R.

R.

Welcome to the June 2024 issue of Board Recruitment, BoardProspects’ flagship publication dedicated to keeping you at the cutting edge of corporate governance and boardroom composition. Our goal is to provide you with the tools and knowledge to make your boardroom better.

In honor of Pride Month, we present our third special feature of 2024: “75 LGBTQ+ Board Members Making a Difference.” With an introduction by Fabrice Houdart, founder of the Association of LGBTQ+ Corporate Directors, this piece celebrates the achievements of LGBTQ+ leaders in corporate governance and highlights the path to better representation at the individual, corporate, and regulatory levels. On behalf of the BoardProspects team, we are grateful to Fabrice for his time and energy and to the Association for their partnership and their much-needed work to advance LGBTQ+ representation in the boardroom.

In addition to this special feature, you’ll find two insightful articles from our BoardRoom Resource Partners:

• Sharpening the Board’s Focus on M&A Due Diligence (Source: Protiviti): Enhance your understanding of effective due diligence practices in mergers and acquisitions.

• Midyear Observations on the Board Agenda (Source: KPMG): Stay ahead of the curve with KPMG’s expert analysis on midyear trends and priorities for board members.

• As always, we welcome your feedback and suggestions. Your input is invaluable in helping us tailor our content to better serve your needs. Thank you for being a valued member of the BoardProspects community.

Mark Rogers Founder and CEO BoardProspects

Low visibility and high volatility aren’t new operating conditions, by any means. But the assumptions that have long driven corporate thinking—cost of capital and sources of energy, geopolitical norms and trade flows, the limits of technology and the security of data, workforce needs and expectations, and traditional competitive threats—continue to be shaken, some profoundly. In short, the fundamentals are changing.

Approaching midyear, business leaders are bullish on growth and the opportunities ahead. Some 87 percent of US CEOs are highly confident in the growth prospects of the US economy, 78 percent are highly confident in the growth of their company, and most expect to increase headcount over the next year.1 At the same time, the macro forces of generative artificial intelligence (GenAI), climate change, a multipolar geopolitical landscape, and the erosion of trust and healthy public discourse

are sobering the outlook and prompting deeper boardroom conversations about risk and strategy, talent, and what the future will look like for the company, corporate America, and the country. The following observations and insights— based on our ongoing work with directors and recent conversations with business leaders and luminaries at the 2024 KPMG Board Leadership Conference2—may be helpful as boards calibrate their agendas for the second half of 2024.

Globalization’s pendulum swing

The continuing pull-back on supply chains is likely just one indicator of a broader pendulum swing that’s reshaping the full-throttle globalization of recent decades. Shifting from the “cheaper-faster” strategies enabled by highly complex, decentralized supply chains to greater or even hyperlocalization and control of a company’s networks—suppliers, services, data/information—is clearly about resilience of the company. But concerns about the resilience of national economies—and of the global business arena at large—are also driving the momentum toward more centralized and local supply chains.

National industrial and security policies and “country-first” models are taking center stage, and de-risking and friend-shoring (particularly in strategic sectors like chip technology and critical minerals) are hedges against geopolitical shocks and exposure to arbitrary local rules. The recognition that the long run of growth driven by cheap capital, labor, and energy is giving way to the realities of a more challenging— and costlier—future is prompting conversations about the resilience of the global economic system.

As this globalization reset unfolds, companies will face pressing questions. Is the company prepared to operate in a higher-cost (of capital, green tech/energy, labor) environment?

What is the right balance between operating efficiently, maximizing

growth, and ensuring resilience? For corporate America more broadly: How will companies use their agency and creativity to help create value not only through consumer-driven growth, but to help build America’s economic and industrial assets and capabilities— including a healthy, educated workforce— to stay competitive in an increasingly multipolar world?

GenAI’s trajectory

“Go faster, but slow down” is a prevailing tension with GenAI adoption, perhaps second only to distinguishing the hype from the reality. It is quickly becoming clear that GenAI will transform the way we work, with substantial near-term gains in efficiency (as one speaker noted, productivity is one of the killer apps of GenAI). Longer term, the second— and third—order effects may produce a seismic shift in societal structures and change political and economic participation, with macro implications for business and society more generally.

While the trajectory of GenAI deployment is still uncertain, for many companies, 2024 will be the year they move from experimentation to larger-scale rollouts; 2025 may be the year of significant measurable results in workforce productivity; and in 2026, we may start to see some breakaway winners and losers, with significant business model implications and competitive fallout. (For more on where directors see GenAI heading at their companies, see our pulse survey.)

The companies that will excel in using GenAI technology at scale understand that it’s also a leadership journey. Fundamentally changing what people do every day and how they work will require leadership, as well as skills and knowhow to assess the company’s processes and workflows and to decide where to insert GenAI to improve productivity. Successful adoption will also require the refinement of risk management frameworks to mitigate critical risks related to inaccurate data and results, bias and hallucinations, intellectual property, cybersecurity, data privacy and compliance, reputation, and talent.

Starting with an inventory of where GenAI is used, boardroom conversations are focusing on the reason(s) GenAI is being used, who has algorithmic accountability, whose data the algorithms are being trained on, how the company is monitoring for data bias, and how third- and fourth-party risks are being managed.

Three broader issues also loom for society: the use of GenAI tools to create mis–, dis–, and mal–information (MDM), which can critically undermine trust in institutions and the rational contest of ideas; the increasing energy needs of GenAI—for computing and cooling systems—which adds a layer of complexity to the fight against climate change; and workforce-related issues such as upskilling, reskilling, and downsizing.

Soft landing or no landing?

A stunningly resilient economy over the past year has buoyed the outlook for

continued growth in the year ahead, though potential shocks and big question marks are tempering optimism: fragile supply chains—the massive cargo ship impact causing the collapse of the Francis Scott Key Bridge in Baltimore, Maryland, being a recent tragic example; escalating tensions in the Middle East; the outcome of the US elections and future outlook on US debt (and the US dollar); simmering inflation; record levels of corporate cash on the sidelines and the implications of 2018-vintage debt coming due; the startling emergence GenAI and discerning hype from reality in the search for productivity gains.

Markets still dislike uncertainty, but investors are perhaps becoming more accustomed to it, with expectations that companies lean into more rigorous scenario planning. Interpreting signs from the Fed—soft landing? No landing? Cutting rates to stimulate or to dial back restrictions?—is still part of the calculus, but determining where a company will place its biggest bets for the months ahead will increasingly depend on having a clear-eyed view of where the global political economy is headed. (See the latest economic analysis from KPMG Economics.)

The business of climate: A bumpy ride ahead

One of the defining characteristics of the next few years will be the messy and deeply contested transition away from fossil fuels. As we note in Climate in context: Geopolitics, business, and the board, a KPMG/ Eurasia Group paper, 2024 may be the coolest year of the rest of our lives. The urgency of climate risk continues to escalate as tangible impacts are felt in markets around the world, from drought hampering shipping through the Panama Canal to failing water supplies, wildfires and other extreme weather events, growing food scarcity, and migration crises.

Three factors are likely to determine whether/when the moment of disruption has arrived: the availability of viable alternatives, incentives to implement them, and readiness of the marketplace to adapt and accommodate them.

For much of the private sector, this tipping point and the transformational opportunities are already in view. Focused on growth potential and longerterm value creation—and pressed by investors and regulators— corporate capital is quickly emerging as a primary engine in the energy transition, with investments, knowhow, and innovation. Although the end point—a low/postcarbon economy—may be clear, expect a bumpy ride. Geopolitical contention, fragmented regulatory regimes and disclosure frameworks, technological innovations (and lagging infrastructure), and trade-offs between near- and

longer-term performance are making energy transition an epic undertaking. Astute boards are deepening their climate conversations.

The complexity of issues factoring into talent and workforce well-being should result in chief human resource officers (CHROs) having a prominent voice and seat in the C-suite and in the boardroom. Among the most pressing challenges are continuing changes regarding where work gets done (e.g., remote work, return to the office); the impact of GenAI on how work gets done; growing employee unrest and the resurgence of labor unions; and intensifying scrutiny of diversity, equity, and inclusion (DEI) efforts.

In the past, technological change primarily impacted blue-collar workers, but with the arrival of GenAI, it’s whitecollar workers who are also anxious about job security. Benefitting from the productivity increases GenAI promises while maintaining a productive and engaged workforce will hinge on having clear plans to reskill, upskill, and crossskill employees, being honest about how their work is evolving, and offering a path for career development. Helping employees understand the mutual benefits of working with GenAI can be a helpful frame for the challenging workforce conversations and cultural changes ahead. As one speaker noted, “AI plus HI [human intelligence] equals the ROI.”3

The competition for talent continues to intensify, with the added challenges of evolving workforce demographics, employees from different generations working side-by-side, and many employees looking for something other than money and security from their jobs. Workplace wellness and wellbeing programs, including flexibility in where and how work gets done, are even more important to employees today than several years ago.4 And DEI (by whatever name) continues to demand leadership’s attention. In a country that is now as diverse as ever—yet also as divided as ever—the notion that increased diversity would be “the fix” is giving way to the understanding that inclusion is the decisive factor. Business leaders need to understand the mood of employees (and unions) and what motivates them, and respond in ways that lead to a strong corporate culture built on mutual trust and a vision for long-term value creation.

The regulatory front: Climate, GenAI, NOCLAR, cyber

With the SEC, California, and the European Union (EU) setting the pace, policymakers and regulators continue to sharpen their focus on climate change and sustainability issues, cybersecurity, and GenAI.

• On climate disclosures, the SEC’s order staying the final rules, pending completion of judicial review of the multiple challenges to the rules by the United States Court of Appeals for the Eighth Circuit, has created uncertainty

around the final rules,5 particularly given that it may take some time for the litigation to be resolved, but the scheduled compliance phase-in dates have not changed. This uncertainty poses a significant challenge for larger accelerated filers, whose earliest compliance obligations begin January 1, 2025 (for calendar-year filers). Many companies are also assessing whether they are subject to the California climate laws as well as EU and other international standards, some of which require reporting Scope 3 greenhouse gas (GHG) emissions data and other disclosures that are more extensive than what is required by the SEC’s rule.6

While the stay of the SEC final rules may reduce the sense of urgency for some companies, a “pens down” posture would likely be shortsighted given the proliferation of new and complex climate disclosure mandates, investor demands, and the SEC’s enforcement actions and comment letters. A key question for boards is whether management has the necessary talent, resources, and expertise—internal and external—to gather, organize, calculate, verify, and report the necessary GHG emissions data, and to develop the necessary internal controls and disclosure controls and procedures to support these and other 10-K disclosures and financial statement disclosures. For many companies, this will require a cross-functional management team (climate team) from legal, finance,

4. Stephen Miller, “Employers Broaden Well-Being Programs”, SHRM, September 4, 2019.

5. KPMG LLP, SEC stays its climate rule pending judicial review, Defining Issues April 2024.

6. KPMG LLP, Understanding the SEC’s climate rule, Defining Iusses, April 2024.

sustainability, risk, operations, IT, HR, and internal audit. At larger public companies, this team may be led by an ESG controller. Identifying and recruiting climate and GHG emissions expertise for a climate team—which may be in short supply— and implementing new systems to automate the data-gathering process will be essential.

• The AI regulatory landscape is developing at a brisk pace at the local, state, national, and global levels. Perhaps most notably, the EU’s AI Act is the first comprehensive attempt to regulate AI. It has broad, extraterritorial reach, covering any entity that is “placing on the market” or “putting into service” an AI system in the EU.7 Currently in the final stages of adoption, the EU AI Act takes a riskbased approach: AI uses deemed to pose an “unacceptable” level of risk (such as biometric categorizing and behavioral manipulation) are banned and other uses are placed within a risk tier, from high to low, with corresponding levels of compliance obligations. Penalties for violations are significant. Companies should understand whether they are subject to the EU AI Act and consider benchmarking their risk and compliance practices against it, as the EU AI Act is likely to be used by other regulators in crafting their own AI regulations.

• The PCAOB’s proposal on auditors’ responsibilities related

to noncompliance with laws and regulations (NOCLAR) should be closely monitored, as it would make sweeping changes to auditing standards. While there are differing interpretations of what the language would require, it has the potential to materially increase the scope of the audit by effectively requiring auditors to audit legal and regulatory noncompliance and alert appropriate members of management and audit committees when instances are identified.

• “Norms and expectations” are beginning to play out on the SEC’s final cybersecurity disclosure rules, 8 which require that companies report a material cyber incident on Form 8-K within four business days after determining that a cyber incident is material. Noting that some companies have voluntarily reported immaterial cybersecurity incidents on Form-8-K, some in the legal community have cautioned that “overdisclosure” can cause confusion and is not welcome by the SEC staff. Unlike most 8-K events, a cyber incident requires an ongoing evaluation of materiality.

7. Artificial Intelligence Act: MEPs adopt landmark law, March 13, 2024.

8. KPMG LLP, SEC finalizes cybersecurity rules, Defining Issues December 2023.

Digital threats and cyber readiness

Cybersecurity risk continues to mount, with GenAI tools aiding hackers in both the sophistication and efficiency of their efforts. The proliferation of criminal hackers, malware developers, and nation-state actors, the ubiquity of ransomware attacks, and ill-defined lines of responsibility for data security— among users, companies, vendors, and government agencies—are keeping cybersecurity risk high on board and committee agendas.

Readiness and resilience have become the critical watchwords for companies and boards today, recognizing the need not only for a robust cyber incident response plan, but also periodic tabletop exercises to simulate how a cyber incident might unfold.

The company’s cyber incident response policies and procedures should be reviewed and updated, as necessary. This would include a clear delineation of responsibilities of management’s cybersecurity and risk management teams, management’s disclosure committee, the legal department, and any outside advisors, as well as escalation protocols, and procedures for determining materiality and for the preparation and review of disclosures. Escalation protocols should also address when the board is notified and how internal and external communications are handled.

The ongoing threat posed by insiders— whether disgruntled or disengaged employees, hostile state-actors, or

third-party vendors offshore and under the radar—should also prompt regular assessment of the company’s process for deterring, detecting, and effectively responding to insider breaches.

Getting ahead of mis–, dis–, and mal–information (MDM)

The growing prevalence of MDM is also hitting the boardroom radar given the significant reputational risks it poses. Inaccurate information—no matter the type, source, or motive—continues to undermine trust and exacerbate polarization. GenAI technology gives the purveyors of MDM the ability to understand what resonates with their target audience and provides the tools to generate content—including deep-fake images, narratives, and voices—that is convincing enough to damage corporate reputations.

To get ahead of MDM, a company should first understand what disinformation narratives can materially impact the business, and who might be likely purveyors of MDM. What will cause investors, employees, or customers to lose trust in the company or its products and services? Second, what capabilities and processes does the company have in place (risk management, corporate communications, investor relations, corporate counsel) to prevent or counter disinformation? Having a clear narrative for the marketplace—and building a surplus of trust with customers—are essentials.

Talent, strategy, risk—a different TSR? The seismic changes and disruptions facing corporate America that were discussed at our conference are causing many boards to rethink their board oversight structure and processes, and how they are spending their time.

Some leading business thinkers are challenging the traditional measure of TSR (total shareholder return), emphasizing a reorientation of the board’s focus to help ensure robust attention to talent, strategy, and risk—a different take on TSR.9 These factors, they argue, determine more than any others whether a company creates long-term value.

Board conversations with the CHRO and CEO about talent typically take place during succession planning, but the deeper question for boards is how the organization handles the broader challenge of talent management. Getting out in the field to meet the company’s up-and-coming talent is more important than ever; talking with employees will provide directors with a ground-level view and potentially different messages from those they hear from management in the boardroom. The transformative developments in GenAI and related digital technologies aimed at increasing productivity should be prompting sharper board attention to employee training.

Major technology investments are only as effective as employees’ ability and propensity to use the tools. Given the current risk environment, which can seemingly impact strategic plans overnight, boards should vet the strategy

at every board meeting. Inextricably linked to strategy and talent, of course, is risk—particularly mission-critical risks, risk appetite, and risk culture—which permeates the enterprise.

The world we see today, as one keynote speaker noted, has been developing for about 20 years—all in plain sight: Russian aggression, flashpoints and conflict eruptions in the Middle East, China’s rise, the resurgence of American isolationism, and a planet in the danger zone on climate. Taken together, these developments— with GenAI as a gamechanging variable—have made for a world that hasn’t been this unpredictable since World War II.

Having better situational awareness to support scenario planning and risk assessment will be vital to operating and strategic decision-making. To that end, understanding historical context and having geopolitical expertise in boardroom conversations can be illuminating. As a case in point, political polarization in the US historically has been as bad as (if not worse than) it is today. What’s different is the dysfunction and paralysis of the policy-making process. For America’s allies and the rest of the world, such paralysis means uncertainty and leaves little choice but to hedge—with other military alliances, economic/trade relationships, and currencies. What are the implications for a company’s operating footprint in an increasingly multipolar world?

To be sure, as a nation of risk-takers, America’s innovative muscle and ability to think differently continue to spark breakthroughs—from GenAI and green technologies to DNA science and privatesector space travel. How competitive America will continue to be, time will tell, and the post-election landscape will likely provide the next major signposts. But it’s clear that leadership from corporate America’s boardrooms will be a vital factor in driving the risk-taking, guardrails, and resilience that business and society will need in the months and years ahead.

Ranked No. 1 in the shareholder activism defense league tables of Bloomberg and FactSet for 2022, as well as Refinitiv for H1 2022

Named “Activist Defense Adviser of the Year” by The Deal in 2022

Chambers USA 2022 ranks Sidley’s Shareholder Activism and Corporate Defense as Band 1 (listed as Corporate/M&A Takeover Defense)

Proxy fights and activist situations are bet-the-company situations, and there is no time for “training on the job.”

Over the past five years, Kai Liekefett and Derek Zaba, the co-chairs of this team, have represented companies in more than 100 proxy contests, several hundred other activist campaigns, and dozens of settlements more than any other corporate defense law practice in the world.

TALENT. TEAMWORK. RESULTS.

Kai Haakon E. Liekefett

New York

kliekefett@sidley.com

Derek Zaba Palo Alto/New York dzaba@sidley.com

sidley.com

By David Haufler and Torin Larsen

Whether an acquisition is a stand-alone, complementary entity, or an integration, the due diligence process is undergoing a paradigm shift due to the higher cost of funding and the impact of failed transactions. Boards should expect a more aggressive focus on due diligence.

How has the due diligence process changed in recent years? For sure, the complexity of certain topics, such as environmental impacts, the supply chain, cybersecurity, and data privacy, has increased. When COVID-19-triggered border closings and government lockdowns precluded in-person meetings, the data-gathering process underpinning dealmaking was driven by videoconferencing. That practice continues in the post-pandemic world to increase efficiency, consistent with the high-touch, high-tech hybrid approach so prevalent in business.1

But the more important shift is due to

cheap money becoming a relic of the past. It enabled buyers to raise funding to execute deals, putting sellers in an advantageous “sellers’ market” whereby they could emphasize speed and competition by limiting the time available for buyer due diligence. As the cost of capital rises, however, sellers’ influence over due diligence wanes, and the mergers and acquisitions (M&A) space shifts toward a “buyers’ market,” which allows buyers to exert more control over the scope of the due diligence process.

Thus, traditional due diligence has given way to a risk-based approach that considers the higher cost of capital and potential issues that could frustrate the combined entity’s achievement of the value expected from the acquisition. This shift in due diligence is toward a deeper dive into several areas through more focused questions.

In the discussion below, our intention is not to add yet another list of questions

1. “Adapting to the ‘New Normal’: Best Practices in M&A Due Diligence,” by Richard Summerfield, Financier Worldwide, June 2022: www.financierworldwide.com/adapting-to-the-new-normal-best-practices-in-ma-due-diligence.

to the literature. Rather, our focus is to suggest the most important questions directors should ask during the due diligence process in specific areas. Fundamental to the process is the “primary asset” question: What are we buying? Answers to this question influence so much of the deal preparation, due diligence, and integration and separation planning and execution processes that it must be answered early and repeated often.

The M&A focus is driven by the “what,” as needs can shift dramatically depending on the primary asset being acquired (e.g., technology, customer relationships, intellectual property, workforce, licenses, and contracts). Key questions include:

• What is the primary asset acquired in this transaction? How does it support our strategic objectives? Are we buying capabilities or seeking cost synergies?

• What asset-specific considerations do we need to make? How is the due diligence process affected by these considerations?

• Could we develop this primary asset more cost-effectively if we built it ourselves?

With this context, we address six areas of interest. We acknowledge that there may be others.

Supply chain resilience. With the pandemic exposing the fragility of global supply chains, third-party evaluations have become increasingly important. In this post-pandemic world,

there is a need to evaluate all aspects of a supply chain that the target may use going forward. This means careful assessment of worst-case scenarios and structuring the diligence questions to focus on them, given the target’s supplier and third-party dependencies, and reviewing documented, actionable response plans and established accountabilities for the execution of those plans.

The M&A focus is driven by the “what,” as needs can shift dramatically depending on the primary asset being acquired (e.g., technology, customer relationships, intellectual property, workforce, licenses, and contracts).

Relevant questions include:

• Who are the target’s key suppliers, and do vulnerabilities exist within the supply chain looking all the way upstream to second- and thirdtier suppliers, considering financial stability, concentration risk, and potentially disruptive bottlenecks to inbound logistics?

• What is the target’s global footprint, and how could it impact the supply chain? Where are materials-handling processes being administered? What contractor or talent relationships are in place, and how do they work together with the materials supply chain?

• Are there any sustainability or social responsibility issues embedded in the target’s supply chain that are not aligned with our company’s values and could present post-acquisition reputational issues?

• Are there potential value-creating synergies between the target’s supply chain and our supply chain that will facilitate future growth?

• If the transaction is an integration, can major supplier contracts be voided post-acquisition to realize expected savings and efficiencies?

• What are the target’s other significant third-party relationships, and do the contractual relationships with them present any post-acquisition concerns?

Due diligence of talent can identify risk, enhance transaction value and provide integration clarity and direction.

Talent pipeline and retention.

Due diligence of talent can identify risk, enhance transaction value, and provide integration clarity and direction. While attrition rates have returned to historical pre-pandemic averages2, companies are asking how they can best identify and retain talent during due diligence rather than after the deal is consummated. Talent retention can make or break a deal. Relevant questions include:

• Who are the target’s top performers who harbor the experience and institutional memory needed to ensure post-acquisition success? Among them, who presents the greatest flight risk, and what steps should we take sooner rather than later to retain them? Are any of these performers of such value to the business that a non-compete agreement is needed before the deal is signed? If the target represents that noncompetes exist, have we validated that representation? Are the non-competes in place valid under existing legal constraints?

• Is there sufficient bench strength to facilitate succession planning?

• How does the target’s culture differ from ours? What are the workplace expectations (e.g., remote, hybrid, inperson)? What steps should we take to accelerate the integration process in assimilating the two cultures and enabling effective team-building?

• Do the target’s employee contracts include contractual obligations that could impact deal-pricing negotiations (e.g., change-of-control clauses, termination payments, or mandatory outplacement costs)? Are the appropriate costs accrued on the target’s balance sheet?

Environmental, social, and governance (ESG):

Evaluating the ESG performance of M&A targets has become an integral part of the due diligence process,

2. “The ‘Great Resignation’ — a Trend That Defined the Pandemic-Era Labor Market — Seems to Be Over,” by Greg Iacurci, CNBC, May 31, 2023: www.cnbc.com/2023/05/31/great-resignation-trend-defining-pandemic-era-labor-market-seems-over.html.

particularly regarding environmental issues. The focus is shifting from a qualitative perspective that considers the target’s stated values, marketing communications, and other external reports to a review of its ESG quantitative performance. It should focus on identifying ESG initiatives and issues that present significant post-acquisition opportunities and risks to the combined company’s bottom line, reputation, and external reporting. Relevant questions include:

• Does the target have an ESG strategy? What ESG procedures, policies, processes, and disclosure controls does it have in place?

• What ESG metrics does the target create and monitor?

• What is the target’s track record related to ESG? Whether it is negative or positive, how does that record impact the deal?

• Are there environmental, legal, and regulatory exposures that the buyer would have to assume postacquisition?

The focus should be on identifying ESG initiatives and issues that present significant post-acquisition opportunities and risks to the combined company’s bottom line, reputation and external reporting.

Cybersecurity and data privacy: Due diligence cannot ignore cybersecurity issues. Too often, these issues lie hidden in the weeds. Here are two examples to illustrate this point:

• After acquiring Starwood Hotels in 2016, Marriott discovered a data breach within the Starwood guest reservation database in 2018 that had been ongoing for two years prior to the acquisition. Having exposed the personal information of about 500 million guests, the breach led to regulatory investigations, lawsuits, and the loss of customer trust.3

• Prior to closing its acquisition of Yahoo seven years ago, Verizon discovered two massive cyberattacks that resulted in a $350 million reduction in the acquisition price.4

The target’s data management strategy and processes are also important considerations. The risks, associated penalties, and fines could amount to significant unrecorded liabilities on the target’s balance sheet. For example, following the Marriott breach mentioned above, the United Kingdom levied a fine of £99 million for violation of British citizens’ privacy rights under the European Union’s General Data Protection Regulation, citing the company’s failure to exercise sufficient due diligence on Starwood’s IT infrastructure.5

3 “Marriott Data Breach FAQ: How Did It Happen and What Was the Impact?” by Josh Fruhlinger, CSO, February 12, 2020: www. csoonline.com/article/567795/ marriott-data-breach-faq-how-did-it-happen-and-what-was-the-impact.html.

4 “Verizon, Yahoo Agree to Lowered $4.48 Billion Deal Following Cyber Attacks,” by Anjali Athavaley and David Shepardson, Reuters, February 21, 2017: www.reuters.com/article/idUSKBN1601EK/.

5 “Marriott Data Breach FAQ: How Did It Happen and What Was the Impact?”

Relevant questions pertaining to cybersecurity and data privacy due diligence include:

• Does the target have a strategy to identify and mitigate cyber breaches? Has it invested sufficiently to execute that strategy effectively?

• If cybersecurity risks are present in the target’s systems and infrastructure, are our decisions regarding the impact of these risks on the deal being made at the right levels? Given the time frames and resource constraints, how are we avoiding poor decisions?

• Given our assessment of the target’s threat landscape and cybersecurity capabilities, have we established a post-acquisition strategy for addressing identified and potentially unidentified risks? What preventive measures do we have in place to reduce the risk of the acquired environment contaminating our company’s existing systems and data?

• Do we have appropriate insurance underwriting for the transaction to cover risks that weren’t disclosed or identified?

• What is the target’s policy for collecting, processing, storing, using, sharing, archiving, monetizing, and destroying personal data and for compliance with applicable data privacy laws and regulations?

Compliance with laws and regulations. While this topic is implicit in the areas discussed above, it merits a separate mention because companies acquiring a business ordinarily assume its unrecorded liabilities. Accordingly, a due

diligence review of the compliance function is in order. Relevant questions to ask include:

• What is the target’s history of compliance with laws and regulatory requirements, including its regulatory strategy, internal policies, results of internal and external audits and regulatory reviews, and overall compliance culture?

• What are the company’s protocols and processes for remediating control deficiencies and addressing new regulatory requirements?

• Are there aspects of the target’s operations that expose it to corporate misconduct (e.g., the nature of its operations, where it operates, or unrealistic performance incentives)? Have there been instances of corporate misconduct in the past?

• Do we have legal advisers who can provide input on compliance, antitrust, securities, and other issues germane to the transaction?

Realizing the true value of a deal relies upon successful integration and utilization of the target acquired. This reality places a premium on day-one preparation and readiness.

Integration effectiveness. With expectations of a 2024 rebound in M&A activity after a decade-low 20236, is the company’s readiness sufficient to engage in the process? Realizing the true value of a deal relies upon successful integration and utilization of the target acquired. This reality places a premium on dayone preparation and readiness. Relevant questions to ask:

• Have we evaluated prior acquisitions and assessed the effectiveness and efficiency of our integration process? What lessons have we learned? If this is our first time executing a deal, do we have the right knowledge and advisers in place to complete the integration successfully?

• Are there aspects of the target’s operations to be integrated into our operations that warrant planning and preparations before the deal is consummated so that the integration process hits the ground running post-acquisition (e.g., the workforce, key processes and systems, and sources of supply)?

• Have we allocated the appropriate resources needed to execute an integration? Is our leadership team for executing the integration and each functional workstream defined?

• What synergies and dis-synergies are planned? Were they appropriately considered in the purchase price? Do our integration plans enable synergy capture?

• What major changes are we expecting, and what change management plans are in place?

In addressing the above areas, it is important to keep in mind the sustainability of the target’s governance plumbing. In this age of disruptive change, unexpected developments are the norm. Over the last two to three years, how has management reacted to unexpected speed bumps? How did they manage a crisis event? Penetrating questions addressing the resilience of the organization in responding to challenging issues and the unexpected can offer transparency regarding the target’s leaders and their values and behavior under fire.

While due diligence focuses on identifying risks, confirming relevant financial information and other facts, verifying or identifying critical deal points, reviewing existing contracts, and establishing a road map to address a transaction’s core issues via integration or separation planning, there are important questions and activities pertaining to the above areas that are germane after the deal is completed. These questions present opportunities for post-acquisition follow-up. We explore some of these questions in a supplement to this issue of Board Perspectives: www.protiviti.com/US-en/ newsletter/bp175-board-focus-mergers-acquisitions-supplement.

• What are the costs of integrating the target, and do they drive any frontend or pricing impacts?

6. “Dealmakers See Rebound After Global M&A Volumes Hit Decade-Low,” by Anirban Sen and Anousha Sakoui, Reuters, December 21, 2023: www.reuters.com/markets/deals/dealmakers-see-rebound-after-global-ma-volumes-hit-decade-low-2023-12-21/.

By Fabrice Houdart, Executive Director of the Association of LGBTQ+ Corporate Directors

At the Association of LGBTQ+ Corporate Directors, we firmly believe that giving visibility to diverse LGBTQ+ Board talent is crucial to ensuring Boardroom excellence. In celebration of Pride Month 2024 and the second anniversary of the Association (created in June 2022), we are tremendously proud to join forces with our partner, BoardProspects, to present the inaugural list of “75 LGBTQ+ Board Members Making a Difference.”

This list features an elite group of Board leaders selected for their unique talents, expertise, and grit, which they employ in corporate boardrooms across various industries in the United States. These board members best illustrate our view

that LGBTQ+ Board Diversity is not a “woke” agenda but a business one. The State of LGBTQ+ Representation Despite growing social acceptance and fairness in business, LGBTQ+ representation in the boardroom remains strikingly low. As highlighted in our 2023 LGBTQ+ Corporate Board Monitor, openly LGBTQ+ individuals occupy just 0.6% of Fortune 500 board seats and 1.2% of NASDAQ ones, while surveys show that LGBTQ+ identities represent a striking 7.6% of Americans1. This underrepresentation is not due to a lack of talent but rather systemic barriers and biases that have persisted for decades.

Our past research has identified three primary barriers to LGBTQ+ representation in the boardroom:

1. The Lost Generation: Many LGBTQ+ leaders in their 60s and 70s faced significant discrimination early in their careers, preventing them from reaching the top echelons of the business world. Additionally, the HIV/ AIDS epidemic had a devastating impact on the subsequent generation of gay men, further depleting the pool of potential board candidates.

2. Industry Biases: Historically, LGBTQ+ professionals were concentrated in so-called “gay-friendly” industries like entertainment and fashion. Although this has expanded to include law, finance, and tech, many industries still lack LGBTQ+ representation. For example, manufacturing companies listed on the NASDAQ have less than 0.2% of Board Members who selfidentified as LGBTQ+ in the Board Diversity matrix included in their proxies.

3. The Network Gap: Many LGBTQ+ individuals have been excluded from traditional networking spaces, the “Country Club effect,” which is critical for board recruitment. This exclusion has created a vicious cycle of underrepresentation.

Despite these challenges, ample LGBTQ+ board talent is available. Among the 600+ members of our Association, 24% have CEO experience, 60% C-suite experience, and 59% have prior board experience. However, these qualified candidates often must be made aware of nominating and governance committees.

To break this cycle of exclusion, we must focus on:

Governance

: LGBTQ+ candidates must proactively seek visibility and networking opportunities within the governance space.

Company Initiatives: Boards and recruiters must actively seek out LGBTQ+ candidates and commit to including at least one LGBTQ+ individual in their nominee pools.

Regulatory Support: Policies like the Nasdaq Board Diversity Rule, which requires companies to disclose the diversity of their boards, can be gamechangers in promoting LGBTQ+ inclusion, and we would love companies to adopt these disclosures voluntarily.

The 75 individuals identified by BoardProspects on this year’s list are not just making a difference in their respective companies but also paving the way for future generations of LGBTQ+ leaders. Time and time again, young professionals have told us how

meaningful it is to read about LGBTQ+ talent at the top of business and their contributions. Their presence in the boardroom challenges the status quo and demonstrates the value of diverse perspectives in corporate governance.

As we celebrate these exceptional directors, we also acknowledge that equity in the boardroom is still a work in progress. We are committed to continuing our efforts to amplify LGBTQ+ voices and ensure that boardrooms across America reflect our society’s rich diversity.

Please join us in congratulating the 2024 “75 LGBTQ+ Board Members Making a Difference” and supporting our mission and that of BoardProspects to create more inclusive boardrooms for all.

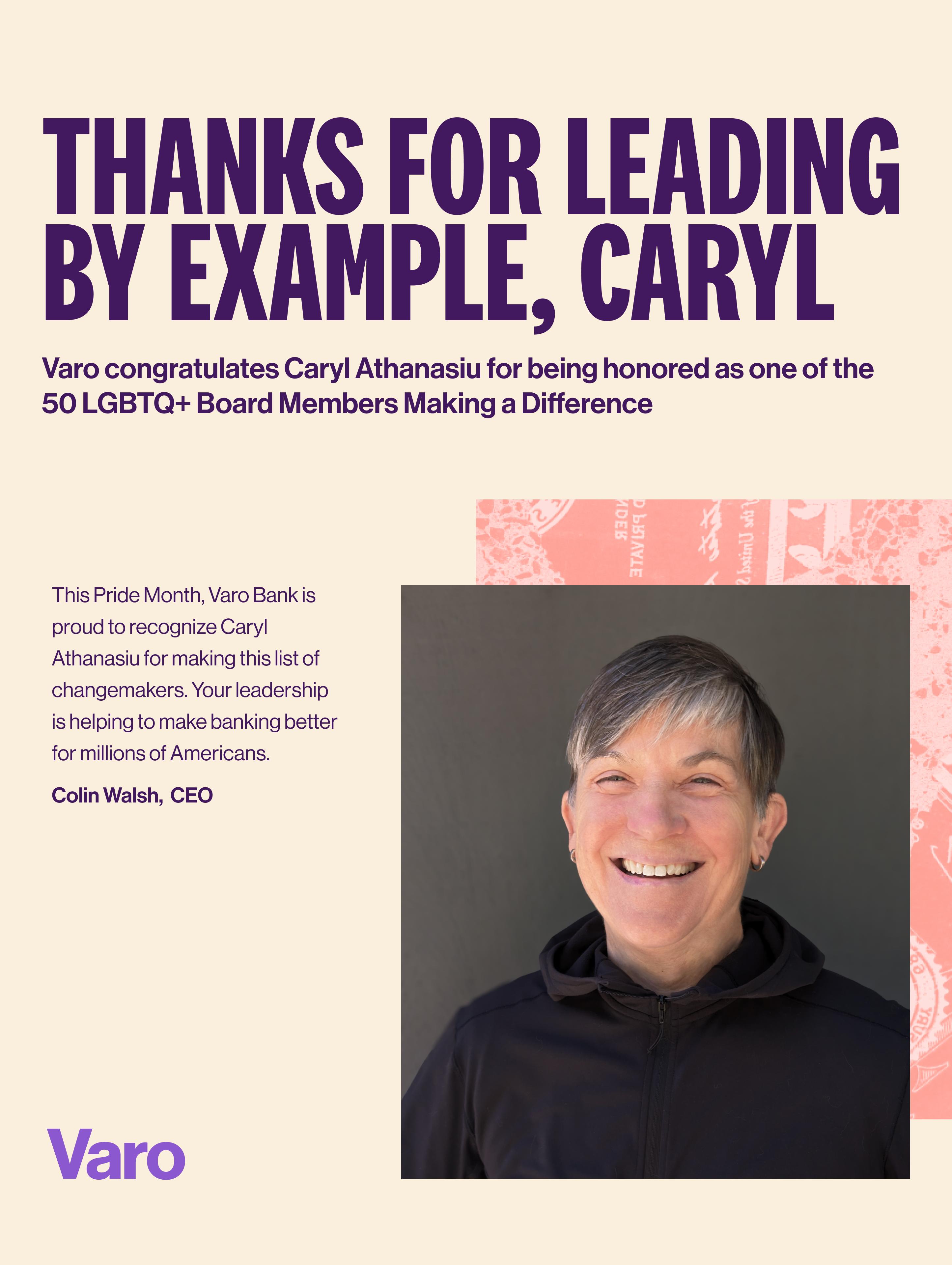

Caryl Athanasiu is a former C-suite banker with Wells Fargo serving as Chief Risk Officer for Wholesale Banking, Enterprise Chief Operational Risk Officer, Head of Corporate Banking (west), and leading enterprise functions including strategic planning and corporate finance. Athanasiu also worked with McKinsey as a Senior Advisor on risk management and payments.

“Caryl is a builder. She engages deeply with the business, team and fellow directors to help achieve high growth, high integrity outcomes. Caryl brings a rare combination of deep financial industry experience and entrepreneurship to her role. She also brings high energy and heart, never leaving any doubt that she is all in.”

Julie Averill is the Chief Information Officer and Executive Vice President at lululemon, a global athletic apparel company. Prior to joining lululemon, Averill served as REI’s first Chief Information Officer. Before REI, Averill spent a decade at Nordstrom where she held several key positions on the company’s IT leadership team.

“Julie was selected for her remarkable leadership in technology within the retail sector. Her previous roles as REI’s first CIO and a decade of IT leadership at Nordstrom demonstrate her significant impact in driving digital innovation. Julie’s extensive experience with leading household name companies makes her a distinguished leader in corporate governance.”

– THE BOARDPROSPECTS TEAM

Current Boards: Ad Fontes Media, Elemeno Health and The Contemporary Austin

Previous Boards: Hideaway Report, Mission Capital, and TextureMedia

Crista Bailey is the Chief Business Development Officer at Him For Her, a social impact venture amplifying networks by connecting CEOs and investors with exceptional, under-networked board talent. Prior, she led turnarounds and exits for two consumer brands, Andrew Harper’s Hideaway Report and TextureMedia. Crista spent more than two decades in entrepreneurial, operating roles leading, launching, reviving and growing emerging consumer brands and reinvigorating iconic ones, including with Ticketmaster Citysearch, IAC, Austin City Limits, Lollapalooza, Nestle, and J Walter Thompson.

“When Crista first joined she had a zoom profile with a power pose-- huge smile and arms up! It perfectly captured what Crista brought to our board: An informed enthusiasm and energy, imbuing our company leadership team with confidence. Crista helped us build the right culture, focus on the right KPIs, and, as a true independent board member, balance the interests of all parties in even the toughest of times.”

– ARUP ROY-BURMAN, Founder at Elemeno Health

Dame Inga Beale is the former Chief Executive Officer at Lloyd’s of London, the global insurance market. Before joining Lloyd’s, Inga was Group CEO of Canopius, an insurance company with its principal operations at Lloyd’s. Prior to that she was a member of the Global Management Board of Zurich Insurance Group in Switzerland. Earlier roles include Group CEO of Swiss reinsurer Converium (now SCOR), and a variety of international leadership positions for GE Insurance Solutions where she was based in the UK, USA, France and Germany. She started her career with Prudential in London.

“Working with Inga as a fellow board member is a privilege. Inga is a versatile person, having a clear view, sometimes out of the box. And that is what you like in a diverse supervisory board. Inga is also a very nice person to work with and does really make an impact. A power lady, a team player, always in a constructive way.”

– ROB LELIEVELD, Board Member at NN Group N.V.

Current Boards: Crawford & Company (USA), NN Group NV (Netherlands), and Willis Towers Watson plc (Ireland)

Previous Boards: Mediclinic International plc (UK)

Current Boards: ZimmerBiomet & Leap Guaranty

Previous Boards: Principal Financial Group, Servo Group PLC, United Technologies, URS, and Telular

Betsy Bernard is the former President of ATT. Prior to that role she held the position of EVP and Division President at Qwest/USWest, SBC, Pacific Bell, as well as CEO of Avirnex Communications.

“Betsy is a fantastic board member, bringing decades of operational experience and leadership. She is always well prepared and has great insights. I truly value Betsy as a peer and a friend!”

– TESSA

HILADO, Board Member at Zimmer Biomet

Paula Boggs fronts the “Seattle-Brewed Soulgrass” Paula Boggs Band, is a voting member and governor of The Recording Academy’s Pacific Northwest Chapter and owns Boggs Media, LLC. She is also a seasoned executive, board member, speaker, writer and Army Airborne (paratrooper) veteran, who led the global law department of Starbucks Corporation 10 years. Before Starbucks she was an executive in the technology industry, a law firm partner, federal prosecutor, U.S. Army Captain and one of America’s first women to receive an appointment to the U.S. Naval Academy. She was appointed by President Obama to the President’s Committee for the Arts and the Humanities and White House Council for Community Solutions. She served 26 years in the American Bar Association’s (ABA) House of Delegates and on its Board of Governors. After serving 18 years as a Johns Hopkins University Trustee, Boggs is a Trustee Emerita.

“Paula brings a wealth of board and legal experience to Banzai’s board. She is cool and collected even in heated situations. She has been a major champion for diversity on our board and has worked to improve that.”

– JOE

DAVY, CEO and Chairman at Banzai

Current Boards: Banzai, Newport Festivals Foundation, Life Board Member Seattle Symphony, and Greater Seattle YMCA

Previous Boards: Avid, Fender Musical Instruments Corporation, School of Rock LLC, Sterling Financial Corporation, Premera Blue Cross, and Pinnacle Holdings, Inc.

Current Boards: Macy’s

Previous Boards: The Finish Line

Torrence Boone is the VP - Global Client Partnerships at Google. He drives Google’s strategy and multi-billion dollar business across a portfolio of the world’s largest global advertisers, spanning the tech, health/beauty and CPG verticals. In this capacity, he leads a team focused on global strategic partnerships that deploy diverse Google products to achieve business transformation and breakthrough marketing results. Boone also co-leads Google’s New York office, the second largest in the network, and serves on Google’s Global Business Hiring and Promotion Committees. Prior to Google, Boone held senior positions with WPP, Publicis and Bain.

“Torrence’s diverse perspective is a valuable asset for our board and our company. He champions diversity in our talent pool, which enables us to attract and retain a wider range of customers and strengthen our long-term strategy and collective vision for Macy’s, Inc.”

– TONY SPRING,

Chairman and CEO at Macy’s

Gary Boston is a private investor and served as Portfolio Manager and Senior Portfolio Manager at APG Asset Management, a leading global manager of pension assets, from July 2005 until May 2016. Prior to joining APG Asset Management, Boston spent ten years as a senior analyst covering the U.S. real estate investment trust sector on research teams at the investment banks Citigroup and PaineWebber.

“Gary was chosen for his experience in the financial sector, highlighted by his roles at APG Asset Management, Citigroup, and PaineWebber. As a former senior analyst and portfolio manager specializing in the U.S. REIT sector, his deep industry knowledge and analytical expertise have been instrumental in shaping financial strategies. Gary’s professional achievements showcase his significant contributions to the industry.”

– THE BOARDPROSPECTS TEAM

Current Boards: Terreno Realty Corp

Previous Boards: Retail Value Inc.

Current Boards: Verona Pharma plc and Panavance Therapeutics Inc

Previous Boards: Montgomery County

Economic Development Corporation

James Brady most recently served as Chief Financial Officer of MedImmune, the biologics discovery and development division of AstraZeneca. Throughout his career at AstraZeneca, James had P&L and management responsibilities for significant operating units and finance functions including MedImmune, the Asia Pacific Region, US Government, Policy and Managed Markets, and Global Marketing. James also served as the Chief Audit Executive for AstraZeneca.

“Jim’s strong financial background is quite valuable to Panavance as the company does not have a full-time CFO. He has a strong attention to detail and experience in navigating management of auditors. He is adept at asking relevant questions at the right level, which results in good discussions. Jim does not hesitate to get involved or assist in all matters of the company. He is a strong partner of the board and inspires confidence and collaboration.”

– CYNTHIA

COLLINS, Board Member at Panavance Therapeutics

“Jim is a model fellow director. He asks insightful questions, is always willing to engage in meaningful discussions, and listens to all views before coming to a decision. Jim brings his industry expertise as well as his substantive experience to his role of director and Chair of the Audit Committee.”

-

MARLA PERSKY, Board Member at Panavance Therapeutics

Beth Brooke is the former Global Vice Chair, Public Policy at EY and was a member of EY’s Global Board. Beth oversaw public policy for the firm’s operations in 150 countries and was the global sponsor for EY’s Diversity and Inclusiveness (D&I) efforts. She has been named eleven times to Forbes “World’s 100 Most Powerful Women” (MPW) list, and has been inducted into the Indiana Basketball Hall of Fame. Beth is passionate about using her leadership platform to make a difference in the world. She is a devoted advocate for the advancement of women and LGBT Inclusion.

“It was wonderful to work with Beth. Her knowledge and experience (and maybe most importantly, steady hand) helped to guide us when it was needed. I would look forward to working with Beth again in the future..”

– SEAN SAINT, CEO and Board Member at Beta Bionics

Current Boards: VERITY Now, The New York Times Company, eHealth, SHEEX, the US Olympic and Paralympic Committee and the Lehigh Valley Health Network

Previous Boards: EY

Current Boards: MetroNet, ContourGlobal, Albioma, ON*Net Fibra Chile, ON*Net Fibra Colombia, Nexo LatAm, and Monterra Energy

Previous Boards: ADNOC Oil Pipelines

Neil Brown is Managing Director, KKR Global Institute and KKR Infrastructure & Climate. He works at the intersection of finance and geopolitics to navigate global complexity, open new markets for investment, and advance investment solutions for climate, energy, and digitization. He is also a Senior Fellow at the Atlantic Council’s Global Energy Center. Prior to KKR, Brown served as Senior Staff of the U.S. Senate Foreign Relations Committee and worked with refugees in Asia and Africa. He’s a board member of the Association of American Rhodes Scholars and Merton College Charitable Corporation. A born Iowa farmer, he loves skiing and surfing.

“Neil’s selection is based on his exceptional work at the intersection of finance and geopolitics as Managing Director at KKR. His expertise in navigating global complexity and advancing climate, energy, and digitization investments, alongside his experience on the U.S. Senate Foreign Relations Committee, underscores his unique professional journey. Neil’s contributions to finance and global policy highlight his impact in these areas.”

–

THE BOARDPROSPECTS TEAM

Zach Buchwald is Chairman and Chief Executive Officer of Russell Investments, a global investment solutions provider with over 85 years of experience in the industry and $300 billion in assets under management. Buchwald is responsible for driving the firm’s global business strategy, fostering a culture of authenticity, integrity and excellence, and championing solutions that implement great portfolios through a multi-manager framework. Buchwald joined Russell Investments in 2023 from BlackRock, where he served as the head of its $2 trillion Institutional Business.

“Zach Buchwald is a visionary leader who understands the investment landscape and client challenges like the back of his hand. His business acumen has steered Russell Investments towards greater competitiveness, but what sets Zach apart is his leadership style – it’s authentic, it’s knowledgeable, and it benefits everyone involved – clients, employees, and investors. He doesn’t just solve problems, he takes emotional ownership and leads his team to innovate and add immense value.”

–

JONATHAN

BAUM, Board Member at Russell Investments

Current Boards: Russell Investments and Challenge Seattle

Current Boards: Vanguard, the University of California, Berkeley School of Engineering and Santa Clara University’s Leavy School of Business, and Lesbian’s Who Tech

Previous Boards: Out & Equal

Tara Bunch is the head of global operations at Airbnb where she oversees community support, trust and safety, and payments for Hosts and guests in 220 countries and regions. She is the former vice president of AppleCare at Apple and previously served as a senior vice president at Hewlett Packard.

“Tara is a strategic and purpose-driven leader, who brings profound technical expertise and a deeply-rooted client-service mindset to Vanguard’s Board of Directors. Her thoughtful perspective is central to our ability to bring to life Vanguard’s mission to give investors the best chance for investment success.”

– MARK LOUGHRIDGE, Board Member at Vanguard

“Tara has been terrific to work with. Besides a wealth of experience in operations and customer service, she also brings to the table valuable strategic insights and a good sense of humor. I’m always curious to hear what she has to say.”

– LUBOS PASTOR, Board Member at Vanguard

Laurie Burns spent 17 years in C-Suite and senior executive positions with Darden Restaurants. As Chief Development Officer reporting to the CEO, Laurie optimized real estate value through the separation of a portion of the real estate assets by completing the spin-off of 424 properties into a separate, publicly traded REIT (Four Corners Property Trust, NYSE: FCPT), and selling 64 properties individually as sale leasebacks, enabling Darden to retire ~$1Bn in debt. Burns served as President of Darden’s Bahama Breeze Island Grille business unit for ten years where she led the turnaround and return to growth and success for the brand. She also co-led the formation of the Pride Alliance (LGBTQ+ employee resource group) and served as its Executive Advisor. Prior to Darden Burns held real estate development positions of increasing responsibility in the restaurant/hospitality industry. Throughout her career Laurie has developed over 600 restaurants and 27 limited-service hotels.

“I learn so very much from Laurie, with her substantive knowledge of the industry. She undertakes her responsibilities in an exceptional manner. She brings a very calm and rational approach to the role especially in her leadership as Chair of the Compensation Committee. She emanates integrity and character and asks important and meaningful questions. I trust Laurie impeccably and feel honored to serve with her on the SVC board.”

Current Boards: Service Properties

Trust and University of Florida College of Business Advisory Council

Previous Boards: Women’s Food Service

Forum and City of Orlando Historic Preservation

Current Boards: Peapack Gladstone Bank and The Normandy Institute

Previous Boards: Deutsche Bank USA, Deutsche Bank Securities, Deutsche Bank Foundation, and University of Connecticut Foundation

Patrick Campion is an experienced financial services operating executive delivering exceptional performance and growth within strong risk and compliance frameworks. He leverages more than 20 years of expertise leading US regional and international teams at Deutsche Bank, HSBC and Citi Private Bank, driving both financial and cultural transformations through crises, perpetual change, and an evolving regulatory landscape. A member of multiple bank boards and executive committees, he sets a tone of transparency and risk-mindedness from the top, resulting in a strong personal brand and enhanced regulatory relationships. A visible LGBT executive, he is a long-standing advocate for diversity with a strong reputation for recruiting, developing, and retaining superior talent.

“Patrick joined the Peapack-Gladstone Financial Corporation board in 2023 and has proven to be an integral part of our growth plan. His 30 plus years as an executive, leading private banking and wealth management business in New York City and across the Americas, along with his innovation and drive to elevate performance, while encouraging diversity of thought and experience, has helped us launch our brand in the New York metro and beyond. We are proud to have him on our team.”

– DUFF MEYERCORD, Chair of the Board at Peapack-Gladstone Financial Corporation

Mr. Campoy is a Board Director and retired public company CFO, known for his strategic financial leadership in the highly regulated life sciences industry. With a global business perspective, Mr. Campoy has a proven track record of leading culturally diverse organizations through growth and transformational change. He is the former CFO of CytomX Therapeutics and of Alder Biopharmaceuticals. Previously, Mr. Campoy held several global executive positions with Allergan and Eli Lilly.

“Carlos brings to Zyme BOD an impressive global strategic executive experience, great work ethic and, equally important, a contagious smile and positive attitude.”

– ALESSANDRA CESANO, Board Member at Zymeworks

Current Boards: Zymeworks Inc.

Current Boards: Edison International, Southern California Edison, Capital Group’s American Funds, Amplify, Inc., the David & Lucile Packard Foundation, and Stanford University

Michael Camuñez is the President and CEO of Monarch Global Strategies, a binational strategic consulting firm. With over 25 years of combined service in the private and public sectors, including at the White House, the U.S. Department of Commerce, and the U.S. Commission on Security and Cooperation in Europe, Camuñez has an intimate knowledge of the workings of the U.S. government, strong relationships with a range of economic policy makers around the globe, and a unique combination of political, legal, corporate governance, economic and international expertise.

“Michael is an intelligent, articulate and valuable member of our board at EIX. His ability to focus in on our customers and employees from an external point of view is very helpful.”

– JEANNE

BELIVEAU, Board Member at EIX Edison International

R. Martin Chávez is a partner and vice chairman of Sixth Street. He is widely known for revolutionizing the role of computer scientists on the trading floor. Prior to Sixth Street, he served in a variety of senior roles at Goldman Sachs, including Chief Information Officer, Chief Financial Officer, and global co-head of the firm’s Securities (now Global Markets) Division. Chávez co-founded various software companies, including Quorum Software Systems, and was the CEO of Kiodex, a risk management software company later acquired by SunGard Data Systems.

“Martin has brought a unique polymathic lens crossing markets, technology, and science alongside history as an entrepreneur, company builder, and industry disrupter to the Recursion board. As we attempt to (often) do the impossible, with Martin as our chair we’ve never questioned the plausibility, no, audacity, of our mission and instead have been able to remain steadfastly focused on executing on the tasks at hand.”

– ZAVAIN DAR, Board Member at Recursion Pharmaceuticals

Current Boards: Alphabet, Broad Institute of MIT and Harvard, and Los Angeles Philharmonic

Debra Chrapaty is the Chief Technology Officer at Toast, where she leads technical planning and operations, architecture, infrastructure, data, AI, and product engineering. Debra brings decades of experience in large-scale technical infrastructure, cloud, operations management, and product management for many brands, including the National Basketball Association (as CTO), E*TRADE (as CIO), Microsoft (as Corporate VP of Infrastructure and Cloud), CISCO (as SVP of Collaboration Software), and ZYNGA (as CIO). Most recently, Debra served as the Chief Technology Officer of Wells Fargo, building services stability, scalability, developer productivity, speed, security, and compliance for the nation’s fourth-largest bank. As the Vice President and Chief Operating Officer of Amazon Alexa, she led product growth and monetization, third-party skills and devices, and international product expansion.

“Debra brings to the boardroom a unique and welcome perspective as a seasoned tech executive from businesses as diverse as Toast, Amazon and Wells Fargo.”

– BLYTHE MASTERS, Board Member at Forge Global

Patrick Chung is Managing General Partner of Xfund. Prior to Xfund, Patrick was a partner at NEA and led the firm’s consumer and seed investment practices. He is a director of 23andMe (NASDAQ: ME) and Philo, and led investments in Guideline, IFTTT, NewtonX, ThirdLove, and Zumper. Past investments include Segment (acquired by Twilio), Kensho (acquired by S&P Global), Plaid (almost acquired by Visa), Pulse (acquired by LinkedIn), Loopt (acquired by Green Dot), GoodGuide (acquired by Underwriters Laboratories), Ravel Law (acquired by Lexis-Nexis), Xfire (acquired by Viacom), and Xoom (NASDAQ: XOOM). Prior to joining NEA, Patrick helped to grow ZEFER, an Internet services firm (acquired by NEC) to more than $100 million in annual revenues and more than 700 people across six global offices. Prior to ZEFER, Patrick was with McKinsey & Company, where he specialized in hardware, software, and services companies.

“Patrick brings a calm, thoughtful and deliberative presence to our board conversations. He adds value to many topics before us, from finance issues to operations to marketing. And, importantly, he has a sense of humor too!”

Current Boards: ISO New England and Somos, Inc

Brook Colangelo is the Chief Information Officer for Waters Corporation (NYSE: WAT), a global leader in analytical instruments and software serving the life, materials, food, and environmental sciences industries. Brook is responsible for driving global IT and digital transformation for Waters. Brook previously served as the Chief Technology Officer for Houghton Mifflin Harcourt (NASDAQ: HMHCO). Prior to HMH, Brook was Chief Information Officer of the White House under President Barack Obama. Brook was responsible for modernizing all aspects of the technology for the first-ever digitally connected President of the United States.

“Brook is the board colleague one seeks out when grappling with thorny board issues or when desiring a companion for happy hour. He is passionate about improving board culture and he combines this passion with attention to detail and thoughtful, constructive insights on the numerous challenges confronting boards. His participation on a board elevates any board room and it is a privilege to have served with Brook on two boards.”

– KATHLEEN ABERNATHY,

Board Member at Somos Inc.

Troy Cox was the CEO of Foundation Medicine until the acquisition by Roche for $5.3 billion. Prior to Foundation Medicine, Cox served as SVP and Officer at Genentech from 2010-2017, where he led US BioOncology for a period of unprecedented growth to over $12 billion, participating in the launch of nearly half of the products from the world’s oncology leader, while accountable to help steer the Roche Genentech R&D portfolio. Before Genentech, Cox held executive roles of increasingly broad accountabilities including President UCB BioPharmaceuticals, SVP Sanofi-Aventis and diverse foundational roles at Schering-Plough.

“I am delighted to serve on the board of Biosplice with Troy. He listens emphatically, contributes knowledgeably, is able to see the woods from the trees and yet pays enough attention to details. I appreciate the fact that he is able to tell it as it is without being offensive. Overall Troy is a great board member and well deserving of this honor.”

– FINIAN TAN, Board Member at Biosplice Therapeutics

“Try is the epitome of professionalism, expertise and social intelligence required to lead an emerging company board such as Sophia Genetics. He balances expertly between pushing the company towards higher ambition and keeping an even keel when challenges strike. It is an honor to serve by his side.”

– LILA TRETIKOV, Board Member at Sophia Genetics

Current Boards: Sophia Genetics, Zymeworks, LetsGetChecked, Standard BioTools, and Biosplice Therapeutics

Previous Boards: MassBio and Foundation Medicine

We Congratulate Laurie Burns SVC Board of Trustees on Her Much Deserved Recognition as One of BoardProspects’ “50 LGBTQ+ Board Members Making a Difference”

Service Properties Trust (Nasdaq: SVC) is a REIT that invests in hotels and service-focused retail net lease properties. SVC’s portfolio of nearly 1,000 properties is well diversified by geography, tenant and industry.

Current Boards: Federal Home Loan Bank of Pittsburgh

Romy Diaz has wide-ranging experience in regulated industries, including energy, environment, and financial services. As General Counsel of Exelon Corporation’s PECO division, he secured regulatory approval and cost recovery for its digital communications infrastructure investment-the largest in company history, after negotiating federal funding to reduce project costs by one-third. Romy enhanced governance of Philadelphia Gas Works and Pensions boards as Philadelphia City Solicitor, restored financial controls as Assistant Administrator of EPA, and reduced annual costs by $100M as Counselor/Deputy Chief of Staff to the Secretary of Energy.

“Romy is a clear asset to our Board. He brings a wealth of knowledge to the table from his many years of experience in the legal profession as well as his exposure to government services.”

–

ANGEL HELM, Board Member at Federal Home Loan Bank Pittsburgh

“Romy is an excellent board member. He matches strong governance experience with valuable business, government policy, and community perspectives. He is particularly dedicated to ensuring ALL constituencies are fairly considered in all of our deliberations.”

– WINTHROP WATSON, President & CEO at Federal Home Loan Bank of Pittsburgh

Eric Dube is the President and CEO of Travere, a public biotech company focused on the development and delivery of treatments for rare disease. His role at Travere has leveraged his deep experience in late-stage development and global launch planning and optimization. His experience in risk oversight and management has helped to strengthen the governance and risk oversight model. Eric has spent over 20 years in the pharmaceutical industry and began his career at GSK as a Medical Science Liaison. Dube’s first significant leadership and P&L role was in 2008, leading the US Oncology business at GSK. He was responsible for three launches in one year and delivering robust top and bottom-line growth.

“Eric brings a fresh, energetic perspective across multiple facets of the biotechnology industry. His experience in both growing and scaling a young maturing biotech company, through many obstacles, allows him to proactively identify potential risks and present alternative strategic options. He is eager to mentor through complex situations; especially those related to commercialization and financing. It was a true pleasure to serve on the board with Eric. He will continue to evolve as a true veteran industry leader.”

– RENEO PHARMACEUTICALS BOARD OF DIRECTORS

Current Boards: Travere and Reneo Pharmaceuticals

Previous Boards: Reneo Pharmaceuticals and AIDS United

Current Boards: East West Bancorp, Inc.

Previous Boards: Edelman, OICS, and Interasia

Serge Dumont is a global entrepreneur, business executive, and philanthropist. He is one of the pioneers in China’s corporate and marketing communications industry. He served as Vice Chairman of Omnicom Group (NYSE: OMC), a leading global holding company, managing its portfolio of companies and spearheading the group’s diversity program. He has been actively involved with the World Economic Forum, addressing pressing global challenges at the Davos conferences. A recipient of honors and awards from several national governments, he has been serving on a number of corporate and not for profit boards.

“Serge brings so much to our board. Our conversations and deliberations are enriched by his many years of leadership in global marketing and communications, his lived experience in China and commitment to cross-border understanding and collaboration, and his service to advance health, philanthropy, the arts and education. For a growing institution in a highly competitive environment, Serge’s expertise, judgment and perspective are of very high value.”

– PAUL IRVING, Board Member

at East West Bancorp,

Inc.

Mark Dybul is a Professor in the Department of Medicine at the Medical Center, Georgetown University and a senior advisor at the Center for Global Health Practice and Impact. Dybul is a member of the Global Health Initiative faculty committee. He served as chair and fellow with the Joep Lange Institute, which promotes and facilitates innovative models in global health. Dybul is an executive director of the Global Fund to Fight AIDS, Tuberculosis and Malaria from January 2013 to May 2017. He Served as the United States Global AIDS Coordinator from 2006 until the beginning of the Obama administration. Dybul Led the implementation of the President’s Emergency Plan for AIDS Relief (PEPFAR), the largest international health initiative in history for a single disease.

“It is an honor to work with Mark. What he does displays astuteness and resilience even when faced with very tough challenges but even more impressive is the way in which he does everything – he is always considerate and respectful and his integrity is unwavering.”

– JAYNE MCNICOL, Board Member at Renovaro

“I’ve known Mark for over 20 years since his days at HHS through his years running PEPFAR and the Global Fund. Mark has always impressed me with his knowledge of science, medicine and public health, and his passion to use that knowledge to address global health challenges, particularly in the area of HIV/AIDS. Today, Mark is showing he is also an outstanding business leader as CEO of Renovaro, where he is leading the company in the development of breakthrough therapies for multiple diseases.”

– GREGG ALTON, Board Member at Renovaro

Current Boards: Renovaro and Purpose Life Sciences

Lewis Fanger is currently the Chief Financial Officer and Treasurer of Full House Resorts. His previous roles include Vice President at Wynn Resorts, CFO at Creative Casinos, and Vice President of Finance at Pinnacle Entertainment. Earlier in his career, Fanger was an investment banker for Credit Suisse First Boston and Lehman Brothers.

“Lewis is one of those rare individuals that combines business acumen with pure kindness. His views never focus solely on finance, his core expertise. His views are equally informed by their impacts to other departments – like marketing or HR – and even to our local community. Since joining Full House Resorts, Lewis has helped to completely transform our company’s culture and strategic direction.”

– DANIEL LEE, President, CEO and Board Member at Full House Resorts, Inc.

Jim Fielding is a Partner at Archer Gray and leads their Co-Lab Division as President. Prior to Archer Gray, Fielding co-founded and was Team Leader at ThenWhat Inc. After a successful 30+ year career with The Gap, Disney, Claire’s, Dreamworks, and 20th Century Fox, Jim has turned his talents to entrepreneurial pursuits, Higher Education, Independent Media, and Advisory Work. Leveraging his experience and drive to make the world a better place, he has channeled his energy and enthusiasm into a diverse set of innovative engagements.

“I have had the privilege to work with Jim on boards in both the philanthropic and private sectors and can think of no board member who is more generous with their time and talent. Jim is an extraordinary leader and team motivator and brings such positive and purpose-filled attention to everything he does.”

– AMY NAUIOKAS, Former Board Member at Make-a-wish International and Inked Brands

Current Boards: Inked Brands and Xcel Brands, Inc.

Previous Boards: Make-A-Wish Foundation International

Current Boards: Teal Omics, Lycia Therapeutics and Mirum Pharmaceuticals

Previous Boards: CTI BioPharma and Senti Biosciences

Laurent Fischer is the President and Chief Executive Officer at Adverum Biotechnologies. Before joining Adverum, Dr. Fischer was Senior Vice President and Head of the Liver Therapeutic Area at Allergan, PLC. Previously, he served as Chief Executive Officer of Tobira Therapeutics until its acquisition by Allergan. Dr. Fischer has held other executive positions at Jennerex, Inc., Ocera Therapeutics and Auxeris Therapeutics, Inc. Over the span of his career, Dr. Fischer has held senior management roles at several companies, including Dupont Pharmaceuticals, Dupont-Merck, and F. Hoffmann-La Roche.

“Laurent was selected for his experience in the biopharmaceutical industry. As President and CEO of Adverum Biotechnologies, and with prior leadership roles at Allergan, Tobira Therapeutics, and other notable companies, Dr. Fischer’s career highlights his expertise in therapeutics and drug development. His proven leadership in innovative healthcare solutions sets him apart.

Jim Fitterling is Chair and Chief Executive Officer for Dow Inc., a global materials science company with 2023 sales of approximately $45 billion. He became CEO in July 2018 and was elected Board Chair in April 2020. Fitterling led Dow’s transformation from a lower-margin, commodity company to one deeply focused on higher-growth markets that value innovation – with an ambition to be the most innovative, customer-centric, inclusive, and sustainable materials science company in the world. Fitterling is a leading voice in sustainability; a strong advocate for a circular and net-zero emissions economy; and vocal champion for inclusion, diversity.

“Jim is a role model director who has had a marked impact on shaping both our board and the company’s strategic direction. As Lead Director, he has an unmatched combination of strategic, financial, growth, and culture expertise. His leadership contributions are always thoughtful and insightful, enabling us to be at our best as individuals and as a whole.”

– ANNE CHOW, Board Member at 3M