$ 5.7 Billion Assets

Locations #1 $ 2.1 Billion Wealth Assets Served Purchase mortgage market share on Cape Cod, Nantucket and in Plymouth OUR MISSION ENRICHING LIVES.

Our mission is simply stated, but there’s so much meaning behind it. We work each day to enrich the lives of those we serve – from supporting the financial health of our clients to helping to sustain the vibrancy and vitality of our communities to creating meaningful opportunities for our colleagues.

$ 1.8 Million Community Giving

Deposit market share in Barnstable County

548 Employees

170 Years serving our communities

OUR VALUES

As we carry out our mission, Cape Cod 5’s values are ingrained in every aspect of our business and guide us in each interaction we have with our clients, colleagues and communities.

• Integrity

• Respect

• Collaboration

• Inclusivity

• Care

Looking back at 2024, a year of economic shifts, evolving regulations and rapid technological advancements, Cape Cod 5’s commitment to partnership – with our clients, colleagues and community members – has never been more important. Through the many partnerships that we have cultivated in the industry, in our communities and within our own organization, we recognize that we are undeniably stronger together. And that strength is what supports the Bank and ensures we’re able to carry on into the future.

The past year presented a challenging external environment and mixed economic conditions, marked with highs and lows that impacted individuals, families and businesses across the region. Locally, housing and labor shortages persisted while inflationary pressures continued to impact household budgets and business operations. The Federal Reserve maintained a cautious approach to interest rates, balancing inflation control with the need to support economic growth. Meanwhile, the banking industry remained under heightened regulatory scrutiny, with banks focused on strengthening compliance, risk management and capital resilience while also navigating the complexities of the interest rate environment.

Through all of this, our team remained focused on our mission: to enrich lives, empower our clients, support local businesses and invest in the well-being of the communities we serve.

We recognize that consumers and businesses expect seamless, secure and convenient financial experiences, and we are committed to rising to those expectations. Throughout the year, we continued to strengthen our relationships and enhance the ways that we reach our clients – however they choose to bank with us. We expanded access to flexible credit options through the introduction of a fully digital small business loan process so that business owners can apply for funding anytime and from anywhere. We invested in digital banking enhancements to provide easier, more convenient money management tools for clients. In addition, we have made improvements in our physical space to offer more comfort and convenience for our clients. We also grew our efforts to provide financial education to our clients and throughout our communities, reaching individuals and businesses at all stages in their financial journeys.

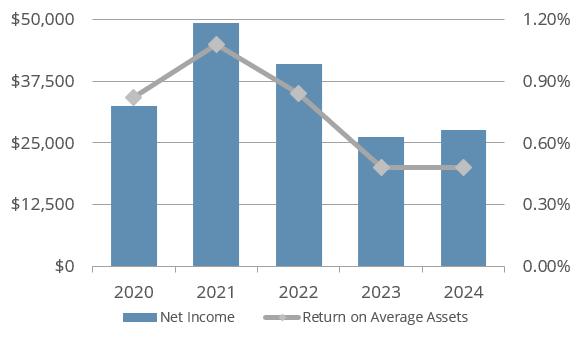

With this expansion of offerings, growth in our consumer and business client relationships and continued prudent financial management, Cape Cod 5 is stronger than ever and we are well positioned to remain a trusted resource for our clients and communities. Working together with colleagues across the institution, Cape Cod 5 achieved $27.5 million in net income, providing for a return on average assets of 0.49%.

With security and safety always top of mind, we continued to enhance the ways that we safeguard data, protect the Bank’s and our clients’ information, as well as offer tools for clients to safeguard themselves against continually emerging threats. We also continued to provide options for 100% FDIC insurance, so that clients can feel confident in the safety of their deposits with Cape Cod 5. Steve Johannessen, Chief Financial Officer, provides additional details about the Bank’s financial strength later in this report.

To support our continued growth, in 2024, Cape Cod 5 formalized its partnership with Fidelity Co-Operative Bank, a community bank headquartered in Leominster, MA. With both organizations under our holding company, Mutual Bancorp, we are able to take advantage of added strength through scale and diversification, as well as through leveraging shared services of our operational support teams and technology. Our focus is to enable each bank to even more effectively serve their unique communities and clients.

Cape Cod 5’s financial strength also enables us to continue to give back throughout our communities on Cape Cod, the Islands and in Southeastern Massachusetts, as being a responsible corporate citizen is a core part of who we are. In 2024, we continued to use our resources to help address key issues affecting our region. These efforts included offering products and services that are accessible and affordable, supporting our colleagues in their individual community efforts, volunteering their time, participating in events, and serving on community boards for organizations that are making a meaningful impact in our region. During 2024, Cape Cod 5 was proud to contribute over $1.8 million in sponsorships and grants to community organizations, helping to support the vitality and vibrancy of our region.

Finally, as a leadership team, we maintained focus on fostering a workplace where colleagues

feel supported, know they have a voice, and recognize a shared commitment to helping others. Their passion and dedication is evident in each interaction with clients and community members. We continue to support their growth with programs like our Leadership Academy, which launched in 2024 to further develop future leaders at the Bank. This year, we were proud to be recognized nationally and locally as a top employer for the seventh year in a row.

Throughout this report, you’ll see highlights from Cape Cod 5’s accomplishments in 2024, which were carried out by our team working together towards our mission.

As we look ahead, we do so with confidence –knowing that together, we will continue to help build a greater future for our clients, colleagues and communities.

Thank you for the trust that you continue to place in Cape Cod 5. If ever we can be of assistance, please reach out. We are, and always will be, Stronger Together.

MATTHEW S. BURKE CHAIRMAN & CEO OF CAPE COD 5 AND MUTUAL BANCORP

At Cape Cod 5, we believe financial strength isn’t built alone - it’s built together. From saving for a home to working toward retirement or planning for the future, everyone deserves a financial partner they can trust. That’s why we’re committed to providing the tools, guidance and personal service that empower our clients to achieve their goals. Whether it’s helping a first-time homebuyer secure a mortgage, guiding a young professional in building credit, or supporting a family in planning for long-term security, we are here - every step of the way.

Our commitment goes beyond transactions; it’s about relationships. We know that financial confidence grows when people have access to the right resources and a banking partner that truly cares. By working together, we help our clients build not just stability, but a stronger, more secure future. Because at Cape Cod 5, we are - and always will be - Stronger Together.

“As a new business, I feel like Cape Cod 5 genuinely cares about our success, and I feel like they value us as a customer as much as I value them as our bank. Cape Cod 5 provides personal and professional services with a friendly and welcoming atmosphere. They are truly about building relationships that help make dreams come true.”

CHRISTINA AND DAVID BUNDA STUZZI

We introduced SaveUp to help clients grow their savings automatically by rounding up purchases made using their debit card and transferring that amount to savings.

In 2024, we opened our new location on Commerce Way in Plymouth in addition to our expanded location in The Pinehills, enabling all of our business lines to better serve individuals and businesses in Southeastern MA from this state-ofthe-art facility.

We expanded financial education programs, offered flexible solutions to finance a home purchase or renovation, and enhanced digital banking tools to make managing money easier and more accessible.

At Cape Cod 5, we know that strong businesses create strong communities. That’s why we’re committed to being more than just a bank—we’re a trusted financial partner, dedicated to helping businesses of all sizes thrive. Whether it’s a local startup looking for its first loan, a family-owned business planning for the next generation, or an expanding company seeking new opportunities, we provide the financial solutions and personalized support to fuel success.

We launched a fully digital business loan application to enable local business owners to apply for financing anytime, from anywhere.

“Cape Cod 5 has improved our business operations by consolidating our banking relationships under one umbrella. We now process our payroll, credit cards, operating accounts and business tax obligations with Cape Cod 5. The combination of having a local branch and the convenience of mobile banking ensures timely processing of financial transactions.”

PETER MALONE SEAPORT SHUTTER COMPANY

We’ve partnered with local businesses to offer workplace banking and financial education wellness initiatives for their employees, with tailored services and resources to empower them on their financial journey.

“Cape Cod 5 is not your typical bank or business lender – they are true partners. While helping me navigate the complexities of securing a loan, they took the time to understand my business plan, financial situation and vision for the future. Their friendly, professional and knowledgeable Plymouth team makes daily banking enjoyable, plus their mobile app lets me conveniently manage my accounts on the go.”

ERIK DAIGLE BLUEFISH RIVER TAVERN

In 2024, we continued to strengthen our commitment to businesses by enhancing our tailored solutions with a new fully digital loan application so that you can apply at your convenience; merchant services backed by your trusted local team; treasury management offerings to make managing your finances simpler; security tools to protect what you’ve worked so hard to build; and expert guidance to navigate an evolving economy. Our team understands the challenges business owners and operators face, and we work side by side with you to provide the stability, flexibility, and resources that you need to grow with confidence.

By partnering with local businesses, we help create jobs, drive innovation and build a more prosperous community. Together, we’re not just supporting businesses – we’re strengthening the foundation of our local economy. Because when businesses succeed, we all do. At Cape Cod 5, we are – and always will be – Stronger Together.

5 FOCUS AREAS OF NEED

Accessible Housing

Education & Enrichment

Economic Stability

Environmental Stewardship

Community Health, Human Need and Veterans’ Needs

STRONGER TOGETHER.

At Cape Cod 5, we believe that a strong community is built through partnership, service and a shared commitment to making a difference. That’s why we go beyond banking to invest in the communities where we live and work – because healthy and vibrant communities allow everyone to rise. We utilize what we refer to as our Five Ways to positively impact our region: community banking; responsible business practices; advancement of financial know-how; corporate leadership & volunteerism; and philanthropy.

“At Cape Cod 5, community engagement isn’t just something we do - it’s who we are. Every year, we’re proud to give back in meaningful ways, staying true to what it means to be an active member of our community. Through partnerships with local organizations and the incredible dedication of our colleagues - who volunteer thousands of hours of their own time - we’re working together to make a continued positive impact.”

ROBERT A. TALERMAN PRESIDENT, CAPE COD 5

$1.8 Million Community Giving

5,152 people reached through financial and fraud prevention education events

$30,000 Employee Voted Grants

Real impact happens when people come together with a shared purpose. By partnering with local organizations, listening to community needs, and actively contributing our time and resources, we help create opportunities and lasting change. Because at Cape Cod 5, we know that we are – and always will be – Stronger Together.

In 2024, we deepened our commitment to community engagement by investing in local initiatives, expanding financial literacy programs, and increasing volunteer efforts. Whether it’s advocating for small businesses, funding affordable housing projects, or volunteering at local nonprofits, our team is dedicated to strengthening the places we call home.

At Cape Cod 5, our employees are at the heart of everything we do. Their dedication, expertise and passion drive our ability to serve clients and strengthen communities. That’s why we are committed to fostering a workplace where our team members feel valued, supported and empowered to grow – both professionally and personally.

In 2024, we continued to invest in our colleagues by enhancing professional development programs, expanding benefits, and fostering a culture of collaboration and inclusivity. From leadership training to wellness initiatives, we prioritize the well-being and success of our team, knowing that when our people thrive, they can even more effectively carry out our mission.

“The best part of working at Cape Cod 5 for me, aside from our dedication to our clients and communities, is the feeling that everyone wants to help me learn and grow and advance my career. There is such a great community feel, and everyone is rooting for you. They also care about work-life balance and family needs, and to me that speaks volumes.”

CAPE COD 5

EMPLOYEE

By working together, we create an environment where innovation, integrity and service excellence flourish. Because at Cape Cod 5, we know that our strength isn’t just in the services we offer – it’s in the people who care and bring them to life every day. We are – and always will be – Stronger Together.

Cape Cod 5 continued to be recognized locally, regionally and nationally as a top employer and workplace

Several colleagues received awards and accolades for their leadership and community commitment

The Bank continued to support the ongoing education and development of our colleagues, including pursuing degrees and advanced certifications

We introduced the Leadership Academy to continue fostering development for future leaders across the organization.

We employed 61 interns from 37 different colleges in roles throughout the organization. Our extensive internship program, along with the opportunities it provides for participants, was recognized by Vault as a Top Intern Program in the country.

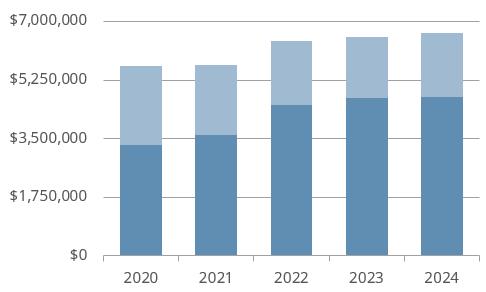

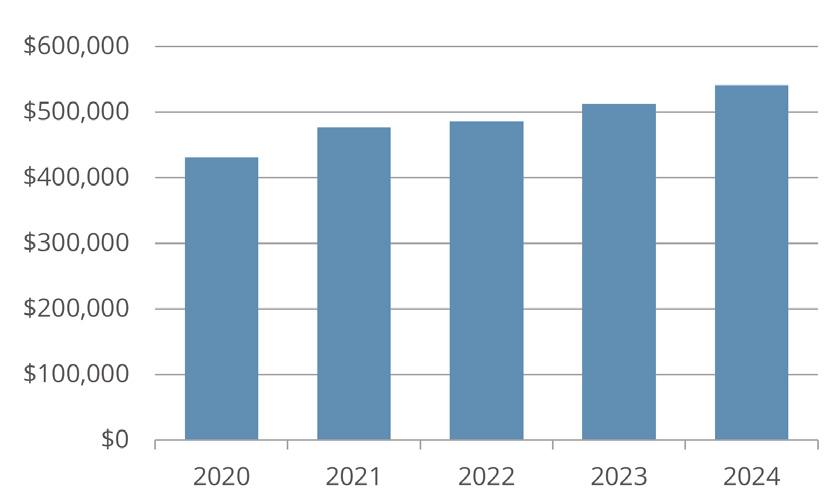

The continuation of a challenging external environment translated to a difficult year for the industry, with most community banks experiencing a pullback in financial results. Cape Cod 5’s proactive approach to managing the risks presented by this environment translated to enhanced financial performance achieved through prudent financial strategies, careful management of operating costs, and collaborative efforts across the Bank to effectively serve clients and grow relationships.

The key results for the Bank and business lines highlighted below are illustrative of the outcomes from our team’s focus on serving as trusted advisors, providing individuals and businesses with sound guidance while offering the products, services and know-how needed to reach their financial goals.

• Financial Performance: Achieved $27.5 million in net income, a 5.0% increase from prior year and exceeding budgeted expectations.

• Asset Growth: Total assets reached $5.7 billion, while the combined assets of Cape Cod 5 and Fidelity Bank totaled $7.2 billion, making the consolidated organization the 7th largest mutual bank in the country.

• Credit: Maintained strong credit quality with non-performing assets totaling just 0.25%, while experiencing minimal loan losses during the year.

• Capital Position: Increased the total risk-based capital ratio to 16.65%, putting Cape Cod 5 in the top 25% nationally and signifying the strength of the Bank’s balance sheet.

* The Cape Cod Five Cents Savings Bank unaudited financial statements

• Business Line Results:

Retained the #1 deposit market share, holding 25.8% of FDIC deposits in our service areas.

Achieved #1 overall residential market share in the markets we serve.

Grew commercial loans 3.1%, exceeding the national average, and reflecting an expanding client base.

New relationship growth and strong market performance drove wealth assets to $2.1 billion, marking an all-time high for the institution.

• Community Commitment: Contributed $1.8 million to community organizations through sponsorships and foundation grants. Looking ahead, our financial strength – combined with the efficiencies and opportunities from our partnership with Fidelity Bank – positions Cape Cod 5 for continued growth and long-term stability. Years Ended December 31, 2024 2023

OFFICER,

Matthew S. Burke, Chairman and Chief Executive Officer

Robert A. Talerman, President

Emilie L. Bajorek, Senior Vice President of Communications

Paul R. Bernier, Senior Vice President, Chief Auditor

Mandee S. Blair, Vice President, Director of Relationship Management

James L. Botsford, Senior Vice President, Manager, Senior Financial Advisor

Liam Cahill, Senior Vice President, Director of Residential Lending Operations

Alison B. Czuchra, Senior Vice President, Chief Fiduciary Officer

Kristen M. Foresta, Senior Vice President, Treasurer

Kimberly J. Geary, Senior Vice President, Director of Residential Sales & Production

Elizabeth S. Hammann, Senior Vice President, Chief Information Security Officer

Kimberly A. Howes, Vice President of Retail Services

Timothy F. Kelleher III, Senior Vice President, Chief Commercial Lending Officer

Stephen H. Johannessen, First Executive Vice President, Chief Financial Officer

Laura E. Newstead, First Executive Vice President, Chief Human Resources Officer

Christopher E. Richards, First Executive Vice President, Chief Banking Services Officer

Michael S. Kiceluk, Senior Vice President, Chief Investment Officer

Joseph R. King, Senior Vice President, Trust Administration and Compliance Officer

Christopher D. Langlais, Senior Vice President, Regional Manager Commercial Loan Officer

Christina L. Mallard, Vice President, Director of RCL Administration

Melissa V. Maranda, Vice President, Director of Treasury Management

Patrick J. McCue, Vice President, Director of Finance; Assistant Treasurer

Kevin A. Mooney, Senior Vice President, Chief Technology Officer

Stephen C. Peck, Senior Vice President, Regional Manager Commercial Loan Officer

Andrea L. Ponte, Senior Vice President, Chief Operational Services Officer

Deborah L. Potter, Vice President, Director of Project Management

Stephanie M. Dennehy, Executive Vice President, Chief Marketing Officer

Vanessa L. Greene, Executive Vice President, Chief Risk Officer

Eleanor P. Williams Executive Vice President, General Counsel

Christopher W. Raber, Senior Vice President, Chief Real Estate Officer

Robert E. Reisner, Senior Vice President, Regional Manager Commercial Loan Officer

Aisling C. Ross, Vice President, Director of Talent Management

Melanie J. Sabin, Senior Vice President, Regional Manager Commercial Loan Officer

Adrian M. Sullivan, Senior Vice President, Chief Digital Officer

Scott D. Vandersall, Senior Vice President, Regional Manager Commercial Loan Officer

Angelique K. Viamari, Senior Vice President of Governance

Taryn M. Wilson, Senior Vice President, Chief Financial Crimes Officer

Matthew S. Burke, Chairman

Karen L. Gardner, Vice Chair

Jane M. Coderre

John C. Dawley

Darren J. Donovan

Paul E. Grover

John J. Judge

Edward F. Manzi, Jr.

James A. Peterson

Melissa D. Philbrick

Paul K. Rumul

Tammy A. Saben

Robert A. Talerman

Denise M. Toomey

Daniel A. Wolf

Alan L. Agnelli

Christopher A. Aguillar

Robert C. Alario

John H. Allen

Shawn J. Almeida

Barbara Stone Amidon

Kenneth P. Basque

Rebecca A. Beaton

Paul B. Bergquist

Melane Bisbas

Karen L. Bissonnette

Jitka Borowick

Guy H. Boyer

Joel J. Brickman

Winfield S. Brown

Matthew S. Burke*

Lyle B. Butts

Howard C. Cahoon, Jr.

Matthew J. CampoBasso

F. Timothy Carroll

Carl F. Cavossa, Jr.

Robert C. Chamberlain

Janet S. Chambers

Olive Chase

Brian J. Cirelli

Jay H. Coburn

Jane M. Coderre

Alvin B. Collins*

Carolyn M. Comandich

Geoghan E. Coogan

Paul J. Covell

Robert D. Crane, Jr.

John C. Dawley*

Shawn M. DeLude

Benjamin W. deRuyter

Penelope Dey

David H. Doherty

William A. Doherty, Jr.

Darren J. Donovan

Stephen L. Doyle

Lawrence F. Drago

Michael A. Dunning

Carolee Eaton

Sheila O’Brien Egan

Deborah J. Ekstrom

Thomas A. Eldredge

Thomas M. Evans

Diane E. Falla

John P. Farrell

Steven R. Fedele

Charran Fisher

John M. Flick

Bruce M. Forman

Melinda S. Gallant

Karen L. Gardner*

Margaret A. Geist

Paul E. Grover

Joseph D. Guercio

Jody Guetter

Lisa C. Guyon

Wendy R. Harman

Frank J. Harrison

G. Howard Hayes

Daniel B. Haynes

P. Jean Hebert

Joseph C. Jasie

Christopher J. Joyce

John J. Judge

Peter W. Karlson

Mark Kavanagh

Devon A. Kinnard

Linda Kosinski

Deborah LaPointe

Chester N. Lay

Eileen M. Leary

James F. Leighton

Jo-Ann M. LeMoine

Geoffrey F. Lenk

Richard J. Leonard

Patricia A. Leonhardt

William G. Litchfield

Nancy S. Lowery

J. Bruce MacGregor

Robert A. Maffei

George W. Malloy

Edward F. Manzi, Jr.*

Linda Ann Markham

Brent Maugel

Christopher W. McCarthy

Edward J. McLaughlin, Jr.

Christopher J. Megan

Ann E. Meilus

Thomas M. Mertzic

Bruce D. Miller

Charisse Murphy

Carey M. Murphy

Susan L. Nickerson

Mark J. Novota

David R. Ojerholm

Liz E. Olivera-Mustard

Michael D. O’Neal

David I. Oppenheim

Enrico W. Palmerino

Paulo Vitor P. Paraguay

Katherine Fulham Parcels

Joan S. Pena

James A. Peterson

Laura Lorusso Peterson

Wayne D. Petty

Melissa D. Philbrick

C. Deborah Phillips

Robert Pillsbury Jr.

Diana C. Pisciotta

Sherri G. Pitcher

Debra Pochini

Frederic B. Presbrey

Paul T. Przybyla

Melanie M. Rabeni

Kurt E. Raber

Francie Randolph

Kenneth Ricker

John C. Ricotta

Cynthia Ring

Mary C. Ritter*

John A. Roberts, III

David T. Robinson

Mark H. Robinson

Paul K. Rumul

Tammy A. Saben

R. Joseph L. Salois*

Dorothy A. Savarese

Judith Walden Scarafile

Lisa F. Sherman

Carol W. Sim

John P. Simison

Andrew L. Singer

Beatriz Pina Smith

Patti Smith

Robert C. Smith

Sidney H. Snow

Lawrence O. Spaulding, Jr.

Douglas Stone

Dean R. Sweeney

Robert A. Talerman*

Harry S. Terkanian

Todd G. Thayer

Rosanne Timmerman

Leslie J. Tondreau

Denise M. Toomey

Jonathan Vitale

Steven Volante

Christopher J. Ward

Richard J. Waystack

Jonathan M. Weaver

John L. Whelan

Seth Wilkinson

Daniel A. Wolf*

Benjamin E. Zehnder

George D. Zografos

* Mutual Bancorp Board of Trustees

As of 12/31/2024