key business information for the UK motorcycle and scooter industry www.britishdealernews.co.uk Key business information for the UK motorcycle and scooter industry • April 2024

Chell calls it a day after 66-years in the business of motorcycles. Read the full story page 18 CYRIL BIDS FAREWELL INDUSTRY NEWS UK NEWS INDUSTRY GREATS WHOLESALE NEWS FUCHS and Triumph lube up Kawasaki Dealer Days announced Yamaha dealer awards ClementsMoto plugs into Peugeot Manufacturers Trade Talk More misery for MCE Insurance

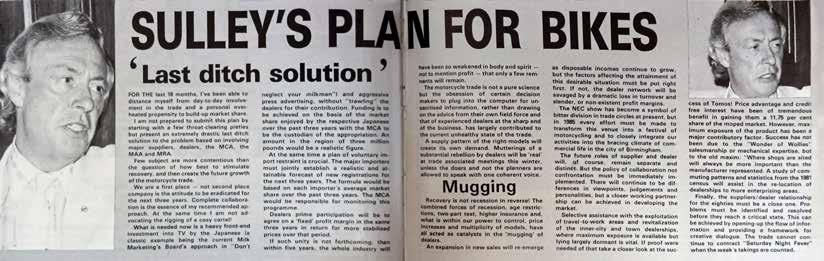

Sulley: Tops for charisma BDN Exclusive www.ls2helmets.com 01670 856342 VECTOR II CARBON ALWAYS AHEAD

Cyril

Eric

UNMISSABLE DEALS IN OUR 60TH YEAR As we celebrate our 60th year, there’s never been a better time to be a KYMCO dealer, but if you’re not already and would like to talk to us about open points, please contact: VSR 125 - £2,459 RRP NOW INCLUDES: FREE Delkevic performance exhaust with carbon silencer • 96% recovery rate • Insurance approved • Theft protection • Peace of mind AGILITY CITY+ 125 - £2,559 RRP NOW INCLUDES: FREE on-the-road (OTR) fees within list price FREE SHAD 29-litre Top Box National Sales Manager | Neil Keeble | 07718 479613 | nkeeble@kymcouk.co.uk | kymco.co.uk FREE Datatool Stealth Tracker* & DNA Security Marking System *requires subscription

April 2024 : Issue 273

HEAD OF CONTENT

Andy Mayo: editorial@dealernews.co.uk

FINANCIAL EDITOR

Roger Willis: editorial@dealernews.co.uk

PRODUCTS EDITOR/DESIGNER

Colin Williams: design@dealernews.co.uk

COMMERCIAL CONTENT MANAGER

Maurice Knuckey: creative@dealernews.co.uk

CONTRIBUTORS

Roger Willis; Dan Sager; Alan Dowds; Rick Kemp; Adam Bernstein; Brian Crichton

ACCOUNTS MANAGER

Mark Mayo: accounts@dealernews.co.uk

ADVERTISING

Alison Payne: tel 07595 219093

Paul Baggott: tel 07831 863837 adsales@dealernews.co.uk

CIRCULATION

circulation@dealernews.co.uk

TAIWAN AGENCY

Albert Yang, Pro Media Co: info@motopromedia.com; tel +886 4 7264437

PUBLISHER

Colin Mayo: editorial@dealernews.co.uk

British Dealer News, 10 Daddon Court, Clovelly Road Industrial Estate, Bideford EX39 3FH

56

the business

Copyright © Mayo Media Ltd: All rights reserved. Reproduction in whole or part by any electronic or mechanical means without express permission is strictly prohibited. Mayo Media Ltd can accept no responsibility for the veracity of claims made by advertisers. Printed by S&G Print Group. the news 20 66 ON THE MONEY Market analysis by Roger Willis 67 INTERNATIONAL SHARE PRICES A snapshot of global performance 68 NEW REGISTRATION DATA MCIA and ACEM statistics 70 REGISTRATIONS ANALYSIS By Glass’s and the NMDA 72 USED BIKE DATA From Auto Trader and MCN 74 MARKET WATCH Market report by cap hpi 32 4 Yet more misery for MCE Insurance 6 Fernandez flicks the Ignition switch 8 Spindogs’ new digital deal with Triumph 9 Fowlers adds S100 cleaning range 10 Harley-Davidson dealer awards 11 NMC joins FIM discussions 12 Yamaha awards for last year’s top dealers 13 Kawasaki Dealer Days announced 14 Springtime auction sensations 16 The man from Honda - Lap 2 18 Cyril sells Stafford business 19 Suzuki fun in the sun 20 ClementsMoto plugs into Peugeot 22 Obituary – Andre Waszczyszyn 23 BDN JobScene and Dealer4Sale 24 What Labour means for business 26 Manufacturers’ Trade Talk 32 Is it easy being Dainese? 33 Lacey Ducati up for sale 34 International news 36 On the Move 37 Reaction - readers air their views 38 Electric news 40 Alternative power registration analysis 42 Off-road news the knowledge the team

BUSINESS BEAT Mitigating the risk of wrongful trading

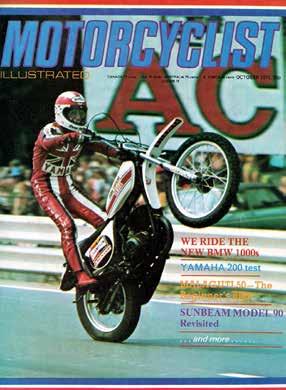

INDUSTRY GREATS – ERIC SULLEY: PART TWO Tops for charisma and best-ever for sales

MARKETING MATTERS You’re having a laugh – from disaster to triumph 54 THE BUSINESS ESSENTIALS Unfair dismissal: A key cause of trouble

44

46

52

PRODUCTS Latest retail profit opportunities with Colin Williams

Contents

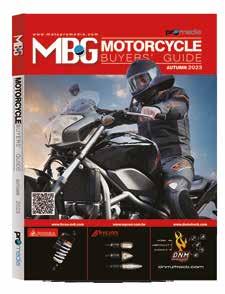

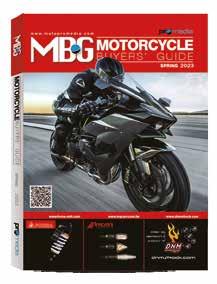

INSIDE NEXT MONTH More than 650 trade suppliers listed in a user-friendly A-Z format Get listed – be seen adsales@dealernews.co.uk 2024 TRADE DIRECTORY www.britishdealernews.co.uk2024 TRADE DIRECTORY www.britishdealernews.co.uk sponsored 020 enquiries@dfcapital.bank6930 dfcapital.bank Get touchto outmore: May 8 April June 7 May July 7 June August 8 July advanced copy deadlines BDN Exclusive weekly yearly information www.britishdealernews.co.uk stats MOTOHAUS MOVES ON X-FORCE daily monthly yearly .britishdealernews.co.uk SHOWTIME SPARKLE RAPID II daily weekly monthly yearly motorcycle industry www.britishdealernews.co.uk motorcycle scooter secures distribution Motorcyclesand alreadyestablishing dealer TRAGOTARGETS THETRADE INTERNATIONAL analysis Bikesuresponsorship Bike crashes Ducati wins Trophy EXPLORER 52 FREE The British Dealer News 2024 Trade Directory

Yet more misery for MCE Insurance

The woes of bankrupt specialist motorcycle insurance broker MCE –once a self-styled candidate for largest bike insurer in the market – continue to grow.

After MCE went bust in July last year, insolvency practitioner Crowe UK was parachuted in as administrator by the Financial Conduct Authority. Crowe’s first report on MCE affairs appeared in September 2023. This projected assets of £2.5m against liabilities to preferential creditors of £1.6m. The latter were split between some 77 unremunerated and now redundant MCE staff members, and HMRC. There was also an estimated £32.3m in unsecured claims, leaving an absence of £30.6m after preferential creditors had been paid in full.

Since then, Crowe has received a further £155.7m in unsecured claims from trade and expense creditors, mushrooming upwards from the original £32.3m estimate. And

adding to MCE’s misery with more HMRC vengeance, in January this year the taxman filed a second preferential claim worth, around £600,000, and issued an additional £35.8m unsecured claim.

To make matters even more confusing as to the total of unsecured creditors, a company called Qubic Trustees intervened, in its role as trustee of the MC Edwards (Insurance Brokers) Limited Employee Trust, making a claim based on another version of the £32.3m figure. It also transpired that MCE had been involved with a now-insolvent Danish insurer Alpha, losing a court case in Denmark which could potentially result in legal claim judgement of somewhere between £1m and £20.1m.

The collapse of MCE’s Gibraltar-based underwriting arm MCE Insurance Company, which folded in November 2021, hasn’t gone away either. Now remonikered in administration as Green Realisation 123, it has

approached Crowe with an outstanding claim on MCE of £51.5m.

Separately, when the offshore MCE Insurance Company failed, its MCE broker parent had appointed leading UK motor insurer Sabre Insurance Group as exclusive underwriter for motorcycle policies. Following MCE’s recent grief, administrator Crowe didn’t anticipate any claim from Sabre. But it’s got one anyway. On the back of the underwriting agreement termination, Sabre is now looking for £9.3m in compensation.

In the face of so many multifarious claims, some of which are probably conflicting, overlap or won’t bear close scrutiny, its unsurprising that Crowe now thinks it may be necessary to extend the administration period considerably, before initiating a liquidation process. The ghost of MCE Insurance’s gruesome BSB pitlane character “Big Ed” may live on for a while yet.

FUCHS Silkolene lubes for Triumph

TRIUMPH HAS LAUNCHED A NEW collection of officially approved oils, greases, and maintenance products produced by FUCHS Silkolene. The new range, branded Triumph Performance Lubricants, is being launched for the new season alongside a deal to supply lubes for the ‘first fill’ of oil at the factory.

FUCHS Silkolene say it has developed superior formulations with ester compounds, specifically designed to offer optimum protection and performance for Triumph’s wide motorcycle range. “The Triumph Performance Lubricants range of top-tier fully synthetic and semi-synthetic engine oils has been meticulously developed for amplified power, optimal engine protection, and unwavering reliability in all riding conditions,” claims the oil firm.

The workshop maintenance and cleaning products range includes brake fluid, chain lube, cleaners, grease, and copper paste and will be available through official dealers. The new product range will also be marketed through sponsorship of the Triumph motocross race team.

Triumph CEO Nick Bloor said: “This collaboration with FUCHS Silkolene will help us deliver an even better and more premium standard of customer service and maintenance, as well as

ensure our motorcycles deliver the very best performance and value. It is part of our Total Care offer for customers, where we strive to deliver an exceptional ownership experience for all our customers through our trusted dealer network, promising premium service and genuine products.

Triumph Performance Lubricants will now be the only lubricant products recommended by Triumph Motorcycles.”

Stefan Fuchs, CEO of FUCHS SE, added, “We are very proud to announce our partnership with a prestigious and iconic brand such as Triumph. Working in partnership with the Triumph R&D team, FUCHS has developed the range of Triumph Performance Lubricants, utilizing the very latest technology that will ensure Triumph motorcycles maintain optimum engine performance and protection throughout their lifespan.”

22 VECTOR 22 26 VECTOR FF811 26 4 APRIL 2024 www.britishdealernews.co.uk Business news

8 13 h + FAST CHARGE TRADE HOTLINE 01670 856342 www.ls2helmets.com ukservice2@ls2helmets.com ls2helmetsukofficial PAUL HASKINS UK Sales Director: 07932 725119 DAVE PRIDDLE South West & South Wales: 07900 682775 NATIONWIDE DEALER SUPPORT • DEALER DIRECT • NEXT DAY DELIVERY • FREE MERCHANDISING • NO QUIBBLE WARRANTY • HUGE UK STOCKS • GLOBAL BRAND, LOCAL SERVICE • INDUSTRY LEADING TRADE MARGINS JON RUSSELL London & South East: 07582 512581 LEE BELL Midlands & North Wales: 07582 178996 PETER CAMPBELL North East, North West & Scotland: 07966 431388 PETER EMMETT Ireland: 0876 622644 ALWAYS AHEAD BLACK Matt NARDO GREY Gloss WHITE Gloss METRIC Black Titanium SPLITTER H-V Yellow TROPICAL Black White SPLITTER Black White II ALWAYS AHEAD RRP £179.99 97 Carrying Backpack OFF R O AD OPEN F A CE VENTURE BO VECTOR II IN STOCK FOR NEXT DAY DELIVERY VECTOR II Matt Black RRP £329.99 6 SHELL SIZES

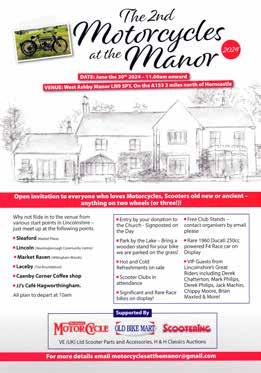

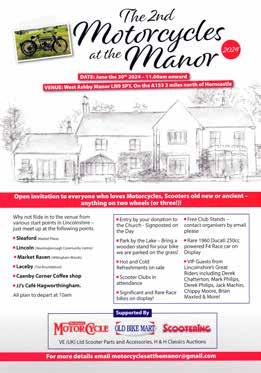

To the manor swarm!

THE SECOND EDITION OF THE Motorcycle at the Manor gathering – open to everyone who loves motorcycles and scooters, old, new or ancient – will happen on 30 June from 11am. Larry Riches’ stately pile is the venue, at West Ashby, two miles up the road from Horncastle, Lincs. Riches, who loves anything ancient, will be remembered for selling his Lintek wholesale business for a small fortune back in the late 1980s. He has support for the one-day event from VE (UK) , H&H Classic Auctions, The Classic Motorcycle , Old Bike Mart and Scootering magazine.

Riches promises a display of significant and rare race bikes, including his 1960 Ducati 250cc powered F4 race car, and plenty of VIP guests, including former racers Derek Chatterton, Mark Phillips, Chippy Moore, Derek Phillips, Brian Maxted and more.

Entry is by donation to the neighboring All Saints Church, and LIVES, an emergency responder charity based in Licolnshire. Free club stands are

Fernandez flicks the Ignition switch

Mike Fernandez (pictured right) will be wellknown to many dealers from his time at Oxford Products. Now, he has struck out on his own with a new distribution firm called Ignition Agencies.

His new company has signed distribution agreements with a number of quality bike kit brands, including Syntol bike lubricants, MotoMate bike dash cams and action cameras, Büse clothing, boots, and helmets from Germany, and Motoairbag, the Italian maker of mechanically activated motorcycle airbag vests and jackets. And as BDN went to press the company had also signed new distribution agreements with

Marushin Helmets and Rusty Stitches clothing.

Ignition Agencies has also taken on Zandonà body armour as its latest client. According to Fernandez, “Zandonà, one of the true pioneers of limb and back protection, has been producing high-quality back, chest, and limb protectors from its production facilities in Italy for more than 25 years. Possibly the most complete collection of European-made motorcycle armour, Zandonà has a wide range of solutions for road and off-road riding, with specific products, fitments, and sizing for men, women and children.”

Ignition is looking for new dealers for the full range of brands.

Mind the GAP?

UK GOVERNMENT REGULATOR, THE FINANCIAL Conduct Authority (FCA), has shut down the operations of multiple insurance firms that were operating Guaranteed Asset Protection (GAP) insurance in the automotive finance world. In a statement, the authority said, “The FCA is concerned that the product is failing to provide fair value to some consumers. In September, the FCA wrote to firms providing GAP insurance products, asking them to take immediate action to prove customers are getting a fair deal. After assessing the responses to this request, the FCA was not satisfied and, as a result, has agreed a pause in sales with these firms. As part of this agreement, they have committed to making changes to their GAP products to provide better value for customers, which is in line with FCA rules.

“This action follows findings in the FCA’s latest fair

“Dealers interested in knowing more about the range should contact me,” said Fernandez.

Ignition Agencies

info@ignitionagencies.co.uk

www.ignitionagencies.co.uk

firms paying out 70% of the value of insurance premiums in commission to parties involved in selling GAP policies.”

Sheldon Mills, FCA executive director of consumers and competition, said: “I welcome the agreement by firms providing GAP insurance to pause sales while they work on improving value for customers. GAP insurance can provide a useful service to customers, but it does not offer fair value in its current form, and we want to see improvements.

“We will continue to work closely with firms as we carry out further engagement to resolve these issues and ensure customers are getting fair value products that meet their needs.”

The FCA added that it has identified concerns with the design of GAP insurance across all distribution channels and is requiring firms to make changes. The regulator

Business news

PADS & DISCS ► PREMIUM QUALITY- MADE IN EUROPE ► 12 PAD COMPOUNDS FOR ALL USES ► FIXED STAINLESS STEEL DISCS ► FLOATING STAINLESS STEEL DISCS ► FITMENTS FOR SCOOTER, ROAD, RACE & OFF-ROAD MOTORCYCLE PARTS | LUBRICANTS | CONSUMABLES | TOOLS | WORKSHOP EQUIPMENT | DIAGNOSTICS TEL. 01536 265633 INFO@LARSSON.UK.COM WWW.LARSSON.UK.COM LARSSON UK WHERE THE BIKE TRADE BUYS BDN-brembo-210x76.pdf 1 2024-03-08 13:54:58

RACING LUBRICANT TECHNOLOGY

MOTUL’s 300V Factory Line range is a unique and unrivalled fully synthetic performance lubricant. Created using premium raw materials based on our ESTER Core® Technology, perfected through years of race winning activities. With 300V you guarantee the very best protection and performance for your motorcycle, from the daily commute to the pinnacle of professional racing.

SHORT CUTS

EX-TRIUMPH MAN FIGHTING BACK

FORMER TRIUMPH EVENTS MANAGER

Gareth Bright is working hard to overcome injuries from two bike crashes and is aiming to take part in a gruelling 12-hour endurance race. Bright, who now runs his own events agency, Woodcote Events, suffered life-changing injuries in crashes in 2019 and 2022, and is using the Dawn to Dusk enduro event in August as a rehabilitation target.

PIZZA SCOOTER!

WE’VE ALL HAD PIZZA DELIVERED BY A SCOOTER, but now you can have a pizza that’s actually been baked in a scooter! British sidecar firm Watsonian has built a Vespa GTS300-based custom outfit, complete with pizza oven and prep area, for restaurateurs Thom and James Elliot, founders of the Pizza Pilgrims pizzeria. “Since the company was founded in 1912, we’ve built thousands of tradesmen’s outfits for all sorts of jobs, including ice cream sellers, milkmen, and even firemen”, says Watsonian MD Ben Matthews. “A tiny pizzeria is definitely a first, and something totally unexpected.”

DUNLOP IMPRESS GSX-8R TESTERS

SUZUKI’S NEW PARALLEL TWIN 800 platform has been a big hit, and the latest GSX-8R is no exception, earning plaudits on the press launch last month. Part of the appeal comes from the premium OE tyres: Dunlop’s Sportsmart TT (TT stands for Track Technology, apparently). The firm claims its new tyre was “engineered for versatility across road and track riding, and is expertly placed to highlight the advanced capabilities of the GSX-8R, with both products demonstrating the ability to strike an impressive balance between sporty, track riding and comfort.”

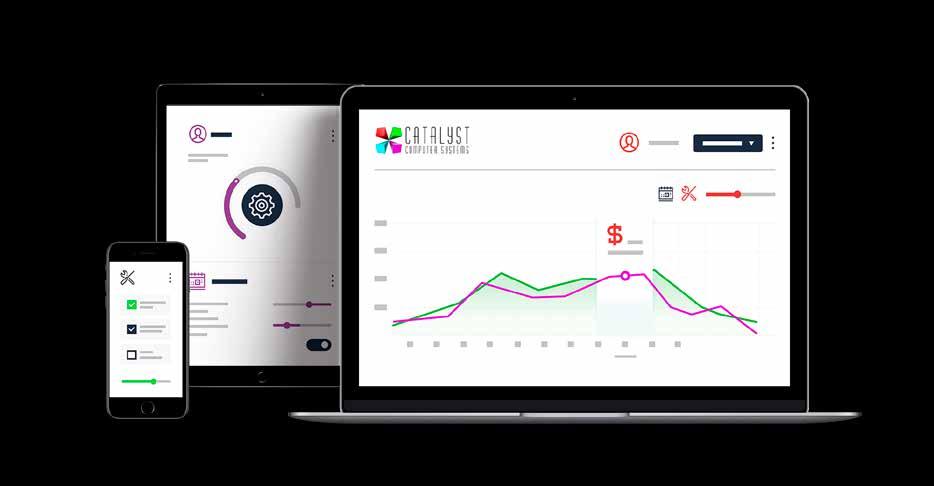

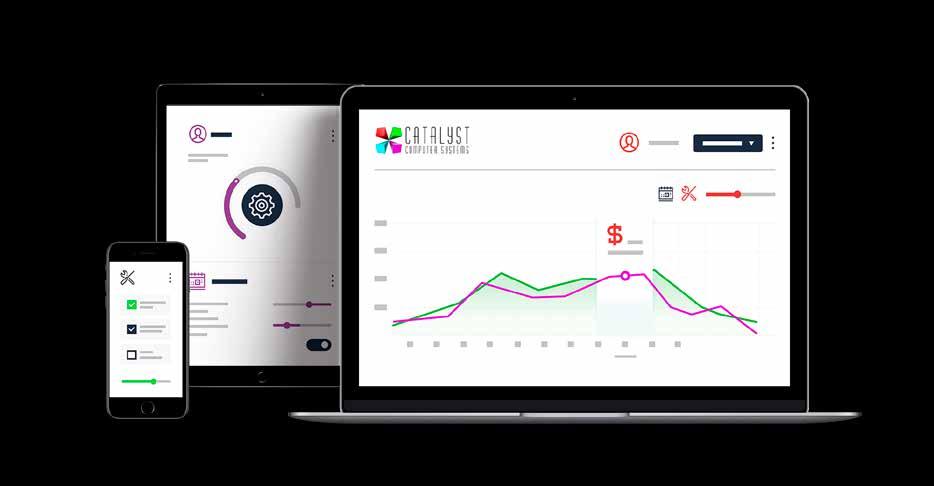

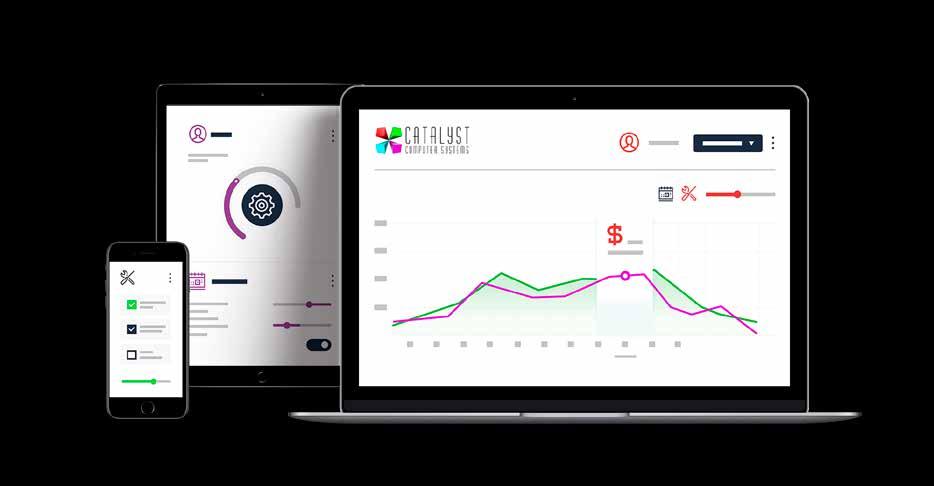

Triumph secures new digital deal

Cardiff-based digital agency Spindogs has agreed a new two-year deal with Triumph which will see the company continue to develop digital services and data systems for the Triumph brand globally.

Spindogs has previously worked with the Hinckley firm on various digital tools and projects, first partnering in 2017, and has been responsible for developing a global first in the two-wheel industry with an online service booking tool. The partnership has already led to developing and deploying a cloud-based platform for Triumph across 800 dealers in 35 countries worldwide, including

a direct Dealer Management System connection to more than 600 dealers.

Malcolm Healey, global aftersales director at Triumph Motorcycles, said: “We’re hugely excited to continue our working relationship with Spindogs and to build on our existing digital platforms that will continue to provide cutting-edge solutions to our dealers and customers all over the world.”

The new partnership will see the two companies continue to develop digital systems for Triumph’s global dealer network to support the brand’s growth and customer service objectives.

Established in Cardiff in 2004, Spindogs employs 70 staff in the city and remotely across the UK. In the year ending October 2022, Spindogs reported a turnover of £3.8m.

Managing director at Spindogs, Liam Giles, said: “Renewing our partnership with Triumph underscores our shared commitment to digital innovation. Our collaboration has already set new benchmarks in the motorcycle industry, and we’re excited to keep that momentum going. Together, we’ve pushed the boundaries of digital excellence, and this new agreement reflects that success.”

New marketing man for Piaggio

THE PIAGGIO GROUP HAS A history dating back more than 140 years. The group includes heritage brands Moto Guzzi and Vespa, and a high-performance brand in Aprilia, which has a trophy cabinet stuffed with world championships.

Yet those brands have underperformed in recent years, particularly in the UK. There’s a new marketing manager at the British office, though: Antonio Mineo. BDN spoke to him at the launch of the new Moto Guzzi Stelvio and V85 models.

Mineo joined Piaggio from the Stellantis car firm, but his heart is firmly on two wheels. “I am a biker, but not a professional biker; speed is not my best skill, but I enjoy it.”

We asked about the state of play for Piaggio’s brands in the UK. “All four brands are separate, and appeal to different market demographics,

which makes my life very busy,” said Mineo. “At this moment, we have many challenges because the market looks to be struggling. We had a fantastic 2022, which was a rebound from the pandemic. We had a lot of stock, and had a record year. But of course, it is difficult to repeat the same performance.”

What about the UK dealer network? Does Mineo see a need for changes there? “We have between 25 and 30 dealers for Aprilia and Moto Guzzi, and roughly 40 dealers sell scooters. There is some overlap; and some dealers are what we call Motoplex, so they retail all four brands.

“We’re looking to add roughly 15 more dealers as quickly as possible. But we also have to look at the current network. There might be some changes, because we want to get to the next level, and we

want quality dealers. We have people that have worked with us for decades, but now it may be time to change because we want to give the customer the best experience.”

Mineo is positive but points to the various hurdles that the whole industry is facing, including (again) Brexit. “Just as we thought we were out of the tunnel with the pandemic, then came Ukraine, and now we have the trouble in the Middle East, so it’s non-stop. And honestly speaking, I don’t think Brexit is doing good for the UK.

“We have plans for the future and want to get to a better position. Also, as a personal challenge, we have the lowest market share in Europe as Piaggio UK, so that is something I definitely want to improve.”

Interested in becoming a Piaggio group dealer? Contact Pete Cleverly: pete.cleverly@piaggio.uk.com

8 APRIL 2024 www.britishdealernews.co.uk Business news

AXXIS HELMETS HIT MOTOGP

NEW LID MAKER AXXIS HAS ANNOUNCED A NEW sponsorship deal which will see its products used in MotoE racing this year. The brand will sponsor riders Miquel Pons and Óscar Gutiérrez in the MT Helmets-MSi team. AXXIS helmets are imported into the UK by exclusive distributor Bickers . www.bickers-online.co.uk

Spindogs managing director Liam Giles (left) with Malcolm Healey, global aftersales director at Triumph

Fowlers cleans up with S100 range

BRISTOL-BASED DISTRIBUTOR

Fowlers, has taken on the Bavarianmade S100 cleaning products line, replacing Motohaus as the official importer.

The S100 range is a premium product, its cleaners regularly performing well in product tests.

The manufacturer, Dr O.K. Wack Chemie, also supplies high-profile OE brands, including Porsche, BMW and Rolls-Royce. It’s now exclusively available from The Key Collection at Fowlers.

Launched more than 40 years ago, S100’s Complete Motorcycle Cleaner was the first of its kind.

The spray-on/rinse-off formula was developed by German scientist Dr

Oscar Wack, an industrial chemist, who wanted an effective way to clean dried-on mud and chain grease off his sons’ motocross bikes.

The firm claims its success is due to high levels of research and development. It claims to have the highest percentage of R&D staff in the industry and invests more than 30% of its turnover in developing and testing new products.

The range includes: S100 Moto Wash, S100 Chain Lube White, S100 Visor and Helmet Cleaner. The complete range is available now from The Key Collection.

The Key Collection 0117 971 9200 www.thekeycollection.co.uk

Dig deep for Tin Lizzie

Larry Riches, former owner of Lintek, is busy fundraising for charity with a forthcoming attempt to drive a 101-year-old Ford Model T from Gibraltar Point in Lincolnshire to Gibraltar, a journey of almost 2000 miles through France and Spain. He will be accompanied by his wife Christine, and by Ralph Kemp and Margaret Sowerby. They are hoping to raise more than £7500 for Cancer Relief.

The team will also be offering voluntary donation rides in the 1923 Ford Model T after arriving in Gibraltar, which is expected to be on or around the 6 May. Their progress will be tracked on the Cancer Relief social media platforms for arrival times.

Riches said: “In the 1920s, half of the cars on the road were Ford Model Ts. This car really put the world on wheels – more than 25 million were manufactured between 1908 and 1926, and we are hoping our vehicle will be on public display in Casemates Square on 8 May.

To donate, head to: tinyurl.com/yw8vywxz

www.britishdealernews.co.uk

Triumph Dealer of the Year is Lings Norfolk

They have been around since Triumph was relaunched in the early 1990s. And now East Anglian founder dealership, Lings Norfolk Triumph, has scooped the 2023 Triumph UK Dealer of the Year award, 32 years after taking on the Hinckley brand.

According to Lings, that partnership has flourished, thanks to “a mutual commitment to quality, performance, and customer satisfaction”. The retailer has worked hard to promote Triumph’s bikes to riders across the UK, hosting community events and supporting motorcycle enthusiasts at all levels. It was previously recognised as Triumph’s Dealer of

the Year in 2016 and 2018.

Reflecting on the achievement, Lings Triumph's brand manager, Scott Lock, said: “We are deeply honoured to receive this recognition from Triumph UK. This award is a testament to our entire team's hard work, dedication, and passion. Our success is built on a foundation of trust and relationships, not only with Triumph, but with every customer who walks through our doors. We share this accolade with our loyal customers and the wider motorcycling community who have supported us throughout our journey.”

www.lings.com

Record fourth award for West Coast Harley-Davidson

IT

WAS A CASE OF ‘GLASGOWS’ MILES

Better’ once again at the annual HarleyDavidson European Dealer Forum in Germany last month. Because the Hillington-based Harley retailer West Coast Harley scooped up the UK and Ireland Dealer of the Year award for the fourth year in a row. Legendary Glasgow dealer principal Don Rutherford, and his team topped the charts for customer service and performance – and the dealer also picked up another four 2023 gongs.

David Hackshall (pictured right), MD at West Coast Harley-Davidson commented: “West Coast have always been dedicated to delivering exceptional service in all areas of our motorcycle business; receiving recognition for this service truly puts the icing on the

cake and is the perfect way to start 2024, our 25th anniversary year.”

Michael Niblett, Harley-Davidson UK country manager, commented on the success of all the category winners: “All dealer staff across our dealership network offer great customer experience – to secure a finalist place in our 2023 dealer awards demonstrates elevating this even further. The award winners take this to a truly exceptional level, and I thank them all for their dedication to delivering for our iconic brand.”

10 APRIL 2024 www.britishdealernews.co.uk

managing director from only £99 2024 TRADE DIRECTORY www.britishdealernews.co.uk sponsored by: 020 3937 6930 enquiries@dfcapital.bank dfcapital.bank Get in touch to find out more: 2024 TRADE DIRECTORY BOOK NOW! 01237 422660 ADSALES@DEALERNEWS.CO.UK Get Listed Be Seen 020 3937 6390 enquiries@dfcapital.bank dfcapital.bank Get in touch to find out more: Sponsored by DF CAPITAL Flexible Working Capital Solutions CAPITAL Working closely with dealers and manufacturers in the motorcycle industry, DF Capital offers flexible working capital solutions throughout the unit distribution cycle. Why DF Capital? We have teams across the UK dedicated to the industries in which we operate, who work in partnership with our customers to ensure they have the funding where it’s needed, when it’s needed. As industry specialists, our customers benefit from our expertise, in-depth knowledge and market insight to guide and support them throughout the funding process. With strong relationships with many well-known companies in the motorcycle sector, we work in partnership with them to provide the support they need to better manage their cashflow and inventory. We want to help grow sales for manufacturers and dealers alike. The facilities we offer are tailored to individual needs and we offer facility limits –according to our customer’s affordability. We put our DF Capital is a specialist savings commercial lending bank, built serve the needs businesses and individuals in the UK. provide personal savings products retail customers award-winning inventory finance solutions to dealer manufacturing businesses across the country – helping them achieve their growth ambitions. GPX Moto provided a six-figure unit stocking facility to GPX Moto a distributor of reliable and lightweight Enduro motorcycles. The programme facility we set up aims to help GPX Moto increase sales across the dealer network and at the same time supports the dealers protecting their liquidity position, obtaining stock on agreed terms and maintain healthy level of inventory. We’re proud to support early stage businesses such as GPX Moto UK and we look forward helping the company grow its presence in the UK and achieve its ambitions. 39 WWW.DFCAPITAL.BANK t:020 3937 6390 e:emcconnell@dfcapital.bank www.dfcapital.bank customers’ needs first – when a business asks us to help, we try our absolute best to find a solution. Committed to realising our core values of being flexible, expert and straightforward in the service we provide to all our customers, we are continually developing our technology with the aim of enhancing the customer experience. Next steps Visit: www.dfcapital.bank and take a look at our product information. We even have videos on our website to help explain how we can help. You can also contact Estelle McConnell, our managing director – powersports on emcconnell@dfcapital.bank and we can discuss ways in which DF Capital can support both manufacturers and dealers. n Terms and conditions apply, subject and affordability. Any used as security may you do not repay secured on it Lukas Distribution We have been working with Lukas Distribution to support the UK import and distribution the iconic BSA Gold Star motorcycle. The heritage brand has been available since the start of 2023 and to help facilitate product reaching UK dealerships, Lukas Distribution approached us to see if it could help provide support from a financial perspective. We set up a six-figure floorplan facility which means we make upfront payments to Lukas Distribution on a dealer’s behalf, when the vehicles are delivered. The dealers then pay when the assets are sold to the end user, which helps them maintain their cashflow position and focus on sales. AWARD-WINNING DF Capital is an award-winning lender. At the 2022 Business Moneyfacts Awards, it was commended in the Best Alternative Business Funding Provider category. In November 2022 it won the Top Inventory and Floorplan Specialist Award at the Leasing World Gold Awards for the second year running. DF Capital was also recognised as one of the UK’s Best Companies to work for in both 2022 and 2023. OUR CORE PRODUCTS Floorplan Finance We support manufacturers and dealers through capital funding throughout the distribution cycle. Floorplan Finance provides businesses with credit facilities across the distribution network which can help to grow sales, improve cash flow and free up working capital. Unit Stocking Finance Dealers are also supported by credit facilities so they can purchase and supply units to their customers when needed without having to pay for them upfront. Unit Stocking brings cash flow and working capital benefits to distributors. Rental Finance DF Capital also provides dealers with flexible funding to enable them to purchase more units so they can hire them out to customers, spreading the cost over time whilst earning rental income. By providing this flexibility, dealers can decide whether to sell or continue to rent out the unit at the end of the term.

From left: Devron Boulton general manager Triumph UK; Matthew Barwick, finance director; Jamie Curtis, dealer principle; Jemma Squire, aftersales advisor; Scott Lock, brand manager; Gareth Jones, technician; Chris Jary,

NMC joins FIM discussions on the future of biking

The FIM (Fédération Internationale de Motocyclisme) controls the rules and regulations for twowheeled motorsport. However, the international body also advocates for motorcycling more broadly, covering safety, licensing, and other statutory matters.

The UK’s National Motorcyclists Council (NMC) has recently been participating in the FIM’s 2024 Commission’s Conference, taking a British voice to the international meeting alongside 380 other delegates.

The three-day conference covered topics including a sound reduction campaign, phase two of the helmets’ homologation programme, airbags, and concussion detection and management. Updates on the competitions featuring motorcycles with electric and internal combustion engines, as well as on the E-bike Technical Steward seminar were shared. The first ever FIM Medical Summit was also held on day two of the conference.

Motorcyclists Associations (FEMA), FIM Europe and the NMC. The commission defends the rights of motorcyclists as citizens and consumers. The commission also deals with the safety of riders on the road and the quality and safety of products used in motorcycling. It advises FIM management – particularly

This was an intensive two days of dynamic discussions about a range of issues

Craig Carey-Clinch, NMC

promotion of rider training. The ACU is also strongly represented on other FIM commissions. Got all that?

Craig Carey-Clinch, executive director at the NMC, is a member of the FIM’s Commission for Mobility (CPM), where he represents the Auto Cycle Union (ACU) and the NMC as part of the joint partnership between the Federation of European

Carey-Clinch said: “This was an intensive two days of dynamic discussions about a range of issues which affect riders internationally and are often very similar country to country. It was an opportunity to exchange best practices, experiences and public affairs strategies from both global and regional groupings and individual countries. With 2024 being an election year in so many places around the world, this was clearly an important session, as motorcycle sports organisations and riders groups continue to develop plans for the future.”

www.britishdealernews.co.uk

Need help? Email us at Info@ReactiveMART.com INTRODUCING... THE BETTER WAY TO SELL The Online Marketplace FOR EVERYTHING MOTO R CYCLE! • THE Online Marketplace for motorcycles / parts / accessories / clothing • ZERO listing fees on auction and fixed price ads. Only £8.32 + VAT for classifieds (good 'til cancelled) • FREE on-boarding process to mirror your listings across other accounts (e.g. Amazon / eBay) • UK based tech / sales support & customer service @ReactiveMART.com @ReactiveMART @Reactive_ MART START SELLING NOW S CAN THE QR CODE TO GET STARTED

SHORT CUTS

ASHFORD CLASSIC BIKE SHOW

EASTER MONDAY IS ON 1 APRIL THIS YEAR, AND the Ashford Classic Motorcycle Show promises to roll away the giant stone of bank holiday boredom with a host of classic, vintage and veteran machinery on show. It’s based at the Ashford Livestock Market in Ashford; more details: www.elk-promotions.co.uk

YUASA MOTOGP HONDA DEAL

JAPANESE BATTERY MAKER YUASA, HAS extended its sponsorship with the factory Honda MotoGP race team. Theo den Hoed, of GS Yuasa Battery Europe, said, “Renewing our partnership with the Repsol Honda Team, especially with talents like Joan Mir and Luca Marini on board, is a proud moment for us. This collaboration is a cornerstone of our brand’s presence in MotoGP, showcasing the pinnacle of battery performance through the Yuasa brand.”

KICKBACK SHOW 2024

THE ORGANISERS OF THE KICKBACK CUSTOM, classic and stunt bike show have announced that the show will double in size this year. The Malvern, Worcs, event will fill two exhibition halls at the Three Counties Showground from 13-14 April. Visitors are promised more than 250 custom and classic show bikes, as well as a thrilling stunt show, club displays, trade stalls, Harley-Davidson test rides and best bike awards. More info: www.kickbackshow.com/malvern-show

TWO WHEELS FOR LIFE

AFRICAN HEALTHCARE CHARITY TWO Wheels for Life, has been selected as the official charity partner for the 2024 Goodwood Festival of Speed. Goodwood owner Charles Gordon-Lennox, Duke of Richmond, said: “We have chosen Two Wheels for Life for the 2024 Festival because it not only provides essential, and much needed, support for people in remote areas of Africa, but also because they use motorcycles to reach those in need.”

TT LINE-UPS ANNOUNCED

IT’LL BE HERE BEFORE WE KNOW IT, AND THE 2024 Isle of Man TT has seen a few more high-profile racer announcements. Manxman Conor Cummins will line up on the Glencrutchery Road for the Milenco by Padgett’s Motorcycles team, having agreed a deal to ride on Honda machinery with the Batley-based team for an eighth successive year. Meanwhile, Josh Brookes and Mike Browne will run Yamaha R6 supersports bikes for the Boyce Precision Engineering by Russell Racing team. The TT kicks off on 27 May for a fortnight of practice and race action.

Yamaha awards for last year’s top dealers

It’s the time of year for the Oscars, BAFTAs, Golden Globes and the Brits. And the annual dealer conference season in the bike trade has also seen many manufacturer award events. Yamaha was no exception with its recent dealer conference.

Yamaha included an awards presentation for outstanding sales, after-sales service, customer care and marketing achievements. Highlights included the Excellence in Marketing Engagement award, which went to Crescent Motorcycles for exemplary marketing campaigns across the board. Multi-product dealer MES Powersports scooped the best marketing event award for its launch day, which saw BSB stars take part in the celebration to launch the opening of a new

showroom in Deeside. Mott Motorcycles was awarded the Excellence in Salesforce Engagement award, while Tamworth Yamaha won a prize for its exemplary implementation of the latest Yamaha Visual Identity.

Veteran dealer Flitwick Motorcycles was awarded the Parts and Accessories Sales Achievement accolade, while Tinkler’s Motorcycles was recognised for Yamalube sales. Alf England (Motorcycles), Saltwater Solutions (Power Products) and Stirlings Powersports (Power Products) were all awarded the Yamaha Training Academy Distinction award for engaging their staff in Yamaha’s training programmes.

The Outstanding Customer Service Award, voted for by customers, was presented to

Alford Bros (Motorcycles), NWS (Marine) and Quadbikes

R Us (Power Products). Finally, Raceways Motorcycles was awarded the Outstanding Brand Ambassador award as their sevenyear tenure as Yamaha Motor UK’s official British Superbike team came to an end in 2023.

12 APRIL 2024 www.britishdealernews.co.uk Business news

Kawasaki extends Dealer Demo Days event into 2024

The complexion of the retail market has undoubtedly changed over the past 12 months, with most people in the trade claiming that it takes more work to get each sale. Punters, who faced stock shortages in 2021 and 2022, now have a veritable smörgåsbord of new bike options, so marketing drives, finance deals and price promotions are the order of the day once again.

As are demo rides. Factorybacked test ride events are a solid sales tool, helping dealers get buyers onto demo bike saddles and helping to clinch deals. No surprise then that Kawasaki is bringing back its Dealer Demo Days, with a test bike roadshow travelling around the country this summer.

This year’s events will run between April and September

and will see the roadshow visit dozens of dealers across the country. Each event will see an array of machines for riders to book test rides on, including the new Ninja 7 Hybrid and Z7 Hybrid machines, the Ninja ZX-4RR, the Z500 and the Ninja 500. Alongside these new models, bikers will also be able to try the ever-popular Ninja 1000SX and Versys range.

Craig Watson, sales and marketing manager at Kawasaki Motors UK, said, “With the better weather just around the corner, the excitement to get out riding again is definitely building! Our Dealer Demo Days have been a huge success in recent years, so we’re pleased to be bringing them back again for 2024, offering bikers a chance to experience some of the latest and exciting machines in our range.”

Ben Spies chooses R&G for stateside campaign

THE RAHAL DUCATI MOTO TEAM, LED BY EX-MOTOGP AND WSBK star Ben Spies and IndyCar racer Graham Rahal, has chosen R&G to protect its bikes this year. The team is running three Ducati Panigale V2s for its inaugural season in the MotoAmerica Supersport class, and the Hampshire firm will supply engine case covers, carbon fibre shark fin sprocket guards and tank grips for the bikes, ridden by PJ Jacobsen, Kayla Yaakov and Corey Alexander.

The new partnership further strengthens the British brand’s presence in America. R&G is currently a sponsor of the MotoAmerica series and the chosen crash protection supplier for Team Hammer Inc. and 2023 Superbike Cup National Champion Nolan Lamkin.

R&G MD Simon Hughes said, “We are absolutely delighted to be working with Rahal Ducati Moto in what is set to be a very exciting inaugural year for the team. We see working with Rahal Ducati Moto as pivotal to our ever-expanding marketing and development program in North America, and everyone at R&G wishes them the best of luck for the 2024 campaign!”

APRIL 2024 13 www.britishdealernews.co.uk

hpo.hocoparts.co.uk or info@hocoparts.co.uk RECEIVE 5 LITRES FOR THE PRICE OF 4! Available in the following viscosities visit: www.hocoparts.com or call: 01484 641 073

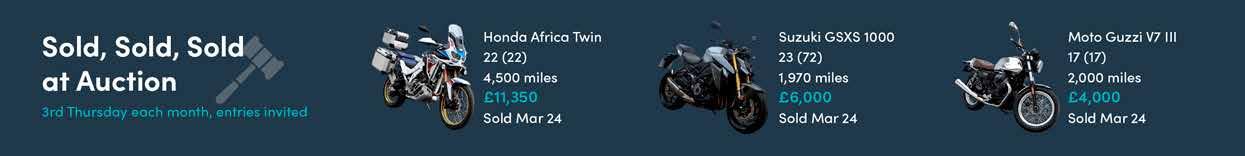

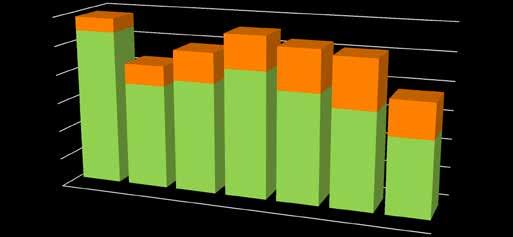

Springtime auction sensations

The springtime auction scene – the busiest period of the year – sees some extraordinary lots come to the auction block, including a 48-cylinder special and an Aston Martin V-twin!

The most flamboyant is a 48-cylinder special. Yes, 48 cylinders – all from Kawasaki 250 two-stroke triples. Arranged in triple decks on both sides, this 4.2-litre edifice of cylinders has to be seen to be believed. A highlight at the main classic sale of the year by Bonhams at the Stafford Classic Motor Cycle Show (2021 April), Tinker Toy carries a £40,000-£60,000 estimate.

At almost three times that estimate – £120,000-£150,000 –a Vincent Black Lightning 1000cc V-twin is Bonhams’ April star lot in value terms. The 14th of 34 Black Lightnings made by the Stevenage, Hertfordshire, factory up to 1955, this classic speed god has the auction world holding its breath in anticipation.

Italian exotics appearing at the Bonhams bonanza include a baroque-style 1959 singlecylinder DOHC Benelli Grand Prix racer. One of three, it is reckoned to be the only runner in existence. Estimate is £40,000£60,000. Last year Bonhams

grossed over £3m at this sale. Did you know that Aston Martin has put its name to a motorcycle? You could have one for an estimated £150,000-£200,000. The eighth of 88 made in conjunction with Brough Superior in Toulouse, France, it comes to auction at Iconic’s Shuttleworth aircraft museum sale on 7 April. This 997cc V-twin is reckoned to give 225hp. It looks sensational, like Aston Martin’s F1 cars, and comes in the same colours.

Other big bucks and interesting Iconic lots include a 1939 Brough Superior SS80 V-twin with Brough sidecar (estimate £60,000-£70,000) and a Japanese 1959 Colleda 250 TT twin-cylinder two-stroke (£12,000-£14,000). A forerunner to the Suzuki marque, the Colleda is reckoned to be one of only a dozen survivors and the only one known outside Japan.

Factory and bespoke custom bikes came out tops at the Bristol Classic Show Dore & Rees auction (Shepton Mallet, Somerset, 25 February). This is indicative of a widening horizon on the auction scene. An American Confederate X132 Hellcat Combat V-twin cost its new owner £27,600, blowing more traditional classics out of the water.

Backing it up in second and fourth spots were a 1972 Triumph X75 Hurricane triple styled by American Craig Vetter (£22,250) and a 2011 Harley-Davidson

1200 V-twin custom (£13,225) by Battistini of Bournemouth. Prices include premium and VAT.

Aston Martin Brough

In America, a market trend in rising values for Japanese models was evident when a 1977 Yamaha XT500D single made £17,407, and a 1975 Kawasaki H2C 500 two-stroke triple made £26,131. The XT500 could be an auction record, and the Kawasaki 500 is up there with Z1 900 values. Also rising to new heights was a Spanish 1969 Bultaco Sherpa T 250 trials bike at £21,776. These prices were made by Mecum at Las Vegas, Nevada, in January. The top seller was a 1928 fourcylinder Indian Ace at £174,217.

As well as the big-money bikes, there are now plenty of bargains at auction. Most auction houses are persuading more and more sellers to enter machines at no reserve. This ensures a result and entices buyers to pitch in. The classic auction scene has matured to the point where there are, in effect, more bikes than buyers.

14

As a result, it’s difficult to predict what will sell and for how much. That said, the auction scene hasn’t lost its confidence and continues to adapt and surprise. This includes more online sales.

12 Oct Bonhams Stafford

16 Oct Mathewsons online, Pickering

17 Oct BCA online

17 Oct Fleet Auction Group, Loughborough

18 Oct Cheffins, Sutton, Cambridgeshire

30 Oct H&H, National Motorcycle Museum, Solihull, Birmingham

31 Oct BCA online

10 Nov Iconic, Shuttleworth Aircraft Museum, Bedfordshire

14 Nov BCA online

21 Nov Fleet Auction Group, Loughborough

27 Nov Mathewsons online, Pickering

28 Nov BCA online

12 Dec BCA online

19 Dec Fleet Auction Group, Loughborough

Further dates to be announced

14 APRIL 2024 www.britishdealernews.co.uk Business news

2024 AUCTION DATES

Apr BCA online

Apr Iconic, Shuttleworth Aircraft Museum, Bedfordshire 18 Apr BCA online 18 Apr Fleet Auction Group, Loughborough 19 Apr Cheffins, Sutton, Cambridgeshire 20 Apr Bonhams, Stafford Showground

May BCA online 16 May BCA online 16 May Fleet Auction Group, Loughborough 30 May BCA online 30 May HJ Pugh, Ledbury, Herefordshire 12 Jun Mathewsons online, Pickering 13 Jun BCA online 20 Jun Fleet Auction Group, Loughborough 27 Jun BCA online

Jul H&H, National Motorcycle Museum, Solihull, Birmingham 6 Jul Spicers, Goole, E Yorks

Jul BCA online

4

7

2

3

11

Jul Iconic, Shuttleworth Aircraft Museum, Bedfordshire

Jul Fleet Auction Group, Loughborough

Jul Cheffins, Sutton, Cambridgeshire 24 Jul Mathewsons online, Pickering 25 Jul BCA online

Aug BCA online 15 Aug Fleet Auction Group, Loughborough 22 Aug BCA online

Aug Newark Motor Auctions, Nottinghamshire

Sept Mathewsons online, Pickering

Sept BCA online 19 Sept BCA online

Sept Fleet Auction Group, Loughborough 3 Oct BCA online

18

19

8

29

4

5

19

Tinker Toy: 4.2 litres, 48 cylinders. Estimated to go from £40k upwards!

With an expanding model range, increased market share, high customer satisfaction, and excellent customer retention, our partners are revelling in the benefits of being a Suzuki dealership. As we continue to grow our network we have key open points, nationwide.

To partner with one of the biggest brands on the market and enjoy all the benefits it affords, contact: 2wdealerdevelopment@suzuki.co.uk

The man from Honda

Last month, we spoke to Honda UK's head of motorcycling, Neil Fletcher, about his background and how he sees his role. In the second part of our interview, we ask about his plans for the future – and how that affects its dealer network in the UK. Alan Dowds reports

Most senior management jobs are focused on the future. If you’re the head of a big operation, in whatever sector, it’s vital that you’re thinking not just about what’s happening now but what’s coming around the corner in a year, two years, or even longer.

That’s certainly true in the bike world, where we have an industry facing a couple of major uncertainties in the medium and long term. The demographics of UK motorcycling are well-known: we’re a bunch of older men generally, with all that brings, for good and ill. And with an upcoming agenda that includes decarbonisation, self-driving vehicles, road safety drives and increased regulation on things like speeding, biking has enough troubles and does not need to seek out more.

So, it was this future-gazing aspect of the job that we started with when we discussed Honda UK’s dealer network plans with its head of motorcycling, Neil Fletcher. “My first impressions coming into the job? Well, I was quite worried, if I’m honest, about both the age profile of the people who owned the businesses that were selling our bikes and the age profile of some of the customers. To be honest, I thought, where is this going to go in five years’ time?”

Dealing with the age profile of bikers is an industry-wide issue, of course, and something that has no easy answer. But when it came to the dealer network, Fletcher could act. “We had probably something like 90 dealers, and I looked and thought, well X% of these guys are not going to be here [with Honda] in five years, though I’d hope they are still enjoying life and everything else! And I needed to understand what the picture looked like. It was interesting: I talked to some business owners, and they wouldn’t have thought about [their future]. They were busy running a seasonal business, which is their passion.

“At the same time, Honda has plans and ambitions for growth. You’ve seen that in the last two or three years with the growing model line. So I could see the retail network that we had was very competent but not necessarily going to be there in the long run. And some probably weren’t going to be big enough businesses to put in the investment needed.”

Fletcher also saw a problem in terms of profitability. “We weren’t making enough money in the motorcycle business, either as the dealer network or as Honda UK. And it was clear that we were going to have to

Honda has plans and ambitions for growth. You’ve seen that in the last two or three years with the growing model line

Neil Fletcher

refresh a lot of the retail sites. So we set out on a mission to go and change that, and, very simply, the mission is to have fewer dealers. That’s the trend, and it’s going that way. But also to make sure that you have dealerships with a succession plan, suitable premises and everything else and then give them a bigger area of responsibility, which means they can get a bigger return.”

Fewer dealers, each making more money, from having a larger catchment area then? “It’s as simple as that. It is quite scientific inasmuch as you’ve got to work out the numbers. We’ve got a very clever bit of software for ride and drive times, and we’re generally in the very high 90% [of population within a reasonable travel time].”

What is the ideal size for this new Honda dealer network, then? “We’ve currently got approximately 60 outlets, and that’s not far off where I think we should be in terms of numbers. I think we have four key [geographical] areas where we haven’t got the right representation, or none, at the moment. So you could say it might go from 60 to 64. Or it may go to 58 before it goes to 62 or something like that, but it’s in that area.”

Where is Honda currently looking to place new retailers? “The big area is in the south coast – we’ve got Bournemouth covered, and we’ve got Pevensey Bay all the way over there, and then we have Crawley (P&H) and Doble in Coulsdon, and then Kent we’ve got covered. So it’s sort of Hampshire, Portsmouth, Southampton and towards Brighton, that coastal strip.

“That’s probably the biggest one. We’ve had a bit of a change around there, and we’re not rushing it because it is really a prime spot. We’ve effectively got two continuous territories, and we’re still pondering whether we should have one or two operators in that space because you could do it with one, but is that enough? And it would help if you were in the right place. It’s no good having one on the edge of the territory, so that’s an interesting one. We’ve had lots of different options on that, but we’re just biding our time.

“We’ve just got a new dealership in Aberdeen, Shirlaws, and I’m really pleased with that. That is an excellent example for me: it’s a new investor coming into the industry, taking over a very well-established and successful family business. There’s a Shirlaw still in the business. And that’s what we’ve been trying to do. We’ve been trying to attract either new or existing investment to do these things.

“One area where we don’t have any representation is South Yorkshire. We’ve got operators around it, but we don’t necessarily have one in the right place. And there are

16 APRIL 2024 www.britishdealernews.co.uk Business news

probably two other areas. “

The other side of the network development coin – often ending long-term business relationships – is more brutal, of course. And Fletcher is keen to stress how much effort he and his team put in there. “There are three businesses at the moment that we’re trying to help with a dignified exit. I want to be able to look myself in the mirror and say, have we given each of our existing dealers a clear direction? Do they know our expectations, and have we been fair and equitable? Now, I’m sure some of them would argue that we haven’t. But we’ve always tried to do that, and while I am in this role, I’ll always try to do that.”

Is it fair to say that some of this change would be inevitable anyway? Is Honda’s strategy simply speeding up the inevitable evolution of an industry which has had too many retailers in the past? It seems likely. “If you go back before my time, there were hundreds of dealers. There was a Honda dealer in lots of market towns, and that just isn’t viable in today’s world,” said Fletcher. “But I think there are dealers who we’ve helped move to whatever they want to do next, and they would say if we hadn’t had the discussion, they wouldn’t have done it. We’ve tried making it as palatable and reasonable as possible.”

And Fletcher insists that he and Honda have both been transparent throughout. “Before we did anything, in 2018, we said, ‘This is what we’re going to do; the long-term future of the network is to have fewer dealers to sell more bikes’. We started that whole conversation, and basically, we were saying don’t be afraid to come to us and say, ‘I’m thinking of selling the business’, or ‘I need to retire’ or whatever.

“And I think there was a reticence, a concern that we would turn around and say, ‘Right, well off you go then’. But that doesn’t do us any favours because we’ve got customers who want continuity and all that sort of thing. So we tried to literally work out what the strengths and the weaknesses were in each case. That might be, is there a succession plan? Is the family or the management team happy to take it on after the incumbent dealer principal or owner? Is there enough funding in the business?”

Not long after this process had begun, though, the tsunami of Covid-19 hit, and all bets were off. However, the effects of the pandemic were more complex to interpret

at first, as Fletcher relates. “Firstly, the industry did very well in Covid, and it put a lot of money back in the coffers of some businesses that hadn’t been doing so well, which was good. It put them on a more solid footing to make better decisions. But it also then drove people to think about the future. I mean, I think we all did. What am I doing waking up at 6 o’clock in the morning to do all this stuff? And some of those conversations we were having became a bit more real and a bit more poignant.”

Who manages the network change processes? “I personally have to sign off all the decisions, so in the end, it’s me. It’s me, together with Richard Schofield, who runs the sales side of

I’m also very conscious that we are the market leader, and if we do the wrong thing, I think that can send all sorts of signals out there

Neil Fletcher

the business, Andy Mineyko and Craig Horne, our franchise development managers. And we also involve the area team because they’ve got much deeper knowledge than me.”

And what percentage of Fletcher’s time does this take up? “Increasingly, it’s become quite a big thing for me. I think there isn’t anything much more important that I could be doing with my time, apart from my team and putting effort into them. A lot of it is discussion; what are you thinking? I mean, I’ve got one conversation going on at the moment, which I feel quite awkward about because I’m pushing hard for that person to think about what they’re going to do with their future. It’s their money, it’s their business, I respect that massively. But I know that they need to make a decision, for them as much as for Honda. And so I’m investing a lot of time and effort trying to make that happen. Honestly, am I pushing it too far? Am I not pushing enough? That’s the bit I have to keep asking myself.”

It’s clear that the man from Honda is deeply involved in this process and takes it very seriously on a number of levels. “What I want to get across is this: none of these have been knee-jerk decisions. Some of the discussions

are more amicable than others, let’s put it that way and some of the very clear signals that we put out there are ignored, and that can only go on so long because, in the end, I’ve got to do what’s right for Honda. But it’s a tricky one. I like to think that my team at Honda are peopleorientated: it’s a people business and a small industry, and we’re trying to do the right thing.

“I’m also very conscious that we are the market leader, and if we do the wrong thing, I think that can send all sorts of signals out there, and that’s not good because the big thing I’m very keen to do is get in new investment. I think what we’ve demonstrated to the dealer network, and I think they’re seeing that, is that Honda cares, for want of a better word.”

When all is said and done, though, Honda will still have – and wants – a fair degree of continuity in the network. “The vast majority of the dealers we’ve got are dealers that we have had for years,” says Fletcher. “Take Mark Smith up in Chester, for example. They’ve consolidated into Honda and built a new showroom with a new corporate identity, and that’s them nailing their colours to the mask for the next 10, 15, 20 years, whatever it is. And that’s great, and that’s what I want. Ideally, we want the people that we’ve already got to be able to be the people that are still here in 20 years’ time. We’ve actually put together a significant multi-million-pound investment fund of our own, which the dealers get towards the development of new facilities. We’ve proven the profitability is there if you do it, and we are also putting our money in to help out. It won’t cover all of it, but we believe in it, and I think that’s important.

“So look, I’m not trying to put a picture of us being perfect. But we have had really strong profitability nationally; the strategy we’ve followed has borne fruit in the sense that those 60 dealers, if you look at the growth of their profitability over the last five years, it’s grown and grown and grown.”

A future, surely, that every senior manager in the bike world would want to see…

APRIL 2024 17 www.britishdealernews.co.uk Business news

Grafton Motorcycles, Miles Kingsport and Firstline Motorcycles (above) all celebrated 45 years with Honda this year

Grafton Motorcycles

Miles Kingsport

Cyril sells

After 66 years in the twowheel trade, 54 years trading as C.G. Chell Motor Cycles and 30 years as EasyRider Europe, Cyril Chell is now calling time. His Marston Road, Stafford properties are being sold to another motorcycle dealer in a deal to be announced shortly.

As with many long-established motorcycle businesses, there were very humble beginnings, and behind it was a proprietor who was not only driven and extremely hard-working but also an entrepreneur with an excellent eye for a business opportunity or a good deal.

Chell’s journey in the two-wheel motorcycle trade started in 1958 at Halfords in Stafford. Moped repairs were Chell’s thing, and in those days, they were Raleigh mopeds – made in Nottingham – and German NSU motorcycles. Chell was at Halfords for four years before going to work at

all aspects of the trade. When the family sold the business, it allowed him to start out on his own, but it wasn’t easy, and he worked the night shift at GEC while running the shop during the day to make ends meet!

Originally, Chell sold mainly used parts for British bikes, with Hondas coming from Bill Smith in Chester. He then took on the Triumph, Norton and BSA franchises, which proved very successful and firmly established the firm. Within six months, C.G. Chell had secured a direct franchise with Honda, and this marked the start of a 45-year relationship which only came to an end in 2014.

The recent decision to sell up means all the stock – bikes, parts, engines, tyres, accessories, clothing, helmets, fixtures and fittings, point of sale, workshop, and office equipment is for sale, together with classic clothing, posters, pictures, and books.

intellectual property for the UK, EU, China and India. Anyone interested will be put in touch with his agent.

Cyril, a former TT rider, European Grand Prix competitor and speedway rider, thanks his customers and suppliers for their many years of support and says he is looking forward to some extensive travel plans once the sale details have been finalised.

The full story and an exclusive interview with Cyril will appear in the May issue of BDN

Business news

BDN Exclusive

OUR PASSION R&G Aero Crash Protectors offer unbeatable protection for your customer’s bike. Designed to stop critical components touching the ground in the event of a drop or crash, R&G Aero Crash Protectors Keeps critical components off the ground. Designed to bend on impact. Bobbins never stick out further than your bars. www. rg-racing .com crashprotection rg_crashprotection RnGRacing RandGTV RandG_official World-class crash protection and styling accessories

Cyril Chell won the BDN Trade Personality of the Year Award in 2017

Suzuki fun in the sun

You might think Japanese bike maker Suzuki had done enough for its dealers of late, with a slew of successful new models and burgeoning market share over the past 18 months. But the Milton Keynesbased importer wanted to give its dealers a little extra. So it took a group of them to the roads around Valencia, Spain, for some product familiarisation on their new season’s machinery – the GSX8R and GSX-S1000 GX, as well as a refresher course on the other recent hits: GSX-8S and V-Strom 800 models.

Leaving behind a dull, frozen, and grey Blighty for the sunkissed Mediterranean coast, dealers enjoyed a welcome dinner, took in some classroom sessions the following day, and hit some pot-hole free roads in the hills behind the city.

Suzuki GB head of motorcycles, Jonathan Martin, said after the event: “Annual dealer training events form an important part of our sales strategy, allowing us to demonstrate where we see the products sitting in our lineup and in the wider market, as well as giving our dealership partners the opportunity to try the bikes for themselves. We have hosted them at Mallory Park in recent years, but it was nice to get back

to Spain and to the sunshine to experience the bikes to their fullest on excellent roads. It’s also a great opportunity for us to ride together, as it's important to remember that we do what we do because of our shared passion for motorcycles.”

Joe Woodvine, franchise manager at Bulldog Suzuki, said: “The trip to Valencia to ride the GX and 8R was my first with Suzuki GB. Riding the two new models in the Spanish mountains was amazing, with great preplanned routes and coffee stops. Whilst being a great opportunity to gain product knowledge in the classroom and on the road, it was also great to get to know other dealers in the network and build relationships.”

5-Ways Motorcycle Centre dealer principal Gareth Robinson added: “Riding the new bikes through the incredible winding roads of the Valencia hills was an exhilarating experience that embodied the bikes’ characteristics perfectly. It was a blast.”

And Mark Handy, general manager at Motech, said: “It was a great few days. Many thanks to all at Suzuki for organising the trip. It was definitely one of the best riding experiences I've ever had.”

R&G backs US series

IT HAS PLENTY OF EXPERIENCE SUPPORTING RACING AT THE HIGHEST levels and now Hampshire-based bike protection firm R&G Racing, is helping out at a more grassroots level, with backing for the US-based Build Train Race series (BTR). BTR is a Royal Enfield project that supports women in two race series: one dirt flat track and one road racing, with riders on custom race-prepared International 650 and Continental GT 650 twins.

This year will be the fifth season of the BTR program, and UK-based R&G is sponsoring the entire series this year. The new partnership means that each competitor will receive a host of crash protection for their machine, including engine case covers, cotton reels, exhaust protectors, fork protectors, brake lever guards, toe guards, and tank traction grips. These will help riders get the most out of their bikes on track and keep them protected in a spill.

Simon Hughes, MD at R&G, added, “It’s been fantastic watching the Build Train Race initiative grow over the last few years and develop a truly inspiring community of female racers. We are really proud to be joining them on their journey for the 2024 season, and we can’t wait to see how this year’s competitors get on!”

THEROADYOURS . JUSTRIDE .

THE ROADSMART IV. EVEN STRONGER FOR LONGER.

With the RoadSmart IV, the road is yours – so you’re free to just keep on touring. The optimised tread pattern and advanced compounds help you command the road with confidence, even in the wet. Ride stronger, ride longer.

www.britishdealernews.co.uk

@dunlopmoto @dunlopmoto /dunlopmoto Follow us… or go to dunlop.eu Find out more

IS

ClementsMoto (CM) is best known as the UK Fantic importer, with a range that incorporates on- and offroad motorcycles and e-bikes. The company’s portfolio also includes the Far East-manufactured Zontes range of motorcycles and scooters, from 125cc to 350cc, all of which are said to represent value for money rather than just being cheap. The addition of Peugeot should neatly round off the CM brand offering.

Peugeot is a name that everyone knows, even though the two- and four-wheel products are entirely separate.

Peugeot is a European manufacturer with over a hundred years of experience producing powered twowheelers. It is well known for

Peugeot gives us a different range that doesn’t directly clash with any of our existing products

Dean Clements, ClementsMoto

its quality, performance, cuttingedge design, durability, minimal environmental impact and, importantly, value for money. The Peugeot range offers 50cc mopeds,

125cc scooters, large capacity two- and three-wheel scooters, as well as 125cc motorcycles. ClementsMoto MD, Dean Clements, got the call from Peugeot just before Christmas when the then distributor was having difficulties. “Peugeot had spoken to me back in 2020 when Three Cross Motorcycles went into administration, but for various reasons, we didn’t proceed with it back then.

Things are a little different this time, and Peugeot could see things

more from our perspective. The first thing we did was to secure all existing stock as we didn’t want it on the market going cheap. Then we needed a more UK-focused range and better colour options.”

CM did what it needed to do to retain the existing dealer network, including the retention of Pete Scott, who’d been in the aftersales department at Three Cross for a couple of decades and has a huge amount of product knowledge and dealer liaison ability.

“Peugeot gives us a different range that doesn’t directly clash with any of our existing products. We gave all the existing Peugeot network the opportunity to stay on board, and about 90% took up the offer. The remaining few weren’t selling much anyway. Some were just using the brand name because Peugeot, to the non-motorcycling public, is a good household name. A parent walking into a motorcycle or

Business news

Peugeot Tweet Active 125

PM-01 125 Supercharge Your Digital Marketing Digitally Charged are a pioneering marketing agency, specialising in advanced data collection tailored to the motorcycle industry. By leveraging target audience data and marketing strategies across various platforms, we are able to pinpoint the most engaged motorcycle enthusiasts both nationally and internationally. Our custom-built data ensures highly effective campaigns and we specialise in lead generation. Check out our some our highlight offerings Location Data Retarget individuals who attend industry shows and events. Lead Generation Capture high quality, inbound sales leads. Motorcycle Type Targeting Access our pre-built audiences to target riders of adventure, sports, naked etc. accountmanagement@digitally-charged.com www.digitally-charged.com

Peugeot

scooter showroom to buy their 16- or 17-year-old their first bike will recognise the Peugeot lion logo and be reassured about product quality etc.”

Establishing the Peugeot network has had brand crossover benefits for CM with Zontes. Quite a few Peugeot dealers have taken Zontes as well, because the model ranges are compatible. The reverse has occurred with existing Zontes dealers.

Clements isn’t too smug about the situation, though, and says that there are still a lot of empty spaces on the firm’s dealer map, which he will be looking to fill over the coming year.

“The new sites have got to be stock holding, fully supporting dealers. The network trading terms had been allowed to slip with the previous distributor. We’ve not made any radical changes, just trimmed a few price points. There was an issue with the PM-01 125cc, which marked Peugeot’s return to motorcycle production after many years and was previously priced at four grand. Now we’ve got it down to £2999. Plus, we’ve shaved a few quid off some other models.”

The Peugeot range includes

more 50cc models than most, but the company is mindful that the moped sector will be first for the chop when decarbonisation regulations are eventually implemented and is already producing electric scooters such as the E-Ludix. However, Clements doesn’t feel the time is right for the UK market. After an upturn during the lockdown for the urban delivery sector, e-scooter sales have dropped in favour of e-bikes, which are better suited to short journeys and urban traffic restrictions. Should the market change, Peugeot will have tried and tested electric products available.

ClementsMoto had a webinar for the existing dealer network where the new deals and the way forward were mapped out. So far, Clements is pleased with progress, and the warehouse is filling with stock and spares, but, as Clements says, “it’s still early days.”

“We’ve had some immediate sales from dealers with whom we already have a business relationship, and we will be happy to talk to all interested dealers around the country. Scooter riders don’t want to have to travel too far to get their scooter serviced or to buy clothing and equipment, so we’re looking to grow the network overall.”

ClementsMoto

01227 720700

www.clementsmoto.co.uk

www.peugeot-motocycles.co.uk

www.britishdealernews.co.uk

Peugeot E-Ludix

Peugeot Kisbee 50 Street Line

John Doe joins Parts Europe portfolio

IT MIGHT SOUND ALLAmerican, but the new clothing brand from Parts Europe is 100% European. The John Doe firm, based near Mainz in Germany, offers a range of premium classic-styled riding gear that incorporates advanced materials and manufacturing processes. These include the firm’s in-house XTM-Fiber Kevlar/Lycra mix for maximum protection and comfort and its own XTM PU armour, which is CE-approved.

The styling is aimed at fans of the casual urban look, centred around protective riding jeans and shirts, plus jackets, boots and other accessories. An initial selection of kit is available to Parts Europe dealers now, and the full range will be available later in the summer. www.partseurope.eu

OBITUARY Andre Waszczyszyn 1956-2024

Andre Waszczyszyn, owner of Webbs Motorcycles with showrooms in Lincoln and Peterborough, died on 15 February. He was 68.

A well-known personality in the motorcycle industry, having been a retailer for 40 years, he was a man whose professionalism, kindness and sense of humour made him popular with suppliers and other retailers.

Webbs Motorcycles was founded in 1960 by Eddie Jago and his wife Betty. In 1975 they were appointed as the Yamaha dealer for Lincoln. In 1984, Andre, together with his brother-in-law Stephen Jago, took out a loan to purchase the business from them. By this time, Andre had met and married Sue Jago, the daughter of the founders.

In 1988, the business moved from its premises in Lincoln town centre to its current purpose-built premises – at that time a very big move! Over the next 35 years, they continued to build the business and, in 1992, were appointed as a founder dealer for Triumph.

The Peterborough store was added in 2003, and together Andre and Stephen developed both stores, winning the Triumph Customer Service Award three times – the only company in the UK to achieve this.

Andre’s greatest achievement, though, was building a strong team at both of the Webbs stores. Their loyalty to him is testament to his commitment to them.

In addition to the business, Andre had many other interests, including travel and dining out with his wife and daughter, often with their many friends. He also enjoyed attending concerts, and he was particularly keen on David Bowie.

The last words about Andre come from his wife, Sue, and daughter, Jo. “He loved the world and created experiences for us throughout our lives. He would notice and appreciate everything. He loved people and wanted to share the pleasure of his life’s experiences with everyone. He gave to life and will be sadly missed.”

Contact sales: 0161 494 4200 | sales@pama.co.uk | www.pama.com 22 APRIL 2024 www.britishdealernews.co.uk Business news

We are looking for a skilled technician to join our long-established business in Taunton, Somerset. Royal Enfield, AJS, Sym & Sinnis official dealers. The successful candidate will: • Have previous experience as a motorcycle technician • Be familiar with current diagnostic equipment and the repair of modern motorcycles and scooters • Have a full UK motorcycle licence Top rates of pay according to experience. Possible accommodation available and help with relocation. Please phone 01823 276012 for an informal chat, or send your CV to contact@gvbikes.co.uk. Motorcycle Technician Suppliers of Classic Bevel Single Ducati parts to both retail and trade Trading since 1998 and now looking for a new pair of hands to take over the reins of this successful small business. For details please visit: www.laceyducati.com or phone 01597 870444 BUSINESS FOR SALE DEALER DISCOUNT OFFER 50% Contact Alison on 01237 422660 or adsales@dealernews.co.uk SEE THE NEW BIKE IT 2024 STREET CATALOUGE SCAN ME Job add_Outlined.indd 1 19/03/2024 10:50 APRIL 2024 23 www.britishdealernews.co.uk JobScene/Dealer4sale 01237 422660 | adsales@dealernews.co.uk | www.britishdealernews.co.uk/jobs

What Labour means for business

Time marches on and soon the country will be in the midst of another general election battle. As to when it’ll be, we don’t know, but at the very latest, unless Rishi Sunak asks the king to dissolve parliament beforehand, it will dissolve automatically on 17 December this year with an election held around 25 days later, excluding weekends and bank holidays.

Not unsurprisingly, political parties are already jockeying for position, but none has yet published a manifesto upon which they will stake their claim on the keys to Number 10.

Of course, it’s not over until the fat lady sings, but the view of the man on the Clapham Omnibus seems to be that it’s odds-on that the next government will be left of centre. That’s not to say that Labour are guaranteed a win, as the events of the early part of February indicated, with three electoral candidates either being removed from the party ranks or being admonished for their alleged anti-semitic views.

A year or so ago, Sir Keir Starmer unveiled his “Five Missions for a Better Britain”, which outlined what the Labour Party seeks in its move towards a “mission-driven government.” Naturally, being this far away from an election, the document was short on detail, but it sought productivity gains and new jobs for growth, along with a stronger hand on net zero. But those keenly digesting the media will

have heard that in early February Labour walked away from its green investment policy on the basis that the country couldn’t afford to borrow around £28bn to fund such green investments. The party, of course, laid the blame at the door of the Conservatives for spending so much during its 14-year tenure. However, sight shouldn’t be lost of what the government did to keep the economy alive during Covid, and that didn’t come cheap. Regardless, Labour’s retraction didn’t look good.

Will it become the party of old where it seeks to tax and spend?

Soon the Labour Party manifesto will be ready, but until it’s published we can only guess at what it’ll include. Will it become the party of old, where it seeks to tax and spend?

At the annual party conference in October last year, shadow chancellor Rachel Reeves said that Labour will focus on economic growth, not higher taxes and that “Labour will tax fairly and spend wisely.” With a background as an economist and roles at the Bank of England, British Embassy in Washington and once having interviewed for Goldman Sachs, it’s hoped she knows what she’s talking about!

In fact, she has previously gone on record stating that she’d support a 2p cut in income tax if the current government proposed it. And also, in January 2022, Reeves said a Labour government would be pro-business and committed to fiscal discipline.

Labour has said that it would want to further fund the public sector and increase investment through a new national wealth fund. It would reform planning rules to build an extra 1.5 million new homes and invest in infrastructure.

As for new sources of money, those who pay for private education or who qualify for ‘nondomiciled’ tax status will find life more expensive; the former will become subject to VAT and the latter will be abolished.