit opbou en vandaar verder deur die blaarweefsel versprei. Vivando® is na toediening in ʼn gasformaat rondom druiwetrosse teenwoordig, wat beskerming binne die tros bied. Dit is ook uiters reënvas en lewer goeie nawerking. Die wye toedieningsvenster sorg vir ʼn wye keuse van posisionering in die witroes-beheerprogram, met geen kruisweerstand teenoor ander aktiewe bestanddele in die beheer van witroes nie. Dis ’n uitstekende keuse om in ʼn weerstandbestuurprogram in te sluit.

BASF SE OPLOSSING VIR BOTRITIS

Cantus® WG is ʼn water-oplosbare korrel met sistemiese werking, wat beskerming bied teen beide botritis en witroes. Cantus® WG se enkele aktiewe bestanddeel, boscalid, verhoed vroegtydige spoorontkieming en swamontwikkeling op en binne die plantweefsel. Dit word as enkelbespuiting voor trossluiting aanbeveel vir optimale beskerming teen botritis. Cantus® WG verseker uitstekende siektebeheer en buitengewone werking sonder die risiko van kruisweerstand. Die betroubare formulasie verseker uitstekende reënvastheid na toediening, en dus is geen hertoediening na reën of besproeiing nodig nie.

The production of apples and pears is estimated to decrease slightly in the 2022/23 marketing year, based largely on stagnated production area and a return to normal yields following record production for the commodities. Apple and pear-producing regions experienced hailstorms in November 2022 which damaged the crop, while the heat wave in January 2023 in the Northern Cape led to table grape losses.

Masego Moobi and Amy Caldwell UNITED STATES DEPARTMENT OF AGRICULTURESouth Africa is self-sufficient in the production of deciduous fruits and only imports small quantities to fulfill niche markets or to satisfy demand during the off-season when supply is limited. Lower exportable supply and challenges in port access are forecasted to reduce exports of apples, pears and table grapes in 2022/23.

The area under apple production has enlarged steadily over the past decade with an average growth rate of more than one percent per annum (Figure 1). This positive trend has been driven by ongoing investments into the deciduous fruit sector on relatively high earnings and improved profitability from export markets.

In addition, enhanced cultivars and better farming practices that included investment in netting resulted in higher yields. However, despite excellent production seasons, the area under apple production in South Africa is estimated to flatten in 2022/23 to 24 950 ha or almost 36 million apple trees, with negligible new planting.

Accelerating farming input costs, elevated costs of packaging materials and storage costs, high shipping rates and depressed markets are diminishing the profitability of apple and limiting continued investment in crop expansion. Ongoing shipping delays at the local ports are negatively impacting the quality of fruit to the export markets and ultimately lowering returns to growers. The industry appears to be in a consolidation phase, with growers focusing investments on increased yields, reliable sources of power and water, and vertical integration to offset high input costs.

The Western Cape is the largest apple-producing area in South Africa, and together with the Eastern Cape, accounts for more than 95% of the apple production. Small, but growing production areas were established further north mainly in the Free State, Mpumalanga and Limpopo. Harvest for South African apples typically begins at the end of January and runs through to June, with peak harvest times falling between February and April.

Controlled atmosphere (CA) storage allows the industry to provide products to both the domestic and international markets year-round. Class 1 fruits are usually stored in CA for about 9 months, then released into regular atmosphere (RA) storage for a shorter term (3 months). Pretoria (Post) contacts

indicate that there is increased demand for cold storage and plans are underway to expand.

Six cultivars dominate apple production in South Africa and account for more than 80% of the area planted. The cultivars of choice are mainly determined by consumer preference and demand in South Africa’s export markets. However, plantings over the past five years have been driven by producers’ desires to increase yields.

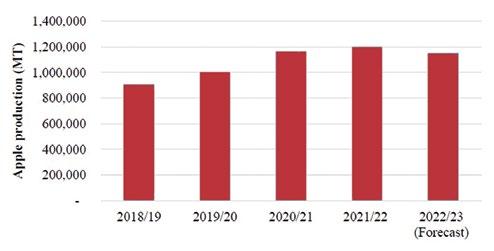

Production

Post forecasts that apple production in South Africa will drop by four percent to 1,15 million metric tons (million tons) in 2022/23 (Figure 2). This forecast is based on a stagnated production area and a return to normal yield following record production in 2021/22.

In November 2022, hailstorms in some areas of the Western Cape damaged the crop. Growers in the region reported that their apples destined for processing increased from an average of 20-25% annually to 55-60% in 2022/23. Post contacts suggested that about 100 000 tons of apples that would usually be intended for fresh consumption have been diverted for processing in 2022/23. As a result, many juicing factories are at capacity for the season and closed doors to non-affiliated producers. Without a clear market for lower-quality products, post forecasts that unharvested areas will grow slightly in 2022/23, reducing production volumes.

In 2021/22, South Africa produced a record apple crop of 1,20 million tons. Favourable rains and adequate chill units during the winter of 2021, guaranteed that producers had

TO PAGE 12

3 redes om SWITCH® vir Botrytis beheer te kies:

• Bevat 2 aktiewe bestanddele – fludioksonil en siprodinil – elk met ’n eie metode van werking vir optimale effektiwiteit, reënvastheid en ingeboude weerstandbestuur.

• Komplimentêre kontak- en sistemiese aktiwiteit beskerm die plantweefsel van binne en buite.

• Beheer Botrytis se lewensiklus op 4 verskillende ontwikkelingsstadiums vir betroubare, langdurige beheer, ongeag wat die weer doen.

enough water for irrigation and favourable fruit development. Conducive weather conditions continued throughout the season ensuring an excellent crop and fruit quality. In addition, more young orchards came into production, contributing to higher volumes.

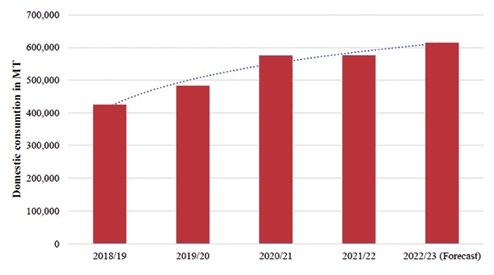

Apples are popular in South Africa and are widely consumed throughout the year. Hailstorms in 2022/23 increased the supply of non-export quality apples and apple juice in the local market. High costs of cold storage fuelled by loadshedding and pressure on cold store capacity also contributed to a significant volume of apples (largely goldens) appearing on the local market immediately following harvest.

The increased supply and lower prices are expected to drive many South African consumers to apples, an affordable fruit, as they seek options to maintain healthy diets despite high food inflation. As a result, post revises consumption upward to 615 025 million tons in 2022/23. Local consumption of apples is expected to increase by 7% in 2022/23 to 615 025 million tons up from 576 022 million tons in 2021/22 (Figure 3). Consumption figures include fresh market sales, as well as apples destined for processing.

In 2021/22, local apple consumption remained constant at 576 022 million tons. Stagnation in consumption was due to relatively higher production of exportable apples and declined supply and increased prices in the domestic market. Additionally, slow economic growth and inflationary pressure led to a decline in the disposable income of consumers and drove consumer purchases toward food staples as opposed to apples (see South Africa: Food and Fuel Feed Rising Inflation).

Post revises the export forecast downwards to 535 000 million tons in 2022/23 on lower production of export-quality apples due to hail in the major growing region. South Africa’s apple exports are forecasted to drop by 14% to 535 000 million tons in 2022/23 down from 625 103 million tons in 2021/22. In 2021/22, apple exports increased by 6% to 625 103 million tons on a record crop. The growth rate could have been larger, but South Africa’s exports of apples in 2021/22 were under

pressure due to rising shipping costs, local port challenges, the impact of the Russia-Ukraine conflict on established trading patterns and inflationary pressure in the United Kingdom (UK).

Exports to Africa are largely driven by strong demand (especially for pink lady, gala, and golden delicious varieties), limited competition in these markets, and apples’ ability to endure suboptimal handling conditions. However, exporting to African countries is limited by the high cost of trade and logistical challenges. South Africa has free trade agreements with both the European Union (EU) and the UK, and benefits from dutyfree exports in these markets.

Although African and European markets have been traditionally strong, growth is expected to be driven primarily by increasing exports to the East. South Africa’s apple exports to India grew by almost 67% in 2022, after the government of India approved in-transit cold treatment for South African apple and pear exports. Exports to India are forecast to grow even higher in 2022/23 as South African exporters seize opportunities created by increased tariffs on competitors.

South African production of apples has been increasing on average by 4% annually since 2017/18. Production gains and improvements in storage technologies have substantially dampened import demand. Post revises imports downwards to 25 million tons in 2022/23 based on an increase in nonexportable, lower-grade apples supplied in the local market.

2021/22 imports of apples are revised downwards to 25 million tons on record production.

United States apple exports are subject to a 4% customs duty. The United States currently has market access for apples from areas free of rhagoletis pomonella (apple maggot). The protocol stipulating the phytosanitary import requirements is available on the website of the Department of Agriculture, Land Reform and Rural Development.

PEARS

Area planted

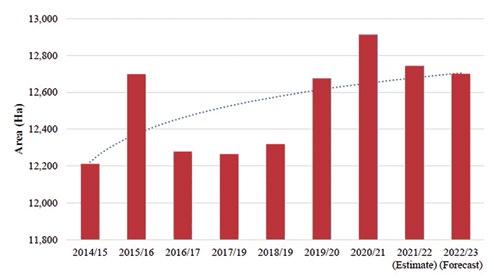

Pears are the third largest deciduous fruit produced in South Africa, representing 17% of the total area under deciduous fruit production. The area under pear production has increased steadily over the past decade with an average growth rate of around one percent per annum to an estimated 12 700 ha or 18 million trees in 2022/23 (Figure 4). As with apple production, the expansion in pear production was driven by relatively high earnings from export markets and sound financial returns on investments. However, the area under pears is expected to flatten in the coming years. Accelerating farming input costs and high shipping rates are diminishing the profitability of pear producers which limits continued investments in the industry. Contacts have suggested that the industry is in a stage of caution due to macroeconomic factors, challenges in accessing export markets, and an uncertain future for the pear canners. As a result, post revises its forecast for South Africa’s production area of pears down slightly to 12 700 ha in 2022/23.

Pears grow well in areas with moderate temperatures. Like apples, pears are predominately grown in the Western Cape, which receives most of its rainfall during the winter months (May to July). Collectively, the top three cultivars represent almost 80% of pear plantings in South Africa.

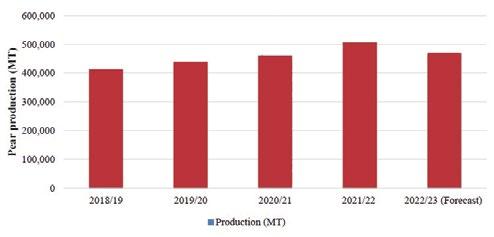

Post revises production upwards to 470 000 million tons in 2022/23 based on heavy rains received in November and December 2022 which provided sufficient irrigation water for the season. However, this is a decline of 7% in 2022/23, down from 506 200 million tons in 2021/22 based on hailstorm damage in a pear-producing region, a return to normal yields, and zero growth in production area. Pear production in 2021/22 was at a record 506 200 million tons. Pear orchards received good rain and sufficient chill units in 2021, resulting in an excellent fruit set and quality. According to Hortgro, South Africa produced 461 200 million tons of pears in 2020/21 (Figure 5).

The industry is mainly export-orientated with more than 50% of pear production destined for foreign markets. Locally, less than 25% of total pear demand is consumed fresh, while the majority is destined for the processing industry. Post revises domestic consumption downwards to 195 200 million tons in 2022/23. The revision is based on an increase in exportable pears and a surge in apple supply in the domestic market at lower prices, which is expected to drive consumer preference toward apples. Local consumption of pears is revised upwards to 218 966 million tons in 2021/22, an increase of 2% from 214 259 million tons in 2020/21 on record production. Consumption figures include fresh market sales, as well as pears destined for processing.

Post revises exports upwards to 275 000 million tons in 2022/23 on increased opportunities in China due to new market access and improving trade logistics to Russia. In 2021/22, pear exports are revised upwards to 287 406 million tons on record production and increased by 16% from 247 122 million tons in 2020/21.

Pear exports to India grew by 35% between 2020/21 and 2021/22 based on approved in-transit cold treatment for South African apple and pear exports. South Africa’s pear exports to the United States are minimal at less than 1 000 million tons per annum.

With the signing of the food safety protocols in 2021, South Africa received final approval to export pears to China. As a result, South Africa’s inaugural pear shipment arrived in China on September 2022. The one-container trial shipment was 18 years in the making. In 2021/22 South Africa exported 558 million tons of pears to China and 826 million tons by March 2022/23. Post anticipates that China will be a growing market, with larger volumes exported in later 2022/23.

As the second largest pear producer in the Southern Hemisphere after Argentina, South Africa imports minimal quantities of pears (around 200 million tons) mainly from China and the United Arab Emirates. Post revises imports downwards to 172 million tons in 2021/22 based on increased production. The United States does not have market access for pear exports to South Africa. In July 2010, the United States requested market access for pears, however, progress on this request stalled and the process has not been finalised. If South Africa grants access, United States exports of pears would be subject to a 4% customs duty.

What happens in the field does not stay in the field, according to Willie Kotze, research and development manager at DuToit Agri.

According to Kotze their controlled atmosphere (CA) and dynamic controlled atmosphere (DCA) systems give them a lot of capability when it comes to storage of the fruit. Although the systems have a complex relationship between oxygen and temperature.

“The storage potential of what is put into those systems is greatly influenced by the maturity of the fruit. What makes it even more difficult is that the maturity of the fruit on the outside differs from the maturity of the fruit on the inside. There is also the risk that producers will experience different physiological disorders.

“The difference in maturity and fruit size is yet another complication that impacts the storage,” says Kotze. “It influences the partial pressure, not just in the room but also inside the fruit itself. Observations in the past few seasons showed that this is a very complicated system. The question is then how can it be made less complicated by reducing the variation of what is put inside the rooms. To reduce that, the first

thing is to start looking at the orchard in which the fruit is produced”.

To reduce the variation of what is being produced in the orchards, the first thing to look at is the canopy structure. It is important to look at what is being produced on each of the trees and what is the light distribution within each of these trees. This makes the cropping and pruning of the trees at the beginning of the season one of the most important steps.

The leaves closest to the fruit are the most important when it comes to the quality of each fruit. The question this poses is whether it is really important to have all the branches and leaves that are currently on the trees. The running branches in connection to the meter of the tree are one of the most critical factors to consider as well as the overlapping bearing units. Is all of this necessary to produce good fruit? It is important to consider both the inner and the outer canopy, as well as the top and bottom of the tree to assess if it is producing the same quality of fruit in all the different positions.

All this means that it is incredibly important to look at the crop load to see if producers actually cropping the tree to its optimal position. If the tree is over-cropped, the colour development is delayed, this means that the tree will most likely be picked at an advanced state of maturity. In turn, this means that the storage potential of the fruit will be decreased and the risk this can cause the fruit to go soft, increasing the likeliness of disorders of lenticels and increasing the risk of internal browning and breakdown.

On the production side, it also requires more labour input, more picks will be needed to go through the orchard and it will also increase the risk of handling errors and more fruit drop, which in turn mean more bruising. If the tree is overcropped, there will also be a risk of uneven return bloom in the next season. Issues with return bloom mean that there will be a bigger variation of fruit and trees, which in turn will mean that there will be a vicious cycle. This will lead to an insufficient crop load with more vigour and competition within the fruit. The fruit will be of a larger size and this will increase the chances of bitterpit, lenticel, softer fruit, reduced storage time, and a bigger chance of breakdown.

These challenges require a mind shift, producers should no longer look at the fruit that has been produced and then decide what the best cause of action is. They should be looking at what they want to produce for optimal storage and then grow the tree and the fruit accordingly.

The question now is: what does the optimal tree structure look like? According to Kotze, there must be enough light penetration throughout the tree and good development of cluster and spur leaves from the inside out and from the top to the bottom. By reducing the canopy structure and making it less complicated, producers can end up with a product that has great uniformity of colour and size.

“If there is a practice of pruning and tree training where fruit on the same quality of wood and the same age at the same time is used, it will reduce the variability of what is start-

ed with and will also reduce the variability of what producers end with,” says Kotze.

When it comes to Watercore, the main factors that influence this is the crop load and the fruit size. It is also influenced by the harvesting window, increasing as maturity increases. Temperature is another influencing factor when it comes closer to harvest time, sunny days with cold nights can really reduce respiration close to harvest and that can increase the Watercore.

“The problem is that the clients are becoming very specific in terms of what they will and will not accept in terms of Watercore, and this can also mean reduced storage time and loss of firmness of the fruit,” says Kotze.

So what is it that can be done to make sure producers have the best possible chance? Producers need to make sure that the fruit is produced on good quality buds. There has to be an even light distribution within the trees. The correct crop load is to be set for each branch. The variations within the orchards should be correct from the start while striving to produce fruit of the same quality.

“It is very important at DuToit Agri to visit each and every orchard beforehand to make sure that the fruit is evaluated. This makes storage and postharvest handling much more informed. Hopefully, if everything is done correctly it will reduce the risk of physiological disorders,” says Kotze.

In conclusion, Kotze said that although producers have very little control over the climate, they should focus on what they can control and that is the end product. Variability in the orchards means variability in storage and this could lead to complications and losses. The weakest link will determine the strength of the chain, so it is important to get a system to group the orchard before sending the fruit to storage.

Wydverspreide hael het beduidende verliese veroorsaak maar goeie reën en koue bring gunstige vooruitsigte vir die komende seisoen.

ANNA MOUTON HORTGRODie Witzenbergvallei is deur strawwe hael getref wat ernstige skade aan appel- en peerboorde berokken het. “Ceres Fruit Growers het ongeveer 30% van die pakvolume verloor,” sê Frederick Odendaal, bestuurder van produsentedienste.

Hael het later ook ander Koue Bokkeveld-streke geteister. Volgens Odendaal het die plase wat laat-haelskade gehad het, groter finansiële verliese gelei. “As die skade laat gebeur, kry die vrugte nie kans om te herstel vir saplewerings nie en daar is reeds groot koste aangegaan om die vrugte vir die varsmark voor te berei.”

Selfs Elgin het in Desember 2022 onder hael deurgeloop, vertel Keith Bradley, algemene bestuurder van AgriDienste by Fruitways. “Dit was hoofsaaklik aan die noordwestelike kant van die Elginvallei. Produsente in die groepering het egter ten spyte daarvan steeds ’n soortgelyke volume vrugte as in die vorige twee jaar gelewer.”

Johan Kotze, hoofbestuurder van DuToit Agri: Oos-Kaap, beskryf die afgelope seisoen se hael in die Langkloof as ’n nagmerrie. “Ek dink daar was in geheel vyf haelvoorvalle van November tot Maart wat verskillende streke gevang het. Die skade aan bome het van 50% tot 100% gewissel.”

Hoewel die Langkloof elke jaar hael kry, was die uitwerking in die 2022/23-seisoen besonder groot omdat verskeie streke op verskillende tye geraak is.

Die risiko van haelskade – saam met sonbrand – motiveer ál meer produsente om hulle boorde met nette te bedek. Volgens Kotze gee drapeernette ongeveer 80% tot 90% beskerming teen hael omdat van die vrugte wat teen die net sit steeds beskadig word. Daarenteen gee vaste nette 100% beskerming.

“Ek dink as die meeste produsente in die Langkloof op die oomblik nuwe boorde vestig, word dit met nette gevestig, meestal permanente nette,” sê Kotze. Hy skat dat ongeveer 30% vrugteboorde in die Langkloof reeds onder nette is.

Hoewel nette minder algemeen in die Ceres-gebied is, reken Odendaal dit gaan verander. “Die risiko van sonbrand en haelskade verminder met nette en daarom die neiging om in die toekoms nuwe boorde met nette te vestig.”

Selfs sonder die haelstorms sou sapfabrieke in alle gebiede ’n besige seisoen beleef het. Volgens Bradley het hoër sappryse Fruitways se produsente aangespoor om reeds in die boord meer vrugte in sapkratte te gooi.

“Sommige produsente in die gebied het in die afgelope jare hulle sapvrugte Ceres toe gestuur omdat hulle beter pryse gekry het,” sê Bradley. “As gevolg van die massiewe klomp hael in Ceres moes die vrugte in die Elginvallei bly.”

Sapvrugvolumes het verder in Elgin toegeneem as gevolg van bogemiddelde verruwing op sommige golden delicious-appels en windskade aan sommige packham’s triumph-pere. Natuurlik het Elgin sy eie haelskade gehad. “Voor mense hulle oë kon uitvee het die sapfabrieke heeltemal oorgeloop,” sê Bradley.

In die Langkloof het goeie sappryse en swakker munisipale markpryse ook sapvrugvolumes verhoog, sê Kotze. “Baie produsente het die som gemaak en as dit nie sinvol was om die vrugte op die plaaslike mark te verkoop nie, het hulle dit sapfabriek toe gestuur.”

Odendaal is dankbaar dat hulle ’n sapfabriek in hulle gebied het. “Dit is positief dat die sapaanleg goeie waarde tot beskadigde vrugte kan toevoeg. Gelukkig is daar ’n goeie vraag na appelsapkonsentraat, met goeie prysverwagtinge vir die jaar.”

Omdat minder vrugte vars verpak word as gevolg van haelskade, het sommige van die vrugteverpakkers op Ceres ekstra koelkamerkapasiteit wat hulle vir sapvrugte kon gebruik. In laat-Junie was daar steeds koelkamers vol appels wat versap gaan word.

Terwyl die sapfabrieke hierdie seisoen meer vrugte gaan hanteer, gaan die pakhuise in veral Ceres weens laer volumes onder druk wees. Odendaal reken dat ongeveer 300 000 kratte – 115 000 ton – van hoofsaaklik appels uit die groter Ceres-gebied as gevolg van haelskade nie gepak is nie.

Die gevolg van ’n korter seisoen gaan minder arbeidsgeleenthede teenoor ’n normale oes wees. “Almal, ook op plaasvlak, het met koste teruggesny,” sê Odendaal. “Die finansiële uitwerking op die dorp is groot.”

Onweer gevolg deur goeie vooruitsigte

Hoewel die stormagtige weer haelskade gebring het, was daar ook goeie reën en die damme in baie gebiede is vol. “In die Langkloof is die skemadamme reeds van Maart af vol,” sê Kotze. Daarenteen was die skemadamme teen Junie 2022 slegs 52% vol.

By Glen Elgin-plaas in Grabouw het Maart die hoogste reënval sedert 1969 gehad en April en Mei het gereeld reën gehad. “Dit was in oestyd, wat dinge nie maklik gemaak het nie,” sê Bradley. “Neem in ag dat ’n groter deel van die oes nou later gebeur omdat daar ál meer cripps red-variëteite in produksie kom.”

Ceres-dorp het teen Junie 2023 reeds 828 mm reën gehad en was goed op pad om hulle totale gemiddelde jaarlikse reënval teen einde Junie te behaal.

Rooi vrugkleur was uitstekend, volgens Jacques Möhr, naoes- tegniese spesialis by Fruitways. “Daar is gewoonlik goeie kleur op gala en dan kom die hittegolwe wat die kleur op fuji, cripps pink en cripps red benadeel. Maar dit het nie hierdie jaar gebeur nie. Met die koue fronte wat heeltyd

deurkom was daar meer kneusings maar beter kleurontwikkeling.”

Sover blyk vrugfermheid effens laag te wees. “Die seisoen is begin met elke kultivar omtrent een tot twee weke voor op fermheid, maar nie op alle maatstawwe van rypheid nie. Fermheid was byvoorbeeld ver voor styselomskakeling,” berig Möhr.

Odendaal reken die stormagtige weer het in sommige gevalle vrugkwaliteit benadeel. “Die vroeë pere se houvermoë was korter en met appels, spesifiek in die Warm Bokkeveld, het meer lentisel-bitterpit voorgekom,” sê Odendaal. “Dit is waarskynlik as gevolg van die baie stikstof wat neergelaat is tydens die donderstorms in November en Desember.”

Wat uitvoer betref het die seisoen positiewe verwikkelinge gehad. Buitelandse aanvraag na vrugte het versterk en die relatiewe swak rand het pryse ’n hupstootjie gegee. Verder lyk dit asof verskepingstariewe begin stabiliseer.

“Die seisoen het moeilik begin maar soos hy aangaan lyk dit al hoe beter,” sê Odendaal. “Ons is versigtig optimisties oor die jaar se markrealisasie.”

Bradley sien uit na die komende seisoen. “Hierdie is die begin van volgende jaar se oes en die gebied het baie reën en uitmuntende koue gehad. As ek kyk na Mei was 2023 een van die beter jare vir opbouing van koue-eenhede.”

Vooruitsigte vir die kernvrugbedryf is positief, vertrou Bradley. “Ek hoop dat 2022 die laagtepunt was – dit was ’n besonder moeilike jaar. Selfs met al die uitdagings begin 2023 weer opwaarts beweeg. Dit was nie die beste jaar ooit nie maar dit was definitief ’n verbetering.”

• Vigorous growth, excellent fruit quality and widely adaptable open field variety

• The large, blocky peppers are sweet, thick-walled, and ripen from green to bright red

• Average fruit weight: 250 – 350g

Dunbar*

• Attractive fruit colour

• High-quality fruit with high yield potential

• Compact plants with a concentrated fruit set

• Vigorous plant featuring large leaves that produce excellent cover

Revelation

• Good shelf life

• Average fruit size of 10 x 10 cm

• Blocky sweet pepper

• Suitable for the fresh market

PS 16351609*

• Tolerant to Phytophthoracapsici

• Extended harvest periods

• Improved marketable yield

Last year, the Registrar of Act No. 36 of 1947 published a letter informing agricultural remedy registration holders in South Africa of his intention to prohibit the use of agricultural remedies (products) that contain one or more active ingredients or co-formulants considered to be classified as category 1A or 1B carcinogenic, mutagenic, or reproductive toxic substances (CMR), according to the Globally Harmonized System (GHS) classification system from 1 June 2024.

Soon thereafter CropLife SA (CLSA) established a working group to identify agricultural remedies containing active ingredients and/or co-formulants that could potentially be classified as substances of concern, assess the impact of the intended phase-out on the crop production industries involved and propose a procedure for the motivation of possible extended phase-out periods of certain products and uses, depending on the availability of suitable alternatives.

The relevant active ingredients and co-formulants considered as substances of concern have been identified and verified with registration holders, based on the GHS classification of their respective products. Subsequently, information on the crops and target pests, diseases, weeds, or other uses on which these active ingredients are registered were sent to each grower association that could potentially be affected.

The various grower associations identified the registered active ingredients that are currently essential for the control of specific targets, and therefore crop production, and indicated whether suitable alternative agricultural remedies are available on the market to control the identified crop-target combinations they highlighted. This feedback was then consolidated and relayed to the working group and the Registrar.

The essential active ingredients and uses identified for pome and stone fruit thus far are reported in Table 1.

CLSA request all registration holders to indicate whether possible alternative products are available to replace or partially replace the active ingredients regarded as essential to production for each grower group. This information will be treated confidentially and could include:

• alternative products for which applications for registration of the essential use have already been submitted to the Registrar’s office,

• alternative products that are already under development; or

• active ingredients that could perhaps be suitable replacements, for possible registration in.

CLSA will collate the data for discussion with the Registrar, with the aim to:

• identify suitable agricultural remedies that have been submitted or are under development for registration, for possible fast-tracking of registration; and

• agree on those active ingredients and essential uses for which derogations can be submitted to motivate an extended phase-out period while alternative solutions are sought and evaluated as potential replacements.

Note that registration holders will need to decide whether they are going to apply for derogations for extension of the phase-out of their agricultural remedies, and those registration holders that wish to participate will do so collectively via a derogation sub-group for the specific active ingredient.

The Registrar has been receiving regular updates from CropLife SA throughout the entire process, and the working group is keen to move forward with the next steps in the process, as indicated.

Hortgro have been intimately involved and continue to be involved in the process, forming part of the CropLife SA (CLSA) Working Group from the onset to ensure that pome and stone fruit essential uses are considered during the process.

Gebalanseerde gewasbestuursprogramme verhoog plante se plantgesondheid en bevorder kwaliteit gewasse. Dit is ook kostedoeltreffend en bevorder volhoubare landboupraktyke.

NexusAG se tweeledige benadering fokus op voeding en beskerming om hierdie doelwitte te bereik.

Grond- en wortelgesondheid word bestuur deur doeltreffende voedingsprogramme en is een van die belangrike aspekte wat in ag geneem word. Gesonde grond sorg vir gesonde wortels, wat ’n gesonde plant en produk tot gevolg het. Plante met gesonde wortelstelsels het ook ’n langer produktiewe leeftyd. Die belegging wat in grondgesondheid gemaak word, word gevolglik op die lang termyn só verhaal.

Gesonde grond voldoen aan drie eienskappe, naamlik chemies (voedingstof-beskikbaarheid, pH- en sout-inhoud), fisies (porositeit, waterhouvermoë en struktuur) en biologies (lewende grond-organismes).

Wanneer net een van hierdie eienskappe uit balans of onvoldoende is, kan dit lei tot sub-optimale wateropname, waterhouvermoë, grond-deurlugting en swak wortelontwikkeling.

Oesbeskerming vorm ’n integrale deel van enige produksiestelsel en derhalwe ook in die produksie van sagte vrugte. Volhoubare oesbeskerming sluit in:

• Plaagbeheermiddels moet verantwoordelik gebruik word om geen omgewings- en menslike risiko in te hou nie, opbou van weerstand onder teiken-organismes te verhoed en die middels moet voldoen aan die mark se behoeftes.

• Die oesbeskerming moet bestuur word, sodat die maksimum residu-limiete (MRL) nie oorskry word nie en dit moet vir die produsent finansieel volhoubaar wees.

• Al die produkte wat gebruik word, moet gevolglik op een of ander manier waarde toevoeg.

Onkruidbestuur is een van die noodsaaklike pilare van optimale oesbeskerming. Deur onkruide te bestuur - hetsy met onkruiddoders of deur meganiese metodes soos die gebruik van bossieslaners - het gewasse kans om beter te presteer.

Gewasprestasie verbeter omdat daar nie mededinging met onkruid is vir water en voedingstowwe nie en daar gevolglik ’n beter verspreiding van water en voedingstowwe in die wortelsone kan plaasvind. Boordhigiëne kan ook makliker toegepas word, wat lei tot doeltreffender bestuur van plae.

Die ander pilare van optimale oesbeskerming is siekte- en plaagbeheer. Suksesvolle siekte- en plaagbeheer begin by die monitering daarvan. Sommige siektes en plae moet voorkomend

behandel word, veral wanneer daar ’n geskiedenis van hierdie siektes en plae in die boorde is. Monitering is steeds noodsaaklik om te bepaal of bykomende stappe geneem moet word. Siektes kan oor die algemeen nie gekwantifiseer word nie, maar die mate van teenwoordigheid kan gebruik word as aanduiding of die huidige oesbeskermingsprogram doeltreffend is en of dit aangepas moet word. Plae is oor die algemeen meer kwantifiseerbaar - veral as lokvalle gebruik kan word. ’n Ander manier om plae te kwantifiseer is deur infestasie-monitering.

Die besluit om plaagbeheer te doen kan geskoei word op:

• Ekonomiese skadevlak (ESV): Die vlak van besmetting is van so ’n aard dat die beheer daarvan gelykstaande is aan die skade wat dit aan die vrugte aanrig; of

• die Ekonomiese drumpelwaarde (ED): Die punt waar die siekte of plaag beheer moet word, voordat dit die ESV bereik.

Drempelwaardes is nie beskikbaar vir alle siektes en plae nie, maar indien dit beskikbaar is kan dit as riglyn gebruik word. Ander faktore wat ook in ag geneem moet word is byvoorbeeld:

• Die tyd van die seisoen – plae kan in sekere tye van die seisoen meer skade veroorsaak.

• Die teikenmark – produkkeuse gaan bepaal of daar ’n aanvaarbare chemiese residu gaan wees of nie. Sekere markte het ook spesifieke fitosanitêre vereistes.

• Die kultivar en vrugtipe – sommige kultivars is minder vatbaar vir sekere siektes en plae.

• Die doeltreffendheid van beskikbare plaagdoders – sekere plaagdoders is doeltreffender as ander of is meer geskik gedurende sekere tye van die seisoen.

NexusAG spesialiseer in omvattende gewasbestuurprogramme wat voeding en oesbeskerming integreer. Dit is die kritiese skakel in die waardeketting tussen top internasionale en nasionale verskaffers van landbouverwante produkte en -dienste en die produsent regdeur die produksiesiklus.

Kontak ’n NexusAG Croplife-geakkrediteerde gewasadviseur vir meer inligting oor volhoubare gewasbestuur van sagte vrugte by 021 860 8040 of besoek www.nexusag.net.

NexusAG spesialiseer in omva ende gewasbestuurprogramme wat voeding en oesbeskerming integreer met toegang tot top internasionale en nasionale verskaffers van landbouverwante produkte en -dienste wat produsente regdeur die produksiesiklus ondersteun.

INSEK- EN PLAAGBEHEERPROGRAMME

• Spuitprogramme en deurlopende bestuur

• Gewasbeskermingsriglyne

BEMESTING

• Bemestingsprogramme vir opbrengs en kwaliteit

• Blaarvoedingsprogramme

• Grondontledings- en regstellings

• Vrugontledings

• Blaarontledings- en regstellings

PLANT- EN HORTOLOGIESE ONDERSTEUNING

• Boordvloer bestuur

• Besproeiingskedulering

• Plantgroeireguleerders, mikrobes en biostimulante vir opbrengs en kwaliteit

BEROKING

• NexFUME berook met `n unieke produkformulasie

WATER- EN KOMPOSONTLEDINGS

• Interpretasie en aanbevelings

GRONDKARTERING

• Regstellings-aanbeveling

• Blokontwerp en dreinering

• Fisiese en chemiese eienskappe

Kontak gerus u naaste NexusAG Croplife-geakkrediteerde gewasadviseur met navrae oor doelgemaakte gewasbestuursprogramme, wat u unieke omgewing en spesifieke omstandighede in ag neem, om volhoubare oplossings vir u boerdery te bied.

Whether it be a commercial pepper farmer or a small-scale grower, it would be wise to gain some knowledge on the fertilization of pepper crops and how this can affect the outcome of a crop to achieve maximum yields and quality.

Nitrogen is one of the nutrients that are often not fully understood and therefore overused. It is an essential nutrient for plant growth and is particularly important for leaf development, chlorophyll production, and overall plant vigour. It also plays a crucial role in reproductive processes, such as flower development and fruit set.

Inorganic nitrogen fertilizers are typically water-soluble and provide readily available nitrogen to plants. Common examples include ammonium nitrate, urea, and ammonium sulphate. These fertilizers deliver nitrogen in their ionic forms (ammonium and nitrate) that are easily taken up by plant roots.

Ammonium nitrogen promotes vegetative growth, while nitrate nitrogen is associated with flowering and fruiting processes. High levels of ammonium nitrogen can inhibit fruit set and reduce overall fruit quality in some crops, including peppers. Therefore, it is important to maintain a balanced ratio of ammonium to nitrate nitrogen sources when using inorganic fertilizers.

Organic sources of nitrogen are derived from compost, manure, or other plant or animal by-products. These fertilizers release nitrogen slowly as they break down, providing plants with a more sustained nutrient supply.

Organic nitrogen sources can improve soil fertility, enhance microbial activity, and promote plant health. However, nitrogen availability from organic fertilizers is typically lower than inorganic fertilizers. This slower release rate may delay the onset of flowering and fruiting, but it can also result in improved fruit quality.

The choice of nitrogen fertilizer type should consider the specific requirements of pepper plants. It is generally recommended to use a balanced approach that incorporates both inorganic and organic nitrogen sources. This can provide an initial boost of readily available nitrogen from inorganic fertilizers to support vegetative growth and early flowering, combined with the long-term nutrient release and soil-building benefits of organic fertilizers.

Additionally, other factors such as overall nutrient balance, soil pH, and environmental conditions (temperature, humidity,

light) also influence pepper growth and fruit set. It is important to consider these factors in conjunction with the nitrogen source to optimise plant performance and maximise fruit production.

Nitrate nitrogen (NO3-) is a highly mobile form of nitrogen in the soil and readily available to plant roots. Pepper plants can efficiently absorb nitrate nitrogen, especially in well-aerated soils. It is quickly taken up and transported to various plant parts, including leaves, stems, flowers and fruits.

Nitrate nitrogen promotes vegetative growth in plants, including leaf development, stem elongation and overall plant vigour. It is associated with the synthesis of proteins, chlorophyll and other plant compounds necessary for photosynthesis and energy production. In peppers, nitrate nitrogen plays a role in flower development and fruit set. Nitrate nitrogen has a neutral effect on soil pH, meaning it does not significantly alter the pH of the growing medium - this makes it suitable for a wide range of soil types.

Ammonium nitrogen (NH4+) is less mobile in the soil compared to nitrate nitrogen. It tends to stay close to the root zone and is taken up by plant roots through active transport processes. The ammonium nitrogen availability depends on soil pH, with acidic soils favouring its retention. If the soil pH is high (alkaline), ammonium can convert to ammonia gas (NH3) and be lost to the atmosphere. Ammonium nitrogen can have both positive and negative effects on plants, depending on its concentration.

Moderate levels of ammonium nitrogen can promote root development and enhance plant resilience to certain stresses. However, excessive amounts of ammonium nitrogen can be detrimental to pepper plants. High concentrations of ammonium nitrogen can inhibit the uptake of other essential nutrients like potassium and magnesium. It can also lead to an imbalance in pH, affecting overall plant health and fruit development. Ammonium nitrogen has an acidifying effect on the soil pH. When ammonium nitrogen is taken up by plants, it releases hydrogen ions (H+), which can lower the pH of the surrounding soil. This can be advantageous in alkaline soils but may cause issues if soil pH becomes excessively acidic.

In practical terms, using a balanced fertilizer that provides both nitrate and ammonium nitrogen is often recommended. This helps maintain a suitable nitrogen ratio for optimal plant growth and fruit set. Nitrate nitrogen contributes to overall plant development and flowering, while ammonium nitrogen can support root development and stress tolerance.

The appropriate ratio may vary depending on factors such as soil conditions, plant growth stage and specific nutritional needs of the pepper plants.

The impact of nitrogen source on pepper shelf life is not directly related to the source itself but rather to the overall plant health and fruit quality influenced by nitrogen nutrition. Adequate nitrogen nutrition can contribute to the development of healthy, high-quality peppers, which in turn can affect their shelf life.

The importance of nitrogen to the pepper plant Nitrogen is essential for plant growth and vigour. A balanced supply of nitrogen promotes the production of healthy foliage, strong stems and a robust root system. Plants with adequate nitrogen nutrition are generally more resistant to pests, diseases and environmental stresses. By promoting overall plant health, the proper nitrogen source can indirectly contribute to longer shelf life by reducing the likelihood of premature decay or damage.

Nitrogen availability can influence the quality attributes of peppers, including their texture, colour, flavour and nutritional content. Optimal nitrogen nutrition can result in well-developed, firm and visually appealing fruits. On the other hand, imbalances in nitrogen supply or excessive nitrogen can lead to poor fruit quality, such as softness, discolouration, or uneven ripening, which can negatively impact shelf life.

Nitrogen availability during the growth stage can influence post-harvest physiology, which can affect shelf life. Nitrogen plays a role in the synthesis and accumulation of certain compounds in peppers, such as antioxidants, sugars and organic acids. These compounds contribute to fruit flavour, aroma and storage characteristics. Therefore, an appropriate nitrogen source that supports the production of desirable post-harvest compounds can indirectly enhance pepper shelf life.

It is important to note that while nitrogen nutrition is crucial, an excessive supply of nitrogen can have negative effects on pepper shelf life. High nitrogen levels can lead to increased

vegetative growth at the expense of fruit development and quality. It can also result in softer fruits, higher susceptibility to diseases and reduced shelf life. Therefore, it is essential to provide the appropriate amount and balance of nitrogen to ensure optimal plant health and fruit quality without overstimulating vegetative growth.

BRASSICAS

A balanced nitrogen supply that promotes healthy growth, high-quality fruits and appropriate post-harvest characteristics are key to maximising pepper shelf life.

While nitrogen is essential for plant growth, excessive nitrogen can lead to excessive vegetative growth at the expense of fruit set. High nitrogen levels can result in lush foliage but fewer flowers and fruits. Ensure a balanced fertilizer application with appropriate nitrogen levels to support both vegetative growth and fruit production.

Pepper plants thrive in warm temperatures and require plenty of sunlight to support fruit set. Ensure that pepper plants receive at least six to eight hours of direct sunlight each day. Maintain a suitable temperature range for fruit set, typically between 21 and 29 °C. Avoid extreme temperature fluctuations and provide protection from frost or cold spells.

Proper irrigation is crucial for fruit set in pepper plants. Inconsistent watering can lead to stress and blossom drop. Water the pepper plants regularly, aiming for moist, well-drained soil. Avoid overwatering, as excessively wet conditions can also negatively impact fruit set.

Pepper plants require pollination for a successful fruit set. If the producer notice a lack of pollinators or poor fruit set despite following the above practices there are several practices to optimise pollination and provide favourable conditions for fruit development.

Producers can resort to hand pollination. Gently transfer pollen from the stamen (male part) to the stigma (female part) using a small brush or cotton swab. Gently brush the inside of the flower, transferring pollen from multiple flowers to increase the chances of successful pollination.

Pollinators such as bees can be encouraged to visit pepper plants by creating a pollinator-friendly environment. Planting flowering plants nearby or providing nesting sites for bees can help attract pollinators to the pepper field. Avoid using pesticides that are harmful to bees and other beneficial insects.

Good air circulation can aid in pollination and fruit set. Proper spacing between pepper plants allows for better airflow and facilitates the movement of pollen from the flowers to the stigma. This can be particularly important in greenhouse or indoor settings where the natural wind is limited. If growing peppers indoors, fans can be used to simulate airflow and enhance pollination.

Pepper flowers have a unique pollination mechanism known as self-pollination, where pollen is transferred from the anthers to the stigma within the same flower. This can be facilitated by gently shaking the pepper plants. The vibration can dislodge pollen from the anthers and increase the chances of pollination within the flower.

To increase fruit wall thickness in peppers, focus on providing the right cultural practices, nutrient management and environmental conditions that promote healthy fruit development.

Here are some strategies to help increase fruit wall thickness:

• Ensure that the soil is well-balanced in terms of essential

nutrients, especially phosphorus (P) and potassium (K). Phosphorus supports fruit development and overall plant vigour, while potassium enhances fruit quality and thickness. Conduct a soil test to determine nutrient deficiencies and amend the soil accordingly with organic matter or fertilizers to meet the crop's nutritional requirements.

• Adequate and consistent moisture levels are crucial for fruit development and wall thickness. Irregular watering, both under- and over-watering, can negatively impact fruit quality. Aim to keep the soil evenly moist throughout the growing season, particularly during fruit formation and enlargement. Mulching around the plants can help retain soil moisture and reduce water stress.

• While nitrogen is essential for plant growth, excessive nitrogen can promote excessive vegetative growth at the expense of fruit development. High nitrogen levels can result in thin-walled fruits. Focus on a balanced fertilization approach, providing sufficient nitrogen to support plant growth without promoting excessive foliage.

• Peppers require warm temperatures and ample sunlight for proper fruit development.

• Heavy fruit loads can sometimes lead to thin walls due to the strain on the plant. Using stakes and trellising to provide support to the plants can help distribute the weight of the fruits and prevent them from dragging down the stems. This support can reduce stress on the plant and promote thicker fruit walls.

• In cases where there is a high fruit set on pepper plants, it

may be beneficial to thin out the fruits. Thinning involves selectively removing excess fruits to ensure that the remaining fruits have enough space and resources to develop properly. Thinning encourages larger and thicker-walled fruits by redirecting the plants' energy toward the remaining fruits.

• The genetic characteristics of the pepper variety also play a role in determining fruit wall thickness. Some pepper varieties naturally have thinner walls than others. By selecting varieties known for thicker fruit walls and implementing the above practices, the likelihood of producing peppers with thicker, more desirable fruit walls increases. Peppers, like tomatoes, alternate between vegetative and reproductive phases, enabling multiple harvests. This is why it is so important to ensure that the right variety is selected and that the balance between nutrients is always kept in check.

For more information on the production practices of peppers as well as selecting the right variety for an area, visit the Sakata website at www.sakata.co.za

DISCLAIMER: This information is based on observations and/or information from other sources. As crop performance depends on the interaction between the genetic potential of the seed, its physiological characteristics, and the environment, including management, no warranty is given express or implied, for the performance of crops relative to the information given nor do Sakata accept any liability for any loss, direct or consequential, that may arise from whatsoever cause.

With new trade agreements with Asian or Middle Eastern markets still many years away, it is in South Africa’s interests to preserve access to traditional markets.

Wolfe Braude AGBIZ FRUITSouth Africa currently enjoys valuable preferential access to mainly traditional markets – the EU, UK, USA, Africa and some South American countries (under Mercosur). In the equally lucrative and fast-growing South and East Asian region, only one agreement potentially exists - a preferential trade agreement with India that remains under negotiation. No trade agreements exist with Middle Eastern states. However, government maintains close relationships with most markets in these regions and efforts continue to deepen trade.

Preferential access is the first prize of trade, it bilaterally removes tariffs, and usually incorporates a set of binding protocols and agreements that enhance trade and cooperation, remove obstacles to current trade and include mechanisms for dealing with disagreements.

Overall, SA agri products are exported globally as follows: Africa 37%, Asia 27%, EU 19%, Americas 7%, and the rest of world (including the UK which comprises over half of this) makes up 10%. The main export crops comprise maize, wine, grapes, citrus, berries, nuts, apples and pears, sugar, avocados, and wool. SA now exports roughly half of its agricultural produce in value terms. The industry, therefore, needs exports to maintain revenue, economies of scale, and thereby jobs and domestic product affordability. Placing exports at risk is to place agri jobs and indirectly domestic food security at risk.

Total SA exports to the US (including non-agricultural products) grew by 16% between 2017 and 2022 and comprised 11% of total SA exports in 2021.

African Growth and Opportunity Act (AGOA) essentially expanded a unilateral preferential tariff regime called the generalised system of preferences (GSP), which was launched by key developed markets under the UN conference on trade and development (UNCTAD) in the early 1970s. The concept was that extending such unilateral duty-free access would create an enabling trading environment for developing countries.

The following countries grant GSP preferences: Australia, Belarus, Canada, the European Union, Iceland, Japan, New Zealand, Norway, the Russian Federation, Switzerland, Turkey, and the USA. South Africa is a beneficiary under GSP programmes run by Japan, Russia, Turkey and traditionally the USA. Like AGOA, the GSP is not a trade agreement, but rather a unilateral benefit offered to less economically developed countries, allowing these countries to increase and diversify their trade with the USA. It is not restricted to African countries, however.

Both GSP and AGOA operate according to a set of eligibility criteria, and can therefore be withdrawn if a recipient country breaches such criteria. The US GSP criteria broadly comprise:

• enforcing arbitral awards;

• not having nationalised, expropriated or otherwise seized property of US citizens or corporations without providing, or taking steps to provide effective compensation;

• taking steps to afford internationally recognised worker rights;

• implementing commitments to eliminate the worst forms of child labour; and

• the extent to which a country provides adequate and effective protection of intellectual property rights.

More than 5 000 products are eligible for duty-free access under the US GSP programme. It must be noted though that the US GSP is currently not active. It expired in December 2020. The programme is usually extended for two to three years at a time. The GSP programme has lapsed prior to its reauthorisation in 10 of the 14 times it was extended though.

A sizeable group within congress is actively lobbying for its renewal, noting that the absence of GSP makes useful imports more expensive for US firms, and decreases US competitiveness and attractiveness vs China. Several bills to reauthorise GSP have been introduced to congress. The president holds the primary authority for GSP but a trade policy staff committee administers GSP and provides annual country review recommendations to the President.

AGOA extended the preferences to nearly all of Sub-Saharan Africa, adding duty-free access to the US market for over 1 800 products, in addition to the GSP products. Since its enactment in 2000, AGOA has been at the core of US economic policy and commercial engagement with Africa. Thirty-five countries were eligible for AGOA benefits in 2023. The eligibility criteria for GSP and AGOA have a large degree of overlap, and countries must be GSP-eligible in order to receive AGOA’s trade benefits. A number of countries have lost and then regained AGOA eligibility over the years AGOA has been in force. For example Cote d’Ivoire, Guinea, Niger, Swaziland, and The Gambia.

AGOA eligibility criteria cover issues such as:

• Firstly a market-based economy, rule of law and political pluralism, elimination of barriers to US trade and investment, developmental economic policies, a system to combat corruption and bribery, and protection of internationally recognised worker rights.

• Secondly, it does not engage in activities that undermine US national security or foreign policy interests.

• Thirdly it does not engage in gross violations of internation-

Table

1.