2022 has been an exciting year for the TV industry, not because anything particularly extraordinary has happened, but rather because of the opposite – it’s been pretty ordinary.

The return to normality after the chaos of the Covid-19 pandemic in 2020 and 2021 has seen execs gather excitedly at live events that had either been cancelled entirely in the previous two years or returned with reduced capacity and copious restrictions in 2021.

This year, however, kids’ events like the Annecy International Animation Film Festival and Cartoon Forum in Toulouse returned with no restrictions. Both Annecy and Cartoon Forum even recorded record numbers of attendees, while Mipcom and MipJunior are expected to see a significant increase on 2021.

While the world has been readjusting, children’s TV has continued to evolve, particularly as viewing habits change and technology advances.

This time last year, Disney was in the process of shutting down 100 linear channels after the international roll-out of its Disney+ streaming service. Following suit, UK pubcaster the BBC announced controversial plans this year to scrap the linear offering of children’s net CBBC.

Elsewhere at the Beeb in 2022, production and distribution arm BBC Studios launched a new division called BBC Studios Kids & Family, formed by the integration of BBC Children’s in-house production arm into BBC Studios Productions. The department’s MD, Cecilia Persson, is delivering

the keynote speech at MipJunior and discusses her strategy on page 9.

In addition to the transition of linear to digital, the kids’ sector is experiencing many other developments resulting from advancements in technology and the way children consume content. These include social media apps, virtual and augmented reality and online games, but most recently the industry has been introduced to the metaverse – a buzzword heard frequently at markets this year. On pages 27 and 33, execs share their thoughts on whether the metaverse represents the future of kids’ content consumption or if it’s just a fad.

Meanwhile, the last couple of years have been a bit of a whirlwind for the production sector. During the lockdowns, animation studios benefited from increased demand for programming, when liveaction productions were halted and children stuck at home were binge-watching at an all-time high.

But this demand is now shrinking as some of the streaming giants tighten their purse strings and cut spending, resulting in platforms like Netflix and HBO Max cancelling multiple animated kids’ projects. For Toronto-based Guru Studio’s Frank Falcone, collaboration is key to helping indies survive this tumultuous period (page 46).

So while 2022 has pretty much been a normal year, that doesn’t mean it has been without its challenges. Industry execs will have a lot to talk about at Mipcom and MipJunior this week.

Karolina KaminskaBBC Studios Kids & Family’s MD describes her strategy for the newly merged division and its content requirements.

COUNTRYFILE: Spain

How the country’s animation business is gaining traction thanks to increased production and tax incentives.

AHEAD OF THE CURVE: Anime in Europe

Anime has given Japanese animation real status, but what future does such content have outside of Asia?

CONTENT STRATEGIES: Duolingo

Linda Simensky reveals how she is developing scripted content for language-learning app Duolingo.

NEXT BIG THINGS: The metaverse Children’s TV evolves constantly due to changing viewing habits and tech. But what impact will the latest innovation, the metaverse, have on the sector?

CONTENT STRATEGIES: WildBrain

Deirdre Brennan sets out her content needs for the Canadian firm’s channels.

AHEAD OF THE CURVE: Cartoon Forum Producers on their way to Cartoon Forum discussed the biggest issues and trends facing the animation sector.

NEXT BIG THINGS: 21 on 21

Our selection of new shows to seek out at this year’s MipJunior includes animation, live-action, history, arts and crafts, superheroes… and sheep.

KIDSTALK: Frank Falcone

Guru Studio’s president looks at creating a sustainable post-pandemic world for kids’ television.

BBC Studios Kids & Family launched earlier this year when BBC Children’s in-house production arm was integrated into BBC Studios Productions. As managing director, Cecilia Persson has been leading the division and unifying the new structure.

“We have one team, one slate and one budget, which has allowed us to combine our content creative abilities and production capabilities with the commercial expertise that we have,” Persson says.

“We’ve been working really hard to find ways of increasing the reach of our in-house productions and starting the process of growing the development of new international brands. We are in a really good position and are on a path to starting a new, exciting chapter for BBC Studios in children’s production.”

The division is structured into the five operational pillars of business, commercial, development, production and content strategy, and Persson is looking for executives to head the content strategy, commercial and development arms.

BBC Studios Kids & Family currently has 16 projects in either

Cecilia Persson of BBC Studios Kids & Family describes her strategy and the newly merged division’s content requirements as she prepares to deliver her keynote speech at MipJunior.

her co de

her co de

By Karolina Kaminska

By Karolina Kaminska

pre-production, production or post-production, including weekly entertainment format Saturday MashUp for BBC children’s channel CBBC and animated preschool series JoJo & Gran Gran for the Beeb’s preschool channel CBeebies.

y p j y

At MipJunior in October, BBC Studios Kids & Family is launching animated slapstick series Supertato, commissioned by CBeebies last

Australian prodco Ludo’s hit animated series Bluey

“In creating this new division and coming together as one team, we’ve really ramped up our development slate, so there are also a number of shows in development at the moment,” Persson adds.

The three current target areas for BBC Studios Kids & Family are animation for children aged over six,

very much an open-door policy here,” she says.

Another area of focus is family content suitable for co-viewing, which has stemmed from a trend that emerged during the pandemic. “That’s something the outlets would still like to continue, while the audience also wants to continue having those experiences,” Persson says. “It’s an area that’s very exciting because it can take so many different forms and executions, so family viewing through a kids’ lens is definitely a focus for us.”

Earlier this year, the BBC announced that it will close the CBBC linear channel, transitioning the brand to a digital-only offering. Persson hints this decision will have little impact on the relationship between BBC Children’s and BBC Studios Kids & Family, whose aim is to reach viewers on whatever platforms they use.

“Our focus has always been on where the audience is and what platforms viewers consume content on. This is not new to us. We’ve even developed and produced specifically for [streaming platform] BBC iPlayer only, with shows like [teen thriller series] Rebel Cheer Squad, for instance,” the exec says.

We are about finding creatives and people with passion and ideas. So even though our focus is around animation, high-end drama and factual, our doors are very much open to all ideas.

Cecilia Persson

We are abo passio focus is around a door Persson

“Kids nowadays are platformagnostic, so our focus is on the story and the characters that will cut through and find the place the viewers are.”

BBC Studios Kids & Fam

BBC Studios Kids & Family

Looking to the year ahead, Persson hopes to secure further partnerships as BBC Studios Kids & Family works to grow its content offering and develop international brands.

year and based on the bestselling books by Sue Hendra and Paul Linnet. The series follows the adventures of the titular character, a potato superhero, as he tackles the mischievous Evil Pea in the supermarket aisles.

th Hend adventures of the titu a a third-part on BBC Studios Kid sla season

Series from third-party producers on BBC Studios Kids & Family’s MipJunior slate include season four of Studio AKA’s popular show Hey Duggee and season three of

factual entertainment and high-end drama, but Persson stresses that all kinds of ideas in a variety of genres and styles are welcome.

“We are about finding creatives and people with passion and ideas. So even though our focus is around animation, high-end drama and factual, our doors are very much open to all ideas. We don’t want to limit ourselves and potentially not be approached because people think it might not fit our current priorities. It is

Its core goals and priorities are “very much to find partnerships that truly realise great content and collaborate with new talent and fellow creatives, producers and distributors,” she says.

“My vision is to shape Kids & Family into a global force in kids’ storytelling. In doing so, we can create international franchises that connect with children on multiple touchpoints, wherever they are. We are looking to work with a wide variety of people and are very much open for business.”

The Spanish animation industry is gaining prominence thanks to an increase in production and attractive tax incentives. But what does the future hold for the business?

By Irene JiménezPocoyo is turning 20 in 2022. The Spanish preschool hit celebrated its best year ever in 2021 – available on channels and platforms in more than 150 countries and with a fifth season in production, it beat its own viewership record on YouTube and spawned successful apps and video games and new consumer products. A true 360-degree property.

But the Zinkia property is not the only animated show produced in Spain. The dragons of Game of Thrones, rendered by VFX studio El Ranchito, Netflix original feature Klaus, directed by Sergio Pablos, and Oscarwinning short film The Windshield Wiper, by Alberto Mielgo, are among the best-known ambassadors of Spanish animation.

The local industry has launched more than 70 animated TV series in the past four years, according to Spanish trade and investment firm ICEX’s guide Who is Who: Animation from Spain. In 2022 alone, six animated series are being released and 26 are at different production stages.

Navarre, while Barcelona and Valencia are more specialised in TV series. The Canary Islands’ studios are mainly dedicated to third-party services and developing in parallel their own IPs,” says Nico Matji, producer of film saga Tadeo Jones and president of DIBOOS, the federation of animation and VFX producers.

While the production of animated feature films has achieved a specific boost thanks to national grants, producers are still negotiating with the ICAA – the national body in charge of policies supporting the film industry and audiovisual production in Spain – for a new and specific line of public funding for animated TV series.

“I am confident we’ll have good news soon. All the producers, institutions and broadcasters are more and more coordinated every day,” says Matji.

“We’ve made some progress lately, but there is still a lot to do in terms of financing. It’s been years since Spanish producers started spreading the specific needs

So it seems the Spanish animation industry is going through a boom. “Nowadays there are no big groups working in animation in Spain, but many medium and small independent prodcos and studios, which are very creative, capable to adapt to new business models and have international potential. I prefer to speak about opportunities more than a boom,” says Yago Fandiño, head of kids’ content at pubcaster RTVE and director of its dedicated children’s channel, Clan.

oduction stages. ation ere are no ndent tive, els and have er to han a f kids’ irector l, Animation ducers and ry. e

of the animation industry among national and regional institutions. Now we can apply for public subsidies in Catalonia, Valencia and

support encia, due to refreshed to recent incentives for nary offer

According to Who is Who: Animation from Spain, there are 260 producers and distributors shaping the industry. The main animation hubs in Spain these days are the capital, Madrid, with the highest volume of prodcos in the country; Barcelona, thanks to the constant support of regional pubcaster TVC; Valencia, due to refreshed public support; Navarre, thanks to recent incentives for animation companies; and the Canary Islands, which off one of the most competitive tax systems for audiovisual production in the world.

“Film production is mostly located in Madrid and

in Madrid and

Madrid,” says Iván Agenjo, co-founder of Barcelonabased Peekaboo Animation (I, Elvis Riboldi, Mironins), president of ProAnimats and VP of DIBOOS.

“I feel optimistic, but we can’t depend on public funding that much, despite attractive tax incentives or new grant programmes. Public funding is limited to 50% of the overall budget, so the participation of private broadcasters, platforms or investors is essential.”

The lack of investment from private media groups and investors is still the main worry and obstacle for Spanish animation producers. Commercial group Atresmedia has a kids’ slot on its young-skewing channel Neox, usually filled with titles distributed by sister company DeAPlaneta Entertainment.

Mediaset España maintains a joint venture with Warner Bros Discovery for free-to-air channel Boing, whose programming is based on Cartoon Network’s properties and original productions focused on family gameshows.

Another pubcaster in the middle of a rethinking is Televisió de Catalunya (TVC). The whole Catalonian corporation is starting a new era and its kids’ channel Super3 will launch new programming this autumn in the face of falling ratings. The main novelty is a slot targeted at the six-plus audience with anime shows and a daily magazine show fronted by two wellknown influencers.

This does not mean TVC will invest less in original animated shows – quite the opposite, the kids’ department is trying to increase the budget every year.

The same goes for Valencian pubcaster À Punt. Ernest J Sorrentino, deputy director of content, says: “Due to our tight budget, coproduction is key for us. We are working closely with RTVE and TVC, and also with the regional body in charge of public grants.”

Since 2008, Disney Channel airs on digital terrestrial television but does not invest in local animation shows.

“In the Spanish market, pay TV platforms and global streamers are focused on drama series in terms of local and original production. If you want to pitch an animation show to any streamer, you have to talk to their offices in London or LA, which makes things more complicated,” says Peekaboo’s Agenjo. That also limits options for young-adult and adult animation projects.

So producers have only one national partner: pubcaster RTVE. “Apart from the mandatory investment in European productions, we decided to participate in coproductions in the early stages of development, so we can take part in the creative process and get some financial return,” says RTVE’s Fandiño.

As a result, the pubcaster will soon launch Petronix Defenders, a production from Mediawan’s ON Kids & Family, with an ambitious licensing strategy.

At the beginning of the 2022/2023 season, Clan is also airing The Happy Farm, coproduced by veteran Barcelonabased studio Motion Pictures and Italy’s Rainbow; Royals Next Door, a Spanish-Belgian-Irish coproduction; musical comedy Turu & the Wackies, coproduced by Spain and Argentina; and Doopie, a show mixing live-action and puppets coproduced in the Netherlands, Belgium and Spain.

The strategy of turning Clan into a more European and less ‘Nickelodeon-ised’ channel is flourishing.

Surprisingly, in its call for animation projects last year, RTVE chose Samuel, the most successful pitch at Cartoon Forum in years. Created by French filmmaker Émilie Tronche, the show targets pre-teens and teens, while Clan’s main audience is preschool and kids.

“We are studying how to get closer to 10- to 12-yearolds,” says Fandiño. “Soon Clan may introduce a transition slot in the evenings to host content from our OTT youth service Playz, so we are scanning the market and Samuel fits.”

In 2022, Clan also commissioned its first live-action original series, The Argonauts, produced by Portocabo (The Avatars, Miracle Tunes).

À Punt has invested €3.3m (US$3m) in acquisitions and coproductions of animated shows since its relaunch four years ago. Among its latest shows are Mironins, Croco Doc and Turu & the Wackies. The regional channel has a kids’ slot at the weekends from 07.00 to 11.00 and most of its animated programming can be watched on its VoD service.

With such limited funding opportunities at home, Spanish producers are used to going abroad in a quest for money. “We coproduce a lot with French companies, but they always want to be the majority producer,”

says Peekaboo’s Agenjo. “So if you want to be majority producer, you’d better dive into Ireland, Belgium or Italy. The latter seems to be very interested in international coproductions now, as well as Poland. Italy and Poland are similar to Spain in terms of cost of living, so coproductions with them may be more equitable.”

Toy makers are becoming more and more important supporters of Spanish animation studios. For example, Hampa Studio is producing up to seven 3D animation series based on toys, such as Cry Babies and VIP Pets, available on YouTube and on global streaming platforms.

“We started several years ago with these branded content productions for IMC Toys and we expect to

“

I feel optimistic, but we can’t depend on public funding that much, despite attractive tax incentives. Public funding is limited to 50% of the overall budget, so the participation of private broadcasters, platforms or investors is essential.

continue until 2027,” says Alejandro Cervantes, CEO of the Valencian studio, which has more than 100 employees and an annual turnover of €4m.

Financial relief from Creative Europe’s Media programme is also allowing the company to develop its own IP. The slate includes three films and two TV series.

“That is why we are participating in many international markets. In the last year, we’ve attended Pixelatl, Cartoon Forum and San Sebastian Film Festival, and we will be at Mipcom, Kidscreen and MIFA,” says Cervantes.

Also from Valencia, Keytoon Animation Studio is working on a number of properties based on toys. “We are delivering the first season of Trotties for Famosa and already working on season two. We are also just about to start two productions for Giochi Preziosi based on [toy brands] Gormiti and Superthings,” says David Cuevas, co-founder of the studio.

Keytoon will soon increase its staff from 30 to 50. “Original developments are always on the horizon, but honestly, we are very busy with these productions and we have no time for more work,” Cuevas adds.

Around 15 animation studios have set up their offices in the Canary Islands, attracted by their 45-50% tax rebate. Amuse and Fortiche (Arcane) from France and Mondo TV from Italy are among the European companies that have relocated to Gran Canaria and Tenerife, but Spanish firms are also taking advantage of the financing system.

Víctor López, MD of Zinkia, chose the archipelago when developing Pocoyo spin-off series Yanco, Dina & the Dinosaurs. Anima Kitchent Media was also one of the first to move to the Canary Islands, followed by Tomavision, B-Water Studios and 3 Doubles Producciones. Some of them are combining production services with their own IP.

According to data provided by the Tenerife Film Commission, during 2021 up to 10 animated series finalised their production process there, which is a record number. This high volume has caused a need for talent that not even new schools have been able to meet in recent years, compounded by the traditional loss of workforce to international studios.

“The only way to retain talent is to offer exciting projects, because Spanish producers will never be able to compete with the level of salaries [at international studios]. Not even the national studios, such as Skydance Animation Madrid (Luck) or The SPA Studios (Klaus, Ember),” says Peekaboo’s Agenjo.

“As an example, the trailer of Best Friends Forever… Stranded!, one of our new projects, has been possible thanks to many Spanish artists who are working for international studios. They were enthusiastic about the show and its creator, José Balbuena, and they found a way to work for us part-time and remotely.”

The Spanish animation industry is better known for its creativity than for its distribution companies. GoldBee, founded by Christophe Goldberger, and DeAPlaneta Entertainment, which has established itself as a producer as well as a distributor, are two examples of distribution companies in Spain.

That is why foreign distribution companies are also usual allies of Spanish animation prodcos. France’s PGS Entertainment is handling worldwide distribution for Momonsters, a preschool series from independent Spanish firm Big Bang Box that premiered on Clan at the beginning of the pandemic.

Big Bang Box is preparing a third season and a TV movie of Momonsters, as well as a comprehensive licensing strategy, according to co-founder and producer Guillermo Velasco. The show had a €4m budget for its first season and has been sold into Latin America, South Korea and China. Velasco says Europe is the next target, having just confirmed a sale to Italy’s Rai.

Also from France, Dandelooo is distributing Jasmine & Jambo, a musical series created by independent Spanish company Teidees, as well as Royals Next Door, a coproduction between Spain and Finland’s Pikkukala, Belgium’s Walking the Dog and Ireland’s Ink & Light.

After 15 years in Montpellier in France, studio In Efecto moved to Tenerife in 2019 and is providing animation services for Disney’s Tara Duncan. It is also coproducing Bertie’s Brainwaves, an original project by the UK’s Flickerpix, which was pitched at Cartoon Forum in September.

“The Canary Islands’ tax incentives were helpful to make up my mind, but I also feel that Spain is more interesting than France in terms of creativity in the animation market right now,” says In Efecto founder and CEO Raúl Carbó Perea.

Big Bang Box’s Velasco adds: “The Spanish animation industry is reliable and cost-effective, with attractive tax incentives and full of creativity. We are continuously developing new IPs and we are used to thinking internationally.”

So after the strong presence of Banijay in Spain and the expansion into the country of French companies Mediawan, Federation Entertainment and Newen, can we expect a new French conquest in the Spanish animation market? Only time will tell.

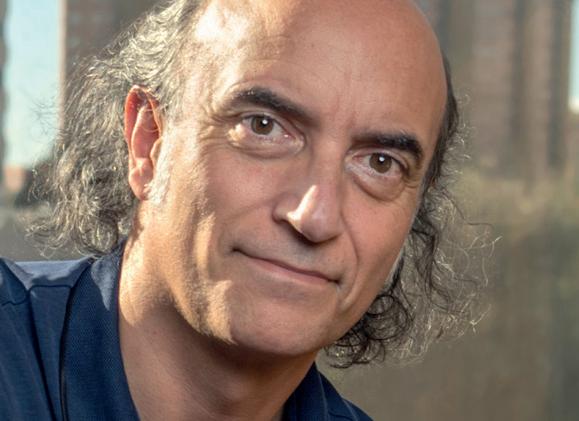

DIBOOS president Nico Matji Royals Next Door is coproduced by Spain and Finland’s Pikkukala, Belgium’s Walking the Dog and Ireland’s Ink & Light“ Apart from the mandatory investment in European productions, we decided to participate in coproductions in the early stages of development, so we can take part in the creative process and get some financial return.

Yago Fandiño RTVE

Anime has given Japan a prominent status in the field of animation. But what potential does the production of anime-style content have outside of Asia, particularly in Europe?

By Karolina KaminskaDreamlandThe anime style of animation has earned Japan a great reputation as a leading country in the production of animated content, from classic 90s series like Sailor Moon and Pokémon to the wonderful world of Hayao Miyazaki’s Studio Ghibli, the maker of Oscar winner Spirited Away and an array of other beautifully animated films.

Anime was once exclusively synonymous with Japan. But over the years, animators in countries like Korea, the US and France have begun to experiment with the style. In Europe, where Japanese anime has seen huge success, more and more producers are exploring the medium in their own productions as regional demand for it increases.

Amit Devani, insights director at Parrot Analytics, highlights a 35% year-on-year increase in demand for anime globally in 2020-21. This was made up by an 18% rise in demand for new anime content, like Tokyo Revengers, and a 17% rise in demand for existing anime content, such as Attack on Titan, Dragon Ball Z and My Hero Academia

"We've noticed the demand for anime content soaring; this has been a five-year trend and it's clear to see it isn't slowing down. There is continued room for growth, ushered along by increased attention from OTT platforms. Anime is borderless; there are no schedules or timings you have to adhere to. The discovery has become astronomical,” Devani says, noting that OTT services have been instrumental in bringing anime to a wider audience.

While the Japanese networks that have traditionally commissioned anime series are key growth drivers for the medium, the global streamers are now upping their game in the field, particularly Netflix.

Netflix added a collection of Studio Ghibli films to its catalogue in 2020 and revealed plans earlier this year to launch 40 new and returning anime projects in 2022. In late August, the streamer acquired 13 anime productions from Japanese broadcaster Nippon TV under a non-exclusive licensing pact that includes series Death Note, Hunter x Hunter, Ouran High School Host Club and Claymore

Anime is one of the cornerstones of Netflix’s investment in Japan and, according to the streamer, more than half of its members around the world watched anime in 2021. One of the most popular productions was series

than half e s The

“ The arrival of the streaming services, especially since lockdown, has created a new attraction for anime. It is becoming more popular, just like mangas are, and the room for growth looks huge.

Raphaël

cont of A in E

services, has created ecoming re, and the

Cosmic Productions’ Biguden is aimed

at six- to nine-year-olds

Seven Deadly Sins, which has become one of the top 10 titles among all series and films on Netflix in more than 75 countries since its launch. Another anime series hit for Netflix is Baki, which has become one of the top 10 titles among all series and films in almost 50 countries since its launch, while film A Whisker Away became one of the top 10 movies in 30-plus countries.

One of Netflix’s most recent anime launches is Cyberpunk: Edgerunners, a Japan-Europe copro from Japanese prodco Studio Trigger and CD Projekt Red in Poland. The 10-episode series premiered in September and is set in a dystopian world riddled with corruption and ‘cybernetic implants,’ where a talented but reckless street kid strives to become a mercenary outlaw, otherwise known as an ‘edgerunner.’

Japan is, naturally, the primary producer of anime content, with the US producing around 4% of the total and other countries combined making up 1%, according to Devani, who says this demonstrates “huge room for growth” in anime production outside of Japan.

"Europe could start to play its hand in this space. France is the top European market when it comes to demand for anime content. Japan leads the way globally, followed by the US and China, then France is at number four,” he says. Germany and Russia take fifth and sixth place respectively, while the Netherlands is also in the top 10, along with Brazil, the Philippines and Canada. The UK takes the 11th spot.

is the top market wh the US and China, then France Germa sixth pl Nethe C 11th sp you that have been w a are now disco

“So you've got your core markets that have been watching anime for a long time, but you've also got new markets that are now discovering anime, and that's contributing to the rise,” Devani says.

looking to explore more,” he says.

“There’s a huge gap in the market that needs to be filled because the type of anime the platforms and streamers are producing is not suitable for kids. Kids are watching shows like Attack on Titan, Demon Slayer and Castlevania, but it's not suitable for them, so the trend in the market is focusing on bringing suitable anime-style content to kids.”

To help fill this gap, Method Animation is producing an anime-style series for six- to 10-year-olds called Ki & Hi Based on a manga series created by French YouTuber Kevin Tran, Ki & Hi depicts the daily life of two reckless but endearing brothers. According to Séjourné, the show will represent a new style that bridges Japanese anime with classic European animation.

Also in France, Raphaël Catheland, CEO of Cosmic Productions, says that while French producers have always experimented with anime-style content, this has been encouraged further by the influx of streamers in Europe and an increase in the popularity of manga in France.

France has f series like ac and at Mediawan Kid t content w i narrative and visuals. It's both in

France has been dabbling in animestyle content for some years, with kids’ series like action-comedy Totally Spies! in the early 2000s. Raphaël Séjourné, producer and deputy head of television at Mediawan Kids & Family’s label Method Animation, says this has been increasing recently in response to a gap in the market for anime content that is suitable for children.

“For the past, I would say, five years, there's been a huge trend in animation that looks like what the Japanese have been doing in terms of the narrative and visuals. It's a trend that broadcasters, both in Europe and internationally, are

“The arrival of the streaming services, especially since lockdown, has created a new attraction for anime. It is becoming more and more popular, just like mangas are, and the room for growth looks huge,” Catheland says, noting that Japanese studio Toei Animation’s manga-based movie One Piece Film: Red, was ranked number one at the French Box Office one day after its release in August.

Cosmic Productions is currently coproducing anime-style series Biguden, aimed at 6-9s, with fellow French prodcos Apaches and Mr Loyal. Based on the comic of the same name by Stan Silas, Biguden centres on a mysterious little girl in a small village by the sea, whose arrival suddenly awakens all the mythical creatures that everyone believed had been hibernating for eons.

At Paris-based Ellipse Animation, MD Caroline Audebert seconds Catheland’s observation of a rising demand

“ Kids are watching shows like Attack on Titan, Demon Slayer and Castlevania, but it’s not suitable for them, so the trend in the market is focusing on bringing suitable anime-style content to kids.

Above: Dragon Striker (main) is being made for Disney EMEA, while movie Nanami & the Quest for Atlantis (inset) is in development

Below: Caroline Audebert, MD of Parisbased firm Ellipse Animation

for manga in France, which she says is fuelling an increase in production of anime-style content. Ellipse’s parent company, Média-Participations, also operates animefocused platform Anime Digital Network, which Audebert notes is seeing a continued increase in subscribers.

Cyber Group has a number of other anime-style projects on its development slate, including film Nanami & the Quest for Atlantis, which is being coproduced with Japan’s Nippon Animation and is based on 90s anime series Tico & Friends

The prodco is also producing The Tern, an anime-style family series that centres on the survivors of a planet devastated by toxic cloud and mists, following them as they travel across the skies under the strict laws of their captain.

“There are anime channels in Europe that have been in existence for the past 10 or 15 years on cable and satellite, but anime has become more prominent today and is probably poised to increase,” says Cyber Group president Pierre Sissmann. “We've been working on the anime style for at least the past three or four years, if not five years. I was fascinated by the anime style and it sort of coincided with a rise in anime productions in the world and with more platforms picking up anime.”

Elsewhere in France, Iliade et Films is producing an anime-style TV special for young adults called Keiko & the Floating World. Set in Fukushima in 2011, the film follows the titular character whose life is turned upside down when her friends are swallowed by a tsunami.

But the anime style is not just taking off in France. Belgian prodco Squarefish is coproducing a teen series with French studio Dada! Animation called Mekka Nikki, about a rebellious teenager who lives on a moon and whose village is struck by a mysterious disease.

And in Romania, Aparte Film is in production on a young-adult series called Karma, which centres on an 11-year-old soldier who has to punish people for their mistakes using a magic toy.

Noting that the demographic of anime viewers is getting younger, Sissmann argues that creating more anime content could be a good way to attract older kids – who tend to ditch animation in favour of live action – back into the animated world.

Cosmic Productions’ Catheland agrees, pointing out that “if the upper target of the kids’ market has preferred live action in recent years, it is also because [animation] producers have focused on a younger audience, offering stories less suited to a pre-teen and teen audience.

of animation an

The exec puts the popularity of anime down to her belief that the stories traditionally told in that medium more accurately reflect the lives of real people than other types of animation, particularly since the serialised nature of traditional anime series allows for character evolution.

The rise of the streaming services has also helped this demand, according to Audebert, as VoD platforms are more likely than broadcasters to pick up serialised animations, with broadcasters typically preferring closedended episodes for animated and children’s content.

The rise o this demand are more lik animations, w episod i on young-ad a French ma

Ellipse is in coproduction with La Chouette Compagnie on young-adult anime-style series Dreamland. Based on a French manga of the same name, the series follows a teenager who travels into another dimension in his dreams.

“However, this potential audience [of older children for animation] exists and they really want to explore the incredible worlds that only animation can offer. The adult audience is ready too. We are living in a moment of strong renewal in the way we think about animation.”

Method Animation’s Séjourné refers back to the gap he sees in the market for anime that is suitable for children, arguing there has been a lack of anime content for kids since Pokémon took the world by storm more than two decades ago.

La Chouette Compagnie is also currently in production on Dragon Striker for Disney EMEA. Coproduced with Cyber Group Studios, it focuses on a 12-year-old boy who discovers he may be the legendary ‘dragon striker’ and joins a team of underdogs to take on the school football champions, while fighting to prevent an ancient evil from resurfacing.

La Chouet S discovers h tea champio

"The age group of 6-10s is craving anime. There hasn’t been any anime for international [children’s] audiences since Pokémon. Twenty-five years ago, all the 6-10s were crazy about Pokémon; today, there are only vintage nostalgia series like Dragon Ball Z,” he says.

“In Japan, there is a lot of anime content for kids, but internationally there's no anime content right now. So kids aged 6-10 internationally, not only in Europe, are looking for anime content that has been lacking in the market since the rise of Pokémon

Children’s TV veteran Linda Simensky talks about her new role at languagelearning app Duolingo and how she is using her decades of experience to develop scripted content for the company.

By Karolina Kaminska

By Karolina Kaminska

Former head of PBS Kids Linda Simensky left the US pubcaster after 18 years in late 2021 to take up a role at language-learning app Duolingo.

As the company’s new head of animation and scripted content, she has been tasked with developing the characters featured on the language courses and creating stories for them.

“Duolingo was looking for someone who could help with the stories in the app and the characters. It was interested in finding a writer or story editor who could work on those stories but also someone who could work on the animation and help solidify the animated content strategy,” explains Simensky.

“The thinking around it was, ‘We have these great characters, so how do we tell better stories with them? How do we develop them a little further? What are all the things we could do with them?’ It was very interesting to me because it sounded so different from most of the things I had done, yet there was that same connection point of character development.”

Ch lea de ensky 21 go. n veloping s and creating who the a y ns ve ll op ngs ting most t same ” of ch es ing as a hey versal themes h

a little bored and detached from things and can’t wait to start college. Lily is a very popular character in China, according to Simensky, as she’s highly relatable to lots of teenagers.

The Duolingo app features a variety of characters that Simensky is developing, each of which have well-thought-out personalities and character traits. The exec is planning story arcs for the characters that develop as a user progresses through the course, as if they are watching a sitcom. Stories will be about universal themes that exist across cultures.

“There is a range of characters with a range of backgrounds and different hopes and dreams. Each character has different goals and is designed to speak to people of all ages using the app all over the world,” Simensky says.

“I have been working on figuring out what their motivations are, what gets in their way and keeps them from fulfilling their dreams, and how to make all those things funny and interesting across the world.”

Characters include Eddy, who Simensky describes as the romantic of the group, who is always looking for a potential love interest but isn’t very good at it. Then there’s Lily, “the typical high school student,” who is

The Duolingo app is populated by a gang of diverse characters

using the app you can get the basic information about the character and some funny things that have happened to them, and then you see that character interacting with some of the others and you start to get a picture of them in your head,” the exec says.

“As you get better at learning the language, as you learn different tenses, the stories get more complex and funnier. Our goal is, as you’re learning the language, as you are getting to know the characters better, you are starting to see that it’s not just individual stories but a lot of them will interconnect to tell a bigger story.

“In a lot of ways, it’s like working on any kind of

“As you start

or

The aim is to use stories featuring the Duolingo characters to keep users interested in learning

“ There is a range of characters with a range of backgrounds and different hopes and dreams. Each character has different goals and is designed to speak to people of all ages using the app all over the world.

Linda Simensky Duolingo

show. It’s just in smaller bite-

sized pieces and the audience is learning a language alongside it.”

Storytelling and language learning fit well together, Simensky says, recalling her days at PBS Kids and prior to that Cartoon Network, when people would often tell her they had learnt English by watching programmes on those channels.

“I was really interested in that and kept it in the back of my head because I thought there was something to it,” she says. “The main thing is that storytelling keeps the user interested. If you’re just reading a bunch of sentences, it’s not as interesting as when you’re really seeing the characters, seeing them unfold and finding out new things about them.

“And you’re paying more attention because you’re translating, figuring out what they’re saying, so that keeps you interested. There’s an element where you want to find out what happens, so you stick with it. There’s an engagement strategy there.

“I had been trying to figure out how to teach Spanish to preschoolers through a show and it was really hard because there was so much repetition. It took twice as long to tell a story because characters would say things and the other characters would say it back to them in the other language. It was not the greatest format. Languagelearning is a lot more interactive than just watching something, so if people can learn just by watching, they could learn better by interacting with it.”

Beyond the initial task of creating stories for and developing the characters, Duolingo has also been piloting some animated shorts that teach language-learners about the cultures of the countries whose languages they are

learning, although Simensky notes that work is still in the very early stages.

The exec is additionally looking at creating stories for literacy app Duolingo ABC, which teaches children aged three and up how to read, featuring the same characters as in the language-learning app but as children.

“Duolingo is developing more apps on other subjects and they will use versions of our characters, so there will be more opportunities for us to figure out how to put more content on the different apps. If any of the characters particularly break out, like Lily, we’ll start to think about where else we could use them. We use the characters in social media now and will use them in a lot of different ways,” Simensky says.

Looking further into the future, the exec highlights the potential for longer-form content surrounding Duolingo’s characters, and that could potentially include a TV series.

“When you come from TV, where you look at every group of characters as a show, you look at every group of people you work with as a show. You’re always thinking about what would make an interesting show. The goal really is to get these characters right, but I think there are a lot of opportunities for them, including maybe some kind of show. We’re not there yet but I think that would be a lot of fun,” Simensky says.

“The question I would have is that these characters are used in the context of learning, so would the show be educational? We’re in the business of bringing education to people all over the world, so what would a show do for that? There would need to be some point to it. Also, we’re an international company, so would we do different things in different countries or try to do something that speaks to everyone? I don’t know the answer to that, but I think it’s an interesting thing to think about.”

Duolingo is working with a mix of internal and external creatives on its scripted and animation projects, the latter including freelance writers and third-party animation studios.

Simensky says her biggest challenge is to “figure out how to do animation in a company where entertainment is not the main thing” and hopes that in a year’s time Duolingo’s scripted and animated content offering will be thriving.

“Entertainment is very important but it’s not the main thing Duolingo is doing. So I’m figuring out the processes that I know from working in television and communicating with a team of engineers, computer scientists and linguists to help them get comfortable with the process of animation and character development. Those are things from a different world for them – they’re not the typical things you would be working on if you’re a computer scientist or linguist,” the exec says.

“In a year, hopefully we’ll have many more stories with the characters that really do develop the character arcs and help people get to the higher levels of language. We will be in the business of making animated shorts, hopefully, and maybe different kinds of content with varying lengths and different goals.”

Strawberry Shortcake: Berry in the Big City

The way we watch content is in a constant state of evolution. In the last 20 years we’ve seen traditional TV turned on its head with the advent of streaming, while further technological advancements have brought us virtual and augmented reality (VR/AR).

Now, we’re being introduced to the world of the metaverse. The Cambridge Dictionary defines the metaverse as “a virtual world where humans, as avatars, interact in a three-dimensional space that mimics reality.” The term is popping up increasingly in the children’s content sector, but what does it mean for the future of kids’ TV?

“The younger generations are primed for the metaverse. Although their parents have witnessed the development of the digital age, the on-demand generation have grown up with the internet at their fingertips,” says Nick Richardson, founder and CEO of The Insights Family.

“The amount of time kids are spending within digital worlds, coupled with their desire to express themselves through their purchases, demonstrates that not only are they open to the concept of the metaverse but they are already engaging with it.”

Arguing that the gaming sector is “creating huge opportunities for TV brands and properties,” Richardson notes Disney has incorporated imagery from its IP into online video game Fortnite, such as characters from the Marvel Cinematic Universe.

“Media companies should therefore be prepared to evolve and adapt their approach to incorporate gaming,” he says. “When taking a global view of all 18 markets surveyed by Kids Insights in 2021, in half of these countries older teens spend more time playing video games than watching TV.

“The average time teenagers in the UK spend gaming has grown, whereas the time this demographic spends watching TV has shown little change. By integrating other entertainment

The children’s TV sector is evolving constantly due to changing viewing habits and advancements in technology. But what impact will the latest of these innovations, the metaverse, have on the business?

wil inn ha B

platforms, streaming services can ensure they remain popular and maintain subscriptions by staying one step ahead of the trends.

“Interactivity will be particularly fundamental to attracting viewers to streaming services. Providers like Netflix and Disney+ will need to adapt in order to appeal to a generation of viewers who have grown up consuming content on YouTube, Snapchat and TikTok, where interactions with their friends and favourite influencers are personal and commonplace.”

In Canada, entertainment company WildBrain has already ventured into the world of the metaverse with two well-known properties: Strawberry Shortcake and Teletubbies

WildBrain revived the Strawberry Shortcake brand, which first appeared in the 1970s, last year with a new animated series called Strawberry Shortcake: Berry in the Big City and a consumer

products range. Alongside these the company launched a Roblox game, Baking with Strawberry Shortcake, in which fans can play with their friends, customise food trucks, create baked goods and compete in baking contests.

Meanwhile, WildBrain has teamed up with digital entertainment platform Azerion to launch virtual Teletubbies products in Azerion’s online games Habbo and Hotel Hideaway. Products available for purchase with virtual currency include Teletubbies branded avatar onesies and custom products including the Tubby Toaster, Custard Machine and Noo-Noo the vacuum cleaner, for players to decorate their rooms in the game.

sive, lean-back-and-watch erience,”

exec VP of M&A and f ficer

“For the past decade, there has been an increasing demand from audiences for personalisation and in the last few years the ability to co-create has grown a lot stronger. Like TV and movies before them, SVoD companies have relied on the emotional and intellectual value of stories to engage audiences and monetise their attention. But the big question is whether people always value this kind of passive, lean-back-and-watch experience,” says Anne Loi, exec VP of M&A and chief commercial of at WildBrain.

WildBrain

Foor 2, it seems this

“For kids aged 6-12, it seems this has changed

For the past decade, there has been an increasing demand from audiences for personalisation and in the last few years the ability to co-create has grown a lot stronger.

Anne Loi WildBrain

Anne Loi WildBrain

“

and it is no longer enough to only consume. In the last two years, the number of kids wanting to create their own content in the US has skyrocketed. So if companies bear this in mind when creating content they will be satisfying the direct needs of their consumer.”

Entering the metaverse creates opportunities for content makers and producers, according to Loi, who also hails it for allowing children to embark on digital adventures that wouldn’t be possible in real life.

“What is great about it is the ability to use the metaverse as a significant lever. A child who happens to be wheelchair-bound, for example, and who has a playdate with a friend in the metaverse can experience moments digitally that aren’t otherwise possible,” she says.

“We also have to remember that consumers choose to keep relationships with companies and brands they find relevant and relatable. As time goes by, if the adoption of the metaverse into brand plans or yearly business objectives becomes the norm, by this stage consumers would have developed an expectation that the brands they have connections to are accessible in places they expect them to be. So keep watching your consumers/audiences and keep close to their preferences and expectations.”

In the US, Genius Brands International’s digital network Kartoon Channel! is rolling out Kidaverse –a ‘metaverse for children’ that includes the channel’s programmes with content in the metaverse to run alongside. Currently undergoing a soft launch, Kidaverse will feature custom avatars and emojis for kids, exclusive games, branded Kidaverse VR goggles, immersive content and non-fungible tokens for kids.

The new platform will also feature collectable digital cards based on many of the channel’s popular characters, including those from the upcoming Stan Lee Universe, which debuts in Q4 this year, and a digital currency for kids called Kidaverse MetaBuck$.

Jon Ollwerther, co-president of Kartoon Channel!, says the idea of the Kidaverse is to “create a safe place for kids to experiment and learn about the behaviours they’ll be practising later down the road in the grown-up metaverse.

“That’s a really important thing to get right. You can’t just have an open architecture or an open system where kids can be contacted by anyone. You have to have really strict controls around that for safety’s sake. Quoting Spider-Man, ‘With great power comes great responsibility,’ and we need to approach this really carefully, with a sense of responsibility for kids and for families,” he says.

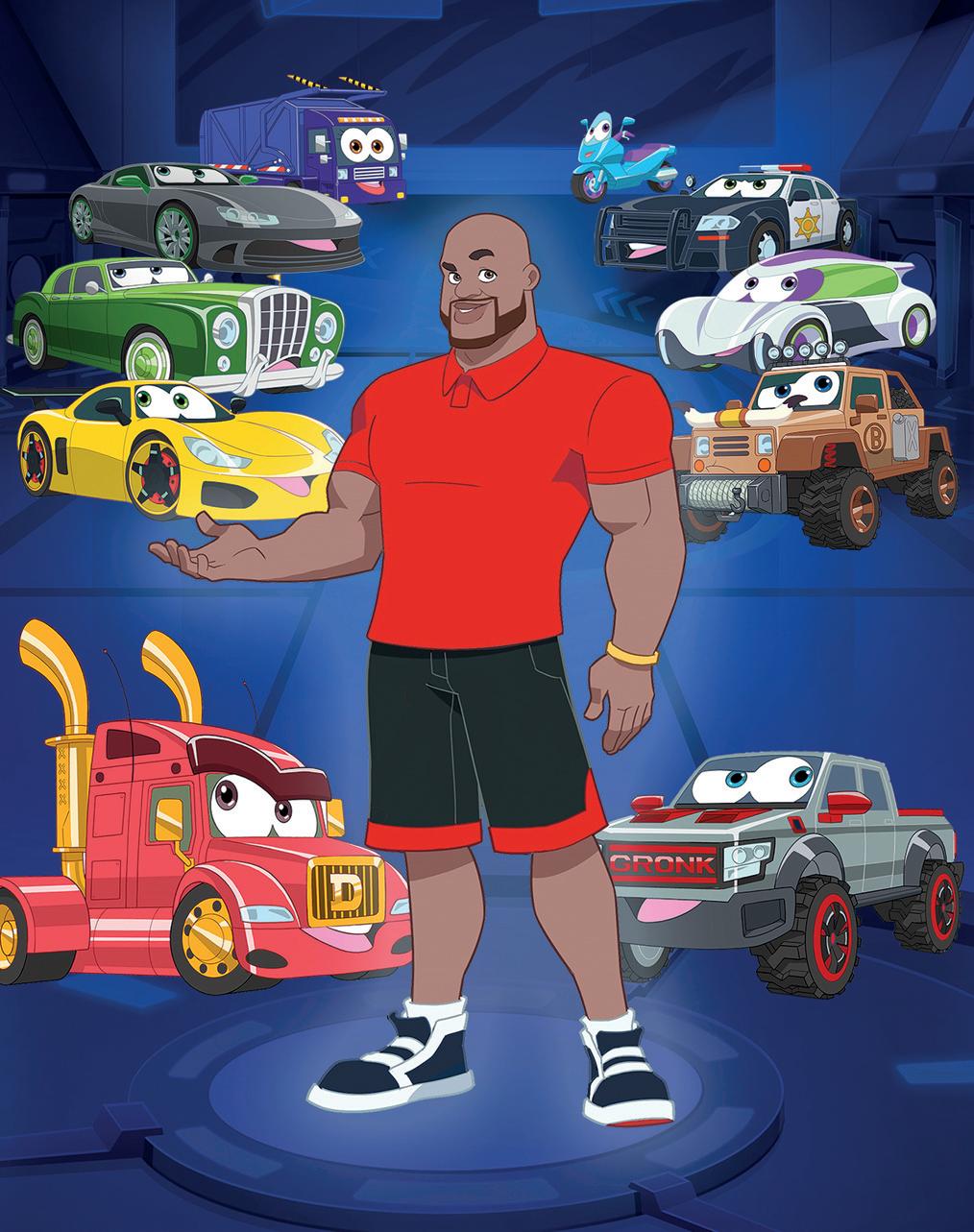

Ollwerther echoes The Insights Family’s Richardson by saying “gaming is going to be the entry point for the metaverse,” and highlights two of Kartoon Channel!’s upcoming programmes which he thinks have potential in the metaverse: Shaq’s Garage and Wolfgang Puck’s Secret Chef Academy Starring and coproduced by former NBA player Shaquille O’Neal, Shaq’s Garage is an animated series about the secret adventures of O’Neal’s extraordinary collection of cars, trucks and unique vehicles which come to life through artificial intelligence.

Wolfgang Puck’s Secret Chef Academy,

meanwhile, is a cooking show led by AustrianAmerican chef Wolfgang Puck.

In 2019, Sebastian Wehner, founder and CEO of Wonderz in Germany, launched WunderBox, a multimedia direct-to-consumer distribution platform that “aims to encompass all media formats a content creator would want to distribute in the future,” including content in the metaverse.

“We are monitoring the current progress and developments and preparing ourselves to extend our platform towards metaverse content formats when the time is right,” Wehner says.

Offering advice to those interested in venturing into the metaverse, he suggests: “You could try to partner with a gaming company to build something in Roblox, do a licensing deal with one of the early players in the space, or make your own smallscale AR experience on mobile to dip your toe in.”

Acknowledging “a lot will constantly change in the coming years,” Wehner says it’s hard to predict what the future of the metaverse is, but is adamant it will never replace mainstream TV.

“I can see we will have television watching in the metaverse – it has already happened in Fortnite – or that streaming platforms might become metaverse hubs. Linear storytelling could also morph in parts to a scripted 3D experience, like mixing theatre and a theme park ride,” he says.

“Whatever happens in the future, linear storytelling is here to stay. It is an art form that started with recounting stories around a bonfire and painting in caves thousands of years ago and it will survive whatever technical revolution or medium we throw at it.”

Kartoon Channel!’s Ollwerther seconds Wehner’s remarks, saying the metaverse represents “another avenue for consumption of entertainment and IPs that we know and love.”

“I don’t think the metaverse will totally replace the entertainment consumption experience we know today, whether that’s movie theatres or sitting on the sofa with your family and enjoying something together,” he says.

WildBrain’s Loi agrees, but urges producers to think about what they might be able to do in the metaverse as the phenomenon will undoubtedly continue to impact content consumption in some form.

“We are a long way from the metaverse becoming a primary video consumption replacement for the current ecosystem. What is important, however, is that in the near future some sort of video content consumption will happen in the metaverse, so producers should think about what type of content – genre, length, format etc – would be most suitable for this particular form of entertainment,” she says.

For Richardson at The Insight’s Family, the cost of the metaverse on the consumer also suggests it is unlikely to replace mainstream TV.

“The current cost of AR/VR units means a total switch to the metaverse is unlikely,” he claims.

“The world of VR actually promises some huge opportunities for streaming platforms and smart TVs, both in terms of marketing and content, casting the metaverse as an addition to existing mediums of entertainment rather than a replacement.”

Catch C21’s NEXT BIG THINGS - The people, programmes and businesses that are changing the game.

Keep reading online and smarten up your programming strategy at c21media.net/ departments/next-big-things/

“ Linear storytelling is here to stay. It is an art form that started with recounting stories around a bonfire and painting in caves thousands of years ago and it will survive whatever technical revolution or medium we throw at it.

Sebastian Wehner Wonderz

metaverse

Canadian kids’ content company WildBrain produces shows like Fireman Sam, Polly Pocket, Malory Towers and The Snoopy Show, and houses a distribution catalogue including the likes of Teletubbies, Bob the Builder and Inspector Gadget

It also operates a number of linear channels – Family Channel, Family Jr, WildBrain TV and Télémagino – and AVoD business WildBrain Spark.

Programmes previously commissioned by Family Channel that are currently available on the network include live-action drama Ruby & the Well, preschool animation Caillou and animated comedy Summer Memories. Family Channel recently ordered five extra episodes of the latter to premiere in 2023.

Acquisitions for Family Channel include animated series Miraculous: Tales of Ladybug & Cat Noir and The Smurfs, unscripted series like American Ninja Warrior Jr and Backyard Blowout, and classic multi-generational shows including sitcom Family Matters

Coming up on Family Channel soon is the new Strawberry Shortcake series Berry in the Big City, while the network recently ordered a new series of animated show Slugterra. Titled Slugterra: Ascension, the 20×4’ series follows on from the original, which ran for six seasons from 2012 to 2016.

Family Channel also recently ordered a live-

action movie spin-off from teen sitcom Life with Derek Life with Luca follows previous spin-off film Vacation with Derek and picks up 15 years after the original series, following Derek as he navigates parenthood. It will debut on Family Channel in early 2023.

Over at WildBrain Spark, its YouTube original Boy & Dragon has proved a huge success, according to WildBrain’s chief operating officer Deirdre Brennan, who says the series has attracted more than two billion minutes of watch time since launching in 2019.

Brennan is looking forward to returning to in-person industry events this year, where she would like to see more animated comedies for older viewers and content that is both entertaining and inspiring. Execs from her team will be at Mipcom to source new projects and partnerships.

“We’re grateful to have many points of engagement with the global creative community, especially as we return to much-missed

Deirdre Brennan of WildBrain is eager to get back to in-person events as she sets out her content requirements for the Canadian company’s channels. By Karolina Kaminska

content pipeline, we have an extraordinary in-house development team, but we do look for partnerships and projects to enhance our offering.

As part of their remit, VP of channels and global acquisitions Katie Wilson and VP of development Lorna Withrington will be meeting with creators

and producers at Mipcom this year to bring more shows and potential partnerships into the WildBrain world.”

markets and industry forums.

This provides an invaluable opportunity to review projects across all stages of development, formats, genres and sources,” she says.

“Personally, I would like to see more older animated comedies going to greenlight in the year ahead, but this reflects the complex nature of financing th t e genre. One thing I am c certain of is that the need to b be entertained and inspired i is more important than ever. Positivity and joyful moments are exactly what families need right now.

“When it comes to finding great projects for our

important vehicle for partnerships. We are always open to, and actively engaged in, copro activity globally,” she says.

According to Brennan, WildBrain doesn’t reserve a specific proportion of its slate for acquisitions and commissions, noting projects are decided upon on a case-bycase basis. She does, however, express the need for coproductions. “Coproduction is an difficult

Brennan foresees a challenging year in 2023 as viewing habits continue to change and the world is pushed from the Covid-19 pandemic into an economic crisis. To survive in this diffi environment, the exec highlights a need to focus on high-quality, diverse content that is available to audiences in a range of fi

financial situations.

“The year ahead will be challenging for us all, given recent shifts in the commissioning landscape, a tense economic climate and the impact of the global pandemic on audience behaviour that is still being felt,” she says.

“As a content company working in this environment, we need to amplify our creative reputation through premium

environment, we need to amplify our creative

originals at the same time as diversifying the pipeline, offering best-in-class content at every price point.”

C21 caught up with producers heading to Cartoon Forum in September to discuss the biggest issues and trends facing the animation sector. Here are some of their responses.

big a th

By Karolina Kaminska

By Karolina Kaminska

Funding new projects, recruiting and retaining talent, and maintaining high-quality production in an intensely competitive environment are some of the biggest issues the animation industry has been facing in recent years.

These topics frequently come up when execs are asked about the challenges they are experiencing in a market that is demanding premium, original content that stands out.

Ahead of Cartoon Forum in September, Lithuanian studio Art Shot’s founder, Agnė Adomėnė, said the biggest issue she sees is with “the originality and variety of content,” warning that original storytelling is not keeping up with the fast pace at which technology is evolving.

“The animation industry is much more focused on the technological aspects of animation and less on the stories it tells. The technologies are evolving much faster than the storytelling in animation,” she said.

Ten years ago, C21 asked producers heading to Cartoon Forum 2012 how interactive content and gaming applications were changing animation production. One exec, Manuel Román, artistic director of Muñecos Animados in Spain, said: “Today, apps and interactive content are everywhere, but tomorrow we don’t know what new surprises we are going to find. We are in a changing market, so we must be alert to ensure all our content is flexible.”

Apps and interactive content are still everywhere, but other novel technologies that promised to change the animation game, like 3D TV, failed to take off completely. Still, Román was right to warn about the technological advancements of tomorrow.

A decade on, we are discovering the brand-new world of the metaverse, which more and more kids’ companies are exploring. Whether or not this phenomenon will transform the content industry or suffer the same fate as 3D TV remains to be seen. The producers we spoke to had mixed opinions.

“One can’t ignore that a wide adoption of the metaverse is coming, and it offers tremendous opportunities for existing IP to grow and for brands to launch,” said John Rice, CEO of Jam Media in Ireland, while Raúl Carbó Perea, founder and CEO of Tenerife-based In Efecto, said the metaverse will “entirely change the game.”

David Michel, president and co-founder of Cottonwood Media in France, noted that the metaverse will “substantially” change the content offering for tweens and teenagers and will reduce animation time, “allowing directors to work faster and more creatively.”

Conversely, Dmitrij Gorbunov, founder of Metaxilasis in Serbia, argued “the metaverse’s influence is overestimated” and won’t impact animation any more than virtual reality games, while Dunja Bernatzky, CEO of Arx Anima in Austria, suggested it “may be another hype that big corporations pour millions into.”

Many people might agree with Bruno Felix, co-founder of Submarine in the Netherlands, who said the metaverse “is a natural progression of what has been happening for a long time.”

But whether it really kicks off or not, the metaverse is certainly providing a lot of food for thought for producers globally, and with it potentially new hurdles to overcome.

As Sebastian Wehner, co-founder of Wolkenlenker in Germany, said: “New, exciting developments, such as virtual production and the metaverse, are on the horizon. There is already a lot of progress in terms of technology and software, which might enable lower costs, faster turnarounds and even new ways and styles of animation. The industry is on the cusp of significant changes. The question is, can producers move fast enough to keep up?”

Agnė Adomėnė, founder, Art Shot

The biggest issue in animation now is the originality and variety of content. The animation industry is much more focused on the technological aspects of animation and less on the stories it tells. The technologies are evolving much faster than the storytelling in animation. It’s especially obvious in the feature animation of the past decade. Mostly, there are two types of feature animation films: 3D family films and 2D ‘war/human rights’ films. The majority of feature animation films are very similar to each other in terms of the subjects and storytelling.

The audiovisual world in general, especially following the arrival of streamers, has changed – in some ways for the better. But the competition has become very fierce and it has become difficult for small independent producers to stay afloat. In fact, there is a clear tendency to entrust projects to large, consolidated groups.

The animation industry is facing the same great challenges as all other industries: how to keep on producing while we have a war in Europe, while basic resources are scarce (electricity and computers mainly) and while all financing fees have tripled. The volume of productions has never been so high, but the amount of qualified talent has not increased by the same amount. And most of all, worldwide global biodiversity is at risk, raising the possibility [we cannot] keep on living on this planet.

The animation industry, just like any other, is greenhouse gas (GHG)-productive. We can have a positive impact on such GHG by adapting our production pipeline. We need to train ourselves, as managers and decision makers, to understand where the priorities of action are. We also need to train our teams.

Manon Massacci, creative development manager, Mr Loyal

There are many challenges the animation industry is facing, but one of the biggest might be the talent shortage. Due to the rise in demand for high-quality animation and new shows, producers have more difficulties in recruiting talented people. It is actually good news because it reflects the dynamism of a flourishing industry, as long as it doesn’t turn into a long-term crunch.

On a global level, our biggest issue is the change in the way projects are financed, because streamers have their own rules, which are different from, for example, the established ways of traditional linear broadcasters, film funds etc. So it is necessary to adapt to the newly created conditions, especially in early phases like pitching and development, and it remains to be seen whether, over time, someone will establish a simple enough and transparent system for these sources, too.

In production, there is a lot of variety and democratisation in many countries, with low budgets, but I am concerned about distribution; it is still dominated by few companies. In the short term, the industry is growing and developing many business areas. But in the medium term, cinema and animated series will have a problem if they don’t get new audiences, like Pixar did at the beginning of the 21st century.

From a producer’s perspective, one of the biggest challenges is the tension between the industry’s desire to invest in new properties versus the need to invest in pre-existing heritage brands. Of course, there are buyers who appreciate the time new IP needs to establish itself and grow its audience organically, but the pressure on the industry at large to produce instant hits can put a squeeze on indies and limit the space in which emerging talent can create innovative and surprising content.

Different countries and markets face different challenges. In Italy, for example, the biggest challenge for the next two years will be finding the talent. Thanks to the launch of various streaming platforms and a law that mandates they have to produce locally, the demand for animated content will increase. But currently we don’t have enough artists to meet the country’s needs.

The TV and streamer landscape is a shrinking kaleidoscope at the same time as we are seeing animation audiences continuing to segment into predominantly preschool and adult (the in-between mainly consume low-cost, single-creator, shortform content). This means more players in a smaller space and breaking through the noise becomes increasingly difficult. Leveraging brand partnerships along with new funding and creative marketing models become keys to success, assuming all creative is created equal.

Catch C21’s AHEAD OF THE CURVE - looking into new trends in the business, how to get ahead of the curve and where the money is to be made from this trend.

Keep reading online and smarten up your programming strategy at c21media.net/departments/aheadof-the-curve

Dunja Bernatzky, CEO, Arx Anima

It may be another hype that big corporations pour millions into. But even if not much comes of it in the end, it does create work that helps companies provide well-paid jobs in our industry, which help families to live a better life. I do strongly believe humans are social beings and therefore will always search for social interactions, which the metaverse wants to facilitate.

David Michel, president and co-founder, Cottonwood Media

I see it impacting production by reducing animation time and allowing directors to work faster and more creatively. As for the type of content we are producing, I’m not sure it will have an impact on our younger viewers (611s), as most of them will not be able to use the metaverse tools in the next few years. Virtual reality helmets are either forbidden or not recommended for kids who are under eight or nine. Social media accounts cannot be opened by those under 12 in most countries and the majority of kids do not have access to NFT [non-fungible token] wallets.

Obviously, this doesn’t mean that some of our audience will not be using the metaverse, but I don’t see it impacting the content they’re watching in the coming years. Older audiences – tweens and teenagers – will obviously become key users of the metaverse, and this is probably where the content offering is going to evolve and change substantially.

Raúl Carbó Perea, founder and CEO, In Efecto

The rise of the metaverse is a new, exciting and weird thing. It looks like sci-fi happening in real life, and along with real-time rendering is going to entirely change the game. We’re not only talking about video games or cinematics or films or series anymore – it’s about people taking part in the adventure and deciding what’s going to happen in the script. It’s totally new and, again, superexciting.

One can’t ignore that a wide adoption of the metaverse is coming, and it offers tremendous opportunities for existing IP to grow and for brands to launch. Currently, we’re developing live concert experiences around our

live-action series Nova Jones, as well as encouraging communities to interact and create user-generated content around our brands. We’re developing multibranch storylines and figuring out where our audience is playing and going to be playing. However, as wearables become the norm, questions do exist around the appropriateness of young children becoming so immersed in a digital world, with regulation undoubtedly coming down the line.

I don’t think the metaverse will influence animation more than virtual reality games do. If we speak about preschool and bridge content, nothing will change. Maybe adult content will be inspired by the metaverse and some new genres will emerge. I think the metaverse’s influence is overestimated. The classic formats will change, but this will happen due to the influence of the general market situation and new trends in content.

Bruno Felix, co-founder, Submarine

I don’t have a crystal ball so I have a hard time giving predictions, but I like the fact the concept of the metaverse is supporting the concept of visual storytelling. This is already central to our industry, but with bigger, more general platforms for communication and information getting more visual, too, it will attract a larger group of people wanting to explore and develop their talents as visual creatives, as well as users and consumers enhancing their skills. It is a natural progression of what has been happening for a long time and it will increase the relevance of the skills we have built in our industry.

Our understanding of the metaverse is that it will be the internet in 3D, highly interoperable without imposed barriers of the corporations starting it, and independent of proprietary servers and services so that if a particular company stops their service, its part of the metaverse is still intact. Suppose the metaverse comes together as such – which it probably won’t, as things are always different in actuality from our collective imagination – then it could lead to more crossover between animation and gaming, which could be fuelled by using the same toolsets and talent. As an animation company, it might be good to at least dip your toes in cooperating with a gaming company.

L-R: 2D animated Shadow’s World from Recircle Studio, Cottonwood Media’s medieval-set Welcome to Lolyland and adventure-comedy The Tinies from Miam! Animation

L-R: 2D animated Shadow’s World from Recircle Studio, Cottonwood Media’s medieval-set Welcome to Lolyland and adventure-comedy The Tinies from Miam! Animation

C21Kids selects 21 new shows to seek out at this year’s MipJunior, featuring a mix of animation, live-action, history, arts and crafts, superheroes, real-life stories, music, gameshows, chatshows, vegetable dinosaurs and sheep. By Karolina Kaminska

Producers: Eagle Vs Bat and Enanimation

Distributor: Serious Kids

They say: “Sixty short stories about sound, as heard through the ears of a small but very active little being called the Sound Collector, who has a passion for sound despite the fact he is very hard of hearing. He spends his days discovering and using new sounds that he finds on his adventures.”

We say: Coproduced for CITV and Rai Yoyo, this stop-motion/live-action preschool series highlights hearing impairments but also the beauty of sound. It is scheduled for launch in January 2023.

Producer and distributor: Xilam Animation

They say: “Karate Sheep follows Trico, an enthusiastic sheep who loves to share new objects and ideas with the rest of the flock. This causes a ruckus in the mountain pastures, which inevitably ends up at the expense of Wanda, a tough ewe whose job is to keep the sheep safe. Not a small feat, especially when Wolf is always lurking, waiting to make the most of this newfound chaos.”

We say: This non-verbal slapstick series is a mix of 2D, CG and stop-motion animation and is aimed at kids aged 6-9. It is due for delivery in Q4 2023.

Producer: Dot to Dot Productions

Distributor: Beyond Rights

They say: “A fantastic comedy arts and crafts show which sees the presenter, comedian Bec Hill, fulfil the wishes of young customers by delivering art to their doors.”

We say: The series consists of two 13x30’ seasons which are being launched at the same time. Sharing unique makes, top tips and inspirational art ideas, Bec Hill experiments with recycled materials and uses her comedy skills to make viewers laugh along the way.

Producer: Cottonwood Media

Distributors: Federation Kids & Family and ZDF Studios

They say: “This exciting high-concept series combines ballet, magic, witchcraft and more, with diversity and inclusivity at the heart of the production.”

We say: In coproduction with Opéra de Paris, Hulu, ZDF, ZDF Studios and France Télévisions, Spellbound is a premium live-action tween series about a 15-year-old girl who relocates from a small town in the US to France to study at the Paris Opera Ballet School. Things soon turn upside down when she discovers a book of family spells.

Producer: Nine Entertainment

Distributor: Fred Media

They say: “Get ready for the greatest comedy gameshow in the history of the world (literally)! For the first time ever, humanity’s biggest names will assemble for an epic knockout tournament. It’s an epic showdown over 200,000 years in the making. Who will rise above the rest and be crowned the G.O.A.T (Greatest of All Time)?”

We say: Produced for Australia’s 9Go, the show sees famous people from different points in history compete in a series of mental and physical challenges. Matches include Einstein vs Leonardo da Vinci, Justin Bieber vs Mozart and Shakespeare vs J.K Rowling.

Producer: Sphere Media and Sphere Animation

Distributor: Abacus Media Rights

They say: “Riley and her band gain supersonic powers when the volume is cranked up during a band jam, causing an electrifying sonic surge. Now they are secret superheroes who use the power of music to save the day. Baddies beware!”

We say: This action-packed, music-filled comedy is based on an idea by Emmy-winning songwriter Matthew Gerrard (Hannah Montana, Dora the Explorer) and musician Mladen Alexander (Pixel Perfect, Degrassi), whose cousin is the inspiration for Riley.

Producer: Kukua

Distributor: Cake

They say: “Super Sema follows 10-year-old Sema and her twin brother MB as they protect their African village from the villainous Tobor and his bungling robot army. A heartless artificially intelligent ruler, Tobor meets his match in Sema, who learns that with determination, creativity and a helping hand from the amazing worlds of science and technology, anything is possible.”

We say: From London- and Nairobi-based female-led studio Kukua, Super Sema is a YouTube Originals series exec produced by Lupita Nyong’o and written by Claudia Lloyd (Mr Bean, Charlie & Lola), that follows the STEAM-fuelled adventures of a brave and heroic young girl.

Producers: Cheeky Little and Studio 100 Media

Distributor: Studio 100 Media

They say: “A fresh and unique take on the dinosaur genre with characters you can only find in this show. Vegetables were never so much fun! Each episode is a standalone mini-adventure driven by Tricarrotops Ginger and her friends, the baby Pea-Rexes.”

We say: Produced for Australia’s ABC and France TV, this CG-animated comedy adventure series leans into relatable themes for upper preschoolers like mealtime, sharing, friendship and play.

Producer: Bionaut

Distributor: Dandelooo

They say: “Small, naive, curious and playful, just like young children, Our Piggy discovers and learns about the things around him. He is most interested in the everyday things that are transformed in his imagination – a box becomes a tractor, a pillow becomes a bee.”

We say: Created and based on the book by Jaromir Plachy, Our Piggy is inspired by the director’s own son’s games, feelings and viewpoints. Aimed at 2-5s, it will be delivered this autumn.

Producer: Studio Redfrog

Distributor: StudioCanal