SUMMER 2023 PAGE 12 REALITY OF RESERVES BORROWING DO’S AND DON’TS HOA POOL FOR RENT THERE’S AN APP FOR THAT PAGE 6 VIRTUAL MEETINGS HERE TO STAY POST COVID? PAGE 4 ELECTRIFYING HOAS REQUIRES CAREFUL PLANNING PAGE 8 PAGE 14 THE GRASS ISN’T ALWAYS GREENER TURF CONVERSIONS THEY’RE NOT ALL EQUAL PAGE 10 RULES OF ASSESSMENTS

2023 CACM Summer Law Journal Editorial Committee

Chief Editor

Attorney Guest Editor

Fred Whitney, Esq. Whitney | Petchul

Matthew A. Gardner, Esq. Richardson | Ober

Summer 2023 Law Journal Committee Members

Nicole Soria, Esq. McKenzie Mena, LLP

John Baumgardner, Esq. Chapman & Intrieri, LLP

Jill Morgan, CCAM Allure Total Management

Hamlet Vazquez, MCAM-HR Wilshire Terrace Co-op

Lorena Sterling, CAFM Community Association Financial Services (CAFS)

An archive of past issues can be found under Member Resources at CACM.org

The CACM Law Journal is a digital publication distributed four times per year to all members, in addition to supporters of the California Association of Community Managers.

DISCLAIMER: CACM does not assume responsibility for the accuracy of articles, events or announcements listed. Please be advised that the opinions of the authors who contribute to the Law Journal are those of the author only, and do not necessarily reflect the opinions of CACM and other industry attorneys. Please note that in a constantly evolving industry there are frequently multiple interpretations of the controlling statutes and case law. The information contained in these articles is of a general nature and not intended as legal advice. If you have any questions, please discuss them with your association’s legal counsel.

2 The Law Journal Summer 2023 | cacm.org

Summer 2023

Follow @CACMchat A PRACTICAL REVIEW OF COMMUNITY MANAGEMENT LAW Interested in advertising in CACM’s Law Journal? Reach out to us at marketing@cacm.org

SUMMIT HIGH RISE & LARGE SCALE VESPERA RESORT | PISMO BEACH , CA SEPTEMBER 21-22, 2023 Join fellow managers from across California who specialize in high rise and large scale communities for this two-day summit. Take a deep dive into your area of expertise, focusing on challenges specific to your discipline, finding creative solutions alongside professional and experienced managers. CLICK HERE TO REGISTER

Letter from the Guest Editor

Summer is sold as a time to relax and enjoy. While owners may be focusing on the fun and sun, for managers it may mean a shift of focus and watching the last few months of the year and starting the process of planning for the next one.

In this issue, we are offering some suggestions on how to plan, how to prioritize, and thoughts on budget season. The authors focused on topics to help get managers through the end of the year, while providing communities with best practices, including on some new issues. VRBO is no longer a new thing, but communities are going to want to learn more about amenity rentals. As the economy shifts into uncertainty, an emerging property-sharing boom may force you to rethink your enforcement priorities.

Managers may not be looking forward to budget season, but our authors have some good news on how to handle assessment increases or work with boards considering borrowing from reserves.

Communities looking at planning new projects are going to want to read more about energy storage and water savings. In times of rising budgets and increased interest in conservation, most boards are going to be seeing requests from owners and from government to take a longer look at energy and water efficiency.

Finally, the end of the declared COVID emergency is forcing boards and managers to reconsider their reliance on video conferences. Learn where the current legislative trends are heading, and find some practical solutions for re-engaging your communities and making board meetings more productive in the post-COVID environment.

As always, this issue is filled with great content from our knowledgeable contributors. Thank them for their contribution, and let us know if there are other topics that deserve our attention. Have a great summer!

Matthew A. Gardner, Esq., is a partner at Richardson | Ober who works with community associations, homeowners and HOA boards of directors to amend governing documents, resolve homeowner/ member disputes, and manage assessment delinquency matters.

Matthew A. Gardner, Esq., is a partner at Richardson | Ober who works with community associations, homeowners and HOA boards of directors to amend governing documents, resolve homeowner/ member disputes, and manage assessment delinquency matters.

cacm.org | The Law Journal Summer 2023 3

“Summer for community managers managers may mean a shift of focus and watching the last few months of the year and starting the process of planning for the next one.”

By Daniel C. Heaton, Esq.

CAN I GET THAT LOG-IN CODE AGAIN?

THE FATE OF BOARD MEETINGS IN A POST-COVID WORLD.

At the outset of the Covid pandemic, community associations were thrown into conflict as boards and managers attempted to comply with state and local restrictions on public gatherings while somehow still following the Open Meeting Act. Amid all the chaos, many associations started conducting their meetings via Zoom and simply ignored the physical presence requirement of Civil Code §4090(a). This solution was not unprecedented, as governments were already following the same practice because Governor Newsom had suspended the physical presence requirement of the Brown Act.

In light of continued health risks, the California Legislature passed SB 391 in September 2021. This took effect immediately and created Civil Code §5450, which authorized meetings to be held entirely by teleconference without first designating a physical location for director or member attendance. Under §5450, the primary condition for boards to legally meet virtually is that “gathering in person is unsafe or impossible because [the HOA] is in an area affected by [a declared state of disaster or emergency].”

What started as a necessity quickly turned into a preference for many associations, as boards, managers, and homeowners realized the benefits of meeting virtually. Many associations experienced an increase in community involvement with the ease of being able to “jump on” at a moment’s notice from any location. Homeowners reported a sense of greater transparency in monitoring the actions of their community leaders. Boards realized they could more readily seek (and afford) the advice of their legal counsel, as they no longer had to pay for travel to and from meetings. It seemed that at least some good came out of such a devastating period.

But what happens when the qualifying condition that allowed these purely virtual meetings disappears? On February 28, 2023, Governor Newsom ended the Covid State of Emergency in California. In January, the Biden Administration announced that the national emergency related to the pandemic would end by May 11, 2023. As a result, associations are no longer able to rely on these declarations to authorize virtual meetings, even though many boards and managers mistakenly believe that §5450 ratified the practice. What is the fate of virtual board meetings and what can managers do to help their associations continue to experience the benefits of virtual meetings?

4 The Law Journal Summer 2023 | cacm.org

GET INVOLVED

The legislative session is again in full swing. Assemblymember Valencia of District 68 introduced AB 648 to build upon earlier statutory provisions and authorize associations to conduct meetings entirely by teleconference without the need for a declared state of emergency or a designated physical location. If passed, AB 648 would authorize this practice at the discretion of the board.

Community managers are in a unique position to help educate their boards and individual homeowners about the importance of pending legislation such as AB 648. They should utilize CACM resources to track AB 648 as it proceeds through the legislative process and help encourage their homeowners to voice support with their representatives. (Visit https://cacm.org/advocacy for additional links!)

GET CREATIVE

Civil Code §5450 has not been rendered meaningless just because the primary national and California Covid declarations have been lifted. Rather, the qualifying condition could be triggered by other proclamations. During the pandemic, multiple federal declarations were announced in addition to the President’s Proclamation 9994. The Secretary of Health and Human Services (HHS) issued a separate emergency declaration under Section 564 of the Federal Food, Drug, and Cosmetic Act. This declaration is not set to conclude in midMay but was renewed by HHS notice on March 17, 2023.

As another example, on March 1, 2023, Governor Newsom proclaimed a state of emergency due to severe winter storms to support disaster relief in 13 counties. While courts may not find that §5450(a) applies because the storms do not necessarily make it “unsafe or impossible” for boards to hold in person meetings, there is at least a reasonable argument in support of authorizing virtual meetings.

GO HYBRID

Although purely virtual meetings might not be permitted, “hybrid” meetings could become the “new normal.” Boards may still conduct their business virtually if they comply with Civil Code §4090(a) by providing notice of at least one physical location where a director or other designated person will be present. This allows members an opportunity to attend “in person.”

Boards should consult with counsel to make sure their hybrid meetings are properly noticed and comply with the Open Meeting Act. Some governing documents contain restrictions on the physical location for meetings (e.g., “in the clubhouse” or “in the county”). However, if no such provisions exist, managers can suggest designating their own office. This would enable managers to

attend multiple meetings for various clients in a single evening, or just have more family time, as they would no longer be required to travel for meetings. Some management companies have even created “Zoom rooms” with a single employee designated to “be present” for all meetings scheduled that night.

Given the availability of hybrid meetings, managers could consider charging more to attend in person since it would require travel and prevent attendance at multiple meetings. With a little advanced planning to meet the requirements of §4090, managers and their associations can utilize a hybrid model to continue to enjoy the benefits of a virtual world.

Daniel C. Heaton, Esq. is a senior associate at Nordberg | DeNichilo, LLP, serving as corporate and litigation counsel to community associations throughout Southern California.

cacm.org | The Law Journal Summer 2023 5

MANY ASSOCIATIONS EXPERIENCED AN INCREASE IN COMMUNITY INVOLVEMENT WITH THE EASE OF BEING ABLE TO “JUMP ON” AT A MOMENT’S NOTICE FROM ANY LOCATION.

SOME MANAGEMENT COMPANIES HAVE EVEN CREATED “ZOOM ROOMS” WITH A SINGLE EMPLOYEE DESIGNATED TO “BE PRESENT” FOR ALL MEETINGS SCHEDULED THAT NIGHT.

By Reggie Schubert, Esq.

SIDE GIG? CAN A BACKYARD BBQ DOUBLE AS A

In today’s world of an ever-expanding gig economy, it has become second nature to avail oneself of the conveniences offered by creative entrepreneurs who are offering their goods and services through a website or app. Many of us have participated in this type of on-demand marketplace transaction when buying or selling goods online, hiring a ride, or ordering groceries for delivery to our front door. The common interest development industry is all too familiar with the effects of vacation or similar short-term rentals.

This era of enterprising business has now brought yet another new concept made feasible using a combination of an online technology platform and occupants of residential property who are willing to hire out the use of a backyard, pool, private park, parking space, or other popular amenities on a daily or even hourly basis.

Sniffspot and Swimply are tradenames of fairly new apps that have been developed with this concept in mind. Sniffspot is targeted to dog owners looking for yard space for their pet. Swimply offers hosts a platform to rent out their pools to the apps’ users. There is no shortage of apps like Parking Cupid, Pavemint, SpotHero and ParkingForMe, just to name a few, which have become popular platforms for on-demand parking.

While this type of amenity rental concept is certainly creative, it brings with it potential problems and pitfalls, especially when it occurs in a common interest development. Several of the many benefits of living in a common interest development, including quality of life and the ability to use and enjoy association amenities, could be threatened if only a handful of residents decide to hire out the use of association amenities or even their own backyards.

Imagine the problems that could arise from the hourly rental of an association pool to an unknown group for a party or similar social gathering. Likewise, the coming and going

6 The Law Journal Summer 2023 | cacm.org

of large groups of people into and out of a community to make use of a private backyard could cause noise, parking, trash, and other problems for nearby residents.

The potential costs, nuisance, and liability exposure that an association could face would likely cause a significant uproar in the community, and rightly so. It is easy enough to identify potential nuisances such as noise, trash, and

than single-family dwelling purposes (See Civil Code §4741(e) allowing owner occupied rentals).

Associations should take appropriate action now in order to discourage or otherwise manage these potential risks. Fortunately, many associations already have restrictions contained in their CC&Rs and operating rules that will likely be useful in this effort. Typically, CC&Rs contain a prohibition against commercial activities and activities that result in an increase in insurance premiums as well as nuisance provisions that a board may rely upon in addressing unauthorized amenity rentals as well as prohibited uses of an owner’s separate interest.

Updated and meaningful fine and enforcement policies should be in place as tools in the board and manager’s toolbox to allow a proactive approach to address such unauthorized uses of either amenities or an owner’s separate interest. As with adoption of any rule, care should be exercised to ensure that such rules do not conflict with an association’s CC&Rs or bylaws and that proper authority is provided for in the CC&Rs or bylaws for adopting rules (See CA Civil Code §§4350, 4360).

Accordingly, appropriate operating rules may be considered to bolster and clarify existing restrictions. Such rules should address: (1) use of amenities and number and procedures for guests allowed; (2) clarification as to prohibited commercial activities to prohibit this type of amenity and separate interest rentals; and (3) appropriate enforcement and disciplinary policies.

Although we may see an increase in popularity of apps such as Sniffspot and Swimply, an association can be proactive by reviewing current restrictions and adopting new rules or restrictions that prohibit certain activities associated with this type of unauthorized amenity and separate interest

The Law Journal Summer 2023 7

Reggie Schubert, Esq., is a founding partner at McGuire Schubert Sohal LLP and serves as general counsel to common interest developments throughout California. He has been in practice since 2003.

Plan, Plan, Plan

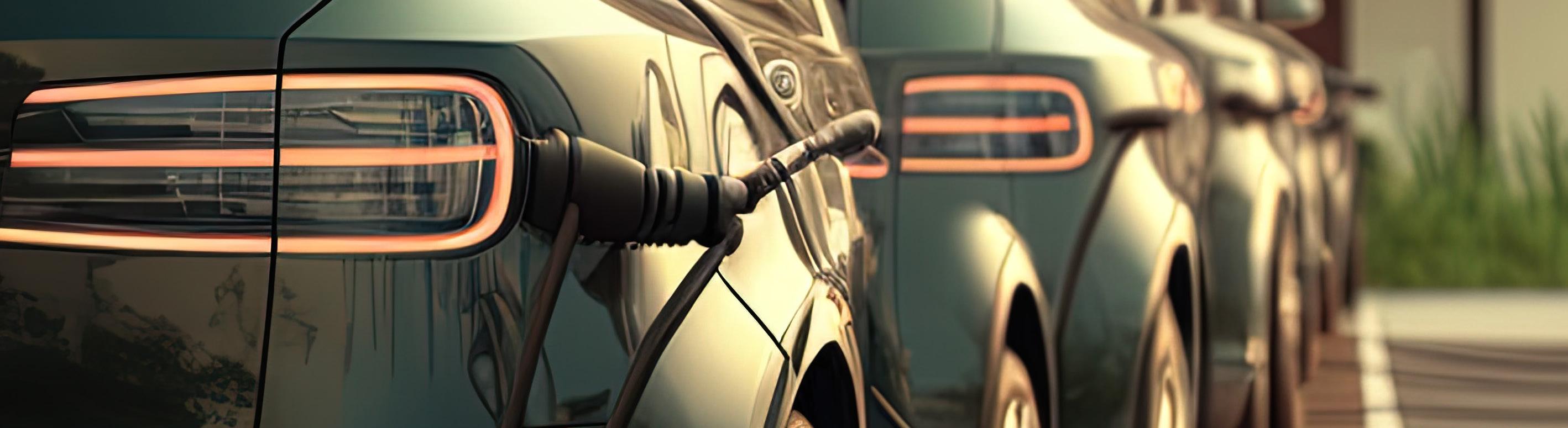

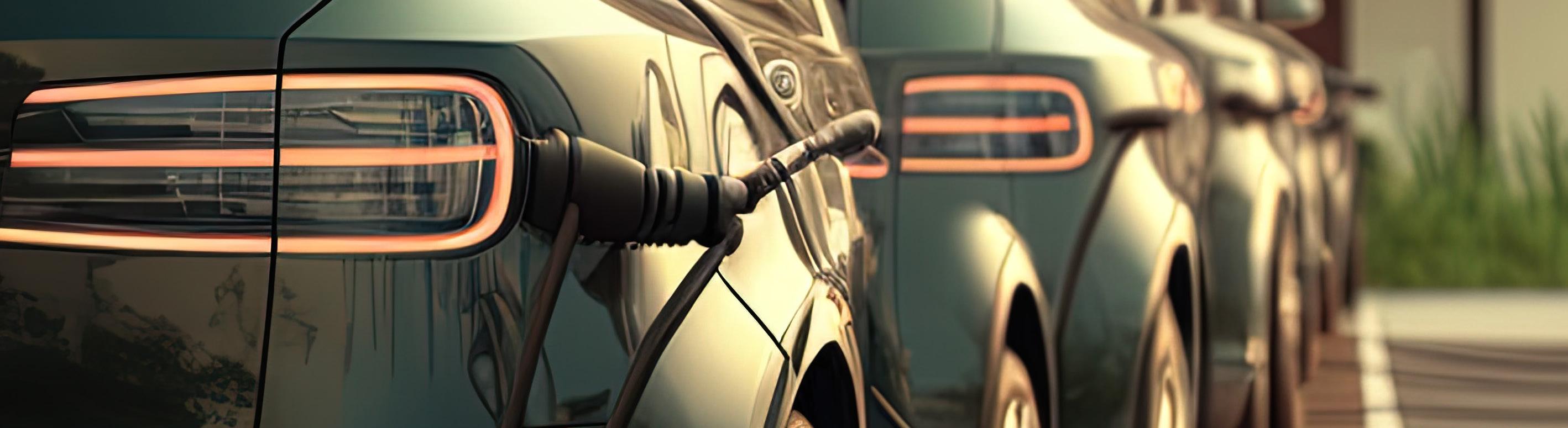

Although renewable energy systems are becoming more common and more affordable, they are also becoming mandated and heavily regulated. By 2035, all new cars sold in California must be electric, and the legislature recently instructed the Department of Housing and Community Development to investigate updating the building code to require electric vehicle (“EV”) charging stations in multifamily dwellings. Gas prices are rising, and power outages are more frequent. This all leads to an increase in renewable energy systems in

By John D. Hansen, Esq.

By John D. Hansen, Esq.

residences, including ways to store that energy. When reviewing applications for such systems, associations must be mindful of limitations on their ability to impose rules, and what is in the best interests of the association when approaching renewable energy systems.

REASONABLE RESTRICTIONS

California law allows associations to impose reasonable rules and regulations subject to an association’s governing documents. (Civil Code §4340 et. seq.; see also, Yan Sui v. Price (2011) 196

Cal.App.4th 933, citing Nahrstedt v. Lakeside Village Condominium Assn. (1994) 8 Cal.4th 361, 386 – (“Whether a rule is reasonable ‘is to be determined not by reference to facts that are specific to the objecting homeowner, but by reference to the common interest development as a whole.’”) Additionally, restrictions (no prohibitions) on solar systems and EV charging stations cannot unreasonably increase the cost ($1,000 on solar) or significantly decrease the efficiency (10% on solar) (Civil Code §§714, 714.1, and 4745.) Owners have a right to install solar panels on condominium buildings, and these limitations apply to both planned developments and condominiums (Civil Code §4746). These limitations likely apply to energy storage as well, even though not expressly stated.

CONSULT WITH EXPERTS

Associations should start planning for the increased use of renewable energy systems. Experts can be retained to inspect buildings, parking lots, and even residences to propose ways to incorporate renewable energy.

8 The Law Journal Summer 2023 | cacm.org

When it comes to renewable energy systems, consult with experts and adopt rules in advance.

Condominium buildings create unique challenges that can be overcome with a solar site survey that identifies usable space on roofs and then fairly allocates that usable space among the units. An expert can identify effective ways to tie the solar into an owner’s electrical system, and locations where a battery could be installed serving the owner’s unit.

New products are available for EV chargers that connect between the electrical meters and breaker box that only require a small installation in a breaker room in a condo building that can then run lines to a charger in a parking garage. An expert can advise on how to fairly use the space in a breaker room, and how to create hangers to bundle large amounts of conduits and lines that will eventually be supplying everyone’s EV charger.

An expert can further advise on how to integrate an energy storage device and where it could be located.

TURN EXPERT ADVICE INTO POLICY

Once equipped with expert advice on how to install and use renewable energy systems in a development, the board can then adopt a policy for how owners can install their own systems. The policy could be both a guide, and a set of enforceable rules. The “guide” part can make recommendations for systems that will be compatible with the electrical systems and building systems installed by the developer, or provide recommendations for local contractors that know the development. The “rules” part can have reasonable restrictions on where an EV charger can be located in a parking garage or lot, where a charger connection or battery can be installed in a utility room, how conduit must be installed in a garage, or where panels can go on a condominium roof.

While these may function like enforceable rules, they will also be based upon expert advice that can identify the only, or most cost-effective way for owners to install these systems. By the

association conducting this investigation on its own, it will avoid having a patchwork approach to adding renewable energy systems that are done differently every time, or that have to be investigated each time.

For example, in a building with 100 units and a parking garage, eventually there will be dozens or more EV charging stations installed, and/or dozens of large batteries installed. An association could do it piecemeal by letting them go in on a case-by-case basis, resulting in a spiderweb of conduit on the ceiling and owners jockeying for space in the utility room for battery space, or the association can have an expert design a plan and install some infrastructure to have an orderly and attractive set of conduit hangers and identified shared areas for batteries.

In addition to the structural limitations in multi-unit housing, there is also an importance of uniformity of these systems in other types of attached residences and even in detached residences. For example, in a community that has a uniform location for AC condensers, an association should consider whether to require a fixed location for a battery, such as on the same side of the residence, or in a garage, or some other accessible location that is the same for all residences. Different styles or models of homes will have different layouts and locations for their electrical panels, so a set of rules could account for that.

The important aspect with all of this is that by the association doing the expert investigation on its own, it creates a uniform, effective and attractive way to utilize renewable energy systems. Additionally, by doing the research in advance, the association can adopt rules that fit within the limitations of Civil Code §§714, 714.1, 4745, and 4746 because we will know the impact on cost up front, and if the experts are researching ways to cost-effectively implement renewable energy systems, the association can avoid the issue of a rule increasing cost or decreasing efficiency.

cacm.org | The Law Journal Summer 2023 9

John D. Hansen, Esq., is an attorney with Baydaline & Jacobsen LLP specializing in general counsel to community associations. He has 14 years of experience in the industry and is based out of Sacramento.

By the association doing the expert investigation on its own, it creates a uniform, effective and attractive way to utilize renewable energy systems.

Navigating Assessment Increases for Aging Properties

By A. Jeanne Grove, Esq., and Marrianne S. Taleghani, Esq.

Assessment increases are an unfortunate reality for aging communities. In the wake of the Surfside tragedy in Florida, association boards face even more pressure to stay on top of maintenanceand-repair cycles, particularly if the structural strength of the building is in question. Meanwhile, homeowners never like to hear that dues (assessments) are going up, sometimes substantially, in order to address deferred maintenance issues. Due to this inherent tension, it is critical that all parties understand the rules around assessment increases and implement best practices to minimize disputes down the road.

The Law on Assessments

A board of directors has a legal duty to manage the association’s budget and fund common area maintenance, repair, and replacement. Civil Code §5600(a) explicitly requires boards to raise all regular and

special assessments that are necessary to do so. For this reason, boards sometimes must levy assessments, even if they would rather not.

The association’s governing documents will describe how assessments are allocated to owners, either as uniform, variable, or blended rates. The two most common types of assessments that an association may raise are regular assessments and special assessments. Regular assessments are determined by the board during the annual budgeting process (Civil Code §5300(b)) and are usually paid by members on a monthly or quarterly basis. They cover day-to-day operations of the association, such as insurance, security, management fees, and maintenance, as well as contributing to a reserve fund.

In contrast, special assessments are for unexpected, underfunded expenses, or capital improvements. For example, boards may levy a special assessment if there has been flooding and the association’s insurance cannot cover the cost of repairs,

or if some homeowners have defaulted and there are insufficient funds remaining. Regardless of the type and amount of the assessment, Civil Code §5615 states that the association must provide 30-days’ notice of the increase before it is due.

Common Myths About Assessment Increases

Membership approval is ALWAYS required to levy assessments. In reality, it depends on the amount and type of the assessment. So long as boards comply with annual budget report requirements, they can unilaterally increase regular assessments by up to 20% of the annual budget; anything more requires approval of a majority of a quorum of members. On the other hand, special assessments can be approved by the board alone if the increase is less than 5% of the budgeted gross expenses for that fiscal year. Always check the governing documents for assessment procedures, but note that this authority of the board is statutory and therefore overrides any restrictions in an association’s governing documents per Civil Code §§5605, 4205(a). For example, a provision in the CC&Rs that requires a supermajority or a 2/3 quorum for assessment approval would be invalid, as it is superseded by the Davis-Stirling Act.

2Other measures are NOT available if the membership votes down an underfunded project. According to Corporations Code §7515(a), the association can petition a court to approve an assessment if necessary. If a property is in dire need of an assessment increase due to a necessary maintenance/repair project, even after a failed assessment vote, the association could petition the court to compel the imposition of an assessment. This assessment could then serve as collateral for a bank loan, thereby providing immediate funds for maintenance.

Special assessments are ALL the same as emergency assessments. In contrast to special assessments, emergency assessments have no monetary cap and never need membership approval. However, according to Civil Code §5610, they must meet the statutory requirements of an “emergency,” i.e. an “extraordinary expense” that is either necessary to defray threats to personal safety on association property or that could not have been reasonably foreseen by the board when preparing the annual budget.

The Pitfalls of Inadequate Reserves

1. Unanticipated assessments will upset owners.

10 The Law Journal Summer 2023 | cacm.org

1 3

2. The association’s inability to plan for future maintenance/repair needs.

3. Project delays because the association cannot agree on the scope of the maintenance/repairs.

All of these factors are a recipe for litigation. The Surfside, Florida building collapse was an extreme, tragic example of that, but one that hopefully serves as a wake-up call to associations to re-examine their own maintenance/repair schedules and related budgeting processes.

There is a reason the Department of Real Estate issued a warning regarding the growing number of underfunded associations in California. With over 52,000 CIDs in California and over 11 million people living in CIDs, underfunded associations are a statewide problem. Failing to utilize assessments and implement assessment increases will result in protracted litigation, significant delays of maintenance/repair projects, and reduction of property values. While assessment increases are never welcome, incremental increases spread out over a longer period of time are less likely to draw the ire of homeowners. Similarly, associations are less likely to incur collection costs, chasing after delinquent homeowners who are unable to keep up with substantial assessment increases.

BEST PRACTICES FOR AGING COMMUNITIES

1. BUDGET.

Assess the association’s budget and determine if the association is collecting sufficient assessments to defray maintenance/repair costs, both shortterm and long-term. If not, implement all necessary assessment increases as allowed by law.

2. HIRE PROFESSIONALS.

Retain licensed professionals to advise on various aspects of association management–e.g. legal, bookkeeping, property management, construction/maintenance.

3. INSPECT.

Conduct regular inspections of the conditions of the property, as often as the applicable licensed professional recommends, and obtain written reports of such inspections.

4. DOCUMENT.

Every inspection, every report from thirdparty professionals, every meeting of the board, and every decision by the board should be documented in writing and promptly communicated to the owners.

Suffice to say, assessments are central to an association’s overall health and function. Avoid the common pitfalls and engage in regular discussions regarding assessments. Failure to do so can have drastic and very costly consequences.

cacm.org | The Law Journal Summer 2023 11

A. Jeanne Grove, Esq., and Marrianne S. Taleghani, Esq., are attorneys with Kaufman, Dolowich & Voluck, LLP and specialize in real estate. They have 20+ years and 10 years of experience in the industry, respectively.

$

Can You Legally Borrow from Reserves?

By Karyn A. Larko, Esq.

When faced with unexpected expenses that cannot be deferred, boards will often look toward their association’s reserves as the solution. While the use of reserve funds may be the best solution in certain circumstances, it is important that boards understand the restrictions and requirements for using reserves so they do not inadvertently run afoul of California law. Knowing the following will help you guide your boards in this regard.

In accordance with California Civil Code (“CC”) §5510(b), a board may only use funds designated for reserves for:

n Maintaining, repairing, restoring and replacing major components the association is obligated to maintain, repair, restore or replace, for which the reserve fund was established; or

n Litigation pertaining to the maintenance, repair, restoration and replacement of these components.

The CC&Rs for an association generally identify, at least broadly, the components for which the association is responsible. To the extent the CC&Rs do not address this issue, CC §4775(a) provides for a default allocation of responsibility. Further, CC §4775(a) states that unless the CC&Rs provide otherwise, an association is responsible for maintaining, repairing and replacing the common area, and repairing and replacing exclusive use common area.

Having well-funded reserves is important. A robust reserve account enables an association to fulfill its maintenance, repair and replacement responsibilities, thereby helping to, among other things, preserve property values and the appearance of the community. A robust reserve account also reduces the likelihood of the need to impose a special assessment or borrow to fulfill these obligations.

There is another benefit to having well-funded reserves – access to a quick source of funds in the event of an unanticipated expense or short-term cashflow deficiency.

Borrowing from Reserves

Although CC §5510(b) limits the purposes reserve funds can be used for, CC §5515 allows boards to temporarily borrow from reserves for other purposes, provided:

• The board votes to borrow from reserves in a duly noticed open session board meeting. The agenda for the meeting must state that the board intends to consider a transfer from reserves, as well as the reason(s) the transfer is needed, some of the options for repaying reserves and whether a special assessment will be considered.

$ $

12 The Law Journal Summer 2023 | cacm.org

• If the board approves the transfer, the minutes of the meeting must include the board’s reason(s) for needing the transfer, and when and how the reserve account will be repaid.

CC §5515 requires that funds borrowed from reserves be repaid within one year of the date of the transfer or the date of the initial transfer if more than one transfer is made.

It is possible to extend the repayment period beyond one year if the board determines it is in the best interests of the association to do so, provided the board follows the same procedure required to initially make the transfer. The CC does not define the term “temporary.” However, it is clear that an extension of more than a year or multiple extensions is not contemplated by the law. Moreover, CC §5515 mandates that boards exercise “prudent fiscal management in maintaining the integrity of the reserve account”, and requires them to levy, if necessary, a special assessment to fully repay reserves. Extending repayment by more than a year would likely not constitute prudent fiscal management in maintaining the integrity of the reserves.

Why Borrow?

When faced with an unexpected expense, especially one that cannot be delayed, and insufficient operating income to cover it, borrowing from reserves is the quickest way to obtain the needed funds.

Obtaining funds through an increase in regular assessments or the imposition of a special assessment takes at least 30 days because CC §5615 mandates that members be given at least 30 days prior notice of assessment increases or special assessment. If a member vote is required to impose the increase or special assessment, the voting process will take at least another 30 days. Further, there is the possibility the members will not approve the measure.

Although a member vote is not required to impose an emergency assessment, it will take at least 30 days to obtain the funds since CC §5615 does not exempt these assessments from the 30-day notice requirement. Further, it is only possible to impose an emergency assessment if the funds are needed to pay an extraordinary expense that is:

• Required by court order;

• Necessary to perform maintenance or repairs for which the association is responsible to abate a threat to personal safety; or

• Necessary to perform maintenance or repairs for which the association is responsible that could not reasonably have been foreseen at the time the board prepared and distributed the most recent budget.

Borrowing is also not a quick process. It takes time to secure a lender and complete the loan process. Oftentimes, this process is made longer by the need for a member vote on the loan, the collateral and/or the assessment needed to repay the loan. Sometimes the reason the funds are needed will disqualify the association for a loan.

Repaying Reserve s

The same options are available for repaying reserves as for covering unanticipated expenses, mainly an increase in regular assessments, a special assessment, a loan or a combination of the foregoing. Additionally, depending on the reason the funds were needed, an emergency assessment may be possible.

Additional Practice Tips

The signature of two directors or one director and one non-director officer is always required to withdraw money from a reserve account.

When a board uses reserves to fund litigation, there are notice and reporting requirements. Review CC §5515 to ensure that the notices include all required information.

A special assessment to repay reserves that, individually or in aggregate with other special assessments imposed the same fiscal year, will exceed 5% of the association’s budgeted gross expenses for that fiscal year requires a member vote.

cacm.org | The Law Journal Summer 2023 13

$

Karyn A. Larko, Esq., is an attorney with Epsten, APC who specializes in community association counsel and has 15 years of experience in the industry. She’s based out of San Diego.

$ $

$

When faced with an unexpected expense, especially one that cannot be delayed, and insufficient operating income to cover it, borrowing from reserves is the quickest way to obtain the needed funds.

Goodbye Grass

Goodbye Grass

Handling turf conversions to drought tolerant landscapes.

By John F. Baumgardner, Esq.

By John F. Baumgardner, Esq.

Despite this year’s drumbeat of storms, California, and the Western United States, have been experiencing a “megadrought” that stretches back to 2000. Although the replenishing of reservoirs and historic snowpacks is a welcome sight, recent above-average rain years have been followed by historic dry periods. This atmospheric whiplash between wet and dry is expected to continue into the near future. The ongoing and predicted future scarcity of useable water has led the California Legislature, State Water Resources Control Board, and local water districts to implement new rules regarding residential landscaping to conserve water usage.

On May 24, 2022, the State Water Resources Control Board adopted an emergency water conservation regulation in response to the current drought that prohibited the watering of non-functional, ornamental grass. Although this regulation did not apply to residential properties, the State Water Resources Control Board explicitly informed homeowners associations that this new regulation applied to any non-functional, ornamental grass in common areas.

Local water districts also passed extensive regulations on watering. For example, the City of Sacramento passed a watering ordinance that limited landscape watering with sprinklers to two days a week between March 1 through October 31. The City of Sacramento’s ordinance excluded, among other things, watering by drip irrigation, watering with a hose and spray nozzle, and watering of

potted plants. Similar water restrictions were implemented by other water districts including the City of San Diego, the Los Angeles Department of Water and Power, and the Santa Clara Valley Water District. Other water districts, including the San Francisco Public Utilities Commission, implemented specific percentages of system-wide water reductions without limiting the types of water usage.

How Does This Affect Homeowners Associations?

Outside of landscaping on individual lots owned by the homeowners as their separate interest, many homeowners associations have significant common area grass that would be considered non-functional under the state’s definition. Non-functional, ornamental grass includes “grass [not] regularly used for recreation or community activities.” Mowable grasses in medians, along parkways, and other narrow strips of grass would likely fall under the state’s definitions. Additionally, even non-ornamental grass areas may continue to be subjected to previously imposed water restrictions and/or to more significant future restrictions.

Associations must consider their obligations for maintaining common area landscaping under these new regulations and ordinances as well as their governing documents. Pursuant to Civil Code §4775, an “association is responsible for repairing, replacing, and maintaining the common area.” Governing documents may also increase these

14 The Law Journal Summer 2023 | cacm.org

(ORNAMENTAL)

obligations by requiring an association to keep the common area in “a first class condition.”

(See Sands v. Walnut Gardens Condominium Assn. Inc. (2019) 35 Cal.App.5th 174.) Even though an association may be following the required water regulations, homeowners may be less accepting of dead grass than the state.

Replacement Options

In light of these obligations, an association should investigate potential long-term solutions as well as the costs and benefits of its current landscaping. First, an association should evaluate how the community uses its common area landscaping (i.e. recreation, community events, or merely ornamental). This will assist the association in identifying potential replacement options, landscape design, and membership outreach regarding the changes.

If the grass is merely ornamental, it will be subjected to the strictest restrictions imposed by the state and local water districts. For these ornamental grass areas, an association may be eligible for grants to replace the existing grass.

Funding Options

An association should also identify a funding plan for any landscape conversion before executing a contract. Many landscaped areas within an association are common area components that should be included in the reserve budget. If the landscaping project can be covered by the association’s reserves, no vote of the membership is required unless one is specified by the governing documents. Importantly, Civil Code §5510 provides that reserve funds may only be expended for maintenance and repairs of components that the association is obligated to maintain and repair and for which the reserve fund was established. Therefore, you should consult with legal counsel prior to using such funds for a new landscaping design/project that may include capital improvements. If the project costs exceed the reserves and are in excess of 5% of the association’s annual budgeted gross expenses, then a membership vote would be required to pass a special assessment to cover the landscape project costs.

The City of Sacramento offers turf conversion rebates to homeowners associations up to $50,000 at $1.50 per square foot. In order to qualify, the converted area must contain at least 60% plant coverage of drought tolerant groundcovers, shrubs, and trees. Similarly, the Los Angeles Department of Water and Power will provide a rebate of $3 - $5 per square foot for turf replaced with “California Friendly plants,” mulch, rain capture features, and drip irrigation.

If an association’s grass is used mainly for recreation, a drought tolerant landscape with significant plant coverage will likely be incompatible with the current usage. Although these rebates can help offset the costs of removing ornamental turf, it is important to note that most of the turf conversion rebates offered do not allow for the installation of artificial turf. However, there may be additional benefits and cost savings associated with artificial turf including reduced water bills, potential reduction of landscaping costs, and a consistent appearance year-round.

Regardless of whether a membership vote is required, it is important to educate the membership about the project and potential benefits and cost savings going forward. Identifying these benefits will help to assuage community concerns, allow for membership input, and reduce potential conflict after the conversion has already been implemented. Associations should also rely upon their trusted vendors (landscapers, contractors, general counsel, CPA) to assist the board and membership throughout the entire process, including budgeting for ongoing maintenance and future replacement costs. Proactive planning can help associations meet the state’s goals of conserving water and introducing drought tolerant plants while keeping communities in a first-class condition.

John F. Baumgardner, Esq., is the primary attorney in Chapman & Intrieri, LLP’s Roseville, California office and has been with the firm since 2014. His practice focuses on representing homeowners associations in general counsel matters, construction defect disputes, general civil litigation, and revision of governing documents.

cacm.org | The Law Journal Summer 2023 15

2022-2023 LEGAL DIRECTORY

ASSESSMENT COLLECTION SERVICES

ALLIED TRUSTEE SERVICES

Assessment Collection & Judgment Recovery Services

Stefan Murphy

Serving All of California For Over 27 Years

990 Reserve Dr., Ste. 208

Roseville, CA 95678

(800) 220-5454

smurphy@alliedtrustee.com www.alliedtrustee.com

ALTERRA ASSESSMENT RECOVERY

Assessment Collection Services

Steven J. Tinnelly, Esq. Your Association’s Assessment Collection Partner

27101 Puerta Real, Ste. 250 Mission Viejo, CA 92691 (888) 818-5949

ramona@tinnellylaw.com www.alterracollections.com

FELDSOTT & LEE, A LAW CORPORATION

Community Association Law

Stanley Feldsott, Esq. Laguna Hills | San Diego

23161 Mill Creek Dr., Ste. 300 Laguna Hills, CA 92653

(949) 729-8002 • Fax (949) 729-8012

feldsott@gmail.com www.cahoalaw.com

UNITED TRUSTEE SERVICES

Trusted Partners In Assessment Collections

Lisa E. Chapman

HOA Assessment Collection Services

696 San Ramon Valley Blvd., Ste. 353 Danville, CA 94526

(925) 855-8554 • Fax (925) 855-8559

lisa@unitedtrusteeservices.com

www.unitedtrusteeservices.com

ATTORNEYS

ADAMS | STIRLING PLC

Community Association Law

Adrian Adams, Laurie Poole, Jason Savlov, Wayne Louvier, Jamie Handrick, Melissa Ward LA, OC, IE, SD, SF, SAC, Palm Desert & Carlsbad 2566 Overland Ave., Ste. 730 Los Angeles, CA 90064

(800) 464-2817 • Fax (310) 464-2817

info@adamstirling.com

www.adamsstirling.com

BEAUMONT TASHJIAN

General Counsel & Assessment Collection Services

Jeffrey A. Beaumont and Lisa A. Tashjian

Serving California With General Counsel & Collection Services

21650 Oxnard St., Ste. 1620 Woodland Hills, CA 91367

(866) 788-9998 • Fax (818) 884-1087

info@HOAattorneys.com www.hoaattorneys.com

16 The Law Journal Summer 2023 | cacm.org

BERDING | WEIL

Construction Defect Litigation

Steven Weil, Tyler Berding, Chad Thomas, Daniel Rottinghaus, Andrew Baugh, Paul Windust

Walnut Creek, San Diego, Orange County, Sacramento

2175 North California Blvd., Ste. 500

Walnut Creek, CA 94596

(800) 838-2090 • Fax (925) 820-5592

jjackson@berdingweil.com

www.berdingweil.com

COMMUNITY LEGAL ADVISORS, INC.

General Counsel & Assessment Collections

Mark Guithues, Esq. & Mark Allen Wilson, Esq. Inland Empire | Orange County | San Diego

509 N. Coast Hwy.

Oceanside, CA 92054

(760) 529-5211 • Fax (760) 453-2194

mark@attorneyforhoa.com

www.attorneyforhoa.com

EPSTEN, APC

Community Association Law, Construction Defect, Litigation & Assessment Recovery

Jon Epsten, Esq. & Susan Hawks McClintic, Esq.

San Diego | Inland Empire | Coachella Valley

10200 Willow Creek Rd., Ste. 100 San Diego, CA 92131

(858) 527-0111 • Fax (858) 527-1531

jepsten@epsten.com

www.epsten.com

FIORE RACOBS & POWERS, A PLC

Community Association Law & Assessment Collections

Jacqueline D. Foster, Esq., Peter E. Racobs, Esq., & John R. MacDowell, Esq.

The Recognized Authority in Community Association Law

Orange County | Inland Empire | Coachella Valley l San Diego County

(877) 31-FIORE • Fax (949) 727-3311

dweissberg@fiorelaw.com

www.fiorelaw.com

GURALNICK & GILLILAND, LLP

Association Law, Assessment Collections, General Counsel

Wayne S. Guralnick, Robert J. Gilliland Jr. Serving Community Associations for Over 30 Years

40004 Cook St., Ste. 3 Palm Desert, CA 92211

(760) 340-1515 • Fax (760) 568-3053

wayneg@gghoalaw.com

www.gghoalaw.com

HICKEY & ASSOCIATES, P.C. Community Association Law

David E. Hickey, Esq. 27261 Las Ramblas, Ste. 120 Mission Viejo, CA 92691 (949) 614-1550 • Fax (949) 748-3990

dhickey@hickeyassociates.net www.HickeyAssociates.net

HUGHES GILL COCHRANE TINETTI, P.C. Community Association & Construction Defect Law

Michael J. Hughes, Esq., John P. Gill, Esq., Amy K. Tinetti, Esq. Complete Representation of Community Associations

2820 Shadelands Dr., Ste. 160 Walnut Creek, CA 94598 (925) 926-1200 • Fax (925) 926-1202 atinetti@hughes-gill.com www.hughes-gill.com

THE JUDGE LAW FIRM

Providing General Counsel & Collection Services Throughout CA For Over 20 Years

James Judge, Esq. HOA LAW

18650 MacArthur Blvd., 4th Fl., Ste. 450 Irvine, CA 92612 (949) 833-8633 • Fax (949) 833-0154 info@thejudgefirm.com

www.thejudgefirm.com

LOEWENTHAL, HILLSHAFER & CARTER, LLP

Construction Defect Litigation

Robert Hillshafer | David Loewenthal

Los Angeles, Ventura, and Surrounding Counties

5700 Canoga Ave., Ste. 160 Woodland Hills, CA 91367 (866) 474-5529 • Fax (818) 905-6372

info@lhclawyers.net www.lhclawyers.net

THE NAUMANN LAW FIRM, PC

Construction Defect Litigation Construction Defect Analysis

William Naumann l Elaine Gower

San Diego l Orange County l Los Angeles l Riverside l San Bernardino

10200 Willow Creek Rd., Ste. 150 San Diego, CA 92131

(858) 522-0763 • Fax (858) 564-9300

elaine@naumannlegal.com

www.naumannlegal.com

PRATT & ASSOCIATES, APC

Community Association Law

Sharon Glenn Pratt

Los Gatos, CA

634 North Santa Cruz Ave., Ste. 204

Los Gatos, CA 95030

(408) 369-0800 • Fax (408) 369-0752

spratt@prattattorneys.com

www.prattattorneys.com

RAGGHIANTI FREITAS LLP

Community Association Law, Construction Defects & Mediation

David F. Feingold, Esq.

Matthew A. Haulk, Esq.

Serving Bay Area Communities Since 1986 1101 Fifth Ave., Ste. 100

San Rafael, CA 94901

(415) 453-9433 • Fax (415) 453-8269

dfeingold@rflawllp.com

www.rflawllp.com

RICHARDSON OBER LLP

Community Association Law, General Counsel, Assessment Recovery

Kelly G. Richardson

Matt D. Ober

Throughout California

(877) 446-2529

matt@roattorneys.com

www.roattorneys.com

SWEDELSONGOTTLIEB

Community Association Law, Construction Defect, Assessment Collection

David C. Swedelson, Esq.

Sandra L. Gottlieb, Esq.

Los Angeles | Orange County |

Palm Desert | San Francisco l Ventura 11900 W. Olympic Blvd., Ste. 700

Los Angeles, CA 90064

(800) 372-2207 • Fax (310) 207-2115

slg@sghoalaw.com

www.lawforhoas.com

TINNELLY LAW GROUP

Community Association Law

Richard A. Tinnelly, Esq.

Steven J. Tinnelly, Esq.

Orange County | Los Angeles |

Palm Desert | San Francisco | San Diego 27101 Puerta Real, Ste. 250

Mission Viejo, CA 92691

(949) 588-0866 • Fax (949) 588-5993

ramona@tinnellylaw.com

www.tinnellylaw.com

Continues on page 18

cacm.org | The Law Journal Summer 2023 17

2022-23 LEGAL DIRECTORY,

Continued from page 17

WHITE & MACDONALD, LLP

COMMUNITY ASSOCIATION LAW, CONSTRUCTION DEFECT LAW

Steven M. White, Esq., Rob D. MacDonald, Esq., James P. Hillman, Esq.

COST EFFECTIVE SOLUTIONS BASED ON EXPERIENCE

1530 The Alameda, Ste. 215 San Jose, CA 95126

(408) 345-4000 • Fax (408) 345-4020 info@wm-llp.com

www.wm-llp.com

WHITNEY PETCHUL APC

Community Association Attorneys

Fred T. Whitney, Esq. l Dirk E. Petchul, Esq.

From Inception To Build-Out And Beyond

27 Orchard Rd.

Lake Forest, CA 92630

(949) 766-4700 • Fax (949) 766-4712

dpetchul@whitneypetchul.com www.whitneypetchul.com

WOLF, RIFKIN, SHAPIRO, SCHULMAN & RABKIN, LLP

Community Association Law

Michael W. Rabkin, Esq.

11400 W. Olympic Blvd., 9th Floor

Los Angeles, CA 90064

(310) 478-4100 • Fax (310) 479-1422

mrabkin@wrslawyers.com www.wrslawyers.com

CONSTRUCTION DEFECTS

BERDING | WEIL

Construction Defect Litigation

Steven Weil, Tyler Berding, Chad Thomas, Daniel Rottinghaus, Andrew Baugh, Paul Windust

Walnut Creek, San Diego, Orange County, Sacramento

2175 North California Blvd., Ste. 500

Walnut Creek, CA 94596

(800) 838-2090 • Fax (925) 820-5592

jjackson@berdingweil.com

www.berdingweil.com

CHAPMAN & INTRIERI, LLP

General Counsel & Construction Defect Litigation

John W. Chapman, Esq. & Mark G. Intrieri, Esq.

Alameda l Roseville l Orange County l San Diego

2236 Mariner Square Dr., Ste. 300 Alameda, CA 94501

(510) 864-3600 • Fax (510) 864-3601

jchapman@cnilawfirm.com www.cnilawfirm.com

FENTON GRANT MAYFIELD

KANEDA & LITT, LLP

Construction Defect Litigation & CID Education

Charles R. Fenton, Esq. & Joseph Kaneda, Esq.

Servicing California & Nevada Communities for Over 30 Years

2030 Main Street, Ste. 550 Irvine, CA 92614

(877) 520-3455 • Fax (949) 435-3801

cfenton@fentongrant.com www.fentongrant.com

THE MILLER LAW FIRM

Construction Defect Analysis & Litigation

Thomas E. Miller, Esq. & Rachel M. Miller, Esq.

The Authority in California Construction Defect Claims for 40 Years

19 Corporate Plaza Dr. Newport Beach, CA 92660

(800) 403-3332 • Fax (929) 442-0646

rachel@constructiondefects.com www.constructiondefects.com

ELECTION ADMINISTRATION

THE INSPECTORS OF ELECTION

Providing Superior Election Support for California HOA’s Since 2006

Kurtis Peterson

Completely Independent Full-Service Election Provider

2794 Loker Ave. W., Ste. 104 Carlsbad, CA 92010

(888) 211-5332 • Fax (888) 211-5332

kurtis@theinspectorsofelection.com www.theinspectorsofelection.com

LIBERTY HOA ELECTION SERVICES, LLC

Election Administration

Deanna M. Libert

We Make Association Voting Management Easy

1900 Camden Ave. San Jose, CA 95124

(408) 482-9659

deanna@hoaelection.com

www.hoaelection.com

RESERVE STUDY FIRMS

ASSOCIATION RESERVES

Reserve Study Firm

Carol Serrano

Reserve Studies for Community Associations

6700 Fallbrook Ave., Ste. 255 West Hills, CA 91307

(800) 733-1365

cserrano@reservestudy.com

www.reservestudy.com

THE HELSING GROUP, INC.

Reserve Study Firm

Ryan Leptien

Serving All of California 4000 Executive Pkwy., Ste. 100 San Ramon, CA 94583

(925) 355-2100 • Fax (925) 355-9600

reservestudies@helsing.com

www.helsing.com

VENDOR COMPLIANCE

ASSOCIATION SERVICES NETWORK

Vendor Compliance

David Jeranko

Vendor Compliance & Risk Management

24000 Alicia Pkwy., Ste. 17-442 Mission Viejo, CA 92691

(949) 300-3702 • Fax (877) 404-2008

davidj@asn4hoa.com

www.asn4hoa.com

18 The Law Journal Summer 2023 | cacm.org

Matthew A. Gardner, Esq., is a partner at Richardson | Ober who works with community associations, homeowners and HOA boards of directors to amend governing documents, resolve homeowner/ member disputes, and manage assessment delinquency matters.

Matthew A. Gardner, Esq., is a partner at Richardson | Ober who works with community associations, homeowners and HOA boards of directors to amend governing documents, resolve homeowner/ member disputes, and manage assessment delinquency matters.

By John D. Hansen, Esq.

By John D. Hansen, Esq.

By John F. Baumgardner, Esq.

By John F. Baumgardner, Esq.