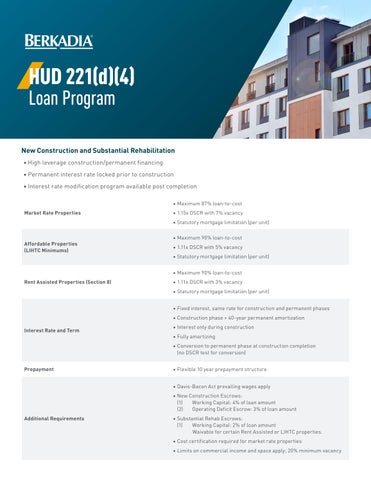

HUD 221(d)(4) Loan Program

New Construction and Substantial Rehabilitation

• High leverage construction/permanent financing

• Permanent interest rate locked prior to construction

• Interest rate modification program available post completion

• Maximum 87% loan-to-cost

Market Rate Properties

Affordable Properties (LIHTC Minimums)

Rent Assisted Properties (Section 8)

Interest Rate and Term

Prepayment

Additional Requirements

• 1.15x DSCR with 7% vacancy

• Statutory mortgage limitation (per unit)

• Maximum 90% loan-to-cost

• 1.11x DSCR with 5% vacancy

• Statutory mortgage limitation (per unit)

• Maximum 90% loan-to-cost

• 1.11x DSCR with 3% vacancy

• Statutory mortgage limitation (per unit)

• Fixed interest, same rate for construction and permanent phases

• Construction phase + 40-year permanent amortization

• Interest only during construction

• Fully amortizing

• Conversion to permanent phase at construction completion (no DSCR test for conversion)

• Flexible 10 year prepayment structure

• Davis-Bacon Act prevailing wages apply

• New Construction Escrows: (1) Working Capital: 4% of loan amount (2) Operating Deficit Escrow: 3% of loan amount

• Substantial Rehab Escrows: (1) Working Capital: 2% of loan amount Waivable for certain Rent Assisted or LIHTC properties.

• Cost certification required for market rate properties

• Limits on commercial income and space apply; 20% minimum vacancy