HUD 223(f) Refinance or Acquisition

Why Berkadia?

Customized Solutions

Berkadia offers tailored debt financing and equity solutions for all project sizes, locations, and borrower profiles, led by top FHA experts.

Proven Experience

With over two decades of experience, our professionals guide clients through the FHA financing process on a nationwide basis.

Client-Centric Values

Inspired by shareholders Berkshire Hathaway and Jefferies Financial Group, we value client relationships and treat clients as family.

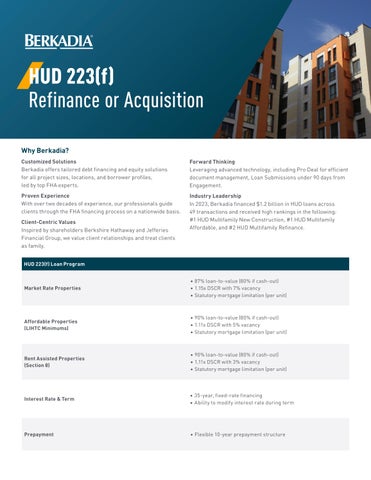

HUD 223(f) Loan Program

Market Rate Properties

Affordable Properties (LIHTC Minimums)

Forward Thinking

Leveraging advanced technology, including Pro Deal for efficient document management, Loan Submissions under 90 days from Engagement.

Industry Leadership

In 2023, Berkadia financed $1.2 billion in HUD loans across 49 transactions and received high rankings in the following: #1 HUD Multifamily New Construction, #1 HUD Multifamily Affordable, and #2 HUD Multifamily Refinance.

Rent Assisted Properties (Section 8)

Interest Rate & Term

Prepayment

• 87% loan-to-value (80% if cash-out)

• 1.15x DSCR with 7% vacancy

• Statutory mortgage limitation (per unit)

• 90% loan-to-value (80% if cash-out)

• 1.11x DSCR with 5% vacancy

• Statutory mortgage limitation (per unit)

• 90% loan-to-value (80% if cash-out)

• 1.11x DSCR with 3% vacancy

• Statutory mortgage limitation (per unit)

• 35-year, fixed-rate financing

• Ability to modify interest rate during term

• Flexible 10-year prepayment structure