6 minute read

Does exness kyc verification in india?

Does exness kyc verification in india is a common question among traders in India who are interested in using the Exness trading platform. Exness, a leading global forex and CFD broker, does offer services in India, and traders here are required to go through a Know Your Customer (KYC) verification process.

💥💥💥Visit Website Exness Official ✅

👉👉👉Click Here To Register On Exness

Exness KYC Verification in India: An Overview

Exness, like most other regulated financial institutions, has implemented robust KYC and Anti-Money Laundering (AML) procedures to ensure the integrity of its platform and protect its clients. The KYC process is an essential step for any trader who wishes to open an account and begin trading with Exness in India.

Conditions for Opening an Indian Account with Exness

To open an Exness trading account in India, prospective clients must meet certain conditions for opening an Indian account. These include:

Minimum Age Requirement

Traders must be at least 18 years of age to open an Exness account in India. This is in line with the legal age of majority in the country.

Residency Status

Traders must be Indian residents, either citizens or permanent residents, to open an Exness account. Non-resident Indians (NRIs) or foreigners are not eligible to open an account.

Compliance with Regulations

Traders must comply with all applicable Indian financial regulations, including those set by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI).

How to Verify Your Account on Exness

The how to verify process for Exness accounts in India involves several steps:

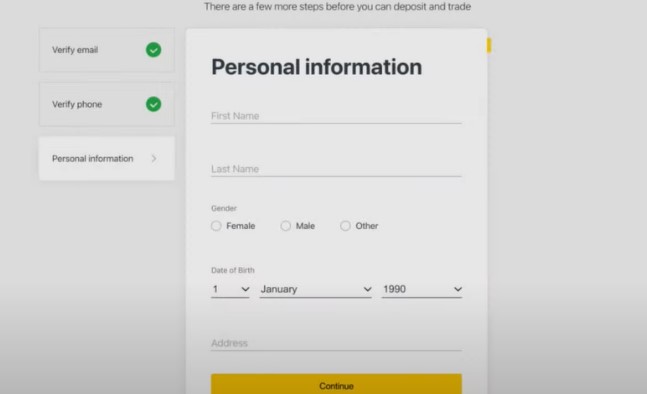

Personal Information Submission

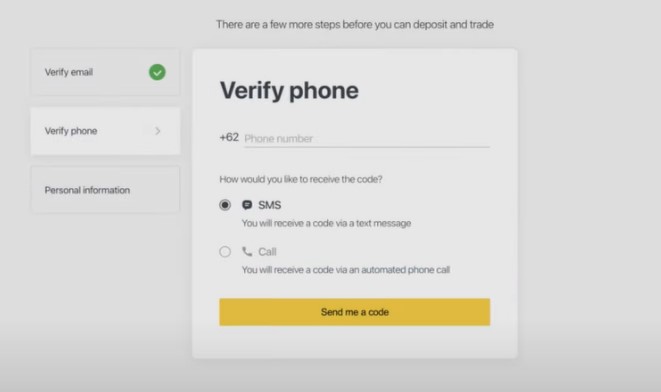

Traders must provide accurate personal information, including their full name, date of birth, and contact details.

👉👉Click Here To Register On Exness

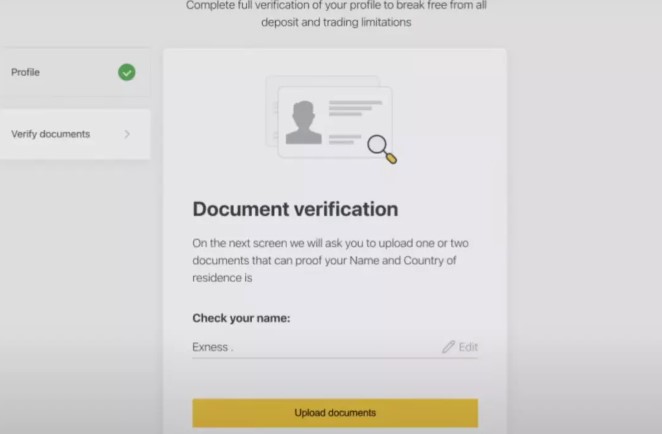

Document Upload

Traders will be required to upload copies of their identification documents, such as a government-issued ID card or passport, as well as proof of address documents like utility bills or bank statements.

Verification by Exness

Exness will review the submitted documents and verify the trader's identity and residency status. This process is crucial to comply with KYC and AML regulations.

Step-by-Step Guide to Complete Exness Verification

The steps to take to complete the Exness KYC verification process in India are as follows:

1. Register for an Exness Account

Traders must first create an Exness trading account by providing their basic personal information and contact details.

2. Submit KYC Documents

Traders must upload the required identification, address, and income documents to their Exness account.

3. Wait for Verification

Exness will review the submitted documents and verify the trader's information. This process may take several business days.

4. Receive Verification Status

Once the verification is complete, Exness will notify the trader of their account status, either approved or requiring additional information.

Common Issues in Exness KYC Verification and Solutions

Traders may encounter a few common issues during the Exness KYC verification process in India, such as:

Incomplete or Incorrect Documentation

If the trader's documents are not clear, do not meet the requirements, or contain inaccurate information, the verification process may be delayed or rejected.

Delayed Verification

In some cases, the verification process may take longer than expected due to high demand or regulatory compliance checks.

Account Suspension or Closure

If a trader's account is found to be non-compliant with KYC or AML regulations, Exness may suspend or close the account.

Importance of KYC in Exness Trading Accounts

The importance of KYC in Exness trading accounts, both in India and globally, cannot be overstated. The KYC process serves several crucial purposes:

Regulatory Compliance

Exness must comply with local financial regulations in each country where it operates, including India's KYC and AML requirements.

Fraud Prevention

The KYC process helps Exness identify and prevent fraudulent activities, such as money laundering or terrorist financing, on its platform.

Client Protection

By verifying the identity and financial standing of its clients, Exness can better protect them from financial crimes and ensure the integrity of their trading accounts.

Financial Regulations Impacting Exness KYC in India

The financial regulations in India that impact the Exness KYC verification process include:

Reserve Bank of India (RBI) Regulations

The RBI is the central banking authority in India and sets the guidelines for KYC and AML compliance for all financial institutions operating in the country.

Securities and Exchange Board of India (SEBI) Regulations

SEBI, the capital markets regulator, also has specific KYC and client identification requirements for brokers and other financial service providers.

Prevention of Money Laundering Act (PMLA)

This Indian law mandates that all financial institutions, including Exness, must implement robust KYC and AML measures to prevent money laundering and other financial crimes.

Tips for a Smooth KYC Verification Process on Exness

To ensure a smooth KYC verification process on Exness in India, traders should consider the following tips:

Provide Accurate and Complete Information

Traders should ensure that all the personal and financial information they provide to Exness is accurate and complete, as any discrepancies may delay or jeopardize the verification process.

Submit High-Quality Documents

Traders should upload clear, legible, and unedited copies of their identification and address documents to expedite the verification process.

Respond Promptly to Exness Requests

If Exness requests additional information or clarification during the verification process, traders should respond as soon as possible to avoid delays.

Stay Informed about Regulatory Changes

Traders should stay up-to-date with any changes in Indian financial regulations that may impact the Exness KYC verification process.

Conclusion

In conclusion, Does exness kyc verification in india is an essential process that all traders in India must complete to open and maintain an Exness trading account. The KYC verification process is designed to ensure regulatory compliance, prevent financial crimes, and protect the integrity of the platform and its clients.

While the KYC verification process may seem daunting, Exness has streamlined the procedures to make it as smooth and efficient as possible for its Indian clients. By understanding the requirements, being proactive in submitting accurate documentation, and staying informed about regulatory changes, traders in India can navigate the Exness KYC verification process with confidence and ease.

🏅 Read more: