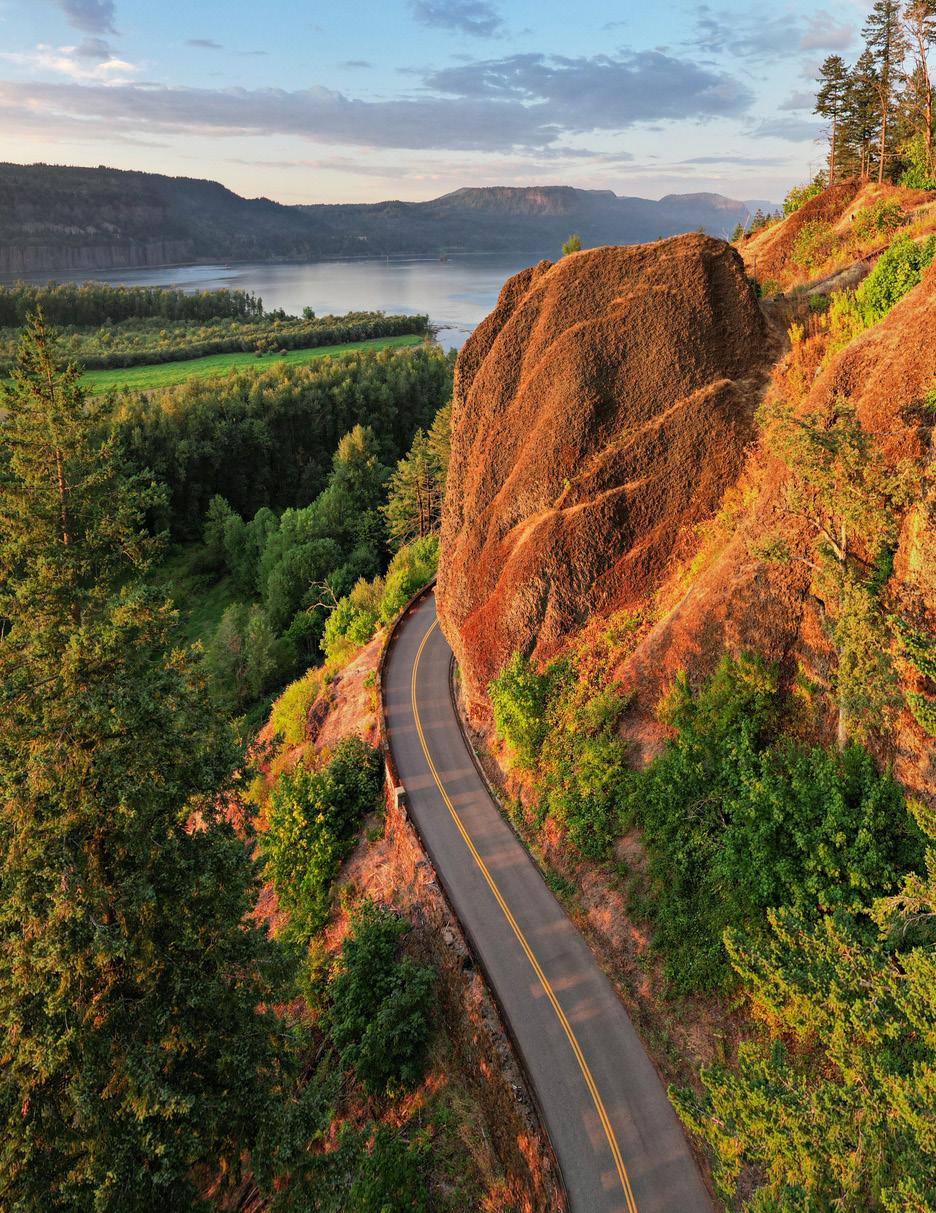

Q2 2024

PACIFIC NW MARKET REPORT

ABOUT THIS REPORT

The Berkshire Hathaway HomeServices Quarterly Market Report features the latest MLS data and local market statistics. Through year-over-year comparisons of key performance indicators and market summaries, this report delivers a comprehensive overview of residential real estate activity for the regions we service across the Pacific Northwest, including:

• Greater Portland Metro Area

• Southwest Washington (Vancouver Metro Area)

• Greater Seattle Metro Area (King, Pierce, Snohomish, & Thurston)

• Mid-Willamette Valley (Marion, Polk, Linn, & Benton)

• Central Oregon

• Eugene, Coastal, and Southern Oregon (Lane, Tillamook, & Douglas)

Learn about trends affecting sales activity and price, read decisive takeaways for each market, and empower yourself with Northwest Knowledge.

ABOUT US

Since 1942, we’ve been helping people buy and sell homes in Oregon and Washington. With 29 offices and a growing regional network of nearly 1,000 real estate professionals, we lead the Northwest in delivering exceptional service backed by datadriven market intelligence, just like you’ll find throughout this report.

For more information and assistance to help successfully navigate today’s real estate market, contact your local Berkshire Hathaway HomeServices broker. We are

All statistics are based upon MLS data for the period of April 1, 2024 – June 30, 2024.

LETTER FROM THE EDITOR

In the real estate industry, spring is called the “selling season,” and as this Berkshire Hathaway HomeServices Quarterly Market Report will show, the Q2 2024 spring market was no exception. New listings increased throughout the Pacific Northwest, with more sellers putting their homes up for sale than at any other time this year.

The springtime surge in supply was a welcomed sight for buyers, who’ve been impacted by recent rate trends and a shortage of inventory. Despite rates still hovering at elevated levels compared to the record lows of recent years, many buyers enthusiastically jumped back into the market during Q2; overall market activity increased on a year-over-year basis in a majority of areas surveyed for this report.

Even with increased inventory putting pressure on pricing, home prices generally continued their upward climb, though in many regions, the rate of that price appreciation did slow. Still, higher prices translate into more value for your home, proving why consumers continue to regard real estate as the best long-term investment.

So, whether you’re looking to enjoy the benefits of homeownership or seeking a successful, stressfree home sale, our Q2 Market Report will empower you with Northwest Knowledge... just like our Berkshire Hathaway HomeServices professionals will help you achieve your real estate and lifestyle goals.

Melanie Weidenbach, President & CEO

Greater Portland Metro Area

As expected during the spring selling season, month-over-month inventory increased throughout the Portland Metro Area, and on a year-over-year comparison, new listings, active listings, closed transactions, and pending sales posted higher figures than this time last year. As supply still fell short of demand, prices continued to trend upward, though the rate of acceleration has noticeably slowed.

DAYS ON MARKET

Average days on market in the Greater Portland Metro Area increased 26% from 31 days in Q2 2023 to 39 days this quarter. In Milwaukie/ Clackamas/Happy Valley, average days on market skyrocketed 61% year-over-year to an average of 50 days. Northeast Portland posted the shortest average days on market (26 days) for Q2 2024, though this number still represented a 13% year-over-year rise.

NEW LISTINGS, ACTIVE LISTINGS, & PENDING SALES

New listings (9,735) increased a slight 3% this quarter compared with Q2 2023; active listings edged up 8% to 13,777 and pending sales (6,689) posed a 2% rise compared with this time last year.

AVERAGE SALES PRICE

Throughout the Greater Portland Metro Area, average sales price increased by 1%, rising from $620,867 in Q2 2023 to $628,255 this quarter. The average sales price in Clackamas County and Washington County was unchanged from this time last year, but prices elsewhere showed movement compared with year-ago figures. In Newberg, average sales price increased 16% to end Q2 2024 at $671,715. With an average sales price of $1,121,426 this quarter, Lake Oswego recorded the highest average price in the region, though it represents a 10% decline from average sales price in Q2 of 2023.

CLOSED TRANSACTIONS

Overall, the Greater Portland Metro Area closed transactions (6,388) increased 3% from year-ago figures. On a percentage basis, Oregon City increased the most year-over-year, where a total of 169 closed units represented a 24% jump from year-ago figures. Closed units in Newberg went the opposite way, falling 30% compared with this time last year to end Q2 2024 at 97 units.

GREATER PORTLAND METRO AREA

Southwest Washington

(Vancouver Metro Area)

New listings, active listings, and pending sales increased throughout Southwest Washington this quarter. Prices climbed on a year-over-year basis, as a competitive market and somewhat stable interest rates coupled with constrained inventory and pent-up buyer demand put upward pressure on pricing.

DAYS ON MARKET

With an increase of 19% year-over-year, average days on market ended Q2 2024 at 37 days. Days on market averages fluctuated significantly throughout Southwest Washington cities: In Ridgefield, for example, average days on market (56 days) jumped 65% year-over-year, and in La Center, average days on market slid 33% from year-ago figures to end Q2 2024 at 40 days.

AVERAGE SALES PRICE

Average sales price in the Vancouver Metro Area increased 4%, rising from $594,625 in Q2 2023 to $619,533 in Q2 2024. On a city-by-city analysis, average sales price mostly increased across the board, though it remained flat from Q2 of last year in Vancouver ($540,874) and fell just 1% yearover-year in Ridgefield ($643,163). Average sales price in Washougal increased 14% from year-ago figures to end Q2 2024 at $808,028.

CLOSED TRANSACTIONS & PENDING SALES

In Southwest Washington, closed transactions (1,725) increased 3% compared with this time last year. Closed units in Washougal experienced the largest year-over-year increase on a percentage basis, rising 35% to 116 units this quarter.

NEW LISTINGS & ACTIVE LISTINGS

New listings (2,611) were up 9%, active listings (3,733) climbed 18% and pending sales increased 5% to end Q2 2024 at 1,855.

SW WASHINGTON METRO AREA

NUMBER OF CLOSED UNITS

Greater Seattle Metro Area

(King, Pierce, Snohomish, & Thurston)

All signs point to a strengthening housing market in the Greater Seattle region, with new listings, active listings, closed transactions, pending sales, and average sales prices all posting higher figures than this time last year. The market moved faster, too; the average days on market stats were lower when compared with year-ago figures.

DAYS ON MARKET

Throughout the Greater Seattle Metro Area, average days on market decreased 19% year-over-year to a fast-moving 21 days. In Redmond/Carnation, average days on market declined 44% from year-ago figures to end Q2 2024 at 10 days, the lowest days-onmarket average recorded for the region.

CLOSED TRANSACTIONS

Closed transactions in the Greater Seattle Metro Area dropped 5% year-over-year to 14,639. Despite the decline in units across the region, many cities throughout the region saw closings trend favorably, with the biggest percentage-based increase experienced in Juanita/Woodinville, where closed units (172) increased 38% compared with year-ago figures. On the opposite side of this trend, closed units in Federal Way/Dash Point declined 28% year-overyear to 207 this quarter.

PENDING SALES, NEW LISTINGS, & ACTIVE LISTINGS

Pending sales (15,446) increased 6% compared with this quarter last year. New listings (21,520) were up 21% year-over-year and active listings increased 18% to 26,651 this quarter.

AVERAGE SALES PRICE

In the Greater Seattle Metro Area, average sales price increased 11% year-over-year, rising to $938,609 this quarter from $848,429 in Q2 of 2023. Average sales price increased in all but two Greater Seattle Metro Area cities (Burien/Normandy Park and Olympia), jumping the most on a percentage basis in Mercer Island, where average sales price climbed 32% year-over-year to $3,096,077 –the highest average sales price record in the region this quarter.

PACIFIC NW MARKET REPORT

GREATER SEATTLE METRO AREA

Mid-Willamette Valley

(Marion, Polk, Linn, & Benton)

Overall, the Mid-Willamette Valley spring real estate market posted moderate gains, remaining mostly within single digital percentage-point differentials from this time last year. New listings in Q2 2024 compared with Q2 2023 were unchanged, a potential byproduct of interest rates keeping some sellers from putting their homes on the market and foregoing their more favorable rates.

DAYS ON MARKET

Rising 4% year-over-year, average days on market in the MidWillamette Valley was 52 days this quarter. Results on a cityby-city basis were mixed; in Independence, average days on market (58 days) dropped 27% compared with year-ago figures, while in Monmouth, the average days on market (52 days) was up 18% year-over-year.

AVERAGE SALES PRICE

The average sales price was $461,680, representing a 3% rise from year-ago figures. Salem/Keizer averaged $459,408, a 5% year-over-year gain. Increasing 11% year-over-year to $558,178, Philomath posted the highest average sales price in the region and also the largest increase on a percentage basis.

PENDING SALES, NEW LISTINGS, & ACTIVE LISTINGS

Pending sales in the Mid-Willamette Valley missed the mark by 6% to end Q2 2024 at 1,186. New listings (1,704) remained flat and active listings increased 3% year-over-year to 2,692 this quarter.

CLOSED TRANSACTIONS

Closed transactions throughout the Mid-Willamette Valley (1,136) were down 6% from year-ago figures. Closed units in Philomath climbed 30% to 26 units this quarter even as market activity in Independence went the other direction, declining 16% from year-ago figures to end Q2 2024 at 37 units.

PACIFIC NW MARKET REPORT

MID-WILLAMETTE VALLEY

MID-WILLAMETTE VALLEY

Central Oregon

The Central Oregon markets saw moderate growth in both units and price appreciation. Despite a somewhat tempered spring marketplace, average sales price in Central Oregon still followed an upward trajectory, though homes remained on the market for longer than they did this time last year.

AVERAGE SALES PRICE

Central Oregon’s average sales price increased 8% yearover-year to $810,849 this quarter. In Redmond/Terrebonne, the average price was up 14% to $582,179 this quarter. At $940,493, Bend recorded the highest average sales price in the region, which represented a 9% rise from year-ago figures.

CLOSED TRANSACTIONS & PENDING SALES

Closed transactions (1,099) increased a slight 1% year-overyear throughout Central Oregon. On a percentage basis, closed units in Sunriver increased the most, rising 22% to 45 units this quarter compared with the same period last year. In Bend, closed transactions declined 5% to end Q2 2024 at 631. Central Oregon pending sales (1,182) this quarter increased 5% compared with Q2 of 2023.

NEW LISTINGS & ACTIVE LISTINGS

New listings (1,934) jumped 15% from year-ago figures and active listings (2,943) were up 19% compared with Q2 last year.

DAYS ON MARKET

Average days on market posted a 16% year-over-year gain this quarter, ending Q2 2024 at an average of 51 days. In Sunriver, days on market jumped significantly, rising 82% year-over-year to an average of 60 days, the longest averagedays-on-market figure recorded in the region. At 44 days, Bend’s average time on the market was the lowest in Central Oregon, though this figure is still 16% higher than in Q2 of last year.

CENTRAL OREGON

Eugene, Coastal, & Southern Oregon

(Lane, Tillamook, & Douglas)

Active inventory in Eugene, Coastal, and Southern Oregon continued to rise throughout the spring selling season, sending average sales prices toward a slight 1% decline as more homes appeared on the market and competition among sellers increased. New listings, active listings, closed units, and pending sales posted stronger numbers than this time last year.

DAYS ON MARKET

The average days on market in Eugene, Coastal, and Southern Oregon was 41 days, just 2% lower than average days on market this time last year. In Garibaldi, average days on market fell 63.6% year-over-year to a fast-moving 28 days, the lowest days on market figure posted in the region. In Netarts, average days on market climbed 288% from year-ago figures to end Q2 2024 at 66 days.

CLOSED UNITS

Closed transactions inched up 1% from year-ago figures to 1,489 this quarter. Closed units in Netarts (12) climbed 70% year-overyear, and closed units in Roseburg (174) notably saw a 21% rise from year-ago figures.

NEW LISTINGS, ACTIVE LISTINGS, AND PENDING SALES

New listings (2,319) were up 10% compared with this time last year, active listings also increased, rising 15% to end Q2 2024 at 3,424, compared with 2,976 in Q2 2023. Pending sales (1,658) posted a 9% gain.

AVERAGE SALES PRICE

Dipping 1% from year-ago figures, average sales price ended Q2 2024 at $444,545. In Netarts, average sales price jumped 21% to $684,959 this quarter. Oceanside posted the highest average sales price for the region – $910,000 – though it represented a 3.3% decline from year-ago figures. Notably, Tillamook’s average sales price surged 215% year-over-year to $449,000 this quarter, though only one closed transaction was recorded.

EUGENE, COASTAL, & SOUTHERN OREGON