AGENCY LENDING

UNMATCHED EXPERTISE MEETS UNPARALLELED SERVICE

Our expertise and dedication show in our hard-earned growth and success in a rapidly evolving industry. Consistently ranked as one of the top agency lenders in the country, Berkadia is comprised of the industry’s top GSE financing experts.

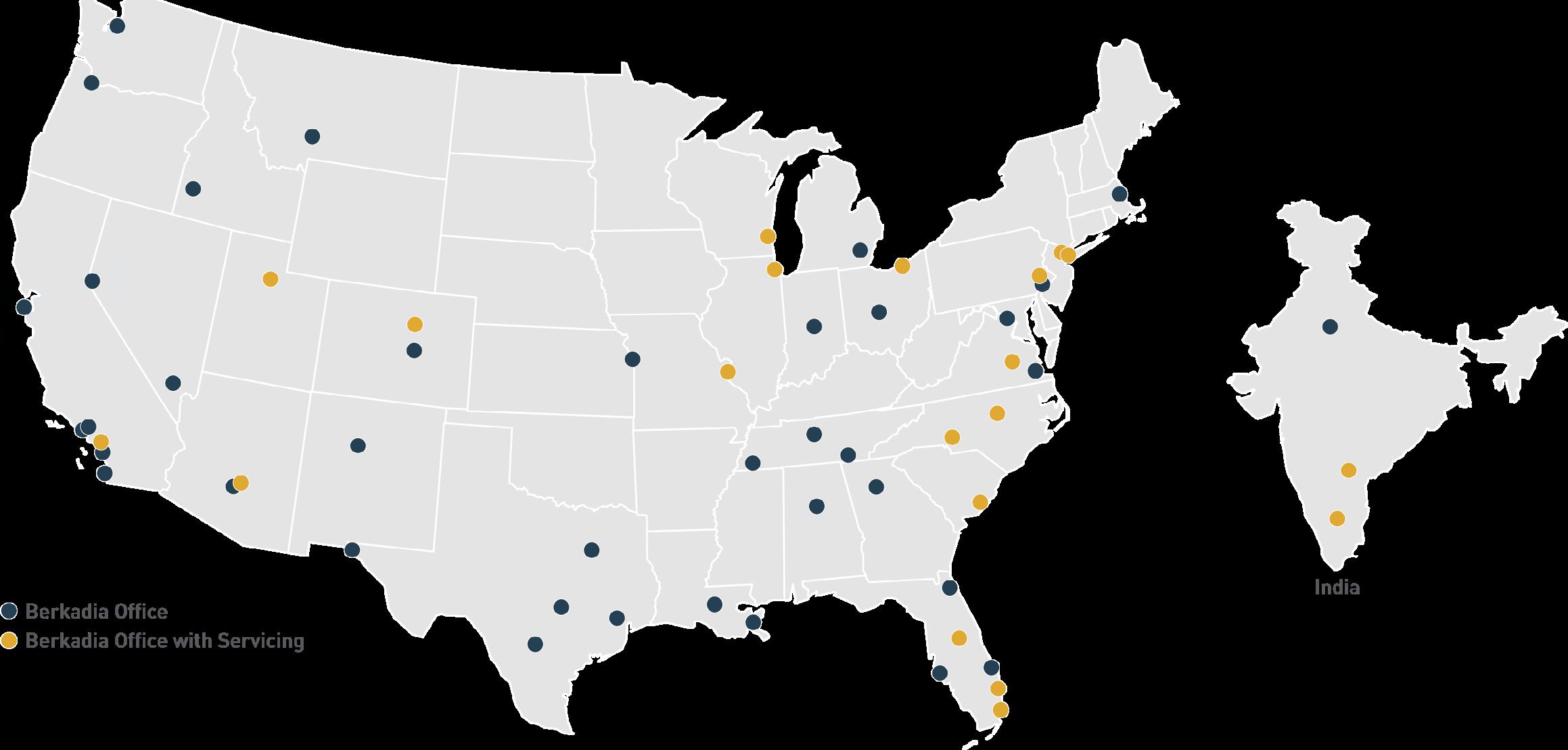

With the support of a network with a presence in every major market nationwide, unparalleled access to data, and the skills and resources to serve the lifecycle of your investment, our advisors are prepared to effortlessly navigate you through the agency lending process.

We’re driven by our passion for CRE and supported by the best resources and data in the industry. Together, we’ll find the right solution for your project, consistently delivering the results you want with the insights you need."

DAN BRENDES SVP – Head of GSE Lending Berkadia

IT'S IN OUR DNA.

Our mission is inspired by our two shareholders who created Berkadia— Berkshire Hathaway and Jefferies Financial Group. Both firms are renowned for their capital strength, sophisticated investment strategies and exacting attention to their clients’ diverse needs.

We're honored to infuse our Berkadia values into everything we do. When you work with us, you’re more than a client, and more than a partner. You’re a member of our family.

Mortgage Banking

Your projects, of any size and location, benefit from best‑in‑class financing partners and unparalleled access to capital.

Servicing

Get customized solutions and seamless service with our established resources and proven expertise.

Investment Sales

When you equip the right professionals with industry leading insights and tools, the result is better investment outcomes.

Technology

Advanced decision‑making with actionable insights backed by our powerful data.

2024 RANKINGS

#1 GSE and HUD Lender by Volume

Freddie Mac

#1 Multifamily Lender

#1 Low-Income Housing Lender

#1 Very Low-Income Housing Lender

#1 Targeted Affordable Housing Lender

Fannie Mae

#2 DUS Lender

#1 Seniors Housing Lender

#2 Green Financing Lender

#2 Structured Transactions Lender

Benefits of Agency Lending

Non recourse debt

Opportunities exist for supplemental financing

Five to 30 year terms at fixed or floating rates are available

Customizable loan terms within structured transactions

#2 Seniors Housing Lender

#3 Conventional Lender

#4 Manufactured Housing Communities Lender

#4 Small Balance Loans Lender

#3 Small Loans Lender

#4 Multifamily Affordable Housing Lender

#5 Student Housing Lender

Can lend nationwide

May offer loans at 80% LTV (or higher for Affordable Housing)

Pricing advantages exist for affordable and green loans

Flexible prepayment options

Fannie Mae

For over 30 years, Fannie Mae has served a wide range of the multifamily market, including conventional, affordable, cooperatives, seniors, student, manufactured housing communities and small loans via their Delegated Underwriting and Servicing (DUS) model. As a highly regarded, delegated DUS lender, Berkadia exercises control and decision making to seamlessly structure, underwrite, close, deliver, and service loans on properties for our valued clients.

Benefits

DUS model allows for certainty of execution as underwriting is completed in house

Single asset securitization model allows for greater flexibility with loan structuring

Streamline Rate Lock (SRL) with preliminary underwriting information can solve for interest rate volatility risk

Freddie Mac

Freddie Mac and Berkadia’s experienced and knowledgeable teams of producers collaborate to quote conventional, affordable, cooperative, seniors, student, manufactured housing communities and small loans. As a top Freddie Mac Optigo Lender, Berkadia works with Freddie Mac to structure and underwrite the most competitive loans available while providing loan servicing for the life of the loan.

Benefits:

Securitization model optimizes available loan terms

Centralized quoting and underwriting model provides consistency for borrowers

Strong index lock and Early Rate Lock (ERL) options help manage rapidly changing market conditions

HIGHLIGHT TRANSACTIONS | FANNIE MAE

Overlook Point & Madison Park

West Valley City, UT & Anaheim, CA

$204.6M UNITS 1,072 FANNIE MAE SIA Facility

ICG Portfolio

Glendale & Phoenix, AZ, Ammon, ID, Ogden, UT & Pasco, WA

$97.9M

1,012 FANNIE MAE Acquisition Financing

Northpoint Apartments

San Francisco, CA

$67.2M

MAE Refinance

HIGHLIGHT TRANSACTIONS | FREDDIE MAC

Park at Hoover Birmingham, AL

$75.6M UNITS 1,060

FREDDIE MAC Refinance

Springs at Foothills Farm Colorado Springs, CO

$58.2M UNITS 264 FREDDIE MAC Acquisition Financing

Advenir at La Costa Boynton Beach, FL

$47.9M UNITS 328 FREDDIE MAC Refinance

HIGHLIGHT TRANSACTIONS | FANNIE MAE

Residences at Lakeview

Memphis, TN

$45M

UNITS 827 FANNIE MAE Refinance

Cityside Huntington Metro Apartments

Alexandria, VA

$96.5M

UNITS 569 FANNIE MAE SIA Facility

2150 Arizona South

Chandler, AZ

$58M

UNITS 289 FANNIE MAE Acquisition Financing

The Atlantic Preserve Plantation, FL

$52.9M UNITS 293 FREDDIE MAC Acquisition Financing

Fountains at Steeplechase Plano, TX

$47.2M UNITS 368

FREDDIE MAC Refinance

Upper West Apartments

West Jordan, UT

$42.9M

UNITS 207 FREDDIE MAC Acquisition Financing

SUCCESS IS NOT PURELY MEASURED BY NUMBERS.

But, they help tell our story:

$47 billion in total loan production in 2023 and 2024.

2,200+ Loans closed in 2023 and 2024.

A top Berkadia ranks as a top U.S. non bank commercial mortgage servicer in the industry.

CLOSING IS JUST THE END OF THE BEGINNING.

We’re in this for the long haul.

To us, every deal is the start of a new relationship or the continuation of one built on performance and trust. Our clients are family, and we’re relentlessly focused on your long-term success.

Conventional, Freddie Mac Conventional, Fannie Mae

DAN BRENDES

SVP – Head of GSE Lending

301.202.3551

dan.brendes@berkadia.com

EMILY SCHULTZ

SVP – Head of Fannie Mae Originations

301.202.3562

emily.schultz@berkadia.com

Affordable Housing Seniors Housing & Healthcare

DAVID LEOPOLD

SVP – Head of Affordable Housing

301.202.3547

david.leopold@berkadia.com

STEVE ERVIN

SVP – Head of FHA and Seniors

Housing Finance

301.202.3575

steve.ervin@berkadia.com