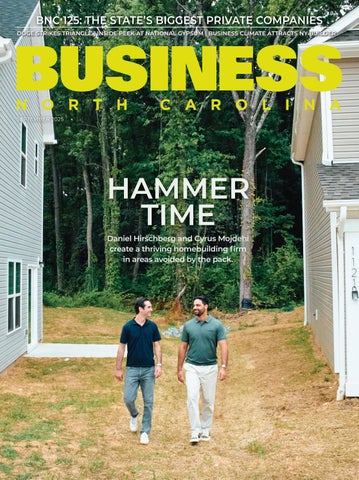

Daniel Hirschberg and Cyrus Mojdehi create a thriving homebuilding firm in areas avoided by the pack.

Starting Carolina Core FC was about more than just soccer for Megan Oglesby, who leads her family’s Earl and Kathryn Congdon Foundation.

North Carolina’s voucher program is squeezing poorer rural public school districts, some superintendents contend.

Mountain county finds hope in a Chinese company; A New York financier’s Outer Banks visit turns into a real estate project; Veteranowned Southern Pines knife manufacturer breaks into the European market; A California-based contractor builds a solid base in the Tar Heel state; How western N.C. wineries are bouncing back after Helene.

North Carolina’s institutions are making it easier for students to enroll in college and taking steps to help more of them graduate.

38

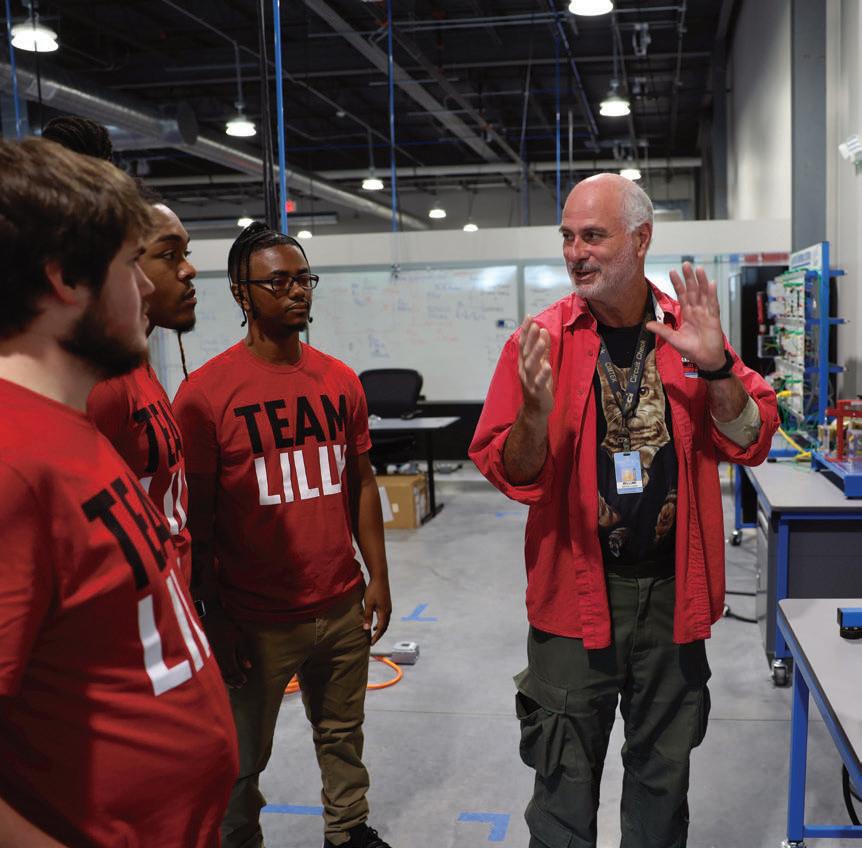

Community colleges are key in workforce development as the North Carolina economy continues to prosper.

Golf courses make Moore County world-famous, while other industries are helping the region deal with record growth.

BY DAVID MILDENBERG

Northway Homes gains national acclaim for its unusual approach to single-family projects around the Queen City.

CAROLINA WAY

BY KEVIN ELLIS

A veteran New York home-building family praises North Carolina’s business-friendly style as it expands south.

BY DAVID MILDENBERG

Crete United excels under a CEO whose unusual military experiences prepared him for a construction career.

BY MIKE MACMILLAN

The Triangle’s acclaimed research complex seeks a new path forward.

BNC 125

BY DAVID MILDENBERG AND ROBERT SPEIR

Our annual report on North Carolina’s biggest closely held businesses.

WALL WIZARDRY

BY DAVID MILDENBERG

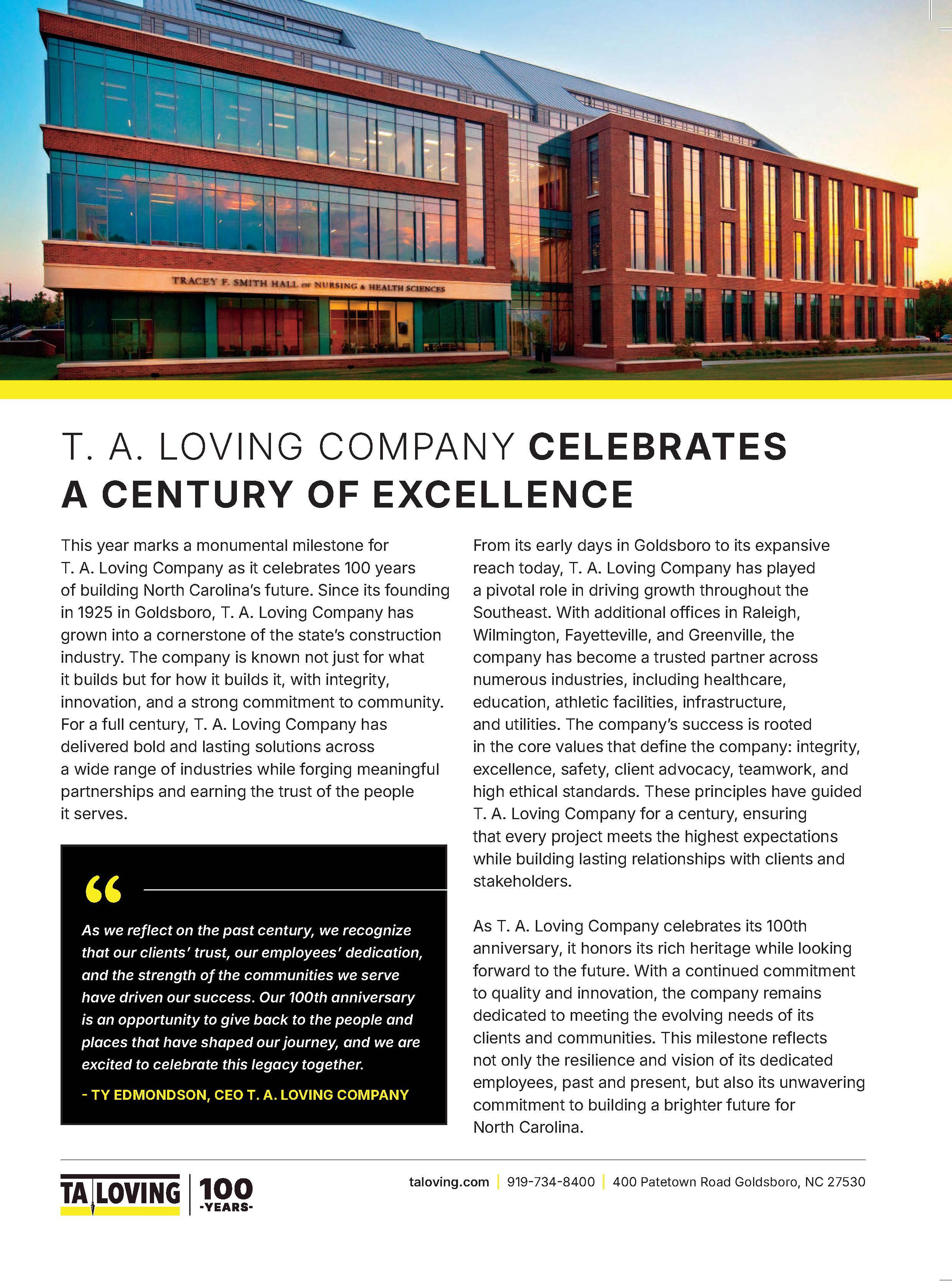

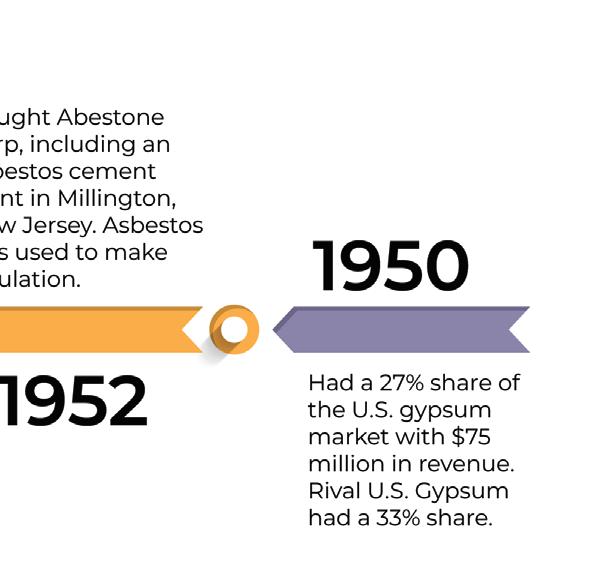

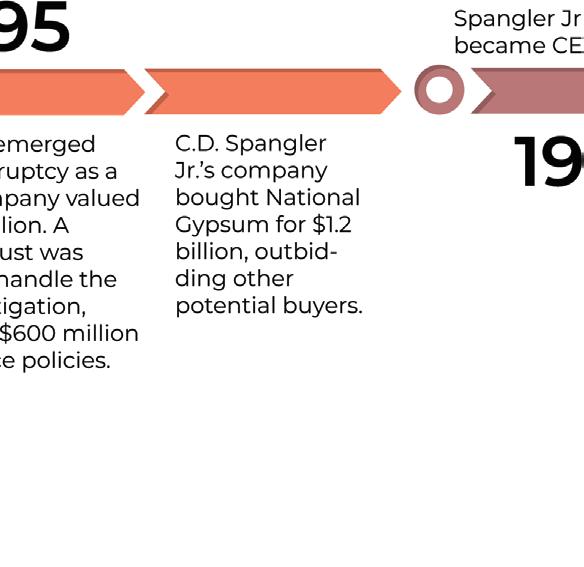

National Gypsum’s quiet style belies its major role in U.S. construction as it celebrates its centennial.

Expectations are sky high for Charlotte’s Pearl innovation district.

National Gypsum’s 100th anniversary and Business North Carolina’s annual list of the state’s biggest private companies led to a rare story this month on the wallboard-maker.

CEO Tom Nelson discussed his work at National Gypsum for the story that starts on Page 66. Like his legendary father-in-law C.D. “Dick” Spangler Jr., who bought the company in 1995, Nelson prefers to stay out of the public limelight.

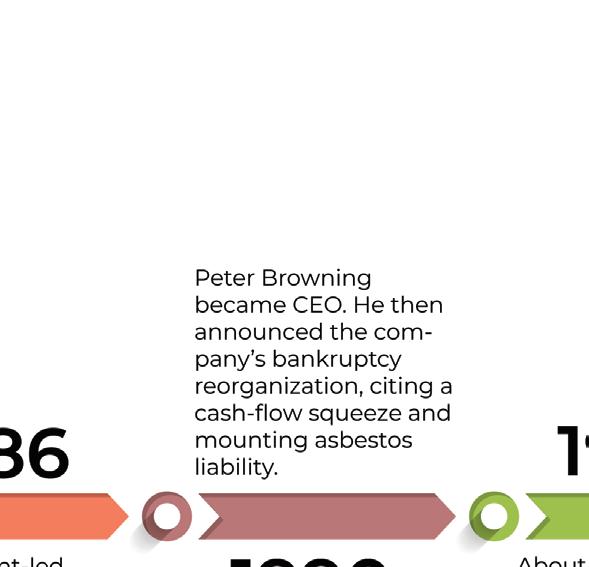

But reporting on the story prompted me to catch up with Peter Browning, one of our state’s more impactful business leaders. He got to North Carolina because of National Gypsum.

Browning says he didn’t have an option to be low-key as the company’s CEO during perhaps its most challenging period.

National Gypsum’s top execs were based in Dallas when they recruited Browning in 1989 to run the company’s main division, which had moved its headquarters to Charlotte a decade earlier.

e plan was for Browning, a 25-year veteran of packaging giant Continental Can, to learn about wallboard, then move to Dallas to succeed an aging CEO.

He got the top job in July 1990, just as the U.S. economy entered a recession that slammed building product sales. It squeezed National Gypsum, which had leveraged up in a 1986 buyout backed by France’s Lafarge construction materials company.

Within three months as CEO, Browning launched a bankruptcy restructuring that kept National Gypsum in the news for the next three years. Forbes magazine, then known for its tough exposés on poorly run businesses, featured Browning in a positive story that he credits for changing Wall Street’s view. e economy recovered by 1992, with wallboard sales rebounding as Browning cut costs. A year later, the company moved its headquarters to Charlotte and exited bankruptcy through a July 1993 IPO.

During this period, Browning helped introduce Lafarge leaders to Spangler and his Charlotte lawyer, Russell Robinson II. at led to Lafarge selling a stake in National Gypsum to Spangler. Two years later, Spangler acquired the entire company.

By then, Browning was gone. He had impressed the Coker family, which controlled the Hartsville, South Carolina-based packaging company Sonoco Products, and its board that included Charlotte kingpins Hugh McColl Jr. and Alan Dickson. In November 1993, he joined Sonoco.

Browning spent nearly seven years running Sonoco, while gaining board seats at Nucor, Lowe’s and Wachovia. A er departing Sonoco, he led Queens University’s business school for three-and-a-half years.

VOLUME 45, NO. 9

PUBLISHER Ben Kinney bkinney@businessnc.com

EDITOR David Mildenberg dmildenberg@businessnc.com

MANAGING EDITOR Kevin Ellis kellis@businessnc.com

ASSOCIATE EDITORS Ray Gronberg rgronberg@businessnc.com

Cathy Martin cmartin@businessnc.com

EDITORIAL INTERN Robert Speir

CONTRIBUTING WRITERS Frank Daniels IV, Bill Horner III, Vanessa Infanzon, Mike MacMillan

CREATIVE DIRECTOR Cathy Swaney cswaney@businessnc.com

GRAPHIC DESIGNER Lauren Ellis

MARKETING COORDINATOR Jennifer Ware jware@businessnc.com

EVENT DIRECTOR Norwood Teague nteague@businessnc.com

ADVERTISING SALES

ACCOUNT DIRECTOR

Moreover, the U.S. company faced 40,000 lawsuits because it had owned a business that for decades sold insulation that used asbestos. e unit never made up more than 10% of total totaled millions

total liability totaled declined to company’s line the time I to bankruptcy,” Browning

Citigroup, National lender, declined to company’s in 1990. the in my had to to spell bankruptcy,” Browning

Browning is now 84. A er serving on 14 public corporate boards, he is down to one, Greenville, South Carolina-based ScanSource, which distributes devices for cloud computing. For 13 years, he’s hosted an annual, invitationonly networking event for about 70 corporate directors, sponsored by EY, Moore & Van Allen and others.

An avid cyclist with four children and seven grandchildren, Browning has visited more than 80 nations. In October, he will celebrate his wife Kathy’s 80th birthday in Italy.

In an interview with the Acertitude executive search rm, Browning shared four timeless lessons for leaders:

Melanie Weaver Lynch, eastern N.C. 919-855-9380 mweaver@businessnc.com

ACCOUNT MANAGER Anne Brundage, western N.C. abrundage@businessnc.com

CIRCULATION: 818-286-3106

EDITORIAL: 704-523-6987

REPRINTS: circulation@businessnc.com

• Listen more than you speak

• Be transparent, even when it's hard

• Earn trust through presence and follow-through

• Don't lose your humanity in pursuit of performance ■

David Mildenberg is editor of Business North Carolina. Contact him at dmildenberg@businessnc.com

OWNERS

Jack Andrews, Frank Daniels III, David Woronoff, in memoriam Frank Daniels Jr.

PUBLISHED BY Old North State Magazines LLC

PRESIDENT David Woronoff BUSINESSNC.COM

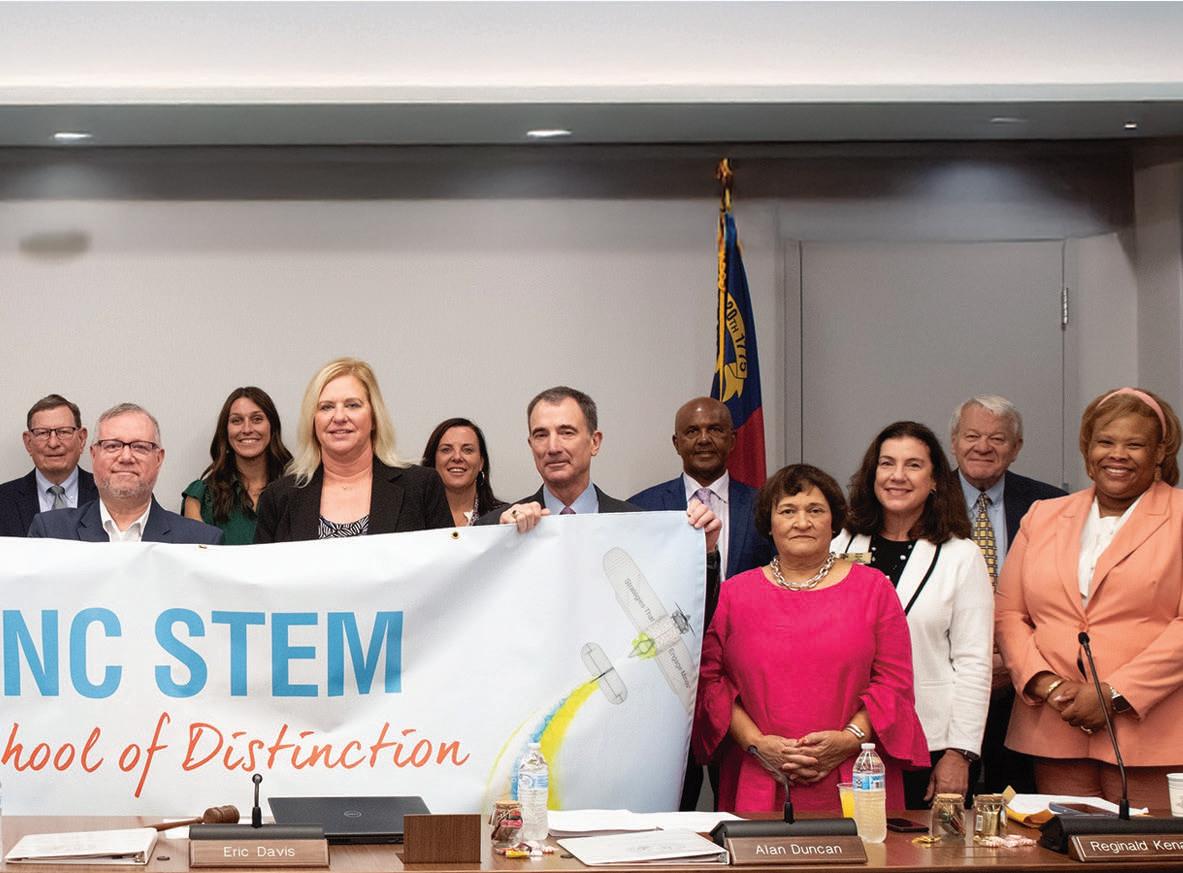

Of the 50 schools across the state recognized for excellence in STEM education, 28% are in Eastern NC, thanks to the growing impact of STEM East, an initiative of the NC East Alliance.

is recognition isn’t just about a title — it reflects the commitment of local educators and communities to connect classrooms to careers. With support from STEM East, schools in Pi , Greene, Lenoir, Beaufort, Wilson, and Onslow Counties are aligning instruction with the skills our students need to succeed in a technologydriven world.

More schools are stepping up, with many already preparing to earn recognition through targeted workshops and support from STEM East’s regional network.

Eastern North Carolina is leading the way in building a future-ready workforce, and it’s only the beginning.

Megan Oglesby joined High Point University President Nido Qubein in the Power List interview, a partnership for discussions with influential leaders. The interview was edited for clarity.

Megan, you’re the principal investor and founder of the Carolina Core FC soccer team.

That’s just one of the ways you are helping transform your hometown. How do you go from being a communication major to sports ownership?

I’ve always led with my values and what I feel like I can bring to the table. One of the first questions I often get when I tell people I’m the Carolina Core FC founder or principal investor is, “You must really love soccer?”

Soccer was part of my life growing up, along with Girl Scouts. But one of the things that made me decide to become an investor in the team was the work we were doing in our community. You were a big part of that, revitalizing our downtown with a multi-sport, multi-use stadium.

We have a great baseball team there, and I was brought to the table to help bring something to our downtown that’s exciting and vibrant and very inclusive.

Megan Oglesby is the executive director of High Point’s Earl and Kathryn Congdon Foundation, which was formed by the family that built Old Dominion Freight Line into one of the largest U.S. trucking companies. Her great-grandfather, Earl Congdon Sr., started the business in Richmond, Virginia, in 1934. Old Dominion moved its headquarters to High Point in 1962. Oglesby previously worked for Business High Point Chamber of Commerce. Last year, she became the second female to be the principal investor in a U.S. professional soccer club, the Carolina Core FC. She has a bachelor’s degree from Elon University and an MBA from High Point University.

We’re in MLS Next Pro. MLS is Major League Soccer and they came up with a secondary league, kind of like the Triple-A of baseball. It’s a development league that started in 2021. In 2022, we decided to go after an expansion. Because it’s a developing league, it has access to opportunity. And soccer is very, very popular.

So what does it take to start a soccer club?

Somebody must have done a pro forma to determine if this region can support a professional soccer team.

You have to start with vision. You have to know where you’re going, and then you have to have a plan. And obviously the financials play into it. And you have to have the people who have the expertise to get it off the ground, especially for a startup.

We’re an independent club, a part of MLS Next Pro. That means we’re not affiliated with a first club. Crown Legacy FC is a part of Charlotte FC. They’re the Next Pro team that moves players up to Charlotte FC. We’re independent, which means that we can move our players anywhere.

Why would you move your players? Do teams bid on these guys?

We want to move our players. We want them to come to us and develop, and then move on to where you want them to go to a higher level.

How did you start the team? By hiring a coach and players and getting the city on board? Did you find the location first?

The answer to all of that is yes. It all sort of had to happen at the same time. Everything kind of had to fall in line. The first thing we did, besides the vision and the plan, was to make sure we had the right people on board.

We have some other minority owners because everybody brings some expertise and perspective to the table. That’s super valuable for our club. So when I’m making big decisions, I lean on our other owners and our staff because they have expertise that I don’t have.

What is that long-term picture for Carolina Core FC?

A long-term picture is that this club outlives all of us. For me, the definition of success is when I see not just players but staff move on to something better. You know, we’re a small enterprise, and we’re a great place to learn. And if people want to stay with us forever, I hope they do.

Why did you call it Carolina Core?

We were going to call it Triad United, but that sounds like an airline. We got the inspiration for the name from the work that the Piedmont Triad Partnership is doing in our region, yourself included, to bring additional jobs to our region. That’s really what Carolina Core FC is all about, and the vehicle is soccer.

When we think about attracting businesses to our region, whether it’s a small mom and pop or a huge company like Toyota, the first thing they’re looking at is, is there a skilled labor force there that I can hire?

Number two is quality of life. What is there to do? What are the school systems? Carolina Core FC is a small part of that. I am a North Carolina native, I love the state. I love this region, I love our town. And we have something to offer for everybody.

What does the foundation look at when it allocates funding?

The Earl and Kathryn Congdon Family Foundation is a private family foundation. The board members are Earl and Kitty, who are in their 90s, and their three grown children, who are in their 60s and 70s.

Our mission statement is to invest in nonprofit organizations that improve quality of life by reducing barriers to opportunity. We have three areas of focus. One is improving the quality of and access to education, including helping with our school systems. Our second one is critical community needs, including homelessness and food insecurity. We are big supporters of our hospital because you have to have a strong hospital to have a strong community.

The third one, which is where I became personally passionate, is economic development for revitalization and stabilization. If you can’t have a stable job, it’s really hard to do anything else. That’s where my passion for creating jobs turned over into my work with Carolina Core FC. (The foundation isn’t directly involved with the soccer club.)

You’re doing great work. I am quite familiar with many of the projects that the foundation has invested in. Does the foundation work principally in High Point?

We focus mainly within the greater High Point area. The family members decided in 2015 when they founded the foundation with their own private dollars, that they wanted to give back to the community that supported them through the hard years.

Megan, you speak with such clarity and with conviction and, yet in your life, you’ve had a challenge with your hearing. One would never know that. But, and I know you have managed that challenge with elegance and responsibility. To the extent that you’re comfortable, tell us about that.

So I was born with a hearing loss. I have about a 75% loss in both ears. At the time, the hospital didn’t test babies when they

were born for hearing loss, so my parents didn’t find out about my hearing loss until a little bit later. So I was delayed in my speech.

As soon as my parents found out, I had speech therapy every day. I got hearing aids back in the 1980s.

One of the things that I’ve thought about a lot as I reflect on my life is that my parents did not give it power. They didn’t say, “Megan, you wear hearing aids, so you can’t be on the swim team. You can’t play on that soccer team because you’ve already lost your hearing aid for the third time.”

They wanted me to go and do what I wanted to do and just figure out how to work with it. So I thank my parents for that. It has shaped who I am.

I also thank God that I was born in at a time with the technology. Had I not had hearing aids growing up, I wouldn’t have learned language. I probably would have been considered disabled. And the technology gets better.

Now the soccer team had its first season in 2024. Was the main challenge getting crowds out there? Is it attracting players? What is the major challenge?

I wouldn’t say there are any major challenges. We’ve had a really great first year. We’ve got a great foundation. Probably the biggest challenge is just keeping everything aligned and moving forward, making sure that everybody who works for you has the same values. Personally, I don’t want to work for a company that my values don’t align with.

You’re really great about saying these are our values here at High Point University. This is what we stand for, and being unapologetic for it because you’re convicted and that you believe so strongly. And so I need to be better about saying these are our values, come on board with us.

If I came to a Carolina Core game, I assume I would see all ages. But the predominant profile would be a young family with young children who are crazy about soccer?

So one of the things that I love the most about our stadium in downtown High Point is that it is a mixed-use multi-sport stadium. When you’re there for soccer, it feels like soccer. What we thought would be one of our biggest challenges ended up being one of our greatest assets. That is the outfield of the baseball diamond, which we don’t use during the soccer game because soccer is rectangular.

Somebody brilliant on our team said, “How about we allow everybody with a ticket to be able to go down on the pitch in the outfield, and we just make it a party? We have a game down there for the kids and a concession stand.

That outfield has been the best thing. The families love it because the little kids get to run around and parents can watch the game or finish a conversation without being interrupted every two seconds by their kid. So when you look around the stadium, you see families with little kids. We even have people carrying their newborn babies.

We have die-hard soccer fans. We have older clients that come and watch the game. And it’s really been one of those things that has felt like such a unifier for our community. A mother came up to me the day after one of our home games the next day, and she said she had four kids, one in elementary school, two in middle school and a high schooler. This is one thing we can do as a family where everybody has a great time. ■

As head of Business Owner Solutions at PNC

Private Bank Hawthorn, Charlotte-based Jim Benedict leads a team that is focused on helping business owners prepare for a crucial milestone: a business ownership transition.

When approached strategically, business succession planning is a multifaceted exercise, charted over the course of several years or decades. At the same time, a prudent approach to planning entails preparing for an unexpected transition that could occur at any time.

addresses a multitude of considerations, from business and personal readiness to tax-efficient transfer strategies and estate planning.”

As Benedict explains, engaging in comprehensive financial planning well in advance of an ownership transition can lead to the implementation of strategies to help maximize the value of a business or provide flexibility when the time comes to negotiate a selling price or exit terms.

“Business succession planning isn’t linear, it’s circular,” says Benedict. “It’s much more dynamic than the transactional aspect of selling a business or passing it to the next generation. It’s about putting strategies in place to help business owners achieve their long-term goals for their business and family, while also preparing the business to successfully sustain a transition – either voluntary or involuntary.”

When helping business owners navigate succession planning, Benedict and his colleagues take the intentional approach of beginning at the end.

“We discuss with business owners and their families how they want to live their lives after the ownership transition – and how they view their wealth as a tool for attaining their personal, philanthropic and family wealth goals,” says Benedict. “These discussions ultimately help inform the development of a comprehensive plan, which

While the circumstances surrounding each ownership transition are unique, one thing is certain, says Benedict. “Whether voluntarily or involuntarily, every successful business will have an ownership transition someday,” he says.

According to the Exit Planning Institute, approximately 50% of all business exits are involuntary, largely precipitated by one of the “5 Ds”: death, disability, divorce, disagreement or distress.

“While we may want to believe that business succession follows a structured plan or scenario, such as a negotiated sale, the reality is that many ownership transitions are unexpected,” says Benedict. “That’s why it’s important for business owners to take actionable steps to ensure their business is ready for an ownership transition today.”

Keeping the business’ financial house in order is a critical aspect of this preparedness. Among the actions a business owner can take include preparing audited financial statements, obtaining a “quality of earnings” statement and bringing financial reporting up to industry standards.

Preparing the business operationally is another key aspect of optimizing business continuity and post-transfer success. Among the actions owners may consider include retaining and attracting key employees; ensuring the business’ operating structure aligns with what is reflected in legal documents; protecting intellectual property; and scheduling an annual check-in with legal, accounting and tax advisors.

Benedict is quick to emphasize that succession planning goes beyond preparing the business for a transition. Preparing the business owner for a fulfilling life, post-exit, is just as important.

According to Benedict, personal readiness starts with understanding what a business owner and family need to maintain their desired lifestyle. “While the sale of a business can create a significant liquidity event, it’s important for business owners to ask themselves if their plan and portfolio can generate the cash flow necessary to support the lifestyle they want to lead,” he says. “Considering an owner’s business wealth often represents 80-90% of their overall net worth1, the importance of this exercise cannot be overstated.”

Additional personal readiness considerations include understanding the obligations to which an owner will be held and the impacts of a triggering event, learning how

an ownership change will be taxed and having the right planning documents in place to facilitate a transfer.

Because succession planning is often accompanied by complex emotions and, in some cases, seller’s remorse, Benedict encourages business owners to give substantial thought to their next chapter.

According to the Exit Planning Institute’s Readiness Survey, 75% of business owners “profoundly regretted” selling their business 12 months after finalizing the deal. Contributing to this regret are such factors as lack of purpose, loss of status or boredom.

“When running a business has been such a major part of an individual’s life for 30-40 years or more, it’s important for them to think about what the new meaning of life becomes once they move on from that business,” he says.

“Building a successful business is the work of a lifetime, and a solid succession plan gives credence to the brilliance of that work and legacy.”

Weston Andress, Western Carolinas: (704) 643-5581

Jim Hansen, Eastern Carolinas: (919) 835-0135

$10.8 MILLION INITIAL BUDGET OF N.C. OPPORTUNITY SCHOLARSHIP PROGRAM, 2014-15

$632 MILLION BUDGET FOR PROGRAM, 2024-25

32,549 VOUCHER RECIPIENTS, 2023-24

80,470 VOUCHER RECIPIENTS AT 642 SCHOOLS, 2024-25

$3,360 TO $7,468 RANGE OF VOUCHERS AWARDED, 2024-25

$4.6 MILLION VOUCHERS AWARDED, 2014-15

$432 MILLION VOUCHERS AWARDED, 2024-25

135,738 N.C. PRIVATE SCHOOL ENROLLMENT, 2024-25

71% PERCENTAGE OF PRIVATE SCHOOL STUDENTS ATTENDING FAITH-BASED SCHOOLS

25.1% PERCENTAGE OF 1.8 MILLION N.C. K-12 STUDENTS WHO DIDN’T ATTEND A PUBLIC SCHOOL, 2024-25

Sources:: Public Schools First NC, Public School Forum of NC, NC Justice Center, Carolina Demography, NC Dept. of Public Instruction

Rural superintendents say a growing voucher program puts public schools at risk. Lawmakers disagree.

BY BILL HORNER III

Over the years, as he’s worked through the labyrinthine process by which North Carolina funds public schools, Don Phipps updates a “Budget 101” slide deck he created to show his local funders — namely, Caldwell County commissioners — how it all works.

One slide includes a warning. “ is information,” it reads, “changes frequently.”

Running (and paying for) rural systems are vexing enough for superintendents like Phipps, who leads the public schools in the northwest N.C. county. And especially arduous when schools are under re, teacher turnover is high and many of North Carolina’s education metrics, including teacher pay and student funding, rank low compared with most states.

So toss into the mix the expanded Opportunity Scholarships voucher program, which dangles hundreds of millions of dollars in the faces of parents curious to explore private school options.

“It just makes it very di cult,” Phipps, now in his 16th year as a superintendent, told me. “I really like the idea of parents having a choice, but the problem I’ve got with the choice model in North Carolina is it’s not fair to us. We should be on a level playing eld, but the fact is we’re not.”

In Caldwell, like the rest of N.C., state funds allocated to public schools have risen steadily over time. Meanwhile, public school enrollment has been declining including a 19% drop in Caldwell over the past 15 years. About 75% of N.C. K-12 students attend public schools statewide now, versus 86.5% in 2010.

Supporters of Opportunity Scholarships cite that shi in arguments for school choice. Why shouldn’t the state ease the nancial burden on taxpaying parents exploring private education?

In 2024, lawmakers removed income caps for parents and prior public school attendance requirements and ooded the voucher program with new money. An annual outlay of $10.8 million a decade ago grew to $432 million last year. Appropriations will reach more than $825 million annually by 2032-33.

For its part, the General Assembly spent almost $12 billion on public K-12 schools last year. (N.C. counties supplement that by varying amounts.) So why ask for even more when state appropriations are up?

Because, the real value of state funding increases has been outpaced by rising fixed costs and inflation, say the rural superintendents and voucher opponents with whom I spoke. The loss of enrollment (and subsequent reduction coming from total per-pupil funding) makes budgeting even more troublesome. Phipps, pressing for more state and local funds, would love a slice of that voucher money, much benefiting families already paying to send their children to private schools.

‘A finite amount of money’

In rural counties, it’s typically more difficult to generate additional tax revenues for higher local appropriations. For this school year, Phipps requested $447,399 in additional salaries and supplements and another $200,000 for increased utility rates. For the sixth time in the past seven years, Caldwell’s commissioners said “no.” Meaning: the county’s appropriation was $14.7 million back in 2014-15, and has been mostly stuck at $14.8 million since 2016-17, two years before he became superintendent there.

“I show them what the personnel costs are,” says Phipps, who was named the N.C, Superintendent of the Year in 2023. “I show them how our retirement expense has increased, what hospitalization [insurance] costs are So the dollars they gave us back in 2016 just don’t go nearly as far in 2025. I know they’ve got a finite amount of money, and they’ve got a lot of folks coming to the table with their hands out…”

Public schools in North Carolina are funded with state, local and federal tax revenues, with a small portion of operating budgets assisted by a variety of grant sources. The state’s portion — 70% in Caldwell, which includes special supplemental dollars earmarked for small and low wealth schools — is the biggest chunk, followed by local (16%) and federal (9%) money. Of those funds, the vast majority — 86% in Caldwell — is spent on salaries and benefits.

Phipps faces the double whammy of being hamstrung on boosting teacher pay while seeing Caldwell ranked near the bottom for local funding. A couple of years ago, a commissioner asked him what it would take to make Caldwell “average” in that ranking.

“My question to him was, ‘Do we aspire to be average?’” Phipps says. “And then I thought, I probably shouldn’t say that to a commissioner, because if you’re 94th and get to 50th, you’re doing a really good job.” Phipps then calculated it would take an additional $8 million per year, a staggering 54% increase over the current $14.8 million.

“That’s an annual increase of $8 million from the county commissioners, and there’s no way we’re going to do that,” he told me. “And that just puts us at 50th out of 100.”

Caldwell County only has two private schools with 167 students as of 2023-24, according to state data. But funding pressures have prompted the public system to eliminate 185 positions and shutter two schools during his time there. Phipps explains that when students move from a public school to private one, the public school can’t conveniently eliminate teacher positions across grades. Lose a few kids in each grade, and you lose per-pupil funding tied to enrollment — but expenses don’t necessarily change.

“You’re still employing basically the same number of teachers,” Phipps says. “We still have to run air conditioning and heat, and run buses.”

Casualties follow. Dollars are stretched, maintenance gets deferred; assistant principals and teaching assistants and summer school programs for struggling students are eliminated. Curriculum updates get put on hold. Phipps saves where he can without sacrificing quality, he says, resorting to strategies such as creating tiered bus routes — which put elementary students on the same buses as high schoolers.

▲Caldwell County Schools Superintendent and NCSSA President Don Phipps, right, talks with students and Davenport A+ Elementary School teacher Dylan Youngsmith.

“It’s not what we want,” he says.

Mike Long, the president of Parents for Educational Freedom in North Carolina, argues voucher programs are part of sorely needed education reform.

“Since 1980, with the creation of the U.S. Department of Education, over $3 billion has been spent on ‘education,’ and it hasn’t improved one test score — not one,” he told me. “If you ask me what I’d do, I would do everything I could to get the federal government and state government out of public education and let each educational district use those dollars to meet the needs of those children.”

Phipps isn’t opposed to school choice. As with each superintendent I spoke to, he simply objects to North Carolina’s voucher model. He has the ear of his board’s attorney, N.C. House Speaker Destin Hall, who represents Caldwell and Watauga counties in the legislature.

Phipps argues that if a school receives state money, “if they’re church, private, charter, whatever, they ought to have to follow the same rules that we have, and then we’d be on a level playing field,” Phipps said. “But the fact is, we’re not, and it’s hard for me to be able to compete against somebody who plays by a different set of rules than we do.” He cites minimal private school requirements for teacher credentials, curriculum or reporting on student performance.

In Wilson County, where 1,504 students, or about 10%, attended private schools last year, Superintendent Lane Mills attributes “the required rigor, the targets, the criteria … the demands placed on instructional time” as stressors public schools face — plus expenses such as lunches and transportation that most private schools don’t provide.

“We’re trying to do everything at once, and you get one chance to do it,” he says. “I tell my staff, ‘Everybody says, OK, good, let’s start with perfect and let’s get better from there.’ That’s the expectation.”

Mills, too, has heard the arguments from voucher supporters that more money won’t solve what’s wrong in public schools.

“Well, we’ve never tried it,” Mills says. “It’s unrealistic to think we’re doing right by our educators. They can’t afford to buy a home in the areas where they’re teaching … I think it’s really hard for them to articulate that because we’ve never been fully funded. We’ve got to at least try it, just once.”■

Bill Horner III is a third-generation newspaper publisher who was an owner and editor of The Sanford Herald and the Chatham News + Record. He and his wife Lee Ann live in Sanford. Reach him at bhorner@businessnc.com

A Chinese company’s pledge to bring hundreds of jobs brings hope to mountainous Graham County.

By Kevin Ellis

More than a decade after Graham County suffered an economic body blow with the closing of its biggest manufacturer, a Chinese company is stepping up with a planned $80.5 million to create 515 jobs in Robbinsville.

Foreign companies have announced investments of $43.5 billion and the promise of almost 65,000 jobs in the Tar Heel state over the previous 10 years. But mountainous Graham County, the third-least populous N.C. county, missed out.

“It’s an extremely rural county that doesn’t get a whole lot of looks,” says Solange Tricanowicz, a recruitment manager for the Economic Development Partnership of North Carolina. That’s part of what made EcoKing Solutions’ jobs announcement in July such a major win for the far western edge of the state.

EcoKing Solutions says it will start manufacturing biodegradable paper products by next year for customers, including Chipotle and Panda Express. Plans call for 300 employees by 2027. Another 215 workers are expected after Duke Energy increases the site’s electrical capacity from 8 megawatts to 24 megawatts.

If EcoKing follows through on its promises, it will be the largest private employer in Graham County, which has about 8,050 residents and a labor force of 3,646.

Potential new industry offers hope for an area that lost 400 jobs when Stanley Furniture closed in 2014 after offering employment to generations of workers for three decades. While North Carolina‘s population grew at the eighth-fastest rate in the U.S. over the past decade, Graham County declined by about 800 residents. Robbinsville, the county seat about 90 miles west of Asheville, has a population of about

563 residents, about 190 fewer than in 2010.

“People had to move away to find jobs,” says Lynn Cody, a Graham County commissioner for 20-plus years. “We’re hoping this will bring some people back.” He calls EcoKing’s decision a “true blessing.”

EcoKing’s parent company started in 2008 in China, where it employs about 1,200 workers. The company started looking for a U.S. site more than a year ago because 80% of its products are sold to American fast-food restaurants and grocery stores, says John Lin, the vice president and project lead.

“Our clients like to use a product made in the U.S.A.,” says Lin, a naturalized U.S. citizen born in Taiwan. He’s moving his family from Atlanta to Robbinsville.

While EcoKing started looking at expanding before the recent friction in U.S.-China trade relations, Lin says President Donald Trump’s threats of higher tariffs on the Asian nation helped push it forward. “Tariffs do affect us a lot,” he says.

The company will use the region’s forests to turn timber into wood pulp to make its products, helping avoid trade duties, says Lin. “We can say we’re made in the U.S.A. and then sell our products to the world.”

The U.S. had a $101 billion trade deficit with China during the first five months of this year, with $148.5 billion in imports and $48.6 billion in exports, government data shows. The deficit totaled more than $1.3 billion over the past four years.

EcoKing’s new jobs are expected to pay an annual salary averaging $46,707 a year, about $1,100 more a year than the current Graham County pay. Those wages are “incomparable” to the low wages earned by EcoKing workers in China, says Lin, but the company will benefit from lower shipping costs.

How did a company 7,500 miles away find tiny Robbinsville? It starts with the 2014 closing of the Stanley plant, says Josh Carpenter, director of the seven-county Mountain West Partnership, which oversees regional economic development.

Stanley’s 601,000-square-foot building is the county’s “largest roof,” Carpenter says. In 2016, Oak Valley Hardwood moved into a “postage stamp” portion of the building, and about 30 workers rough-milled lumber and shipped it to China, where it was turned into furniture and other products. That business closed at the start of the pandemic in 2020.

The previous business owner tried to market the building on his own without success. In late 2023, after Carpenter convinced the owner to use a broker, the building immediately began to attract attention from data centers and potential tenants because of its size and available electric power. The all-brick building is “built like a tank,” says Carpenter. “There’s nothing else like it in the county.”

EcoKing’s parent company was scouring several Southern states to locate its first U.S. factory. A phone call from its real estate broker in Atlanta set the wheels in motion, says Carpenter.

EcoKing needed a big building because it wants to build three production lines here. “More space equals more production equals more people,” says Carpenter.

Before EcoKing’s announcement, Chinese companies had created more than 3,400 jobs and made more than $897 million in capital investments in North Carolina since 2014.

Chinese companies with a large North Carolina presence:

KSM Castings, Shelby

Haeco Cabin Solutions, High Point

Uniquetex, Grover

YanJan, Statesville

CARSgen Therapeutics, Durham

WH Group, parent company of Smithfield Foods, Tar Heel

Lenovo, Morrisville

Recruiting a Chinese company presented unique circumstances. Just before the first big meeting between Graham County leaders and EcoKing executives, Carpenter realized none of the N.C. team spoke Mandarin. A day before the meeting, he recruited Western Carolina University business professor Yue Cai Hillon, who is from the same region in China as EcoKing’s parent company. That was an unexpected bonus, Carpenter says.

The rest of the project followed a fairly normal process. “As everyone is, they were enamored with the beauty of the place, first,” says Carpenter.

State and local incentives totaling about $7.5 million, which are tied to meeting job and investment targets, helped close the deal. About 60 Chinese-owned companies operate in the state, though scrutiny has tightened in recent years as trade relations became more tense, according to state economic development officials.

EcoKing expects to draw workers from a 45-minute drive, including Cherokee, Macon and Swain counties. It plans to invest at least $10 million prepping the property over the next year and will use as many local workers as possible, Lin says. Construction jobs will employ about 100 people. EcoKing plans a showroom in Robbinsville for new customers, bringing more exposure to the region.

County residents also helped sell the project, says Carpenter. EcoKing executives ”just kept saying, ‘You all are the nicest people.’” ■

A kiteboard-loving former hedge fund manager invests in Hatteras Island hospitality.

By Vanessa Infanzon

fter Richard Fertig’s 23-year marriage ended in 2016, the hedge fund manager needed a change of scenery from New York City. He’d heard about kiteboarding in North Carolina’s Outer Banks and visited Hatteras Island in Dare County. In 2018, he enrolled in REAL Watersports Zero to Hero Kite Camp, a three-day immersion experience, to learn kiteboarding.

“I had no intentions other than to learn how to kite, [but] fell in love with the area and saw massive opportunities,” Fertig says. He then owned a few short-term rental properties in other states and decided to expand in North Carolina.

Instead of buying houses, Fertig purchased 50 acres of Hatteras waterfront property and began building three singlefamily homes. Several miles away, he converted a former retail location into a lodge that Conde Nast Traveler magazine called one of the most exciting U.S. hotel openings of 2024.

The flagship home under Fertig’s Edgecamp brand boasts 14 bedrooms and 12,000 square feet. The property is zoned for another 45 homes, but Fertig is hesitant, even though he has permits ready for several other lots.

“We’re a little bit on hold primarily because interest rates are so high, construction costs are high and real estate values have flattened or started to decrease a little bit,” he says. “We’re going to be more conservative than aggressive. We view this as a very long-term opportunity. The only thing that I think could derail us is being a little too aggressive at the wrong time.”

In 2021, Fertig launched Stomp Capital, a private equity real estate fund that has invested more than $20 million. He’s the largest investor, along with some limited partners.

Fertig manages five other real estate projects with his second wife, Erika Bossi, from their homes in Jackson Hole, Wyoming, and Sag Harbor, New York. The couple spent summers from 2018 to 2022 in Dare County, but moved once they could hand the project off to staff.

“This is not a reflection on our love of Hatteras Island or Dare County,” he says. “We can’t reside at any one of our properties because we’re a growing private equity firm, and we want to have half a dozen or a dozen locations. We visit them all, but we can’t live at each of them.”

Fertig had an unusual youth, with his family living three months of the year in New York City, then nine months in Costa Rica. His father had a successful mail-order catalogue business, but “prioritized quality of life over income,” Fertig wrote in a 2017 Forbes magazine story.

He majored in psychology and economics at Cornell University, then earned an MBA in finance from The Wharton School at the University of Pennsylvania. In 1998, he joined giant money manager Blackstone, where he focused on “absolute return” investing strategies.

“Back then, we said we wanted equity-like returns with bond-like volatility and never lose money,” Fertig says. “Those three principles have guided my investments for decades.”

In 2001 he moved to Ramius, helping founder Peter Cohen grow the business into one of the largest U.S. hedge funds. At its merger with Cowen Group in 2009, Ramius managed $7.7 billion, the New York Times reported. Amid the financial crisis that crippled many banks and investment firms, Fertig was let go, prompting him to start his own business.

Edgecamp is about three and a half miles south of Rodanthe in Dare County, which has roughly 20,000 short-term rentals, mostly individually owned, and 57 hotels and motels. The county attracts 3.5 million annual visitors, with the three summer months accounting for about 65% of lodging revenue.

“When we looked at the 3,000 single-family homes for rent on Hatteras Island, the vast majority are four to seven bedrooms,” Fertig explains. He had a vision for something different.

“We recognized there are a lot of larger families, extended families, corporate off-sites and small weddings, and people were renting multiple homes in order to accommodate their groups. We thought we could build one larger home and do all that. It’s been wildly successful.”

Edgecamp properties generally sell out during peak season, with the homes renting from $1,000 to $3,000 per night. Most guests come from the Carolinas, Atlanta, Philadelphia, Washington D.C. while some fly from California, Florida and New York.

While at the Outer Banks, Fertig often passed by a twostory retail shopping center for sale in Rodanthe. The price

caught Fertig’s attention when the price was marked down to less than both the assessed land value and the replacement cost.

“We said, ‘Gee, everyone is looking at this as a retail center, that’s not the best use of this location,’” Fertig says. “What this island really needs is a hotel.”

Fertig converted the building into Edgecamp Pamlico Station, a two-story hotel. The 14 luxury suites highlight the style of New York designer Jonathan Adler. Rooms range from $250 to $600 a night.

“It’s a fundamental shift in how we view risk and return,” Fertig says. “We like to do things that we believe are needed and are missing, and no other entrepreneur has had the idea, the vision or the wherewithal to actually do it.”

During due diligence, Fertig found a Dare County law calling for 24/7 staffing at hotels but permitting guests to check themselves in at single-family homes. This posed a problem because Pamlico Station’s business model included self-check-in. Fertig was successful in lobbying Dare County to update the law to include hotels and motels.

“We changed the zoning,” he says. “We changed the law and then we gut- renovated the entire thing. We took it down to the studs and the pilings so there was nothing else. We built, from scratch, a boutique hotel.”

As Fertig continues to build the Edgecamp brand, the properties will offer a sense of place with a focus on unique architecture and design.

“We believe that travel and immersive experiences are the future of travel and so we don’t have to be right for everybody,” he says. “We are really niching down to who our target audience is. They tend to be affluent, love the outdoors and want to feel connected to the location.”

Some of them may even learn kiteboarding. ■

A veteran-owned knife business shows persistence in chasing lucrative European sales.

By Frank Daniels IV

It’s important to stay sharp through the years, especially at a knife-making company such as Southern Pines-based Spartan Blades.

After selling 30,000 blades since founding the business in an old mule barn in 2008, Curtis Iovito and Mark Carey keep the company honed through a dedication to excellence and growth.

Most recently, they added the Euro Blade Worx, or EBX, a branch of the company which expands Spartan’s reach into the European market. The joint venture with Czech knife designer Ondřej Němec was born from a series of challenges that are common for American knife makers.

“Whenever we sell knives into Europe, they’re almost double in price — they’re not cheap here in the U.S.,” says Iovito. “People just can’t afford to pay it.”

of the largest outdoor trade shows in the world. So we figured, ‘Hey, we need to go.’

“They loved our knives. They love American quality when it comes to outdoor stuff, whether it’s tents, socks, underwear or knives.”

That comes from shipping costs, import taxes and the EU’s value-added tax, which is a consumer-side tax applied at each stage of the good’s supply chain.

Iovito says Spartan has grown its market share in Europe since it first visited the IWA OutdoorClassics trade show in Nuremberg, Germany, about 10 years ago.

“(Europeans) have a big outdoor camping culture, so a lot of people carry knives, [for] hunting, camping,” says Iovito. “It’s one

Spartan Blades’ quality led to relationships with European dealers and dedicated customers, both for utility and collectors.

Iovito and Carey are former Special Forces soldiers, with more than 40 years of combined military service. After pursuing knife-making as a business, it was their goal to make the highest quality knives for combat, producing a reliable tool for soldiers and civilians alike.

They considered the Yarborough knife as a premier example, and reached out to Chris Reeve Knives in Idaho, which makes the knives exclusively for the Army to award to freshly forged Green Berets.

“We called them, and said, ‘Hey, we’re two guys — just got out of the Army — we’re looking to start a business,’” says Iovito “‘We want to make knives and wondered if you would help us out?’

“And they said, ‘Absolutely.’”

Iovito and Carey visited the Idaho facility, and came away days later with a leg-up in their process, and a connection to the industry “family” that they still value.

That connection led to meeting with William W. Harsey Jr. and the company’s first collaboration with a world-renowned blade designer. The Spartan-Harsey Model I garnered the company its first award.

The company’s growth has continued, sometimes as much as 400% year-over-year, Iovito says.

In the late 2010s, he and Carey developed a relationship with John Stitt, the CEO of Olean, New York-based KA-BAR, which is considered a legendary company by knife lovers. Iovito and Carey converted Spartan Blades’ assets into a new corporation called Pineland Cutlery.

“We sat down, had a meeting, and we showed them our books,” says Iovito. “We can tell you in 2009 how many green handles we sold on a knife, and we keep exacting records. We told them that, and I think there was a little bit of eye rolling, and then we showed them.”

In 2019, KA-BAR bought half of the company. Iovito and Carey declined to disclose company finances.

Even KA-BAR has been hampered by the European trade system. As Spartan Blades became known in Europe and throughout the world, Carey and Iovito struggled to gain military contracts around the European Union because of one overriding factor.

“Three different contracts in Europe we bid on,” says Iovito. “All three times the competition came down to us and one other knife. Well the knife manufactured in Europe always won.”

In recent years, the Spartan founders have explored ways to move some manufacturing to the EU. They searched in Italy, where an award-winning consortium operates in Mantego, but its necessary markup would repeat Spartan’s original problem. Manufacturers in Germany say their costs are already too high to quote work for new lines.

“We finally realized, ‘Hey, we found it here in North Carolina, maybe we just should do it ourselves,’” says Iovito. “And we’re not moving any manufacturing from here. We just want to sell more in Europe.”

So they made an offer to Němec, who agreed to run a manufacturing facility as EBX’s managing director, making Spartan and KA-BAR knives for the European market. The team began setting up the facility about a year ago.

It remains too early to tell how successful they’ll be. “It’s far too early for sales projections in the EU as we are just finishing our first production knives now,” Iovito says.

Expanding U.S. offerings has been another priority. The merger with KA-BAR gave them access to broader production capabilities, and they added silver pro-grade blades, which are produced in New York by KA-BAR, and bronze field-grade ones, produced in Taiwan. They now use the term gold, or elite grade, for the original line of knives, still manufactured in North Carolina with Crucible Particle Metal steel.

The elite grade is manufactured at sites in Moore County, where they have 10 employees, Union County, High Point and Greensboro. They order the specialty steel from Akron, New Yorkbased Niagara Specialty Metals.

“We bring it to Monroe. We water-jet all the blanks out. We take it here (Southern Pines) and machine them just across town here. Take them to High Point for heat treat, Greensboro for coating, bring them back here and then we do all the assembly, laser marking, sharpening shipping and send it out,” says Iovito.

Zoning regulations prevent them from manufacturing at their Southern Pines headquarters, Iovito says. Visitors are often surprised when they don’t find a factory, he adds.

Němec will be overseeing the gold line in South Moravia in the Czech Republic, where they have six employees.

“This is more than a factory — it’s a knife-making and logistics hub designed for the next generation,” he said in a news release. “We’re blending European manufacturing tradition with American design innovation to serve a truly international community.”

Iovito says the designs coming out of EBX will be unique, utilizing Němec’s skills and knowledge of the region.

“It’s amazing the amount of people that’ll travel to knife collecting meetups and build out their collections,” said Iovito. “Part of making knives in Europe, that are specific to Europe with slightly different designs, is the collectors have new things to collect, and they can interface with other people they normally wouldn’t. Because really it is a culture.”

That process started in early July with the Willow, a variation on the Enyo, a small, fixed-blade knife that sells well in Europe.

“It’s the easiest model for us to make first,” Iovito says. “As we train our people and progress, we can do knives that get a little more difficult over time.” Plans call for three fixed-blade knives, and then a folding knife.

Back stateside, Pineland Cutlery is planning to expand into kitchen and home utility, including titanium chopsticks the company made in its early days, along with wine tools and steak and chef’s knives.

“We’re doing them a bit different, higher-end,” said Carey. “They’ll have carbon fiber handles, silver tool handles — they’ll match modern kitchens.”

For the time being, Spartan and KA-BAR will focus on ramping up sales of knives made in the U.S. Once EBX’s production has smoothed, they will look to expand distribution partnerships with other knife brands with an eye on the European market.

“(The new initiative) is going to tighten ties between us and people [in Europe]” says Iovito. “What we want to do is take American manufacturing excellence, and just show everybody else, ‘Here, look what the Americans can do.’” ■

This story first appeared in The (Southern Pines) Pilot.

Swinerton cracks into Carolinas contracting.

By David Mildenberg

It takes serious aspirations for a West Coast general contracting rm to break into North Carolina’s competitive construction business, but Swinerton isn’t lacking ambition.

Founded in 1888, Swinerton emerged in the early 20th century as one of California’s largest contractors, building or renovating many of the largest and most famous structures in Los Angeles and San Francisco. It expanded in other western states and Texas, but didn’t make a transatlantic bet until 2018. at’s when it remodeled a 67,000-square-foot building in a gentrifying west Charlotte neighborhood, FreeMoreWest, and set up an East Coast regional headquarters.

Seven years later, East Coast projects will produce revenue of about $450 million, including about $185 million in the Carolinas, says Kevin Smith, who has been the region’s division manager since 2023.

at makes up a small part of Swinerton, which reported $4.85 billion in revenue last year, earning the No. 30 slot on ENR’s annual list of the largest U.S. contractors, up ve spots from the previous year. ( e company is named a er Alfred Swinerton, who joined the company in 1906.)

Swinerton’s regional enterprise remains smaller than rivals such as Greensboro-based Samet, the largest N.C.-based contractor with revenue of $1.4 billion last year, ENR reports.

“I’ve been surprised at how many general contractors there are [in the Carolinas],” Smith says. “We’re growing every year, year over year, at a steady pace. We are being innovative, executing really well, keeping to our principles and listening to how we can help our clients.”

Asked what sets Swinerton apart beyond the basics, Smith points to its strategy of o en handling carpentry, drywall and other work with its own employees, rather than using subcontractors. Many work on the company’s adaptive reuse projects, which typically range from $500,000 to $5 million.

“It’s a big di erentiator for us, and we’re trying to let people know that we are not just general contractors,” he says.

en there’s the rm’s push into alternative building materials, most prominently through its mass timber a liate, Timberlab. Mass timber involves nailing or gluing multiple solid wood panels together, providing a low-carbon option to concrete or steel structures.

Projects include a four-story building in Wilmington and apartment developments in Charlotte’s NoDa neighborhood. e process o en remains more expensive than traditional construction, but tends to be more cost-competitive in larger projects, Smith says.

“Mass timber is taking o because some architects and owners are excited by the sustainability factor and the ease of construction,” he says.

Like other contractors, Swinerton is facing more delayed private-sector projects, partly because of higher nancing costs and space vacancies. at prompted the business to seek more public-sector jobs, which have included the rst all-electric rehouse in Charlotte and a police station in the Queen City. Smith says he’s also pushing hard for more healthcare projects because of the sector’s robust growth.

e success in making that shi is evident in the higher ENR ranking, o cials say.

Swinerton also distinguishes itself as an Employee Stock Ownership Plan business, with each sta er having equity. Its ESOP rules limit any employee from owning more than 4% of the company, unlike some ESOPs that are tilted to senior leadership ownership.

“Everyone has a nancial stake in the company, so everyone is incentivized to make good business decisions, whether you are a carpenter or division manager,” says Smith, who joined the company in Hawaii in 2010. “ e goal is to push wealth down to all of the company.”

Concern over the impact of higher tari s is a real issue, but Smith says the company has a backlog of projects extending through 2028. “ e name of the game is constantly lling the pipeline with new projects,” he says.

“Your foot always has to be on the gas pedal.” ■

of their wine club. For two weeks, everybody chipped in to complete the harvest.

That full harvest was great for Marked Tree, except the lack of power meant the grapes could not be stored in the winery’s chilled fermenting tanks. For several nights, co-owner Lance Hiatt drove a truckload of grapes 155 miles to Childress Vineyards in Lexington, joined by a second truck driven by an employee of a nearby apple orchard.

While Childress Vineyards near Lexington wasn’t impacted by the storm, owner Richard Childress and winemaker Mark Friszolowski agreed to store Marked Tree’s grapes for as long as needed. Meanwhile, on return trips, Hiatt stopped at a Sam’s Club to fill the truck with food, water, cans of gasoline and other necessities to help people in Henderson County.

How several N.C. wineries rebounded from Helene.

After Hurricane Helene brought historic flooding and tropical storm force winds to western North Carolina last fall, several industries struggled to get back up and running. Among them were dozens of wineries and vineyards directly impacted by the storm.

Each year, N.C. wine producers thread the needle with a delicate business model that relies on viticulture (growing grapes), enology (the science of making wine) and tourism (the primary way wineries sell their product).

With the full fury of Mother Nature unleashed on the region, all three aspects of the region’s winemaking industry were severely impacted. By banding together and mixing ingenuity with determination, the wineries in WNC made it through what could have been a fatal blow to their operations.

Earlier this year, leaders from several mountain vineyards shared their stories on the “Cork Talk” podcast produced by the NC Wine Guys, Joe Brock & Matt Kemberling.

“This is a story to me of serious resilience. In the midst of that hurricane, life went on,” says David Coventry, winemaker and general manager at Mountain Brook Vineyards in Tryon. “A bunch of us had wine and grapes in fermenters and we had to keep going. We had to be very, very creative.”

Coventry reverted to ancient winemaking techniques that predated the invention of electricity. At Parker-Binns Vineyard in nearby Mill Spring, Cory Lillberg hauled water to a bathtub so he could clean the newly harvested grapes, then sourced an old compressor from Mountain Brook Vineyards, which helped his winery get back on its feet.

In Helene’s wake, Flat Rock’s Marked Tree Vineyard was left with 30 tons of grapes to pick, nearly half its crop. They cobbled together an army of employees, volunteers and even members

“We were a mini-gas station for a few days, we were a minigrocery store for a few days,” Marked Tree co-owner Tim Parks said on the podcast. “We were giving things out to people on our road because it is hard to get to.”

Marked Tree is one of eight wineries in Hendersonville’s crest of the Blue Ridge wine region, which has gained popularity since its federal designation as an American Viticultural Area in 2019. However, all that momentum took several steps back last fall.

Saint Paul Mountain Vineyards and Appalachian Ridge Artisan Cidery in Hendersonville lost $1 million in revenue because of the storm, says owner Alan Ward. But, he adds, you can’t live in the rearview mirror.

“We had wine tastings without electricity during the daytime, so we tried to keep things moving forward,” Ward says. “We’re doing a lot of new and different things we probably would not have done if this hadn’t happened. And that may actually make us bigger, better and brighter.”

Heath Little, whose family owns Stone Ashe Vineyards in Hendersonville, stresses the importance for wineries “to not let this define the future of the area or the businesses in the area.” However, Little echoes what other mountain wineries have noticed in 2025: Visitor traffic has been slow to return.

Not too long ago, Marked Tree Vineyard, which also operates a tasting room in downtown Asheville, received a phone call with those all-too-familiar questions: Are you open? Is it safe to travel there? Are there hotels and places to stay available?

“That’s probably the biggest thing that we’ve been having to do is get the word out that ‘we’re open, we’re ready, we’re safe,’” Parks says.

Podcast co-host Kimberling says oenophileswill enjoy visits to the region: “We’ve been coming to western North Carolina for 10 years now, and people may not realize there’s really great quality wine coming out of the western part of the state.”

On Sept. 27, the wineries will experience the one-year anniversary of Helene’s unwanted swing through the mountains. When asked about preparing differently for a future storm, Little points out that Stone Ashe, like most vineyards in the region and the state, plants its vines on terraces and the steepest slopes possible. “There isn’t too much else we can do.”

Duke Energy made several moves to help finance an $87 billion, fiveyear capital campaign. It is seeking regulatory approval to merge its two distinct divisions in the Carolinas; it plans to sell 20% of its Florida business to Brookfield Asset Management for $6 billion; and it will trade the Tennessee division of its Piedmont Natural Gas subsidiary for $2.48 billion to St. Louisbased Spire.

Six Flags CEO Richard Zimmerman will step down at the end of the year. He joined Cedar Fair in 2006, when it acquired Kings Dominion, where he had been a vice president and general manager since 1998. He had been CEO of Cedar Fair, the owner of Charlotte’s Carowinds theme park, since 2018. He remained as CEO after last year’s merger with Six Flags.

SPAR Group is relocating its corporate headquarters from Auburn Hills, Michigan, putting the provider of merchandising services closer to southeastern-based retailers. The South End area office will have 50 to 60 team members. The publicly traded company is leaving the Detroit suburbs after it terminated its merger agreement with Highwire Capital.

BankUnited, the fourth-largest bank based in Florida, is expanding here, marking its fourth growth market outside of the Sunshine State. The Miami Lakes-based bank has hired three local commercial bankers in the Queen City, although it hasn’t picked an office location. It has about $35 billion in assets.

Dentsply Sirona appointed Daniel Scavilla as CEO, succeeding Simon Campion, who had held the post since September 2022. The manufacturer of dental products and technologies, has been restructuring for more than a year, including laying off about 640 of its 16,000 global employees. It also sold its Swedish-based Wellspect Healthcare

business, which provides treatments for bladder and bowel dysfunction.

USAA plans to grow its workforce by as many as 300 at its South End office, citing strong demand from the region’s large military population. The digitalfirst financial company, which serves more than 1 million in the Carolinas, opened the site in 2022 and now employs about 700 in the region.

Sullenberger Aviation Museum named former educator Stephanie Hathaway as its president, replacing Stephen Saucier, who announced his plans to retire earlier this year. Saucier guided the museum through a $34 million capital campaign and reopening in 2024. The museum reported more than 100,000 visitors last year and $3 million in revenue, about 14% more than expenses.

CommScope shares more than doubled after it agreed to sell its Connectivity and Cable Solutions segment to Connecticut-based Amphenol for $10.5 billion. The deal

is expected to close in the first half of 2026. CommScope expects to use about $10 billion in net proceeds to repay debt, redeem preferred equity and pay a special dividend to shareholders

Novant Health received approval from the N.C. Department of Health and Human Services to build a 50-bed acute-care hospital, about five miles west of Atrium Health’s facility in Concord. Novant Health Cabarrus Medical Center is slated to open in 2030 and cost about $336 million. It will serve residents from Cabarrus, Rowan and Stanly counties

Atlanta-based convenience chain RaceTrac will open its first North Carolina location in September on U.S. 74. The privately held company has more than 800 stores, including about 300 in Florida.

Duke Energy wants to add two natural gas-powered turbines at its former coal-fired plant in Rowan County, according to a filing with the N.C. Utilities Commission. The project at the former Buck Steam Station would have a combined capacity of 850 megawatts and may open by 2030. A 718-megawatt natural gas-fired plant opened at the site in 2011.

Dallas-based Compass Datacenters plans a five-building data center on 340 acres of farmland off I-40 in west Iredell County. The rezoning proposal faces community opposition over environmental concerns. The Planning Board will consider the project Aug. 26, with City Council hearings in September and October.

Fayetteville State University unveiled Bronco Pride Hall, a $50 million, 87,930-square-foot residence for 336 freshmen and sophomores. The four-story hall offers single- and double-occupancy rooms, study spaces, a full kitchen and laundry facilities. It replaces the aging Vance Hall. Students chose the building’s name.

KS Bank opened its 11th office, and first in Nash County. The town has about 600 residents and is 15 miles west of Wilson. KS has branches in Harnett, Johnston, Nash, Wake, Wayne and Wilson counties. It had assets of $613 million on Dec. 31,, and a $6.1 million profit in 2024. The market cap is $59 million. The market cap is $59 million.

LG Textile, a fabric developer and apparel manufacturer, will add a cutand-sew plant here that is expected to create about 70 jobs this year and another 130 by 2027. The company says its move marks its commitment to 100% domestic production.

Sun Asian Supermarket, a locally owned grocery store, will become an anchor tenant of the Midtown at Coalition mixed-use property being built at the Military Business Park near Fort Bragg. Construction for apartments and a food hall is underway at the site.

The U.S. Senate’s fiscal 2026 defense authorization bill includes $240 million for Fort Bragg, supporting infrastructure and the readiness of elite units. Funding covers new infantry training facilities, a four-bay maintenance hangar, and an $80 million microgrid for energy resilience.

Predicate AI Labs has partnered with Mayo Clinic to advance early detection of sepsis using predictive AI. The firm’s OpenDx platform analyzes real-time patient data to identify risk earlier. CEO Morris Nguyen called the agreement a major validation for the pre-market company.

NCDOT awarded a $182 million contract to Wilson-based S.T. Wooten for the second phase of the Hampstead Bypass, with construction starting this fall. The full 12.6-mile project aims to ease U.S. 17 congestion and is set to open by 2030. Total costs have risen to $502 million.

Despite losing nearly $10 million in pledged support from New Hanover County and the New Hanover Community Endowment, Northside Food Co-op officials say they remain committed to opening a grocery store in the city’s underserved Northside. Leaders are reassessing the store’s location and business model while seeking new funding and community partnerships.

Florida-based 4th Dimension Properties bought most of Independence Mall for $48.8 million and a nearby Wells Fargo site for $2.45 million. The firm, which owns malls nationwide, plans to

position the property as a community hub. Former owner Rouse Properties redeveloped the mall after acquiring it in 2017.

Qorvo will shut down its chip fabrication plant here and cut 175 jobs in 2026 as part of a multi-year restructuring. The company hasn’t disclosed the closure timeline. As of October, Qorvo employed about 1,400 people in Guilford County.

City taxpayers will provide $75,000 in incentives to The Mason Jar Group for a new cocktail bar near Truist Point Stadium. The group pledges 22 full-time jobs and a $625,000 investment. Other cities considered included Winston-Salem, Lexington and Greensboro.

Furniture Clearance Center, which also has a store in Greensboro, has launched Furniture Clearance Direct, expanding from brick-and-mortar to a national omnichannel model. The site offers factory-direct pricing, free nationwide shipping and optional whiteglove delivery, aiming to reach customers across the U.S.

Lumos, now owned by T-Mobile and EQT, has grown its workforce by 18% since 2024 and expects 13% more growth by late 2025. T-Mobile is investing $1.45 billion to expand Lumos’ 7,500-mile fiber network. Lumos, which acquired the former North State Communications, will retain its name locally but transition customers to T-Mobile Fiber this fall.

Nester Hosiery acquired the majority of the assets of Fox River Mills, a sock manufacturer in Osage, Iowa. Nester will relocate Fox River’s production from Iowa to Mount Airy, according to the company. Nester’s ranks will grow from about 155 employees to 195, with about 175 in N.C. About 20 will remain in Iowa in sales, marketing and design.

Old Dominion Freight Line reported a 16.6% decline in second quarter net income and reduced its workforce by 1,081 jobs as shipping demand softened. Earnings missed analyst expectations by 2 cents per share. Its workforce reduction of 4.8% brings its payroll to about 21,600 employees.

Novant Health opened a $6 million, 18,000-square-foot Wellness and Education Center at Thomasville Medical Center, including Davidson County’s first outpatient mental health facility. Services include behavioral health, diabetes care, lactation support, occupational medicine, and therapy. Leaders say the center redefines holistic care for the region.

The best way to jump start your business day. Daily Digest is a must-read for anyone seeking an insider understanding of North Carolina business. More than 17,000 subscribers and top execs receive the daily e-newsletter covering North Carolina’s most important business news. Subscribe and get the latest business news from all around North Carolina straight to your inbox… for free!

Daily Digest Extra will publish twice a week – on Tuesday and Thursday afternoons – and contain breaking news about the latest business dealings in North Carolina, from mergers and acquisitions to executive changes to who’s adding or cutting employees. It will focus on news and analysis that can’t be found in any other media.

The NC Tribune is a great way to find out what’s happening in the state legislature and other legislative bodies around North Carolina and what it means for business. The daily newsletter covers North Carolina politics, politicians, policies and elections and will cover news that directly impacts our state’s business community – including topics that no one else is covering. We’ll also spotlight can’t-miss stories from dozens of other news outlets across our state Simply set up a username name and password on the Tribune website. After that, apply the discount code “founders” to receive a $100 discount for an annual subscription.

Dan Barkin’s email on our state’s growing military business sector and its impact on the N.C. economy is a must-read. The military provides roughly 11 percent of N.C.’s employment. That’s 653,000 jobs in North Carolina, over $49 billion in state personal income, and nearly $80 billion in gross state product. These are some of the reasons why Business North Carolina created the “NC Military Report,” a weekly newsletter covering military-related business news around the state, providing news and analysis that impacts all of us.

Atrium Health Wake Forest Baptist opened a $426 million, seven-story critical care tower, the largest singlecampus investment in its history. The 327,000-square-foot facility, featuring new ICUs, operating rooms and emergency space, was named for retiring CEO Dr. Julie Ann Freischlag. An endowed chair was also announced in her honor. Brasfield & Gorrie and Frank L. Blum Construction were the general contractors and the architects were HKS and CPL.

Canada’s Gildan Activewear will buy HanesBrands for $2.2 billion, keeping the company headquarters in Montreal, but promising the combined company will continue to have a strong presence in Forsyth County. The companies put the transaction’s value at $4.4 billion when

HanesBrands’ debt is included. The transaction is expected to close in late 2025 or early 2026.

A Florida-based real estate group purchased the 17-story, downtown Marriott for $56.15 million. The buyer, an affiliate of 1754 Properties, specializes in resorts, hotels and apartments. The 2.12-acre site spans more than 219,000 square feet. Built in 1986 and last renovated in 2000, the property was previously owned by Rockbridge, which purchased it in 2022 for $49.5 million.

MedCost was acquired by HPI, a third-party administrator based in Westborough, Massachusetts, and a subsidiary of Harvard Pilgrim Health Care. The seller, Charlotte-based Advocate Health, had owned MedCost as part of its regional benefits offerings.

Cornerstone Building Brands named Gunner Smith as its CEO. Smith had worked for Owens Corning almost 17 years, and had been president of its roofing division since 2018. He replaces Rose Lee, who left the manufacturer of windows, siding and other building materials following a $1.19 billion net loss for 2024.

Mama Dip’s, the Southern soul food restaurant founded by Mildred “Mama

Dip” Council in 1976, has closed. The institution that grew out of an 18-seat diner had transitioned a year ago to takeout-only. The Council family plans to carry the brand forward with a new fast casual concept. Mama Dip died in 2018 at age 89.

UNC Chapel Hill leaders outlined plans to cut roughly $70 million from the university’s operating budget, citing reduced state and federal funding — including research cuts from the Trump administration. Proposed measures include consolidating jobs and reducing financial aid for out-of-state students. Separately, university leaders proposed the “NC Colosseum,” a 25,000-seat stadium at Carolina North less than two miles from the main campus to host soccer, rugby and cricket ahead of the 2028 Olympics. The project could generate more than $5 billion of economic activity over its first decade.

UNC Health acquired full control of Johnston Health Services from a countyaffiliated not-for-profit, enabling better access to capital as the area’s population surges. More than $100 million in expansions are planned at hospitals here and Smithfield, with construction expected to

begin by year’s end. A local advisory board replaces prior joint governance.

Sarepta Therapeutics laid off 21 employees as part of a companywide cut of 493 jobs, following FDA concerns over patient deaths linked to its gene therapy Elevidys. The Massachusettsbased biotech also paused U.S. shipments and saw its stock plunge nearly 90% this year. Sarepta has longstanding ties to the Triangle.

Biogen will invest $2 billion to boost manufacturing here, where it operates seven regional factories with plans to open an eighth later this year. The Cambridge, Massachusetts-based company is known for its treatments for neurological diseases, including multiple sclerosis, Alzheimer’s disease and Parkinson’s. Since 1995, it has invested $10 billion across campuses in Wake and Durham counties, and employs more than 1,500 employees and 400-plus contractors.

Avalara, which creates tax compliance software and employs 5,300, filed for an IPO. The business was acquired by Austin, Texas-based Vista Equity Partners for $8.4 billion in 2022. That was much lower than its peak market

Sprouts Farmers Market will anchor the $200 million Westside Bottling project, joining Shake Shack, Ulta Beauty, and others in the 70% pre-leased development. Located on the former Coca-Cola bottling site, the 12-acre mixed-use project includes 370 apartments and 35 townhomes. Plans call for a buildout by mid-2027.

value during the pandemic. Avalara was running at about $800 million in annual revenue at the time of the acquisition.

Duke University will conduct involuntary layoffs following nearly 600 voluntary staff buyouts amid federal funding threats under the Trump administration. Additional faculty retirements and budget cuts are expected. The university cited a need to offset reduced research funding and endowment taxes, aiming to trim as much as 10% of its budget.

PBS NC will cut jobs, freeze hiring and offer voluntary separations after losing nearly $5 million in federal support. CEO David Crabtree said the network aims to avoid layoffs. Programming impacts remain unclear.

Drone delivery firm Flytrex ceased operations, citing FAA restrictions that prevent necessary automation for scaling. The move ends a longrunning pilot program launched with NCDOT and the FAA. Flytrex is now expanding in Texas, while NCDOT says North Carolina remains committed to advancing drone integration statewide.

New York-based gene therapy biotech Kriya Therapeutics, which has joint headquarters here and in Palo Alto, California, raised $313 million, the company said in a Securities and Exchange Commission filing. It was the fourth-biggest biotech capital raise this year. Kriya was co-founded by Liquidia CEO Roger Jeffs, who remains a director.