all very proud of.

Our customers voted First Response Finance as the ‘Best Car Finance Provider’ in the Consumer Credit Awards 2022 - for the second consecutive year. In addition to that, we also won the prestigious ‘Firm of the Year’ award!

The second recognition came from our dealer partners, who voted us ‘Finance Provider of the Year (Sub-Prime)’ in the Car Dealer Power Awards. We are honoured to have won this award 8 times!

Vans, cars, motorbikes - it doesn't matter what type of vehicle we’re financing, our award-winning service remains the same.

If you want to set up an account with us, email us at marketing@frfl.co.uk

HEAD OF CONTENT

Andy Mayo: editorial@dealernews.co.uk

FINANCIAL EDITOR

Roger Willis: editorial@dealernews.co.uk

PRODUCTS EDITOR/DESIGNER

Colin Williams: design@dealernews.co.uk

COMMERCIAL CONTENT MANAGER

Maurice Knuckey: creative@dealernews.co.uk

CONTRIBUTORS

Roger Willis; Dan Sager; Alan Dowds; Rick Kemp; Adam Bernstein; Brian Crichton

ACCOUNTS MANAGER

Mark Mayo: accounts@dealernews.co.uk

ADVERTISING

Alison Payne: tel 07595 219093 Paul Baggott: tel 07831 863837 adsales@dealernews.co.uk

CIRCULATION circulation@dealernews.co.uk

TAIWAN AGENCY

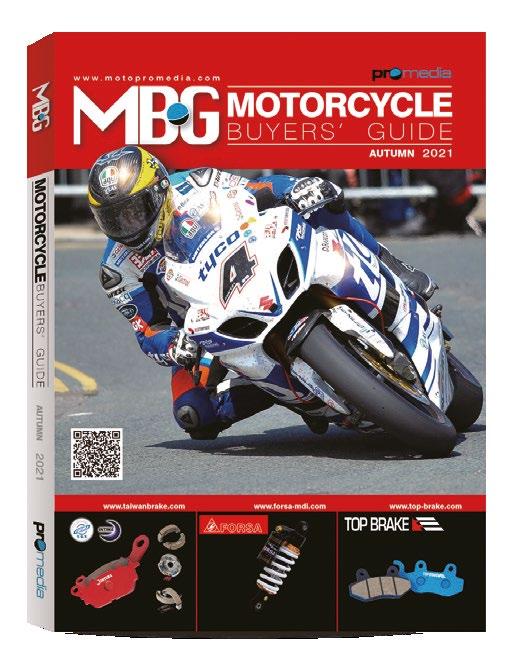

Albert Yang, Pro Media Co: info@motopromedia.com; tel +886 4 7264437

PUBLISHER

Colin Mayo: editorial@dealernews.co.uk

British Dealer News, 10 Daddon Court, Clovelly Road Industrial Estate, Bideford EX39 3FH

The march of high-end solus Ducati stores continues apace, with Dorset’s first Ducati-only dealership opening in Wimborne. The new Ducati Bournemouth store covers both Ducati and Ducati Scrambler brands at its fully renovated 7000sq.ft premises which include a high-end workshop facility with the usual showroom and retail spaces. Fans at the opening event on 30 April were treated to pizza and coffee while watching the Spanish MotoGP round with top WSBK racer Chaz Davies as a special guest.

Fabrizio Cazzoli, Ducati UK MD, said, “Today we are here in Dorset for the opening of our brand new store, Ducati Bournemouth. With the highest standards in corporate identity and people quality, there is no better way to bring Ducati values of style, sophistication and performance to the UK. I would like to sincerely thank Mark Langford and John Piper of Breeze for their outstanding work.”

Mark Langford, MD of Breeze Motor Group, which owns Ducati Bournemouth, said, “We’re

excited to have finally opened Ducati Bournemouth for the start of the season. We’d like to thank everyone for their patience

and support – we can’t wait to welcome you through the doors and are confident you’ll agree it’s been worth the wait!”

AS PART OF ITS RETAIL EXPANSION, NORTON has become the first motorcycle brand to be sold by the Oakmere Motor Group. The V4 SV and Commando models go on show alongside Morgan, Caterham and Lotus cars at the firm’s Cheshire

rich heritage and exciting new products. From the outset, it was clear Norton shared our values and a passion for quality, so we are delighted that we are now a Norton sales partner.”

Christian Gladwell, CCO at Norton

BIKETRAC IS THE LATEST TO BOOST ITS MENTAL health resilience with a new mental health first aider (MHFA) programme. The security and tracker firm’s business development manager Julie Emmitt has completed a course with the Mental Health Motorbike charity.

MHFA are similar to normal first aiders – they offer support in a crisis while professional medical help is sought. “I have found that riding my bike has helped me through some of the tougher times in life,” said Emmitt, “so I jumped at the chance to become a mental health first aider, to allow me to give something back and support others in the biking community.”

FRENCH BIKE BATTERY MAKER BS BATTERY is upping its profile with a new sponsorship deal in MotoGP. Both Aprilia riders, Maverick Vinales and Aleix Espargaro, will carry the logo on their Aprilia RS-GP racebikes. Massimo Rivola, Aprilia Racing CEO, said, “We are proud to have a partner like BS Battery at our side. A collaboration that stems from our enthusiasm and common values of innovation, technology and competition.”

Top bike insurer Bennetts, has long been expanding its remit via its Bikesocial editorial arm, and now it seems to be looking to develop its brand presence further outside insurance, with a new High Performance Award scheme, which it claims, will help riders identify the best protective riding gear.

BRITISH BODYWORK SPECIALIST PYRAMID is sponsoring the 44Teeth YouTube team in the BMW F900R Cup race series. The one-make championship runs in BSB, and the 44Teeth team of Al Fagan, Chris Eades and Mike Booth are pushing hard. “We’re thrilled to be the title sponsor for such a talented team,” said Adam Bowser, Pyramid MD. “This is a great opportunity for us to further our reach and showcase our products to the motorcycling community whilst also working more closely with the guys at 44Teeth.”

THE NEW 2023 CONTROL MICHELIN SLICKS FOR the MotoE series have a lot of recycled and sustainable material in them – 34% in the front hoop and 52% in the rear. The recycled material is scrap steel for the cords and used car and truck tyre rubber, while the sustainable material includes natural latex rubber, sunflower oil, pine resin and – amazingly enough – orange and lemon peel. It’s part of the firm’s plan to make its entire production sustainable by 2050.

THE NATIONAL MOTORCYCLE MUSEUM HAS announced the winner of its 2022/23 winter raffle and also revealed the prize for its summer competition. Gary Cropper of Leicester won the first prize, a 2023 BSA 650 Gold Star, with Gordon Winsor of Devon snapping up the second prize, a 1968 BSA Bantam Bushman 175cc. The prize for the summer raffle is an immaculate 1974 Norton Commando 850, complete with AP Lockheed front brake disc conversion. Tickets and more info from the museum: www.thenmm.co.uk

According to Bikesocial consumer editor John Milbank, “the new scheme will give a Gold award to garments that meet EN17092 AAA, gloves that are Level 2 and boots that are Levels 1/2/2/2 or 2/2/2/2. Platinum and Diamond awards are available for garments that meet EN13595 Level 1 or 2 respectively, or –as this standard has now been withdrawn – garments that have had a small amount of testing done in addition to EN17092 in order to prove their higher performance.

“We’ve already got submissions coming in, which use a Terms document and require links to the Declaration of Conformity and copies of the test certificates (though these aren’t made

public). We don’t charge anything for it, and we’re delighted with how many products are appearing so quickly.”

As Milbank explains, the scheme should simplify the minefield of acronyms and standards on protective riding kit labels. “Ultimately, the only real difference between motorcycle clothing and anything you could buy at a hiking shop is protection, and as so many riders consider the protective performance of the protective kit they’re buying, the award scheme is there to help

THEY’RE ALREADY competitively priced, but Royal Enfield is now looking to help more people get on to its bikes, with a new consumer credit deal signed with CA Auto Finance. The finance deals will be available across the whole range – from the 350 Classic, HNTR and Meteor singles, through the Himalayan and Scram 411 models, up to the 650 Interceptor, Continental GT and Super Meteor twins. Deals will start from as little as £49.99 a month for a new HNTR 350.

George Cheeseman, UK country manager, said, “It’s an incredibly exciting time for Royal Enfield as we enter a

new chapter of operating our own wholly owned subsidiary with the distribution and direct network infrastructure going live on 1 May 2023. Our mantra is simple: to provide unrivalled accessibility to quality motorcycles for our customers. We are passionate about enabling anyone who wants to own a Royal Enfield, to be able to do so.

“We have searched hard for the ideal finance partner and are delighted that CA Auto Finance shares our dedication to providing market-leading affordability and quality customer experience.”

www.royalenfield.com/uk

them if they want. With four different standards to understand, and multiple levels, the HighPerformance Award simplifies the protective performance, leaving the buyer to choose based on comfort, features and price.”

It’s an interesting project –up till now, RiDE magazine has pretty much had the field to itself in terms of editorial schemes for independent product rating marks. There’s more info on the scheme on the Bennetts website: www.bennetts.co.uk/highperformance

Older readers may well remember the 2007 launch of the Department for Transport’s SHARP helmet rating scheme. It initially caused some consternation when some quite pricey brands found themselves with a lower rating on the five-star scale than some much cheaper lids. After consultation with the trade, the scheme settled down, and SHARP became an accepted part of the retail landscape. Helmets were tested according to the SHARP protocol; they were then given a score published on the government-backed website. A publicity campaign ran alongside, telling riders to check the rating on a lid before buying it, aiming to improve safety by encouraging the purchase of lids with higher SHARP safety ratings.

It’s fair to say that SHARP has become a bit anonymous in recent years. It’s still in operation, but with much less in the way of PR or advertising campaigns. Budgets were cut drastically across government from 2010 on, and SHARP was an easy target.

Now though, the scheme is undergoing a revamp. SHARP 2025 is the title of a new project undertaken by the DfT with the help of the Transport Research Laboratory (TRL), which will both update the testing protocols and launch a new publicity campaign to get the rating scheme back into bikers’ minds. As the name suggests, it aims to have the revamped scheme in place for 2025.

Dr Phil Martin is head of transport safety at TRL, and one of the leading minds behind the revamp, and has worked previously on the safety of vulnerable road users (including motorcyclists). His PhD was focused on the biomechanics of injury, particularly head and thorax. He knows a lot about helmets and how they work.

“I was still a fresh-faced undergraduate when SHARP launched! But the ECE 22.06 regulations have accelerated the need to re-look at SHARP, re-examine the evidence base used for the test protocols, and reassess whether they are still fit for purpose. Do they still evaluate the safety of motorcycle helmets above and beyond regulatory requirements? That’s the whole purpose of SHARP.”

The aim is to give consumers more information. The latest ECE 22.06 helmets are all safe – but SHARP wants to show how they perform compared to each other above that standard.

“For the ECE 22.06 requirements, you have

to test a motorcycle helmet by dropping it from a particular height. SHARP goes further and increases that energy, the impact speeds, and then you can see how helmets perform against each other.”

So, how does SHARP come up with the higher testing impact speeds? “Those speeds are based on the evidence we have about the speeds that motorcyclist helmets are struck during collisions, so it’s based on accident data. Ultimately there is a need for the SHARP protocol to change, including things like an impact against angled anvils to align with ECE 22.06, and we also need to look at rotational injuries and the injury risk compared between different helmets.”

Martin also told BDN about some interesting work on digital modelling –simulating motorcycle crashes, to learn more about the forces experienced by a rider in a bike crash. “There are simulations recreating collisions where, if you’re simulating it in a computational environment, you can get a lot more information about head impact speeds and angles. A lot of research is carried out in that field that informs SHARP and the upgrade of the protocols.”

Of course, it doesn’t matter how good

SHARP is if riders aren’t aware of it or don’t care about it. And the job of publicising and promoting SHARP 2025 is almost as big as revising the test protocols. It’s a problem Phil Martin is aware of: “There’s a real acceptance that a big part of SHARP 2025 is to engage with consumers right from the moment they first make the decision to even want to ride a bike. So, when they apply for a provisional license, they get information that tells them to consider the helmet’s safety when they buy their first one, right through to advanced rider courses. SHARP will take every opportunity to engage with consumers, industry, and riders.”

The DfT and TRL are engaging with the industry, riders’ rights groups and other stakeholders as part of the SHARP 2025 revamp. “We’ve been in talks with the MCIA,” said Martin. “They see the value in it in terms of the benefit to society, consumers knowing how their helmets perform, and that being part of the buying decision process, but the MCIA naturally wants that to be as objective as possible and they will have a big part to play in terms of contributing to the development of those protocols.”

FRENCH RETRO-BIKE SPECIALIST

Mash Motorcycles has launched a comprehensive new three-year warranty to cover its range of bikes. The new warranty covers both parts and labour, and has unlimited mileage coverage, making it more inclusive than many of its competitors.

The warranty activates on the date of vehicle handover by the dealer and covers all market-compliant motorcycles, from 50-650cc sold by the official Mash importer and

their authorised dealers.

“For more than a decade, Mash Motorcycles has been developing vehicles with passion and high standards to meet new market trends,” says Jean-Michel

Paquient, general manager of SIMA (manufacturer of Mash Motorcycles). “It was therefore natural for us to be able to offer our future customers a three-year manufacturer’s warranty.”

Motomondo 01429 650555

uksales@motomondo.com

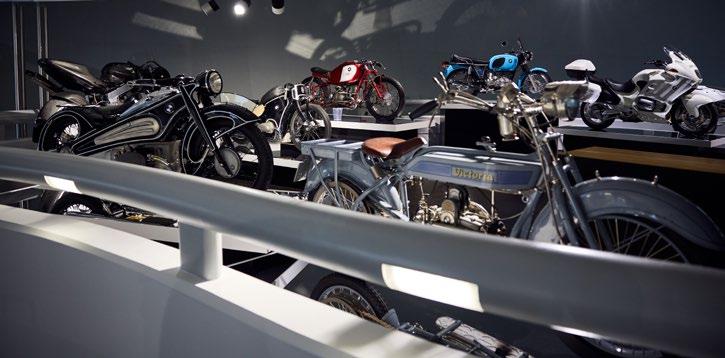

BMW is celebrating 100 years of motorcycle production this year, and the manufacturer invited BDN to Munich to see a couple of new bikes while taking in a new ‘100 Years’ exhibition at the firm’s corporate museum, based at the famous BMW ‘Four Cylinder’ HQ near the Olympic Park. The boss of BMW Motorrad, Dr Markus Schramm, was there, and he answered our questions on the current state of play for the brand.

First up was a tour of the new centenary exhibition. The BMW Museum has a central bowl structure, with a winding pathway up to the main level, and there are exhibits set up all the way along. Visitors get a taste of the firm’s early two-wheeled history, with the first Boxer engine – the 6bhp M2B15 from the R32 – on show alongside the very latest 136bhp R1250 Shiftcam motor. Milestone machines, like the R37, the R5, the R75/5, R90 S, R80 G/S, S1000 RR and more, are on show, and there

are even super rare prototypes like the desmodromic-valved 996cc R1 superbike from 1992 and the artdeco styled 1937 R7.

The 100 Years showcase also looks at the important figures in the firm’s history, from Max Friz,

as British architect Elspeth Beard who circled the globe in 1982 on an R60/6.

Open until next May; the 100 Years exhibition is well worth a look. Opening times are Tues-Sun 10am-6pm, and entry is €10.

firm managed to achieve record sales of almost 203,000 bikes last year, with Covid, semiconductor and logistic woes, and a war in Europe all having an effect.

who designed the first Boxer, through to German designer Hans Muth who was behind the R90 S and R100 RS. BMW’s competition heroes also get a mention, with shrines to desert race aces Gaston Rahier and Hubert Auriol, plus road race legends including Georg Meier and Michael Dunlop. BMW also tips its hat to the pioneer adventure tourers who set out on BMW bikes back in the day, such

BMW SHOWED OFF TWO BRAND NEW models at its 100 Years event. First is a new retro bagger version of the massive R18 cruiser called the Roctane. It marries up the basic dynamic package of the R18 – 91bhp 1802cc Boxer, steel tube frame, shaft drive – with a new 21in custom front wheel, built-in swoopy panniers, footboards and an R5-style headlight surround. Priced at £22k, it looks very striking but will undoubtedly be a niche seller in the UK. More mainstream was the next reveal –the new R12 nineT. The confusing name was explained as a rebrand of BMW’s 1200cc heritage line-up to fit in below the R18 family – expect a range of R12 models next year based around this new platform. The air/oil-cooled engine is apparently all-new despite looking very similar to the current ‘oilhead’ R nineT unit,

A veteran of BMW, Dr Markus Schramm has been at the firm since 1991, and took over as head of BMW Motorrad in 2018. The keen motorcyclist and marathon runner spoke to BDN at the special 100 Year exhibition opening and gave an update on where BMW is now and how it’s coped with the recent crises.

We started by asking how the

and it claims to have better performance and improved future emissions compliance while offering more support for the latest high-tech digital systems.

This next-generation R nineT replacement will also be even more customisable, with owners able to swap out parts like the dual-analogue clock pods for a trick TFT LCD screen, as well as the usual seat, wheels, exhaust and other more cosmetic customising options. The new bike will also be compatible with BMW’s smartphone apps, allowing retro fans to buy a bike that matches their style while also getting the modern tech common across the rest of the BMW range.

The new R12 nineT we saw was a preproduction prototype: the firm is launching it as a 2024 model and will release more info later this year.

“The secret behind us is the strength of the brand, which we’ve invested heavily in for the past five years,” said Schramm. “Yes, certainly Covid was a challenge for us. Can you imagine that we had to shut down our plant for six weeks, and the first day after we opened up again, we had to start production of the R18? At the same time, parallel to the Covid situation, we had significant challenges with semiconductors. We set up our own task force linked to the car side and managed much better than the car industry.”

And Schramm gave a concrete example of the practical impacts of the war in Ukraine. “75% of our wiring harnesses are produced in Ukraine. So, one day [when the war began in February 2022], there were no harnesses… In record time,

Developments in carbon-neutral e-fuels may help bikes escape the proposed ban on petrol and diesel engines for cars in the EU from 2035R12 nineT R18 Roctane Dr Markus Schramm

we built up parallel production in India, Thailand and South Africa. But four weeks after we launched the first production in Thailand, the women in the Ukrainian plant (harness production staff are 100% women) were back on two shifts. Can you imagine, these women were sending their father or son or husband to war, and they came back to shift operation after four weeks?

“We went immediately back to Ukraine, and we said you are our partner, and now they are back to the same volume as before the war, and we are very proud that we could support them.”

Schramm spoke about BMW’s global successes next. “For us, the fastest growing market in 2022 was India, followed by China. So especially in Asia, we are very successful. We always joke that we have a ‘20,000 Club’, which means 20,000 bikes are sold in a country. We did this for some years in France and in Germany for a long time. But now China is joining the club. Italy wants to join and the US is joining the club.”

What about the UK? “The UK is far away – the UK needs to push to join the 10,000 club! But this is certainly a very good indication that our success is not

built on one region. It’s really spread over the world.”

Schramm was also, perhaps surprisingly, quite bullish about the prospects for future internal combustion engines in motorcycles while also praising BMW’s efforts on electric power. He claimed that its CE 04 scooter had more than 80% of the global market for over-11kW batterypowered bikes in the first quarter of 2023 while accepting the bike world is some way behind in electric acceptance. “Compared to cars, we are at least ten years behind in terms of acceptance, in terms of getting customers by emotional means, not regulation. But it comes! Last year 2.5% of our retail sales were electric and the car side was there ten years ago. This year we’ve got 5%.”

But the good doctor also pointed out that bikes produce a tiny amount of CO2 in Europe –just 0.3%. And he suggested that this, alongside developments in carbon-neutral e-fuels, may help bikes escape the proposed ban on petrol and diesel engines for cars in the EU from 2035.

“At the end of the day, we have 0.3% of the CO2 emissions in Europe, so we don’t need too much lobbying, and also, we are under the radar. Two-wheelers were always excluded from the European Commission’s Green Deal and potential ICE ban. It was always mentioned as only cars.”

Could the UK government take this on board as part of its consultation on cutting carbon emissions? It would be a big help to the industry if it did.

THE THREE-YEAR PARTNERSHIP BETWEEN the Two Wheels for Life charity and Yamaha Europe enters its second year, with the donation of 16 Yamaha AG100 bikes for the Riders for Health project in the Republic of The Gambia. The project is also raising funds for health projects in Africa, with auctions for WSBK and MXGP tickets and sponsorship of the Yamaha Ténéré world rally raid team.

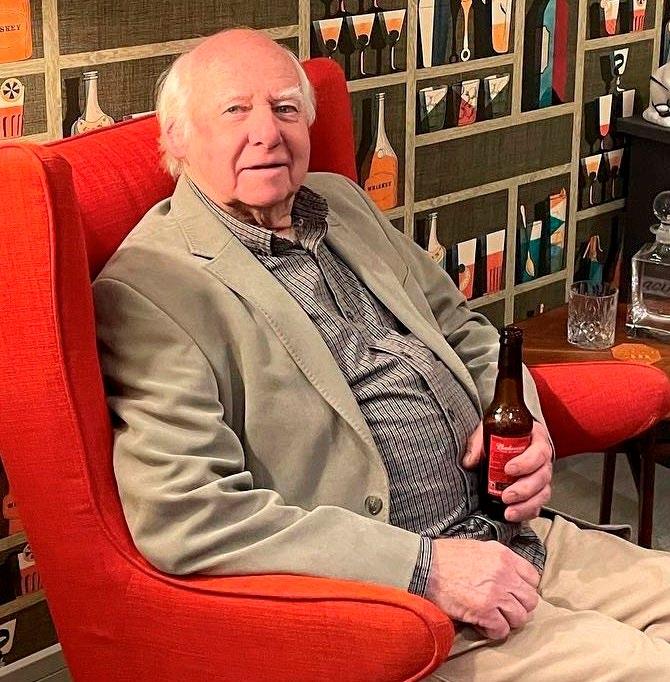

HENRY COLE RETURNS TO TV

HENRY COLE IS BACK WITH HIS SHED AND Buried TV programme. The new series, featuring Cole alongside Allen Millyard and other helpers, has ten new episodes, broadcast on Tuesday nights at 9pm from 23 May on the Quest channel. And Henry Cole is back on ITV4 as well, with his Motorbike Show. Allen Millyard is the straight man once again, and the new series features all eras and styles of motorcycling, from pre-war bikes at the famous Banbury Run to the latest, high-end £60,000 Bimotas. Plus, the 75thanniversary celebrations of the BSA Bantam, there’s also some slow fun on Fizzies. Six new hour-long episodes are broadcast on ITV4 weekly, starting on 12 June at 9pm.

Ducati moved from the Gherkin in the City of London to the Outernet art/exhibition space in Soho for its latest glitzy London presentation – this time focusing on the new Scrambler lineup. A host of young, attractive, brand-friendly guests sampled bespoke cocktails and boogied to a selection of modern rhythmic beats, as Ducati presented the updated 2023 models in the 800cc retro V-twin roadster range.

ADVENTURE BIKE RIDER FESTIVAL

KIWI OFF-ROAD LEGEND CHRIS BIRCH, WILL be staring at the Adventure Bike Rider festival on 23-25 June. Birch will be flying in from New Zealand, courtesy of sponsor Kriega, to talk about his experiences and show off his amazing skills on the Adventure Park riding trail. www.abrfestival.com

Members of the not at all young or attractive motorcycle press were also in attendance, spoiling the vibe a little. So BDN got the chance for a chat with a very senior member of Ducati’s management team – Patrizia Cianetti. Cianetti is the marketing and communications director of Ducati Motor Holding and she has been at the firm since 2000.

We started off by talking about the Ducati Scrambler sub-brand. Launched in 2015, it was seen by some as an attempt to do the same job as the MINI did for BMW: give the firm a whole new outlet for its technology and opening up a different market. For Scrambler, that appeared to mean younger, perhaps less affluent, maybe more novice riders and women – people who wouldn’t necessarily think of a Ducati as their first big bike.

Has it turned out that way?

Cianetti thinks so. “Scrambler has always been a model able to talk to a wide type of riders, age, riding competencies, male, female. It’s also the range with the biggest percentage of female riders in the Ducati family and this makes a lot of sense since women are half of the world!”

And she’s keen to stress that the new 2023 bikes are set to continue this. “Of course, the evolution of this new generation of

Scrambler is meant to talk more to the younger generation: all the different colours, customisation, opportunities for self-expression. The way we are presenting and talking to people, the idea of evolving the Scrambler, keeping the same soul, the same attitude and personality, but bringing a contemporary style and more technology, like the LED lights, TFT dashboard, electronics, ABS. But also a new riding experience: smoother, more dynamic and also more fun.”

terms of product and the riding experience. So we introduce probably the level of fun and excitement as needed, also to talk better to younger generations.”

CIanetti bristles a little when we ask if there will be more ‘retro’ bikes from the company. “We don’t like to call it retro, but when we presented the first Scrambler in 2015, the idea was to keep the same style and values but with a contemporary interpretation. If you compare it with the other bikes in the segment, the

She insists that Scramblers aren’t only for novices, though. “Scrambler is probably the model in the whole Ducati family that is able to talk to the very widest audience. We have Panigale riders that also have a Scrambler in their garage. But you may only have a 35kW [A2 licence] Scrambler, so it’s really wide. And then, of course, we also have riders who maybe have had a license but have not been riding for many years, and they decide to come back. The Scrambler is there with technology that is contemporary, safe and modern, with rider modes, traction control etc.”

Does Ducati have to be careful that the Scrambler doesn’t cannibalise the main range – of the Monster, say? “We say that Scrambler is more of an addition [to the Monster], and it is really complementary to Ducati, not only in terms of brand and communication codes but also in

Scrambler looks like a completely modern bike.”

Could Ducati move back into the 1970s, with perhaps a reboot of something like the original 1975 900 Supersport?

“We love to take inspiration from the past in general, so from time to time, we visit our museums with the designers from the Centro Stile [Ducati’s design centre]. We have an idea, like what happened with the DesertX, and then you may define it as retro, but it’s not!”

A straight retro copy of an old bike would be too simple, then? “We don’t like normally to copy, but when there is both the inspiration and the opportunity and we believe that it will be a fantastic Ducati, then we try to create a new bike that takes inspiration and elements from our history, it’s not just copying.”

Turning to the UK bike market in general – how important is it to Ducati? “You know, this event is

It was seen by some as an attempt to do the same job as the MINI did for BMW: give the firm a whole new outlet for its technology and opening up a different marketElectric bike maker Maeving’s co-founders Will Stirrup and Seb Inglis-Jones took to the streets of London during the King’s coronation procession last month, entertaining the crowds on their British-built motorcycles. Riding a pair of Maeving RM1s, the bosses toured central London to celebrate the coronation. It’s perhaps surprising they weren’t arrested, with their Union Jack jumpsuits, Union Jack capes and hats (fastened to their helmets), tooting Kazoos as they went!

will happen in Rome, Munich, Madrid and Paris, and London is the first. Recently we ran the first Live event from Ducati London, so it’s an incredibly important market for us. It’s a country in which the motorcycle culture is so much a part of the entire culture, but there are also plenty of icons and great riders.”

How does the firm do its marketing differently in the UK? “I think we try always to be true to ourselves, following our values and our mission. Everything we do is guided by science, sophistication, performance, to produce unforgettable and exceptional experiences around our motorcycles. So I think this is the founding base of all the marketing and communication activity we do, and here it’s the same.

“Of course, we want to enlarge maybe the lifestyle and cool side of riding a Ducati. Not only on the race track but also to develop even further, in the touring adventure segment.”

Fabrizio Cazzoli, Ducati UK MD, adds: “We are present at all the main happenings of the motorcycle industry; you see us at the NEC, ExCeL, and ABR. And of course, it needs to be tailormade because the audience is slightly different, nevertheless, without compromising our DNA or who we are.”

Does Ducati’s recent massive race success in MotoGP and WSBK – winning both titles last year – help with the basics of selling Scramblers day to day? Patrizia Cianetti thinks so. “It helps a lot. It’s a big stage where we put on a great show for our Ducatisti. And of course, when you win

everything, it is a nicer show! For us, the racing environment is, first of all, the best possible technological laboratory for moving our technology into the production series. But it is also an opportunity to entertain and to engage with Ducatisti, and we even give an opportunity to [Panigale V4] Superleggera owners to ride the MotoGP bikes; we’re the only brand to do that. And we have a lot of Scrambleristi going to the events – it’s not the case if you like Scrambler you don’t like racing, and so for us, it’s a very wide opportunity.”

We round off our chat by asking what changes Cianetti has seen in the past 23 years. “Yes, I am part of the furniture! When I started in 2000, the Texas Pacific Group owned the company, and there have been incredibly big steps forward. The company really is brand-new in every part: product, processes, organisation, technologies, size, everything. And we are also celebrating ten years of CEO Claudio Domenicali, and I think he gave a strong push in the right direction to make Ducati as big, as strong, and I would say trustworthy as it is now compared to the past.”

How has the Volkswagen Audi Group takeover changed things? “The acquisition from the Volkswagen group has been incredibly positive. Because they trust us, they leave us be. We share objectives and discuss strategies, but they respect us. And when they started the relationship, they said, ‘Ducati remains Ducati,’ and the most important thing is that all the company’s earnings stay in the company. That allows us to invest more, and that allows us to develop the product and develop the company itself.”

Three prime ministers and five chancellors since the last general election in 2019 and it is arguable that the country has not bettered itself in nearly four years. Granted we survived Covid which damaged countless economies around the world. Then there was Brexit which, as Richard Hughes, the head of the government’s independent Office of Budget Responsibility, noted at the end of March, caused a 4% drop in GDP compared to where the UK would have been if it were still in the European Union.

Of course, it was inevitable that in doling out billions of Covid cash that taxation would have to rise to repay the debt that the state took on. Indeed, from the government’s point of view, and that of business and citizens too, low interest rates are ideal since debt – public and private – would cost less to service. Equally though, high inflation eats away at the value of government debt so what the government really wants we can only guess at.

However, with rising inflation, that was meant to be ‘transitory’ but which became more engrained, interest rates were going to rise.

But what no one counted on was the clusterf**k that was the imperfect interaction of short-term prime minister Liz Truss – who left office faster than a well stored onion spoils, and her chancellor, Kwasi Kwarteng. Their attempts to restart the economy may have been well intentioned but were ill-thought out and uncosted. And the market spoke leading to interest rates that were forced up faster than expected causing untold misery and financial pain, and the Bank of England being forced into more bond buying to maintain a price floor.

It’s fair to say that Truss and Kwarteng’s actions didn’t accelerate the rise in interest rates and taxation, but rather, poured accelerant on. (It should be said that the Bank actually made £3.5bn profit on buying the bonds low and then selling them in a stronger market).

There were warnings late last year of serious recession. In fact, the British Chambers of Commerce was one organisation that warned in December 2022 that recession could last for five quarters and into 2024.

when they fell to an all-time low of 0.10%.

No one likes high interest rates and there are many who are suffering rising mortgage payments on large piles of debt. Partly they had no choice, but to borrow large sums if they wanted to buy property in an overheated market. But equally, there are a number of households that overspent in many areas –holidays or on PCP-funded vehicles – who had forgotten the impact and risk of higher interest rates more akin to the norm.

All of this aside, it appears that the UK has dodged the bullet and won’t enter into recession. That’s good. But the economy isn’t bubbling away either. The most recent interest rate rise –to 4.5% in May – was a bit of a shock since most expected inflation to head below 10%. But rising fuel and food prices put paid to that.

As for the future, the expectation is that rates will fall. Capital Economics reckons that the base rate will be cut to 3% at the end of 2024 and to 2.5% by the end of 2025.

Subsequent to a new government, Jeremy Hunt was brought in by Rishi Sunak to be a safe pair of hands. He did stabilise the ship by halting virtually all of the Truss government’s economic plans.

With Hunt’s autumn statement and March 2023 budget, taxation is now at its highest since the Second World War. Interest rates too are at a 14-year peak. But it shouldn’t be forgotten that since the start of the millennium, they’ve hovered around 5%. They only dipped below the current 4.25% in five quarters before the financial crash of 2008

IT’S PROBABLY ONE OF THE MOST UNLIKELY scientific research programmes that we’ve seen at BDN. But the maker of ComfortAir bike seat air cushions has commissioned a specialist laboratory to work out what causes long-distance pain and discomfort to riders.

The lab used special ‘rear-end’ pressure mapping equipment to compare a rider on a standard bike seat with the same rider on the same bike with a ComfortAir seat cushion. And the results are actually pretty interesting. According to the researchers, many bikes put riders in unnatural sitting positions, putting too much pressure on

the lower torso and buttocks. That reduces blood flow and compresses nerves, causing muscles to become fatigued and sore. The higher pressures also means more heat and sweat, further increasing muscle pain and cramp.

The pressure mapping obtained from the experiments showed that the ComfortAir cushion does help to counteract these three issues: it evenly distributes the rider’s weight, eliminating painful pressure points on the pelvis and spine, protects against shocks and dampens vibration while helping blood circulation. Space between the air cells is also shaped to encourage airflow under the

High interest rates mean that the cost of borrowing money to purchase a higher-value ticket item increases, making the overall cost of ownership more prohibitive. Many buyers will hold off purchasing or opt for a cheaper or second-hand alternative model.

Interest rates can also have an impact on the length of financing terms. Buyers may opt for shorter loan terms when interest rates are high to avoid paying more over time. This can result in higher monthly payments, which may deter some buyers. As interest rates continue to fluctuate, it will be important for the motorcycle industry to stay attuned to changes in buyer behaviours and adapt accordingly.

rider’s behind, reducing the risk of ‘hot-spots’.

ComfortAir’s Wayne Harrison said, “We’re really encouraged by the results, which reinforced just how effective our seat cushions can be in reducing serious discomfort on longer rides. We definitely won’t be sitting on these results, we’ll be using the data to inform the development of the next generation of ComfortAir.”

It’s fair to say that Truss and Kwarteng’s actions didn’t accelerate the rise in interest rates and taxation, but rather, poured accelerant on

THE SCRUTINY COMMITTEE OF Hackney Council has refused to intervene in the London borough’s massive increase in motorcycle parking charges. The committee met on 24 April to hear evidence from Hackney residents, workers and carers about the disproportionately high parking charge increases – up to £50 a week – and how they would cripple predominately low-paid people in the area. But the majority of Labour councillors then voted to take no further action, with no explanation, despite the attempts of both Green and Conservative councillors.

A Save London Motorcycling spokesperson said: “We, alongside thousands of others, do not accept this result. The council has a responsibility to make policy that is evidence-based and to monitor the impact of its policies on those who will be affected most. Some of the lowest-paid workers and most vulnerable Hackney residents will suffer extreme hardship as a direct result. Yesterday’s charade of scrutiny laid bare the utter farce which is governance in Hackney today. The panel’s questions clearly revealed fundamental flaws in the policy, but still councillors voted to blindly press ahead with completely

unprecedented and devastating charges without any idea what the impacts will be.

“After spending more than an hour discussing the cost of living crisis, foodbank use and the devastating impact of a £10 a week benefit cut, in the very next item councillors dismissed their £50 a week charges for motorcycle and scooter riders as being affordable and insignificant. This level of hypocrisy defies belief, and shows any pretence of Labour Hackney councillors caring about hardpressed residents and workers is nothing but cynical empty gesturing. We urge everyone concerned with fairness and the lives and livelihoods of Hackney workers, residents, and carers to join our campaign and stand up against this injustice, and all Hackney residents to carefully consider whether this council displays the standards they want from their representatives.”

Hackney’s new bike parking charges are up to £10 a day, which is 20 times more than in any other London Borough. And the parking charge will apply even to electric bikes or mopeds, scotching even the flimsiest arguments about air pollution being a factor.

Continuing its crusade on “bread and butter” motorcycling issues, the Motorcycle Action Group (MAG) is renewing its campaign for improved road surface conditions. It’s a matter close to many riders’ hearts, of course: the impact (literal and metaphorical) of a big pothole can be much greater on a motorcycle than a car or truck. And with the risk of expensive wheel, tyre and suspension repairs – or even severe crashes – potholes really are a big issue for motorcyclists. Indeed, MAG says more than 70 riders are killed or seriously injured each year in incidents where road surface is a factor. Declining revenues and cost-cutting by local councils and highway authorities, together with a miserable winter, means many riders are dealing with worse-thanusual road conditions.

So MAG is throwing its weight behind promoting a new parliamentary petition for motorcyclists. The petition, raised by Dean Murphy, calls for increased road repair and resurfacing funding and is available online at: tinyurl.com/xw98nsy4

MAG director Colin Brown, said, “Potholes are an emotive subject for riders. A simple request for stories of pothole-related crashes on MAG’s social media attracted a response rate higher by an order of magnitude than other posts. Potholes have always been in the top five issues that get raised by our membership.

“The recent announcement by Jeremy Hunt of an extra £200m to tackle the issue is risible when taken in the context of the £14bn backlog of repairs reported by the Asphalt Industry Alliance in their 2023 ALARM report.”

HARLEY IS 120 YEARS OLD THIS year, and its UK arm is celebrating with a big nationwide demo ride tour. It kicked off at Sam’s Diner in St Austell, Cornwall, in May and continues through to September.

The tour has a range of the latest Harley models available for customers to try, including the all-new Nightster 975 Special and Breakout 117, plus the Pan America 1250 adventure tourer. There’s also a selection of Softail cruisers and luxurious Grand American Touring models.

TOUR DATES 2023:

1 July: Poulson Creative

Customs, Essex

8 July: Docks Beers, Grimsby

9 July: NY500, Pickering

15 July: Bridge House Café, Lancaster

29 July: Baffle Haus, Pontypool

6 August: Rivos Hub, Poole

19 August: The Green Welly, Crianlarich

23 September: Rykas, Box Hill

Anew firm – backed by a highly experienced man of the industry – is launching an innovative range of bike aftercare products it claims will help dealers make more money from each bike sale.

That industry veteran is Steve Keys, who’s been in the bike trade for more than 40 years. Keys’ new business is launching with a bike care package, which includes a ceramic paintwork treatment product and an anti-corrosion system for exposed metalwork, both applied by dealers before a bike is released to the customer. The customer gets a 12-month supply of aftercare products to maintain the finish, and UltiMoto claims that the paint and anti-corrosion products will keep a bike in the best possible condition. The ceramic coat is suitable for both matt and gloss

paint finishes – a first in the industry – and has been specially formulated to work on bikes rather than being a rebadged car product.

“I’m on a mission to make sure nobody ever polishes their motorcycle again!” said Keys when BDN spoke to him. “Because polishing is what damages the paintwork. We want customers to spend more time riding their bikes than cleaning them while enhancing residual values. Remember that on PCP deals, they need to get to the right level of quality to have enough deposit left over for the next one.”

And Keys says there’s more to come from Ulti-Moto, with a comprehensive portfolio of aftermarket products and services ready to be launched

and all set to increase revenues. “This is the start of a brand we’re initially launching with these care products, but we have other products we will bring to market soon to help dealers make a lot of money.

“Ulti-Moto is here to support the industry and create profit opportunities that would otherwise be unavailable. Over the next six months, we’ll be bringing new, innovative products to the market that no one else has been able to make available previously.”

Ulti-Moto

07966 797856

steve@ulti-moto.com

CUSTOMERS INCREASINGLY LIKE TO communicate by text message (SMS) rather than voice calls – and digital marketing firm Marketing Delivery is making it easier to manage this process. The firm’s LeadBox lead management software has added a new SMS tool that allows dealers to have two-way communications via text messages, with potential or existing clients.

The firm estimates a third of aftersales customers prefer to hear from dealers via SMS, but many current systems only allow one-way

communication. LeadBox, together with the firm’s VoiceBox software, means customers always have a way to reply: there’s no ‘noreply’ email addresses, withheld numbers, or unmonitored text message chats.

“Changes in consumer behaviour have increased expectations of instant interactions with dealerships, but daily life doesn’t always lend itself to an excess of phone calls if the workshop needs to contact the customer,” said Jeremy Evans, chief executive at Marketing

Delivery. “Adding two-way SMS functionality to our aftersales software makes it simple for the customer to respond using their most preferred method. Workshop teams can now use SMS, for example, to seek and secure approval of costs before commencing work and the SMS thread can be synced to the customer record for future reference.”

Marketing Delivery 01892 599911

www.marketingdelivery.co.uk

At the start of March, the government announced the reintroduction of the Data Protection and Digital Information (No.2) Bill. First mooted in July 2022, the original Bill was withdrawn “to allow ministers to consider the legislation further.”

Despite the UK GDPR and Data Protection Act being not even five years old, the government says it wants to capitalise on post-Brexit freedoms as some elements of the UK GDPR and DPA create barriers, uncertainty and unnecessary burdens for businesses and consumers.

And for many, the delay from last year was welcomed – especially by the European Commission since, as Euractive.com commented, “London's planned reform of its data protection regime has attracted considerable attention in Brussels, given its potential implications for the EU-UK data adequacy agreement reached in 2019, which facilitates ongoing data transfers between the two.”

In response, the Department for Culture, Media and Sport has said that the UK had been in “constant contact” with the European Commission in creating the new Bill.

In overview, there are several changes. Subject Access Requests – where individuals seek their information – can be refused or charged for if vexatious; there will be new legitimate interests for processing data; there are to be new rules on data security; a ‘senior responsible person’ who is part of an organisation’s

senior management must be appointed; record-keeping requirements are to be diluted except for ‘high risk’ activities; the role of artificial intelligence in data processing will be clarified; and the penalties for breaching rules on electronic marketing are to be radically increased.

There is confidence in the revised Bill in that it has been co-designed to create more integrity and transparency. Of course, the fact that elements of bureaucratic red tape have been removed or watered down is going to be good for business; they'll have new-found clarity about when they can process personal data without needing consent without weighing up their own interests against an individual's rights.

But lawyers such as Jeanette Burgess, head of regulatory and compliance at Walker Morris, are warning that the Bill doesn't radically change the data protection regime, as “organisations still need to make sure that they only process personal data where they have a lawful basis to do so, and that data protection principles are

compliant with the UK GDPR will not need to make any significant changes as the main principles and obligations of the current data protection regime will remain. However, it’s hoped that the burdens on organisations are eased, but the results will take time to become apparent.

More detail will filter out on the Bill at gov.uk

There is confidence in the revised Bill in that it has been codesigned to create more integrity and transparency

Full-year results for the world’s biggest bike brand were another display of unassailable superiority. Honda’s annual motorcycle business revenue increased remorselessly, 33.1% up to £17.203bn. Operating profit climbed by 56.9% year-on-year to £2.891bn. Operating margin rose to 16.8% from 14.3%.

To underline such absolute domination for powered twowheelers, turnover from parallel Honda car production was nearly four times larger at £63.9bn but yielded only a slimline £249m operating profit.

The driving force has been global wholesale growth of 10.2% to 18.757 million Honda-branded bikes during the 12 months. Some 12.161 million of these were made by wholly-owned subsidiaries, the rest by joint-venture affiliates.

Vast emerging Asian markets led the way, rising by 10.4% to 16.108 million machines sold.

The three Japanese motorcycle brands counting their beans across an April 2022 to March 2023 fiscal year have enjoyed a terrific post-pandemic recovery. But all of them are now anticipating markedly slower growth – or in Kawasaki’s case a decline – in the new 2023-2024 period. BDN financial editor Roger Willis wasn’t impressed by the lack of excuses

Astra Honda in Indonesia, a JV partnership with British overseas trading conglomerate Jardine Matheson, was leading contributor, its output improving by 15.7% to 4.48 million despite ongoing semiconductor shortages. Honda-owned factories in India were close behind, together boasting a 16% advance to 4.025 million. Subsidiary plants in Vietnam and Thailand followed, respectively 16.3% up to 2.407 million and 25.1% up to 1.456 million.

Other emerging regions accounted for a 10.9% improvement to 1.597 million. Within those, Honda’s Brazilian production hub at Manaus put on 15.4% to 1.125 million. In more profitable developed-world markets, North America topped the pile, 5% higher to 459,000. European sales improved by 9.5% to 347,000. Japanese domestic numbers were almost flat, though, 0.8% up to 246,000.

Forecasts for the new fiscal year to March 2024 are surprisingly

modest. Honda estimates that its total motorcycle unit sales will rise by a mere 2.3% to 19.18 million. Asia will grow by only 1.7% to 16.375 million and other emerging regions by just 2.1% to 1.63 million. However, developed markets should do better. The prediction for Europe is a 25.4% rise to 435,000. North America will be 2.4% up to 470,000 and Japan is set to recover by 9.8% to 270,000.

¥-£ currency translation at forex rates applicable on 11 May

According to its full-year results, good times were rolling again for the powersports and engine division of Kawasaki Heavy Industries. But apparently not for much longer.

Total revenue for the 12 months exceeded estimates, 32% up to £3.498bn. Motorcycles destined for the developed world generated the biggest contribution, a 24.3%

increase to £1.25bn (but slightly below forecast). Motorcycles for emerging markets yielded an above-forecast 14.9% rise to £685m. Turnover from utility vehicles, quadbikes and personal watercraft – mainly aimed at US customers – delivered a 47.4% improvement to £949m. A 51.8% boost from general-purpose petrol engines accounted for the rest.

Divisional operating profit almost doubled, growing by 90.7% to £423m. Operating margin increased from 8.3% to 12.1%. Global wholesale motorcycle shipments rose by 13% to 555,000. The four-wheel and PWC segment shipped a 7.4% volume increase to 87,000 units.

Developed motorcycle markets were 13.9% up to 237,000. Within that, US dealer demand soared by 38.4% to 119,000 and Canada put on 66.7% to 10,000. But European inventory slumped by 5.6% to 67,000. Australia was 8.3% down to 11,000 and Japanese domestic sales fell by 12.9% to 27,000.

Bikes for emerging countries advanced by 12.4% to 318,000. The Philippines were way out in front, adding 29.8% to 209,000. Indonesia and China respectively declined by 4.4% to 43,000 and 18.9% to 30,000. Brazil flatlined on 10,000 and Thailand plunged by 57.1% to just 3000. Some 20,000 went to elsewhere.

Having withdrawn from global sporting engagement in favour of more modest objectives, Suzuki Motor Corporation’s motorcycle business satisfactorily banked this change in direction. Full-year revenue accelerated by 31.4% to £1.961bn. Operating profit went ballistic, 170.2% up to £172m. Operating margin reached a record 8.8%.

Asian performance was to the fore in elevating turnover, 30.9% up to £976m. Suzuki’s wholly-owned Indian motorcycle and scooter subsidiary played the biggest role in that, adding 40.6% to £521m. Other emerging markets improved by 28.6% to £338m. Among key developedworld contributors, Europe boasted a 33.3% rise to £230m and North America mounted a 60% recovery to £282m.

Good times were rolling again for the powersports division of Kawasaki Heavy Industries. But apparently not for much longer

Bike production during the year grew by 7.3% to 1.914 million. The vast majority were made in Asian plants. Only 111,000 originated from Japan. Worldwide unit sales were 13.4% up to 1.859 million. Asia consumed 1.528 million of them, a 15.4% increase. Within that, India put on 21.4% to 740,000. China was 6.8% higher at 430, 000 and the Philippines climbed by 22.5% to 197,000. Elsewhere in the emerging firmament, Latin America was 17.5% up to 198,000.

Forecasts for Kawasaki’s new fiscal year to 31 March 2024 are considerably less enticing. The company plans a reduction of about 7% in the supply of motorcycles to developed countries and a commensurate increase in emerging markets. Unsurprisingly, it predicts this will lead to an approximate 2% drop in annual turnover to £3.432bn and slash operating profit by 34.3% to £278m.

On a brighter note, at least Kawasaki is continuing joint research on hydrogen-fuelled internal combustion engines with Toyota, Nippon Denso and four other motorcycle manufacturers. ¥-£ currency translation at forex rates applicable on 14 May

European sales volume rose by 9.1% to 31,000 and North American numbers were 11.5% up to 32,000. The Japanese domestic market fell by 14.6% to 46,000.

However, Suzuki’s new fiscal year isn’t so promising. Production is set to expand by just 3% to 1.971 million bikes, with projected global sales volume only 4.4% up to 1.941 million. Asian growth is forecast at a mere 4.3% to 1.594 million, while smaller emerging markets should see a 3.5% decline to 215,000.

North America is likely to flatten on only a 3.4% gain to 33,000. But saving the good news until last, European volume should rise with a predicted 39.6% surge to 43,000.

¥-£ currency translation at forex rates applicable on 15 May

Posh model mix and premium prices evidently ensured that BMW Group’s motorcycle business was laughing all the way to its bank in Q1, despite struggling unit sales volume.

Total revenue during the period grew by a useful 16.8% to £820.4m. Associated operating profit went ballistic, 42.6% up to £135.4m, and quarterly operating margin improved to 16.5% from 13.5% year-on-year. Pre-tax income also sat on £135.4m, although growth was marginally lower at 41.3%. Net profit contribution by the Motorrad segment increased by 23.6% to £96.7m.

However, retail deliveries to customers worldwide advanced marginally, by 1.1% to 47,935 motorcycles and maxiscooters. The nowusual paucity of information on performance covering individual markets then kicked in. MCIA resources independently available to BDN indicate UK registrations for the brand in Q1 declined by 0.1% to 2677 bikes. Beyond that, we were none the wiser.

Oddly, BMW wasn’t so shy about bragging rights across its automotive segment –providing detailed breakdowns of delivery

Healthy bottom lines were pretty much ubiquitous for motorcycle manufacturers revealing corporate performance in the opening quarter of this year. But retail activity has been fairly stagnant or in retreat in many cases, as wholesale demand from dealers eager to rebuild inventory meets the inflationary strain facing consumers. BDN financial editor Roger Willis suspects that number-crunching further into 2023 may prove to be somewhat more fraught

volumes throughout various global markets, and even the role played in them by specific vehicle model variants. Battery-electric vehicle output also got a massive topical splash.

Motorcycles only reappeared as full-year forecasting footnotes in the results statement. Annualised bike deliveries are “predicted to increase slightly”. Operating margin is “expected to finish within a range of between 8% and 10%”. And RoCE (return on capital employed) will be “between 21% and 26%”. €-£ currency translation at forex rates applicable on 4 May

Ticking virtually all the right boxes for its Volkswagen Group parent, Ducati performed exceptionally in the first three months of 2023.

Quarterly revenue for the Bologna-based but Wolfsburg-owned brand climbed remorselessly by 40.3% to £282.6m. Higher sales volumes, a better model mix and after-sales growth took the credit. Operating profit went stratospheric, boasting a 134.2% increase to £50.8m. Operating margin leapt from 10.7% to 17.8%.

Underlying that success were total production

figures 8.2% up to 17,043 and global retail deliveries to customers rising by 9.1% to 14,725.

The Naked/ Sport Cruiser segment spanning Diavel, Monster and Streetfighter models shipped 22.5% more machines to dealers, a 6600 headcount, with retail 15.5% higher at 5010. Monsters topped that particular slot with 2005 bikes sold to hoi polloi Ducatisti.

Dual/Hyper, armed with Hypermotard, DesertX and Multistrada products, lifted wholesale by 28.4% to 5982 and retail 30.2% up to 5822. The best-selling Multistrada V4 adventure range led that charge, thanks to 2688 of them rolling out of showrooms. Some 1442 examples of the DesertX reaching customers were worthy of an honourable mention too. Sport production, covering SuperSport and Panigale superbike machinery, also increased substantially, by 35.3% to 3691. But retail sales flatlined, 0.8% down to 2729. Really poor numbers came from Ducati’s Scrambler subbrand, though, where wholesale output plunged by 74.2% to just 770 and retail was 39.8% lower on 1164. Specific component shortages may have been responsible for that.

European markets accounted for 61% of all retail transactions, improving from 57% in the same period last year. Italian domestic sales were strongest, 7% up to 2717 bikes. Germany put on 21% to 1666. The US market, Ducati’s second-largest export target, also added 21% to 1677, increasing its global share to slightly more than a tenth.

Ducati is now represented in more than 90 countries via a sales network currently stretching to in excess of 800 dealers. And the company says it intends to add 55 new outlets during 2023. Among those already unveiled in the first quarter is an inaugural AudiDucati retail integration dealership in Zurich, Switzerland’s largest city, which may prove to be an ominous sign of the times.

€-£ currency translation at forex rates applicable on 5 May

Kicking off the corporate reporting season with a relatively robust set of first-quarter numbers, there are still a lot of unanswered questions in Harley-Davidson’s future – not least, affordability of increasingly premium-priced products on home turf.

Total quarterly revenue grew by 19.6% to £1.435bn. The primary constituent was a 20.5% rise in turnover from motorcycles and related products to £1.25bn. The HDFS consumer credit and dealer inventory funding arm’s revenue contribution put on 16.2% to £179.1m. Input from Harley’s LiveWire electric bike spinoff added £6.2m, a notional annualised decline of 25.4%.

Commenting on these figures, chairman and chief executive Jochen Zeitz said: “HarleyDavidson delivered a solid start to the year with consolidated first quarter revenue reflecting the progress we continue to make in advancing our Hardwire strategic plan.”

Overall operating profit rose by 27.8% to £296.3m. Within that, income from motorcycles and related products was 53.4% up to £269.1m. But HDFS profitability slumped by 32.4% to £46.9m, owing to higher borrowing costs and POS bad debts. Such loan defaults were ostensibly caused by several unidentified factors relating to the “current macro environment”. LiveWire incurred an operating loss of £19.7m, worsening from a booked loss of £12.8m in the same period last year.

However, net profit stacked on 36.7% to £243.9m, so Jochen Zeitz was a happy bunny on behalf of fellow stakeholders. Although Harley’s share price initially plunged by more than 6% when the results were announced, it almost completely recovered in that full session’s trading.

the profitable core product segments, following “sunsetting” of the late but fondly remembered Sportster range.

Latin America in its entirety shifted only 606 machines to paying customers, a 25.1% reduction, thanks to being adversely impacted by tough regional economic conditions. And then alleged growth in Asia-Pacific countries –of a minimal 2.7% to 6881 motorcycles – was hailed as continuing strong demand across key markets, including Japan and Australia.

For its full-year 2023 forecast, Harley has reaffirmed previous guidance and continues to expect revenue growth of 4% to 7% from motorcycles and related products, and an operating margin of 14.1% to 14.6%. But the HDFS funding arm’s operating profit is set to decline by somewhere between 20% to 25%. LiveWire electric motorcycle sales are likely to be in a broad range of 750 to 2000 units, with an annual operating loss of about £90m to £100m.

Subsequent negative commentator reaction to these Q1 results focused on unadventurous forecast growth targets and drawing parallels between the aforementioned weak domestic retail demand and fresh economic data showing that US personal consumption remained flat in March. Persistent inflation is apparently discouraging budget-conscious Americans from committing to larger discretionary purchases –as it almost certainly is elsewhere. $-£ currency translation at forex rates applicable on 28 April

Of course, much of this good news had been based on banking an early-season Q1 surge in wholesale shipments, which were 13.7% up to 62,237 units, to boost dealer inventories worldwide. Global retail sales were less enticing, 12.5% down at 39,425, with a variety of excuses on tap.

US domestic retail performance fell sharply by 17.3% to 24,277. This was blamed by Harley on timing of new product launches, as well as somewhat amorphous “shifting macro conditions”. Sales in adjacent Canada were a more modest 6.7% lower at 1744, which sounds like an acceptable result given Canucks often still have snow on their boots during much of the three months in contention.

The EMEA region, which predominantly means the whole of Europe and was Harley’s biggest export market for many years, sank by 5.9% to a fairly pathetic 5917 bikes leaving showrooms. According to available excuses, this was primarily driven by market exits, in addition to a planned unit mix shift towards

It may seem counter-intuitive to name your historic headline product after an unpleasant insect species. But vespidae (wasps) are lucky in Pontedera, where Italian scooter giant Piaggio has just notched up its best-ever Q1 results.

Piaggio’s consolidated quarterly revenue to 31 March buzzed 20% up to £477.3m. And a 4.8% increase to 124,700 powered twowheelers sold worldwide, plus associated spares and accessories, was credited with generating £382.2m of that – in turn a 17.1% increase yearon-year.

The resultant operating profit sting was 62.2% higher at £39.2m. Operating margin climbed from 6.1% to 8.2%. Pre-tax profit rose by 78.7% to £31.9m. And a record-breaking Q1 net profit almost doubled to £21m, against £11.1m in the same period last year. Net debt was reduced by £11.3m to £373.5m.

PTW sales turnover in the EMEA and Americas together was reportedly 21.9% up. On this side of the Atlantic, revenue in Italy grew by 40.3%. In the USA, it was 58.2% higher. The Asia-Pacific region was a more modest contributor, rising by 12.4%.

There are still a lot of unanswered questions in HarleyDavidson’s future –not least, affordability of increasingly premium-priced products

In Europe, Piaggio claimed a 21.7% share of the scooter market, improving slightly from 21% in Q1 last year. Share of the North American scooter market rose from 24.6% to 26.4%.

Piaggio’s scooter sector as a whole boasted a 16.8% advance in global turnover, led by an 18% increase for the Vespa brand and support from the Piaggio MP3 three-wheeler plus Piaggio Beverley, Medley and Liberty high-wheel scooters.

The motorcycle sector allegedly achieved revenue growth of 12.7%. Moto Guzzi claimed its best-ever quarter, with sales volume up by about 30% and turnover improving by approximately 55%. The new Moto Guzzi V100 Mandello apparently played an important role. Aprilia also signalled an excellent quarterly performance from RSV4, RS660, Tuono 660 and 1100, and Tuareg 660 models. But, as ever, actual unit sales figures for either brand were entirely absent.

€-£ currency translation at forex rates applicable on 8 May

Although US powersports giant Polaris expects annual growth outlook for 2023 to remain fairly weak, particularly in its crucial domestic market, a combination of strong wholesale availability, higher pricing and dealer demand for inventory boosted Q1. Retail performance was generally a disappointment, though.

Total quarterly turnover improved by 22.4% to £1.75bn. Resultant operating profit was 60.8% up at £129.3m. Net profit rose by 62.2% to £91m, before a dodgy non-GAAP adjustment represented the bottom line as growing by 47.1% to £95.5m.

Revenue from the key Polaris off-road vehicle (ORV) segment, which primarly covers both sport and utility side-by-sides, plus quadbikes, but also includes snowmobiles, put on 18.6% to £1.278bn. Wholesale uptake was reportedly driven by higher volume and favourable pricing. However, North American retail ORV unit sales fell by 10%.

In the on-road segment, dominated by Indian Motorcycle medium and heavyweight cruisers, but also featuring Slingshot sporting trikes and moped-licenced Aixam quadricycles, revenue

climbed by 41.9% to £259.7m. Broadly referring to the Indian brand, Polaris said wholesale success was bolstered by better product availability on the back of an improving supply chain environment, as well as a favourable product mix. Sales of related parts, garments and accessories also surged by 19%.

Nevertheless, Indian retail sales in North America were flat. The only redeeming aspect of that was retail for comparable motorcycles on home turf (ie Harley-Davidson) sank by a double-digit percentage during the quarter. $-£ currency translation at forex rates applicable on 2 May

After a lot of now generally redundant bleating about supply-chain glitches and semiconductor shortages, Yamaha has responded to strong demand with ramped-up production and shipments – and the proof is higher sales and profits in Q1.

The brand’s first-quarter motorcycle business revenue put on 25.3% to £2.043bn, on the back of global unit sales improving by 12.1% to 1.274 million. Asia was 22.6% up to £1.228bn, thanks to a 13.6% sales volume increase encompassing 1.028 million of those bikes.

More profitable developed markets together rose by 30.8% to £530m. Prominent within them, European turnover climbed by 29.8% to £309m as associated unit sales added 7.8% to 55,000. North America achieved a particularly remarkable recovery – more than doubling revenue through a 110.7% hike to £139m and increasing unit sales by 85.7% to 26,000. Latin America and various other markets were 26.8% higher at £275m, as volume grew marginally by 0.7% to 144,000.

Radically improved operating profit from motorcycles also more than doubled, rising by 120.9% to £161m. Operating margin lifted from 4.5% to 7.9%.

Yamaha’s forecasts going forward through 2023 are mixed. While it anticipates continued strong demand for bikes in emerging markets as they experience economic recoveries, the company is cautious about uncertainties in the US and European economies.

¥-£ currency translation at forex rates applicable on 15 May

THE INTERNATIONAL MOTORCYCLE Manufacturers’ Association (IMMA) has appointed a new president for the 2023-2025 term. Eric de Seynes, current Yamaha Motor Europe president and CEO and long-time motorcycle enthusiast, was elected to take over from Rakesh Sharma, the 2020-23 president.

De Seynes, nominated by ACEM (the European manufacturers association), was elected alongside Johannes Loman, nominated by FAMI, who was elected vice president. De Seynes is also a senior executive officer at Yamaha Motor Company, and Vice President of ACEM. Loman is a director at PT Astra International Tbk Indonesia and president of the IMMA-member associations FAMI (Federation of Asian Motorcycle Industries).

Accepting his election, De Seynes pledged to advance safe and sustainable motorcycling through education, innovation, and cooperation. “Thank you for your confidence in electing me. I am fully committed to the task and look forward to working with the members and with the secretary general, defending and promoting the industry and motorcycling.”

A familiar face at the EICMA show each year, de Seynes inherited his father’s passion for motorcycles at a very young age. He started competing in motorbike racing in 1974 and took part in the Paris-Dakar in 1982. In 2016, and after holding several leadership positions in the motorcycle industry, he was appointed group executive officer of Yamaha Motor Company, before becoming president and CEO of Yamaha Motor Europe, a first for a non-Japanese employee.

Intercom maker Cardo has strengthened its European distributor network, with three new deals covering Romania, Slovenia and Austria. The Aures company in Slovenia and Xajo in Austria will distribute the full range of Cardo products, adding to the relationship, started last year, with Moto Mus in Romania.

Jonathan Yanai, VP global sales for Cardo Systems, says: “We are very happy to welcome Aures, Xajo and Moto Mus to our global distribution network. They have fantastic experience distributing premium brands and extensive knowledge of the local markets. I look forward to working closely with Aures and Xajo to develop Slovenia and Austria. We started working with Moto Mus in 2022 and so far have seen great growth in the Romanian market – I am confident that we can grow this successful partnership even further.”

BATTERY MAKER YUASA HAS ANNOUNCED THAT IT is building a new Japanese production plant in collaboration with Honda to make lithium-ion cells for electric vehicles. The new Kyoto factory, backed by the Japanese government, represents an investment of ¥434bn (£2.545bn), and will produce the equivalent of 20GWh battery capacity per annum for the companies’ joint venture – to be called Honda GS Yuasa EV Battery R&D – which will launch at the end of 2024.

On a smaller scale, in the UK Yuasa has announced a new training partnership with the IMI (Institute of the Motor Industry). The two organisations say they will work together to develop new training programmes for bike technicians, focusing on new and existing battery technologies.

Berlin-based electric bike maker eROCKIT, has announced a million-euro investment in the firm by Indian investor Motovolt – and the new partner is also setting up a €10m production plant in India. According to eROCKIT, the new investment will strengthen the production of its unique eROCKIT One model in Hennigsdorf near Berlin, as well as funding the development of a new entry-level model, which will serve as a platform for further international models.

The firm produces a unique range of bikes, which blends 125cc-equivalent electric bike performance with the ‘human hybrid’ system that uses pedals, like an e-bicycle, enabling riders to hit nearly 60mph, while pedalling…

Andreas Zurwehme (CEO eROCKIT AG) said, “Our technology serves people and solves mobility problems worldwide. Our vehicles stand for healthy exercise, clean mobility, better air in our cities and less noise. In addition, we are helping to achieve the climate goals with eROCKIT.”

Tushar Choudhary (CEO Motovolt) commented, “India is the largest two-wheeler market in the world. The demand for innovative and emissionfree vehicles is enormous. For us, eROCKIT means cutting-edge technology and German engineering. We are therefore investing in this company and together we will lead it to great international success.”

Known in the trade and the racing community as the country’s top man for frame and wheel straightening, Ray Palmer of Maidstone Motoliner, Aylesford, Kent, died recently in Maidstone Hospital after suffering from cancer and a short illness aged 80.

Born in Crayford, Kent, Palmer left school aged 15 to work in a hardware store. The shop was shut on Wednesdays, convenient for Palmer to attend motorcycle practice days at nearby Brands Hatch.

The following year his father bought him a motorcycle. From then on Palmer was besotted with powered two-wheelers. He immediately joined the Erith Motorcycle Club and got to know local key players in the racing world.

Moving on to work for a Dartford gearbox repair company, he took up motocross on a 350 Matchless, followed by a Greeves, and then switched to grass track which became his passion, especially the design and construction of frames for solo and sidecar use.

He was able to develop his frame-building and tuning skills when he became the first employee at Crosthwaite and Gardner, vintage and classic car restorers, whose later work included creating replicas of the 1930’s V16 Auto Union race car.

Palmer and his first wife Jacqui, lived above the firm’s Lamberhurst, Kent, premises. After working on Bugattis, Maseratis and the like, he had access to tools and space to work on two and three-wheel projects when off-duty. His first grass track special was a 175 MV in a straight tube chassis.

When Crosthwaite and Gardner moved premises, Palmer joined grass track and long track manufacturer and champion rider Don Godden at Little Preston, Kent.

Palmer later left Godden so that he could have more freedom to develop radical designs at his home workshop in East Farleigh, Kent. One was an Ariel 250 two-stroke twin grass tracker in a frame which integrated a fuel tank and expansion chambers.

Palmer sponsored riders and organised events at international level, the best known being the Bonfire Burn-up at Collier Street, Kent. A founder of the Tonbridge Motor Cycle Club, he was selfless in his enthusiasm for grass track and speedway.

In 1975 he and 50cc racer Maurice Thomas set up Molray Engineering in Dover Street, Maidstone. Thomas’s nickname was Mol, hence the name of

companies gave their approval after denying Palmer cover using his home-made frame jig.

While Thomas was an expert on spoke wheels, Palmer concentrated on the growing cast wheel market as well as working the Motoliner and modifying it to suit later alloy and cast frames. His skills with a hammer, torch and hydraulics became legendary.

In 1987 Palmer moved next door to set up Maidstone Motoliner as a separate business. In 1990 he moved it to its current premises at Aylesford, Kent. Son Tommy joined him in 1991 and competed in speedway and grass track, becoming the 1994 350 British grass track champion (Jawa 4-valve).

In 2000 Ray and Tommy acquired a second Motoliner to cater for the classic bike market. By this time, the business was long established as the UK’s leading frame and wheel truing specialists, attracting work from BSB and other top race teams, private riders and trade.

With Tommy taking a more prominent role in the business Ray was able to winter in Australia, where he married his second wife, Sue, in 2004.

An indulgence was collecting lightweight Italian bikes, Ray’s involvement with the Pope brothers’ 50cc Itom Road racer as a young man being a key influence.

A fun-loving character who enjoyed a glass of Budweiser, home parties around a snooker table and a bit of mischief revving up JAP grass trackers at any time of day or night, Ray Palmer leaves sons Tommy and Jody, daughter Rachael, and six grandchildren.

Maidstone Motoliner continues to be in high demand, run by Tommy Palmer, working with a fulltime and a part-time employee.

business strategies that will assist in driving sales opportunities and helping to open new sales avenues for dealers. In addition, she will support dealers by providing exclusive retail promotions from the brand and partner organisations.

We are looking for experienced journalists from all parts of the UK who can produce accurate news reports with photographs and write compelling features on distributors, dealers and manufacturers in the motorcycle trade.

BDN is committed to providing objective reports on all the latest industry news and events, and we are looking to expand that team. Interested? Email: editorial@dealernews.co.uk

HGB Motorcycles/Daytona Motorcycles are both well-established and respected Kawasaki/Suzuki/Yamaha and Honda Motorcycle Dealerships based in Ruislip Manor, Northwest London.

We are currently looking for the following:

An experienced Motorcycle Technician/Mechanic

The successful candidate must have experience of modern motorcycle technology and be able to demonstrate an understanding of current diagnostic equipment. The role will be responsible for servicing and repairing predominantly Kawasaki/Suzuki/Yamaha motorcycles.

We are looking for a top quality candidate to come and join our very successful team to sell some of the motorcycle market’s most exciting and popular bikes and scooters in our busy showroom.

A competitive salary and benefits package will be awarded to the successful applicants which will reflect both qualifications and experience.

Please forward your CV with a covering letter to; Dealer Principle, HGB Motorcycles (Ruislip) Ltd, 69-71 Park Way, Ruislip Manor, Middx HA4 8NS or email to brigid@hgbmotorcycles.co.uk

West London Yamaha, are looking for an additional Motorcycle Mechanic to add to our busy and successful Yamaha workshop team.

Regarded as the #1 Motorcycle store in West London perfectly placed at the edge of Twickenham to serve the whole of West London.

This could be a perfect opportunity for someone with the right level of experience, or with less, as we can offer training to the right candidate.

A very competitive salary and benefits package will be awarded to the successful applicant which will reflect both qualifications and experience.

Please send in CV to Peter email sales@westlondonyamaha.co.uk

WHENEVER A JOURNALIST speaks to a dealer about electric bikes, they are often told that we’ll need a ‘big player’ to launch a battery powered bike before it can take off properly. And now the biggest of them all – Honda – has entered the scene, with its first production electric two-wheeler to go on sale in the UK and Europe.