Differently

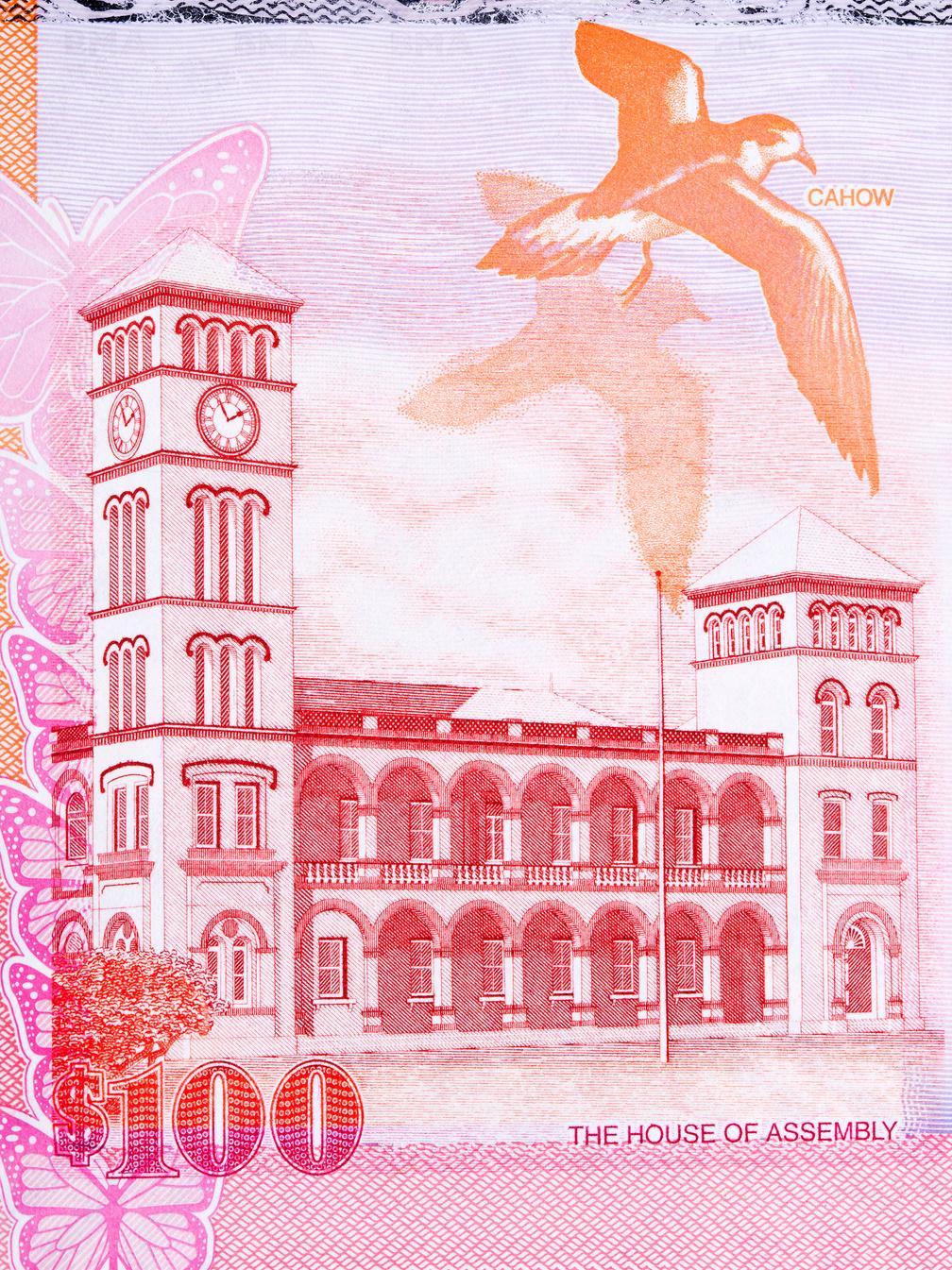

BRUSH UP ON YOUR BUDGETING SKILLS

KIDS TO BUDGET 13 WAYS TO TEACH YOUR

THE SPECIAL RELATIONSHIP BETWEEN LANGUAGE BASED LEARNING DISABILITIES AND ANXIETY

Differently

BRUSH UP ON YOUR BUDGETING SKILLS

KIDS TO BUDGET 13 WAYS TO TEACH YOUR

THE SPECIAL RELATIONSHIP BETWEEN LANGUAGE BASED LEARNING DISABILITIES AND ANXIETY

Summer is a flurry of swimming, barbecues, camps, snow cones, Cup Match and then in a blink it’s time to head back to school!

While you may be extra cautious about sun safety in the summer, it’s important to keep protecting your child’s skin even after the school bell rings

In Bermuda, the average maximum UV index is eight in September; eight is “ very high” with a burn time of 15-25 minutes without sun protection. Recess is usually about 15 minutes, and lunch lasts at least 30 minutes Even if that is the only outside time your child gets in a day, there’s enough time to burn.

Most children will have even more outside time Nurseries and preschools spend more time playing outside, and school-aged children have physical education classes that also take them outdoors

How can you help your child to be SunSmart at school? Slip, Slop, Slap, Seek, Slide!

If your child is going to nursery or preschool, choose clothes with a UPF rating of 30 or more.

UPF stands for Ultraviolet Protection Factor, and this number indicates how much ultraviolet UVA and UVB radiation can go through the fabric and onto your child’s skin

Can’t find UPF-rated clothing for your tot? Choose clothes that offer better protection, like dark colours and tighter knits

If your child is heading to primary, middle or senior school, your clothing choices are limited to the school uniform, which makes the other aspects of the SunSmart Programme even more crucial

Apply sunscreen to your child 20 minutes before they head out for the day, and pack some in the school bag to reapply throughout the day Your child’s sunscreen should have at least SPF 30, which protects the skin 30 times longer than without sunscreen. Don’t forget to apply sunscreen on yourself while you’re at it!

Slap on a hat.

All school students should wear wide-brimmed hats during outdoor play Check with your older child’s school to see which hats are allowed when the children are outdoors. If necessary, remind the school that a wide-brimmed hat reduces the amount of sun that reaches your child’s face, neck, and ears, which are the most common areas for both nonmelanoma skin cancer and melanoma.

Seek Shade.

Encourage your child to seek out shady areas to play during recess and lunchtime. Talk to your school and PTA about getting shade canopies for the playground at your child’s school Seeking shade gives your child’s skin a break from UV rays

UV damage accumulated during childhood and adolescence is strongly associated with an increased risk of skin cancer in adulthood Schools have a duty of care to safeguard children against the damaging effects of over-exposure to UV which can lead to skin cancer in later life

Bermuda Cancer and Health Centre promotes safe skin habits through its SunSmart Programme, which assists schools with meeting their duty of care requirements in sun protection and occupational health and safety obligations in UV risk reduction It supports staff and help students understand safe and unsafe exposure to the sun and how to reduce the risk of sun damage, including skin cancer.

Through free 15 to 20-minute presentations sponsored by the St Baldrick’s Foundation, Bermuda Cancer and Health Centre effectively imparts sun safe behaviours in an engaging and ageappropriate manner to both staff and students

Talk to your child’s school to see if there are any restrictions on sunglasses during outdoor recess and lunchtime Sunglasses labelled UV 400 offer 100% UV protection for your child’s eyes and delicate skin around the eyes. Keep the sunglasses protected with a glasses case inside your child’s backpack

These sessions are conducted in both public and private schools, ensuring that students are educated about the risks of sun exposure and equipped with knowledge on how to safeguard themselves when outdoors If your child’s school is interested in becoming SunSmart accredited or scheduling a presentation for the students and staff, email sunsmart@chc.bm.

Slide on sunglasses.

Reprint from past Bermuda Parent

"I tried very hard to be normal…I tried to hide as much as I could…You think you go day by day but it’s like every day is a full lifetime And it’s like, 'Oh my god! I have to get through this...the amount of anxiety, stress, and fear is enough to fill a lifetime...it is just so stressful…once I go to bed, it is like the end of my life ' "(Cole, 181)

As a student with a language-based learning disability (LBLD), Cole knows better than most what it means to live with anxiety Indeed, the literature reports that rates of anxiety are significantly higher for students with learning disabilities (Alesi, Rappo & Pepi, 2014) While the reasons for this remain unclear students with LBLD connect their

increased stress level to a number of factors The difficulty of performing daily school tasks, as Cole describes, may certainly trigger a constant state of hypervigilance. Emily, 18, shares the same worry. Teachers “would go around the room and have us read I remember chewing on my sleeves because I was so nervous a

Many students with LBLD also describe an intense preoccupation with friendships. “Once I started having problems in the classroom, I became more shy, and I focused so much on having friends even as a 6 year old, I was worried about socializing...,” added Emily. That worry may spread to social anxiety: “As I got older...I would get anxiety about getting anxiety. I would not want to go to social events in my freshman or sophomore year, I could not even eat at the cafeteria,” she said

School interventions to address the LBLD may have a negative impact on students’ sense of self and their peer interactions, thus increasing their anxiety

Whether from teachers’ inappropriate comments, as Jessica, 15, recalled: “[I had] constantly been told…that I was either not trying hard enough and I was not going to do anything with my life,” or the effect of instructional approaches, even if well intentioned and effective “

Getting taken out of class, taking tests in separate rooms, and having an aid walk up my way more often than she would to other people…things like that single you out…I guess seeing that made [other students] think that there was something wrong with me, and they wouldn’t think that I could play sports with them, or do the same kinds of arts and crafts just because they thought I was different,” Mike, 18, shared.

about being picked,” she said The acute sense of being different, described by many of our students as beginning in kindergarten or first grade, often tightens the grip of that anxiety “I was so self-conscious about my learning and comparing myself to other kids…I would put myself down because I felt I was not as smart as the other kids,” recalled Emily That anxiety may lead to school refusal (Kearney & Albano, 2004, 2008).

Parents reading this might be getting anxious just thinking about their child’s potential for developing anxiety! The truth is that parents are invaluable advocates and resources for their children with anxiety

Parents should educate themselves on their child’s disability and its impact on learning At times, students with LBLD can look as though they lack motivation, are lazy, apathetic about school, avoidant, defiant, or even just angry Knowing more about their disability will help you understand what you see in terms of behaviors with regard to school Then, explain the learning disability to your child. It is the first step in countering the thought that they are not smart enough to succeed, a conclusion that students with LBLD often draw from their repeated failures in school

Parents can be their child’s advocate with the school system to develop an educational program that will lead to more successful learning and emotional well-being This is an essential issue that will require significant commitment and resiliency as a parent

Amid all of this tough work, it is important that you maintain an ability to play with your child, appreciate the many sides of their personality and abilities in life, and enjoy one another To this end, encourage your child to engage in interests to develop a sense of competency in other areas of their life: physical, artistic, dramatic, musical, scientific, or technological

Examine the thoughts and emotions leading to your own reactions as you are helping your child with school-related tasks: anxiety about deadlines or test performance for your child, visualizing your own fears about the future, embarrassment about repeated failures, etc. Your ability to remain calm and model calm under pressure is more likely to foster a similar attitude in your child

When you encounter challenge with regard to school tasks or anxiety, remember that threats and angry demands are counterproductive and typically lead to the opposite result because your child becomes more anxious, feels misunderstood, and is resentful. Of course an LBLD diagnosis paired with anxiety is tough on parents; no parent ever wants to see their child struggle. Still, parents and their modeling of managing the disability and anxiety will be key to the child’s success and development of resilience.

Procrastination and avoidance are the “go to” responses for students with anxiety, and they are typically automatic and unconscious Unfortunately, it leads to the child’s increasing fear since the fear is never “faced ” There are different ways of countering this tendency Here are some strategies to use with your children.

Help them learn how to manage their homework load. This may involve decisions about the order in which to tackle the assignments (from easy to difficult, or the opposite, or according to class order) Also break down the task into manageable units and have the student praise themself for completion.

Change the perception of their LBLD so that they see it as a manageable issue Kids with LBLD develop selfdefeating thought processes that prevent them from even attempting work With help, your child can learn to identify those thoughts and counter them. Whenever she made a mistake, Rose’s mind would spin out of control: “ I am so dumb, I will never be able to learn this, I will not go to college, and I will end up working at McDonald’s for the rest of my life ” She would rip up her work, and walk away. When the self talk changes, then the behaviors can change, too. Encourage children to talk to their anxiety and help them form positive responses like, “I can do this, I’ve been able to before” or “I can try this and then ask for help if I’m unsure ”

As Emily says, “When you are thinking and putting yourself down, like that I am dumb…you notice…” Instead, students can remind themselves that they are smart, that they succeeded before and can again Encourage their use of distraction to shift the thought process. Students with anxiety often get stuck in a “hamster wheel” of worried thoughts At times there is no using logic to get out, and distraction can be a useful technique to calm the anxiety. Nicole, 17, said she likes “to go outside so I can feel not trapped or [I] listen to music and tune out to the beat of the song.” Jessie, 10, an elementary student prefers to “ watch funny Youtube videos or look at a picture of my dog to help distract my brain...that puts it back on track.”

Remind students to reach out for support Sometimes anxious feelings are so strong that students need to talk to a trusted adult or peer to practice one of the strategies above, or have validation that their worry makes sense, but it still does not need to be taking over Students who are really feeling stuck and might need adult support could find it helpful to take a walk or get a drink, as an additional way to reset the body so that the mind will reset, too.

Support their practice of breathing exercises, mindfulness, and muscle relaxation to counter the anxious mindset and calm the fear response (Harvard Medical School, 2018) Jessie shares, “When I worry, I use my calm app to listen to rain sounds and practice breathing ” A high schooler notices “muscle relaxation…[for] when you feel you have the body symptoms…helped a lot with anticipatory anxiety I had before public speaking or if I had a race it helps your body relax it helps your head ” Students who take part in mindfulness at the start of each day at school notice that they are able to reset or take a quick “nap” to quiet their mind before class and that they can tap into this feeling before a test, or when their worries flare up

Lastly, it is worth mentioning that anxiety may be so overwhelming that students cannot access their internal resources and help themselves A medication evaluation may be indicated and make a significant difference in making them more able to take advantage of other therapeutic strategies.

In a world where we are being told that anxiety is at pandemic levels for youth, we know that our students with LBLD are well versed in what it is like to live with both a learning disability and anxiety. Despite these challenges, they can go on to be resilient, creative adults with fulfilling lives.

1 References

Denotes student’s name (changed for anonymity) and current age

Alesi M, Rappo G, Pepi A (2014) "Depression, Anxiety at School and Self-Esteem in Children with Learning Disabilities " J Psychol Abnorm

Child 3:125 doi:10 4172/2329-9525 1000125

Harvard Medical School:Relaxation techniques: Breath control helps quell errant stress response

Kearney CA School absenteeism and school refusal behavior in youth: a contemporary review. Clin Psychol Rev. 2008;28(3):451–471. doi: 10 1016/j cpr 2007 07 012 [PubMed] [CrossRef]

It's important for kids to be financially savvy for several reasons:

Financial Independence: Teaching kids about money empowers them to make informed financial decisions as they grow older This independence helps them avoid financial struggles and make positive choices for their future.

Budgeting Skills: Learning to budget allows kids to manage their money effectively, ensuring they have enough for essentials, savings, and discretionary spending. This skill is invaluable in adulthood.

3. Avoiding Debt: Financially savvy kids are more likely to understand the dangers of excessive debt and make responsible borrowing decisions, preventing them from falling into debt traps later in life.

4 Savings Habits: Instilling savings habits early sets the foundation for a lifetime of financial security It encourages long-term thinking and prepares them for emergencies and future expenses.

5 Goal Setting: Financial literacy helps kids set and achieve financial goals, whether it's saving for a toy, a car, college, or even retirement. This fosters a sense of accomplishment and motivation

6. Critical Thinking: Making financial decisions requires critical thinking skills Kids learn to evaluate options, consider consequences, and prioritize needs versus wants.

7. Entrepreneurial Spirit: Financial literacy can nurture an entrepreneurial mindset Understanding money allows kids to explore opportunities for earning, investing, and starting their own businesses.

8 Responsible Consumer Behavior: Financially savvy kids are less likely to succumb to impulsive buying. They learn to compare prices, read reviews, and make informed choices about purchases

9 Risk Management: Understanding financial concepts like insurance and investment helps kids learn how to protect their assets and plan for the future.

10 Charitable Giving: Financial literacy includes the concept of sharing and giving back Kids can develop a sense of social responsibility and empathy by learning to allocate a portion of their resources for charitable purposes.

11. Crisis Management: Financially savvy individuals are better equipped to handle financial emergencies and unexpected events They can navigate tough situations with confidence and resilience.

12. Avoiding Financial Scams: In today's digital age, financial scams and fraud are prevalent Teaching kids about financial literacy helps them recognize and avoid scams, protecting their assets and personal information.

13. Reducing Stress: Financial difficulties can be a significant source of stress Being financially savvy helps kids develop a sense of control and confidence in their ability to manage their finances.

14. Long-Term Wealth Building: Understanding the basics of investing and wealth-building strategies can set kids on a path to financial prosperity and security in the long run

15. Breaking Generational Cycles: Financial literacy can break the cycle of financial instability and poverty that may exist within families. It equips kids with the tools to make positive financial choices for themselves and future generations

Overall, being financially savvy equips kids with the skills and knowledge they need to lead financially secure and successful lives. It's a crucial aspect of their overall education and development.

Follow on instagram @kidsfinanciallysavvy

START

Begin teaching budgeting concepts to your children at a young age As soon as they start receiving an allowance or money for chores, you can introduce basic budgeting principles.

Children often learn by observing their parents Be a good financial role model by demonstrating responsible budgeting and spending habits. Discuss your budget and financial decisions with your children to show them how you make choices

3. EXPLAIN THE BASICS Income: Explain where money comes from, such as allowances, gifts, or earnings

Make sure your kids understand the fundamental concepts of budgeting:

Expenses: Discuss common expenses like food, clothing, toys, and activities.

Saving: Emphasize the importance of saving a portion of their income for future goals

Use visual aids like charts, graphs, or jars to represent income and expenses This can help younger children grasp the concept of budgeting For example, you can use jars to allocate portions of their allowance for different purposes, such as saving, spending, and giving

Help your kids set financial goals These could be short-term goals like saving for a new toy or long-term goals like saving for college Having specific goals can motivate them to budget and save.

Give your kids the freedom to make spending decisions within the boundaries of their budget Encourage them to think about their purchases and prioritize their spending based on their goals

Teach your children to keep track of their income and expenses This can be done using a simple notebook, a smartphone app, or a spreadsheet. Regularly review their budget with them to assess how well they are managing their money

Begin teaching budgeting concepts to your children at a young age As soon as they start receiving an allowance or money for chores, you can introduce basic budgeting principles.

Children often learn by observing their parents. Be a good financial role model by demonstrating responsible budgeting and spending habits Discuss your budget and financial decisions with your children to show them how you make choices

It's okay for kids to make budgeting mistakes, as they are valuable learning opportunities Encourage them to reflect on their decisions and identify ways to make better choices in the future.

As they get older, introduce the concepts of credit and debt Explain how credit cards work and the importance of responsible borrowing and managing debt.

As your children grow older, gradually increase their financial responsibilities You can give them more control over their budget and expenses, such as clothing, school supplies, or even a portion of their school lunch money

Budgeting doesn't have to be boring You can gamify the process or reward them for meeting their savings goals Consider using financial literacy games or apps designed for kids.

Budgeting is an ongoing process Continuously reinforce the importance of budgeting and financial responsibility throughout their childhood and adolescence.

Remember that teaching kids about budgeting is a gradual process. Be patient, answer their questions, and adjust your approach based on their age and level of understanding. By instilling good financial habits early on, you can help set them up for a financially secure future.

For more information like this Follow us on Instagram @kidsfinanciallysavvy or Email: kidsfinanciallysavvy@gmailcom to learn more

This was a survey done in India. What do you think the answers would be for Bermuda?

If you are wondering how to teach your child to be money wise or your struggling with your teen who doesn’t understand money. You’re not alone.

GET ON THE WAITLIST

Email us at kidsfinanciallysavvy@gmail.com

Follow us on IG @kidsfinanciallysavyy

Brushing up on your own budgeting know-how is a smart move to improve your financial health and make informed money decisions. Here are steps to help you refresh your budgeting skills:

Based on your financial goals and spending history, create a budget that outlines your income and expenses

Be realistic and conservative when estimating your income and set specific limits for each spending category

Consider using budgeting apps or software to make the process easier Many tools can link to your bank accounts and credit cards to automatically track your spending

Based on your financial goals and spending history, create a budget that outlines your income and expenses

Be realistic and conservative when estimating your income and set specific limits for each spending category

If you have investments, review your portfolio regularly to ensure it aligns with your longterm financial goals Consider consulting with a financial advisor if you're unsure about your investment strategy

The key to successful budgeting is consistency and discipline Stick to your budget and revisit it regularly to ensure you're making progress toward your financial goals By