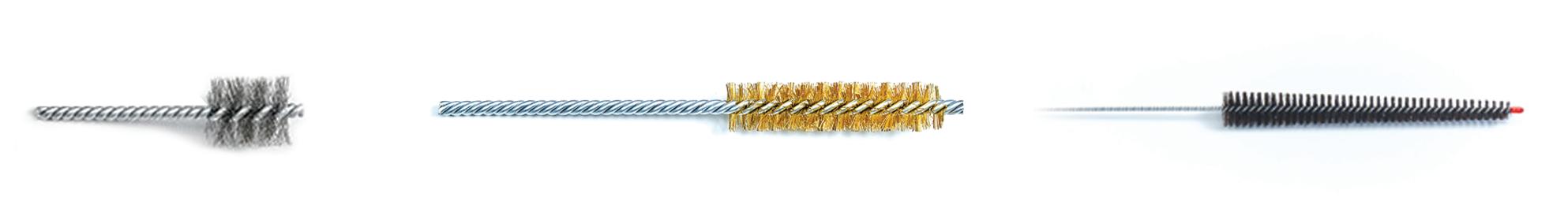

It all started a century ago in a small store in Cleveland, Ohio. From this humble beginning we have grown to become the largest U.S. manufacturer of twisted-wire brushes.

Mill-Rose has set the standard for quality, performance, and innovation in brush technology for the past 100 years. We design, engineer, and manufacture standard and custom brushes in any quantity, and our expertise is second-to-none. Choose from thousands of standard and not-so-standard sizes and shapes. Call or visit MillRose.com.

When the FEIBP preview issue goes into production, I know fall is right around the corner. Summer offers plenty of opportunities for family time and an escape from the school, sports and activity regimen. And yes, while most folks are enjoying golf, pickleball or lake time, I find as much time as I can to be on the croquet court. So, I quite enjoy summer, but at some point, it does feel right to go back to the full routine, refreshed and ready to finish out the year strong.

And from that perspective, we are excited for the 63rd FEIBP Congress in Belfast, Northern Ireland. While I am disappointed that I cannot personally attend, we will have our correspondent Katharina Goldbeck-Hörz covering the event and I look forward to hearing about the topics covered. Admittedly, I like to see all of the submissions for the innovation awards. After all, actual brush products are what this magazine is all about.

The full Congress preview from Gwyneth Bowen starts on page 22 and offers a travel guide for Belfast with local tips and you’ll also find the profiles for both keynote speakers and the full event schedule.

The issue also offers a deep dive into the wire filaments segment with a two-part question-and-answer piece that includes insights from five of the industry’s key players. The piece from Bob Lawrence starts on page 28 and targets wire brush manufacturers in Part I and wire filament suppliers for Part II.

Brushware – a bi-monthly publication edited for key personnel in the brush, roller, broom, mop and applicator industry. Published continuously through the years, the one publication that is the spokesman for the brush and allied industries: 1898-1923, called Brooms, Brushes & Handles; 1924-1947, called Brooms, Brushes & Mops, 1948-today, called Brushware

PUBLICATION OFFICE

Brushware Magazine

Goodwin World Media LLC P.O. Box 7093

Overland Park, KS 66207 Tel: 913-636-7231

GENERAL MANAGER

Susan Goodwin info.brushware@goodwinworldmedia.com

PUBLISHER

Dylan Goodwin dylan.goodwin@goodwinworldmedia.com

EDITOR

Gwyneth Bowen news.brushware@goodwinworldmedia.com

GRAPHIC DESIGNER

Elizabeth Goodwin

CORRESPONDENTS

Bob Lawrence

Phillip M. Perry

Katharina Goldbeck-Hörz

We are wrapping up our fifth year as the owners of Brushware, so I did indulge and participated in the 125th Anniversary Interview series on page 18. It’s always nice to assess progress and while certain projects for the magazine may be off schedule, others have exceeded expectations. The one thing I can say for certain is that thanks to our digital edition and social channels — Brushware has likely never had a bigger total readership that it does today. All indications are that we’ll continue to grow and better serve the brush community.

For attendees of the FEIBP Congress and readers across the world, I hope you enjoy this edition and as always I invite your feedback and questions. Have a wonderful fall season!

Dylan Goodwin | Publisher dylan.goodwin@goodwinworldmedia.comMark E. Battersby

Lisa Anderson

Brushware (ISSN 00072710) (Canadian Sales Agreement Number 0650153) is published bimonthly by Goodwin World Media LLC, P.O. Box 7093, Overland Park, KS 66207 USA. Periodical postage paid at Overland Park, KS 66207 and at additional mailing offices. Printed in the USA.

Subscription: $95/year for US, Canada and Mexico. All other countries $210/year.

POSTMASTER – Send address changes to Brushware Magazine, P.O. Box 7093, Overland Park, KS 66207. Copyright 2023. All rights reserved. Materials in this publication may not be reproduced in any form without permission. Requests for permission should be addressed to: Brushware Magazine, P.O. Box 7093, Overland Park, KS 66207.

the must-attend event for brushware professionals in 2024.

Borghi Spa provides you with the best machine solutions for the broom and brush industry, with a widely different service approach. Flexibility and Versatility, combined with Quality and Reliability at your disposal since more than 75 years.

Eager to live an unforgettable experience?

Borghi Spa is waiting for you at World Brush Expo, May 22/24, 2024 - Bologna, Italy

THE BRAND NEW TRADE FAIR FOR THE BRUSH, PAINTBRUSH, PAINT ROLLER, ORAL CARE AND MOP INDUSTRIES

MAY 22-24, 2024

BOLOGNA | ITALY

The room block is now open for the 107th Annual ABMA Convention to be held at the Omni Resort in picturesque Amelia Island, Florida, March 19-22, 2024. This year the convention will follow a Tuesday-Friday pattern instead of the usual Wednesday-Saturday schedule.

ABMA attendees are eligible for a discounted group rate of $349 per night, which will be available three days before and after the convention dates, allowing guests to extend their stay and enjoy everything that Amelia Island has to offer. To secure your reservation at the discounted group rate, it is recommended that attendees book early.

Guests at the Omni Resort will enjoy premium amenities and oceanfront views from their balconies. The resort’s open-air breezeway provides a breathtaking vista of the expansive tree canopy and mesmerizing sunsets, making it the perfect place to unwind after a day of networking and learning.

All rooms feature balconies facing the ocean and are a delightful place to welcome an energizing sunrise during breakfast or sip an evening cocktail while enjoying the sweeping views. The beautiful natural surroundings are everpresent, including the views of the expansive tree canopy and sunset from the open-air breezeway that leads you to your guest room.

RESERVATION LINK: https://www.omnihotels. com/hotels/amelia-island/meetings/abma-annualconference-2024-03172024

Perlon® – The Filament Company – headquartered in Munderkingen, Germany, which specializes in the manufacture of synthetic filaments for the paper, technical textile, personal brush and dental industry announced the purchase of Shaun Filaments based in Goa, India Shaun Filaments is a leading Indian producer of different types of filaments mainly for the Asian market.

The acquisition announced in June allows Perlon® to expand its Asian presence and market leadership in the following business segments: paper machine clothing, advanced technical textiles, technical brush filaments and personal care. All employees and production lines located in the Shaun Filaments factory in Goa are part of the purchase.

“With the acquisition of Shaun Filaments, we are expanding our presence in the Asian market and creating a company that is geared towards the global filament industry of the future and we are expanding our market leadership in all segments. Shaun Filaments is a perfect fit for the Perlon® Group with its long-term experience, strong reputation and knowledge in the production of filaments for the Asian market,” says Florian Kisling, CEO of Perlon®.

Perlon® is the world’s leading manufacturer of synthetic filaments and generates annual sales of over 160 million Euro, employs more than 850 people and operates from locations in Germany, Poland, USA and China.

To learn more about Perlon, visit www.perlon.com.

The filament winding experts from Roth Composite Machinery traveled to Paris for JEC World to present an innovative automation concept for reliable fiber changes as well as the new special winding software “µRoWin.” The composites industry event was held April 25-27, 2023 and Roth Composite Machinery attended with an international team of experts from Germany, the U.S., Korea and China and presented its service portfolio as well as its latest innovations.

The new splicing unit, which resulted from the company’s own development work, is an innovative automation concept in which compressed air is used to swirl the individual fibers for all fiber strands in parallel to create a secure connection with the changeable fibers. Until now, the rovings have either been knotted or spliced by hand when they are changed — a process that is not only time-consuming but also prone to errors. The automated process, together with the corresponding machine, can execute the fiber-changing process quickly and safely.

In addition, automation, safety and time-saving were highlighted for the new winding software µRoWin at JEC World. The software solution for generating programs for the machine movement has been specially adapted to the high-level filament winding machines of Roth Composite Machinery. It offers a fluent workflow and allows all relevant input parameters to be checked at any time. The transparency and precision of the algorithms anchored in the software ensures the highest placement accuracy of the fibers — and is thus an important instrument for quality assurance.

The powerful and user-friendly special software not only optimizes the winding process but also ensures maximum efficiency beforehand: the structure can be designed and optimized via 3D simulation. This “digital twin” can then be transferred to the machine as a control code simply by pressing a button.

Learn more about Roth Composite Machinery at ww.roth-composite-machinery.com.

Nexstep Commercial Products, Exclusive Licensee of O-Cedar, has announced the purchase of the assets of Cedar Creek Cleaning Products in Winchester, Virginia. Cedar Creek Cleaning Products developed and manufactured cleaning tools in both the commercial and retail markets for over 65 years. Nexstep hopes to continue its founding principle; to focus on the health, comfort and efficiency of the people using the cleaning tools, maximizing their performance while minimizing their efforts.

Todd Leventhal, President of Nexstep Commercial Products, says this acquisition will strengthen Nexstep’s presence in the growing competitive market. Nexstep looks forward to serving all of Cedar Creek Cleaning Products’ customers and offering them the opportunity to expand their product assortment with Nexstep’s full line of commercial-grade cleaning solutions.

ISSA Show North America 2023 is open for industry-wide registration. Industry members are encouraged to register now for the event taking place November 13-16, 2023, at the Mandalay Bay Convention Center in Las Vegas, Nevada.

“ISSA Show North America brings the industry together like no other cleaning industry event,” says ISSA Executive Director John Barrett. “It’s the premiere place to learn, network, celebrate, discover new products, and ultimately guide the cleaning industry to a brighter future.”

ISSA Show North America 2023 will host over 70 sessions, providing resources for attendees to stay up to date on the latest trends and solutions for cleaning, disinfection, and infection prevention and for pursuing accreditation, training, and certification. The event will feature industry leaders and new speakers covering the industry’s most pressing issues.

To learn more about the 2023 ISSA Show, visit www.issashow.com.

For more than 80 years, Celanese Filaments, formerly owned by Dupont, has been recognized as a leader in innovative synthetic filaments that enable brush manufacturers to address emerging trends and meet evolving consumer expectations.

The most important component of a toothbrush lies in the bristle. With outstanding industry expertise accumulated over the years, coupled with our proven technologies, Celanese Filaments is dedicated to the oral care brush industry with our nylon solutions under the brand names of Celanese Tynex®(nylon 612) and Celanese Herox®(nylon 610). Leading toothbrush brands and manufacturers are able to produce very high quality brushes with a balance of consistent quality, wear performance and unmatched productivities in tufting and end-rounding by using Celanese filaments. As consumer trends in toothbrush are increasingly focused on the six major areas of 1) Visual Attractiveness, 2) Interdental Cleaning, 3) Plaque Removal, 4) Gum Comfort, 5) Gingival Cleaning and 6) Anti-microbial within the filaments, Celanese Filaments has been working closely with the leading global brands in oral care as well as toothbrush manufacturers by fulfilling these needs with our broad range of innovative products in the portfolio

Celanese Natrafil® filaments, a pioneering filament from Celanese’ s unique polyester based material, contain proprietary texturizing additives that create a structured surface that mimics animal hair. Natrafil® filaments offer a synthetic alternative to animal hair in premium cosmetic powder brushes with more consistency in the bristle while maintaining the touch-and-feel of premium animal hair. Studies have shown that brushes made with Natrafil® filaments have equal to superior pickup and release performance versus brushes made with animal hair.

Like most industries, steel manufacturers are always looking forsquare feet of metal through the mill, cleaned and coated faster

than ever before. To accomplish this, steel mills are using more aggressive cleaning solutions. The problem is that the cleaning brushes typically used were quickly degrading because many plastics used in the brush filaments can’t handle the solutions of the extreme PH. The technical resources at Celanese Filaments were able to help solve the problem by adding stabilizers to one of our nylon polymer formulations, effectively extending the pH range where these filaments can be used. Brushes made with our filaments deliver cleaning performance for a longer life, helping over an improved service life, helping steel manufactures to achieve higher productivity.

Another need voiced by customers is higher aggressiveness in metal finishing applications. Celanese Tynex® A filaments, a family of ceramic grit-containing filaments, was developed to meet this need.

When manufacturers began changing their paints to water-based formulations, more people began using paintbrushes made with synthetic bristles because the hog bristles traditionally used in paintbrushes lost stiffness in water-based paints. Synthetics such as Celanese Tynex®, Celanese Chinex® and Celanese Orel® brand filaments quickly became popular choices. As paint manufacturers continue to improve their water-based formulations by reducing volatile organic compound (VOC) content, increasing solid loadings and decreasing drying times, there is an ongoing need for increasingly higher performing brushes. To meet this need, Celanese Filaments continues to innovate and help customize solutions. For example, we developed filaments with stiffer crosssection that can push higher viscosity paints more efficiently. We also changed the shapes of the filaments so that they not only pick up more paint from the can for faster application, but are easier to clean.

The Mill-Rose Company held the 63rd annual Victor F. Miller Memorial Golf Tournament at Shaker Heights Country Club in Cleveland, Ohio, on Thursday, June 22, 2023. Brush manufacturers and suppliers from around the world gathered for the annual event honoring The Mill-Rose Company’s past president, Victor F. Miller.

The golf event serves as the culmination of activities the week before where brush company representatives renew alliances, and discuss business trends and opportunities for the brush manufacturing industry. Brushes manufactured by these companies are used in virtually every type of industry around the world. Applications include makeup/mascara brushes, hair brushes, floor sweeping and polishing brushes, gun cleaning brushes, car wash brushes, copier toner brushes, brooms, paint brushes and special brushes used in the medical field. The weather was perfect for the golfing event. The skills of the golfers ranged from novice to near professional, however, a good time was enjoyed by all. Prizes were awarded to golfers for outstanding performance including:

• First Place, Low Gross – Dan Kirtz (Malish Corp)

• Second Place, Low Gross – Jim Benjamin (Precision Brush)

• Third Place, Low Gross – Tie Breaker between Chris Monahan (Brush Fibers) and RJ Lindstrom (Zephyr Manufacturing) going to Chris Monahan

• Closest to the Pin – Dan Kirtz (Malish Corp)

• Longest Putt, Ian “Lord” Moss (Brush Fibers)

• Longest Drive, RJ Lindstrom (Zephyr Manufacturing)

• Paul M Miller Wolf Championship, First Place, Chris Monahan (Brush Fibers)

Last but not least, an award was given to Bart Simon, previously of Phillips Brush, for his dedication to the event. It was noted that his support of the Victor F. Miller Annual Golf event began in 1973, spanning 50 years!

“Tradition” was the keynote speech delivered by host Gregory Miller, stressing the importance of association activities like the Victor F. Miller golf event.

“I’m always impressed by the support and camaraderie at our events that strengthen bonds and create opportunities within our great industry. Look within your own organizations and push the next generation to get involved in association and brush-related activities,” says Miller.

To learn more about The Mill-Rose Company, visit www.millrose.com.

Chip Preston, Terry Hogan, Jim Benjamin and Scott Enchelmaier Scott Enchelmaier and Greg MillerCottam Director, Ben Cottam, recently attended an event at the House of Lords as a guest of BIPC North East. The Business & Intellectual Property Centre is operated by the British Library and offers support to small businesses in the U.K. Cottam was invited to attend after benefitting from the BIPC’s advice on intellectual property when developing their rapid lock system, an innovative assembly solution that is now used across the company’s broom range.

The event was part of the launch of the Democratising Entrepreneurship 2.0 report, which looks at the impact the BIPC national network has had over a three-year period. During the event, Cottam was given the opportunity to display their weir brush system. The water industry has been criticized by the media in recent months, particularly around the handling of wastewater overflowing into U.K. rivers and seas.

With cleaner water and operational efficiency on the agenda for many water companies, weir systems and in particular the cleanliness of weir systems is often overlooked.

The Cottam wastewater brush (manufactured at Cottam sites in Hebburn, Tyne and Wear) is used to clean settlement tanks, which results in improved performance and reduced downtime.

Zahn Unique Brushes announces BRISLEX, a groundbreaking synthetic bristle that revolutionizes the industry. BRISLEX offers an innovative alternative to natural bristle brushes, delivering exceptional quality and performance for artists, hobbyists, and professionals alike. Brislex features a 100% synthetic filament composition available in various profiles, diameters, and color shades, meticulously designed to replicate the look and feel of natural bristle. This remarkable synthetic bristle offers unparalleled advantages

SUPERIOR PAINT UPTAKE: BRISLEX exhibits the highest paint uptake, ensuring smooth and efficient application, resulting in precise and vibrant artwork.

EXCELLENT PAINT HOLDING CAPACITY: With its exceptional ability to hold paint without dripping, BRISLEX guarantees a controlled and mess-free painting experience, allowing users to focus on their creative process.

HIGH ELASTICITY AND SHAPE RETENTION: The bristles’ remarkable elasticity and shape retention ensure consistent performance over time, providing users with reliable tools that maintain their integrity even after extensive use.

NO SWELLING: Unlike natural bristle brushes, BRISLEX remains unaffected by swelling, preserving its shape and quality throughout its lifespan.

CONSISTENT FILAMENT QUALITY: BRISLEX guarantees consistent filament quality, offering artists peace of mind and reliable results with every stroke.

SOLVENT RESISTANCE: BRISLEX is resistant to most solvents, making it versatile and compatible with a wide range of paint mediums and techniques.

Zahn Pinsel’s BRISLEX is the perfect alternative to natural bristle brushes, providing artists with a reliable and consistent painting experience. Discover more about the benefits and features of BRISLEX synthetic bristle by visiting https://www.zahn-pinsel.com/en/current/news/ vegan-synthetic-bristle-brislex.

Among the remarkable products in the Brislex range is the BRISLEX Spalter Brush, available in Series 913142 Nr. 3/4" – 5". Designed for priming, varnishing and a variety of painting applications, the Spalter Brush ensures excellent paint uptake and outstanding painting performance. Its extensive size range makes it suitable for diverse surfaces and projects.

Additionally, the BRISLEX Bended Brush from Series 605059 offers a unique design with a bended ferrule, providing users with enhanced comfort and control. The brush’s ergonomic shape allows for easy painting in hard-to-reach areas, enabling smooth and precise brushwork.

For stencil enthusiasts, BRISLEX offers the Stencil Brushes in Series 91003, providing a vegan synthetic alternative to traditional natural bristle stencil brushes. These brushes, made with BRISLEX filament, deliver exceptional painting results and offer an excellent price-to-quality ratio. Crafted with meticulous attention to detail, these quality brushes are proudly made in Germany, adhering to the highest standards of craftsmanship.

All BRISLEX brushes feature ergonomically shaped handles made of FSC®-certified birch wood, providing a comfortable and balanced grip during extended painting sessions. Zahn Pinsel also offers the option to customize handles with your brand logo, allowing for a personalized touch (minimum order quantity of 120 pieces per size). Various packaging options are also available to cater to individual point-of-sale requirements.

For more information about Zahn Unique Brushes, visit www.zahn-pinsel.com.

The ABMA’s new three-part webinar series “Good Jobs Enable Core Innovation And Supply-Chain Partnering” kicked off in August, but still has two sessions upcoming in October and February. The webinar series featuring esteemed presenter Bruce Merrifield examines critical strategies that empower companies to navigate the challenges of the ever-evolving manufacturing landscape.

Bradshaw Home, a leading designer and marketer of kitchenware, bakeware, cookware, food storage and cleaning products, with brands including GoodCook®, Casabella® and Evercare® announced today it will open a 1.2 million sq. ft. distribution center in Effingham County, Georgia. The new facility, located in Savannah Portside International Park in Bloomingdale, GA, was selected for its proximity to the Savannah port and access to Georgia’s logistics infrastructure. The facility will open in November and have an immediate impact on Bradshaw’s ability to better serve retail customers.

“More than 75% of Bradshaw’s customers are east of the Rocky Mountains, 55% are east of the Mississippi River,” says Bradshaw CEO Tony Hair. “By opening an east coast location, we expand our distribution network to more effectively service customers while significantly reducing freight miles to transport our products – a win-win for both retailers and the environment.”

Bradshaw is making a significant investment in infrastructure while partnering alongside NFI, a leading provider of North American supply chain solutions, to manage operations inside the facility. “The exponential growth of the Savannah port market has been remarkable,” says William Mahoney, Chief Commercial Officer at NFI. “East Coast ports enable shippers to diversify their port strategy and reduce the shipping time to major metropolitan areas. Our relentless dedication to efficiency, innovation, and customer service has enabled us to partner and develop solutions with customers like Bradshaw Home.”

The manufacturing industry is no stranger to continuous expansion as businesses seek growth through increasing product portfolios and customer bases. However, the rising complexity and diminishing incremental profits in this pursuit require a reevaluation. With this in mind, leading companies like Coca-Cola have made strategic decisions to downsize marginal SKUs and customers to realign focus on their core strengths and better-performing brands.

The first webinar of the series, titled “More From Your Core,” was held on August 8, 2023, and focused on insights into optimizing core competencies to drive innovation and growth in their businesses.

For the upcoming second webinar, manufacturers are seeking ways to simultaneously address downsizing, upgrading and renewal and that means attracting, engaging and retaining the best employees. Merriman offers his guidance on the task with “How To Migrate To A High-Performance, All-Win, Good Jobs Company,” which will be held on Thursday, October 26, 2023, at 1:00 pm (ET). As a renowned consultant in the world of independent-distribution channels, Merriman will share the “Good Jobs Strategy.” This system-thinking solution, pioneered by FedEx in 1973, emphasizes the value of prioritizing people, service, and profits to achieve operational excellence and flexibility. Costco’s successful adoption of this strategy since its inception in 1983 further underscores its relevance and effectiveness.

To conclude the series, with the world and the U.S. economies continually facing “perma-crises,” the need for agility becomes paramount. The third webinar, “Agility and Earned, Partnering-Possibilities With Gazelles,” will be conducted on Tuesday, February 6, 2024, at 2:00 pm (ET). Participants will explore how companies can adapt swiftly, transforming challenges into opportunities for growth and success. Additionally, forging partnerships with the top five percent of the best supply-chain players, also known as “Gazelles,” is an effective approach to enhancing a company’s competitive advantage and market position.

The ABMA encourages participants to take advantage of this unique opportunity to learn from Bruce Merrifield’s invaluable insights and practical wisdom.

WEBINAR LINK:

https://abma.org/em_case_study/good-jobs-enable-core-innovation-andsupply-chain-partnering/

It’s rare to find employees who work 25 years at the same company, especially in the volatile software industry. That’s why Global Shop Solutions, a leading provider of ERP software for manufacturers, is proud to announce the 25th anniversary of Mike Melzer, Vice President of Operations & Service.

On August 10, 2023, the breakroom at Monahan Partners, Inc. turned into a family-filled jubilation as colleagues, friends, and loved ones gathered to commemorate a remarkable milestone in one employee's journey. Cory Humphrey, a dedicated and steadfast member of the Monahan family, was met with an unexpected surprise. Humphrey's parents, children, wife and coworkers were all on hand to celebrate his 25-year anniversary with Monahan.

Hospeco Brands Group, a full-line manufacturer of cleaning and protection products to serve the janitorial, industrial supply, foodservice, healthcare and hospitality markets, has promoted Brett Snow to the new position of senior director corporate accounts — janitorial/sanitary and foodservice. Snow, a 30-year jan/san sales veteran, will be responsible for growing highprofile food service accounts. Snow has extensive experience in national accounts, crisscrossing the continent and developing connections that result in mutually beneficial relationships. In his previous role as Hospeco’s corporate account manager for jan/san, he routinely fostered relationships resulting in exponential sales growth. This includes increasing overall sales of existing products with key customers as well as driving new product adaptation — growing account penetration from a handful of SKUs to hundreds.

“At Global Shop Solutions headquarters, Mike is often the first to arrive and the last to leave,” says Dusty Alexander, President and CEO of Global Shop Solutions. “We deeply appreciate his energy, integrity, loyalty, and knack for addressing our customers’ most challenging issues. As I’ve often said during our numerous customer visits together, standing alongside Mike makes me feel 10 feet tall – together, we can tackle anything!"

Melzer earned his Engineering degree at the Colorado School of Mines and joined Global Shop Solutions shortly thereafter. Starting out in service and consulting, he spent much of his time on the road converting customers to the latest version of Global Shop Solutions ERP software. The experience taught Melzer how to build good working relationships with customers and brainstorm better ways to get things done. It also paved the way for what was to come.

“This company is exceptional to work for,” says Melzer. “I love traveling, helping people solve problems, teaching customers and coaching employees. Most of all, Global Shop Solutions is a great group of people. We have a world-class ERP product that I am proud of, but what separates us from the competition is our people.”

The ABMA has announced the loss of Jill C. Shinners, 58, who died peacefully on July 12, 2023, surrounded by her loving family. She was born in Holyoke in 1964 and lived in West Springfield, Massachusetts, all her life. She was a 1982 graduate of West Springfield High School and received her bachelor’s degree in 1986 from Marist College in New York City. She is the third generation of her family to become president of the Pioneer Packaging Company in Chicopee, Massachusetts.

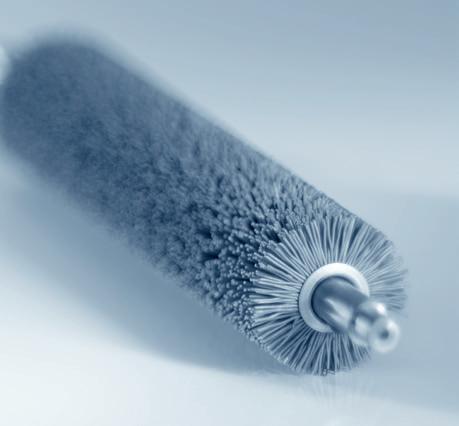

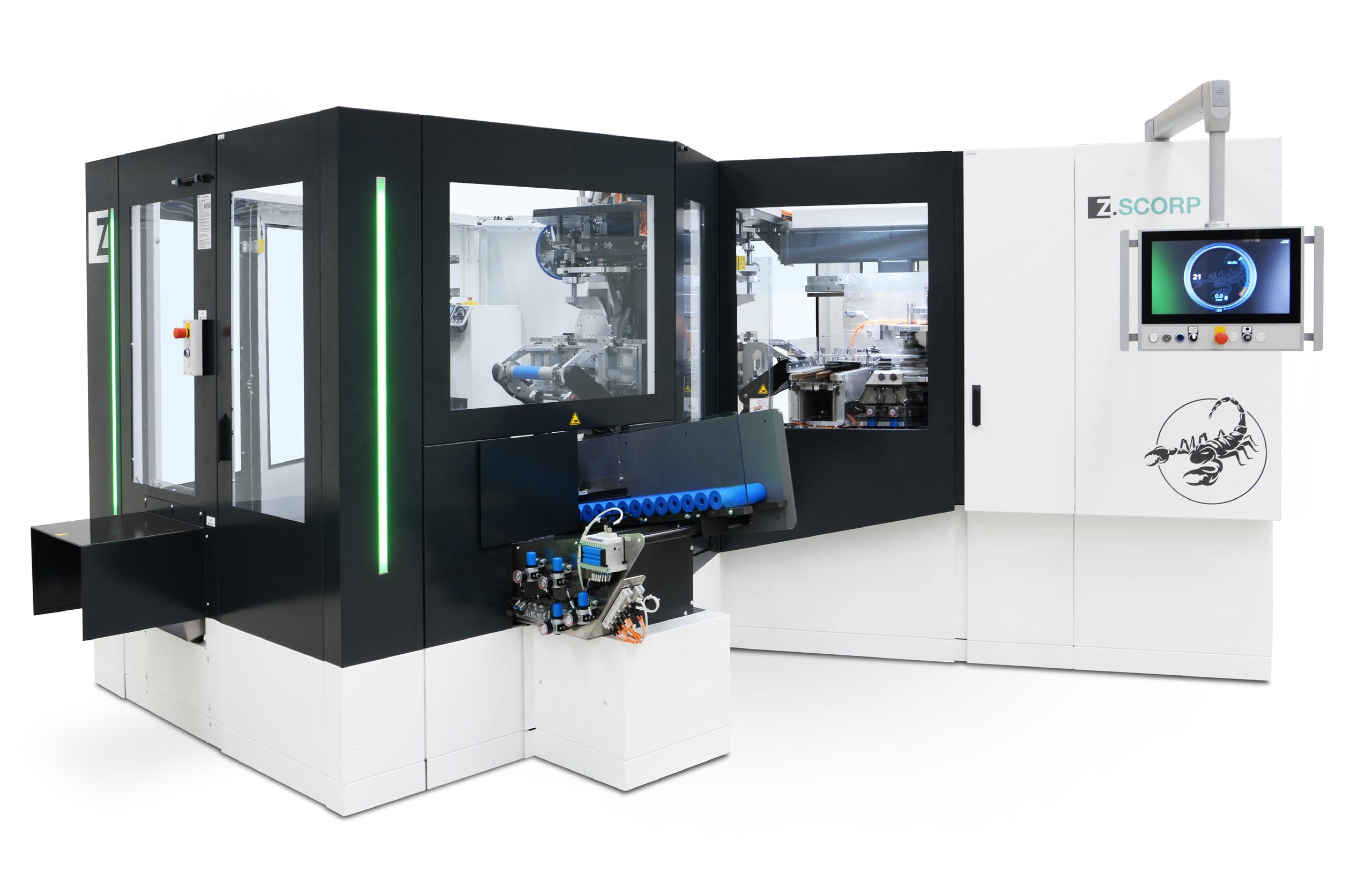

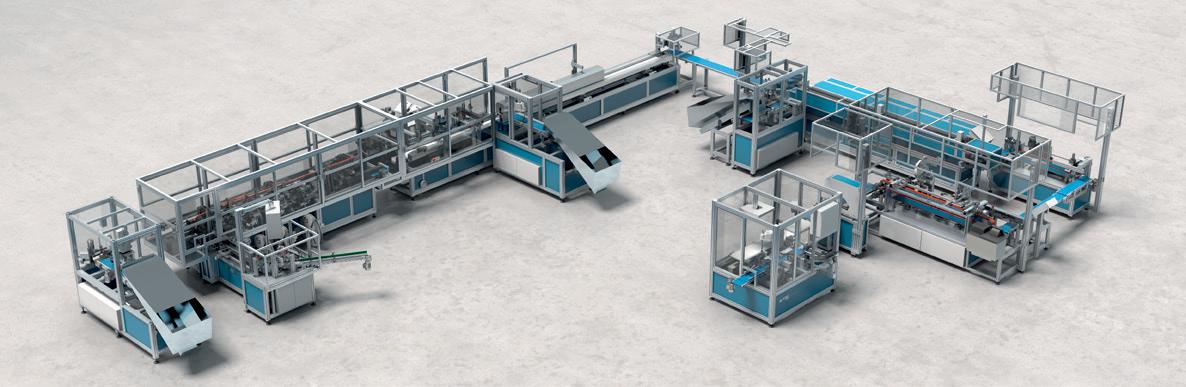

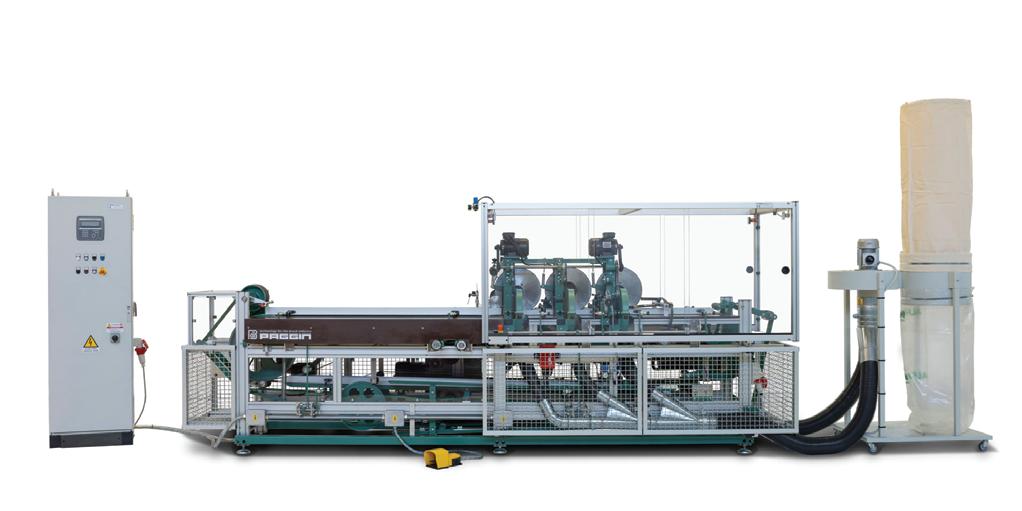

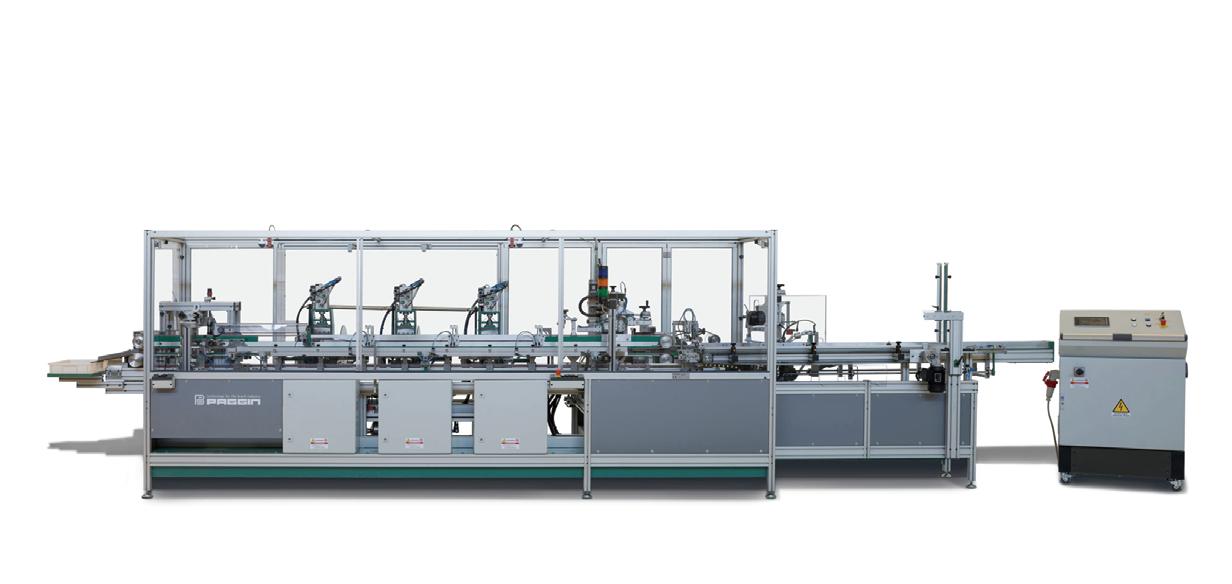

standards in terms of output, flexibility and automation in the production of disc or cylindrical brushes - this is what the new Z.SCORP production line from ZAHORANSKY stands for. Thanks to the integrated trimming unit, the compact machine design enables fully automatic production of technical brushes directly after the tufting process. Compared to the usual combination of a drilling and tufting machine with a trimming machine, this saves space in the production hall and significantly increases both efficiency and process reliability. Full automation ensures up to 30 percent higher output compared to conventional brush production and effectively prevents operator errors and quality fluctuations.

The Z.SCORP also shows its strengths in flexible and fast changeover to other brush types. Both the trimming and drilling units and the brush length can be adapted to produce different brush designs in just a few steps. The programming and visualization of the desired trimming contours and brush designs is then carried out directly on the machine via the smart ZMI 4.0 machine control system. In addition, the Z.SCORP is currently the only machine on the market that can be converted for the fully automated production of disc brushes as well as cylindrical brushes thanks to the simple changeover option of the carriage and the infeed system.

As a so-called 3-station, 5-axis carousel, the Z.SCORP offers maximum productivity in the field of technical brushes. The machine is configured to produce disc or cylindrical brushes depending on the customer's requirements but can be retooled by the customer at any time if necessary - for example, to expand the product portfolio. The highly efficient and safe manufacturing process is as follows: Brush bodies made of plastic or wood are first fed into the system either manually or fully automated by robot. Then the machine drills the necessary holes with high precision and diameters of up to 8.5 millimeters, and tufts them. Plastic and wire filaments as well as natural fiber and natural hair with an unfolded length of up to 260 or 320 millimeters can be used. With up to 600 tufts per minute and the option of using up to three different colored filaments simultaneously, the Z.SCORP is extremely productive. The brushes are trimmed directly afterwards. The integrated trimming unit works with precision to the millimeter according to the stored contours and brush designs. Cylindrical brushes can be produced up to a maximum length of 600 mm and a diameter of up to 320 mm, and disc brushes up to a maximum diameter of 610 mm and a total height of 170 mm.

If the machine should produce a different brush model, the changeover is extremely quick and uncomplicated. Thanks to the ergonomic operating concept with easy accessibility and the highest safety standards, necessary adjustments to the

trimming unit can be made in under 3 minutes without tools. This alone saves around 15 minutes of downtime in production. Corresponding adjustments to the brush length and the drilling unit can also be made in just a few steps. Adjusting the trimming contours is just as easy. These can be programmed easily and flexibly in less than a minute via the ZMI 4.0 machine control system. The brush can be visualized at any time to get a direct impression of the final product. The finished design is then stored in the system and can be retrieved at any time. The final removal of the finished brushes is either manual or fully automatic. However, efficiency and wellthought-out design play a major role in the machine not only in the manufacturing processes. For clear visualization of the current operating status, the machine has vertical LED bars with a traffic light function that allow operators to see directly whether material is missing, there is a problem, or everything is running normally.

More information on the new Z.SCORP can be found at: www.zahoransky.com/en/broom-and-brush/z-scorp.html

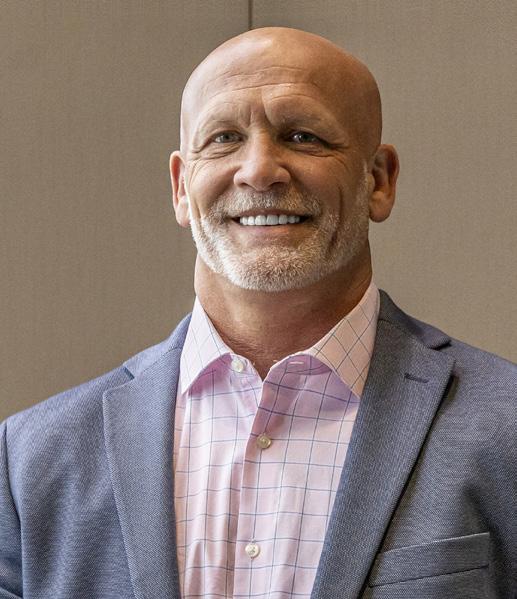

As part of our 125th Anniversary Celebration, Brushware is offering an article related to the history of the magazine in each edition for 2023. For our fifth installment in the series, we have the following interview with current Brushware owner, Dylan Goodwin.

Current Location: Kansas City

When did you start with Brushware?

We were looking for several years to expand our small magazine business and a print salesman tipped me to Brushware in the summer of 2018. I connected with the previous owner Norman Finegold in August of 2018 and he happened to be in the middle of a move from North Carolina to the Kansas City area. We finalized the acquisition in December 2018.

How did you get into publishing?

Accidentally? I grew up in northeast Kansas and my senior year English teacher said I should go to KU and major in journalism. I opted to move to Arizona and clean carpets for a year instead. After a year-and-a-half of that, I saw that most of my friends were having fun in college, so I changed gears and moved back to attend the community college in Highland, Kansas. I took a journalism class there and later transferred to the University of Kansas, where I majored in magazine journalism. After college, I did a bit of sports writing for the local paper in Hiawatha, Kansas, then went to work for a media company in Kansas City in 1994.

What is your favorite part of working on Brushware?

My favorite part is seeing the good leads come through our online directory that we are able to pass on to our advertisers. And in general, I like those times when we get inquiries and we are able to help someone out. That’s the goal of Brushware and I always enjoy when we are able to be a resource for someone with a need.

What do think is the key strength of Brushware? There are probably two strengths that I focus on. The first is that we are the only brush industry media brand to cover all of the bases — print magazine, digital magazine, newsletter, website, online directory and active social channels.Additionally, we have been willing to get outside of the box and try new things. That’s something we will always do. I see it as a continual process of measuring results and looking for ways to push into new areas. Some advances are easy to see, and some are small, but we are always working to take Brushware overall to another level.

Is there anything about producing Brushware that might come as a surprise to the readers?

Our readers may not know that we also partner with the United States Croquet Association to produce their member magazine — the Croquet News. Since it’s quarterly, the two magazines do sometimes bump up against each other. It’s not pickleball, but thanks to the growth of golf croquet the sport is gaining momentum globally and it’s fun to be covering that development.

What is your favorite component of the current Brushware portfolio?

Again, I am proud of our diverse channels, and we put our heart into each one. I would say I am most pleased right now with the performance of the digital edition for the magazine. It was a natural first step and we started with a low baseline, so I had low expectations. However, I have been very happy to see that our digital readership has been

building and the momentum continues to build in the past 24 months. I’ve been around digital magazine editions for 18 years, so I was a bit surprised by that, but it also makes sense based on having a global audience.

How can Brushware best serve the brush industry going forward? Through our analytics, we definitely see a desire for more data and researchoriented insights. So, plans are developing around that to upgrade our approach there and make sure that we are providing information that is vital to readers. So that’s on deck, but the answer really is in the question itself. We need to explore all methods that Brushware can offer to help the brush industry stay connected as a community.

Any final thoughts on the 125-year anniversary of Brushware?

We are very proud to be the caretakers of this legacy. It’s truly an amazing achievement for the magazine and rare for a media brand to go over 100 years, let alone 125. I personally feel a lot of pressure to live up to that legacy and deliver an excellent issue with each run. I love the challenge of taking a traditional brand and modernizing it to hopefully achieve another 125 years.

US Distributor: Brush Fibers Arcola

Please contact us for further information, specifications and offers:

Reinhold Hoerz Senior Sales Manager, Brush Industry Phone +41 44 386 7901 Mobile +41 79 785 4657

reinhold.hoerz@dksh.com www.dksh.ch/brush

Think Asia. Think DKSH.

By Lisa Anderson

By Lisa Anderson

Executives are tired after surviving the pandemic, navigating supply chain disruptions, handling soaring inflation, and dealing with one challenge after another. However, it is not time to rest as supply chain risks abound. From the RussiaUkraine war to China’s aggression in the South China Sea and as well as hurricanes, strikes and bank failures, supply chain risks are not abating; they are simply changing.

Prepared companies will thrive. The rest will dwindle and die. For example, the recent labor unrest was the last straw for Yellow Freight after years where they struggled to stay afloat. Which will you be?

Eighty percent of success is derived from what you focus on. Thus, priorities are vital. Each industry is different, and each company is different. Assess the likelihood and impact of your risks. For example, if you have a union, evaluate your labor unrest risk and assess the impact if it occurs. For example, in working with a beverage manufacturer that had a union, their risk of labor unrest was higher than a non-union shop; however, the likelihood was small because of their proactive process. Thus, although the impact of a production shutdown would be high with unhappy customers, it wasn’t considered a priority risk.

In another example, a household manufacturer was purchasing materials from China which presents a high likelihood of disruption if China were to get into a conflict with a neighbor in the South China Sea. However, they have a low impact risk since they have been purchasing 20 percent of their materials from a backup supplier in the U.S. who has agreed to ramp up as needed. In this case, although the likelihood of risk is high, the impact is low and so addressing the risk is not a priority.

On the other hand, an industrial manufacturer was purchasing a key material from the Russia/ Ukraine region and didn’t have an alternate supplier outside of the region. Thus, not only was the likelihood high in this case, but the impact was also high since it could shut down production, which elevated a solution to top priority.

Smart manufacturers will focus on prevention and preparation to mitigate priority risks. For example, instead of hoping your union will continue to function without increasing costs to the point where you might have to file for bankruptcy as occurred in the Yellow Freight example, smart manufacturers will proactively meet with the union, establish and maintain lines of communication and roll out advanced systems, technologies and applications to improve employee engagement and the customer experience.

In the industrial manufacturer example, the purchasing team collaborated with their demand planning and SIOP (Sales Inventory Operations Planning) teams to confirm the sales forecast, secure supply for a year and to pursue alternate sources of supply and the expansion of regional manufacturing. The best companies partner with suppliers to ensure excess supply and/or capacity availability in areas of strategic potential and differentiation so that they can take advantage of opportunities as they arise.

Companies that prioritize, prepare and prevent supply chain risks can take advantage of opportunities to grow and thrive while the rest deteriorate.

Lisa Anderson is the founder and president of LMA Consulting Group, Inc., a consulting firm that specializes in manufacturing strategy and end-to-end supply chain transformation that maximizes the customer experience and enables profitable, scalable, dramatic business growth. She recently released “SIOP (Sales Inventory Operations Planning): Creating Predictable Revenue and EBITDA Growth”, an e-book on how to better navigate supply chain chaos and ensure profitable, scalable business growth. A complimentary download can be found at www.lma-consultinggroup.com/siop-book/.

Fáilte! Welcome to Belfast host city of the 63rd annual FEIBP Congress. The program features two days of sessions plus plenty of outstanding opportunities to take in Belfast attractions before, during and after the Congress.

The keynotes will feature Dorcas Crawford, one of Northern Ireland’s well-known business leaders who will share her expertise on being a leader and Emma Trevor of Valpak who will cover the ever-changing aspects of EPR in manufacturing and also participate in the Friday Brush Forum. The flow of the event will be enhanced and facilitated by its location at the Europa Hotel.

Opened in July 1971, the Europa was built on the site of the former Great Northern Railway station. During The Troubles, the hotel was where most journalists stayed and was known as Europe’s most bombed hotel, having been targeted 33 times between 1970 and 1994. Today the Europa is part of

the peace story of Northern Ireland and has transformed into an iconic symbol of Belfast’s survival as well as an outstanding place to stay with one of the best Afternoon Teas in the city. Their Piano Bar is also a local favorite. The Europa sits in the City Centre (less than 3 square km, 1 square mile), which is home to many iconic buildings and attractions.

Belfast is the most populous city in Northern Ireland and geographically covers 115 square km (44 square miles). Belfast’s name is derived from the Gaelic Béal Feirste (Mouth of the Sandbank [or Crossing of the River]). The city’s modern history began in 1611 when Baron Arthur Chichester built a new castle there and received a charter of incorporation in 1613.

Belfast’s symbol, a seahorse, is featured on their coat of arms along with bells, a ship and a chained Irish wolfhound. The sea, ships and seahorses center around aspects of the city’s history, however, the earliest known use of a seahorse image in Belfast was on tokens used for travels. Since the seahorse was originally a symbol of good fortune and protection that would naturally be welcome to those traveling by boat or ship. Seahorses can

be spotted around the city, including the seahorse sculpture at Belfast’s port and the glowing seahorse logo on the side of the lofty Grand Central Hotel.

In the 1800s, industry in Belfast was booming. Known for shipbuilding, other industries included the production of rope and tobacco. By the end of the 1900s, the city also paved the way in the world’s linen industry, was recognized as the world’s linen capital and carried the nickname Linenopolis. Many of the era’s linen houses were in the district now known as the Linen Quarter which is located behind City Hall and includes the Crown Bar, Grand Opera House, Ulster Hall, May Street Church and St. Malachy’s Church.

During the 1900s Belfast produced the most famous ship built, the RMS Titanic. When completed, it was longer than the height of the world’s tallest building at just under 269 m (882+ feet) in length. The Titanic was to be the heaviest manmade moveable object the world had ever seen, weighing in at 46,328 tons.

On Friday evening delegates and partners will enjoy an opportunity to explore the world-class Titanic Experience before enjoying the Gala Dinner at the same site. The Titanic Experience is not what Hollywood movies have portrayed but rather an immersive journey through the construction of the immense ship, literally from top to bottom. Visitors “become” part of the team of builders experiencing the sights, sounds, smells and stories that were part of the ship’s construction.

When arriving at The Titanic Experience museum, one is immediately awestruck by its exterior which is a life-size replica of the ship’s hull. The building is located beside the Titanic Slipways, the Harland & Wolff Drawing Offices and Hamilton Graving Dock — the very place where the Titanic was designed, built and launched. It will be both a memorable evening and a grand finish to time together at the Congress.

While the program is full and includes visits to Belfast attractions some additional locations are walkable from the Europa. Next door is the Grand Opera House, Northern Ireland’s premier theatre. Established in 1895, it hosts a range of drama, opera, dance, comedy, pantomime, musicals, family and West End productions with shows daily.

In the opposite direction is Ireland’s second tallest building, Grand Central Hotel, which is only a five-minute walk away. Standing 23 floors high (80m/262.5 feet), makes the luxurious Observatory Bar on the top floor the highest location for a bar in Ireland, with some of the most spectacular city views you’ll ever see.

Also in the City Centre area ten minutes away is one of Belfast’s oldest markets and one of the best in the U.K., St. George’s Market. Between the Market and the Europa are City Hall and May Street Church.

Belfast City Hall is Belfast City Council’s civic building. Inside City Hall, an experienced tour guide will take you around the Hall imparting its history while you’re exploring its finest

Conflict Management Consultant, Mediator, Facilitator and TEDx Speaker

Crawford is a former lawyer, having spent 34 years in Belfast law firm, Edwards & Co. Solicitors where she was Senior Partner until 2021. Crawford qualified as a mediator in 2008 and in 2015 launched ‘The Better Way’, a specialist conflict management service. She sold her law firm in April 2021, retiring from the law to pursue her passion for helping people to find solutions for conflict through training, facilitation and mediation.

Crawford is well known as a business leader in Northern Ireland, particularly for her innovative Twitter networking initiative hashtag “#Belfasthour,” which became known as one of the most effective online marketing communities for SME’s. She is a regular speaker at business events and conferences.

Crawford is President of Lean In Ireland (2022-23), she is also a committed supporter of Bowel Cancer UK and is an ambassador for Community Foundation NI and NOW Group.

• Overview of the waste framework directive and the concept of EPR (Extended Producer Responsibility)

• Key similarities and differences between member states

• Overview of labelling — including implementation dates and possibility for digital labeling

• Eco-modulation overview

• Looking forward – PPWR and any major changes

• Packaging EPR in the USA

• Overview of Valpak’s services

As International Compliance Manager for Valpak, Emma Trevor oversees a team of account managers and researchers as well as looking after her own accounts. She is responsible

for the direction of research and coordinates discussions across Reconomy Group Brands to ensure the most up-to-date international compliance knowledge and trends.

Valpak helps companies become (and stay) compliant. Valpak can help your business meet the requirements of the Packaging Waste, Waste Electrical and Electronic Equipment WEEE and Waste Batteries Regulations, by taking on your legal obligation, checking the accuracy of your data and submitting it to the appropriate environmental agency. Joining Valpak can save your business time, resource, and money.

• In Northern Ireland, the phone number is 999 for Police, Fire Service, Ambulances and Coastal Rescue.

• For the most part, Belfast is safe at night. In fact, Belfast has been voted to have one of the best nights out in the UK and Ireland; lots of “good crack!”

• There are some topics best avoided: politics, the Troubles, religion, Northern Ireland’s history, Britain or the U.K.

• Ireland is famous for its unpredictable climate. It can be bright and sunny one minute, then windy and rainy the next. Be sure to pack for multiple climates - layering is key. Ireland is green for a very good reason; always have a raincoat or a travel umbrella on hand.

• Northern Ireland uses Pounds sterling, while the Republic of Ireland uses Euros. ATMs and currency exchanges are widely available on both sides of the border. Credit cards are pretty widely accepted too.

• On the subject of money, some insight regarding tipping, Ireland does not have as heavy of a tipping culture as you’d find in the United States, for example. It’s still customary to leave 10-15% of your tab for service at a restaurant or pub. Tipping is usually not mandatory or expected for taxis in Ireland, though it never hurts to round up the tab.

• When not at the Congress, you may encounter a pay toilet (loo) and coins will be needed. The rates vary, so be sure to have a variety of coin denominations.

• If you choose to drive, Ireland drives on the left side of the road everywhere on the island. It’ll require an adjustment if you’re used to driving on the right.

• Related to the previous tip, crossing the street in Ireland means turning your head to look to the right. If you’re visiting Ireland from the USA or another right-side driving country, it’s instinctive to look left so this is something you’ll have to remind yourself of for safety’s sake.

63rd FEIBP Preview | September 20-22, 2023

Belfast, Northern Ireland

features. The grounds include the Titanic Memorial Gardens, a tribute to the 1,512 people who perished on the Titanic. May Street Presbyterian church was built in 1829 for the famous minister, Rev Henry Cooke. The church is situated in the Linen Conservation Area of Belfast (designated so in 1992). It is a classical Georgian building with the galleried church set over a basement and is now Grade A Listed. A Binns organ was installed in 1914 and is still in regular use.

Also in the Linen Quarter, over 150 years after its opening, The Ulster Hall continues to play a strong part in the cultural life of Belfast. During the Second World War, the Ulster Hall became hugely popular as a dance hall and was a big hit with American troops stationed on those shores. Throughout the forties and fifties, it became Northern Ireland’s premier boxing venue. Many home-grown champions lit up the boxing ring, while international boxing legends like world heavyweight champion Sonny Liston traded blows with the local stars.

Since the 1960s the Ulster Hall has been Northern Ireland’s spiritual home of rock music, hosting an almost endless list of famous names including U2, Coldplay, Thin Lizzy, The Clash, The Rolling Stones, Muse, Red Hot Chili Peppers, Snow Patrol, Johnny Cash, Jim Reeves, The Who, AC/DC and many more. Led Zeppelin played their classic Stairway to Heaven for the first time ever at the venue.

The northern section of the City Centre is the Cathedral Quarter, “the city’s buzzing, creative soul, where Belfast’s vibrant cultural life bubbles visibly to the surface.” Being one of the livelier areas to visit in Belfast, it is home to some of the city’s oldest and most beautiful buildings and streets, along with a wide variety of pubs and restaurants with delicious food and drink as well as some of the finest street art in Belfast.

If you hadn’t yet heard folks mentioning “crack (craic),” you would in this section of the city. No, it is not a reference to drugs. Crack is a term originally meaning “to have a chat” but it has morphed into also meaning “fun, great time.”

Of note in this area is Belfast Cathedral, aka the Cathedral Church of St. Anne. The foundation stone of the Cathedral was laid in 1899 and the building itself, Romanesque in style, has continued to grow over the years. It is home to the iconic Spire of Hope, intricate mosaics by the Martin sisters and elaborately carved stonework by sculptors Rosamond Praeger, Morris Harding and Esmond Burton.

On a different note, famed pubs in the area include The Duke of York; The Dirty Onion; The National — a contemporary twist on the beautiful listed Victorian building it’s housed in; The Thirsty Goat — a friendly bar with live music every night of the week; Harp Bar — once a bonded warehouse for the Old Bushmills Distillery, now a traditional bar with Belfast

atmosphere and live music nightly; and The Jailhouse — a unique spot in the basement of the former Crumlin Road Gaol.

Speaking of the Crumlin Road Gaol, this local attraction dates back to 1845 and closed its doors as a working prison in 1996. Today you can take a guided tour of the prison and hear about the history of the site from when women and children were held within its walls.

On Saturday several additional options are available and they are fully described on the Eurobrush site: https://www. eurobrush.com/feibp-congress/speakers-and-events. If you are planning to extend your visit, locals also recommend the following:

• Take a Black Cab tour where you’ll be driven around Belfast by a seasoned guide who will masterfully take you through the city’s turbulent past.

• The Belfast Walking Tour is three hours and takes you through the city’s vast history and along both sides of the Peace Line near the Falls and Shankill Roads.

• Tour the SS Nomadic, the original tender ship to the Titanic; built alongside the now-infamous vessel in 1911. In April 1912, the Nomadic successfully transferred the first and second-class passengers from the shallow dockside in Cherbourg out to the Titanic, which was moored in deeper water nearby. Stretched out over four decks, a visit to the Nomadic will immerse you in over 100 years of authentic maritime history via a variety of interactive, technical and traditional storytelling methods. Ireland as a whole is not large so your time there for the Congress can also be a great way to take advantage and see more beyond Belfast. The landscapes are beautiful, the history, historical buildings and landmarks are fascinating. Irish people are known for their welcomes and friendliness. There’s great crack around every corner!

Wednesday | September 20

Europa Belfast

ALL 16.30 – 18.30 h

Registration desk, TBC BOARD

17.00 – 18.30 h

Board meeting, room “Rotunda”

DELEGATES & PARTNERS

19.00 – 22.00 h

Welcome evening - buffet and drinks (Dress code: casual), Penthouse Suite

Thursday | September 21

Europa Belfast

ALL

08.30 - 09.30 h

DELEGATES

08.30 - 09.30 h

Registration desk, in front of reception

Official Opening 63rd FEIBP Congress

- Welcome from President Andrew McIlroy

- Greetings of the President of ABMA

- Presentation of all First Time attendees

- Presentation: 14th Innovation Award

DELEGATES & PARTNERS

18.30 – 18.45 h

19.00 – 22.00 h

Meet Walk to Ulster Reform Club (10 minutes)

Ulster Reform Club, Belfast city center Strict Dress Code: No denim, sportswear or trainers. Men must wear a collared shirt and smart suit-type jacket (ties are no longer mandatory. Women should wear smart casual attire.

Friday | September 22

Europa Belfast

SPONSORS

08.00 – 08.30 h

DELEGATES

Brush forum setup, Grand Ballroom

08.30 – 11.15 h Brush forum

09.30 - 11.45 h Coffee

11.45 – 13.00 h General Assembly, Grand Ballroom

PARTNERS

08.30 - 13.00 h

Free to shop

DELEGATES & PARTNERS

13.00 – 14.00 h Lunch at congress hotel-Piano Restaurant

09.30 – 10.45 h

09.30 - 10.45 h

10.45 – 11.15 h

11.15 - 12.50 h

11.15 - 12.50 h

13.00 – 14.00 h

14.00 – 15.15 h

15.15 – 15.45 h

16.00 – 17.30 h

PARTNERS

09.45 – 14.30 h

Working Group Personal Care

Working Group PHB

Coffee Break

Working Group Paintbrushes

Working Group Technical Brushes

Lunch including “young attendees”, Piano Restaurant (beer, wine and soft drinks at own expense)

No Man Is An Island “The Isolated Leader” — Dorcas Crawford

Coffee Break

EU Packaging Regulations — Emma Trevor, Valpak

Ulster Folk Museum & Lunch

14.30 – 16.30 h Spa at Culloden

14.00 – 16.30 h

17.50 – 18.00 h

18.00 – 19.00 h

Belfast Bus City Tour

Transfer to Gala-Dinner

The Titanic Experience

Gala-Dinner at Titanic & 24.00 h (Dress code: Smart Casual)

19.15 – 23.30

Saturday | September 23

Belfast Activities (Upon Request)

08.45 - 18.30 h

• North coast tour - Via Coast road (£45 + lunch)

• Giant’s Causeway

• Dunluce Castle

• Carrick-A-Rede Rope Bridge

• Carnlough

• Carrickfergus Castle

10.00 – 14.00 h

• Belfast Food Tour™ (£65)

Ask anyone outside the brush industry what wire brushes are used for and most will cite menial tasks such as grill cleaning, having no realization that they’re essential in most major industries producing products and services ubiquitous in their lives, from aerospace and automotive to agriculture and telecommunications. As such, it’s a high-growth segment of the brush industry, according to a July 2023 Business Research Insights analysis of the global wire brush market. The findings: it’s expected to grow from over $553 million (USD) now to $784 million at a compound annual growth rate of six percent by 2028. This bodes well for wire filament producers and distributors as well as wire brush manufacturers, both of which are, and have been, dealing with all the major issues associated with doing business in their home countries and globally. To gain insight from their perspective, Brushware posed questions to wire brush manufacturers and wire filament suppliers

What was the status of raw wire material availability for your company in 2022 and how has it been so far in 2023?

Ken Rakusin, president & chief executive officer, Gordon Brush, USA, speaking for the 12 brush and other companies under his company’s umbrella: Gordon Brush and our sister companies were able to work during 2022 and six months into 2023 without any issues with wire availability.

Tony Ponikvar, president & chief executive officer, Felton Brushes, Hamilton, Ontario, Canada: In 2022 wire supply was tight, and this year it’s been 26-week lead times with prices jumping by 30 percent.

Chip Preston, Spiral Brushes Inc.: We buy crimped and level wire in a few grades of steel, stainless steel, brass, and bronze, and in multiple diameters from 0.003” up to 0.030”. Prices and lead times began increasing back in mid-2021, accelerated through most of 2022, and finally began to moderate in late 2022 into early 2023.

What do you think availability will be for the remainder of the year as well as going into 2024?

Tony Ponikvar: I think that if you order simple product and add the value of crimping or end collection in-house you will be in much better shape than relying on other companies for this service. There are not many of them left to do this work.

Ken Rakusin: There is nothing on the horizon that looks like 2024 will be an issue.

Chip Preston: Availability has been improving as alternative sources from outside the United States have been developed by the value-added domestic suppliers who provide services such as draw, crimp, bunch, straighten and cut to length.

What are the primary source countries for the raw wire material you purchase?

Ken Rakusin: The majority of the wire we source is domestic but we believe that the actual origin is somewhere overseas.

Tony Ponikvar: USA I like to think, but I see that it has been increasing in numbers from the Orient. It appears that Beakart and others have bought up the smaller players and consolidation has occurred in the industry.

Chip Preston: It seems like China, India and Korea have become significant sources of wires that perform competitively against the power brush wire that has been historically made in the United States.

When buying raw material, do you stay with particular providers or do you shop the global markets?

Tony Ponikvar: As a small to medium player we are very loyal to our suppliers as the quality is the number one concern and saving some money is not worth the consequences of losing a customer on a purchasing error.

Ken Rakusin: We typically stay with one provider as most changes in fill material mean that the brush-making machines need to be adjusted. Sometimes this is easy but other times we waste too much time and create too much scrap trying to get the machines to work with different materials.

Chip Preston: We do not shop the global markets, because our requirements are smaller than what an exporter might want to economically ship. We also rely on the services of domestic suppliers to crimp and strand to a variety of specifications based on the wire diameter. A number of our domestic suppliers have been buying material from international sources for final processing in the U.S.

A June report by Reuters’ Beijing bureau says China is set to export the most steel this year since 2016 due to the weakening yuan, competitive prices, and weak demand in that country. In the first five months of this year, Chinese Steel exports were up 41 percent compared to a year ago. Given that, do you expect lower prices for China steels will trickle down and impact brush wire?

Ken Rakusin: Interesting observations. We know price is always a factor but quality and delivery are more significant to us. We’re constantly reviewing costs from our suppliers and will wait and see what happens.

Tony Ponikvar: I hope so. That is a question for wire distributors. It seems that prices never come down. We will be lobbying for a decrease though. It makes sense that it does.

Chip Preston: Some price relief has begun to materialize in 2023.

What was happening to the price of raw wire materials in 2022 and how have prices been this year, and what accounts for that?

Tony Ponikvar: Not sure. But it was explained that supply was so tight that prices were going up.

Ken Rakusin: We didn’t notice a major change with wire prices over the last 18 months or so.

Chip Preston: Prices for brush wire from our domestic sources increased dramatically in 2022, possibly due to supply chain constraints and shortage pricing, as well as the effects of higher material and labor costs driving up the total price and margin dollars in an effort to maintain percentage return on sales.

Where do you see raw wire materials prices going from now and on through the next year and why?

Ken Rakusin: We are unaware of any reasons for pricing to dramatically change.

Tony Ponikvar: I expect them to stay steady, as there is always a reluctance to lower prices by our suppliers. I think it may be a good time to shop around though to see if there are deals.

Chip Preston: We would expect that prices will continue to moderate as supply chain capacity constraints are resolved, and greater availability and shorter lead times should re-introduce greater competition — in effect a shift from shortage to a surplus of brush wire in the market.

During this year have there been any impediments to acquiring raw wire material to produce wire brush products?

Tony Ponikvar: We have still experienced supply issues, but not chokingly as it was two years ago.

Ken Rakusin: 2023 has been pretty simple for wire purchases as supply and prices have been consistent.

Chip Preston: Yes, delayed shipments of brush wire have negatively affected our own lead times for our customers, stretching deliveries to 13 weeks from a previously normal 6-8 week manufacturing lead time for our products.

How did you overcome those issues?

Tony Ponikvar: We begged and we have relationships with key suppliers who respect us and likewise. Suppliers are very important and you want to befriend them, and they will do what they can to help you.

Chip Preston: We were forced to qualify new suppliers to improve our lead times and to offset the pricing power of our primary wire suppliers. Once we had qualified new suppliers, we began to tell our previously dominant suppliers that their quoted prices and extended lead times were not competitive.

Do you think it would be advantageous for supply chains to shift to more countries, and if so what would be the impact?

Ken Rakusin: We rely on our vendors to source raw materials as they need so this isn’t an area that we are familiar with.

Tony Ponikvar: I would rather it all be in the USA and Canada, as quality is mostly ensured. That being said, other countries where labor is low and abundant could offer price relief.

Chip Preston: As I noted earlier, the domestic processors and resellers of brush wire have already expanded their sources of supply to diverse countries outside of the U.S. More foreign sources introduce greater purchasing options, but also introduce issues of foreign exchange rate changes and shipping logistics.

What was the demand for wire brushes in the past two years and what has been the demand throughout this year?

Tony Ponikvar: We have been steady to an increase, due to hard work and winning business in the marketplace for us. I look forward to answers from others in the industry, as we keep our heads down and are not really aware of the overall trend in the industry.

Ken Rakusin: Our demand continues to grow each year as our business increases in scope and size.

Chip Preston: Over the past 2 years, demand decreased somewhat as the result of shifts in consumer demand during the COVID-19 pandemic, as well as temporary shutdowns of certain industries in the first quarter of 2020. Demand has surged back this year (2023), and business has returned to 2019 levels.

What do you anticipate demand will be during the next two years or more?

Tony Ponikvar: I am optimistic. Cautiously though. I predict a five percent increase in the market for our brushes.

Ken Rakusin: We expect to see increased growth going forward as our product and customer base continue to expand.

Chip Preston: We expect continued moderate growth over the next few years.

Ken Rakusin: All pricing has increased from two years ago because labor rates increased dramatically as well as every other cost factor.

Tony Ponikvar: Brush prices are up seven percent I would say.

Chip Preston: Prices for finished brush products increased significantly during 2021 and 2022 as the result of higher input costs. Prices remain elevated in 2023 because cost-push inflation may have slowed down, but for the most part, price deflation has not yet hit our various inputs to brush manufacturing.

Regarding the previous question, what is the cause for that?

Tony Ponikvar: Brush companies passed on increases, and perhaps a penny more to keep ahead, and customers for the most part understood it, for once in a long time.

Ken Rakusin: This is one of those million-dollar questions that even the best economists might struggle to answer. As interest rates rise, health insurance increases, oil prices remain high and minimum wages across the country rise, prices will increase.

Chip Preston: We are closely monitoring changes in the costs of materials for our products, including brush wire, but also a multitude of other metal components. To date, we have not seen sufficient moderation of the high prices demanded by our supplier base. Also, the higher costs are built into a broad swath of our raw materials inventory, and we have to use up the higher cost inventories first, before any sort of pricing flexibility returns.

Ken Rakusin: My best guess is that prices will increase next year as inflation is still a major factor in pricing.

Tony Ponikvar: I think up 2-3 percent with labor becoming the biggest issue.

Chip Preston: Difficult to forecast, but will be “data dependent.” Have there been increases in production costs during this year and last, such as wage and energy cost increases, and what do you anticipate regarding such issues over the next two years or so?

Tony Ponikvar: Increases for us have been 8 percent on labor and same for most inputs.

Ken Rakusin: Cleaning off my crystal ball, there is nothing I’ve seen that suggests that pricing will stop increasing.

Chip Preston: Yes, production costs have increased, as raw materials costs rose sharply with the “re-opening of the U.S. economy” and the shortages that resulted from that upswing. Similar dynamics also affected the labor markets, as starting wages had to rise fairly significantly to attract the attention of the insufficient quantity of persons looking for work in a manufacturing environment. Finally, service providers have also begun to push up their prices to reflect their own labor and operating cost pressures.

Has inflation been an impactor on any phase of your business?

Ken Rakusin: Inflation is why all our costs have increased.

Tony Ponikvar: Yes.

Chip Preston: All of the above are forms of inflation. What matters in the long run is how the current higher prices draw in more sources of supply, so that more competition is restored and costs come back down.

What impact or ramifications has any of the above had on your customers?

Tony Ponikvar: Their demand has increased so I think not so much.

Ken Rakusin: Most of our customers understand the inflationary effect on our pricing. Some are ordering in larger quantities to take advantage of volume discounts but most seem okay.

Chip Preston: For a while in late 2021 and early 2022, the predominant response that we heard from customers was — “Everybody else is raising prices, so go ahead and do what you need to do to remain profitable.” We expect that most of our customers were able to pass through the higher prices.

What are the dominant wires used in your wire brush production?

Ken Rakusin: We use a lot of stainless steel, high carbon steel and brass in our brushes, and this dates to our founding in 1951. I see no reason for any change as we move forward.

Chip Preston: Steel, Brass, Stainless Steel.

Other than the brush industry, what other industries use your wire brush products?

Tony Ponikvar: Automotive, pharmaceuticals, food, aerospace, transit and transportation, military, etc.

Ken Rakusin: Based on our sales to our fantastic distributor base and other brush manufacturers, our products are used in every industry imaginable including having been sent to the Moon and Mars.

What country or countries supply the raw material for your production?

Ralph Rosenbaum, president, Stainless Steel Products, USA: We receive raw materials from mills in the United States, France, India, Taiwan and China. But we are de-emphasizing China because of the high import tariffs being increasingly added in the U.S.

Josh Deligdish, vice president of sales, Deligh Industries, USA: We directly source a wide variety of wire/raw materials from approximately 20 countries. The three largest groupings are primarily across Asia, Europe and the Middle East.

When buying raw material, do you stay with particular sellers or do you shop the global markets?

Josh Deligdish: We maintain strong and longstanding relationships with our partners, with many relationships spanning 20-50 years. We believe this foundation and trust is irreplaceable in weathering unforeseen obstacles, and this principle proved its value over the last three years. That said, we supply a variety of markets ranging from highly technical to commodity products, and we are continuously exploring alternative sources of supply for many items. There is rarely a downside to having more qualified partners.

Ralph Rosenbaum: We like to stay loyal to our current vendors. However, because of the China situation, we are open to potential new vendors for the limited products we buy from there.

A June report by Reuters’ Beijing bureau says China is set to export the most steel this year since 2016 due to the weakening yuan, competitive prices, and weak demand in that country. In the first five months of this year, Chinese Steel exports were up 41 percent compared to a year ago. Given that, do you expect lower prices for China steels will trickle down and impact brush wire?

Ralph Rosenbaum: I believe most of that increase in steel is going to other countries in Asia, the Middle East and Africa. South Korea is the largest importer of Chinese steel. In the U.S., steel tariffs and additional China tariffs are really placing American companies at a major disadvantage versus other countries. For example, South Korea pays a flat 10 percent VAT tax on all imported goods, including Chinese steel. On the other hand, the U.S. pays 25 percent steel tariff PLUS an additional 7.5 to 45 percent China tariff depending on the

actual steel product. That is a minimum disadvantage of 22.5 percent and as much as 60 percent from what I have seen. This is in addition to higher freight rates for the longer journey to the U.S. versus South Korea. I do not believe imports of steel from China will have a positive impact on lowering prices of materials in the U.S. brush industry. On the contrary, I believe the U.S. steel tariffs in general and additional China tariffs are placing US manufacturers at a disadvantage when competing globally.

Josh Deligdish: There is a general misconception regarding “steel” and its relationship with wire products across multiple industries and applications. While there absolutely are commonalities, equating the two is overly simplistic — especially within the more specific segment of brush wire. Major metrics for steel exports are generally composed of flat products (hot rolled coil, cold rolled coil), pipe and tube and sheet. There are a multitude of factors from both manufacturing and economic standpoints which cause these items to behave dissimilarly to more specialized brush wire. Any price improvement would more likely come from a currency standpoint, but labor and energy costs as well as other market conditions may offset that to an extent.

Where do you see raw wire materials costs going for the rest of the year and on into the next year?

Josh Deligdish: This is dependent on the item in question. For more common items which are less specialized, we have already experienced cost reductions which we have passed through to our customers. For these items, any additional cost reductions would likely be minimal. For more specialized products it is difficult to say, but we expect pricing to remain stable.

Ralph Rosenbaum: If you believe the economic “soft landing” will be pulled off by the Fed, as I do, then I do not see prices dropping much from current levels. If the U.S. falls into a recession, then perhaps prices may continue falling a bit further. Chatter in our industry says order and production levels are now similar to before the pandemic, as opposed to the spike witnessed over the last year or so. Nevertheless, pricing for nickel, and therefore, stainless steel will most likely rise about 4-5 percent annually as demand outstrips supply due to the increasing demand from electric vehicle production and reduced Russian output from the war in Ukraine. Likewise, copper-based products should see a steady rise in prices due to increased global demand over the next year or two. I have seen estimates at 50 percent higher for copper prices versus 2023 by 2025. Nevertheless, one major variable in all of this forecasting is going to be the strength in demand from China for its production.

What’s have you experienced on costs for raw materials over the last few years?

Ralph Rosenbaum: The pandemic has really created a see-saw effect on raw material prices. Initially, prices fell as demand plummeted. Then prices rose as freight costs and labor shortages ensued. Demand came back strongly keeping prices high. Now with governments around the world raising interest rates, in order to curb inflation, economic activity is slowing down as borrowing gets more difficult, inventories have been built up, and many shortages are beginning to dissipate.