Data drives innovation. Th rough CTE InSight , advanced statistical analysis identifies opportunities for improvement and predicts the most impactful change for plant performance. Better data clarity enables optimization. Turn InSight into action.

President & Editor Tom Bryan tbryan@bbiinternational.com

Senior News Editor Erin Voegele evoegele@bbiinternational.com

Contributions Editor Katie Schroeder katie.schroeder@bbiinternational.com

Features Editor Lisa Gibson lisa.gibson@sageandstonestrategies.com

Vice President of Production & Design Jaci Satterlund jsatterlund@bbiinternational.com

Senior Graphic Designer Raquel Boushee rboushee@bbiinternational.com

CEO Joe Bryan jbryan@bbiinternational.com

Chief Operating Officer John Nelson jnelson@bbiinternational.com

Senior Account Manager Chip Shereck cshereck@bbiinternational.com

Account Manager Bob Brown bbrown@bbiinternational.com

Senior Marketing & Advertising Manager Marla DeFoe mdefoe@bbiinternational.com

Ringneck Energy Walter Wendland Commonwealth Agri-Energy Mick Henderson Western Plains Energy Derek Peine Front Range Energy Dan Sanders Jr.

Minneapolis, MN (866) 746-8385 | www.safconference.com

Serving the Global Sustainable Aviation Fuel Industry Taking place in September, the North American SAF Conference & Expo, produced by SAF Magazine, in collaboration with the Commercial Aviation Alternative Fuels Initiative (CAAFI) will showcase the latest strategies for aviation fuel decarbonization, solutions for key industry challenges, and highlight the current opportunities for airlines, corporations and fuel producers.

St. Louis, MO (866) 746-8385 | www.fuelethanolworkshop.com

Now in its 42nd year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine —that maintains a strong focus on commercialscale ethanol production, new technology, and near-term research and development. The event draws more than 2,300 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

St. Louis, MO

(866) 746-8385 | www.sustainablefuelssummit.com

Customer Service Please call 1-866-746-8385 or email service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge with the exception of a shipping and handling United States. To subscribe, visit www.EthanolProducer.com/Subscribe, send an email to subscriptions@bbiinternational.com or call 866-746-8385. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to: Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND, 58203, or editor@bbiinternational.com. Please include contact information. Letters may be edited for clarity or space.

The Sustainable Fuels Summit: SAF, Renewable Diesel, and Biodiesel is a premier forum designed for producers of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to learn about cutting-edge process technologies, innovative techniques, and equipment to optimize existing production. Attendees will discover efficiencies that save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine and SAF Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers, and producers to advance discussions and foster an environment of collaboration and networking. Through engaging presentations, fruitful discussions, and compelling exhibitions, the summit aims to push the biomass-based diesel sector beyond its current limitations. Co-located with the International Fuel Ethanol Workshop & Expo, the Sustainable Fuels Summit conveniently harnesses the full potential of the integrated biofuels industries while providing a laser-like focus on processing methods that deliver tangible advantages to producers. Registration is free of charge for all employees of current biodiesel, renewable diesel, and SAF production facilities, from operators and maintenance personnel to board members and executives.

Please recycle this magazine and remove inserts or samples before recycling

The laboratory is the nerve center of an ethanol plant. The critical testing and quality assurance done there is the foundation of plant health and process optimization. But the effectiveness of every lab is dependent on their tools, resources, management, data and, increasingly, third-party support. Each of those things is covered in our first two stories, both geared toward high-level lab performance.

In “Analytics Amalgamated,” on page 14, we look at the myriad tools and methods available to help ethanol producers capture, visualize, catalog and use lab and process data. Collecting accurate fermentation data with consistency is challenging enough, but as the story’s subhead points out, “integrating it all—and removing information silos—may be the real difference maker.”

Adding breadth to our lab theme, we bring you “Synergy In Every Test,” on page 20, a profile of subsidiary lab companies in Sioux Falls, South Dakota, offering ethanol producers standards and testing under one roof. Axion produces and distributes analytical standards and reference materials for labs, while Soliton is highly focused on analytical test methods that support its clients’ quantification of cellulosic ethanol from corn kernel fiber. Suffice to say, the CKF work alone has been keeping their equipment buzzing non-stop.

Jumping from process to policy, we shed light on the somewhat contentious proposal to limit the RIN credit values of foreign biofuels (or biofuels derived from foreign feedstock). The U.S. Environmental Protection Agency included the proposal in its 2026-’27 RFS “Set 2” rule at about the same time foreign fuels and feedstocks were excluded from 45Z tax credit eligibility. “Feedstock Flagging,” on page 26, unpacks these related policy developments that, like them or not, are a result of the current administration’s “America-first” doctrine.

Our page-30 feature, “In Doubt About Denaturant,” wades into another thorny industry issue, one that’s not the result of contemporary legislation but Prohibition-era rules. In addition to its unapologetic domestic bent, the Trump administration has also expressed interest in removing burdensome regulatory barriers on industry. So, many industry leaders think now is a good time to lobby for the abolishment of a nearly century-old rule that requires fuel ethanol to be denatured, typically with natural gasoline, prior to shipment. The Renewable Fuels Association is leading this effort. Other groups have been less vocal on the subject. It may be unlikely to happen, but the “call for change has been aired”—and it’s a good read.

Finally, following a recent case of suspected arson at an ethanol plant in Iowa, we bring you “Detect and Deter,” on page 34. This is a piece about the various security and site surveillance systems available to ethanol producers, from AI-enabled cameras and voice deterrence systems to high-voltage fencing and actual guards. Without hyping up the risk, the need for site security will likely be elevated by our industry’s low-carbon pursuits and “evolving societal threats.” Probably time to get serious about it.

A new day is dawning for ethanol production. Our industry-leading lineup of yeasts, yeast nutrition, & enzymes are pushing the limits of fermentation and reaching levels of performance never achieved before. Paired with our renowned educational programs and expert services, we’re setting a course for even greater yields and performance.

With LBDS, THE FUTURE OF FERMENTATION IS BRIGHT AND THE POSSIBILITIES ARE ENDLESS.

Across America’s heartland, corn farmers are finishing a record harvest—only to face some of the lowest prices in years. They’ve done their job; now Washington needs to do its part. Outdated federal rules—like obsolete pump labeling and unnecessary equipment certifications—are suppressing demand for ethanol and, by extension, undercutting a new market opportunity for our nation’s farmers.

The clearest way to boost crop demand is to expand access to higher ethanol blends, especially E15. Nationwide, year-round E15 availability could create demand for over 2 billion bushels of corn and sorghum, while saving consumers 10–30 cents per gallon at the pump. That’s why we need Congress to pass the Nationwide Fuel Retailer and Consumer Choice Act this fall, which would finally put E15 fuel regulations on a level playing field with E10.

But the need for legislative action goes beyond that. In August, a bipartisan group of senators and representatives introduced the Ethanol for America Act. This bill would require the EPA to finalize a long-stalled rule—first proposed in January 2021—to modernize E15 labeling and equipment standards. Originally proposed at the end of the first Trump administration, the rule sat idle under President Biden. It includes commonsense steps: updating or removing E15 pump labels, allowing flexibility in underground storage tank requirements and ensuring future fuel infrastructure is compatible with higher ethanol blends.

Finalizing this rule should be an easy win—and we urge policymakers and the administration to get the job done as soon as possible. In 2024, President Trump said gas stations should be able to “use the existing pumps” for E15. We agree, and recommended these steps in a recent letter to the president:

• Eliminate E15 Misfueling Mitigation Plan requirements.

• Establish a presumption of E15 compatibility for all fuel dispensers, underground storage tank systems, and hanging hardware installed after 1998. Existing equipment should be deemed compliant with applicable compatibility regulations.

• Offer safe harbor for retailers that follow EPA guidance.

• Provide technical support to help local authorities enable E15 infrastructure use.

Congress and the Trump administration can take these simple steps now to strengthen America’s agriculture sector and stave off an impending crisis in farm country. We urge our nation’s leaders to act quickly to open new market opportunities for corn and ethanol—like year-round E15. Doing so would restore demand-driven dynamics in the grain market and significantly reduce the need for assistance in the form of farm program payments.

The recent EU-U.S. trade agreement is only latest example of how the ever-shifting transatlantic relationship continues to reshape the outlook for the ethanol industry around the world.

While economic and political uncertainty seem to have become the new normal on the global stage, there are still some ways that ethanol producers everywhere could take advantage of opportunities created by the right policy choices.

Here are five ways policymakers around the world could spur global growth in renewable ethanol and help move beyond counterproductive trade disputes:

1. Adopt a more flexible approach to de-fossilizing road transport: It’s clear that motorists—not just in Europe but also around the world—are not yet buying battery-electric vehicles as eagerly as some regulators would like. In fact, within Europe, hybrid and petrol vehicles remain the leading choices among new-car buyers. Renewable ethanol is the best way to reduce emissions from these cars. As EU regulators revisit their regulation on reducing car emissions in the coming months, they need to follow the advice of European Commission President Ursula von der Leyen and be more “pragmatic”—using solutions that work and including sustainable biofuels, such as renewable ethanol, in the definition of CO2 neutral fuels.

2. Move faster on higher ethanol blends: Governments around the world are waking up to the importance of reducing car emissions with renewable ethanol. Japan is moving to adopt E10, India is accelerating its ethanol policy to use E20, and even Brazil—long a champion of higher ethanol blends—has increased its blending mandate. In Europe, there’s still time to encourage wider uptake of the E10 standard in more member states, as well as a revision of the EU’s regulations—including harmonization of vehicle standards—to facilitate the adoption of E20 in Europe.

3. Take action to combat fraudulent biofuels: European renewable ethanol is produced from domestic feedstock and adheres to sustainability standards that are among the strictest in the world. But it’s apparent that some fraudulent practices in biofuel imports are a systemic problem for the entire EU biofuel market and must be addressed with appropriate controls and regulations. This is the best way to ensure that legitimate biofuels such as renewable EU ethanol are not displaced.

4. Be pragmatic on the use of ethanol for maritime/aviation: Governments around the world are setting high ambitions for decarbonizing maritime and aviation. Unfortunately, the EU missed key opportunities with its ReFuelEU Aviation and FuelEU Maritime regulations by excluding first-generation bioethanol from their scope—even though ethanol is considered sustainable under the Renewable Energy Directive. There’s still time to change course. In 2027, the EU will revisit these aviation and maritime regulations and should include first-generation ethanol in their scopes.

5. Unleash the potential for ethanol as a feedstock for biochemicals and materials: Europe’s renewable ethanol sector is at the forefront of biobased innovation as biorefineries already serve as platforms for the development of biobased chemicals and materials. We see the role of ethanol as precursor of biobased chemicals and materials, such as ethyl-acetate and bio-ethylene; renewable ethanol molecules are the biobased molecules with the largest volumes produced to date, as they have benefitted from the development of biofuels. The current volumes could be progressively made available on a large scale for the chemistry sector that could easily replace fossil-based molecules.

These are just some ways that the renewable ethanol sector can do even more to help the world’s economies move beyond fossil resources. European ethanol producers remain committed to working with policymakers and partners to make this vision a reality.

At the 65th Annual Board of Delegates Meeting, U.S. Grains Council members voted and passed an organizational name amendment to change from the U.S. Grains Council to the U.S. Grains & BioProducts Council (USGBC).

“The council stands on the precipice, and there is the opportunity for exponential growth with becoming the U.S. Grains & BioProducts Council,” said Ryan LeGrand, USGBC CEO and president. “The U.S. Grains & BioProd-

ucts Council encompasses both the organization’s grains side and ethanol side to create one global powerhouse organization.”

“This organizational name change will open doors previously closed to us—those in the energy space for which our ethanol team are diligently trying to gain access to so we can spur sales in ways that we haven’t been able to in the past.”

Rayonier Advanced Materials, the global leader in cellulose specialty products, announced the signing of a memorandum of understanding with GranBio, a pioneer in biochemicals and biofuels, to jointly explore the development of a small-scale commercial cellulosic sustainable aviation fuel (SAF) facility co-located at RYAM’s Jesup, Georgia site.

Under the agreement, GranBio will lead the proposed project to de-

ploy its proprietary AVAP technology to convert lignocellulosic biomass into second-generation ethanol, which will be upgraded into SAF for sale to an offtaker. The new facility would leverage RYAM’s infrastructure at the Jesup plant, including feedstock, utilities and logistics. The project will be partially financed through GranBio’s $100 million grant from the U.S. Department of Energy.

Union Pacific and Norfolk Southern announced an agreement to create America’s first transcontinental railroad. These companies will seamlessly connect over 50,000 route miles across 43 states from the East Coast to the West Coast, linking approximately 100 ports and nearly every corner of North America. This combination will transform the U.S. supply chain, unleash the industrial strength of American manufacturing, and create new sources of economic growth and workforce opportunity that preserves union jobs.

Under the terms of the agreement, Union Pacific will acquire Norfolk Southern in a stock and cash transaction, implying a value for Norfolk Southern of $320 per share based on Union Pacific’s unaffected closing stock price on July 16, 2025, and representing a 25% premium to Norfolk Southern’s 30-trading day volume weighted average price on July 16, 2025. The value per share implies an enterprise value of $85 billion for Norfolk Southern, resulting in the creation of a combined enterprise of over $250 billion.

The Andersons announced it has acquired full ownership interest in The Andersons Marathon Holdings, which operates four ethanol plants. TAMH has been renamed The Andersons Renewables.

The company operates four ethanol plants with a combined production capacity of 500 MMgy. The facilities are located in Albion, Michigan; Clymers, Indiana; Greenville, Ohio; and Denison, Iowa. Previously, The Andersons held 50.1% ownership in TAMH and Marathon held 49.9% ownership. Under the transaction, The Andersons has acquired

the remaining 49.9% ownership interest in TAMH from a subsidiary of Marathon Petroleum Corp. for $425 million, inclusive of $40 million of working capital. The transaction closed July 31.

The Andersons’ renewables segment reported pretax income of $17 million for the second quarter and pretax income attributed to the company of $10 million, compared to $39 million and $23 million, respectively, during the same period of last year. EBTIDA was $30 million, compared to $52 million.

For over 20 years, Beyond has been the innovative and trusted experts in selling, implementing and suppor ting grain processing ERP software solutions.

We provide tailored expertise and innovative technology to plants across North America 80+ Ethanol Plants

10,000+ Transactions

We process more than 10,000 digital transactions per daymore than any competitor

From advanced grain processing to strategic financial tools, we provide comprehensive solutions tailored to your needs Tailored Solutions

IFF leverages advanced tools and constant innovation to help its customers maximize ethanol and DCO yields.

By Katie Schroeder

Drawing from its robust suite of process-optimizing tools, technologies and talent, IFF is helping ethanol producers improve distillers corn oil (DCO) yields through customized enzyme application and the intelligent use of process information. Corn oil mapping, for example, helps the company gather the information required to create successful strategies that utilize both the enzymatic and process elements of DCO extraction. Through this mapping process, IFF is able to provide its customers with detailed insights into the plantwide flow of DCO, identifying areas where yield loss is occurring.

“With oil mapping, we actually take samples throughout their process at the customer’s facility,” says Pauline Teunissen, global applications director for grain processing with IFF. “We take samples of their whole stillage, of their syrup feed, of their wet cake, of their final syrup, the centrates, ferm drops, and then we measure the fat content in those samples.”

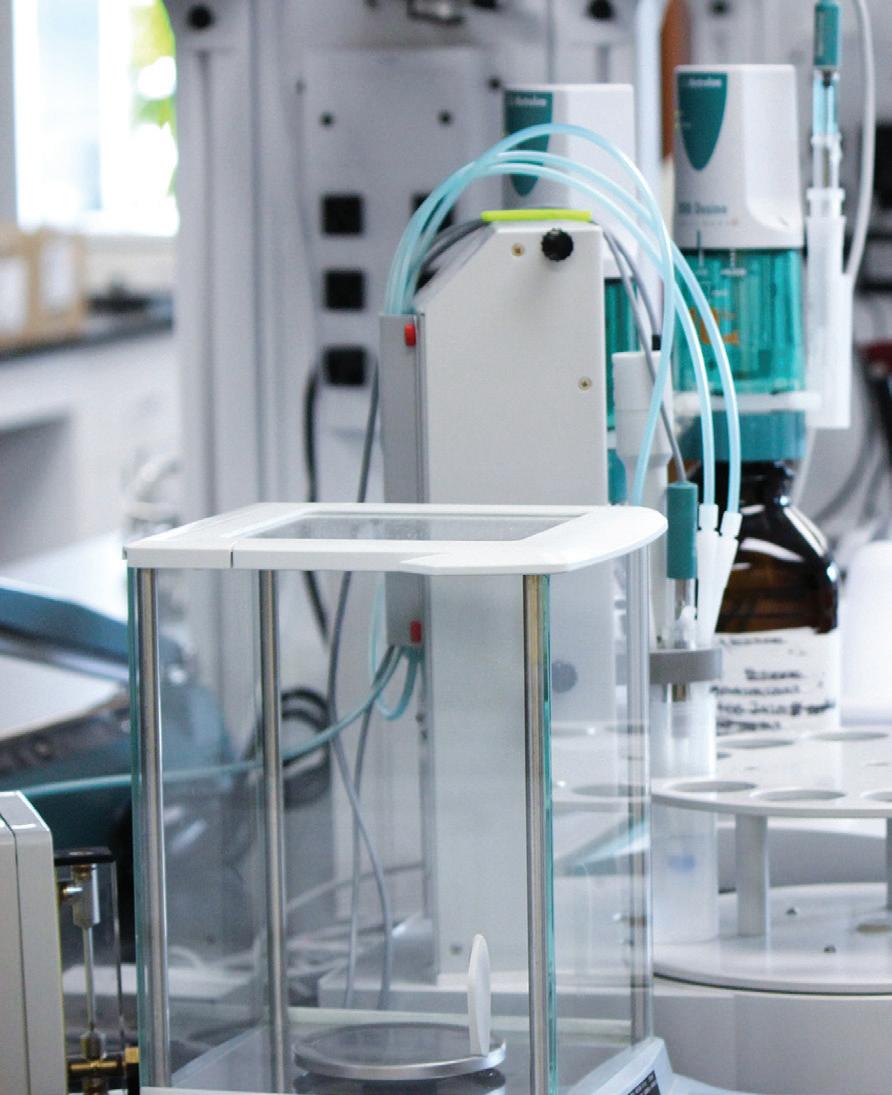

Data quality and timely test results both determine how accurate and useful the map will be. Ensuring sample consistency and utilizing advanced lab equipment helps IFF improve data quality. The company focuses on executing the right sample preparation every time. Teunissen explains that using advanced lab instruments helps hasten the turnaround of test results without compromising on quality. In-house lab technologies, like rapid NMR fat analyzers make test results available in days rather than weeks.

Significant research and innovation stand behind each IFF product. Teunissen adds that the company’s R&D team data mines enzyme genome libraries for new enzymes and compares them to the traits needed for IFF’s applications.

IFF continues to innovate in its R&D

facility in Palo Alto, California, and its Applied Innovation Center (AIC) in Cedar Rapids, Iowa. The AIC and R&D lab have the equipment needed to mimic an ethanol producer’s process from beginning to end, giving detailed insight into how enzymes will perform onsite. Although the lab scale cannot serve as a substitute for testing at the “very large scale” of an ethanol facility, Teunissen explains that the lab model systems and the pilot plant in AIC helps IFF gather very good “directional data” by giving the R&D team an indication of how the enzyme will react to the process environment in liquefaction and/or other parts of the ethanol production process

“We can mimic customers fermentations in a shake flask, and we have made sure that, for instance, the sugar and organic acid profiles we measure do mimic what they also see in their plants,” she says. “So that’s also a way to test our enzymes and yeast strains, and then we also have methods that mimic parameters of the downstream processing.”

IFF strives to bring about real results for its customers while continuously advancing sustainable-minded innovation. The company’s sustainability goals are more than an ambition, says Teunissen. Every project is examined through that lens, and IFF’s sustainability team analyzes energy use and other key metrics to give each project a sustainability score.

“And we use an internal methodology that informs the decision-making and also feeds back into [what’s uncovered during] our innovation process,” she says. “And some of the things we are looking at [include]: How are we able to reduce energy? How can we work with sustainable raw materials? What are some of the improvements we can make on our internal microorganisms or internal enzyme production?”

These questions inform IFF’s product development strategy, including solutions geared toward lower-carbon intensity production. Teunissen adds that IFF also considers how its products can help reduce chemical costs for producers, decrease energy consumption and improve plant efficiency.

To further assist ethanol producers in assessing sustainability impacts, IFF has created XCELIS® AI, a holistic production facility model, which allows customers to model the outcome that applying a new technology or enzyme could have on their bottom line and carbon intensity.

“I’m very excited about all the innovation projects that we are currently working on, the products that we will bring to market in the coming months and years,” Teunissen says.

Ethanol producers are collecting, storing and analyzing more lab and process data than ever before. Integrating it all—and removing information silos—may be the real difference maker.

By Katie Schroeder

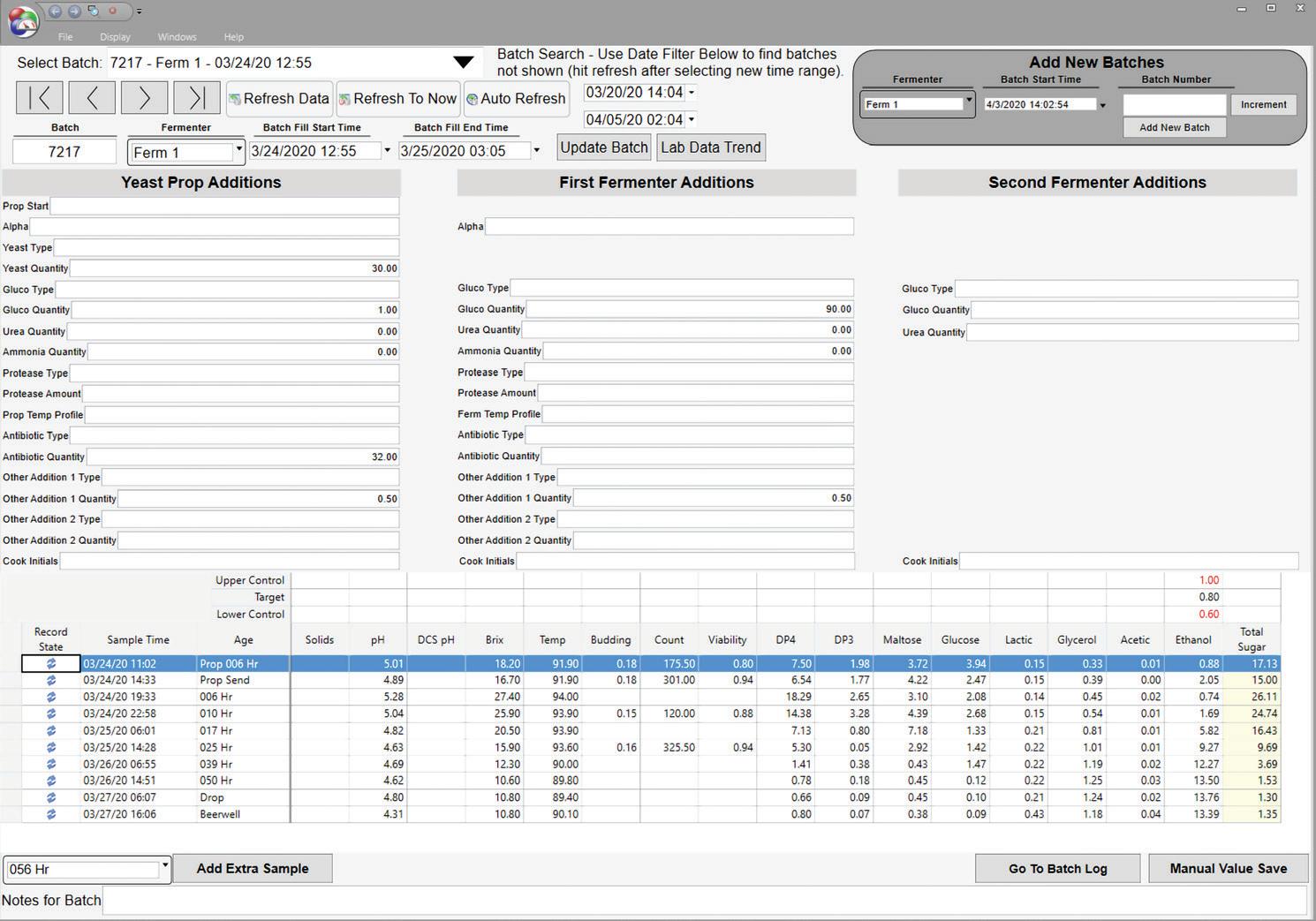

Ethanol producers’ data often ends up divided between departments, making it hard for production and lab teams to compare notes. Process information streaming from the plant’s distributed control system (DCS) and the intermittent test results measured by the lab every few hours are frequently disconnected from data stored in various areas of the facility. These information silos prevent ethanol producers from using that data to find problems and optimize their processes.

“Bridging that gap and making sure there’s really clear communication between lab and process is critical because so many things in fermentation follow what’s happening on the process side,” says Wesley

Reznicek, technical service representative with Phibro Ethanol.

On top of the challenges associated with siloed data, tracking and analyzing fermentation data often comes with a time-delay, limiting the process team’s ability to react and maximize production. Several companies are innovating to make fermentation data more accessible, accurate and actionable. Keit Industrial Analytics gives ethanol producers real-time data on their batch via the company’s proprietary mid-infrared spectrometer. Gathering accurate and constant information on the fermenting batch helps the lab optimize the fermentation, improving yeast health and ethanol yields. Phibro helps diagnose ethanol plant fermentation problems, such as out-ofcontrol bacteria growth or yeast stress. Inte-

grating process and lab data streams enables producers to better analyze the data. That’s possible through platforms like dataPARC, which enables producers to store and picture process data, and JMP, which helps producers recognize trends by analyzing and visualizing data.

In many ethanol facilities, lab data goes into Excel spreadsheets, explains Adam Cooper, applications engineer with dataPARC. Though Excel is a useful tool, overreliance on it tends to lead to vital lab and process data existing in separate, locked down files. “Any barriers to accessing data, like segregated systems, difficult to access systems or systems that are slow, hamper personnel at all levels to be able to make those key decisions,” says Cooper. “Also, being able to see historical data plays a

key part in learning from the past and being able to make better decisions going forward.”

Ethanol plant lab teams do high-performance liquid chromatography (HPLC) testing, examining eight main data points: ethanol, lactic acid, acetic acid, glycerol, DP4, DP3, DP2 and glucose. “DP” stands for “degree of polymerization,” with the number beside it designating the total glucose monomers strung together in a line, explains Reznicek. Observing the amount of glucose present in a ferm gives the lab insight on the amount of sugar available for conversion into ethanol. Too much glucose could result in “sugar shock” because the yeast cannot process it quickly enough. Too little, the yeast will starve.

Keit CEO Dan Wood explains that samples are often taken every eight to 10 hours. Typically administered a few times each day, these tests do not provide minute-by-minute data on the ferm’s status, but rather serve as a snapshot of the ferm when the sample was collected.

Tracking fermentation data benefits ethanol producers as it allows them to identify levers that can help improve yields. Reznicek works closely with ethanol producers, examining and verifying data to identify issues that cause bacterial growth. Gathering information on the fermentation’s progress helps producers dial in their recipe, determining how much yeast and glucoamylase are needed. This information helps determine how producers utilize antibiotics and analogous antibacterials, which are vital to sustaining and improving ethanol yields. Staying ahead of the bacterial growth curve—which is all about knowledge and timing—is, or should be, tightly connected to process analytics.

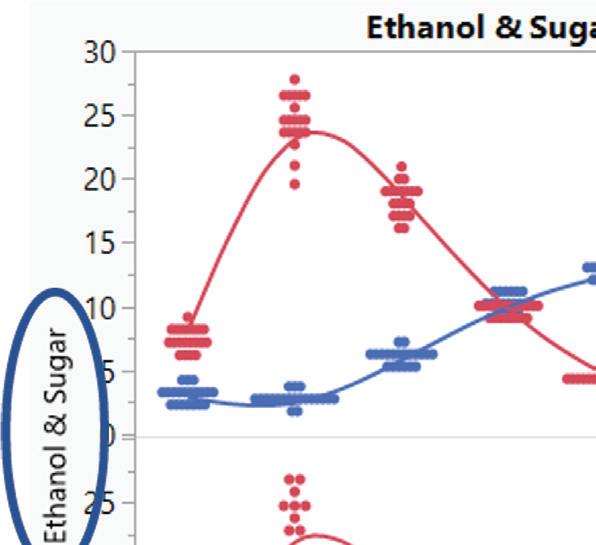

Analyzing data also helps producers gather the information needed to identify other potential levers that can improve production yields, explains Jerry Fish, senior systems engineer with JMP Statistical Recovery. JMP focuses on analyzing collected data rather than gathering and storing it.

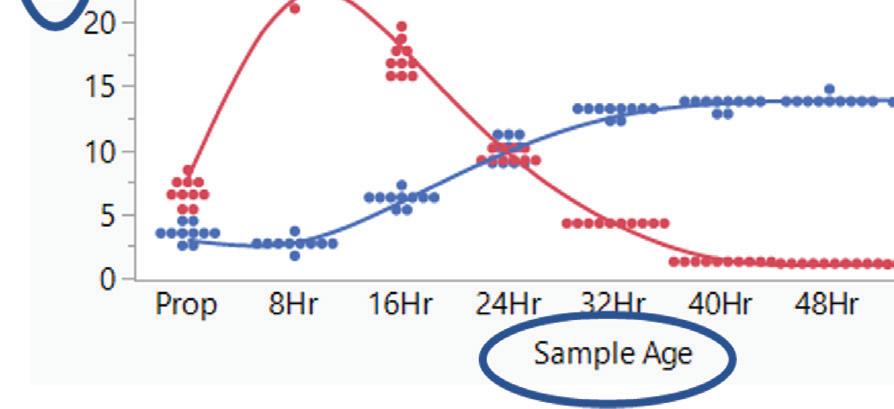

Through JMP’s drag-and-drop Graph Builder tool, ethanol producers can visualize data analyses through graphs. According to Bill Worley, principal systems engineer with JMP, this tool helps producers compare baseline data with trial results when testing a new process component or product, such as an enzyme or yeast. “Once you’ve collected it, we can grab the data from different sources, but then we analyze it, [which] starts with graphing, and it goes through all of the normal … statistical analysis tools—analysis of variance and regression and all of those things,” Fish says.

Graph Builder helps producers do core analysis, but JMP’s advanced tool found in JMP Pro, Functional Data Explorer, provides even more analysis potential. Producers can

TIMELY

use the Design of Experiments function to test and determine the best settings to run an experiment. Worley says that function helps producers build a predictive model to help optimize process inputs and assess new data.

Determining the optimal operation parameters starts with producers asking the right questions about the data. “It might be like, ‘When do we add the sugar and how much sugar do we add, and when to make this process work the best it can?’ We don’t want to flood the batch with sugar too early when the yeast can’t eat it,” Fish says. “And we don’t want to wait too late, or the yeast starves. You’ve got to get to that optimum [window] to get the right results.”

Alongside Graph Builder and Functional Data Explorer, ancillary features available to the ethanol industry include Model Driven Multivariate Control Charts, a statistical process control tool, and Time Series, which forecasts data trends. Worley explains that the companys’ platform improvements are often derived from customer’s feature requests.

Curating data and assessing its quality plays a vital part in making it work. “Data curation is a big driver in JMP, too,” says Worley,

explaining that curation includes identifying data outliers, reconciling inconsistent entries and correcting misspellings. For example, he says, it can be problematic if one operator types in a word differently than another; standardization is vital.

For data to be actionable, it also must be timely and accurate. Keit Industrial Analytics’ mid-infrared spectrometer grants producers instantaneous information on key fermentation metrics.

Wood explains that the company’s IRmadillo, a mid-infrared spectrometer, can be directly tied into the production process. Originating from the U.K.’s space program, the IRmadillo was designed to withstand the intense vibrations that occur during a rocket launch. Now, the IRmadillo has found a home in the ethanol industry, providing real-time data to the operations team and lab staff alike.

“We’re generating the source of data that normally only [the lab team] will see, but we’re generating it in the process environment,” says Wood. “The operating procedures that [most producers] have … require that the level of

THE STATISTICS: Graphs like this from JMP provide valuable visualization and insight on metrics such as consistency between fermenters.

IMAGE: JMP

detail we’re providing be analyzed by the lab, not by production. We’re trying to get the two sides to become one and have a joined-up conversation.”

Facing a shrinking workforce, ethanol producers may need to run their facilities with fewer people, explains Wood. The IRmadillo’s accuracy provides an ethanol plant with the baseline information needed to automate their process and take fewer samples. IRmadillo serves as a starting point for incorporating automation, such as automatic dosing for antibiotics. Wood emphasizes that the goal of automation is not to get rid of existing jobs, but to adapt to a smaller workforce as ethanol plants struggle to replace retiring employees.

Once Keit trains the IRmadillo using the plant’s HPLC lab results, it shows the process team real-time readouts of the “HPLC eight,” as Wood calls them. These readouts help the production team catch bacterial infections or other process problems before they ruin the batch.

“If you get a … lactobacillus infection in your fermentation, you can, on a really bad one, lose half your yield. And that’s, I think, in the hundreds of thousands of dollars each time,” he says. “It may be about $100,000 per ferm if you lose half the yield.”

IRmadillo also offers the capacity to detect other metrics beyond the main eight benchmarks. If the producer wanted to test for free amino nitrogen (FAN), the spectrometer could be trained to measure that as well. Crucial for yeast health, nitrogen supply can be the difference between a good ferm and a bad one. An ethanol producer would simply need to send a sample to a larger laboratory with the instrumentation needed to measure FAN, thereby allowing Keit to “train” the spectrometer.

Producers can also address information silos with a process data historian and management system, rather than file-based systems.

Leveraging its expertise, dataPARC gathers and synchronizes all that data.

By integrating data management systems and streamlining reporting, dataPARC makes it easier for managers and operators to analyze and take action on their data.

Ethanol plants often store lab data, process information and the “business” network separately, meaning that information must be transferred three times before it is merged into one program and can be analyzed by management. With the integration of dataPARC’s historian which records, stores and configures data, plant staff can access data easily. PARCview utilizes a web client that allows users to access displays and data within a web browser, according to Cooper. These two innovations enable plant staff to review fermentation performance information while away from the control room, or even offsite. More accessible data simplifies alignment of fermentation and process data across the facility’s entire workforce.

The Security Console tool further enhances data sharing abilities, allowing producers to designate varying degrees of access to specific users. For example, producers could give third-party vendors access to specific datasets relevant to the machinery they are maintaining or the chemical they are selling.

“Data is the new currency, and that information is at your plant,” Cooper says. “It’s just a matter of you being able to harness it.” Whether producers are diagnosing a fermentation batch gone awry, visualizing collected data and statistics, getting realtime information on the ferm’s progress or storing data in an accessible, actionable format, vendors have the tools, expertise and products to assist.

Author: Katie Schroeder katie.schroeder@bbiinternational.com

Offering standards and testing under one roof, sister companies Axion and Soliton operate jointly to help ethanol producers achieve optimal results.

By Luke Geiver

The science behind the analytical standards and test methods used in ethanol production today often originates in Sioux Falls, South Dakota, where a small but experienced team with years of developmental work for the U.S. ethanol sector runs a pair of sister organizations designed to make “science brilliant.”

Shon Van Hulzen, chief operating officer, oversees Axion and Soliton. Axion, formerly known as Bion, is an ISO 17034 accredited company, producing and distributing analytical standards and reference

materials for laboratories. The 17034 label means Axion can help its clients seamlessly adhere to global regulatory requirements. For biofuels, Axion has a portfolio of analytical standards designed for fermentation, grain handling and starch processing. These standards, and other ready-to-use, certified reference materials, serve in-house or thirdparty lab managers looking to achieve the highest levels of precision, accuracy and reliability. The team behind Axion also regularly performs custom work for its ethanol industry clients, along with third-party vendors working to prove out the effectiveness of their own products.

Van Hulzen started his ethanol resume by helping to stand up an ethanol plant in

Luverne, Minnesota, before spending several years at one of the nation’s largest ethanol production companies.

“I grew up in the ethanol industry,” he says.

Soliton, the sister organization, is an ISO 17025-accredited laboratory best known for its analytical test methods that support its clients’ quantification of cellulosic ethanol from corn kernel fiber (CKF). According to Van Hulzen, the personnel at Soliton help producers prepare to claim lowcarbon cellulosic fuel credits under several regulatory programs, including the Renewable Fuel Standard (i.e., generating D3 RIN ethanol) and California’s Low Carbon Fuel Standard.

Over the last decade, Van Hulzen estimates, Soliton has helped its clients by running over 2,000 official cellulosic ethanol certification events. Collectively, he adds, Soliton’s expansive client list accounts for over 9 billion gallons of U.S. ethanol production.

Emily Reade has been the director of scientific products at Axion for nearly 14 years. Reade was instrumental in helping Axion introduce its services to the ethanol space. At the time of launch, Reade and her team took five popular standards and sent them to every single ethanol plant in the U.S. Standards are used to establish a baseline for

everything from instrument performance to material specification and quality control.

“They all really liked those products,” Reade says.

Van Hulzen says Reade and her team have a standard for essentially any test an ethanol plant runs.

Today, some of the most popular products Axion offers are ready-to-use calibration and validation standards for high-performance liquid chromatography (HPLC), gas chromatography (GC), ion chromatography (IC), acidity and Karl-Fischer, as well as reference materials for starch at various levels.

Axion’s newest product is a comprehensive analysis test kit designed for the quantification of total starch. The kit includes all the enzymes needed to analyze for total starch in foodstuffs, cereal grains, grain processing byproducts, fermentation residuals and more. In addition, the kit also comes with the calibration standards required to set the analytical technique used to measure the resulting glucose from the assay. Reference materials needed to validate the results obtained are also included.

Reade helps producers with unique projects, one-off questions and, not infrequently, custom solutions. Her team’s ability to gain the trust of hundreds of producers, she says, is rooted in a commitment to customer service.

“Customer service is important to us,” she says. “We want plants to be able to call

us anytime, not just when they need something.”

Reade also has ethanol plant work experience and a rich understanding of lab operations and best practices. She places an importance on customer service because she also knows that no two plants are the same. Experience levels, capabilities and technologies vary. Some plants are stand-alone while others are part of a larger group with the ability to share insight more easily.

Reade’s approach has allowed her team to develop custom standards as well. Most of the work revolves around HPLCs. Some labs want to use tailored HPLC standards containing specific components at concentrations tied to their internal processes. In the case of high-purity alcohol testing, some plants want to test for a handful of components while others want to examine for 10, 20 or more.

A typical ethanol fermentation verification check standard comes with stated analyte concentrations. The analyte components for an ethanol fermentation verification check include DP4+ (saccharide), maltotriose, maltose, glucose, lactic acid, glycerol, acetic acid and ethanol. All of the analytes will be certified by a percentage of weight to volume.

The team also performs lab proficiency testing that compares the performance of a client’s lab instruments, methods and staff to that of peer labs. The result of such testing provides a client with defensible data.

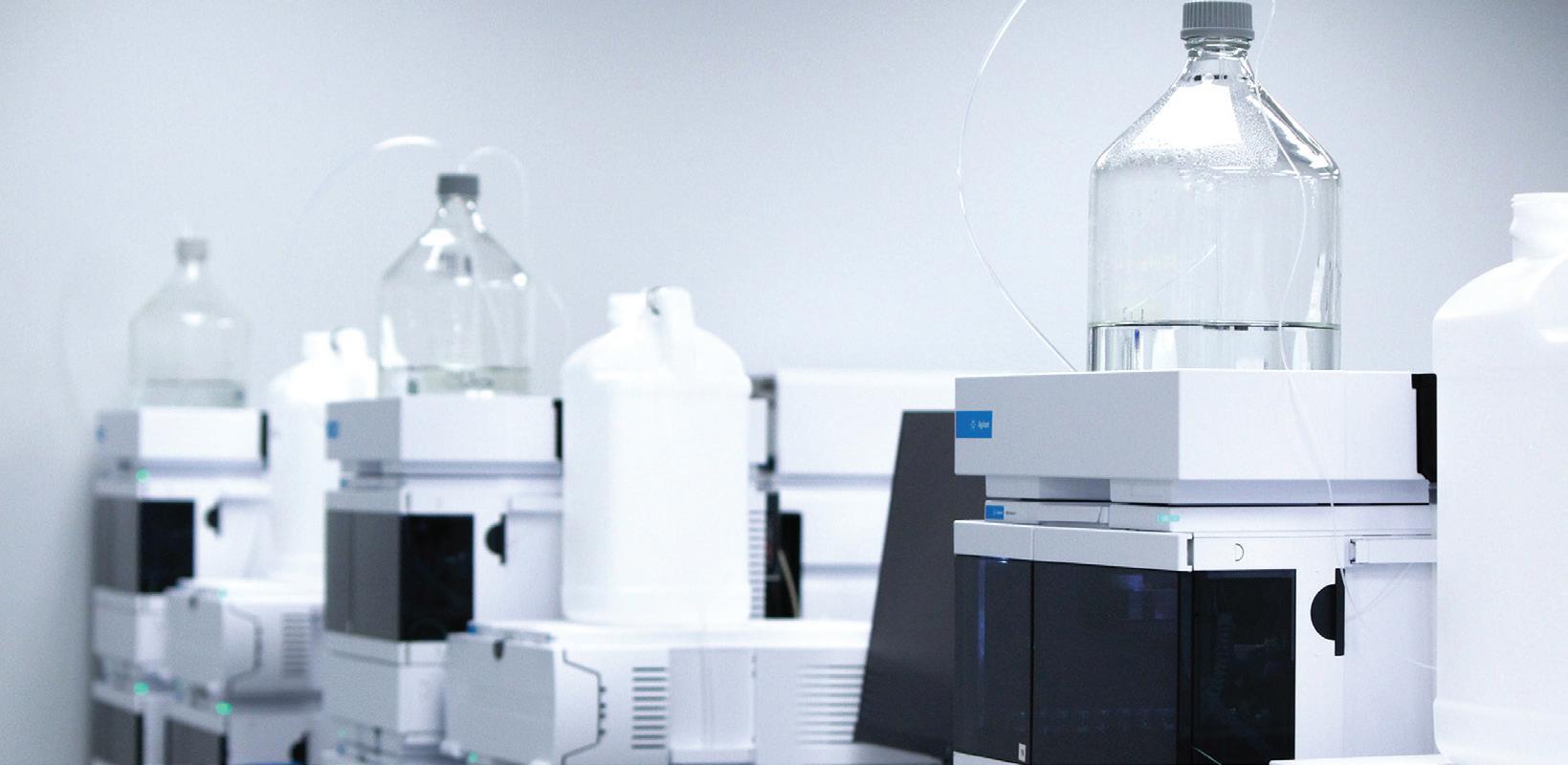

LAB TECH: Axion/Soliton’s 12,000-square-foot lab features an array of high-end testing equipment, including Karl-Fischer units and other critical technologies.

Plants looking to develop a custom standard should expect a two-to-three week wait time while Reade and her team develop and verify the work.

Tessa Schmitz, director of quality assurance at Soliton, runs a lab that performs oversight quality testing, creates new research methods and verifies the work of her counterpart at Axion. All of the standards that Reade creates at Axion go through Schmitz’s lab. As part of their R&D efforts, the team is working to bring a new hemicellulose method forward that would quantify the fiber conversion from hemicellulose, including all C5 and C6 sugars.

Schmitz has a suite of in-house testing capable of quantifying CKF conversion. Ethanol producers could pair existing cellulose methods with the new hemicellulose method to capture more of the overall conversion occurring in their processes.

Ask Schmitz about the difference between testing protocols and requirements at the state or federal level and she’ll provide an extensive masterclass on what each test achieves and how they differ. The portfolio is extensive and includes tests for any process tweaks a producer might want to make.

To date, the team has done more than 6,000 CKF fraction tests, each test representing a single data point on how much fiber was converted. Testing is performed under a simple, locked-in fee structure that

isn’t tied to a client’s product or RIN/CI credit values.

What have they learned about CKF conversions? Schmitz and Van Hulzen are quick to answer.

“It really varies,” they both say. No. 2 yellow corn can vary in composition. Enzyme treatment rates matter as well

as other things a producer is doing to convert fiber. All of that leads back to Schmitz and her team.

“There is always such a huge necessity to test to confirm the most optimal conversion conditions for each producer,” she says.

The interest in hemicellulose has prompted the Soliton team to develop a test to quantify its conversion rate. Schmitz says her team has invested over two years in R&D and method development to provide a solution for the ethanol industry.

Van Hulzen says the companies have made a big investment in instrumentation, and in 12,000-square-feet of lab space. The team has access to a large fleet of instruments ranging from gas chromatography to various titration systems to Karl-Fischer equipment. At any given time, it has 19 HPLCs deployed on standards development in addition to dedicated research and development instruments. One section of

the lab is solely dedicated to CKF conversion testing.

“We have a lot of glassware and beakers,” Schmitz says. “It looks and feels like a big lab.”

Van Hulzen says Soliton and Axion have found such success in the ethanol space because of the synergy they share— an overlap of great science.

One team creates standards and the other tests them to ensure they are as accurate as possible. Schmitz and Reade actually share an office, and clearly take pride in the quality of their work.

Schmitz says if Axion didn’t exist she would be significantly less effective in her parallel role in testing. Reade echoes that sentiment, explaining that she needs testing to verify her standards. They say larger companies that create testing and standards for

massive industries typically aren’t interested in creating custom solutions for niche testing like CKF, for example.

“We really depend on each other inhouse,” Schmitz says.

Working in unison has helped Axion and Soliton grow organically, not only in the U.S. but across the globe.

“‘We are very used to working in highly regulated markets,” Van Hulzen says.

Axion is now supporting international markets with standards being sold into more than a dozen countries, including the U.K., Bulgaria, Poland and Brazil, where the Axion team has spent time touring sugarcane ethanol plants and meeting with clients.

Soliton helps test biofuels for clients looking to demonstrate compliance to international fuel specifications.

Van Hulzen estimates that the team at Axion and Soliton has more than 100 years of combined lab and scientific experience in the fuel ethanol space. But even with decades of knowledge, excellent products don’t come easy. Their R&D is challenging—even “wild at times,” Schmitz says, but it’s hard work made fruitful by elegant results: fine-tuned products that keep ethanol plants running optimally.

In the end, the science behind much of the work Axion and Soliton do is more about people than technology, they say. They’re all able to work together toward a larger goal and the results, they believe, speak for themselves. They say they are known for precision, accuracy and the reliability of standards or testing verifications in the ethanol world. An open line of communication with industry clients has been crucial. As Reade says, their biggest point of pride is a willingness to talk to customers before any product of any kind is ever sold.

Ultimately, Van Hulzen says, the synergies between Axion and Soliton create an environment where the whole truly exceeds the sum of its parts. “Together, these two companies empower ethanol producers to identify and extract more value,” and that, Van Hulzen believes is, “Science made bril

liant.”

Author: Luke Geiver writer@bbiinternational.com

We stand for quality, integrity, and defensibility in lab analysis and data all the while bringing innovation and the best value in the industr y.

We employ all available analytical methods for corn kernel fiber conversion pathways.

NREL approved by EPA for RFS D3 RINs

ASTM approved by EPA for RFS D3 RINs

Our Proprietar y Analytical Methods have been approved by CARB for LCFS and provide an unrivaled level of accuracy and precision.

We are an ISO 17025 Accredited Laborator y and a member of ASTM International.

LET’S TALK.

As the enhanced 45Z tax credit rolls out excluding nonUSMCA fuels and feedstocks, the EPA is proposing a similar RIN value advantage for U.S.-made—and sourced—biofuels.

By Luke Geiver

The recently enhanced 45Z Clean Fuel Production Credit, which now extends through 2029, will provide four full years for the biofuels industry to follow through on investments and projects meant to grow capacity, says Paul Winters, director of public affairs and federal communications for Clean Fuels Alliance America, a trade group representing U.S. biodiesel, renewable diesel and sustainable aviation fuel (SAF) producers. The landmark extension, enhancement and clarification of 45Z should also provide a significant benefit to American farmers and domestic biofuel producers of all kinds thanks to one rather contentious adjustment.

Under the new version of the policy framework, 45Z credit eligibility is limited to fuels derived from feedstocks produced or grown in the U.S., Mexico or Canada (USMCA). Lawmakers had initially proposed to place no geographical limits on feedstock eligibility but would have reduced the value of the credit by 20% for non-USMCA inputs. That changed when the language on feedstock eligibility was updated prior to Senate passage

of the One Big Beautiful Bill Act (OBBBA)— signed into law by President Donald Trump on July 4—which made non-USMCA fuels and feedstocks altogether ineligible.

Producers utilizing foreign inputs for domestic biofuel production were ostensibly disappointed with the foreign feedstock exclusion, as 45Z’s value was stripped from their business plans. They had no time to lament the loss, however, with another battle over RIN values already upon them.

In mid-June, shortly before OBBBA’s passage, the U.S. Environmental Protection Agency released its proposed Renewable Fuel Standard revisions—the so-called “Set 2” Rule—laying out two years of renewable volume obligations (RVOs), overhauling various elements of the program, addressing volumes lost through small refinery exemptions and, notably, differentiating between foreign and domestic fuels and feedstocks.

The agency’s proposal introduces a new two-tier structure for RIN valuation, granting U.S. biofuels and feedstocks full credit while assigning only 50% RIN value to foreign equivalents. According to the EPA, this framework is intentionally designed to favor American producers and limit the RFS value for imports. If implemented as proposed, imported renewable fuel or fuel made domestically with foreign feedstocks would generate half the

RINs of purely domestic renewable fuel. And the reduction would apply to all foreign-produced biofuel, including product coming from Canada and Mexico.

The EPA is framing the proposed change on feedstock RIN allocation percentages as having a correlation to national security and North American economic benefit. “The reduction of RINs generated for import-based renewable fuel reflects the reduced economic and energy security benefits provided by these fuels relative to renewable fuels produced domestically using domestic feedstocks,” EPA said.

The public comment period on the proposed 2026-’27 RFS program closed Aug. 8— all the expected trade groups submitted their input—and finalization of the plan is tentatively slated for Oct. 31.

Winters and CFAA have applauded the decision for the foreign feedstock provision. Others, including the Advanced Biofuels Association, have not only voiced their displeasure with the proposal, but produced research to back up their objections to the penalty on foreign feedstock.

Reducing the RIN value associated with fuels and feedstock sourced outside the U.S. will support domestic oilseed processors, pro-

tect the investments they’ve made, and keep more of the value of U.S. crops here at home, Winters says.

“The feedstock limit will require farmers and oilseed processors to adopt new recordkeeping and traceability requirements,” Winters points out. “It remains to be seen how onerous those requirements are, or could become under a different administration.”

The EPA believes the new feedstocktracking requirements will be “minimally burdensome.” Under the new rule, domestic renewable fuel producers will be required to keep records of feedstock purchase transfers including bills of sale, delivery receipts and other forms. The documents will identify the feedstock’s point of origin and impact every biofuel producer generating RINs. According to the EPA, the feedstock point of origin would depend on the feedstock type and where it is grown, produced, generated, extracted, collected or harvested.

Planted crops, cover crops and crop residues could use the location of the feedstock supplier—the entity providing the feedstock to the producer—as an acceptable point of origin. A grain elevator, for example, would suffice, the EPA says.

For oil derived from planted crops, a crushing facility supplying a biodiesel producer would work. Fats, oils and greases, along with

municipal solid waste, could be verified by providing the location of a processing facility. A landfill or digester would be enough for biogas. The harvest site of woody biomass would qualify. For all feedstocks, the point of origin would need to be included in the renewable fuel batch reports.

U.S. ethanol trade groups such as Growth Energy and the Renewable Fuels Association are generally supportive of biofuel feedstock policy that limits any unfair advantage a foreign feedstock provider might have over U.S. growers and suppliers. In fact, ethanol trade groups advocated for harmonizing 45Z and RFS feedstock provisions, citing the benefits of limiting eligible feedstocks, under both policies, to those originating in USMCO. They also asked the EPA to exempt corn and sorghum from proposed RFS feedstock tracking requirements. As proposed, limiting the RIN value of foreign product is a domestic advantage that comes with some work. But the EPA believes point-of-origin tracking, for the most part, will be something most producers will already be doing, whether to tap 45Z tax credits or access low-carbon markets.

Michael McAdams, president of the ABFA, came out in July against the idea of reducing RIN values by 50% for foreign feed-

stocks. He says the drafted rule could threaten continued investments, limit consumer access to American-made fuels and artificially inflate prices. ABFA believes the foreign feedstock reduction would also make it harder for U.S. advanced biofuel producers, including those targeting SAF, to meet the projected volume obligations (RVOs) or continue on with their plans for production.

GlobalData Agri analyzed the issue on behalf of the ABFA, releasing a study titled “Lipid Feedstocks Outlook to 2030 and RVO Analysis.” The study concluded that, although the majority of growth in biomass-based diesel (BBD) supply can come from domestic feedstocks, imports will continue to be needed across the sector.

“The gulf in value created by the proposed RIN system will push up prices to consumers and limit growth in the BBD market,” the report said.

According to the ABFA, reducing credit values for foreign-based RINs would effectively create a $250 to $400 per-metric-ton premium for domestic feedstocks, which may sound good to suppliers and growers, but not biofuel producers or consumers.

While vocalizing industry concerns about reduced RIN values for foreign fuels and feedstocks, McAdams also expressed hope that the U.S. Department of the Treasury—which

oversees 45Z—could still revise the foreign feedstock exclusion of the production tax credit before it is fully implemented.

Like McAdams, Winters is also eyeing Treasury’s handling of the policy, and the pace at which it gets the new version of 45Z going. “Producers are already trying to adapt to the new rule and put in place feedstock contracts for the start of 2026,” Winters says. “They need proposed and final rules from Treasury immediately so they can calculate the incentives relative to state and international markets for different feedstocks.”

Troy Bredenkamp, senior vice president of government and public affairs at the RFA, says the biofuels industry is widely pleased with the way 45Z enhancements shook out, along with the EPA’s proposed 2026-’27 RVOs. He says a wide swath of congressional leaders, along with key figures within the Trump administration, see an opportunity with both policies. “Of all of the Inflation Reduction Act credits that were passed in the Biden Administration, 45Z was one of the only tax credits to survive and get extended,” he says.

Many ethanol producers are not as focused on 45Z’s foreign feedstock exclusion as

they are the policy’s forthcoming roll out. In addition to other favorable enhancements, the RFA was pleased that the new version makes the tax credit transferable for producers. In the previous version, it was not.

Bredenkamp also cites the importance of eliminating indirect land-use change (ILUC) as a variable used to calculate carbon intensity scores. “For corn ethanol, that is a little over six CI points,” he says. “That was enough to move a majority of our member plants from being just outside the program (i.e., qualifying for the 45Z credit) to being in it. That’s significant.”

According to Bredenkamp, his team performed an analysis that revealed if the ILUC factor had remained in the 45Z policy framework, most corn ethanol plants would have re-

mained at a score of above 50, enough to keep them out of qualifying for 45Z.

Fastmarkets, a commodity info and tracking provider, called the ILUC removal a bright spot as well. “The updated policy makes crop-based oils financially viable, expanding the feedstock pool, reducing supply risk and strengthening domestic supply chains, ultimately encouraging scaled production and long-term investment,” the company said.

CI scores are calculated by using the GREET model, which accounts for the greenhouse gas emissions of each step in the biofuels supply and production chain. Previous versions applied an ILUC value into the calculations. The lower the CI score, the higher the tax credit. And under the new 45Z framework,

biofuel producers can earn a tax credit of up to $1 per gallon.

For SAF producers, the new 45Z structure lessens the total tax credit value they can earn. Plus, SAF producers cannot receive overlapping tax credits, and there are no longer premiums for SAF. Previous versions of the 45Z framework would have provided an extra 75 cents per gallon.

Bredenkamp, a Nebraska resident who farms outside of York, says the one wildcard with 45Z is whether the climate-smart ag provisions initiated under the Biden administration will resurface. There is currently no language that would require or incentivize any climate-smart ag practices by a feedstock provider (such as no-till or cover cropping).

Now that 45Z is in the policy rollout loop, Bredenkamp and the rest of the ethanol industry are focusing on year-round E15.

“E15 is our top priority,” he says from his home in Nebraska, following a long stint in D.C. this past summer. In the fall, Bredenkamp will head back to D.C., continuing to push for year-round, nationwide E15. “We need to find a legislative vehicle that the provision can be attached to,” he explains. “There are very few legislative bills that move as a single subject.”

Finding a must-pass piece of legislation near the end of the year can be difficult, he says, but there are options. Appropriations bills or continuing resolutions that keep the government running are great options for the team to include a year-round E15 policy.

To explain the importance of an E15 year-round policy, Bredenkamp points to the bumper corn crop in Nebraska, Iowa or South Dakota in August. “This could be a corn crop for the record books,” he says. “That scenario will only help emphasize the need for our domestic markets to increase demand for that product.”

Author: Luke Geiver writer@bbiinternational.com

Some ethanol industry leaders see a window of opportunity under the Trump administration to stop a questionable federal requirement that’s over a century old.

By Holly Jessen

The federal regulation that requires ethanol producers to blend a small amount of denaturant with their pure biofuel prior to shipping has been in place for more than a hundred years and is deeply entrenched in the requirements of multiple governmental agencies. Likely or not, a call for change has been aired.

“This is just such an antiquated way of trying to separate two supply chains, which are already separated,” says Geoff Cooper, president and CEO of the Renewable Fuels Association. “There’s just no need for the additional burden of denaturant.”

Mick Henderson, general manager of Commonwealth Agri-Energy LLC, joins

other U.S. producers who say the time is ripe to do away with the requirement once and for all. Asked if he believes it’s worth all the work required to make it happen, Henderson quickly answers.

“Yes. Wholeheartedly.”

Currently, the ethanol industry blends 2%-2.5% denaturant, primarily what is called natural gasoline—a byproduct of fracking— with fuel ethanol, before it leaves the facility, Cooper says. This requires ethanol producers to transport denaturant to every facility, store it in ample volumes, and then ship it out again mixed with fuel ethanol. Not only is that expensive, many producers argue, but it makes ethanol less environmentally friendly—by adding a fossil fuel—and less safe during transportation, especially via rail.

The RFA has had its eye on the denaturant requirement for a couple decades. “It’s been one of those issues that has sort of been on the back burner, I think, for many years,” Cooper says. “But given the current political landscape and the emphasis on removing burdensome unnecessary regulations, we felt like this was a good time to bring this issue back to the forefront for some discussion.”

On his first day in office, President Donald Trump issued an executive order— “Unleashing American Energy”—which, among other things, called for an immediate review of any actions that could burden the development of domestic energy, including biofuels. He asked that all agency heads identify any “undue burden on the identification, development or use of domestic energy resources.”

As far as RFA is concerned, the denaturant requirement for fuel ethanol fits the bill perfectly. “We think [it’s] really the poster child for wasteful, unnecessary, outdated regulations that have no benefit whatsoever to the U.S. economy or society,” Cooper says. “It’s a big burden on ethanol producers, and there’s really no rationale for keeping these requirements.”

Eric Mosbey, general manager of Lincolnland Agri-Energy LLC, agrees. “Eliminating the use of denaturant has been discussed for years, but there have always been bigger priorities for the industry,” he says. “Since there is now more emphasis on deregulation and eliminating waste, this is a good time to push this issue.”

It started in the early 1900s, when the government issued guidance allowing industrial alcohol manufacturers to denature alcohol, exempting it from beverage alcohol taxes. By 1920, with Prohibition in place, the focus was on making sure ethanol was unfit for human consumption by adding toxic substances like benzene or methanol, which actually resulted in some deaths.

“This all came about during an era of copper stills and bootlegging, and you know, stoneware, jugs and oak barrels,” Cooper says. “This is all ancient history but, unfortunately, more than 100 years later, our government is acting like nothing has changed, and we still have the same requirements for denaturant in place.

SIGNIFICANT VOLUMES: If ethanol producers weren’t required to add denaturant—typically natural gasoline— to their product, the industry could potentially produce an additional 350 million gallons of

“We are not producing ethanol in pot stills in a cave in the hill, somewhere.” he says. “These are highly complex, highly regulated, very large-scale facilities where every drop is accounted for when it’s leaving the facility.”

A small number of ethanol plants produce fuel ethanol as well as beverage alcohol or other products. One is Commonwealth Agri-Energy in Hopkinsville, Kentucky. The plant has completely separate process tanks, storage tanks and load-out equipment for those products, Henderson says. The company also complies with the separate paperwork requirements in order to do that. “We obviously can [produce fuel ethanol] and [also] sell a product that’s undenatured or specially denatured and have no issues,” he says.

Cooper talks about that separation as well. “Things have just evolved in a way, and the industry is of such a scale today, that there’s no risk of cross contamination, so to speak, or co-mingling of these products,” he says. “There’s also no risk of really anybody trying to circumvent beverage taxes.”

Mosbey agrees. “Gallons are tracked so meticulously now, there is virtually no chance gallons could be directed other than to the original intention, which is fuel ethanol,” he says.

He points to the temporary guidance issued by the U.S. Food and Drug Administration during the COVID-19 pandemic, which allowed ethanol producers to sell some gallons into the hand sanitizer market. Since it was for human use, rather than adding denaturant, the FDA specified the addition of a very small amount of so-called bitterant. “This had us thinking again about the inefficiency of hauling in thousands of gallons of natural gasoline, just to haul it right back out in the fuel ethanol,” he says. “It is one of the most hazardous materials in an ethanol plant, so why not eliminate it if we can, or … replace it with a more efficient bitterant that could safely fulfill the same purpose.”

Many countries, including Brazil, do not have a denaturant requirement for their ethanol industries, Henderson says. He also has concerns about the potential barrier denaturant could pose as the ethanol industry works to open up new export markets. “It’s not just domestic, it’s going to be international export reasons why I’d really like to see that reduced.”

For a typical 120 MMgy ethanol plant, the denaturant requirement means spending at least $4 million annually to transport natural gasoline to the facility, store it and blend it with ethanol, Cooper says. Across the whole industry, the number reaches nearly $600 million per year.

“That’s just the denaturant, that doesn’t include the amount of investment that’s al-

ready been put into the tankage and the other infrastructure and the blending equipment and the amount of money spent on permitting these tanks,” he says. “So, it’s a huge cost burden on the industry. In fact, it ranks right up there with labor costs. We’re spending as much money, as an industry, on denaturant as we’re spending on our workforce, which is crazy.”

If ethanol producers weren’t required to add denaturant, the industry could potentially produce an additional 350 million gallons of ethanol annually. “That, in turn, would boost corn demand by roughly 120 million bushels, especially at a time when farmers are looking at a record corn crop, low prices and a growing surplus,” Cooper says.

Beyond the economic considerations, Cooper says his biggest pet peeve is that the denaturant is a “dirty, toxic hydrocarbon” with very low octane, high sulfur content and extremely high volatility. In other words, ethanol starts out as a clean, environmentally friendly fuel that, due to government regulations, becomes more polluted. “It makes no sense that the ethanol industry should be the dumping ground for the dregs of the fracking industry,” he says. “I mean, you’re taking

this product that has very little use anywhere else and that’s what’s being dumped into ethanol.”

That leads into another good reason to do away with the denaturant requirement: rail safety. Kelly Davis, vice president of New Energy Blue, says she worked on the denaturant issue for years while working previously for the RFA as vice president of technical and regulatory affairs. “The absurdity of taking a low-volatility product like ethanol and [blending it with] a higher-volatility product like natural gasoline … and then putting it into the transportation world,” she exclaims.

It wasn’t only RFA that noticed this. Davis recalled a past leader of the National Transportation Safety Board who picked up on it after a 2017 rail accident involving ethanol. He started asking questions that had long been on the minds of people in the ethanol industry. “What’s going on here, why do we add this?” she says, adding that the agency made it a goal at the time to look into whether it would be safer to transport fuel ethanol without denaturant.

The first stop to change the denaturant

requirement would be with the Alcohol and Tobacco Tax and Trade Bureau (TTB). That agency oversees taxes on beverage alcohol, which are significantly higher than the taxes on fuel ethanol.

Although it is possible to make this change, Davis acknowledges it will be difficult. The TTB is an agency with old school rules and a reluctance to change. Plus, if the TTB requirement is successfully changed, multiple additional changes would be required, such as with the Renewable Fuel Standard, renewable identification numbers (RINs) rules for biointermediates and more.

“Those of us in the regulatory world know that it interacts with a lot of other rules that would be changed at the same time,” she says. “It seems easy, and it seems reasonable, but it would be very difficult to go after, and it would take a lot of angles to work it.”

Cooper compares it to the many layers of an onion. Over the years, many in the ethanol industry have looked at the denaturant requirement and said, “This is just too big, it’s too ingrained, it’s too complex to take on.” The difference now is that with President Trump in office, there’s a real chance for change. “We just need to have the opportunity to sit down at the table with these decision makers and have this conversation,” he says.

Author: Holly Jessen writer@bbiinternational.com

By Luke Geiver

Ethanol plant security doesn’t often make headlines. With all the focus on cyberattacks and data breaches, the need for actual plant and property security—surveillance, gates, guards and such—has maybe taken a back seat. But it hasn’t gone away. In May 2025, an ethanol plant in northern Iowa reported a corn stover stackyard fire. The county sheriff’s office was called in, and after performing an investigation, the fire was ruled arson.

The incident, which reportedly made the entire facility appear ablaze against the backdrop of night, resulted in about $5 million in feedstock loss. The plant’s general manager called it a “serious criminal act that put people and property at risk.” A $10,000 reward has been issued for information on the fire, which is still unsolved.

The incident was an uncomfortable reminder that the physical security of ethanol plants should not be ignored. Fortunately, numerous resources are available to producers that can help them identify, deter and hopefully stop trespassers. From intrusion protection plans to cameras enabled by artificial intelligence (AI) to high-tech fences and gates, security options exist for almost every possibility.

A broad range of security solutions is available to large-scale, industrial complexes that operate 24/7 on multi-acre sites with critical infrastructure. For perimeter security, many services provide guards that monitor access points, manage vehicle and pedestrian traffic and prevent unauthorized entry. They also maintain access control with ID verification and badging, closely manage the movement of visitors and restrict certain areas of the complex to authorized personnel only. Numerous firms offer security services, some not only tailored to ethanol plants but each unique facility’s specific vulnerabilities. In some cases, security personnel can be trained to respond to safety hazards, fires or medical incidents by executing emergency response plans, evacuation procedures, first aid and more.

Amarok, a perimeter security provider with a footprint across several industries, says remote locations are a natural draw to intruders, burglars and vandals. According to the company, numerous access points, easy concealment opportunities and few potential witnesses make rural industrial facilities like ethanol plants appealing to criminals.

Regarding electrical infrastructure alone, the company estimates there are 1,700 annual reports of suspicious activity, vandalism or physical attacks per year. The average cost of a physical security breach is nearly $100,000, according to Amarok.

“Energy and industrial operators face a more complex and dynamic risk landscape than ever before, with evolving societal threats and rising global instability creating domestic risks,” says Chris Brooks, chief operating officer at ECAM, a live surveillance technology provider that relies heavily on AI. Brooks agrees with Amarok’s statements. “Remote sites are particularly vulnerable, but the latest technology can secure areas where traditional guarding is impractical and infrastructure is constrained.”

According to Titan Protection, a security firm that specializes in farm and agricultural site protection, the three main types of agricultural crimes are vandalism, trespassing and theft. The most frequently stolen items from regular farm sites are mowers, loaders and tractors. And, Titan’s team says, 68% of farm vandalism victims report more than one occurrence.

3D Security Inc., a Sioux Falls-based security specialist that recently opened a second location in western South Dakota, provides custom ag business surveillance and security solutions. 3D helps protect assets year-round for remote bin sites, elevators, dairy operations, chemical warehouses, equipment storage, machinery sales facilities and ethanol plants. The company typically deploys a combination of video surveillance, intrusion alerts and driveway detection systems, sometimes with gate access control, to monitor and restrict property access.

3D Security’s digital video systems allow for remote monitoring and recording. The video can be recorded in high-definition or analog for lower-budget surveillance. A video analytics process can also be used to monitor traffic patterns for irregularities. The company’s intrusion alarm systems rely on a combination of motion, vibration and beam detection. They are also able to install door and window sensors or glass-shatter sensors. Panic buttons, temperature sensors and environmental sensors are also a possibility.

To manage driveways and entrances, 3D Security uses buried triggers completely invisible to traffic. There are several alert possibilities for traffic, the company says. For clients’ peace of mind, the company pro-

Our team of experts have over 20 years of ethanol plant maintenance expertise. We o er full service and parts for all Fluid Quip equipment to ensure peak performance.

vides 24/7 on-call support and also services all brands of video and fire security systems. The team also offers central station monitoring of intrusion and fire alarms while providing web access, enabling clients to view daily security reports.

• OEM Parts Warehouse

•$2 million+ inventory on-hand

•Factory Trained & Certified Techs

•MZSA™ Screens

•Paddle Screens

•Grind Mills

•Centrifuges

•Gap Adjusters

To date, 3D Security has worked with Dakota Ethanol, Redfield Energy and Advanced Bioenergy, along with several grain elevators, equipment sites and seed warehouses.

SMP Security Services, another firm located in the Sioux Falls area, provides warehouse security including in-person and virtual guard services. The cost of a security system varies depending on building and risk profile, SMP says. A small office with four to six cameras and basic intrusion sensors can average roughly $2,500 to $4,000 for hardware plus $35 to $55 per month to monitor. Warehouses, however, often invest $6,000 to $12,000 for wider coverage and longer video retention.

For a 10,000-square-foot warehouse, the company advises one wide-angle camera per 2,000 square feet of indoor space, plus another camera for every dock door or exterior corner. All of that usually equals out to an average of 8 to 10 cameras per 10,000 square feet of space being monitored.

Warehouse and industrial facilities need to take regional and local issues into consideration when placing cameras. South Dakota, for example, requires that installers follow local building codes for wiring, and the state restricts camera placement to areas without reasonable expectation of privacy.

Although most insurers and regulatory bodies recommend that video footage be saved

for 30 days, industries that are high-risk, like food processing or pharmaceuticals, sometimes keep footage stored for up to 90 days, SMP says.

For some companies in the agri-industrial space, tried-and-true perimeter security— an electric fence—is critical. Amarok’s electric fences can be installed and running within weeks. The 7,000-volt systems are available with solar power for continuous run-times and no outage concerns. The company provides all the maintenance, service and updates. There are no initial costs or down payments, just a monthly fee. The systems also reduce the needs for on-site security guards while being easily integrated into existing fencing.

However, serious safety and regulatory considerations must be followed when installing electric fencing anywhere near an ethanol plant.

Pelco, a Motorola Solutions brand, offers cameras on every level of the tech spectrum. Pelco’s dome security cameras are ideal for areas that require discretion and allow operators to observe multiple areas at once. The company’s bullet and box cameras (two distinct types) offer optionality with size and angle. Pan-tilt-zoom cameras give operators the ability to adjust angles, move and zoom in. Panoramic cameras, Pelco says, offer wide coverage areas and are meant to detect people, vehicles and wildlife with a 360-degree angle for optimal situational awareness. Not all cameras come with the same housing. Pelco provides options for weatherproofing and vandal resistance.

SMP says clients should understand the difference between motion detection in cameras and overall video analytics. Motion detection flags pick up any movement in a frame, often leading to false alarms. Video analytics, which can rely on AI, reduce false alarms but still pick up suspicious human behavior and other notable activity.

Powerful new hybrid security “architectures” are being assembled that couple video analytics with edge-computing—enabling things like license plate recognition—and cloud-based platforms are exponentially enhancing the capacity of video archiving, according to Jason Showen, senior account executive at ECAM.

In addition to hybrid security architecture, ECAM says several trends are shaping the industry in 2025. More clients are using security systems to gain insights into operational efficiency, energy usage and customer behavior. The demand for high-resolution image clarity is on the rise. Some security firms are prioritizing hardware platforms that allow for regular software upgrades. Mobile surveillance units (trailers with cameras, probe lights and more) are becoming more popular in places that don’t have security guards. Drone use is on the rise, too. New, autonomous drones preprogrammed to take off, land and record preplanned routes are now an option, Showen explains.

ECAM’s motto helps summarize where the surveillance industry is headed: “Every camera. Always monitored.” Physical security is no longer just about protecting assets, Brooks says. It’s about ensuring continuity, safety and peace of mind.

“The remote video monitoring sector has seen more innovation in the last five years than in the previous 15,” Brooks says. ECAM has developed its own AI-enabled surveillance system complete with video analytics that are well-suited for energy and remote infrastructure.

Companies like Spot AI are creating camera systems that provide contextual awareness with deterrence options. A Spot AI camera can use AI-enabled video analytics to determine a threat, then vocalize “contextual talkdowns” to an intruder from an attached speaker that would mirror a security guard’s interactions.

“By embracing these key technological trends, organizations can enhance their security posture and adapt to the evolving landscape of threats and challenges,” Showen says.