Market Builds Momentum into Key Selling Season

2Q 2025 | Market Update

The market is steadily building momentum out of the doldrums that we saw in 2023, with 170 deals closing across Carmel, Pebble Beach, Pacific Grove, Monterey, Preserve, Tehama, Monterra, Carmel Valley Ranch and the Carmel Highlands this quarter, raising $443M overall. Despite macroeconomic uncertainty, we saw a strong rebound over last quarter, as overall dealfow is up 19% from 1Q25. While the rebound hasn’t been even across the entire region, we have seen buyers across all regions take a renewed look and anticipate growth continue to increase throughout the summer.

Historically, demand has been strongest in downtown Carmel and radiates outward, which has certainly been true this quarter as Carmel led the pack this quarter with $143M closed in 39 deals, up 72% and 44% over last quarter, respectively. Pebble Beach is also starting to gain steam with 29 deals closing this quarter for almost $100M, up 16% and 39% over last quarter, respectively. As demand continues to climb up the price point, Pebble and the Preserve are poised to show the largest increase over the next 12 months as they both have healthy levels of inventory and high quality product. Pacific Grove has continued to hold steady in the face of higher interest rates with 40 deals closing for $63M. Monterey also climbed this quarter with 42 deals closing for $52M, which was a strong rebound from last quarter. The Carmel Highlands jumped this quarter from 6 to 9 deals for $44M as the market continues to pay for ocean views. We represented another seller in Tehama, which was the top sale so far at $9.8M to bring total sales to $13.2M this quarter. Quail had 4 sales close for $9.3M as inventory continues to get snapped up quickly in that market. Carmel Valley Ranch slowed a bit to $5.8M, which isn’t atypical as that area is prone to seasonal swings but overall looks healthy. The Preserve has slowed considerably this quarter to $4.8M but we’re seeing strong demand from new buyers entering the space, so we anticipate this changing over the next 6 months.

In the face of uncertainty, the top of the market tends to hold on big investments initially, but the historic stability of this area has turned into it’s own asset class with people shifting money from the stock market and into real estate in this area. As such, we have seen prices continue to climb with the median sales price going from $1.78M last quarter to $2.77M this quarter. While sellers are still needing to work with buyers on terms, this price appreciation is driven more by stronger demand at the top of the market - a trend we anticipate continuing throughout the year.

This is a very nuanced market that balances patience from a seller and a deliberate approach to buying in this area, as the likelihood of more competition on the buy side increases every day.

SOPHISTICATED COASTAL LIVING 64SPANISHBAY.COM | OFFERED AT $4,250,000

Quarterly Sales by Region

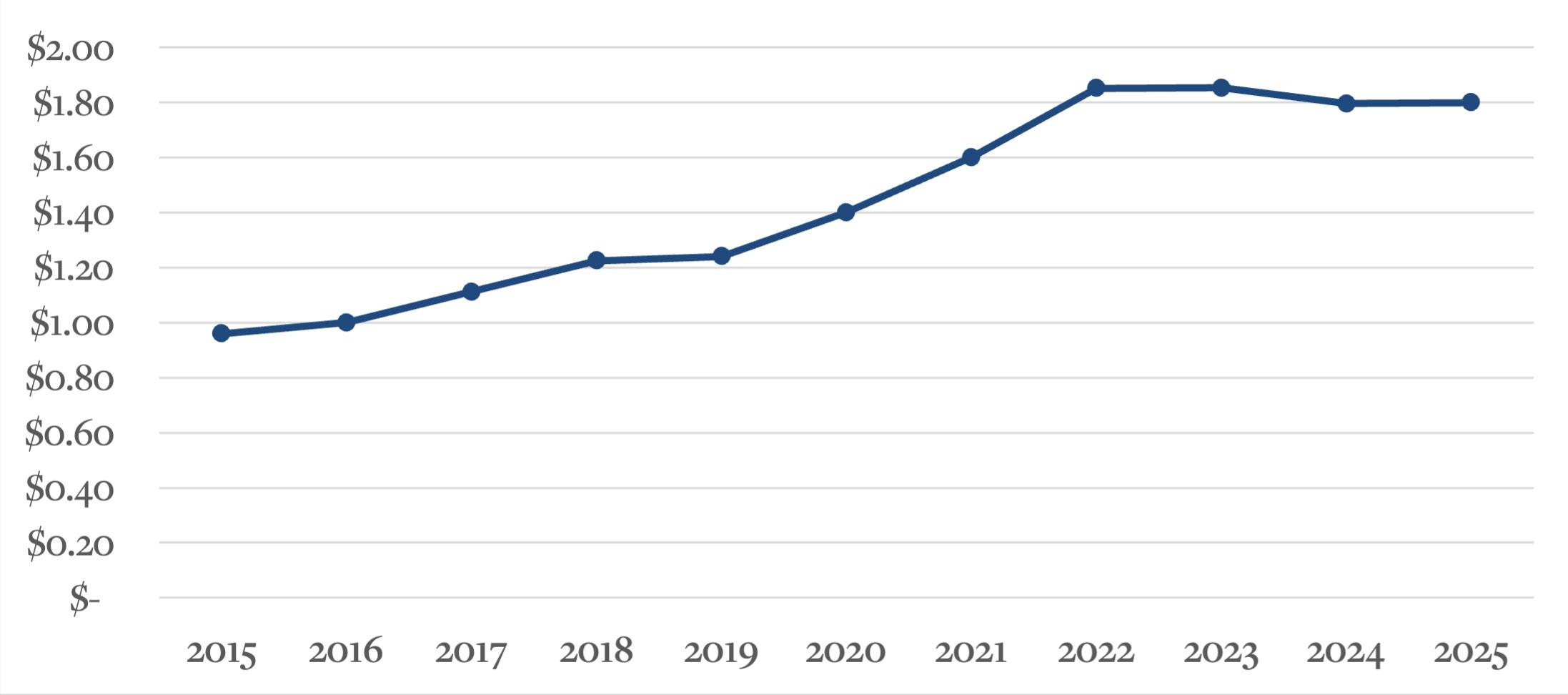

Median Sales Price ($M)

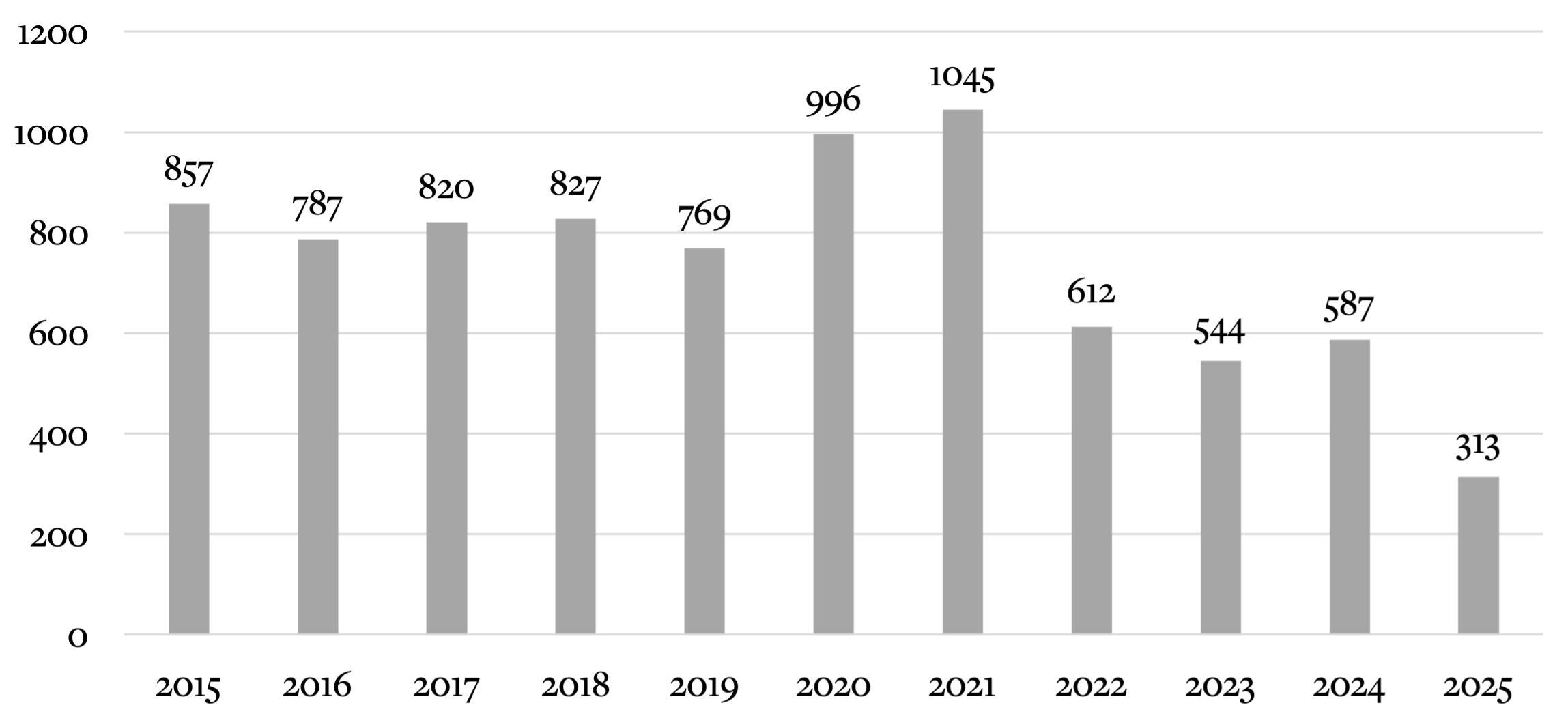

Historic Sales Averages by Price Range

“ Carmel saw a strong rebound this quarter with 39 sales totaling $143M—up 72% from last quarter and nearly a third of all Peninsula investments. Market strength is evident in faster sales (54 days on market) and tighter pricing (3% off list). The western side led with nearly half of all deals: Golden Rectangle (10), Northwest (9), and Northeast (8). Median price rose to $3.7M from $3.2M, returning to last year’s levels.”

$142.65 m

Pebble Beach

“The Pebble Beach market gained momentum in 2Q with 29 sales (+20.8% QoQ) and total investments of $99M (+39% QoQ). As anticipated, inventory levels continue to rise as we enter our summer selling season – reaching a recent high of 48 active listings. The highest concentration of listings are in the $2M-$4M price bracket (21 active listings, followed by the top of the market ($9M+), which holds 15. Will be interesting to see if demand keeps up with rising inventory levels – particularly in the $2M-$4M price bracket, which has been the most active over recent quarters.”

2Q Region Overview

“Activity in the Carmel Highlands rose this quarter to 9 total sales (+50% QoQ) and total investment jumped to $43.49M (+83.7% QoQ). A new highwater mark was achieved in the coveted community of Otter Cove with the sale of 30680 Aurora Del Mar at $14.75M; we were honored to represent the sellers of this incredible property. With the expected rise in inventory levels this summer, paired with more cautious and selective purchasing patterns from buyers of late, we’ll be tracking this sub-market to see if this upward trend in deal flow maintains pace throughout Q3.”

m

9

Quail Lodge / Meadows

“ Quail Meadows saw 5462 Quail Way this quarter for $5.6M, which was a great property that combined privacy with an outdoor swimming pool - perfect for families. Quail Lodge also had three sales in the area: two condos and one vacant lot. 7020 Valley Greens #6 closed just off list at $1.6M and 7026 Valley Greens #18 booked at $1.3M. There continues to be far more demand for Quail Lodge than inventory, so we anticipate continued strength in this market over the next year.”

2Q Region Overview

“The Preserve marked its 25th anniversary with strong community spirit and healthy real estate activity. With 148 completed homes and 50 in planning or construction, the community is halfway built out. In 2Q25, one home sold (4 Rumsen, $4.8M), one is under contract, and another is in off-market negotiations, while seven homes are active. No land sales occurred, though 35 parcels are listed, softening land prices. Buyers remain selective, so strategic pricing and presentation are key. Architects and builders are ready to help bring your dream home to life.”

Santa Lucia Preserve

Carmel Valley Ranch

“As predicted, Carmel Valley Ranch saw steady activity: 3 sales, 2 pending, 1 contingent, and 5 homes on the market. The median sales price dipped slightly from 1Q25 to $1.95M, with DOM holding at 59 days. Fire insurance has become a key concern, particularly for financed buyers. Well-priced, newly remodeled homes like Oakshire Way are moving quickly, while those needing work or lacking a main-level primary see slower interest. A diverse inventory is encouraging, and with demand remaining strong, we’re optimistic this momentum will continue through the summer.”

2Q Region Overview

“ Teháma had a strong quarter with one home and two lots sold. We proudly represented the seller of 15 Alta Madera, a stunning $9.8M estate with ocean and valley views. Lots at 51 Marguerite ($1.75M) and 12 Alta Madera ($1.65M) offered great views, privacy, and access to Carmel. Demand remains steady as buyers continue to pay a premium for location, views, and Teháma’s low dues.”

“ Monterra was quiet this quarter with no sales, but three homes are listed from $5.695M to $6.895M—high for the area but move-in ready with Club access. Seven lots are also available, priced from $980K to $1.5M. With home values in the $5–6M range, building in Monterra can be more cost-effective than other gated communities, especially for buyers struggling to find the right home.”

2Q Region Overview

“The second quarter brought a notable boost in home sales for the New Monterey neighborhood —10 homes sold, more than doubling the four sales recorded in Q1. This surge reflects a growing interest in this charming coastal neighborhood. While homes are taking a bit longer to sell at 46 days average, values continue to trend upward, indicating continued buyer demand and confidence in this special part of the Monterey Peninsula. We are closing the quarter with 13 active listings in New Monterey.”

“Monterey’s market saw a healthy uptick in Q2, with both sales (42) and total volume ($52.35M) outpacing Q1 by 36%. And as Q2 came to an end, the market experienced its quickest sales pace of the year, with homes averaging 40 DOM – signaling strong momentum as we move into the second half of 2025.”

2Q Region Overview

“Pacific Grove’s real estate market held steady through Q2, with consistent inventory averaging 20–25 active listings and 8–10 homes in escrow at any given time. Buyer interest remained strong across a range of price points, with April and May recording multiple closings above $2.5M, including a standout $3.7M sale in the Beach Tract. Homes that were well presented and thoughtfully priced saw the strongest activity, while others required more time on the market or price adjustments. As we head into summer, steady supply and motivated buyers continue to support firm property values.”

Pacific Grove

2Q 2025 Significant Sales

Why Us?

Market Expertise:

With years of experience selling real estate on the Monterey Peninsula, we have a deep understanding of the local trends, property values and emerging opportunities.

Personalized Service:

We take pride in offering personalized and attentive service to our clients. Your goals are our priority, and we are committed to tailoring our approach to meet your specific needs.

Proven Track Record:

Our track record speaks for itself. We have successfully assisted hundreds of clients in our area achieve their real estate objectives, while delivering results that consistently exceed expectations.

Innovative Marketing Strategies:

In today’s competitive market, a strategic approach to marketing is essential. We leverage cutting-edge marketing strategies to ensure your property receives maximum exposure.

The #1 TEAM in 2020, 2021, and 2022

TOP 10 TEAM for Sotheby’s International Realty for 9 years