Berries Australia extends a warm welcome and sincere thanks to all our Berry Industry Partners for 2025–26

Your support plays a vital role in strengthening the Australian berry industry and helping us continue to deliver value to more than 700 growers nationwide. By joining the BIP program, you’re contributing to a more connected, innovative, and resilient future for the sector.

Specialised crop protection and production solutions for horticulture agnova.com.au

Suppliers of high-quality polytunnels and crop protection systems elitetunnels.com

Suppliers of high-quality coir substrates for sustainable crop growth atlantiscoco.com

Distributor of high-quality growing media for berry cultivation globalaxis.com.au

The leading global provider of end-to-end smart irrigation solutions netafim.com.au

Designed for long-lasting horticultural crop support nztubemills.co.nz

Industrial automation design, build and installation services automationtechniques.co.nz

Expert irrigation and greenhouse solutions, design and installation services. irribiz.com.au

Experts in greenhouse technology and horticultural automation solutions powerplants.com.au

Leaders in spraying equipment and crop protection technology croplands.com

Offer Tasmanian farmers, growers, and contractors quality solutions with support. marshallmachinery.com.au

Australian provider of specialty fertiliser and crop protection inputs tanuki.com.au

Sustainable, innovative crop nutrition and protection solutions for horticulture agspec.com.au

Smart, sustainable irrigation solutions backed by global expertise rivulis.com

Leading supplier of pots and containers for horticulture gardencityplastics.com

A leading provider of specialist fumigation services trical.com.au

Innovative crop protection solutions that support healthy, productive berries corteva.com/au

Supplier of high-chill strawberry runners and plug plants jclmfarming.com.au

AI-powered blueberry grading that boosts profitability cailu.ai

Innovative cocopeat growing media for sustainable crop production ecomix.com.au

out how to join today at

Rachel Mackenzie

| 0408 796 199 |

As we near the end of 2025, it’s rewarding to reflect on the significant progress the berry industry has achieved with the support of Berries Australia. From securing long-awaited market access to driving the Berry Basket Marketing campaign and strengthening our IDO and communications work, we continue to champion the sector for the benefit of growers.

The standout achievement of 2025 was securing market access for blueberries to Vietnam, our first successful entry into a new protocol market. This milestone confirms that Berries Australia has the technical expertise and advocacy capability to deliver complex trade outcomes and positions the entire sector to capitalise on future opportunities. Enormous credit goes to our Head of Trade and Market Access, Jenny Van de Meeberg, for leading this work.

Our new consultation process with Hort Innovation is also starting to deliver tangible outcomes. Projects such as the root wrapping, chilli thrip and leafroller programs are now underway, with several more in the pipeline. These include berry residue trials to generate data for minor use permits, along with Rubus and strawberry mite efficacy trials.

We have secured two years of funding for the Berry Basket Marketing campaign through a mix of voluntary levies, statutory levies and strawberry royalty funds. The $500,000 per annum campaign is now running through to September 2027. Around 65% of activity is focused on out-of-home advertising to drive household penetration, with the remaining 35% invested in social media to build long-term brand equity. Seasonality charts have been developed to ensure strawberries, Rubus and blueberries are each ‘heroed’ at their peak, providing fair representation across the sector.

rachelmackenzie@berries.net.au

Reducing the cost and compliance burden on growers remains a core advocacy focus, and 2025 has delivered several important wins. We joined a coalition of agriculture industry associations to successfully oppose the Australian Government’s proposed biosecurity levy, which would have imposed unnecessary costs on growers.

We are also close to finalising the removal of the nursery pot levy obligation for berry growers. After four years of negotiation with government, the formal request has now been lodged with the Minister. We extend sincere thanks to Greenlife Australia for their collaborative support in progressing this issue.

Following extensive advocacy, we have also minimised the impact of the new mandatory food safety standards. Implementation in Victoria and Western Australia has adopted a ‘light touch’ approach that recognises our existing robust programs, with New South Wales soon to follow. We continue to work with Queensland and Tasmania to ensure similar outcomes are achieved.

On the ground, we are working to provide greater certainty for growers regarding infrastructure. We are currently supporting a test case in the New South Wales Land and Environment Court to confirm that nets and tunnels are essential farm tools rather than buildings. We also successfully prevented excessive development approval requirements being imposed on growers in the Nambucca region. Ensuring planning frameworks remain practical and fit for purpose will remain a priority.

Finally, we are pleased to confirm that BerryQuest International 2027 will be held in August on the Gold Coast, with farm tours beginning in Coffs Harbour and travelling north to showcase the best of our blueberry and Rubus production.

Wishing you all the best for the remainder of the yearmay the festive season be productive for those in harvest, and restful for those between peaks.

Anthony Poiner | 0412

010 843 |

As we reflect on the past year, it’s worth noting that Berries Australia is now seven years old, and our continued progress would not be possible without the support of our valued partners, in particular Hort Innovation, whose collaboration remains central to our success.

This year has been marked by meaningful progress across our organisational priorities and industry initiatives, driven largely by the strong performance of our Berries Australia subcommittees.

Each subcommittee has taken substantial steps forward, reflecting the dedication and expertise of the members involved. I would like to acknowledge two examples here. Gavin Scurr's leadership of the Propagation Subcommittee has been exemplary. His efforts have helped drive constructive dialogue and improved collaboration within this important part of our supply chain. Nathan Baronio has taken responsibility for shaping the next two years of our joint marketing investment and his guidance is ensuring that growers receive the maximum benefit for the funds invested.

A truly notable achievement this year was BerryQuest 2025, which was an outstanding success. The event delivered exceptional value to delegates, sponsors, and industry partners alike, showcasing the depth and innovation of our berry industries. A special mention must go to Simon Dornauf and the event team. The positive feedback we received is a testament to their collective efforts. Block out your diaries for August 2027 when the next BerryQuest International conference will take place at the Gold Coast in Queensland.

Our export development work has also advanced significantly. Australian blueberries secured technical market access to Vietnam, opening new commercial

anthony@smartberries.com.au

opportunities for growers. We also successfully hosted an inbound Chinese delegation, strengthening relationships in a key market and laying important groundwork for future trade. In addition, our progress with Japan remains on track, and the momentum across all markets is extremely encouraging. The ongoing research supporting strawberry and Rubus export access continues to move forward, ensuring our industry will be ready to capitalise on these opportunities as phytosanitary pathways are finalised.

Communication remains one of our great strengths. Both the Australian Berry Journal and The Burst continue to be consistently published, widely read and well-regarded. These platforms play an essential role in keeping growers, researchers, and stakeholders informed and connected.

Of course, not everything has been smooth sailing. Labour costs remain a significant challenge for growers nationwide, even though labour laws themselves appear to have stabilised for now. Managing workforce pressures while maintaining viability remains a key priority.

Finally, I want to emphasise the importance of maintaining our social licence. As an industry, we have made great progress, but we cannot allow ourselves to become complacent or assume our standing is guaranteed. Continued transparency, responsible practices, and proactive engagement are essential to sustaining trust with consumers, regulators, and the broader community.

In summary, this has been a year of strong achievements and positive momentum. I extend my sincere thanks to everyone who has contributed their time, knowledge, and leadership across our committees and industry initiatives. Together, we are building a resilient, innovative, and forward-looking berry industry.

With this year’s Annual General Meetings taking place in October and November, here’s the highlights from each Association chair and confirmation of the Committees for the next year.

It has certainly been an interesting and, at times, challenging twelve months for the Australian blueberry industry. Despite the ups and downs, our sector continues to demonstrate resilience, collaboration, and a strong commitment to improvement and innovation.

The new Committee elected at this year's AGM are:

President: Andrew Bell

Vice President: Rob King

Treasurer: James Kellaway

Secretary: Sally Jolly

Members:

John Simonetta

Joshua Clementson

Devinder Knunkun

While the activity of this Committee has been somewhat limited due to the growing role of Berries Australia, it’s worth highlighting just how successful that arrangement has proven to be. The outcomes achieved on behalf of members have been tangible and positive, and I would like to extend my sincere thanks to everyone involved. A special mention must go out to Christian Parsons, who has long served on the ABGA committee and Berries Australia, including a term as President of the ABGA. Christian has moved on to other endeavours within Costa, and I thank him for his valuable contribution over the years.

From a production standpoint, our winter–spring season was impacted by weather events across the Northern Rivers and Mid North Coast regions. Fortunately, this was partially offset by stronger pricing, but it remains a reminder of the volatility our growers face. Another significant issue has been the ongoing legal proceedings in the NSW Planning and Environment Court, where we are contesting Coffs Harbour City Council’s position that nets and tunnels constitute farm buildings and therefore require development approvals. The hearing is set for 11 November, and the outcome has the potential to set a precedent that would affect growers across NSW.

On a more positive note, our joint berries marketing campaign continues to deliver strong results. The ABGA has contributed $200,000 towards the campaign, which strategically flexes to highlight each berry type during its peak production period. This collaborative approach has strengthened our collective presence in the market and reinforced the positive image of Australian berries.

Our research and development work remains a cornerstone of our efforts. The root wrapping project continues to progress, the Chili Thrip and Leaf Roller project has been contracted, and important work is ongoing in the area of chemical permits, ensuring growers have the tools and confidence to manage crops effectively and sustainably.

Finally, it’s pleasing to end on a high note. We have recently been granted market access to Vietnam for the export of fresh fruit: our first protocol market. This is a major achievement and a testament to the hard work and persistence of Jenny and her team, to whom we owe a great deal of thanks. It will be exciting to see Australian blueberries on shelves in Vietnam in the coming months. I would, however, remind all producers that the market’s demand is for premiumquality fruit; this new opportunity must not become a dumping ground for lower-grade produce.

Thank you once again to everyone involved in supporting and advancing our industry over the past year. Your dedication and professionalism continue to make the Australian blueberry industry one to be proud of.

The new Committee elected at this year's AGM are:

President: Gavin Scurr

Vice President: Andrew Terry

Treasurer: Richard McGruddy

Secretary: Kate Sutherland

Members:

Manpreet Sidhu Christy Poynton

It has been a year of transition and progress for our industry, marked by collaboration and consolidation across the berry sector. One of the most significant developments has been the continued move from individual commodity groups to the unified Berries Australia model. This structure, with its five dedicated subcommittees covering marketing, strawberry propagation, sustainability, R&D, and BerryQuest, is now operating effectively and delivering real benefits through shared focus and coordination.

In the spirit of better communication, all association committee members should now be receiving Berries Australia meeting minutes, ensuring everyone stays informed about what’s happening at the national level. This increased transparency helps align our efforts and strengthens our collective voice as an industry.

It has been a roller-coaster year for raspberries and blackberries, with unpredictable weather and fluctuating prices creating challenges. Autumn pricing was difficult, but market conditions have since improved and are now performing better than expected. More broadly, fruit prices outside traditional peak periods have strengthened, highlighting the importance of managing production peaks collectively.

Weather impacts have been mixed around the country. Tasmania suffered severe winds, losing more tunnel skins this year than in the previous five combined, while Queensland experienced what many consider one of their best seasons in years.

Despite the challenges, the year has demonstrated the value of working together. With continued cooperation under the Berries Australia framework, we are well placed to build a resilient and profitable future for all growers.

This year has seen strong progress across the strawberry industry, supported by the continued evolution of the Berries Australia structure. Recent board changes and the effective operation of several subcommittees have provided clearer focus, better coordination, and stronger strategic leadership. I would especially like to acknowledge Nathan Baronio for his excellent leadership of the Marketing Subcommittee, which has already strengthened our national marketing approach.

The new Committee elected at this year's AGM are:

Chair: Simon Dornauf

Vice Chair: Nathan Baronio

Treasurer: Adrian Schultz

Members:

Anthony Yewers

Clarrisa Cincotta

Jamie Michael

From a production perspective, the southern season performed well, with favourable conditions delivering good fruit and solid pricing. In Queensland, growers faced challenges, but this has not been the worst season on record. Despite weather pressures and regional variability, many have managed to maintain production and adapt effectively.

A major achievement this year has been the industry’s progress in blueberry export development. There is also promising potential for strawberry exports, with ongoing medfly-related work expected to unlock new markets once regulatory requirements are finalised.

Another highlight was BerryQuest 2025 in Hobart, which received overwhelmingly positive feedback from growers, researchers, exhibitors and international guests. The strong turnout and high-quality content demonstrated the importance of bringing our industries together. Planning is already underway to build on this success at BerryQuest 2027, ensuring it remains a world-class event.

Finally, I extend my sincere thanks to everyone involved with Strawberries Australia Inc. Your ongoing commitment and collaboration continue to drive our industry forward.

Brett Fifield, Hort Innovation, Chief Executive Officer

Australian horticulture is on track to become a $21 billion industry by 2030. But the number alone isn’t the measure of success; the profitability and sustainability of our growers is what truly matters. It’s a vision for keeping clean, green Australian produce on plates at home and around the world. It’s ambitious, achievable, and absolutely necessary if we want to keep growers profitable and hold our reputation for quality, safety and sustainability.

Achieving it will take collaboration and innovation across the whole sector. As we close out a big year and look toward 2026, we face real challenges: rising costs, climate volatility, labour shortages, and shifting consumer expectations. But we also have significant opportunities. If we act together, we can build an industry that is not just resilient, but remarkable.

Productivity: Doing More with Less: Productivity is the engine room for growth and profitability. Labour accounts for more than a third of input costs, and availability remains a constant hurdle especially at harvest. Our recent Factors Driving Horticulture Productivity report shows that through innovation - automation, data-driven decision making, and mechanisation - the industry’s annual value added could nearly triple.

These aren’t abstract ideas. Hort Innovation has already invested more than $220 million in on-farm productivity projects, from new tech to food safety and disease risk research. But we know adoption takes time, which is why our investments support growers with knowledge, connections and confidence, not just funding.

Productivity isn’t a silver bullet, but it is a powerful lever. If we get it right, our sector will be more profitable, more competitive and better prepared for the future.

Consumption: Closing the Serving Gap: Australians aren’t eating enough horticultural produce. ABS data shows we average 2.2 serves of vegetables and 1.3 serves of fruit a day, far below recommended levels. This is a national health challenge, but it’s also a major opportunity for growers.

Hort Innovation is investing over $30 million in behavioural research, marketing campaigns and school-based trials to shift fresh produce from “good to have” to “must have”. When Australians consume more horticulture, everyone benefits; growers, consumers and the nation.

Unlocking Global Markets: At Hort Innovation, we’re focused on expanding high-value export markets that deliver profitability and sustainability for growers. This isn’t just about trade, it’s about positioning Australian produce as premium, trusted, and in demand across the globe.

Horticulture exports hit a record high of $2.9 billion, reaching 76 countries in FY23/24, to continue growing the sector to reach that $21 billion goal, exports and opening up new markets will be key to unlocking new consumers for Australian growers.

Through global engagement - such as Asia Fruit Logistica - and partnerships including the Australian Food and Wine Collaboration Group, we are actively supporting market access and trade development. When we export, we’re not just sending produce; we’re exporting trust, quality and innovation.

Let’s Grow Smarter, Together: The decisions we make now will shape horticulture for decades. If you have an idea - whether it’s a breakthrough technology, a new market opportunity, or a smarter way to reach consumers - talk to the team at Hort Innovation.

Together, we can achieve the $21 billion vision and keep Australian horticulture thriving, sustainable and respected around the world.

Dr Angela Atkinson, Research & Development and Biosecurity Manager 0499 645 836 | angelaatkinson@berries.net.au

Since the last research and development update in Spring, the projects endorsed by the berry prioritisation panels this year have gone out to open tender (summary below). The tender responses received by Hort Innovation are evaluated by panels of industry experts appointed by Berries Australia and Hort Innovation, which include levy paying growers, ensuring the chosen delivery partners are addressing the needs of industry. Berries Australia’s involvement in this process is new and proving to be a positive step for better industry participation in project funding through the levy system. If you would like to know more about how the horticulture levy system works, see PAGE 25.

Hort Innovation is currently asking industry to provide input into the next five-year berry strategic investment plan through their new SHIFt process (see article on PAGE 24). The investment plan helps to shape priorities for levy investment, and by providing input you can help ensure levy investments in the future continue to address grower’s needs. Please participate in the short survey to provide your feedback.

Complete the survey by scanning this QR code or visit bit.ly/BA-SHIFt-Survey

MT25006 Generation of data - Rubus and strawberry mite efficacy and residue trials: This project has been contracted and will gather data for new miticides for control of broad mite and two spotted mite.

MT25007 - Generation of Data - Berry Residue trials: This project has been evaluated, is in the process of contracting, and will provide data required by the APVMA to extend 15 minor use permits which are expiring soon (5 Rubus, 9 blueberry and 1 for all berries).

MT25004 Mid-term reviews for Industry Development and Extension projects: This project reviews IDO and extension projects across a number of hort industries, to ensure good governance. The cost of the reviews is factored into the projects.

National bee pest surveillance program:

This is an extension of the previous 5-year project through Plant Health Australia. While we now have Varroa mite in Australia there are a lot of other bee pests, particularly viruses which can be spread by Varroa mite, that we still don’t have here and which can severely impact honeybee colonies.

In addition, a variation of the Rubus IPDM program (RB21000) has been proposed to include work on an emerging pest issue in southern growing regions, Bronze Leaf Beetle.

After endorsement by the prioritisation panel to support the Berry Basket Marketing Campaign through the strawberry royalty stream, Berries Australia will continue to deliver this program for a further two years. You can find out more about this on PAGE 65.

There are also a number of Hort Frontiers projects underway involving the berry industry. Hort Frontiers projects are multi-industry projects funded through a different mechanism, not industry levy funds, and are often technology-driven and focused on commercial outcomes. They are usually delivered by a consortium of service providers.

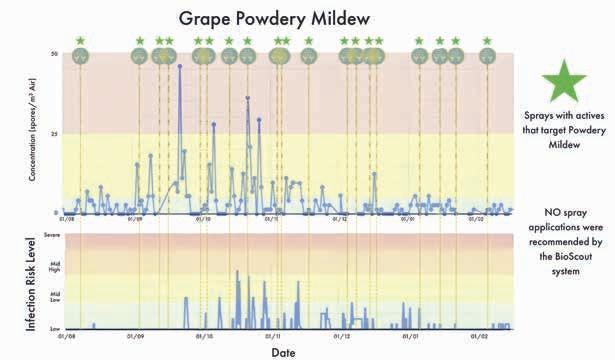

AS23010 – Robotic UV-C System for powdery mildew control

AS23002 – Driving on-farm productivity with augmented technologies for fruit growers

BY23002 – Next-Generation Weed Management

AS24007 - Drone-Enabled Bird Management for Australian Horticulture

AS23001 – Growing horticulture through protected cropping innovation

More information on any of these projects can be found at horticulture.com.au by searching for the project code.

The next round of the ideation workshop and prioritisation panel meetings will take place in March and May 2026. If you would like to get involved, please contact me on 0499 645 836 or angelaatkinson@berries.net.au

Wendy Morris, Berry Industry Development Officer 0484 272 963 | qldberryido@berries.net.au

Christmas will be approaching by the time this edition hits your desk, however I’m writing this report during the lull period between winter and summer season strawberries. Pricing is excellent for those who have fruit to send to market, with raspberry prices also surprisingly holding firm even as production ramps up. What fate awaits the blueberry season remains to be seen.

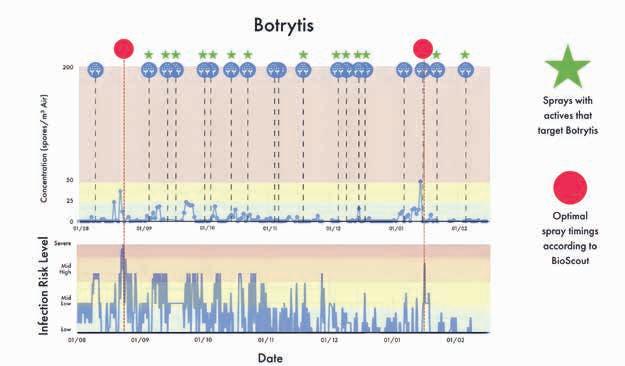

For those who are ending their season, it’s a welcome break from what’s been a tough year, hampered by drizzly, overcast days and the usual litany of pests and disease. Grey mould cut a path through winter season strawberries, as the weather didn’t let up. The season also saw incidences of nitrogen stunting and albinism in in-ground strawberries, with plants unable to effectively uptake and utilise the nutrients in the soil due to poor weather conditions. Thankfully, there were no incidences of foliar nematodes on farms this year, however ‘behind the scenes’ we are continuing to explore all possible control options as we know they’ll be back at some point!

There have been a slew of fabulous webinars over the past few months, all of which are available in the online Resource Library at bit.ly/BA-RL. Can’t find what you’re looking for? Email admin@berries.net.au and we’ll send you the link. Recent webinars include three sessions on strawberry cultivars, as well as an overview of drones (covering legislation, opportunities and threats) and a best practice spray session presented by Syngenta.

Very often I find myself in the trap of ignoring a webinar or event invitation because I’m busy and can’t seem to make the time. But did you know that a drone can’t be flown within 30m laterally of a person not essential to its operation? Or that it needs to be

kept within sight at all times? Are you aware that just because the active ingredient is the same, doesn’t mean one pesticide will be the same as the next? There are so many seemingly minor details that can make crucial differences to the efficiency of your operations, and these are covered in these recent webinars.

Red Imported Fire Ants (RIFA) continue to be an irritation for many of our Sunshine Coast region growers, however Berries Australia and QSGA have been working with the National Fire Ant Eradication Team to help develop understanding and – fingers crossed –redevelop treatment strategies to better suit the needs of growers. Plant Health Australia has recently published a Red Imported Fire Ant (RIFA) Quick Guide which can be found in our Resource Library if you want to know more about this troublesome pest.

QSGA and Berries Australia have also received feedback from growers wanting to know how we can encourage consumers to eat more delicious Queensland strawberries. As well as the national Berry Basket Marketing program (SEE PAGE 65), which is running continuously from now until mid-2027, Adrian Schultz and I will be engaging with our contacts and drawing up a plan for 2026. In the past, strawberry festivals have played an important role in local community engagement, and our experiences at the Ekka this year emphasised just how keen consumers are to know more about their berries and where they come from. The biggest change? Traditionally promotional activities have taken place during the peak of the season. We’re looking at a pre-season launch, to get everyone excited and willing to spend money when profit margins are at their highest for growers.

If you have any other suggestions or comments, please don’t hesitate to reach out to your local IDO. In the meantime, enjoy a wonderful and safe Christmas break.

Growers and IDO’s toured the Multisteps facility at Narangba as part of the recent Gatton AgTech Bus Tour

Simon Neil, Berry Industry Development Officer 0400 100 593 | berryido@fruitgrowerstas.org.au

It’s been a busy few weeks hitting the ground running as the new Tasmanian Berry Industry Development Officer, following on from the great work of Ella Roper, who many of you will know for her dedication and enthusiasm for the industry. I’m already connecting with growers across the state and I’m genuinely grateful for the warm welcome and support I’ve received.

My background is a little different, having spent several years in Tasmanian aquaculture farming oysters in the stunning, freezing waters of our East Coast lagoons. What I’ve quickly observed is that both aquaculture and horticulture share the same fundamental challenges: unpredictable weather, volatile trade policies, seasonal labour shortages, logistics bottlenecks, and everpresent pest and disease pressures.

Farmers battle all these and more in pursuit of an excellent product, despite the odds. I’m proud to bring a mindset of problem-solving, observation, and persistence with me; it feels right at home in the berry sector.

Spring has certainly sprung down here in Tassie, and growers big and small have been feeling the full force of the season. Spare a thought for those repairing tunnel and infrastructure damage from the mighty northwesterly winds that brought gusts of up to 150 kph in the higher regions. And with all signs pointing to another hotter-than-average summer, as well as active zones around the state, this is a good time to double check fire plans and think through the knock-ons for flowering, pollination behaviour and water management.

In my first few weeks I’ve been visiting growers, meeting researchers, and building connections with my fellow IDOs. A highlight was travelling to Queensland for the Department of Primary Industries and Hort Innovation AgTech showcase day in Gatton, coupled with by visits to Multisteps packaging in north Brisbane and Bugs for Bugs in Donnybrook. The showcase offered a glimpse at new tools and technologies emerging across horticulture, while the Multisteps tour provided insight into how packaging innovation is evolving to meet sustainability goals and the specific handling needs of berry crops. You can read more about these visits on PAGE 18.

The visit to Bugs for Bugs was especially fascinating; seeing the production of beneficial insects firsthand was a great reminder of how biological control is continuing to grow in importance across all horticultural sectors. I picked up some interesting tips for maximising the effectiveness of beneficial insects for pest control that are worth sharing.

1. Be Ready Before They Arrive

Beneficials are living organisms with a short window of peak activity. Make sure your crop environment is ready before delivery, that pests are present but not out of control, compatible crop protection products are in place, and there’s adequate habitat available to support the bugs (shelter, pollen, or nectar sources if required).

2. Handle Deliveries with Care

When the insects arrive in the post, treat them gently. Open the package immediately, check product condition, and store exactly as directed by the supplier. Whatever you do, avoid leaving boxes in the sun or a hot vehicle as overheating can quickly kill beneficials.

3. Release at the Right Time

Release insects early in the morning when temperatures are mild and light is low. This reduces stress and helps them disperse and settle into the crop canopy. Gently rotate or mix the carrier material to distribute them evenly, following the supplier instructions for each species.

4. Avoid Chemical Conflicts

Check product compatibility as many pesticides, fungicides, and even some adjuvants are harmful to beneficial insects. Use Integrated Pest Management (IPM) compatibility charts or consult your supplier before spraying. If a spray is unavoidable, time releases several days after application.

5. Monitor and Support Their Success

Use sticky traps, field scouting, or magnification lenses to check that beneficial populations establish and pests are under control. Provide ongoing habitat (flowering refuges, banker plants) and avoid broad-spectrum sprays to keep beneficials thriving long-term.

I’d like to extend my thanks to everyone involved in hosting these events, as well as to the Queensland farms that welcomed us so generously. It was a great opportunity to see firsthand how things are done outside of Tasmania.

The next few months will be about getting around more of the state, listening, learning, and linking growers with the tools and resources that can help. Tasmania’s berry industry is full of innovation and quiet determination, and I’m looking forward to supporting that wherever I can.

I’m keen to hear directly from growers about the kind of support, resources or connections that would make the biggest difference. So please reach out anytime as your ideas will help shape our work in Tasmania.

Gaius Leong, Berry Industry Development Officer 0484 055 748 | gaius.leong@dpi.nsw.gov.au

Hort Innovation visited the Coffs Harbour berry industry in early November. They were here on a strategic visit to understand challenges that the NSW berry industry faced (Rubus and blueberries), which would help guide investment decisions to achieve future industry goals. The visiting team included Eduardo Barbosa (R&D Manager), Dumi Mhlanga (Berry Industry Service Manager) and Leanna Smith (Acting CFO).

The first stop was Oz Group Cooperative’s facilities, where the group was taken on a tour of the pack house by Parminder Singh (Operations Manager). The group was taken through the process of receival, sorting and packaging blueberries.

At the second stop, the group dropped in to visit Pardip and Arjun Gill on their farm in Bucca, innovative growers who provided insights into the on-ground challenges growers face on a day-to-day basis. They are currently members of the Oz Group Cooperative growing both Mountain Blue and Driscoll’s genetics.

The last stop was at Costa Group’s Upper Corindi farm where the team was introduced to various on-farm innovations and challenges by the Costa team.

Some key challenges and needs that were highlighted are:

• Urgent access to softer (IPDM friendly) chemistry alternatives for the industry, especially as older chemistry are phased out

• A centralised up-to-date database of current, available control measures for pests and disease in the berry industry that is easy to access, perhaps similar to the old ‘Infopest’ system

• Addressing community concerns and misconceptions about the berry industry

• Improvement of source water quality and fertigation line management

• Investment in practical technology that is economically viable

Thank you to the Hort Innovation team for taking to time to get out on our berry farms.

Helen Newman,

Berry Industry Development

Officer

0428 335 724 | Helen.Newman@dpird.wa.gov.au

Winter wrapped up in WA with above average rainfall and average to slightly above average temperatures, albeit significantly cooler than 2024. Several sites recorded their highest August total rainfall on record, including Anketell which received 204mm. Wanneroo also received a drenching with its highest August total rainfall since 1965 with 228mm. Pearce RAAF and Muchea both had their highest daily rainfall on record on 10 August with 50mm and 70.6mm (that’s a lot for WA!).

August temperatures were close to average throughout berry growing regions. Above average rainfall continued into September and Pemberton received its highest daily rainfall on record on the 8th with 67mm. Maximum temperatures were slightly above average in September, and minimums were average to slightly cooler than average in parts. October was a mixed bag with slightly above average rainfall in the greater Perth and Geographe regions, but average to below average elsewhere. Maximum and minimum temperatures were also mixed, but generally close to average.

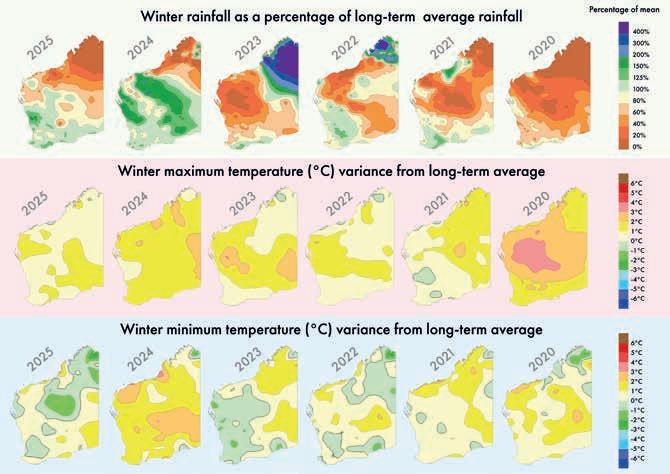

The weather chart in Figure 1 shows interesting variations for the last six years compared to the longterm averages for rainfall, maximum and minimum temperatures for WA.

Compared to 2024 (and potentially 2020 which was also warmer and sunnier), berry crops were behind schedule leading into spring but appear to be catching up as the weather gets warmer.

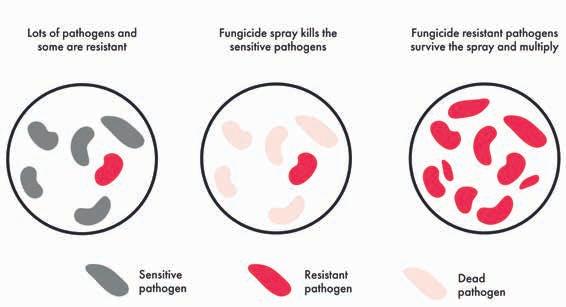

Perth region strawberry growers keeping second-year strawberry plants over the summer should be mindful of chilli thrips populations and the impact this may have on surrounding crops and new season plantings. Maintenance of second-year plants can also pose challenges with fungicide resistance as there is no break in the resistance cycle between crops. Early applications of protectant (multi-site) fungicides and limited, strategic use of curative (single-site) fungicides is recommended. You can read more about Resistance Strategies in Strawberries on PAGE 92.

All WA berry crops, particularly those in the northern growing regions, can benefit from shading during the summer months. Shading cools ambient (daytime) temperatures, reduces water loss from the soil, and reduces transpiration stress and sunburn. Rapidly evolving technology may soon make agrivoltaics an attractive option for shading berry fields.

Researchers throughout Australia are investigating the feasibility of using agrivoltaics to offer crop shading while having the added benefit of electricity generation through the University of Melbourne led project ‘Plant production agrivoltaics across southern Australia’.

In WA, the South-West WA Drought Resilience Adoption and Innovation Hub, with industry partners, has installed a demonstration solar array at Plume Estate in Bickley as proof-of-concept for deploying agrivoltaics in WA viticultural systems. Soil, climate, vine yield and quality data will be captured at the site, for modelling of production and economic impacts. Growers and industry visited the site on 28 October and will be invited back in early 2026 to hear the initial results of the trial.

This demonstration is expected to lead to further investment in research, development and adoption of agrivoltaics as part of a national CRC Zero Net Emissions project and a proposed Agrisolar CRC

More information:

• SW WA Hub: hub.gga.org.au/plant-productionagrivoltaics-across-southern-australia

• Agrisolar CRC: agrisolarau.com

• Zero Net Emissions Agriculture CRC: zneagcrc.com.au

1. Last six years compared to the long-term averages for rainfall, maximum and minimum temperatures in WA © Commonwealth of Australia, Bureau of Meteorology

Berry growers were well represented at this year’s WA Horticulture Update (WAHU) at Mandoon Estate in Caversham held in late October.

The program kicked off with a keynote presentation from Grant Dusting, a social researcher who advises organisations on how to respond strategically to current and future trends. Grant explored WA’s demographic trajectory to 2040 and the implications it has for food consumption, agricultural productivity, and sustainability.

He explained the cultural, generational and values changes we will continue to see and how the consumer base is expanding to both younger and older generations.

WAHU also included panel sessions with growers and industry groups on the topics of ‘Productivity and growth in a changing world’ and ‘Reconnecting consumers to growers: rebuilding value’. The day wrapped up with a talk on leadership and support from former Australian cricketer Brad Hogg and a sundowner in the trade display.

For growers that were unable to attend on the day, the WAHU 2025 page on the DPIRD website includes a range of Program resource links that may be useful. Find the links at www.dpird.wa.gov.au/businesses/plant-and-crop-farming/horticulture/WAHU2025

Victorian

Sandy Shaw, Berry Industry Development Officer 0408 416 538 | vicberryido@berries.net.au

Spring has been busy across South Australia and Victoria, with shifting weather patterns bringing strong windstorms, a freak tornado, and unexpected rain right at the beginning of strawberry season and amidst key pollination for Rubus and blueberries. Production initially looked set to surge off the back of warmer than average temperatures in September and October, but slowed abruptly with a late cold snap.

Rainfall increased in October and November which had significantly detrimental effects on outdoor production but unfortunately not a significant impact on water storage, which remains over 15% down from the same period in 2024. Despite the increased rainfall both Victoria and South Australia remain drought-declared. Looking ahead, forecast modelling suggests a warm but slightly wet summer for both South Australia and Victoria. As such, I will continue to focus on seeking opportunities for growers to access improved irrigation management tools and drought readiness resources. As I mentioned in my last update, both Victoria and South Australia are currently running drought support programs which can help growers weather the drier conditions. These programs include access to rebates to support the installation of drought-ready infrastructure improvements and water efficiency upgrades.

Victorian growers can access $5,000 to $10,000 in rebates depending on their LCA. South Australian growers can access up to $20,000 but applications should go in soon as the South Australian program closes 31 January 2026.

For more information on drought support for South Australia, go to the PIRSA website (pir.sa.gov.au/emergencies_and_recovery/drought) and look at more information on programs including mental health and resilience support, financial counselling support, the drought infrastructure rebate, and more.

For more information on drought support for Victoria, go to the AgVic website (agriculture.vic.gov.au/farm-management/droughtsupport) and look at more information on programs including farm management and drought support planning, news on the latest drought extension events, the drought support grants, and more.

Victorian growers who want to hear more about their drought support options can also opt to re-watch the Drought Support Webinar from mid-October which included speakers from AgVic, Rural Financial Counselling Service, and Netafim. The webinar presented options to growers from a number of angles: government support, private financial counselling, and increasing self-knowledge and capacity for drought resilience. You can find the webinar in the Berries Australia Resource Library or visit bit.ly/AgVic-Drought-Webinar

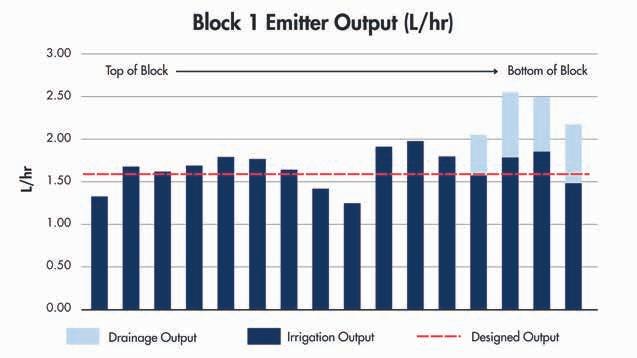

In late August we collaborated with Agriculture Victoria to run an irrigation workshop for all berry growers. Jeremy Giddings, AgVic’s regional irrigation manager for the Mallee very graciously made the long trek down from Mildura to run a half-day workshop for berry growers in the Yarra Valley focused on designing, optimising, maintaining and monitoring irrigation systems for maximum efficacy. Many thanks to Jeremy and the AgVic Horticulture team for their hard work making the workshop possible.

October was a busy month. In addition to the Victorian Drought Support webinar, we also continued our Strawberry Variety Overview series with a webinar in partnership with ABZ Seeds, a flower and strawberry breeding company from the Netherlands that focuses on breeding strawberry varieties to be produced from seed. Many thanks to Robbie Gieslink, their head breeder, and to Lefroy Valley, their Australian distributor, for making that happen. You can watch the webinar anytime by searching for it in the Berries Australia Resource Library

The Victorian Strawberry Growers’ Association hosted their AGM at Cherry Hill Orchards on a beautiful October morning. The morning included inducting their newest Hall of Famer, John Hasan and discussing topics of relevance to the Victorian strawberry industry. Berries Australia CEO Rachel Mackenzie, Hort Innovation Berry Industry Service Manager Dumi Mhlanga, and Hort Innovation General Manager for Production and Sustainability R&D Dr. Anthony Kachenko joined to discuss the SHIFt Initiative (SEE PAGE 24) and ongoing national projects and funding opportunities.

I did a bit of traveling in October as well, going to Queensland to attend the Gatton AgTech Showcase and to spend some time with my fellow IDOs (SEE PAGE 18) and over to South Australia to check in with growers there. While I was in South Australia, I was joined by Dr. Scott Mattner of VSICA Research and Dr. Cathryn Todd of SARDI, who gave a joint presentation on best practice charcoal rot prevention and best practice for pest and disease identification and sampling. The event could not have been accomplished without the help of Fruit Producers South Australia, who also provided an update to growers on local initiatives and activities, and the fantastic team at Beerenberg who hosted us.

Thank you to everyone who has hosted, attended, or contributed to recent events and visits; your involvement makes these events possible. Over the coming months, I’ll return to my usual focus: visiting growers and industry members to listen, learn, and connect. If you’d like a visit or just a chat, please don’t hesitate to reach out. All

Jen Rowling, Project Manager, Berries Australia

The Industry Development Officers (IDOs) are funded as part of the strategic levy investment project ‘Facilitating the development of the Australian berry industries (MT22010)’ under the Hort Innovation Strawberry, Blueberry and Raspberry and Blackberry Funds.

With our busy Berry Industry Development Officers dispersed across the country, it’s not often that the project team are able to get together in person. But an invitation to join a bus trip to an AgTech Field Day in October provided us with the ideal opportunity to spend some quality time together as a team. It was also a great chance to meet and get to know our newest IDO, Simon Neil who took over the reins in Tasmania in September. To make the most of the visit to Queensland, we added some farm visits, joined a factory tour and bus trip to Gatton, and held a team building workshop across three very busy days.

First stop for the day was Queensland Berries at Ningi. Richard and Melissa McGruddy have invested heavily over the last few years in infrastructure development and expansion into blueberry production, adding to their existing crops of strawberries, raspberries and blackberries. It was fantastic to see just how much progress has been made and the IDOs were suitably impressed with the scale of development and the on-farm tech employed by the team. Jared Maloney, General Manager and Lucy McGruddy were happy to provide the IDOs with a guided tour.

The Bugs for Bugs insectary at Donnybrook was the next stop on the day’s itinerary. Paul Jones, Director and James Hill, Farm Manager for the insectary provided the team with an overview of the business and the site. Bugs for Bugs has been supporting Australian growers since 1981, and as of May 2025, it’s entering an exciting new chapter, now wholly owned by the Biobest Group. It will continue to operate proudly under the Bugs for Bugs name, delivering the same trusted expertise in biological pest management, now backed by a global leader in sustainable crop protection.

The IDOs were given a tour of the many climate-controlled glasshouse structures where the team work to maintain continuous insect production of each beneficial species including Persimilis predatory mites and Hayati wasps. It’s a challenging task which requires constant monitoring of the rearing systems and attention to detail.

The rearing process involves three key stages: first, growing a healthy crop of host plants; next, introducing the target pest and allowing its population to build up to a critical level; and finally, releasing the predatory insects so their numbers can rapidly multiply as they feed on the pest. Once the populations of predator are at a significant level, they are harvested for distribution to growers Photos

After lunch at the insectary, the IDOs visited Perfection Fresh to meet the team there and hear more about the production side of the business in Queensland. They then headed over to Piñata Farms with just enough time to get a quick tour of the raspberries.

The IDO Project Team joined a group of local growers for a full day bus tour organised by Qld IDO Wendy Morris, starting the day off right with a delicious breakfast at Gather and Feast in Caboolture. With full bellies, we headed off to the first stop of the day, the new Multisteps packaging manufacturing facility in Narangba.

Multisteps is a global leader in food packaging with manufacturing facilities across three continents. The state-of-the-art Narangba facility combines cutting-edge technology, sustainability-driven production processes, and strict quality controls to ensure shorter lead times, reduced environmental impact, and premium-quality products for customers.

The 7,200m2 facility operates four advanced PET RP production lines with state-of-the-art thermoforming technology. An on-site extruder allows 100% of trim waste to be recycled back into production, effectively eliminating waste and ensuring consistent material quality.

It’s fantastic to see a facility of this calibre right on our doorstep and the Multisteps team provided a comprehensive and informative tour which was enjoyed by all. They were also keen to give the group a sneak peek at some new cutting-edge packaging technology coming through. It is hoped that this will be available in 2026 but is under wraps until then. Stay tuned!

Then it was off to Gatton! A couple of hours to relax on the bus before arriving at the Gatton AgTech Showcase. This biannual event offers industry an exciting opportunity to inspect emerging AgTech and innovations designed to grow and boost profitability and productivity.

This year’s focus was ‘Protected Cropping’ and we were pleased to see Queensland Berries support the event by providing Australian Strawberry Breeding Program variety ‘Red Rhapsody-ASBP’ in coir bags as part of the on-site demonstrations. As the team observed during the previous day’s farm visit, Queensland Berries is

no stranger to cutting edge technology. They did not build their business by doing things ‘the way it’s always been done’ and instead placed innovation at the core of their business model. It was great to see their fabulous berries in the protected greenhouse, and to see several of their staff supporting the event and continuing to expand their knowledge.

The showcase also featured live demos and a full speaking program. It was a fantastic opportunity to learn more about autonomous sprayers and machinery, drone imaging and data analysis, compostable mulch, and new greenhouse technologies. There was also a strong attendance from industry stalwarts, who could advise growers on beneficial bugs, growing media and irrigation.

The showcase is held every two years and even if you’re not sure it’s entirely for you, it’s an excellent opportunity to catch up with colleagues and make new connections.

A professional development team workshop rounded out the three days together, facilitated by the wonderful Jo Eady of RuralScope. With Jo’s warm, supportive and entertaining guidance, we spent the morning learning more about each other and our individual working styles, and identifying ways that we can continue to improve collaboration and team development.

These sessions are a great way to remind ourselves that we are all unique and although we may operate somewhat differently to each other at an individual level, we each have a place in the team and provide a valuable contribution to the project and the delivery of industry development and communications to the Australian berry industry.

Jane Richter, Communications Manager, Berries Australia

With more than 30 years’ experience across a wide mix of crops and countries, Hort Innovation’s new Senior Industry Services Manager Dumi Mhlanga is bringing energy, fresh ideas, and a grower-first approach to the berry industry.

Dumi’s horticulture story began in 1994, after graduating in Production Horticulture and later completing a Masters in Agribusiness at the University of Melbourne. In his career to date, he has worked across Australia, South Africa and Zimbabwe, getting hands-on with everything from stone fruit, apples, pears and cherries through to walnuts, open-field cut flowers, native Australian flowers, organic herbs, and protected cropping in tomatoes and herbs.

These experiences have given him not only technical know-how, but a real passion for supporting growers and helping industries find new ways to thrive. That passion was seeded early in his childhood growing up in a farming family in Zimbabwe, so Dumi is certainly no stranger to long hours. He was often up at 5am to help with the cattle before school, then back out on the farm again afterwards. Those formative years gave him a deep respect for farming life and a strong connection to the land.

While the berry industry is new ground for him, Dumi sees plenty of crossover with his past work. “The lessons I’ve learned managing such a wide range of crops are very transferrable,” he says. “Whether it’s problem-solving, building industry capability, or finding opportunities for research and innovation, the core principles remain the same.”

In his role, he sees himself as a bridge between growers and Hort Innovation. That means keeping communication open and transparent, making sure grower needs are front and centre, and helping to guide levy-funded research and development that delivers real results.

I will be looking for levy investment opportunities that can benefit multiple industries, encourage collaboration across sectors, and help steer strategic investments. A big part of my role is working closely with growers and industry bodies to pinpoint R&D priorities, using targeted investment and collective problem-solving to drive innovation and lift productivity across horticulture. My first priority is building relationships with berry growers and really understanding the challenges and opportunities faced in this booming sector of Australian horticulture, he explains.

Looking ahead, he believes the berry industry has strong opportunities to keep growing both by boosting domestic demand and creating more export markets. At the same time, he recognises the hurdles growers are facing, from agrichemical access and profitability to building capability and industry capacity.

“There’s no set list of projects yet - it’s about working with the industry to set priorities together,” he says.

If there’s one thing growers can expect from Dumi, it’s accessibility. Whether through regional visits, working with Berries Australia and state bodies, or picking up the phone for a one-onone chat, his approach is all about listening and staying connected.

I’m always available for a chatgrowers can call me anytime, even after hours. I want to make sure your perspectives are heard and help champion them wherever decisions are being made. I believe strong relationships and open conversations lead to real change. That’s what will help make horticulture more resilient in the long run.

Berry growers are encouraged to get in touch with Dumi: 0447 091 186 dumi.mhlanga@horticulture.com.au

Dumi Mhlanga, Senior Industry Service Manager, Hort Innovation

Imagine an investment system that truly reflects your needs as a grower. One that adapts to change, delivers real outcomes, and keeps your voice at the centre of decision-making. That’s exactly what Hort Innovation is building with the Strategic Horticulture Investment Framework (SHIFt).

This new framework is more than a plan, it is a bold step toward transforming how research, development, and marketing investments are shaped beyond 2026. Developed in partnership with industry and informed by feedback from over 400 stakeholders, SHIFt is designed to create a simpler, more transparent, and flexible approach to investment planning.

The current Strategic Investment Plans (SIPs) have guided levy investments for years, but they expire on June 30, 2026. This milestone offers a unique opportunity to re-think the system and introduce a model that is ambitious, effective, and future-ready. Through SHIFt, Hort Innovation aims to:

• Deliver greater impact and value for the industry

• Simplify planning and reporting for clarity and efficiency

• Deepen engagement with growers and stakeholders to ensure priorities align with real-world needs

For berry growers, SHIFt promises a planning system that is responsive, and results driven. It is about creating a framework that adapts to evolving challenges and opportunities, ensuring that every investment counts.

The new strategic plan for the berry industry is scheduled for release in June 2026, supported by clear dashboards and timelines to keep progress visible and transparent.

Industry consultation is the cornerstone of SHIFt. Hort Innovation is inviting berry growers to share their insights and help shape the priorities for the next five years. A short survey has been created to capture your feedback, and your input will directly influence the strategic objectives and initiatives that guidefuture investments.

This is your chance to make a real impact on the future of the berry industry. By participating in the consultation process, you ensure that the next generation of investment plans reflects your needs and ambitions. Don’t miss the opportunity to have your say, your perspective matters, and together we can build a stronger, more innovative industry.

Complete the survey by scanning this QR code or visit bit.ly/BA-SHIFt-Survey

Hort Innovation advances Australia’s $16.3 billion horticulture industry by investing in research and development, marketing and trade to build a prosperous and sustainable future for growers. We partner with Australian and international co-investors including government, leading science, technology and consumer strategy experts to anticipate future challenges and opportunities. Our role is to capture value from the investments we make to benefit all levy payers.

Horticulture levies are raised by growers for investment into research and development, marketing or both

Government contributions are accessed by Hort Innovation for each R&D investment. Marketing investments are not eligible for government contributions

Advice from industry helps Hort Innovation determine investments aligned to industry-specific investment plans

Statutory levies are paid to the Australian Government Voluntary levies are paid to a collective industry fund collector

Levy funds are entrusted to Hort Innovation for management

Information on how Hort Innovation manages levy funds at our website

More on the levy system at the Department of Agriculture, Fisheries and Forestry website

NSW based Driscoll’s manager Tyler Scofield received the Industry Impact Award at BerryQuest International 2025.

Behind every award is an innovator and inspirator, someone who drives change and leads others through troubled waters. For Berries Australia CEO, Rachel Mackenzie, it was Tyler Scofield’s work with the Varroa mite crisis which led to his nomination for this inaugural award.

Born and raised in Watsonville, California, the birthplace of Driscoll’s Berries over 100 years ago, Tyler grew up idolising growers. They had the best stories, they looked out for and cared for communities, and they had a natural level of respect from those around them.

Over Tyler’s ten years in Australia, he’s noted the challenges that lay ahead; IPM, water usage, harvest costs, run off management, chemical access and biosecurity risks. And, when the industry called for help with the 2022 Varroa mite response, he did not hesitate to step up to the plate.

His detailed understanding of the pollination requirements of the sector along with his strong links to growers meant he was the perfect conduit between the berry industry, government and the pollination sector. The role of industry liaison officer is key to the success of any biosecurity response and Tyler’s contribution, along with that of AHBIC CEO Danny Le Feuvre meant growers could keep growing even with the restricted areas.

Tyler is proud of the strong collaboration between key industry representatives during the Varroa mite initial incursion and pathway to management. He recognised that the local knowledge and contacts he had at his fingertips would be vital in helping growers get their crops harvested. Progress wasn’t always easy, and at times it felt like an uphill battle, but persistence paid off ensuring berry growers could keep accessing the pollination services they needed.

With Varroa mite now in the management stage, Tyler’s attentions have returned to new varieties and genetics.

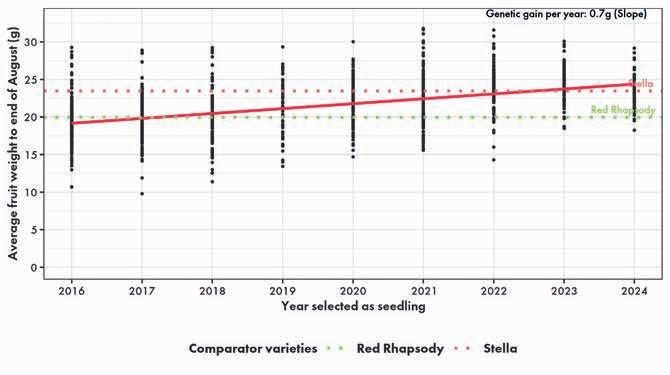

As Tyler says, “There are some fantastic varieties available out there, but we are really only scratching the surface. The blueberry breeding programs globally are in a bit of a race. Everyone is searching for that ‘perfect’ berry and the information that the consumer is providing is helping to define what that berry is. As the berries get bigger, juicier, firmer and sweeter we can see that people are buying more and that’s exactly what we want to see.”

Berries Australia was thrilled to be able to recognise Tyler with the Industry Impact Award, especially as his contribution was the inspiration for the development of the entire industry award program. Berries Australia would also like thank Driscoll’s Australia for making Tyler available to assist the whole sector in its hour of need.

For 25 years, Freshcare has been quietly shaping the way Australian growers and supply chain businesses demonstrate food safety, quality, and sustainability. What began as an industry-led initiative to create a practical, affordable assurance program for Australian growers has evolved into one of the most trusted and respected certification standards in the country, now working with more than 4,600 businesses nationwide, supporting the people who make Australian horticulture, wine and supply chains thrive.

Freshcare’s CEO, Jane Siebum, says the organisation’s success comes down to collaboration.

“Freshcare is where it is today because of the invaluable contributions of industry members, growers, business owners, horticultural and agricultural experts, and the many stakeholders who’ve shared this journey with us,” she said. “Their expertise, collaboration and commitment have shaped Freshcare into Australia’s leading provider of certification standards.”

The program has always had one clear purpose: to give Australian growers a fit-for-purpose food safety solution

Industry organisation Freshcare received the Supply Chain Champion Award at BerryQuest International 2025 earlier this year.

For 25 years, Freshcare has been proudly supporting Australian fresh produce supply chains with practical, industry-owned and operated assurance standards.

Rachel Mackenzie, CEO Berries Australia, nominated Freshcare for their advocacy which ensured Australian berry growers’ compliance with global food safety standards was acknowledged by government, preventing costly duplicate audits while protecting industry sustainability as part of the newly introduced Primary Production and Processing (PPP) Standards.

built for local conditions. From soil to supermarket, Freshcare helps ensure that Australian produce is safe, sustainable and of the highest quality.

Over the years, Freshcare has continued to refine and expand its standards to meet the changing needs of both growers and customers. Its continuous improvement philosophy has driven innovations in training, digital tools, auditor support and governance, all while keeping the system practical and grounded in real-world farming operations.

“Freshcare has grown alongside Australian horticulture,” says Jane.

“It’s evolved from its early ‘growing up’ years to become an internationally benchmarked program that was built by industry, for industry.”

Behind Freshcare’s success is a dedicated onshore team who live and breathe the values of Australian agriculture and viticulture. They work closely with growers and businesses every day providing practical support, guidance, and expertise to help them meet their assurance goals and maintain the confidence of consumers at home and overseas.

Supporting them is a highly skilled and experienced Board, whose leadership ensures Freshcare remains accountable, transparent, and strategically focused on the future needs of Australian horticulture and wine industries.

Complementing this governance is the Freshcare Technical Steering Committee: a network of industry specialists in agriculture, food safety, sustainability, and certification. Their collective knowledge and hands-on experience ensure Freshcare’s standards stay practical, credible, and relevant, reflecting the realities of Australian production while meeting the expectations of markets and regulators worldwide.

The Supply Chain Champion Award recognises this enduring commitment: to integrity, to collaboration, and to helping every grower, packer and supplier deliver food that’s safe, sustainable, and proudly Australian.

Jane Richter, Communications Manager, Berries Australia

Berry growers across Australia have the chance to take part in one of horticulture’s most exciting international events, and thanks to Hort Innovation and Agriculture Victoria, you could be going for free.

Hort Innovation, a platinum sponsor of the XI International Symposium on Irrigation of Horticultural Crops, is supporting berry growers to experience this world-class event, hosted at Tatura SmartFarm, Victoria, on 20–21 January 2026.

Through this partnership, Berries Australia is giving away three free tickets: one each for a strawberry, Rubus, and blueberry grower, to attend the symposium’s dedicated workshop and technical tour. It’s a unique opportunity to gain firsthand insight into the latest irrigation research, technology, and global best practice, right here in Australia.

The two-day grower program includes:

• Access to R&D sessions, presentations, and an industry-tailored workshop on Tuesday 20 January

• Entry to the technical tour of the Goulburn Valley region on Wednesday 21 January, with bus transport provided

• Networking opportunities with international scientists, growers, and policymakers

Please note: accommodation and general transport costs are not included.

The workshop theme “Sustaining future orchard profitability in years with reduced access to irrigation water” could not be more timely, given the drought situation being faced currently in Victoria. You can expect in-depth discussions on AI-driven water management, smart irrigation systems, and innovative agronomic practices that help producers adapt to the challenges of low water availability.

Dr Alessio Scalisi, Symposium Convenor, says the event will offer something special for every grower.

The International Symposium on Irrigation of Horticultural Crops is more than a scientific meeting. It’s where the brightest minds in horticulture come together to shape the future of water, energy and climate-smart farming. We can’t wait to welcome the world to Tatura.

Dr Ian Goodwin, from Agriculture Victoria agrees. This symposium is a rare opportunity to connect researchers, growers, and innovators from across the globe. Together, we’ll share solutions that make horticulture more resilient, more profitable, and ready for the challenges ahead.

A single-day registration normally costs $550, making this giveaway an exceptional opportunity to expand your knowledge and network with leading irrigation experts, all while representing Australia’s berry industry on the world stage.

To enter, simply complete the entry form online at bit.ly/BA-XI-Symposium. Winners will be selected to ensure one grower from each berry crop type secures a ticket. Entries close 5.00 pm AEST, 15 December 2025.

For more details on the full symposium program, visit www.irrigation2026.com.au/program-overview

Jane Richter, Communications Manager, Berries Australia

For Australian berry growers, pollination is the unseen engine that drives productivity, quality, and profitability. The difference between an average and an exceptional harvest often lies in the small but mighty efforts of bees who are the silent workforce ensuring that flowers become good quality berries.

Bees are essential partners in berry growing. Whether it’s strawberries, blueberries, raspberries or blackberries, effective pollination improves both the yield and quality of fruit. While some berry plants can self-pollinate, the presence of bees dramatically enhances results, and that’s backed by decades of local and international research.

In strawberries, bee activity can lift yields by up to 18%, producing larger, firmer fruit with better shape and higher sugar content. Blueberries, highly dependent on insect pollination, rely on honey bees to increase fruit weight and reduce development time resulting in more uniform crops that meet market specifications. Even blackberries benefit from improved pollination, producing larger, more symmetrical berries with an extended shelf life.

For growers, that translates directly into greater productivity, higher pack-out rates, and better returns per hectare. Robust pollination isn’t a luxury, it’s a business investment that pays off every season.

Despite its importance, reliable pollination is becoming harder to secure. Australia’s beekeeping industry is under increasing pressure from several fronts. Rising competition for hives across multiple horticultural sectors has tightened supply. The arrival of the Varroa mite in Australia has further disrupted colony availability and management costs. Add to that unpredictable weather events and shifting flowering times, and many growers are finding that traditional handshake arrangements with local beekeepers are no longer guaranteed.

A shortfall in pollination can mean significant yield losses, a risk that few growers can afford in a competitive marketplace.

Recognising this emerging challenge, a South Australian AgTech start-up ‘HiveHub’ has developed a new, free online platform that connects growers and beekeepers across Australia. Designed to complement, not replace, existing relationships, HiveHub aims to strengthen pollination security and transparency while providing a reliable backup network when challenges arise.

The idea is simple: make pollination management easier, clearer, and more resilient by bringing together growers with pollination service providers, and using modern technology to create a win-win relationship coupled with reliable pollination outcomes.

Growers can use HiveHub to:

• Register their farms (free forever) – providing key details like crop type, location and flowering periods so local beekeepers understand their needs

• Find available beekeepers nearby – access profiles showing experience, hive availability, and service regions

• Communicate and negotiate directly – message beekeepers through the platform to confirm details, timing and terms

• Create and sign digital agreements –formalise arrangements with clear expectations and conditions to protect both parties

• Track and manage pollination activity –monitor hive placements, dates and milestones through a simple dashboard

• Facilitate payments and resolve disputes –use HiveHub’s built-in tools for secure payments and structured issue resolution

• Build a trusted history – review and be reviewed after each season, helping to create a national reputation network that rewards reliability

For growers, HiveHub delivers clarity, accountability, and confidence which are three things that have often been missing in informal pollination arrangements.

Berry crops are particularly sensitive to timing and quality in pollination. Missing even a small window can compromise yield and fruit uniformity. HiveHub helps growers safeguard against those risks by offering:

• Access to a wider beekeeper network – ensuring backup options if a usual supplier is affected by Varroa, weather events, or high demand

• Centralised records – keeping contracts, payment details, and past arrangements in one easy-toreference location

• Transparency and security – digital agreements provide clarity for both parties and reduce misunderstandings

• Biosecurity awareness – HiveHub fosters good record-keeping and encourages best practices to protect bee health across regions

• Future-proofing – participation helps build a stronger national pollination network that benefits the entire horticulture sector

For berry enterprises that depend on reliable flowering windows and premium fruit quality, these benefits translate into reduced pollination risk and improved long-term sustainability.

HiveHub isn’t about disrupting existing grower–beekeeper relationships; it’s about strengthening them. Many growers already have trusted beekeepers they work with season after season. HiveHub’s tools simply make those arrangements easier to manage by providing digital records, automatic reminders, and secure payment options to streamline an oftenoverlooked part of farm operations.

At the same time, it creates new opportunities. If a grower’s regular beekeeper becomes unavailable,

HiveHub offers an immediate pathway to find alternatives nearby saving time, protecting yield potential, and maintaining business continuity. The platform is designed for ease of use, with step-by-step guidance and support available to help first-time users. Once a farm profile is set up, growers don’t need to revisit it until they’re ready to arrange pollination again keeping administration light and practical.

HiveHub’s broader mission is to support the resilience of Australia’s pollination ecosystem. The arrival of Varroa has underlined how interconnected the nation’s horticultural industries are, and how important it is to plan ahead for continuity of service.

By linking growers and beekeepers through a transparent, structured system, HiveHub contributes to:

• Greater regional pollination security

• Better data on national hive demand

• Improved biosecurity awareness and traceability

• A more collaborative agricultural community

For berry growers, that means greater control over pollination planning, improved risk management, and a stronger voice in shaping the future of pollination services.

HiveHub is inviting Australian berry growers to be part of this movement. The platform is FREE to join, easy to use, and backed by a support team ready to help with setup and onboarding.

By signing up, growers can protect their upcoming harvests, strengthen existing beekeeper relationships, and gain access to a growing network of reliable pollination partners across the country.

As HiveHub’s founder explains, “Our goal is to give growers confidence. Pollination shouldn’t be a source of stress, it should be something you can plan for, manage easily, and rely on every season.”

In a time when bee health and hive availability are under increasing strain, HiveHub represents a practical, grower-focused solution that is worth signing up for.

To learn more and register your farm free of charge, visit hivehubpollination.com and join the HiveHub community.

Professor Alan Dorin, Monash University

In this article I offer some personal perspectives, observations and suggestions, related to insect pollination in polytunnels. As I explain below, there are many aspects of tunnels that make it hard for bees to visit crop flowers under plastic. Nevertheless, by offering this informal opinion piece (it’s not a research article, but it is backed by my understanding of the literature, my own research and field experience) I hope to provide some food for thought.

I’m not a grower. You are the expert on your crops and know them much better than I do! My perspective is that of a computer scientist researching bee behaviour and pollination monitoring, simulation and management on semi-protected berry crops. I hope you’ll find some relevant detail here on the complexity of pollination management, some clarity about why more research is needed, and also, why “quick fixes” to pollination issues may not work.

Honeybees’ colour vision extends into the UV range where human vision doesn’t respond, and it falls short of the range of colours we perceive as red. Honeybees have compound eyes that don’t clearly image a scene like our own eyes. They can only resolve spatial detail about 170 times less effectively than humans. So, what do these factors mean for bees visiting crops?

Although we can easily detect a white flower at a distance of a few metres against a dark green background, for example a strawberry flower against foliage, it may not be easy for a honeybee to spot it. A cluster of white blueberry flowers, perhaps 5cm across, will be easier to detect from the same range. But factors such as the

illumination, (green-) colour contrast, reflectivity of background surfaces such as leaves, mulch or weedmat, will all also impact flower detection.

Sometimes, humans can easily distinguish between one variety of a crop flower and another planted nearby, or between a weed and a crop flower. However, under some circumstances a honeybee may find these seemingly very different flowers to be indistinguishable from one another, especially from a distance approaching the limits of their vision. The opposite can also be true. For instance, if a bee detects two flowers that look similar to humans, but one absorbs incoming UV light and the other reflects it, the flowers will be more easily distinguishable to the bee than to us.