Belledune Generating Station’s Black Pellet Progress Page 10

PLUS AHEAD OF THE CURVE

The Potential Role of Pellets, Residuals in SAF

Page 16

Seizing Grant Opportunities to Fund Expansion, Innovation

Page 22

Co C unt on Mystik® Greas a e to o combat t relenttless weaear r and tear a in se s vere r app p lications s of o plain and rol o liing g beearrings that t operate in i mild to t higgh h temperatatur u es wh w ere high h loads and metal-too metaal fr f iction exi x st s .

Wh W en the press s ure’s s on to ge g t th t e job done, , ou o r lu lubr b icants help keep e you u runni n ng strong. g MADE TO MAKE IT L AST.

10

PELLETS Bringing Black Pellets to Belledune

New Brunswick Power is exploring the feasibility of repowering its coal-fired Belledune Power Station with black pellets.

By Keith Loria

16 MARKETS

Forest Waste to Flight Fuel

Pellet and forestry experts explain the potential of woody biomass and pellets as a sustainable aviation fuel feedstock.

By Katie Schroeder

CONTRIBUTIONS

22 FINANCE

Funding Forest Innovation: Leveraging the Wood Innovations Grant Program

For pellet producers, the Wood Innovations Grant Program can provide crucial grants to fuel innovation and expansion.

By Joel E. Dulin

24 OPERATIONS

Enhancing Profitability Through Operational Excellence

By applying proven best practices from the pulp and paper and wood products industries, pellet producers can unlock new pathways to long-term, sustainable success. By Alexander A. Koukoulas and Stefan Kucher

Anna Simet

DIRECTOR OF CONTENT/ SENIOR EDITOR asimet@bbiinternational.com

A Black Pellet Resurgence and New Markets

For the past couple of decades, there have been many stints during which black pellets were touted as the next big thing in biomass—promising higher energy density, water resistance and smoother logistics. Yet after each wave of excitement, enthusiasm faded as commercialization hurdles proved tougher than many anticipated.

In my 17 years covering this industry, I’ve done much reporting on the topic. For example, more than a decade ago, the 550-MW Boardman Coal Plant in Boardman, Oregon, sought to repower with torrefied biomass. The utility performed a series of test trials and the effort lasted several years beginning in 2013, but it was ultimately deemed unfeasible due to technical challenges with the torrefaction process and difficulties in securing a reliable, sustainable biomass fuel supply, among other reasons. The plant permanently closed several years ago and was demolished, despite having many years of potential life left.

Today, however, the tide appears to be turning. New projects, improved technologies and fresh investment are bringing the concept back into focus—and this time, progress feels more tangible than ever. The market for torrefied and steam-treated pellets may finally be taking shape, as reflected by the increasing coverage in Pellet Mill Magazine, including this issue.

In our page-10 article, “Bringing Black Pellets to Belledune,” contributing writer Keith Loria explores the Belledune Clean Fuel Project in New Brunswick, Canada, which is seeking an alternative fuel source and examining the long-term viability of 100% advanced pellets after completing two test burns. The plan is to be off coal by 2030—still four years away, but that will come quickly.

All of the above said, white pellets aren’t going anywhere. Their global production base, proven reliability and established supply chains continue to anchor the biomass sector—and will for years to come. As black pellet ventures gain traction, it’s not a story of replacement, but one of expansion and diversification within a maturing industry.

New markets for white pellets are also emerging. In our page-16 feature article, “Forest Waste to Flight Fuel,” Associate Editor Katie Schroeder covers a panel at the North American Sustainable Aviation Fuel Conference & Expo, during which industry experts made the case for wood pellets and other wood residuals as potential feedstocks for sustainable aviation fuel production. I was shocked to learn that a storm in Bemidji, Minnesota, this summer took down an estimated 9 million trees. Instances like this raise the question: What can be done with this waste—and why not use it for SAF or other bioenergy initiatives, if no other higher-value use?

Of course, project developers can’t rely on storms to provide the consistent feedstock streams they need. In the article, Schroeder reports on the remarks of the U.S. Industrial Pellet Association’s Darrell Smith, who focused on the abundant and increasing forestry resources in the Southeast and why it makes sense for landowners and pellet producers to participate in biofuel and bioenergy markets. While industrial wood pellet producers have historically served overseas markets, he noted, they would like to develop domestic outlets as well. Smith also pointed to the downturn of the pulp and paper industry as a catalyst for finding new uses for wood waste and residuals. “We need to build more pellet mills because we really need more of them—it’s one of the only solutions to this declining paper market,” he said.

Finally, I’d like to mention that the abstract portal for speaking opportunities at the International Biomass Conference & Expo is now open. We have a dedicated track for wood pellets and biocarbon and fully expect all spots to be filled. Join us in Nashville in 2026—apply to speak, register or learn more at biomassconference.com.

EDITORIAL

DIRECTOR OF CONTENT/SENIOR EDITOR

Anna Simet | asimet@bbiinternational.com

SENIOR NEWS EDITOR

Erin Krueger | ekrueger@bbiinternational.com

ASSOCIATE EDITOR

Katie Schroeder | katie.schroeder@bbiinternational.com

MAP DATA & CONTENT COORDINATOR

Chloe Piekkola | chloe.piekkola@bbiinternational.com

DESIGN

VICE PRESIDENT, PRODUCTION & DESIGN

Jaci Satterlund | jsatterlund@bbiinternational.com

SENIOR GRAPHIC DESIGNER

Raquel Boushee | rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan | jbryan@bbiinternational.com

PRESIDENT

Tom Bryan | tbryan@bbiinternational.com

CHIEF OPERATING OFFICER

John Nelson | jnelson@bbiinternational.com

SENIOR ACCOUNT MANAGER

Chip Shereck | cshereck@bbiinternational.com

ACCOUNT MANAGER

Bob Brown | bbrown@bbiinternational.com

SENIOR MARKETING & ADVERTISING MANAGER

Marla DeFoe | mdefoe@bbiinternational.com

2026 International Biomass Conference & Expo

MARCH 31 - APRIL 2,

2026

Gaylord Opryland Resort & Convention Center | Nashville, TN

Now in its 19th year, the International Biomass Conference & Expo is expected to bring together more than 900 attendees, 160 exhibitors and 65 speakers from more than 25 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world—powered by Biomass Magazine—is renowned for its oustanding programming and maintains a strong focus on commercial-scale biomass production, new technology, and near-term research and development. Join us at the International Biomass Conference & Expo as we enter this new and exciting era in biomass energy.

(866) 746-8385 | www.biomassconference.com

2026 International Fuel Ethanol Workshop & Expo

JUNE 2-4, 2026

America's Center | St. Louis, MO

Now in its 42nd year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-tobusiness environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine —that maintains a strong focus on commercial-scale ethanol production, new technology, and near-term research and development. The event draws more than 2,300 people from over 31 countries and from nearly every ethanol plant in the United States and Canada (866) 746-8385 | www.fuelethanolworkshop.com

2026 Sustainable Fuels Summit: SAF, Renewable Diesel and Biodiesel

JUNE 2-4, 2026

America's Center | St. Louis, MO

The Sustainable Fuels Summit: SAF, Renewable Diesel, and Biodiesel is a premier forum designed for producers of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to learn about cutting-edge process technologies, innovative techniques, and equipment to optimize existing production. Attendees will discover efficiencies that save money while increasing throughput and fuel quality. This world-class event features premium content from technology providers, equipment vendors, consultants, engineers, and producers to advance discussions and foster an environment of collaboration and networking. Through engaging presentations, fruitful discussions, and compelling exhibitions, the summit aims to push the biomass-based diesel sector beyond its current limitations.

(866) 746-8385 | www.sustainablefuelssummit.com

Something About Eggs and Baskets

BY TIM PORTZ

In mid-September, the Pellet Fuels Institute attended a House Energy Subcommittee meeting titled “Energy Subcommittee: Appliance and Building Policies: Restoring the American Dream of Homeownership and Consumer Choice.” The meeting promised to examine several pieces of introduced legislation that all sought to reverse, halt or slow state and federal regulation that peered into American homes and dictated the kinds of dishwashers, showerheads, and even heating and cooking fuels that consumers could purchase, install and use.

Regrettably, the hearing devolved into partisan mudslinging, with Democratic members of the committee taking shots at Jeff Novak, the U.S. Department of Energy’s acting general counsel, who did little more than offer to take the question “on the record, officially,” whatever that might mean.

It was evident early in the hearing that that there would be little to no substantive debate around the issue of how the everyday energy needs of Americans would be met. It made more sense, then, to listen for any areas of common ground. Fortunately, one emerged early in the hearing. As they made their arguments, committee members from both parties pointed to the exploding demand for electric power created by the meteoric growth of artificial intelligence, data center servers and processors—and for good reason. While studies vary in their projections of exactly how much new power will be needed, even the conservative estimates place the figure at tens of gigawatts, with aggressive estimates approaching the hundreds of gigawatts. Current U.S. electric generation capacity is about 1,200 gigawatts, so the aggressive estimates suggest the U.S. may need to grow its generation capacity by nearly 10% to meet this new demand source. The country has not seen a new demand center of this magnitude emerge since modern air conditioning. For Democrats on the committee, this underscored the need for increasingly efficient appliance standards, and they railed at the Trump administration for gutting the federal programs that supported consumer purchases of such appliances, including the 25C tax provisions for

more efficient furnaces, better doors and windows, and qualifying wood and wood pellet appliances. The Republicans on the committee countered and pointed to the lunacy of state policies—such as New York’s natural gas ban—that will effectively mandate the electrification of new construction home heating and cooking in the state by 2026. The last thing the grid needs in the era of AI, they offered, is to suddenly be expected to meet home heating and cooking needs, too.

Interestingly, there was zero discussion about whether this headfirst leap into the energy-ravenous technology that is AI was worth the societal cost. It’s a strange thing to watch policymakers debate whether a closet lightbulb should be incandescent or fluorescent while offering no guidance on a new demand source that will require U.S. power generation to grow by as much as 10%.

Where, then, does all of this leave wood pellet heating? Estimates put the percentage of American homes that use wood or wood pellets at just 2%. For context, nearly half of all American homes use natural gas as a heating fuel. As the AI leviathan grows along with its insatiable appetite for more electrons, the argument for curtailing any fuel source seems ill-timed. In fact, the counterfactual is a more appropriate discussion, and energy thought leaders are recognizing that powering the AI revolution with wind and solar alone isn’t feasible.

Expecting electric power to meet the exploding power needs of AI while also insisting that consumers use it to meet their basic cooking and heating needs feels like it is entering “too many eggs in one basket” territory. American consumers are right to bristle at being forced to rely on an energy source facing rapidly growing demand and potential unintended consequences—brownouts, grid instability and rising prices—when affordable, clean-burning, carbon-beneficial fuels can meet those needs without further straining an already burdened grid.

Author: Tim Portz Executive Director, Pellet Fuels Institute tim@pelletheat.org

The True Cost of Grease Selection in Wood Pelleting

In the extreme environment of wood pellet production, grease is a critical investment. A mill producing 2,040 tons of pellets per day can consume over 130 pounds of grease daily, resulting in tens of thousands of dollars a year in lubrication costs alone.

Faced with such significant expenses, it’s no surprise that some plant managers look to cut costs by purchasing the cheapest grease available. While this may offer short-term savings, it often leads to costly long-term consequences. Using the wrong grease can accelerate equipment wear, cause excessive grease waste and even cause premature equipment failure.

When it comes to machinery efficiency, grease quality matters. Pellet mills operate

under intense heat, heavy loads and constant exposure to moisture—especially in roller bearings, jackshafts and main shafts. These conditions demand a specialized, high-performance, high-temperature lubricant designed to ensure optimal efficiency and machine reliability

While most OEMs specify recommended lubricants, operators can use alternatives—provided these greases match performance specs like temperature range, viscosity, extreme pressure and additive packages. All factors considered, an NLGI 2 high-temperature grease with extreme pressure properties is the recommended lubricant for pellet mill applications. However, alternative greases may require OEM approval to keep equipment warranties.

Grease is composed of base oil, thickener and performance-enhancing additives. Common thickeners include aluminum, calcium, lithium (and their complexes), calcium sulfonate and polyurea. To prevent issues like oxidation, oil separation and contamination, it’s important to use a highquality grease like Mystik® LithoPlex Pellet Mill #2 Grease, as well as relubricate at proper intervals and use the right volume of grease.

Investing in the right grease pays off. By prioritizing quality before price, pellet plant operators can extend equipment life, reduce downtime and improve their bottom lines.

Count on Mystik® Grease to combat relentless wear and tear in severe applications of plain and rolling bearings that operate in mild to high temperatures.

Pellet News Roundup

Renova to Restart 75 MW Omaezakikou Biomass Plant in October

Japan-based Renova Inc. on Sept. 22 announced that its 75-megawatt (MW) Omaezakikou Biomass Power Plant is expected to resume operations in October. The facility was idled in June following a malfunction of auxiliary boiler equipment.

The Omaezakikou facility, located at the Port of Omaezaki in the southernmost part of Shizuoka Prefecture at the mouth of Suruga Bay, is fueled with wood pellets and palm kernel shells. It is one of several biomass power plants developed by Renova. In November 2023, the company announced its 75-MW Morinomiyako Biomass Power Plant had begun operations. The following month, Renova announced startup of its 74.8-MW Tokushima Tsuda Biomass Power Plant, while the 75-MW Ishinomaki Hibarino Biomass plant began operations in March 2024. The 50-MW Karatsu Biomass Power Plant is expected to begin operations in September 2025. Additional Renova biomass plants that are currently operational include the 20.5-MW Akita Biomass facility and the 75-MW Kanda Biomass plant.

US Forest Service Funds Biomass Transport Projects for Pellets, Bioenergy

The U.S. Forest Service on Sept. 16 awarded $23 million to 35 grant recipients to support the removal and transport of approximately 1.1 million tons of low-value woody biomass from national forests to processing facilities. A portion of that material is expected to be used to produce energy and wood pellets.

The grants, delivered through the agency’s Hazardous Fuels Transportation Assistance Program, will fund 65 projects across the lower 48 states. The program is designed to help businesses, nonprofits and state, local and tribal governments make use of trees, downed vegetation and other hazardous fuels that would otherwise go to waste or fuel catastrophic wildfires.

US Pellet Production Reaches 900,000 tons in May

U.S. wood pellet manufacturers produced approximately 900,000 tons of densified biomass fuel in May, according to the latest edition of the U.S. Energy Information Administration’s Monthly Densified Biomass Fuel Report, released Sept. 18. Sales of

densified biomass fuel reached 850,000 tons during the month.

The EIA collected data from 75 operating densified biomass fuel manufacturers, which reported a combined production capacity of 13.04 million tons per year and collectively had the equivalent of 2,417 full-time employees.

Respondents purchased 1.8 million tons of raw biomass feedstock in May, produced 900,000 tons of densified biomass fuel and sold 850,000 tons of densified biomass fuel. Production included 116,791 tons of heating pellets and 786,223 tons of utility pellets.

Domestic sales of densified biomass fuel in May reached 84,185 tons at an average price of $238.82 per ton. Exports in May reached 770,610 tons at an average price of $203.36 per ton.

Inventories of utility pellets expanded to 513,862 tons in May, up from 498,781 tons in April. Inventories of premium/standard wood pellets reached 342,064 tons in May, up from 297,016 tons in April.

Data gathered by the EIA shows that total U.S. densified biomass fuel capacity reached 13.43 million tons in May, with all of that capacity listed as operating or temporarily not in operation. Capacity included 1.97 million tons in the East, 10.67 million tons in the South, and 797,700 tons in the West.

Genesis and Foresta in Biomass Supply Negotiation

Genesis Energy Ltd. and Foresta Ltd. have signed a term sheet to advance negotiations on the supply of torrefied black wood pellets for electricity generation at Huntly Power Station, the largest thermal power station in New Zealand.

The term sheet is the first that Genesis has signed with a potential New Zealand biomass producer as it seeks to establish a sustainable, economic supply for the power station. Gensis is targeting a supply of 300,000 metric tons of torrefied black wood pellets by 2028 to reduce or eliminate New Zealand’s current dependency on coal for electricity generation at Huntly. Gensis is work-

ing with a number of potential producers in parallel to achieve this target.

Foresta is building an integrated pine chemical and torrefied wood pellet production facility in Kawerau in the Bay of Plenty, which will be one of the first manufacturing plants of its kind established in New Zealand.

Musser Biomass, Trex Company Join Forces to Advance Pellet Industry Sustainability

Musser Biomass, a leader in engineered wood fiber and premium pellet products, announced a new sustainability partnership with Trex Company, the world’s largest manufacturer of wood-alternative decking and a pioneer in recycled materials innovation.

As part of the collaboration, Musser Biomass will display the NexTrex Recycling logo on its Forest Fuel Heating, Forest Farm Bedding and Alpha Fiber Bedding product lines. This initiative highlights the shared commitment of both companies to responsible material sourcing, waste reduction and environmental stewardship.

Musser Biomass operates one of the most advanced low-temperature drying systems in North America, reducing energy use and preserving the integrity of wood fiber. The facility’s annual wood pellet production capacity is approximately 86,000 metric tons.

Through its NexTrex program, Trex Company recycles plastic film materials, keeping them out of landfills and turning them into high-performance composite decking. The use of the NexTrex logo signals a company’s verified participation in this program and its alignment with best practices in sustainable sourcing and processing. It also conveys to consumers that the packaging material can be recycled through the NexTrex program.

The updated packaging will roll out nationwide, giving environmentally conscious consumers and retailers a clear symbol of innovation, collaboration and accountability.

SOURCE: EUFAS

EU Wood Pellet Consumption Expected

to Expand in 2025

Wood pellet consumption in the European Union is expected to begin to rebound this year, reaching 23.45 million metric tons (mmt) with increases for both residential and industrial use, according to a report filed with the USDA Foreign Agricultural Service’s Global Agricultural Information Network.

According to the report, EU consumption of wood pellets declined in 2023 and 2024 due to a mild winter, high stocks, lower power prices and power plant outages. Increased consumption in 2025 is also expected to push imports higher.

The EU is expected to produce 20.5 mmt of wood pellets in 2025, up from 19.9 mmt in 2024 and 19.97 mmt in 2023. Imports are expected to reach 4.68 mmt this year, up from 4.48 mmt last year and down from 4.9 mmt in 2023. Exports are expected to reach 1.7 mmt in 2025, up from 1.66 mmt in 2024 and 1.17 mmt in 2023. EU wood pellet consumption is expected to reach 23.45 mmt in 2025, up from 22.62 mmt last year, but down slightly when compared to the 24.03 mmt of wood pellets consumed in 2023.

Of the 27 countries in the EU, the top consumers of wood pellets are Germany,

France, Italy, Denmark, the Netherlands, Sweden and Austria. France consumed an estimated 3.5 mmt of wood pellets last year, followed by Germany at 3.37 mmt and Italy at 2.8 mmt.

Germany is also a top producer of wood pellets in the EU, with production estimated at 3.7 mmt in 2024. France manufactured approximately 2.45 mmt of wood pellets last year, followed by Latvia at 1.98 mmt, Austria at 1.8 mmt and Sweden at 1.65 mmt.

Italy was the EU’s top importer of wood pellets in 2024 at 1.84 mmt. The U.S. supplied only 7,000 mt of that volume. Denmark imported 1.66 mmt of wood pellets in 2024, including 703,000 mt imported from the U.S., while the Netherlands imported 1.5 mmt, including 759,000 mt from the U.S. Overall, the U.S. exported 1.9 mmt of wood pellets to the EU in 2024, down from 2.91 mmt in 2023.

The U.S. was the main supplier of wood pellets to the EU last year at 1.9 mmt, followed by Canada at 619,000 mt and Brazil at 419,000 mt.

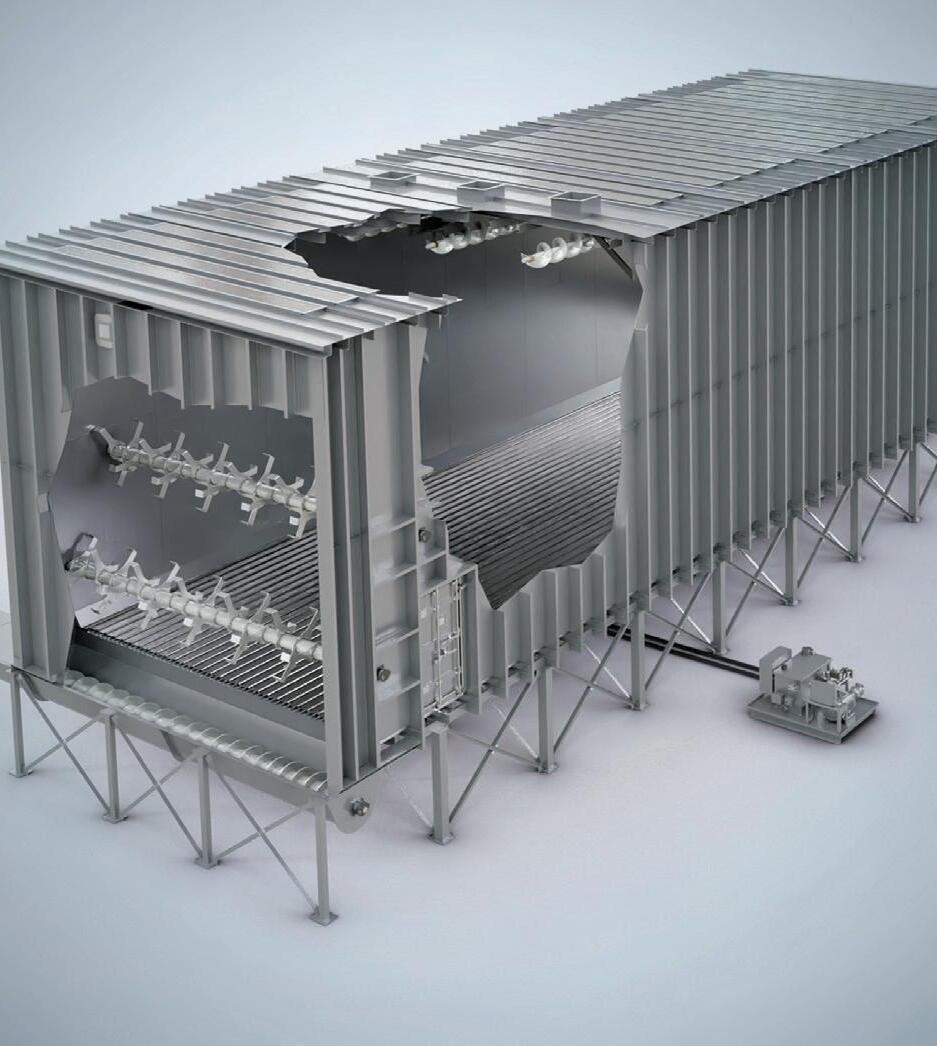

BRINGING BLACK PELLETS TO BELLEDUNE

New Brunswick’s Belledune Generating Station is testing advanced wood pellets to lower emissions and extend its operating life.

BY KEITH LORIA

Perched on New Brunswick’s northern coast, the Port of Belledune has been charting a new course—one built on clean energy and innovation—for many years. Long known for handling bulk commodities and heavy industry, the port now envisions itself as a hub for low-carbon development, with biomass playing a central role. From exporting renewable fuels to attracting green manufacturing, the port’s ambitions are as bold as they are pragmatic.

That vision extends inland to the Belledune Generating Station, where NB Power is evaluating the potential to convert the coal-fired facility to run on sustainably sourced biomass. The move could preserve local jobs, leverage existing infrastructure, and tie the region’s decarbonization goals

together. For Belledune, it’s a fitting evolution—one that reflects a community determined to turn its industrial past into a clean energy future.

Weighing the Options

The 467-MW Belledune Generating Station has been a cornerstone of New Brunswick’s electricity grid for more than three decades and is gearing up for a transformation. As part of Canada’s federal commitment under climate policy to eliminate coal by 2030, NB Power is testing advanced or black wood biomass pellets as a fuel source.

The coal-fired thermal generating station is responsible for 15% of New Brunswick’s electricity needs and uses approximately 1 million metric tons (mmt) of coal

per year, therefore a significant source of greenhouse gas emissions and other pollutants in the province. In 2018, the federal government announced the phase-out of coal-fired generation by 2030. This regulation would see the Belledune Generating Station cease to burn coal in 2030, 10 years earlier than its planned retirement date. As a result, the Belledune Clean Fuel Project was created.

To start, NB Power analyzed multiple options to continue operation of the station past 2030 using alternative fuels. Some of these fuel options include traditional biomass, torrefied biomass, liquified natural gas, renewable natural gas and conventional natural gas. “Finding an alternative renewable fuel source for the Belledune Generating Station is part of our long-term strat-

egy to drive New Brunswick to a cleaner, greener future and be more environmentally sustainable for generations to come,” says Brad Coady, vice president, business development and strategic partnerships at NB Power. “We have explored several options and strongly believe advanced wood pellets are the most cost-effective and efficient choice for our customers.”

In March 2024, Belledune began introducing woody biomass (advanced pellets) to the boiler to test its feasibility as a fuel source. The station successfully operated twice on 100% advanced pellets. “The test showed promising results and confirmed that advanced pellets could be an option for Belledune,” Coady says. “To help refine our capital cost estimate for a full conversion from coal to advanced pellets, another

test was completed in November 2024. The tests confirmed that advanced wood pellets in the form of both steam-treated and torrefied pellets could be an alternate fuel source for Belledune. Successful test burns are key to getting off coal by 2030 and achieving a net-zero energy future—an objective in our strategic plan.”

The Road Ahead

A final investment decision is slated for this February. If the conversion to biomass goes ahead, the plan is for it to be operational by sometime between 2028-'30. “Transitioning from coal to advanced wood pellets is an exciting strategy because we are moving from fossil fuel to a renewable fuel,” Coady says. “Converting to a renewable fuel source will make Belledune our largest renewable generator; currently it is our most greenhouse-gas intensive energy generator in our fleet.”

As a cost-of-service utility, NB Power evaluates the lowest-cost option to meet

New Brunswickers’ energy needs and is forecasting the need for about 300,000 metric tons of advanced wood pellets a year to support the transition from coal. “Based on our testing, it appears that advanced wood pellets are like coal,” Coady says. “For example, they can tolerate damp conditions and be stored outside. They grind and burn in the boiler in a similar manner as coal. As we continue our transition process, more analysis and further testing will be carried out to determine any unique aspects to handling and burning wood pellets at Belledune.”

New Brunswick’s Belledune Port Authority is expected to be a key partner in NB Power’s clean energy transition. It already played an integral part for the test burns, with the port importing 2,500 metric tons of advanced wood pellets to the generating station last year. Denis Caron, port president and CEO, notes the port’s role in the Belledune Clean Fuel Project reflects years of planning to support both domes-

JEFFREY RADER

tic and international biomass markets, with biomass growth a part of a deliberate shift toward greener operations. For instance, the port’s investments in new storage and terminal infrastructure have helped boost biomass volume from 224,000 mt in 2018 to more than half a million mt this year.

Additionally, the terminal expansions and automated handling systems at the Port of Belledune allow for high-volume shipments, ensuring that pellets can be efficiently moved from storage to the generating station. Coal deliveries historically accounted for roughly 40% of port cargo, highlighting the significance of shifting a portion of that volume to biomass.

David Kelly, communications officer for the government of New Brunswick’s Energy and Utilities and Finance and Treasury boards, notes that as electrification increases and the population continues to grow, it is essential that the necessary systems are in place to guarantee a consistent and secure supply of energy for New

O ering the tightest top-size control on the market and slower operating speed reducing wear and optimizing overall e ciency and cost-e ectiveness

Brunswickers and still meet the province’s clean energy strategy. “As the coal-fired regulations are federal requirements, the province has worked with NB Power to advocate for federal funding to support the clean energy transition, including the conversion of Belledune,” he says. “The Belledune Generating Station is a key employer for the region and provides important benefits to the province’s electricity system. Any conversion to biomass will continue to support jobs in the region while reducing the greenhouse gas emissions from the facility.”

Supplying Pellets

NB Power is exploring securing biomass supply locally and regionally—ensuring sustainability—and avoiding creating large-scale new forestry damage. “We have signed memorandums of understanding with several potential pellet suppliers,” Coady says. “These partners will study the location and size of their respective pellet

facilities, helping us ensure we have a reliable supply chain.

“Our goal is to primarily source our renewable fuel needs from New Brunswick-based businesses,” Coady continues. “It is important to note that today, about 500,000 mt of white wood pellets are exported from New Brunswick to Europe each year by many local businesses. Based on our conversations with the wood pellet industry, we are confident a sufficient supply of advanced wood pellets will be secured in the coming year.”

Gordon Murray, executive director of the Wood Pellet Association of Canada, notes that local producers are individually evaluating the opportunity for installing thermal pellet capacity to supply NB Power. “The proposed Belledune project will be the largest consumer of black pellets worldwide which, as a first mover, introduces significant risk for potential suppliers,” he says. “The challenge for any producer is to scale up the available equipment for making thermally treated pellets. There are several reputable vendors of equipment for the processes of torrefaction or steam explosion. However, none of these have been used yet for making thermally treated pellets at a large scale.”

BLACK PELLETS »

Since NB Power’s strategy is to source this renewable fuel from forestry byproducts, this conversion will not lead to new large-scale harvesting of New Brunswick forests. Instead, there will be a more complete and effective use of trees that have already been harvested for other products that power the New Brunswick economy.

All members of the WPA are SBP certified, and the pellet sector has no impact on forest harvest levels. “Our sector is 100% reliant on residues from the sawmill sector in the form of sawdust, shavings, chips and low-quality logs left over from harvesting operations that are unsuitable for making lumber,” Murray says. “We don’t anticipate any impact on being able to supply the domestic heating market, though there is a possibility that some volume could potentially be displaced from the European industrial pellet markets.”

Challenges of Transition

While things are looking positive for the transition, the project is not without its technical, financial and logistical challenges. “There is a lot of work to be done, and we are still in the process of refining capital cost estimates and will follow all necessary regulatory processes as the project progresses,” Coady says. “It is crucial we have strong relationships with different groups, including the forestry and transport industries, to secure consistent and high-quality biomass that ensures reliable operation of the station for our customers. We want to ensure the biomass program is affordable and reliable, along with proper policies in place by both levels of government to ensure we are operating effectively.”

Meeting Goals

If the conversion proves successful, as NB Power expects it to be, the Belledune Generating Station will play an important role in the region’s economy and in helping New Brunswick reach its 2030 and net-zero targets. “Belledune will continue to play an essential role in providing reliable, renewable energy to help meet the winter demands of homes and businesses across New Brunswick,” Coady adds. “A switch to treated pellets could fuel economic development and support our forestry, trucking, rail and shipping industries.”

After all, converting NB Power’s Belledune Generating Station from coal to biomass is part of New Brunswick’s strategy to meet decarbonization goals, specifically to phase out all coal-fired electricity by 2030. “In the long term, our planning looks at biomass not as a stand-alone solution, but as part of a diverse mix that could include renewables like nuclear, hydro, wind and solar,” Coady adds. “The goal is to ensure that any biomass option we pursue is sustainable, cost-effective and aligned with our net-zero priorities.”

Author: Keith Loria Contributing Writer, Pellet Mill Magazine

Forest Waste to Flight Fuel

Pellet and forestry experts explain the potential for woody biomass and pellets from waste wood residues to be used as a sustainable aviation fuel feedstock.

BY KATIE SCHROEDER

As airlines pursue decarbonization, sustainable aviation fuel (SAF) has emerged as the most viable option. Airlines including Delta, United and American have set goals to replace their conventional, fossilbased jet fuel with SAF. Meeting lofty goals will require a diverse array of feedstocks, and wood fiber and pellets are promising candidates.

At the 2025 North American Sustainable Aviation Fuel Conference, two panelists shared their perspectives on this new market for forest residues. The panel, titled

“Decentralized SAF Innovation with Forest and Regional Resources,” featured panelists including Darrell Smith, executive director of the U.S. Industrial Pellet Association, and Eric Schenck, executive director of the Forest Resources Council in Minnesota.

Forests at Risk

One theme shared by both presenters was the crucial need for more industries that will utilize wood waste. Smith explained that the lion’s share of the U.S. industrial pellet industry is located in the Southeast, with 33 mills spread across 11 states, sup-

plying 5,000 jobs across the U.S. The pellet industry utilizes residuals from the lumber industry and woody biomass located in the Southeast region’s plentiful pine forests. The paper industry was historically major employer in the Southeast, also known as the “Paper Basket” due to how quickly trees grow in the warm climate. In recent years, however, the paper industry has shrunk, depriving many communities of a keystone employer.

Smith explained that the declining number of paper plants could indirectly cause deforestation. About 86% of forests in the

area are owned privately, so if the owners cannot find someone to use their wood or a way to make money off of the land they own, they may consider selling it to a developer to build a strip mall or housing development. “These aren’t old growth forests, these aren’t national parks; this is land that is meant to grow pine trees to be used as an agricultural product, and [it’s] been doing it for a very long time,” Smith said.

All U.S.-manufactured industrial pellets are exported for heat and power generation around the world—primarily to Europe and Japan—meaning that currently, none of

them are currently used in the U.S. “We’re dispatchable energy in Europe,” he said. “The U.K., for instance, is totally off coal. They don’t burn coal anymore, and a large portion of the U.K. is running on wood pellets. My employee who lives in York, England—his house would go dark without wood pellets.”

Shipped by the boatload, the industry pelletizes tons of waste wood material that the lumber industry cannot use, including mill residues, treetops, limbs, thinnings and lower-quality wood. “We’re not going out into a forest and clear cutting them,” he

said. “That would not make financial sense, to turn the forest into pellets.” Smith explained that responsible forest management requires the thinning of forests to keep them healthy by allowing light to reach the forest floor, preserving animal habitats and reducing wildfire risk. The biomass is pelletized for transportation because it makes the material more energy dense.

Smith explained that USIPA met with the Trump administration twice in the two weeks before the conference to ensure that industrial pellets are included in the $750 billion worth of energy that the European

Union had committed to buying. “We want to keep sending these pellets overseas, because it’s a very valuable market for us,” he said. However, USIPA would like to find a domestic market for industrial pellets as well. Industrial pellet production has increased fivefold since 2012 and intends to keep growing, according to Smith. “Every time I talk to a state forestry [organization] since I’ve had this job for six months, the first thing out of their mouth is, ‘We need to build more pellet mills because we really need more [of them], it’s one of the only solutions to this declining paper market,’” he said.

Although it may seem counterintuitive, creating markets for woody biomass is crucial to reducing deforestation. Because 43% more wood is grown than removed each year, woody biomass in pellet form has great potential for SAF production, Smith said.

The U.S. can sustainably produce an additional 63 million dry tons per year of woody biomass, according to the U.S. Department of Energy. Smith added that the DOE also estimates that approximately 2 billion to 5 billion gallons per year of SAF production could be possible from woody

biomass. “Forestry residues are one of only a few sustainable scalable feedstocks that can contribute millions of gallons,” he said. “Wood pellet production is carbon neutral and compatible with advanced conversion pathways.”

Dead Wood in the Northwoods

The growing fire risk in Minnesota’s forests requires a solution. According to Schenck, state organizations do not have the funding to manage Minnesota’s millions of acres of forests. Currently, fire prevention measures are primarily focused on protecting existing structures, rather than

stopping the fire in the first place, simply because the resources needed to prevent a significant wildfire from occurring are not available. “There are a lot of things going on in our forests that are creating big challenges for their sustainability and future health,” Schenck said. “And we’re trying to figure out how to manage for these things.”

The Minnesota Forest Resources Council played a role in efforts to get a pellet plant established in northern Minnesota, Schenck explained. However, this effort did not work out due to the transportation dynamics. The state also had bioenergy as part of its energy grid in the past, but the power companies eventually moved away from biomass to power.

However, SAF could provide an excellent use for the dead trees that are building up in the forests. Insects including the emerald ash borer, spruce budworm and eastern larch beetles have killed around 1 million acres of trees in Minnesota, according to Schenck. The number is likely to grow as winters get warmer and the emerald ash borer is able to survive farther north. “Without a market for that wood, which otherwise has no market value, we’re pretty helpless to do much with it,” he said. “Sadly, here’s what often follows that kind of dis turbance: wildfire.”

Severe weather events have caused mass tree blowdowns, resulting in millions of dead trees that present a significant fire risk. One such blowdown happened near Bemidji, Minnesota, in August this year, when 100 mph winds knocked down 9 mil lion trees. According to Schenck, climatedriven disturbances like the one in Bemidji are killing five times more trees than are on harvested acres in Minnesota’s forests. In northern Minnesota’s Boundary Waters

‘All the wood we really need for the biomass market is out there lying on the ground.’

- Eric Schenck, executive director, Minnesota Forest Resources Council

region, a popular recreational area, a blowdown was followed by a wildfire, which caused human safety issues and impacted the area’s usability for visitors. Because the council is “in the healthy forests business,” Schenck and his colleagues would like to see residuals get used up, rather than serve as fuel for wildfires.

Utilization Opportunities

Black liquor, a paper processing byproduct and tarry substance that contains the wood’s lignin, could be used as … could be used as a feedstock for SAF. “So, the waste product could potentially become a money maker for these mills,” Schenck said. “And … we don’t want to lose them

‘Wood pellet production is carbon neutral and compatible with advanced conversion pathways.’

- Darrell Smith, executive director, USIPA

because we don’t want to lose the ability to manage the forests.”

Flying with jet fuel made from wood residues has already been done, he added. In 2016, the state of Washington, Washington State University, the state Department of Ecology, Gevo, Alaska Airlines and others worked together to make SAF out of forest residuals and flew the plane from Seattle to Washington, D.C.

Schenck is hopeful that Minnesota will be among the places where the woodto-SAF technology becomes a commercial reality. “We have all these different sources of woody biomass,” he said. “We have the logging slash, we have the weather-related disturbances and climate-driven disturbances. We have sawmill residuals; we have paper

mill residuals. All the wood we really need for the biomass market is out there lying on the ground.”

Woody biomass’ availability makes it a great feedstock option, compared to the feedstock development needed for specialized crops, Schenck explained. The carbon intensity of Minnesota’s forests is well understood, due to the council’s efforts in commissioning a carbon study. “One of the things we documented was that the forestry sector is the only net-negative sector in Minnesota’s economic sector,” he said. “We offset 13% of all the other emissions in the state. When you compare us to agriculture, we’re offsetting about two thirds of the agriculture.”

The council is excited to see the work that the Greater MN SAF Hub is doing to develop a SAF industry in the state, Schenck said. Minnesota also has a SAF tax credit of $1.50 per gallon, which is in place through 2035. A bill has also been introduced that would add a supplemental tax credit of two cents per gallon for each additional 1% of carbon intensity reduction beyond 50%, maxing out at 50 cents more per gallon, increasing the possible credit to up to $2 per gallon. The state is also looking at a clean fuel standard that would create policy to make the state net zero by 2050.

Although industrial pellets have found an important role in supplying energy internationally, they could provide a solution for transporting woody biomass and making it useable in SAF production processes. Schenck and Smith agree that forest residues need to be utilized, both to maintain forest health and to mitigate the economic impacts of a shrinking paper industry.

Author: Katie Schroeder Associate Editor, Pellet Mill Magazine

Funding Forest Innovation: Leveraging the Wood Innovations Grant Program

BY JOEL E. DULIN

Administered by the U.S. Forest Service, the Wood Innovations Grant Program has consistently funded capital projects, market expansion and product innovation in the wood products sector for the past decade. For those in the pellet industry, it’s critical that they don’t miss this opportunity—virtually no grants that support pellets exist outside this program.

The Wood Innovations program includes three grants: the self-named Wood Innovations Grant, the Community Wood Ener-

gy Grant and the Wood Products Infrastructure Assistance Grant. Each targets a different slice of the wood products and forest management ecosystem, and each can be highly relevant for pellet producers.

What Projects Qualify?

The Wood Innovations Grant Program is designed to expand markets for traditional wood products and wood energy. For pel-

let producers, that means any project that increases the amount of wood processed is generally eligible. This can include installing a new production line, upgrading existing equipment, or even running a marketing campaign to promote the use of residential pellet stoves. The goal is to get more wood processed more efficiently and into more markets.

This grant is capped at $300,000 and comes with a 50% costshare requirement. So, if you want a $300,000 award, you must contribute at least $300,000 to the project yourself.

A few examples include PK Wood Pellet, which secured $300,000 in 2025 to install a new pellet mill at a former sawmill site, supporting market expansion and forest management efforts. Similarly, Western Wood Products used its award to automate pellet processing in New Mexico.

The Community Wood grant will cover 35% of the total project costs up to $1 million. It supports shovel-ready projects that either install a wood energy system (think biomass boilers) or build an innovative wood product facility. If you’re interested in producing biochar pellets or torrefied “black” pellets, this grant is for you. However, note that the Forest Service is required to allocate 75% of these funds toward thermal energy systems. It never receives enough qualifying applications to meet that quota, though, which opens the door for innovative pellet-related projects.

PK Wood Pellet also benefited from this grant. This summer, it was awarded funds to install a wood boiler system at a new pellet plant in Vermont.

The third grant, Wood Products Infrastructure Assistance, is designed explicitly for projects that utilize feedstock from forest restoration efforts on federal or tribal lands. Awards can reach $1 million. Two examples of successful pellet-related applications to this grant include Junction Commodities’ pellet production upgrades in New Mexico and Tech Woods USA’s pellet-fueled thermal modification plant in Montana.

Project Readiness and Qualifications

Before you apply, you should know a bit about the grants’ requirements. All projects must take place in the U.S. or its territories. Projects should be well defined, include detailed budgets, have multiple quotes for equipment (if relevant), and come with a clear timeline. You must also have access to a physical site, and permits should at least be filed for approval. The Forest Service expects to see a complete, thought-out project plan. Anything less will not be competitive.

What to Expect Post-Application

After you apply, the Forest Service will begin its review process, which usually takes six months. For the Wood Innovations grant, you cannot spend any budgeted funds until after you receive

a notice of award. That includes your share of the budget. So, only apply if you can wait to begin spending. Keep in mind, though, that you must only account for $600,000 in the application budget. You are free to incur project costs outside of what you list.

The Community Wood program is a bit more flexible. You may spend your share—termed “leveraged funds”—before receiving a notice of award, but you cannot touch the federal portion.

Ownership is another consideration. For 10 years, the federal government retains a financial interest in any tangible property that it helps fund (equipment over $15,000). If you’re financing the project, this could conflict with your lender’s requirements. However, there are ways to structure your budget to sidestep this issue. For example, you can apply federal funds to installation costs, personnel or engineering—nontangible costs that don’t create ownership claims. Or, if you must allocate federal funds to equipment, cover pieces in full so you won’t need to finance them.

Another important note: These grants are reimbursementbased. You’ll need to cover the cost upfront and then get reimbursed—unless you successfully request a prepayment. Alternatively, you can obtain a bridge loan from a lender against the grant award to access the capital faster.

Finally, be aware that federal grants come with requirements and conditions. You will be required to pay taxes on the award, and there are additional administrative burdens, including detailed financial reporting and performance tracking. Factor in the cost of hiring a grant writer or assigning a staff member to manage compliance, as well.

Tips for a Successful Application

Your first step is to contact your regional Wood Innovations coordinator at the Forest Service. These coordinators are accessible and honest. They’ll tell you whether your project is a good fit, and if it is, they’ll encourage you to submit an application. That initial call can save weeks of wasted energy—or confirm that your application is worth the time and effort.

The Wood Innovations grants provide tangible support for pellet producers who are ready to grow, adapt or innovate. Whether you’re adding a new line, breaking into biochar or installing a biomass boiler, now is the time to act—applications open during National Forest Products Week in October. If your project is defined and your timeline flexible, this funding can help catalyze your operation’s growth.

Author: Joel E. Dulin President & CEO

Jozana Grant Services

Enhancing Profitability Through Operational Excellence

BY ALEXANDER A. KOUKOULAS AND STEFAN KUCHER

Wood pellets have become a cornerstone of renewable energy, particularly in Europe and North America, offering a sustainable alternative to fossil fuels. However, as demand surges, the industry faces mounting pressure to deliver consistent quality, optimize costs and reduce its environmental footprint. The solution lies in adopting a rigorous Operational Excellence framework and drawing on the latest thinking in the pulp and paper and wood products sectors to elevate wood pellet production into a world-class, sustainable practice.

Key Operational Excellence Levers

AFRY defines Operational Excellence not as a rigid methodology but as a mindset that drives continuous, integrated improvement across processes, technology and people. The goal is to maximize the performance of existing assets, uncover opportunities to enhance reliability, and ultimately boost profitability.

At the heart of Operational Excellence are several interconnected levers that, when applied thoughtfully, can transform wood pellet manufacturing. Reliability and maintenance stand out as a foundation. By shifting from reactive repairs to predictive strategies powered by sensors, data analytics and artificial intelligence, operators can anticipate failures in critical equipment like dryers, conveyors and hammer mills, reducing downtime and extending the life of their assets.

Equally important is process standardization, which helps stabilize operations and align the entire organization behind clear, meaningful performance indicators. By defining and cascading key performance indicators—such as moisture consistency, throughput and

yield—companies can ensure that operators, supervisors and executives are all working toward the same objectives.

A holistic view of the supply chain is another essential lever. Integrating data from forestry operations, inventory systems and customer demand allows plants to optimize procurement, minimize waste and respond more effectively to market fluctuations.

Energy optimization also plays a crucial role. Through techniques like heat recovery, combined heat and power systems, and electrification of auxiliary processes, plants can significantly reduce their energy consumption and emissions while improving margins.

Finally, none of these improvements can succeed without strong cross-functional collaboration. Operational Excellence depends on clear communication and cooperation across departments such as production, maintenance, quality, logistics and sales. When these teams work in sync, they can eliminate bottlenecks, respond quickly to challenges, and deliver consistent quality and service to customers.

All together, these levers form a cohesive framework for continuous improvement, positioning wood pellet producers to achieve higher efficiency, resilience and sustainability.

A Roadmap to Excellence

In Operational Excellence, the ultimate goal is not just profitability but sustainable performance—creating lasting value while fostering a culture of continuous improvement. By minimizing input waste, reclaiming residues and improving energy efficiency, pellet mills can significantly lower their carbon intensity, contribute to circular bio-

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Pellet Mill Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

economy goals, and bolster their reputation. This supports global momentum for renewable materials and positions pellet producers as trusted partners in delivering sustainable energy solutions.

Achieving Operational Excellence in the wood pellet industry requires more than isolated initiatives—it demands a clear, structured roadmap that aligns actions with long-term goals. The following strategic steps provide a practical pathway for producers to do so (see Figure 1). By approaching these recommendations as an integrated journey rather than a checklist, companies can build resilient operations that deliver both profitability and sustainability.

Begin with an asset diagnostic (ExGAP). Begin with a structured assessment—such as AFRY’s Execution Gap (ExGAP)—to establish a baseline for performance across reliability, yield, energy and supply chain. The ExGAP identifies the gap between an asset’s potential and its actual performance, highlighting profit leakage and pinpointing areas where optimization can deliver the greatest impact.

In wood pellet production, the cost of wood is by far the largest component of variable costs, typically representing 50%–70% of the total. Leveraging AFRY’s Smart Forestry ecosystem, wood sourcing teams can reduce unit costs by approximately $5–$10 per ton through precise digital forest inventories and optimized operations, eliminating inefficiencies such as empty truck hauls and inaccurate procurement valuations.

Launch analytics and predictive maintenance pilots. Start small—install vibration, temperature or moisture sensors on a critical asset (e.g., dryer) integrated into a dashboard. Demonstrate return on investment through uptime gains and maintenance cost reductions.

Standardize KPIs across the board. Define clear, tiered metrics for key performance indicators (KPIs):

• Operator level: moisture and throughput variance.

• Mid-level: asset utilization, scrap rates, energy per ton.

• Executive level: overall equipment effectiveness, throughput yield, cost per ton, emissions intensity.

Optimize energy systems. Assess heat flows to uncover opportunities for combined heat and power or heat recovery. Explore options such as cofiring fines or dust or switching to renewable electricity to reduce reliance on fossil fuels.

Implement cross-department process workflows. Use valuestream mapping to uncover bottlenecks in production, maintenance scheduling and order fulfillment. Improve with joint control boards and integrated planning.

Capture waste streams for valorization. Repurpose byproduct streams—fines, dust and residues—selling them as fuel or biochar or recycling them internally. Package byproducts for wood panel, biochar or fuel markets.

Embed OE in culture through leadership training. Launch internal workshops to cultivate Operational Excellence mindsets to promote visibility, experimentation, accountability and cross-functional collaboration.

Scale and sustain with governance. Establish oversight teams to track OE initiatives, integrating them into quarterly reviews, capital planning and sustainability reporting.

Case Study

While Operational Excellence has not yet been widely applied

in the wood pellet sector, an illustrative example from a related industry—sawn softwood production—demonstrates the potential impact of this approach. AFRY recently partnered with a large sawn softwood producer that operates several mills with a combined annual output of approximately 750,000 cubic meters, to unlock performance gains through a structured, sustained Operational Excellence program.

Prior to implementation, AFRY conducted an ExGAP diagnostic, which identified an opportunity worth $18 per cubic meter through improvements in production, yield and product quality. Building on these insights, AFRY worked with the client over a 12-month period with weekly on-site presence to redesign management systems, optimize production planning, strengthen maintenance processes and implement a robust change management program.

The results were transformative:

• Production: Increased by nearly 12% across all mills, thanks to improved uptime and runtime efficiency.

• Yield: Improved by over 5%, reducing waste and maximizing output from each log.

• Value: Average product value rose by nearly 6%, driven by better quality and optimized product mix.

• EBIDTA Improvement: Together, these gains contributed to an annualized EBITDA improvement of approximately $10 million, based on the final three months of AFRY’s presence.

Sustainability of these gains was ensured through regular systemmaturity audits and impact reviews with the management team.

Although this case originates in the sawn softwood industry, the parallels to wood pellet manufacturing are clear: Both industries rely on heavy machinery, face variable raw material quality, and operate within tight margins and sustainability expectations. The success of this project demonstrates that a disciplined Operational Excellence approach—combining diagnostics, implementation support and cultural change—can unlock significant untapped value even in mature manufacturing environments. It reinforces the notion that the wood pellet sector can adopt similar methodologies to improve reliability, efficiency, product consistency and profitability, aligning with both commercial and environmental goals.

Conclusions

The wood pellet industry stands on the cusp of a transformative opportunity. By embracing Operational Excellence—combining predictive assets, process discipline, energy optimization and byproduct valorization—pellet mills can dramatically boost efficiency, sharpen profitability and enhance sustainability. Aside from short-term gains, this positions producers as leaders in the circular bioeconomy and aligns with global climate imperatives.

Operational Excellence isn’t just about doing things better, but doing better things and leveraging every aspect of production as a value lever. By applying proven best practices from the pulp and paper and wood products industries, pellet producers can unlock new pathways to long-term, sustainable success.

Author: Alexander A. Koukoulas, Ph.D., Director Stefan Kucher, Director

AFRY www.afry.com

Become an Exhibitor

Create One-on-One Meetings

Increase Your Networking

Becoming an exhibitor undeniably offers a plethora of bene ts for companies seeking to boost their brand relevance, establish a rapport within the biomass energy audience, understand industry competitors, and most importantly, create lasting impressions.

19th ANNUAL

Change Service Requested