www.ethanolproducer.com PAGE 20 Making PHEVs E85 Ready POWER PAIRING PLUS DOE Embarks On Carbon Management Mission PAGE 12 Summit's Rastetter On the Transformative Potential of CCS PAGE 28

INNO VA TION is more than products Contact a representative today. cte-global.com Introducing CTE Global Educational Programs CTE Global leads innovation from the ground up. Led by our team of industry experts, we guide you through hands-on training and plant-specific statistical analysis, then o er insights and best practices to improve your workforce at every turn.

Bryan

12 SEQUESTRATION

Digging Deeper: Ethanol’s Role In the Carbon Age

Supporting CCS becomes high DOE priority

By Luke Geiver

20 MARKET

Converting Engines, and the E85 Narrative Making PHEVs compatible with ethanol's highest blend

By Luke Geiver

By Luke Geiver

Facing the Challenge of Change

Summit's Bruce Rastetter on the transformative potential of CCS

By Katie Schroeder

By Katie Schroeder

32 LAB

Staying Up to the Test

Marquis Energy lab manager

talks tech, shares current priorities

Questions by Katie Schroeder

34 OPERATIONS

A Digital Workflow Solution

Golden Grain Energy adopts Shiftconnector platform

By Natae Shreeves

4 | ETHANOL PRODUCER MAGAZINE | OCTOBER 2023 DEPARTMENTS 5 AD INDEX/EVENTS CALENDAR 6 EDITOR'S NOTE Not Giving Up On the Necessary By

8 VIEW FROM THE HILL It’s Time for Flex Fuel Fairness By Geoff Cooper 9 GLOBAL SCENE Workshops Held to Boost Ethanol Consumption in Asia By Mackenzie Boubin 10 BUSINESS BRIEFS 39 MARKETPLACE Ethanol Producer Magazine: (USPS No. 023-974) October 2023, Vol. 29, Issue 10. Ethanol Producer Magazine is published monthly by BBI International. Principal Office: 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Periodicals Postage Paid at Grand Forks, North Dakota and additional mailing offices. POSTMASTER: Send address changes to Ethanol Producer Magazine/Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, North Dakota 58203. Contents

THE COVER

Tom

ON

Escape

in hybrid electric vehicle and converting it to run on E85, the Renewable Fuels Association has been

it

events

the country,

recently

Farm Progress Show in Illinois. PHOTO: RFA OCTOBER 2023 VOLUME 29 ISSUE 10 12 20 28 32 FEATURES

After buying a Ford

plug-

displaying

at

across

most

at the

28 PROFILE

CONTRIBUTION

Advertiser Index

EDITORIAL

President & Editor

Tom Bryan tbryan@bbiinternational.com

Online News Editor

Erin Voegele evoegele@bbiinternational.com

Staff Writer

Katie Schroeder katie.schroeder@bbiinternational.com

DESIGN

Vice President of Production & Design

Jaci Satterlund jsatterlund@bbiinternational.com

Graphic Designer

Raquel Boushee rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan jbryan@bbiinternational.com

Vice President of Operations/Marketing & Sales

John Nelson jnelson@bbiinternational.com

Senior Account Manager/Bioenergy Team Leader

Chip Shereck cshereck@bbiinternational.com

Account Manager

Bob Brown bbrown@bbiinternational.com

Circulation Manager

Jessica Tiller jtiller@bbiinternational.com

Marketing & Advertising Manager

Marla DeFoe mdefoe@bbiinternational.com

EDITORIAL BOARD

Ringneck Energy Walter Wendland

Little Sioux Corn Processors Steve Roe

Commonwealth Agri-Energy Mick Henderson

Aemetis Advanced Fuels Eric McAfee

Western Plains Energy Derek Peine Front Range Energy Dan Sanders Jr.

Upcoming Events

2023 National Carbon Capture Conference & Expo

November 7-8, 2023

Iowa Events Center | Des Moines, IA (866) 746-8385 | www.nationalcarboncaptureconference.com

The National Carbon Capture Conference & Expo is a two-day event designed specifically for companies and organizations advancing technologies and policy that support the removal of carbon dioxide (CO2) from all sources, including fossil fuel-based power plants, ethanol production plants and industrial processes, as well as directly from the atmosphere. The program will focus on research, data, trends and information on all aspects of CCUS with the goal to help companies build knowledge, connect with others, and better understand the market and carbon utilization.

2024 International Biomass Conference

& Expo

March 4-6, 2024

Greater Richmond Convention Center | Richmond, VA (866) 746-8385 | www.biomassconference.com

Organized by BBI International and produced by Biomass Magazine, this event brings current and future producers of bioenergy and biobased products together with waste generators, energy crop growers, municipal leaders, utility executives, technology providers, equipment manufacturers, project developers, investors and policy makers. It’s a true one-stop shop – the world’s premier educational and networking junction for all biomass industries.

2024 International Fuel Ethanol Workshop & Expo

June 10-12, 2024

Minneapolis Convention Center | Minneapolis, MN (866) 746-8385 | www.fuelethanolworkshop.com

Celebrating its 40th year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine—that maintains a strong focus on commercial-scale ethanol production, new technology, and near-term research and development. The event draws more than 2,000 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

2024 North American SAF Conference & Expo

September 10-12, 2024

Saint Paul RiverCentre | Saint Paul, MN (866) 746-8385 | www.safconference.com

Please recycle this magazine and remove inserts or samples before recycling

COPYRIGHT © 2023 by BBI International

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer.com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to editor@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space. TM

The North American SAF Conference & Expo, produced by SAF Magazine, in collaboration with the Commercial Aviation Alternative Fuels Initiative (CAAFI) will showcase the latest strategies for aviation fuel decarbonization, solutions for key industry challenges, and highlight the current opportunities for airlines, corporations and fuel producers. The North American SAF Conference & Expo is designed to promote the development and adoption of practical solutions to produce SAF and decarbonize the aviation sector.

ETHANOLPRODUCER.COM | 5 2023 National Carbon Capture Conference & Expo 36 2024 Int'l Fuel Ethanol Workshop & Expo 38 Beyond (a Christianson Company) 24 Check-All Valve Mfg. Co. 15 CTE Global, Inc. 3 D3MAX LLC 18-19 Fagen, Inc. 17 Fluid Quip Mechanical 35 Fluid Quip Technologies, LLC 23 Foundation Analytical Laboratory 2 Growth Energy 22 IFF, Inc. 7 Keit Industrial Analytics 14 Lallemand Biofuels & Distilled Spirits 27 Midland Scientific Inc. 16 Natwick Associates Appraisal Services 25 Phibro Ethanol 31 SAFFiRE Renewables 39 SGS North America, Inc. Agricultural Services 26 & 37 Sicgil Industrial Gases Limited 10 Victory Energy Operations, LLC 40 Zee Loffier 11

Not Giving Up On the Necessary

Those who doubt the veracity of our industry’s drive toward net zero don’t understand our determination to get there. Goals, after all, are validated by persistence, pressing through the hard parts. We all know corn ethanol can someday attain carbon neutrality, but not without credit for low-carbon farming, and certainly not without sequestering our fermentation CO2 . For the latter to happen broadly, pipelines and injection sites must be community supported, approved and built. The companies trying to get these things done aren’t alone. Hundreds of ethanol producers are on their side, and the U.S. Department of Energy is, too.

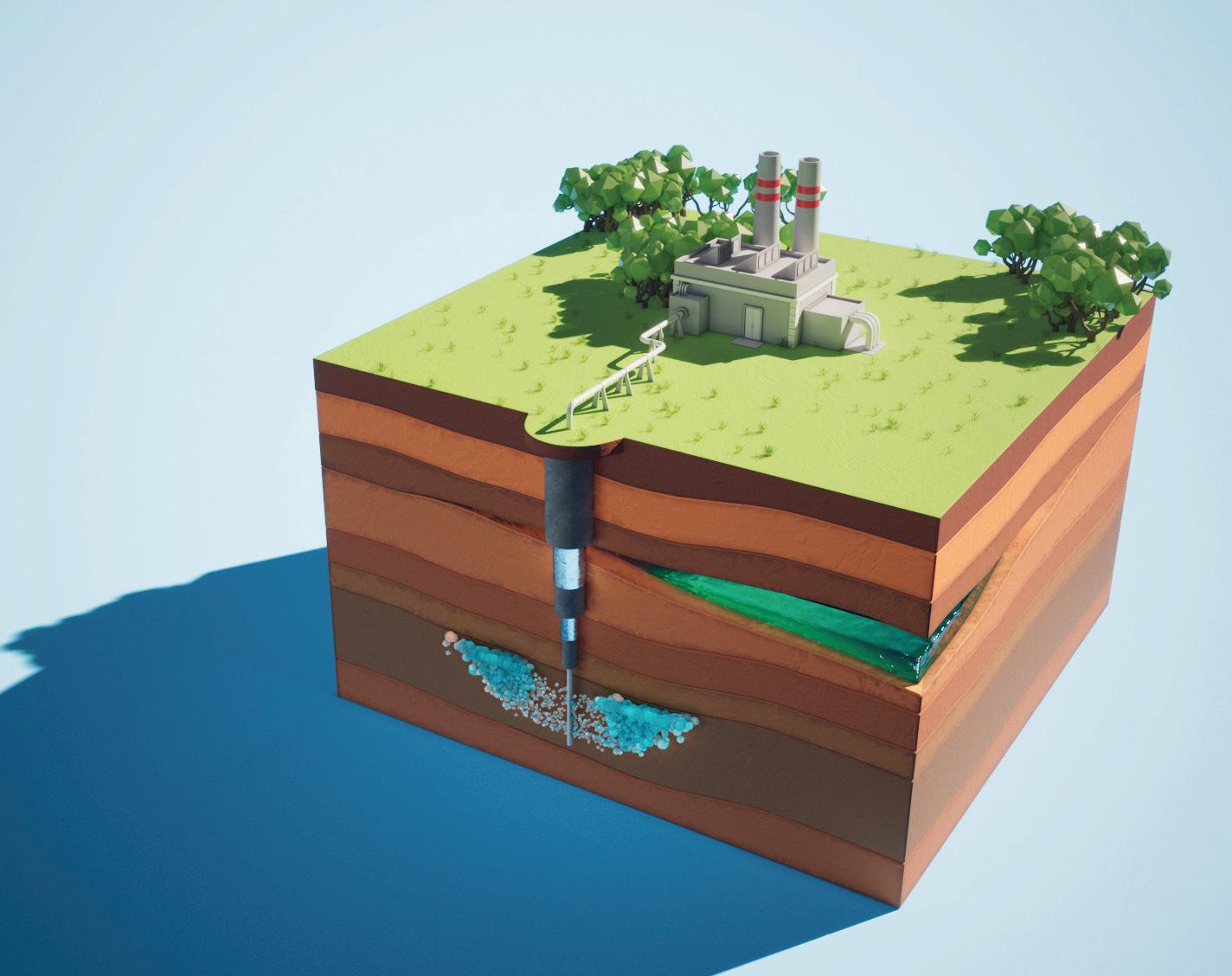

In “Digging Deeper: Ethanol’s Role In the Carbon Age,” on page 12, we look at federal supports for carbon capture and sequestration (CCS) in the context of the DOE’s overarching carbon management vision. We also report on the groundwork to develop pipelines and storage hubs in places like North Dakota—the planned destination for the CO2 that 34 Upper Midwest ethanol plants are eager to capture and deliver. As one DOE official put it, carbon management has entered an “unprecedented time,” with the 45Q tax credit for sequestration and utilization in place for a decade, hundreds of would-be CCUS projects, many in ethanol, are lining up across the country. Pipeline development remains challenging, but it’s sure nice to have the DOE offering to help iron out looming questions about infrastructure and community engagement.

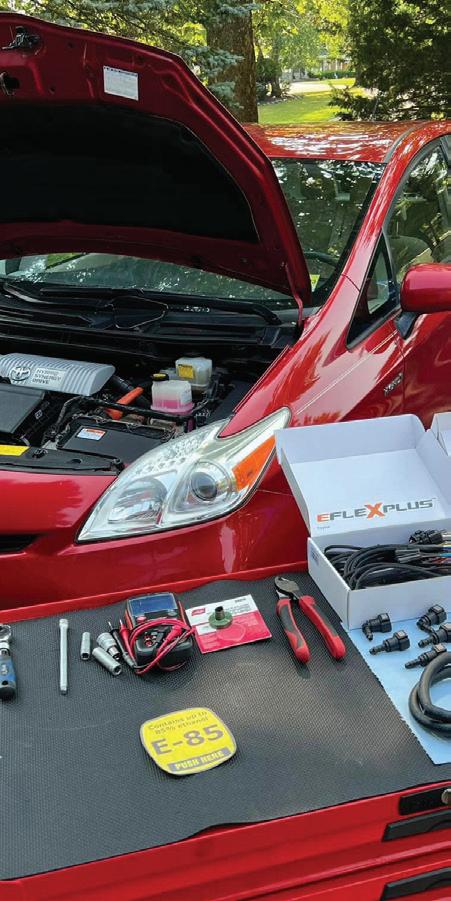

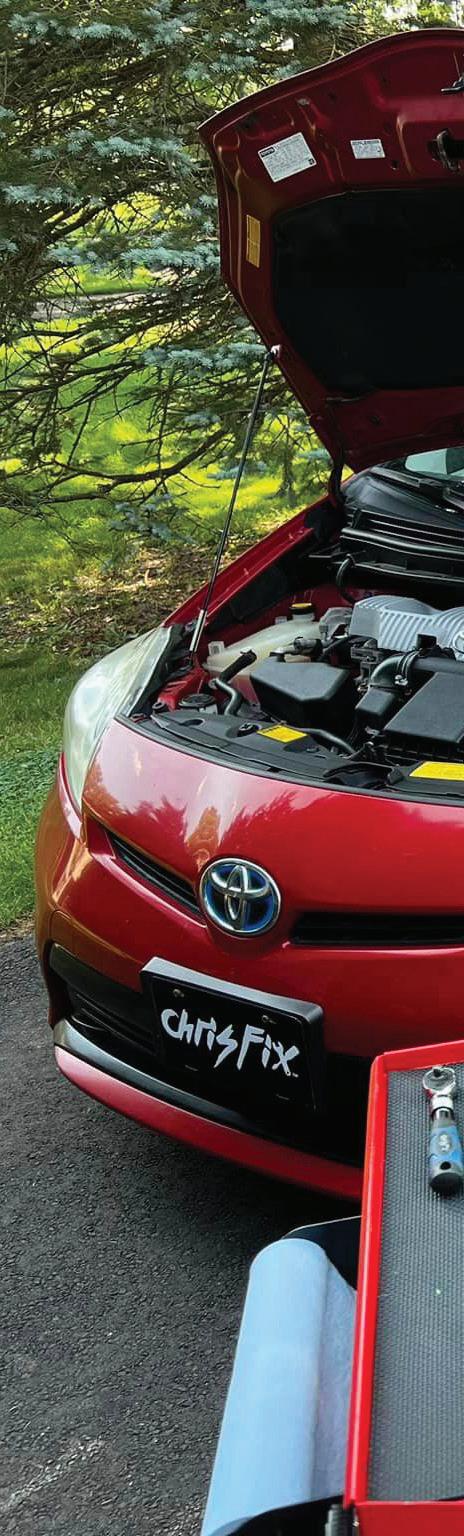

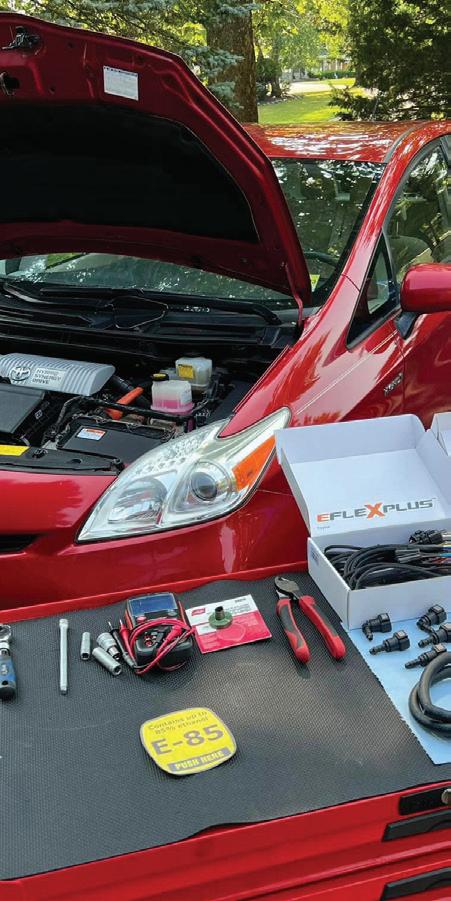

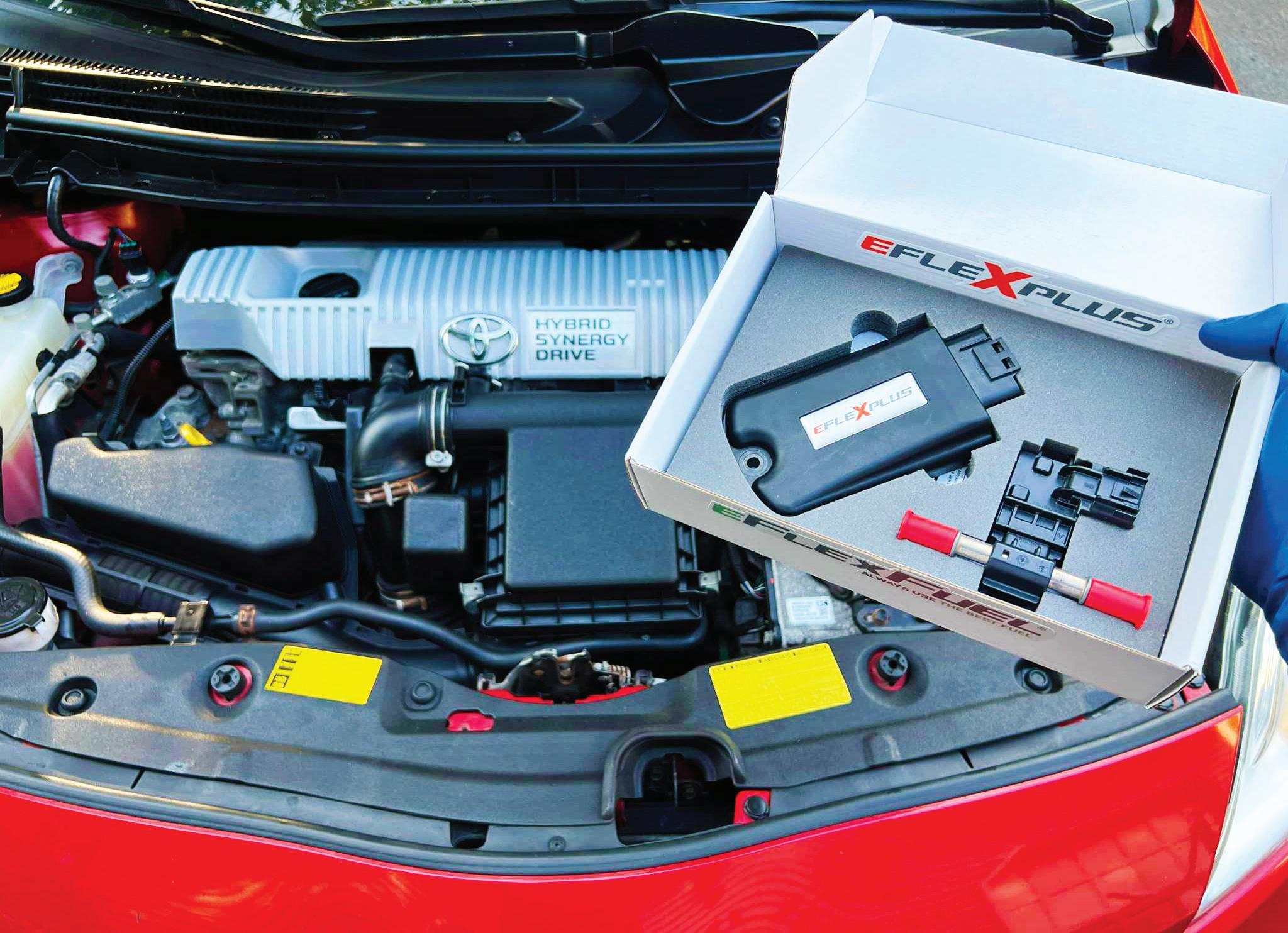

Next, in our page-20 cover story, “Converting Engines, and the E85 Narrative,” we report on an E85 conversion kit that allows non-flex-fuel vehicles to run on E85, which boosts the environmental performance of plug-in electric hybrid vehicles with a lower-cost fuel. As we report, both the Renewable Fuels Association and the American Coalition for Ethanol are testing and showcasing Ford PHEVs—two different models—that have been retrofitted with affordable flex-fuel conversion kits made by a small Finnish company (we explain).

Our page 28 feature, “Facing the Challenge of Change,” profiles a man at the forefront of the ethanol industry’s CCS movement, Bruce Rastetter, CEO of Summit Agricultural Group, parent company of Summit Carbon Solutions, one of the most high-profile proposed CO2 pipelines in North America—which, by the way, would bring CO2 to North Dakota for deep underground storage. In the piece, Rastetter reflects on his career, changes in agriculture and ethanol production, and the advent of both CCS and sustainable aviation fuel. Referring to the planned pipeline, Rastetter says, “I don’t think there’s anything that I’ve ever done in my life that will be more transformative to ag than this.”

Be sure to read “Staying Up to the Test,” on page 32, a Q&A with Marquis Energy Lab Manager Lauren Aubrey, who graciously shares her thoughts on the benefits of new lab technology and practices in the context of everyday operations at America’s largest ethanol plant. Plus, it just so happens that Marquis Energy’s effort to reduce unnecessary lab clutter—paper, binders, etc.—segues nicely into our final story, “A Digital Workflow Solution,” on page 34, which looks at Golden Grain Energy’s recent adoption of a process management workflow solution for digitalizing shift logs, product logbooks and more.

Enjoy the read.

6 | ETHANOL PRODUCER MAGAZINE | OCTOBER 2023 FOR INDUSTRY NEWS: WWW.ETHANOLPRODUCER.COM OR FOLLOW US: TWITTER.COM/ETHANOLMAGAZINE Editor's Note

S YNERXIA ® GEMS T ONE C OLLE CTION

UNL O CK Y OUR PL ANT’ S PO TENTIAL

Yeast blends are often greater than the sum of their parts. Achieve the perfect synergy of fermentation yield, speed and robustness with the SYNERXIA® Gemstone Collection.

Our broad portfolio of yeasts and yeast blends offers greater flexibility to tailor solutions based on shifting process requirements or market conditions.

Powered by XCELIS® AI, our proprietary data analytics and predictive modelling tool, the SYNERXIA® Gemstone Collection helps de-risk decision making with custom yeast blends that take your ethanol production process to the next level.

Find the right yeast or yeast blend to meet your plant performance goals.

Learn more at bioscience.iff.com/synerxia-gemstone

©2023 International Flavors & Fragrances Inc. (IFF). IFF, the IFF Logo, and all trademarks denoted with ™, or ® are owned by IFF or its affiliates unless otherwise noted

X CELIS® Yeasts

gcooper@ethanolrfa.org

View from the Hill

It’s Time for Flex Fuel Fairness

In 2014, nine major auto manufacturers produced and sold more than 2.8 million flex-fuel vehicles (FFVs) capable of running on fuel with up to 85 percent ethanol (E85). In fact, one out of every six vehicles sold in the U.S. market that year was an FFV. By 2022, however, FFV production had plummeted to less than 350,000 vehicles, and Ford was the only manufacturer still making FFVs available to everyday consumers. What caused the collapse in FFV production? Well, the answer can be summed up in three letters: EPA.

Prior to 2016, automakers that made FFVs earned substantial credits that could be used to comply with federal fuel economy and tailpipe emissions standards. The credits were based on the notion that FFVs would operate on lower-carbon E85 half of the time; and extra credit was provided based on E85’s ability to significantly displace petroleum. The combination of these credits provided a powerful incentive that caused FFV production to double between 2010 and 2014.

But the Obama administration did a quick U-turn on FFVs, adopting regulations in 2010 that would phase out the petroleum displacement credit for them by 2016. And beginning that same year, automakers that wanted credit for building FFVs would be required to prove to EPA that those vehicles were actually using E85. At the time, the agency said, “EPA believes the appropriate approach is to ensure that FFV emissions are based on demonstrated emissions performance.”

Oh, the irony.

Today, 13 years later, EPA has proposed regulations that allow electric vehicle manufacturers to assume that those vehicles have zero emissions, even when it is well known that there are significant upstream emissions related to electricity generation and battery manufacturing. In other words, EPA is allowing automakers to simply assume all EVs are entirely free of any carbon impacts, while at the same time requiring FFV makers to prove that those vehicles are using E85. This zero-emissions assumption for EVs provides an overpowering incentive that will effectively force automakers to abandon internal combustion engines in favor of battery-powered vehicles.

Fortunately, a bipartisan duo of senators has recognized the bias and incongruity of EPA’s proposal— and they are doing something about it. In July, Senators Amy Klobuchar (D-MN) and Pete Ricketts (RNE) introduced the Flex Fuel Fairness Act, a bill that would level the playing field for FFVs by properly recognizing the emissions benefits associated with using E85 flex fuels.

Just as EPA assumes an EV will always use zero-emissions electricity, the Flex Fuel Fairness Act creates a similar assumption that FFVs will always operate on E85—a fuel that reduces lifecycle GHG emissions by 31 percent per mile compared to gasoline today. The bill allows auto manufacturers who produce FFVs to use a tailpipe emissions value that is 31 percent lower than the value for the corresponding non-FFV model. This incentive would strongly encourage automakers to ramp up FFV production—alongside increased EV output—to ensure consumers have more low-carbon vehicle options.

Clearly, the timing is right. Demand for low-carbon E85 has soared in recent years, just as FFV production has been crashing. For example, the sale of E85 in California in 2022 surged 66 percent over 2021 and was more than double the volume sold in 2019. Today, more than 5,700 gas stations offer E85 in the United States, and the fuel typically sells for 20 to 25 percent less than regular gasoline, a price difference that more than makes up for any potential fuel economy loss.

RFA is encouraging all ethanol proponents to call your senators today and ask them to support the Flex Fuel Fairness Act. This innovative legislation would level the playing field for low-carbon vehicle technologies and give American consumers the options they desire—both at the auto dealer lot and at the filling station.

8 | ETHANOL PRODUCER MAGAZINE | OCTOBER 2023

Geoff Cooper President and CEO Renewable Fuels Association 202-289-3835

Workshops Held to Boost Ethanol Consumption in Asia

Potential policy changes in Asia could create massive demand for imported ethanol that U.S. producers are ready to meet. The U.S. Grains Council conducted several events across the continent this summer to support that goal by informing local government officials and industry leaders about the positive impact of implementing higher ethanol blends in their countries.

The Vietnam Ministry of Industry and Trade, Vietnam Petroleum Association and the USGC jointly organized the first iteration of Decarbonize Asia: Vietnam Biofuels Forum in July to discuss technical, commercial and environmental considerations for the expansion of fuel ethanol use in the country.

Approximately 150 participants, including regulators, policymakers, Vietnamese biofuel producers and fuel companies, international vehicle manufacturers, technology providers and academia, attended the forum. Additional presentations focused on Vietnam infrastructure and vehicle compatibility with E5 and E10; Southeast Asia ethanol trends and developments; U.S. ethanol sustainability; ethanol-to-jet fuel pathways; carbon sequestration technologies; and consumer sentiment about ethanol in Vietnam.

The forum was an opportunity to showcase the benefits of U.S. biofuels while Vietnam’s government is evaluating a potential policy action to migrate its E5 RON92 mandate to all grades of gasoline. An E5 mandate in Vietnam would increase ethanol demand by 400 percent and create a potential export market of 95 million gallons per year for U.S. fuel ethanol.

The strategic ethanol partnership between Vietnam and the United States is a strong example of how our two countries can work together to find mutually beneficial solutions to decarbonize road transportation, bolster fuel security, improve human health and generate further investment against the backdrop of the clean energy transition.

The international transportation sector, a significant contributor to carbon emissions, plays a crucial role in this process. The urgency to reduce carbon emissions has led more than 60 countries worldwide to adopt low carbon fuel policies to capture the environmental, human health and economic benefits of ethanol.

The Taiwanese government, motivated by the effects of climate change, has set an ambitious goal of achieving net-zero carbon emissions by 2050. To accelerate progress, the council held a policy discussion meeting, the Diversified Carbon Reduction & Sustainable Development Forum in Taipei, Taiwan, in June.

The meeting attracted industry representatives from sectors including energy, transportation, environmental protection and the vehicle industry. lndustry representatives also shared their perspectives and proposed options from their respective sectors, including implementing E10 blends in the transportation sector.

The USGC’s Taiwan office is consolidating these recommendations into a comprehensive policy proposal on behalf of the industry. Additionally, the United States’ experience in net-zero transportation policy, specifically in the low-carbon fuel domain, is expected to advance cooperation between Taiwan and the United States and open avenues for U.S. producers to supply the country’s growing interest and need for biofuels.

The council has also been active with programming in Korea and Japan, laying the groundwork for higher biofuel blends throughout the region. By building strong relationships and establishing a track record of continued engagement in Asia, U.S. ethanol producers can feel confident about the emergence of new and larger global marketplaces with ample opportunities for sales.

ETHANOLPRODUCER.COM | 9

Mackenzie Boubin Director of Global Ethanol Export Development mboubin@grains.org

Global Scene

Mackenzie Boubin, the USGC’s director of global ethanol export development, discusses global ethanol policy developments at Decarbonize Asia: 2023 Vietnam Biofuels Forum in Da Nang, Vietnam.

PHOTO: USGC

BUSINESS BRIEFS

ACE elects board of directors during annual business meeting

The American Coalition for Ethanol re-elected several board members and elected two new members to the organization’s board of directors during its annual business meeting prior to ACE’s 36th annual conference in Minneapolis, Minnesota, in late August.

Re-elected to the board of directors for three-year terms are: Badger State Ethanol, represented by David Kolsrud; ICM Inc., represented by Trevor Hinz; Mid Missouri Energy, represented by

Aemetis provides update on CCS, efficiency upgrades

In a recent earnings report, Aemetis Inc. outlined its exploratory work on a carbon capture and storage (CCS) project that would sequester CO2 produced at the company’s existing corn ethanol plant in Keyes, California, as well as its proposed Riverbank facility.

Eric McAfee, the company’s CEO, said the CCS endeavor has a state-issued permit for the CO2 characterization well, the first issued in California. The well site access road and drilling pad have already been engineered, permitted and constructed. Data gathered

Chris Wilson; and the Nebraska Ethanol Board, represented by Reid Wagner.

Harmon Wilts, representing Chippewa Valley Ethanol Co., was elected to take a seat previously held by Jan Lundebrek; and Dave Ellens, representing the South Dakota Corn Growers Association, was also elected to the board for a three-year term. ACE’s current board of directors has 19 members.

through the well will be used to secure a Class VI injection well from the U.S. EPA.

Meanwhile, the Keyes plant is continuing to undergo energy efficiency and carbon reduction upgrades—including the installation of a solar microgrid, all-electric dehydration, an AI-enabled DCS and additional projects —that will reduce natural gas usage at the plant by 80 percent or more.

10 | ETHANOL PRODUCER MAGAZINE | OCTOBER 2023

PEOPLE, PARTNERSHIPS & PROJECTS

Gevo’s Net-Zero 1 project reaches key milestone for DOE loan guarantee

Gevo Inc.’s Net-Zero 1 ethanol-to-jet fuel project has been invited by the U.S. Department of Energy to proceed with due diligence and term sheet negotiation on a $950 million loan guarantee. The invitation is based on the DOE’s determination that the NetZero 1 project is highly qualified and suitable for federally-assured financial backing.

GLE to install Whitefox ICE dehydration system at Mina plant

Whitefox Technologies recently announced that Glacial Lakes Energy LLC will install a Whitefox ICE membrane dehydration system at its ethanol plant in Mina, S.D. The ICE installation, Whitefox’s second in South Dakota, will help Glacial Lakes achieve the business objective of increasing its production capacity while reducing natural gas consumption. The project is anticipated to be completed during Q2 2024.

This milestone marks the successful completion of the phase II application and diligence process, which Gevo publicly announced in January; it also signifies the commencement of the underwriting phase for debt financing. The Net-Zero 1 plant, under development in Lake Preston, S.D., is expected to have a capacity of 65 MMgy of sustainable aviation fuel and other renewable hydrocarbons.

“[In addition to] reducing energy input into our process, the Whitefox ICE system will allow us to debottleneck our distillation system to allow for an additional 8 million gallons per year of ethanol production,” said Pat Hogan, director of operations for GLE. “Whitefox is a great partner to help Glacial Lakes Energy achieve its carbon reduction goals.”

YOUR TREATMENT SHOULD BE AS WELL. YOUR PLANT IS UNIQUE ADDITIONAL BENEFITS OF OUR DELASAN CMT PROGRAM CAN INCLUDE: Contact your Zee|Loeffler sales representative. FOR MORE INFORMATION

Digging Deeper: Ethanol’s Role In the Carbon Age

Carbon capture efforts in North Dakota and the greater ethanol industry showcase the current and long-term vision of the U.S. DOE’s carbon management team.

By Luke Geiver

By Luke Geiver

Ethanol production is currently at the epicenter of the carbon capture and sequestration movement. Just ask two of the world’s most well-versed carbon experts. Sarah Forbes, deputy director for Carbon Management Technologies at the Office of Fossil Energy and Carbon Management for the U.S. Department of Energy, has been working in the carbon space for the better part of her career. She helped stand up a carbon capture utilization and storage (CCUS) effort through the White House Council on Environmental Quality as its first director in 2021. Prior to that, she helped shape policy and the broader understanding of carbon capture technology possibilities in the U.S. and around the world. Today, she is helping to bring the former DOE Department of Fossil Energy into a new era, one

that includes a department name change to better reflect the nation’s push to manage carbon. According to Forbes, ethanol production is top of mind right now for CO2 capture, sequestration or utilization projects big and small. It’s pure. It’s available in large volumes. And, with a whole lot to gain from monetizing capture, ethanol producers are eager to enter the play.

“I don’t think we can underscore this enough,” Forbes says, “but this is an unprecedented time.” Forbes is referring to the entire gamut of CCUS funding opportunities, technical rollouts and real-life adoption of technology being explored to capture or store CO2 across the country—especially in the ethanol production sector. We spoke with Forbes and her CO2 counterpart from the DOE, Brad Crabtree, assistant secretary for the Office of Fossil Energy and Carbon Management at the DOE, to help highlight

where CCUS is now and where it's headed in the future.

Why Carbon Capture Is On A Roll

Like Forbes, Crabtree is a qualified expert in the field of carbon. Prior to helming the Carbon Management expansion at the DOE, he helped grow the nation’s understanding of carbon management in numerous roles. Both Forbes and Crabtree believe the rapid growth of CCUS projects and research across the country, and globally, is occurring for a few specific reasons.

First, technology for carbon capture, storage or utilization is increasingly proven and scalable. “We have the technology today to scale up carbon management at a commercial scale,” Crabtree says.

The U.S. is the leader, capturing roughly 20 million to 25 million tons of CO2 per

12 | ETHANOL PRODUCER MAGAZINE | OCTOBER 2023

Sequestration

year, a number Crabtree and Forbes believe is a fraction of what’s to come.

Carbon capture is no longer seen as unattainable or technically impractical, either. “It is no longer a risk. It’s an opportunity, Crabtree says,” explaining that part of that opportunity is linked directly to a robust policy framework that reduces risk and creates an incentive to capture carbon. “Three to four years ago that wasn’t the case.”

The policy framework in place today provides the 45Q tax credit (currently valued at $85 per ton of CO2 sequestered or $60 per ton utilized) and as of the last two years, government funding for CO2 projects in the billions. On top of that, the 45Q tax credit has already been approved through 2032, so as Crabtree points out, there shouldn’t be any uncertainty surrounding the tax incentive the way other clean energy industries have been plagued by short-term

and lapsing incentives. Since the 45Q came out, more than 100 carbon capture projects have been announced. Crabtree and Forbes expect there to be many more.

And it's not just the 45Q tax credit driving the new-age of carbon capture. The work at the DOE is just getting started, Crabtree and Forbes say. The list of funded CO2 projects across the country continues to grow, but in late August, their team announced the DOE’s intent to launch a responsible Carbon Management Initiative. The work will help industry and project developers with safety, environmental stewardship, accountability, community engagement and other benefits related to carbon management projects.

Although the ethanol sector is already well-versed in navigating the permitting, technological and sequestration aspects of CO2, other industries are not quite there,

Forbes says. They are all watching the ethanol sector, she adds, including industries outside the United States. While ethanol production, fertilizer production or gas treatment have been the first major industries to adopt CO2 capture processes, others are lining up, including pulp and paper, steel, concrete and more, she says.

Crabtree points out that other countries are following the U.S. as well. “This U.S. experience has really captured the imagination of countries and industries around the world,” he says. Although Norway, Denmark, Japan and other Southeast Asian countries are all heavily invested in carbon capture, the U.S. is still the leader. Interestingly, however, the U.S. is not currently engaged in offshore CCS, but countries like Brazil are.

ETHANOLPRODUCER.COM | 13

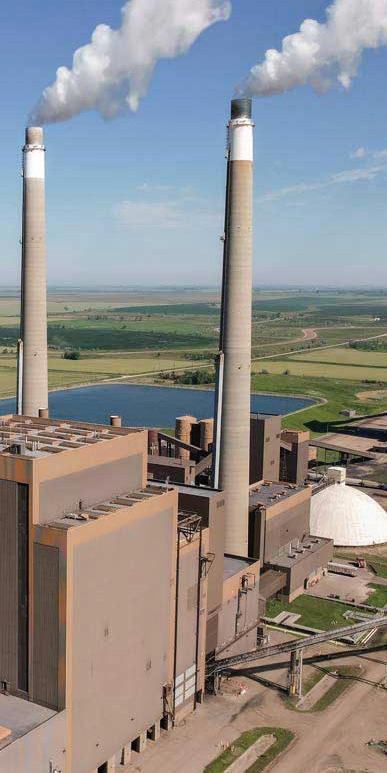

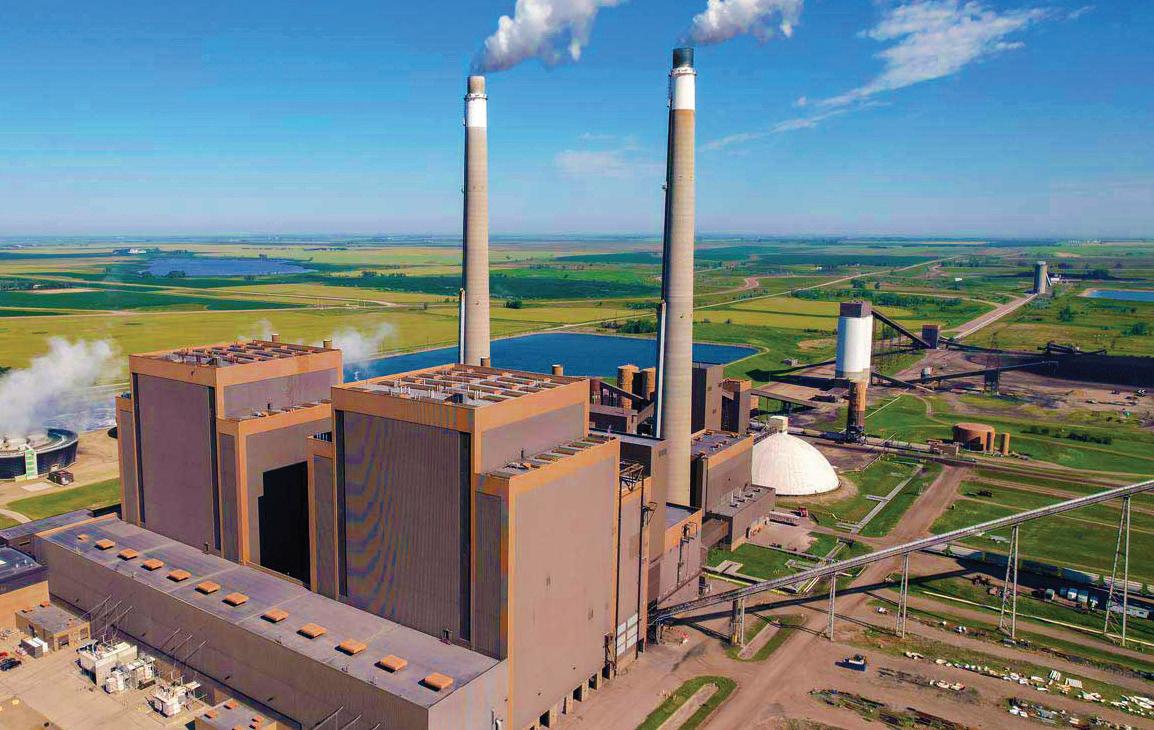

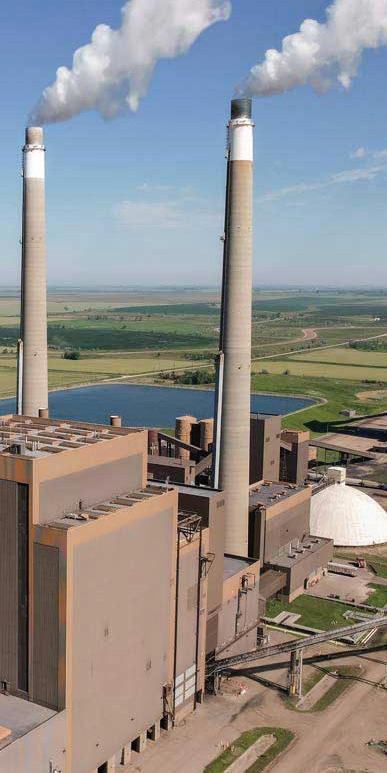

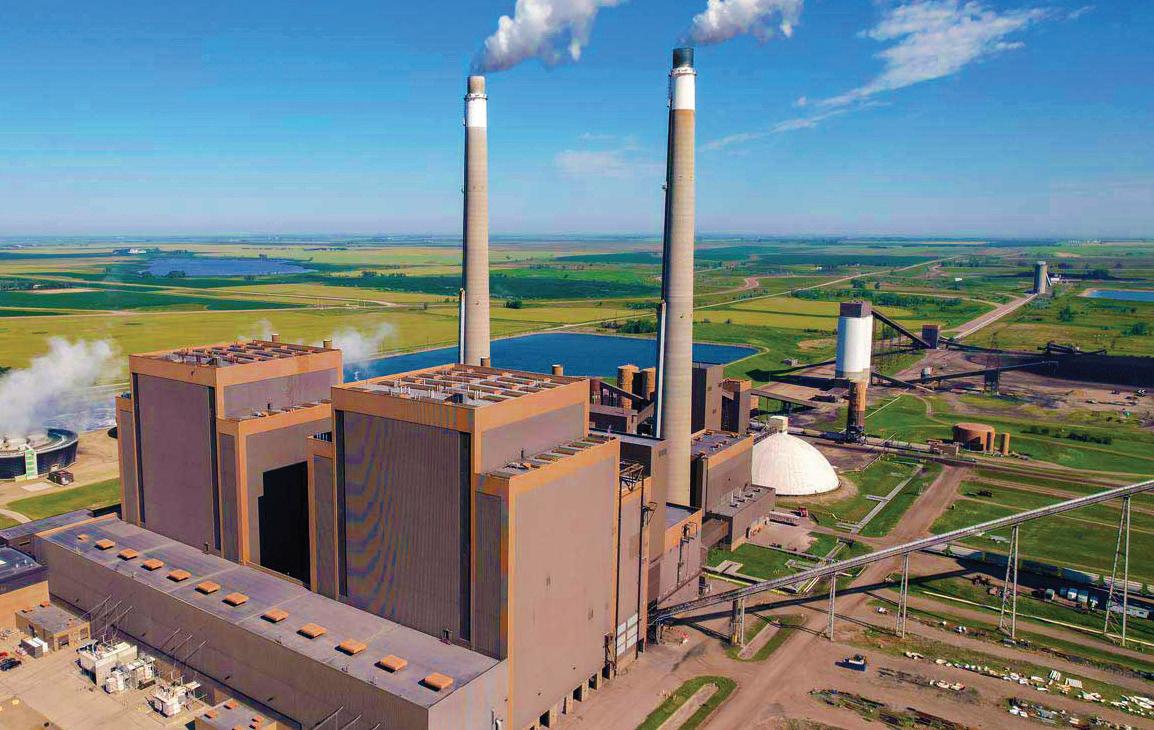

NORTH DAKOTA EXEMPLIFIES: Rainbow Energy Center, a coal-based power plant in central North Dakota, will be connected to a carbon capture injection project that is also linked to an ethanol plant, Blue Flint Ethanol.

PHOTO: RAINBOW ENERGY CENTER

Sequestration

Carbon Capture: The Trajectory

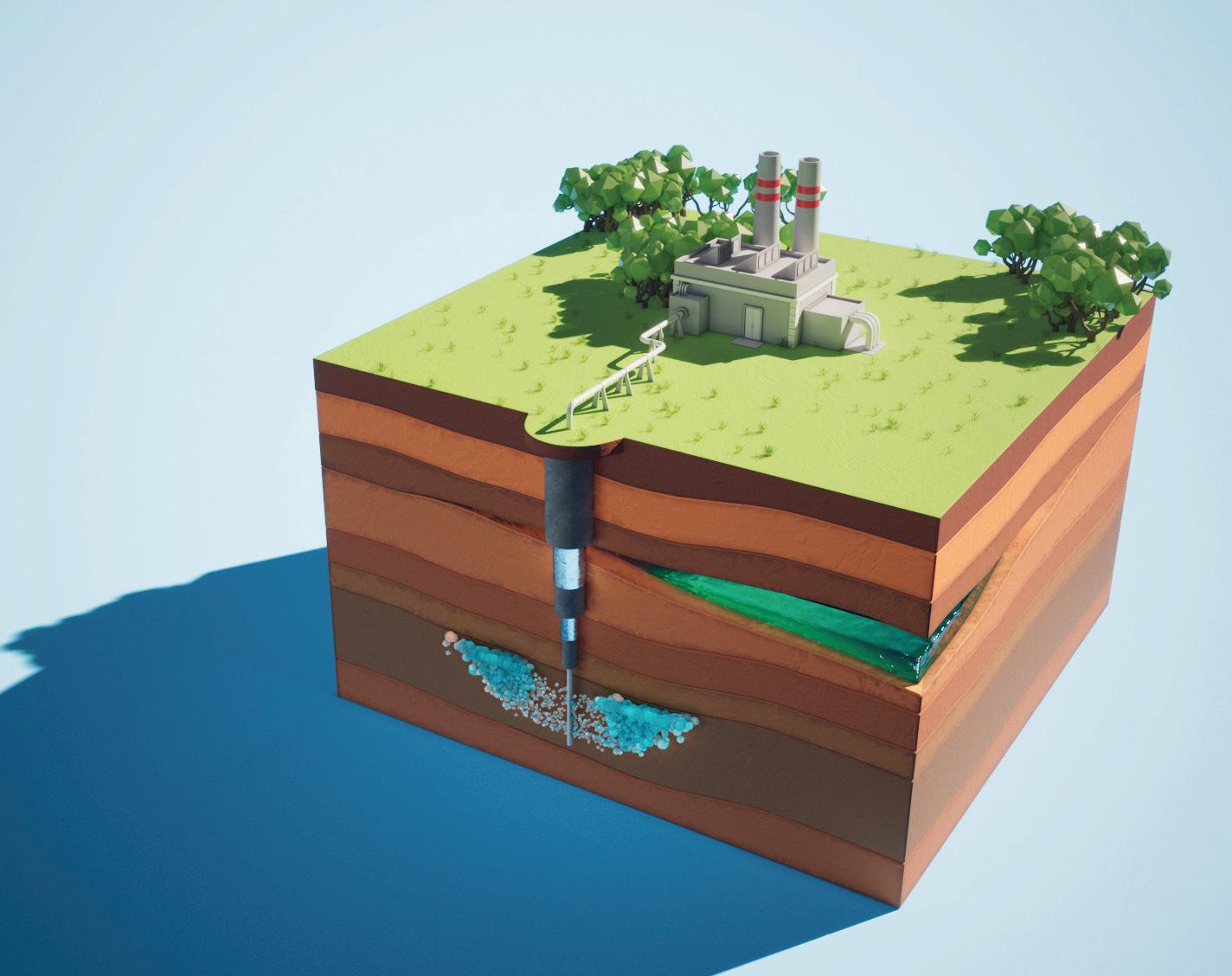

The ethanol sector's push to add carbon capture and utilization has revealed several facets of a growing industry. The technology is there. (Crabtree and Forbes like to hammer that point home). Policy is in place. Tax incentives are there as well. Now, as the ethanol sector continues to iron out the aggregation and transport of CO2, the DOE is working to help. It is focusing on multiple areas, especially infrastructure and community engagement.

The DOE has funding to help with pipelines and storage sites. It has programs to help with advanced characteristics of underground storage facilities. And in the future, it will likely have infrastructure options for every industry participating in carbon capture. Crabtree hopes to develop 20 to 40 regional geologic sites across the country for industries to use.

“Our strategy is that over the coming decade, no matter where you are, you are going to have an option for transporting and storing your CO2,” he says.

That aspiration won’t come to fruition by infrastructure construction alone, he clarifies. Community engagement is an important piece. Although most industries and

major carbon producers are now aligned with the benefits of capturing carbon, local communities in the path of infrastructure are less aligned, he says. The DOE is working to change that.

On the subject of current CO2 capture projects, mainly pipelines, Crabtree says there are lessons to be learned about how projects should be developed. Community engagement strategies are important, he says, and it appears the industry may have been surprised by the opposition to infrastructure. Many landowners or communities don’t understand carbon, he says.

According to Crabtree, CO2 pipelines are some of the safest we have, and the U.S. already transports commercial quantities of CO2 via pipeline. The DOE is now investing in—and requiring—community engagement planning for its funding applicants. Communities need to have a better understanding of technology that will be used. In addition to a community engagement plan, applicants will also have to show workforce development plans along with emission reduction expectations. “There are a lot of challenges in local acceptance of these projects we’re finding,” he says. “They will only be successful if there is local support.”

The type of CO2 capture project hap-

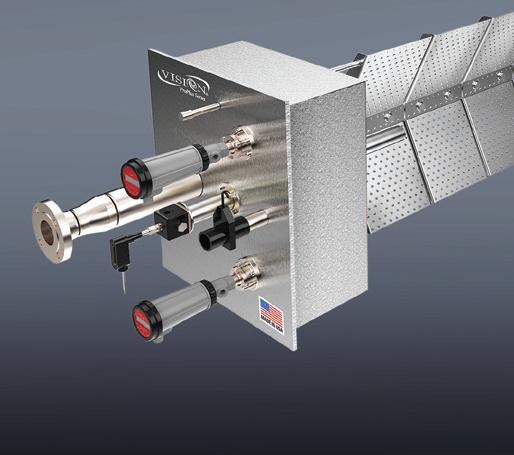

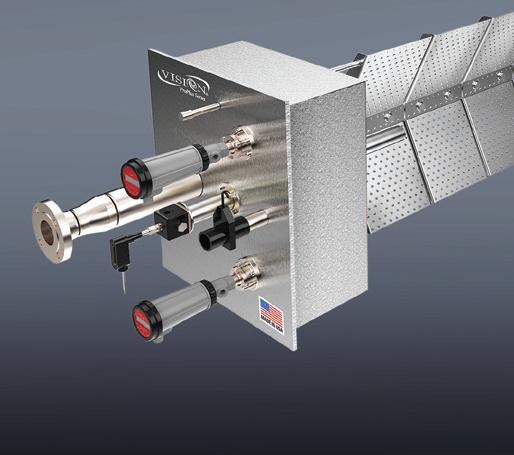

Continous, real-time process analysis

pening across the U.S. continues to evolve. Ethanol production continues to be at or near the center of every type of project, Forbes says.

North Dakota and the Upper Midwest is a great example of how ethanol is on the leading edge of carbon capture. Red Trail Energy LLC, an ethanol producer near Richardton, North Dakota, is operating a CO2 capture facility that injects roughly 180,000 metric tons of CO2 into an adjacent underground site. That project helped the DOE, ethanol industry and CO2 experts at the University of North Dakota’s Energy and Environmental Research Center (EERC) showcase their collective abilities.

The EERC and the ethanol industry appear to be well on their way to another carbon capture project in North Dakota. With $38 million in funding from the DOE, EERC will help develop a CO2 storage hub in central North Dakota near the Coal Creek Station power plant and Blue Flint Ethanol facility. The storage hub could eventually store up to 200 million metric tons of CO2

The project showcases several of the benefits of the DOE’s push to enhance carbon capture across the country. Crabtree and Forbes believe that many industries are no longer looking at carbon capture as an option, but a necessary part of their future.

Scan to learn more www.keit.co.uk

ETHANOLPRODUCER.COM | 15

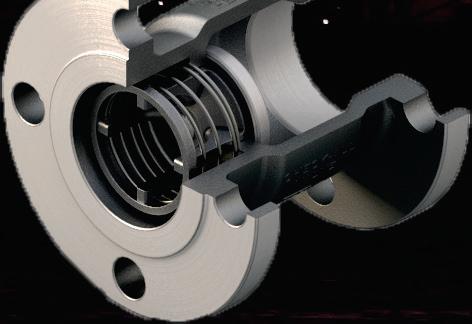

CAPTURED: Carbon capture technology is now proven and ready for deployment at commercial scale for multiple industries, including corn ethanol production.

Mo re than a Check v alv e Order at: ww.check all.com Call us at 515-224-2301 or email us at: sales@checkall.com

PHOTO: U.S. DEPARTMENT OF ENERGY

Sequestration

Rainbow Energy Center LLC acquired the Coal Creek Station with the intention of capturing the carbon produced at the power plant. Rainbow made that clear from the start of its acquisition effort.

“Carbon capture and storage is vital to continued operation of Coal Creek Station,” says Stacy Tschider, president of Rainbow Energy.

Blue Flint Ethanol, a Harvestone Company, was the applicant for the class VI storage well that will be used in the project awarded $38 million by the DOE. Jeff Zueger, CEO of Harvestone, said the permit is part of the company’s overall vision to make its ethanol plants net-zero carbon. In addition to Blue Flint Ethanol, Harvestone operates Dakota Spirit, another ethanol plant in North Dakota, as well as Iroquois Bio Energy Co. in Indiana.

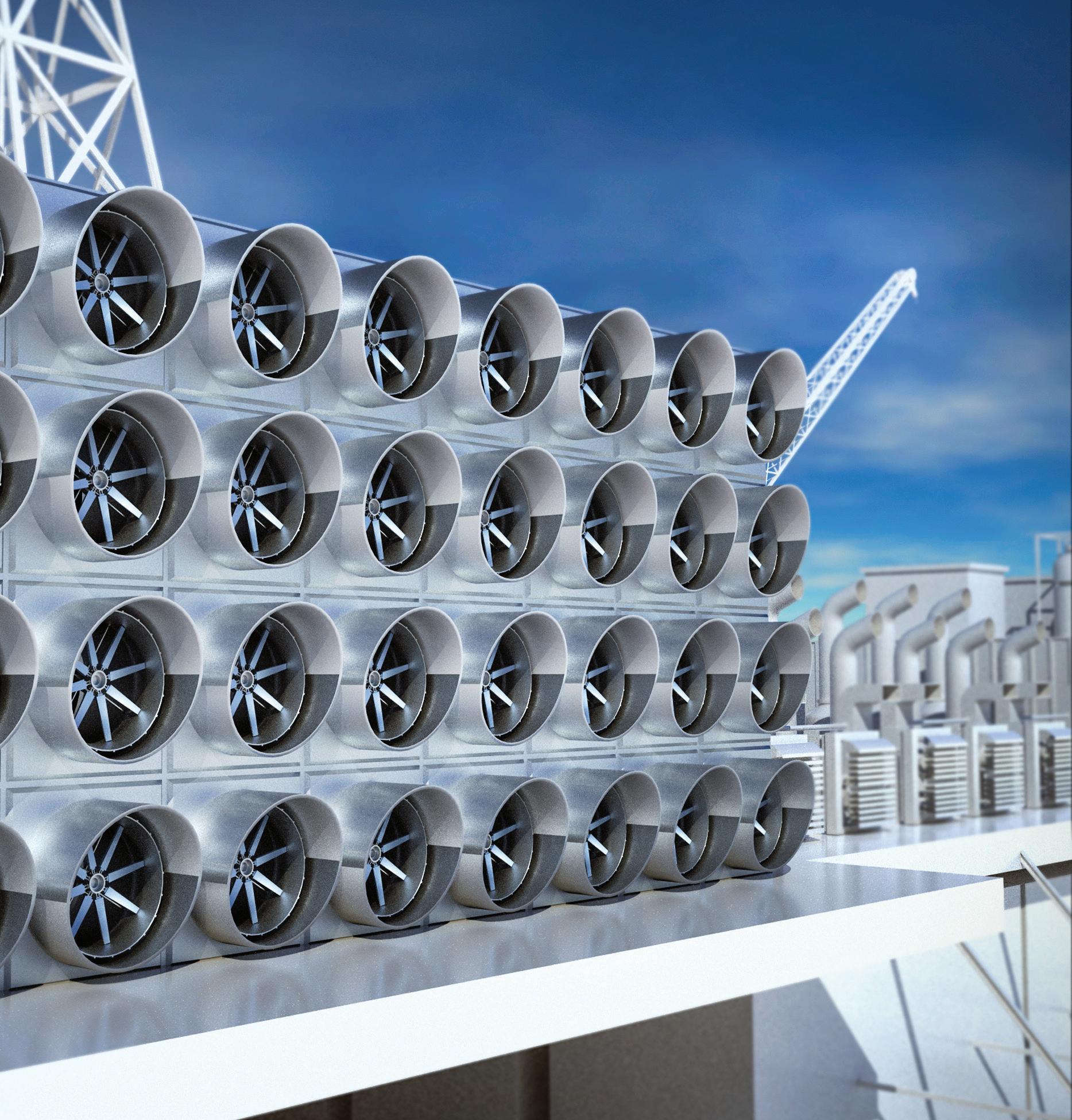

As an indication of its growing ability to help promote and facilitate more carbon capture projects—not just from ethanol pro-

duction—the DOE team is also excited to point out other projects in North Dakota. Through another funding round with the EERC, the state will demonstrate a lowercost direct air capture (DAC) technology from Climeworks and permitted CO2 storage facilities at megaton scale. At the Prairie Compass Hub, Climeworks will deploy its DAC tech. Total DOE funding for the project was $12.5 million, with another $15 million coming from non-DOE sources for a total value close to $28 million. In August, the DOE announced roughly $1.2 billion to Texas and Louisiana for the build-out of two DAC projects that could be the largest to date in the world.

In addition to carbon management, the DOE Fossil Energy team also manages hydrogen production, critical mineral innovation, the export of natural gas and a handful of other areas. But, according to Crabtree, it's carbon that garners the bulk of the work and attention of the team now. Places like

16 | ETHANOL PRODUCER MAGAZINE | OCTOBER 2023

North Dakota, where multiple carbon capture projects are taking place, will become the norm, they believe. Industry adoption of carbon capture, like that seen in the ethanol industry, will also be more common across other industrial sectors. Ethanol finds itself at the forefront of it all, potentially creating long-term changes in the way all industries look at carbon and opening up myriad new possibilities for both storage and utilization, Crabtree and Forbes say.

“This is no longer a discussion of tech and policy. It is now about economics. This is no longer being seen as R&D. It is now being seen as essential to the survival of so many industries,” Crabetree says. “It is no longer about managing a problem but is now a solution.”

Author: Luke Geiver Contact: writer@bbiinternational.com

DIRECT AIR CAPTURE: New technology that directly captures CO2 from the air is being more widely explored in the U.S. The DOE has funded projects in North Dakota, Texas and Louisiana.

ETHANOLPRODUCER.COM | 17

PHOTO: U.S. DEPARTMENT OF ENERGY

Converting Engines, and the E85 Narrative

By Luke Geiver

By Luke Geiver

Whether Tuomo Isokivijärvi is meeting with venture capitalists in Palo Alto, California, Finland or anywhere else in the world, he’s usually trying to explain how his company’s E85-based conversion kit technology applies to current and future light-duty passenger vehicles. He doesn’t shy away from explaining the limitations of electric vehicles—why EVs alone won’t be able to fulfill the transportation needs of the world anytime soon, despite what many investors have been repeatedly told. And he relays the comparable affordability of the eFlexFuel technology his company, StepOne Tech Ltd., has commercialized over the past decade. Isokivijärvi is quick to explain that adding an eFlexFuel conversion kit to

a compatible vehicle achieves the same lifetime emissions reduction as switching to a battery EV—for less than the price of a new smartphone.

Although there are other technology providers offering similar products to StepOne Tech’s eFlexFuel conversion kit, none have taken the steps to push the idea of such ethanol-based technology forward quite like Isokivijärvi. Should it work and catch on, E85 could be heightened to a different status, Isokivijärvi believes, and ethanol’s highest percentage U.S. blend— decades in use and growing, but below full potential—could gain broader appeal as a practical climate solution with the ancillary benefit of saving drivers money at the pump. For that to happen, the collaboration forged, and the progress recently made by StepOne Tech and the U.S. ethanol industry must continue. Here’s what they’ve achieved to date.

20 | ETHANOL PRODUCER MAGAZINE | OCTOBER 2023

Market

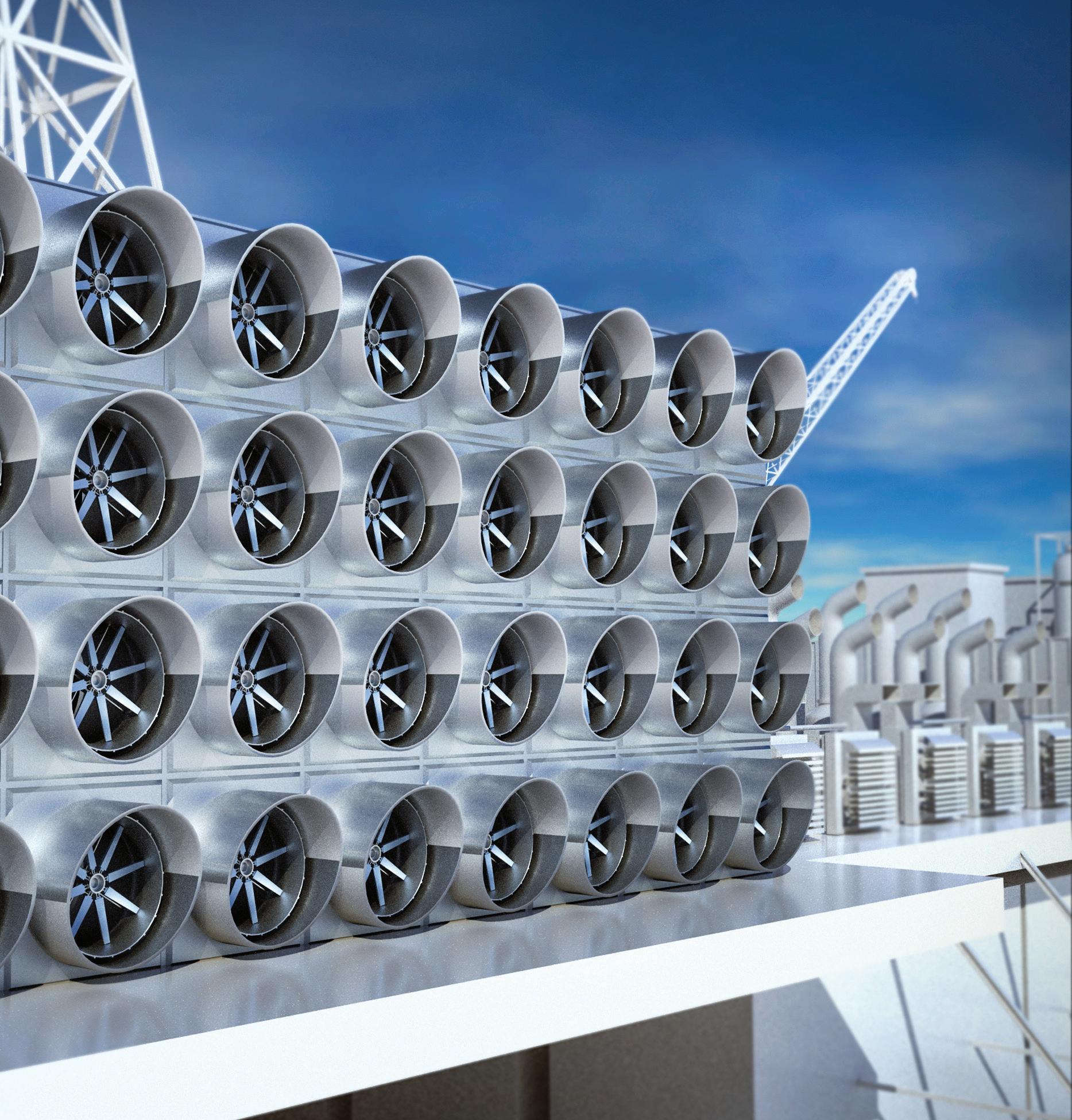

A new E85 conversion kit could complement the rise of EVs by giving drivers plug-in electric hybrid vehicles capable of running on high blends of ethanol.

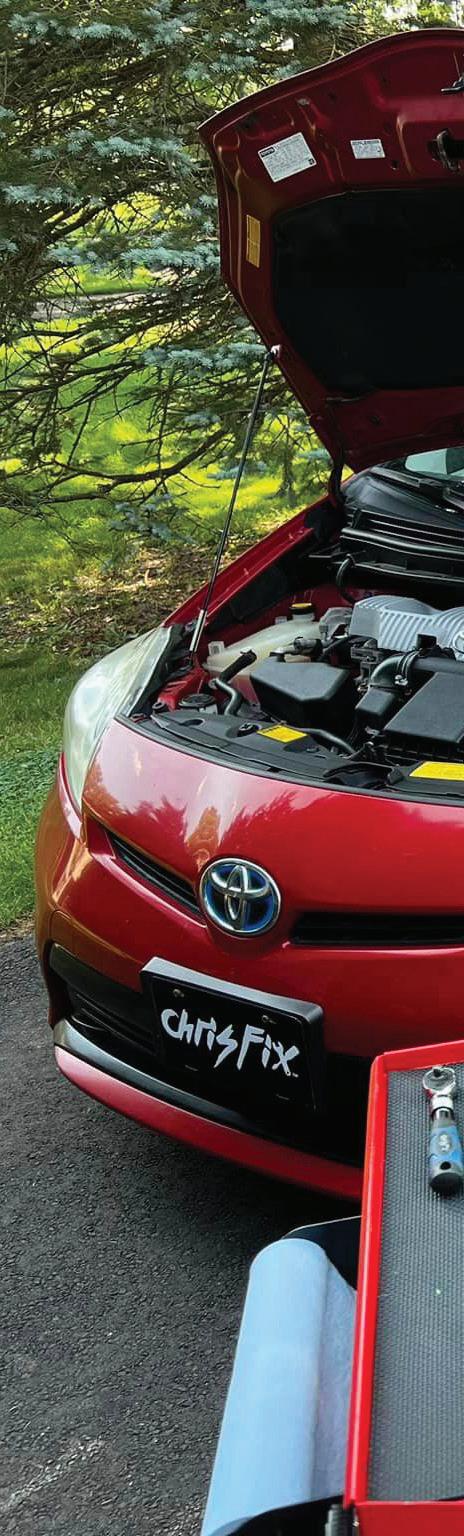

10 MILLION VIEWS:

ChrisFix, the world’s largest automotive DIY’er on YouTube, recently filmed the process of installing the eFlexFuel E85 conversion kit system.

PHOTO: EFLEXFUEL

ETHANOLPRODUCER.COM | 21

Made with American biofuels, E15 delivers big savings at the pump .

Initiating Conversion

Last year, the Renewable Fuels Association purchased a new 2022 Ford Escape plug-in hybrid electric vehicle (PHEV) to display at events across the country. Working with the University of Nebraska’s Husker Motorsports Team, the RFA installed an eFlexFuel conversion kit from StepOne Tech to showcase the capability of the PHEV when fueled with E85. The vehicle is a plug-in hybrid with external charging and an electric motor that powers the vehicle independently from its internal combustion engine (ICE). When the battery is low, ICE capabilities are activated. The electric motor is recharged by regenerative braking during operation. There is an 11-gallon liquid fuel tank, and the range of the vehicle is 420 to 440 miles on a full tank and full charge. The range breakdown starts with 30 to 40 miles on electricity first, followed by 390 to 400 miles on E85. Recharge times vary depending on the power source. On 110v, charge times are typically in the 10 to 11-hour range.

Since 2019, American drivers have enjoyed yearround access to lower-cost, lower-carbon E15. Without ac tion, those fuel savings could vanish from gas stations next summer. Learn more at GrowthEnergy.org/E15

According to the RFA, the association purchased the PHEV and added the E85 conversion kit for several reasons. First, they wanted to prove that low-carbon liquid fuels in combination with hybrid technology can deliver superior environmental performance at a low cost to the consumer. Second, the RFA wanted to show that consumers don't need to sacrifice optionality, convenience or affordability for superior environmental performance. Third, to show what refueling times, refueling locations, vehicle ranges, purchase prices and cost of operation numbers would look like. And, finally, to demonstrate synergies between low-carbon ethanol and electricity. “Ethanol and electricity can be complementary decarbonization solutions,” the RFA stated last year.

In addition to the PHEV roadshow, the RFA has also had the vehicle tested for tailpipe emissions on E10, E85, and splashblended E30 at the University of CaliforniaRiverside’s Center for Environmental Re-

search & Technology. Although tailpipe emissions testing and lifecycle emissions testing is still underway, the results show a significant reduction in NOx emissions with E85, among other findings.

“We expect the study to show that a plug-in hybrid electric FFV running on cleaner, greener E85 can offer comparable or better carbon performance than many battery electric vehicles,” the RFA revealed.

eFlexFuel: Converting the World

Isokivijärvi grew up in a sawmill family. After working in the timber-cutting industry in Finland, he took a job at a local tire manufacturing facility. He and four other co-workers were skilled at mixing rubber and considered some of the topperformers at their tire plant. In 2012, despite their recognized performance, they were all let go. It turned out to be a good thing. Three months after their departure from the tire plant, they developed their first prototype E85 conversion kit. While Isokivijärvi was the entrepreneurial leader willing to set up, run and represent the company, the others focused on the tech-

WORTH THE DISPLAY: After buying the Ford Escape plug-in hybrid electric vehicle and converting it to run on E85, the Renewable Fuels Association has displayed it across the country.

WORTH THE DISPLAY: After buying the Ford Escape plug-in hybrid electric vehicle and converting it to run on E85, the Renewable Fuels Association has displayed it across the country.

Market

PHOTO: RENEWABLE FUELS ASSOCIATION

nical side of product development, using their engineering skills for automotive and computing.

In 2012, they tested the first system on a Nissan Sentra owned by Isokivijärvi. Today, their conversion kits have been used on 55,000-plus vehicles across the world. Their main customers are those focused on engine performance. The octane and power part of E85 is what they’re after. But lately, the emissions piece has been gaining importance. That’s where the new

narrative comes into play for Isokivijärvi.

“When I talk with [venture capitalist investors], many have bought the mainstream narrative that nothing else will be needed other than EVs,” he says.

According to Isokivijärvi, he met one startup in Palo Alto that was a one-man show. The nascent company was proposing to build an app that would help EV owners sell their vehicles to would-be buyers. At the time, it was simply a proposal, there was no app yet and it wasn’t proven

©2023 All rights reserved Fluid Quip Technologies, LLC. All trademarks are properties of their respective companies. Scan the code to unlock more oil today! MORE OIL, MORE REVENUE, PROVEN TECHNOLOGY. WHAT MORE COULD YOU ASK FOR?

THE E85 + ELECTRIC SOLUTION: From consumer data by StepOne Tech to the emissions testing being done by the RFA, the electric vehicle combined with E85 solution is not only real, its proven.

PHOTO: RENEWABLE FUELS ASSOCIATION

or tested. Just an idea. They got $10 million right away. So Isokivijärvi is working on the narrative, he says, because some companies touting their relevance in the EV space are looked at differently even as many investors also tell Isokivijärvi they understand that the world will need more than just EVs.

“Investors are interested in the mission. A lot of them see the big picture and they see the global energy market. They see it is very oil heavy and that it will take a long time to change it,” he says.

It's not that Isokivijärvi and his team haven’t accomplished a lot despite that difficult narrative headwind. In 2013 they collaborated with St1, a leading biofuel producer in Northern Europe that produces ethanol in Finland. StepOne Tech has tried to perform emissions tests with every available technology on the market and because of that has achieved full market compliance in their home country. They are also making strides in the U.S. The California Air Resources Board has granted the company market compliance status for its technology. The tech is already in a half-million Toyotas, and while working with the RFA, the company was recently featured on a popular YouTube video produced by the world’s largest automotive DIY’er, ChrisFix.

“We have just scratched the surface,” Isokivijärvi says, “but it has been a lot to navigate.”

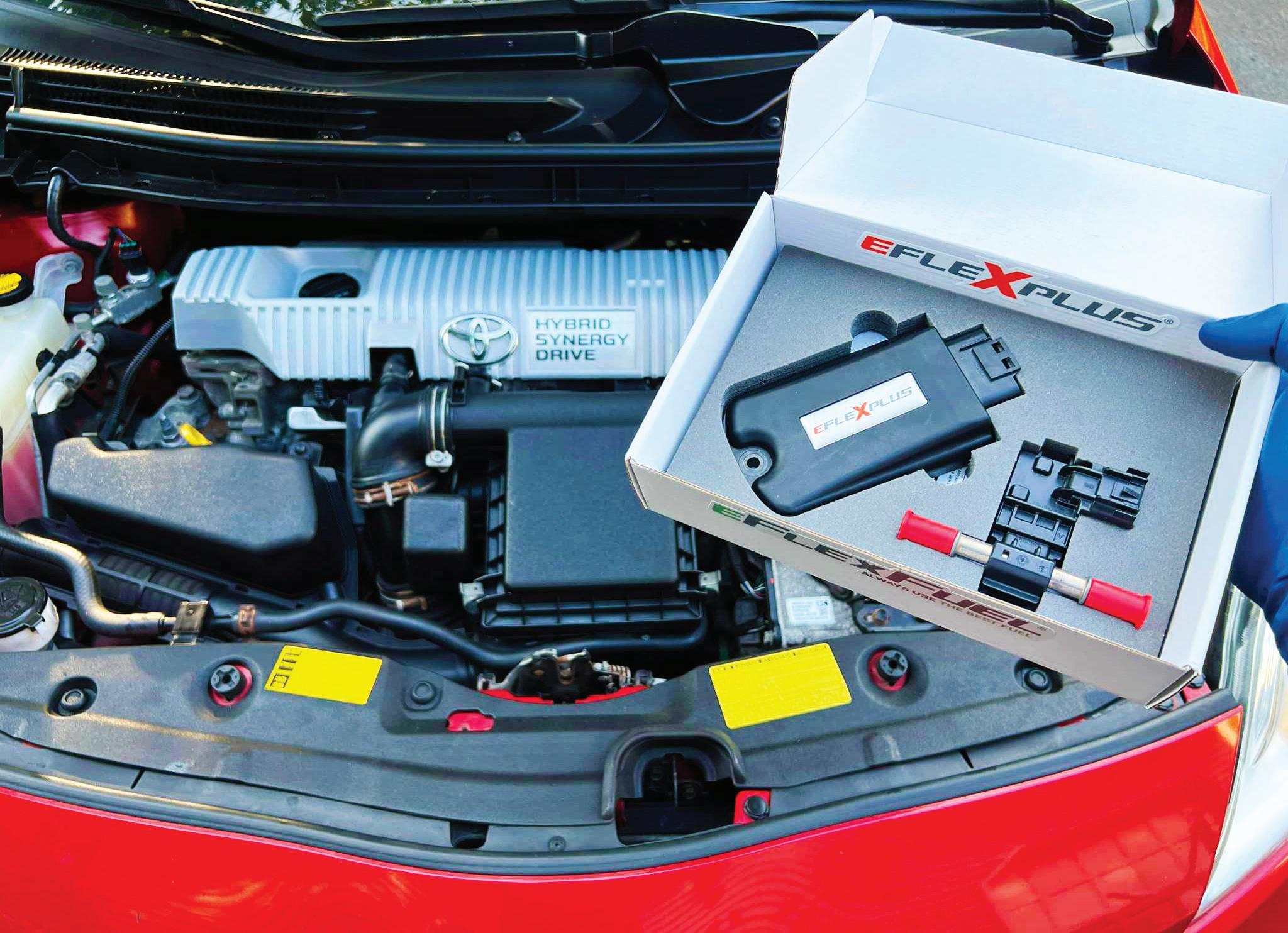

eFlexFuel Conversion Tech: What You Get

Included in the eFlexFuel conversion kits, depending on the version ordered, is everything needed for a fully automatic system that can run on E85, gasoline or a combination of the two. Each system is customized to the vehicle with everything included for DIY installation. There are systems for cars and motorcycles. The piggy-back tech doesn’t interfere with the OEM's engine system. Through a smartphone app, the engine can be monitored and run on economy, sport or dynamic modes.

An ethanol sensor is provided that connects to the fuel line and provides realtime ethanol content info. An eFlexFuel control unit, installed to the fuel injectors, controls the fuel injection based on the fuel ethanol content, engine temperature and the fuel injection pulse. The unit maintains perfect air-to-fuel ratios for optimized fuel economy and power output. A thermal sensor, installed on the engine block, provides engine temperature data in real time. (Note: The team at StepOne Tech funded their re-

E85 KIT: Included in the conversion kit are all the materials needed to run the engine on E85, customized for each vehicle. Installation usually takes an hour or less.

PHOTO: EFLEXFUEL

E85 KIT: Included in the conversion kit are all the materials needed to run the engine on E85, customized for each vehicle. Installation usually takes an hour or less.

PHOTO: EFLEXFUEL

EFLEXFUEL TECHNOLOGY VEHICLE ON DISPLAY AT ACE CONFERENCE

Two years after unveiling its own Ethanol Hybrid Electric Flex Fuel vehicle at the 2021 American Coalition for Ethanol annual conference in Minneapolis, Minnesota, ACE demonstrated the project’s value to conference attendees at this year’s conference, once again held in the Twin Cities in August. Ron Lamberty, ACE’s chief marketing officer, shared updated stats over the first two years of driving the 2019 Ford Fusion standard hybrid, made flex-fuel capable courtesy of California E85 wholesaler Pearson Fuels and an eFlexFuel.com conversion kit. The vehicle, nicknamed “HEFF”—an acronym for hybrid electric flex fuel—was on display at the event venue, and Juha Honkasalo, head of industry relations for eFlexFuels, was also onsite to answer questions from interested conference attendees.

Two years ago, with the push for net-zero vehicles intensifying, and “netzero” being widely understood as meaning battery electric vehicles (BEVs) only, ACE announced the first-of-its-kind, three-year vehicle demonstration project to disrupt the “EV-only” narrative by showing that a standard hybrid vehicle powered by higher ethanol blends can have lifecycle greenhouse gas (GHG) emissions as low or lower than plug-in electrics, and is likely to reach net-zero long before BEVs.

“Range anxiety” continues to be a top reason drivers hesitate to buy EVs, and hybrids address those fears. Lamberty said hybrids make sense from a total GHG reduction standpoint, too, especially when teamed with ethanol. He said ACE’s project “reminds everyone a battery isn’t a fuel source, it’s a fuel tank, and to reduce carbon pollution, you fill a vehicle’s ‘tank’ with the cleanest fuel available, which is currently E85. While BEVs don’t have tailpipe emissions, electricity doesn’t come out of the wall, it comes from power plants that have plenty of emissions. Sixty percent of U.S. electricity still comes from burning fossil fuels, while E85 continues to lower its carbon intensity (CI), with some ethanol CIs in the 20’s.”

ACE devised the hybrid flex-fuel project after calculating a hybrid electric vehicle running on the lowest CI E85 available at the time (85 percent corn-fiber ethanol, 15 percent renewable naphtha) could obtain a total GHG score as low as 40 to 50 grams of CO2 per mile—far lower than current EPA total GHG emissions calculations for PHEVs or full EVs.

Yet, while hybrid vehicle sales increase, no carmaker has ever offered a flex-fuel hybrid in the U.S. So, ACE partnered with eFlexFuel to make its own. The conversion kit manufacturer is happy with the results so far. “This project with ACE has been a success,” Honkasalo said. “The results point out great potential for decarbonization in the current vehicle fleet with technology and fuel that are already widely available. With ethanol, we can achieve similar or even a lower carbon footprint than a plug-in electric vehicle. Best of all, flex fuel and ethanol are affordable and don’t force consumers to compromise on their driving.” SOURCE: AMERICAN

ETHANOLPRODUCER.COM | 25 800-279-4757 701-793-2360 Callusforafree,no-obligation consultationtoday. Natwick Appraisals 1205 4th Ave. S., Fargo, ND 58103 www.natwickappraisal.com natwick@integra.net The Specialist in Biofuels Plant Appraisals • Valuation for nancing • Establishing an asking price • Partial interest valuation Few certi ed appraisers in the United States specialize in ethanol plant and related biofuels properties. Natwick Appraisals o ers more than 50 years of worldwide experience. Your appraisal will be completed by a certi ed general appraiser and conform to all state and federal appraisal standards. Our primary specialty in industrial appraisal work is with ethanol, biodiesel, and other types of biofuel facility appraisals, including cellulosic ethanol plants.

COALITION FOR ETHANOL

search for the conversion kit by writing software for other companies).

In addition to the main components, other DIY essentials are supplied, including a user manual with instructions, cable ties, fuel hose, quick couplings, hose clamps and a fuel line release tool. The kit installation on the RFA’s PHEV took roughly an hour. The systems can’t be used on every vehicle, at least not yet, Isokivijärvi says.

The adoption of such technology is taking off in France. And the StepOne Tech team is planning for rapid growth from its current headcount of about 30 employees across the U.S. and Europe.

For those that want to see the cost advantages of installing the system, eFlexFuel has a calculator that allows a user to see how much can be saved over three years of fuel costs and carbon dioxide emissions when a vehicle is converted to E85.

The Future of E85 And EVs

Isokivijärvi believes that in order for the conversion kit approach to work on a national scale, his company has to work with American ethanol producers and their associations. “I'm a huge fan of the ambition across the U.S. ethanol industry,” he says. “If we are going to bring this to consumers and others to make it mainstream, we have to work together.”

In the U.S., the early push of the technology continues to be driven by vehicle owners looking for more power. But over time, Isokivijärvi says, the average car owner concerned with emissions will be a big factor in driving the growth of the StepOne Tech offering.

“This isn’t a path many companies have gone down,” he says. “There isn’t a clear path that has been paved.”

Part of what makes the technology appealing to investors, despite its unclear path, is that its future proof, according to Isokivijärvi. The current U.S. vehicle fleet is very gasoline heavy. “With our technology, we could move some of these gasoline powered vehicles into this flex fuel category. We could grow that pool bigger and bigger, even though there might be zero factory made flex-fuel vehicles introduced into the market,” he says. Isokivijärvi believes, at the end of the day, there is demand for a solution that can provide the same carbon footprint reduction as a battery-powered EV.

The RFA seems to agree with him, even though testing isn’t yet complete. Low-carbon E85 in combination with hybrid technology can deliver superior environmental performance at a low cost to the consumer, the RFA says. Customers don’t need to sacrifice optionality, convenience or affordability when they choose a PHE/FFV. Vehicles like PHEVs converted to E85 (for less than the cost of a new smartphone) combines the best of both worlds, the RFA says. “Ethanol and electricity can be complementary decarbonization solutions.”

Author: Luke Geiver Contact: writer@bbiinternational.com

Market

MEET TODAY’S GOALS. ANSWER TOMORROW’S QUESTIONS. SOLUTIONS, DESIGNED BY LBDS.

We put Fermentation First™. You get yeast, yeast nutrition, enzymes and antimicrobial products, alongside the industry leading expertise of our Technical Service Team and education resources. Find the right solution for your ethanol business at LBDS.com.

© 2023 Lallemand Biofuels & Distilled Spirits

© 2023 Lallemand Biofuels & Distilled Spirits

FACING THE CHALLENGE OF CHANGE

A conversation with Bruce Rastetter about his history in agriculture and ethanol production, as well as the transformative potential of CCS.

By Katie Schroeder

Bruce Rastetter, CEO of Summit Agricultural Group, has deep roots in the Midwest and the ag industry. With a background in farming and ethanol production, both domestically and abroad, Rastetter has a resume like few others. He shares his story with Ethanol Producer Magazine, covering his experience in agriculture and ethanol along with his recent endeavors into carbon capture and sequestration as well as sustainable aviation fuel. The common thread running through Rastetter’s reflections on agriculture and the renewable fuels industry is the importance of change and the “transformative” potential of low-carbon products.

Raised on a 300-acre farm in Alden, Iowa, Bruce Rastetter has deep roots in the agricultural world. In the 1980s, when he went to college, farming was a tough business. “I was going to become a lawyer, always intended to, started law school after I didn’t want to do that, came back, and wanted to farm, got involved in some different ag businesses, and I started selling feed[.]”

After founding Summit Farms in 1990, Rastetter expanded his interests and entered the pork industry, founding Heartland Pork four years later. The company reached over a million hogs per year before it was sold in 2004. He entered the renewable fuels industry by forming Hawkeye Renewables, completing a 60 MMgy ethanol

28 | ETHANOL PRODUCER MAGAZINE | OCTOBER 2023

LEGACY PURSUIT: “I don’t think there’s anything that I’ve ever done in my life that will be more transformative to ag than this,” says Bruce Rastetter, CEO of Summit Agricultural Group, shown here speaking at the 2022 FEW. Referring to the combined opportunity of CCS and SAF, Rastetter believes the global market for ethanol could essentially quadruple.

PHOTO: BBI

plant in Iowa Falls, Iowa, in 2003. The initial plant and expansion was followed by three 120 MMgy plants across Iowa, becoming the third largest ethanol producer in the nation at the time. Hawkeye Renewables made it through the 2008 financial crisis before being sold to Koch Industries in 2011.

Freed up by the sale, Rastetter visited Brazil and decided to move forward with developing a corn-based ethanol plant there. Summit Ag opened Brazil’s first corn ethanol plant in 2017. Since then, Summit has built two more plants in the country, together the three produce a total of 550 MMgy, utilizing second-crop corn as their feedstock. The company’s experience with RenovaBio, Brazil's national biofuels policy, helped it get acquainted with carbon scoring, having gone through the process to rate its plants’ carbon sustainability scores.

“We’re understanding the challenges of the U.S. industry,” Rastetter says. “Because agriculture has been my life and everything about it is really important to me—[the] markets and how we have a viable Midwest economy[.]” In response to these challenges and primed with the company’s understanding of a carbon scores, Summit Ag launched Summit Carbon Solutions, a company aiming to build carbon capture and sequestration pipeline that would move CO2 emitted from ethanol plants to permanent storage deep underground in North Dakota.

Doing Good Business

Throughout his years as an entrepreneur, Rastetter has developed some key principles by which he makes investment decisions. One of those principles is having partners with integrity and sound business practices. “You can’t get everything in a contract, you have to have people with integrity to do business with,” Rastetter says.

Some of the good businesspeople Rastetter has worked with over the years include Dave VanderGriend, CEO of ICM Inc., and Harry Stine, founder and owner of Stine Seeds. “I’ve done business with Harry for 25 years, and a handshake is always his word. I think you first start with that; [try] to do business with the best people,” Rastetter says.

A knowledgeable and adaptive team allows Summit to stay on top of new opportunities, such as Summit’s recent SAF venture. In May 2022, Summit announced plans to build an SAF plant using Honeywell’s alcohol-to-jet technology.

“Be honest and do business ... that’s kind of the guiding principle we try to have here,” he says. “And we try not to be the smartest guys in the room, but know the smartest guys in the room, and then make common sense business decisions, hopefully, and try to do what’s right.”

Throughout his time in the biofuels industry, Rastetter has seen a lot of changes. One of them being the shift from ethanol being seen as a non-toxic replacement for MTBE to an octane enhancer in fuel, while at times being pulled into the food-versus-fuel debate as ethanol started to take up a larger percentage of the nation’s gasoline pool. As he reflects on his career, he explains that he has seen both good times and hard times. “For me, one of the best experiences was

having a successful company, one of the hardest was going through tough times,” Rastetter says. “Whether it was 9-cent hogs, a 50-year low in 1998—which wasn’t any fun—to ethanol prices plummeting because of both supply and demand during the financial crisis of 2008.”

The lesson he learned from going through those tough times was that the industry needs to grow and develop new markets to weather those situations, which are hard on plants, investors, community members and corn prices.

Expanding Markets

One of Summit Ag’s projects that has been garnering attention throughout the Midwest is the Summit Carbon Solutions pipeline. The CCS project would put net-zero ethanol production within reach, lowering each participating plant’s CI score by roughly 32 points. Covering nearly 2,000 miles and crossing five states, Summit’s pipeline would have the capacity to move 18 million metric tons of CO2 per year from ethanol plants to North Dakota for sequestration deep underground. Since inception in 2020, the project has partnered with 34 plants representing 22 ethanol companies across the Midwest, most of which have CI scores in the 60s. Sequestration of CO2 coming from fermentation would lower ethanol’s CI score by about 32 points. With the addition of post combustion and sequestration, which lowers the score by another eight points, a 40-point overall reduction is possible.

This pipeline would give ethanol producers “line of sight” on net-zero or ultra-low-carbon ethanol, allowing the industry to have a lower carbon footprint than electric vehicles. “They won’t be able to do that if the pipeline doesn’t go in the ground. But if we do, we have a whole new world that could get opportunities for agriculture and biofuels,” Rastetter says. “And that, in my mind, [will be] really transformative by creating generational wealth in rural America, and you know, frankly that’s what we care about.”

Rastetter explains that Summit wanted to have a variety of plants across the pipeline footprint as well as diversity in the sizes of different facilities. “I don’t think there’s anything that I’ve ever done in my life that will be more transformative to ag than this,” Rastetter says. “And I think one of the messages that we try to send when we speak publicly or talk privately—saying the same thing—is that I’m not here to debate climate change. But I think agriculture [and] biofuels have [always been about] accessing new markets and responding to consumer demand.”

This pipeline could provide a significant boost for ethanol producers and farmers alike since it would open up new market opportunities for ethanol and its feed coproducts. Agriculture and biofuels have always tried to respond to consumer demand, and the CCS pipeline is a way to respond to the worldwide demand for sustainability. It would also enable the ethanol industry to compete with electric vehicles, lifting “all boats” in the agricultural world through higher commodity prices.

Both farmers and ethanol producers would be able to produce

ETHANOLPRODUCER.COM | 29 Profile

more if there was a market for it, Rastetter says; however, they have been limited by the risk of oversupplying the market. The ethanol industry is currently competing over a 15 billion gallon market. However, with carbon reduction technology, ethanol producers could access the 50 billion gallon SAF market, which when accounting for the conversion rate, would require 75 billion gallons of ethanol. The CCS pipeline could usher in a “golden era” of agriculture, Rastetter believes. With lower carbon ethanol, there is more potential for the ethanol industry to make SAF, which would make it possible for the ethanol industry’s growth to accelerate and benefit farmers. With the recent addition of ethanol producers Absolute Energy and NuGen Energy, Summit Carbon’s pipeline will impact nearly 45 million acres of farmland with these benefits, Rastetter explains.

Reflecting On Markets

Rastetter discusses the relationship between ethanol producers and farmers, as well as the importance of efficiency and sustainability to the future of both industries. He has seen firsthand the value the ethanol industry offers to grower profits. “[Nearly two decades ago], I had a farmer in Iowa Falls, Iowa, tell me that in 30-some years of farming he only had two years that were profitable without government subsidies, prior to 2004,” Rastetter says. “And since then, the only real government subsidy we have, [maybe excluding what's there for] some smaller crops, is federal crop insurance. And the reason for that is profitability driven by the market demand [built by domestic ethanol production].”

Every producer on Summit’s pipeline may be able to sell its ethanol for 35 cents per gallon more because of sequestration, which would allow the plants to pay farmers a dollar more per bushel and still be able to break even, Rastetter explains. Each producer has plans to expand 15 to 25 percent when Summit gets its needed permits and constructs the pipeline.

A cleaner environment is the benefit of pursuing greater efficiencies, allowing farmers to access new markets while mak-

ing more with less. Embracing sustainability also empowers farmers to access markets they couldn’t before and improve the market overall. “We have to lower those carbon scores for us to attain those new markets,” Rastetter says. “And to me that’s critical, and why we feel so passionate that we have to succeed with Summit Carbon or this industry’s going to struggle.”

He is concerned that if change is not accepted, U.S. agriculture will be left behind international competitors. Since American farmers cannot double-crop like Brazilian farmers, they need to “create value” with their singular crop. “And I think, with that, you have to embrace the change that allows you to attain new markets, because if you don’t, the world will leave you behind quickly,” Rastetter says. “And ... that’s the biggest thing that strikes me.”

Agriculture has an opportunity to move forward and increase the overall corn crop up to 20 or 25 billion bushel crops, Rastetter believes. He believes that it could be a similar development to what happened when corn production and prices rose in the 2000s. Farmers with more money are able to invest in newer and better technologies, and farm equipment companies will jump to make

new equipment for farmers to buy. “We’ll be producing a hundred bushel soybean per acre instead of 50,” he says. “We will produce everything more productively and with less nutrients, because of improvements in the root system of the plant or the timing of nutrient application.”

Although Rastetter believes the Summit Carbon pipeline will help the environment, he sees access to new markets as equally important. “And that’s what will drive wealth creation in agriculture if we do that,” Rastetter says. “We don’t have to return to the days of setting ground aside or thinking we all have to go [to] electric vehicles, that’s crazy.”

For Rastetter, accepting change and the value of decarbonization is vital to the health of the agriculture industry. “I think if you know the world is changing and you embrace it and you find a way to work within those markets, your life is going to be better, your community is going to be better and your companies will be better,” Rastetter says. “And it’s challenging.”

Author: Katie Schroeder

Contact: katie.schroeder@bbiinternational.com

30 | ETHANOL PRODUCER MAGAZINE | OCTOBER 2023

Profile

PLOTTING A NEW FUTURE: The Summit Carbon Solutions pipeline would cover nearly 2,000 miles across five states, delivering carbon dioxide from at least 34 ethanol plants to North Dakota for deep, safe and permanent sequestration. Each ethanol plant participating could lower its CI score by roughly 32 points.

PHOTO: SUMMIT CARBON SOLUTIONS

ETHANOLPRODUCER.COM | 31

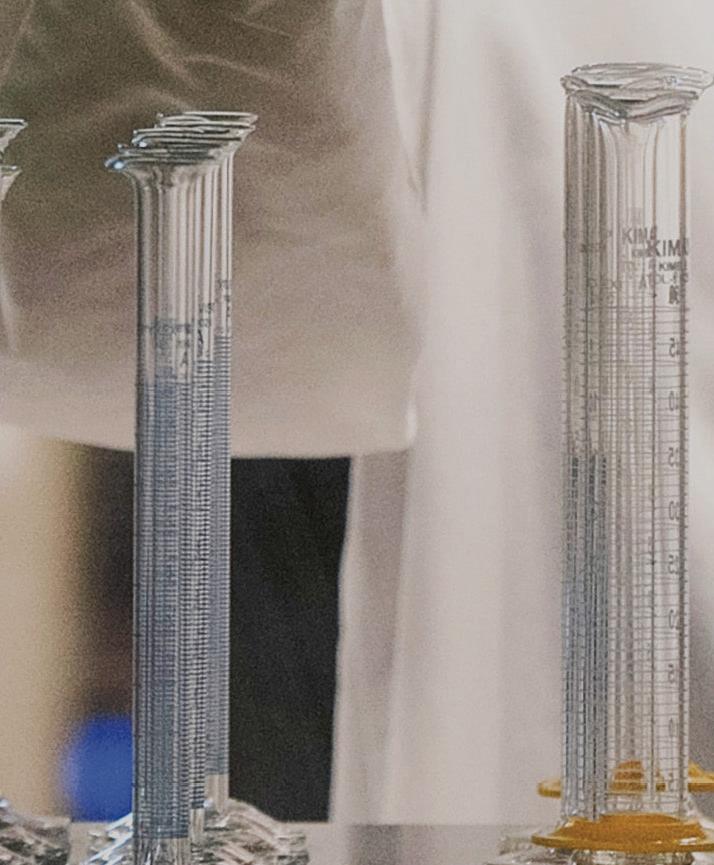

Staying Up to the Test

Questions by Katie Schroeder

Q: How have ethanol plant lab practices changed, if at all, in the past few years?

A: We have noticed tighter regulations in lab practices as GMP+[certification] has become an important part of our process.

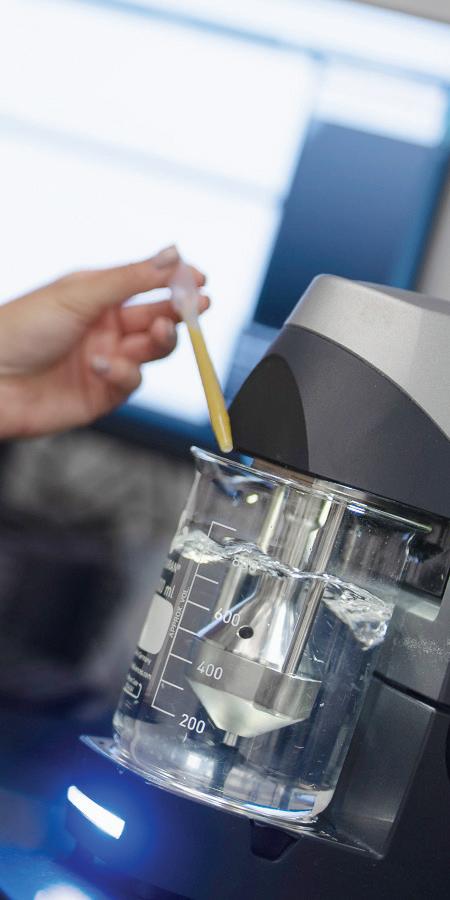

Q: Have your in-house staffing, technology or capability requirements changed in the past few years? If so, has that been related to increased or decreased reliance on third-party labs, other services, or changing operational priorities?

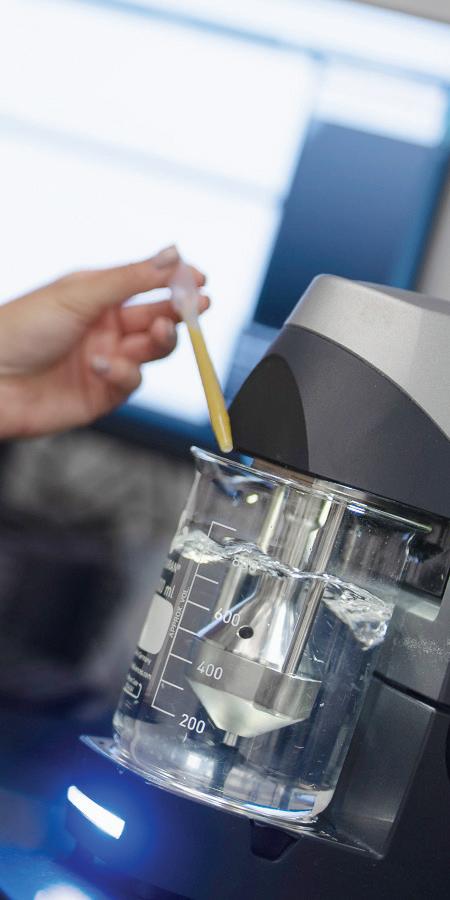

A: We have hired an Analytical Chemist/NIR [near infrared spectroscopy] Technician to develop reliable NIR methods that are frequently being monitored and updated. This has allowed us to get a better understanding of fat and protein throughout our plant and improved our ability to make real-time decisions without having to wait for third-party results to come back. We also invested in a protein analyzer to help us validate our methods without using a third-party lab for all of our samples. As new technologies have been implemented in our plant, it has prompted us to increase the testing that we perform, and we are also testing many more streams in the plant. For example, we are monitoring viscosity and particle size due to SGT [system], fat, protein, and solids throughout the plant—[as well as] thin stillage clarification and stressor testing on DEER streams.

Q: What are some new or evolved lab products, equipment, or technologies that have created notable improvements in your lab practices in recent years?

A: As mentioned above, our new Bruker NIR and the method development associated with it have advanced our lab practices. We also invested in a Mastersizer 3000 to monitor particle size, which has been a big help to our lab technicians since the manual method was very tedious.

Q: What is the biggest challenge you and your team have faced in the wake of the pandemic?

A: Supply availability and pricing. Since the pandemic, we have encountered many more supply backorders and shortages from our regular vendors as compared to before. With inflation, we have also seen a significant increase in pricing for many lab supplies. We have also faced issues getting technical representatives for instruments out quickly. It seems as if they got so behind on PMs and service during the pandemic that they are still struggling to catch back up.

Q: What are some of the innovations or improvements that you and your team have found helpful in your day-to-day work?

32 | ETHANOL PRODUCER MAGAZINE | OCTOBER 2023 Lab

A FEW NEW TOOLS: Marquis Energy Lab Manager Lauren Aubrey (pictured), says ethanol producers can significantly benefit from investing in new lab equipment. For example, a new Bruker NIR spectroscopy machine (above, behind Aubrey). and a Mastersizer 3000 (far right) particle size analyzer are just two examples of new devices that have helped advance lab practices at Marquis.

PHOTO: MARQUIS ENERGY

A conversation with Lauren Aubry, lab manager with Marquis Energy, on new advancements in the lab, helpful technology and challenges lab managers and technicians face daily.

A: The use of DataParc has been and continues to be very helpful. We are continuing to learn new ways to utilize the program and it makes a big difference in the ease of looking at data. The ability to pull the tags from the DCS, as well as the manual data the lab techs and operators are inputting all in one Excel sheet, accelerates the data analysis process. We also use many dashboards through DataParc that allow us to get a quick snapshot of different areas of the plant, which is great. Having one program that holds all of our data is also helpful to our operators, so they do not have to navigate many different Excel sheets from various locations and remember where to find the information that is needed.

Q: What are some of the challenges your team faces in daily operations? How have you overcome those challenges?

A: Lab space has been a big challenge for us. As we continue to add new technologies to our plant, increased testing and lab equipment has come with that, along with more staff members. We have limited counter space and at times congestion in the lab. We have overcome that by getting creative with how we utilize our space and automating what we can to reduce the amount of unnecessary clipboards and binders we previously had. For example, all samples requiring testing or certification now have an automated check-in process through a tablet, so we no longer need binders and clipboards containing the information. Due to the size of our facil-

ity, the lab faces a high sample volume throughout the day. When running calibration checks, this limits the time available for fermentation samples, specifically on HPLCs. Fermentation samples need to be analyzed quickly, which presents a challenge when we have standards running on our HPLCs. This sometimes causes frustration among our operators since it prolongs the time it takes for their samples to run. Our lab team does a great job of communicating with process operators on sample times to make sure our instruments are calibrated regularly and accurately.

Q: Where do you see the most potential for improvement in the lab side of ethanol production?

A: I think there could be improvement opportunities for inline monitoring. This would be especially helpful in streams that are coming around to our front end to help notify us of any potential stressors that could impact fermentation.

Q: What is something that makes you excited about the future of your plant, or the industry as a whole?

A: I am excited to see how the industry changes as carbon capture and sustainable aviation fuel continue to become a bigger part of it. We have plans to move forward with both of these at our site, and it is exciting to see the industry move in that direction.

ETHANOLPRODUCER.COM | 33

A Digital Workflow Solution

Case study: Golden Grain Energy is leveraging a plant process management and digital transformation solution that optimizes plant communication and workflow with a quick ROI.

By Natae Shreeves

By Natae Shreeves

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Ethanol Producer Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

34 | ETHANOL PRODUCER MAGAZINE | OCTOBER 2023

Midway between Des Moines and Minneapolis, lies Mason City, Iowa, a vibrant community in northern Iowa where Golden Grain Energy LLC planted its roots back in 2004. The company produces approximately 130 million gallons of ethanol annually, DCO (distillers corn oil), and both wet and dry distillers grains, providing a feed source for local livestock farmers. In 2021, the facility became home to the “World’s Largest Grain Bin,” which is large enough to park a 767 Boeing jet inside, according to Sukup Manufacturing Co. Now, construction is underway on a another grain bin of the same size, which is anticipated to begin operations in late 2023.

Matt Dutka, Golden Grain Energy’s plant manager, has been with the company since its inception, and has also served as production manager and maintenance supervisor during his tenure.

In 2019, Dutka and his team deployed a Plant Process Management (PPM) solution by eschbach trademarked Shiftconnector, which has proven to be a critical and necessary complement to the plant’s PLC/DCS investment for digitalizing manual workflow for shift logs and shift handover.

With 24/7 operations, the Shiftconnector enterprise platform is central to Golden Grain Energy’s digital transformation journey in that it ensures consistent workflow and transparent documentation, creating a single version of the truth and a reliable audit trail. All information regarding high priority events, shift logs, shift handover, open tasks, and unacknowledged instructions is organized for both operators and supervisors, including those covering for co-workers out ill, on vacation or otherwise not available.

After utilizing Shiftconnector and validating it within the company, the team recognized an opportunity to begin using the software to track additional data that was being maintained through paperbased logbooks like incoming and outgoing products, transportation method, relevant dates, bills of lading, vendors, grains inventory, safety and process bypass interlocks, and plant events and announcements.

“I was starting to see how time-consuming and cumbersome it was for managers, supervisors, and operators to gain visibility into the key information that was needed on a routine basis to efficiently run the plant. We knew that utilizing Shiftconnector to continue to automate our workflows and transition to electronic records was the solution, but what we didn’t have was the extra bandwidth to address it alongside all the other projects that were in our pipeline.” Dutka says. “That’s when I reached out to Novaspect to explore the services they could provide so we could quickly make improvements, free up our production team’s time, and make everyone’s jobs easier.”

Dutka decided to engage Novaspect, an eschbach Shiftconnector solution partner. Jon Hall is the vice president of Novaspect’s Digital Transformation Business Unit and has been with the company since 2000. Hall oversees an experienced team of MES Application, loT Data Integration, and Software engineers who manage and successfully deploy a wide range of digital solutions projects.

“Initial discussions with Matt and his team centered around their current processes and how to fully leverage Shiftconnector to further digitize Golden Grain Energy’s workflows, eliminate unnecessary paperwork, be more efficient with routine tasks, more effective with nonroutine tasks and steps, and ensure that key information could be easily viewed, analyzed and shared,” Hall says.

Our team of experts have over 20 years of ethanol plant maintenance expertise. We o er full service and parts for all Fluid Quip equipment to ensure peak performance.

• OEM Parts Warehouse

•$1 million+ inventory on-hand

•Factory Trained & Certified Techs

•MZSA™ Screens

•Paddle Screens

•Grind Mills

•Centrifuges

•Gap Adjusters

Operations

©2023. All rights reserved Fluid Quip Technologies LLC. All trademarks are properties of their respective companies. FluidQuipMechanical.com | 920-350-5823