Welcome to the January 2025 Issue of Board Recruitment

As we begin a new year, BoardProspects remains committed to providing timely insights on corporate governance and boardroom composition� Our goal is to equip you with the knowledge and tools necessary to navigate the evolving governance landscape

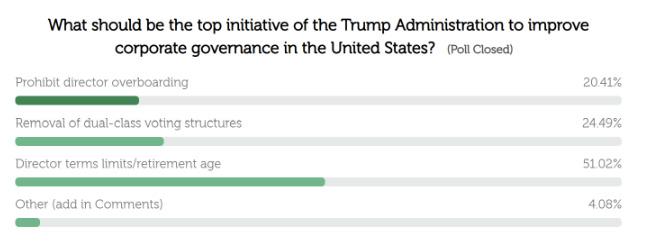

This month’s lead article, “Potential Corporate Governance Initiatives in the Trump Administration,” explores the possible governance priorities of the incoming administration� As a new era begins in Washington, D�C�, understanding potential shifts in corporate governance regulations and practices is essential for boards seeking to stay ahead From the influence of Elon Musk to thoughts shared from our community in our weekly polls, this article provides a few educated guesses on what might lie ahead for corporate boards�

This issue also features a special breakout section highlighting BoardProspects’ Free Board Opportunity Posting tool For-profit companies can use this innovative resource to identify their next board member from our esteemed community of aspiring and experienced directors at no cost� We encourage you to explore this tool to strengthen your board with top-tier talent� Additionally, we are pleased to include valuable insights from our BoardRoom Resource Partners:

• “Welcome to the New Era of Total Rewards for C-Suite Executives” (Source: Robert Half): Learn about the latest trends in compensation and benefits for senior executives�

• “Activist Investors and Executive Pay” (Source: Compensation Advisory Partners): Explore how activist investors are influencing executive compensation strategies and governance practices

• “Organizational Blind Spots in Disruptive Times” (Source: Protiviti): Discover how boards can identify and address blind spots to better navigate organizational disruption�

• “On the 2025 Audit Committee Agenda” (Source: KPMG): Gain insights into the critical priorities for audit committees in the year ahead�

As always, we value your feedback and are committed to delivering content that supports your board’s success� Thank you for being a valued part of the BoardProspects community�

Mark Rogers Founder and CEO, BoardProspects

By Shaun Bisman, and Cedrick Jean-Louis

Shareholders can influence a company’s executive compensation program through a non-binding advisory vote known as “Say on Pay.” While this vote doesn’t directly allow shareholders to influence overall compensation policies, companies often maintain outreach programs to address shareholder concerns about specific aspects of the compensation plan. Another way for shareholders to have a say in executive compensation is by gaining a seat on the Board of Directors.

However, the purpose of obtaining a seat is not solely for executive compensation reasons but to advocate for broader changes within the company. Achieving this is challenging and less common; investors typically pursue this through a proxy contest, where an investor advocates for change in company strategy and may raise executive compensation as an issue.

Investors who seek change through a proxy contest are often referred to as “activist investors�” This term describes individuals (such as hedge fund managers) or groups (like alternative investment firms) who acquire a stake in a company’s equity with the goal of increasing shareholder value, typically by gaining one or more seats on the Board of Directors� Once on the Board, these activists push for changes they believe will improve the company’s performance, strategy, or governance� These changes can take various forms, depending on the investor’s objectives�

Common goals of activist investors include:

• Enhancing financial performance by advocating for cost reductions, optimizing capital allocation, or promoting share buybacks and higher dividends�

• Strategic changes, such as refocusing on core business areas or recommending mergers, acquisitions, or spin-offs of non-core assets�

• Seeking changes in senior management or the Board of Directors�

Activist investors aim for these changes to boost company value, thereby increasing the worth of their own stake� However, they are sometimes criticized for prioritizing short-term gains over long-term stability� `This article updates Compensation Advisory Partners’ (CAP) research on 2015 - Activist Investors and Executive Pay� It aims to provide a refreshed

perspective, incorporating

Between 2020 and 2024, activist investors have increasingly asserted their influence in boardrooms, achieving success in various proxy contests To gain insight into their strategies, CAP reviewed 48 proxy contests initiated by activist investors among companies in the Russell 3000 Index, finding that concerns about executive compensation programs were raised in 23 cases�

Data indicates that executive compensation was often tied to broader concerns about the companies’ strategic direction, operational execution, and financial performance� Essentially, executive compensation disagreements were not the main

or sole rationale for engaging in the contest� Instead, activist investors use these disagreements to highlight deeper underlying concerns with a company’s direction or performance to induce change�

For instance, if Total Shareholder Return (TSR) is not used as a performance metric while the company has faced a prolonged period of shareholder value decline alongside rising CEO compensation, activist investors will highlight these issues as signs of a flawed business strategy and misaligned incentive structures�

In many cases, concerns about executive compensation support their broader calls for leadership changes, strategic adjustments, and stronger governance practices�

The chart shows that among the 23

governance structures (26 percent)� Less frequent concerns included outsized peer comparisons, performance metric adjustments (both 17 percent), high dilution, excessive perquisites, and long-term incentive plan design (all 13 percent)� A smaller number of cases raised issues with high director compensation, lack of disclosure, or excessive change-in-control provisions (each 9 percent)�

The chart shows that among the 23 companies where activists raised concerns about executive compensation, the most common issue was pay-for-performance misalignment (91 percent). Activists frequently argued that CEO compensation packages were insufficiently tied to company performance, advocating for changes to link pay more directly to long-term shareholder value rather than short-term performance metrics. They also often pointed out that CEO pay was disproportionately high compared to peers. Other prominent issues included excessive CEO compensation (57 percent) and weak corporate governance structures (26 percent). Less frequent concerns included outsized peer comparisons, performance metric adjustments (both 17 percent), high dilution, excessive perquisites, and long-term incentive plan design (all 13 percent). A smaller number of cases raised issues with high director compensation, lack of disclosure, or excessive change-in-control provisions (each 9 percent).

Ultimately, we found that activist investors often leverage executive compensation issues to strengthen their case for securing seats on the target company’s Board of Directors.

The chart shows that among the 23 companies where activists raised concerns about executive compensation, the most common issue was pay-for-performance misalignment (91 percent)� Activists frequently argued that CEO compensation packages were insufficiently tied to company performance, advocating for changes to link pay more directly to long-term shareholder value rather than shortterm performance metrics� They also often pointed out that CEO pay was disproportionately high compared to peers Other prominent issues included excessive CEO compensation (57 percent) and weak corporate

Proxy Battle Result

Gained Board Seat (n=11)

CYE = Calendar Year-End

Ultimately, we found that activist investors often leverage executive compensation issues to strengthen their case for securing seats on the target company’s Board of Directors�

Note: For companies with proxy contests in 2024, TSR post contest represents year-to-date TSR (as of 12/17/24).

Of the 23 proxy contests that specifically targeted aspects of executive compensation, 11 ultimately resulted in the activist investor gaining board seats at the target company�

Companies with successful activist campaigns (2020-2024): Masimo Corporation, Norfolk Southern

Corporation, Southwest Gas Holdings Inc� WisdomTree Inc�, Illumina Inc� Pitney Bowes Inc�, Apartment Investment and Management Company, Griffon Corporation, Exxon Mobil Corporation GameStop Corp�

The most common issue in these contests centered on the misalignment between executive pay and company performance�

For example, activist investors argued that management at Norfolk Southern Corporation received substantial compensation packages despite the company losing millions in shareholder value during the same period�

In this case, activists also pointed out that the Board awarded the CEO over $10 million in equity grants, even though the company missed all annual performance targets related to financial performance, customer service, and safety� This issue with executive compensation gave activists an opportunity to criticize the Board for weak corporate governance�

Ultimately, their campaign was successful, and they were able to elect three of their nominees to the Board�

Activist investors often tie compensation-related concerns to broader business strategy issues, rallying support from other investors in the process� When shareholders are dissatisfied with their returns, they are more inclined to align with activist investors to drive change This dynamic was evident in Carl Icahn’s high-profile contest with Illumina, where he not only succeeded in electing a board member but also saw the CEO resign shortly afterward

Conclusion

There has been a rise in activist investors accumulating stakes in companies with the goal of pushing for change to enhance the company’s value�

While our analysis focused on proxy contests specifically addressing executive pay issues (e�g�, pay-forperformance misalignment), there are also cases where companies reach settlements with activist investors, avoiding a public confrontation and granting them one or more seats on the Board�

To be well-prepared, Boards and Compensation Committees should:

• Monitor 13D Filings (Schedule D) to see if an individual or group acquires more than 5% of a company’s voting shares�

• Ensure the Board has a strategy for effectively engaging with shareholders via regular communication channels�

• Align executive compensation with performance�

• Conduct annual reviews of executive compensation programs

• Ensure transparent and clear communication on pay programs, levels, and compensation philosophy�

• Proactively seek feedback from shareholders throughout the year

The Compensation Committee should collaborate with management to create an executive compensation program that can be defended based on the company’s performance�

By taking these steps, companies can better defend their executive compensation programs during a proxy vote and minimize the chances of conflicts with activist investors or shareholders�

Being transparent, responsive, and proactive is key to managing

Company Activist Year

Masimo Corporation

Global medical technology company

Medallion Financial Corp.

Commercial and consumer loan company

Xperi Inc. Technology company

Norfolk Southern Corporation

Rail transport services company

The Walt Disney Company

Entertainment and media company

Alkermes plc

Biopharmaceutical company

shareholder expectations and ensuring a smoother voting process�

Executive Compensation Issue Highlighted By Activist Contest Result

Politan Capital Management 2024 y Bottom 1% of Russell 3000 for Say-on-Pay vote results

y CEO annual compensation is 2x peer levels

y Misuse of company assets i.e. charitable donations, security, and the corporate jet

y Employment agreement guarantees CEO ~$600 million and acts as a “poison pill” forbidding shareholders from replacing 1/3rd of the Board

ZimCal Asset Management 2024 y President & COO’s compensation is too large compared to cumulative profits

y Belief that executives should be compensated for core performance excluding non-core, nonrecurring items. Core performance has actually declined every year since the peak in 2021 however bonuses have increased

y Board approved $1.4 million bonus and perquisites of $140k for President & COO despite $39.9 million loss

Rubric Capital Management 2024 y Excessive compensation vs. peer group (and a failure to identify peer group in the proxy)

y Lack of performance incentives. Where performance metrics are indicated, Board is not transparent about hurdles

y Significant dilution from restricted stock units (RSUs) since spin-off from predecessor, with Board granting 11% of the float to insiders in 5 quarters

y Additional one-time bonus granted in July 2023 on top of normal-course compensation schemes to further enrich executives – without transparency

Ancora Holdings Group LLC 2024 y Failed to adequately include a safety component in the CEO’s initial compensation package

y Despite being among the worst in industry TSR performance over CEO tenure, CEO was paid more than $23 million

y The Board granted more than $10 million in stock and option awards to CEO in 2023 despite missing all 6 annual incentive targets pertaining to financial performance, customer service and safety

Trian Partners 2024 y “Over-the-top” compensation packages granted to CEO

y CEO received $216 million in total compensation despite Disney’s poor TSR

Sarissa Capital Management 2023 y Over the last 15 years, Alkermes underperformed the Nasdaq Biotechnology Index by 341% while the CEO was rewarded with over $150 million in compensation

Two dissident nominees elected to the Board

CEO removed from the Board and resigned subsequently

No dissident nominees elected to the Board

No dissident nominees elected to the Board

Three dissident nominees elected to the Board

No dissident nominees elected to the Board

No dissident nominees elected to the Board

Masimo Corporation

Global medical technology company

Mind Medicine (MindMed) Inc

Biopharmaceutical company

WisdomTree, Inc.

Financial services company

Illumina, Inc.

Biotechnology company

Blue Foundry Bancorp

Holding company for Blue Foundry Bank

Pitney Bowes Inc.

Technology company

Apartment Investment and Management Company

Real estate investment trust

Politan Capital Management 2023 y Failed Say-on-Pay 6 of the last 12 years; bottom 1% of the Russell 3000 for Say-on-Pay results

y CEO annual compensation is 2x peer levels

y CEO excessive change-in-control payment that is 38x peers

y Misuse of company assets i.e. charitable donations, security, and the corporate jet

y Employment agreement guarantees CEO ~$600 million and acts as a “poison pill” forbidding shareholders from replacing 1/3rd of the Board

Two dissident nominees elected to the Board

FCM MM Holdings 2023

y Approved full performance payouts despite executive failure to improve stock price

y Approved golden parachutes for management

ETFS Capital 2023 y CEO has accumulated over $20 million in compensation over the last five years all while presiding over the destruction of approximately $921 million in stockholder value during the same period

Carl Icahn 2023 y Questions regarding the independence of independent Chair of the Board

y Despite stock declining 62% resulting in $50 billion of value destruction, Board increased CEO compensation with an 87% increase to $27 million

No dissident nominees elected to the Board

One dissident nominee elected to the Board

One dissident nominee elected to the Board

Chair of Board removed

CEO resigned shortly after

Lawrence Seidman

2023 y Disagree with management’s proposed approval of stock-based benefit plan which would allow directors and CEO to be paid restricted stock and options despite company’s poor financial performance

Hestia Capital Management 2023 y Lack of Board independence, particularly on the compensation committee

y CEO pay increase of more than 40% in 2022 despite significant stockholder value deterioration

y Exorbitant golden parachute of nearly $23 million upon termination following a change in control

No dissident nominees elected to the Board

Land & Buildings Investment Management

2022 y Responsible for paying the bulk of Apartment Income REIT Corporation’s CEO compensation despite completing spin-off

y Payments made to executive team family members for “vague” services

Four dissident nominees elected to the Board

CEO resigned months later

One dissident nominee elected to the Board

Hasbro, Inc. Toy and game company

Genworth Financial, Inc. Insurance company

Southwest Gas Holdings, Inc.

Natural gas utility holding company

Alta Fox Capital 2022

Huntsman Corporation Chemical company

Griffon Corporation Holding consumer products company

y Misaligned executive compensation with performance given relative performance in shareholder return and S&P 500 in same period

y Compensation committee consistently lowered performance targets despite declining performance

y CEO pay outsized peers despite 4th lowest TSR

Scott Klarquist 2022 y CEO has been given $70 million in total compensation in the past nine years, including $30 million in total cash compensation. Meanwhile, the value of Genworth’s stock fell 50% during the same period

Icahn Enterprises L.P 2022 y Despite underperformance, management increased compensation

y CEO pay increased 132% over period of time where share price increased by just 15%

No dissident nominees elected to the Board

Box, Inc

Cloud-based content management company

Starboard Value 2022 y Company has poor pay-for-performance alignment

y Frequently changes performance peers and uses two different peer sets to benchmark performance and compensation

y Lack of board independence leading to weak corporate governance

y Failure to tie pay to performance

Voss Capital 2022 y $30 million paid to top four executives in 2021 and highest CEO pay of any of its 21 proxy peers on average over the past 10 years while producing bottom tier total returns for shareholders

y NEO compensation equaled 27.4% of pretax income

y CEO compensation 10.5x peer group median

y “Cherry picking” new peers with higher CEO pay and lower TSR

y Consistent underperformance compared to S&P 600 median approval for Say-On-Pay from 2014-2021

Starboard Value 2021 y Lack of disclosure around compensation as only 3 NEOs are disclosed

y Stock-based compensation expense as percentage of market cap is twice peer group median, resulting in dilution

y Granted 100% time-based restricted stock for its long-term equity program

Activist withdrew their nomination before the annual meeting

Settled and at least three and up to four dissident nominees elected to the Board

CEO resigned shortly after

No dissident nominees elected to the Board

One dissident nominee elected to the Board

No dissident nominees elected to the Board

As your company responds to these uncertain times, your pay plan should too. Take this diagnostic to see whether you should revise your executive and employee pay programs.

What is your company experiencing?

Shifting company economics (e.g., growth, downturn, turnaround situation)

Change in strategy

New executive leadership or governance

Change in shareholders or structure (e.g., combination or divestiture)

How is pay perceived?

Out-of-step or inflexible in today's environment

Misaligned with the goals, time horizon or risk to the firm

Unfair or inequitable

Below competitive or, conversely, a windfall to recipients

Either too high or low relative to performance, contribution, or e ort

Too complex or not valued by executives or employees

What external factors are you facing?

Shifting industry economics or increased volatility

Challenges in recruiting talent in “hot” geographies or critical skill sets

Pressure from external stakeholders

Reacting to changes in accounting, tax, and legal regulations

Are you seeing unintended behaviors?

Pay plans or measures are creating unintended behaviors / results

Discretionary payments are needed to produce more fair and equitable pay levels

Individual “one-o ” compensation negotiations occur frequently

Turnover is higher than normal or unexpected

Pay conversations take a significant amount of time to discuss and resolve

reporting GenAI

leadership, composition, and agenda responsibilities—financial reporting and growing range and complexity of other

Drawing on insights from our survey work nine issues to keep in mind as audit committees

organization

By KPMG Board Leadership Center

committees can expect their company’s financial reporting, compliance, risk, and internal control environment to be put to the 2025. In addition to existing challenges—from global economic the wars in Ukraine and the Middle East to cyberattacks, preparations for US and global climate and sustainability reporting requirements, and advances in artificial intelligence (AI)—the change in administration could have a significant impact on the business and risk environment that companies must navigate. Audit committees should take look at their skill sets and agendas. Does the committee have the leadership, composition, and agenda time to carry out its core oversight responsibilities—financial reporting and internal controls—along with the range and complexity of other risks?

Stay focused on financial reporting and related control risks—job number one.

committees can expect their company’s financial reporting, compliance, risk, and internal control environment to be put to the 2025. In addition to existing challenges—from global economic the wars in Ukraine and the Middle East to cyberattacks, preparations for US and global climate and sustainability reporting requirements, and advances in artificial intelligence (AI)—the change in administration could have a significant impact on the business and risk environment that companies must navigate. Audit committees should take look at their skill sets and agendas. Does the committee have the leadership, composition, and agenda time to carry out its core oversight responsibilities—financial reporting and internal controls—along with the range and complexity of other risks?

Audit committees can expect their company’s financial reporting, compliance, risk, and internal control environment to be put to the test in 2025. In addition to existing challenges— from global economic volatility, the wars in Ukraine and the Middle East to cyberattacks, preparations for US and global climate and sustainability reporting requirements, and advances in artificial intelligence (AI)—the change in administration could have a significant impact on the business and risk environment that companies must navigate. Audit committees should take a hard look at their skill sets and agendas. Does the committee have the leadership, composition, and agenda time to carry out its core oversight responsibilities—financial reporting and internal controls—along with the growing range and complexity of other risks?

Audit committees can expect their company’s financial reporting, compliance, risk, and internal control environment to be put to the test in 2025. In addition to existing challenges—from global economic volatility, the wars in Ukraine and the Middle East to cyberattacks, preparations for US and global climate and sustainability reporting requirements, and advances in artificial intelligence (AI)—the change in administration could have a significant impact on the business and risk environment that companies must navigate. Audit committees should take a hard look at their skill sets and agendas. Does the committee have the leadership, composition, and agenda time to carry out its core oversight responsibilities—financial reporting and internal controls—along with the growing range and complexity of other risks?

Audit committees can expect their company’s financial reporting, compliance, risk, and internal control environment to be put to the test in 2025. In addition to existing challenges—from global economic volatility, the wars in Ukraine and the Middle East to cyberattacks, preparations for US and global climate and sustainability reporting requirements, and advances in artificial intelligence (AI)—the change in administration could have a significant impact on the business and risk environment that companies must navigate. Audit committees should take a hard look at their skill sets and agendas. Does the committee have the leadership, composition, and agenda time to carry out its core oversight responsibilities—financial reporting and internal controls—along with the growing range and complexity of other risks?

Clarify the role of the audit committee in the oversight of generative AI (GenAI), cybersecurity, data governance.

committees can expect their company’s financial reporting, compliance, risk, and internal control environment to be put to the 2025. In addition to existing challenges—from global economic the wars in Ukraine and the Middle East to cyberattacks, preparations for US and global climate and sustainability reporting requirements, and advances in artificial intelligence (AI)—the change in administration could have a significant impact on the business and risk environment that companies must navigate. Audit committees should take look at their skill sets and agendas. Does the committee have the leadership, composition, and agenda time to carry out its core oversight responsibilities—financial reporting and internal controls—along with the range and complexity of other risks?

focused on financial reporting and related internal risks—job number one.

committees can expect their company’s financial reporting, compliance, risk, and internal control environment to be put to the 2025. In addition to existing challenges—from global economic the wars in Ukraine and the Middle East to cyberattacks, preparations for US and global climate and sustainability reporting requirements, and advances in artificial intelligence (AI)—the change in administration could have a significant impact on the business and risk environment that companies must navigate. Audit committees should take look at their skill sets and agendas. Does the committee have the leadership, composition, and agenda time to carry out its core oversight responsibilities—financial reporting and internal controls—along with the range and complexity of other risks?

Understand how technology is affecting the organization’s talent, efficiency, and value-add.

Reinforce audit quality and stay abreast of PCAOB auditing standards.

Monitor management’s preparations for new climate reporting frameworks/standards

Drawing on insights from our survey work and interactions with audit committees and business leaders, we highlight nine issues to keep in mind as audit committees consider and carry out their 2025 agendas:

Audit committees can expect their company’s financial reporting, compliance, risk, and internal control environment to be put to the test in 2025. In addition to existing challenges—from global economic volatility, the wars in Ukraine and the Middle East to cyberattacks, preparations for US and global climate and sustainability reporting requirements, and advances in artificial intelligence (AI)—the change in administration could have a significant impact on the business and risk environment that companies must navigate. Audit committees should take a hard look at their skill sets and agendas. Does the committee have the leadership, composition, and agenda time to carry out its core oversight responsibilities—financial reporting and internal controls—along with the growing range and complexity of other risks?

Monitor management’s preparations for new reporting frameworks/standards.

insights from our survey work and interactions with audit committees and business leaders, to keep in mind as audit committees consider and carry out their 2025 agendas:

insights from our survey work and interactions with audit committees and business leaders, to keep in mind as audit committees consider and carry out their 2025 agendas:

Drawing on insights from our survey work and interactions with audit committees nine issues to keep in mind as audit committees consider and carry out their 2025

Audit committees can expect their company’s financial reporting, compliance, risk, and internal control environment to be put to the test in 2025. In addition to existing challenges—from global economic volatility, the wars in Ukraine and the Middle East to cyberattacks, preparations for US and global climate and sustainability reporting requirements, and advances in artificial intelligence (AI)—the change in administration could have a significant impact on the business and risk environment that companies must navigate. Audit committees should take a hard look at their skill sets and agendas. Does the committee have the leadership, composition, and agenda time to carry out its core oversight responsibilities—financial reporting and internal controls—along with the growing range and complexity of other risks?

Make sure internal audit is focused on the risks—beyond financial reporting and compliance—and valuable resource for the audit committee.

Drawing on insights from our survey work and interactions with audit committees nine issues to keep in mind as audit committees consider and carry out their 2025

the role of the audit committee in the oversight of generative AI (GenAI), cybersecurity, and governance.

focused on financial reporting and related internal risks—job number one.

Stay focused on financial reporting and related internal control risks—job number one.

insights from our survey work and interactions with audit committees and business leaders, to keep in mind as audit committees consider and carry out their 2025 agendas:

Make sure internal audit is focused on the risks—beyond financial reporting and compliance—and valuable resource for the audit committee.

Drawing on insights from our survey work and interactions with audit committees nine issues to keep in mind as audit committees consider and carry out their 2025

Stay focused on financial reporting and related internal control risks—job number one.

Stay focused on financial reporting and related internal control risks—job number one�

focused on financial reporting and related internal risks—job number one.

Make sure internal audit is focused on the company’s critical risks—beyond financial reporting and compliance—and is a valuable resource for the audit committee�

insights from our survey work and interactions with audit committees and business leaders, to keep in mind as audit committees consider and carry out their 2025 agendas:

the role of the audit committee in the oversight of generative AI (GenAI), cybersecurity, and governance.

Make sure internal risks—beyond financial valuable resource

Understand how technology is affecting the finance organization’s talent, efficiency, and value-add.

focused on financial reporting and related internal risks—job number one.

Clarify the role of the audit committee in the oversight of generative AI (GenAI), cybersecurity, and data governance.

Probe whether management has reassessed compliance and whistle-blower programs September Evaluation of Corporate Programs

Make sure internal risks—beyond financial valuable resource

Drawing on insights from our survey work and interactions with audit committees nine issues to keep in mind as audit committees consider and carry out their 2025

Stay focused on financial reporting and related internal control risks—job number one.

Understand how technology is affecting the finance organization’s talent, efficiency, and value-add.

the role of the audit committee in the oversight of generative AI (GenAI), cybersecurity, and governance.

Make sure internal audit is focused on the risks—beyond financial reporting and compliance—and valuable resource for the audit committee.

Stay focused on financial reporting and related internal control risks—job number one.

Clarify the role of the audit committee in the oversight of generative AI (GenAI), cybersecurity, and data governance.

audit quality and stay abreast of changes to auditing standards.

Clarify the role of the audit committee in the oversight of generative AI (GenAI), cybersecurity, and data governance�

the role of the audit committee in the oversight of generative AI (GenAI), cybersecurity, and governance.

Make sure internal risks—beyond financial valuable resource

Make sure internal audit is focused on the risks—beyond financial reporting and compliance—and valuable resource for the audit committee.

Probe whether management has reassessed compliance and whistle-blower programs September Evaluation of Corporate Programs

Understand how technology is affecting the finance organization’s talent, efficiency, and value-add.

Clarify the role of the audit committee in the oversight of generative AI (GenAI), cybersecurity, and data governance.

Understand how technology is affecting the finance organization’s talent, efficiency, and value-add.

Clarify the role of the audit committee in the oversight of generative AI (GenAI), cybersecurity, and data governance.

Reinforce audit quality and stay abreast of changes to auditing standards.

Understand how technology is affecting the finance organization’s talent, efficiency, and value-add.

management’s preparations for new climate reporting frameworks/standards.

Understand how technology is affecting the finance organization’s talent, efficiency, and value-add.

Probe whether management compliance and whistle-blower September Evaluation

Make sure internal risks—beyond financial valuable resource

Probe whether management compliance and whistle-blower September Evaluation

Stay apprised of tax legislative developments the potential impact on the company and

Probe whether management has reassessed compliance and whistle-blower programs

Probe whether management has reassessed the company’s compliance and whistleblower programs in light of the DOJ’s September Evaluation of Corporate Programs guidance�

Stay apprised of tax legislative developments the potential impact on the company and

Understand how technology is affecting the finance organization’s talent, efficiency, and value-add.

management’s preparations for new climate reporting frameworks/standards.

Reinforce audit quality and stay abreast of changes to auditing standards.

Understand how technology is affecting the finance organization’s talent, efficiency, and value-add�

Reinforce audit quality and stay abreast of changes to PCAOB auditing standards.

Reinforce audit quality and stay abreast of changes to auditing standards.

Probe whether management compliance and whistle-blower September Evaluation

Probe whether management has reassessed compliance and whistle-blower programs September Evaluation of Corporate Programs

Reinforce audit quality and stay abreast of changes to PCAOB auditing standards.

Understand how technology is affecting the finance organization’s talent, efficiency, and value-add.

Stay apprised of tax the potential impact

Take a fresh look at the audit committee’s skill sets.

September Evaluation of Corporate Programs

Stay apprised of tax the potential impact

Probe whether management compliance and whistle-blower September Evaluation

Take a fresh look at the audit committee’s skill sets.

Monitor management’s preparations for new climate reporting frameworks/standards.

Reinforce audit quality and stay abreast of changes to PCAOB auditing standards.

management’s preparations for new climate reporting frameworks/standards.

Stay apprised of tax legislative developments the potential impact on the company and

Monitor management’s preparations for new climate reporting frameworks/standards.

Reinforce audit quality and stay abreast of changes to PCAOB auditing standards�

management’s preparations for new climate reporting frameworks/standards.

Stay apprised of tax legislative developments in Washington and the potential impact on the company and its operations�

Reinforce audit quality and stay abreast of changes to PCAOB auditing standards.

Take a fresh look at skill sets.

Stay apprised of tax the potential impact

Stay apprised of tax legislative developments the potential impact on the company and

Take a fresh look at skill sets.

Stay apprised of tax the potential impact

Take a fresh look at the audit committee’s skill sets.

Monitor management’s preparations for new climate reporting frameworks/standards.

Monitor management’s preparations for new climate reporting frameworks/standards.

Take a fresh look at the audit committee’s composition and skill sets�

Take a fresh look skill sets.

Take a fresh look at the audit committee’s skill sets.

Take a fresh look at skill sets.

Stay focused on financial reporting and related internal control risks—job number one.

Focusing on the financial reporting, accounting, and disclosure obligations posed by the current geopolitical, macroeconomic, and risk landscape will be a top priority and major undertaking for audit committees in 2025 Key areas of focus for companies’ 2024 10-K and 2025 filings should include:

Forecasting and disclosures� Among the matters requiring the audit committee’s attention are disclosures regarding the impact of the wars in Ukraine and the Middle East; government sanctions; supply chain disruptions; heightened cybersecurity risk, inflation, interest rates, and market volatility; preparation of forward-looking cash-flow estimates; impairment of nonfinancial assets, including goodwill and other intangible assets; impact of events and trends on liquidity; accounting for financial assets (fair value); going concern; and use of non-GAAP metrics� With companies making more tough calls in the current environment, regulators are emphasizing the importance of wellreasoned judgments and transparency, including contemporaneous documentation to demonstrate that the company applied a rigorous process� Given the fluid nature of the long-term environment, disclosure of changes in judgments, estimates, and controls may be required more frequently�

Internal control over financial reporting (ICOFR) and probing control deficiencies� Given the current risk environment, as

well as changes in the business, such as acquisitions, new lines of business, digital transformations, etc�, internal controls will continue to be put to the test Discuss with management how the current environment and regulatory mandates affect management’s disclosure controls and procedures and ICOFR, as well as management’s assessment of the effectiveness of ICOFR� When control deficiencies are identified, probe beyond management’s explanation for “why it’s only a control deficiency” or “why it’s not a material weakness” and help provide a balanced evaluation of the deficiency’s severity and cause� Is the audit committee— with management—regularly taking a fresh look at the company’s control environment? Have controls kept pace with the company’s operations, business model, and changing risk profile?

Nonfinancial disclosures� In 2025, companies should expect the SEC to continue to prioritize nonfinancial disclosures, particularly disclosures regarding climate, cybersecurity, and AI, including the adequacy of internal controls and disclosure controls and procedures to support the company’s disclosures� Despite the stay of its final climate rules, the SEC continues to issue comment letters on climate disclosures based on the 2010 Commission Guidance Regarding Disclosure Related to Climate Change and its 2021 sample letter� As to cybersecurity disclosures, company procedures for identifying and reporting cyber incidents and risks will be under even greater scrutiny given the new Form 8-K reporting requirements for material cybersecurity incidents as well

as the SEC’s recent enforcement actions in this area� Regarding AI, in a June 2024 statement, Eric Gerding, director of the SEC’s Division of Corporation Finance, highlighted AI as a disclosure priority for the SEC and explained in some detail how the division will assess company disclosures regarding AI-related opportunities and risks� In a February 2024 speech focusing on AI and AIrelated risks, Chair Gary Gensler warned about “AI washing” or making inflated claims about the use of AI, which have now been the focus of SEC enforcement actions

Audit committees should task management with reassessing the adequacy of the company’s internal controls and disclosure controls and procedures to support the company’s current climate and AI disclosures (including disclosures contained in SEC filings, as well as voluntary disclosures), and reassess the company’s processes and procedures for identifying and escalating potentially significant cybersecurity incidents and risks to ensure timely analysis and disclosure of those determined to be material�

As disclosures under Item 1�05 of Form 8-K are limited to material cybersecurity incidents, it is essential that companies establish and maintain protocols and processes for making materiality determinations�

Clarify the role of the audit committee in the oversight of GenAI, cybersecurity, and data governance.

The explosive growth in the use of GenAI has emphasized the importance of data quality, having a responsible use AI policy, complying with evolving privacy and AI laws and regulations, and rigorously assessing data governance practices or, in some cases, developing data governance practices� As a result, many boards are probing whether the company’s data governance framework and interrelated AI, GenAI, and cybersecurity governance frameworks are keeping pace� A key question for boards is how to structure oversight of these areas at the full board and committee levels, including the audit committee�

In assessing the audit committee’s oversight responsibilities in these areas, we recommend the following areas of focus:

Assessing audit committee oversight responsibilities for GenAI� Many boards are still considering how best to oversee AI and GenAI and the appropriate roles of the full board as well as standing committees as they seek to understand GenAI’s potential impact on strategy and the business model� As we discuss

in On the 2025 board agenda, oversight for many companies is often at the full board level—where boards are seeking to understand the company’s strategy to develop business value from GenAI and monitor management’s governance structure for the deployment and use of the technology� However, many audit committees already may be involved in overseeing specific GenAI issues, and it is important to clarify the scope of the audit committee’s responsibilities� GenAI-related issues for which the audit committees may have oversight responsibilities include:

• Oversight of compliance with evolving AI, privacy, and intellectual property laws and regulations globally�

• Use of GenAI in the preparation and audit of financial statements and drafts of SEC and other regulatory filings�

• Use of GenAI by internal audit and the finance organization, and whether those functions have the necessary talent and skill sets�

• Development and maintenance of internal controls and disclosure controls and procedures related to AI and GenAI disclosures, as well as controls around data�

Assessing audit committee oversight responsibilities for cybersecurity and data governance� For many companies, much of the board’s oversight responsibility for cybersecurity and data governance has resided with the audit committee� With the explosive growth in GenAI and the significant risks posed by the technology, many

boards are rigorously assessing their data governance and cybersecurity frameworks and processes�

Given the audit committee’s heavy agenda, it may be helpful to have another board committee assume a role in the oversight of data governance and perhaps cybersecurity�

Understand how technology is affecting the finance organization’s talent, efficiency, and value-add.

Finance organizations face a challenging environment—addressing talent shortages, while at the same time managing digital strategies and transformations and developing robust systems and procedures to collect and maintain high-quality climate and sustainability data both to meet investor and other stakeholder demands and in preparation for US, state, and global disclosure requirements� At the same time, many are contending with difficulties in forecasting and planning for an uncertain environment�

As audit committees monitor and help guide the finance organization’s progress, we suggest two areas of focus:

• GenAI goes a long way toward solving one of the biggest pain points in finance: manual processes� Labor-intensive systems increase the risk of human errors, consume valuable resources, and limit realtime insights� At the same time, given the broad role for finance in strategy and risk management, finance professionals can play a role

in spearheading the company’s use and deployment of GenAI� GenAI and the acceleration of digital strategies and transformations present important opportunities for finance to add greater value to the business�

• Finance organizations also play an important role in many of the company’s climate and sustainability initiatives For example, many finance organizations have been assembling or expanding management teams or committees charged with preparing for US, state, and global climate and sustainability disclosure rules—e g , identifying and recruiting climate and sustainability talent and expertise; developing internal controls and disclosure controls and procedures; and putting in place technology, processes, and systems�

It is essential that the audit committee devote adequate time to understanding the finance organization’s GenAI and digital transformation strategy and climate/sustainability strategy, and help ensure that finance is attracting, developing, and retaining the leadership, talent, skill sets, and bench strength to execute those strategies alongside its existing responsibilities Staffing deficiencies in the finance department may pose the risk of an internal control deficiency, including a material weakness�

Reinforce audit quality and stay abreast of changes to PCAOB auditing standards

Audit quality is enhanced by a fully engaged audit committee that sets the tone and clear expectations for the external auditor and monitors auditor performance rigorously through frequent, quality communications and a robust performance assessment�

In setting expectations for 2025, audit committees should discuss with the auditor how the company’s financial reporting and related internal control risks have changed—and are changing—in light of the geopolitical, macroeconomic, regulatory, and risk landscape, as well as any changes in the business�

Set clear expectations for frequent, open, candid communications between the auditor and the audit committee, beyond what is required� The list of required communications is extensive and includes matters about the auditor’s

independence as well as matters related to the planning and results of the audit� Taking the conversation beyond what is required can enhance the audit committee’s oversight, particularly regarding the company’s culture, tone at the top, and the quality of talent in the finance organization�

Audit committees should probe the audit firm on its quality control systems that are intended to drive sustainable, improved audit quality—including the firm’s implementation and use of new technologies such as AI In discussions with the auditor regarding the firm’s quality control systems, consider the results of PCAOB inspections, Part I and Part II, and internal inspections and efforts to address deficiencies� Discussions should also include the status of the firm’s preparations for the PCAOB’s new quality control standard, QC 1000, A Firm’s System of Quality Control, which the SEC approved in September 2024�

QC 1000 will require audit firms to identify specific risks to audit quality and design a quality control system that includes policies and procedures to mitigate these risks� Audit firms will also be required to conduct annual evaluations of their quality control systems and report the results of their evaluation to the PCAOB on a new Form QC� QC 1000 is effective on December 15, 2025, with the first annual evaluation covering the period beginning on December 15, 2025, and ending on September 30, 2026�

Audit committees should also monitor developments in the PCAOB’s proposal

on noncompliance with laws and regulations (NOCLAR), which could significantly increase auditors’ responsibilities related to NOCLAR� Due to the PCAOB’s recent deferral of action on the proposed NOCLAR standard to 2025, there is uncertainty regarding the proposal�

Monitor management’s preparations for new climate reporting frameworks/ standards.

Despite the uncertainty associated with the SEC and California climate mandates, companies may have to comply with multiple inconsistent laws and will need to determine how best to structure their compliance and reporting programs to address new and complex climate disclosure requirements�

Given these near-term demands and growing consensus around common, comparable reporting standards— likely in accordance with the standards of the International Sustainability Standards Board, which incorporate the Task Force on Climate-related Financial Disclosures standards and Greenhouse Gas (GHG) Protocol—audit committees should closely monitor the state of management’s preparations for new climate reporting frameworks/ standards�

The uncertainty associated with the SEC’s climate disclosure rules is unlikely to temper the forces demanding climate disclosures by other means� Whether the SEC rules are upheld, struck down in whole or part, amended, or abandoned, pressure from investors, stakeholders,

and other regulators continues to drive the momentum toward detailed climate and sustainability disclosures� Even in the absence of legally required disclosures, many companies will continue to issue voluntary sustainability and climate-related reports� Moreover, many companies will be subject to European Union and other mandatory reporting regimes Companies not subject to mandatory climate reporting may be asked to provide climate information to companies to which they provide products and services�

Many companies will be impacted by more than one disclosure regime, and in that case, it is important to assess the level of interoperability between the relevant regulations in order to mitigate the impact of having to comply with multiple regulations at or near the same time� Preparation is about more than disclosures; it could require reassessments of the company’s climate-related risk management and board oversight processes, and other governance processes that are the subject of the disclosures�

In the coming months, a priority for audit committees will be to monitor the state of management’s preparations� A key question is whether management has the necessary talent, resources, and expertise—internal and external— to gather, organize, calculate, assure, and report the necessary climate data, such as GHG emissions, and to develop the necessary internal controls and disclosure controls and procedures to support the regulatory and voluntary climate disclosures� For

many companies, this will require a cross-functional management team from legal, finance, sustainability, risk, operations, IT, HR, and internal audit� Identifying and recruiting climate and GHG emissions expertise for a climate team—which may be in short supply— and implementing new systems to automate the data-gathering process will be essential

As discussed in Oversight of climate disclosures: SEC stay shouldn’t mean stop, we recommend the following areas for audit committees to focus in addition to management’s climate-related expertise and resources:

• Management’s plans to meet compliance deadlines

• Considerations of materiality and double materiality

• Disclosure controls and procedures, and internal controls

Preparations will be a complex and expensive undertaking, involving difficult interpretational issues, and likely may take months or perhaps years for some companies, especially for multinational organizations� The design and build of a functioning sustainability reporting process that meets regulatory needs will be an iterative process that will take time� Due to this, it is important that audit committees keep the topic on their agendas and continue to challenge management on progress towards compliance�

Make sure internal audit is focused on the company’s critical risks—beyond financial reporting and compliance— and is a valuable resource for the audit committee

At a time when audit committees are wrestling with heavy agendas and issues like GenAI, ESG, supply chain disruptions, cybersecurity, data governance, and global compliance are putting risk management to the test, internal audit should be a valuable resource for the audit committee and a crucial voice on risk and control matters� This means focusing not just on financial reporting and compliance risks, but on critical operational, GenAI and other technology risks and related controls, as well as ESG risks�

ESG-related risks include human capital management—from diversity to talent, leadership, and corporate culture—as well as climate, cybersecurity, data governance and data privacy, and risks associated with ESG disclosures� Disclosure controls and procedures and internal controls should be a key area of internal audit focus� Clarify internal audit’s role in connection with ESG risks and enterprise risk management more generally—which is not to manage risk, but to provide added assurance regarding the adequacy of risk management processes Does the finance organization have the talent it needs? Do management teams have the necessary resources and skill sets to execute new climate and ESG initiatives? Recognize that internal audit is not immune to talent pressures�

Make sure internal audit is focused on the company’s critical risks—beyond financial reporting and compliance— and is a valuable resource for the audit committee

At a time when audit committees are wrestling with heavy agendas and issues like GenAI, ESG, supply chain disruptions, cybersecurity, data governance, and global compliance are putting risk management to the test, internal audit should be a valuable resource for the audit committee and a crucial voice

on risk and control matters� This means focusing not just on financial reporting and compliance risks, but on critical operational, GenAI and other technology risks and related controls, as well as ESG risks�

ESG-related risks include human capital management—from diversity to talent, leadership, and corporate culture—as well as climate, cybersecurity, data governance and data privacy, and risks associated with ESG disclosures� Disclosure controls and procedures and internal controls should be a key area of internal audit focus� Clarify internal audit’s role in connection with ESG risks and enterprise risk management more generally—which is not to manage risk, but to provide added assurance regarding the adequacy of risk management processes� Does the finance organization have the talent it needs? Do management teams have the necessary resources and skill sets to execute new climate and ESG initiatives? Recognize that internal audit is not immune to talent pressures�

Given the evolving geopolitical, macroeconomic, and risk landscape, reassess whether the internal audit plan is risk-based and flexible enough to adjust to changing business and risk conditions� Going forward, the audit committee should work with the chief audit executive and chief risk officer to help identify the risks that pose the greatest threat to the company’s reputation, strategy, and operations,

and to help ensure that internal audit is focused on these key risks and related controls� These may include industryspecific, mission-critical, and regulatory risks; economic and geopolitical risks; the impact of climate change on the business; cybersecurity and data privacy; risks posed by GenAI and digital technologies; talent management and retention; hybrid work and organizational culture; supply chain and third-party risks; and the adequacy of business continuity and crisis management plans�

Internal audit’s broadening mandate will likely require upskilling the function� Set clear expectations and help ensure that internal audit has the talent, resources, skills, and expertise to succeed— and help the chief audit executive think through the impact of digital technologies on internal audit�

Probe whether management has reassessed the company’s compliance and whistle-blower programs in light of the DOJ’s September Evaluation of Corporate Compliance Programs guidance.

In September, the US Department of Justice (DOJ) released a revised version of its guidance for Evaluation of Corporate Compliance Programs (Guidance), which is a tool prosecutors use to evaluate a company’s compliance program in determining how to resolve a criminal investigation�¹ The revised Guidance focuses on the risks posed by emerging technologies,

1 U S Department of Justice Criminal Division Evaluation of Corporate Compliance Programs (updated September 2024)�

2� Principal Deputy Assistant Attorney General Nicole M� Argentieri Remarks at the Society of Corporate Compliance and Ethics 23rd Annual

such as AI, as well as whistleblower protections, and important lessons learned “from both the company’s own prior misconduct and from issues at other companies to update their compliance programs and train employees�”

In prepared remarks, Principal Deputy Assistant Attorney General Nicole M� Argentieri stated that the revised Guidance includes an evaluation of how companies are assessing and managing the risks related to the use of new technology such as AI both in their business and in their compliance programs�²

“Under the [revised Guidance], prosecutors will consider the technology that a company and its employees use to conduct business, whether the company has conducted a risk assessment of the use of that technology, and whether the company has taken appropriate steps to mitigate any risk associated with the use of that technology.

For example, prosecutors will consider whether the company is vulnerable to criminal schemes enabled by new technology, such as false approvals and documentation generated by AI. If so, we will consider whether compliance controls and tools are in place to identify and mitigate those risks, such as tools to confirm the accuracy or reliability of data used by the business.

We also want to know whether the company is monitoring and testing its technology to evaluate if it is functioning

as intended and consistent with the company’s code of conduct.”

The revised Guidance also includes questions designed to evaluate whether companies are encouraging employees to speak up and report misconduct, and whether a compliance program has appropriate resources and access to data, including to assess its own effectiveness�

Given the significant risks posed by GenAI and the focus of regulators such as the DOJ and SEC on how companies are managing and mitigating the risks posed by the technology, companies should reassess their compliance and whistleblower programs and update the programs as appropriate�

Stay apprised of tax legislative developments in Washington and the potential impact on the company and its operations.

The new administration’s policy agenda—from infrastructure investments and business incentives to tax and regulatory priorities—will shape the business environment for years to come� As companies and their boards consider the policy implications, tax policy should be front and center given the potential impacts on cash flow, investment location, and the business landscape generally�

With $4 trillion in tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) set to expire at the end of next year, 2025 is going to be a big year for tax as House and Senate Republicans are expected to negotiate extending some of its provisions� The White House will require Congress to take the lead on legislating a solution to the 2025 tax cliff, and philosophical shifts in both parties since the TCJA was enacted make what either might do less predictable�

Ultimately, the tax picture that emerges will be driven by a combination of budgetary, fiscal, and political realities, which makes it difficult to predict� Boards and audit committees should prompt deeper conversations with management about how their companies are preparing for a range of possibilities, including by asking management about the type of scenario planning being done; understanding the variables that may be more “forecastable” and

looking at the impacts on cash flow; and considering how best to monitor state, federal, and global regulatory developments�

These and other considerations can help the audit committee support management in thinking through various scenarios and positioning the company as the post-election policy landscape unfolds�

Take a fresh look at the audit committee’s composition and skill sets.

The continued expansion of the audit committee’s oversight responsibilities beyond its core oversight responsibilities (financial reporting and related internal controls, and internal and external auditors) has heightened concerns about the committee’s bandwidth and composition and skill sets� Assess whether the committee has the time and the right composition and skill sets to oversee the major risks on its plate� Such an assessment is sometimes done in connection with an overall reassessment of issues assigned to each board standing committee�

In making that assessment, we recommend three areas to probe as part of the audit committee’s annual self-evaluation:

• Does the committee have the bandwidth and members with the experience and skill sets necessary to oversee areas of risk beyond its core responsibilities that it has been assigned? For example, do

some risks, such as mission-critical risks as well as supply chain issues and geopolitical risk, require more attention at the full board level—or perhaps the focus of a separate board committee?

• How many committee members have deep expertise in financial accounting, reporting, and control issues? Is the committee relying only on one or two members to do the “heavy lifting” in the oversight of financial reporting and controls?

• As the committee’s workload expands to include oversight of disclosures of nonfinancial information—including cybersecurity, climate, GenAI, and other environmental and social issues—as well as related disclosure controls and procedures and internal controls, does it have the necessary financial reporting and internal

control expertise to effectively carry out these responsibilities as well as its core oversight responsibilities? Does the committee need the input from experts in order to discharge its oversight duties?

With investors and regulators focusing on audit committee composition and skill sets, this is an important issue for audit committees�

By Frank Kurre and Jim DeLoach

With the pace of change, technological advancement, geopolitical developments, and business-model evolution in the marketplace, the topics of organizational blind spots and industry disruption continue to command interest in the boardroom. Recent events hosted by Protiviti offer additional insights on these important topics.

In October, Protiviti hosted two events attended by more than 700 directors and senior-level executives to discuss organizational blind spots and industry disruption1� Prior issues of Board Perspectives have discussed these matters Our intention in facilitating the expert panels at these two events was to solicit further commentary on these topics of interest to many directors�

Following are 10 key takeaways discussed at these events:

DIRECTORS NEED TO THINK BROADLY AND HOLISTICALLY AS THEY ENGAGE IN STRATEGIC CONVERSATIONS REGARDING THE ORGANIZATION’S RISKS. THERE SHOULD BE EMPHASIS ON ASKING, “WHAT WOULD WE DO IF THIS WERE TO HAPPEN?”

1 The first event was a breakout session, “Blind Spots in the Boardroom,” on October 8, 2024, at the National Association of Corporate Directors (NACD) Summit in Washington, D C The second event was a webinar, “Disrupt or Be Disrupted,” conducted the following week on October 15

1� Adopt an enterprise risk management mindset to identify blind spots�

2� Identify scenarios and gather around the table�

3� Foster more engagement and forward-looking dialogue�

4� Identify potential disruptors�

5� Don’t wait to be disrupted�

6� Know where the company is on the disruption continuum�

7� Recognize promptly when the company is being disrupted—or face the consequences�

8� Make the company’s crisis management plan world-class�

9� Reduce blind spots by interacting with employees�

10� Pay attention to board culture, skill sets, and performance�

Adopt an enterprise risk management (ERM) mindset to identify blind spots.

Risks are dynamic and shifting frequently, giving rise to multiple issues simultaneously� A strong focus on ERM emphasizes having robust processes for analyzing risk in the context of strategic objectives, designing cost-effective mitigation activities and evaluating preparedness for the unexpected� The management team should present its view of the top risks and the mitigation efforts in place to the board periodically� Directors need to think broadly and holistically as they engage in strategic conversations regarding the organization’s risks� There should be emphasis on asking, “Whatwould we do if various scenarios were to happen?”

Identify scenarios and gather around the table.

Because blind spots can result in the unexpected, tabletop exercises offer a useful process for playing out various scenarios to evaluate organizational preparedness� Examples of common scenarios cited were:

• Cyberattacks

• Loss of a major customer

• Loss of significant market share to a competitor

• Natural disasters

• Data center outages

• Product failures

• Regulatory changes

At the events, some commenters suggested that not enough companies are looking at scenarios related to reputational issues involving highprofile lawsuits or negative media or to scenarios related to sourcing and retaining critical talent and the effects of changing demographics, declining population growth and generational differences on the workforce pipeline In addition, changes in customer loyalty and experiences and the effects of innovation programs of major competitors were also mentioned as areas warranting more attention Tabletop exercises are useful in getting leaders to brainstorm and think outside of the box in their preparations� They should conclude with a debrief that enables participants to discuss what went well and what didn’t so that improvements in the process can be identified and addressed� They can also feed the need for effective intelligence functions to understand what competitors and new market entrants are doing�

Foster more engagement and forwardlooking dialogue.

Blind spots interest directors because they understand that what they don’t know can often be as impactful as what they do know� They also understand that the world is unpredictable� Thus, free-flowing strategic discussions in the boardroom regarding the issues that matter should be used to establish a context for identifying blind spots� For example, boards should keep the focus of their meetings on the three things going well for the company, the three

things not going well and the three things with the greatest uncertainty� Directors should offer suggestions on how information can be presented and streamlined to highlight the most useful information in an organized way� Board decks should be condensed and focused so that they are a valued strategic tool rather than an administrative exercise The boardroom culture and the supporting board materials should foster forward-looking critical thinking�

Identify potential disruptors.

For this discussion, we define “disruption” as referring to various situations that could force significant adjustments to a company’s strategy, business model, talent pool or supply chain, and in some cases could even disintermediate the firm’s position in the value chain� Such situations may be technology-driven when a market player or new entrant creates transformative offerings that enable superior customer experience

A HIGH PERCENTAGE OF CEOS EXPRESS CONCERN THAT THEIR COMPANIES MAY NOT REMAIN VIABLE OVER THE NEXT 10 YEARS.

UNCERTAINTY MAY BE AT THE ROOT OF THIS CONCERN. IT IS INEVITABLE THAT INNOVATIONS WILL RESHAPE EVERY INDUSTRY. THESE MATTERS PROVIDE CONTEXT FOR BOARDROOM DISCUSSIONS.

and competitive advantage� They may also result from sudden events (e�g�, a pandemic or regional conflict) or longterm developing trends (e�g�, shifting demographics)

Interestingly, a high percentage of CEOs express concern that their companies may not remain viable over the next 10 years�2 Uncertainty may be at the root of this concern It is inevitable that innovations will reshape every industry, giving rise to questions regarding which new products and services companies are currently developing that will replace the ones that will eventually lose relevance�

Following are examples of disruptive blind spots cited in the discussion during the two events that augment the summary of scenario examples noted earlier:

• The related uncertainties around the responsible deployment of AI strategy and other advanced technologies and the related impacts on business models and customer experiences�

• The potential for supply chain disruption — not just the direct supply chain but also the indirect supply chain comprising those tier 2 and 3 companies further upstream whose raw materials and components are critically vital to the organization’s success�

• Attacks on the electric grid and disruptions to other sources of energy�

• Succession planning, with an

emphasis on who can step in immediately� (For example, if something were to happen to a key executive, what is the plan to keep the company running? Are there travel rules regarding which and how many executives can fly together?)

• The effectiveness of secondary and higher education in supplying essential skills to the workforce over the next 10 years�

• The business interruption plan to address a ransomware attack�

• Other events that can impair reputation and brand image

These matters provide context for boardroom discussions� They suggest a need to identify potential disruptors that could affect the company� To that end, it was noted that Blockbuster’s CEO had been approached by the founders of Netflix to invest in streaming� It was a rare situation in which an eventual industry disruptor walked into the CEO’s office and presented a timely opportunity to reimagine the company’s approach to the market� In turning it down, Blockbuster forgot its value proposition: Offer convenience to the customer� This example illustrates the blinding effects of clinging to a soon-tobe-obsolete business model�

Also, the conversation regarding potential disruptors suggests a need to keep an eye on activists� To that point, conduct a tabletop exercise with investment bankers or other seasoned outsiders and ask them to play the role

2� “More CEOs fear their companies won’t survive 10 years as AI and climate challenges grow, survey says,” by Courtney Bonnell, AP News, January 15, 2024: https://apnews�com/article/davos-ceo-survey-ai-climate-changeeconomy-cdf526bec5ce12812b5d2704dc054867�

of an activist and inform management about what the company’s weak spots are�

OFTEN, THE COMPANIES DISRUPTED ARE THOSE THAT EMBRACE THE STATUS QUO, ARE DIGITALLY UNDERDEVELOPED, ARE TOO ASSET-HEAVY, ARE COMPLACENT IN HIDING BEHIND MOATS THEY BELIEVE TO BE IMPREGNABLE, ARE CONSTRAINED BY SHORT-TERMISM, OR ARE CONTENT WITH INCREMENTALLY IMPROVING PROCESSES, PRODUCTS AND SERVICES. AND, UNFORTUNATELY, THEY MAY NOT SEE WHAT’S COMING UNTIL IT IS TOO LATE.

Don’t wait to be disrupted.

Recently, Fortune featured Mary Barra, CEO of General Motors Co�, on the cover of its magazine with a quote, “We’re not going to wait to be disrupted�” Barra is leading GM to adapt and transform the company proactively rather than passively waiting to react to the inevitable changes in the industry, particularly in the face of the growing electric vehicle market and continued technological advancements�3 Her point is clear: No organization is immune to disruptive forces; therefore, waiting for disruption is incongruent with an organization’s intent to thrive�

During the October events, various steps were suggested for companies

to stay ahead of the disruption wave before it crests� The basic suggestions include focusing on customer feedback, continuously analyzing market trends, gathering competitor intelligence, investing in innovative products and processes, upskilling the workforce to succeed, embracing digital transformation opportunities, and implementing strong cybersecurity measures� The fine points include adopting agile practices, entering into strategic partnerships, diversifying revenue streams, maintaining liquidity and adopting sustainable practices

Directors should insist that these and other appropriate proactive measures be considered during the strategysetting process to better manage the risk of disruption�

Know where the company is on the disruption continuum.

Often, the companies disrupted are those that embrace the status quo, are digitally underdeveloped, are too assetheavy, are complacent in hiding behind moats they believe to be impregnable, are constrained by short termism, or are content with incrementally improving processes, products and services� And, unfortunately, they may not see what’s coming until it is too late�

As the late academic and business consultant Clayton Christensen indicated, disruption is more about anticipating customers’ unstated or

3 “GM CEO Mary Barra has spent a decade determined not to be disrupted How she’s transforming the auto giant for the EV future,” by Michal Lev-Ram, Fortune, October 2, 2024: https://fortune com/2024/10/02/gm-ceo-marybarra-cruise-electric-vehicles/

future needs than meeting their current needs 4

Thus, the phrase “disrupt or be disrupted” is an implicit call for businesses to become more proactive and agile� It is a question of where a company chooses to position itself on the disruption continuum� Is the company:

• A disruptive leader that transforms the industry or even creates an entirely new industry (e�g�, Amazon, Netflix)?

• A disruptive aspirant, meaning it aspires to become a leader but isn’t there yet? (This may include startups�)

• An agile follower that can quickly pivot and stay in the game and even make first-mover offerings far better (e�g�, Apple)?

• A reactive follower (i�e�, slow to respond)?

• A skeptical laggard that clings to the status quo (e�g�, Blockbuster)?

For the board, a company’s positioning on this continuum is indicative of its commitment to: adapting to evolving customer preferences, employee expectations and competitor actions; making data-informed decisions at market speed; and continuously innovating to create value for their customers in new ways�

In today’s digital world, companies must be either proactive in shaping their future as well as the future of their

4�

industry or agile enough to qualify as an early mover in the marketplace� Alternatively, they cede this opportunity to their competitors�

Recognize promptly when the company is being disrupted — or face the consequences.

In the October webinar, we asked two questions: How would you know you are being disrupted, and when would you know it? To the first question, the top three responses from over 400 directors and C-level executives were:

• Monitor emerging disruptive trends or technologies (33%)�

• Monitor industry fundamentals and competitor actions (32%)�

• Monitor significant revenue decline and losses of major customers (10%)�

To the second question, the top three responses were:

• In time to pivot with necessary adjustments (28%)�

• Whn strategic assumptions are no longer valid (26%)�

• When our core market offerings are no longer relevant (17%)�

• These two questions are highly relevant in the boardroom�

Make the company’s crisis management plan world-class.

The existence of blind spots suggests it is impossible to anticipate every possible disruption� Therefore, any discussion of blind spots and disruption must acknowledge the need for a

MANY BOARD MEMBERS SERVE ON MULTIPLE BOARDS, GIVING THEM A BROADER PERSPECTIVE AS THEY LOOK ACROSS MORE THAN ONE COMPANY. IN ADDITION, BOARD MEMBERS CAN MINIMIZE THEIR BLIND SPOTS BY INTERACTING WITH MANAGERS AND EMPLOYEES AT LEVELS BELOW THE C-SUITE — PARTICULARLY THOSE WHO ARE MARKET-FACING.