New Tax Begins Jan. 2022

First-in-the-nation long-term care tax coming in Jan. 2022 by Janelle Guthrie Communications Director

Washington will soon become the first in the nation to offer long-term care benefits for all workers in the state. The new benefits won’t be available to eligible residents until 2025, but employers must start collecting the new payroll tax from ALL Washingtonbased employees in January 2022 to fund these benefits. Here’s what you need to know and resources for you and your employees. Payroll tax collection starts January 2022 Starting in January 2022, the Long-Term Services and Supports (LTSS) Trust Act requires employers to collect a 0.58% payroll tax from all employees (with no income limit)—unless the employee applies and is approved for an exemption. Every employee contributes—employers do not. If you are selfemployed, you can opt-in to the Trust.

8

Up to $36,500 in lifetime benefits available The state will start paying the benefits to eligible individuals in January 2025. Each person may receive a lifetime benefit of up to $36,500 to pay for longterm services and supports, regardless of their contribution. The benefit can be used for a range of services and supports, such as: n Professional personal care in your home, an assisted living facility, an adult family home or a nursing home n Adaptive equipment and technology like hearing devices and medication reminder devices n Home safety evaluations n Training and support for paid and unpaid family members who provide care as well as respite care

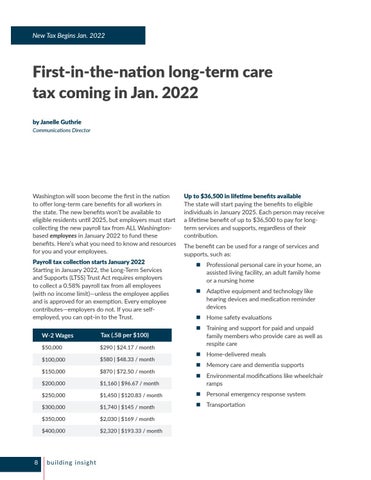

W-2 Wages

Tax (.58 per $100)

$50,000

$290 | $24.17 / month

$100,000

$580 | $48.33 / month

$150,000

$870 | $72.50 / month

$200,000

$1,160 | $96.67 / month

n Environmental modifications like wheelchair ramps

$250,000

$1,450 | $120.83 / month

n Personal emergency response system

$300,000

$1,740 | $145 / month

n Transportation

$350,000

$2,030 | $169 / month

$400,000

$2,320 | $193.33 / month

building insight

n Home-delivered meals n Memory care and dementia supports