Reg Jones and the USGA raise the state’s prominence as a golf mecca.

Wake Forest University medical school Dean Ebony Boulware discusses healthcare’s future.

8 POINT

NC East Alliance is helping connect teachers with employers to show students many career opportunities.

Why Trump is counting on Michael Whatley for electoral success; Bob Timberlake releases Amishinfluenced furniture; A Triangle marketer scores by focusing on franchising; Charlotte mulls incentives for developers to revive the center city.

78 PROJECT

The state’s primo business rankings stem from solid analysis, leaders say.

Industry leaders describe the importance of N.C. transportation, shipping and logistics. 62 REGIONAL SPOTLIGHT:

N.C.

Beaches, industrial parks and a military presence help drive regional economic growth.

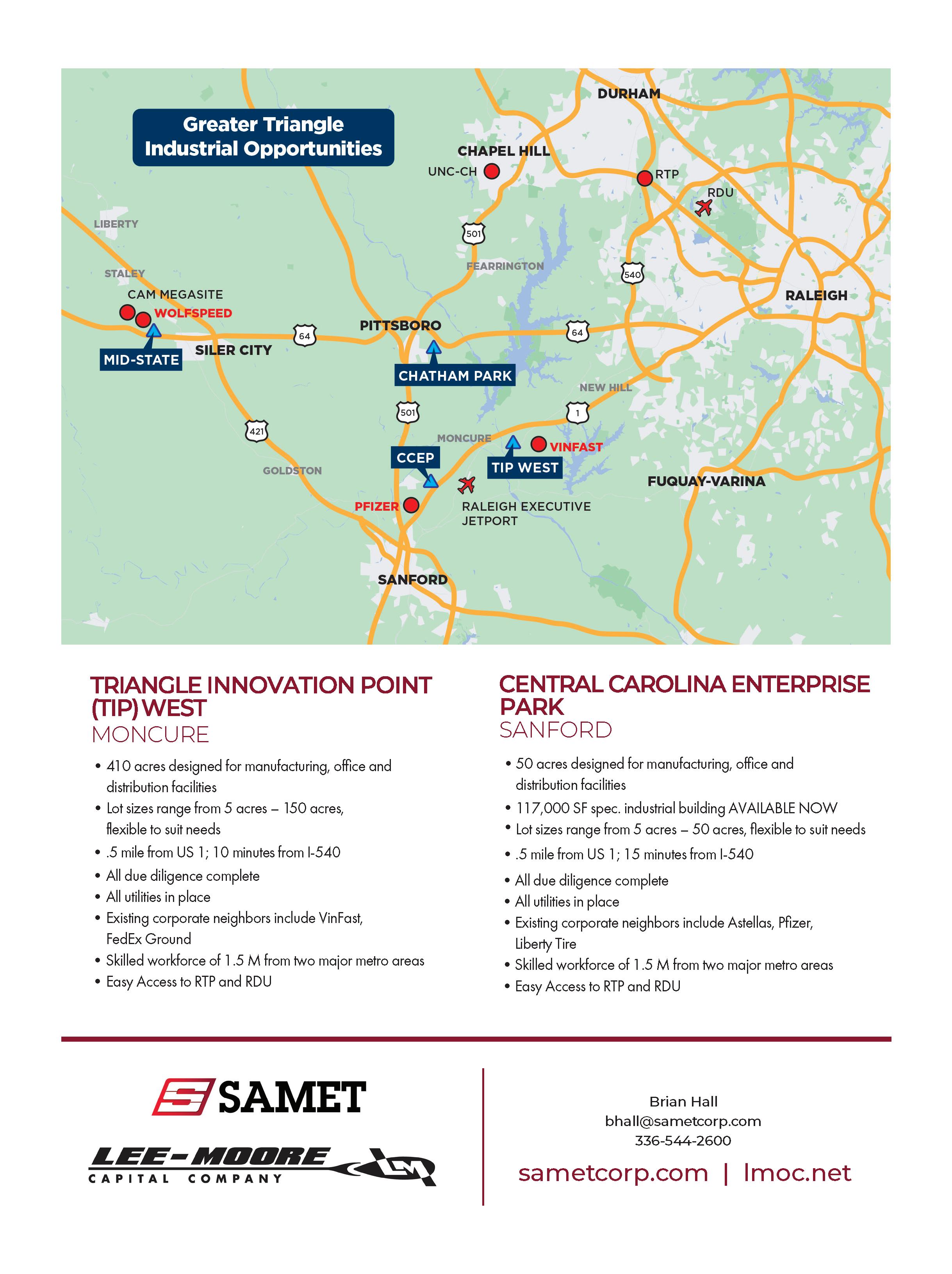

72 ECONOMIC DEVELOPMENT: INDUSTRIAL PARKS N.C.

Megasites have the potential to transform a community, but they require a lot of hard work.

USGA executive Reg Jones preps for the U.S. Open’s return to Pinehurst. BY BRAD

KING

The N.C. Golf Panel presents its annual survey of the state’s 100 best courses.

Ten treasured moments in North Carolina golf tournament history.

Moore County scores a major annual boost from a global youth competition. 24 ROUND TABLE: TRANSPORTATION & LOGISTICS

Duke Energy’s bid to replace coal with natural gas pleases Person County. Environmentalists aren’t as happy. BY MIKE MACMILLIAN

OrthoCarolina chief Dr. Leo Spector mixes an elite business degree with expertise in spinal surgery. BY KEVIN ELLIS

Travelers between Charlotte and Asheville view Shelby as a traffic grind. Officials promise change is coming. BY KEVIN ELLIS

Th at North Carolina has a pro-business climate envied by other states is a viewpoint widely held across the political divide, from Phil Berger to Roy Cooper. A story on page 78 describes how state ratings work.

Now, some influencers say that reputation is at risk. Lt. Gov. Mark Robinson’s Republican March primary victory set off punditry suggesting that his views on social issues could threaten decision makers’ perception of the state.

National columnists quickly castigated North Carolina voters for favoring Robinson. They paint him as a bigot lacking respect for women and the LBGBTQ and Jewish communities, among other things.

Robinson calls that criticism nonsense, arguing his working-stiff career and life experience makes him a great choice. Many likely N.C. voters apparently agree: Polls show he is in a tight race with Attorney General Josh Stein, the Democratic Party nominee and an experienced government official.

Strong caveat here: Our magazine doesn’t endorse candidates or take political stands. I’m not credible enough to tell anyone how to vote.

But how much a governor matters for economic performance is an interesting issue. Probably not much, especially in a state with the nation's weakest gubernatorial powers, says Western Carolina University political science professor Chris Cooper.

“At the end of the day, it is a state's business climate, labor climate and tax code that carries the day — not the particular person occupying the governor's mansion,” says site-selection consultant John Boyd, whose New Jersey company has advised businesses for decades. ”I see the state not skipping a beat on the business attraction front should outspoken conservative Mark Robinson win in November.”

Boyd notes that progressive-leaning West Coast businesses, such as Apple, Intel, Meta and Microsoft, have expanded in conservative states such as Arizona, Nevada, Ohio and Tennessee. Apple, of course, has big plans for the Triangle.

Boyd cites JPMorgan Chase CEO Jamie Dimon as an outspoken critic of “anti-woke” legislation, which passed in Florida, North Carolina and Texas. He also notes the New York megabank is nearing 20,000 employees in Texas and building big operations in Florida and North Carolina.

North Carolina's HB2 controversy in 2016 is often cited as how social-issue legislation can hurt an economy. Backlash to the since-repealed law cost the state hundreds of millions of dollars in lost tourism, convention and corporate investment, Cooper contends. Others say the impact was exaggerated.

Eight years later, CEOs understand the dangers of taking controversial political stands, and have toned down the rhetoric, says former Gov. Pat McCrory, whose failed re-election bid in 2016 was probably affected by his HB2 stand.

“The days of corporations falling for wellcoordinated political campaigns are past. Can you spell Bud Light,” he says, citing plummeting sales of the top-selling beer brand after a controversial ad campaign.

“CEOs have learned you can’t make shortterm political decisions for business purposes. People realize how hypocritical and inconsistent that is,” McCrory adds.

The NC Chamber made news with a post-primary statement contending that several populists in Council of State and legislative races defeated candidates with superior qualifications. More extreme candidates make it harder "to move our state forward,” it said.

No reference was made to the gubernatorial race, suggesting the business lobbying group knows where the key decisions are made in North Carolina and that there is no upside to riling up a potential future governor.

Business North Carolina and the North Carolina Tribune are hosting an event on April 26 in Raleigh that will spotlight key issues facing the state. We’ve invited a dozen impressive leaders to discuss issues including workforce development, artificial intelligence, college athletics reform and medical marijuana. Join us at the City Club of Raleigh for a fastpaced morning. Sign up at the Business NC website’s events link.

Contact David Mildenberg at dmildenberg@businessnc.com.

PUBLISHER

Ben Kinney bkinney@businessnc.com

EDITOR

David Mildenberg dmildenberg@businessnc.com

MANAGING EDITOR Kevin Ellis kellis@businessnc.com

EXECUTIVE EDITOR, DIGITAL Chris Roush croush@businessnc.com

ASSOCIATE EDITORS Ray Gronberg rgronberg@businessnc.com

Cathy Martin cmartin@businessnc.com

SENIOR CONTRIBUTING EDITOR Edward Martin emartin@businessnc.com

CONTRIBUTING WRITERS

Dan Barkin, Brad King, Mike MacMillian, Heath Pulliam

CREATIVE DIRECTOR Cathy Swaney cswaney@businessnc.com

GRAPHIC DESIGNER Pam Fernadez

CONTRIBUTING GRAPHIC DESIGN Ralph Voltz

CONTRIBUTING PHOTOGRAPHER John Gessner

MARKETING COORDINATOR Jennifer Ware jware@businessnc.com

ADVERTISING SALES

ACCOUNT DIRECTOR

Melanie Weaver Lynch, eastern N.C. 919-855-9380 mweaver@businessnc.com

ACCOUNT MANAGER AND AUDIENCE DEVELOPMENT SPECIALIST Scott Leonard, western N.C. 704-996-6426 sleonard@businessnc.com

CIRCULATION: 818-286-3106

EDITORIAL: 704-523-6987

REPRINTS: circulation@businessnc.com

OWNERS

Jack Andrews, Frank Daniels III, David Woronoff, in memoriam Frank Daniels Jr.

PUBLISHED BY Old North State Magazines LLC

PRESIDENT David Woronoff

Wake Forest University medical school Dean Ebony Boulware joined High Point University President Nido Qubein in the Power List interview, a partnership for discussion with some of the state’s most influential leaders. Business North Carolina’s annual Power List publication spotlights the state’s powerbrokers.

Ebony Boulware is the dean of Wake Forest University School of Medicine and chief science officer of Advocate Health, the third-largest operator of not-for-profit hospitals. Her move to Wake Forest in January 2023 followed a distinguished career after her graduation from Duke University School of Medicine. She was a faculty member of the Johns Hopkins Bloomberg School of Public Health for about 12 years, then returned to Duke’s medical school to head its general internal medicine section and, later, directed the Duke Clinical and Translational Science Institute. She is a graduate of Vassar College, where she played field hockey and basketball for four years. Boulware has two children, ages 17 and 18.

This story includes excerpts from Boulware’s interview and was edited for clarity.

You were a star basketball player in college. You should have been in the WNBA! But you ended up in an important medical position. How did this happen?

Sports are a great way to learn about teamwork, partnership and leadership. I’ve always been driven to be a part of a team, always been driven to win and to be a part of excellence. I think those core values are what also led me to become a leader in medicine.

Is it unusual for an English grad to be a medical student?

Yes, I think many people, especially when I was entering medical school, were focused on the sciences as their majors, and I was an English major. But I grew up in a family of two doctors, so I had some confidence about just taking the premedicine courses. I found that being an English major and in liberal arts was very informative in how I work with people and how I think about things. And so it’s been very beneficial, especially as I think about the research career that I’ve had and thinking about important problems and how to communicate with people.

Wake Forest is expanding into Charlotte, one of largest cities without a four-year medical school. What’s going to happen there?

We’re thrilled to come to Charlotte and expand our programs there. We’re building out a full medical school with the full four years of education. We’re also building our research programs. They’re enhancing our faculty. So we’re really focused on the full spectrum of activities for medical education and research. You already have the hospital because of Advocate Health.

Why don’t we have more medical schools?

Well, we are seeing growth in the number of medical schools, and our second campus is a part of that growth and trying to meet the need. We do have a need to grow the institutions of higher education with regard to medicine. And so we’re working on that at Wake Forest.

Just give me an example of your day. I know no two days are alike, and you have a family, so work-life balance is very important to you?

As soon as I wake up, I go for a run for an hour. I meditate every morning for 20 minutes. I’m just running toward good health and better health. And I get up, make breakfast for my son, get into the car, get started on emails, do some meetings, and do planning for the school, a lot of strategic planning. We have a lot of problemsolving meetings.

What is the most complex part of your job? Is it dealing with intelligent, engaged, demanding faculty?

You love them unconditionally or there’s some angst unconditionally. OK. Yes, it is truly wonderful students, truly wonderful faculty. It is expanding one school with two campuses. So it’s a very exciting, explosive time for the school. Our growth with Advocate Health is very exciting. I think just the dynamics of change are probably the most complicated aspects of practicing medicine today.

I’m going to ask you a sensitive question, which I also asked former Secretary of State Condoleezza Rice, who was the youngest woman and only woman of color to become provost of Stanford University. How did Ebony Boulware achieve what she did? You’ve had a beautifully balanced and successful life. You exude confidence and you command respect. So many others need to know your story and need to aspire to do what you have done. Tell me, what is your secret?

First, it’s an honor to even be in the conversation with Dr. Rice because I’m standing on the shoulders of people like Dr. Rice and my parents, who were early pioneers in terms of gaining professional careers and making success. In my case, my own grandmother could not get to college because she had to clean houses.

My father was part of the first generation of my family to get a college education, let alone go on to medical school. And I’m really standing on generations of people who sacrificed for that. I’ve always kept that in mind. It’s very important to work hard, stay focused and keep my goals in mind.

As you look forward 10 years, tell me where are we going to be as a nation vis a vis health care?

We’re going to be an aging nation for sure. Our hope is that we’re doing health care better and we’re making sure more people can get access to health care. So my number one concern is making sure that everybody can have access to health care.

We are improving the rates of health care insurance. North Carolina just took on Medicaid expansion. That’s an important advance. Where we see that states have taken that on, where we have more access to health care, people do have better health outcomes.

That’s an improvement. But we’re not seeing the narrowing that we’d like to see in many of the disparities in terms of health for rural individuals and people who are racial and ethnic minorities. We’re

still seeing big gaps in terms of health and health outcomes. So I’d like to see in 10 years that we’ve made an improvement there.

We can expect that we’re going to see a lot of technological improvement. We’re seeing more care being done in people’s homes outside of the health care system. And the use of things like artificial intelligence, optics, robotics, that’s really explosive.

What did you find different about the Winston-Salem campus, versus your presence at Duke. Did you find differences in the communities, in the culture, in the strategic direction and administrative viewpoints?

Both are wonderful. Winston-Salem is a wonderful growing area. There’s a tremendous investment in innovation. One of the wonderful things that I’ve enjoyed is seeing our Institute for Regenerative Medicine really grow. Director Dr. Tony Atala is an incredible leader. That has really allowed for the institution to grow, which is why I’ve been so excited to join.

The other part is retaining healthcare workers, and having a sustainable future. How difficult is that?

It’s very competitive. We’re fortunate at Wake Forest University School of Medicine to have an outstanding faculty, and we do everything we can to keep them with us as they’re making incredible discoveries. It is a competitive area, so we want to invest in people, make sure we’re out in front and make sure that we’re growing their programs.

We’ve had a huge growth in our research funding over the last several years, and so we’re very excited to be able to invest in our faculty that way.

I talk to a lot of MDs and there’s some discontent, though not necessarily at Wake Forest. Doctors are making less money and working just as hard. I have a lot of buddies who are choosing to retire. What is your observation?

We know we have very high rates of burnout in our profession. Across the entire field, we’re working hard on ensuring that physicians in particular, but nurses as well, and others who are really on those front lines have the right types of rest and integrate action and professional fulfilment so that they want to stay with us. We need this group of people.

I don’t know that I ever met a basketball star who rose to the deanship of the medical school. I know some who became CEOs of businesses. Are you unique in that regard?

I haven’t polled my colleagues to find out who was engaged in athletics. It’d be very interesting to find that out.

I’m grateful for the opportunity to contribute to help people live longer lives and better lives in the most equitable ways. That’s what really drives me. I’m also grateful to be able to train that next generation of leaders that are coming behind me. That’s the most gratifying component of the work that I do. ■

The NC East Alliance economic development agency in Greenville has come up with a plan to keep youngsters in eastern North Carolina and working in local industry. They are enlisting teachers.

The stakes are high for the future of the region from Virginia south to Jacksonville. The General Assembly and private funders, notably the BelleJAR Foundation, are providing serious money. If it works, it will be tempting for other rural areas losing population to replicate it.

The idea is to train hundreds and maybe eventually thousands of teachers in two- and three-day workshops about career opportunities in the region. So, for example, it trains teachers about jobs in the health sciences by walking them through the ECU Health complex in Greenville. It takes teachers through the Navy’s Fleet Readiness Center East in Havelock. Then it helps the teachers design what they have seen into their lessons.

“For us, traditional economic development in rural eastern North Carolina was no longer effective,” says Todd Edwards, a Farmville general contractor who chairs the NC East group. “We were experiencing population loss in about two-thirds of our counties — or maybe a little more than two-thirds of our counties. Just that talent bleed.”

NC East, through its STEM East program, was helping schools with science and math, but that didn’t stop population losses. “We were training the workforce for other places. They were getting trained up and seeking opportunities elsewhere,” says Edwards.

And that was because many young people in the region had no idea what career options were available within a 15- or 30-minute drive. Their parents didn’t know. Crucially, many of their teachers didn’t.

“We have major pharmaceutical manufacturers here,” says Edwards. “We have marine systems—we have, I think, 60-something boat manufacturers in the region. We’re the epicenter in North

Carolina down here of smart ag. And I could keep going. We’ve got all sorts of advanced manufacturing, but as these students and the general populace drive by these buildings daily, weekly, monthly, they have no idea what’s going on inside.”

So NC East created the new initiative, called Industry Cluster Education, with $15 million from the legislature to help cover the next three years

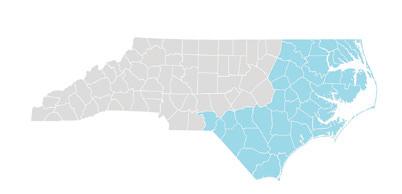

There are good jobs in eastern North Carolina if you know about them. Manufacturing pays well and, by my count, there are more than 1,000 manufacturing firms in the 29 counties with 60,000 jobs.

But it will be hard to sustain them in many counties — or attract new jobs — if folks keep leaving. The 29 counties have about 1.4 million residents. The region lost around 28,500 residents between the 2010 and 2020 censuses, which doesn’t sound bad, except that growth in a handful of coastal counties like Onslow and Currituck masked losses inland. Some 22 of the 29 counties lost population, 12 of them at double-digit rates.

This shows up in public school enrollment. At an NC East conference in January, senior regional economist Laura Ullrich of the Richmond Fed showed a slide of enrollment trends between 2000 and 2019. Six school districts showed gains, like Onslow and Pitt, home to ECU. The rest had losses, five by more than 40%.

Folks have been leaving and taking their kids. This gives a lot of urgency to NC East’s project, to give parents hope for their children.

Last summer there were three pilot workshops. The health sciences one was a good example. It started at Pitt Community College with 22 teachers from throughout the region, and it was built around a scenario. “You just got bit by a shark. Let’s talk about what it takes to stabilize you,” says Bruce Middleton, executive director of the STEM East program. It was an immersion into the variety of jobs that support ECU Health’s treatment of a shark victim. Like who maintains the medivac helicopter. Or who purchases medical supplies.

“We had teachers there, listening with both their ears,” says Middleton. “One ear may be going, ‘Oh my gosh, I had no idea that there were so many individual, separate career pathways.’”

“We need all the doctors and nurses,” says Middleton. “But there are also HVAC technicians, there are plumbers, there are electricians, there are computer technicians.”

The second day, the teachers went around Pitt to hear what’s involved in getting ready for the jobs they had seen, some with short certificate programs and some with associate degrees. That training is available at the 16 community colleges in the region, close to everyone.

“Then we came to the classroom, and we finished with that conversation about how do you then sit down with your standards? What are you actually having to teach at your grade level? How do you then take everything you’ve heard [and] have students have the same picture of what you’ve seen?”

When the teachers go back to school, they have access to folks in the industry clusters who have agreed to make themselves available to teachers, who can come to the schools and have the students come to them. “We use the term ‘human library,’” says Middleton.

Population growth by county from 2010 to 2020

This summer there will be as many as nine workshops, expanding to other industry clusters in the region, including maybe biopharma — a hot area — with as many as 30 teachers each. This is a heavy lift, happening right now. They have to get teachers signed up from around the region, and that means having superintendents get the word out. The community colleges, key partners in this, are handling a lot of logistics and lining up industry partners for the workshops. A lot of stuff has to get done in the next three months.

There are about 12,000 public school teachers in the region. Next summer’s workshops may include 300 of them. NC East is staffing up to bring in folks to coordinate each industry cluster, and it will be able to handle increasing numbers of workshops over the next few years. What is hoped is that teachers who go through this program will share what they have learned with colleagues in their schools.

Plans also call for a different approach to career and job fairs, which have typically been highly localized.

“When we talk to industry,” says NC East CEO Vann Rogerson, a veteran economic developer who grew up on a Martin County farm, “they are siloed within the county that they’re domiciled. The school system, the colleges, the employers have job fairs and interact with each other in that county.

“But when you really talk to the companies, they’re interested in other school systems, and other communities in their labor shed surrounding their domicile county. Companies say, ‘I want to be visible past here.’”

Middleton has been an educator for 40 years, in the classroom and administration, and wishes he could have done what he is training now. “I was a high school biology teacher. And when I think about my own teaching, I go wow, if I really thought hard about taking biology class and using, as the context for teaching, using something like this relevant to kids. Using health science or using agriculture, and at the same time connecting that to our regional healthcare and our agriculture systems.

“Not only would I have had much better luck with my kids understanding the importance of what I was teaching, because they could see it in action, but it would also be connected to a career in the region. Where they would go, ‘I’m learning this and that’s where I want to go to work someday.’” ■

Less than 2% (-2%) to 2% More than 2%

Less than 2% (-2%) to 2%

More than 2%

By Kevin Ellis

aston County’s Michael Whatley has the top job of helping Donald Trump get back to the White House. e former president handpicked the leader of the North Carolina Republican Party in March as chair of the Republican National Committee. Wilmington native Lara Trump, who is married to Trump’s son Eric, is co-chair.

GIt’s a prestigious post, but calling it challenging may be an understatement, given the former president’s track record for a revolving door of top associates, from cabinet secretaries to senior aides. at includes Trump’s displeasure with Whatley’s predecessor, Ronna McDaniel, who was pushed aside a er seven years, with the rst presidential rematch since 1956 looming less than eight months away.

What does the “You’re red” guy see in the Watauga County native, whose most prestigious Beltway job was as chief of sta to Elizabeth Dole, a one-term U.S. senator from North Carolina?

Trump recognizes how Whatley’s mind sees things “a step or two ahead,” says David Holt, his business partner for 15 years. Holt likens Whatley’s political savvy to the way he strategizes a game of three-dimensional chess, where each player controls three vertically stacked boards rather than a single board.

“He carefully considers all the available options and how they may play out,” says Holt. Whatley also has other intangible qualities, his longtime associate says. “Above all, he is an endlessly positive and optimistic man and he delivers what he promises. at’s a recipe for success anywhere.”

Holt, Andrew Browning and Whatley used their initials to co-found HBW Resources in 2007. e advocacy and communications company, which now has 30 employees, has run “more than 300 successful campaigns,” mostly representing energy and environmental industry clients, according to its website. ose clients include both traditional fossil fuel-oriented business and alternative energy suppliers. Holt, who worked in the George H.W. Bush administration, lives in Houston. Browning,

a U.S. Department of Energy appointee during the Clinton administration, is based in Denver.

Whatley, who declined interview requests, le HBW in May 2022 to focus on his North Carolina Republican Party job. He had lessened his day-to-day responsibilities over the previous three years as he focused on keeping North Carolina a politically red state.

“Michael has always had a calling to serve and to give back to the country. His rst love has always been politics and supporting American democracy, and politics is how he was called to serve,” Holt says. “We are very proud of him.”

Whatley declined a salary while chairing the state party, an N.C. GOP spokesman says. He resigned from the post a er joining the RNC in March. McDaniel had total compensation of nearly $360,000 in 2022, according to Federal Election Commission data.

e RNC job is a big step from his previous post, says Michael Bitzer, a politics and history professor at Catawba College in Salisbury. Whatley will have to show “absolute loyalty to Donald Trump and whether he’ll show that back is another question,” he says. Within days of taking charge at the RNC, Whatley red more than 60 sta ers and required others to re-apply for their jobs, according to Politico

Whatley stepped in with the national Republican Party facing nancial challenges. Campaign nance reports showed the RNC entered February with $8.7 million of cash on hand, compared with $24 million for the Democratic National Committee. e DNC’s chair is Orangeburg, South Carolina, native Jaime Harrison, who lost the U.S. Senate race to Lindsay Graham in 2020.

Raising a lot of money is Whatley’s rst challenge, says Bitzer. “ e real test is whoever gave to Nikki Haley, will they open their wallets and pockets to Donald Trump?” he says. “ is is going to be a monumentally expensive election.” Spending in the 2020 BidenTrump election totaled $5.7 billion, according to Opensecrets.org, which tracks campaign nance.

e RNC’s nancial troubles may solve themselves. Haley’s campaign was heavily supported by major Republican donors dissatis ed with Trump, such as the Koch family network’s Americans for Prosperity Action. With the former South Carolina governor out of the race, more money may ow to Trump. A key issue is whether the RNC will help Trump pay his legal bills, which political observers say could depress donations.

Whatley’s work in North Carolina garnered national respect because Tar Heel Republicans have been more successful politically than peers in other Southern states, including Georgia and Virginia.

Trump carried the state in 2016 and 2020. In 2022, his endorsement of Ted Budd helped the Davie County businessman win his U.S. Senate seat, overcoming a 30-percentage point de cit to former Gov. Pat McCrory.

Whatley earned a bachelor’s degree in history from UNC Charlotte, a master’s degree in religion from Wake Forest University and a law degree from Notre Dame in 1997. He moved to Gastonia more than 20 years ago to take a job as a federal law clerk in Charlotte and later worked for George W. Bush during the 2000 Florida recount process and for the U.S. Energy Department, before joining Dole’s Senate sta .

e GOP also continues to dominate the N.C. General Assembly, gaining super-majorities in the state Senate and House, aided by a party switch in 2023 by former Democratic state Rep. Tricia Cotham of Charlotte. Whatley also helped Republicans build a 5-2 majority on the state Supreme Court, which had leaned Democratic before the 2022 election.

A er Kay Hagan won the 2008 Senate election, Whatley returned to Gastonia to rejoin HBW. Friends describe him as an active family man and church member, even as he has traveled for corporate and political work. He and his wife, Suzanne, have three children.

“Republicans have built a strategy and organization to show up at a higher rate for elections than Democrats, and even independents. at strategy in North Carolina has worked consistently,” says Bitzer.

Trump also handpicked McDaniel as RNC chair a er his 2016 election, but criticism of her mounted because of weak fundraising and the GOP’s failure to make expected gains in the 2022 congressional elections. e Democratic party retained control of the Senate and kept the GOP from adding many seats in the House.

e RNC divides up money for both the presidential contest and House and Senate races. at’s always a tricky challenge, but even trickier for Whatley given Trump’s unusual clout over the party and the former president’s court-related nancial challenges. In February, a New York judge found Trump guilty of civil fraud, putting him on the hook for $454 million in nes and interest. He is appealing the verdict.

Back in his home county, Whatley’s rise is a matter of pride. “Gaston County has an RNC chair. at’s pretty cool,” says State Sen. Brad Overcash, a Belmont Republican seeking a second term. He recalls how critics called Whatley a “Washington guy” when he ran for state party chair in 2019. “Oh no,” says Overcash, who’s known Whatley for a decade. “He’s been hanging around Gaston County a long, long time. He has spent a lot of time in Washington, but that’s just what a [senator’s] chief of sta does.”

“It’s incredible to see him balance his professional responsibilities with his home life,” says Jonathan Fletcher, former chair of the Gaston County Republican Party. “I think it shows his character.” Fletcher and Overcash expect Whatley’s style to transition well on the national level. Whatley took over the state party when it was also on shaky ground, following the resignation of Chairman Robin Hayes. e former congressman from Concord pleaded guilty to bribery charges but was later pardoned by Trump.

Whatley bolstered party nances by using data to communicate fundraising strategies to potential donors, his friends note. “ ere’s nothing fake or phony at all about Michael,” says Overcash. “Yes, he’s risen to a high place in politics, yet he’s not changed at all. He’s a genuinely nice guy.”

Whatley can “take the heat when Trump gives it” and “tell Trump the truth when he needs to hear it,” adds Fletcher. “Whatley has learned to do all that masterfully. It’s not blind loyalty, but it is a combination of dependability, competence and patience. at’s a combination that anyone Trump discards either never had or has lost somewhere along the way.”

Adds Overcash: “I think Trump, and the entire national Republican push in this election, is in much better shape with Michael Whatley in charge.” ■

A star performer for decades, Uptown Charlotte ponders public support for developers.

By Heath Pulliam

harlotte’s central business district is not the same bustling business hub that it was pre-pandemic, a similar fate facing many U.S. cities. Widespread retail vacancies are obvious, while eight Uptown buildings are at least 50% vacant.

Between 2019 to 2023, overall vacancy in center city Charlotte doubled from less than 10% to 21%, according to the CBRE real-estate services firm. Overall, the Charlotte market had the seventhsharpest increase in office occupancy over the past four years, among 50 markets tracked by Cushman & Wakefield, another big real estate firm.

Vacancy rates are poised to rise even higher, as many leases are set to end this year.

situation, city officials are considering supporting property developers through a combination of taxpayer funds and incentives.

The gloom shouldn’t be overstated. The district remains home to headquarters for Bank of America, Truist, Honeywell, Duke Energy and other big companies. The center city’s struggles are also tempered by growth in the South End neighborhood, which lies across a four-lane loop highway that circles Uptown. Office leasing volume gained 35% in South End last year, while the rest of the city experienced a 28% decline, according to the CoStar real estate data firm.

Still, to revive the center city and avoid a “ghost town”

The property getting the initial incentives spotlight is 526 S. Church St., which became Duke Energy’s headquarters when it opened in 1975, then called the Electric Center. The building was acquired for $35 million in December 2022 by Washington, D.C.-based MRP Realty and Charlotte-based Asana Partners. The developers plan to convert the 13-story office building into 440 residences with retail properties on the first floor. The $250 million project would include a separate adjacent retail building.

In February, Assistant City Manager Tracy Dodson, who leads economic development efforts, pitched the incentive program for MRP and Asana to the Charlotte City Council, which gave tentative approval. She promised to provide more details in the next few weeks.

Dodson and city officials say the incentives program can increase the city’s tax base, provide public parking and community spaces and create jobs. If the proposal is approved, developers may set aside some space for affordable housing, while improving adjacent pedestrian areas.

Developers say incentives are needed to ease the hefty expense of converting office space to livable units. Having public support also ensures that Charlotte officials have a voice in developers’ plans, potentially steering positive impacts.

“For office to multifamily conversions to be successful, the market rent has to be strong, the construction costs have to be manageable and the [cost] basis of the property has to be extremely low,” says Rob Cochran, senior managing director at Cushman Wakefield. “Given some of the current softness in the multifamily market, converting to residential will be difficult in downtown Charlotte right now.”

Most of all, the city wants to avoid empty buildings with declining property values, which depresses tax collections. Some former Uptown employers have moved a mile or two south to South End, often taking less space. Examples include the Alston & Bird law firm and Grant Thornton accounting business. The vacancy rate for newer South End offices is less than 12%, according to CBRE.

“Right now the tax values are over-inflated on many highly vacant office buildings, and those tax values will continue to decline over time,” says Patrick Gildea, a CBRE vice chair in Charlotte. Conversions to different uses can lead to higher valuations and tax collections, he adds.

Cities such as Chicago and Washington have moved forward with conversion projects driven by tax breaks, though Charlotte’s effort is a rarity for North Carolina.

As an older building needing renovation and with a lower market value than newly built structures, the former Duke Energy site may make sense for a renovation. The project’s retail section probably needs to be “destination entertainment” that attracts people to the area, says Gildea.

“It is incredibly interesting because again we have service retail uptown, but we don’t have a lot of exciting destination or

entertainment-focused retail, and that’s the brand that Asana is most known for,” he says. Asana focuses on redeveloping retail centers in older neighborhoods, including Park Road Shopping Center in Charlotte and Brightleaf Square in Durham.

Redeveloping Uptown Charlotte is challenging because many of its 1980s-era office towers “have a lot of core space, including elevator banks, that would require windowless bedrooms and other less-than-ideal layouts for apartments,” says Chuck McShane, CoStar’s director of market analytics. “Charlotte has a handful of buildings where it could work, but conversions won’t be a panacea to all of the vacancy problems.”

The COVID-19 pandemic forced downtowns to diversify away from their heavy focus on offices, McShane says. Charlotte, which emerged as a major office market largely because of its big banks’ growth, has to figure out a smart response to a changing world. ■

A Triangle marketer scores with a focus on franchising.

By David Mildenberg

Sixteen years ago, veteran Triangle marketing executive

David Chapman was coaching a youth baseball team when another dad mentioned his work as an executive with a franchising company. e chance encounter prompted Chapman to shi his business’ focus to a sector that now dominates many U.S. industries.

Since then, Holly Springs-based 919 Marketing has worked for about 200 franchising companies involved in many business sectors, helping grow revenue and attract franchisees. at includes restaurants, home services, auto repair, senior housing and healthcare.

While many marketing company owners prize their independence, Chapman concluded he could have a bigger impact and expand his operation by selling a majority stake to a privateequity group. Working with a business broker, he had contact with 300 rms before picking ve nalists.

e winning bidders in November 2020 were London-based Landon Capital Partners, a familyowned group that has an o ce in Boston, and Green Farms Capital of Westport, Connecticut. Terms weren’t disclosed.

919 is among 11 portfolio companies — ranging from a Wisconsin-based cheese maker, a 2,000-employee industrial parts manufacturer based in Virginia and a Connecticut-based mattress company — listed on Landon’s website.

Since the transaction, 919’s parent, Big Rock Brands, has acquired marketing agencies in Florida and Virginia, plus a data analytics company in the Sunshine State. e combined company employs about 120 people, plus additional subcontractors.

Chapman completed his three-year non compete agreement with his investors last year, and in March stepped down as CEO. He remains chairman of 919, with the business based at his Holly Springs o ce. His son, Graham, remains chief growth o cer,

while his wife, Sue Yanello, who Chapman credits as a key force in the company’s success, is a consultant.

e company’s new CEO is Lorne Fisher, whose Fort Lauderdalebased company, Fish Consulting, was acquired by Big Rock Brands in 2023. He previously worked for the Ketchum ad agency and Visa.

Chapman was born in Winston-Salem, but lived in many places including the Bahamas, Canada and Guam, as his father took di erent jobs with AT&T. A er graduating from Appalachian State University in 1980, he worked for several companies, including the Long, Haymes & Carr advertising agency in Winston-Salem. It is now part of Interpublic Group.

He started 919 in 1996, building a traditional marketing rm with clients including Greensboro-based Apex Analytix, and Hosted Solutions, a Cary-based datacenter company that was sold for more than $300 million in 2010 a er less than a decade in business.

He shi ed to a franchising focus when he concluded the business model’s growth would accelerate. Restaurant clients over the years have included Golden Corral and Wayback Burgers.

“Franchising companies do better during economic downturns, partly because laid-o corporate executives want to own their businesses,” he says. “Good franchisors provide training and support, in return for a portion of revenue. at can be an advantage over starting a business from scratch.”

Yanello, a former television journalist in Raleigh, helped recruit a team skilled in writing, video and social media. “Having veteran storytellers has been critical,” she says. “We have former TV reporters in Dallas, Miami and other cities who know how to shape our clients’ stories and get customers in the doors.” For example, an urgent-care client developed local TV features that helped viewers identify di erent types of coughs.

“David has capitalized on market trends throughout his tenure as CEO, providing franchise brands with actionable marketing data, analytics and world-class content creation,” says Michael Kessler, a Big Rock board member who owns Green Farms Capital.

e biggest change that Chapman has seen in his career is the marketing industry’s obsession with metrics to analyze results.

“Clients have to know what is being e ective. ere’s much less patience than years past.” ■

By Chris Roush

egendary painter and designer Bob Timberlake is returning to the furniture business.

He’s struck deals for his “American Home” line with Archbold Furniture and Carolina Customer Leather to manufacture bedroom, dining room and office furniture. It’s been rolled out to test stores and will launch nationwide later this year.

“I’ve had to fight hard to keep my furniture ‘Made in America,’ believing American craftsmanship is second to none,” says Timberlake, 86. “I spent a few days with Archbold at their facilities and having worked all year with Carolina Customer Leather, there is no question this fact remains true today.”

The “World of Bob Timberlake” line with Lexington Furniture sold an estimated $2.2 billion, an industry record after it was introduced in October 1990. Sales at the famed Harrods department store in London topped $100 million annually for more than a decade.

At the end of 2009, Timberlake’s license with Lexington expired after he objected to the company using Chinese manufacturers to make his furniture. He then worked with Hickory-based Century Furniture, which made the furniture until the end of 2019. He spent last year designing a new line and finding the right manufacturers.

Archbold Furniture, a privately held company based in Ohio, has made solid-wood furniture since 1900, though it started as a ladder

manufacturer. The ladder business was sold in 1997. In 2010, it partnered with an Amish finisher, and its products have 13 stain options applied using old-fashioned Amish techniques. The company’s furniture is sold to nearly 500 retailers in the United States, Canada, Mexico and Puerto Rico.

Carolina Custom Leather is based in Conover and uses solid hardwood frames and offers more than 500 leather and fabric covers in its manufacturing. Its owner, Todd Stroud, was previously president of The Tanner Co., furniture importer. He also worked at Hickory-based BradingtonYoung, which makes chairs, recliners and sofas.

“We are excited to be working with Bob on the new Bob Timberlake American Home collection,” says Stroud. “All the upholstery will have Bob’s love for the outdoors.”

Carolina Custom Leather will debut five sofas, six chairs, two office chairs and three dining room chairs from the collection in April.

Timberlake’s son, Dan, says the company conducted extensive research and evaluated furniture manufacturers to select the partners. The Timberlakes plan to strike other licensing deals later this year for lamps, lights and rugs.

The 15 test stores offering “American Home” are all east of the Mississippi River

in various states – Ohio, Michigan, Illinois, New York, New Jersey, Virginia, Tennessee, South Carolina and Georgia, for example – says Dan Timberlake. He added that more stores wanted the furniture, but that they wanted to limit the initial rollout.

Sales are exceeding expectations, says Dan Timberlake, declining to provide numbers. The line will launch for nationwide distribution on April 13 at the International Home Furnishings furniture market in High Point.

At the Doerr Furniture store in New Orleans, the king-sized bed is selling for $3,150 while a nine-drawer dresser retails for $2,887. A fivedrawer chest costs $2,250, and a two-drawer nightstand sells for $871. A mirror is $540.

Bob Timberlake became famous in the 1970s for his paintings of rural America, which have been shown around the world. His Lexington gallery, which is open Wednesday through Sunday, sells prints and originals, as well as some of his previous furniture designs. ■

Truist Financial agreed to sell its remaining holding in Truist Insurance to an investor group led by Stone Point Capital and Clayton, Dubilier & Rice. The sale values the fifth-largest U.S. insurance brokerage at about $15.5 billion and bolsters Truist’s capital.

Bojangles franchisees are suing the brand over its marketing fund, arguing that the company stopped providing regular information on how those dollars get used. Bojangles said remains “committed to working shoulder to shoulder with them.”

Virginia-based Dollar Tree will close 970 Family Dollar stores over the next few years. The company CEO says persistent inflation and lower government benefits hurt lowincome consumers who are a big part of Family Dollar’s customer base. The Levine family started Family Dollar here in 1959 and sold the business to Dollar Tree for $8.5 billion in 2015.

Charlotte Pipe and Foundry broke ground on 80 acres in Maize, Kansas. Once complete, the plant will employ at least 50 people. Charlotte Pipe, which is familyowned and has been in operation since 1901, manufactures cast iron and plastic pipe and fittings.

South Bend, Indiana-based Steel Warehouse will invest $30.5 million in a Hickory plant, creating 58 jobs. The 77-year-old industrial steel processor operates 15 locations in the U.S., Mexico and Brazil. Salaries will have an average annual wage of $62,000, exceeding the Catawba County average of $54,151.

PDQ closed its restaurants here and in Raleigh, Durham, Cary, Winston-Salem and Wake Forest. It also shuttered South Carolina locations in Greenville and Columbia.

Charlotte-based Albemarle Corp. is “kind of slow playing” its plans to start mining lithium at a long-closed site here, CEO Kent Masters told an industry conference. Because of sharp declines in the pricing of lithium, he says. In January, the company said it was delaying a $1.3 billion refining plant in South Carolina that was expected to open in 2026 and a $180 million research center in north Charlotte.

A 40-plus-year-old Mooresville company that makes specialized electronics parts plans to close, resulting in the loss of 97 jobs. General Microcircuits East West, owned by Atlanta’s East West Manufacturing, said layoffs start April 22.

Tire Masters closed after a massive sinkhole put the business in jeopardy. Mayor Chris Carney says the responsibility for the sinkhole has unfairly been placed on the owners. Tire Masters was at the location for 28 years.

Mills Automotive Group signed an agreement to open dealerships in Charlotte and Raleigh to sell the Fisker electric vehicle. It will also open one in Greenville, South Carolina. The Ocean SUV starts at $38,990 and has a range of up to 360 miles.

California-based GrubMarket acquired Salisbury-based Performance Produce for an undisclosed price. Performance Produce sells 80 different produce items to nearly 100 different retail customers. J.R. Roach and his wife, Virginia, founded Performance Produce in 2007 with an empty warehouse. The company now has dozens of employees.

Dallas-based Jacobs Solutions, an international professional services firm, plans to lay off 240 workers through midMay at the military base after a government contract wasn’t renewed. The company said that its government client has selected a new contractor, who may employ most of the existing workforce.

Phoenix-based SunTree Snacks announced in September 2022 it would invest $10.1 million and create 94 jobs at a manufacturing facility here for its sweet and salty, nut-based snacks. Eighteen months later, the company announced it would permanently close the plant by April 30, putting 29 people out of work.

The 2024 North Carolina Main Street Conference brought community and economic development leaders here from across the state to examine downtown revitalization and economic development strategies. The three-day annual conference is organized by the North Carolina Department of Commerce and its Main Street and Rural Planning Center.

MrBeast — aka Jimmy Donaldson, a 25-year-old Pitt County native – was the subject of a cover story in Time

magazine. Donaldson has more than 400 million followers across all social media. The magazine calls MrBeast the biggest beneficiary of a new media ecosystem.

Nine McDonald’s restaurants in Robeson, Bladen and Columbus counties that were owned and operated by Rust Enterprises have been sold to Chapman Family Enterprises. It was established in 1969 in New Jersey. Terms were not disclosed.

The state is closer to buying more than 400 acres here, which would lead to the permanent conservation of property teeming with habitat that supports federaland state-listed species. The local board agreed to sell the tract to the N.C. Wildlife Resources Commission for $660,000.

The N.C. Department of Labor fined Barnes Farming $187,509, its maximum penalty, after the September death of seasonal farm worker Jose Arturo Gonzalez Mendoza, 29. The agency cited Barnes Farming with three “serious” violations. W

Wanchese Fish Co., started 88 years ago by a local fisherman, closed its fish offloading and packing operations here. Cooke Seafood bought the local company in 2015. A marine and fishing equipment store will remain open.

Smithfield Foods named Kraig Westerbeek president of its hog production operations, reporting to CEO Shane Smith. Westerbeek joined Smithfield in 1993. He helped start Smithfield Renewables, the company’s carbon reduction and renewable energy platform.W

Environmental Protection Agency Administrator Michael Regan announced a nationwide $3 billion Clean Ports Program at the Port of Wilmington. The program will help fund a shift to zero emissions equipment and infrastructure for the nation’s ports. Officials didn’t disclose how much the Wilmington site would receive.

General Electric Aerospace will invest $46 million in North Carolina as part of a $650 million investment in its manufacturing facilities and supply chain in 2024. GE Aerospace has $22 million going to Wilmington, $11 million going to Asheville, $7 million to Durham and $5 million to West Jefferson.

Enviva Pellets, a supplier of wood pellets used for energy generation with a presence at the Port of Wilmington, filed for bankruptcy protection. With 10 plants across the Southeast, the Maryland-based company has leased a storage facility and terminal at Wilmington since 2016.

The N.C. Department of Transportation submitted the Cape Fear Memorial Bridge replacement project for federal grant consideration, which could pay for as much as half of the $400 million-plus new bridge. The funds would go toward constructing a higher, 135-foot fixed bridge.

Monteith Construction and its Grey Interiors and Citadel Masonry units adopted an employee stock ownership plan. The 165-employee company formed in 1998 and has four Carolinas offices.

Patricia Kusek resigned less than six months after becoming a New Hanover Community Endowment director. She’s a former vice chair of the New Hanover County Board of Commissioners.

India-based industrial hose manufacturer Polyhose plans to double the size of its current facility inside Pender Commerce Park. The company picked the site in 2019 and moved into its building in 2021.

Pennsylvania-based Potters Industries purchased the former Ardagh Glass facility for $6.5 million, for warehouse use. The facility, which is 500,000 square feet and sits on more than 114 acres, was previously used to make beer bottles.

Germany-based Schott Phama is investing $371 million to build a pharmaceutical production plant that will create 401 jobs. It is eligible for $4.9 million in state incentives.

A new joint venture plans to spend $60 million and add 133 jobs for a production facility here that will make parts for electric vehicle batteries. FTBC, a joint venture between Fujihatsu Tech America and Toyota Tsusho America, will make and sell prismatic aluminum cell cases and covers with discharge valves. Production should start in 2025. The operation will support the Toyota Battery Manufacturing North Carolina facility.

Old Dominion Freight Line will add a freight terminal in Buckeye, Arizona. The logistics company applied for a rezoning for nearly 160 acres in Buckeye, which is about 30 miles west of downtown Phoenix. It is projecting between 300 to 350 new jobs with an average salary of about $80,000.

Marshall Aerospace, which has plans for a $50 million plant at Piedmont Triad International Airport, launched a hiring page for the facility on its website. The U.K. aerospace manufacturer confirmed in April its plans for a 240-job maintenance, repair and overhaul facility with operations beginning in early 2025.

The City Council signed off on Oak View Group to run the Greensboro Coliseum Complex and Tanger Center, effective July 1. The Los Angeles-based company manages more than 350 venues worldwide, including the Durham Convention Center. The city, wwould still own both sites.

The city condemned the former News & Record building, which is owned by Berkshire Hathaway, former owner of the newspaper. The city announced in February that it would condemn the building after a fire department inspection found it contained drug paraphernalia, human waste, damaged furniture and trash.

High Point University received a $20 million donation from Doug Witcher, the founder and CEO of Greensborobased Smart Choice, an insurance agency network with more than 10,000 affiliated independent agencies. Witcher earned an education degree from High Point in 1977. The university is naming its School of Humanities and Behavioral Sciences after him. Also, trucking magnate David Congon made a gift exceeding $10 million to the university, which will name its new School of Entrepreneurship after him. It’s the largest of many donations to the school by the Congdon family, which in 1934 started Old Dominion Freight Line.

Office furniture-maker Haworth closed its longtime seating manufacturing facility. The company declined to release how many employees were affected by the shutdown. The company did not file a notice with the state, a requirement for companies with at least 100 full-time workers.

Lucern Capital Partners, a real estate investment firm based in Red Bank, New Jersey,, acquired four buildings within Indeener Business Park for $4.1 million. The buildings sit on 7.9 acres and are 100% occupied. An additional 1.02-acre adjacent parcel allows for further growth.

Drylock Technologies, a Belgiumbased manufacturer, plans to create 113 jobs and invest $26.9 million to build its first U.S. baby care plant. The factory will move production from Europe to a 450,000-square-foot manufacturing site that will support faster product development for U.S. clients. Drylock has a plant in Eau Claire, Wisconsin, that manufactures incontinence products.

HanesBrands reached a three-year extension of its collegiate apparel partnership with the University of Mississippi that gives the manufacturer exclusive rights to its Ole Miss clothing in the mass retail channel. Mississippi joins Auburn, Clemson, Florida State, Michigan, N.C. State, Penn State and nearly 30 schools that partner with the company.

Truliant Federal Credit Union acquired P1 Finance Holdings, a 37-yearold premium finance company based in Norcross, Georgia. Terms were not disclosed. P1 Finance, founded in 1987, focuses on helping companies finance their premiums for property and casualty insurance.

Labcorp faces a class action lawsuit for allegedly sharing confidential patient data with Google. The clinical lab testing company is accused of installing software that allows Google to “intercept an array of individually-identifiable health information.” LabCorp hasn’t filed any responses in court to the allegations.

The North Carolina Bar-B-Q Hall of Fame inducted its inaugural class, honoring Sam Jones of Sam Jones BBQ in Raleigh, Pete Jones of Skylight Inn BBQ in Ayden, Kent Bridges of Alston Bridges Barbecue in Shelby, Steve and Gerri Grady of Grady’s BBQ in Dudley, Charles Hursey of Hursey’s Bar-B-Q in Burlington, Mebane and Graham, Wayne Monk of Lexington Barbecue in Lexington and Charles Stamey of Stamey’s Barbecue in Greensboro.

Yarn manufacturer McMichael Mills is closing its facility here, idling about 80 employees. The company is consolidating its operations with its plant in Mayodan. McMichael manufactured stretch yarns for items including socks, medical applications, athletic shoes and mattress ticking.

Loparex is closing its plant here over the next six months resulting in the loss of 91 jobs. The company uses silicone in the manufacturing of release liner solutions on a variety of paper and film substrates used in healthcare and other industries, including food labeling, hygiene, tapes, graphics, waterproofing and other uses.

Software company SAS had a round of layoffs in its Retail Solutions division. The number of layoffs wasn’t disclosed. While realigning what jobs are necessary, the

global company also continues to hire, and has 24 openings listed at its headquarters.

James Goodman, a veteran executive at the American Dental Association in Chicago, took over as CEO of the 4,000-member North Carolina Dental Society. He succeeds Alex Parker, who retired last March after 16 years as executive director.

UNC Health will remain in-network for patients insured by Blue Cross and Blue Shield of North Carolina for another four years, extending a long-term relationship. The two sides will “continue collaboration on new ways to improve care and access for patients,” officials said.

The UNC System Board of Governors approved a policy change that will make it more complicated for state universities to move from one athletics conference to another. The board’s action comes amid an uncertain future for the ACC.

Fortrea, a $3 billion spinoff from Labcorp, agreed to sell two businesses to private equity firm Arsenal Capital Partners. Fortrea will receive an initial $295 million when the deal closes plus another $50 million upon hitting certain milestones.

Spiffy, the remote car cleaning service, acquired a Texas competitor, NuVinAir, for an undisclosed amount. NuVinAir offers vehicle cleaning technologies and products. Beyond cleaning, Spiffy provides preventative maintenance such as brake service, repairs, and advanced detailing solutions.

BioResource International, a developer of feed additives designed to aid animal gut health, was acquired by St. Louis-based Novus International, for an undisclosed amount. Novus is a global animal nutrition and health company.

BioResource, co-founded by father and son Jason Shih and Giles Shih in 1999, licenses technology developed at N.C. State University.

The Duke University board of trustees elected alumnus and NBA Commissioner Adam Silver to serve as the board’s next chair. He succeeds Laurene Sperling. Silver’s three-year term will begin July 1. He’s been a member of the board since 2015.

The Duke Herbarium, one of the largest herbaria in the country, will shut down and have its plants relocated over the next two or three years, according to The Chronicle student newspaper. It’s the second-largest private university herbarium in the U.S.

Town officials hope construction on North Carolina’s first Buc-ee’s will begin in June or July, although road improvements will be needed before the arrival of the mega-store on the 34-acre site. The Texasbased company plans a 120-gas pump operation and a 74,000-square foot store.

Syneos Health, a contract-research company acquired for $7 billion in 2023, dropped out of the state’s Job Development Investment Grant program that would have paid it $8.4 million. It cited a decline in staffing. It had 2,077 employees as of December.

The N.C. Community College System board endorsed the PropelNC plan, aimed at modernizing operations and funding of state’s 58 colleges. A main focus is to reward colleges that are producing more students earning certificates and other credentials, who are in increasing demand by industry. PropelNC calls for a $68.6 million increase in state funding for updating the “resource allocation process,” plus $24.4 million more to boost per college funding by 5.8%.

Advance Auto Parts struck an agreement with hedge fund operators Third Point and Saddle Point Management, which appointed three independent members to the company’s board of directors.

The Centennial Authority, which oversees PNC Arena, picked designers Gensler and local partner LS3P for the $300 million venue renovation. The project is slated to be finished by 2028. PNC Arena is home to the Carolina Hurricanes and N.C. State University men’s basketball team.

North Carolina State University closed its College of Education and Department of Psychology building, or Poe Hall, for the rest of the year. Last year, the building tested positive for PCBs, toxic chemicals that have been linked to cancer and are a possible carcinogen for humans.

Nowell’s Clothiers, which has been in business for 103 years, will close this spring. Siblings Matt, LuBet and Schooner Nowell are in their 70s.The business started in 1921 when Arthur Nowell and his cousin started Horton-Nowell Clothing.

Pennsylvania-based Equus Capital Partners, a real estate investment manager with an office here, acquired nine properties in the Charlotte and Greensboro markets totaling more than 1.4 million square feet for $124 million. The seller was Bahrain asset manager Investcorp. The portfolio is predominantly composed of single-tenant bulk distribution properties and is 100% leased to nine tenants.

Pin Point, the largest U.S. indoor pickleball and golf facility operator, will open a complex this summer with 16 pickleball courts, eight golf simulators, a chipping and putting area, a full-service bar, and a pro shop.

Saint Augustine University Interim President Marcus Burgess says the HBCU owes millions of dollars to contractors and the IRS. He called the situation “very dire.” WRAL News reported that the college

of about 1,200 undergrads did not pay employees on time.

Japanese pharmaceutical company Kyowa Kirin plans a manufacturing plant here that will cost $200 million and add 102 jobs. Kyowa Kirin expects to complete the project in four years. The average salary will be $91,496.

PlantSwitch, which has a technology to make plastics more compostable, raised $8 million from investor NexPoint Capital. The money will be used to launch PlantSwitch’s first commercial manufacturing facility in Sanford and expand its team.

London-based GKN Automotive is closing its Person County plant as it consolidates machining and assembly operations in Alamance County. Around half of the 475 employees will have the opportunity to transfer to the Alamance site.

The Body Shop International, a cosmetics distribution center, closed abruptly, laying off 63 workers. The London-based company filed for administration under United Kingdom insolvency laws, less than three months after it was bought by Aurelius Group.

Mission Hospital says it is the first in North Carolina to perform a new ablation strategy for treating atrial fibrillation, the most common type of arrhythmia affecting

as many as 7 million Americans. The new Farapulse PFA System increases the safety of the ablation procedure, officials said.

UNC Asheville’s $6 million budget shortfall is forcing is forcing faculty layoffs, early retirement and cuts to academic programs. UNCA’s sharp decline in enrollment is the leading cause of the financial crisis, says Chancellor Kimberly van Noort.

The Great Smoky Cannabis Co., operated by Qualla Enterprises, will open April 20, a holiday in marijuana culture. Members of the Eastern Band of Cherokee voted more than 2-to-1 in September 2023 in support of legalizing the possession and use of cannabis by people 21 and older. It would lead to North Carolina’s first legal purchases of marijuana for recreational use.

Alcohol

Commissioner George Mitchell Littlejohn was arrested on six felony charges and five misdemeanor charges related to misuse of Tribal funds. The commission was created in 2009 after voters approved a referendum to permit alcohol sales at Harrah’s Cherokee Casino.

Mayor Wes Brinegar and Town Manager Ryan Wilmouth resigned during the same meeting . Brinegar had been mayor since 2017. He quit over how a possible firing of Wilmouth was being handled.

A vacant, 42-acre site of the former Beacon Manufacturing blanket factory will become a multi-use park. A group of local investors want to revitalize the site that housed a sprawling plant that burned in a massive 2003 blaze. At its peak, the mill employed 2,300 workers. ■

The transportation industry’s importance to the N.C. economy has never been more evident.

The statistics show the importance of the transportation, shipping and logistics industry to the state of North Carolina. In 2022, North Carolina’s trucking system moved 478 million tons of freight, valued at $741 billion. From 2022 to 2050, freight moved by trucks in North Carolina is expected to increase 64% by weight and 97% by value.

In addition, North Carolina is served by 17 airports with cargo activity, as reported by the Bureau of Transportation Statistics. And with more than 3,200 miles of track, North Carolina boasts the largest consolidated rail system in the nation. From this rail network, one can ship directly to 22 different states.

Business North Carolina recently gathered leaders from the transportation, shipping and logistics industry to discuss trends and issues. Executive Editor Chris Roush moderated the roundtable. What follows is an edited transcript.

Photography by John Gessner

The discussion was sponsored by:

•Epes Transport Systems, Greensboro

•Guilford Technical Community College, Greensboro

•N.C. Department of Transportation, Greensboro

•N.C. Trucking Association, Raleigh

•Piedmont Triad International Airport, Greensboro

•South Atlantic\Wheelhouse Packaging, Winston-Salem

PECK: Our biggest issue is just strictly capacity. There’s more capacity than there is goods to move. So it’s a challenge for there to be profitable business and enough to keep drivers and companies busy. It’s a pretty broad statement, but I can’t think of anything bigger right now. And we have to reach a better equilibrium than what has been the last nine months.

BOSSONG: So our biggest challenge is that retail has shifted to just-in-time inventory. And as a result, there is a lot less demand for consumer goods right now. We do see that changing in the near term. And we do see a lot more volatility continuing whether it’s supply-chain oriented or demand oriented.

PENTZ: So my job is to teach students. What I read the most about is overcapacity in North Carolina but also globally. There’s too much production capability. There’s too much transportation capability. And I think that’s a big issue.

FOX: The funding in terms of being able to continue to build infrastructure and then maintain that infrastructure. We’re one of the fastest-growing states – people are going to continue to move here, businesses are going to continue to move here. And so we need to make sure that we have adequate funding to be able to maintain the good infrastructure we have already and continue to grow to keep pace with the growth we’re going to have.

BAKER: Mike already hit upon one of those being having enough funding to do what we all need to do. The state’s

commercial service airports combined have something like $300 billion or $400 billion worth of need. And then the other half of it is the planning. Right now the roadway system around here is unbelievable because of decades of planning. And we have assets at the airport that are very strong. But we need to think about 50 years out and 100 years out.

PECK: This business goes through cycles, ups and downs. We’ve been at a low trough point for quite a while. It can’t sustain much more but there are multiple ways you can reach that equilibrium. You can have capacity taken out of it, you can simply have more demand and more goods purchased, transported on trucks or rail or both. So any and all of those might solve it, but there is already some capacity exiting the market.

From a small trucking company standpoint, there’s a lot of independent contractors that are exiting. A lot of those

become company drivers. There’s also a lot of small companies that are being absorbed into larger companies. There’s a lot of M&A in it. Right now, the best way is to have enough demand where those goods are priced at a profitable margin for trucking companies or any transportation means.

BOSSONG: Everyone used to have a just-in-time philosophy of inventory management. When COVID came, we saw some significant supply chain issues. Everyone’s shifted into a just-in-case model. I’m going to make sure I have inventory squirreled away in various places in my supply chain. I think this is one of the reasons why we’re seeing overcapacity. Retailers are shifting toward just in time. As they shift, they’re eradicating their inventory and putting the pressure back on the manufacturers or saying we just don’t want this inventory. The consumer is used to instant gratification. They also have fewer dollars

to spend, for economic reasons. They’re saying, “I’m no longer going to buy a year’s worth of toilet paper. I’m going to buy this next week’s worth of toilet paper at the absolute last minute.” So they’re just in time as well. So there’s a lot of inventory that our consumer goods customers are managing their way down. As the just-in-time transition finishes, what we will see happen is everything will come back to equilibrium, and we’ll get back into growth mode.

YOUR COMMENT ON INFRASTRUCTURE, ARE WE NOT DOING ENOUGH RIGHT NOW IN THE STATE? WHAT NEEDS TO BE DONE?

FOX: The needs that have been identified far exceed the amount of funding that we have. And there’s virtually no part of the government where you’re ever going to be able to fully meet that necessarily. But we’d like to get a little closer, particularly given that we anticipate so much growth. Part of the reason that people like to live in the state and they’d like to come here is

we have generally good infrastructure. That’s because we planned ahead. And if we don’t continue doing that, then in 20 years, we’re going to have all this growth and people are going to be complaining that the infrastructure’s not caught up.

PECK: I think the praise is not high enough for what the state of North Carolina has done, as opposed to other states we travel in, for planning ahead years ago. Traveling through North Carolina is about as pleasant an experience for a commercial driver as any other state that we go to. Greensboro in particular is a standard by which access to highways and specifically for commercial vehicles is exactly the way you want it. I can name multiple cities and other states where you can’t share that kind of praise.

GREENBERG: I can echo that. In North Carolina, being a part of a federation of trucking associations, we have research arms that are tracking bottlenecks throughout the country. And North Carolina consistently ranks well. We want to keep our interstates off the

top 100 bad list. Right now, we’re doing well in that regard.

KAREN, ARE YOU SEEING A DEMAND FROM STUDENTS WHO WANT TO GET INTO THIS INDUSTRY?

PENTZ: I see an increased interest, particularly in the last year where students are calling. Some of them are in another career and they’re interested in supply chain because they hear about the potential to make money. Students are asking for a supply chain job because they want a career that will help them to have a family, be able to buy a home, and be able to live the life they want. That’s what they think supply chain can offer. We want to prepare them to be able to step into a job and do that.

KEVIN, OBVIOUSLY YOUR BUSINESS IS A LITTLE BIT DIFFERENT THAN TRUCKING. WHAT DO YOU SEE IN THE NEXT 10 OR 15 YEARS IN TERMS OF AIRLINE SHIPPING?

BAKER: I always say COVID was like throwing a bowling ball into a still pond on a Sunday morning. The ripples go on for the next 10 years. With COVID, what happens to the passenger traffic, it goes to near zero, right? In cargo, everybody all of a sudden was ordering even their food to be delivered by Amazon. So all of a sudden, all the cargo carriers went crazy. But now what you see over the last 16 to 18 months has been a 20% to 30% decline in the level of air cargo. What you’re seeing is a comparison to a spike year. So therefore, it looks a lot worse than it really would have been had you just stayed on a normal growth line.

GREENBERG: People started talking about supply chain at the Thanksgiving table. People running out of toilet paper started appreciating a little bit about what the industry does. I started joking with the tagline we were essential before essential was cool, right? You look at transportation and trucking – it’s been essential for a long time, over 85% of communities in North Carolina are solely reliant on trucking for getting their goods. I think over 96% of the freight by tonnage has moved on a truck. So we’ve always been essential. I think we’ve appreciated some of the promotion and some of the more widespread understanding at that Thanksgiving table about what transportation does for the state and for the greater economy.

BOSSONG: My son is a senior at Wake Forest, and he has a number of different avenues that he can take. He’s very interested in supply chain, as are a lot of his friends. It’s needed. It’s growing. And it’s not going to go away. AI is going to enable it and put it on steroids and really help it. I think it’s a great opportunity for young aspiring professionals.

BOSSONG: I look at it from a bigger picture on what we’re going to see happening with consumer goods and buyer behavior, not just in the transport arena. We’re going to see a lot more planning around supply chain and logistics. Where’s my inventory? And how do I optimize that? How do I make

sure I got the right inventory in the right place before emerging weather patterns? We’re also going to see AI kick in in product development of consumer goods. So we used to have a project that was going to go from concept to retail ready in 12 to 18 months. Now we’re going to start seeing things go from concept to retail ready in weeks. When that happens, it’s going to require a lot more agility on our part to make sure we’re ready because the consumer’s not going to shift in their mindset. They want it right now. We’re going to have to be very agile and have redundancy in place to make sure we can meet their emerging needs.

FOX: A close second to funding is technology. Technology in transportation has been changing ever since the invention of the wheel, and the method by which we power our transportation is clearly evolving. We will have to deal with that, and that also impacts the funding as well because the vast majority of the funding for transportation infrastructure in North Carolina is motor fuels tax. Even if you don’t have an electric car, you might have a hybrid and traditional gasoline-powered cars are getting more fuel efficient with the technology. So that source of revenue is declining. We have to account for that and work toward different methods of funding. Autonomous vehicles will come at some point, and we have to make sure we have the infrastructure to handle those. Can those vehicle’s sensors read the markings on the road?

I WAS IN SAN FRANCISCO IN SEPTEMBER AND SAW AUTONOMOUS DELIVERY CARS, AND IT FREAKED ME OUT. I WAS LIKE, WHERE’S THE DRIVER?

FOX: On a couple of different campuses, they have some little robots that will deliver pizza, and you just see him running around. We’ve got a couple of autonomous shuttles that travel around the state that run a fixed route, and people just get on and get off. And those are well accepted and working well. So I think the future is there.

BAKER: Think of George Jetson’s birthday. The show was set in 2062. And he was 40 years old. Supposedly, the birth date was July 31, 2022. He was flying all over the place. Think of

that drone that flies you around. It’s happening. They’re flying right now with people on a trial basis. It’s going to be the next big thing in this industry. It doesn’t necessarily replace the airplanes that fly you from New York to London, but it could replace the plane that’s going to fly you from New York to Boston.

GREENBERG: The move toward zero emission vehicles is definitely something that’s concerning the industry, in terms of what the government might be trying to mandate. California is kind of leading the way there. We saw a little bit of that in North Carolina in the last session that was resolved in the budget about whether the

OEMs are going to be required to sell a higher percentage of electric trucks.

I think everybody agrees that technology is interesting and exciting. It’s just not there yet. And we’re all concerned about the current freight recession that we’re in. And you can’t really add too many variables in there from a cost standpoint. I think a lot of people see these large trucking companies and think they must be deep pockets, whether it’s for building new roads and bridges or for producing cleaner air. But the reality is, you’ve got a lot of companies that spend $1 to make a nickel. That’s what you’re talking about in terms of operating ratios. And the pressure that you’re seeing to early adopt a technology that is just not viable for most use cases is stressful for the industry in terms of when you look at what an electric truck can do versus what a clean diesel engine can do.

Victor "Scott" Lamm

Robeson Community College’s dean of University Transfer, Health Sciences, and Business programs