Theglobalceramicsindustryisundergoing a profound transformation – shaped by shifting consumer preferences, supply chain recalibrations, and increasingly intense regional competition. As we navigate this evolving landscape, the ASEAN sanitaryware market stands out as one of the most dynamic and fast-changing segments –where tradition meets innovation, and design sensibility converges with sustainability.

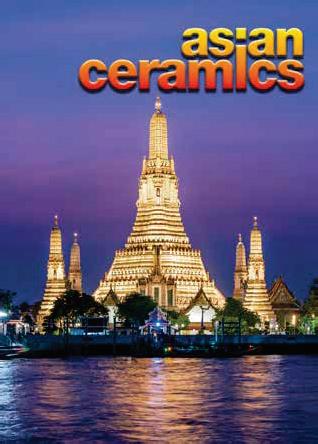

Our cover story, ‘Changing preferences for ASEAN sanitaryware’ by Jahir Ahmed, explores how Southeast Asia’s growing urban middle class is redefining what modern bathrooms should look and feel like. From Thailand to Vietnam, demand is no longer driven solely by affordability or durability – it is increasingly shaped by aesthetics, water efficiency, and smart design. Local manufacturers are innovating rapidly, while global players recalibrate their product portfolios and distribution networks to align with the new consumer mindset. The story demonstrates how ASEAN’s domestic brands are coming into their own – leveraging regional design identities and sustainability narratives to carve out market share against longestablished global competitors.

Yet, the shifts in ASEAN do not occur in isolation. They are intertwined with the broader dscape – where Thangadh and Morbi owerhouses. In our feature ‘Thangadh v Morbi: der Singh Malik examines the competitive h, steeped in tradition and renowned facturing prowess and export strength of lects India’s wider industrial evolution, where finding ways to coexist and complement

spar, the often-overlooked hero of ceramics. Gunasekera analyses how price volatility, gies are influencing production economics ance may fly under the radar, yet it is the quiet -efficiency of the products we admire and

aking its mark. In ‘Expanding lores how the country is leveraging create export opportunities. Once a w gaining international recognition for oning the country as a rising contender in

74 in Rapperswil-Jona, Switzerland, gy. In India, it operates as Geberit hyam, recently appointed managing Asian Ceramics about her experience ities shaping the company’s growth. Her calised to navigate India’s unique market

heme – the regionalisation of ceramics. o longer confined by borders. The with ASEAN, India and Bangladesh each

Editor Isaac Hamza

Email: ihamza@asianceramics.com

ADVERTISING AND DESIGN

Advertising Sales Paul Russell

Email: prussell@asianceramics.com

Direct line: + 44 (0) 787 621 2193

Valerie Adamson

Email: vadamson@asianceramics.com

Direct line: + 44 (0) 207 664 4574 Mobile: +44 (0) 7774 255 0514

Production and design Tim Mitchell www.corpsvector.co.uk

Bangladesh Jahir Ahmed jahir@asianglass.com

India

Yogender Singh Malik yogender@asianglass.com

Sri Lanka Rohan Gunasekera rohan@asianglass.com

Research Manager Andy Skillen

Email: askillen@bowheadmedia.com

HEAD OFFICE

27 Old Gloucester Street, London WC1N 3AX, UK.

Directors:

Valerie Adamson and Paul Russell.

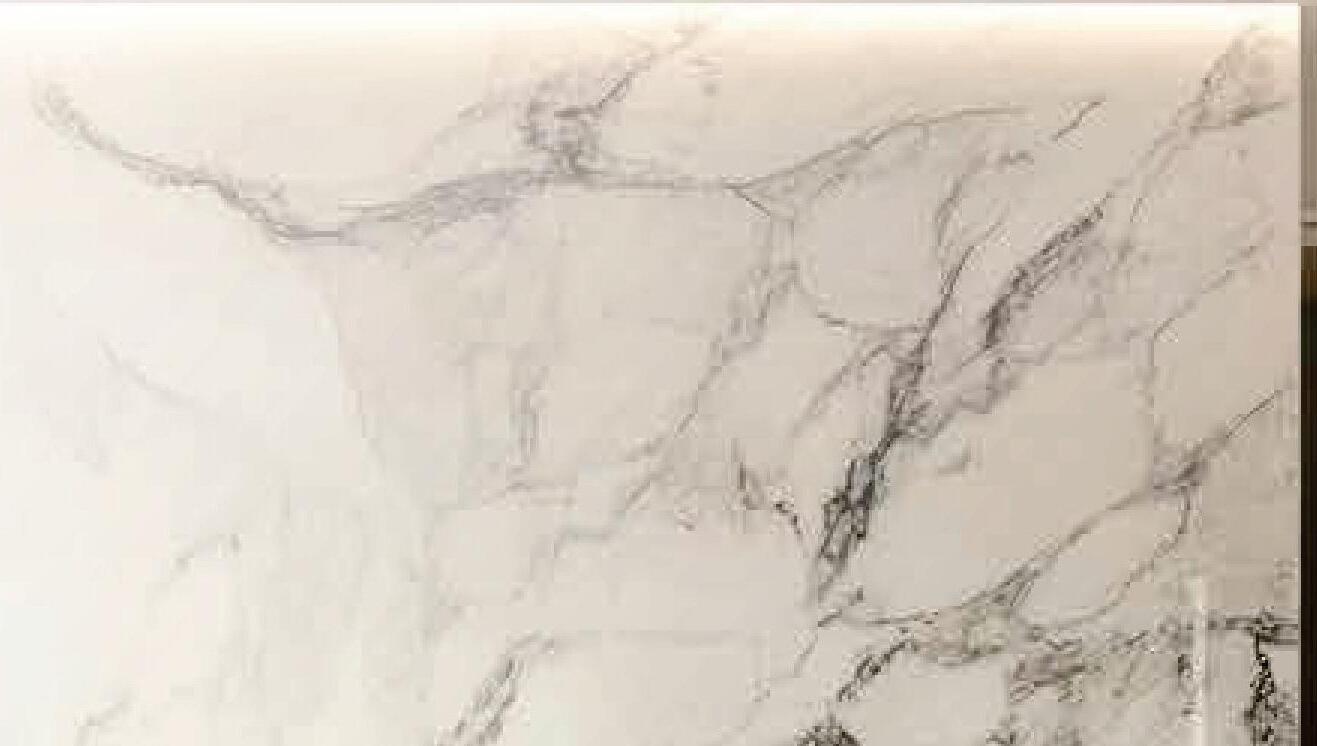

Infinity Sky is the latest evolution in digital decoration by System Ceramics: the advanced printing solution designed to deliver maximum flexibility, outstanding print quality, and long-lasting performance

With a cutting-edge automated maintenance system and a modular configuration of up to 16 independent bars, Infinity Sky enables the creation of complex graphic effects, refined gradients, and sharp textures. The ink recirculation inversion system combined with ultrasonic activation ensures consistent operation, reduced waste, and extended component life.

Infinity Sky sets a new standard in ceramic decoration: a sustainable, fully customizable solution that reflects the technological excellence that has made System Ceramics a global leader in industrial innovation.

Visit systemceramics.com to discover more!

sanitaryware. Yogender Singh Malik examines how these rival

design trends reshape demand. Jahir Ahmed analyses how manufacturers and suppliers can capitalise on these shifting preferences.

sector is expanding its international footprint, with manufacturers steadily growing exports across key markets, writes Jahir Ahmed.

Gunasekera examines rising demand from ceramics and glass, and the growing pressure this places on global supply.

With a population nearing 70 million, Karnataka has become the largest consumer of ceramic tiles and sanitaryware in southern India, driven by urban growth, infrastructure expansion and rising real estate demand.

leadership,

Andy Skillen, special correspondent for Asian Ceramics, reports

REFINED C L A Y

Please scan the QR code to explore our product range.

Our kaolin and clay products o er excellent plasticity, workability, and strength, making them ideal for a wide range of industries — from ceramics to paper production.

With high-purity minerals and top-tier performance features, our products enhance e ciency in manufacturing processes.

of Investments. creating additional income for farmers and promoting sustainable agricultural practices.

India’s ceramics industry has entered a defining moment. Long driven by the tile hub of Morbi in Gujarat, the sector has rapidly scaled into a global heavyweight. In 2025, India overtook several European competitors to become the world’s second-largest exporter of ceramic tiles, behind only China. This milestone reflects a powerful mix of manufacturing scale, entrepreneurial drive, and technological adoption. Yet as trade dynamics shift, Indian producers face mounting challenges that demand a recalibrated strategy to safeguard momentum.

Navigating new trade pressures

The most immediate disruption comes from across the Atlantic. In April 2025, the US Department of Commerce imposed countervailing duties on Indian ceramic tiles, arguing that exports were benefiting from state subsidies. This decision sharply increased the landed cost of Indian products in one of their most important overseas markets. Earlier in the year, the US had also introduced a blanket 25% tariff on Indian imports. For Gujarat’s ceramic manufacturers, the double blow of specific and general tariffs raises fears of lost market share. Spain, Italy, and Turkey – long-standing competitors with robust global distribution – stand ready to capitalise. If India’s foothold in the US weakens, the damage extends beyond revenue losses to brand perception and reliability in international trade circles. Morbi, contributing the lion’s share of India’s ceramic output, is particularly exposed. For local exporters, the challenge is no longer just price competition but navigating a shifting geopolitical trade environment where policy risk can upend business models overnight.

Diversifying markets, doubling down on innovation

The turbulence in the US underscores the urgency of diversifying export destinations. Encouragingly, India’s recent Free Trade Agreement with the UK offers a window of opportunity. Tariff relaxations and improved market access could enable UK-bound exports to expand significantly – potentially doubling

within the next four years. For Morbi’s manufacturers, this provides a buffer against US volatility and a platform to grow share in Europe. Yet geography alone is not enough. Competitiveness will increasingly hinge on innovation and value addition. Indian firms are already investing in precision kilns, digital glazing, and automated inspection systems. These upgrades improve efficiency and consistency while pushing product quality closer to European benchmarks. Highend buyers increasingly expect such standards as a given. Equally important is sustainability. Buyers are under pressure to cut carbon footprints, and Indian tiles must align with those expectations. Several Morbi producers are experimenting with energy-efficient kilns, closed-loop water systems, and eco-friendly raw materials. Firms that credibly demonstrate compliance with global environmental standards will not only differentiate themselves but also future-proof exports against tightening regulations.

Digital channels: a new trade frontier Another lever of resilience is digital transformation. Historically, tile exports relied heavily on exhibitions, showrooms, and in-person distributor networks. But post-pandemic shifts and digital adoption have changed buyer behaviour.

Virtual showrooms, 3D product configurators and online B2B marketplaces now allow manufacturers to connect directly with architects, contractors, and distributors worldwide. For India’s ceramic sector, this digital pivot reduces dependence on traditional trade fairs and accelerates entry into underpenetrated markets. Early adopters use digital platforms not just for sales but also to tell brand stories, showcase sustainability credentials, and highlight design innovations.

At the heart of India’s ceramic success is the ability to combine traditional craftsmanship with modern manufacturing. Morbi remains the anchor of this ecosystem, where generational know-how in design

and finishing merges with industrialscale production lines. This blend gives India the cost and design edge needed to capture markets across the Middle East, Africa, and now Europe. The question is whether this model can carry India forward in a world of trade uncertainty and sustainability scrutiny. Success will demand sharper positioning, stronger branding, and continued technology upgrades.

The path forward

India’s ceramic industry stands at a crossroads. The immediate challenge is cushioning the impact of US tariffs through market diversification and policy engagement. Simultaneously, the sector must invest for the long term – strengthening research and development, embedding sustainability, and scaling digital platforms. Resilience will not come from relying on historical strengths alone. It depends on how quickly and decisively exporters adapt to shifting global conditions. If the industry seizes this moment to rethink its approach, India can not only hold its position as the world’s second-largest tile exporter but also redefine its global role as a supplier of sustainable, innovative, high-quality ceramics. The stakes are high, but so is the opportunity. For Indian ceramics, the next phase of growth will be written not just in Morbi’s factories but in how boldly the sector responds to the demands of a new global trade era.

Baherden Ceramics sets up Turkmenistan sanitaryware plant • Eriez names Vietnam manager to boost APAC growth Technology and Rokid join hands promoting AR • Time Ceramics seeks approval for 292-M expansion in Batangas Materials acquires Ceramat • Chairman Bian Shares the "Breakthrough Code" for Going Global • Marjan announces

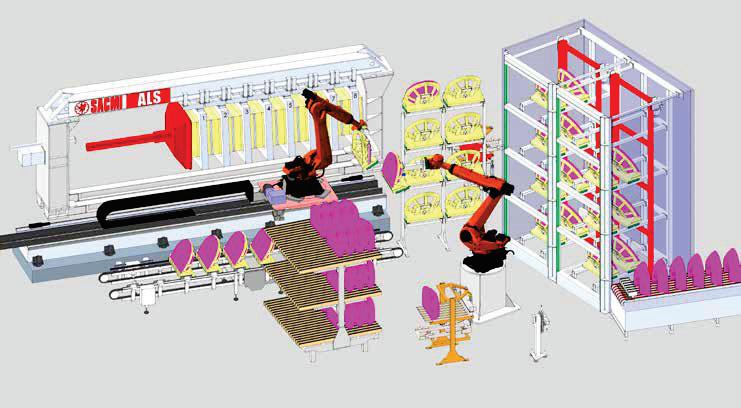

The Baherden Ceramics Sanitaryware plant has just been successfully started production in Turkmenistan, part of a megaproject tasked to SACMI to create a greenfield factory for the manufacture of ceramic tiles and sanitaryware.

The most modern factory in the country, created to substantially increase the national production share, the plant has recently been put into operation to start manufacturing, during this first phase, 200,000 pieces per year of high-quality design sanitaryware.

Already set up for future expansion, the plant was commissioned by Dowletli Dowran, a multi-business group operating in a variety of sectors from construction to the agri-food industry and built by the state-run ‘Eziz Doganlar Economic Society’. The inauguration ceremony was held in March last year in the presence of the highestranking government officials in Turkmenistan.

SACMI designed the entire plant according to the latest technological standards recognised in the sector. This is true from the body preparation department – already large enough to accommodate

future production expansion – to high-pressure casting technology with porous resin moulds, for which the customer chosetheSACMIALSmachine. The latter is renowned for manufacturing multi-mould items in vitreous china such as washbasins, pedestals, water tanks, oriental toilets and lids.

For the production of WC bowls during this first phase of the project a special department has been created to make plaster moulds using manual and mechanised casting with a BCV casting bench for double battery casting and servomechanised demoulding.

The decision to invest in modern technology, in line with the most advanced developments in the ceramic sanitaryware industry, has been the hallmark of the entire supply. Furthermore, with the help of the customer, SACMI has put together the entire technological know-how on all subjects ranging from the testing of bodies to modelling developments, subsequently perfected on site during the start-up stage. As regards the products, elegant shapes have been chosen, with a wide range of colours and modern design features.

Gadam Hoshvagtov, general manager of Dowletli Dowran, said: “With this project, we set ourselves two highly ambitious objectives. The first was to build one of the most modern factories in the country and, indeed,intheentirearea,ableto make a substantial contribution to national production in a sector where domestic market demand is growing rapidly.

“The second goal was to fix a market benchmark for product and process quality in line with thebestinternationalstandards. This is the reason we turned to SACMI, renowned throughout the globe for the quality of its technology and service.”

The plant also includes highefficiency SACMI dryers and RobotGlaze technology, with Gaiotto GA2000 robots. The two-position carousel supplied ensures perfect glazing quality, eliminating manual operations. The innovative solution leads the way also in terms of sustainability since it is equipped with the exclusive SACMI Mass Control system for controlling the flow rate and optimising the glaze trajectory.

The glazing booth is also equipped with dry filters for 100% glaze overspray recovery.

Automation and performance

are also the key features of the Riedhammer kiln, model HWS 15/500/140, with automatic handling, loading and unloading of 10 kiln cars, reaching a production output of 780 pieces per day (future production expansion has been considered here too).

Hoshvagtov said: “We are extremely satisfied by our partnership with SACMI not just thanks to their capacity to supply technologies and systems which are among the most advanced in the world, but above all because of their ability to manage every aspect of such an ambitious and complex project, the first of its kind to be carried out in our country.

“Fromtheinitialplanningstage right through to plant start-up, every step has been managed with skill, care, a cooperative spiritandinperfectsynergywith our technical teams, enabling us to fully reach the objectives we set.”

Eriezhas namedChien Dang Tranas country manager in Vietnam, reinforcing the company’s commitment to expanding across Southeast Asia while delivering more responsive support for local industries.

In this newly established position, Tran will shape Eriez’ strategy in Vietnam by cultivating lasting partnerships, uncovering emerging opportunities and

collaborating with regional representatives to provide separation technologies tailored to market needs.

Ezio Viti, regional sales director for Eriez Asia-Pacific, said: “This appointment represents another milestone for Eriez as we extend our reach across the Asia-Pacific (APAC) region.

“Chien’s customer-focused mindset and deep knowledge of Southeast Asian markets

make him uniquely equipped to accelerate our expansion in Vietnam.”

Viti added that “by placing experienced leaders in key markets, Eriez ensures that businesses benefit from localised expertise backed by the innovation, resources, and dependability of a global organisation.”

Established in 1942, Eriez is a global leader in separation

technologies. The commitment to innovation has positioned us as a driving market force in several key technology areas, including magnetic separation, flotation, metal detection and material handling equipment. The company’s more than 1,000 employees provide trusted technical solutions to the mining, food, recycling, packaging, aggregate, and other processing industries.

growth

•

STL, QNu Labs sign MoU to advance quantum communications • Lens Batangas • Roca Group acquires Australian company Phoenix • Lionstead Applied nounces RAK Central infrastructure completion...

STL,anadvancedconnectivity solutions company for digital infrastructure, has signed a Memorandum of Understanding (MoU) with QuNu Labs Pvt. Ltd. to strengthen research and development in quantum communications over optical fibre transmission.

Foundedin2016andincubated at the IIT Madras Research Park, QNu Labs is India’s first company to develop end-toend quantum cybersecurity solutions. Supported by the National Quantum Mission (Department of Science and Technology, Government of India), QNu aims to protect digital infrastructure from quantum threats and position India as a leader in quantumsecure communications.

India’s quantum communications market is projected to grow to USD 139.8 millionby2030,withacompound annual growth rate of around 34.6%. Under the National Quantum Mission, backed by

funding of approximately 6,000 crore, the country is aiming to build operational quantumsecure systems by 2031.

STL has been among the first companies globally to demonstrate field deployments of Multi-Core Fibre (MCF) technology, a key enabler for quantum communication. MCF usesSpaceDivisionMultiplexing in four- and seven-core configurations to deliver high transmission capacity within the same fibre diameter. The technology has already been deployed at the Department of Telecommunicationssponsored Advanced Optical Communications Test Bed at IIT Madras, meeting Essential Requirements under Telecom Engineering Centre standards.

As part of the collaboration, QNu Labs has demonstrated its Quantum Key Distribution (QKD) system over STL’s fourcore multi-core fibre (MCF). The demonstration achieved secure key exchange across 170

kilometres alongside 800 Gbps of classical data transmission, and over 150 kilometres with 1.8 Tbps of classical traffic. This represents a milestone in integrating quantum security with high-capacity optical networks.

Through this partnership, STL aims to accelerate research in quantum-secure communications by combining its optical fibre transmission capabilities with QNu Labs’ expertise in QKD, hybrid quantum cybersecurity and quantum cryptography. Both organisations plan to develop scalable architectures to support India’s participation in global quantum network development.

Sunil Gupta, CEO of QNu Labs, said: “We are not just protecting digital assets – we are working towards making India a quantum-safe nation and fortifying our digital sovereignty. Our partnership with STL will bring together their expertise in advanced optical fibre

networks and our quantum security solutions, enabling the development of next-generation, secure communication infrastructure that can scale for India and beyond.”

Dr Badri Gomatam, CTO of STL, added: “STL has always pushedtheboundariesofwhat’s possible with optical fibre, and teaming up with QNu Labs adds a whole new dimension – STL’s global leadership in optical fibre transmission and QNu’s pioneering quantum security expertise. Together, we can build secure, future-ready networks that not only serve India’s needs but also set new benchmarks globally.”

The global augmented reality (AR) sector is entering a new phase of rapid growth, fueled by rising consumer demand and advances in optical waveguide technology. In China, AR device maker Rokid recently sold more than 10,000 pairs of its AR glasses in a single day, generating revenues exceeding RMB 30 million.

Supporting that milestone is Lens Technology, a Hunanbased precision manufacturing company that serves as Rokid’s exclusiveproductionpartnerand astrategicinvestor.Bycombining its manufacturing capacity with Rokid’s technological expertise, Lens Technology has

positioned itself as a central player in the industry’s transition from niche innovation to mass-market adoption.

The company contributes to Rokid’s success by delivering high-quality optical modules and providing comprehensive assembly services. According to the founder of the XR Research Institute, “The optical waveguide AR industry in 2025 has shifted its primary challenge from demand scarcity to production capacity constraints.” For Lens Technology, a global company in large-scale manufacturing, this shift plays directly to its strengths.

The partnership between

Rokid and Lens Technology has created what industry observers describe as a strong competitive edge: Rokid’s breakthroughs in optical waveguide design drive product innovation, while Lens Technology’s scalable infrastructure helps overcome production bottlenecks. With orders for optical waveguides projected to rise sharply in 2026, Lens Technology has indicated it will seek to optimise capacity utilisation and refine pricing strategies to capture growth.

As a strategic investor in Rokid, Lens Technology also stands to benefit financially from Rokid’s market expansion. Industry analysts suggest that

as AR glasses move from early adoption into the consumer electronics mainstream, Lens Technology’s expertise in precision manufacturing and scalable production will open up significant opportunities. Lookingforward,thecompany’s strategy of ‘independent innovation, scalable production, and ecosystem integration’ reflects its ambition to transform China’s AR supply chain from a follower into a global leader. With capacity constraints emerging as the defining challenge of the industry, Lens Technology’s role in enabling mass adoption of AR is expected to become increasingly significant.

Time Ceramics Philippines Inc. has applied for regulatory approval to expand its ceramic tile manufacturing facility in San Pascual, Batangas, with a planned investment of 292 million, according to media reports.

The proposed expansion aims to boost the plant’s production capacity from 49,000 to 450,000 metric tonnes per year, in response to growing demand from the residential, commercial, and industrial construction sectors. The company said the project would be implemented within the existing facility, as covered by its current environmental compliance certificate, and would not involve theconstructionofnewbuildings

or product lines.

According to Time Ceramics, consultations with stakeholders will be held to ensure transparency, gather feedback, and address potential concerns regarding environmental and community impacts. These discussions will form part of the company’seffortstocomplywith environmental regulations and secure the necessary approvals.

The manufacturer highlighted that the expansion would rely heavily on locally sourced raw materials such as clay, feldspar, and silica. This, it said, would promote the local supply chain while supporting the production of cost-effective and sustainable ceramic products.

Time Ceramics added that the

project is expected to generate employment opportunities, stimulate local business activity, and increase tax revenues for San Pascual and neighbouring municipalities. In line with its commitment to environmental stewardship, the company outlined several initiatives aimed at reducing ecological impact. These include the installation of advanced pollution control systems, the adoption of safer chemical alternatives, and the implementation of waste recycling programmes. Additionally, it plans to employ low-toxicity glazes, optimise the use of energy-efficient kilns, and introduce continuous emissions monitoring systems

to ensure compliance with environmental standards.

Time Ceramics underscored that the expansion aligns with bothcorporategrowthobjectives and national sustainability goals. The company said the project represents a balance between industrial advancement and environmental responsibility, contributing to the broader push for greener manufacturing practices in the Philippines. If approved, the expansion is expected to significantly enhance the firm’s production capacity and strengthen its role as a key player in the local ceramics industry, supporting the country’s construction and infrastructure development agenda.

RocaGroup,aglobalcompany in the design, production, and marketingofbathroomproducts, has acquired Phoenix, a tapware company in the mid-to-highend market segment, renowned for its design leadership and numerous international awards.

Phoenix is one of the leading tapware companies in the Australian market, where it designs, assembles, and markets bathroom and shower fittings. Founded in 1989, it has over 30 years of experience and offers a wide portfolio of products known for their highquality design.

The company, based in Melbourne and focused on design innovation, recorded a turnover of 35.4 million in 2024. Thecompanyhastwofacilitiesin Melbourne and one in Balcatta

(Perth). The main warehouse in Bayswater (Melbourne) was specifically designed to optimise the company’s logistics operations. Meanwhile, the Balcatta facility houses a showroom and a smaller warehouse, aimed at providing support and direct service to customers in the western region of the country.

Phoenix has established itself as a benchmark brand in the mid-to-high-end market segment thanks to its in-house design team, ranked number one in Australia and Oceania according to the international iF Design Award ranking. Its collections have received prestigious accolades, including the Red Dot Award and the Good Design Award, for their excellence in design, innovation,

and functionality.

With this acquisition, the group strengthens its position in Australia, where it is already present with its global brands Roca and Laufen. By the end of thisyear,itwillopenanewRoca Gallery in Sydney – bringing the total to eight worldwide – as well as a Laufen Space, where products from this brand will be showcased.

RocaCorporaciónEmpresarial is a Spanish, family-owned company headquartered in Barcelona, specialising in the design, manufacture and sale of bathroom-space products. It operates in over 170 countries, with 79 production plants in roughly 18-22 countries and employs around 20,000 people globally.

Originally founded in 1917 in

Gavà (Barcelona) as Compañía Roca Radiadores, the company began with cast-iron radiators, later adding boilers, cast-iron bathtubs (1929), sanitary porcelain (1936) and taps (1954).

Since 1999, Roca has pursued international expansion through acquisitions (notably Keramik Laufen in Switzerland) and by establishing production facilitiesabroad.In2005itexited the heating and air-conditioning business to focus entirely on the ‘bathroom space’.

LionsteadAppliedMaterials, the advanced materials platform of Lionstead Ventures (LV), acquired 100% of Ceramat Private Limited, a leading manufacturer of bioceramics and a subsidiary of Tata Steel Advanced Materials Ltd.

The acquisition strengthens LV’s advanced ceramics

portfolio and reflects our visiontoinvestintechnologies that will drive the next wave of industrial innovation in India.

Ceramat’s high-purity, biocompatible materials will address rising demand across orthopedics, oral care, pharmaceuticals, food, and cosmetics, where much of India’s needs are still met

through imports. Ceramat is positioned to deliver greater accessibility, lower costs, and stronger supply chain resilience for both domestic and global markets.

The opportunity ahead is immense. According to industry research bodies, the global advanced ceramics market, valued at $80 billion,

will reach $105 billion by 2030, while the bio-ceramics subset is expected to nearly double from $5.6 billion to $10.5–12 billion over the same period.

This is just the beginning. We are excited to help shape the future of advanced materials — from India to the world.

The second salon of the Guangdong Enterprises Future Forum, organised by the Guangdong Development and Reform Commission, was held at KEDA Industrial Group, bringing together leading business figures to discuss strategies for Chinese enterprises expanding globally.

Themed ‘New Heights, New Journey: Breaking Through and Accelerating Growth for Private Enterprises Going Global’, the event gathered over 30 entrepreneurs and executives from across Guangdong province. Attendees explored new ideas for globalisation, innovation, and resilience in the face of economic challenges.

During the forum, Peng Diao, director of the Private Economy Development Bureau of the Guangdong Development and Reform Commission, delivered opening remarks recognising KEDA Industrial Group

as a model of successful internationalisation within China’s manufacturing sector. He praised the company’s ability to adapt through changing market cycles and maintain a leading position in the global ceramics and building materials industry.

Under the leadership of Chairman Cheng Bian, KEDA has demonstrated the vision and adaptability needed to compete globally, noted Diao.

Bian was invited to deliver the keynote address, sharing insights from KEDA’s extensive experience in building a global presence. Drawing on lessons from the company’s building materials business, Bian outlined four key principles for success namely partner with strong, trustworthy collaborators; identify and develop untapped markets; empower and reward young talent; and maintain rigorous operational discipline.

Bian highlighted that despite the broader economic slowdown,KEDAhascontinued to perform strongly across its diverse business segments.

This resilience, he explained, has been driven by a strategic focus on export growth, talent development, and technological transformation.

KEDA’s ongoing investment in digitalisation, technology upgrades, and lean managementhasstrengthened its global competitiveness. The Group continues to prioritise efficiency, quality, and cost control, supporting steady growth even in challenging market conditions.

Bian also encouraged fellow entrepreneurs to remain thoughtful and patient amid uncertainty. “In times of change, slowing down to think deeply is essential,” he said. “Only by reflecting carefully can companies identify real opportunities and shape a

Marjan, the developer of freehold properties in Ras Al Khaimah, has announced the completion of infrastructure works at RAK Central, a mixeduse commercial development positioned as the emirate’s upcoming business hub. The company has also appointed Middle East Construction Group ALEC as the main contractor for the RAK Central HQ Office Complex, marking a significant milestone in the project’s progression.

RAK Central spans 3.1 million sq. ft. of prime land and offers 8.37 million sq. ft. of gross floor area. The completed infrastructure includes comprehensive wet and dry services such as stormwater, sewerage, firefighting, irrigation, potable water, electrical networks, and street lighting. Roads, cycle tracks, landscaping, and green spaces with hundreds of trees have also been delivered,

providing the foundation for vertical development.

With infrastructure now in place, sub-developers are set to commence commercial, residential, retail, and hospitality projects. The flagship RAK Central HQ Office Complex is scheduled for completion in Q1 2027.

Abdulla Al Abdouli, CEO, Marjan, said: “With the completion of infrastructure works and onboarding of global contractors, RAK Central has progressed into a new activation phase. The involvement of leading developers reinforces our vision to create a world-class hub that brings together business, lifestyle and tourism, enhancing Ras Al Khaimah’s reputation as a compelling destination for international investors and families alike.”

DesignedasRasAlKhaimah’s commercial nucleus, RAK Central offers Grade A offices,

sustainable, successful future.” The Guangdong Enterprises Future Forum serves as a platform for sharing strategies and fostering cooperation among private enterprises. By hosting the second salon, KEDA Industrial Group reaffirmed its leadership role in promoting dialogue on global business development and innovation within China’s industrial sector.

residences, hotels, retail spaces, and a Town Square with premium amenities. The LEED Gold certified office buildings will feature dual licensing and investor-friendly frameworks, managed under a hospitality-driven model.

Located on Sheikh Mohammed bin Salem Al QasimiStreet,thedevelopment overlooks Al Hamra Golf Club andtheArabianGulf,withdirect access to the E-11 highway. The masterplan includes three million sq. ft. of rentable office space, more than 4,000 residential units, four hotels with over 1,000 keys, multiple parks, retail and entertainment facilities, and over 1,000 visitor parking spaces.

SinceitsJanuary2024launch, all plots within RAK Central have sold out, underlining investor demand.

Marjan, known for flagship projects such as Al Marjan Island, continues to drive Ras

Al Khaimah’s competitiveness in real estate, tourism, and investment, leveraging the emirate’s natural assets to deliver large-scale masterplanned communities.

RAK Ceramics has signed a memorandum of understanding (MoU) with the Sheikh Saud bin Saqr Al Qasimi Foundation for Policy Research to support the training and employment of Emirati graduates.

The agreement was signed during the third Ras Al Khaimah Jobs and Internships Festival (RAKJIF), held at the RAK Exhibition Centre on 9th October. The event was organised by the Al Qasimi Foundation in partnership with the Department of Human Resources Ras Al Khaimah and the Investment and Development Office.

The MoU was signed by Rui da Silva, deputy director of the Al Qasimi Foundation, and Jasem Al Khateri, chief human resources officer at RAK Ceramics. It sets out plans for a structured programme of internships and graduate placements aimed at giving Emirati students and jobseekers practical experience in the manufacturing industry.

According to the Al Qasimi Foundation, the initiative is intended to link academic learning with on-the-job training and to improve the employability of local graduates. RAK Ceramics will provide internship and entrylevel opportunities within its operations, offering exposure to different departments and production areas.

The partnership forms part of ongoing efforts by both organisations to develop local talent in line with the UAE’s Emiratisation policies. No financial terms or specific targets for the programme were disclosed.

RAKJIF attracted more than 2,000 visitors, including students, graduates and jobseekers. Around 70 employers from sectors such as government, construction, banking, hospitality, energy, and manufacturing took

part. Exhibitors conducted interviews, recruitment drives, and career workshops throughout the one-day event.

The festival, first held in 2023, aims to connect Emirati jobseekers with employers across Ras Al Khaimah and the wider UAE. It is part of a broader strategy to support local employment and align skills development with the needs of regional industries.

A separate session titled AI and the Future of Work ran alongside the main exhibition. Speakers from academic institutions and private companies discussed how artificial intelligence is changing the workplace and whatskillswillberequiredinthe coming years. The discussions focused on adaptability, digital literacy and the integration of AI technologies into existing business functions.

Kerasys® LC Repair Solutions for Sanitary Ceramics

The Ras Al Khaimah Jobs and Internships Festival is expected to return in 2026 with continued participation from major employers and educational institutions. The organisers said future editions would maintain a focus on linking education, training, and workforce requirements in key sectorssuchasmanufacturing.

Kyocera Europe has announced a new collaboration with Switzerland’s iPrint Institute to accelerate research and development in industrial inkjet applications, including 3D printing, coating, and printed electronics. The partnership, beginning in October 2025, forms part of Kyocera’s wider strategy to expand its digital printing technologies into new industrial sectors.

The initiative will see Kyocera – known globally for its fine ceramic technologies and precision printhead manufacturing–workalongside iPrint, a public research institute within the School of Engineering and Architecture of Fribourg (HEIA Fribourg), part of the University of Applied Sciences and Arts Western Switzerland (HES-SO).

Digital printing technologies such as inkjet are increasingly recognisedascleanerandmore

flexible alternatives to traditional analogue processes. Unlike plate-based methods, they allow manufacturers to produce the required quantity directly from digital image data, while reducing environmental impact by eliminating liquid waste generatedduringplatecleaning. This shift from analogue to digital has accelerated in recent years, driven by growing demand for customised, small-lot production and ongoing automation in industrial environments.

Kyocera brings decades of experience in fine ceramics, fluid channel design, and manufacturing to the collaboration. Its proprietary ‘EX Series’ inkjet printheads currently hold the leading global market share in textile and commercial printing. Building on this foundation, the company aims to extend its technological expertise to new

industrial applications such as additive manufacturing and printed electronics.

Under the agreement, Kyocera will establish a dedicated research space within iPrint’s Fribourg facility. The institute’s advanced laboratories –equipped to handle a broad variety of inks and materials – will provide Kyocera with the environment to evaluate special inks and materials that have traditionally been difficult to process. The company will collect and analyse data from these evaluations to enhance and streamline its technical support capabilities.

Both partners have emphasised the environmental benefits of digital printing, particularly its potential to reduce waste and improve production efficiency. The collaboration aligns with Kyocera’s broader corporate goal of promoting sustainable

manufacturing through innovationandthedevelopment of more eco-efficient industrial processes.

By combining Kyocera’s expertise in ceramics and engineering with iPrint’s research infrastructure, the partnership aims to advance inkjet technology and strengthen its role in supporting next-generation industrial manufacturing.

iPrint conducts applied research in diverse applications such as graphic printing, electronics, and biomedical applications, and pursues R&D in state-of-the-art inkjet technology. With its interdisciplinary structure, iPrint connects people and knowledge, fostering innovation that supports the development of valuable products for the well-being of society and ecosystems in a sustainable manner.

Marking a major milestone in its four-decade journey, Ceramics China 2026 is set to open its 40th edition from 24th27th June next year at the China Import and Export Fair Complex in Guangzhou. Reflecting the Confucian notion of ‘Reaching Clarity at Forty’, the event moves forward with a renewed mission, steadfast identity and a clear vision for the future of the global ceramics industry.

Since its inception, Ceramics China has evolved into one of the world’s most influential platforms for technological exchange, trade cooperation and innovation in the ceramics andalliedsectors.Organisedby Unifair Exhibition Service Co., Ltd., the annual event continues to unite leading manufacturers, suppliers, and innovators under one roof—serving as both a driver and a mirror of the industry’s transformation.

The 2025 edition achieved unprecedented success, setting new benchmarks in participation and engagement. Compared to the previous

year, the show grew by 11% in exhibition space, 12% in exhibitor numbers, and 31% in visitor origin countries and regions.

Exhibitor satisfaction reached 93%, reflecting strong approval of the event’s scale, visitor quality and networking opportunities. Meanwhile, 92% of visitors rated the exhibition highly for its professionalism, comprehensive product range, and industry relevance.

The show floor featured a dynamic array of cuttingedge technologies, advanced

equipment, and innovative materials, addressing the evolving demands of a rapidly diversifying market. From automation and AI to green production and sustainable design,exhibitorsdemonstrated the sector’s readiness to embrace a smarter, cleaner, and more connected future.

Beyond the exhibition itself, Ceramics China 2025 hosted a series of concurrent forums and themed events focusing on digital transformation, AI integration, international cooperation, intellectual

property protection, marketing strategies, and environmental sustainability. These sessions provided actionable insights for businesses navigating the challenges of globalisation and industrial upgrading.

Over the past 40 years, Ceramics China has played a pivotal role in connecting global resources, fostering technological advancement, and accelerating industry modernisation. It has established itself not only as a showcase for innovation but also as a bridge linking global ceramic enterprises and markets.

As the industry looks to the future, Ceramics China 2026 promises to celebrate its 40th anniversary with a spirit of renewal and progress. With the theme “Forty with Clarity, Forward to Infinity,” the upcoming edition aims to pioneer a new era of integrated innovation, closer global collaboration, and sustainable growth for the ceramics and allied industries.

KAJISEKI has built asystem capable of manufacturing tableware without the need for skilled engineers. Operation using an interactivedisplay not only allows you to manage the manufacturing process, but also gives you control over aspects of the production system such as production quantity and production errors.

Head Office : 2-2-1 Hachiman-cho, Takahama, Aichi 444-1302, Japan

URL : http://www.takahama-ind.co.jp

E-mail : info@takahama-ind.co.jp

TEL : +81-566-52-5181

The Polish tableware manufacturer Lubiana hasrea rmeditstrustin SACMI-SAMAtechnology with a new investment in the DUO automatic dip glazing system. The move underlines the company’s commitment to maintaining flexibility and cra smanship quality, even within a highly automated and robotised productionenvironment.

Founded in 1969, Lubiana has established itself as one of Europe’s well-known producers of porcelain tableware, known for its advanced manufacturing systems and consistent product excellence. In recent years, the company has undergone significant modernisation, with majorinvestmentsinautomation, roboticsandenergye ciencyat its production site in Lubiana, nearKoscierzyna,Poland.

Among its technological highlightsarethePHO700SAMA presses,equippedwithautomatic robotised finishing units, demonstrating Lubiana’s drive towards full process integration.

Now,withtheadditionoftheDUO dip glazing unit, the company is extending this approach to its glazingoperations.

Designed by SAMA, the DUO systemprovidesanidealsolution for managing small production batches, prototypes, and complex shapes such as bowls, teapots and co ee pots. While loadingandunloadingoperations are performed manually, all glazing parameters are digitally managed through the control panel, ensuring precision, repeatability and high-quality surface finishes. These features makeDUOparticularlysuitedfor integrationalongsideautomated production lines, o ering maximum flexibility without compromisinge ciency.

The successful start-up of the new unit marks another step forward in Lubiana’s continuous improvement journey. Alongside the DUO investment, the company has recently inaugurated a new production hall featuring a SAMAisostaticpressinglinewith high-performance presses and

robotised forming and finishing units. Notably, the installation includes belt conveyors beneath the pressing stations to collect excess ceramic material directly from the process, minimisingwasteandsupporting sustainabilitygoals.

In addition, SAMA has implemented energy-saving upgrades to the presses, further reducing power consumption and contributing to Lubiana’s broader strategy for sustainable

industrialdevelopment.

The latest collaboration continues the partnership between SACMI-SAMA and Lubiana, reflecting shared objectivesininnovation,product quality, and environmental sustainability. Both companies plan to maintain joint e orts in automation and e ciency improvements, positioning their cooperationasareferencepoint for technological developments intheceramicssector.

BMW Group and E.ON have launched Germany’s first commercial Vehicle-toGrid (V2G) solution for privatecustomers,markingakey milestone in the integration of electricmobilitywiththenational energytransition.

The new service enables the BMW iX3 to become an active participantintheenergymarket, both consuming and feeding electricity back into the grid. For the first time in Germany, private electric vehicles can act as flexible energy storage units withineverydayuse.

The system is based on bidirectional charging, where the high-voltage battery of the BMW iX3 can return power to the grid via the BMW Wallbox Professional. Energy management is handled through E.ON’s digital platform and supported by a specially

developed V2G electricity tari that allows energy to flow in bothdirections.

The underlying so ware was co-developed by BMW and E.ON, designed for simplicity and transparency. Customers who make their vehicle battery available for smart charging and discharging can earn an annual bonus of up to €720. According to BMW, this could allow drivers totravelupto14,000kilometres ayearate ectivelynocharging cost, while contributing to grid stability and renewable energyintegration.

Marc Spieker, management board member of E.ON SE, Commercial, said: “What our customers need is a reliably charged vehicle, simple, convenient, and at attractive costs. That’s exactly what we provide,andmore.

“Together with BMW, E.ON is

bringingVehicle-to-Griddirectly to the people. Neue Klasse meets new energy. This is how we unlock the potential of the vehicle for each individual’s personalenergyfuture.

“We combine charging convenience with tangible economic benefits. And, as a bonus, every connected vehicle can help lower the overall costs of the energy system, for the benefitofall.”

Joachim Post, management board member of BMW AG, Development, said: “With the Neue Klasse, BMW makes the car an active part of the energy system, creating tangible customer value. Vehicle-to-Grid reducesthemobilitycostsofthe customer through new revenue opportunities while driving the futureofelectricmobility.”

Customers retain full control over their vehicle’s charging

goals, ensuring mobility needs are always met. Intelligent energy management protects batterylongevitybymaintaining optimalchargelevels.

The V2G technology will first be introduced with the BMW iX3, before expanding to other model ranges. In the long term, BMW and E.ON plan to integrate the service into a broader energy platform linking charging systems, photovoltaic installations, heat pumps and smart-home devices, forming the basis of an open and interoperableenergyecosystem.

UK ceramics firms fork out an estimated £875,000,000 a year in energy costs, Britain’s Labourconferenceheardon29th September,GMBUnionreported.

Thefigurehasshotupbymore than£330,000,000since2020.

Analysis by Nottingham Trent University suggests UK ceramics firms spend 70% of turnover on energy costs, and 14 per cent on Governmentandregulatorylevies.

Turnover of UK ceramics firms is around £1.25 billion, suggesting energy costs could be an enormous £875,000,000, with

leviesupto£150,000,000.

Analysisofhistoricenergyprices suggest in 2020 energy costs madeupjust55%ofturnoverfor UK ceramics firms – giving the figureof544,509,381.

Meanwhile the equivalent Chinese or US ceramics manufacturer, using the same amount of electricity, would be payingapproximatelythesameas what UK businesses were paying five years ago, and around 50% lessthantheydoatthemoment.

GMBwilltodaydemandgreater support for manufacturers and measurestolowerenergyprices

at the Labour Party conference inLiverpool.

Addressing the conference, Sharon Yates, a ceramics worker, who has worked at Dunoon in Stone,Sta ordshire,formorethan 30years,said:“I’maproudpottery worker.Justlikemydadbeforeme.

“The most highly skilled potters makeceramicsinmytown,andwe exportthemaroundtheglobe.But theindustrywerelyonisdying.

“Spiralling energy prices –especially gas – mean that UK ceramic firms fork out 875 million pounds in energy costs eachyear.

“That’s right – almost a billion pounds just on energy costs. All while counterfeit products from China have flooded the market, driving down demand for the goodswemake.

“The results are devastating. Thegovernmenthashelpedour industry with electricity costsbutwerelyongas.

“If we do not help industries like ceramics with energy costs now – and invest in their cleaner future – we will keep losing decent, unionised jobs. And when those jobs go, our communitiesgowiththem.”

Spanish ceramic manufacturer Venux has partneredwithGruppoB&T tomoderniseitsproduction line, aiming to address previous performanceissuesandincrease operational flexibility. The upgradeincludestheinstallation oftwoEVO8308pressesfromSiti, designedtoenhanceproduction speed, stability and consistency

while maintaining compatibility withVenux’sexistingequipment.

The EVO 8308 presses are reported to provide uniform compaction and faster, more stable production cycles. Gruppo B&T emphasised that the technology was fully tested and familiar to the customer, facilitating integration without operational

disruptions. The installation allows Venux to expand its product range, including new formats, and increase overall productioncapacity.

In addition to the presses, Venux continues to use the Dryfix digital printer from Projecta, a system capable of producing both decorative designs and high-discharge full

fields through the application of glue and grit. The technology supports detailed design work and enhanced aesthetic quality infinishedceramicproducts.

Gruppo B&T provided technical support throughout the installation and integration process, ensuring that the new equipment aligns with Venux’s productionrequirements.

Building materials giant Saint-Gobainhaslaunched a new five-year strategic plan, ‘Lead & Grow’, aimed at raising its growth and profitability targets while expandingitspositioninlightand sustainableconstruction.

The plan follows the success of the Group’s previous strategy, ‘Grow & Impact’, and will focus on outperformance through a broader suite of sustainable building solutions. Saint-Gobain, whichholdsnumber-onepositions in most of its markets, said it is targeting “mid-single-digit sales growth” in local currencies between 2026 and 2030, with an EBITDAmarginof15%to18%and aROCEabove13%.

ChairmanandCEOBenoitBazin said: “As the worldwide leader in lightandsustainableconstruction, Saint-Gobain is best positioned to address the key challenges of

the construction sector thanks to its full suite of innovative and sustainable solutions. With ‘Lead & Grow’, the Group further elevates its trajectory for growth, profitabilityandvaluecreationfor itsshareholdersandcustomers.”

Underthenewplan,thecompany intendstoinvestaround€12billion ingrowthcapitalexpenditureand acquisitions over the period, net of divestments. Asset rotation is expectedtorepresentmorethan 20%ofsalesby2030,withfurther portfolio optimisation to support valuecreation.

Saint-Gobain also plans to allocateapproximately€20billion in total capital between 2026 and 2030, maintaining a net debt-to-EBITDA ratio between 1.5x and 2.0x. Of this, about €8 billion is expected to be returned to shareholders – €6 billion via dividends and €2 billion through sharebuybacks.

The Group aims to boost its presence in high-growth regions such as North America, AsiaPacific and emerging countries, whichareforecasttoaccountfor around 60% of sales in the long term, compared to 50% today. It is also stepping up exposure to non-residentialandinfrastructure markets, including healthcare facilities, data centres, and transportprojects.

Bazin added: “Thanks to the know-how and commitment of ourteams,Iamconfidentwewill outperform in each geography and seize major opportunities: in Asia and high-growth countries driven by demographics and urbanisation, in North America with strong structural needs, and in Europe with significant potentialforrecovery.”

Saint-Gobain’s sustainable solutions now represent about 75%ofitssales,withitsproducts

CoorsTek, a global manufacturer of technical ceramics, has o ciallyopeneditsnew CoorsTek Academy Training Center, a state-of-the-art facility designed to train and upskill the next generation of advanced manufacturing workersinColorado.

Theribbon-cuttingceremony, held in July, brought together company leaders, state o cials, and education and industry partners to mark what CoorsTek described as a major step forward in workforcedevelopment.

Supported in part by the StateofColorado’sOpportunity Now grant, the new Academy will o er immersive, handson learning experiences for individuals pursuing careers in advanced manufacturing, a sector considered key to the state’s long-term economicgrowth.

Irma Lockridge, chief people and systems o cer at CoorsTek, said: “The opening of theCoorsTekAcademyTraining Center is the realisation of a

bold vision to shape the future of advanced manufacturing in Colorado. This facility reflects our commitment to developing talent,fosteringinnovation,and investinginthepeoplewhowill lead this industry forward. It's more than a training centre –it's a launchpad for meaningful careersandlong-termimpact.”

The Academy features modern manufacturing equipment to simulate realworldproductionenvironments. Training programmes will include apprenticeships in maintenance and tool and die, as well as certifications in CNC and advanced manufacturing, developed in partnership with local educational institutions. The curriculum has been tailored to reflect current and emergingindustryneeds.

Colorado Governor Jared Polis, who spoke at the ceremony, highlighted the role of initiatives like the CoorsTek Academy in addressing the state’sgrowingskillsgap.

“In Colorado, we are growing astrongworkforcetoday,tofill thejobsoftomorrow.Colorado’s

advanced manufacturing industry includes over 6,300 companies that employ over 150,000 workers. And as the industry continues to grow, so toowillthedemandforworkers with the skills needed to drive growth and innovation, helping students gain the necessary skills to succeed and fill indemandjobs.”

Founded in 1910, CoorsTek is a family-owned company headquartered in Golden, Colorado. It is recognised as a global leader in technical ceramics,supplyingengineered materials and components for industries including semiconductor, medical, automotive, and aerospace. The company operates with more than 400 proprietary ceramic formulations and advanced manufacturing systems,supportingcustomers worldwide in developing solutions to complex technicalchallenges.

With the launch of the CoorsTek Academy, the company aims to strengthen bothitsowntalentpipelineand

contributing to an estimated onebilliontonnesofavoidedCO emissions over their lifespan. The company has already reduced its own emissions by 34% since 2017 and is targeting a 40-45% cut by 2035, in line with its commitment to achieve net-zero carbon emissions by2050.

Foundedin1665,Saint-Gobain is a global leader in light and sustainable construction, designing, manufacturing and distributing materials and solutions that improve energy e ciency, comfort and performance in buildings and industry. Operating in 76 countries with around 160,000 employees, the Group reported more than €50 billion in sales in 2024. Its mission is to make the world a better home through innovation, sustainability and localvaluecreation.

Asia’s largest kiln furniture manufacturer

Trusted supplier to major names

Reliable global partner

ISO accredited - validated systems

R&D customer support centre

Emil Muller, a wholly owned subsidiary of CeramTec, has unveiled a new brand identity under the name EMG – The Saltcore Experts, marking a strategic step in strengtheningitsglobalpresence andsharpeningitsmarketfocus.

The rebrand highlights EMG’s positionasaleadinginternational specialistinsaltcoretechnology, with an emphasis on innovation andadistinctidentitywithinthe CeramTecGroup.Thecompany’s new corporate design, modern logoandupdatedwebsiteaimto createaunifiedglobalimageand

reinforce trust and recognition amongitscustomersworldwide.

“For over 40 years, EMG has stood for the highest level of expertise in the production of saltcores,”thecompanysaidina statement. With manufacturing operations in Germany, Poland, Brazil, Mexico and India, EMG produces more than 20 million salt cores annually, supplying complex and customised applicationstoindustriesaround theworld.

While EMG has long been a key supplier to the automotive industry, the company is

now expanding its reach into sanitary technology, power tools and mechanical engineering. The broader focus reflects its ambition to diversifyapplicationsofsaltcore technology and respond to new marketdemands.

Chris Su , managing director of EMG, said: “With EMG – The Saltcore Experts, we are giving the long-standing expertise of EmilMullerGmbHaclearface.

“Thebrandhasanindependent international presence and is expanding its product portfolio in order to respond even better

totheneedsofourcustomers.”

The relaunch consolidates EMG’s decades of technical experience under a single, recognisable brand while maintaining its connection to parent company CeramTec GmbH, a global leader in advancedceramics.

By repositioning itself as EMG–TheSaltcoreExperts,the company aims to strengthen its identity as a dedicated partner for precision salt core solutions, combiningprovenexpertisewith a forward-looking approach to innovationandcustomerservice.

CeramicsUKmemberswere givenauniqueopportunity to discuss frontline issues in their businesses, and the wider sector, directly with parliamentarians at an exclusive event held at the House of Commonsrecently.

Representatives from across Ceramics UK’s membership, including clay brick, gi and tableware, refractories, advanced ceramics, suppliers and sanitaryware manufacturers took advantage of the trade association’s parliamentary dinner to engage with governmentrepresentatives.

HostedbyGarethSnellMPand sponsored by AMRICC, this was the second parliamentary event to take place in 2025, following the successful launch of the initiative by Ceramics UK earlier thisyear.

O ering meaningful exposure and direct engagement with key parliamentarians, each member had the opportunity to speak duringthecourseoftheevening to highlight the challenges and opportunitiestheyfaced.

Key issues raised included spiralling energy costs and the lack of a level playing field with internationalgoods.

Liam Byrne MP, Chair of the Business and Trade Select Committee,wastheguestspeaker and other parliamentarians in attendance included David Williams MP, Linsey Farnsworth MP, and Amanda Hack MP, who attended with members from

theirconstituencies.

Rob Flello, CEO, of Ceramics UK, said: “The evening o ered a unique opportunity for members to state really clearly the challenges that our industry faces,aswellastheopportunities.

“They set out the situation where government can step up and put in place the infrastructure, the support, the help, the guidance needed tothrive.

“With these measures in place, our UK ceramic sector can go from strength-to-strength, building a platform for national and international growth to enable this vital industry tothrive.”

Brynesaid:“Eventslikethisare absolutely critical in bringing frontlinerealitiesfromtheprivate sector, together with politicians who can make an impact here inParliament.

“We cannot get the legislation right without conversations like thoseheldhere.

“We've heard loud and clear some really strong messages fromindustryleaders.

“Energy costs are absolutely top of the list, but we've also heardabouttheneedtolevelthe playing field and address unfair competitionfromabroad.

“We also discussed the real opportunities for the industry to innovate, to grow and to contribute to our economic security and help us project that UK so power around the world forbrandsthatpeoplelove.”

Sebastian Lazell, CEO of the Denby Group, was one of the members at the event. He said: “There are always many messages to share, but at the heart of it, we're a 200-year-old brand and business that is a key part of the government's growth agenda, exporting ‘Made in England’productstocountriesall acrosstheworld.

“However, in these challenging economic times, we really need helpandsupportontheveryhigh cost of energy, both electricity and gas, so that there is a level playing field with competitors across the world who are better supportedandsubsidisedintheir ceramics and tableware industry bytheirgovernments.

“If we have a level playing field with that level of support, our goods will win day a er day, achievingmorecustomers,more business and more growth for Britain, but we need that help and we need it now because we havethemostexpensiveindustry energy costs anywhere in the worldandit'sreallyhurting.”

Earlier this year, Ceramics UK expressed disappointment that the multi-billion pound sector had not been acknowledged in the Government’s IndustrialStrategy,

Flello said: “The UK ceramics sector is a world-leader in the production of both traditional andadvancedceramicmaterials, supporting industries ranging from gi ware through to aerospace,defence,construction,

cleanenergyandelectronics.

“It contributes more than £2billiondirectlyto the UK economy annuallyanddirectly employs approximately20,000people as wellasenablingtensofthousands of other jobs from advanced manufacturing, through steel and glass workers, to bricklayers andmorebesides.

“We need to get the message acrossaboutitshugesignificance totheUKeconomyandthisevent in parliament o ered a unique opportunityformemberstostate really clearly the challenges that ourindustryfaces,aswellasthe opportunities."

Airbus Ventures announced its investment in Fourier, emerging from stealth with its pioneering on-site, on-demand, hydrogen production systems, as part of the company’s $18.5 million in Series A funding. With this latest funding, the company will begin scaling manufacturing, accelerating commercial deployments, and expanding its engineering efforts to integrate its systems into critical energy infrastructure.

As the world’s energy demands skyrocket with the proliferation of artificial intelligence (AI) and advanced technologies, the need for energy solutions that are more reliable, secure, affordable, scalable, and cleaner continues to evolve. Hydrogen holds enormous potential to meet these demands, but high costs, inefficient production and complex distribution logistics have long stood in the way of its widespread adoption.

Al-Amir Aldan, co-founder, Fourier said: “At Fourier we are all about engineering audacity, bringing the brightest minds together to engineer solutions to biggest challenges that matter to us all. With rapidly growing demand for energy from AI and electrification, ensuring energy resilience is paramount (after all, energy is the foundation of human progress).

“For us, the first step is hydrogen. We are rethinking hydrogen delivery by making it on-site, on-demand and scalable. Our modular, software-defined approach does not just improve hydrogen production, it transforms it into a truly viable solution for energy resilience.”

Siva Yellamraju, co-founder and CEO, Fourier said: “We are just getting started. With this new capital, we are scaling fast, pushing boundaries and building a more energy-resilient world, where hydrogen plays a defining role.

“We are already seeing tremendous customer demand,

with early pilots yielding exceptional results across industries, like specialty chemicals, pharma manufacturing, metals and ceramics.”

At the core of Fourier’s technology is an ultramodular, software-defined system architecture that sets its hydrogen production apart from currently available systems. Their approach is driven by advanced algorithms that optimise performance in real-time, constantly adjusting to deliver the highest efficiency and reliability. Its architecture can monitor and predict performance, minimise downtime and ensure peak operational efficiency.

Airbus Ventures senior associate Abigail Hitchcock said: “Industrial decarbonisation will require revolutionary energy solutions. Fourier’s unique fusion of machine learning, modular electrolysis systems, and real-time optimisation is a powerful synthesis for structural advantage in scaling hydrogen where others have faced challenges.

“We believe this approach has the potential to reshape not just hydrogen production, but how we think about distributed energy systems more broadly.”

Fourier’s modular methodology reduces upfront costs, simplifies deployment, and ensures scalability as demand grows. By removing the logistical constraints of traditional hydrogen production, Fourier has helped forge a pathway for hydrogen to become a viable, cost-effective solution for industries like transportation, heating and cooling, and power storage.

Airbus Ventures operates in service of deeptech entrepreneurs who are inspired to design, build, and service complex engineering products capable of unlocking entirely new economies.

Fourier is a Palo Alto, California-based hydrogen production systems company.

QuantumScape Corporation, a developer of next-generation solid-state lithium-metal batteries, has signed an agreement with Corning Incorporated to jointly develop ceramic separator manufacturing capabilities. The collaboration aims to support high-volume production of ceramic separators for QuantumScape’s solid-state batteries, a critical step towards large-scale commercial applications.

The companies said the partnership combines QuantumScape’s expertise in battery technology with Corning’s long-standing strengths in ceramics and advanced materials manufacturing.

“QS and Corning are driven by a shared spirit of innovation in science and technology,” said Ron Verkleeren, senior vice president of Corning’s Emerging Innovations Group. “We’re excited to collaborate with QS to help advance the future of battery technology.”

Siva Sivaram, CEO and president of QuantumScape, described Corning as a natural fit for the company’s growing

ecosystem of partners.

“Corning’s world-class capabilities in ceramics manufacturing makes it an ideal addition to the QS technology ecosystem,” he said. “Together with our ecosystem partners, we’re building the foundation for scalable production of our high-performance solidstate batteries.”

QuantumScape’s solid-state lithium-metal technology is designed to deliver higher energy density, faster charging and improved safety compared with conventional lithiumion batteries, supporting the transition to a lower-carbon energy landscape.

Corning, a global leader in glass and ceramics with more than 170 years of innovation, brings extensive experience in glass science, ceramic science and optical physics across industries including automotive, semiconductors and energy storage.

The agreement represents a significant move toward industrialising solid-state battery technology, with ceramics at the centre of enabling large-scale energy storage solutions.

Researchers at the Federal Institute for Materials Research and Testing (BAM) have developed an innovative approach to make solid-state batteries more powerful and suitable for everyday use. Their goal: batteries that charge faster, last longer, and are more sustainable than conventional lithium-ion batteries. A new solid electrolyte could pave the way for a pioneering battery technology.

Conventional lithium-ion batteries have reached the limits of their performance: their anodes, which are usually made of graphite, can only store a limited amount of ions. Anodes made of pure lithium or the more sustainable and cheaper sodium offer an alternative – they could increase energy density by up to 40%. However, to operate safely, they require a solid electrolyte instead of a liquid one. A key problem here is that contact losses and voids can occur at the interface between the solid anode and the solid electrolyte, rendering the battery unusable. One possible solution is a partially liquid anode.

“However, this technology can currently only be used at 250 degrees Celsius. Our goal is to transfer its advantages to room temperature.”

To achieve this, the research team is experimenting with potassium additives that lower the melting point of the anode. The challenge here is that many common solid electrolytes are not stable enough when exposed to potassium.

The solution could lie in a special solid electrolyte based on sodium super ionic conductors (NASICON). These materials offer high ionic conductivity at room temperature and are chemically stable against potassium – especially when doped with hafnium. However, hafnium is rare and expensive.

In the NASICON project, Graeber and his interdisciplinary team of BAM experts are therefore looking for alternative additives that are just as effective but more sustainable and widely available. The most promising candidates are being tested directly in sodium batteries.

“In a study, we were able to show that a liquid alkali metal anode is a hundred times more powerful than conventional graphite anodes,” explains Gustav Graeber, battery material expert at Humboldt University in Berlin and guest researcher at BAM.

“Our research project is a decisive step toward highperformance batteries that are more sustainable, cheaper, and more efficient,” says Graeber. “Sodium solid-state batteries could drastically reduce charging times and significantly improve the performance of mobile and stationary energy storage systems— an important contribution to decarbonisation.”

Plug Power, a global comprehensive hydrogen solutions provider, announced in June a significant expansion of its partnership with Allied Green Ammonia (AGA), with a new twogigawatt (GW) electrolyser opportunity tied to a sustainable fuels project in Uzbekistan.

The deal will be executed during the Tashkent International Investment Forum, where Sanjay Shrestha, president of Plug, and Alfred Benedict, managing director of Allied Green, will be on site for the official signing.

Plug’s electrolyser technology has been selected as the foundation of a new $5.5 billion green chemical production facility in Uzbekistan that will produce sustainable aviation fuel, green urea, and green diesel. The project is backed by the Government of Uzbekistan and further strengthens Plug’s position as the preferred electrolyser provider for global-scale decarbonisation initiatives.

Andy Marsh, CEO of Plug, said: “This latest expansion with Allied Green demonstrates how Plug is leading the global hydrogen transition with proven electrolyser technology and execution at industrial scale.

“With a 5 GW partnership now spanning two continents, this is a defining example of our ability to deliver for customers building the future of energy.”

Benedict said: “This agreement reflects our deep confidence in Plug’s team, technology and ability to deliver on bold, world-class projects. Together, we are creating meaningful momentum for global decarbonisation, first in Australia, now in Uzbekistan, and in future regions to come.”

The Uzbekistan project builds on Allied Green’s previously announced three GW electrolyser commitment for its flagship green ammonia facility in Australia. The project remains on track for a final investment decision in the fourth quarter of 2025.

Shrestha said: “This continued collaboration with Allied Green reflects Plug’s ability to support ambitious decarbonisation goals with scalable electrolyser technology. As we look to expand our relationship, we see strong alignment in our shared vision for accelerating the global shift to low-carbon hydrogen across industries and regions.”

Plug’s technology is deployed or under development across five continents, supporting customers in the industrial, transportation, energy and chemical sectors. As global companies invest in green hydrogen infrastructure, Plug continues to stand out as the most experienced and scalable partner—delivering the integrated hydrogen ecosystem necessary to power the energy transition.

Boston-based Electrified Thermal Solutions, a company in electrified heating and thermal energy storage solutions, and HWI, a member of Calderys, one of the suppliers of refractory products and services in the US, recently announced a strategic manufacturing partnership. The collaboration will develop and produce electrically conductive firebricks (E-bricks) which will be used in Electrified Thermal's Joule Hive Thermal Battery.

The Joule Hive Thermal Battery takes in electricity, then converts and stores it as heat through the E-bricks at temperatures up to 1,800°C (3,275°F), hot enough to power even the most demanding industrial processes. This capability allows customers to deliver consistent, high-temperature heat using renewable electricity at lower cost than traditional fossil fuels.

The E-bricks will be manufactured at HWI's production facilities, combining Electrified Thermal's technology, developed at MIT, with HWI's 160 years of refractory expertise. By leveraging this strategic collaboration, Electrified Thermal and HWI will demonstrate a viable pathway to reduce costs and mitigate emissions across energy-intensive industries. Electrified Thermal's first commercial-scale demonstration is expected to be operational in 2025, with the goal of deploying two gigawatts of electrified thermal power by 2030.

Daniel Stack, co-founder and CEO of Electrified Thermal Solutions, said: "Industrial heat represents one of the most challenging frontiers in the world's effort to address climate change. The majority of energy used annually for industrial heating worldwide comes from burning fossil fuels.

"To make a meaningful impact at global scale, we needed a solution that could be produced rapidly through existing supply chains. Our partnership with HWI transforms what could have been a manufacturing bottleneck into a powerful scaling advantage, allowing us to meet the multi-gigawatt demand we're

seeing from industrial customers worldwide."

Ben Stanton, director, Applications Technology for Thermal Markets, EEC and C/I Network, at HWI, said: "For generations, HWI has been developing advanced refractory solutions for the most demanding applications in industry. Electrified Thermal's E-Brick material is a breakthrough in refractory technology that maintains the high-temperature durability required by customers, while also generating the heat to run their processes.

“This partnership aligns perfectly with our Group's commitment to supporting our customers through their energy transition journey."

The industrial sectors increasingly seek viable pathways to reduce emissions while maintaining reliable performance, and this collaboration offers both benefits while providing opportunities to expand production throughput.

Bruno Touzo, global vice president of innovation and technology for Calderys Group, said: "Leveraging our extensive global network, deep expertise in refractory materials, and established supply chains, we are wellpositioned to support the design and rapid scale-up of E-brick manufacturing. This collaboration aligns closely with our broader innovation strategy and enables us to respond effectively to the growing demand from industries transitioning to cleaner energy solutions."

Electrified Thermal Solutions is pioneering the future of zerocarbon industrial heat. Developed at MIT, the electrically and thermally conductive bricks at the heart of Electrified Thermal's Joule Hive Thermal Battery (JHTB) represent a step-change improvement in electric heating technology in terms of hightemperature performance and durability. The company's JHTB generates, stores, and delivers unprecedented near-flame temperature heat (up to 1,800°C / 3,275°F), offering the most cost-effective, clean alternative to fossil fuels.

Egypt has discussed plans to develop a major industrial project focused on processing kaolin sand – a key raw material for the ceramics sector – as part of its wider strategy to expand domestic manufacturing and attract new investment into the minerals industry.

The initiative was discussed at a meeting chaired by Prime Minister Mostafa Madbouly at the government headquarters in the New Administrative Capital. The session was attended by Minister of Investment and Foreign Trade Hassan El-Khatib, Minister of Petroleum and Mineral Resources Karim Badawi, and INCOM Egypt Chairperson Hesham Sheta, alongside senior officials from both the public and private sectors.

The project, led by INCOM Egypt, will be based in the Suez Canal Economic Zone at Ain Sokhna. It represents a total investment of around 90 million and will focus on transforming Egypt’s extensive kaolin reserves into refined, high-value products used across industrial applications, including ceramics, paper and refractories.

According to government spokesperson Mohamed ElHomsany, the facility will incorporate advanced refining technologies that physically, chemically and thermally process kaolin to produce materials suitable for both domestic use and export. This approach is expected to reduce the country’s dependence on imported minerals while positioning Egypt as a competitive supplier in regional and international markets.