7 minute read

FROM HIGH BROWTO HAY BARN

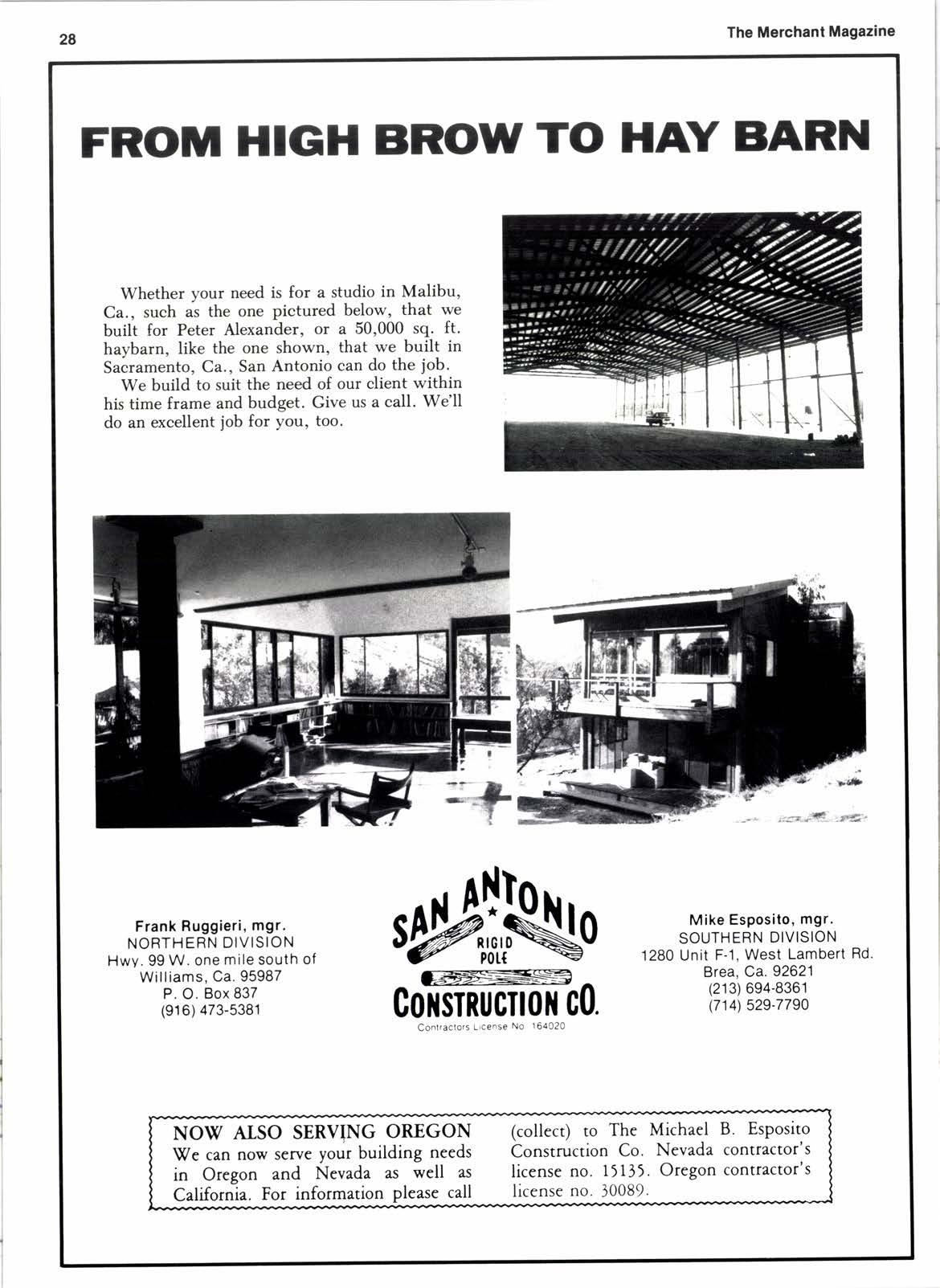

Whether your need is for a studio in Malibu, Ca., such as the one pictured below, that we builtfor Peter Alexander, or a 50,000 sq. ft. haybarn, like the one shown, that we built in Sacramento, Ca., San Antonio can do the job' We build to suit the need of our client within his time frame and budget. Give us a call' We'll do an excellent job for you, too.

Hardwood Facelilt for Plane

Hardwood is found in many breathtaking applications, often in exotic locations, but few of these offer the challenge of decorating the interior of an aircraft with beautiful woods.

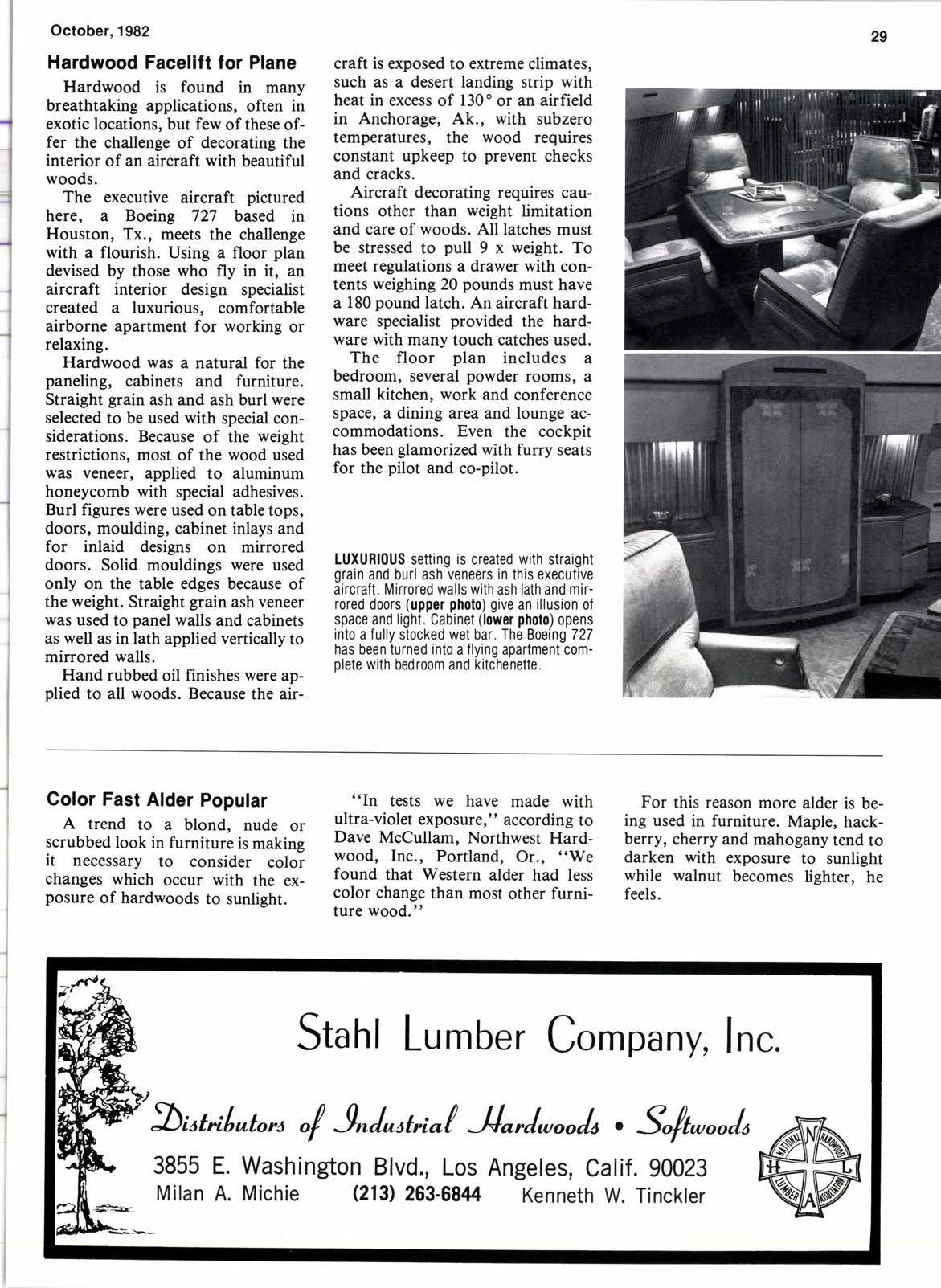

The executive aircraft pictured here, a Boeing 727 based in Houston, Tx., meets the challenge with a flourish. Using a floor plan devised by those who fly in it, an aircraft interior design specialist created a luxurious, comfortable airborne apartment for working or relaxing.

Hardwood was a natural for the paneling, cabinets and furniture. Straight grain ash and ash burl were selected to be used with special considerations. Because of the weight restrictions, most of the wood used was veneer, applied to aluminum honeycomb with special adhesives. Burl figures were used on table tops, doors, moulding, cabinet inlays and for inlaid designs on mirrored doors. Solid mouldings were used only on the table edges because of the weight. Straight grain ash veneer was used to panel walls and cabinets as well as in lath applied vertically to mirrored walls.

Hand rubbed oil finishes were applied to all woods. Because the air-

Color Fast Alder Popular

A trend to a blond, nude or scrubbed look in furniture is making it necessary to consider color changes which occur with the exposure of hardwoods to sunlight.

craft is exposed to extreme climates, such as a desert landing strip with heat in excess of 130o or an airfield in Anchorage, Ak., with subzero temperatures, the wood requires constant upkeep to prevent checks and cracks.

Aircraft decorating requires cautions other than weight limitation and care of woods. All latches must be stressed to pull 9 x weight. To meet regulations a drawer with contents weighing 20 pounds must have a 180 pound latch. An aircraft hardware specialist provided the hardware with many touch catches used.

The floor plan includes a bedroom, several powder rooms, a small kitchen, work and conference space, a dining area and lounge accommodations. Even the cockpit has been glamorized with furry seats for the pilot and co-pilot.

LUXURIOUS setting is created with straight grain and burl ash veneers in this executive aircraft. Mirrored walls with ash lath and mirrored doors (upper photo) give an illusion of space and light. Cabinet (lower photo) opens into a fully stocked wet bar. The Boeing 727 has been turned into a flying apartment complete with bedroom and kitchenette.

"In tests we have made with ultra-violet exposure," according to Dave McCullam, Northwest Hardwood, Inc., Portland, Or., "We found that Western alder had less color change than most other furniture wood."

For this reason more alder is being used in furniture. Maple, hackberry, cherry and mahogany tend to darken with exposure to sunlight while walnut becomes lighter, he feels.

Presidential Hardwood Floor

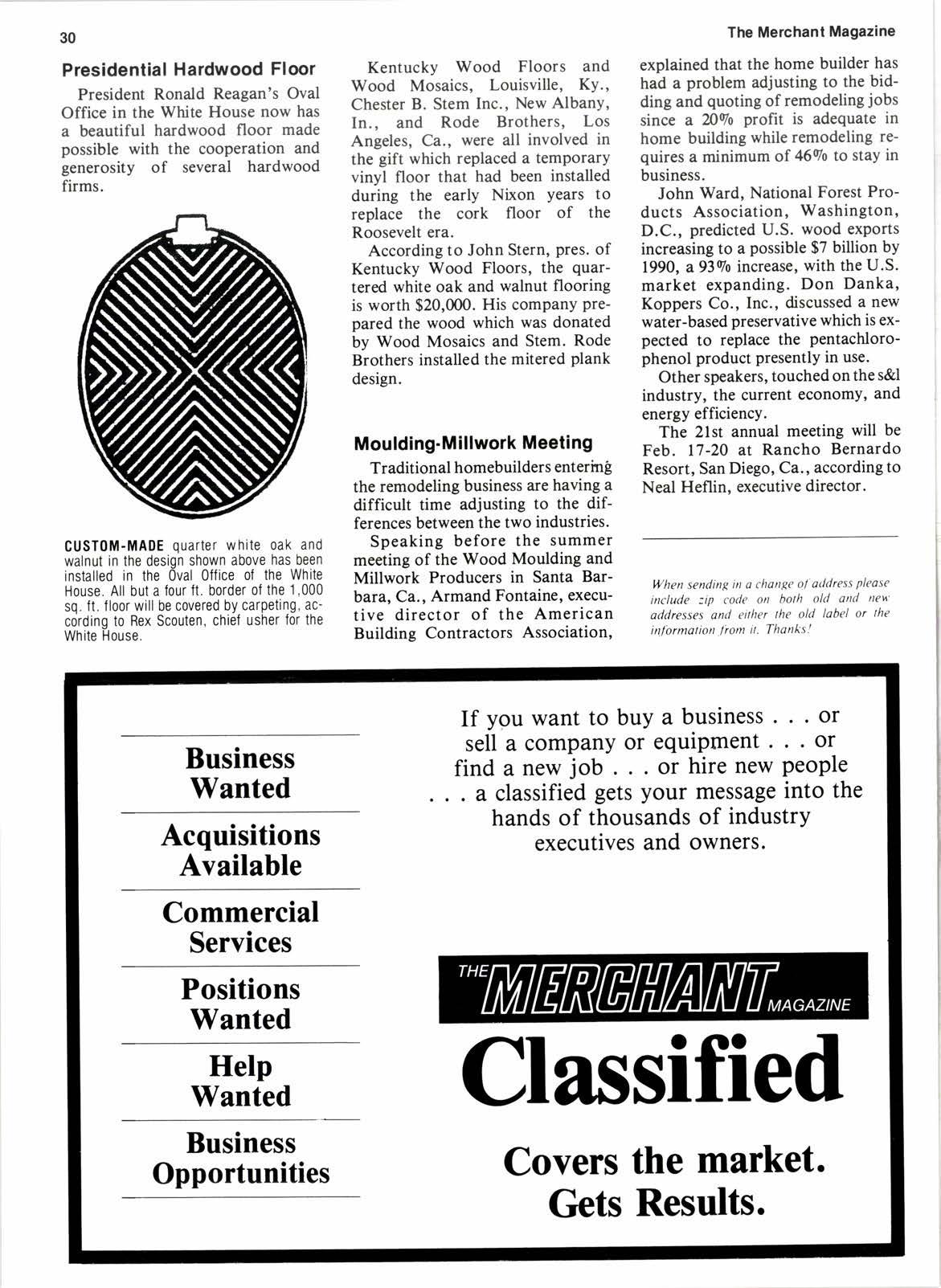

President Ronald Reagan's Oval Office in the White House now has a beautiful hardwood floor made possible with the cooperation and generosity of several hardwood firms.

Kentucky Wood Floors and Wood Mosaics, Louisville, KY., Chester B. Stem Inc., New Albany, In., and Rode Brothers, Los Angeles, Ca., were all involved in the gift which replaced a temporary vinyl floor that had been installed during the early Nixon years to replace the cork floor of the Roosevelt era.

According to John Stern, pres. of Kentucky Wood Floors, the quartered white oak and walnut flooring is worth $20,000. His company Prepared the wood which was donated by Wood Mosaics and Stem. Rode Brothers installed the mitered plank design.

Moulding-Millwork Meeting

Traditional homebuilders entering the remodeling business are having a difficult time adjusting to the differences between the two industries.

The Merchant Magazine explained that the home builder has had a problem adjusting to the bidding and quoting of remodeling jobs since a ?nslo profit is adequate in home building while remodeling requires a minimum of 46s/o to stay in business.

John Ward, National Forest Products Association, Washington' D.C., predicted U.S. wood exPorts increasing to a possible $7 billion by 1990, a 9390 increase, with the U.S. market expanding. Don Danka, Koppers Co., Inc., discussed a new water-based preservative which is expected to replace the pentachlorophenol product presentlY in use. Other speakers, touched on the s&l industry, the current economY, and energy efficiency.

The 2lst annual meeting will be Feb. 17-20 at Rancho Bernardo Resort, San Diego, Ca., according to Neal Heflin, executive director.

CUST0M-MADE quarter white oak and walnut in the desiqn shown above has been installed in the oval 0ffice of the White House. All but a four ft. border of the 1,000 sq. ft. floor will be covered by carpeting, according to Rex Scouten, chief usher l0r the White House.

Speaking before the summer meeting of the Wood Moulding and Millwork Producers in Santa Barbara, Ca., Armand Fontaine, executive director of the American Building Contractors Association,

- Ploning,Detoll,Ripping, Cul-to-Length

- LorgeLlbrory of Stondord& Custom Knives

- PreTolliedOok & Alder Bundles

- Fost Dellvery

- SlreomlinedWill Coll Service

Morlne Products X E

- Glue

- Morine Plprood: Teok, Fir, Mohogony, Cobin Sole

Plus Much More m E

- QuortersownOok, Honduros Mohogony

- Aromolic Cedor Shelving & Plywood

- {0" + wide 4/4 Wolnut, os long os stock losts AVAILABLE IN ALL POPULAR SIZES AND THICKNESSES

Home Center

(Continued from Page 22) volume of $1,186,000,000) and second place Mervyn's,

Other home centers who made their list were:

Handy City and Busy Beaver both tied for *9E.

Surveys nnd morket studies: ManY retailers are getting a handle on where they are positioned in their market place by surveying their customers in store and by phoning or mailing questionnaires to homes in their market area. They find it's best to have the preparation, administration and interpretation of these surveys done by an outside source such as a market research company, the local newspaper's research department or the research facilities available at most colleges and universities' Researchers suggest that the retailers survey their own employees, too-and be prepared for some surprises.

2Vo for cash: Taking the lead from the major gasoline companies who are now offering a three price option to drivers (full service, self serve credit card and self serve cash), one midwest building material chain is installing new cash registers that are programmed to deduct 290 for cash. They'll be promoting heavily in the ads.

(By the way, many consider R.H. Macy's to be the flrst discount house. Prior to World War II their slogan was 690 less for cash.)

Why Should The IRS Be An Heir?

A report just released by the Independent Business Institute, of Akron, Ohio, points out that with double-digit inflation, the value of a business doubles every 6 to 8 years from inflation alone; true growth speeds the increase in value, pushing the owner's estate into highly taxed brackets. Yet most estate-tax planning techniques do little to reduce taxes; they merely shift the burden to current expenses or create a gift-tax liability. Standard estate-planning arrangements simply are ineffective in a period of soaring inflation.

Gifting stock ownership of a business is a popular tactic. Between the owner and hiswife.$20,000 worth of stock can be given annually to an heir/successor. But if lhe business is worth, say $500,000, inflation pushes its value up far faster than it can be given away! At l5qo inflation, the owner would have to have a dozen heirs just to catch up with inflation. Gifting is fine as far as it goes; it just does not go far enough.

Another popular arrangement is to have one or more successor heirs buy the owner's stock. This means giving them a raise and letting them use the extra money to buy the stock. But stock purchases are not deductible; they are made with after tax dollars. For every one the owner gets, the IRS gets another. This becomes totally impractical for a business of any significant value.

Another version is to give some stock to the heir, then the owner gradually sells his own stock back to the business. But the objection is the same: Stock is always purchased with after-tax dollars. In this case, after the business taxation. Once again, for every dollar the owner gets (which is taxable), the IRS gets another.

Trusts form an extremely complex subject, but stripped to basics, a trust is a legal entity, just like a corporation. Gifting stock to a trust which will hold it on behalf of heirs was once a very popular scheme. But gifts to a trust are taxable. Further, the owner loses control of the business when 5l9o of the stock has gone into the trust. If he retains vicarious control by being the trust executor, thetrust itself has an estate-tax obligation. Just as bad, the trust must be irrevocable to be of value-and the laws are changeable! A trust can become a horrible trap as the laws change.

Preferred-stock schemes are common; generally they involve giving the heirs nonvoting common stock and then trading the owner's common for voting preferred. But the value follows the controlling vote; when the owner retains the vote its value will be taxed at estate time. Worse yet, the income on the preferred is taxed as a dividend-not deductible by the business, and highly taxed as received. This is merely an IRS enrichment scheme.

Insurance-funded buyouts come in many variations, but the insurance generally goes to pay taxes and eliminate a stockholder (the deceased). Years ago, this worked. But with l59o inflation, it is impractical. At 1590, everything doubles in value every 5.5 years: 4X in I I years, 8X in 16.5 years, l6X in 22 years. Who can afford to buy insurance to cover the taxes at those valuations? The only technique which appears (Please turn to page 37)