Administration Guide

August 13, 2024

About this Guide

Purpose

This guide provides a basic description of the consortium’s function, the consortium member’s role and Benecon’s role. If there are any inconsistencies between this guide and the executed consortium agreements; the agreements will govern. Your Account Management team is your starting point for questions and requests.

Shared Services Administration Guide Revision Process

The most recent version of this administration guide will live online at www.benecon.com. The front of the guide will show the last revision date Any changes made to content will be shown in orange font until the next version of the guide is uploaded

Terminology

• SSHP: Shared Services Health Plan: the stop loss policy is placed with the SSHP

• SSC, LLC: Shared Services Consortium, LLC: the SSC, LLC is the plan sponsor.

• Breach: when an enrolled member of the consortium member’s health plan reaches the individual specific stop loss deductible.

• Consortium Member (or member as defined in the consortium agreements): refers to each participating college/university who has joined the consortium

Benecon Contacts

Account Management Team

Main Office

www.benecon.com

888-400-4647 Fax: 888-974-0369

Daniel Jones, Senior Account Manager 717-723-4677 djones@benecon.com

Cindy Derk, Senior Associate Account Manager 717-723-4675 cderk@benecon.com

Michelle Joy, Vice President, Account Management 717-723-4647 mjoy@benecon.com

Financial Reporting & Billing

Fax: 888-974-0369

Stephanie Styer, Senior Finance Specialist 717-723-4614 sstyer@benecon.com

Timothy Rath, Accounting Manager, Private Sector Accounting 888-400-4647 trath@benecon.com

Elizabeth Clark, Director, Private & Public Sector Accounting 888-400-4647 eclark@benecon.com

Program Management (SSC/SSHP Boards)

Zachary Peirson, VP, Program Management 717-723-4600 zpeirson@benecon.com

Nicole Miller, Executive Programs Coordinator 717-723-4600 nmiller@benecon.com

ConnectCare3 www.connectcare3.com

Main Office

Scott Wagner, Senior Wellness Solutions Consultant

Compliance

Kelly Knight, VP, Compliance Services

Donna Swinford, Senior Compliance Analyst

877-223-2350 Fax: 717-735-3594

717-735-4710 sawagner@connectcare3.com

717-723-4600 kknight@benecon.com

717-723-4600 dswinford@benecon.com

New Shared Services Consortium Members

Necessary Immediate Actions

1. Place or revise an existing fidelity bond

a. This coverage cannot be placed retroactively

b. Requirement applies to all consortium members regardless of church plan status

2. Define every instance in which group health insurance continues and for how long for each employee type (if it differs), through a call scheduled by your Account Management team with Benecon’s Senior Compliance Analyst. Following this call Benecon creates a signature-ready policy. Benecon shares the signed policy with the stop-loss carrier.

3. Determine who, at your college/university, will receive monthly invoices, financial reporting and the IBNR (incurred but not reported) letter via Box.com. Provide each person’s name, title, phone number and email address to the Account Management team.

4. Designate one voting board member.

5. Identify those at your college/university who should receive ConnectCare3 and compliance newsletters and webinar invitations.

Shared Services Structure

New members joining the Shared Services Health Plan (SSHP), also join the Shared Services, LLC Consortium (SSC) and the Shared Services Health Plan Trust (SSHPT). Below is a brief description of each

The SSHP is the health plan that was formed for the benefit of the health plan members (participating colleges and universities) and their employees to aggregate all health plan members’ health coverage into one pool and to negotiate self-funded contracts and rates including both administration and stop loss coverage.

Plan Year vs. Benefit Year: Return to Table of Contents

Plan Year: the SSHP has a 7/1-6/30 plan year. Form 5500 filing, plan renewal, stop loss renewal and other tax and compliance requirements are based on the 7/1-6/30 plan year. All consortium members’ health plans have the same 7/1-6/30 plan year.

Benefit Year: each consortium member may designate a benefit year that may or may not coincide with the plan year for purposes of providing employees the opportunity to make changes following an open enrollment period. A benefit year could be January 1, June 1, or whichever month best suits the consortium member. If the consortium member’s benefit year is January 1, for example, the Form 5500 for the health plan will still be based on the 7/1-6/30 plan year and will be filed by the SSC, LLC.

The SSC, LLC is a limited liability company formed in 2001 by Bucknell University, Dickinson College, Gettysburg College, and Franklin & Marshall College for the purpose of group purchasing many items, mainly health insurance. Initially, the program did not provide the expected results, so it was disbanded.

In response to a request from founding member, Franklin & Marshall College, the SSC received an exemption from the Pennsylvania Insurance Department to operate “as exempt under Section 208 of the Insurance Department Act”; thereby allowing SSC members to share risks without regulatory oversight. The SSC is the only group out of eight Benecon private sector consortiums that has been granted this state exemption. This financial model enables greater cost-savings.

In 2008 the SSHP was relaunched by Franklin & Marshall College, Susquehanna University and Rosemont College. Benecon was chosen as the General Administrator due to the company’s proven results in developing self-health insurance consortiums in the public sector. The SSC became a single plan sponsor of the health plan which requires all members to join both the SSHP and the SSC. See the SSHP/SSC Timeline at the end of this guide.

The Shared Services Health Plan Trust (SSHPT) was established to receive and hold consortium member contributions and to pay health plan expenses.

SSHP/SSC, LLC Boards

Designated representatives from each consortium member sit on both the SSHP and the SSC, LLC boards. Benecon’s program management team emails the agenda and board meeting packets to each board member prior to the board meeting. The agenda indicates those board business items which require board vote.

• The SSC, LLC board meets in July annually.

• The SSHP board meets three times per year.

SSHP/SSC, LLC

Operating Expenses & Board Approval Items

Audit & Preparation Fees

providesnurse navigation, wellnessprograms, chronic disease mgmt., and overall health and wellness servicesfor all employeesand dependentsenrolled in the SSHP. Monthly fee is billed on aPEPM basis using monthly contract counts(census obtained from carrier).

Policiesfor the boardsprovide coverage to board membersin their dutiesasboard membersof the consortium and SSC, LLC. D&Opoliciesprovide insurance for negligent acts, omissions, or misleadingstatementscommitted by directors and officersthat result in lawsuitsbeingfiled against the company or organization.

Chosen Audit firm preparesthe Financial Statementsand Supplemental Schedulesrequired by the DOL and filed with the Form 5500.

Original contract approved by board

Board approval required

Board approval required to engage audit firm & approve/accept financials Form 5500 & Preparation

As part of the Employee Retirement Income Security Act’s (ERISA) reporting, a 5500 filingisrequired to ensure that employee benefit plansare operated and managed in accordance with prescribed standards. Consortium auditors prepare and file thisannual form by the April 15th deadline.

Form 990: Annual return for tax-exempt organizations (VEBA Status) due Nov 15th (ext = May 15th)

SSC – Form 1065, Federal tax return ofpartnership income due Sept 15th (ext = March 15th)

SSC – PA65, State tax return or partnership income due Sept 15th (ext = March 15th)

Affordable Care Act fee on issuers ofspecified health insurance policiesand plan sponsors of applicable self-funded health plansthat helpsto fund the PCORI

As legal fees are incurred they are paid using available funds in the SSC OperatingAccount

Established fee for Benecon’sperformance of accounting servicesmanaging the SSC, LLC. The management fee is$50 per quarter.

SSHP/SSC, LLC Filing Requirements

Form 5500 - Due January 31

Board approval required to engage audit firm

Board approval required to engage audit firm

Board chooses/approves calculation method

Board reviews and/or approves

Under ERISA, a Form 5500 must be filed by the last day of the seventh month following the end of the plan year for the SSHP (6/30). It is prepared by the board-selected independent auditing firm. Since the SSHP is a single plan with the SSC, LLC as the plan sponsor, every consortium member’s medical/Rx plan is filed under the SSHP Form 5500 and signed/filed by the board chair following Shared Services board review and approval.

Consortium members are responsible for filing Form 5500 for any non-medical ERISA plans they offer. Upon request, Benecon will prepare these filings (limited to ERISA health and welfare plans, not retirement plans). Consortium members’ non-medical plan year may differ from the SSHP 7/1-6/30 plan year.

Form 5558

Filed prior to the Form 5500 filing deadline, the Form 5558 applies for an extension of time to file the Form 5500 up to an additional 2 ½ months. If the extension is needed for the SSHP plan and a non-medical plan for which Benecon will be preparing the Form 5500; Benecon will

file the Form 5558 to obtain the extension and notify the consortium member that the extension has been filed/granted.

Independent Auditors’ Report

Following the audit of the test samples, the board-selected auditing firm provides their report and renders their opinion on the plan. The independent auditor’s report accompanies the Form 5500.

Summary Annual Report (SAR)

The SAR provides a narrative summary of the financial information contained in the Form 5500 and a statement of the right to receive the full annual report including the Form 5500. Each enrolled member of the health plan as of the plan year end date included in the Form 5500 must receive the SAR. This includes active employees, former employees enrolled in COBRA and former employees who were enrolled during the plan year who are not enrolled in COBRA.

Annual SSHP Audit Timeline

The audit process begins with the plan year ending June 30. The Form 5500 plus the independent auditor’s opinion must be filed within seven months following the close of the June 30 plan year (due the following January 31). Benecon typically requests the 2 ½ month (penalty-free) filing extension which generally brings the filing due date to April 15, depending on the day of the week that April 15 lands

During the July SSHP board meeting, Benecon’s Director of Private & Public Sector Accounting reviews the timeline for the upcoming audit, Form 5500 and tax return of the SSHP:

July/August

• Engage the independent auditor chosen by the board. Chair’s signature required on all engagement letters.

• Each consortium member signs an audit confidentiality agreement which is also signed by the health insurance carrier and the auditor.

• Benecon requests updated fidelity bonds from each consortium member

September/October

• Benecon provides a census for each of the selected consortium members showing all employees who are covered by the plan to the independent auditor

• The independent auditor selects samples for participant data and eligibility testing. These samples may not necessarily include every consortium member each year. Consortium members who have selected samples will be contacted by the auditor to provide the following for testing:

o Support for coverage or waiver of coverage

o Benefit deduction for selected pay periods

o Payroll register for each person in their sample selection that covers a particular pay period which shows if any amounts are withheld for medical plan purposes

o Rate sheet for each consortium member showing all levels of coverage and the required employee contribution for each level.

o Support for the specific amounts withheld for the sample selection (i.e., enrollment form)

o If a particular level of coverage requires a certain age, or years of service, independent auditor will need support for that as well such as date of hire and/or date of birth.

• Independent auditor communicates directly with the selected consortium members (and copies applicable brokers) to arrange a mutually convenient date/time to complete onsite (or virtual) testing

• All consortium members must provide the cumulative total of medical plan contributions for the audit period 7/1 to 6/30. This includes:

o payroll deductions,

o retiree contributions and

o COBRA premium payments

October/November

• Independent auditor performs audit testing at Benecon.

January

• Benecon obtains SOC1 reports.

• Independent auditor prepares SSHP draft financial statements for review and distribution to consortium members

February/March

• SSHP financial reports and Form 5500 distributed to consortium members for review and approval

• Final financial statements issued and required signatures obtained

April

• SSHP board chair signs the Form 5500.

• Final reports (financial statements, audit letter, Form 5500, accompanying SAR and Form 990 distributed to consortium members)

• Consortium members distribute the SAR to their plan participants

ERISA Fidelity Bond a.k.a. Crime Policy

What is a Fidelity bond?

A fidelity bond is a form of crime insurance protection that covers an employer or business from losses incurred as a result of dishonest and/or negligent acts by employees.

Return to Table of Contents

What is an ERISA Fidelity bond?

An ERISA fidelity bond covers the plan itself, protecting it against loss due to fraud or dishonesty by plan officials. Usually, the plan is the named insured and a surety company provides the bond. The persons covered are those who handle plan funds or property. Each person covered must be bonded for at least 10% of the amount of funds he/she handles.

What does it mean to “handle” plan funds or property?

“Handling” includes duties or activities which could result in plan funds or property being lost due to fraud or dishonesty. Handling occurs whenever a person has the ability to affect disposition of plan funds or property either directly or in a supervisory capacity. This can include actual physical contact or control, the power to transfer funds to oneself or a third party, disbursement authority, authority to sign negotiable instruments, or any decision-making responsibility that poses the risk of fraud or dishonesty.

What is the proper form and scope of an ERISA fidelity bond?

A single bond can insure more than one plan. The bond can cover an individual, multiple named individuals, multiple named job positions or use a blanket form covering the plan officers and employees without a specified list of those covered.

ERISA Fidelity Bond Requirements as an SSHP Member

• Self-funded health insurance plans are required to have a fidelity bond in place. The Shared Services Health Plan is considered an ERISA plan and the fidelity bond requirement applies whether or not the consortium member is a church plan

• Consortium members are responsible for placing and paying the premiums for fiduciary insurance.

When securing or revising your existing fidelity bond you will need:

Name of the Specified Plan: which is the Shared Services Health Plan Trust, ERISA plan or ERISA fidelity. If you already have an existing fidelity bond you can add the above specified plan name.

Provide the Specified Plan Limit of Liability: 10% of the consortium member’s claim fund or attachment point. The Benecon Account Management team can provide this dollar amount. Coverage cannot be placed retroactively.

Risk of Civil Penalties from the DOL: If there is no fidelity bond in place plan fiduciaries (plan sponsor of the Shared Services Health Plan) could be liable for damages to the plan if the failure to be bonded causes a loss to the plan.

Form M-1 – Due March 1

The SSHPT is a MEWA (multiple employer welfare arrangement) and the SSC, LLC is the administrator and sponsor of the MEWA. ERISA requires a Form M-1 electronic filing with the DOL by March 1 for all MEWAs.

Benecon prepares the M-1 filing which includes:

• Name and address of each consortium member

• name and address of financial institutions holding assets for the MEWA

• Actuarial/insurance information related to the MEWA.

Once Benecon completes the M-1 form, the Compliance team sends detailed e-signing and submission instructions to the SSHP board chair to complete the filing

VEBA (Voluntary Employees Beneficiary Association)

The Internal Revenue Service has deemed the Shared Services program exempt from federal income tax under Section 501(c)(9) of the Internal Revenue Code, thus designating the trust as a VEBA

To maintain its VEBA status, there can be no more than a 3% de minimus of all claims paid for domestic partners each plan year. Benecon tracks the dollars paid for domestic partners and contacts each consortium member who covers domestic partners, for the names of employees and their domestic partners so that we can obtain a claims report from the carrier(s).

PCOR Fee – Due July 31

The Affordable Care Act imposes a fee on issuers of specified health insurance policies and plan sponsors of applicable self-funded health plans to help fund the Patient Centered Outcomes Research Institute (PCORI). The fee, required to be reported once a year on the second quarter and paid by July 31, is based on the average number of lives covered under the plan. The fee rate is based on the plan ending month and may fluctuate in subsequent years.

Consortium members do not need to calculate, pay and submit the Form 720 for their own medical plan. As the single plan sponsor, the SSC pays the PCOR fee out of the SSC operating account on behalf of the SSHP The payment must accompany IRS Form 720 and cannot be submitted by a third party on behalf of the plan sponsor. Once the SSHP board approves the calculation method most beneficial to all consortium members, Benecon prepares the Form 720 for the board chair to sign/file. Note that new consortium members may have to continue to pay and submit the Form 720 for the period of time before they joined Shared Services.

Consortium members who maintain an HRA and/or an FSA plan which requires PCOR fee filing, are responsible for filing the PCOR fee(s) for these plans. Benecon assists with providing the calculation for the applicable plans and filing instructions.

Medicare Part D CMS Disclosure – Due 60 Days Following Plan Year End

All group health plans that provide prescription drug coverage to Medicare Part D-eligible individuals (whether actively working, retired or disabled) are required to notify the CMS (Centers for Medicare & Medicaid Services) whether or not the coverage provided is creditable. This disclosure is required whether the coverage is primary or secondary to Medicare. The requirement is to file the disclosure notice through the CMS website within 60 days of the plan year end. Since the SSHP plan year end is June 30, the disclosure must be done within 60 days of June 30. If you offer an actual Part D plan, you are exempt from this filing requirement. Employers who have applied for a retiree drug subsidy are not required to complete this form.

If a consortium member is interested in Benecon’s Account Management team filing the disclosure with the CMS, you would need to provide the date that the Individual Medicare Part D Creditable Coverage Disclosure was provided to employees the previous year (this must be distributed by October 14 annually) and then we will:

• Contact the carrier to confirm that the consortium member’s health plan is creditable or not

• Obtain counts of Medicare Part D eligible individuals from the carrier(s)

• File the disclosure on the consortium member’s behalf via the CMS website.

• Share with you the CMS disclosure and confirmation.

Non-Medical Plans

Form 5500

ERISA non-medical plan(s) sponsored by consortium members also have a Form 5500 filing requirement by the last day of the seventh month following the end of the plan year. Note that the plan-year end date follows the plan year of the non-medical plan sponsored by the consortium member and may not necessarily line up with the SSHP 6/30 plan year end.

If requested, Benecon can assist with preparing the Form 5500 for non-medical plans. Our Compliance team will contact the consortium member directly to request the items needed to prepare the Form 5500. If an extension is needed, Benecon will notify the consortium member in advance that the Compliance will file or have filed an extension which allows an additional 2 ½ months to file from the due date.

Once all items are received, the Compliance team prepares and sends the Form 5500 with DOL pin instructions as well as a PDF copy of the Form 5500 to the form signer and consortium member contact. In a subsequent email, the Compliance team provides a PDF of the SAR for distribution.

Stop Loss (a.k.a. Excess Loss or Reinsurance Coverage) Background

Stop loss insurance provides protection against catastrophic (shock) or unpredictable losses for self-funded plans. Employers who self-fund their medical/prescription drug plans purchase stop loss coverage to cover losses that exceed a specified limit or deductible.

Specific or Individual Stop Loss provides protection for the employer against a shock claim on any one individual after that individual has exceeded the specific stop loss deductible during the policy period or plan year

Aggregate Stop Loss caps the dollar amount of eligible expenses that an employer would pay in total during a policy period, a.k.a aggregate deductible or attachment point. The stop loss carrier reimburses the employer at the end of the policy period for eligible aggregate claims.

Lasering is a tactic used by stop loss carriers to reduce their exposure where an individual, based on prior claims experience or a known condition, is covered by the stop loss policy but at a higher specific deductible than the rest of the group

Stop-Loss Coverage

Under the SSHP

Policy Period: is the Plan Year of 7/1 to 6/30, regardless of each consortium member’s benefit year

Stop Loss Carrier: is selected by the Benecon Actuarial team. Price leveraged by large Benecon blocks of business. Stop loss carrier prohibited from imposing new lasers.

Specific Stop Loss Deductible is set by the Benecon Actuarial team which varies by consortium member. When claims for an individual covered member exceed the annual specific stop loss deductible, the Benecon Finance Team generates a claim form for completion by the consortium member. Finance sends the completed claim form to the stop loss carrier for processing.

Aggregating Specific Stop Loss Side Fund (Side Fund) was set up as another method to reduce overall stop loss premiums paid by consortium members. Each consortium member pays in a pre-determined amount to the Side Fund to pay for specific stop loss claims. Once the Side Fund exhausts, the remaining stop loss claims are submitted to the stop loss carrier for processing.

Aggregate Stop Loss: Claims reimburse from the SSHP Cross Share Fund first. After the Cross Share Fund exhausts, SSHP claims for the policy year which exceed the aggregate deductible/attachment point (determined by the Benecon Actuarial team using enrollment and maximum claim fund rates) are submitted to the stop loss carrier to process up to the policy maximum.

Aggregate Stop Loss – SSHP Cross Share Fund: All consortium members pledge a percentage of their annual surplus funds to the SSHP Cross Share Fund to assist other consortium members in the event of an aggregate stop loss breach. If Cross Share Funds utilized, consortium members only contribute against their surplus from the related plan year, not surplus remaining in their account from prior plan years. The SSHP Cross Share Fund reduces the overall stop loss premiums paid.

Completing the Specific Stop Loss Initial Claim Form

Benecon provides the stop loss carrier with the SSHP plan document, the SPD (summary plan description) for each consortium member and any continuation or leave policies. The stop loss carrier reviews the completed claim form and the claim details from the health insurance carrier against these documents to determine claimant’s benefits eligibility. If the claimant was ineligible to be enrolled on the benefits plan during the period of the stop loss claim, the stop loss carrier will deny the claim.

Through completing the specific stop loss claim form, the consortium member demonstrates that the claimant enrolled when initially eligible and maintained their benefits eligibility during any absence by:

• Including the original benefits enrollment form. If this is not available, the original benefits enrollment date must be on the consortium member’s letterhead and submitted with the claim form.

• Including the spouse or dependent’s original benefits enrollment form when they were initially eligible (if different from the employee’s) and their initial benefits enrollment date If this is not available, the original benefits enrollment date must be on the consortium member’s letterhead and submitted with the claim form.

• Providing the life status information and original benefits enrollment form if the employee, spouse and/or dependent were enrolled outside of their initial benefits eligibility date due to a life event

• That the employee has maintained benefits eligibility for him/herself (and, by extension, his/her spouse or dependent) by indicating:

o Specific dates of employee absences such as: vacation, PTO, sick time, disability periods, FMLA (request and approval forms), COBRA (include election form and proof of monthly premium payments) or an internal leave policy. The leave policy must state during which kinds of absences the group benefits were maintained and the duration.

o Approved short and/or long-term disability claims insure a portion of the employee’s compensation only and does not automatically grant the employee continued group health coverage during a leave.

• Completed COB (coordination of benefits) form when the stop loss claimant is a spouse or dependent child.

Return to Table of Contents

Aggregate Stop Loss Claim: if the SSHP Cross Share Fund is exhausted and the attachment point is reached, the Benecon Finance team submits the claim form to the carrier at the end of the plan year.

Specific & Aggregate Stop Loss Claim Reimbursement

Benecon’s Finance team files the stop loss claim form which includes the itemized carrier claims, employee/dependent eligibility verification, FMLA request/approval forms, COBRA initial election/proof monthly premium payment if applicable and leave policies, if applicable, to the stop loss carrier for each specific and aggregate loss claim within the timeframe stated within the stop loss policy. When the stop loss carrier receives all requested information and completes their audit, a reimbursement is deposited into the consortium member’s trust account and shown in a particular month’s summary cost analysis as a “stop loss reimbursement”. Aggregate stop loss reimbursement generally has a longer review process than specific stop loss claims.

Medical/Rx Plan Enrollment

Each consortium member is responsible for enrolling eligible employees and dependents for coverage under the rules and guidelines of their respective ASO carrier. Enroll only those employees and/or dependents who meet eligibility for the plan as defined in your SPD.

Do not enroll any individual with a severance arrangement or classification not defined in the eligibility section of your SPD. Failure to follow your plan’s eligibility criteria could result in increased risk to you. Stop loss coverage will be void for any ineligible enrollees on your plan. If you are unsure of the eligibility of an existing or potential employee, or need to make changes to the eligibility of your SPD, please contact your Benecon Account Management team.

Instruct your employees to notify you within the time period designated within your SPD of any changes in employee or dependent eligibility. Any changes outside of your open enrollment period must be a permissible change as defined in your SPD.

Invoices/Payment Information

Invoices

Benecon generates monthly invoices from enrollment data obtained from your claims administrator. Benecon’s Finance team distributes the invoices to the designated consortium member contact(s) via Box.com each month.

Each invoice represents the billing for the following month (i.e., an invoice sent in July represents coverage for the month of August). Each consortium member receives three separate invoices:

1. Medical/Rx – includes carrier ASO fees, Benecon Program Management fees, consultant/broker fees (if applicable), Claim Fund and Spec Share Fund (a.k.a. Side Fund) charges. Return to

2. Stop loss premium

3. ConnectCare3 – Benecon bills the $4.00 CC3 fee to each member and collects the payments in and pay them out of the SSC admin account. As the plan sponsor for the SSHP, the SSC cannot exist solely for the purpose of sponsoring a health plan, therefore, there needs to be other services offered by the plan sponsor. Benecon meets this requirement by showing CC3 as a separately offered service.

These invoices should be paid out of your general assets. See Appendix A for sample invoices.

Please pay as billed. The next invoice will reflect any enrollment changes and/or rate corrections.

Payments: Medical/Rx Invoice and Stop Loss Invoice

Payments may be mailed, wired or ACH’d with receipt by the first of the coverage month. Please pay as billed. Enrollment changes and/or rate corrections will be reflected on the next month’s invoice. Timely payment assures Benecon pays the claims and administrative expenses within the timeframes required by the ASO carrier and the stop loss carrier.

Make checks payable to Shared Services Health Plan Trust and mail to:

Shared Services Health Plan Trust

P.O. Box 5406

Lancaster, PA 17606-5406

Send ACH/Transfer Instructions:

Shared Services Health Plan Trust

Bank Name: UMB Financial Corporation

Routing Number (ABA): 101000695

Account Number: 9872676173

1010 Grand Boulevard

Kansas City, MO 64106

Payments: ConnectCare3 Invoice

Make checks payable to: Shared Services Consortium and mail to:

Shared Services Consortium

P.O. Box 5406 Lancaster, PA 17606-5406

Send ACH/Transfer Instructions:

Shared Services Consortium

Bank Name: UMB Financial Corporation

Routing Number (ABA): 101000695

Account Number: 9872676165

1010 Grand Boulevard

Kansas City, MO 64106

Return to Table of Contents

Funding Rates

Benecon’s Actuarial team develops the monthly claim fund amounts for each consortium member using available historical claims experience, benefit plan design(s) and demographic census data. Any material plan design or enrollment changes may require a recalculation of the monthly claim fund rates. Contributions to fund all aspects of the program are calculated annually and deposited on a monthly basis.

The expected funding rate is the cost of expected claims which is equal to the maximum claims minus the claim fund corridor.

The maximum funding rate calculation includes amounts for expected claims plus a claim fund corridor The actuarial expectation is that the consortium member’s claims will end the plan year at the expected cost and the claim fund corridor would be returned as surplus. Claim fund renewal rates shown on the sample renewal (ex. 1) are invoiced to each consortium member as “Claim Fund Single” and “Claim Fund Family” (a two-tier basis only) as shown in the corresponding portion of invoice with claim fund charges (ex. 2).

Corresponding Portion of Invoice with Claim Fund Charges (ex. 2)

Consortium members may choose to use maximum funding rates for setting employee contributions. If chosen, Benecon’s Actuarial team can provide multi-tier rates for employee contribution development.

COBRA Premium Rates a.k.a. FIEs (Fully Insured Equivalents)

Return to Table of Contents

Sample Renewal (ex. 1)

Benecon’s Actuarial team creates five-tier COBRA premium rates based on the expected annual funding (without the claim fund corridor) When converting the expected rates into a five-tier structure, the total annual funding at expected remains the same whether it is based on two or five tiers. Most of the consortium members use the FIE rates to develop their employee contributions.

Sample FIE Rates:

Note that the Benecon-provided five-tier COBRA premium rates do not include the 2% administration fee. The COBRA administrator adds the 2% administration fee which they retain with each monthly COBRA premium payment.

Maximum Funding Rates vs COBRA Rates

Consortium members may use maximum funding rates for setting employee contributions but cannot use those rates for COBRA premiums since it would result in charging COBRA continuants more than the expected claims cost for similarly situated employees, which would be in violation of COBRA regulations.

COBRA Rates – HRA

Benecon’s Actuarial team can also create COBRA rates for a consortium member’s HRA plan which are also based on fully insured equivalents.

Call for Funds

Shock claims may occur early in the plan year which may require a consortium member to advance funds outside of the monthly billing cycle if there aren’t enough funds in their account to cover the claims. Benecon’s Finance team works closely with the stop loss carrier to receive advance payment for aggregate and specific stop loss claim breaches; however, a call for funds may be made in these instances:

• Reimbursement from the stop loss carrier not received within 48 hours and consortium member’s claim fund balance is insufficient to cover the claim.

• There is a mid-month breach and an aggregate accommodation cannot yet be filed (this can only be filed at month’s end)

• At the end of the plan year, ASO carriers may process claims more quickly to get them adjudicated as part of the current stop loss contract. Consortium members benefit, especially if some of the claims are for an existing stop loss claimant who has already

met their specific stop loss deductible and/or the consortium member is close to reaching their attachment point.

Full reimbursement of stop loss claims may not occur during the 12-month policy period. A consortium member who receives a call for funds during the policy period may exceed its maximum liability until claim reimbursement is received from the stop loss carrier and the subsequent funds are credited to the consortium member’s money market account. Benecon recommends that consortium members have a plan in place to cover potential cash calls.

Distribution of Surplus Funds

Upon completion of the 7/1-6/30 plan year, unused payments into the claim fund may be used as a credit against future monthly claim funds costs (only) of the monthly medical/Rx invoice or they can be used to establish plan reserves. Benecon recommends that consortium members retain at least one times its IBNR (incurred but not reported) estimate in its claim fund account as a reserve for possible shock claims.

After all specific and aggregate stop loss claims have settled, typically during the fourth quarter of the year, Benecon will send a Surplus Funds Allocation Election Form Appendix B to each consortium member with a claim fund surplus. Consortium members can designate how to allocate the claim fund credits on future medical/Rx invoices. The form is prepopulated to allocate the funds across a 12-month timeframe; however, consortium members can adjust these amounts.

The maximum surplus that can be used per month is the total claim fund amount on the medical/Rx invoice which can fluctuate based on enrollment.

Reporting

Through Box.com, consortium members receive a monthly Cash Performance Report, a monthly bank statement, a quarterly IBNR certification letter (after six months of claims experience) and a monthly aggregate report. Samples of these reports can be found in Appendix C. Descriptions of each are below.

Cash Performance Report (monthly)

Contains totals on a monthly and plan year basis broken down by ordinary income/expense and claim fund income/expense:

• Ordinary Income/Expense: shows the monthly/plan year revenues and expenses associated with the administrative costs of the plan including ASO fees, management fees and stop loss insurance premiums.

• Claim Fund Income/Expense: shows the monthly plan year revenues and expenses associated with the claims account for the plan, including monthly deposits and stop loss reimbursements. The claim expenses reflect the actual amounts expended for claims payments.

Benecon’s Finance team sends the Cash Performance Report after the stop loss reporting is received for all consortium members which is typically the latter half of the month following the reporting month-end.

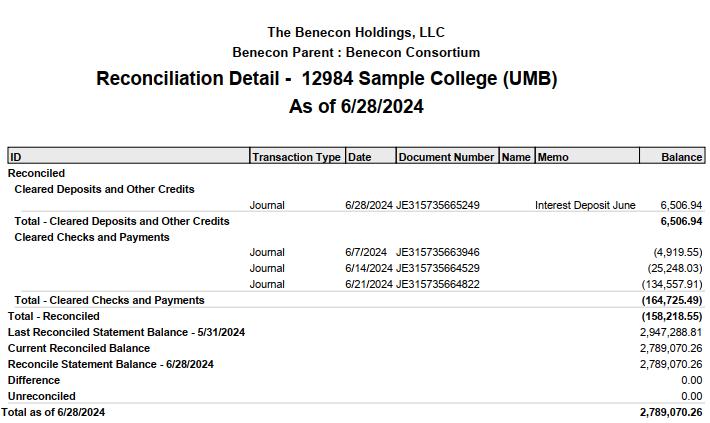

Monthly Bank Statement

Sent monthly along with the Cash Performance Report. The bank statement shows all claim fund activity in the account for the prior month.

IBNR Letter (quarterly):

The IBNR letter provides an actuarially certified estimate of claims that have not been reported on the Cash Performance Report. The estimate includes:

• Estimated unreported claims;

• Reported but unprocessed claims; and

• Processed but unpaid claims

The IBNR estimate does not include claim settlement expense liabilities. The method used to derive the estimated unpaid claims liability applies the reserve factor to a credible best estimate volume measurement of paid claims (typically a monthly average of the past several months of medical and drug claims). The estimate is for claim liabilities below the specific stop loss deductible limit. Due to the short nature of this reserve liability, time value of money is not used to discount future payments.

Recognizing that the determination of liabilities for incurred but not paid medical/Rx claims is an estimate of the true liability that will emerge, Benecon considers this estimate to have an appropriate provision for moderately adverse deviations.

Variance Report (monthly)

Sent along with the Cash Performance Report and the monthly bank statements which provide a description of the differences between the bank balance and the Cash Performance Report balance. It also provides the pending specific stop loss reimbursement for that month.

Aggregate Report (monthly)

Includes a monthly breakdown of claim fund deposits, net claims paid, interest income and the final claims fund balance for the plan year. Consortium members who end the year in a surplus, once all stop loss reimbursements have been finalized for the plan year, receive this report in the fourth quarter of the year.

Sample Journal Entries

Sample journal entries as described in this section can be found in Appendix D.

Standard Monthly Entry: Year One

Return to Table of Contents

Employee Benefit Expense: each month Benecon’s Finance team generates an invoice based on the current enrollment, administrative fees and funding rates (developed by Benecon’s Actuarial team) and provides the invoice to each consortium member via Box.com. The example in Appendix D shows how an entry would be stated in the first year of participation in the Shared Services Consortium or if prior surplus funds were not being used to offset the current-year claims payments.

Deficit: in some cases, actual claims may exceed the maximum claim rates. When that occurs, an additional entry will be necessary to recognize the additional funding. The most common scenario for this situation would be in the first year of participation in the consortium when surplus funds are not available or when stop loss reimbursements have not yet been received.

Adjustment to Employee Expense Entry for Actual Claims Data

Surplus Situation: it is up to each consortium member and its auditors as to the frequency of when an adjustment for surplus is made. The adjustment can be prepared at any interval, but it must be done at least annually by the close of business of the calendar year following the plan year end of 6/30. The actual claims-paid data that you receive will be reduced by any stop loss reimbursements. There will always be a lag between when a shock claim is paid and the stop loss reimbursement is received. Due to the level of fluctuations that can exist, the longer the interval between adjustments for surplus, the better.

Annual Adjustment for IBNR Liability

The IBNR is initially recorded at the end of the first plan year. Going forward, this liability is adjusted up or down based on IBNR reports provided by Benecon on a quarterly basis. This entry should be recorded annually at the end of the 6/30 plan year. Benecon’s Actuarial team determines this amount. This accounting-entry amount is used to accurately portray an amount representative of run-out claims to be paid in the event a consortium member leaves the consortium.

Standard Monthly Entry in Year Two

This would be the same journal entry noted in Appendix D and assumes that surplus funds from the first year in the consortium have not been used to reduce the current year’s maximum claim rates obligation.

Compliance

Initial Compliance Review

Benecon offers an initial compliance review during implementation of new consortium members at no additional fee. This includes an initial conference call with the new consortium member, Benecon’s Senior Compliance Analyst and the Benecon Account Management team. The benefit to having a completed compliance binder and keeping its contents current is in the event the consortium member is audited by the DOL, the compliance binder will contain the items typically requested during an audit.

During the initial conference call, Benecon’s Senior Compliance Analyst completes the compliance questionnaire and identifies issues and/or needed documents. Topics typically discussed during the compliance review call include:

• Plan document review/creation of the wrap, POP, FSA, HRA, STD, dental and vision documents.

• Form 5500 filing

• LOA review/continuation policy creation

• COBRA.

• HIPAA.

• Medicare Part D.

• Required notices

• Agreements/fidelity bonds

• Booklet/certificate review

• ACA: W-2, PCOR, SBCs and employer reporting.

• Wellness.

The goal of the compliance review call is to:

• Identify all plan documents needed:

o The Compliance team will write required documents not otherwise written by other administrators

o Consortium member reviews the draft document(s) for accuracy

o Signed document becomes part of the consortium member’s compliance binder.

o The Compliance team shares the medical SPD with the stop loss carrier.

• Identify, collect and include in the compliance binder: all notices, SBCs, agreements, and booklets/certificates of in-force benefit plans

The Compliance team delivers the completed compliance binder electronically to the consortium member and reviews the contents via a subsequent conference call.

Compliance Binder Refresh

Over time the contents of the compliance binder become outdated, policies and/or plan documents/SPDs may need revised or there may have been turnover at your organization, etc. Your Account Management team and/or the Senior Compliance Analyst may recommend that a compliance binder refresh call be held to determine what needs to be updated. This call will run in a similar fashion to the initial compliance binder review call. After missing or revised documents have been placed into the compliance binder, the Senior Compliance Analyst will send the compliance binder electronically to the consortium member and host a conference call with the consortium member and the Account Management team to review the contents.

Return to Table of Contents

ConnectCare3 (CC3)

CC3 services are an enhancement to an individual’s medical benefits and available at no additional cost to employees and their dependents covered on the consortium member’s group health plan. CC3 offers solutions to help build health literacy and reduce barriers to care while aiming to help consortium members with cost reduction strategies through their wellness solutions services. CC3 is a unique independent advocate and have no affiliation with any insurance carrier or hospital system.

Clinical Services Patient Advocacy

• Support clinical team with provider and social service resources.

Nurse Navigation

• Assist patients in understanding their diagnosis and treatment options.

• Prepare questions for physician appointments.

• Identify well-credentialed physicians for second opinions.

• Provide clinical support throughout diagnosis

Chronic Disease Management & Prevention

• Multidisciplinary team of registered nurses, registered dietitians, and certified health coaches

• Assist individuals with prediabetes, diabetes, high blood pressure, high cholesterol or obesity

• Provide the resources and support to make and sustain healthy lifestyle change needed to improve health.

Nutrition Education

• Help patients understand the connection between diet and health by providing nutritional assessments and healthy meal plans.

• Promote healthy and sustainable dietary changes to decrease risk of disease.

Tobacco Cessation

• Work one-one-one with certified health coaches to achieve and maintain a tobacco-free life.

• Can be used as reasonable alternative program.

Wellness Solutions Collaboration

• CC3 will evaluate an organization’s needs and assist them in accomplishing a wide range of goals. This can be straightforward, such as developing an employee engagement strategy and providing ready-to-use educational tools, or as expansive as building a wellness committee and creating a three- to five-year strategic wellness plan.

Consultation

• CC3 will help employer design wellness programming suited specifically to their organization’s culture and demographics. They can provide wellness campaigns and educational resources on relevant and timely health topics. Consortium members can use these resources to support their wellness initiatives with minimal added work required for them. They can also assist employers in exploring incentives as an employee engagement tool.

Connection

• CC3 will equip consortium members with marketing materials, webinars, and other communication tools to help drive the utilization of CC3 services. They also connect consortium members with additional wellness resources from their insurance carrier, employee assistance program, or within the community that may be available at little to no cost. They can help identify the most appropriate wellness vendors, if needed, for screening services.

Appendix A – Sample Invoices

Return to Table of Contents

Appendix A – Sample Invoices

Stop Loss Invoice

Return to Table of Contents

Return to Table of Contents

IBNR Letter (Quarterly)

Return to Table of Contents

Appendix C – Sample Reports

Monthly Aggregate Report

Return to Table of Contents

Appendix D – Sample Journal Entry

SharedServicesHealthPlanTrust(SSHPT)

Sample Journal Entries

Eachmonth, aninvoiceis generatedandprovidedtoeachcollegebasedoncurrent enrollment andthespecific administrativeandclaims rates. The rates arepredeterminedby Benecon's actuarialdepartment. Anexampleofaninvoiceis attached. This entry wouldbethestandardentry inYear1of theconsortiumorifpriorsurplus funds arenot beingusedtooffset current yearclaims payments.

Insomecases, ActualClaims may exceedtheMaximumClaimRates. Duringthosetimes, anadditionalentry willbenecessary torecognizethe additionalexpense. Themost commonscenarioforthis situationwouldbeinYear1oftheconsortiumwhensurplus funds arenot availableorwhen stoploss reimbursements havenot yet beenreceived. This wouldbevery rareintheSSHPTconsortiumsincefunds canbesharedamongthe schools incases wherethereis ashort falloffunds.

It is uptoeachcollegeas tothefrequency ofwhenthis adjustment is made. It canbepreparedat any intervalbut it must beat least annually at the endoftheplanyear. TheActualClaims paidwillbereducedby any stoploss reimbursements received. Therewillalways bealagbetweenthetime alargeclaimis paidandthetimeastoploss reimbursement, ifapplicable, willbereceived.

Theadjustment notedhereforthePlanYear2ending06.30.17is reflectedontheattachedfinancialstatement (thetotalofNet OtherIncomeplus Surplus Utilization). At thetimeoftheentry, Net ClaimIncomeforPlanYear2was $151,571.49.

Duetotheleveloffluctuations that canexist, thelongertheintervalbetweenadjustments thebetter. This practicewillhavetobedeterminedby each collegewithinput fromtheiroutsideaccountant.

at theendoftheplanyear. Theamount is determinedby Benecon's actuarialdepartment (anexampleis attached). IBNRcomputations areprovidedquarterly. This amount is only paidinthecaseofacollegegoingfromaselfinsuredplantoafully insuredplan.

This is thesamejournalentry notedaboveandassumes that surplus funds fromYear1havenot beenusedtoreducethecurrent year's Maximum Claims Rateobligation.

Inthis case, theschoolhas electedtousesomeoftheprioryearsurplus ($5,000.00)tooffset thecurrent year's medicalexpenseobligation ($68,592.33). Theamount ofthesurplus tobeusedinYear2is determinedby eachcollegeusinganelectionformprovidedby Benecon(anexample

If you have questions, please contact Jill D. Brewster, Senior VP Finance, Benecon at jbrewster@benecon.com or (717) 723-4600, ext. 161.

SSHP/SSC Timeline

Following is a brief history of significant developments and actions of the Shared Services Consortium, LLC and the Shared Services Health Plan. The preamble to this history is by Michael Coyne, former Executive Vice President Finance and Administration, Susquehanna University. Mr. Coyne served as Board Chair from 2008 to 2022.

Preamble

The Shared Services concept was initially created through a grant from the Mellon Foundation. Ernst & Young conducted an extensive study approximately 20 years ago about ways in which member colleges and universities could share services and reduce costs. The founding members included Bryn Mawr College, Franklin & Marshall College, Bucknell University, Haverford College, Dickinson College, and Gettysburg College. These members shared quite a few services. One of the services that was offered was student insurance, which was run by the Presidents of the schools, not the CFOs or HR staff. The institutions were led to believe that the loss ratio would be approximately 40-50% and that it could be a great money-maker for the institutions. However, the loss ratio was much higher and not feasible to continue with the current program. At that time, the CFOs took over running the Consortium and the previous Executive Director and the Consortium parted ways. It was decided that the Shared Services Consortium would come to an end.

At that same time, Franklin & Marshall College, Rosemont College, and Susquehanna University were ready to launch their own health insurance program. John Fry, President of Franklin & Marshall College, had a very good relationship with Governor Ed Rendell and prevailed upon him to grant an exemption to the insurance regulations that would allow Shared Services to share risk. Through extensive negotiations, these three institutions were successful in taking over the already founded consortium and utilizing the insurance department’s exemption to share risk. At that time, Benecon was asked to come on board to be the consortium’s consultant and general administrator to manage the risk share program through their actuarial department.

The State Insurance Commission requires that there is one other business in addition to providing employee healthcare. The LLC chose to fund ConnectCare3. One requirement of the LLC is to hold an annual meeting. The LLC is also subject to all necessary filings as an LLC, since it is a for profit entity. It was not feasible to incorporate this Consortium as a not-for-profit entity.

Timeline

September 2004

January 2005

John Fry, President of F&M College writes to PA Chief of Staff, Office of Governor, in reference to the success of the SSC and desire to expand to health insurance.

John Shaddock, President/CEO Shared Services Corporation (SSC) and John Fry meet with PA Insurance Commissioner to discuss group insurance project.

March 10, 2005

July 2, 2007

August 7, 2007

November 15, 2007

January 2008

April 21, 2008

August 1, 2008

October 2, 2008

October 24, 2008

November 1, 2008

November 25, 2008

December 4, 2008

PA Insurance Department grants permission for the SSC to operate as a shared risk insurance program with conditions. Letter on file.

Benecon meets with John Shaddock to explore formation of a Group Health Plan/Consortium under auspices of SSC.

Benecon presents health benefits consortium concept to SSC Schools.

Benecon presents Shared Services Health Plan (SSHP) proposal, savings estimates and implementation timeline to SSC schools at F&M College.

John Shaddock begins marketing group health plan concept to targeted PA schools, including Rosemont College.

Benecon presents consortium rate proposals to SSC schools including Rosemont, Susquehanna, Immaculata and Juniata at meeting held at Franklin & Marshall. Notification of interest requested by May 9.

Target “go-live” date for SSHP consortium for F&M, Susquehanna, and Rosemont.

SSC schools vote to conditionally approve launch of SSHP as of 11/1/08 based on Benecon’s offer to assume management responsibilities and pay the legal fees associated with the Health Plan.

Final SSC approval to implement SSHP as of 11/1/08.

Shared Services Health Plan Trust goes live with three Member schools: Franklin & Marshall, Susquehanna University, and Rosemont College.

First SSHP Board meeting held.

John Shaddock’s employment as SSC President & CEO is terminated by vote of SSC schools; Ed Loftus of Bucknell named interim, part-time Executive Director.

March 12, 2009

September 2009

Return to Table of Contents

SSHPT Board meeting – directive from SSC not to expand beyond SSC schools.

Benecon drafts and distributes White Paper on growth in attempt to jump-start its SSHP marketing efforts beyond SSC schools.

April 2010 SSC Board agrees to allow expansion of SSHP schools beyond SSC.

July 2010

February 2011

March 2012

July 2012

July 24, 2012

July 24, 2012

October 2012

October 23, 2012

March 2013

July 23, 2013

October 23, 2013

SSC eliminates all staff positions, reinforces moratorium on SSHP Expansion.

Benecon updates White Paper on Growth to include specific list of target schools.

Mr. Coyne stated that as part of the reorganization of Shared Services Consortium, five of the seven original members (not including F&M College) would be leaving and Susquehanna University, Rosemont College and Elizabethtown College will move from associate members to full members upon completion of the Membership Agreement.

Board approved the adoption of the General Administrator Agreement with Benecon through June 30, 2014.

The board approved a resolution to continue the SSC, LLC as permitted under PA law.

Benecon introduces CC3 to the SSC and the many wellness and nurse navigation programs and activities that are available.

Chair Coyne writes to PA Insurance Dept. to confirm operation of the SSHP and the continuation of the program under the previous authority granted by the PID in 2005.

The SSC, LLC/CC3 Agreement was revised and copies provided to the members.

Based on study and legal opinion the board felt it would not be cost effective to move to a not-for-profit status with the LLC with little benefit. The board decided to maintain the for-profit status.

Chair Coyne noted the insurance commission requires that the purchase of insurance not be the only activity of the LLC. To satisfy that requirement, ConnectCare3 services are purchased through the LLC

The board adopted changes to the Operation and Membership Agreements. The revisions to the Operating Agreement pulled out references to the old members, removed requirements for quarterly board meetings and a board, removed sections pertaining to school properties which the LLC is no longer involved in and added the availability of electronic meetings. Return

April 1, 2014

July 29, 2014

July 14, 2015

January 12, 2016

January 12, 2016

July 18, 2017

April 4, 2018

July 29, 2021

April 2022

June 2022

Benecon reviewed the PCOR filing requirements with the board. This is the first year that Shared Services Consortium, LLC will be facilitating the PCOR filing on behalf of the health plan.

The board adopted changes to the Brokerage & Administrative Services Agreement (Benecon Agreement). In addition, the board recommended a memo indicating that any significant management personnel changes that impacts SSHP be communicated to the board.

The board approved a revised Hold Harmless Agreement, the termination of the Statement of Principles and to pay Sarah Ivy of McNees, Wallace & Nurick up to $3,500 for a general review of the Cooperation Agreement.

The board approved changes to the Cooperation Agreement (Member Agreement) to be effective February 1, 2016. The reason for the new agreement is to update and streamline the document. Per the board’s request, McNees, Wallace and Nurick reviewed the agreement and provided the red-lined version with recommended changes

The board approved the Whistle Blower, Record Retention, and Conflict of Interest policies, as well as the induction of the Vice Chair as Compliance Officer to be effective February 1, 2016.

Benecon’s Actuarial Department recommended to the board that Members keep two times IBNR in surplus and use it to offset the current year’s claim funding. Benecon noted that SSHP groups features risk sharing and cash-advancement.

The board approved changing auditors to Baker Tilly. Mr. Coyne indicated there is a 33% reduction in audit fees with the RFP.

Benecon, through ConnectCare3, introduced new services with the intent to increase health literacy and participation in CC3 services. The services include Diabetes Management; Healthy Weight Management; Importance of Primary Care and Preventive Screenings; Heart Health, Mental Health Matters; Debunking Fad Diets; and Tobacco Cessation.

As of April, 2022 there are eleven colleges/universities representing 2,957 employees in the Shared Services Health Plan.

Michael Todd, Vice President Finance and Administration-F&M College is elected the new chair of Shared Services.