Why massive interest in microdramas?

Why massive interest in microdramas?

It’s begining to look a lot like Xmas all year

FX balances the epic with the up-and-coming

PLUS: Belgium’s RTBF puts crime and repeatability top of its wishlist | BritBox International’s commissioning ambitions

Around 18 months ago, several new names began appearing on the app download charts in North America, surpassing established streaming players like Netflix, Hulu and Disney+.

These new entrants included the likes of ReelShort, DramaBox and, more recently, FlareFlow, all platforms specialising in cliffhanger-laden vertical series with episodes lasting between one and two minutes and often spanning more than 70 parts.

New players are flocking to the vertical video market as it becomes embedded in traditional production and distribution pipelines – and there are suggestions US studios are circling despite their run-in with Quibi.

The unexpected ascension of these apps has largely been ignored by the traditional Hollywood ecosystem, which swore off shortform once and for all after the oft-cited collapse of Quibi. But some have been watching with interest.

One of those companies is Cineverse, the LA-based studio and free ad-supported streaming television (FAST) company that wowed Hollywood last year as its low-budget horror feature Terrifier 3 achieved a US$90m box-office on a US$2m production budget.

Cineverse was previously backed by Chinese private equity, and its principals have keenly followed developments in both China and the broader pan-Asian market, as these typically serve as a precursor to trends in North America.

The trend lines were quickly becoming too clear to ignore, according to

By Jordan Pinto

Cineverse’s president and chief strategy officer Erick Opeka, and the company felt it needed to move quickly to capitalise on an opportunity that has not yet been understood in Hollywood, which has historically been slow to react.

Today, there is already an established ecosystem around microdramas, with multi-billion-dollar revenue streams and an engaged fan base that simply didn’t exist when Quibi came and went. According to a recent report from Media Partners Asia, microdrama revenues in China will exceed the country’s box office this year, having grown from US$500m in 2021 to US$7bn in 2024 and projected to reach US$16.2bn by 2030. Outside China, revenue is expected to hit US$9.5bn by 2030, up from US$1.4bn last year.

Earlier this year, Cineverse partnered with Banyan Ventures, a venture capital outfit led by Lloyd Braun that had also been circling the microdrama space. The resulting 50/50 joint venture, MicroCo, was formally launched in August, with two more high-profile execs joining jumping aboard: ex-Showtime president Jana Winograde as CEO, and former NBCUniversal Television & Streaming chairman Susan Rovner as chief content officer.

MicroCo will serve as both a studio for producing vertical series and a platform to stream them, with the company saying it wants to be the “first US-based studio and AInative platform built specifically for high-quality microseries: serialised, shortform, mobile-first content specifically designed for modern viewing habits.”

A (micro)climate change for the industry?

Opeka says the microdrama opportunity is arguably unlike anything seen in the content space for the past 25 years.

“I look at it as probably the first new professional format in the market since reality TV. And whether you like reality TV or not, it changed the game for television,” he tells C21. “It created a whole plethora of companies, and an entire ecosystem in the tens of billions of dollars annually – of production, development, releasing and its own star system. That is exactly what’s going to happen with the microdrama space.”

The new format is already creating recurring stars, several platforms are growing rapidly and traditional producers are flocking to get in, making it very different to the contracting TV business and the now-mature streaming sector. Microdrama “embodies a lot of the excitement in the space that is very much needed to invigorate the community,” says Opeka.

There is also the matter of money. While budgets range quite widely, the average cost is around US$200,000, according to estimates. That can drop to around US$15,000 for very small projects and go up to US$400,000 for bigger ones from established vertical drama studios. In the future, it is believed AI will bring down costs further.

“ I look at it as probably the first new professional format in the market since reality TV. And whether you like reality TV or not, it changed the game for television

Erick Opeka Cineverse

As shortform vertical dramas become more common in Hollywood, they may also cause companies to take an expanded approach to production, says Opeka. One example would see MicroCo extending some of the IPs housed within Cineverse, or Braun’s various companies, into the microdrama space. Another would see it produce dedicated shortform vertical versions of longform projects.

“When we make a low-budget movie, can we tack on an extra seven days of production and make the microdrama for an incremental increase on the budget? That’s one option we’re exploring,” he says.

Opeka adds that MicroCo hopes to bring some traditional Hollywood business models into the microdrama space. Namely, sharing in revenue with producers and creators.

“We know that the industry works best when the talent is compensated, versus more constrained models,” he says.

By Opeka’s count, there are currently between 40 and 50 “viable” microdrama apps in the market globally, though perhaps none have the same access to Hollywood talent that MicroCo does. The company plans to elevate the writing and the production quality, although Opeka is quick to stress that “the format doesn’t need ridiculous sums of money.”

Leading lights of a micro revolution

Globally, ReelShort has been one of the platforms spearheading the ascension of microdramas. Owned by Silicon Valley-based Crazy Maple Studio, which is in turn backed by China’s COL Group, the platform has drawn huge viewership for its proprietary titles, including The Double Life of My Billionaire Husband (492 million views) and Breaking the Ice (334 million). In both cases, these projects have been adapted into multiple languages, with the remakes also garnering hundreds of millions of views. Other scripted romance titles include How to Tame a Silver Fox and The Quarterback Next Door

While soapy, over-the-top, romance-focused stories have been ReelShort’s bread and butter, the platform is beginning to dabble in new genres too. It recently launched its first reality series, Love Bombing, consisting of 175

ReelShort’s

episodes. C21 understands more reality projects are in the works, while the platform is also moving more fully into the thriller genre.

Within ReelShort, there is a growing sense that microseries from outside the romance genre will be a meaningful growth driver in the future. As such, it recently launched a global contest, Real Vertical Impact, asking creators to showcase a 40-second vertical creation. The winner will have their project adapted as a full microseries. In Canada, ReelShort’s development and production is overseen by project manager Keri-Lee Kroeger, who says she is hunting for stories of all descriptions. “I want great story with dynamic characters and addictive plots, ones that you just can’t look away from, whether they come from existing IPs or if they’re original stories,” she says.

In terms of the production model, Kroeger says projects are typically financed in one of three ways: by ReelShort’s in-house team, commissioning third-party producers or, on occasion, with outside investors backing specific projects.

One example of ReelShort searching for IP in interesting places is The Billionaire’s Fake Wife, an adaptation of a 1980s Bollywood film called Kissi Se Na Kehna. Set to shoot in the fall, it is ReelShort’s first announced project in the Canadian market, with production from Vancouverbased Service Street Pictures, led by Sammie Astaneh. Many more are expected to follow in Canada, which has become something of a hotbed for production for these shortform projects.

For Astaneh, who was primarily a TV movie producer before expanding into microdramas last year, he believes now is a good time to be involved in the space, given the number of platforms coming online, the enormous appetite for new content and the scope to innovate in both storytelling and financing models.

The producer, whose company has also produced One Last Temptation Before I Say I Do for platform GoodShort, says the format is a surprisingly nuanced meeting of art and science. “People might say the content is a bit tropey, slapstick or over the top, but there’s a lot of data and science behind every single episode, especially the first 10 episodes when you’re establishing the story,” he says.

Monika Dalman, a casting director working in British Columbia, has had a front-row seat for the expansion of the vertical drama sector. Since mid 2023, Dalman alone has cast more than 60 microdramas – indicating just how many such projects are being filmed in North America.

Created, written and directed by Mackenzie Crook ( Detectorists, Worzel Gummidge) Produced by Gill Isles ( Gavin & Stacey, Alma’s Not Normal)

Created, written and directed by Mackenzie Crook ( Detectorists, Worzel Gummidge) Produced by Gill Isles ( Gavin & Stacey, Alma’s Not Normal)

Comedy Series: 6 x half hours

sphere-abacus.com sales@sphere-abacus.com

Dalman estimates there are at least 20 shooting in Vancouver at any one time. And given that production usually takes around 10 days, it’s easy to see how quickly the format is growing in North America.

In 2023 and 2024, Dalman says microdramas were the exclusive domain of small video production companies, but more established players are beginning to move in. They have had to learn some lessons along the way, though.

“ I want great story with dynamic characters and addictive plots, ones that you just can’t look away from, whether they come from existing IPs or if they’re original stories.

Keri-Lee Kroeger ReelShort

Around six months ago, Dalman says some established TV and feature film producers reached out asking where they were going wrong. They were pitching vertical dramas that would typically “knock it out of the park” for a network but getting no bites from the microdrama platforms. The disconnect, says Dalman, centred around stars.

“For these projects, it’s not about attaching a name and team that is considered to be bankable,” she explains. “When [microdrama platforms] see an actor who’s famous, all they see is somebody who is expensive, and they know from experience that they don’t need to spend huge money on an actor to get the results they’re looking for.”

TV movies are the closest thing to microdramas in the traditional content world, argues Dalman, as they have a similar romance-fuelled storylines, a similar number of script pages and are similarly reliant on cliffhangers to get viewers to sit through commercials.

Networks that commission these types of projects –Hallmark, Lifetime and, increasingly, streamers like Netflix – would be smart to experiment in the microdrama arena, says Dalman, potentially allowing them to retain their audiences and attract new ones.

Using the very rough calculation that a TV movie costs between US$1m and US$5m and a microdrama costs US$200,000, one could theoretically make between five and 25 of the latter for the cost of the former. This makes microdramas – which typically now draw much larger audiences than TV movies and provide much better audience data – an ideal “sandbox” in which to experiment, she says.

“It would be a great investment, because as time goes on and the leads on Lifetime, Hallmark or other shows get older, we of course want to introduce new talent. And if you could treat a vertical like a sandbox for a network, you can test different storylines and talent pairings, but for a fraction of a cost,” Dalman says. She adds that some networks are already experimenting with this idea, which she argues would “strengthen brand awareness” rather than cannibalising the existing audience.

How could microdramas shake up international distribution?

On the distribution side of the business, there are also indications that microdramas could start to become an important piece of the licensing pie.

Earlier in the year, Crazy Maple Studios parent company COL Group launched a content distribution division, with over 1,000 titles being made available to broadcasters, streamers, telcos and digital platforms in both English and Cantonese. From Rags to Rank One is among COL Group’s most successful titles, with the 105-part historical epic drawing 238 million views in just one day, according to the company, and 77 minutes of watch time per user. In China alone, that project has cleared one billion views.

Prentiss Fraser, the newly installed president of sales and distribution Fox Entertainment Global (FEG), also recently told C21 that vertical video is an area she is interested in. She stopped short of saying it was an area FEG would certainly enter, but signalled her interest in the burgeoning medium as part of a goal to “experiment and invest in parallel paths.”

Is it a matter of time before US studios and streamers re-enter the fray?

The bigger the microdrama space becomes, the more likely it seems that the major US studios will get involved. Cineverse’s Opeka believes it will happen sooner rather than later, as the revenue potential becomes too enticing –and without the risk of rapidly lighting billions of dollars on fire, as was the case with Quibi.

“Studios are slow adopters, usually late adopters, and usually acquirers,” says Opeka, citing FAST as an area where US studios were slow to move until the “revenue streams were undeniably rich enough.”

Given how rapidly the microdrama sector is growing, however, the adoption cycle is going to be far shorter than it was for FAST.

“It’ll probably be a couple years,” he says. “But the venture capital and foreign money pouring in, and the undeniable rankings and revenue streams that you’re starting to see in the app stores, mean it’s going to be undeniable for them. Especially given the values it’s going to bring to their existing base of IP, they stand to benefit the most of anybody by leveraging it.”

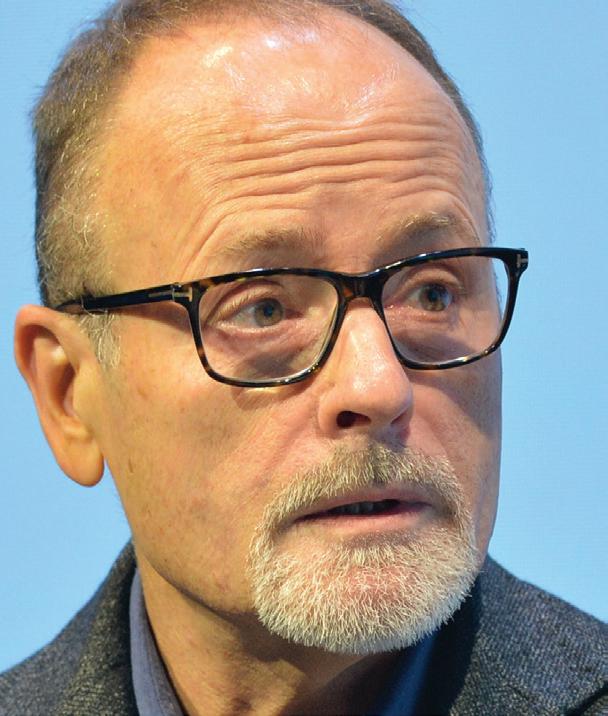

“FX has always had vibrant slate and I’m the schmuck who has to figure out how to replace shows generation a er generation. Every time we have success with a show like The Bear, the clock starts ticking and it’s ‘What’s next?’ O en those shows come from the most unexpected sources.

John Landgraf

Walt Disney Companyowned pay TV network

FX is looking to take more ambitious swings on epic “large-canvas” drama series with global appeal, back inexperienced creative talent capable of originating “miraculously great shows” and create new IP that taps into the human condition.

FX chairman John Landgraf, who has affectionately been nicknamed the ‘Mayor of TV’ by his fellow Hollywood bigwigs, says the cablenet is seeking the next generation of storytellers who can produce content worthy of one day replacing acclaimed shows such as The Bear and English Teacher

Balancing a slate of epic ‘large-canvas’ flagship drama series with fresh IP from up-andcoming storytellers is key to John Landgraf’s programming manifesto for FX.

The veteran executive has previously described FX as a “relatively modest-sized brand inside of a very large global streaming service”

storytellers

By Neil Batey

which relies on new talent to create out-of-the-box series to help the network stand out in a crowded marketplace.

Landgraf says that FX makes around 15 to 20 shows a year, with Disney seeing the network as an incubator for fresh IP from ambitious creatives who don’t necessarily have to possess a proven track

FX is a place that’s an engine for new storytelling,” says Langraf. “The strategy is to find extraordinary and gifted people who have terrific ideas, then take as much time, energy and care as one must to bring [those ideas] to fruition.

The Bear, created by Christopher Storer and produced by FX record.

“Disney has been very supportive and part of that is because what they want from

“FX has always had a vibrant slate and I’m the schmuck who has to figure out how to replace shows generation after generation. Every time we have success with a show like The Bear, the clock starts ticking and it’s ‘What’s next?’ Often those shows come from the most unexpected sources.”

Productions, has been a runaway success for the network. Starring Jeremy Allen White as a celebrated chef who works in the kitchen of his late brother’s sandwich shop, it was recently renewed for a fifth season.

New commissions include Cry Wolf, an adaptation of the Danish psychological thriller Ulven Kommer

The limited series stars Olivia Colman and Brie Larson and follows a social worker and a mother who find themselves in a crisis when the mother’s teenage daughter accuses her of abuse. It is produced by FX Productions and Colman’s South of the River Pictures.

FX has also handed a series order to a Ryan Murphy-produced adaptation of Bret Easton Ellis’ novel The Shards. The project, produced by Disney’s 20th Television in association

with Ryan Murphy Television, is set in 1980s Los Angeles and follows a teenager (based in part on Ellis) in his final year at an elite prep school.

Although those two commissions are based on proven IP, Landgraf says FX will happily take a risk on new projects from inexperienced showrunners. “You can’t just take and re-purpose other people’s work, you have to do some of your own,” he told delegates at the Royal Television Society Cambridge Convention in the UK this summer.

“Chris Storer, who made The Bear, had no prior experience. For the most part we work with people who are brand new at it. They have this extraordinary ability but what they need is for us to wrap our arms around them, support and sometimes challenge them.”

While Landgraf explains that shows such as The Bear are rooted in US culture for FX’s local audience, other projects need to appeal to global audiences who discover series through international streaming platform Disney+. These projects are bigger swings that fall into the highend TV category and hark back to classic epics of the past.

Historical drama series Shogun, for example, is based on the 1975 novel by James Clavell, which was previously adapted into a 1980 NBC miniseries. Made by FX Productions and the largest international production in the network’s history, the story is set in feudal Japan with a predominantly Japanese cast and dialogue.

Sci-fi horror Alien: Earth, meanwhile, is the first TV series in the Alien franchise and is set two years before the events of Ridley Scott’s seminal 1979 film. It is produced by Fox Productions, Scott Free Productions and 26 Keys Productions.

“I know now that I have to make a few things that really work globally,” Landgraf says. “Alien: Earth was a rare circumstance where I had access to some corporate IP. It’s the first time in 22 years that has happened but there was a sense that we could do something with a TV series that was different to the films.

“Both Alien: Earth and Shogun will have more consumption outside of the US. That’s really a new thing and I want to have a certain number of projects in the slate that achieve that for the benefit of our colleagues in Asia, Latin America and Europe.

“Having been here for over 20 years, I’ve gained a measure of credibility and can take risks that others can’t. The strategy behind Shogun was clear and it goes all the way back to epics like Lawrence of Arabia and [more recently] Game of Thrones

“We’ve got out of the habit of making epics out of anything other than space and the future. I didn’t realise at the time that Shogun would take a decade to bring to the screen and that more than half of it would be in Japanese. It’s terrifying but also exciting to make these large-canvas shows and there’s a certain segment of the audience that really loves an epic.”

From the early FX days of launching shows such as edgy police procedural The Shield, medical drama Nip/Tuck and Denis-Leary fronted firefighter hit Rescue Me, to long-running comedy It’s Always Sunny in Philadelphia and upcoming Ethan Hawke neo-noir The Lowdown, Landgraf says the network’s ambition is to “find miraculously great stories that come out of nowhere.”

As to the kind of content FX doesn’t want, he is not interested in leaning into the kind of YouTube-inspired, creator-led content that many others are pivoting towards. “I can’t imagine any of us who are in longform storytelling will succeed if we compete with YouTube on its terms,” he says.

“Ultimately, what I’m trying to do is make something that’s worthy enough to not only cause people to put their phones down and devote their attention to only one screen, but better yet watch it with somebody else they care about, like a friend or spouse. I believe that form of attention is inherently more valuable. If you’re going to compete on volume with literally 100 million creators, you’re simply going to lose.

“Shortform internet content doesn’t have a lot of context, while the best storytelling has layer upon layer of deeper meaning. So a powerful way of describing our brand is that [our shows] derive from the human condition and what it feels to be alive right now. It gives us a deeply specific way of approaching storytelling.”

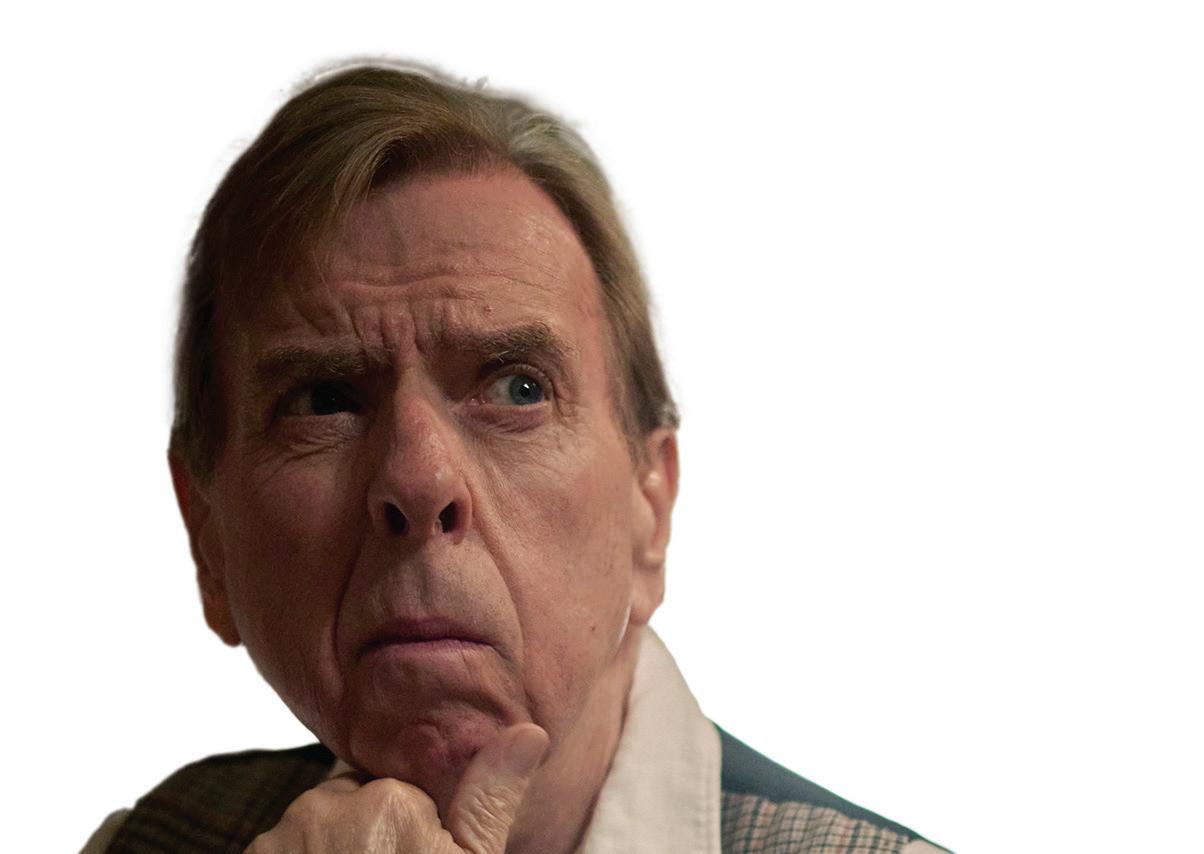

RTBF’s head of fiction, Marc Janssen, sets out his content wishlist, with procedural crime and repeatability among the top requirements for the Frenchlanguage Belgian pubcaster.

Scripted crime has proven an intergenerational audience driver for RTBF, ranking as the top fiction genre for the French-language pubcaster in 2024, led by murder mysteries and ‘cosy crime’ procedurals.

Many are French coproductions, including its leading scripted title, French crime drama HPI (Haut potentiel intellectuel), a copro with local commercial broadcaster TF1.

Vive, an adaptation of the Turkish series Persona, starring Clémentine Célarié as a woman diagnosed with Alzheimer’s disease who seeks revenge before losing her memory. “This was a bit of a risk,” says Janssen. “It’s a little o eat, but M6 really believed in it, we like Clémentine Célarié and wanted to try something di erent.”

RTBF is a relative newcomer to drama commissioning, having jumped on the high-end drama wagon just over a decade ago.

By Gün Akyuz

RTBF directly commissions between three and four drama series per year for its mainstream channel La Une. In addition, RTBF regularly coproduces with French broadcasters TF1 and France TV, and more recently M6, mining a growing seam of murder mysteries, often femaleled, with quirky characters and some comedic elements.

“They have something di erent and original that we really liked, and for our audience it really struck a chord. They’re among the most popular we’ve commissioned and coproduced,” says RTBF’s head of fiction, Marc Janssen.

As well as being popular among viewers, the ‘case of the week’ format is valuable due to its repeatability, which is key for most European broadcasters, who are “struggling with budget constraints and who need still to fill a linear schedule,” says Janssen.

RTBF has entered into a number of copros with French partners including HPI (Haut potentiel intellectuel), with local commercial broadcaster TF1

As one of the new kids on the block, RTBF “had to build almost an industry from the ground up” over those 10 years, with its scripted commissioning priorities developing hand-in-hand with its evolving relationship with local scriptwriters, directors and independent producers. “The writers we have are very talented, but their experience was in cinema or theatre, and totally di erent to writing a series,” says Janssen, noting the similar pivot required of directors and producers.

RTBF continues to develop its creative partnership with writers and is attempting to steer them towards the cosy crime genre as it seeks more popular, repeatable murder mystery procedurals.

with budget constraints and who need still to fill a linear Memoire mystery procedurals.

RTBF’s French copros also include

For now, the genre is most likely to be coproduced via French collaborations, given their wide availability.

“Before we invest as coproducer, we need to make sure that there is a French broadcaster

“We don’t co-commission,” advises Janssen. “Before we invest as coproducer, we need to make sure that there is a French broadcaster attached to the programme. It’s not in our mission to develop projects that are made abroad. The money we have for development is for Belgian [writers] and to support that sector.”

development is for Belgian [writers] and to

commissions. “We’re not looking for success just for the sake of it. We still also want to reach younger audiences, and we also

we have in Belgium. As a small country, we have to be original and di erent in order to exist,” he says.

Janssen’s wider mission is to build a diverse slate across its four annual drama commissions. “We’re not looking for success just for the sake of it. We still also want to reach younger audiences, and we still also want to showcase the talent that we have in Belgium. As a small country, we have to be original and di erent in order to exist,” he says.

At least one of those commissions should be a “genre that connects with people and says something about society or human relations,” Janssen continues, highlighting British scriptwriter and showrunner Sally Wainwright and her gritty serialised crime drama Happy Valley as the type of series he aspires to.

be a “genre that connects with people and says something about society or drama to.

“Happy Valley is an example of an amazing strong female character, great plot lines, addictive and really compelling as well, but also in a setting that’s not glamorous or ‘cosy.’ It works because it says something about

‘cosy.’ says

northern industrial England today and where it’s at, its ambitions and lost dreams. The genius of people like that is to combine the drive to attract viewers with a story and characters that are beautiful and complex, fragile and flawed.”

Another challenge for RTBF is most of its local Belgian dramas are serialised miniseries, which don’t repeat well. “We’ve tried to rerun them two or three years after they first aired, but the audience just didn’t come back. It’s a lot of money being invested in content – absolutely for a great reason – but the return on investment, in terms of how you can fill your schedule, is trickier,” says Janssen.

Crime series and procedurals like HPI do well when repeated, however.

French-led copro Astrid & Raphaëlle (Astrid: Murder in Paris), made with pubcaster France Télévisions, successfully aired as reruns in primetime on Tuesdays in the summer season, where they achieved 22-23% shares, and e ectively without “costing any money,” says Janssen.

RTBF has also started coproducing with its Flemish counterpart VRT. The first was true crime series 1985, from Flemish prodco Eyeworks, about a wave of terrorist attacks and murders in Belgium in the 1980s. It attracted an intergenerational audience, including younger adults, says Janssen.

It is now teaming up with Eyeworks and VRT on a third season of The Twelve, centred around a jury in murder trials. The first two seasons were in Flemish, but the third season has been given a bilingual setting.

In a first for RTBF, it also boarded six-part UK drama I, Jack Wright by Chris Lang (Unforgotten) as a coproducer, following an approach by Federation Stories seeking a partner to help finance it, says Janssen. The show averaged a 19% audience share across its run – considered a good result for a non-French-language show.

Janssen is open to other UK deals. “I invested in British drama because I think it’s among the best being made right now. Thanks to BBC Studios, ITV Studios [and others], we’re able to buy a lot of those shows and bring them to our platform and really carve identity around them. But we’ve never really talked with the creative side. There are ways in which we could be working together, but the British sector seems a little closed,” he says.

Local projects lined up for 2026 include Ethernal (6x52’), a murder mystery sci-fi story in which humans can speak to the dead through objects that were precious to the deceased people. “It’s a very beautiful, almost sporadic series, but one that also has international intrigue and a murder mystery,” says Janssen. The coproduction, with Hélicotronc, is expected to launch in the second half of 2026.

Another series in the pipeline Janssen has high hopes for is Vital from prodco Sequel Prod, a thriller/murder mystery set in a hospital, with two young actors in the leading roles.

RTBF is also in pre-production on four-part true crime series Haemers, about a famous Belgian gangster of the late 1980s and early 90s. The project, made with Sequel Prod, is still in the process of completing its financing, but Janssen is optimistic and hopes to see it air next year.

Also in the works is comedy Les Beaux Malaises (8x30’), skewing towards younger adults and a remake of the French-Canadian sitcom. It revolves around a famous

stand-up comedian who fakes his own life and charts the ups and downs of being a comedian in Belgium. Alongside commissions and copros, mainstream La Une has 90 slots a year for acquired drama, while on Tipik, aimed at 25-45s, scripted acquisitions are mainly US or French movies. Arts- and culture-leaning La Trois, meanwhile, coproduces or acquires movies and recently opened up a slot for period drama. External competition in the region has increased further with the arrival of TF1+ in the last 18 months, and any audience gains for RTBF’s digital RTBF Auvio have yet to match losses on linear TV, says Janssen.

Janssen’s main commissioning challenge over the coming year will be “financing while still being creative and finding new forms of partnership.”

RTBF’s series need international partners due to high production costs and a growing funding gap. Janssen’s budget for acquisitions and coproductions has been steadily eroded year by year, and although his commissioning budget has not, it’s now being capped.

The average production cost for a single episode of a TV series is €600,000 (US$700,570), which is partially supported by Belgian tax incentives and other soft money from regional funders, as well as local partners like telcos, but it often still leaves a funding gap that requires plugging by distributors internationally, says Janssen.

“ We’re not looking for success just for the sake of it. We still also want to reach younger audiences, and we still also want to showcase the talent that we have in Belgium. As a small country, we have to be original and di erent in order to exist.

Marc Janssen

RTBF

A particular funding challenge is 6x30’ shows targeted at younger audiences. These are di cult to attract funding for due to the shorter format and too few episodes for a small audience segment, says Janssen. “Even if we do make some sales, a lot of them go to BVoD platforms, and we haven’t been able to find a virtuous funding model for them yet,” he says.

Janssen rules out joining foreign copros because “cofunding a Dutch or Swiss or Portuguese show with a lot of promise won’t help the local Belgian creative sector. So the shows we want to make are very local. We believe they can travel because the concept and the pitch is so strong, but they will be written by Belgians and played by Belgian actors and would take place in Belgium.”

Providing the best of British programming has proven to be a vital niche for BBC Studios-owned streamer BritBox International, with content chief Jon Farrar seeking to push the envelope with big commissioning swings.

By Neil Batey

K content streamer BritBox International is looking to take big swings within its core commissioning and coproducing pillars of ‘crime and corsets’ programming, as well as seeking returnable series and cross-genre concepts.

The platform was set up as a joint venture between BBC Studios (BBCS) and ITV, but the latter sold its 50% stake to BBCS for £255m (US$344m) last year. BritBox International is present in several markets globally including the US, Canada, Australia and the Nordics, where in 2022 it rolled out to Denmark, Norway, Sweden and Finland.

on the content we want to invest in. There’s maybe a misconception that BritBox is either just a library service or only buys finished tape, but we’ve moved upstream significantly over the last two or three years and have become an essential partner to the UK ecosystem.”

Former SkyShowtime and BBC Studios executive Farrar joined BritBox International in early 2024, leading on all areas of programming, from commissions and acquisitions to strategy and planning.

Recent commissions and co-commissions include Agatha Christie’s Tommy & Tuppence, produced by Lookout Point and starring Antonia Thomas, Imelda Staunton and Josh Dylan; and The Lady, a Left Bank-produced drama series about former royal aide and convicted murderer Jane Andrews.

While many global streamers have struggled to achieve profitability and grow their subscription bases in recent years, senior executives at BritBox say the service’s laser-focus on only the best of British programming makes it stand out in a crowded, competitive market.

“BritBox International is thriving, with doubledigit subscriber growth over the last year and our revenues are up 20% year-on-year,” says Jon Farrar, senior VP of group editorial and content. “Because we’re a niche streamer, we’re not looking to be a four-quadrant service which is trying to do everything for everyone.

At this year’s Edinburgh TV Festival, the service announced that new Sally Wainwright punk rock drama Riot Women, a co-commission with the BBC and produced by Drama Republic, will premiere on October 22. While that series examines the friendships of four menopausal women who form a band, Farrar explains that BritBox’s current content strategy is defined by the dual pillars of crime and corsets.

“We want to bring the best of British TV to the world, and we’ve always been hyper-focused

“Crime is the bedrock of BritBox International,” he says. “It drives engagement and new audiences to the service. Within that genre, mystery and detective whodunnits are key. We want to do mystery in a really elevated way to

attract the viewers of content like Only Murders in the Building, Knives Out and Poker Face

“Corsets is period drama, which is so closely associated with British programming, and I think there’s a bigger play for us in that space with series like the upcoming The Other Bennet Sister, made by Bad Wolf. It’s a very modern story, but with the sort of bucolic gloriousness that you expect from a traditional period drama.

“We have to make more noise with those two areas of commissioning focus, so we need bigger IP, better talent and buzzier concepts.”

Farrar and Steve Nye, head of commissioning, are also interested in hearing pitches for shows that are a mash-up of traditional drama genres. “Looking at all our commissioning sweet spots, what would a Venn diagram look like if those genres started overlapping?” says Farrar. “What would happen, say, if you brought period drama and mystery together?

“Very high up on Steve’s hit list is a modern take on [classic US detective series] Hart to Hart. I could also mention Moonlighting as an example of a show in which different genres intersected successfully.”

While BritBox has worked with high-profile scripted players such as Bad Wolf (Industry), Playground (Wolf Hall), Lookout Point (Happy Valley) and Left Bank Pictures (The Crown), Farrar says the service will also work with smaller prodcos – if the idea is right.

“Producers who are at the top of their game all want to work with BritBox,” he tells C21. “It’s a real joy to collaborate with the best in the business, but equally we’re also interested in young prodcos, talent and new writers. We’re led by the best possible ideas and scripts.

“We’re taking big swings and looking to push the envelope with a more high-level spend for our premium shows.”

BritBox is also significantly increasing the number of copros and commissions it does, partly “because we’re not seeing the supply in the market for the kind of mystery content our audience loves, so we’ve got to make those shows ourselves,” Farrar explains.

“We’re flexible and have several different copro models. There are partnerships where sometimes we are the lead commissioner, and other times we aren’t. What we’re looking for is a shared editorial vision where both partners carry the financial responsibility for a show, rather than one subsidising the other. The relationships need to be transparent,

so we’re working together openly to deliver the best possible creative for a project.”

However, coproductions with the US have dipped in recent months as American buyers favour local programming over international projects, says Farrar. “It’s fair to say that North America is a tougher market for British programming than it was two or three years ago.

“There’s a reduction of original content being made in the US, so commissioners are favouring local produce more than international projects. Britishness is still a real byword for quality, so there are still strong projects that go through, but in terms of overall volume there’s less being invested in

“Britishness is still a real byword for quality, so there are still strong projects that go through, but in terms of overall volume there’s less being invested in North America – and that provides opportunity for BritBox.

Jon Farrar

8 Out of 10 Cats as library additions, unscripted content is not high on the list when it comes to originals.

“Unscripted and factual are not areas of commissioning focus right now,” he says. “We have unscripted programming on the service, but we tend to pick that up almost exclusively as finished tape. With content acquisitions, we can pick up shows in the second window and broaden out our scope and take a little bit more risk, but we also stay tightly focused on our core genres.

“Within scripted drama, the sub-genres that are a little bit more difficult for us include science-fiction –partly because it’s expensive but also because our audience prefers shows that feel very authentic and grounded, not so high-concept.”

Recent acquisitions in the scripted space include UK drama The Hardacres, the North American streaming rights to which BritBox picked up from Banijay Rights. The period show, produced by Playground in association with Screen Ireland and Red Berry Productions for 5 in the UK, debuted on BritBox in September. The streamer also took Australian and North American rights to British drama from BBC Studios.

North America – and that provides opportunity for BritBox.

North America – and that provides opportunity for BritBox.

“That slight dip that we’re seeing play a more important part in getting

“That slight dip that we’re seeing in the US market has allowed us to play a more important part in getting US funding for British projects. That means that the quality of the production companies that we’re working with now is very different to two or three years ago.”

Farrar’s remit also involves acquisitions, and while BritBox will pick up formats such as comedy panel show

drama Death Valley from BBC Studios.

Producers looking to pitch projects to BritBox International are advised to send their proposals to Nye. The commissioning team’s slate for the current financial year is close to full, but they will consider projects both in the very early stages of ideation or developed further with an initial script and series bible.

full, but they will consider projects both in the very early stages of ideation or developed further with an initial script and series bible.

“I put something into development off the back of a 10-minute conversation earlier this year,” says Farrar. “There was no documentation; it was just an amazing idea

“I put something into development off this year,” says Farrar. “There was no documentation; it was just an amazing idea and pitch.

“Generally, though, BritBox has a tight and focused remit so we would expect producers to have bring ideas to us that aren’t

“Generally, though, BritBox has a tight and focused remit so we would expect producers to have done their homework and bring ideas to us that aren’t too off-piste. We’re a small team and sift through a lot of submissions, so we appreciate being pitched key projects rather than throwing everything at us and seeing what sticks.”

For some in the television industry, Christmas started back in July. C21 investigates how holiday programming is becoming a yearround business, extending beyond the small screen and keeping the classic TV movie sector healthy.

By Louise Bateman

There’s a company saying at Hallmark Entertainment: “It’s always Christmas at Hallmark.” Though it’s a “lovingly” expressed “joke,” according to the company’s chief marketing o cer Darren Abbott, it’s one that has more than a tinsel of truth attached to it.

After all, the Kansas City-based retail brand known for its greeting cards that also operates three TV networks and a streaming service is gradually extending its ‘holiday season’ through on-screen content as well as live events and experiences.

“We’re always thinking of great Christmas stories and we’re always talking about Christmas, but it really gets going with our event that we have in July that we call Christmas in July,” explains Abbott. “That’s when we really start leaning into the new programming. It’s also when our product in retail business starts debuting and premiering the Christmas product line-up that we’ll have that year. That really builds over the third and fourth quarter as we reach that crescendo at the end of the year with Christmas.”

Hallmark has built strong equity in holiday storytelling over the last 10 to 15 years – and you can see why: classic family-oriented movies still guarantee to pull in the viewers during the holiday season, making them valuable assets to streamers and linear broadcasters alike.

According to market research company Ampere Analysis, in December 2024, the classic Christmas title, Home Alone, starring Macaulay Culkin, ranked as the second most popular title tracked globally despite first being released in 1990. Not far behind it in 11th place globally was 2000’s How the Grinch Stole Christmas, followed in 13th place by Love Actually (2003). As Rahul Patel, principal analyst at Ampere, notes, these classic festive films cut through despite not having new releases at that time. “Like clockwork, every year you will see engagement with those titles rise as families view together,” he says.

Movies outperform series for holiday content, says Patel, because the 90- to 120-minute format is ideal for family viewing. “Certainly, within the festive space and the Christmas space, the right movies are the optimal way to go in terms of wanting to capture a piece of content that everyone can enjoy,” he notes.

space and the Christmas space, the right movies are the optimal way to go in terms of wanting to capture a piece of content that everyone can enjoy,” he notes.

don’t quite hit that. And then, from the perspective of wanting to create something that audiences will

“Just from the duration perspective, TV shows don’t quite hit that. And then, from the perspective of wanting to create something that audiences will return to again, it’s just more feasible when we’re talking about a movie.”

“ There’s tradition, it’s how people watch these events with their families. They’ve done it year a er year. They’re also in the holiday spirit and mood, and that drives the brand loyalty for us.

But what of the TV movie? Once a firm favourite on linear TV screens, following the growth of cable and streaming platforms, the genre took a hit. Louise Oliver, a veteran of the TV movie distribution business, however, has noticed a change in that downward trend. She recently joined Happy Accidents, the LA-based deficit-financing film and TV studio, as senior VP of international sales, because of the company’s “extremely strong TV movie slate.”

Jen Neal NBCUniversal

She notes there has been a resurgence in demand for TV movies in the past five years, as viewers seek out nostalgic, feel-good content –

“

We’re always thinking of great Christmas stories and we’re always talking about Christmas, but it really gets going with our event that we have in July that we call Christmas in July.

Darren

Abbott

Hallmark Entertainment

with Christmas TV movies doing particularly well. “With Christmas movies, people are going back to them time and time again because they’re looking for familiarity, they’re looking for comfort, they’re looking to be transported to a picture perfect, small-time, small-town holiday fantasy, during what is a very hectic time,” she comments.

Another trend regarding Christmas TV movies is the period in which they are being scheduled, which is extending beyond the traditional viewing patterns, says Oliver: “Christmas movies are being scheduled much earlier on and are going over the Christmas period into the following year,” she says, adding, “the demand seems to be really strong.”

In the case of Hallmark, that extension of the season is now as much about how it is bringing Christmas forward as it is about how it is filling the gaps in its calendar of event-led programming. While its flagship programming event Countdown to Christmas, which celebrated its 15th anniversary last year, kicks o mid-October, it is only recently that Hallmark is capitalising on the growing popularity worldwide for Halloween on October 31, something Abbott admits to being “a missed opportunity” by the media company.

Halloween “has been a real phenomenon here in the US, but it is increasingly so around the world, including the UK, Europe, and in some of the Asian cultures as well,” he notes. “As a result of that, we’re leaning in with new Halloween programming. That’s not something that Hallmark’s done a lot of in the past. We’ve got to go where the audience is. They want those types of stories.”

Halloween movie that’s coming out this year with Lacey Chabert. We’ve got several other titles as well. And as we move forward, even as we look beyond 2025 into 2026, we’re going to continue programming and thinking about Halloween as a real growth platform for us,” says the exec.

Meanwhile, on the TV movie side what has surprised Oliver is that players such as the BBC and ITV – known for their high-end drama commissions – are moving into the TV movie space. “I am surprised, having handled all the major territories, that the likes of the BBC and ITV – which years ago would never have picked up Christmas movies, would never air Christmas movies – are now doing so. The trends have really shifted, whether it’s the linear broadcasters or the catch-up platforms, it’s supplying on-demand what people want to watch,” she says. “For example, ITVX has completely ramped up and they’re looking for Christmas movies, and Paramount, Five and Sky too, they are looking to boost their o ering.”

Hence, this year, it will be a Halloween-themed movie, Haul Out the Halloween – the third instalment in Hallmark’s Haul Out movie series – that for the first time will be “the tentpole” of its programming season, which traditionally kicks o in

instalment in Hallmark’s movie series Fall into Love

September. “We’re really excited for the Haul Out the

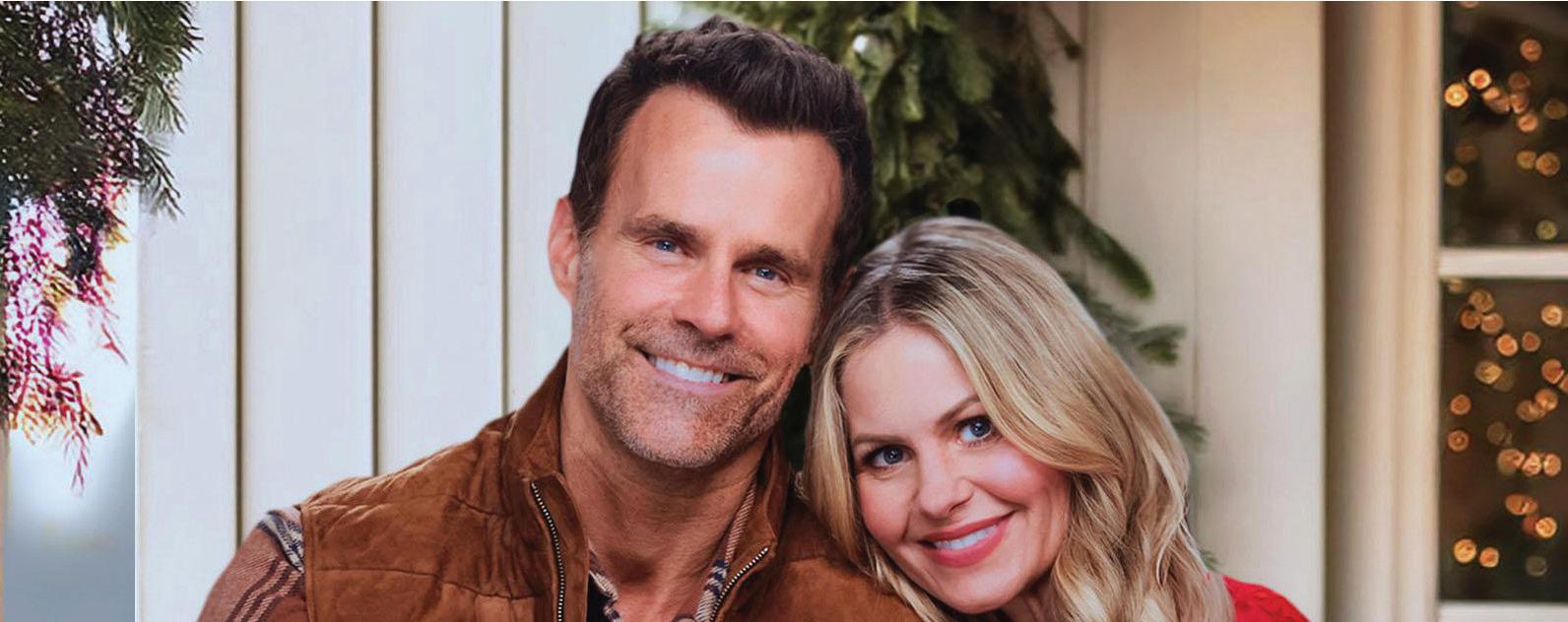

Underlying this take on the growing international demand for TV movies is Happy Accidents’ announcement of 50 licensing deals with major European broadcasters including Sky in the UK, Rai in Italy, M6 in France and TV2 Norway, for a slate of 19 TV movie titles. These include holiday titles such as A Christmas Less Travelled, starring Candace Cameron Bure, the actor and producer who has starred in hit Hallmark Channel Christmas movies including A Shoe Addict’s Christmas, The Heart of Christmas and Christmas Under Wraps “Candace Cameron Bure is very well known in the TV movie space,” says Oliver, who says Happy Accidents is distributing several other Christmas TV movies internationally that star Bure, including Home Sweet Christmas Sweet Christmas Wedding, which is currently finalising production. Also on the slate is Timeless , starring Bure. All three titles are being aired in the US on Great American Media, the Texas-based linear TV network and streaming service “that celebrates faith, family and country”, and where Bure acts as chief creative o cer.

TV movies internationally that star Bure, including , and its follow-up, Home , which is currently finalising production. Also on the slate is Timeless Tidings of Joy titles being aired in the US on Great American Media, the Texas-based linear TV network and streaming service “that celebrates faith, family and country”, and where Bure acts as chief creative o cer.

According to Oliver, A Christmas Less Travelled has been sold to TV3 in the Baltics, TV2 in Norway, M6 in France, NBCUniversal for Central Eastern Europe, Sky Italia and Sky in the UK.

As for the BBC, Oliver says no sales have yet been closed but conversations are ongoing: “I met with the BBC [for the iPlayer o ering] probably about three years ago now, and they said for the first time, we would be interested, I haven’t worked with them yet and they are full for TV movies for this year, but we’ll meet in Cannes and see what we could do for 2026,” she says, adding: “It’s really interesting. You would never have thought that you would see a Hallmark TV movie scheduled on the BBC.”

In an era of contracting commission budgets and growing risk-aversion, the BBC, which has seen its funding fall by £1bn a year in real terms compared to its funding in 2010, has yet to announce its Christmas 2025 schedule, but it’s a traditionally important period for the legacy broadcaster as it looks to capitalise on family viewing through exclusive high profile events and shows.

For example, on Christmas Day last year, the Gavin & Stacey finale attracted an average of 12.3 million TV viewers – the largest Christmas Day audience in more than a decade. Meanwhile, Aardman’s 2024 animated film Wallace & Gromit: Vengeance Most Fowl attracted nine million viewers on BBC One.

“

NBCUniversal, for example, has invested heavily in live events and describes itself as “the destination for holiday programming.” The company’s holiday season kicks o with the Macy’s Thanksgiving Day Parade on November 27.

Last year, the live event that has strong cultural significance domestically, reached one in three households in the US and delivered a “recordbreaking” number of viewers. This was achieved by simulcasting across not just NBC and streaming platform Peacock but also across NBCUniversalowned Telemundo to capture a more diverse audience.

With Christmas movies, people are going back to them time and time again because they’re looking for familiarity, they’re looking for comfort.

Among the specials the BBC has already announced it is lining up for this Christmas period is a new hour-long comedy Stu ed, described as “a modern-day Christmas caper for the whole family,” from Baby Cow and Dice Roll Productions, for BBC iPlayer and BBC One. Also announced to premiere this Christmas on the BBC is The Scarecrow’s Wedding. Produced by Magic Light Pictures, it marks the 13th animated special produced by the multi-Oscar nominated producer for the BBC based on the Gru alo author Julia Donaldson’s illustrated books. Last year’s Tiddler drew in 7.3 million viewers on Christmas Day for the BBC.

In an increasingly competitive marketplace where eyeballs, particularly among the younger demographic, are increasingly turning to YouTube and social media channels, family-orientated content associated with holiday time is a safe bet for many linear broadcasters and streamers alike. According to Ampere’s monthly consumer survey that aggregates data across the 30 major media markets, the popularity of children and family content has remained steady over the years at between 30-40%.

Patel also notes that in terms of new release patterns, the start of the holiday season is an important period particularly for streamers who have their biggest push in November to coincide with Thanksgiving in the US. “The festive season is a period they can expect a lot of sign-up activity for their services. And so, they want to have that new product,” he explains.

Other important live events in NBCUniversal’s holiday line-up includes the company’s Thanksgiving primetime NFL game, and a week later, the traditional tree-lighting ceremony, Christmas at Rockefeller Centre.

Louise Oliver Happy Accidents

other times during the year. There’s tradition, it’s how people watch these events with their families.

year. They’re also in the holiday spirit and mood, and that drives the brand loyalty

Neal says her philosophy

and that of her team’s is “to innovate, change and build on these important cultural franchises and times of the year.” This includes extending the holiday season with more live events, most notably this year a live musical TV special , featuring Cynthia Erivo and Ariana Grande, which is scheduled to air in November at the Peacock Theatre in LA in the run-up to Wicked: on November 21. Also scheduled to extend the holiday season on NBC and Peacock

hosted by Snoop Dogg live from Snoop Dogg’s

programming as “more important than ever as a real di erentiator” and “superpower” in this space

power, using broadcast TV (NBC), streaming (Peacock) and Spanish-language platform Telemundo simultaneously. “Streamers don’t always have the advantage of having to be able to put

it as our superpower to use the combination,

According to Jen Neal, exec VP of live events and specials at NBCUniversal, what sets holiday programming apart is its ability to “truly drive urgency and viewership di erently than some other times during the year. There’s tradition, it’s how people watch these events with their families. They’ve done it year after year. They’re also in the holiday spirit and mood, and that drives the brand loyalty for us,” she says. Neal says her philosophy and that of her team’s is “to innovate, change and build on these important cultural franchises and times of the year.” This includes extending the holiday season with more live events, most notably this year a live musical TV special of Wicked, featuring Cynthia Erivo and Ariana Grande, which is scheduled to air in November at the Peacock Theatre in LA in the run-up to the theatrical release of Wicked: For Good on November 21. Also scheduled to extend the holiday season on NBC and Peacock into the New Year will be a twohour New Year’s Eve special hosted by Snoop Dogg live from Miami, entitled Snoop Dogg’s New Year’s Eve. Neal describes live programming as “more important than ever as a real di erentiator” and believes NBCUniversal’s “superpower” in this space is its combined distribution power, using broadcast TV (NBC), streaming (Peacock) and Spanish-language platform Telemundo simultaneously. “Streamers don’t always have the advantage of having to be able to put their content on broadcast as well. So, we use it as our superpower to use the combination, the collectiveness of NBCU,” she notes.