Economic Dashboard

US Manufacturing Backtracks Again in November PMI For Italian and the UK Manufacturing Activity Pushes Into Growth Territory U.S. manufacturing activity contracted for the ninth straight month in November, according to the latest ISM® Manufacturing PMI Report. Despite a modest production boost, declining orders and continued labor pullbacks point to ongoing uncertainty for the sector. The Manufacturing PMI fell to 48.2 percent, down 0.5 percentage points from October’s 48.7 percent. While the broader U.S. economy marked its 67th consecutive month of growth (excluding the April 2020 pandemic dip), the factory sector remains mired in prolonged contraction, driven by uneven demand and trade-related headwinds. The New Orders Index slid two points to 47.4 percent, marking its third consecutive month of decline following a brief uptick in August. In contrast, production rebounded into growth territory, with the Production Index rising 3.2 points to 51.4 percent, buoyed by residual strength in backlogs from earlier in the fall. Labor conditions continued to deteriorate. The Employment Index dropped to 44.0 percent, down 2 points from October, as most firms maintained cautious staffing strategies. According to survey feedback, 67 percent of panelists reported holding headcounts steady or actively reducing staff. Supplier deliveries accelerated, as the Supplier Deliveries Index fell to 49.3 percent, down from 54.2 percent in October. This marks a return to faster delivery performance after three months of slower lead times. Inventory levels showed signs of stabilization, with

the Inventories Index climbing 3.1 points to 48.9 percent, still in contraction but at a more moderate pace. Export and import activity improved slightly. The New Export Orders Index rose to 46.2 percent, while the Imports Index moved up to 48.9 percent. Both figures are still below the neutral 50 mark but trending in a positive direction. New Orders and Backlog of Orders moved lower, outweighing modest gains in export orders and customers’ inventories. The latter remains in “too low” territory, a signal typically seen as positive for future production activity.

COMMODITIES UP IN PRICE: Aluminum (22); Copper (3); Copper Products (3); Corn; Corrugate; Electrical Components (8); Electronic Components; Metal-Based Products; Steel* (8); Steel — Stainless (7); and Steel Products (7). DOWN IN PRICE: Polypropylene Resin; and Steel* (2). IN SHORT SUPPLY: Electrical Components (3); Electronic Components (7); Labor; Rare Earth Magnets; and Semiconductors. NOTE: The number of consecutive months the commodity is listed is indicated after each item. Asterisk denotes items reported both up and down in price.

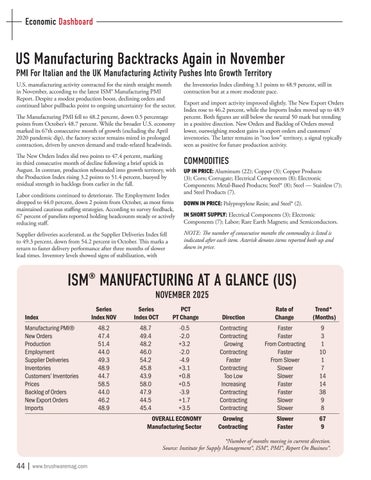

ISM® MANUFACTURING AT A GLANCE (US) NOVEMBER 2025

Index Manufacturing PMI® New Orders Production Employment Supplier Deliveries Inventories Customers’ Inventories Prices Backlog of Orders New Export Orders Imports

Series Index NOV

Series Index OCT

48.2 47.4 51.4 44.0 49.3 48.9 44.7 58.5 44.0 46.2 48.9

48.7 49.4 48.2 46.0 54.2 45.8 43.9 58.0 47.9 44.5 45.4

PCT PT Change Direction -0.5 -2.0 +3.2 -2.0 -4.9 +3.1 +0.8 +0.5 -3.9 +1.7 +3.5

OVERALL ECONOMY Manufacturing Sector

Rate of Change

Trend* (Months)

Contracting Contracting Growing Contracting Faster Contracting Too Low Increasing Contracting Contracting Contracting

Faster Faster From Contracting Faster From Slower Slower Slower Faster Faster Slower Slower

9 3 1 10 1 7 14 14 38 9 8

Growing Contracting

Slower Faster

67 9

*Number of months moving in current direction. Source: Institute for Supply Management®, ISM®, PMI®, Report On Business®.

44 | www.brushwaremag.com