THE PROJECT LANDSCAPE ISSUE

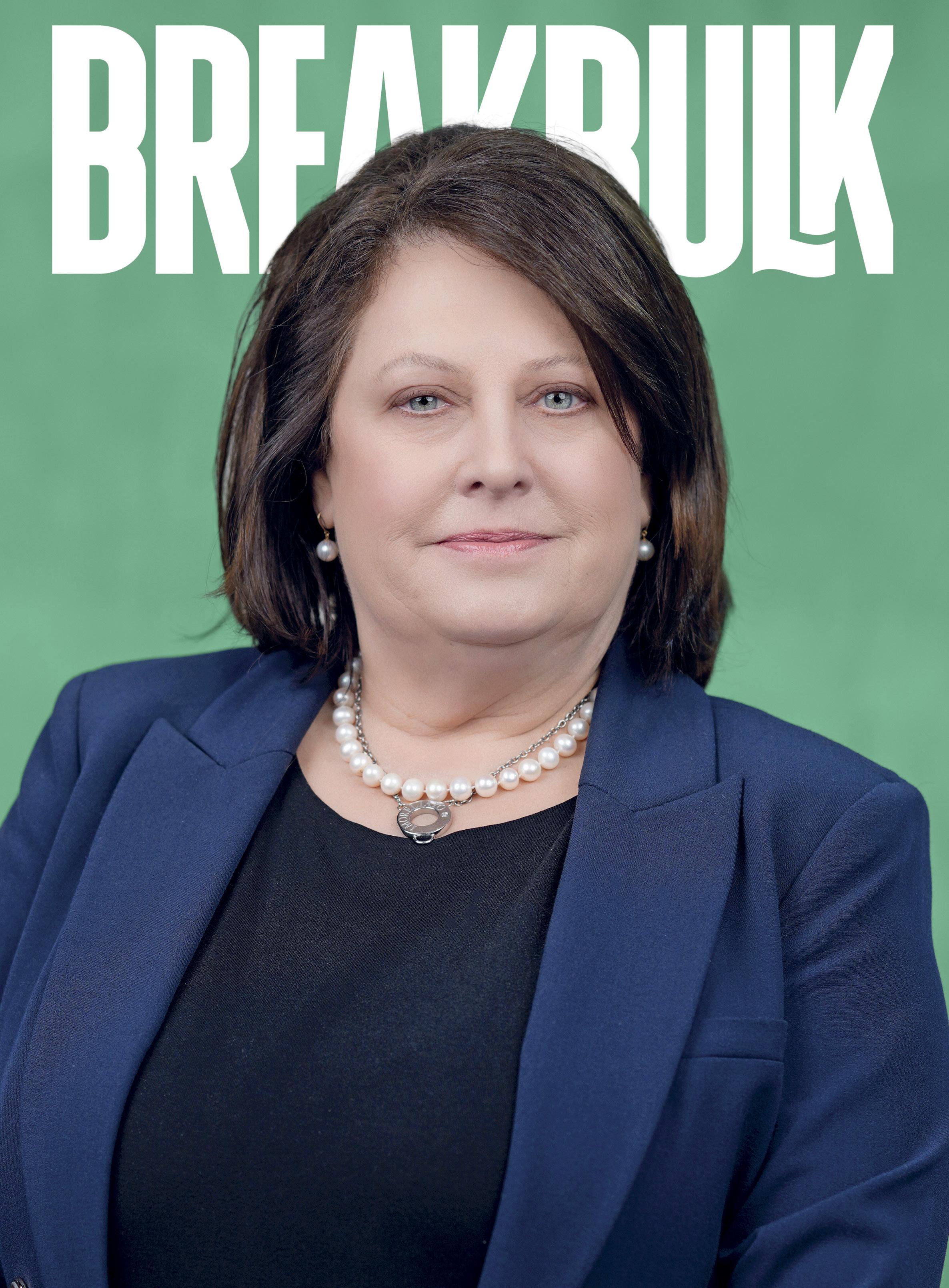

Margaret A. Kidd: Champion for Breakbulk’s NextGen Houston Stalwart Forges Academia, Industry Bonds

Issue 2 2024

Wind, Infrastructure, Oil & Gas, CCS and Hydrogen Opportunities

3 Breakbulk Magazine Issue 2 2024 breakbulk.com Inside This Issue 46 Europe Too Many Turbines, Too Few Vessels Could Lack of Heavy-lift Vessels Slow Europe’s Offshore Wind Ambitions? 50 Europe Lessons Learned From CCS Projects Heidelberg Materials’ Facility Overcomes Challenges 54 Europe SASA’s Çelikoğlu Rises to Quake Challenge Petrochem Producer Mobilizes Resources for Search and Rescue Support 58 Europe Closing the Loop With Circular Logistics Increasing Focus in Sustainable End-to-End Logistics Solutions 60 Europe Trying Terrain for Collett Turbine Move Partnerships Smooth Out ‘Sharp Corners and Pinch Points’ 64 Americas Chile Seeks to Speed Up Project Approvals Forwarders Welcome Plans to End “Nightmare” Permitting Process 26 Global How China Plus One Derisks Supply Chains Revisit Sourcing Strategies to Reduce Overdependence 30 Global Prepping for a Hydrogen Heyday Wider Adoption a New Business Line for Project Cargo Specialists 33 Global Nickel Needs Set to Drive Mining Projects Metal Demand Forecast to Increase 65% by 2030 36 Profile Sameer Parikh: Epitome of an Earnest Operator JM Baxi Heavy President Breaks Boundaries 40 Global Accelerating Vehicle Growth Drives Capacity Constraints High and Heavy Volumes Strong Amid Geopolitical Risks 44 Global Alliances Make Even the Trickiest Projects Run Smoothly Engagement Brings Construction, Engineering Teams Together Cover Story 70 Mark Your Calendars for Upcoming Breakbulk Events Breakbulk Europe 21-23 May 2024 Rotterdam Ahoy, Netherlands Breakbulk Americas 15-17 October 2024 George R. Brown Convention Center, USA Breakbulk Middle East 10-11 February 2025 Dubai World Trade Centre, UAE 46 Margaret A. Kidd: Champion for Breakbulk’s NextGen Houston Stalwart Forges Academia, Industry Bonds Nickel Needs Set to Drive Mining Projects

4 Breakbulk Magazine Issue 2 2024 breakbulk.com Inside This Issue 66 Americas US Wind Projects Set back, Not Stalled Supply Chain Issues, Escalating Costs Are Surmountable 70 Profile Margaret A. Kidd: Champion for Breakbulk’s NextGen Houston Stalwart Forges Academia, Industry Bonds 74 Middle East Saudi’s Horizon of Project Opportunities Look Beyond NEOM for More Mega Developments 78 Thought Leader Mining For Glory in Africa Continent on Brink of Minerals, Metals Explosion

Middle East Iraq’s Mega-project Sparks Infrastructure Boom Country’s US$17 Billion Road and Rail Plan to Create Opportunities

Middle East Africa’s Oil and Gas Sector Surges US$800 Billion Investment Drive Accelerates Amid Rising Demand

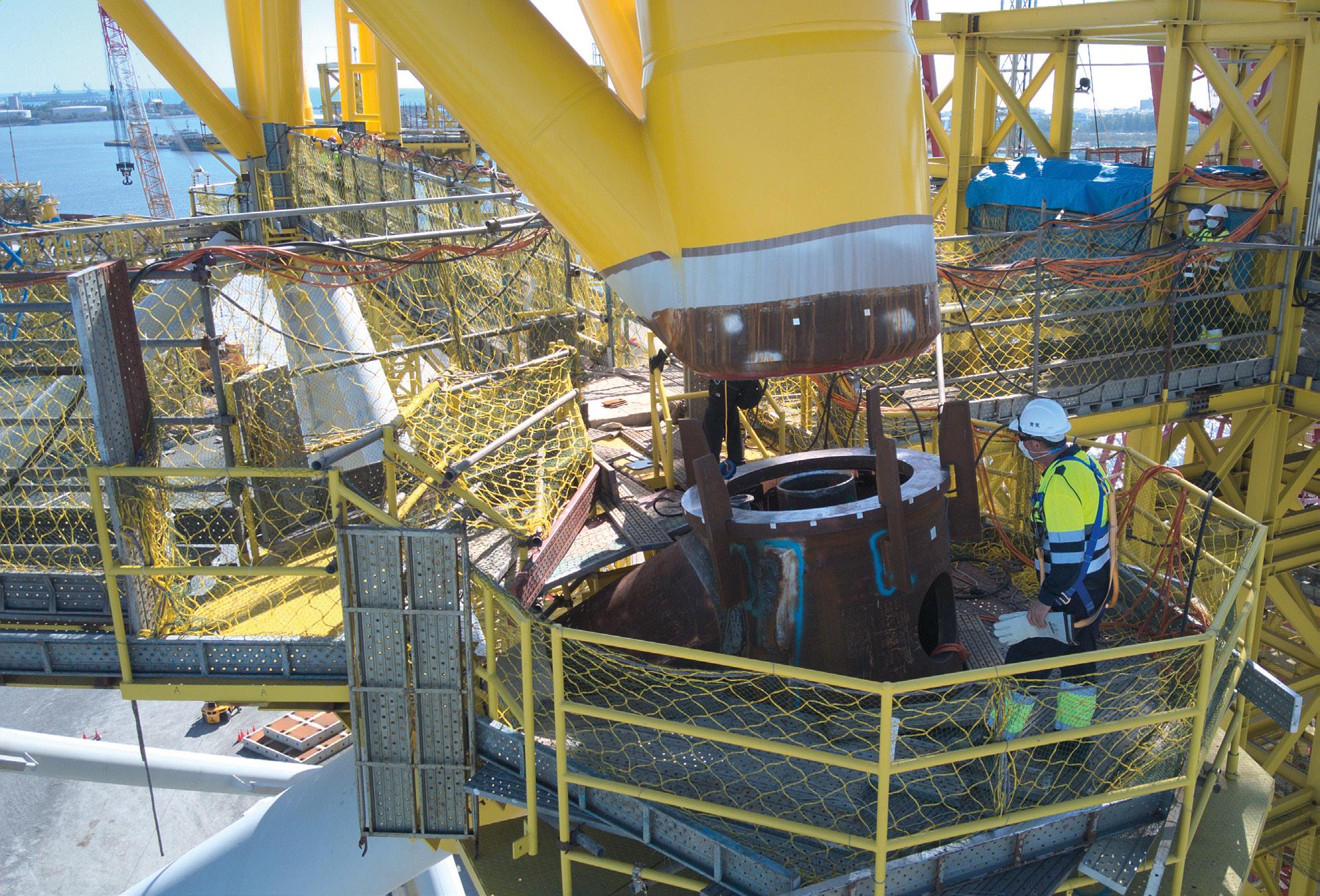

Asia Asia Set to Dominate Wind Power Scene Offshore Projects Ready for Liftoff in Region Also in This Issue 06 Foreword 09 UpFront 86 Breakbulk Middle East Recap 93 Best of BreakbulkONE 96 Projects in This Issue 66 82 US Wind Projects Set back, Not Stalled Africa’s Oil and Gas Sector Surges

79

82

90

Delivering what your customers need.

Houston City Docks

Port

www.porthouston.com

A BOOMING PROJECT LANDSCAPE BECKONS

I can describe this issue in just one word: opportunity.

The project landscape is bursting with opportunities across multiple sectors.

Along with wind farms and oil & gas projects, new areas like carbon capture and storage (CCS), hydrogen, and futuristic infrastructure projects are rapidly gaining momentum.

Of course, with any opportunity comes its share of challenges such as meeting equipment needs and finding capacity for project cargo shipments, but industry professionals are optimistic. The key word here is collaboration. By working together, we can tackle these challenges headon and ensure everyone benefits from the exciting times ahead.

To help you navigate this dynamic picture, we’ve packed this issue with insightful articles and features.

Starting with the global section, “How China Plus One Derisks Supply Chains” by Felicity Landon explores a strategic approach to managing geopolitical risk. Move on to “Prepping for a Hydrogen Heyday” by Luke King who delves into the global rise of hydrogen projects, opening a new business line for project cargo specialists.

In our Europe section, take a candid look at project development in Felicity Landon’s “Lessons Learned From Heidelberg Materials CCS Project.” This story offers a thorough assessment of what went right and what could have been done differently in this brownfield project where laydown space was at a premium.

In Türkiye, project cargo service providers have had their share of challenges, but nothing can daunt their

commitment to seeing projects through completion. Check out Q&As with three Turkish exhibitors who you can meet at Breakbulk Europe. Staying in Türkiye, “SASA’s Çelikoğlu Rises to Quake Challenge,” by Simon West, presents an interview with Uğur Çelikoğlu from Turkish chemicals giant SASA. Çelikoğlu relates his on-the-ground experience as his project was rocked by the devastating February 2023 earthquake.

Travel across the Atlantic to the Americas where our cover story focuses on a familiar industry face at Breakbulk events. In “Margaret A. Kidd, Champion for Breakbulk’s NextGen,” read about her remarkable journey from Wall Street to the University of Houston and onto the international stage as the go-to resource for all things logistics.

Looking at projects, offshore wind in the U.S. is facing challenges, but Carly Fields’ report on the sector reveals a more optimistic picture as discussed by deugro’s Thomas Wylie and UTC Overseas’ Marco Poisler.

Moving on to the Middle East, Africa and Asia, writer Heba Hesham gives us a look at “Iraq’s Mega-project Sparks Infrastructure Boom” through the expert eyes of Captain Cem Ercan, CEO for CETA Logistics & Projects. Ercan is involved in the US$17 billion Development Road project to link Iraq with Türkiye via high-speed rail. Liesl Venter reports on Africa’s oil and gas project boom fueled by an accelerating US$800 billion investment, while Thomas Timlen reveals the most promising markets for offshore wind across major Asian markets.

Our next issue is the Europe edition and will be distributed at Breakbulk Europe, May 21-23. To discuss opportunities and challenges in person, plan to join us in Rotterdam.

Best,

Leslie Meredith Marketing and Editorial Director Breakbulk Events & Media

Marketing and Editorial Director

Leslie Meredith / +1 (801) 214 4229

Leslie.Meredith@breakbulk.com

News Editor

Carly Fields carly.fields@breakbulk.com

Senior Reporter

Simon West simon.west@breakbulk.com

Designer

Mark Clubb

Reporters

Heba Hashem

Luke King

Felicity Landon

Lori Musser

Malcolm Ramsay

Thomas Timlen

Liesl Venter

Breakbulk Magazine Editorial Board

John Amos Amos Logistics

Tina Benjamin-Lea Air Products

Dea Chincuanco dship Carriers

Elisabeth Cosmatos Cosmatos Group of Companies

Dennis Devlin Maersk Project Logistics

Dharmendra Gangrade Larsen & Toubro

Margaret Kidd University of Houston

Stephen “Spo” Spoljaric Bechtel Corporation

Jake Swanson DHL Global Forwarding

Grant Wattman Combi Lift Americas

Portfolio Director

Jessica Dawnay

Jessica.Dawnay@breakbulk.com

To advertise in Breakbulk Media products, visit: http://breakbulk.com/page/advertise

Subscriptions

To subscribe,

6 Breakbulk Magazine Issue 2 2024 breakbulk.com Foreword

A publication of Hyve Group plc. The Studios, 2 Kingdom Street Paddington, London W2 6JG, UK

go to https://breakbulk.com/page/ breakbulk-magazine

Leslie Meredith

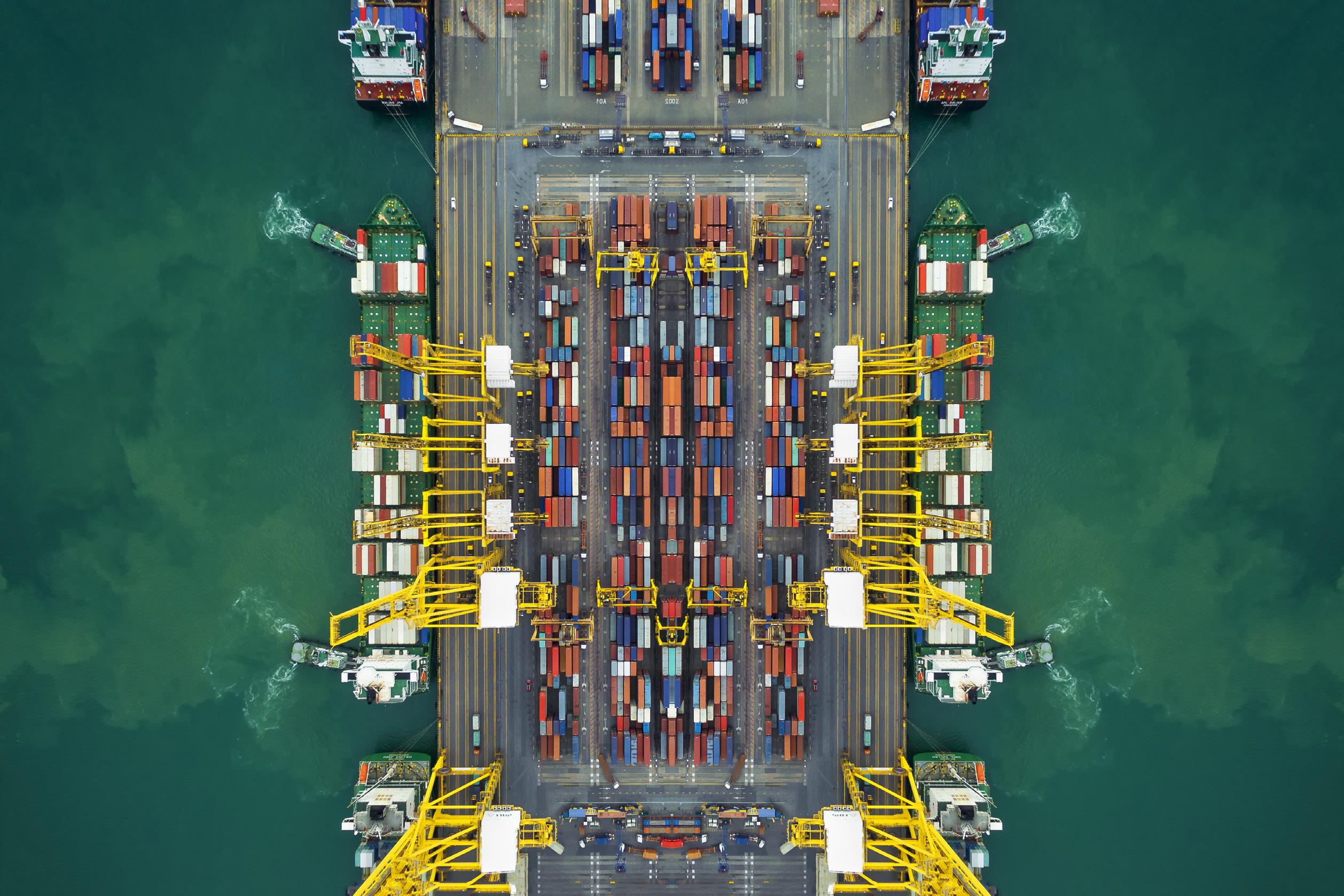

SEAMLESS CONNECTIONS

At DP World, our ports and terminals help businesses streamline operations, lower costs and achieve sustainability goals.

We’re working to end supply chain disruption by reducing friction in every part of your cargo’s journey, creating certainty and security for all.

From the factory floor to your customer’s door, DP World is working to ensure the fast, transparent movement of goods, connecting you to your customer.

Speakers, Exhibitors and Breakbulk Global Shipper Network Members in this issue:

Movers & Shakers, page 12

AsstrA-Associated Traffic AG, CEVA Logistics, Fracht Group, Gebrüder

Weiss, Port of Corpus Christi, Port of Rotterdam, RAK Ports

Driving Excellence in SPMT Operations, page 10

Fagioli, Goldhofer, Mammoet, TII Group, Wagenborg, Collett, Technip, Saipem and Siemens Gamesa

Africa’s Oil and Gas Sector Surges, page 82

John Pittalis, Head of Marketing and Communications, AAL Shipping (AAL)

Gopalakrishnan Srinivasan, General Manager for Special Projects –Energy, GAC Group

Accelerating Vehicle Growth Drives Capacity Constraints, page 40

Emmanuel Cheremetinski, Global Finished Vehicle Logistics Leader, CEVA Logistics

Trying Terrain for Collett Turbine Move, page 60

Roy Edmondson, Project Manager, Collett & Sons

GE Renewable Energy

Prepping for a Hydrogen Heyday, page 30

Thies Holm, General Manager, GAC Germany

Lorenzo Simonelli, Chairman and CEO, Baker Hughes

David R. Edmondson, Chief Executive Officer, NEOM Green Hydrogen Company (NGHC)

Port of Stade, Seaports of Niedersachsen, PD Ports, Chipolbrok

Iraq’s Mega-project Sparks Infrastructure Boom, page 79

Captain Cem Ercan, CEO, CETA Logistics & Project Daewoo Engineering & Construction, Hyundai Engineering and Construction, JGC

Nickel Needs Set to Drive Mining Projects, page 33

Colin Charo, CEO, Trans Global Projects

Trevor Blair, Senior Supervisor of Strategic Planning and Business Development - Raglan Mine, Glencore

Sameer Parikh: Epitome of an Earnest Operator, page 36

Sameer Parikh, President & Chief Business Officer, JM Baxi Heavy Larsen and Toubro, Wärtsilä, Caterpillar, Technip

Closing the Loop With Circular Logistics, page 58

Dr. Sven Hermann, Professor of logistics and Supply Chain Management, NBS Northern Business School Hamburg, and Founder and Managing Director of ProLog Innovation GmbH (speaker)

André Starke, Head of Project Logistics, Andritz Hydro

Daniel Duus, Global Head of Logistics, thyssenkrupp Uhde

How China Plus One Derisks Supply Chain, page 26

Vilasini Krishnan, Vice President, 4D Supply Chain Consulting

Peter Molloy, senior maritime research analyst, Drewry

Dr. Ferenc Pasztor, Deputy Head of Research at Drewry

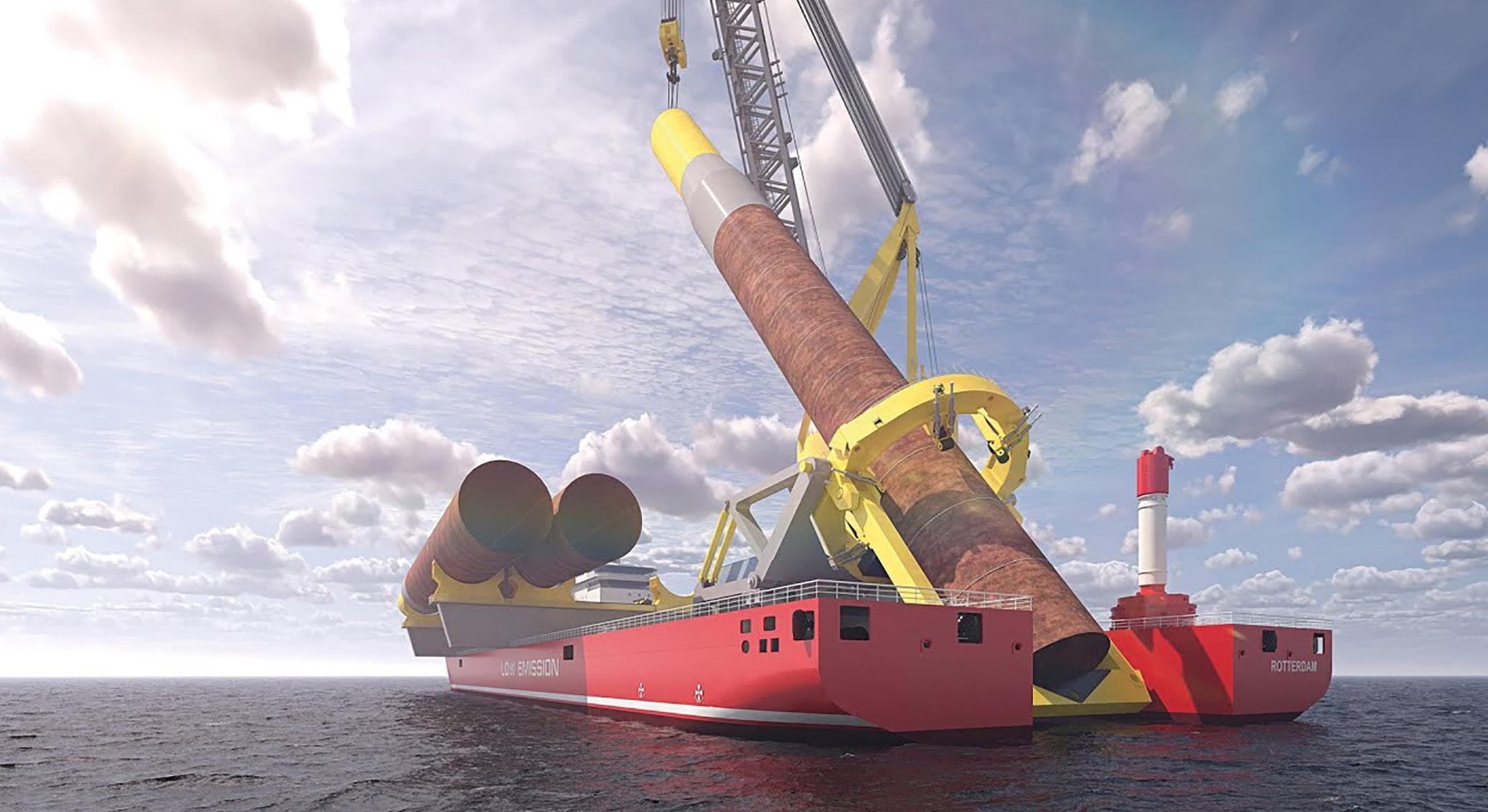

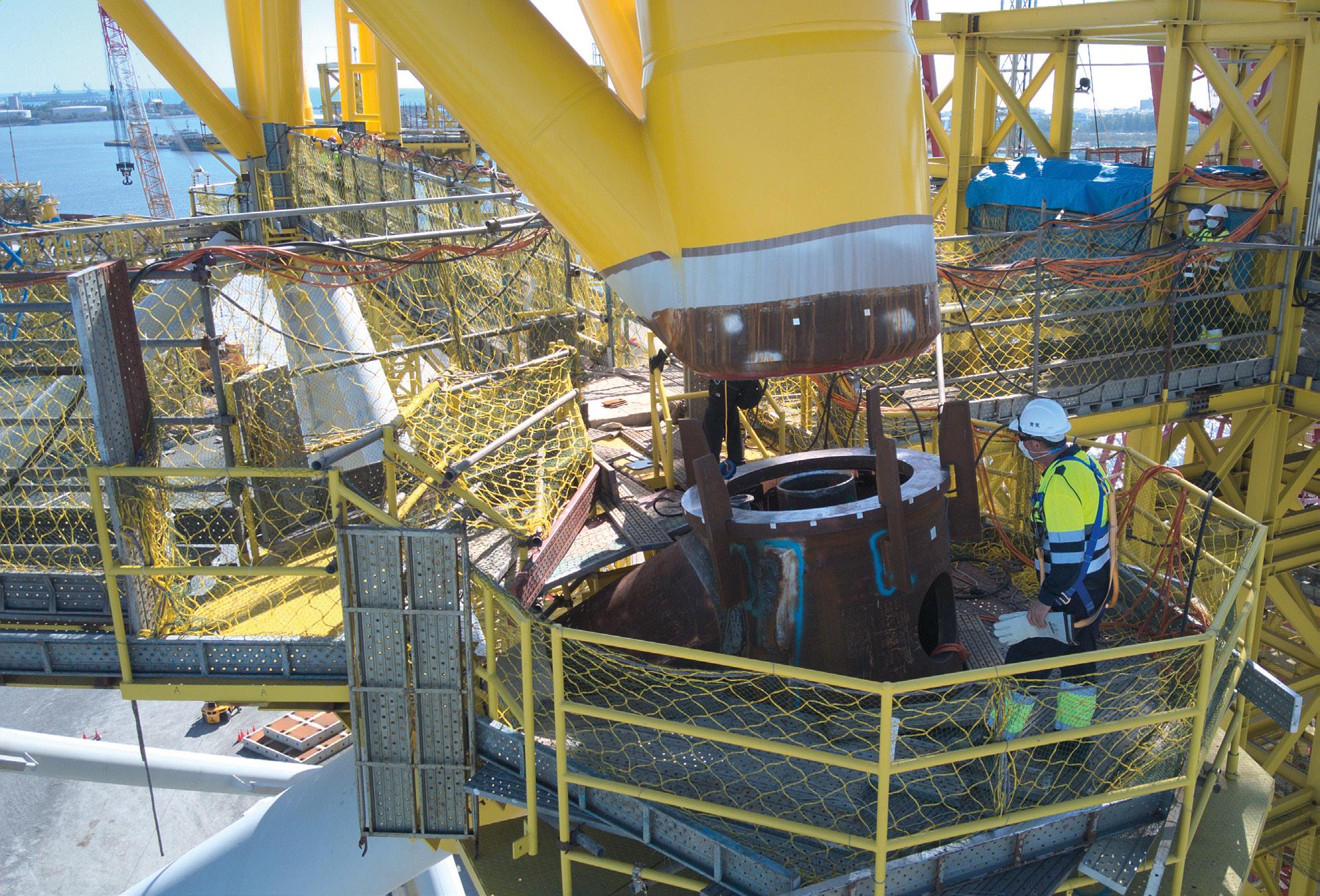

Too Many Turbines, Too Few Vessels, page 46

Brian Boutkan, Manager Commerce Offshore, Jumbo Offshore

Ørsted, Allseas

Carriers, Shippers, Forwarders Need to Be United, page 86

Denis Bandura, Managing Director, BBC Chartering UAE*

Carsten Wendt, Head of Sales for High & Heavy and Breakbulk, Wallenius Wilhelmsen

Vilasini Krishnan, Vice President, 4D Supply Chain Consulting

Call for Supply Chain Agility, Resilience, page 87

Jamilya Garajayeva, Logistics Manager, Petrofac

Peter Dudas, Head of Global Commercial and Tendering Strategy, DHL Industrial Projects

Christopher Grammare, Managing Director, AAL Shipping

Women Leaders Inspire Next Generation, page 88

Abir Leheta, CEO, Egytrans

Dalia Farahat, Regional Control Tower Manager O&G – MEA IP, DHL

Global Forwarding

Simona Peter, Business Development, Fleet Line Shipping

Alia Janahi, Vice President of HSE, DP World GCC

Corpus Christi to Handle More Project Cargo, page 93

Omar Garcia, Chief External Affairs Officer, Port of Corpus Christi

AAL Responds to Perils of Red Sea Routes, page 94

Christopher Grammare, Managing Director, AAL Shipping (AAL)

Swire Projects Launches Asia-Americas Service, page 95

Rufus Frere-Smith, Regional Head of Americas, Swire Projects

Lessons Learned From CCS Project, page 50

Meriaura, Paldiski North Port, Port of Antwerp-Bruges, Port of Rotterdam

Navigating an Unprecedented Challenge, page 54

Uğur Çelikoğlu, New Investments Logistics Lead, SASA CJ-ICM Logistics

Chile to Speed Up Project Approvals, page 64

Alberto Oltra, CEO for South America and Country Manager for Chile, DHL Global Forwarding

US Wind Projects Set Back, Not Stalled, page 66

Thomas Wylie, Head of Global Strategic Projects and Accounts, deugro

Marco Poisler, Chief Operating Officer, Global Energy and Capital Projects, UTC Overseas Ørsted

Saudi’s Horizon of Project Opportunities, page 74

Almajdouie Logistics Company, Mawani, Saudi Ports Authority

Ma’aden, Saudi Aramco, Technip Energies

Key:

Breakbulk Global Shipper Network Member

Credit: BBC Chartering

Inside This Issue 8 Breakbulk Magazine Issue 2 2024 breakbulk.com

Credit: Wagenborg Ton Klijn on SPMT Growth Movers & Shakers Spotlight on Türkiye New Faces at Breakbulk Europe 2024 Breakbulk Middle East – By The Numbers Gift Guide INSIDE

Thought Leader

DRIVING EXCELLENCE IN SPMT OPERATIONS

Urgent Need for Operator Training and Standards

By Ton Klijn

One of the most notable trends in logistics and heavy transport markets in recent years has been the rapid growth in the use of selfpropelled modular transporters, or SPMTs.

For the uninitiated, an SPMT allows very large and heavy loads to be transported with great precision. It consists of a platform supported by computer-controlled axles and the modular nature of the system allows for unlimited configurations by adding axles lines.

They are used for moving massive objects, such as large bridge sections, oil refining equipment, ships, heavy machinery and industrial components – in other words, loads that are too big or heavy for trucks.

The growth in off-site manufacturing and construction, combined with all industries’ continuous quest for greater efficiency, has resulted in a steady increase in the height, size and weight of modules, components and structures needing to be transported, and hence, strong growth in the market for SPMT services.

But that success comes with a price. There is no industry-wide standard or system for training SPMT operators, and the growth in demand has attracted increasing numbers of inexperienced entrants into the market.

The simple and unpalatable truth is that around the world, we are seeing far too many accidents involving SPMTs and we firmly believe that improved technical guidance coupled with properly regulated operator training are essential for the future.

Stability Guidance Published

At the end of last year, ESTA – the European Association of Abnormal Road Transport and Mobile Cranes – published a new transport stability guideline for the use of modular hydraulically suspended trailers including SPMTs.

If we were in any doubt before publication about the industry’s need for such work, those doubts were rapidly dispelled. We had the biggest response we have ever received in my time working with ESTA.

The guideline is the product of ESTA’s SPMT working group whose member companies come from eight different countries, reflecting the widespread concern across Europe.

It specifies the factors to be considered when verifying the global stability and capacity of a modular hydraulically suspended trailer by calculation, assuming that the trailer is operating on a stable surface.

It also details the conditions and considerations for local stability of trailers within a transport arrangement and the stability of the cargo itself and is referenced in the DNV ST-N001 Maritime Operations Standard published by DNV, an independent expert in assurance and risk management.

The guideline will eventually be incorporated into a completely updated best practice guide to be published later this year.

Alongside this work, ESTA has started on plans to develop SPMT operator training through the launch of ETOL – a European Transport Operators Licence – using the structures developed for our European Crane Operators Licence (ECOL).

We will create a new European Crane and Transport Operators Licence organization as an umbrella body that will oversee both the existing ECOL and the new ETOL which will initially focus on training for SPMT operators. We decided that this will be simpler and more efficient than creating a completely new organization from scratch.

10 Breakbulk Magazine Issue 2 2024 breakbulk.com

Common, professional operator training standards – using the structures developed for ECOL – will not just raise safety and efficiency but will also help the industry recruit the operators it needs going forward.

Of course, we have been working on improving our industry’s safety and efficiency for many years – that is what ESTA exists to do. But the truly exceptional response to this project underlines the crucial importance of our work in this area. We’d love to hear from you if you want to join in.

The companies helping ESTA in this work are Cometto, DNV, Fagioli, Goldhofer, Mammoet, Sarens, Technip, TII Group, Wagenborg, BMS, Collett, Saipem, Siemens Gamesa and Transportes y Grúas Aguado. Ton Klijn is director of ESTA and chair of the ECOL Supervisory Board. Further information about ESTA can be found at www.estaeurope.eu

*Breakbulk Europe exhibitor. Visit: www.europe.breakbulk.com/home BGSN member

Mammoet puts an SPMT through its paces

11 Breakbulk Magazine Issue 2 2024 breakbulk.com

Credit: Mammoet

MOVERS AND SHAKERS

Highlighting Recent Industry Hires, Promotions and Departures

Fracht Group

Breakbulk Europe Advisory Board member Tim Killen has joined Fracht Group as the Switzerland-based logistics company’s head of growth for projects with overall responsibility for supporting the strategic development of the organization’s global project growth across all key offices, regions, and markets.

Killen boasts more than 25 years of experience working on capital projects across all the main energy related industry verticals for companies including deugro, Abnormal Load Engineering and Alstom Power. Prior to joining Fracht, the executive served as A.P. Moller-Maersk’s global head of growth for project logistics and was also a non-executive director on the board of the Energy Industries Council (EIC).

Port of Corpus Christi

The Port of Corpus Christi, the largest U.S. port in revenue tonnage, has stuck with a familiar face after naming Cindy Bertolami as its new CFO, a role she had been undertaking on an interim basis since September. Bertolami, previously the Texas port’s finance director, takes over from Kent Britton, who last year was appointed CEO.

In her new role, the executive will oversee the port’s real estate, IT, finance, accounting, procurement, and risk management departments. “Cindy brings a wealth of knowledge to her new role as CFO that will be a strong benefit to the Port of Corpus Christi team and our customers,” Britton said. “I have no doubt she will not

only continue this institution’s commitment to financial accountability and transparency, but also continue the push to improve our internal processes and systems.”

CEVA Logistics

CEVA Logistics has appointed Milton Pimenta as its new managing director for Latin America, tasked with driving the company’s growth in the region. Pimenta joined CEVA in 2001 and has held various executive roles – based mainly in Sao Paulo – including in business development and operations. In 2019, the executive left Brazil to become managing director of CEVA in Australia & New Zealand.

“I’m deeply honored and excited to lead CEVA Logistics in the dynamic Latin America region,” Pimenta said. “We have a deep-rooted culture of operational excellence at CEVA, and I’m committed to building upon that culture by delivering innovative logistics solutions and exceptional service to our valued customers. Together with our dedicated team, we will continue to drive growth and success in LATAM, ensuring that CEVA remains a trusted partner for all of our customers’ supply chain needs.”

K2 Project Forwarding

Ida Ullestad Misje has begun a new role as head of operations at K2 Project Forwarding, the Norwaybased logistics venture founded in 2021 by Peak Group and deugro. Misje joins K2 after a 15-year stint at Kuehne+Nagel, where she enjoyed executive roles in marine logistics, projects, and chartering.

“Ida’s experience, network, and positive attitude will be of great benefit not only for our clients but for the whole team,” said Leif Arne Strømmen, CEO at K2 Project Forwarding.

Tim Killen

Cindy Bertolami

Milton Pimenta

12 Breakbulk Magazine Issue 2 2024 breakbulk.com

Ida Ullestad Misje

Gebrüder Weiss

Gebrüder Weiss has chosen Torge Runge as new senior operations manager of Industrial Projects & Energy Transport Solutions – North America, overseeing all project cargo operations and related activities. Runge, who will report to the division’s director Michael Ruediger, boasts more than 25 years of experience in project logistics, enjoying managerial stints with companies including Kuehne+Nagel, Conceptum Logistics USA, and deugro.

Runge and Ruediger are based at the company’s Houston office, which is dedicated to specialized projects and project transportation. “We are thrilled to have Torge join the project team,” said Mark McCullough, CEO of Gebrüder Weiss North America. “The caliber of his leadership abilities and operational expertise is second to none, and his vast experience will further enhance the tailor-made logistics solutions and project execution capabilities we provide to our clients.”

Asstra-Associated Traffic AG (Middle East)

AsstrA-Associated Traffic has named Daniel Staples as its new head of industrial projects in the Middle East. Staples will be based in AsstrA’s Dubai office, which was launched in December 2023. The executive boasts more than three decades of experience in the logistics sector –working mainly in the UAE – and has enjoyed stints with several leading players including CEVA Logistics, deugro, and Hellmann Worldwide Logistics.

In this latest role, Staples will focus on expanding AsstrA’s project logistics business throughout the region while overseeing efforts to optimize supply chain processes, foster innovation, and drive sustainability, the company said, adding that his strategic leadership will play a “pivotal role” in shaping the company’s fortunes in the region.

Port of Rotterdam

Boudewijn Siemons has begun his new role as CEO of the Port of Rotterdam Authority, succeeding Allard Castelein, who left the Port Authority last summer. Siemons had been serving as CEO on an interim basis since Castelein’s departure, in addition to his position as COO. The process of looking for a new COO has begun, the Port Authority said.

Siemons, who will serve as CEO for four years, said working at Rotterdam gave him “enormous energy.” He added: “The port of Rotterdam connects Europe with the rest of the world through logistics chains. With our employees and customers, the Port Authority is shaping a future-resilient port that is firmly rooted in the region and the city.” Rotterdam is host port for Breakbulk Europe 2024, happening May 21-23 at Rotterdam Ahoy.

RAK Ports

RAK Ports in Ras Al Khaimah, the northernmost emirate of the UAE, has named Hugh Cox as its new chief commercial officer. Cox, a senior ports and supply chain leader with more than a decade of experience in large infrastructure, ports, and heavy bulk supply chains, previously served as commercial manager for DP World, based in Sydney.

In his new role, Cox will focus on retaining existing customers, attracting new business to the port, developing and delivering new products, and accelerating the organization’s growth strategy. RAK Ports operates at four hubs across Ras Al Khaimah, including Saqr Port, the biggest bulk handling port in the region, and RAK Maritime City, the only freezone in the region to have direct quayside access.

Torge Runge

Daniel Staples

Boudewijn Siemons

13 Breakbulk Magazine Issue 2 2024 breakbulk.com

Hugh Cox

SCANDINAVIA EXPORTS GREEN ENERGY KNOW-HOW TO US

Extending the Hand of Project Trade Friendship Across the Atlantic

By Ilya Goncharov

In the breakbulk world we are on the cusp of a remarkable transition. The expansion of Scandinavian green technologies into the U.S. marks a pivotal moment in our industry. I am thrilled to witness and be part of this transformative journey. The influx of Scandinavian companies, encompassing onshore and offshore firms, forwarders, and shipping companies, heralds a new era of sustainable business and environmental stewardship.

Recent developments have underscored the momentum of this expansion. Eurowind Energy’s establishment of new offices and projects in the U.S. signifies the growing appetite for sustainable energy solutions. Its foray into onshore and offshore wind projects is a clear indication of the expanding renewable energy market in the U.S. Likewise, the Danish Embassy in North America’s recruitment drive for the offshore sector signals a burgeoning industry.

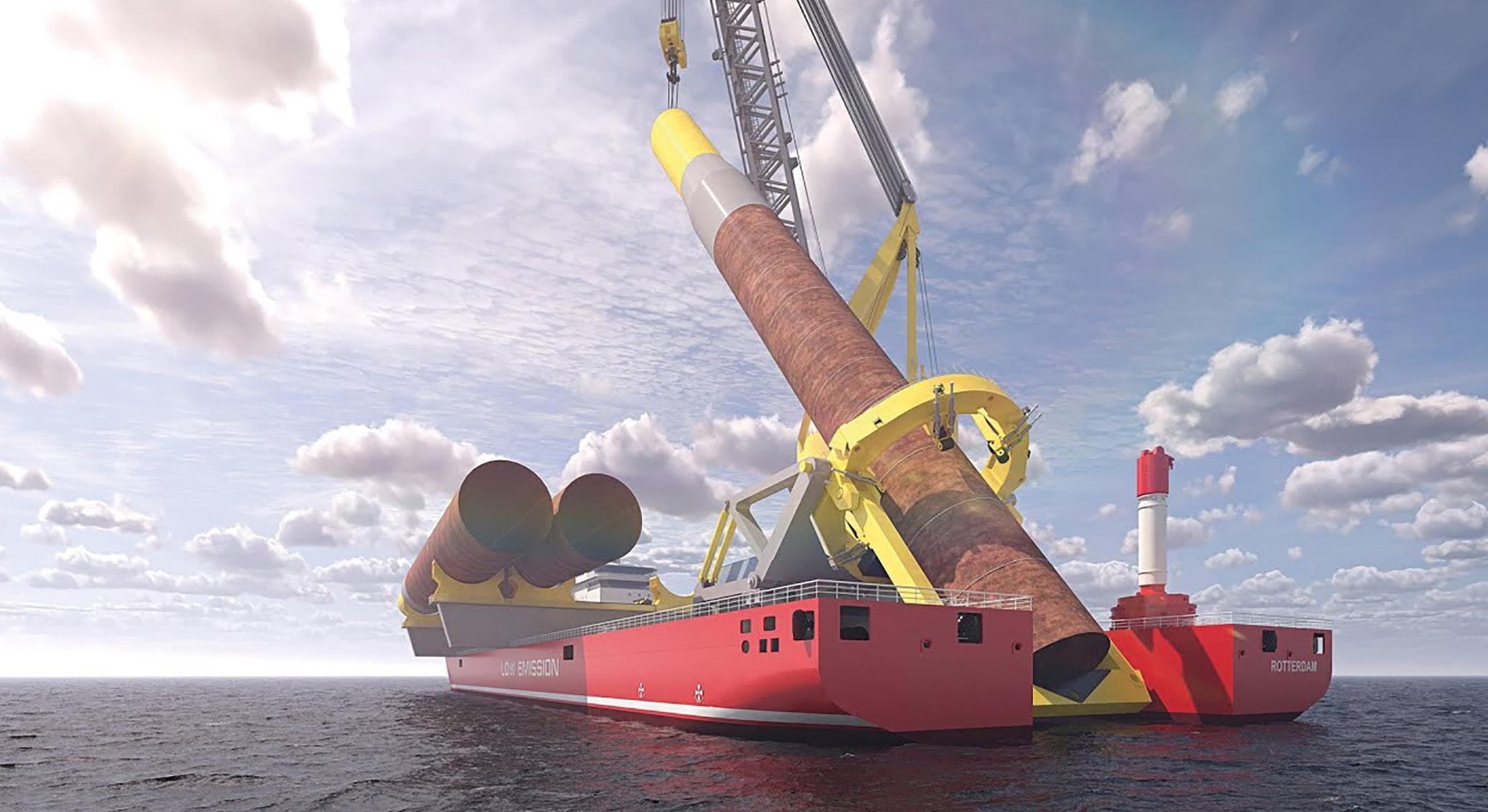

Scandinavian company 3P Logistics plays a pivotal role in this green shift. This spring, we managed a project from Denmark for the Dutch vessel Bokalift 2, which was engaged in a new offshore project in the U.S. This endeavor is a prime example of the increasing logistics challenges and opportunities presented by the green technology wave.

The establishment of a new Vestas plant in New York for blade manufacturing, alongside Ørsted’s significant offshore wind projects, further illustrates the scale of this transformation. These initiatives are not just business expansions; they are beacons of sustainable change.

Ilya Goncharov is global 3PL project manager, BDM, at 3P Logistics Group. Thought Leader

Forming Alliances

A noteworthy addition to this narrative is the formation of the Green Maritime and Port Alliance. This initiative aims to strengthen cooperation and dialogue between the U.S. and Denmark, leveraging expertise in maritime innovation, particularly in areas crucial for the green transition. The alliance brings together a wealth of competencies and capabilities, setting a new benchmark for international collaboration in sustainable maritime practices.

Adding to this green mosaic is the Swedish company Cinis Fertilizer, which is set to construct a new plant in the U.S., reinforcing the country’s commitment to eco-friendly solutions. The presence of Danish companies like FORCE Technology, COWI, DEIF, Dansk Gummi Industri, DIS Creadis, and Global Wind Service fortifies this green bridge between Scandinavia and the U.S. And of course, the new Coastal Virginia Offshore Wind project is the largest contract ever for Bladt Industries.

The backdrop to these expansions is the special energy research agreement between Denmark and the U.S., aimed at accelerating decarbonization efforts. In line with President Biden’s Investing in America agenda, this partnership catalyzes a clean energy industrial revolution across America, with Denmark playing a crucial role.

The increased volume of shipments from Danish shipping and forwarding companies is a tangible indicator of this growth. This surge in logistics demand necessitates innovative, efficient solutions to manage the green technology supply chain.

As industry leaders, we must adapt to and embrace these changes. The expansion of Scandinavian green technologies in the U.S. is more than a business opportunity; it is a commitment to a sustainable future. This green revolution is reshaping our industry, and we stand ready to navigate these exciting new waters.

14 Breakbulk Magazine Issue 2 2024 breakbulk.com

COUNTRY SPOTLIGHT: TÜRKIYE

We spoke to some of our Turkish exhibitors at Breakbulk Middle East about their companies, the project outlook in Türkiye, and what they are looking forward to at Breakbulk Europe 2024.

Hareket Heavy Lifting and Project Transportation

Hareket H ü samettin Aldatmaz, Qatar

Country Manager

Stand 2G50-H51

Road Transport

Tell us a little bit about your company?

We are a 66-year-old company, specializing in engineering, heavy-lift, and project transportation services. We are headquartered in Istanbul, but we have a global presence in CIS countries such as Uzbekistan, Kazakhstan and Azerbaijan. In East Europe, we have a presence in Ukraine, Poland and Germany and in the Middle East region, we have offices in Dubai, Abu Dhabi, Qatar and now we are establishing a new company in Saudi Arabia.

What is the project outlook in Türkiye right now?

For Türkiye, there are a lot of opportunities, especially for renewable energy such as wind turbine installation. We have a key part in this process including transportation and building. In Türkiye, we have experience of up to 6.5 gigawatts capacity from wind turbines. This is not just for us but for other regions as well. We are the turnkey providers for wind energy. Now we are planning for offshore wind energy. There are still studies going on but they will start in around three years. Hareket wants to be a part of this process. There is so much potential.

What should people understand about doing business with Turkish companies?

Most of the business now is heavy project cargo transportation. We are personally working on power plant transportation and nuclear energy. We have finished so many projects just in the last five years.

What are the three most important values to your company?

From the client side the most valuable part is that we are a reliable supplier.

We have so many competitors, but when it comes to complete solutions Hareket has more of an advantage because we have a transportation division, a heavy lifting

division, and a mechanical installation division. It combines all the projects. It means we can provide all services to our clients.

We also make sure we are very professional on HSE requirements. Finally, we make sure our team is very well educated and committed to the highest class.

What is more important, years in business or technical expertise?

Technical expertise. It’s very important for these kinds of global projects because our clients are spending so much money; they’re investing a lot. And if you cannot supply enough expertise on an operation they will fail, and we could lose part of the project. We must pass our technical qualifications because we are doing business globally. Everyone knows everyone.

Do you prefer email, video call or in-person meetings? In-person meetings in this region [Middle East] work well. The people here want to see you, they want to discuss in person and face-to-face.

Hareket is an exhibitor at Breakbulk Europe 2024 (Stand 2G50-H51), what are you looking forward to at Breakbulk Europe?

We are a global heavy-lift and project transportation company; we have branches in Europe. We have ongoing projects in this region. For Breakbulk Europe we want to meet our global clients. It is a show with global attendance, so we are also discussing other regions besides Europe.

Who are you looking to meet at Breakbulk Europe 2024? We are looking forward to meeting EPCs.

Öznakl¡yat

Filiz Bozat, General Manager

Stand 1F01

Road Transport

Tell us a little bit about your company? Our company is 75 years old. We are experienced in heavy transport, project transportation, warehouse management, and empty container

16 Breakbulk Magazine Issue 2 2024 breakbulk.com

storage. We have our own customs clearance department and container transportation.

What is the project outlook in Türkiye right now? In the near future, there will be a second nuclear power plant, but right now there are no big projects in Türkiye, There are some individual investments for energy power plants and many valuable factories producing transformers, and wind turbines.

What should people understand about doing business with Turkish companies?

We can work 24 hours and 365 days in a year. We can travel very easily because of our location in the world, and we are easily reachable because we have a very good airport in Istanbul. As a country we have so many ports, seaports, and international customs ports. We are like a hub between Europe, the Middle East, and Central Asia. So many transshipments pass through Türkiye so we can handle anything and deliver to anywhere in the world.

What are the three most important values to your company? For our company: trustworthy, innovative, and experienced.

What is more important, years in business or technical expertise?

It depends on each customer and subcontractor.

Do you prefer email, video call or in-person meetings? I am old-fashioned and prefer face-to-face meetings always. They are very valuable to me. But of course, when you think about the current world conditions, we are having so many online meetings. I can have a meeting in China in the morning and a meeting in the U.S. in the afternoon.

Öznakl¡yat is an exhibitor at Breakbulk Europe 2024 (Stand 1F01), what are you looking forward to at Breakbulk Europe? Collaborating with new partners. Building a reputation and spreading our company brand out and of course promoting our services and new equipment.

Who are you looking to meet at Breakbulk Europe 2024? Freight forwarders know us very well because in Türkiye most are located in Istanbul. But of course, the first thing is to find the EPC companies.

Gürkan Nakl¡yat

Furkan Bayram, Sales Operations Assistant

Stand 1F40

Maritime Transport

Tell us a little bit about your company?

Our company is based in Istanbul, Türkiye. So, we work with road transportation with our oil trucks, our trailers, and other equipment. We are doing transportation from Europe to Türkiye and CIS countries, as well as Russia, Iraq, and Iran.

What is the project outlook in Türkiye right now?

For us it’s good. Türkiye is the center of the world; most products and cargo ships arrive in Türkiye at some point. If cargo is going to CIS countries, it comes to Türkiye first.

What should people understand about doing business with Turkish companies?

We are friendly and trustworthy people.

What are the three most important values to your company? Everything is important.

What is more important, years in business or technical expertise?

Both of them.

Do you prefer email, video call or in-person meetings? Email. Sometimes it is hard to understand each other on video calls or on the phone. But in emails I find it easy.

Gürkan Nakl¡yat is an exhibitor at Breakbulk Europe 2024 (Stand 1F40), what are you looking forward to at Breakbulk Europe?

We like going because the show is so big. We can find whatever we want in Rotterdam. We are really looking forward to it.

Who are you looking to meet at Breakbulk Europe 2024?

Freight forwarders.

17 Breakbulk Magazine Issue 2 2024 breakbulk.com

NEW FACES AT BREAKBULK EUROPE 2024

Get to know some of the new exhibitors at Breakbulk Europe 2024.

Kınay Transport and Logistics

Özgür Konakçi, Brand and Marketing Manager, Kınay Stand 2H74

Türkiye

Freight Forwarder

1. What is the most interesting thing about your business?

Our company, Kinay Group, epitomizes a comprehensive approach to logistics, offering a spectrum of services through our flagship brand, Kinay, and its distinguished sub-brands. At the core of our operations lie KTL (Kinay Transport and Logistics & KTL International Logistics & Trading Inc.), which provides a seamless array of forwarder services spanning ocean, air and road freight. Complementing this, KC (Kinay Chartering) specializes in chartering services, catering to the diverse needs of our clientele. ARK (A.Riza Kınay Agency) is a beacon of excellence in agency services, ensuring meticulous attention to detail and unmatched efficiency. Additionally, LIMSER signifies our commitment to excellence in port operations and project shipment handling services. Our integrated approach consolidates logistics solutions under one roof, offering unparalleled convenience and efficiency to our esteemed clients.

2. What made your company want to exhibit at Breakbulk Europe?

Our decision to exhibit at Breakbulk Europe stems from a strategic initiative to showcase our expertise in port operations and project shipment handling on a global platform. As a leader in the logistics industry, we recognize the significance of Breakbulk Europe as a premier event for networking, forging partnerships, and staying abreast of industry trends. By participating in this esteemed event, we aim to highlight our capabilities, foster meaningful connections with industry peers, and explore collaborative opportunities that align with our vision for growth and expansion. It is a testament to our commitment to excellence and innovation in the European market.

3. What is your company’s outlook on project opportunities in Europe at the moment?

Our company maintains a highly optimistic outlook on project opportunities in Europe, underscored by our

strategic presence and ongoing investments in the region. With established branches in the UK, Netherlands and Belgium and imminent operations in Italy, we are strategically positioned to capitalize on the burgeoning demand for logistics solutions across Europe. Our expansion initiatives reflect our confidence in the region’s economic prospects and our unwavering commitment to serving our clients with unparalleled excellence. By continually investing in infrastructure, technology, and talent, we are poised to seize emerging opportunities, drive innovation, and set new benchmarks for success in the dynamic landscape of European project logistics.

Musfeld Kran AG

Sebastian Menze, Clerk for Large-Volume and Heavy Transport Warehouse Logistics,

Musfeld Kran AG

Stand 2A72

Switzerland Equipment

1. What is the most interesting thing about your business?

We see ourselves as a full service provider for our customers. We offer national and international heavy transport, customs clearance and cranes for loading or unloading. Thanks to a wide range of locations and strategic partnerships, we can respond quickly to all of our customers’ concerns throughout Switzerland and beyond.

2. What made your company want to exhibit at Breakbulk Europe?

We would like to take this opportunity to introduce ourselves to a wider audience. Switzerland is a rather closed, selfsufficient market. We would like to break through this and establish interesting new contacts with hopefully future partners and customers.

3. What is your company’s outlook on project opportunities in Europe at the moment?

We look positively into the future. Although we expect a slight decline in the number of projects compared to last year, we think that the Swiss market will remain quite stable. We also expect constant to increasing numbers for projects in the

18 Breakbulk Magazine Issue 2 2024 breakbulk.com

energy sector. In contrast, we suspect a decline in the area of mechanical and plant engineering.

A positive thing to mention is that it is much quicker to obtain special permits for heavy transport compared to last year!

Origin Logistics

Burcin Civan, Marketing Communications Manager, Origin Logistics

Stand 2L21

Türkiye

Freight Forwarder

1. What is the most interesting thing about your business?

The most interesting thing about our work is that each project has its own rules, characteristics, strategy and operation.

2. What made your company want to exhibit at Breakbulk Europe?

To come together with all overseas agents that we want to work with. And, to explain that we are a good project company and are recognized all over the world.

3. What is your company’s outlook on project opportunities in Europe at the moment?

We have completed our office organization in Türkiye and have plans to open offices abroad.

We may invest in other parts of Europe depending on future opportunities – places where projects are decided and where large industrial factories are located.

Trans Global Projects

Colin Charnock, Group CEO, Trans Global Projects Group

Stand 2D94

United Kingdom

Freight Forwarder

1. What is the most interesting thing about your business?

The variety! No two days are the same and varying developments, usually positive seem to arrive unexpectedly with pleasing regularity.

2. What made your company want to exhibit at Breakbulk Europe?

Breakbulk Europe is by far the most important such event in the project shipping calendar every year.

3. What is your company’s outlook on project opportunities in Europe at the moment?

We are bullish about project opportunities in Europe at present based on the momentum of developments in energy transition.

Red Global

Luis Padilla, Managing Director / CEO, Red Global Logística Stand 1A41

United States

Road Transport

1. What is the most interesting thing about your business?

Red Global is heavy haul based on a growing economy in Brownsville, Texas. Our operation yard is located inside the Port of Brownsville that gives us a magnificent spot to support our clients, also we, as a Mexican/American company, are able to move the cargo on both sides of the border and even execute projects in Mexico.

2. What made your company want to exhibit at Breakbulk Europe?

Brand positioning, so that companies in Europe can know that Red Global is a capable company to be able to do business. We have a team of professional people dedicated to providing the confidence and security that every project requires.

3. What is your company’s outlook on project opportunities in Europe at the moment?

Energy sector (wind, power plants, oil and gas), and car manufacturers with press machines.

Welcome Airport Services

Izabela Kamińska, Senior Marketing Specialist, Welcome Airport Services Stand 2H91

Poland

Air Transport

1. What is the most interesting thing about your business? We are the largest ground handling agent in Poland in terms of the number of carriers served. WELCOME Airport Services has been providing cargo handling services to dozens of airlines for nearly 25 years We have the most modern terminals in Poland, where we carry out security checks of cargo and mail based on the Registered Agent status, which we have in all our locations. We are GDP (Good

19 Breakbulk Magazine Issue 2 2024 breakbulk.com

Distribution Practices) certified. As well as Customs Agency (in 2022 we received AEO permit) We handle other types of cargo transported by air. We have high specialized staff in the field of handling dangerous materials (DG), radioactive materials (RRY), perishable materials (PER), live animals (AVI), shipments valuable (VAL) and other types of special cargo (HUM, CRT, COL, PIL). We have equipment to service all types of aircraft, as well as all types of ULD, including 20-foot units and a 30 t high loader. We handle loads using drones.

2. What made your company want to exhibit at Breakbulk Europe?

Breakbulk Europe is the place to be. We hope to meet the biggest players in the industry in one place. In our opinion, the aviation market of Central and Eastern Europe is still underestimated and poorly recognized. Our ambition is to show its potential, convince potential investors of our professionalism and indicate that they may have a reliable partner for expansion in this area.

3. What is your company’s outlook on project opportunities in Europe at the moment?

We are a European company, so we already operate on this market. In our part of Europe, we see potential in the development of the market in Ukraine after the end of the war. We count on the creation of a large hub airport in our country and the resulting dynamics in the development of new transport possibilities. Welcome Airport Services invest in innovation and infrastructure. We have plans related to the observed development of transport using drones. We initiate comprehensive solutions by developing our own road transport fleet and comprehensive customs services.

NEW EXHIBITORS AT Breakbulk Europe 2024

AeKo Dynamics 2J74 IT Germany Alatas Crane Services Worldwide 1E41 Equipment United Kingdom Aprojects nv 2D21 Freight Forwarder Belgium Ast Uluslararasi Tasimacilik Ve Dis Tic Ltd 1L25 Freight Forwarder Türkiye Baggio Shipping & Chartering - Multimodal Logistics 1G10 Freight Forwarder Italy Best-Hall 2E71 Industry Related Services Finland Block 1H31 Air Transport Finland Bruhat Logistics 2E84 Freight Forwarder Singapore Cansu Warehouse, Port & Logistics Services 2H34 Industry Related Services Türkiye Caucastransexpress 2F101 Freight Forwarder Georgia Centrimex 1D51 Freight Forwarder France Chinaland Shipping Pte. Ltd. 2E65 Freight Forwarder Singapore Chirey Global Logistics Group Limited 1J50 Freight Forwarder China Clockwork Logistics 2C89 IT United States Dahlia Technologies Pte. Ltd. 1L51 IT Singapore Dataloy Systems 2M25 IT Norway Delta Shipping Agency 2J24 Marine Transport Romania DeMase Trucking Co., Inc. 1K52 Road Transport United States dteq Transport Engineering Solutions GmbH 2L14 Freight Forwarder Germany

Company name Stand number Sector Country 20 Breakbulk Magazine Issue 2 2024 breakbulk.com

NEW EXHIBITORS AT Breakbulk Europe continued

ESL shipping 1F47 Marine Transport Finland Faisal M. Higgi & Associates Co. Ltd. 2F80 Industry Related Services Saudi Arabia Friday & Co Shipbrokers B.V. 2H20 Industry Related Services Netherlands Fuchs a Terex Brand 1D50 Equipment Germany Global Soluções em Logistica 2A45 Industry Related Services Brazil GreenRouter 1M22 IT Italy Hapo International Barges BV 2C83 Freight Forwarder Netherlands Heavy Haul Solutions 1G50 Equipment United States Industrias Murtra Cadenas, S.L. 1J43-H44 Equipment Spain ISA / CNAN EL DJAZAIR 1L10-K11 Marine Transport Belgium Italian Trade Agency & Assoporti 2G91 Industry Related Services Italy Itg Bohwa Shipping Limited 2M51 Freight Forwarder China Kınay Transport and Logistics Inc. 2H74 Freight Forwarder Türkiye Leon Vincent Overseas 2C90-D91 Freight Forwarder France Logiswift DWC LLC 1C51 IT United Arab Emirates Marguisa 2F74 Marine Transport Spain Musfeld Kran AG 2A72 Equipment Switzerland Noord Nederlansche P&I Club 1C24 Industry Related Services Netherlands Origin Logistics 2L21 Freight Forwarder Türkiye Palco Transportation 2L24 Road Transport United States Port de Sete 1J40-H41 Ports & Terminals France Promartime International 1C45 Freight Forwarder France Red Global 1A41 Road Transport United States Relopack Solutions Sp. z o.o. Sp.k 1A53 Industry Related Services Poland Rongtua Shipping Group Pte.ltd. 2J54-K55 Marine Transport Singapore ScLashing Shanghai Co.,Ltd 2M02 Freight Forwarder China Seashell Logistics Pvt Ltd. 1F55 Freight Forwarder India Shanghai Honghao International Freight Forwarding CO.,LTD. 2M08 Freight Forwarder China SIA Bolivar Logistic 1F45 Freight Forwarder Latvia SIBRE 1B50 Equipment Germany Simex Transport and Forwarding B.V. 2E103 Freight Forwarder Netherlands SSA Marine 2E81 Marine Transport United States TAD 2M35 Freight Forwarder Ukraine Trans Global Projects 2D94 Freight Forwarder United Kingdom Transporter Industry International Sales 2M11 Road Transport Germany TSA Agency Sweden AB 2J80 Ports & Terminals Sweden VOSS International 2A71 Road Transport Germany Welcome Airport Services 2H91 Air Transport Poland

Company name Stand number Sector Country 21 Breakbulk Magazine Issue 2 2024 breakbulk.com

BREAKBULK MIDDLE EAST BY THE NUMBERS • ABB Adani Group • Air Liquide Air Products • ArcelorMittal Projects Baker Hughes Energy • Bechtel Corp. • Bharat Petroleum • Calik Energy • Caterpillar SARL • CB&I • China Petroleum Engineering & Construction Desmet • Elsewedy Electric Emirates Steel • Enerflex Energy Envision • Fluor • General Electric • Hitachi Energy • Hyundai Engineering • Infinite Mining & Energy • Lamprell Energy • Larsen & Toubro Linde Engineering • Ma’aden Macsteel International • Maire Tecnimont McDermott Middle East • National Oilwell Varco • NMDC Energy • Oman & Etihad Rail • Petrofac • Samsung Engineering • Saudi Aramco • SLB Shell • Siemens Energy Subsea 7 • SULB Sumitomo Corporation • Technip Energies • Tecnicas Reunidas • Tecnimont • Unisteel International • Wartsila • Westinghouse 301 77% Breakbulk Global Shipper Network SHIPPERS THE DECISION-MAKERS EVERYONE WANTS TO MEET 7,197 2,406 157 Companies Exhibitors 101% Rebooked for 2025 (11% increase compared to 2023) Attendees of shippers attended the event to source new suppliers and network Watch the Official Video here 22 Breakbulk Magazine Issue 2 2024 breakbulk.com 127 Countries Top 4 countries: 1. UAE 2. India 3. Saudi Arabia 4. United Kingdom Including: Top 4 countries accounted for Türkiye Oman Germany Pakistan Egypt Qatar Singapore China Netherlands United States Spain Italy Belgium France 73 % attendance UNLOCKING THE GATEWAY TO PROJECT CARGO & BREAKBULK ROUND THE WORLD

BREAKBULK STUDIOS: CONVERSATIONS HEARD AROUND THE WORLD... THE RIGHT AUDIENCE FOR NEW BUSINESS TOP SECTORS BUYING POWER 35 % 35 % 19 % 31 % 5 % 5 % Freight Forwarder Final Purchasing Authority Maritime Transport Recommend/Specify EPC Manufacturer JOIN 18,000+ AND FOLLOW BREAKBULK EVENTS & MEDIA ON LINKEDIN FOR ALL THE LATEST NEWS TOP INTERVIEWS How Projects Are Transforming Saudi Arabia Lars Greiner, Managing Director/ RSGT Multipurpose Business for Red Sea Gateway Terminal DHL Strategy Provides Stability in an Uncertain Market Peter Dudas, Head of Global Commercial and Tendering StrategyIndustrial Projects for DHL Global Forwarding Técnicas Reunidas: Manageable Challenges for Huge Project Growth Across GCC Alberto Solana, Managing Direct Head of Purchasing for Spanish EPC Tecnicas Reunidas NETWORKING BEYOND THE EXHIBITION FLOOR 240 100 200+ Golfers in attendance attended GOLF DAY WOMEN IN BREAKBULK BREAKFAST NETWORKING WELCOME RECEPTION AT 25 HOURS HOTEL Sponsored by Sponsored by See them all on our YouTube Breakbulk Middle East playlist https://youtube.com/playlist?list=PLQ4mPLfWAHh05azvHGqT2qdQeM_TuN0pZ&si=2CrSbzzq5o6p-Vuf 23 Breakbulk Magazine Issue 2 2024 breakbulk.com

BREAKBULK SPRING GIFT GUIDE

Get ready for spring!

Spring Medley from Snackmagic

US$50

Celebrate the season’s fresh flavors of citrus, florals and vegetables to help put a spring in your step. www.snackmagic.com

Standard Baggu in Orange Tree Periwinkle

US$14

Carry everything in style this spring. www.baggu.com

ban.do - Puffy Picnic

Blanket in Green Gingham

US$70

A quilted nylon picnic blanket with a velcro closure so you can roll it up and bring it anywhere. www.bando.com

Chamberlain Coffee Cold Brew Coffee Starter Pack

US$44

A perfect way to cool off as the temperatures start to heat up. www.chamberlaincoffee.com

Kite Stripes - Sun Squad

US$8

High-flying fun for the little ones!

www.target.com/p/kite-stripes-sun-squad-8482/-/A-88914785

24 Breakbulk Magazine Issue 2 2024 breakbulk.com

HOW CHINA PLUS DERISKS SUPPLY CHAINS

Revisit Sourcing Strategies to Reduce Overdependence

Apple, Samsung, Sony and Adidas have all moved some of their manufacturing activities from China to elsewhere in South-East Asia – as UNCTAD reported in its Review of Maritime Transport towards the end of last year – due to rising labor costs in China and risk management considerations.

Summary:

Project cargo companies looking to reduce the risks of overreliance on China for shipbuilding and manufacturing can shift to a China Plus One strategy to diversify sources. Raw material sourcing is ripe for change, while nearshoring and reshoring could lead to a major shift in supply chains over the next five years.

“A strategy adopted by some companies for diversifying supply sources and reducing overdependence on China is the ‘China Plus One’ strategy, where companies expand outside China while still maintaining a presence there,” UNCTAD said. For example, the share of U.S. container imports from Vietnam increased from 4 percent in 2017 to 8 percent in 2022, while India’s share moved up from 3 percent to 5 percent. China’s share dropped from 40 percent in 2017 to 31 percent in 2022.

According to 4D Supply Chain Consulting, an independent supply chain consultancy focused on the heavy-lift market, there has also been a shift in the project cargo sector, as shippers are concerned about the risk of overreliance on one country when it comes to project sourcing.

By Felicity Landon

“There is definitely a desire to adopt the China Plus One strategy, or to find new sources, but how much it affects project budgets is a big question,” said Vilasini Krishnan, vice president of 4D. “How soon it will happen, where possible, is where the complexity is.”

26 Breakbulk Magazine Issue 2 2024 breakbulk.com

Vilasini Krishnan

ONE CHAINS

For starters, with the cost of labor increasing in China, there is money to be saved by sourcing from elsewhere in South-East Asia, she said; but in the medium term, we could see far more radical change.

While project cargo owners are – at present – largely sourcing components from the same places, their sourcing of raw materials is shifting, said Thomas Skellingsted, president of 4D. “During Covid-19 we saw that sourcing moved from China to other Asian countries, including India. But now we are also seeing things moving across to the Americas. The U.S. is sourcing much more locally or regionally. There are governmental incentives to do so. Projects’ components are still coming from the normal suppliers –it’s more about where these suppliers are sourcing their raw materials

from. The U.S. is also talking about building a free trade zone close to Mexico, which is another factor.”

Shifting Supply Chains

Skellingsted predicts that in five years’ time, supply chains will look very different, with a huge shift to nearshoring or even onshoring. The crisis in the Red Sea, with ships taking the long route around South Africa to avoid the Suez Canal, and the limits of navigation caused by drought in the Panama Canal, could well accelerate these moves. There is also the concern of the potential introduction of emission trading systems similar to the EU’s in other parts of the world, creating challenges for the shipping industry.

Skellingsted said that the pandemic served as a wake-up call for many shippers who hadn’t perhaps given sourcing that much thought before. “The way in which China handled Covid was when companies found out how vulnerable they were,” he said. “There are also rumors that some parts of China are going into recession financially. Is that also because of the China Plus One trend? Possibly.”

Most of 4D’s clients are within the heavy-lift industry – cargo owners looking for support and transparency in their supply chains for projects, he said. “We have clients who have no idea about the cost of shipping. When a project requires 500,000 tonnes of steel to be shipped from India or China, sometimes logistics is the last scope to be considered.

“You’re talking half a million dollars for breakbulk to go around South America instead of through the Panama Canal. The same thing is now happening with the Suez Canal; all the multipurpose vessels are going south around the Cape of Good Hope, which means they are out of sync by 12-14 days. That is delaying things within the project business and adding to everything else that is going on.”

The current supply chain model for containerized consumer goods is based on “warehousing on the ocean,” Skellingsted added. “Of course, within breakbulk we are also trying to optimize the usage of the vessels because there is a lack of vessels. Every year vessels are being taken out of service and we do not have the same number coming into the market. For shippers, therefore, it is a carrier’s market, not a buyer’s market.”

Capturing Risk

4D advises its shipper clients on landed cost, emerging trends, changing concepts and “seeing what we can do now,” he said. “For example, procuring items in Brazil and importing directly into the U.S. instead of from India.”

Krishnan added: “The risk analysis we do is essential. We can capture risk and projected risk, but we can’t predict unseen issues like war. However, we can at least provide options – not putting all your eggs in one basket; consider what are the alternatives if something goes wrong. We can build in contingency plans.”

And that appears to be the crux of it – projects can be meticulously planned in advance, but having a back-up plan seems to be increasingly essential.

Skellingsted said: “Take the insurance of cargo going through Suez – prices have gone through the roof. So the budget you had one year ago, you can throw out now. Depending on the project, some shippers do pin down the shipping costs in advance but, as I said, it’s a carrier’s market. The carrier will come back to the freight forwarder and say, ‘we can’t do this’ and effectively tear up the contract.”

Covid made it painfully clear where shippers did not have contingency plans or, indeed, any visibility as to where things were coming from and how, Krishnan said.

Of course, when it comes to specialist projects requiring specific, complex and sophisticated modules or units, for example,

27 Breakbulk Magazine Issue 2 2024 breakbulk.com

Global

there is often a limited choice of ‘baskets’ to put the eggs in.

“In project procurement, there is a limited number of manufacturers/ countries that would supply items to the standard the project developer is looking for,” Krishnan said. “But we can look for a ‘contingency pipeline’. If a certain manufacturer is not up to standard, what can we do as a partnership to ensure that standard is reached? In other words, if it’s not 100 percent of what you are looking for but there is potential, it’s probably worth investing time and effort in the longer-term to bring the production up to standard. You see it in vendor management of project forwarding; the same can be applied in manufacturing and in logistics.”

Alternative Bases

Are companies looking to open new offices in strategic alternative sourcing option countries?

“The big companies already have offices in many countries,” Skellingsted said. “The medium-size companies are not going to have this set-up, especially in the short-term, and

the small companies are struggling as well due to the fact they are not present in these countries.”

This is an issue 4D is looking to tackle, he said. “We use our network to help our clients find alternative solutions. With some certainty, I can say that, in the future, you will see a lot of companies joining forces to match up skills and ability and a lot of consolidation on projects going forward.”

This is a new concept for 4D, he said, bringing together large and small companies to work together. For example, an oil major might have a project in Guyana. The company goes to its regular suppliers, but rates are high and it is difficult to find a supplier for a certain product. In this scenario, another company may have the relevant product in Brazil but has never supplied to Guyana or to the oil major concerned.

“Bring the two together and you get the product at the right time in the right location.”

4D is setting up a register of project companies and suppliers, region by region, to join up these dots, starting with a pilot of 15 companies.

However, Skellingsted is frustrated by the secrecy of the project cargo freight forwarding world: “We all know who’s who, who’s doing what. Let’s break down those walls, and work together. Traditionally, companies keep everything secret because they are afraid of losing out and afraid of the competition, so there is no transparency. But companies can sign NDAs so each party is still protected. They can work together and share the profit. Ultimately, this is necessary to weather the challenges that the industry is currently facing.”

Shipbuilding Concerns

From Drewry’s point of view, the biggest concern around China for the project cargo sector is the concentration of shipbuilding in the country’s yards.

“When looking at MPVs, about 85-90 percent of the orderbook in deadweight-ton terms is being built in China,” said Peter Molloy, senior maritime research analyst. “These are our heavy-lifters, all the project vessels that we are expecting we will need to do energy products and the green transition. So, the whole

28 Breakbulk Magazine Issue 2 2024 breakbulk.com

Global

A deugro petchem move to Long Son, Vietnam. Credit: deugro

[energy transition] plan is based on the capacity of ships coming out of China.”

A recent analysis of delivery rates of ships from European and Chinese yards showed the Chinese deliveries slipping quite a bit more, Molloy said. “We do get concerned that there is an overreliance on China and that is before we even get down the road of geopolitical concerns. If China falters in any way, the knockon effect on several projects and on the global plan for the environment becomes quite concerning.”

This focus on China is to the detriment of the skillset that should be spread across other countries and therefore spread the risk, he added. “These are highly specialized and advanced vessels where there is going to be a saving by going to China – but the saving is maybe not as big as you think.”

China has a huge share in shipbuilding across all categories. As Dr. Ferenc Pasztor, deputy head of research at Drewry, said: “With container ships and LNG vessels, the shift to China has just started. Most of the tier one yards in Korea and Japan have been taken up for either container ships or LNG carriers for the next four years.”

Hence, he said, any attempt to move away from China and build large MPVs in other countries would likely run into trouble. Not only are yards in Korea or Japan ‘maxed out’ but MPVs have mostly not been built in these countries for nearly ten years. “The last deliveries were 2014-15 and it was only a handful of vessels. The shipbuilding experience

in the large MPV segment outside China in the last decade is basically gone.”

Early Delivery Benefits

Molloy’s concern is with the slow nibbling away of the Chinese economy. If things slow down, these ships may not be delivered. “People will say they are building their ships but what if the ships don’t arrive in time as we try to get projects started?”

Time is money, he added. A ship owner might go to China and be told they will have a two-year wait for a newbuild. What if that vessel could be built elsewhere for an additional US$2 million-3 million? “The question is, are you going to make an additional US$4m or US$5m by having it earlier? Or maybe having the vessel sooner enables you to get a two-year contract.”

There may be a margin of cost saving by building in China, Molloy said. “But it’s about having the ship or not. You will make up that margin very quickly if you have a trading vessel [more quickly].”

When it comes to sourcing patterns for actual project components, Pasztor

and Molloy pointed out that in general, these projects are not centered on one location. Most large projects source the various components from different manufacturers/ countries in any case. Meanwhile, steel production is well spread out.

“I don’t see China Plus One being a concept for a large project because it’s rare for full manufacture to happen in one place, except for the final assembly.”

Pasztor suggested that much of the China Plus One idea is ‘just a kind of a show’. “I don’t think there will be a complete move away from China. It will always be superficial. It will be Chinese components going into Vietnam, being assembled there and shipped to the U.S.

“The U.S. will buy fewer things directly from China, buying them instead from Mexico. But where does Mexico buy the components from? China! So much of this nearshoring merely adds additional players and steps into the supply chain.”

29 Breakbulk Magazine Issue 2 2024 breakbulk.com

Felicity Landon is an award-winning freelance journalist specializing in the ports, shipping, transport and logistics sectors.

Global

Dr. Ferenc Pasztor

The Jumbo-SAL-Alliance transported units for the Basra Refinery Upgrade Project from facilities in China, India, Thailand and Korea.

Credit: Jumbo-SAL-Alliance

PREPPING FOR A HYDROGEN HEYDAY

Wider Adoption a New Business Line for Project Cargo Specialists

By Luke King

Project forwarders are increasingly preparing to serve the hydrogen industry, buoyed by substantial investment in clean technology and favorable international environmental policies.

In Europe, shipping and logistics group GAC has opened a new office in Stade – with one eye on future hydrogen

Summary:

New facilities, projects, investments, and policy frameworks are combining to promote global clean hydrogen production and use. From Canada and Saudi Arabia to India and Europe, hydrogen projects are taking shape across the world.

investment in Germany. “As hydrogen grows in popularity and becomes more commercially viable as an alternative fuel source, there is no question that hydrogen production – especially the setup of new hydrogen production facilities – will generate business for companies involved in the project cargo supply chain,” Thies Holm, general manager of GAC Germany, told Breakbulk “Components for the plants are not produced onsite and their dimensions usually make them perfect for handling as project cargo. As the magnitude of production grows, those components will get even bigger. This is comparable with oil and gas refining projects we have worked on in the past, which saw multiple shipments being transported from specialized facilities around the

world. We would expect to see a similar scenario for future hydrogen projects.”

Explaining the rationale behind January’s office opening in Stade, Holm elaborated: “Germany has made a long-term commitment to developing renewable energy sources, including hydrogen, and the Port of Stade is set to play a key role in the construction of production facilities in the region. Aside from the environmental appeal, the economic argument for hydrogen is also becoming more compelling.

“Production costs are falling, more advanced technologies are being developed, and federal initiatives such as the National Hydrogen Strategy are making hydrogen significantly more appealing to investors. GAC Germany has had ship agency services in the

30 Breakbulk Magazine Issue 2 2024 breakbulk.com

Global

GAC has opened an office at the port of Stade, Germany.

Credit: Ulrich Wirrwa

region for some time, culminating in the decision in late 2023 to set up a permanent base at the port to support Germany’s long-term targets.”

Holm said he was “confident” about the development of hydrogen plants in the coming years, pointing to Germany’s National Hydrogen Strategy, which includes the completion and conversion to hydrogen of 1,800 kilometers of pipelines by 2027/28. Existing onshore liquefied natural gas (LNG) terminals are also supposed to be hydrogenready, enabling them to switch promptly once LNG imports are stopped.

“To meet this expected rise in demand, Germany’s port infrastructure must be expanded and improved in the coming years. We expect the Port of Stade to become a critical import location for hydrogen and other renewable energy options, hence our decision to open an office there. This switch to hydrogen will not happen overnight but we have already begun our preparations to be ready when it does,” Holm concluded.

COP Accord

New hydrogen projects could soon be underway across Europe, the Americas, Asia Pacific and MENA following the signing of a strategic development agreement at the UN’s Climate Change Conference, COP28, held in Dubai last December.

Masdar, also known as the Abu Dhabi Future Energy Company, said it would team up with Hy24, the

world’s largest clean hydrogen pureplay investor, to spend up to US$2bn on large-scale green hydrogen projects in various global markets.

The two companies agreed a framework to explore the development and investment in projects along the “Power-to-X value chain”, which involves producing renewable power converted via electrolyzers into green hydrogen and, subsequently, its derivatives such as green ammonia, e-methanol, sustainable aviation fuel and liquid hydrogen.

“Hydrogen is unanimously recognized as one of the most promising tools for the energy transition, a view that has been reinforced at COP28,” said Pierre-Etienne Franc, co-founder and CEO of Hy24. “Our joint agreement aims to unlock investments for some of the largest and most strategic green hydrogen projects in the world. We need to see more capital allocated by institutional investors and sovereign wealth funds to climate action.”

Also in December, the UK said it would support 700 new hydrogen jobs with funding worth £2bn over the next 15 years. The UK will back 11 major projects to produce green hydrogen via electrolysis and has confirmed suppliers will receive a guaranteed

price from the government for the clean energy they supply. Energy secretary Claire Coutinho said the funding would help deliver 125 megawatts (MW) of new hydrogen for businesses, including PD Ports in Teesside, which will use hydrogen to replace diesel in their vehicle fleet, decarbonizing port operations from 2026.

Europe’s Hydrogen Backbone

The European Union, meanwhile, adopted the 6th list of Projects of Common Interest, or PCIs, in November. The list details initiatives which the European Commission has identified as key to integrating energy infrastructure in the EU and are therefore eligible to receive public funds.

For the first time, the list includes 65 hydrogen-related projects, though most of those selected are located in Western Europe and just two were offshore pipeline projects. “The inclusion of hydrogen projects for the first time in a PCI list is a major step forward and shows Europe’s commitment to lay the foundation of a European hydrogen backbone,” said Daniel Fraile, chief policy officer at Hydrogen Europe, an organization which seeks

31 Breakbulk Magazine Issue 2 2024 breakbulk.com

Global

A Baker Hughes NovaLT16 gas turbine. The energy technology company claims to have achieved a number of “milestones” for the development of the hydrogen industry. Credit: Baker Hughes

Thies Holm

Credit:

to promote the sector. “This first selection process is also a valuable lesson learnt. We will be working with our members to ensure the next list includes more diversified projectsboth type wise and geographically.”

As Breakbulk went to press, representatives of hydrogen associations in nine central European and Baltic states signed a cooperation agreement in Paris, pledging to develop the hydrogen sector in the region. The agreement was concluded at February’s Hyvolution conference by the 3 Seas Hydrogen Council, which plans to represent the sector in the European Commission and Parliament. Its aims include supporting regional funding and encouraging joint hydrogen projects in the participating countries, which include Poland, Czechia and Hungary.

Further afield, India’s largest stateowned oil and gas company, ONGC, said it would spend US$10bn on two green hydrogen and ammonia projects by 2035, plus US$12bn on installing 10 gigawatts (GW) of renewable energy assets by 2030. ReNew Power, one of India’s largest renewable-energy developers, has reportedly proposed a 2GW green hydrogen and ammonia project in the southwestern state of Kerala.

Hydrogen ‘Milestones’

In January, Baker Hughes, the Houston, Texas-based oilfield services and energy technology company, said it had achieved a number of “milestones”

that it said would support the entire hydrogen value chain – from production to transportation and utilization.

Among the developments announced was the opening of a new hydrogen testing facility in Florence, Italy – a manufacturing site that will be used to further support the deployment of hydrogen-ready technologies and serve as a hub for Baker Hughes’ collaboration with its hydrogen customers.

The company, which began working on hydrogen projects in the 1910s, said it had recently concluded manufacturing and testing of its NovaLT™16 hydrogen turbines for Air Products’ Net-Zero Hydrogen Energy Complex in Edmonton, Canada. The turbines underwent full load testing at the newly unveiled Florence facility and form part of a family of turbines that can be deployed for a variety of industrial applications, including combined heat and power, as well as for pipeline and gas storage operations.

Baker Hughes also reported progress on another Air Products’ hydrogen project, with the delivery of the first two trains of advanced hydrogen compression solutions for the NEOM project in Saudi Arabia, the largest green hydrogen project in the world. It has recently expanded its manufacturing site in Modon, Saudi Arabia, to further support the delivery of projects in the country, including NEOM.

“These low-carbon and carbon-free energy advancements illustrate how

the urgency of the energy transition has transformed customer relationships into comprehensive partnerships for innovation across several projects,” said Lorenzo Simonelli, chairman and CEO of Baker Hughes. “There is no path to net-zero without innovation and collaboration, and our work with customers and partners, including Air Products, is proving the validity of the hydrogen economy.”

NEOM Shipments

The NEOM project is already generating work for multipurpose shipping line Chipolbrok, which has delivered wind turbines to the port of NEOM in northwest Saudi Arabia for NEOM Green Hydrogen Company (NGHC).

In November, NGHC said it had taken an initial delivery of the wind turbines to power the world’s largest green hydrogen plant, with 250 turbines expected to be installed to power the facility via a dedicated electricity transmission grid.

NGHC’s facility, located in Oxagon, NEOM’s industrial city, will integrate as much as 4 GW of solar and wind energy to produce up to 600 tonnes of carbonfree hydrogen daily. Once the plant is fully operational in 2026, 100 percent of the green hydrogen produced will be available for global export in the form of green ammonia, through an exclusive long-term agreement with Air Products.

David R. Edmondson, chief executive officer of NGHC, said: “This is the first of a series of major equipment deliveries arriving over the next year. We continue to make great progress and are on track to start exporting green hydrogen in 2026. It is a major milestone in NGHC’s journey to becoming a leader in green hydrogen and a major step forward in Saudi Arabia and the wider region’s energy transition.”

Luke King is a freelance reporter and communications consultant who has been involved in the project cargo industry since 2007.

*Global Event partner / Breakbulk Europe Exhibitor

Visit: www.europe.breakbulk.com/home

*BGSN member

32 Breakbulk Magazine Issue 2 2024 breakbulk.com

Global

Barrow Green Hydrogen is one of 11 major projects to receive government funding in the UK.

Barrow Green Hydrogen

NICKEL NEEDS SET TO DRIVE MINING PROJECTS

Nickel may have historically been one of the more ‘invisible’ elements –despite its use in virtually everything from stainless steel to mobile phones – but it’s becoming a more widely known presence because of its contribution toward renewable energy sources such as rechargeable electric cars and vehicle batteries. The International Energy Agency has predicted that by 2030, demand for nickel will increase by at least 65 percent. New mines and project cargo logistics support will be needed to support the growth.

Clare Richardson, director of communications and member services at the Nickel Institute, said that the

Summary:

Metal Demand Forecast to Increase 65% by 2030

By John Bensalhia

The global energy transition hinges on greater extraction of nickel for renewable energy sources, supporting a need for new mines. Boring equipment and heavy-duty machinery are on the shopping lists of mine developers. Next stop, securing logistics to move out-of-gauge units to mines in remote locations.

main benefits of nickel mining are that it enables society to benefit from an amazing resource that is very versatile. “Nickel has a range of

properties which enable it to be used in thousands of applications. Most nickel production is used to make stainless steel. In this application, it brings ductility and works with the chromium in stainless steel for corrosion resistance. Nickel-containing stainless steel is long lasting and is suitable for hygienic applications like food preparation and medical equipment.”

Richardson added that there are some great examples of longevity: “Take the Chrysler building in NY –it has only been cleaned a couple of times in over 90 years, and the nickel-containing stainless steel cladding still looks amazing.”

33 Breakbulk Magazine Issue 2 2024 breakbulk.com

Global

TOP: Quarry Bear stream, Norilsk, where interspersed copper-nickel ore is mined. Credit: Nikolay Zhukov, imaggeo.egu.eu, CC BY 3.0

Oversize Equipment Need

With such demand, project cargo movers are increasingly involved in the burgeoning nickel mining sector, shifting large, oversized equipment to mines.

Mining projects around the globe have continued apace, and in some cases, are relatively new. Pacific Nickel Mines Ltd, which owns the majority of Pacific Nickel Mines Kolosori Limited, recently completed its first direct-ore shipment.

While it may not have had the giftwrapped goodies of Santa’s sleigh, a 60,000 deadweight-ton bulk carrier was used to transport the nickel ore on Christmas Day 2023. Four 3,000ton barges were employed to transfer the ore from Isabel Island (in the Solomon Islands) on to the vessel.