If you’re among BC’s approximately 2 million property owners, you should receive your 2023 property assessment in the mail early in January. If you haven’t, call us toll-free at 1-866-valueBC.

Access and compare property assessment information using our free assessment search service at bcassessment.ca.

The 2023 assessments are based on market value as of July 1, 2022.

If you have questions or want more information, contact us at 1-866-valueBC or online at bcassessment.ca.

The deadline to file an appeal for your assessment is January 31, 2023.

For more property information and assessment highlights, visit bcassessment.ca

“A professional penman, a copyist, a scribe . . . a Notary.” Thus the Oxford English Dictionary describes a scrivener, the craftsman charged with ensuring that the written affairs of others flow smoothly, seamlessly, and accurately. Where a scrivener must record the files accurately, it’s the Notary whose Seal is bond.

We chose The Scrivener as the name of our magazine to celebrate the Notary’s role in drafting, communicating, authenticating, and getting the facts straight. We strive to publish articles about points of law and the Notary profession for the education and enjoyment of our members, our allied professionals in business, and the public in British Columbia.

Published by the BC Notaries Association

Editor-in-Chief Val Wilson

BCNA CEO Chad Rintoul

Administrative Coordinator Olivia Kuyvenhoven

Courier Lightspeed Courier & Logistics

Production fractal design inc. (fractal.ca)

email: scrivener@bcnotaryassociation.ca website: www.bcnotaryassociation.ca

Send photographs to scrivener@bcnotaryassociation.ca.

All rights reserved. Contents may not be reprinted or reproduced without written permission from the publisher.

This journal is a forum for discussion, not a medium of official pronouncement. The BC Notaries Association does not, in any sense, endorse or accept responsibility for opinions expressed by contributors.

CANADA POST: PUBLICATIONS MAIL AGREEMENT No. 40010827

Postage Paid at Vancouver, BC RETURN UNDELIVERABLE CANADIAN ADDRESSES TO CIRCULATION DEPT.

BC NOTARIES ASSOCIATION SUITE 201, 2453 BEACON AVENUE SIDNEY, BRITISH COLUMBIA V8L 1X7 WWW.BCNOTARYASSOCIATION.CA

The theme for this edition of The Scrivener highlights how significant the relationship is between a BC Notary and their clients.

Many British Columbians get to know their local Notary when they are young adults purchasing their first home. That initial professional interaction often marks the beginning of a lifelong relationship where clients come to trust their Notary to provide them with other noncontentious legal services.

Estate planning and the preparation of a Will pave the way for creating Representation Agreements, Powers of Attorney, and the process of planning and helping to organize the clients’ affairs for the future.

The BC Notaries Association (BCNA) has been advocating for the expanded scope of practice for Notaries so the same Notary who has handled your real estate conveyancing and written your Will can prepare a testamentary trust as a part of your Will and probate your Will when the time comes. Those services are congruent with the work already carried out by BC Notaries. British Columbians are already asking their Notary to provide those additional services.

During November 2022, the BCNA hosted a series of MLAAppreciation Events in Victoria, all excellent opportunities

• to meet with the caucuses of all three political parties in the Legislature;

• to thank MLAs for their service to British Columbians; and

• to educate them on our advocacy initiatives.

We appreciate the time the Members of the Legislative Assembly took to meet with the BCNA Board and Notaries from the Victoria area to learn more about the work BC Notaries do in their communities throughout the province.

I have no doubt that serving as an MLA can be both challenging and rewarding. We greatly appreciate the work they do as they strive to make life better for everyone in our province.

As the Ministry of the Attorney General works toward legal-professions legislative and regulatory modernization, the BCNA will continue to advocate for BC Notaries to be able

• to assist British Columbians with preparing testamentary trusts and life estates;

• to file probate documents; and

• to incorporate and maintain records of BC companies.

We believe all MLAs will agree it is in the public interest to give British Columbians increased access to legal services and a choice when it comes to the provision of noncontentious legal services.

On behalf of all of us at the BC Notaries Association, I wish you a Healthy and Happy New Year!

We are looking forward to upcoming events, including

• the New Notaries Career Fair on February 11, 2023, a virtual opportunity for students in the Simon Fraser University Master’s degree in Applied Legal Studies Program to meet potential future employers or business partners, and

• of course the long-awaited return to our Annual Continuing Education Conference taking place in Kelowna, April 21 to 23, 2023. We look forward to seeing you there! s

Respectfully Chad Rintoul, Chief Executive Officer

Estate planning and the preparation of a Will pave the way for creating Representation Agreements, Powers of Attorney, and the process of planning...

Iam

to Fall . . .

Summer seemed to last forever (that’s for all of you who saw Bryan Adams in Vancouver in November), then, suddenly, it was Winter. Here’s hoping Winter is short and Summer comes back early.

In this exciting issue, we delve into the topics of Personal & Estate Planning and Medical Assistance in Dying (MAiD).

Notaries Public have been providing legal advice to British Columbians around their estate plans for decades by preparing Wills, Representation Agreements, Advance Care Directives, and Powers of Attorney. Further, when Notaries are setting up Tenancies on property transfers, they are simultaneously working with clients on estate planning.

British Columbians are so appreciative of the assistance BC Notaries provide them and really look to the profession to provide sound legal advice they can understand. People are looking for Estate Planning assistance; BC Notaries provide that advice and the legal documentation that goes with the advice.

• British Columbians need to appoint a person to help manage their financial

affairs . . . Notaries advise and prepare the Power of Attorney.

• British Columbians need someone to assist with their future health and their personal care . . . Notaries advise and prepare the Representation Agreement and the Advance Health Care Directive.

• British Columbians want to be sure their estate will properly disperse to their loved ones when the time comes . . . Notaries advise and prepare the Last Will and Testament.

The other theme for this Scrivener is Medical Assistance in Dying (MAiD). MAiD became law in Canada in 2016 with the passing of Bill C-14 after the Supreme Court of Canada made its ruling that criminalizing the assistance in another person’s death violated the Canadian Charter of Rights and Freedoms. That was known as the Carter v. Canada case. Many may remember Sue Rodriguez who first took on the Supreme Court back in the early 1990s. Sue had ALS and wished to end her own suffering.

MAiD is now legal in Canada; the law permits its use only in a very narrow set of circumstances and only after specific criteria have been met. Further changes came into force in early 2021 that included enhancements to eligibility

and safeguards to protect those wanting to access MAiD.

One of the best places to get information on end-of-life matters is through your local Hospice organization. I had the pleasure of serving on the Board of Directors of a new startup Hospice society in Delta known as the Heron Hospice Society of Delta. Hospice societies provide compassionate care to individuals facing lifelimiting illness and support to those who are grieving the loss or imminent loss of someone close to them. I consider Hospice organizations an integral part of our health care system. We all have seen recent emphasis on managing people’s emotional health and the benefits it can bring to our quality of life. Hospice organizations provide that critical mental support we all need when dealing with grief.

Hospices are often set up and operated as not-for-profit societies with charitable status. That means they operate without significant government funding and rely on members and donors to support the critical work they do.

I encourage you all to reach out to your local hospice and learn about the work they do and then consider becoming involved as a volunteer and/or a donor.

I hope Spring arrives quickly!

not sure what happened

The articles in this issue will help you know more about

• Personal & Estate Planning (to protect the assets you do have);

• the legal documents you need; and

• the process for updating those documents over time.

It is always better to consult an experienced legal professional when you decide to create or update your Will, Representation Agreement, Advance (Health Care) Directive, and Power of Attorney. (WRAP)

That will help ensure that the clearly stated intent, instructions, and wishes in your documents will prevail.

To create those important legal documents, confer with and trust a BC Notary with the details about your family and estate situation. BC Notaries really care about helping their clients ease the sting of making decisions that may be causing personal stress or confusion.

It is essential that you have serious conversations with your

loved ones about legal planning. Enter the conversations with an open mind.

Here is a delightful story about a loving grandma whose family members were very reluctant (in fact, refused) to discuss her eventual demise—and also their own. She invited them all to dinner at her home. When they arrived, Grandma made it very clear that the family was about to hear the plans and wishes she had stated in her Will and other planning documents. She also announced that talking about their own Wills was a required activity that day! “Do you want dessert?”

When they saw Grandma was totally serious about the Wills subject, one by one they agreed to comply! Her happiness was very important to each of them.

Welcome to our new writer, BC Notary Jeremy Andersen, CPA, MBA, for the topic of Tax. His first article is on page 64.

Do it NOW!

This true story is about two close friends in their 40s who delayed creating the legal documents that would protect their interests.

John lent David $200,000 to start a business. The loan was totally undocumented. “I will have the legal docs prepared next week to show that I owe you that money,” David assured John. The next day, David perished in a tragic highway crash. John was left to grieve the death of his buddy and the foreverlost $200,000.

This year it will become fashionable for people to be kinder to each other, tell the truth, stop labelling/ criticizing others, and to better accept individuals who are different.

Let’s espouse the values of kindness, courtesy, consideration, appreciation, and respect—and apply them liberally throughout the New Year! s

Val Wilson, Editor-in-ChiefEven if you believe you don’t have much of an estate, it’s important to make a Will.

One of the first acts of ancient peoples was to build a system to keep track of time.

That was crucial for the survival of their societies . . . they needed to know when to plant. No plant, no food, no life. They found the fundamentals high up in the firmament and employed the moon and the sun for their earthly endeavours.

As a result they invented the calendar. Our Monday (the moon) and our Sunday (the sun) still refer to the anchor points in the system. That Roman genius Julius Caesar most famously reformed the calendar in a form still known to us. One month (yes, there is the “moon” again) was even named after him: July.

He became the first Roman Emperor. In some countries, they used his last name for the top position—the German Kaiser and the Russian Tsar.

The calendar allowed us to plant and to plan. From the Latin agere, to act, we created the agenda, a list of action-items. Both words, agenda and calendar, are used interchangeably these days.

A tool that expanded the system became known through an Arabic word—almanac. Many words

starting with al appear to have an Arabic origin, such as alcohol and algebra. The almanac became a useful manual because it added key information to our calendars—tide tables, planting dates, names of Saints (important for scheduling festivals), and so on . . .

From listing action-items and recording relevant facts to attempting to predict future events was only a small step. But it took a leap of faith.

Astronomy, the study of the stars, led to the pseudo-science of astrology, the interpretation of the locations and movements of the stars. Some believed the constellations (stella, Latin for star) had an influence on human conduct.

Those who portrayed themselves as able to forecast events and provide guidance for future conduct became known as prophets, from the Greek prophesy, to predict. The word predict is Latin. Both words mean to foretell or to forecast.

Arguably, the most famous or infamous was the 16th century seer Nostradamus. The French philosopher wrote during the years of the plague known as the Black Death. Survivors back then desperately needed to hear what else the future held in store and he obliged.

His predictions took him far into the future. They are formulated in such vague terms that still today many credit him with accurately predicting major events.

That was, however, many moons ago. One valuable lesson we can take away from this brief etymological history is: Make hay while the sun shines.

Because it is written in the stars that life does come to an end, as certain as the rising and setting of the sun and the rotations of the moon.

As such, planning for our demise, as well as our diminishing health, should be a priority actionitem on anyone’s agenda. Who wants to leave unfinished business behind?

The British Columbia lawmaker has provided the tools—think Will, Power of Attorney, and Representation Agreement; any BC Notary Public is well-versed in advising you how to use them.

I am not promising you the moon but once your planning documents are in place, you can ride off into the sunset. With no agenda, hidden or otherwise s Notary Public Filip de Sagher is the Manager of Complaints at The Society of Notaries Public of British Columbia.

Filip de Sagher

Filip de Sagher

Recently I had the privilege of giving a presentation to members of the North Shore Royal Canadian Mountain Police on Personal and Estate Planning. Having firefighters in my family has made me very conscious of how necessary it is for First Responders to have their legal documents organized.

Approximately 50 members of the local RCMP attended the recent lectures offered them through Wellness seminars covering areas of sleep hygiene, career management, fitness, nutrition, lifestyle, Wills and estates, PTSD and burnout, chaplaincy, and general support services.

It seems to me that those on the frontlines protecting and caring for our communities every day are the very people who need to have adequate estate planning in place.

Protecting themselves and their personal family members should also be a top priority in their planning. Police, firefighters, doctors, nurses, and emergency services employees are all occupations where lives are potentially at risk daily, due to their choice of employment.

I was able to provide the seminar attendees with the legal basics on creating and updating records of their assets and liabilities in an Estate Record Keeper. It is essential to know what documents are required in our province for good personal and estate planning.

Police, firefighters,

and

services employees are all occupations where lives are potentially at risk...

• Power of Attorney (granting financial authority)

• Representation Agreement and Advance Directive (both granting medical authority)

• Do-Not-Resuscitate documentation

• Last Will and Testament

Many questions arise when you turn your attention to those basic documents. Based on the scenarios in your individual life, some situations require personal discussions with your trusted legal professional.

It is always important to start with the basics and proceed from

Marg Rankin

there to contact the professionals with the skills to provide specific estate planning advice.

Many individuals don’t know where to start or the relevance of making sure their legal documents are ready. They don’t understand the ramifications of not having a Power of Attorney in place if a person becomes incapable of handling his or her own legal and financial affairs. That can put your next-of-kin in a situation where a Court application to appoint a “Committee” (pronounced comitay in this case) may be necessary to deal with personal assets. That very costly and time-consuming procedure can be avoided by having a current Power of Attorney in place.

A Representation Agreement (to grant medical authority) gives a trusted person (Representative) the ability to make medical decisions if you are unable to make those decisions for yourself. The environment of a hospital or care facility can be isolating.

If you appoint a Representative, you will have a trusted advocate with the legal power to help. Through a Representation Agreement document, the medical authorities have permission to discuss your medical history, diagnosis, and prognoses with the Representative who will be informed and then able to make decisions on your behalf.

doctors, nurses, emergencyA Will is required to appoint an Executor/Trustee, to specify

• the persons who will receive your estate upon your death;

• the people who will be the guardian of any minor children (and pets) you have at your death; and

• what is to happen to your remains.

Without a Will, it would be necessary to apply to the Supreme Court for a Grant of Administration of your Estate to deal with assets registered in your name.

Again, that is a costly procedure requiring the services of a lawyer to prepare the Court application and compile all the required documentation on

• who should be appointed by the Court;

• how to contact your next-of-kin; and

• your assets.

Due to poor or nonexisting records, relevant information is often never discovered.

Although it does take time and effort to organize your life to ensure you and your loved-ones are protected, you will have great peace-of-mind once that has been done!

If you spend months or even years to plan your next holiday, it is definitely worthwhile to spend time to plan for the management of your estate should you become ill, incapable, or die.

Please consult your local BC Notary Public or lawyer for advice on how to get started. It’s worth it! s Margaret Rankin is a Notary Public practising in North Vancouver, BC.

“We’ve ensured our legal and health care wishes will be carried out, should either of us become incapacitated or pass away. Our loved ones will not be burdened by the stress of making our decisions for us.”

Health Care Directive P ower of Attorney

Give the gift of advance planning to your loved ones. Call your BC Notary today. www.bcnotaryassociation.ca (604) 676-8570

Trevor, Jackson and Chuck E. Todd providing excellent legal services in contested wills, trusts and estates for over 50 years. disinherited.com rttodd@disinherited.com | t. 604.264.8470

Wills are important documents that speak for you when you are gone.

If you don’t do a Will, your loved ones will have to step in and follow the statutory framework for distributing your estate. Instead, you can take control and make the final decisions by doing a Will.

A Will can dictate to the executor how your special items will be distributed.

Examples . . .

• My client wanted to give his shoe collection to his best friend.

• A client who had an original AY Jackson painting from the Group of Seven wanted to give his oldest grandson the first right to purchase that valuable painting from the estate.

• Another client had two World Series Baseball Rings and wanted to give each ring to a different person.

Life changes—it ebbs and flows—so your Will needs to reflect your thoughts and wishes at the moment.

Morrie BaillieYour Will can include information about how your remains will be managed.

Of course, the common solutions are

• to be buried, or

• cremated.

I draft Wills stating clients want the greenest, most environmentally friendly, and cost-efficient final process available.

Some of the most cuttingedge methods for dealing with their remains include having them converted into mulch in Washington State, USA, then have them scattered in their garden. Unfortunately, that process is not available in British Columbia.

A water cremation is apparently possible in the USA; it is a greener process than traditional cremation. When you don’t have a Will, you leave your loved ones guessing; that generates chaos and can compound grief. I tell my clients that doing a Will is “the grown-up thing to do.”

Life changes—it ebbs and flows—so your Will needs to reflect your thoughts and wishes at the moment.

It is very typical to update your Will as you move through life. For example, you may need to adjust your alternate guardian to be a more suitable person as your kids get older—or you may have fallen in love and want to include your new partner in the Will.

The rule of thumb is to look at your Will every 3 to 5 years; if nothing requires a change, put the Will away and look at it again in 3 to 5 years.

One of the newer trends I see in my estate practice?

Calls from potential clients who have completed an online Will and need support executing or witnessing the document.

In my practice, I do not sign Wills I have not drafted. As BC Notaries, it is our duty to provide legal advice, guide the process to ensure the document is a true reflection of wishes, and that there is no undue influence or outside pressure.

The online platforms offer a simple method to complete a Will for those who are tech-savvy. Those online programs, however, do not

guide the Will-maker or explain the pitfalls of drafting a Will, such as the discussion around excluding a child from a Will or the options available for a child with a disability

They take the time to ensure you understand the entire process; explain the various options available to you, and offer you the time to ponder and reflect before signing your Will.

I recommend you call your local BC Notary to set up an appointment to either review your current Will or start the process to draft a new one. s

Notary Public Morrie Baillie, practising for almost 10 years, exclusively focuses on Personal Planning. One of the statutory examiners for new BC Notaries (Personal Planning), she is a committee member for the British Columbia Law Institute (Undue Influence Committee) and Vice President of the BC Notary Association. Morrie has recently

The rule of thumb is to look at your Will every 3 to 5 years; if nothing requires a change, put the Will away and look at it again in 3 to 5 years.

For example, when I get involved in preparing an estate plan, I tend to spend at least 30 minutes with my clients to understand their values, aspirations, family status, financial situation, and so on, even before discussing any details regarding their Wills.

“Our five children are grown and married and have children of their own. Our eldest passed, leaving a widow and daughter. Our financial planner encouraged us to update our legal documents. Consequently, we met with BC Notary Lilián Cazacu.

Estate Planning is more than just writing your Will. The majority of my Wills clients approach me with one request: “I just need a simple Will.” As many of my Notary colleagues may attest, there is no such thing as a simple Will.

While family dynamics may vary from home to home, and some situations may require a more or less straightforward Will and estate plan, most people require forwardthinking discussions and an analysis of their family dynamics, their assets and liabilities, and even the goals and dreams that may affect the way they would ideally plan their estate distribution.

I’m still amazed by how people invest so much time and resources into their financial planning, by researching and planning extensively, where and how to invest their money, but when they approach estate planning, they’re looking for a “pill” to give them peace of mind for the time being.

A good homemade meal requires considerably more preparation time than your favourite fast-food. Similarly, a proper estate plan requires some intentional planning from the clients and the Notary practitioner.

Having a quick Will prepared could give you some peace of mind, but won’t provide you with a bullet-proof estate plan that will cover all the bases.

To make sure someone has all their “ducks in a row,” their estate plan should include all the areas of their life, such as accounting, investing, tax, and family-relationships dynamics. My approach in preparing our clients’ estate plan is to work in tandem with the clients’ other professionals such as their accountant, tax advisor, financial planner, and lawyer, so the estate plan accomplishes the clients’ goals from all those points of view.

I’m very passionate about solving challenging estate puzzles and rarely find an estate plan to be a straightforward solution. Moreover, instead of seeing “Will-making” as a one-time solution to all the estate planning needs, I prefer to look at an estate plan as a beautiful, diverse puzzle where the Will and Power of Attorney documents are just pieces of the big picture that is comprised of various day-to-day decisions, such as the way they decide to register their names on the title of their home.

Therefore, our final product is a custom-made, thorough estate plan that ultimately accomplishes our clients’ goals, such as helping protect their estate from any future legal battles or family discord, save taxes if that is possible, and even mend their struggling family relationships.

Ken and Gabriela P. (Lilián’s clients) “We became a ‘blended’ family 31 years ago. Finances were tight so we arranged a very simple Will through a volunteer service offered by a local church.

“We had a great in-depth assessment of our situation at Lilián’s office before proceeding to the drafting of any documents. Eventually, the division of our estate was tax-efficient and according to our specific situation. That could not have been achieved with a quick Will-drafting or by one of the “DIY” Will kits.

“Since major financial assets are held jointly and pass to a surviving spouse, the share arrangement covered the eventuality of joint demise and describes disbursement of remaining assets to the surviving family members.

“While we are a very close-knit family, all those arrangements were made to preclude any future conflict among our children.

“Therefore throughout all this painless process, our goal of wise planning to minimize additional pain and stress upon our demise has been achieved! To that end, our Notary has provided necessary and crucial help.”

Barry and Doris knew a,bout the Variation Act clauses in WESA (Wills, Estates and Succession Act, [SBC 2009] and resented the fact that the Court could change their Wills

on terms it thought appropriate. They felt they didn’t need Wills because they didn’t have much and the Court could intervene, anyway. But once they understood the lengthy BC Supreme Court process for applying to be an Estate Administrator for intestate deaths, they agreed it was better for their loved ones if they died with a Will than without one.

Forty-five-year-old Luba was on edge when she entered the office with her ageing parents. They had “Make a Will” on their bucket list and wanted to clear it off. Luba was an only child and even the contemplation of her parents’ death brought her to tears. But listening to her parents get deeply involved with the Will interview process prompted her to compartmentalize her grief and get involved with their planning that featured her significantly as their personal representative, trustee, and sole beneficiary.

Mandeep presented as a 40-ish woman who was well-established

financially and professionally. She wanted to do a Will but did not have a relative in the world! Her parents were deceased and she had no siblings, spouse, or children.

Mandeep had decided to have a trust company be her executor. We talked about how trust companies cannot charge more than the standard 5 per cent executor fee but many also charge administrative fees for every transaction they facilitate, including property sales. She agreed she could broaden her thinking about who could do that task for her, and perhaps see if any of her trusted colleagues at work would consider being her executor.

Adrienne and Andrew were in their early 80s. She was very wealthy, he less so. She wanted to leave him money to safeguard his accustomed lifestyle, but her strategic objective was to protect her legacy and ensure her wealth largely passed to her three daughters from her first marriage.

The ratio of women-to-men in Andrew’s age bracket in Kelowna is about 2:1. Adrienne worried that if she died first and left her estate under Andrew’s stewardship, he could be manipulated into another marriage; his new spouse (the “key risk”) would then take control of Adrienne’s money.

Adrienne’s current Will had set up a life estate and trust, which she felt could not defend against the key risk. I suggested an “Andrew Fund” (the “Fund”) to be administered by one of her daughters in collaboration with Andrew. Adrienne liked that idea but was concerned that if the Fund should grow over time, it would be a target for the key risk. Ultimately I believe she will leave three quarters of her money to her daughters and have the daughter who is executor receive and manage the fourth quarter as an “unofficial fund” for Andrew on a monthly basis until he dies. Thus Adrienne’s wealth would not be visible to anyone else. s

Let’s face it; no one wants to ponder his or her own morality.

More often than not, that means estate planning permanently rests at the bottom of the priority pile. Yet having an estate plan is about much more than death and taxes.

It’s about people. . . you and the people you care about. It’s about planning for those “what ifs” along your ageing journey.

• What if you die?

• What if you get injured or incapacitated?

• What if you become dependent?

Having a good estate plan starts by asking questions. The more you learn about what you want and how you can facilitate your wishes, the easier it is to move your estate planning to the top of your “to do” list.

I am always hopeful but never surprised at the lack of waving hands when our workshop presenters ask attendees, “Who has their estate planning documents in place and recently reviewed?”

There’s inevitably a multitude of reasons why not, but the answer that always resonates the most with me is this: “It’s so complex and I didn’t know where to start.”

But then I’m hopeful again because our estate planning workshops are always full and education is a great first step.

Here are five things you can do to get started.

• To get information about the planning process and documents, see if seniorserving organizations in your community are offering any free estate-planning information workshops.

• Make a list of questions for your BC Notary, financial advisor, and accountant.

• Talk with your loved ones so they are clear about what you want.

• If you don’t already have your team of professional advisors in place, ask friends and family for recommendations; then make a list of interview questions to help you choose the professionals who are right for you.

• Be curious. You don’t know what you don’t know, until you know what you should have asked!

The Eldercare Foundation believes strongly in the value of providing free education to help people navigate the journey of ageing. We engage experts from the health care, financial, and legal professions who gladly volunteer their time to lead free estate and financial planning workshops at the Wellness Centre, Adult Day Programs, and extended care facilities Eldercare supports.

Take a look to see what is available in your community.

If you haven’t gotten around to documenting your estate plan yet, don’t wait until that “what if” happens and your world is turned upside-down.

Armed with your list of questions and some basic knowledge, you’ll find it much easier to engage the right professionals to ensure that your estate plan reflects you and your wishes. s

Lori McLeod is Executive Director of Eldercare Foundation in Victoria, BC.

I am always hopeful but never surprised at the lack of waving hands when our workshop presenters ask attendees, “Who has their estate planning documents in place and recently reviewed?”

Legacy gifts power the possible.

With community members across BC leading the future with their values-based decisions, our children and grandchildren have more of a chance to fulfill their hopes and dreams.

BC Children’s Hospital Foundation receives legacy gifts from all corners of the province. We appreciate how our communities, through legacy gifts, recognize the vital medical treatment that their neighbourhood kids have received and how those children’s lives were saved or significantly improved.

Just think of how childhood cancer survival rates have changed in the last 50 years from 20 to 80 per cent. Significant strides in addressing childhood disease take place because thoughtful donors create their legacy gift by thinking ahead. We don’t rest on our laurels. The 20 per cent of children not surviving cancer are the propelling force for our researchers because every single child lost to the disease is one too many.

Children are 100 per cent our future. BC Children’s Hospital is the sole pediatric hospital in our province; all children with complex care needs are treated at BC Children’s.

In 2021 more than 138,000 kids from all across BC received expert care. Personalized medicine means each child receives treatment

tailored to their medical situation. That often encompasses a unique collaboration between our physicians and researchers, what we call “bench to bedside,” where research in the lab can provide clues to a novel medicine that specifically targets the child’s illness.

Our site is home to a research institute, acute care hospital, and mental health and rehabilitation centres, so each child benefits from a seamless care experience.

BC’s kids don’t go it alone, nor does our community of donors, fortunately. Notaries across our province understand the power of legacy and how the smallest community-members have the potential to be as mighty as adults.

Smithers exemplifies a community where our Notary friends have provided exceptional guidance to ensure that a loving legacy of care became reality. A leading Notary provided seamless services to ensure that donor intent was expressed accurately within a Will. Communities benefit from friendly conversations where thoughtful dreams are birthed in the accuracy of Will clauses.

A well-known Notary in Victoria not only assisted donors with their Will language, she took a further step to create her own future legacy to help tomorrow’s children. I could mention Chilliwack, Surrey, Kitsilano, and many more locations where BC Notaries help create a healthier future.

Our Foundation’s Legacy Team is available for in-depth conversations around areas the donor may wish to support. Our donors have told us that those conversations are vital starting points as they explore ideas, consider some pitfalls, and simply need an unbiased listening ear before heading to their BC Notary.

Based on insights from estate administration, here are my top three tips for any future legacy donor.

1. Engage the services of legal professionals who have a track record of estate planning to give you advice on various options that take care of your family and navigate any difficult circumstances you may foresee for the future.

2. Look at your current or anticipated wealth and think about the joy you could experience today, by giving to make a difference.

3. Activate tax benefits now. Our greatest joy is to thank donors. It is best summed up in the words of our Legacy Circle member who wrote after our recent Appreciation Tea, “I could feel and hear—in the voices of the care team—the love they have for each child. It was absolutely heart-warming—tears came to my eyes.”s

Hilary Beard is the Director of Gift & Estate Planning at BC Children’s Hospital Foundation.

Hilary Beard

Hilary Beard

The BC Law Institute (BCLI) has

documents.

Many Scrivener readers will be familiar with the original version that has been listed for a number of years as a practice resource on the websites of both The Society of Notaries Public and the Law Society, and used in teaching Notarial candidates in the Master of Arts Program in Applied Legal Studies at SFU.

The new version with the shorter title, “Undue Influence Recognition and Prevention: A Guide for Legal Practitioners” (the “new BCLI Guide”), has been revised and updated to reflect changes in law and practice since the original version appeared in 2012.

In particular, they include remote execution and witnessing of Wills, Powers of Attorney, and Representation Agreements by audiovisual technology, electronic Wills, and increased use of videoconferencing generally in legal practice in the postpandemic era.

The Notary Foundation funded the development of both the original and updated versions of the BCLI Guide; prominent members of the BC Notary profession played an important role in the process at both times.

Notaries Laurie Salvador and R. H. (Rick) Evans served on the counterpart committee that developed the original Guide.

The Project Committee, assembled by BCLI to assist in the revision and updating of the Guide, brought interdisciplinary expertise to bear on the exercise. Its members had extensive knowledge and experience in law, medicine, social work, psychology, and risk management. In the course of the project, BCLI and the Project Committee consulted with

• the professional governing bodies and professional associations;

• leading practitioners with a special interest and expertise in undue influence; and

• numerous community and national organizations with mandates related to the purposes of the Guide.

issued a new version of its Guide on recommended practices for dealing with potential undue influence surrounding Wills and other Personal Planning and EstateNotaries Morrie Baillie, Patricia Fedewich, and Hilde Deprez served on the Project Committee that developed the new BCLI Guide.

The list of “red flags” that should factor into a legal practitioner’s awaremess that undue influence might be in operation has been expanded in the new BCLI Guide to cover nonverbal cues more extensively with appropriate cautions, and new points specifically associated with videoconferencing in client communications.

The chapter entitled “What Is Undue Influence in Fact?” contains additional information on the medical and psychological aspects of undue influence, while the chapter on the law of undue influence covers nontestamentary undue influence more extensively.

Intercultural communication is another area expanded in the new BCLI Guide. Undue influence is a sensitive subject to address with any client and differences in language, attitudes, outlook, and family dynamics between and among cultures can make it much more so.

The new BCLI Guide informs legal practitioners of cross-cultural matters they need to bear in mind

when communicating with Indigenous clients, those belonging to other cultural communities, and their supporters.

Suggestions are made for conducting cross-cultural communication that is both respectful and effective in situations when practitioners find it necessary to explore the possibility that drafting instructions do not represent the client’s true wishes, but instead those of someone exerting undue influence on the client.

The new BCLI Guide contains an updated version of the popular Reference Aid consisting of a checklist that can be used in conducting client interviews and a flowchart.

As before, the Reference Aid is also being made available as a separate publication. Like the original version, the new BCLI Guide is available free of charge in PDF format or in print. The PDF may be downloaded from the BCLI website at www.bcli.org. s

Gregory G. Blue, KC, is a Senior Staff Lawyer for the British Columbia Law Institute.

The chapter entitled “What Is Undue Influence in Fact?” contains additional information on the medical and psychological aspects of undue influence...

An Advance Care Plan

(ACP) is a helpful tool that walks you through questions and considerations having to do with emergency and end-of-life care. The purpose of the ACP Kit is to help you get in touch with and express your wishes regarding your future health care decisions.

Those wishes and details can then be included in the creation of specific legal documents.

• Section 9 or Section 7 Representation Agreement

• Advance Health Care Directive

Note: At the present time, Medical Assistance in Dying (MAiD) cannot be included in those documents.

• Power of Attorney or Enduring Power of Attorney

If you have a Representation Agreement, you will have chosen a Representative to make some decisions on your behalf if you become incapacitated, Your Representative should be a person very familiar with your beliefs, values, and wishes regarding your future health care treatment so

he or she can make an informed decision based on what you would want in the situation.

3. Parent (either, may be adoptive)

4. Brother or sister (birth order doesn’t matter)

5. Grandparent

6. Grandchild (birth order doesn’t matter)

7. Anyone else related to you by birth or adoption

8. Close friend

9. Person immediately related to you by marriage (in-laws, stepparents, step-children, etc.)

If you know you would want someone lower on the list to be your TSDM, you should legally name that person as your Representative in a Representation Agreement. It is recommended that you choose an alternate Representative as a backup. The person(s) you choose must agree to be your Representative.

If you don’t have a Representative, a temporary substitute decision-maker (TSDM) will be chosen by your medical team. According to BC law, one individual must be approached— in the following order.

1. Your spouse (married, common law, same sex—length of time living together doesn’t matter)

2. Son or daughter (19 or older, birth order doesn’t matter)

Two types of Representation Agreement formats are in use in British Columbia. The BC government has specific Representation Agreement templates available, although some lawyers have developed their own formats; the completed forms must be witnessed by two people. Only one witness is required if the witness is a member-in-goodstanding of The Society of Notaries Public of BC or a lawyer.

The Section 7 Agreement allows the Representative to make personal care and some health care decisions as well as basic financial decisions. It does not allow the Representative to accept or refuse life support or life-prolonging medical interventions.

Both types of Representation Agreements are available

• online in the BC Government publication, “My Voice: Expressing My Wishes for Future Healthcare Treatment,” and

• through your local BC Notary and lawyer.

Most people appoint a Representative through completing a “Section 9 Enhanced Representation Agreement.” That legal document allows the adult to name a person who can make personal care decisions and some health care decisions for the adult, including decisions to accept or refuse life support or life-prolonging medical interventions.

Less common is the “Section 7 Standard Representation Agreement” that allows an adult with a lower level of capability— due to a developmental disability or injury/illness of the brain that affects cognitive ability—to do some advance planning. The Section 7 Agreement allows the Representative to make personal care and some health care decisions as well as basic financial decisions. It does not allow the Representative to accept or refuse life support or life-prolonging medical interventions.

This question often arises: How will hospital health care teams know you have a Representation Agreement and a Representative and/or an Advance Health Care Directive?

We advise the following steps.

1. Have vital conversations with your loved ones, your Representative, and your health care team.

2. Complete a Representation Agreement. Provide a copy

of it and your Advance Health Care Directive to your Representative and your primary health care provider. Ask your Representative to take those documents to the hospital when the time comes.

3. Paramedics are trained to look on the fridge for important medical documents. Either put your Representation Agreement and Advance Health Care Directive on the fridge or put a note on the fridge indicating where those legal documents can be found by the paramedics.

4. Ask your family physician to scan your documents and put them in your medical file.

5. You may also wish to upload those documents to a central repository, such as Nidus.ca or CARP Health 360.

Connie Jorsvik, a Vancouver-based BSN health care navigator and owner of Patient Pathways, offers detailed advice and guidance in her book Advance Care Planning, in which she states, “Advance care planning is for all adults of all ages and all stages of health. The earlier we begin those conversations, and the planning that goes along with them, the more natural, less scary, and less fraught with emotion the planning process is.”

Make sure to revisit your legal documents and ACP Kit every 3 years or when your medical situation changes. Most important, make sure the people close to you are aware of your values and wishes. Choose a Representative who will honour them. s

https://www.dyingwithdignity.ca/ education-resources/advance-careplanning-kit /

Alex Muir is Chair, Metro Vancouver Chapter, Dying With Dignity Canada (www.dyingwithdignity.ca).

There are two certainties in life, one is birth and the other is death. Both have a celebration and a gathering of friends and family. Both events inspire emotions in our lives . . . happiness with a newborn child or sadness in the case of death.

The natural order of life is parents pass away before their children. As parents, we nurture, love, educate, and care for our children for many years as we watch them grow into young adults with the hope that someday, they too will become parents, completing what is commonly called “the Circle of Life.”

But when the natural order is altered, either through illness or accident, parents endure the greatest hardship of all, the death of their child. I joined that group of parents 2 years ago last July, when my 29-year-old daughter passed away after a year-long struggle with cancer.

When Sydney was young, our family trips to China, England, Ireland, and the Jersey Channel Islands sparked her sense of adventure, leading her postgrad to South East Asia and Australia on a solo journey that had been her dream for many years.

Sydney was in the prime of her life. She met her soulmate Darragh while travelling in Cambodia and they ended up living in Sydney,

Australia. After a year together, the couple took a Christmas trip to Ireland to meet his family.

In early 2019 while living and working in Australia, Sydney began feeling unwell. She was diagnosed with cervical cancer. Her diagnosis brought her home to Vancouver to live with my wife Mary and me.

It was a challenging time. She started radiation and chemotherapy. When her results continued to come back with increasingly serious results, I don’t think she was ready to hear it; she had no point of reference that would have allowed her to accept the severity of that type of news.

Sydney didn’t accept the fact that her cancer was terminal and did everything in her power to fight the inevitable. The cancer metastasized early and her treatments became life-extending rather than life-saving.

I had long accepted the eventuality of her passing and knew that at any time things would take a turn for the worse. We managed at home for a while. Several trips to

emergency, and an extended stay in the hospital, made it clear that Sydney needed to be admitted to the local Victoria Hospice in the Richmond Pavilion at Royal Jubilee Hospital where they could help her manage her complex symptoms and pain.

I know she didn’t want to go. It was hard for her to be moving to a place where people were dying when all she wanted was to get better and live many more years.

Due to complications and the need for postsurgery monitoring, Sydney’s end-of-life care took place in acute care at Victoria’s Royal Jubilee Hospital with the constant support of the Palliative Care Team. She received the gifts of kindness and compassion from the staff and had the care she truly needed. We were touched by their genuine and amazing dedication.

I am sure parents living with and caring for their children, as they fight for their lives with a terminal disease, struggle with helping their child prepare for their passing. I know it was the hardest thing to broach the subject, never mind complete the work.

Having been executor for both my parents, whose Wills and legal affairs were up to date, I knew what had to be done. But this was different . . . this was my daughter and she was not ready to talk about dying or anything to do with it. That included her Will. That discussion just wasn’t part of her daily mindset.

Of all the responsibilities we have as a parent, beyond all the decisions and advice we provided in their lives, having our children create a Will so their affairs can be wound up in an orderly fashion is so important and necessary.

As Sydney’s health deteriorated and her medications were increased to bring comfort and rest, I

consulted my friend and BC Notary to ask for help to prepare her Will. I knew it would be a difficult time emotionally, when I would be needed to perform the least desirable duty as a parent, but it was one duty I felt obliged to do.

Sydney did finally acknowledge the extent of her condition and calmly drifted into a peaceful, life-ending sleep. She passed away comfortably in Palliative Care with her partner and her family present. Our brave and loving daughter, sister, and partner Sydney was in a wonderful place for her final days of life.

The last night I spent in the hospital, we had only a few moments when Sydney was awake. Her last words to me were, “I love you, Dad.” That’s the best wish anyone can have fulfilled, to be loved . . . and I was.

Hoping Sydney would make it to her next treatment, Mary and I had signed onto a waiting list for a care dog to support Sydney. News of the pup’s birth came within days of Sydney’s passing.

Some children and young adults are able to accept their fate and communicate and share stories and memories with their parents, helping them transition to accepting the day their child will pass. But my daughter would not do that and I suspect many young adults fall into that category.

Sydney and I never talked about her dying. She spoke only of getting better, living her life with her partner, and someday maybe being a parent herself. I wish I could have shared a few stories and relived the happy times. I wish I could have laughed one more time with her.

I wish I knew where to spread Sydney’s ashes—where that happy place would be. But I was able to do what is the most important step—secure her wishes and complete the signing of her Will. That allowed me to carry out my duty as her executor and her father. Getting the Will signed brought me some much-needed peace of mind.

Mary and I proceeded with the adoption and brought home Dylan, a bouncy black Wheaton TerrierPoodle—a ray of light at the end of a dark tunnel. We feel like a hole in our hearts is being filled. He is most loving and affectionate and he lifts our spirits daily with his playful antics. I believe Dylan has Sydney’s spirit in his wee soul.

I trust that sharing our family’s care journey will ease the fear and mystery about palliative and end-oflife care for patients and caregivers finding themselves on a similar path. s

James Spack is a former Technology and Marketing Consultant to the BC Notaries Association. Sydney 2017 Pilates Studio Office Manager, West Vancouver

Palliative and hospice care teams assist patients to find peace and calm in their final days.

People should understand that those specialized care teams deliver endless amounts of comfort, care, and love with a heartfelt passion for helping their patients.

Definitions of Palliative and Hospice Care

Palliative Care is an approach that improves the quality of life of patients—adults and children— and their families who are facing problems associated with serious and/or life-limiting illness. It prevents and relieves suffering through the early identification, correct assessment, and treatment of pain and other problems, whether physical, psychosocial, or spiritual.

Palliative care uses a team approach to support patients and their caregivers. It offers a support system to help patients live as actively as possible until death.

ultimate goal of hospice palliative care is to provide a refuge where patients and families can focus on being together through to endof-life, with the support of specialized care teams and volunteers.”

Hospice Care (sometimes known as “hospice palliative care”) is whole-person care that lies within palliative care for those at the end stage of a life-limiting illness, when life expectancy is weeks to short months. An interdisciplinary team that includes specially trained hospice volunteers provides clinical care and comfort, addressing specific physical, psychological, social, spiritual, and practical issues with a focus on quality

of life through to death and into bereavement for the families.

In hospice, the furnishings and lighting are more home-like, less clinical, and the pace is decidedly different than an acute hospital ward. According to Jill Gerke, Island Health’s Director for Palliative and End-of-Life Care, having dedicated hospice spaces across Vancouver Island has been a key priority for Island Health.

“Over the last year in particular, through partnerships with local community hospice organizations, we have been able to increase the options for specialized end-of-life care for patients and their families through the increase of hospice beds in Victoria Hospice and the new Cowichan Hospice House in Duncan,” notes Gerke.

“The ultimate goal of hospice palliative care is to provide a refuge where patients and families can focus on being together through to end-of-life, with the support of specialized care teams and volunteers.”

“The

Palliative and end-of-life care providers are uniquely kind and caring individuals who provide understanding, peace, and compassion that keeps the dignity of dying in the hands of the person and the family.

Dr. Jody Anderson, Medical Director for the program at Island Health, says quality end-of-life care doesn’t just address the patient’s care needs; it addresses the fundamental need of families to know their loved ones are safe and comfortable, and not in pain.

“Our palliative care teams are well aware that when someone has a life-limiting illness, it can be overwhelming for the patient and their loved ones,” says Anderson. “Our role is to provide practical support to all involved to help them navigate one of the most difficult experiences of their lives, as painlessly as possible. It is a privilege to care for patients and their (chosen) families at this time.”

Both palliative care and hospice care are offered by specialized teams in hospital, long-term care, hospice settings, and in an individual’s home. s

For more information www.islandhealth.ca/learn-abouthealth/end-of-life-care-hospice

Audrey Larson, a communications and engagement consultant with Island Health, is grateful to live, work, and learn in Coast Salish territory. Audrey believes wholeheartedly in the power of collective impact and strives to support community connections that create better health for all.

We have cited parts of Audrey Larson’s article published in Island Health Magazine, Spring 2021, by Island Health Communications.

You and your clients can help end animal cruelty and comfort animals in need. Contact us today to learn more about how they can leave a gift in their Will.

Charitable Number: 11881 9036 RR0001

Clayton Norbury cnorbury@spca.bc.ca 1.855.622.7722 ext. 6059 foreverguardian.ca

This year, help them plan to share their everlasting love.

As most practitioners will be aware, federal legislation in the form of amendments to the Criminal Code of Canada, (i.e., the Medical Assistance in Dying Act, S.C. 2016 c.3), that provides for medical assistance in dying (MAiD) has been in place since 2016.

The legislation was amended in March 2021 by the Criminal Code (Medical Assistance in Dying) Amendment Act, S.C. 2020, c.2 (a.k.a. Bill C-7) to allow access to MAiD for those whose death is not imminent but who otherwise qualify for the procedure. In 2019, the original and more restrictive provisions that required a natural death be reasonably foreseeable before MAiD could be provided were found to be unconstitutional by the Quebec Superior Court (see, Truchon and Gladu v. the Attorney General [Canada] and the Attorney General [Quebec] 2019 QCCS 3792), and the Court ordered the governments of Canada and Quebec to change the offending provisions of their legislation. The Court held that the provisions violated sections 7 (life, liberty, and security of the person) and 15 (equality) of the

Canadian Charter of Rights and Freedom, and could not be justified under section 1 of the Charter. The governments of Canada and Quebec subsequently changed the offending provisions of their legislation.

on MAiD time to consult, consider, and resolve a number of significant issues only one of which is the vexed issue of a mentally disordered adult’s capacity to request MAiD.

At the time of writing, the March 2023 expiration date has not been changed despite the opposition mounted by some health care providers who want more time to prepare. There is some indication the federal government is listening to the concerns; the sunset clause, section 241.2(2.1) of the Act, may be extended when Parliament resumes in 2023.

The amending (2021) legislation has created a twotrack system for MAiD requests based upon whether or not an adult’s natural death is reasonably foreseeable. In a nutshell, if a natural death is reasonably foreseeable, the procedure contains fewer obstacles than if it is not reasonably foreseeable. The legislation has also addressed the issue of whether MAiD should be available to an adult who is experiencing a mental disorder, (i.e., a mental illness), as their primary underlying condition. Adults with mental disorders have been temporarily ineligible for MAiD for a 2-year period, expiring March 17, 2023. That has allowed the Special Parliamentary Joint Committee

According to the most recently available Health Canada Annual Report on MAiD, (i.e., the third Annual Report, released in 2022), there were 10,064 MAiD deaths during the 2021 calendar year. By the end of that year, there had been a total of 31,664 MAiD deaths (since 2016) and the procedure had been used in every Canadian jurisdiction. In the vast majority of cases, assistance has been provided by physicians (especially family practitioners) and (to a lesser extent) nurse practitioners, with a minimal number of (permissible) self-administered deaths using prescribed medications. Those interested in a wealth of detailed information about the practice of MAiD in Canada are urged to read the Health Canada report.

Those interested in...the practice of MAiD in Canada are urged to read the Health Canada report.

The evident popularity of MAiD is reflected in the steady rise in MAiD deaths as a percentage of all deaths in the country. British Columbia is a province with one of the highest percentages of such deaths each year. By 2018, the BC percentage of MAiD deaths stood at nearly 2.5 per cent compared with the national average of 1.5 per cent. The BC percentage had risen to 3.3 per cent of all deaths in Canada by the end of 2021.

The popularity of the procedure is a welcome development for many but it is also creating some logistical and other problems. In October 2022, the National Post pointed to access problems caused by a national shortage of MAiD practitioners. Apparently, many were stepping away from involvement because of the perceived moral hazards associated with the ever-widening eligibility criteria including the fear that MAiD requests were being driven by social and economic, rather than purely medical, factors. In this regard, concerns have been raised about the possibility that some staff working with Veterans Affairs have suggested MAiD as an option to clients seeking additional services.

Regardless, MAiD is clearly the procedure of choice for many older Canadians who wish to end their lives because of intolerable medical conditions. According to Health Canada, the age range of participants was 56 to 90 years (the average age was 72), and they were almost evenly split along gender lines (51 per cent were men). Cancer-related illnesses were the most frequent reason for seeking MAiD but some participants had unbearable neuro-degenerative disorders, (e.g., Alzheimer disease), and some were suffering from severe, unbearable circulatory/ respiratory conditions.

As most readers will be aware, the MAiD provisions in the Criminal Code intersect with provincial health care consent and related legislation and, probably more important, for British Columbia, the legislation governing the creation and use of Advance Health Care Directives as well as Representation Agreements for health care and personal care decision-making. It is highly likely that the latter instrument will be favoured by those who want to plan for MAiD in the Province because of the numerous safeguards built into that legislation, the existing and widespread popularity among users, and the levels of familiarity on the part of both medical and legal practitioners. We are not yet at the point where the option is permissible for those seeking MAiD but it is clearly under active consideration.

The issue of advance requests for MAiD including Advance Directives and other instruments for planning for future health and personal care has been addressed by the federal government. The latter, wisely, commissioned the independent Council of Canadian Academies to create expert panels to examine and provide reports (but not recommendations) in three important and controversial areas.

1. Whether MAiD should be available to “mature minors”

2. The issue of Advance Directives/ planning, especially in the case of mentally competent adults in the early stages of, for example, neuro-degenerative disorders such as Alzheimer disease or Amyotrophic Lateral Sclerosis

3. The situation affecting individuals who are suffering from mental disorders who seek MAiD

The commissioned work was completed, and the required reports were submitted to the federal government at the end of 2018, with the hope that those (and other) issues would be addressed as part of the mandatory review of MAiD in the Spring of 2020. No one anticipated the impact of the COVID-19 pandemic that has frustrated a number of legislative and policy initiatives at both the provincial and the federal levels. At the time of writing however, (November 2022), the MAiD review appears to be well under way through the Joint Parliamentary Committee on MAiD.

When it is permissible, there will be an obvious impact on legal practice, including Notarial Practice. Existing clients will likely seek to add specific MAiD clauses to their incapacity planning documents and new clients will likely seek assistance with the creation of new documents.

While the focus has been on those with mental disorders, (primarily because of the Truchon decision), it is highly likely that advance planning, (e.g., Advance Directives), will be the next item under consideration. That is because of the apparent popularity of the option and the potential

Regardless, MAiD is clearly the procedure of choice for many older Canadians who wish to end their lives because of intolerable medical conditions. According to Health Canada, the age range of participants was 56 to 90 years (the average age was 72), and they were almost evenly split along gender lines...

for a fusion of existing provincial personal planning legislation with the new federal legislation governing MAiD.

At the same time, in British Columbia the fusion will not be as simple as adding MAiD provisions to existing statutes such as the Representation Agreement Act. The federal legislation requires that a person seeking MAiD be an adult, (i.e., at least 18 years of age). The relevant provincial legislation in BC, (and some other jurisdictions), sets the age of adulthood at 19; and that affects both Representation Agreements and Advance Health Care Directives. The BC provincial legislation sets out a rebuttable presumption of capacity (or capability) in the case of adults, (i.e., those who are 19 or older), and may require qualification in the case of MAiD applications to ensure appropriate protections for adults with diminished capacity.

Similarly, the existing statutory test of in capacity (in capability) in health care matters and the procedure for assessing incapacity will undoubtedly have to change, in as yet undetermined ways. That may involve a new test of capacity (as opposed to incapacity) specifically for MAiD applicants. That important issue has been reviewed by The Canadian Association of MAiD Assessors and Practitioners (CANAP) which in April 2020 produced a useful report focused on the issue of capacity to consent to the procedure (see the reading list at the end of this article). Their report includes guidelines that constitute a set of best practices for those working in the field but do not have the force of statute or regulation at this time.

Clearly, medical assistance in dying is an extremely active area of Canadian law and practice. It contains controversial aspects that

create concerns in some quarters; a handful of heath care institutions (especially those affiliated with certain faith communities) have been reluctant to allow practitioners to use their facilities. Perhaps the most high profile case was that involving the Delta Hospice Society in BC which, in April 2022, was required to leave a particular government-funded hospice in the Vancouver area for refusing to offer MAiD (see Farrish v. Delta Hospice Society, 2020 BCCA 312).

track system with associated procedures,

• one that affects those for whom death is reasonably foreseeable, (i.e., imminent);

• the other affecting those for whom death is not reasonably foreseeable).

The first track is a simplified version of the previous procedure; for example, in cases where death is reasonably foreseeable, a final consent to MAiD will not be required if the adult could lose the capacity to make decisions before MAiD can be provided.

The second track is not simplified and reflects the federal government’s attempt to ensure appropriate safeguards are in place especially to protect adults with disabilities. Those wanting more detailed information should consult the resources listed at the end of this article.

That case was resolved in favour of those wishing to provide MAiD. On the other hand, there are organizations that favour a dramatic expansion of MAiD, most notably the Quebec College of Physicians which—according to a recent report in the National Post (October 11, 2022)—has suggested that MAiD be available to address issues relating to infants aged up to 1 year who are born with severe malformations and other grave and severe conditions where the prospect of survival is extremely low.

Not surprisingly, that proposal was vehemently opposed by disability organizations, (mainly Inclusion Canada), that stopped short of drawing direct parallels with the euthanasia programs introduced in Nazi Germany during the 1930s.

In a nutshell, the new legislation has introduced a two-

Just to remind readers, adults can receive MAiD if they satisfy five criteria.

1. They must be eligible for health care services in Canada.

2. They must be at least 18 and mentally capable of making health care decisions.

3. Their request for MAiD must be voluntary.

4. They must give informed consent to the procedure.

5. They must have a grievous and irremediable medical condition that must be serious and incurable and in an advanced state of irreversible decline, and they must be experiencing enduring physical or psychological suffering that is intolerable to them and that cannot be relieved in a manner acceptable to them.

It should be obvious that there is more in the offing and practitioners

Clearly, medical assistance in dying is an extremely active area of Canadian law and practice.

are likely to benefit significantly from a relatively close monitoring of developments, especially with respect to Advance Directives and Representation Agreements, and particularly over the next 12 months.

Further Reading Canadian Association of MAiD Assessors and Practitioners. 2020, Assessment for Capacity to Give Informed Consent for Medical Assistance in Dying: Review and Recommendations. Vancouver, CAMAP.

Council of Canadian Academies, 2018, Medical Assistance in Dying: The State of Knowledge on Medically Assistance in Dying for Mature Minors, Advance Requests, and Where a Mental Disorder is the Sole Underlying Medical Condition. Council of Canadian Academies. Ottawa.

Gordon, R.M., 2021. The Annotated British Columbia Incapacity Planning, Adult Guardianship, Medically Assisted Dying, and Related Legislation. Toronto, Thomson Reuters; especially Chapter 4.

A 2023 edition of the Gordon text will be available in the Spring 2023, once MAiD is available to adults who have mental disorders as their underlying medical condition.

It is also helpful to monitor the online journal “Policy Options” for the work of Professor Jocelyn Downie from the Health Law Institute at Dalhousie Law School, and especially the related end-of-life project (see, eol.law.dal.ca).

Practitioners should also be aware of the information about MAiD procedures in BC that is available on the provincial Ministry of Health website. s Dr. Robert Gordon is Professor Emeritus in the School of Criminology, Simon Fraser University.

•

•

•

•

•

•

•

•

•

•

I’m trained as a family doctor. I did 10 years cradle-to-grave medicine, general practice, and then focused exclusively on maternity and newborn care for another 12 years.

Ron Usher: You’ve seen the whole spectrum. Through the births of my own three children, I know how remarkable maternity practice is. My sister-in-law has just retired from a long career as a midwife.

In

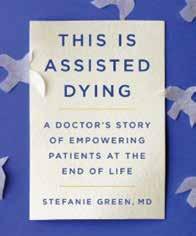

Ron Usher: Dr. Green, thanks so much for joining me today. This interview is prompted by positive reviews of your new book, This is Assisted Dying: A Doctor’s Story of Empowering Patients at the End of the Life, published by Scribner. Congratulations.

The Scrivener magazine is read by many legal professionals in BC and others. Let’s focus a bit on your career history.

Stefanie Green: That is a very privileged job. I love my years in maternity care.

Ron Usher: What you’re doing now is also a remarkably privileged position. Please tell us about it.

Stefanie Green: There’s a lot of paradox in the work I do right now. I feel my time in maternity really helped prepare me for end-of-life work. The skill set was remarkably transferable. I didn’t realize that when I began.

Doing maternity care, I walk into the room for the delivery as a knowledgeable expert to help guide the family through one of the most intense and important days of their lives . . . it’s very emotional, very intense . . . lots of family dynamic at play.

Ron UsherI’m not the most important person in the room. Something really impressive is going on. After the moment I place the baby onto the chest of the mum, I don’t stay to have champagne with the family. I gracefully withdraw.

What I just said about maternity care can be equally said about end-of-life and assisted dying. It is also one of the most emotional and important days . . . with lots of family dynamics. I’m there as a knowledgeable guide and a witness. There’s a time when I should respectfully withdraw from that grieving moment. Being invited into that very intimate space with families, whether it’s a birth or a death, is incredibly privileged work and very, very meaningful. To be able to facilitate someone’s final wish is a remarkable invitation.

Ron Usher: Our BC Notary members facilitate Personal Planning. They assist people to prepare Wills, Representation Agreements, Advance Directives, and Powers of Attorney—legal documents about the unknown future.

When you sit down with someone who’s completed a request form for assistance-in-dying, Dr. Green, that moves from theoretical

planning to very precise planning. I imagine that’s quite a different step psychologically for people.

Stefanie Green: Yes. I’ve never practised law or been a Notary, but I imagine some pretty vulnerable conversations take place in those offices. You talk to your clients about their wishes and the person they want to speak for them in future. You encourage people to go through that thought process; you’re certainly inspiring that kind of conversation internally with people and probably with their loved ones, too.

There’s definitely some overlap between your consultations with your Notary clients and my medical consultations.

When someone comes to ask me for assisted dying, they’re very much in the moment. For a person to qualify, a list of things needs to be true. One of them is the patient is suffering intolerably. Being a physician is a very special position. I am with someone who has come to me at their most vulnerable.

Society has given doctors an aura of authority and respectability and trustworthiness. People will tell us their deepest fears and greatest secrets and explain why they want to have an assisted death, what they’re trying to avoid, and what they’re experiencing. They are very much in the moment and in the thick of it.

Ron Usher: As the story goes, no one at their death says, “I wish I had spent more time at the office.”

That’s what I especially value about your book. You tell the stories accurately. People are having

conversations about topics we normally don’t talk about. You’ve noted in a couple of the interviews in your book how you found yourself needing to speak plainly and freely.

Stefanie Green: Yes, very much so and patients really appreciate that. They’ve often not had the opportunity to sit down with a health care practitioner who’s willing to be that frank with them.

North Americans are not very good about talking about death and dying in general. I’d like to facilitate change. I think some of that change has to come from the clinicians, as well.

Many specialists are not comfortable talking plainly about what to expect and what happens if the treatment doesn’t work and what the normal or natural dying process looks like and what the person can expect along the way. Sometimes people come to me to ask for an assisted death, but they’re not well informed about what palliative care can offer them and how a natural death can be supported. Part of my job is to explain that process fully so they can make a more-informed decision.

Some people are surprised; they say, well, that actually doesn’t sound quite so bad . . . I could do that. If I had that kind of support, then I wouldn’t need to call you, Doctor.

And that’s a win for me. When you don’t need to choose one or the other, you can go down whatever path. And if it’s not working for you, you can always call me to see what we can line up for you.

When someone comes to ask me for assisted dying, they’re very much in the moment. For a person to qualify, a list of things needs to be true.

Frank conversations are essential for informed consent and they’re also essential for people. Their families are very, very grateful for that frank and honest conversation.

Ron Usher: You bust through all the euphemisms and the dancing around and get to the point.

There’s a marvellous little paragraph in Moby Dick where Ishmael makes a Will after a particularly scary whaling experience. It’s a beautiful description of the relief he feels. He was directly confronted with the possibility of his own death. When he’s taken care of business, he just feels relief.

Certainly my own experience drafting large numbers of Wills is that people, even if they were hesitant, feel very grateful when the Will is done and for the plain talk and the chance to have confronted their wishes.