Prioritizing Water Efficiency Can Lower CI

PAGE 14

Front-End Skimming Boosts DCO Yield PAGE 22

Distillers Technology Council Brand, Mission Renewed PAGE 38

Data drives innovation. Th rough CTE InSight , advanced statistical analysis identifies opportunities for improvement and predicts the most impactful change for plant performance. Better data clarity enables optimization. Turn InSight into action.

President & Editor Tom Bryan tbryan@bbiinternational.com

Online News Editor Erin Voegele evoegele@bbiinternational.com

Contributions Editor Katie Schroeder katie.schroeder@bbiinternational.com

Features Editor Lisa Gibson lisa.gibson@sageandstonestrategies.com

Vice President of Production & Design Jaci Satterlund jsatterlund@bbiinternational.com

Graphic Designer Raquel Boushee rboushee@bbiinternational.com

CEO Joe Bryan jbryan@bbiinternational.com

Chief Operating Officer John Nelson jnelson@bbiinternational.com

Director of Sales Chip Shereck cshereck@bbiinternational.com

Account Manager Bob Brown bbrown@bbiinternational.com

Circulation Manager Jessica Tiller jtiller@bbiinternational.com

Senior Marketing & Advertising Manager Marla DeFoe mdefoe@bbiinternational.com

Ringneck Energy Walter Wendland Commonwealth Agri-Energy Mick Henderson Western Plains Energy Derek Peine Front Range Energy Dan Sanders Jr.

September 22-24,

Minneapolis, MN (866) 746-8385 | www.safconference.com

Serving the Global Sustainable Aviation Fuel Industry Taking place in September, the North American SAF Conference & Expo, produced by SAF Magazine, in collaboration with the Commercial Aviation Alternative Fuels Initiative (CAAFI) will showcase the latest strategies for aviation fuel decarbonization, solutions for key industry challenges, and highlight the current opportunities for airlines, corporations and fuel producers.

St. Louis, MO (866) 746-8385 | www.fuelethanolworkshop.com

Now in its 42nd year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine —that maintains a strong focus on commercialscale ethanol production, new technology, and near-term research and development. The event draws more than 2,300 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

St. Louis, MO (866) 746-8385 | www.sustainablefuelssummit.com

Please recycle this magazine and remove inserts or samples before recycling

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer.com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-7468385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to editor@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space. TM

The Sustainable Fuels Summit: SAF, Renewable Diesel, and Biodiesel is a premier forum designed for producers of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to learn about cutting-edge process technologies, innovative techniques, and equipment to optimize existing production. Attendees will discover efficiencies that save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine and SAF Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers, and producers to advance discussions and foster an environment of collaboration and networking. Through engaging presentations, fruitful discussions, and compelling exhibitions, the summit aims to push the biomass-based diesel sector beyond its current limitations. Co-located with the International Fuel Ethanol Workshop & Expo, the Sustainable Fuels Summit conveniently harnesses the full potential of the integrated biofuels industries while providing a laser-like focus on processing methods that deliver tangible advantages to producers. Registration is free of charge for all employees of current biodiesel, renewable diesel, and SAF production facilities, from operators and maintenance personnel to board members and executives.

COPYRIGHT © 2025 by BBI International

Ethanol plants are sometimes criticized for their water use, but it’s hard to find examples of comparable industries that have gone so far, invested so much, to manage and reduce their water utilization. From sustainably sourcing and recycling water to investing in myriad new technologies to bring down consumption, producers have taken remarkable steps to lower their H2O requirements, often gaining additional benefits along the way.

Our lineup begins with “H2Opportunity In Every Drop,” on page 14, which examines an array of solutions producers can leverage to decrease water use and improve overall plant performance. In today’s carbon intensity-driven industry, we report, producers are keenly interested in opportunities to lower their CI via reduced water consumption and higher performance from water-linked infrastructure. From combating process-inhibiting foulants and optimizing circulation rates to deploying custom-engineered equipment, media and controls, conserving water, sensibly so, goes hand in hand with reducing energy use.

On page 22, we turn to coproduct optimization in “Capturing Free Oil,” catching up with Alfa Laval on the front lines—and front end—of DCO extraction. Many of the companies that serve ethanol also serve other industries, and sometimes that’s beneficial. In this piece, we look at one such product: a two-phase decanter that, while applicable to other industries, helps ethanol plants fully capture the free oil found in whole stillage. Specifically, we report on the company’s front-end skimmer, which can boost DCO yields by 25%-30%.

Jumping back into water, we introduce you to ZwitterCo in “Molecule-Coated Membranes,” on page 30. The story explains the company’s new approach to water reduction and treatment, which is as novel as its principal product, zwitterions, which attract water while rejecting troublesome organic compounds. By harnessing the properties of these novel molecules—paired with a copolymer for durability—ZwitterCo has been able to design and commercialize an advanced membrane technology that offers a chemistry breakthrough for treating wastewater streams.

Finally, we catch up with the newly rebranded Distillers Technology Council, an organization that’s older than the U.S. ethanol industry itself. The group, which was founded as the Distillers Feed Research Council in the 1940s and, for the past 30 years, operating as the Distiller Grains Technology Council, refreshed its name and mission last year to reflect a broader focus beyond distillers grains to a larger array of coproducts including distillers corn oil, high-quality protein, highly digestible fiber and more. While most rebrands are about getting more narrow in focus, the DTC is now casting a wider net to represent an evolving industry with new coproducts in need of support and delineation.

Enjoy the read!

2.25 MILLION BUSHELS

On his first day in office, President Trump issued an executive order directing federal agencies to identify and suspend unnecessary regulatory requirements that “impose an undue burden” on domestic energy resources, specifically including biofuels.

While ethanol producers face undue regulatory requirements each and every day, there is no better example of a wasteful, unneeded and costly regulatory burden than the requirement that fuel ethanol must be “denatured.” Both the Alcohol and Tobacco Tax and Trade Bureau and Environmental Protection Agency require that small amounts (generally 2-2.5%) of toxic denaturing agents be added to ethanol to render it unfit for beverage use.

The denaturant requirement is a regulatory relic that dates back to the early 1900s. At the turn of the century, the government allowed distillers to denature grain-based alcohol so that it could avoid steep beverage taxes when used as a solvent, cleaning agent, or additive in consumer products like detergents and perfumes. During Prohibition, the government began mandating the use of denaturants like methanol and benzene to prevent human consumption. Rigid requirements have been in place ever since, with natural gasoline (a product of fracking) emerging as the denaturant of choice in recent decades.

Of course, the world has changed significantly since denaturant regulations were first put in place. The requirements have clearly outlived their purpose, and there is no logical justification for maintaining them today.

Fuel ethanol is produced at highly regulated, high-tech, large-scale biorefining facilities (not the small distilleries and farm stills of a century ago) and shipped to gasoline blending facilities primarily in secure 29,000-gallon railcars or 5,000- to 11,000-gallon tanker trucks (not oak barrels and jugs!). Whereas prior to the Prohibition, the same small distillery might manufacture alcohol both for beverage use and fuel use, today the fuel ethanol industry and its supply chains are entirely distinct and separate from the beverage alcohol industry. In addition, a host of other regulatory requirements have emerged for both beverage alcohol and fuel ethanol that serve to further isolate the two markets from each other.

Today, there is essentially zero risk of fuel ethanol finding its way into the beverage alcohol marketplace. Similarly, there is effectively zero risk that beverage alcohol manufacturers could somehow attempt to avoid taxation by “disguising” their product as fuel ethanol.

While the societal benefits of denaturant requirements are illusory, the costs to ethanol producers are very real. A typical biorefinery will spend $3-4 million per year on denaturant. In fact, ABF Economics estimates that industrywide spending on denaturant is close to $600 million each year—roughly equivalent to the industry’s labor expenses. In addition, biorefineries must install and maintain separate storage tanks for denaturant, along with equipment to blend denaturant into ethanol.

At the same time, adding fossil-derived denaturant to ethanol raises carbon intensity, lowers the octane value, adds sulfur and boosts certain tailpipe emissions. Why are we polluting an intrinsically clean fuel with dirty, toxic denaturants?

And because it displaces pure ethanol, denaturant requirements reduce ethanol and corn demand. The industry adds 300-400 million gallons of denaturant to ethanol each year—displacing volume that could otherwise be satisfied with ethanol. Thus, eliminating denaturant requirements would immediately bump ethanol demand, which in turn would boost corn grind by roughly 125 million bushels per year. That would provide a welcome shot in the arm for America’s farmers.

As administration officials ramp up efforts to identify and remove “burdensome and ideologically motivated regulations,” we encourage them to start by eliminating costly, outdated and completely unnecessary denaturant requirements.

Experience the Alcohol School like never before. With revamped sessions, fresh topics and more opportunities to connect, this year’s event blends cutting-edge innovation with expert-led education.

Se ptember 7-12, 2025 | Montreal, Quebec, Canada REGISTER TO DAY

El evate your exper tise.

Faced with an uncertain transatlantic trade relationship, European leaders have begun to re-think certain policy priorities in a way that emphasizes domestic assets and competitiveness.

For the EU biofuels sector, this should come as good news after all, what better way to achieve energy independence, boost food security, valorize the EU bioeconomy, support farmers and help reduce transport emissions than with a homegrown resource such as renewable ethanol?

In fact, even though EU policy continues to unfairly hamstring the potential contribution of cropbased biofuels to these important efforts, there have been some encouraging signs lately that maybe the tide is turning.

One example was in March, when European Commission President Ursula von der Leyen signaled a high-level shift in the EU approach to transport defossilization. Von der Leyen talked about the “need to listen to the voices of the stakeholders that ask for more pragmatism in these difficult times, and for technology neutrality, especially when it comes to the 2025 targets” for reducing emissions from cars.

These “stakeholders” include European citizens, who are voting with their pocketbooks. Every month, sales figures from the European automobile industry confirm the need for a more flexible EU approach to road transport decarbonization, as sales of battery electric vehicles are not yet living up to the Commission’s expectations.

In fact, hybrid vehicles are now the number-one category of new car sales in the EU, representing 35.2% of sales so far in 2025 and “remaining the preferred choice among EU consumers,” according to ACEA, the European Automobile Manufacturers’ Association.

Gasoline, gasoline hybrid and plug-in hybrid cars together make up more than 71% of new cars. These vehicles will be on the roads for a long time, and the most immediate and cost-effective way to reduce their greenhouse-gas emissions is with renewable ethanol.

Importantly, these cars can run on renewable fuels that are readily available and deliver immediate GHG reduction. Even after 2035, plug-in hybrids running on a blend of 100% renewable bioethanol and bionaphtha will meet the regulatory requirements for carbon-neutrality. Everybody in Europe wins: automotive companies, motorists, farmers whose crops produce renewable fuel.

This synergy has been illustrated this spring across the EU in a project called the Tour d’Europe, in which cars and trucks on a three-month road trip across 20 countries demonstrated the decarbonization potential provided by renewable fuels, raising awareness about their accessibility and ease of use in Europe, and underlining their significant role in reaching the EU’s objective of climate neutrality by 2050.

The Tour d’Europe cars and trucks were equipped with a software tool called a “digital fuel twin” (DFT) that verified the use of renewable fuels and the resulting reductions in CO2 emissions.

It’s always been clear that technology-openness and a flexible approach are essential if the EU wants to achieve its ambitions for defossilising transport and for boosting competitiveness and strategic autonomy.

Now the Commission needs to turn words into actions and include the contribution of renewable liquid fuels such as ethanol, which has a proven track record of GHG reduction in the petrol and hybrid vehicles Europeans continue to buy.

• Delivers up to 15% increased corn oil recovery

• Enables pathway to produce low-CI cellulosic gallons

• Dewaters corn kernel fiber for reduced natural gas consumption

• Maximizes plant operability

To learn more, contact your account manager.

E15 = $10.7 Billion in

a strong focus on safety, sustainability and regulatory compliance, the company partners with clients to optimize processes, scale proprietary technologies and enhance facility efficiency.

With the E15 waiver in place, consumers can unlock billions in fuel savings this summer. Lower cost. Higher octane. Made in America.

The Renewable Fuels Association announced the addition of two innovative companies, Nelson Baker Biotech and Verdova, as new associate members. Their expertise in biotech engineering solutions and field-level agricultural data will further strengthen RFA’s efforts to advance renewable fuels through technology, sustainability, and continuous improvement.

Nelson Baker Biotech delivers custom, turn-key solutions for the biotech industry, combining engineering expertise with hands-on field experience. With

Verdova is a farmer-founded, farmer-led team on a mission to make farm data accessible and valuable for growers and agricultural stakeholders. Its goal is to bridge the data delivery gap that currently limits the usefulness of agricultural data.

Solenis, a global provider of water and hygiene solutions, has been selected as a 2025 U.S. Best Managed Company for the fifth consecutive year. This also marks its second time as a “Gold Honoree,” designating four or more consecutive years of recognition. Sponsored by Deloitte Private and The Wall Street Journal, the program acknowledges outstanding U.S. private companies.

The 2025 designees are U.S. private companies that have demonstrated

excellence in strategic planning and execution, a commitment to their people, as well as maintaining financial performance and governance. Designees drove their businesses forward while remaining dedicated to their people and focusing on their customers. Advanced technology, including AI, took a center role for most of these companies to create efficiencies and enhance the quality of their products and experiences.

Scientists at Washington State University have found a new way to produce sugar from corn stalks and other crop waste, potentially opening a new pathway to sustainable biofuels.

Newly published in Bioresource Technology, their experimental process used ammonium sulfite-based alkali salts to convert corn stover—leftover corn stalks, husks, and other residues—into low-cost sugar for production of biofuels and bioproducts, making the process more economically feasible.

“Inexpensive sugar is the key to commercial success for new technolo-

Iowa Secretary of Agriculture Mike Naig announced that the Iowa Renewable Fuels Infrastructure Program board recently approved an additional 95 applications from Iowa gas stations to support new and expanded ethanol infrastructure projects. These investments help drivers save money by providing expanded access to lower-cost and cleaner-burning homegrown biofuels like E15 (Unleaded 88). The cost-share grants were awarded

SOURCE: WSU

gies that make fuels and useful products from renewable biomass,” said Bin Yang, professor at WSU’s Department of Biological Systems Engineering and a lead investigator on the study.

Yang and collaborators at the University of Connecticut, the National Renewable Energy Laboratory, the USDA Forest Products Lab in Madison, Wisconsin, and Washington University in St. Louis, Missouri, sought and found a cost-competitive way to efficiently turn cellulosic biomass into sugar.

Our team of experts have over 20 years of ethanol plant maintenance expertise. We o er full service and parts for all Fluid Quip equipment to ensure peak performance.

• OEM Parts Warehouse

•$2 million+ inventory on-hand

by the RFIP Board during its quarterly meeting on April 15.

The approved project sites are located in 38 counties and total $940,121 in state cost-share. These are in addition to the 114 ethanol and biodiesel projects that the RFIP board awarded at the end March, which set a record for the number of projects approved in one quarter.

•Factory Trained & Certified Techs

•MZSA™ Screens

•Paddle Screens

•Grind Mills

•Centrifuges

•Gap Adjusters

Proven solutions and alternative strategies can decrease water usage and improve overall plant performance.

By Luke Geiver

Water issues can show up everywhere in an ethanol plant. From the beginning, source water volumes need to be considered, as impurities can require mechanical or chemical pretreatment for fluoride or iron. Inefficient or improperly maintained infrastructure such as cooling towers or boilers can increase the volume or purity requirements for production and efficiency. Dehydration and wastewater systems can also impact total volumes used or treated, including the energy bill required to make either process work.

In the push to reduce carbon intensity (CI) scores, water can present significant challenges. But as several plants, technology providers, engineers and researchers are illustrating, focusing on H20 can create opportunities to lower CI and improve efficiencies from end to end via reduced volumes and higher performance from water-linked infrastructure.

Helping ethanol producers minimize water use, water discharge and fuel consumption is what ChemTreat, a provider of water and process treatment solutions, does best.

“It is really our bread and butter,” says Patrick Shultz, corporate director of biofuels for ChemTreat. “For over 50 years, this has been our company’s area of focus. We work with our ethanol customers to increase their efficiency, protect their assets and conserve resources.”

ChemTreat deals primarily in boilers and cooling towers. It also works with producers to optimize cleaning processes and evaporator scale control. In 2023, the company released a case study documenting solutions it provided for an ethanol plant struggling with boiler feedwater and condensate corrosion issues. The plant’s approach to its boiler was based on a standard three-component program, consist-

ing of three chemical containments to manage, along with three pumps and three products to test for.

ChemTreat simplified the process by recommending an update with a single product containing polymer to inhibit scaling, a neutralizing amine to reduce the potential for carbonic acid attacks and a filming amine to create a protective barrier over the entire feedwater and condensate system.

The company also offers its trademarked FlexPro, which dramatically reduces corrosion, according to Shultz.

“We have found that in the past, cooling water corrosion rates had often been treated as an afterthought in the ethanol industry, but that is changing,” Schultz says. “As plants begin to age, minimizing corrosion rates becomes very crucial.”

In addition to the FlexPro offering, ChemTreat has also created a line of broadspectrum cleaning products to deter mineral scale and organic foulants found in front-end fermentation and evaporators. Because evaporators require pure water, any impurities present in the towers have to be flushed out.

Schultz says the experience level of ChemTreat’s on-site account managers is what really separates them from the competition. “Our account managers have a thorough understanding of the water at each of our customers’ sites, allowing them to identify each customer’s unique limiting factors.”

Schultz points out that most of the account managers at ChemTreat have more than

10 years of experience in the industry. It seems that ChemTreat’s unique approach has been very well received by the ethanol industry. “In just the past four years, we have more than tripled the number of ethanol customers that we service,” Schultz says.

Kurita America, another water specialist that serves the ethanol sector, offers a checklist of questions that producers can review if they believe their cooling towers are an issue for performance or overall high water consumption:

• Can the circulation rate of the cooling system be increased?

• Does the fill need to be replaced?

• What are the flow rates through the plant exchangers?

• What are the temperature profiles showing versus what they should be?

• If modifications are made to the Btu output in one area to maximize efficiency, how does that affect cooling tower operations?

Some technology providers, engineers and plant managers look upstream first to turn water issues into opportunities.

Watertech of America, a Wisconsin-based water expert and solutions provider, took an upstream approach to help a 50 MMgy ethanol plant deal with issues in its cooling tower. The company focused on the high levels of iron in the well water, fouling both the cooling tower and the fermentation heat exchangers. The location of the cooling tower presented a challenge as it was exposed to high dust and heat.

At one point, the iron removal filters were malfunctioning and showing higher iron levels than the untreated well water did prior to filtration.

To fix the issue, Watertech put together a plan that rebuilt two systems, including underdrain systems, while also adding custom-engi-

neered media and controls. The resulting work increased production at the plant by roughly 15,000 gallons per day, lowered maintenance on chillers and CO2 production and reduced the need for biocides. Watertech says the plant saved up to $50,000 annually.

In Iowa, Synder & Associates transformed Elite Octane’s cooling water resources, drawing 1.2 million gallons of water per day from municipal wastewater instead of community wells. The project required the city of Atlantic, Iowa, to install three 72 horsepower submersible pumps in its effluent tanks and 4,300 feet of 12-inch main pipe through a right-of-way easement connecting the plant to the city. According to Synder, Elite Octane is covering the cost of pumping and transferring the treated effluent. As a result of the project, the discharge water from the plant exits cleaner than it otherwise would have, and the amount of wastewater the city discharges into the East Nishnabotna River is reduced.

“This project blazes the trail for future ethanol production facilities to use treated wastewater effluent as a substitute for freshwater sources,” Synder said in a statement.

Bruce Dvorak Professor of Civil and Environmental Engineering University of NebraskaLincoln

Tharaldson Ethanol of North Dakota also works with its local city on water supply. Between 2008 and 2016, the city of Fargo says it supplied Tharaldson Ethanol with just over 2.57 billion gallons of water that would have otherwise been discharged after treatment into the Red River of the North. Prior to reaching the river, a portion of the city’s treated wastewater is diverted to an advanced water treatment facility that then

provides high-quality water to the Tharaldson plant.

For improved cleaning solutions, Arkansas-based Water Tech Inc. offers a specialized, portable CIP skid that minimizes the need for more labor-intensive manual cleaning, while providing a convenient solution that makes effective cleaning processes repeatable, the company says. The CIP skid can utilize a number of different products offered by the company, including anti-foam chemistries and deposit control chemistry.

Bruce Dvorak, University Nebraska-Lincoln professor of civil and environmental engineering, has been studying ways for ethanol plants to reduce water and energy consumption during ethanol production since 2022. Dvorak and his team are almost ready to divulge their data and findings after two years of intense work. The majority of the research, he

Continued on page 19

FLEXPRO POWER: ChemTreat’s unique FlexPro product helps control corrosion and impurities that impact boilers and cooling tower components crucial to overall ethanol water usage.

Another University of Nebraska-Lincoln researcher helps to provide a big-picture view of water and ethanol. Richard Perrin, a Jim Roberts professor of agricultural economics, focuses on three areas of research: productivity in agriculture; how biofuels affect agriculture and the environment; and the Ogallala Aquifer’s potential to feed the world.

The Ogallala Aquifer is part of the High Plains Aquifer, an underground body of water that serves as a main water source for several Central Plains states including those that produce ethanol like Nebraska, Texas, Oklahoma or Kansas.

According to Perrin, the aquifer in Nebraska is relatively stable, except in the southwest part of the state. South of Nebraska, he says, saturated thickness is less and it appears that current rates of water extraction from the Ogallala are not sustainable. Water efficiency and wastewater use could help reduce the amount of water drawn from the aquifer.

From idea to install, Sam Carbis Solutions Group keeps your product transfer process safer and more efficient. Loading arms, cage systems, and platforms engineered to work together ensuring compliance with mandates and easier loading and unloading.

See how we have helped other organizations with their safety needs at CarbisSolutions.com

Continued from page 16

says, has focused on the volume of water truly needed by a plant. Some areas that require water may not be running at the right capacity, causing excess water to go to waste in other processes. CO2 scrubbers also require a high volume of water.

Dvorak and his research team acquired sampling equipment to monitor air emissions from CO2 scrubbers in an effort to study how much water might or might not be needed to achieve the right level of performance from the scrubbers.

While the research, once released, will shed light on water use in Nebraska ethanol plants, the work will also help researchers explore yet another opportunistic process to reduce water use.

His team has been designing and testing a bioscrubber column that reduces water use by potentially eliminating the CO2 scrubber altogether. The intricate system involves flowing water infused with CO2 over a microbe-

rich solution that helps diffuse hazardous air pollutants, or HAPs. The microbes are fed via CO2, the same CO2 that would otherwise be treated in the scrubbers.

Entities like the City of Chicago Municipal Wastewater utility use the same process to remove odors from water streams.

“We think this process could be good for ethanol production,” Dvorak says. “Any process that helps improve water usage at a plant is a good thing.”

Author: Luke Geiver writer@bbiinternational.com

Fluid Quip Technologies sets the standard for oil recovery and low-CI process design.

By Ryan Cariveau

In a rapidly evolving ethanol market where every drop of oil and every BTU of energy counts, Fluid Quip Technologies (FQT) is setting the pace for technological advancement. With unmatched expertise in oil liberation and recovery enhancement, low energy distillation, and overall plant energy reduction, FQT has become the industry’s go-to partner for integrated, performance-driven solutions that boost plant profitability and reduce carbon intensity (CI).

At a time when ethanol producers are under growing pressure to increase yields and meet sustainability targets, FQT delivers the technologies—and the leadership— that keep the industry moving forward.

FQT’s innovations in oil recovery and enhancement have fundamentally changed how plants think about separation, yield and efficiency. With systems engineered to extract more corn oil at every phase, the company has enabled producers to unlock millions in new revenue with minimal disruption to existing operations.

Technologies like Overdrive™, designed to optimize underperforming oil separation systems, and Selective Grind Technology™, which liberates more oil from slurry, are just two examples of how FQT brings precision and performance to oil recovery. The DCO Technology™ further sets FQT apart, separating solids from thin stillage to dramatically improve both oil recovery rates and evaporator efficiency.

This integrated approach to oil enhancement doesn’t just generate higher yields—it reshapes how plants think about coproduct value, system balance and overall ROI.

FQT is also leading the way in reducing ethanol’s carbon footprint. Its suite of Low Energy Distillation™ and Mechanical Vapor Recompression (MVR) solutions have earned industry-wide attention for pushing thermal efficiency to new heights.

FQT’s distillation and MVR systems consistently deliver some of the lowest steam usage rates in the industry, cutting energy costs while helping facilities meet increasingly strict CI standards. In several installations, these technologies have played a central role in qualifying for California’s LCFS, Canada’s Clean Fuel Standard, and global SAF programs.

Whether retrofitting an existing site or engineering a new-build facility, FQT’s systems are designed with CI in mind— integrated for long-term energy savings, reduced water usage and minimal environmental impact.

What truly sets FQT apart is not just its technology—it’s the people behind it. The original founding team remains actively involved in leading the company today, bringing decades of experience and a relentless focus on innovation.

This consistent leadership has allowed FQT to stay nimble, visionary and deeply aligned with the real-world needs of ethanol producers. Unlike many tech companies that lose touch with their roots as they grow, FQT’s founders continue to guide product development, customer engagement, and strategic direction.

Their presence ensures that every innovation is grounded in a deep understanding of plant operations, economic drivers, and the future of renewable fuel markets.

FQT doesn’t just invent great technology, it delivers it. The company’s engineering and field teams work directly with plant staff to integrate systems efficiently, safely, and with a clear eye on uptime and return. From feasibility engineering assessments through construction, commissioning and optimization, FQT brings a full-project mindset to every client solution.

And the results speak for themselves: double-digit oil yield improvements, significant reductions in steam load, and stepchange CI reductions across dozens of facilities in North America, South America and Europe.

As the ethanol industry continues to evolve toward a low-carbon, high-efficiency future, Fluid Quip Technologies stands as both a trailblazer and a trusted partner. With several new systems set to launch in the coming year, including enhancements in oil recovery and next-gen thermal systems, FQT’s role in shaping the next era of ethanol production is only growing.

For producers ready to elevate performance, capture more value, and futureproof their operations, one name continues to rise above the rest: Fluid Quip Technologies.

Author: Ryan Cariveau, Director of Engineering

About the Author: Having managed one of the world’s largest ethanol plants before joining Fluid Quip Technologies, Ryan Cariveau brings firsthand insights into operations and project execution from the producer's viewpoint. His time at FQT has shown him how FQT’s unmatched technical depth and executional excellence deliver real, measurable results for customers.

DCO Technology™

• Wash more oil to thin stillage and remove fine solids from evaporators to increase oil yields and reduce energy consumption

Overdrive™ Technology

• Boost oil yield with your existing system by creating optimal syrup conditions for oil recovery

• Secondary milling to release more oil from germ particles and increase ethanol yields

• FQT conducts oil optimization studies to optimize operating conditions and help you evaluate the best options for improvements

By leveraging FQT’s full oil recovery suite, up to 90% of available corn oil can be recovered.

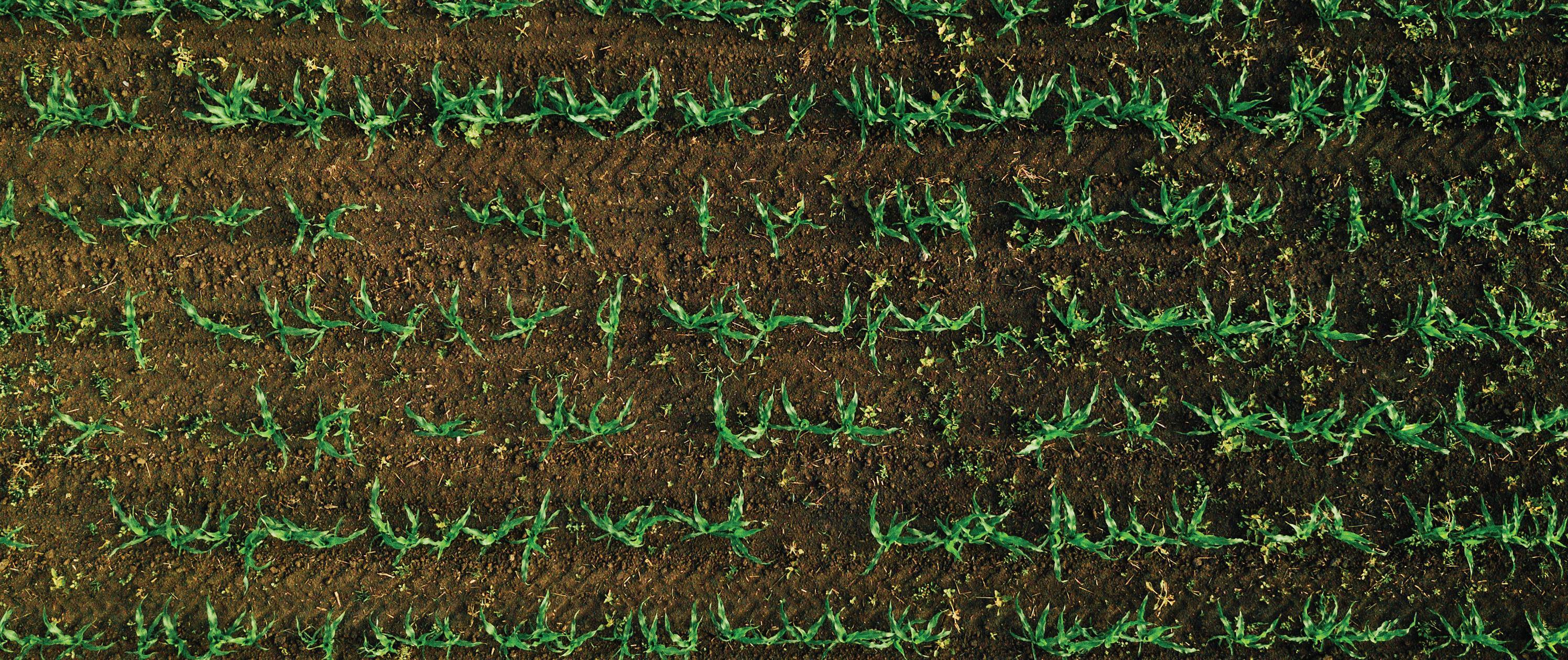

Alfa Laval’s DCO extraction technology captures free oil on the front end

of the ethanol production process.

By Katie Schroeder

Alfa Laval specializes in heat transfer, fluid handling and separation technologies, serving the ethanol, food and brewery industries. Because of the company’s diverse customer base, Alfa Laval can utilize its technologies cross-industry. One such technology is the Prodec 65 Oil Plus Skimmer, a two-phase decanter that helps ethanol producers collect 99% of the free oil found in the whole stillage.

Prodec Oil Plus improves DCO yields by 25% to 40% when incorporated into the front end of the production process, according to the company. Yields vary by plant, says Dennis Schoenwald, business development manager – Ethanol and Biofuels Technologies with Alfa Laval. Dakota Spirit Ethanol, an 80 MMgy plant located near Spiritwood, North Dakota, installed Prodec in October 2024 and has seen yield increases between 25% and 30%, according to Brian Markegard, senior process engineer at Dakota Spirit, owned by Harvestone Low Carbon Partners.

Most ethanol plants extract 0.8 to 0.9 pounds of DCO per bushel of corn, with high-yield plants extracting around 1 pound per bushel, but Schoenwald says even high-yield plants have seen significant production boosts. Temperature, use of a demulsifier, the amount of oil present in the corn crop or the fermentation process can all impact oil yield. Schoenwald credits Greg Maimares, sales representative for Applied Material Solutions, with supplying the demulsifier that releases the free oil so it can be captured by Alfa Laval’s technology.

Through testing and analysis, Alfa Laval can give producers an accurate estimate of oil yield increase with Prodec Oil Plus, which helps producers determine whether the investment makes sense financially.

“The reason for the large-scale test is everybody’s been dealing with the syrup, which is like 70 to 100 gallons a minute per machine,” says Stephen Ludes, a

represents a crucial income stream for ethanol producers, so many are focused on increasing their yield through add-ons and efficiency enhancements.

'Why not get that oil before it goes to the whole stillage decanter before it becomes impregnated, and before you start creating unnecessary losses on the back end?'

- Dennis Schoenwald, Business Development Manager, Ethanol and Biofuels Technologies, Alfa Laval

sales manager focused on agricultural processing at Alfa Laval. “Now you’re telling everybody that you need to put it through the full whole stillage flow, which, for a 60 million-gallon plant, is roughly 600 gallons a minute. If you’re a 100 million-gallon plant, you’re 1,000 gallons a minute. It’s a big capex upfront, so they need to justify the recovery and return in order to make the investment.”

Alfa Laval verifies its estimates in the lab. “We do a rough 5- or 10-minute spin down, depending on whatever their standard lab procedures are at the plant, and spin it down just to get a value of where we’re at and because of the knowledge we’ve gained over the last two to three years, we already know how much [yield] that’s going to lead to,” Ludes says.

Free oil is often incorporated into the solid material in the whole stillage as the whole stillage decanters dry out the cake. The remaining liquid is sent to the evaporators, concentrated and sent to disc stacks or tricanters for oil extraction. Schoenwald explains that implementing Prodec Oil Plus

on the front end of the process after the beer column is the most “valuable” location, rather than extracting DCO from the syrup. Although Prodec Oil Plus can work at the back end of the process, where disc stacks and tricanters are usually employed, the yield bump is only 5%. The turbulence later in the process binds the DCO into the DDGS, making it impossible to break those bonds. Ludes explains that oil extraction at the back end of the plant also has a role to play, because sometimes the heat from evaporators breaks those bonds and maximizes capture.

“Why not get that oil before it goes to the whole stillage decanter before it becomes impregnated, and before you start creating unnecessary losses on the back end?” Schoenwald says. The Prodec 65 Oil Plus has some similarities to a standard whole stillage decanter, which is designed to make a drier cake and remove as much water as possible, using the different densities and gravities of oil and water, enabling skimming of the free oil off the top.

DCO’s specific gravity is around 0.9, while water’s specific gravity is over 1. This difference speeds up the separation between the two substances. “In this particular case, we want two liquid phases,” Ludes says. “You’re getting the oil phase out, and we want the other phase to stay a liquid and pumpable so it can go right to your whole stillage decanters.”

“This oil capture is super critical to the plant because it is paying lots of bills,”

Schoenwald says. “I mean everybody is only getting maybe, at most, an additional 5% by adding another disk stack or a tricanter on the back end of syrup. [So,] that’s the beautiful thing about our technology in [terms of] our placement: We don’t have this extremely complicated bolt-on technology.”

Schoenwald introduced the technology to Dakota Spirit’s management team in

2021. The plant had already been exploring the idea of removing the free oil from the whole stillage early in the process.

“We knew that we were losing oil in our whole stillage,” Markegard says. “It was going out with the whole stillage into the DDG and never making it into our backset or our centrate, and ultimately into our syrup.”

Before adding Prodec Oil Plus, the plant was able to maintain around 1 pound per bushel of DCO by using strategies such as replacing its hammer mills to make a finer flour. “We were looking for the next step to improve that recovery and felt like without additional technology, we weren’t going to get to where we would like to be,” Markegard says.

Dakota Spirit had an existing relationship with Alfa Laval, using its decanter-style centrifuges for whole stillage. The project also looked like a “plug and play opportunity” that was easy to execute compared to other bolt-on technologies, according to Markegard.

Dakota Spirit ran a year-long test with a full-size machine before purchase, which gave the plant the opportunity to create mass balance and assess how the technology would impact evaporators, DDGS and other elements of the production process. The facility’s team gathered helpful data after two months, but ran it for another 10 to account for any variables that could impact performance.

Dakota Spirit was among the first ethanol producers to run a test of Alfa Laval’s larger Prodec Oil Plus skimmer. “We wanted to figure out what one of our bigger machines would look like in a commercial setting that would take a commercial flow and Dakota Spirit was that candidate at that time,” Schoenwald explains.

Installation requirements include the decanter, as well as a surge tank to hold the whole stillage and a surge tank for storing corn oil, in addition to some pumps and venting equipment. “Compared to other

solutions, ours is about as simple as it gets from that standpoint—from an installation perspective,” Ludes says.

The space requirements for the equipment can be a significant challenge when working on installation, he explains. The Prodec Oil Plus decanter must be located above the ground floor, so the de-oiled whole stillage can drop down into a surge tank after going through the decanter. Some producers have the space available already, but those that don’t may need to construct another building or a second-floor mezzanine level. “They’re basically taking the beer columns and dropping them down, feeding it to these machines and then taking what comes out of here and feeding it to the whole stillage rather than going straight from the beer columns to the whole stillage to decanters,” Ludes says. “All they’ve done is add this step in this little block in front of it.” The return on investment for Prodec Oil Plus is usually estimated at around two years, though it could be longer if a new building is needed to house the machinery.

Dakota Spirit did not need to install a new building, but installing the technology in an existing building brought its own challenges, as the engineers had to navigate the process layout around existing pipe racks and electrical cabinets. Markegard says Dakota Spirit’s personnel worked together to map out the project before going into the engineering process; and Nelson Baker Biotech translated the management team’s vision for the installation into reality.

The engineering firm designed redundant pipework so that the whole stillage flow can be redirected back to its normal course without interruption, in the event that the oil skimmers need to be taken offline for any reason.

Ludes breaks down the impact DCO yields make on a producer’s bottom line. For example, if a 60 MMgy ethanol plant’s DCO yield is at 0.95 pounds per bushel before installation, a 30% increase brings the yield up to about 1.25 pounds per bushel, bumping up DCO production by 7 million pounds of oil each year. If the DCO price

stands at $0.50 per pound, then the producer receives $3.5 million in additional revenue.

“That’s why, whether it’s us or any other technology, they’re chasing corn oil, because that’s a lot of money per year,” Ludes says.

As a lucrative product for ethanol producers, even a 2% increase brings significant profit. Producers must consider that not every piece of technology will be worth the investment. “I’d say every plant’s dynamics are

different, so what you know, using the data to instruct what technology is best for that plant is the way to go,” Markegard says. “Whatever makes the most money.”

Author: Katie Schroeder katie.schroeder@bbiinternational.com

With its zwitterionic copolymer membranes, ZwitterCo has a new option for producers focused on water treatment.

By Luke Geiver

ZwitterCo’s new approach to water reduction and treatment is as unique to the ethanol industry as the Massachusetts-based company’s name. Recognized by Fast Company as one of the world’s most innovative companies in 2024, ZwitterCo has created a novel membrane technology unlike almost anything, according to Alex Rappaport, CEO and cofounder. Rappaport built ZwitterCo from a Tufts University Lab idea into the 2023 breakthrough technology company of the year at the Global Water Summit.

Over the past five years, the team has raised multiple rounds of capital (including a second startup round of $54.8 million), added leading experts in water treatment to its team and debuted its technology in several sectors

with known water handling issues, including ethanol and biorefining.

The company name is a direct reference to zwitterions, molecules that have unique properties allowing them to attract water while rejecting organic compounds. By harnessing those properties, ZwitterCo has been able to design and commercialize an advanced membrane technology that offers a chemistry breakthrough for treating wastewater streams. A ZwitterCo membrane, made with zwitterion-infused material, has unprecedented fouling resistance, the company says, and organic material doesn’t get stuck in the unique pore structure like it might in traditional membrane systems. It’s like the difference between a cooking pan with a normal surface versus an option with a brand-new non-stick coating, Rappaport says.

While the company was formed with a big-picture vision of addressing water scarcity and reuse, the team’s industry-specific approach can be distilled down to a goal of providing better membrane performance and usability over time.

“We believe if you are going to try and get plants off of the water grid, membranes have to be more scalable and sustainable,” Rappaport says.

A plant can’t afford to use membranes if they need to be replaced every two weeks while also requiring enzymatic cleaning, he emphasizes. “We wanted to engineer a membrane that could last for years in tough environments that you could clean with generic chemicals,” Rappaport says. “We wanted to create something that could take biological or chemical treatment processes out of the equation.”

The work has allowed the team to grow quickly and enter most markets that need wastewater treatment, while also helping other sectors that doubted treating certain waste streams would ever be possible.

Organic fouling is the enemy of all membranes used in contaminated surface water or high-strength industrial wastewater streams. Clogs limit the lifespan and effectiveness of the pore structure or filter substrate. Membrane material made with zwitterions, however, helps to repel organic compounds like proteins, fats and oils that would normally stick to a membrane and create fouling.

Most membranes have a certain permeability over time, Rappaport explains, with some options only lasting 20 cleaning cycles. Part of

the issue is the pressure required to maintain membrane performance through fouling.

The zwitterionic option prevents severe fouling, so the outflow remains at the right levels, helping to maintain the integrity of the filtration media longer. Less cleaning is required with fewer harsh cleaners, which helps maintain the integrity of the filtration media longer.

“You can go from cleaning a fouled membrane every couple of days with expensive, formulated chemicals to cleaning once every week or two using generic cleaners,” Rappaport says.

Part of the secret to the material is the electrical charge. Zwitterions have an equal number of positive and negative charges, so they act like salt to water. According to ZwitterCo, the hydrophilic property “pulls water to the membrane, actively displacing or repelling

organic compounds so they cannot adhere to and foul the membrane.”

Using the latest techniques in molecular self-assembly, the zwitterions are situated on the membrane material in a way that creates water-loving channels. Rappaport says the membranes essentially have a single layer of water molecules that act as a shield against organic compounds. While most membranes are made to control air pockets to allow water flow, the ZwitterCo approach is more about creating water highways. During filtration, water passes through the highways, while the large organics remain behind.

To create a more durable membrane that can withstand more wastewater streams for longer periods of time, the company adds a proprietary copolymer to the zwitterions that helps prevent the molecules from wearing

away. The secret sauce of ZwitterCo is somewhere in the combination of the charged particles and the copolymers.

DCVC, an early investor in ZwitterCo, says there are several use cases for the technology. The investment firm celebrated the opening of a ZwitterCo innovation center outside of Boston in 2024, noting interest in dealing with water usage in a world with an ever-expanding population.

“Membranes are the treatment workhorses of the water industry,” DCVC said in a statement. “You will find water treatment membranes in every Starbucks, hospital and manufacturing plant, as well as small and large municipal water and wastewater facilities. But the chemistry from which membranes are made has been essentially unchanged for decades.”

Since opening the innovation center, ZwitterCo has been able to launch a reverseosmosis filter product along with multiple offerings for specific industries.

Evok Innovations, an investment entity that led a round of funding for ZwitterCo, said in a statement that its investment recognized the “interlinked challenges of decarbonization and water scarcity.”

“The full spectrum of the energy transition, from power and next-gen fuels to mining and critical minerals, relies on clean water,” said Naynika Chaubey, partner at Evok Innovations. “The increasing unreliability of global water sources could put many of our energy systems at risk.” Chaubey also noted that the membrane technology “is critical and timely, making this investment a cornerstone of Evok’s portfolio.”

In its quest to help create clean water from every source, ZwitterCo has worked with companies in power generation, dairy processing, food waste digestate, produced water, meat and poultry, bioprocessing and others. The company has clients in the refin-

NEW PATHS: After losing time and enzymes to traditional filtration media and systems, Solugen added ZwitterCo’s super filtration media and has reduced cycle times by 100%.

MAINTAINING ENZYMES: ZwitterCo’s unique membrane allowed Solugen to reuse water and save more of its enzyme mix during its biomanufacturing process.

ing industry in Europe and the U.S. Rappaport once spent time in the Permian Basin of West Texas, explaining the filtration tech to an engineer trying to treat shale-oil wastewater and other products.

amount of water passing through the evaporators and ultimately reducing load on downstream evaporators by more than 75%.

With Mott Corp., ZwitterCo provides waste solutions for manure and food-waste digesters, breweries and distilleries. The company has also installed the membrane solution for Brown County Organics, which operates the world’s largest manure biogas project.

In the meat and poultry industry, ZwitterCo created a version of its super filtration option as an alternative to dissolved air floatation, a mechanical screening process used to treat wastewater.

The super filtration membranes can also be used to purify food ingredients and highvalue molecules to improve product quality and enable lower-CI processes. By using a membrane process to remove suspended solids, proteins and other dissolved compounds, applications such as enzyme refining or active pharmaceutical ingredient refining following fermentation or sugar purification following saccharification can yield high-quality product outputs, but with fewer unit operations and less overall energy and water usage.

For the biofuels sector, ZwitterCo can specifically help producers lower CI scores by dealing with residual organic-laden streams like thin stillage in the ethanol industry or digestate in the renewable natural gas (RNG) space. The company’s tech can reduce impact on energy consumption, operational costs and overall CI scores, it says.

The super filtration option offered by ZwitterCo is designed to concentrate thin stillage by more than three times, reducing the

Solugen, a biotech and clean energy company creating biobased products in Texas and Minnesota through a strategic partnership with ADM, was an early adopter of ZwitterCo membrane technology.

At its state-of-the-art biomanufacturing facility in Houston, Solugen worked with ZwitterCo to find a lower-maintenance membrane solution that allows for the reuse of enzymes. Solugen relies on a water-based chemi-enzymatic process that removes impurities from a water stream while maintaining

the presence of enzymes. ZwitterCo offered Solugen a product that required four to six times less energy than traditional, open-channel membranes.

After adopting a ZwitterCo membrane solution, Solugen was able to reduce cycle times by nearly 100%, according to the company. The plant’s maintenance requirements

were reduced and cleaning of the membranes streamlined. Solugen says it uses a warm water flush, caustic wash and a water rinse to clean its membranes and restore the original clean water to roughly 95%. Its enzyme solution also isn’t compromised.

The membrane solutions from ZwitterCo can be customized to an individual plant or process, but most are drop-in replacements for existing filtration tech. The engineering team at ZwitterCo can provide turn-key systems or work with other preferred third parties. Rappaport says the company does a lot of on-site work and is not a membrane-in-a-box supplier. ZwitterCo takes a system approach to filtration, whether at a biogas facility or a grain processing plant.

The engineering team helps interested parties set up feasibility studies at their respective plants or explore financial options for firsttime use.

Although Solugen was the first plant that installed the tech, ZwitterCo has since worked with more than 100 facilities. The capital raised to date has helped the team expand to meet demand in an area it believes is increasingly drawing more focus: industrial water use.

“Right now, there is a confluence of market factors working and looking at the cost of water and how much gets used,” Rappaport says.

The market factors include consumer pressure, perspectives on availability and in the case of ethanol production, the push to use water as a vehicle to lower a plant’s overall CI score. Rappaport emphasizes that he is just one of many water entrepreneurs trying to tackle the issue at scale now.

ZwitterCo is ready to save the world’s unusable water, he says. With the zwitterionic copolymer membranes, the company says it can go “where no membrane has gone before,” and that its unique name will someday be central to any discussion on water.

Author: Luke Geiver writer@bbiinternational.com

Council updated its name to reflect the coproduct advancements of beverage and fuel industries,

A longtime industry organization has a new name that it says better reflects its multipronged focus on distillers industries and their evolution—Distillers Technology Council.

By Lisa Gibson

Its name has evolved, but the organization originally known as the Distillers Feed Research Council has had the same goals since 1945: to help find markets for coproducts in distilling, help guide, advocate for and connect those industries, and provide educational resources. Initially formed through a request from the alcoholic beverage industry, it has developed and enhanced markets for distilling coproducts over the decades, boosting margins for producers.

When ethanol production began in the late 1970s and early 1980s, the council expanded its focus to serve both beverage and biofuel industries and in 1996 named itself the Distillers Grains Technology Council. Acknowledging the evolution taking place in both industries, DGTC rebranded itself the Distillers Technology Council in 2024. Because “distillers is beyond just grains,” says DTC Executive Director Joe Ward.

“Our mission has remained the same,” Ward says. “We are a service support organization. We are the industry’s voice for distillers coproducts. We work closely with the industry stakeholders on market development, distillers coproduct research initiatives, and current issues affecting the beverage, fuel and livestock industries.

“We’re very proud of what we’ve done and where we’ve been,” Ward adds. “This group has been diligent in being the spokes-

person and the voice for distillers coproducts arising from the beverage and ethanol biofuel industries for decades. As the industry has grown and changed over the years, we continued to evolve in how we disseminate and share information.”

Since Ward took on his executive director role in 2024, DTC has filled its plate with projects to benefit its industries. “Our board has been extremely proactive about working with the industry and assisting [us on getting] the word out about what we’re doing,” he says. “The industry has evolved tremendously in how we manufacture and produce ethanol using separation technologies, the enzymes, biologicals, processing aids. We have a much larger array of coproducts being produced from the ethanol/biorefinery industry, especially ethanol, including distillers corn oil, concentrated high-quality protein products as well as highly digestible fiber products.”

Bill McDonald, DTC board member and director of agricultural sales for Canadabased ethanol producer Greenfield Global, says “The rebrand reaffirms DTC’s mission to support research, foster collaboration, and drive new global opportunities for members. For Greenfield, it brings DTC into closer

alignment with our beverage, ethanol and biorefinery, as well as our shared commitment to educating the industry about distillers coproducts’ value and potential.”

Certainly, coproducts such as DDGs, DDGS and wet distillers grains come out of both industries. Jackie Lissolo, DTC vice president and regulatory affairs manager for ICM Inc., says she even knows of one distilled spirits producer separating corn oil, with more considering it. The oil could be used in the same markets as DCO from ethanol production, such as biodiesel and renewable diesel, or in animal feed, she says.

But even grains from the two industries are not exactly alike.

“Anything that is thin stillage or DDGS will be in the same ballpark in both of our industries,” says Annick Mercier, business area manager North America for Lallemand Biofuels & Distilled Spirits, a provider of yeast, enzymes, yeast nutrition and antimicrobials to both industries.

“I think one of the challenges is, in distilled spirits, various facilities use multiple grains,” Mercier adds. “They’re not just focused on corn. They might use rye, malted

grains, etc., so stability or consistency of those products may be more of a challenge as well as drying those small grains.”

Nutritional content has a role as well, says Craig Pilgrim, vice president, marketing and product development for LBDS. “For the most part, the products are largely similar, but on the fuels side, we try to get as much alcohol as possible. Distilled spirits producers try to get as much yield as possible, too, but can sacrifice yield a little while looking for different flavor components.”

For biofuels, Pilgrim says, yield is king. But for distilled spirits, flavor is king.

Mercier adds that, depending on location, some spirits producers might look at other value-added coproduct opportunities such as dog biscuits. “That may be a bit different in the distilled spirits industry because what we’re doing is more food-grade from the start and they ensure that throughout the process.”

Some ethanol producers have entered pet food industries as well, with high-value coproducts like corn fermented protein (CFP). The emergence of technologies to develop corn fermented protein is strong, particularly as fuel and beverage industries emphasize sustainability, Ward says.

DTC is focused on determining the best way to provide information on that new ingredient definition, a project spearheaded by Lissolo.

Across DTC’s subcommittees—regulatory, communications, lab proficiency, sustainability, trade and symposium—the group has kept busy with a number of projects, coproduct ingredient definitions being at the top of the list.

DTC has created a table of coproduct names and definitions that has been very well received by marketers and researchers, Ward says, specifically in CFP. “We’re looking at new product definitions to better reflect the coproducts being produced with the evolution going on in the industry. Clarifying and

refining new and existing distillers coproduct ingredient names is one of our many goals for our group,” he says.

DTC coined the term “corn fermented protein” while building its table, Lissolo says, as a way to differentiate it from other DDGs. CFP reaches 48% protein and above, Ward explains, but is often used interchangeably in ingredient lists with DDG. “It’s a catchall term accepted by the industry but may not adequately reflect the attributes of the product from a marketing and feeding perspective. It is important to denote [the] feed quality characteristics [of CFP]; it should be differentiated. The regulatory committee is exploring the best way to define and differentiate these new evolutionary distillers coproducts.”

The CFP product has potential in pet and aqua industries, where traditional DDGs can’t play.

Pilgrim says differentiated products are ideal. “Anything differentiated to get a different price is better. That doesn’t always happen on the fuel side.”

DTC has also focused on lab proficiency, recognizing the need to enhance reliability and accuracy in procedures. “We really became very engaged as a board three to five years ago, realizing that the lab results coming out of the production facilities at times have been inconsistent and have not accurately reflected the products proximate analyses,” Ward says, adding different procedures yield very different results.

DTC has worked closely with ASTM to develop and build a robust laboratory proficiency program and established an ASTM DDGS subcommittee. “Nobody has reexamined the laboratory procedures to determine if they are still the correct ones to use since 2007, even though the processing inputs and manufacturing methods to produce the distillers coproducts have evolved substantially,” Ward says, citing crude protein, crude fat, crude fiber and minerals. “The DTC has taken a leadership role to review the current laboratory procedures used by the industry

for determining the content of DDGS. We are reviewing the best laboratory methods and procedures for distillers coproducts.

“I’ve been a nutritionist for 35 years and we’ve been doing this analysis all these years and we still at times don’t have it right,” he adds. “It is crucial for the industry and its evolution that we get it right.”

DTC has also focused recently on mycotoxins, missions with the U.S. Grains Council and Lissolo’s regulatory committee has even conducted trainings for the FDA, focusing on product safety, processing aids, good manufacturing techniques and the feed value of the distillers coproducts for foodproducing animals, pets and other companion animals.

Mercier says she hopes to see DTC continue to evolve, perhaps even getting down to a more granular marketing level that could focus on the unique needs of small distilleries and breweries. “In the future, as we continue to grow as an industry and see synergies and that there’s value-add in those products, it would be great if there were some thoughts more toward smaller scale.”

McDonald says DTC will continue to serve as an important hub for innovation and education. “Greenfield Global values collaboration and continuously strives to strengthen the value of our coproducts ... Our membership in the DTC is a keyway to stay connected with industry peers and trends, and we’re proud to participate in its research and events.”

The rebrand only enhances those connections and benefits. “It serves us better because we’re more of an umbrella organization now that encompasses all modalities, both in beverage and the ethanol biorefinery industries,” Ward says.

Author: Lisa Gibson lisa.gibson@sageandstonestrategies.com

We’r e making it ea sy to ma ximize pr oduc ti vity and pr ofi tability.

Simply adding the Phiber Flex™ pr ogram to your oper ation can have major impacts down the line. By combining the power of XylaPlus® and CelluMax™ enzymes, PhiberFlex can:

Impr ove cellulosic ethanol conver sion —quali fy ing for D3 RINs

Impr ove corn oil pr oduc tion

Incr ease ethanol y ields

Lower residual star ch

A sk your Phibro repr esentative about tr ialin g the Phiber Flex pro gram.

E-methanol supplies ethanol producers with a unique utilization option in place of carbon capture and sequestration.

By Omar Hamid

Global biofuel demand is expected to surge, with the IEA projecting a 23% increase by 2028. Renewable diesel and ethanol are expected to account for two thirds of this growth with new regulations such as FuelEU stimulating uptake. However, the domestic outlook for U.S. ethanol looks more

uncertain with the acceleration of electric vehicle (EV) adoption, despite possible headwinds from federal policy.

Although the country’s goal to achieve 50% of new vehicles being electric by 2050 was revoked at the beginning of 2025, market analysts suggest that EV demand will continue to grow in line with overall

market growth. State-led initiatives, particularly California’s Advanced Clean Cars II program, which requires 100% of new vehicle sales to be zero emissions by 2035, is gaining traction in 11 more states, including the large vehicle sales markets of New York and Massachusetts. This will play a key role in shaping the future fuel landscape.

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Ethanol Producer Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

Along with improved automobile efficiency, the continued penetration of EVs into road transportation will reduce fuel ethanol demand for gasoline blending. To retain competitiveness and futureproof revenue, diversification of revenue streams and markets will be important to ethanol producers in the Midwest.

Midwest ethanol producers are well aware of the potential value of their biogenic carbon dioxide waste product. The 45Q tax credit of $85 per metric ton makes carbon capture and sequestration an attractive new revenue stream. However, transporting carbon dioxide for sequestration is where we have seen issues arise. Not all plants are proximal to existing pipelines, and getting approval for a new pipeline over multiple jurisdictions is a lengthy process, not without complexity.

For example, one substantial pipeline project proposes to build a network across Iowa, Minnesota, North Dakota, South Dakota and Nebraska for the carbon captured to be sequestered in the North Dakota basin. But the project faces extensive public opposition from landowners, environmental rights groups and residents, which could delay the project for many years before it becomes a reality. In the meantime, millions of dollars of carbon dioxide are being lost out the vent stack.

An emerging opportunity that warrants consideration is that of growing interest in synthetic fuels such as e-methanol for use as marine fuel. E-methanol is produced by combining green hydrogen with biogenic carbon dioxide that can be directly sourced from an ethanol plant. The liquid e-methanol product can be easily transported via rail and avoids becoming entangled in the lengthy multi-jurisdiction permitting pro-

cess necessary to construct a pipeline. Instead, an ethanol plant would have certainty on execution of its revenue diversification project.

Europe’s potential e-methanol market demand is particularly notable due to new regulations. On January 1, 2025, the European Union implemented the FuelEU Maritime regulation which mandates the progressive reduction of the greenhouse gas intensity of fuels for all ships above 5,000 gross tonnage calling at European ports. While the regulations start with a modest 6% decrease in 2030 against a 2020 baseline, an 80% reduction in greenhouse gas intensity is expected by 2050.

The regulation is technology-agnostic, but a sub requirement for ships is to use 2% of renewable fuels of non-biological origin (RFNBO) per year from 2034. Emethanol usage as a marine fuel is expected to grow rapidly to meet the FuelEU RFNBO demand. Ahead of the regulations, many engine manufacturers have begun offering dual fuel engines using methanol and major shipping companies have begun to convert their fleets. For example, late last year, Maersk finished its first methanol dual fuel conversion of its 14,000 TEU containership the Maersk Halifax. The OEM estimates the conversion of the ship will reduce its CO2 emissions by 90%. Maersk has also actively expanded its fleet selecting dual fuel newbuilds in pursuit of its ambition to achieve net zero operations by 2040.

The potential size of the global emethanol market is staggering, with some projections estimating a compound annual growth rate of over 25% between 2024 and 2031 – equivalent to expanding the market sixfold. To meet demand, e-methanol production capacity must be increased quickly so speed in design and construction is a key competitive factor.

While typically an e-methanol plant takes four to six years to build, Worley has collaborated with Topsoe, a global leader in catalysis and process technology, leveraging their shared expertise to accelerate this timeline. Their standardized, modular production model will significantly reduce development time for plants producing up to 600 metric tonnes per day, helping the industry meet demand at the pace required.

To achieve this, the collaboration has taken a ‘design one, build many’ approach to accelerate delivery and commissioning while enhancing flexibility in facility design. As part of the design, key components, including technology licensing for both green hydrogen and methanol synthesis, along with most engineering and cost structures are pre-established. Each facility then only needs site specific adaptations such as civil works, risk adjustments, and final safety checks. This makes the project more efficient, lowers the levelized cost of e-methanol production and shortens the project’s time to revenue. The approach has already been successfully trialed in South America and the Middle East, as well as for other technologies such as green hydrogen.

The standardized, modular approach is highly applicable across all types of energy transition projects, helping to speed deployment and lower costs. The same approach could be applied to ramp up sustainable aviation fuel production, building plants to transform ethanol into jet fuel. For now, there is a strong case for ethanol plant owners across the Midwest to consider the benefits of capturing and converting their biogenic CO2 into high value e-methanol marine fuel. A modular, standardized path to construction can help projects progress faster.

Author: Omar Hamid, Renewable Fuels SME and Group Manager, Worley

Nesika Energy increases revenue with efficient corn oil production.

By Christopher Zdvorak

Established to provide easily digestible corn for cattle feedlots near their Scandia, Kansas, location, Nesika Energy LLC successfully produces 10 million gallons of fuel-grade ethanol annually. In 2023, management recognized that money was being left on

the table. The distillers dried grains with solubles being fed to the cattle contained almost 13% fat, but cattle only need 8% fat for a healthy diet. The challenge: find a system that takes out just the right amount of corn oil from the grain, so the feed remains nutritious. And, at the same time, add another revenue stream to the plant.

“We wanted to identify a system that could remove the corn oil without significantly increasing the electrical load on the plant. After reviewing available equipment, management decided to begin testing with a GEA RSE 90 disk centrifuge in early 2024,” explains Alec Finegan, plant manager at Ne-

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Ethanol Producer Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

sika. “It was felt that a single motor/VFD combination would be a more efficient choice for us versus a decanter that required two motors, two [variable frequency drives] VFDs, more wiring and more piping.”

Given the current output of the facility, an RSE 90 (capacity of 35 – 40 gallons per minute), was selected for the test. GEA RSE disk centrifuges are available in capacities from 15 to 200 gallons per minute when processing syrup. Considering power usage and additional maintenance requirements, total cost of ownership (TCO) for a disk centrifuge is half that of a three-phase decanter.

Once the team was ready, testing commenced using a rental skid provided by GEA. “We connected the electrical and did

some minor piping modifications to get the RSE 90 working in the plant. Hoses ran from the skid to a tanker in the yard. We could observe it working and, as an added benefit, even generate revenue while we tested,” notes Finegan. “While we were running the skid, we were also analyzing the nutritional content of our distillers grains, making sure the product still contained adequate fat levels for the cattle feed.”

The GEA finetuner on the RSE 90 allows precise control of the amount of oil removed from the distillers grains. A combination between a centripetal pump and a paring tube, the finetuner provides substantially improved efficiency compared to a conventional centripetal pump. Adjustment is done via a pneumatic actuator on the control unit. At Nesika, only a small amount of demulsifier is required to reduce emulsification that results when the syrup passes through centrifugal pumps prior to entering the high G-force centrifuge.

“All in all, the three months of testing we did went well, and we were satisfied with the results,” Finegan says. “We decided to purchase the disk centrifuge. Installation was completed in April 2024 and operation has been flawless.” A truck comes weekly to pick up the recovered oil, adding to Nesika’s revenue stream.

RSE 90 maintenance is simple. The machine is cleaned every seven days using a diluted caustic solution. A program switches all the valves, takes the machine off-line and CIP begins.

“Testing was key to our purchase decision,” notes Finegan. “We were able to see how elegant and simple the machine was to operate. We would not have moved forward without seeing the positive results for ourselves.”

Author: Christopher Zdvorak, Midwest Sales Engineer, GEA Chris.Zdvorak@gea.com

Apache Stainless experts outline the various kinds of vessels and best practices for scope development.

By Jessica Jacobson

Ethanol processors define the types of ethanol vessels required for the new applications, considering chemical compatibility, process conditions, capacity and size, safety and compliance, and operational

control. With four basic types of ethanol vessels (shell and tube heat exchangers, columns, pressure vessels and storage tanks), thousands of engineering and design configuration combinations are unique to the ethanol processor’s application. Best practices for procuring an ethanol vessel include collaboration with the manufacturer

and the structural, process and safety teams to clarify and refine parameters that may or may not be fully defined in the data sheet or specification manifest.

Ethanol production and the byproducts at each processing facility drive the

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Ethanol Producer Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).