5 minute read

Exness Pro Account vs Raw Spread Account: A Comparison for Informed Traders (2025)

Choosing between two advanced account types can be a challenge, especially when both offer premium trading conditions. If you're debating between the Exness Pro Account and the Raw Spread Account, you’re not alone.

Each caters to a specific trading style. In this article, we’ll break down the key differences, strengths, and ideal use cases for both accounts to help you make a strategic choice.

👉 Get started with either account today – Open your Exness trading account here

Why Choosing the Right Account Type Matters

Aligning Account Features with Trading Goals

Your trading success depends heavily on choosing the right structure for your strategy. Whether you trade daily, scalp the markets, or swing trade over time, the cost and execution conditions will impact your outcomes.

How Your Strategy Influences Your Ideal Account

High-frequency scalpers need low spreads and fast execution.

Volume traders may prefer low commissions.

Position traders may value simplicity and lower upfront costs.

What Is the Exness Pro Account?

Core Features and Advantages

The Pro Account is tailored for professional traders and features:

Zero commission trading

Spreads starting from 0.1 pips

Instant execution

High leverage (up to 1:2000)

Who Should Use It

Intermediate to advanced traders

Swing traders and volume-based strategies

Traders who prefer straightforward costs via spreads

What Is the Exness Raw Spread Account?

How It Works and Who It’s Built For

The Raw Spread Account offers raw market spreads—often as low as 0.0 pips—with a small commission per lot (typically $3.50 per side per lot).

Benefits for Scalpers and Algorithmic Traders

Precise spread control for scalping strategies

Accurate backtesting for automated trading systems

Greater visibility during high-volatility conditions

Key Differences Between Pro and Raw Spread Accounts

Cost Structure – Spreads vs Commissions

Pro Account: No commissions, but slightly higher spreads

Raw Spread Account: Near-zero spreads, with fixed commission per trade

Execution Speed and Trading Style Compatibility

Both accounts offer ultra-fast execution, but Raw Spread is often favored by scalpers who need microsecond precision.

Minimum Deposit and Leverage Options

Both accounts typically require a minimum deposit starting at $200, with flexible leverage up to 1:2000, depending on the region and asset.

👉 Compare live – Visit the official Exness site

When to Choose the Pro Account

Best Use Cases and Trading Scenarios

The Exness Pro Account is the better choice if:

You prefer trading without commissions and can work within slightly wider spreads.

Your strategy involves moderate trading frequency rather than high-speed scalping.

You want instant execution and reduced slippage during volatile sessions.

You’re focused on swing or trend-following strategies over multiple timeframes.

This account type suits traders who value cost transparency and efficiency, without needing raw pricing levels for ultra-short-term trades.

When to Choose the Raw Spread Account

Ideal Scenarios and Trading Approaches

The Raw Spread Account shines when:

You use scalping or high-frequency strategies where every pip matters.

You run automated trading systems (EAs) that require precise market data and tight spreads.

You’re comfortable paying a small commission per trade in exchange for better entry/exit pricing.

It’s also a top choice for traders who like to execute multiple trades per session with razor-sharp precision—especially during news releases or volatile events.

Platforms and Tools Offered on Both Accounts

MT4/MT5 Access

Both the Pro and Raw Spread accounts are compatible with:

MetaTrader 4 (MT4) – ideal for manual trading, EAs, and quick charting.

MetaTrader 5 (MT5) – offers advanced analytics, more timeframes, and depth of market (DOM) features.

Technical Tools and Expert Advisors

Both accounts support:

Custom indicators

Automated trading systems

VPS hosting (optional for low-latency trading)

Real-time news and technical updates

This ensures traders on either account enjoy the full suite of Exness tools and trading environments.

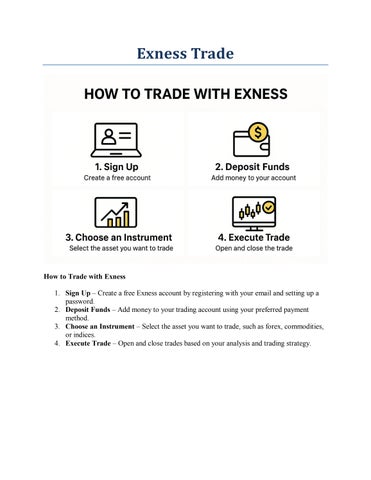

How to Open Either Account on Exness

Step-by-Step Setup for New Users

Go to the Exness sign-up page.

Enter your email, create a password, and select your country.

Complete the KYC process by uploading your ID and proof of address.

In your dashboard, choose “Open New Account” and select either Pro or Raw Spread.

Select your platform (MT4/MT5), set your leverage, and fund your account.

Switching Between Account Types

Exness allows you to open and manage multiple accounts simultaneously. You can switch between Pro, Standard, or Raw Spread accounts anytime from your Personal Area.

FAQs – Pro vs Raw Spread at Exness

Q: Which account is better for beginners?A: The Pro Account is generally better for beginners due to its simplicity and no-commission model.

Q: Can I change accounts after opening one?A: Yes. You can open new accounts or switch types through your client dashboard without closing your current account.

Q: Are spreads fixed or variable?A: Both accounts offer variable spreads—but Raw Spread starts near zero, while Pro has slightly higher average spreads.

Q: Is there a difference in trading instruments?A: No. Both accounts give you access to the same wide range of instruments: forex, metals, crypto, indices, and energies.

Conclusion: Pro or Raw Spread – Which Account Is Right for You?

The best account depends entirely on your trading style, goals, and strategy.

Choose the Pro Account if you want a commission-free model, slightly wider spreads, and a cleaner cost structure for trend or swing trading.

Choose the Raw Spread Account if you're an active scalper, day trader, or algo trader who needs ultra-tight spreads and precise pricing—even with small per-trade commissions.

Either way, Exness delivers professional-grade conditions, secure platforms, and flexible trading environments.

👉 Choose the account that fits your edge – Open a Pro or Raw Spread Account now

See more: