13 minute read

Is Exness a good forex broker in India 2025

Is Exness a good forex broker in India? This is a question that many Indian traders have been asking, as they seek to find a reliable and trustworthy forex broker to manage their investments. In this comprehensive blog post, we will explore the various aspects of Exness and its suitability for Indian traders.

Is Exness a Reliable Forex Broker for Indian Traders?

When it comes to forex trading, reliability and trustworthiness are crucial factors for traders, especially in a market as dynamic and volatile as the forex market. Exness, a global forex broker, has been operating in the industry for over a decade, and during this time, it has established a strong reputation for its reliability and commitment to its clients.

💥Visit Website Exness Official ✅

Regulatory Compliance and Licensing

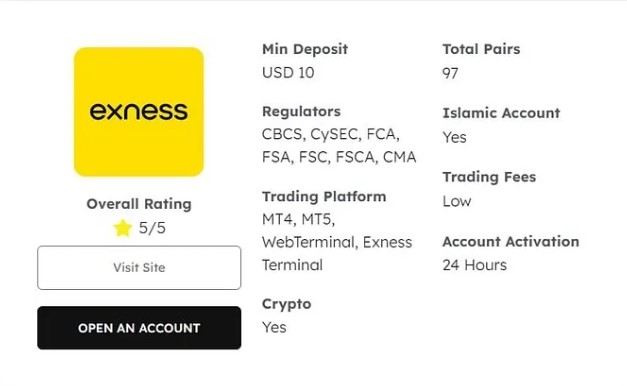

One of the key factors that contribute to Exness' reliability is its strict adherence to regulatory compliance. Exness is regulated by reputable financial authorities, including the Financial Services Authority (FSA) in the Seychelles and the Cyprus Securities and Exchange Commission (CySEC) in the European Union. These regulatory bodies enforce stringent guidelines and requirements to ensure that brokers operate with transparency, protect client funds, and maintain high standards of ethical conduct.

Financial Stability and Security

In addition to its regulatory compliance, Exness is also known for its financial stability and the security it provides to its clients. The broker maintains a well-capitalized balance sheet, ensuring that it has the necessary resources to support its operations and fulfill its obligations to traders. Exness also employs industry-standard security measures, such as SSL encryption and segregated client funds, to safeguard client assets and protect against the risk of fraud or misappropriation.

Reputation and Client Feedback

Exness' reputation as a reliable forex broker is further bolstered by the positive feedback and reviews from its clients. Many Indian traders have reported positive experiences with Exness, citing its efficient execution, prompt customer support, and reliable trading conditions. This feedback, coupled with the broker's long-standing presence in the industry, reinforces the perception of Exness as a trustworthy and reliable partner for Indian forex traders.

Exness Review: Pros and Cons for Indian Investors

When it comes to evaluating Exness as a forex broker for Indian traders, it's essential to consider both the advantages and potential drawbacks. By understanding the pros and cons, Indian investors can make an informed decision about whether Exness is the right choice for their trading needs.

💥Visit Website Exness Official ✅

Pros of Exness for Indian Traders

Competitive Spreads and Commissions Exness is known for offering highly competitive spreads and commissions, which can be particularly beneficial for Indian traders who are looking to optimize their trading costs and maximize their profits.

Diverse Trading Instruments Exness provides access to a wide range of trading instruments, including major, minor, and exotic currency pairs, as well as commodities, indices, and CFDs. This diversity allows Indian traders to diversify their portfolios and explore various trading opportunities.

Innovative Trading Platforms Exness offers a suite of cutting-edge trading platforms, including the popular MetaTrader 4 and MetaTrader 5, as well as its proprietary web-based platform. These platforms are known for their user-friendly interfaces, advanced charting tools, and extensive customization options.

Robust Risk Management Tools Exness equips its traders with a range of risk management tools, such as stop-loss and take-profit orders, to help them manage their exposure and protect their trading capital.

Cons of Exness for Indian Traders

Limited Deposit and Withdrawal Options While Exness does offer a variety of deposit and withdrawal methods, the options available for Indian traders may be relatively limited compared to some other brokers operating in the region.

Regulatory Oversight Concerns Although Exness is regulated by reputable authorities, some Indian traders may have concerns about the broker's regulatory oversight, particularly in relation to the Indian market, where there may be additional local requirements or restrictions.

Language and Cultural Barriers As an international broker, Exness may not always provide the level of localization and cultural understanding that some Indian traders may prefer, which could potentially create communication and support challenges.

Understanding Exness Trading Conditions for Indian Users

The trading conditions offered by Exness are a crucial consideration for Indian traders, as they directly impact the overall trading experience and the potential for profitability. Let's dive deeper into the key trading conditions that Exness provides to its Indian clients.

Minimum Deposit and Account Types

Exness offers a range of account types to cater to the diverse needs of Indian traders. The minimum deposit requirement for opening an account with Exness varies depending on the account type, but it generally ranges from $10 to $500. This accessibility can be particularly appealing to Indian traders, who may be looking to start with smaller trading capital.

Leverage and Margin Requirements

Exness provides its Indian clients with access to high leverage, with ratios ranging from 1:1 to 1:2000, depending on the account type and the trading instrument. This can be advantageous for traders who seek to amplify their trading opportunities, but it also comes with increased risk. Exness also adheres to the margin requirements set by regulatory authorities, ensuring that Indian traders are provided with a secure and transparent trading environment.

Spreads and Commissions

As mentioned earlier, Exness is known for offering highly competitive spreads and commissions, which can be a significant factor for Indian traders looking to optimize their trading costs. The spreads offered by Exness can vary depending on the trading instrument, account type, and market conditions, but they are generally considered to be within the industry standard.

Execution Quality and Slippage

Exness is renowned for its fast and reliable order execution, which is crucial in the fast-paced forex market. The broker's trading platforms are designed to provide low-latency execution, minimizing the risk of slippage and ensuring that Indian traders' orders are filled at or near the requested price.

Exness Regulation and Security for Indian Forex Traders

Regulation and security are paramount concerns for Indian forex traders, as they seek to protect their trading capital and ensure that their funds are managed responsibly. Let's explore how Exness addresses these critical aspects.

Regulatory Oversight

As mentioned earlier, Exness is regulated by reputable financial authorities, including the Financial Services Authority (FSA) in the Seychelles and the Cyprus Securities and Exchange Commission (CySEC) in the European Union. These regulatory bodies enforce strict guidelines and requirements, ensuring that Exness operates with transparency, safeguards client funds, and maintains high standards of ethical conduct.

💥Visit Website Exness Official ✅

Segregation of Client Funds

Exness adheres to the industry-standard practice of segregating client funds from the broker's own operating funds. This means that client deposits are kept in separate bank accounts, ensuring that they are protected in the event of the broker's insolvency or financial difficulties.

Data Security and Privacy

Exness takes data security and privacy seriously, employing industry-standard encryption protocols and implementing robust security measures to protect its clients' sensitive information. The broker's trading platforms and website are secured with SSL encryption, ensuring that all communications and transactions are encrypted and protected from unauthorized access.

Compensation Schemes and Investor Protection

In the unlikely event of Exness' financial difficulties or insolvency, Indian traders may be eligible for compensation through the regulatory authorities' investor protection schemes. These schemes are designed to safeguard client funds and provide a safety net for traders in such scenarios.

Customer Support and Services Offered by Exness in India

Effective and responsive customer support is a critical aspect of a forex broker's services, and Exness has dedicated significant resources to ensure that its Indian clients receive the assistance they need.

Multilingual Customer Support

Exness offers customer support in multiple languages, including English, which is widely spoken and understood by Indian traders. This multilingual approach helps to bridge any language barriers and ensures that Indian traders can communicate effectively with the broker's support team.

Dedicated Indian Support Team

Exness has a dedicated team of customer support representatives who are well-versed in the specific needs and requirements of Indian traders. This team is knowledgeable about the Indian forex market, local regulations, and the unique challenges faced by Indian traders, allowing them to provide more tailored and relevant support.

Responsive and Accessible Support Channels

Indian traders can access Exness' customer support through a variety of channels, including live chat, email, and phone. The broker's support team is known for its responsiveness, with quick response times and a commitment to resolving client issues in a timely manner.

Educational Resources and Trader Support

In addition to its customer support services, Exness also offers a range of educational resources and trader support tools to help Indian traders improve their skills and knowledge. This includes access to webinars, trading tutorials, market analysis, and a comprehensive learning center.

Exness Trading Platforms Available for Indian Clients

The trading platforms offered by a broker are a crucial factor for Indian traders, as they directly impact the overall trading experience, the range of trading tools available, and the efficiency of executing trades.

MetaTrader 4 (MT4)

Exness offers the popular MetaTrader 4 (MT4) trading platform, which is widely used by forex traders around the world, including in India. The MT4 platform is renowned for its user-friendly interface, advanced charting tools, and a vast array of technical indicators and automated trading features.

MetaTrader 5 (MT5)

In addition to MT4, Exness also provides access to the MetaTrader 5 (MT5) platform, which offers an enhanced trading experience with additional features and functionalities. MT5 includes advanced order types, a built-in economic calendar, and more sophisticated trading analytics tools.

Exness Web Trader

For traders who prefer a more web-based trading experience, Exness offers its proprietary web-based trading platform. This platform is designed to be accessible from any device with an internet connection, providing a seamless trading experience without the need to download any software.

Mobile Trading Apps

Recognizing the growing importance of mobile trading, Exness has developed dedicated mobile trading apps for both iOS and Android devices. These apps allow Indian traders to access their accounts, execute trades, and monitor the markets on the go, ensuring that they can stay connected to the markets at all times.

User Experience: What Indian Traders Say About Exness

When it comes to evaluating a forex broker, the experiences and feedback from actual users can provide valuable insights. Let's take a closer look at what Indian traders have to say about their experiences with Exness.

Positive Testimonials and Reviews

Many Indian traders have reported positive experiences with Exness, citing the broker's reliable execution, competitive trading conditions, and responsive customer support. Traders have particularly praised the broker's transparency, the quality of its trading platforms, and the overall user-friendliness of the trading experience.

Complaints and Negative Feedback

While Exness has predominantly positive reviews from Indian traders, there have been some instances of negative feedback, primarily related to issues with deposit and withdrawal processing, as well as occasional technical glitches or platform outages. However, these complaints appear to be relatively isolated, and Exness has generally been responsive in addressing and resolving such issues.

Trustworthiness and Reputation

Overall, the consensus among Indian traders seems to be that Exness is a trustworthy and reputable forex broker. The broker's long-standing presence in the industry, its regulatory compliance, and the positive experiences shared by many traders have contributed to its reputation as a reliable and credible partner for Indian forex traders.

Deposit and Withdrawal Options at Exness for Indian Customers

The availability and ease of deposit and withdrawal options are crucial considerations for Indian forex traders, as they directly impact the convenience and efficiency of managing their trading accounts.

Deposit Methods

Exness offers a range of deposit methods for Indian traders, including bank wire transfers, credit/debit cards, and online payment gateways such as Skrill and Neteller. While the specific deposit options may vary depending on the region and regulations, Exness strives to provide a diverse range of alternatives to cater to the preferences and needs of its Indian clients.

Withdrawal Procedures

When it comes to withdrawals, Exness has established streamlined processes to ensure timely and hassle-free transactions for its Indian clients. Traders can request withdrawals through the same payment methods used for deposits, and Exness is generally known for its prompt processing of withdrawal requests.

Withdrawal Limits and Fees

Exness sets reasonable withdrawal limits and minimal fees for its Indian clients, ensuring that the overall withdrawal process is cost-effective and accessible. However, it's important for traders to familiarize themselves with the specific limits and fees applicable to their account type and payment method.

Compliance and Regulatory Considerations

Exness adheres to stringent compliance and regulatory requirements, which may impact the deposit and withdrawal options available to Indian traders. This is particularly relevant in terms of anti-money laundering (AML) and know-your-customer (KYC) procedures, which Exness must follow to maintain its regulatory standing and protect the integrity of the platform.

Final Verdict: Is Exness the Right Choice for Forex Trading in India?

After thoroughly examining the various aspects of Exness as a forex broker for Indian traders, we can draw a comprehensive conclusion on whether it is the right choice for forex trading in India.

Based on the information presented, Exness appears to be a reliable and reputable forex broker that offers a compelling proposition for Indian traders. The broker's regulatory compliance, financial stability, and robust security measures instill confidence in its ability to safeguard client funds and provide a secure trading environment.

The trading conditions offered by Exness, including competitive spreads, high leverage, and efficient order execution, are generally well-received by Indian traders. The availability of popular trading platforms, such as MetaTrader 4 and MetaTrader 5, as well as the broker's proprietary web-based platform, cater to the diverse preferences and trading styles of Indian investors.

The customer support services provided by Exness, with a dedicated team and multilingual assistance, aim to address the specific needs and challenges faced by Indian traders. The broker's educational resources and trader support tools also contribute to the overall user experience, empowering traders to enhance their skills and knowledge.

While there are some potential drawbacks, such as the limited deposit and withdrawal options and occasional concerns about regulatory oversight, these issues do not appear to be significant enough to undermine Exness' overall appeal as a forex broker for Indian traders.

Ultimately, the decision to choose Exness as a forex broker in India will depend on the individual trader's preferences, trading goals, and risk tolerance. However, based on the evidence presented, Exness appears to be a solid choice for Indian forex traders who are seeking a reliable, well-regulated, and user-friendly trading experience.

Conclusion

In conclusion, Exness emerges as a compelling option for Indian forex traders who are looking for a reliable and trustworthy broker to manage their trading activities. With its regulatory compliance, robust security measures, competitive trading conditions, and comprehensive customer support, Exness has established itself as a reputable player in the Indian forex market

✳️ Read more: