13 minute read

Exness only position closing is allowed?

Only Exness is allowed to close positions?. In the world of online trading, the ability to manage your positions effectively is crucial. One of the key features offered by many brokers is the ability to close positions, but what happens when this functionality is limited? In the case of Exness, a leading global broker, there are specific conditions and procedures in place regarding position closure. Let's explore the details and understand why Exness may be the only one allowed to close your positions.

Is Exness Allowed to Close Positions

No, Exness does not have the authority to unilaterally close your open positions. As a regulated broker, Exness is bound by specific rules and regulations that protect client interests.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

Exness' Position on Position Closure

Exness, like most reputable brokers, maintains the right to close trading positions under specific circumstances outlined in their client agreement and other policy documents. This is a common practice in the financial industry and serves to protect both the broker and the trader from potential risks and complications.

Regulatory Requirements and Position Closure

The ability of a broker to close a trader's positions is often dictated by regulatory requirements and guidelines. Exness, as a regulated entity, must adhere to the rules and regulations set forth by the relevant financial authorities in the jurisdictions where it operates. These regulations may place limitations on the broker's ability to unilaterally close a trader's positions, ensuring a balance between the broker's risk management needs and the trader's autonomy.

Exness' Commitment to Transparency

Exness is known for its commitment to transparency, and this extends to its position closure policies. The broker's client agreement and other relevant documents clearly outline the conditions under which Exness may close a trader's positions, ensuring that traders are aware of these scenarios and can make informed decisions about their trading activities.

Conditions for Closing Positions at Exness

Exness, like many other reputable brokers, reserves the right to close trading positions under certain circumstances. These conditions are typically outlined in the broker's client agreement and other policy documents, and traders should familiarize themselves with these terms before engaging in trading activities.

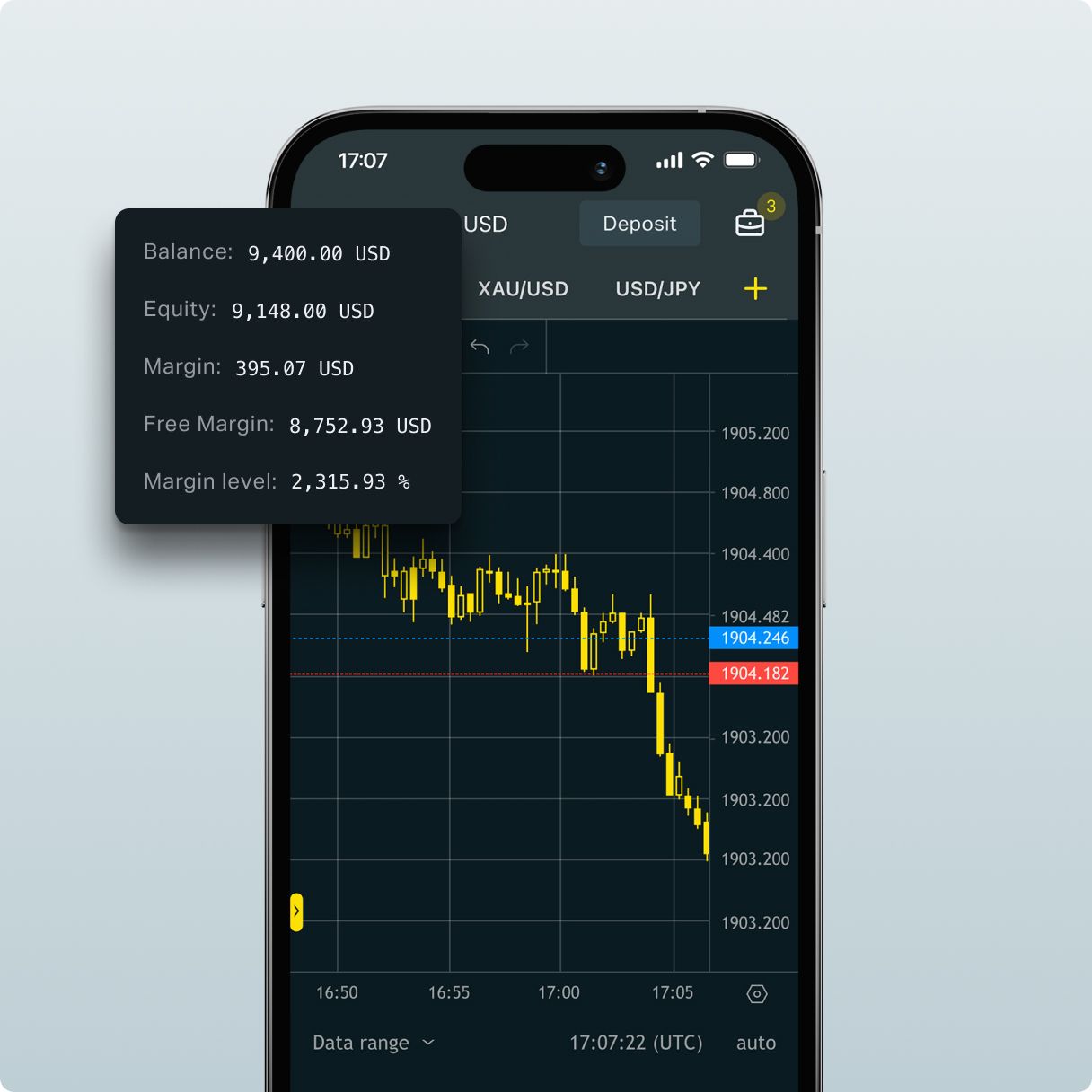

Margin Calls and Insufficient Margin

One of the most common scenarios where Exness may close a trader's positions is in the event of a margin call. If a trader's account equity falls below the required margin level for their open positions, Exness may initiate a margin call and close some or all of the trader's positions to bring the account back to a compliant margin level.

Violation of Trading Policies

Exness also reserves the right to close positions if a trader is found to be in violation of the broker's trading policies or terms of service. This may include, but is not limited to, engaging in abusive trading practices, using unauthorized trading strategies, or attempting to manipulate the market.

Regulatory or Legal Compliance

In some cases, Exness may be required to close a trader's positions due to regulatory or legal compliance requirements. This could happen if the broker is instructed to do so by a relevant financial authority or if the trader's activity is deemed to be in violation of applicable laws and regulations.

Platform Malfunction or Disruption

In the event of a platform malfunction or a disruption in Exness' trading systems, the broker may need to close open positions to mitigate the impact of the issue and protect the integrity of the trading environment.

Step-by-Step Guide to Close Positions on Exness

Closing positions on the Exness trading platform is a straightforward process, and traders can do so in a few simple steps. It's important to note that the specific steps may vary slightly depending on the trading platform or account type used, but the general process remains similar.

Accessing the Trading Platform

The first step in closing a position on Exness is to log in to your trading account and access the trading platform. Exness offers several platform options, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as their proprietary web-based and mobile trading platforms.

Identifying Open Positions

Once you've accessed the trading platform, you'll need to identify the positions you wish to close. This can typically be done by navigating to the "Open Positions" or "Trades" section of the platform, which will display a list of your currently open trades.

Closing Positions

To close a position, simply select the trade you want to close and then click the "Close" or "Sell" button, depending on whether you have an open long or short position. Some platforms may also allow you to close multiple positions simultaneously using a "Close All" or "Hedge" function.

Confirming the Closure

After clicking the "Close" or "Sell" button, you'll be prompted to confirm the closure of the position. This is an important step to ensure that you're closing the correct position and that the transaction is executed as intended.

Reviewing the Closure

Once the position has been closed, you should review the details of the transaction, including the closing price, the profit or loss, and any applicable fees or commissions. This information is typically displayed in the "Closed Positions" or "History" section of the trading platform.

Why Only Exness Can Close Your Positions

While Exness may have the ability to close a trader's positions under certain circumstances, it's important to understand that this is a common practice among regulated brokers and is not unique to Exness.

Broker's Risk Management Obligations

Brokers, including Exness, have a responsibility to manage the risks associated with their clients' trading activities. This includes the ability to close positions in order to protect the broker's own financial stability and the integrity of the trading environment.

Regulatory Requirements for Position Closure

As mentioned earlier, a broker's ability to close positions is often dictated by the regulatory requirements and guidelines in the jurisdictions where they operate. Exness, as a regulated entity, must adhere to these rules, which may include provisions for position closure under specific circumstances.

Contractual Agreements and Position Closure

The terms and conditions under which a broker can close a trader's positions are typically outlined in the client agreement and other policy documents. By agreeing to these terms, traders acknowledge and consent to the broker's ability to close positions under the specified conditions.

Protecting Traders from Excessive Losses

In some cases, the broker's ability to close positions may be a protective measure aimed at preventing traders from incurring excessive losses. This can help to mitigate the risks associated with volatile market conditions or trading strategies that may be unsuitable for the trader's risk profile.

Impact of Market Conditions on Position Closure in Exness

The market conditions prevalent at the time can have a significant impact on a broker's decision to close a trader's positions. Exness, like other brokers, may need to adjust its position closure policies and practices to adapt to changing market dynamics.

Volatile Market Conditions

In periods of high market volatility, Exness may be more inclined to close positions more quickly to manage the increased risks. This could include lowering the margin requirements or tightening the stop-loss parameters, which could result in the closure of positions more frequently.

Liquidity Constraints

During times of market illiquidity or disruptions, Exness may need to close positions to ensure that the broker can continue to fulfill its obligations to clients and maintain the integrity of the trading environment.

Regulatory Intervention

In some cases, Exness may be required to close positions due to regulatory intervention or changes in the regulatory landscape. This could happen if the relevant financial authorities impose new rules or guidelines that affect the broker's ability to manage client positions.

Managing Counterparty Risk

Exness, as a broker, also has to manage the risks associated with its own counterparty relationships and the broader financial system. In certain circumstances, the broker may need to close positions to mitigate these risks and protect the interests of its clients.

How to Manage Your Positions with Exness

As a trader, it's important to understand how to effectively manage your positions with Exness to ensure the successful execution of your trading strategies and to minimize the risk of position closure by the broker.

Maintaining Adequate Margin

One of the most critical factors in managing your positions with Exness is maintaining adequate margin in your trading account. This means ensuring that your account equity is sufficient to cover the margin requirements for your open positions, thus reducing the risk of a margin call and the potential closure of your positions.

Utilizing Stop-Loss and Take-Profit Orders

Implementing effective risk management strategies, such as using stop-loss and take-profit orders, can help you maintain control over your positions and minimize the risk of excessive losses. Exness provides various order types and tools to help traders manage their risk effectively.

Monitoring Market Conditions

Staying informed about the prevailing market conditions and being proactive in your position management can help you anticipate and respond to potential position closure scenarios. By monitoring economic indicators, news events, and market volatility, you can make more informed decisions about your trading positions.

Communicating with Exness

If you have any concerns or questions about the closure of your positions, it's recommended to communicate directly with Exness. The broker's customer support team can provide guidance and clarification on the specific policies and procedures related to position closure.

Exness Policies: Who Can Close Positions?

Exness' position closure policies are clearly outlined in their client agreement and other relevant documents. These policies define the specific circumstances under which Exness may close a trader's positions, as well as the procedures and responsibilities involved.

Trader-Initiated Position Closure

In the majority of cases, traders are responsible for managing and closing their own trading positions. Exness provides the necessary tools and functionality within its trading platforms to allow traders to open, modify, and close their positions as needed.

Broker-Initiated Position Closure

As mentioned earlier, Exness may close a trader's positions under certain circumstances, such as in the event of a margin call, a violation of trading policies, or regulatory compliance requirements. The broker's ability to do so is clearly outlined in the client agreement and other policy documents.

Regulatory and Legal Obligations

Exness, as a regulated broker, must adhere to the rules and regulations set forth by the relevant financial authorities in the jurisdictions where it operates. This may include complying with instructions or directives from these authorities to close a trader's positions in certain scenarios.

Dispute Resolution Procedures

In the event of a dispute or disagreement regarding the closure of a trader's positions, Exness has established dispute resolution procedures that allow for the review and investigation of such cases. Traders are encouraged to follow these procedures to address any concerns or issues they may have.

Navigating the Exness Platform for Position Closure

Exness offers several trading platforms, each with its own user interface and set of features. Regardless of the platform you use, the process for closing positions on Exness is generally similar, though the specific steps may vary slightly.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

The MetaTrader platforms, MT4 and MT5, are popular choices among Exness traders. These platforms provide a comprehensive set of tools and features for managing trading positions, including the ability to close positions with a few simple clicks.

Exness Web-Based Trading Platform

Exness also offers a web-based trading platform that can be accessed directly from the broker's website. This platform provides a user-friendly interface for managing trading positions, including the ability to close positions.

Exness Mobile Trading Apps

For traders on the go, Exness offers mobile trading apps for both iOS and Android devices. These apps provide the same functionality as the web-based platform, including the ability to close trading positions from your mobile device.

Customizing the Trading Platform

Exness allows traders to customize their trading platforms to suit their individual preferences and trading strategies. This may include the ability to set up custom hotkeys or shortcuts for quickly closing positions.

Common Issues When Closing Positions on Exness

While the process of closing positions on the Exness trading platform is generally straightforward, there are a few common issues that traders may encounter.

Slippage and Execution Delays

In fast-moving or volatile market conditions, traders may experience slippage or delays in the execution of their position closure orders. This can result in the position being closed at a different price than the one initially requested.

Platform Outages or Disruptions

In rare cases, traders may encounter platform outages or technical disruptions that prevent them from accessing the trading platform or closing their positions in a timely manner. Exness has contingency plans in place to minimize the impact of such events.

Incorrect Position Identification

Traders may sometimes inadvertently select the wrong position to close, leading to unintended consequences. It's important to double-check the position details before executing the closure.

Compliance and Regulatory Issues

In some cases, traders may encounter issues related to compliance or regulatory requirements that could impact their ability to close positions. Exness would work closely with the trader to resolve any such issues.

Best Practices for Position Management at Exness

To effectively manage your trading positions with Exness, it's important to adopt a set of best practices that can help you navigate the platform and minimize the risk of position closure.

Understand Exness' Position Closure Policies

Familiarize yourself with Exness' position closure policies and procedures, as outlined in the client agreement and other relevant documents. This will help you anticipate and prepare for potential scenarios where the broker may need to close your positions.

Maintain Adequate Margin Levels

Ensure that you consistently maintain adequate margin levels in your Exness trading account. This will help you avoid margin calls and the potential closure of your positions by the broker.

Implement Effective Risk Management Strategies

Utilize stop-loss and take-profit orders to manage your risk exposure and minimize the potential for excessive losses. This can help you maintain control over your trading positions and reduce the likelihood of position closure by Exness.

Stay Informed about Market Conditions

Monitor market conditions and economic events that may impact your trading positions. This will allow you to make more informed decisions about managing your positions and anticipating potential position closure scenarios.

Communicate with Exness Customer Support

If you have any questions or concerns about the closure of your positions, don't hesitate to reach out to Exness' customer support team. They can provide guidance and clarification on the broker's policies and procedures.

Conclusion

In the realm of online forex and CFD trading, the ability of a broker to close a trader's positions is a complex and often misunderstood topic. While Exness, as a reputable broker, does have the ability to close positions under certain circumstances, this is not a unique practice and is often dictated by regulatory requirements and the broker's own risk management obligations.

🏅 Read more: