3 minute read

National wholesalers meeting

T HE survival, profitability and I continuity of small family-held and closely-held corporations was the theme for the keynoter's address at the recent 83rd annual meeting of the North American Wholesale Lumber Assn., held at Hot Springs, Va. KeYnoter Dr. Leon Danco, University Services Institute, Cleveland, Oh., sparked great interest among the wholesalers and provided a base to build uPon through the three daY convention, which drew more than 500 members and wives.

Other speakers included Roger Peterson, A.T. Kearny Co., Chicago, who discussed incentive compensation plans, and Gene Dunbar, Newark, Ca., who led the distribution yard segment through sales and time management. All speakers gave formal presentations in the morning and followed uP with informal "Sessions in the Sun" in the afternoon.

An interesting program was the Tuesday afternoon Hardwood Session which piovided delegates with a topflight panel ofhardwood manufacturers and distributors.

Many members are intere.sted in widening product lines into the hard-

Story at a Glance

Family-held concerns, incentive compensation plans, government affairs and the increasing sales of hardwoods bY NAWLA members highlight annual gathering . . . Paul S. Plant elected new president.

woods area and this type of session will be repeated in futuro meetings.

A government affairs session was led by government affairs chairman Dick Gittings of Denver, Co. Dick and other members of his committee had a very successful Washington, D.C., visit enroute to The Homestead meeting. In an organized visit, NAWLA members met with their respective legislators prior to the convention.

On the final day, June 19, an economic overview panel of NAWLA members provided delegates with projections of business activity by geographical location for the remainder of 1975. This well-received session was ably handled by Eric Canton of Minneapolis, Mn. Sessions for direct mill strippers was another popular program that was well attended by delegates.

The board moved on a number of items including a new categorY of membership. Service affiliate memberships are now open to firms that provide goods and services to wholesalers of forest products. They will be limited in number and will be non-voting. Such a membership will provide directory listings, bulletins, O&E Report subscription and other services.

Paul S. Plant, Ralph S. Plant Ltd., Vancouver, B.C.,was elected president. He is the third Canadian president in the history of the organization. James E. McGinnis, Jr., The McGinnis Lumber Co., Inc., Meridian, Ms., and Carleton Knight, Jr., The Lawrence R. McCoy & Co., Inc., Worcestet, Ma., were elected lst and 2nd v.p.s. respectively. James K. Bishop, PlunkettWebster Lumber Co., New Rochelle, N.Y., was re-elected treasurer.

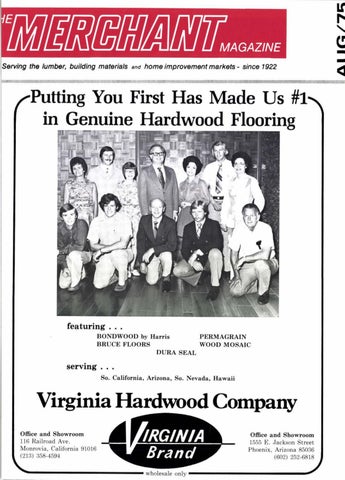

SMILES from the board of directors, just prior to NAWLA's 83rd annual meeting.

That sure, steady upturn in housing starts so lovingly foreseen by the experts this spring, pooped out in sltmmer '75 as still reluctant home buyers decided to stay put.

An unexpected clecline dropped the seasonally adjusted annual rate to I ,070,000 (lowest for any June silrce '46); at halftime '75, starts are down l/3rd from '74's lst half, which wasn't a boom period by a longshot. . bldg. permits moved up a piddling 1.5% from May.

A housing assn. spokesman called the figs. "very disconcerting; we had becn looking t'or another increase;" they may shave their I .2 million total start estimate for all af '7 5. .the major area of weakness in starts was in apt. construction.

Charging that Pres. Ford is getting bum advice, Nt'I. Assn. of Home Builders seeks an econontic summit on housirtg to develop ways to end the housing sag. . construction activity in June , however, maintained its improved level of recent mos.: June figs. for future construction were uD 13% over the same mo. in '74. .'.

Home mortgage interest rates rose in June after declining for 5 mos., a possibly spooky signal of things to come. .consumer confidence, says the U. of Michigan, has rebounded, but only to a point that is one of the lowest levels of the '70s.

The prime rate (the bank's minimum interest charge on corp. loans and the basis for all other lending rates) moved up to 7/27o, as the Federal Reserve topk steps to combat further inflation; some experts averred that it was a bump, not the start of a new hillclimb rn rates.

Reports from the recent Chicago Housewares Show tell of optimistic exhibitors (not surpris- ing) but also of wary retailers who plan to keep svelte inventories, anticipating continued consumer hesitancy regarding housewares.