A self-funded health benefits purchasing program for municipalities in Lancaster and York Counties

It all started with four local government groups in 1991

Recognizing the effectiveness of group purchasing, Benecon pioneered self-funded consortium and cooperative programs. Today, we’re proud to manage fourteen programs across the country and maintain membership retention of more than 98%. With our full suite of services, Benecon is able to provide unlimited expert support through Account Management, Actuarial, Compliance, Finance and the Producer Services Divisions. With the unparalleled Nurse Navigation and Wellness Solutions of our subsidiary, ConnectCare3, Benecon is a powerhouse in the self-insurance marketplace.

October 1, 2024

Dear IIC Members,

Thank you for being a valued member of the Intergovernmental Insurance Cooperative (IIC). We strive to provide a costeffective program with excellent service and stability to our members. Healthcare has not been spared by the rising costs we see elsewhere and generally serves as a lagging indicator of inflation. Some of these costs are driven by provider contract increases, worsening population morbidity, the spreading popularity of GLP-1s and innovative new gene and cell therapies. Despite all of this, our goal is to help you control risk while providing transparency and the tools to utilize cost containment strategies. On behalf of the IIC Board of Directors, thank you for your ongoing participation in the program.

For 2025, the average renewal increase for the 64 members of IIC is 11%. When developing the rates for individual members, the actuarial staff considered the following:

• Medical trend estimate (projected at 9% for 2025)

• Plan designs and demographics for each member group

• Claims experience for 2023 and the first six months of 2024

• Fixed costs (reinsurance fees and administrative fees)

The IIC will continue to stabilize the reinsurance costs of its members through the collective purchasing power of the cooperative.

Your renewal is only one indicator of the total cost of your health insurance program. For the 2023 plan year, 70% of IIC members received a surplus. When combining surplus returns with your projected 2025 costs, many members experience level-funding or decreases in their total costs.

This renewal booklet and accompanying packet include other information relating to your 2025 renewal, the IIC program, Benecon, your claim fund performance and dental & vision rates. We hope you take a few minutes to review this important information.

We appreciate your participation in the IIC. It is our pleasure to work with you and we look forward to serving you in 2025.

Sincerely,

Joy VP Account Management

VP Program Management

Brian Zimmerman Account Manager

Cindy McKillips

Associate Account Manager

Nicole Miller Executive Programs Coordinator

Anne

Walls

Senior Enrollment Specialist, Account Services

Intergovernmental Insurance Cooperative (IIC) is a self-funded group purchasing program developed and administered by The Benecon Group for municipalities in York and Lancaster County, Pennsylvania. Benecon is a nationally recognized leader in the industry, dedicated to providing its members with efficient and safe access to the self-insurance market.

Full Transparency

Know

Control

Be in the driver’s seat when choosing your benefits

Administered by Benecon

30+ years of experience

$3.5+ billion administered funds

98% retention

$700+ million stop-loss placed

Surplus & Savings

Any surplus after year end reconciliation is returned

Flexibility

Choose the plan design that works best for your employees

Ralph Hutchison

7 Members - 2 Year Term (7/1/24-6/30/26)

East Lampeter Township, Manager 2250 Old Philadelphia Pike | Lancaster, PA 17602 Office: 717.393.1567 | rhutchison@eastlampetertownship.org

Ryan Strohecker Chairman

Cindy Schweitzer Treasurer

Nancy Harris

Tim James Secretary

Kelly Kelch Vice Chairman

Jenny Gunnet

Manor Township, Manager 950 West Fairway Drive | Lancaster, PA 17603 Office: 717.397.4769 | manager@manortwp.org

East Hempfield Township, Manager 1700 Nissley Road | Landisville, PA 17538 Office: 717.898.3100 ext 222 | manager@easthempfield.org

Ephrata Borough, Manager 124 South State Street | Ephrata, PA 17522 Office: 717.738.9232 | nharris@ephrataboro.org

Manchester Township, Manager 3200 Farmtrail Road | York, PA 17406 Office: 717.764.4646 | t.james@mantwp.com

West Manchester Township, Manager 380 East Berlin Road | York, PA 17408 Office: 717.792.3505 | kkelch@wmtwp.com

Windsor Township, Manager 1480 Windsor Road | Red Lion, PA 17356 Office: 717.244.3512 | jgunnet@windsortwp.com

Akron Borough 10

Carroll Township 21

Clay Township 5

Columbia Borough 42

Dallastown Borough 8

Dillsburg Area Authority 12

Dover Township 47

East Cocalico Township 37 East Cocalico Township Authority 10

East Donegal Township 8

East Hempfield Township 76

East Lampeter Township 79

East Manchester Township 8

Elizabeth Area Water Authority 10

Elizabeth Township 3

Elizabethtown Borough 42

Ephrata Borough 108

Ephrata Township 7

Fairview Township 39

Hanover Area Fire and Rescue 8 Hanover, Borough of 140

Township 8

Lancaster Airport Authority 17

Lancaster Area Sewer Authority 52 Lancaster County Solid Waste Management 99 Lancaster Township 14 Lititz Borough 33 Manchester Township 28

Manheim Area Water and Sewer 11

Manheim Borough 20

Manheim Township 206 Manor Township 43

For the 2023 plan year, we returned nearly $4.4 million dollars in surplus claim funds to 70% of IIC members. Most IIC members received a 75% distribution of their 2023 surplus in May 2024. The balance was distributed in July 2024 after all claims were closed out.

For 2024, the IIC Wellness Grant Program transitioned to Loyalty Credits. The previous Wellness Grants were limited to a certain number of groups (based on total funds available) and the money was only allowed to be used for efforts within a wellness program. The new Loyalty Credits were shared with all active IIC groups as a thank you for your loyalty and the money could be spent however you wish.

At the end of February 2024, checks were mailed to all active IIC members for your 2024 Loyalty Credits. The amount of your check was calculated based on your enrolled number of employees as of January 31, 2024 and a credit of $46.53 PEPY.

Your membership in the IIC affords you the opportunity to receive these funds, which does not happen in a typical fully-insured plan. When determining your total cost for health insurance in our program, please consider these Loyalty Credits as a benefit of your IIC membership. As always, we thank you for being a valued member of the IIC.

IIC members use Highmark’s online portal or Benecon’s Simon platform to process adds, changes and terminations to your medical plans.

Additionally, IIC members can use Benecon’s Simon platform to process adds, changes and terminations to your dental and vision plans.

For IIC members not currently using Benecon’s Simon platform for your dental and vision plans, you must send a completed universal benefit form (UBF) via secure email to Account Services or fax the form for processing.

Need a new ID card for an employee? Requests for medical plan ID cards can be made through Highmark’s online portal. For dental and vision plans, send Account Services an email to request a new one. Most insurance carriers take 7-10 business days to generate and mail a new card. Don’t forget to include the employee’s address in your request!

Any other enrollment related questions, we have you covered!

IIC invoices are delivered securely each month using Box.com. Upon receipt of your monthly notification email, you are able to log in to Box.com to retrieve your most recent invoice as well as review invoices from previous months. To avoid mispayments, please make sure you are accessing the newest invoice each month by following these steps:

• Log in to Box.com and click on “All Files”

• Click the arrow next to recent files to hide this section. The recent files section shows the last files you opened, not the most recent files uploaded.

• Click the “Billing” folder

• Click the most recent month’s folder “yyyy-mm”

Helpful tips: Including the following information in the memo section of your check helps to ensure payments are applied correctly.

• The month of the invoice you are paying

• Your Client Manager Key (this is the 3-digit or 4-digit number located under your Group’s Name in the upper left corner of the Medical Billing Invoice)

Please remember to submit all Open Enrollment changes via the Highmark online portal (for medical) or to AccountServices@benecon.com (for dental and vision) prior to 12/13/2024; this includes new enrollments, changes, and terminations for an effective date of 1/1/2025. If new ID cards are needed prior to 1/1/2025, then we strongly suggest submitting your Open Enrollment changes by 12/6/2024.

For IIC members who are currently using Benecon’s Simon platform, all Open Enrollment changes for medical, dental and vision must be entered into Simon prior to 12/6/2024 for an effective date if 1/1/2025.

IMPORTANT NOTE: additional enrollment changes can be made in Simon through 12/27/2024 (for an effective date of 1/1/2025), but ID cards will not be received prior to 1/1/2025.

Any Open Enrollment changes submitted after the first of the year cannot be processed.

Anne Walls Senior Enrollment Specialist

Erin Willman Enrollment Specialist

Evaluate your organization’s wellness needs

Develop a targeted approach to wellness

Enhance an existing wellness program

Increase employee engagement

Collaborative review of claims data

Identify chronic conditions and gaps in preventive care

Actionable insights and strategies from our Wellness Solutions team

Included as part of the ConnectCare3 benefit

Increase awareness of ConnectCare3's clinical services

Engage employees with incentives & challenges

Improve employee health literacy

Empowering a Healthier Workforce

Engage employees with incentives and challenges

Increase awareness of ConnectCare3’s clinical services

Improve employee health literacy

Available online and via Google Play/Apple Store

Included as a part of the ConnectCare3 benefit

HealthyU Learning Modules

Incentive Tracking & Reporting

Wellness Checkpoint Health Risk Assessment

Mayo Clinic Resource Library

Wellbeing Challenges

Push Notifications

Available in English & Spanish

The IIC Board endorsed Benecon to offer a Life & Disability program for all Members. IIC believes there is power and efficiency in group purchasing and encourages all Members to participate.

1. Provide a significant rate reduction on current Life/STD/LTD Coverage

2. Match each group‘s current plan designs & level of benefits

3. Provide a multi-year rate guarantee

4. Place all Members with one carrier

1. Current employee census (Name, DOB, DOH, Occupation, Salary)

2. Copy of current plan designs (Summary Page of Benefit Booklet)

3. Copy of most recent invoice

Insurance Provider: OneAmerica

1. “A“ financial rating from all rating agencies

2. 141+ years experience

3. $83 billion in assets

Experience: Benecon

Benecon has successfully aggregated the Members of many other Cooperatives to create a significant purchasing power for Life & Disability coverage.

Did you know that IIC offers dental and vision coverage?

With plans from United Concordia, Davis Vision and National Vision Administrators, we are sure to have a plan that works for you.

For more information, please contact your Benecon Account Manager.

With Benecon’s Administrative Services, gain access to a full suite of value-added services.

A Health Savings Account is an employee owned, taxadvantaged savings account used in conjunction with a High Deductible Health Plan (HDHP).

The Consolidated Omnibus Reconciliation Act gives employees who lose their benefits the right to choose to continue group health benefits provided by their employer for limited periods of time if the employee experiences a qualifying event.

A Health Reimbursement Arrangement is an employer funded arrangement that may be used to reimburse employees for qualified medical expenses set by the employer.

Monthly billing services for eligible retirees.

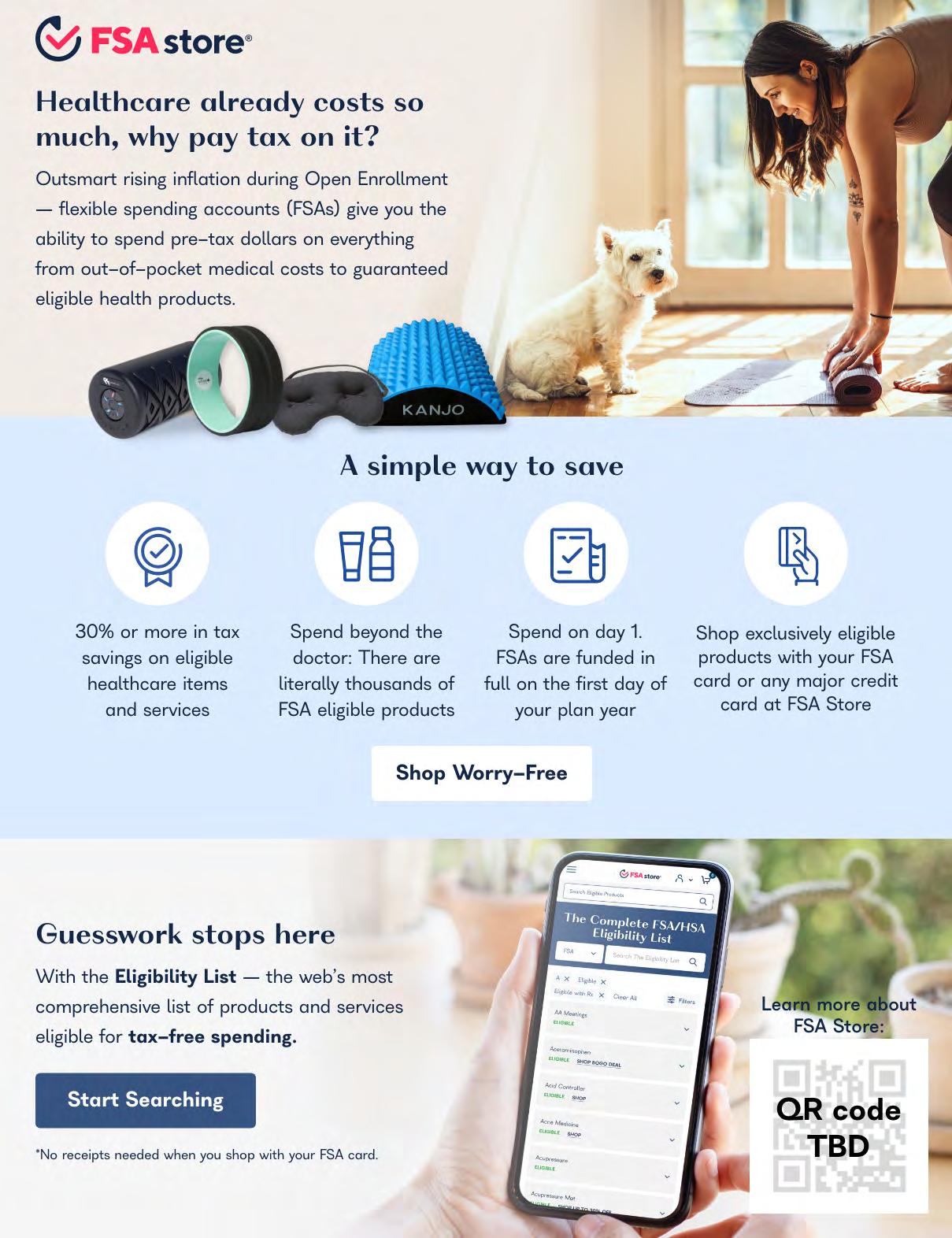

A Flexible Spending Account is an employer offered, tax-advantaged account funded by the employee to pay for qualified medical expenses with pre-taxed dollars.

A Dependent Care Assistance Plan is an employer offered, tax-advantaged plan funded by the employee to pay for care for eligible dependents, such as children or disabled family members.

An Individual Coverage HRA is an employer funded, tax-advantaged arrangement in which employers of any size can reimburse employees for some or all of the premiums that their employees pay for health insurance that they purchase on their own.

A Qualified Small Employer HRA is an employer funded, tax-advantaged arrangement in which employers with under 50 Full Time Employees can reimburse their employees for their health insurance premiums that they purchase on their own.

Employer funded, tax-advantaged plan that can pay an employee up to $5,250 in educational assistance benefits each year.

Employer established, tax-advantaged account funded by the employee and/or the employer to pay for qualified mass transit and parking expenses on a monthly basis.

An Excepted Benefit HRA is an employer funded, taxadvantaged arrangement, under which employers provide funds towards the cost of vision, dental or short term limited duration insurance premiums that they purchase on their own.

In addition to our CDH & COBRA offerings, Benecon’s Administrative Services Team provides best-in-class customer service and access to industry-leading mobile and web-based services.

24/7 access to Employer & Participant Portals

Enhanced Reporting Capabilities

Enrollment and Eligibility Management

Account Funding and Contribution Management

IOS/Android App That Makes Account Management Easy

Personalized Customer Service

Representatives Available During Working Hours to Assist our Partners and their Clients

Personalized CDH Open Enrollment Presentations and Marketing Materials

Plan Setup and Renewals with no extra charges (*excluding Mini-COBRA)

No Minimum Requirements on Employee Plan Participation

Compliance Webinars and Instructional Videos

Special deals on eligible FSA & HSA products

Industry Leading Web Browsers for FSA/HSA Eligible Items

Customized Communications for Participants

Purchased Products Require Zero Substantiation if paired with a Benecon FSA/ HSA Debit Card

Benecon Portal: www.my-healthshopper.com/?id=10624

Bringing together the leader in health spending accounts and the leader in online retail to deliver the easiest way to learn about, shop for, choose and purchase HSA/ FSA eligible retail items online. Under the “Eligible Expense List“ on the Home Page, learn about what expenses can be reimbursed under your program and what documentation may be required.

Search for products on Health Shopper, and when ready to purchase, you will be guided to Amazon to procure the product.The transaction experience will work similar to any other purchase a consumer makes on Amazon, including utilizing Amazon Prime benefits.

Get Started Today!

www.my-healthshopper.com/?id=10624

CDHServices@benecon.com

Amazon is responsible for delivery and customer service for purchases made via Health Shopper.