Louisiana explores the promise—and reality—of small modular reactors as industrial energy needs soar.

PLUS: Energy whiplash

Community engagement playbook

Recruitment & retention

Louisiana explores the promise—and reality—of small modular reactors as industrial energy needs soar.

PLUS: Energy whiplash

Community engagement playbook

Recruitment & retention

When the petrochemical industry needs sound legal advice, they turn to Kean Miller for innovative counsel.

KEAN MILLER, YOUR COUNSEL

Louisiana explores the promise—and reality—of small modular reactors as industrial energy needs soar.

Federal

How

Winning

Quantum

Publisher: Julio Melara

Associate Publisher: Erin Pou

EDITORIAL

Executive Editor: Penny Font

Editor: Sam Barnes

Contributing Photographers: Cheryl Gerber, Don Kadair, Leroy Tademy

ADVERTISING

Sales & Marketing Operations Manager: Kynley Lemoine

Senior Multimedia Marketing Consultant & Team Leader: Kelly Lewis

Multimedia Marketing Consultant: Emma Walker

42 Strengthening the bond Petrochem owners expand their toolkit to retain workers in an increasingly competitive market.

45 Building the bench

As shortages loom, Louisiana industrial leaders are connecting with students long before graduation day.

50 Our maps of the projects driving industrial growth 54 Toughest Challenge

Mike Blake evolves and adapts to a changing offshore landscape.

25 Leaders of Industry 10/12 Industry Report shines a light on companies and organizations that make an impact in their fields and in their communities.

48 Presidents Forecast Opportunity. Outlook. Challenges. Growth. In this special section, business owners, CEOs and other leaders in the Capital Region share their opinions on what to expect in the coming year.

Multimedia Marketing Consultant/Custom Publishing: Judith LaDousa

Digital Operations Manager: Devyn MacDonald

Partner Success Manager: Matt Wambles

Digital Operations Coordinator: Sydney Deville

Corporate Communications Strategist: Mark Lorando

Content Strategist: Emily Hebert

STUDIO E

Creative Director: Timothy Coles

Custom Content Editor: Lisa Tramontana

Business Development Manager: Manny Fajardo

Creative Producer: Jessi Bajoie

Post-Production Supervisor: Taylor Stoma

Production Supervisor: Ari Ross

MARKETING

Marketing & Events Assistant: Mallory Romanowski

ADMINISTRATION

Business Manager: Tiffany Durocher

Business Associate: Kirsten Milano

Office Coordinator: Donna Curry

Receptionist: Cathy Varnado Brown

CREATIVE SERVICES

Creative Services Manager: Ellie Gray

Art Director: Hoa Vu

Senior Graphic Designers: Melinda Gonzalez Galjour, Sidney Rosso

Graphic Designer: Britt Benoit

AUDIENCE DEVELOPMENT

Chief Technology Officer: James Hume

Audience Development Campaign Manager: Catherine Albano

Circulation and Client Experience Manager: Ivana Oubre

A publication of Melara Enterprises, LLC

Chairman: Julio Melara

Executive Assistant: Brooke Motto

Vice President-Sales: Elizabeth McCollister Hebert

Chief Content Officer: Penny Font

Chief Digital Officer: Erin Pou

Chief Operating Officer: Guy Barone

Circulation/Reprints/Subscriptions/Customer Service 225-928-1700 • email: circulation@businessreport.com Volume 11 - Number 2

Scan

Alliance creates, delivers and manages just-in-time training that meets compliance standards – available as computer-based courses in our labs, remotely proctored online learning or instructor-led, in-person training.

Reach out to discover how we can help you build a robust training matrix that can include Basic Orientation Plus, site-specific training, orientations, OSHA courses and our signature programs.

OTI Education Center

The Mid-South OSHA Training Institute (OTI) Education Center, a consortium between Alliance and LSU’s College of Engineering, delivers occupational safety and health classes.

The Certified Occupational Safety Specialist (COSS) program caters to new safety practitioners, while the Certificate for Occupational Safety Managers (COSM) program is for experienced safety professionals. Both can qualify as CEUs for safety professional certifications.

The SAF suite of computer-based courses provides standardized, awareness-level training on 40+ safety topics, i.e., fall protection, hazard communication and ladder safety.

High-risk driver behaviors within fleets can be specifically targeted with assessment-based online learning modules and flexible data reporting.

HAZWOPER 24- and 40-hour courses include scenario-based lessons and handson, real-time air monitoring exercises.

ICYMI

In a state where oil refineries, chemical plants, and energy export terminals define the skyline, a new initiative is set to recognize the people and projects driving that industry forward—both in its traditional forms and its emerging frontiers.

The inaugural Louisiana Energy Awards, launching this year, will celebrate leadership, innovation, and community impact across Louisiana’s diverse energy sector. From the Gulf’s deepwater platforms to carbon capture initiatives and renewable energy investments, the awards aim to reflect the complexity and evolution of an industry that remains central to the state’s economy.

“Louisiana has a deep history in energy, but it’s also playing an increasingly visible role in shaping what’s next,” said Julio Melara, president and CEO of Melara Enterprises, the parent company of 10/12 Industry Report. “This awards program is designed to reflect both.”

Nominations open April 8 and will be accepted through June 30. Eligibility is limited to individuals, companies, or projects with a strong connection to Louisiana’s energy economy.

A selection panel—comprising energy executives, renewable energy specialists, academics, and economic development professionals—will review the nominations.

The program will culminate in a formal dinner and awards ceremony in Baton Rouge on Nov. 5. Both finalists and honorees will be featured in the fall edition of 10/12 Industry Report, which is producing the event.

Seven categories will be recognized, including Lifetime Achievement, Energy Executive of the Year, Emerging Energy Leader, Energy Company of the Year (split between large and small to midsized businesses), Energy Deal of the Year, and a Community Impact Award.

Panelists will identify up to five finalists per category and select one overall honoree, with final decisions made during a formal review session in September.

The Community Impact Award will recognize an energy company’s philanthropic or volunteer initiative that delivers measurable benefits to Louisiana communities.

The Louisiana Energy Awards are sponsored by the LSU Institute for Energy Innovation.

Get all the details at 1012industryreport. com/energyawards.

BY SAM BARNES

Beth Ann Branch brings a much-needed global perspective to the Port of New Orleans.

Since her hiring as president & CEO in October, her knowledge of the international supply chain has become more important by the day as the port edges toward the most significant investment in its history the $1.8 billion Louisiana International Terminal in St. Bernard Parish.

Branch grew up in Saudi Arabia her father was head of engineering operations for a rail company then later lived in Bulgaria, Denmark and other locales as she undertook various shortterm work assignments around the world.

Along the way, she developed a passion for the global supply chain, international trade and maritime sectors.

“I stumbled into it quite by accident,” Branch says. “I’d had a long career in nonprofit and public sector work prior to finding landing a job at Sea-Land Service in Charlotte, N.C., which was heavily involved in container ships. For nearly 20 years with them and their successor, Maersk, it evolved into a rewarding career.”

She lived in Copenhagen for five years, overseeing global business processes, then moved back to the U.S. to head up marketing and communications for a Maersk subsidiary.

After a five-year stint at the Port of Oakland, she took a job at the Port of Mobile as chief commercial officer.

At both ports, Branch spearheaded strategic initiatives that resulted in record container volumes, significantly boosting throughput and operational success.

Branch’s experiences on an international stage provided her with a holistic view of global trade and its various parts and pieces, which eventually led her to apply for the Port NOLA position. She sees great potential in the port,

propelled by the promise of the new LIT container terminal. “A greenfield container terminal hasn’t been constructed in this country for decades,” she says. “It’s a transformative project and a compelling strategic vision.”

She says Port NOLA is uniquely qualified to oversee the unprecedented project. “We have the benefit of operating like a business with the support of the state behind us. That gives us a powerful platform to do things, particularly massive infrastructure projects such as LIT.”

She recently shared her insights with 10/12 Industry Report.

STYLE.

We can look at things as a basket of problems or as a basket of opportunities. I always want to think

about how we look at problems as something to be solved, and hopefully to be solved collaboratively.

For example, Gov. Jeff Landry’s Louisiana Ports & Waterways Investment Commission (announced in August) will serve as an advocate for all our state’s ports and waterways investment interests.

But it’s a pretty big lift to bring these active ports together and all get in the sandbox together to talk about how we prioritize this maritime complex that we operate. It’s important that we view everything as opportunities, not insurmountable problems.

We have two very strong partners who have committed about $400 million to the Louisiana International Terminal Ports

America, one of the largest stevedoring companies in the U.S., and Terminal Investment Limited, based in Switzerland.

Sometimes they might not see eye to eye on everything, but we all share the end goal, which is standing up and building a nearly $2 billion container terminal about 17 or 18 miles downriver from where we are today.

To make that happen, we must power through problems and solve them. You don’t get everything you want all the time, but we must try to move forward for the greater good of the project and keep our eye on the prize enabling the state to play in the global maritime supply chain space.

I start every week thinking about how we can materially move the project forward. Sometimes that’s with financing, sometimes that’s through partnerships, sometimes that’s with the state or the railroad. And what’s my role? How do I make sure we’re at 90% design, that we’re engaging the community? We think about it every week and try to move things forward.

I don’t think I’ve ever lived in a place that’s more welcoming, and I’ve lived in 12 different places in my career. I now say that I wished I’d punched my career card much earlier in New Orleans. I don’t think I would have ever left.

There are some incredible women CEOs that hosted a lunch to welcome me here about a month ago. I haven’t seen that kind of outreach in my professional life ... ever.

We at the port are excited to be a small part of the vision for the state. The port is an arrow in the quiver. If we can help the state land business because we provide the ability to get goods to and from markets, or feedstock to and from factories, we are proud to be part of that.

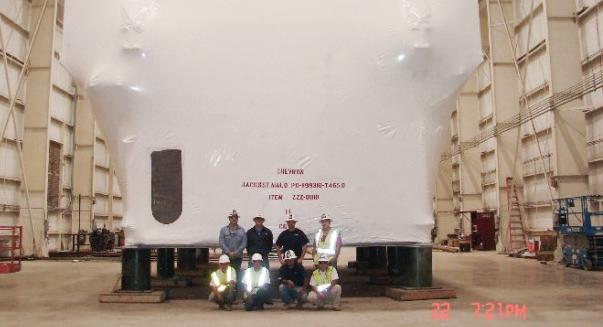

Turnkey Industrial Construction Services since 1973.

Industrial Construction

Small & Large Capital Projects

Civil Projects & Tank Foundations

Tanks

API 653 Repair

Floating Roof Seal

Inspections & Repair

Mechanical Piping, Structural Steel and Equipment Setting Conveyor Systems

API 620 & 650 Design Build 3D Scanning and Modeling

U, U2, R & S Stamps

ASME Div 1 & 2 Coded Vessels

State of the Art Welding Equipment

70,000 SF Facility & 10,000 SF Segregated Alloy Shop, Located in Springfield, LA Vessels, Reactors, Columns, API

620/650 Shop Tanks, Process Skids & Modular Construction

Get the latest updates on Louisiana’s 10/12 corridor delivered straight to your inbox.

Every Tuesday at 5:30 AM, receive six must-read stories on energy, infrastructure and industry trends; so, you’re always informed.

Louisiana explores the promise—and reality—of small modular reactors as industrial energy needs soar.

It’s not necessarily a new topic. The promise of what’s dubbed as “advanced nuclear” has been bandied about for well over a decade. What’s different is the urgent tone of the current conversation, which has noticeably intensified in just the last several months.

Nuclear power, the oft-controversial renewable energy source, has once again bubbled to the surface of public discourse, but this time with serious fervor and on multiple fronts. State agencies are collectively engaging in nuclear discussions with experts from across the country, local energy providers are making serious plans for nuclear expansion, LSU researchers are pursuing the development of a local nuclear workforce, and most interestingly perhaps, Dow and other industrial owners are considering its implementation at the plant level.

The reasons behind the movement are both economic and environmental.

Louisiana’s fledgling data center market promises to attract a surge of energy-intensive facilities just as the state’s industrial sector plans unprecedented levels of investment.

Simultaneously, industrial owners are searching for ways to achieve stringent “net-zero” emissions targets mandated by their corporate headquarters.

“Solar and wind power just won’t get them there,” says John Flake, chemical engineering professor at LSU, who has studied the potential of nuclear energy in the chemical industry. “It’s almost impossible for solar or wind to supply the bulk of the renewable power that plants will need to meet emissions goals. I think they’ll provide something like 15 percent, but the other 85 percent would need to come from either natural gas combined with carbon sequestration … or nuclear.”

However, instead of the conventional 1,000-plus MW nuclear powerplants of the past—often encumbered by lengthy regulatory and construction delays— consider the Vogtle Electric Generating Plant in Georgia— recent discussions have focused on Small Modular Reactors, or SMRs, and microreactors, both of which fall under the

BY SAM BARNES

Instead of these conventional 1,000-plus MW nuclear power plants, Louisiana discussions center on Small Modular Reactors, or SMRs, and microreactors.

advanced nuclear umbrella.

“They’re closer to what you might see on a Navy submarine,” Flake says. “They’re trying to change the rules so that advanced nuclear doesn’t have to go through the same regulatory hurdles as a larger power plant. These newer reactors are small and much safer—the fuel is still uranium, but it is encapsulated in small triple-coated particles that make it impossible for them to melt, even with no cooling water. The entire reactor would be the size of a tennis court.”

Of particular interest to industrial owners are the multiple problems that nuclear energy can address.

“The big advantage is the heat,” he adds. “Solar and wind just give you electricity, but with nuclear you can get both electricity and heat, just like from natural gas. That’s a huge differentiator.”

SMRs could also serve as “drop in” replacements for the 65 or so electrical cogeneration units currently operating within Louisiana’s industrial plants, and provide anywhere from 30 to 300 MW, or roughly 3% to 30% of the power output of a large nuclear reactor such as River Bend in St. Francisville.

Companies including TerraPower (founded by Bill Gates), X-energy and NuScale Power are each getting closer to turning the technology into a commercial reality, possibly in as few as five years. “Right now, these reactors are

expensive,” Flake says, “but I see value in nuclear as a low-carbon product and as a hedge against high natural gas prices in the future.”

As such, LSU has been actively working with Idaho National Laboratory to understand what it would take to incorporate a reactor into the operations of an industrial plant.

“This is a big deal,” he adds. “While it’s true that carbon sequestration can get you to netzero, for the long-term it’s better to avoid making the carbon dioxide altogether.”

Mark Zappi, executive director of the Energy Institute of Louisiana at ULL and a member of Louisiana’s Clean Hydrogen Task Force, says a handful of regulatory and economic hurdles will need to be cleared before SMRs can become a commercial reality, “but I’m anxious to see some of these get out there.

“The SMRs will be the first to market, but I’m also intrigued by the potential of microreactors (nuclear units that produce less than 20 MWs),” Zappi says. “They’re smaller, but the technology is less mature than the SMRs. Still, there are several companies saying that they’re getting close.”

A significant amount of due diligence will need to occur first, but the earlier the dialogue can begin the better, Zappi says. Until then, the commercialization of nuclear energy will remain largely

“We feel Louisiana can achieve the goal of adding nuclear resources to its power mix but also get involved in the manufacture of components on the world stage.”

ERIC SKRMETTA, District 1 commissioner, Louisiana Public Service Commission

“It’s almost impossible for solar or wind to supply the bulk of the renewable power that plants will need to meet emissions goals.”

JOHN FLAKE, chemical engineering professor, LSU

conceptual. “I’ve learned that there is going to be some form of opposition to any new technology,” he says. “There’s no magic bullet out there. They all have pros and cons. Nuclear will have to go down that path as well.”

The potential of advanced nuclear energy has also captured the attention of the Louisiana Legislature. On Feb. 11, a joint hearing of the House and Senate Natural Resources Committee convened to discuss the possibility of expanding nuclear energy, with a focus on recycling nuclear waste and utilizing new technologies.

Greg Upton, executive director of the LSU Center for Energy Studies, presented at the hearing. “If you really want to get to net-zero by the end of the next decade, the obvious option is nuclear energy,” Upton says. “Will that be the most cost effective? I don’t know. But you’ve got these data centers coming in and petrochemical companies are wanting to buy zero carbon power and that makes nuclear very interesting to them.”

Upton says a handful of industrial owners have expressed an interest in nuclear, and they’re just waiting for the technology to mature. “A few of them have told me that if someone could install an SMR

that would allow them to reduce their emissions and still give them the power, heat and pressures that they need … they would love to do it. There just aren’t any options out there right now.”

Nevertheless, Upton mixes his message with a dash of skepticism. “They’ve been talking about this for years, since I first began working here,” he adds. “Could we be at the edge of it really taking off? We could be. The difference is that companies are now willing to spend a little more money to have lower carbon-intensive products.”

The Louisiana Public Service Commission advanced the conversation a few steps further in 2024 by authorizing Eric Skrmetta, District 1 commissioner in Metairie, to develop a collaborative task force—the Louisiana Advanced Nuclear Competitive Edge, or LANCE—to prepare for the eventuality of advanced nuclear.

In its role, LANCE seeks to develop economic opportunities through advanced nuclear energy, attract investment for nuclear projects, develop and test advanced nuclear fuels and train the workforce needed for nuclear technology.

For help in organizing the group, Skrmetta reached out to Paul Kjellander, a former president of the National Association of Regulatory Utility Commissioner with connections to the Idaho National Laboratory.

“He put together a team from BWXT Nuclear Operations Group, which produces a range of

nuclear components and services, and other folks from the Nuclear Energy Institute in Washington D.C.,” Skrmetta says.

Also on the task force are representatives of Gov. Jeff Landry’s office, the PSC, Idaho National Laboratory, a team of nuclear scientists and others. Additionally, they’ve enlisted the help of LSU in establishing a new curriculum in nuclear engineering.

The group held its first technical conference last year in Baton Rouge and later developed a road map that could pave the way for advanced nuclear in the state. One big area of focus: Promoting the state as an internationally recognized manufacturer in the nuclear space.

“We feel Louisiana can achieve the goal of adding nuclear resources to its power mix but also get involved in the manufacture of components on the world stage,” Skrmetta says.

The demand will certainly be there. The Nuclear Energy Institute estimates that between 300 to 600 new nuclear reactors will be needed, worldwide, over the next 15 to 20 years. “We could build steel mills that operate off of our current nuclear facilities, then produce the steel at net-zero to meet the requirement for

components exported to Europe,” the commissioner adds.

They’re also looking into industrial uses of nuclear, such as the incorporation of ship-based reactors for industrial consumers and microreactors in the Permian Basin to power drilling operations. Additionally, industrial owners such as Dow Chemical are interested in incorporating microreactors and SMRs for the nuclear steam they create, which can be used in their chemical processes.

“There’s a sincere interest in utilizing these devices and getting them into play,” Skrmetta says.

“The key to doing that in a meaningful way is to have the federal government look at streamlining the permitting process. We can get a new gas plant up in about three years, but it currently takes about eight years for a nuclear facility. Under the right regulatory framework, we might be able to get it down to five to six years.

“If Louisiana can get to an energy profile of 60 percent natural gas and 40 percent nuclear, we will be net-zero as a state, and all of our industrial owners will be able to say they’re producing with net-zero power.”

Perhaps nothing advanced the nuclear conversation more than December’s announcement by Meta that it would build a $10 billion AI data center in Richland Parish.

To power the facility—which will span more than a mile long— as well as meet future energy needs, Entergy has proposed constructing three natural gas fired power plants at a cost of $3 billion that could one day be converted to clean energy production.

Entergy currently generates about 5,000 megawatts of carbon-free power within its existing nuclear fleet, consisting of five reactors at four locations in Arkansas, Louisiana and Mississippi. “With projected load growth, utilities will need to plan additional generation to meet customer demands in a way that balances reliability, affordability and sustainability,” says Jody Montelaro, vice president of public affairs at Entergy Louisiana. “With regard to data center load growth, many of those customers are focused on sustainability as well, presenting an opportunity to partner with those data center customers to cover the costs of new sustainable generation.”

Like any fission reactor, a small modular reactor uses energy from a controlled nuclear chain reaction to create steam that powers a turbine to produce electricity. Advanced SMR designs span a range of sizes and technology options. Some use light water as a coolant while others rely on coolants such as a gas, liquid metal or molten salt. Some SMRs would use fuel akin to what runs today’s nuclear reactors, while others would use new types of fuels.

Different designs can have different end uses such as power generation, process heat supply or desalination. Small modular reactors also can vary in size from a dozen megawatts to hundreds of megawatts per module. Modules can be added or taken offline to match electricity demand, giving the plants immense flexibility. The modules can also be individually refueled so that an SMR plant is never fully offline.

SOURCE: Idaho National Laboratory

Jim Smiley, senior manager of nuclear project management at Entergy in Madison, Mississippi, says nuclear energy is an important element of Entergy’s long-term strategy.

“For us, it’s not a matter of ‘if,’ but it’s really a matter of ‘when’ and ‘how,’” Smiley says. “We are actively evaluating potential paths to new nuclear with a focus on managing the risks inherent with projects of this magnitude.

“… Nuclear satisfies environmental sustainability goals as a clean, carbon-free generating source and reliability goals as a stable, 24/7, baseload source,” he adds. “This sets nuclear apart from other carbon-free energy sources and other baseload alternatives.”

“There are a number of small modular reactors in development today with the promise of utilizing modular construction methods to lower construction costs and schedule durations,”

“For us, it’s not a matter of ‘if,’ but it’s really a matter of ‘when’ and ‘how.’”

JIM SMILEY, senior manager, nuclear project management at Entergy in Madison, Mississippi

the financial risks inherent with a project the size and scale of a new nuclear project,” he adds, “so we are exploring an ‘all of the above’ approach that could involve partnerships with our customers or joining a consortium of other utilities, reactor designers, and/ or engineering and construction companies, as well as support from our state and the federal regulators to get us there.”

Power demands facing the industry will require leveraging all generation options, and nuclear energy will be part of the solution.

“That said, building a new nuclear plant is neither an inexpensive nor quick proposition,”

Smiley says. “It remains to be seen which of these new designs can deliver on that promise.

Issue Date: March 2025 Ad proof #2

• Please respond by e-mail or phone with your approval or minor revisions.

• AD WILL RUN AS IS unless approval or final revisions are received within 24 hrs from receipt of this proof. A shorter timeframe will apply for tight deadlines.

Since project costs and schedule durations are the most significant challenges to new nuclear, they say innovations that shorten construction schedules, such as SMRs and microreactors, will help make new nuclear more economical.

• Additional revisions must be requested and may be subject to production fees.

“Another critical aspect of efficient deployment of new nuclear involves the maturity of the industrial base and supply chain to deliver the necessary materials and components and execute the construction.”

Carefully check this ad for: CORRECT ADDRESS • CORRECT PHONE NUMBER • ANY TYPOS This ad design © Melara Enterprises, LLC. 2024. All rights reserved. Phone 225-928-1700

Entergy is hopeful that the U.S. Nuclear Regulatory Commission will develop a more streamlined and simplified regulatory framework specific to the deployment of new, advanced reactors, as the outcome of the effort has the potential to improve the overall economic viability of new nuclear projects.

Montelaro says partnerships with customers will also be an essential element to making new nuclear a reality.

“Ultimate success means adequately managing and mitigating

Smiley says. “Our industry has experienced cost overruns and schedule delays with nuclear construction projects. From a pure capital investment standpoint, nuclear costs more and takes longer to implement than other new power sources.

“However, if you take into account all of the positive nuclear attributes such as the long life,

resilience, dispatchability, clean attributes etc., along with the recognition that costs will come down as we build more, the total business case begins to make more sense.”

Before any nuclear project can take its first tentative steps toward commercialization, Louisiana will need a nuclear workforce to support it all. The manpower issues encountered during a delay-plagued expansion project at the Vogtle Electric Generating Plant in Georgia should serve as a cautionary tale, says Manas Gartia, LSU mechanical and industrial engineering professor.

The project began in 2009 but wasn’t completed until 2022 at double the original estimated cost. “They needed 9,000 workers but they couldn’t find them,” Gartia says. “They had to go to 48 different states to find these people, because there hasn’t been any sig-

the U.S. since the 1980s. We’d lost that technical expertise.”

To stay ahead of expected future demand, in January Gartia spearheaded a multi-department effort at LSU in applying for a five-year, $22 million U.S. Department of Energy grant to develop a

local nuclear workforce. The comprehensive proposal involved multiple governmental entities and included letters of support from Louisiana Economic Development and other trade associations.

The overriding goal of the grant is to prepare the local work-

force to build, maintain and operate all forms of nuclear energy in Louisiana and across the U.S. Gartia expects a decision from DOE this summer. “To operate the reactor you’ll need nuclear engineers, but also mechanical and electrical engineers,” he says. “We’ll also need welders, pipefitters, etc., so there will be a diverse workforce required.”

The grant money would be used to establish training programs in collaboration with local industry groups, Baton Rouge Community College and Entergy, who would provide hands-on training in a nuclear setting. Gartia also plans to purchase a nuclear simulator. “We want to increase the number of people available to take jobs in those industries when it’s available,” he says.

Should they be awarded the grant, “we will establish the framework for the training with the help of our other educational partners,” he adds. “We need to fill all those gaps to make it a

In business, a Dinosaur represents a company stuck in outdated methods, resistant to change, and ultimately on the brink of obsolescence. Alfred Miller Companies shreds the trend of building projects with a massive amount of manpower. Our automation, technology, and lean construction management principles are the better solution for schedule, cost, quality AND SAFETY. Don't be a Dinosaur –

THINK PRECAST

▪Piles: 14, 16, 18, 24, 30 & 36

▪PileCaps

▪PipeRacks

▪DeckPanels

▪Trenches

▪DuctBanks

▪WallPanels

▪Columns

▪Bridges

▪Manholes

▪Girders

▪Barriers

▪Buildings

BY SAM BARNES

While the oil and gas market has been virtually unthrottled by recent Executive Orders from the Trump administration and subsequent hard reverses in regulatory policy, others in Louisiana’s nascent “all things energy” space are taking a more tentative tone these days.

Much of the uncertainty is due to the intertwining of EOs and congressional legislation by the previous administration, making it difficult to determine the actual impacts of the most recent actions on a variety of renewable energy and decarbonization projects.

“Many of these projects received funding from the Infrastructure Investment and Jobs Act and they all have Justice40 and disadvantaged community requirements (as mandated by a Biden administration EO),” says Greg Upton, executive director of the LSU Center for Energy Studies.

The Justice40 Initiative ensures that at least 40% of the benefits from federal investments in climate and clean energy goes to disadvantaged communities.

“However, in one of his first actions as president, Trump rescinded these community initiatives,” Upton says, “so no one really knows whether these projects will continue to be funded. On one hand, you’ve signed a contract with the federal government, but on the other hand, some of these community measures were not the intent of Congress when they appropriated the funding.”

There’s additional ambiguity around projects receiving 45Q for CCUS projects and 45V for clean hydrogen projects tax credits, as well as production tax credits for wind and solar, in the Inflation Reduction Act.

“No one really knows, but my reading of the tea leaves is that those will continue to be available because we have a history of production tax credits for wind and solar,” Upton says. “And there’s

never been an instance, that I’m aware, where Congress passed a similar subsidy and later reduced the time frame in which it was initially passed.”

Of course, there’s little to no ambiguity around offshore oil and gas, since an expected increase in the number of federal offshore and land leases and reduction in the industry’s regulatory burden will undoubtedly be beneficial to the sector.

“It’s more complicated for refining and chemicals,” Upton says. “Those are big export-oriented industries, so the talk of tariffs and trade restrictive policies internationally could negatively impact that sector. However, an expected increase in production could make them more competitive. It’s a bit of

a double-edged sword.”

“In one of his first actions as president, Trump rescinded these community initiatives, so no one really knows whether these projects will continue to be funded.”

GREG UPTON, executive director, LSU Center for Energy Studies

Mark Zappi, executive director of the UL Energy Institute of Louisiana, says it’s hard to imagine two presidential administrations with more starkly different approaches to energy. “The actual economics of everything seems to matter more to the current administration, whereas with the previous administration it was more ‘let’s ignore the numbers and move forward because we think it’s the right thing to do,’” Zappi says.

While he’s not opposed to federal and state incentives, Zappi says renewable energy sources work best when they’re economically sustainable on their own. “I’m a cheerleader for all sides—let’s continue to develop an ‘all-handson-deck’ approach to alternative energy, but let’s also be cognizant of the economics so that we don’t outprice our jobs and our industries.

“But all too often, it’s all or nothing with every new administration,” he adds. “I believe we can have our cake and eat it, too. We need to continue to reduce emissions, but we also need to keep our feet on the ground in the process.”

Perhaps no other energy sector has endured more regulatory whiplash than offshore wind. President Trump, as one of his first acts in January, froze offshore wind leases and permitting in federal waters and dealt a difficult blow to an already struggling industry.

In a brutally ironic twist, GNO Inc. hosted its annual Louisiana Wind Energy Week just a week after the Trump Executive Order.

Wind Week brings together national and global partners who are interested in Louisiana and offshore wind energy opportunities.

In attendance were national industry associations, all three of the current offshore wind lease holders in the Gulf—RWE (in federal waters), and Diamond Offshore Wind and Cajun Wind (both in state waters)—as well as Dustin Davidson, the deputy secretary of the Louisiana Department of Energy and Natural Resources.

“Naturally, there was a lot of discussion about the Executive Order,” says Cam Poole, GNO Inc.’s energy and innovation manager. “There’s a lot to be interpreted and understood. Obviously, the leasing and permitting hold affects a number of projects, but for those projects that are past all the leasing and permitting milestones, they have the right to proceed with construction.

“According to RWE and DENR, they plan to keep trucking along,” Poole says. “We’re going to keep doing what we’d planned to do over the next four years, particularly because it doesn’t require much permitting authority to advance at this stage.

“That being said, given the probable impacts of the EO on the supply chain and overall industry growth, it would be incorrect to assume that because they have the permits and the leases that everything is on track for those projects.”

DENR also plans to continue executing its Louisiana’s Offshore Wind Map and expects research as part of the endeavor to be completed in 2026. Overseen by a DNER advisory committee, the

map will provide guidance and recommendations on developing a sustainable offshore wind industry in Louisiana. It’s aimed at attracting offshore wind investment in local supply chains through effective procurement mechanisms, supporting local jobs and ensuring mitigation measures are in place to protect the natural environment.

Patrick Courreges, communications director at DENR, says many of the concerns outlined in the EO are already being addressed as part of the Wind Map initiative.

“The EO put a hold on new leases and permitting pending studies of impacts to navigation, marine life, bird flyways and environmental and economic concerns, which are all being looked into,” he says.

“This was always expected to be a slow burn anyway. The roadmap is supposed to be two-year process, and we’re barely six months in. I think a lot of eyes are waiting to see what we come up with.”

Chett Chiasson, executive director of the Greater Lafourche Port Commission, has been pushing for the development of an offshore wind complex at Port Fourchon for years—along with all other forms of energy—and he doesn’t plan to stop. The port has evolved into a testbed, of sorts, for innovation as it pursues investors in offshore wind, hydroelectric power, LNG, coastal restoration, and offshore platform fabrication and decommissioning.

“We’ve been defending the offshore oil and gas industry for years under the last administration; now we have to defend offshore wind,” Chiasson says. “The ‘all of the above’

approach to energy is still our strategy. It’s still what we believe our country should be doing … looking at all sources of energy and how we can help provide for different sources of energy.”

On Feb. 11, Chiasson testified to the House Committee on Natural Resources in Washington D.C. about the importance of offshore energy. Presumably, the information gathered during the meeting—dubbed “Restoring Energy Dominance: The Path to Unleashing Offshore Energy”—will be used to develop a new five-year lease plan for offshore oil and gas.

“I harped a lot in my testimony about consistency,” he says. “We just want to know what the plan is and be able to move that forward, and not have the rug pulled out from under our feet every few years.”

Later this year, Gulf Wind Technology expects to complete construction of the state’s first wind turbine at the port’s Coastal Wetlands Park. The 187-foottall turbine will collect data and potentially power the port’s nearby emergency operations building, as well as demonstrate and test various turbine technologies.

Once the turbine is operational, Chiasson hopes to showcase his port as a national leader in the servicing of offshore wind power. Given the pause in federal offshore leases, he plans to shift his focus to those leases already sold in state waters (Diamond Offshore Wind and Cajun Wind) and the sole lease in federal waters (RWE).

James Martin, CEO of Gulf Wind Technology in Avondale, remains passionate about the potential of the Gulf for offshore wind

“For those projects that are past all the leasing and permitting milestones, they have the right to proceed with construction.”

CAMERON POOLE, energy and innovation manager, GNO Inc.

From refining and petrochemical to shipyard, offshore, natural gas, and nuclear industries, Deltak Manufacturing delivers cutting-edge fabrication solutions. With advanced technology, skilled professionals, and an unwavering commitment to quality, we bring your most complex projects to life.

• Robotic welding, modular fabrication, and automated beam/pipe processing

• Custom steel fabrication, ASME pressure vessels, structural and piping systems

• Blasting & coating, and tailored insulation solutions

• Electrical & instrumentation manufacturing services

• Advanced design solutions with AutoCAD and SOLIDWORKS for precision manufacturing

• 178,000 sq. ft. facility on 140 acres

• Over 140 expert employees

• Equipped with 10 CNC fully-programmable welding robots, Bystronic lasers, press brakes, laser and plasma cutters, and more

• 150,000 sq. ft. of fabrication facilities on 47 acres

• Climate-controlled blasting and coating workshop

• Waterfront access with open-cell bulkhead featuring 6,000-ton load-out capacity

• Modular fabrication capabilities for pipe racks, production skids, and structural systems

Our operations prioritize safety and rigorous quality control, ensuring 100% traceability in every project. Coupled with outstanding customer service, Deltak delivers trusted solutions tailored to your needs.

Johnny Curtis | Managing Director | johnny.curtis@deltakmfg.com Walker, LA: Eddie Hilbert | (225) 435-7400 New Iberia, LA: Billy Sullivan | (225) 435-7420 www.deltakmfg.com

and plans to continue pressing forward with the Port Fourchon test turbine.

“There’s a lot of demand for power in the offshore market, with all the rigs and refining, so we’d love to see that market thrive,” he says. “In the meantime, we’re going to be working our turbine at Port Fourchon to test new technologies. Those plans are not going to change.”

Still, he admits that the federal lease and permitting freeze will have an undeniable impact on the overall offshore wind industry.

“Of course it will be disruptive,” Martin says. “Having support for the market in terms of permitting and policy would have driven more volume, so it will have an undeniable impact on momentum in the market.”

onshore wind market.

“We’ve been defending the offshore oil and gas industry for years under the last administration; now we have to defend offshore wind.”

CHETT CHAISSON, executive director, Greater Lafourche Port Commission

“There’s usually a silver lining for technology companies and people who develop turbines,” Martin says. “They use these tough times to develop and demonstrate the next generation of technology.”

Loren C. Scott & Associates in Baton Rouge. “I think that market is probably in the target. When it comes to this particular issue, Louisiana is probably most at risk for losing some of these projects.”

There are economic variables handicapping the industry as well—sales of EV vehicles have been lackluster in recent months, a fact that has only been exacerbated by a Trump executive order revoking a Biden EV measure that would have ensured half of all new vehicles sold in the U.S. would be electric by 2030.

“I wouldn’t be surprised if the demand for EVs goes down this year and next, and the tariffs aren’t going to help,” he adds. “They’ll increase the price of all cars.”

• AD WILL RUN AS IS unless approval or final revisions are received within 24 hours from receipt of this proof. A shorter timeframe will apply for tight deadlines.

• Additional revisions must be requested and may be subject to production fees.

He remains hopeful that there will be other opportunities coming out of the new administration. For example, international tariffs could bring more of the turbine manufacturing operations to the U.S., which would help service a thriving

Louisiana’s fledgling EV battery materials market has its own worries, since it owes much of its existence to more than a dozen incentives enacted through Congress and issued through the U.S. Department of Energy.

At present, there are about $1.3 billion in announced EV battery projects that have not yet pulled the trigger, many of which are heavily concentrated in the Baton Rouge metropolitan area. Federal monetary incentives have made it financially viable for owners to consider transporting mined materials from such faraway places as Australia, Mexico and Mozambique into the state to manufacture the EV battery components.

“If I didn’t have my check in hand, I would be nervous,” says Loren Scott, an economist with

Without government assistance, the return on investment for many of the projects will cease to be attractive. “Sometimes, these projects need the federal money to make the numbers work out. You’re just not going to do it, until you get more firm ground from which to make a decision,” Scott says.

“With so much uncertainty, I would expect many of these announced projects to wait until at least the summer to let the dust settle.”

Publicly, at least, many of the projects appear to be moving forward. Syrah Resources in Vidalia is already producing active anode material for the battery market and UBE Corp. broke ground in February on a dimethyl carbonate and ethyl methyl carbonate battery materials plant at Cornerstone Energy Park near New Orleans.

Another five announced projects “all seem to be moving,” Scott says. “Element 25 is now looking at a site in Baton Rouge, Capchem Technology in Ascension Parish is on schedule and expecting an FID in June, and Koura in St. Gabriel has a DOE grant but hasn’t broken ground just yet.”

A smaller project by Ucore in Rapides Parish recently announced a delay in their timeline, with the owner

now expecting to complete their renovations in mid-2025 and open in 2026.

On the bright side, utility-scale solar appears to be the least vulnerable of Louisiana’s renewable energy sources, given its economic viability even without federal assistance.

And while utility-scale solar projects do receive tax credits through the IRA, Terry Chambers, director of the Energy Efficiency and Sustainable Energy Center at

ULL in Lafayette, is hopeful that they won’t be eliminated.

“They’re tax law, so they can’t be repealed by an executive order,” Chambers says. “Those tax credits have served as a major incentive for the installation of solar at the utility and residential scales, and they’re still available in the law.”

However, the EPA has temporarily frozen the distribution of money for its “Solar for All” program, funded under the Inflation Reduction Act, which provides grants and loans for low income and disadvantaged communities to

“There’s usually a silver lining for technology companies and people who develop turbines. They use these tough times to develop and demonstrate the next generation of technology.”

JAMES MARTIN, CEO, Gulf Wind Technology in Avondale DONKADAIR

build out solar infrastructure.

“Through Louisiana’s incarnation of that—Solar for Y’all—the Baton Rouge Area Foundation has been managing the program as a green bank and administering those grants and loans for primarily residential and multi-family housing installations, as well as for community solar,” Chambers says. “The funding is currently under review, but it may still go forward after it’s completed.”

Politics aside, Chambers says utility-scale solar is currently the most practical renewable energy source in the industrial space as owners continue to pursue net-zero emissions goals.

“Even unsubsidized, the levelized cost of solar compared to other energy generation technologies is very favorable,” Chambers says. “Utility scale PV (photovoltaic) solar ranges from $29 to $92 per MW hour, whereas a gas-combined cycle plants range from $45 to $108 … so it’s actually cheaper than combined cycle. And it’s much cheaper than coal or nuclear.”

10/12 Industry Report shines a light on companies and organizations that make an impact in their fields and in their communities.

Delta Machine & Ironworks has been on an incredible upward trajectory for the last few years, much of which can be chalked up to its ability to see the need and to do whatever it takes to meet that need.

The 41-year-old manufacturer of custom pipe supports has an agile business model that’s helped it grow from a small mom-and-pop operation into a $44 million company servicing multimillion-dollar projects for some of the biggest industrial contractors in the country. Delta’s craftsmen average over 200,000 manhours annually, delivering 335,000 products (1,700 metric tons of steel).

The lion’s share of Delta’s work is in large-scale

industrial improvement and expansion projects, and the company remains in lockstep with its clients from the beginning to the end of every job. Most significantly, it has become a leader in the fabrication of structural pipe supports, and even ramped up its planning and project management team—currently numbering 15 people—to accommodate the workload.

“We take the headache of pipe-supports away from our clients,” says Heidi Holmes, engineering and technology director. “In the past, supports were a major delay or holdup on most projects … often not even purchased until after they were already late. We make sure that doesn’t happen.” The company is now ISO 9000-certified, and it

has added three new office locations for planning, accounting and estimating in Prairieville, Denham Springs and Zachary.

Delta President Cody Odom is a decidedly “hands on” type of owner. Most days, you’ll find him in the middle of the action, somewhere within Delta’s eight-building Choctaw Drive fabrication facility. He’s always intimately aware of the status of every job and can provide real-time project updates to clients or recommend constructability tweaks.

“I give much of the credit for our success to the people we have out there,” Odom says. “The magic is in finding the right people and making them

want to be here. It’s a family business and we treat them as part of our family.”

Quality is central to everything that Delta does. Its product reject rate is less than .01 percent and the company prides itself on its greater than 95 percent on-time shipping record. What’s more, Delta can quickly adapt to any situation. Case in point: when a local client needed a fabricator that could work a project in Canada, Delta’s welders immediately took steps to become CWB (Canadian Welding Bureau) certified. Ultimately, six welders and a welding supervisor received the certification in record time.

Delta’s competitive edge lies in its teamwork. Employees consider themselves as part of the team on every client’s project. “We provide a Total

Support Solution (TSS),” Holmes says. “When our clients get drawings, we get them at the same time, then we’ll provide them with requisitions for exactly what supports are needed. We are partners from the

very start of the project.

“We take supports off, ensure all of the project specs are met, submit any necessary RFIs, manage drawing revisions, provide real-time status updates and more … we do everything, lock, stock and barrel.”

And while competitors will “nickel and dime” their clients for services and documentation, such as MTRs, drawings, expediting reports, shipping logs and customized tagging, Delta provides it all under one contractual umbrella. “If you go with Delta, there are no surprises,” Holmes says. “The cost is the cost and the promise dates are met. We hold to our word as partners. Whatever it takes to ensure a strong, successful relationship and a superior end product.”

Located along the Mississippi River in Iberville Parish, St. Gabriel is a small yet thriving city of 6,433 residents. Once rooted in agriculture, this 25-square-mile community has transformed into an industrial powerhouse, hosting over 10 facilities that produce essential products like purified water, pharmaceuticals, and advanced plastics. This industrial growth has propelled St. Gabriel to become the largest and fastest-growing municipality in the parish.

Under the leadership of Mayor Lionel Johnson Jr., St. Gabriel has fostered an environment of collaboration and progress. The city’s industries generate over $1 billion annually for Iberville, Ascension, and East Baton Rouge parishes, creating well-paying jobs, stimulating local business growth, and providing a steady tax revenue stream that funds crucial community

improvements. Recent investments include upgraded sewer projects, a recent police station and senior center, enhanced recreational facilities, and improved drainage infrastructure.

St. Gabriel’s location on the Mississippi River gives it a strategic edge, connecting industries to markets locally and globally. This has attracted major investments from companies like Nutrien, Plug Power, Koura, and Syngenta. These and other companies are working at advancing green technologies, modernizing operations, and driving sustainable growth while creating jobs.

Hidrogenii, a joint venture between Plug Power and Olin Corporation, is nearing full operation. Utilizing hydrogen as a byproduct of Olin’s chlor-

alkali production process, the facility purifies and liquefies hydrogen for major customers like Amazon and Walmart, providing a sustainable alternative fuel source.

Beyond its economic contributions, St. Gabriel’s industrial base enriches the community through initiatives like East Iberville INC, which offers scholarships, recreational programs, and resources for residents of all ages. Local industries provide both monetary contributions and volunteer support, enhancing the quality of life for the city’s residents.

For example, Nutrien, a world leader in manufacturing clean ammonia that helps feed the world, and Koura, a global leader in

fluoroproducts, including those that support America’s lithium-ion battery production supply chain, recently announced major expansion projects. Both companies are also expanding their presence in the community.

Nutrien, employing over 300 workers—many from Iberville and Ascension parishes—is actively involved in community initiatives like Junior Achievement programs, financial literacy education, and partnerships with the Greater Baton Rouge Food Bank and East Iberville Industry Neighbor Companies.

Koura continues to strengthen its ties to the

community through innovative programs. The company anticipates its first scholarship program participant graduating this summer and transitioning to full-time employment. Building on this success, Koura is hosting the second cohort of its High School Summer Institute (GEAR UP), which introduces students to industrial careers free of charge.

Mayor Johnson envisions St. Gabriel as a model for how industry and community can coexist and thrive together. By modernizing industrial facilities, operations become cleaner and safer, ensuring

benefits for both residents and the environment.

“Where there is industry, there is commerce … where there is commerce, there is a steady, predictable tax base to benefit the residents of St. Gabriel,” Johnson said.

With a strategic location, thriving industrial base, and commitment to community progress, St. Gabriel stands as a model for successful industrial synergy. Its forward-thinking leadership continues to position the city as a dynamic hub of innovation and opportunity, inspiring other communities to follow its example.

For over a century, Lard Oil Company has set the standard in the petroleum industry with its commitment to service, innovation, and excellence. In that time, we have grown into one of the largest authorized Mobil distributors in Louisiana and Mississippi, with over 500 employees, 20 convenience stores, and 9 bulk plants.

Looking ahead, we reaffirm our dedication to excellence with three major milestones: securing the Mobil Marine contract for the Southeastern territory, earning the ExxonMobil Circle of Excellence Gold Award, and launching our Back to the Basics initiative.

We are proud to be awarded the Mobil Marine contract, enabling us to supply high-quality Mobil Marine lubricants to fleets, ports, and offshore

operations across the Southeast. This recognition strengthens our role in delivering reliable, high-performance solutions for demanding marine environments.

Additionally, we are honored to receive the ExxonMobil Circle of Excellence Gold Award, a testament to our operational excellence, innovation, and dedication to customer satisfaction. This achievement reflects our team’s hard work and our continued investment in efficiency.

Looking toward the future, we launched our Back to the Basics initiative that focuses on five key pillars: Training, Resources, Accountability, Culture, and Growth. This strategy focuses on implementing efficient processes, enhances internal collaboration, and equips our team with the

Executives: Johnny Milazzo, President

best resources to succeed.

Beyond fuel and lubricants, we provide specialized services through:

• FilterIT: A dedicated team providing oil purification services like high-velocity oil flushing, dehydration, and varnish mitigation to extend the life of oil and equipment.

• Fuel IT: Our fleet management team that helps businesses monitor, track, and control fuel purchases, optimizing efficiency and reducing costs.

• Reliability Services: Offering proactive solutions to help businesses establish and maintain robust lubrication programs.

With a future full of opportunities, Lard Oil Company remains dedicated to executing at the highest level, no matter the circumstance.

BY SAM BARNES

How LED and a ‘whole of government’ approach landed the Meta investment.

Rob Cleveland’s phone has been blowing up these last few months. Ever since Meta announced that it would be fast-tracking the construction of a $10 billion AI data center in Richland Parish, nearly 20 other developers have contacted the president and CEO of Grow NELA to talk about

potential investments.

The economic development agency, which covers a 10-parish area in northeast Louisiana, had 22 active leads as of early March, an incredible number for the predominantly rural area.

“The words ‘unprecedented’ and ‘transformational’ get thrown around a lot in the economic development space, but I can’t

think of any better words to use,” Cleveland said. “It’s utterly remarkable what has happened and what continues to happen.”

In December, Facebook and Instagram parent company Meta announced it would build the mammoth facility on 1,400 acres of state-owned land, a transformational investment that Louisiana Economic Develop-

ment hopes will cement the state’s status as a major innovation hub and put the rural community on the leading edge of a global digital revolution.

To power the data center— which will span more than a mile long—as well as meet future energy needs, Entergy has proposed constructing three natural gas fired power plants at a cost of $3

billion that could one day be converted to clean energy production.

Cleveland credits a confluence of factors for pushing the mega-project forward with unprecedented speed. “We had the right land, the right owners and the right state leadership,” he says.

“Typically, we’ll pursue projects that are one-tenth this size and work on them for three or four years. The fact that this one—at $10 billion—came together in eight months is just incredible.

“It’s an entirely different level of economic development. I was on a call today with a data center developer from the Midwest. I told him how it all came together so quickly, and he didn’t believe me.”

“We were just pulling triggers. The entire cabinet was working on it, along with several members of the legislature … all under nondisclosure agreements. It was a ‘whole of government’ approach.”

SUSAN BOURGEOIS, secretary, Louisiana Economic Development

The journey began during Washington Mardi Gras 2024, when Entergy Louisiana approached officials with Louisiana Economic Development about an unnamed developer planning to build a “significant” data center somewhere in the south. The energy provider had been actively marketing the Richland Parish site through its Site Selection Center and Go Entergy platforms, emphasizing its potential for large-scale developments.

Within two weeks LED, Entergy and Gov. Jeff Landry’s office were mapping out a game plan.

“Louisiana was ideally positioned for a couple of reasons,” says Susan Bourgeois, LED secretary.

“Amazon Web Services had just

announced their data center project in Madison, Mississippi, and xAI had announced another in Memphis, so there was already this ‘Digital Delta’ taking shape. And in Richland Parish there’s land, natural resources and accessibility to the grid … so we were well positioned simply because of geography and the fact that Louisiana didn’t have a data center yet.”

Having a development ready, LED-certified site readily available also went a long way toward meeting Meta’s “speed to market” requirement, an absolute necessity in the ultra-competitive data center space. The state had owned the land for years, having acquired it from a local landowner during the Bobby Jindal administration

in hopes of landing an automobile manufacturer.

Nevertheless, there were a few obstacles to overcome before the project could move forward. At the top of the list: Louisiana didn’t offer sales tax rebates on equipment purchases, which is an absolute necessity for a data center operator who must regularly and frequently replace equipment.

“Gov. Landry said if you bring me a project, I’ll call a special session and do what I can to get you a sales tax exemption,” Bourgeois says. “But in the middle of the session, the project quickly started getting legs and we didn’t have the luxury of waiting. So we found a bill moving through the session that could be amended to include the rebate and made it happen.”

It was a recurring theme—each time the project reached an impasse or encountered a regulatory barrier, the cross-functional team would work to find a solution. “We were just pulling triggers,” Bourgeois says. “The entire cabinet was working on it, along with several members of the legislature … all under non-disclosure agreements. It was a ‘whole of government’ approach.”

Workforce development was another critical piece of the puzzle, so Bourgeois asked Dr. Monty Sullivan, president of the Louisiana Community and Technical College System, or LCTCS, to contact administrators at Northern Virginia Community College, long been recognized as having “best in class” data center operations curriculum. “Before the project was even announced, Monty and his team were actively developing the curriculum,” she adds.

LCTCS also allocated $250,000 to Delta Community College in Monroe from its Workforce Training Rapid Response Fund so that the college could expand its curriculum and staffing to train the welders, electricians and other skilled laborers needed to build the Meta facility.

“Typically, we’ll pursue projects that are one-tenth this size and work on them for three or four years. The fact that this one—at $10 billion—came together in eight months is just incredible.”

ROB CLEVELAND, president and CEO, Grow NELA

“We worked collectively with Delta to ensure we had enough for construction, and eventually for data center operations,” says Chandler LeBoeuf, vice president of education at LCTCS.

LeBoeuf says the experience ultimately strengthened the bond between LCTCS and state officials. “It just wasn’t like this in the past,” he adds. “More typically, we’d be brought in at the last minute, at the end game, then would have to scramble to align resources.

“But this new successful, proven partnership model could continue in perpetuity for any future economic development projects,” he adds. “That’s important, as the relationship between the LCTCS system and the state must be strong in order to maintain open lines of communication and ensure that the colleges in our system are responsive to the needs.”

LED’s FastStart also assisted, primarily as a liaison between the various parties in the workforce development arena. Chelsea Dufrene, FastStart director, says her agency delivered critical workforce data—education pipelines, staffing reports, job postings, occupational snapshots and wage studies aligned with potential Meta needs—to Delta Commu-

“It just wasn’t like this in the past. More typically, we’d be brought in at the last minute, at the end game, then would have to scramble to align resources.”

CHANDLER LEBOEUF, vice president of education, Louisiana Community and Technical College System

nity College and Bossier Parish Community College to assist in the development of curriculum.

“We continue to collaborate with all of our partners, specifically with LCTCS to maximize their financial commitment to support both the construction workforce needs and eventual operation of the Meta data center,” Dufrene says.

Bourgeois revels at the speed at which LED and its partners delivered the Meta project to Louisiana. Their success recently garnered national attention, in fact, when the state agency received Business Facilities Magazine’s 2024 Platinum Deal of the Year Award.

“Even with all of our institutional memory here at LED, no one remembers a deal of this size and scale being done so quickly,” she says. “Typically, when we announce a deal, there’s a lot of paperwork to do after the fact. But not with Meta. When we announced on Dec. 4, every piece of paper had been signed. Everything that needed to happen for dirt to be turned was signed and the ink was dry.”

The “whole of government” approach represents a seismic shift in Louisiana’s economic development strategy, one that Bourgeois plans to replicate on future pursuits. “When all levels of state government, along with local government and private sector partners come together, towing on the rope in the same direction, things can happen and happen very quickly.”

It’s her hope that Meta’s historic investment is just the beginning of a bold strategy to drive economic

growth through AI, as well as expand and diversify the state’s tech sector. “The folks at Meta wanted to put their biggest data center in the world in Louisiana, and we made it easy,” she says. “Just think what that does for the business narrative in Louisiana.”

Meanwhile, Grow NELA’s Cleveland is working to capitalize on a data center “gold rush” in his corner of the state. “Companies are attracted to this area’s low tax rates, low regulatory environment and lots of available inexpensive land … and we have folks in state government who are willing to do what they need to do,” he adds. “It’s moving fast, because these data centers all understand that there’s a limited power supply.”

“We continue to collaborate with all of our partners, specifically with LCTCS to maximize their financial commitment to support both the construction workforce needs and eventual operation of the Meta data center.”

CHELSEA DUFRENE, director, FastStart

“Many think that there is an end point. There never is. The securing of trust is not enough; you’ve got to continue to sustain and strengthen it throughout the life of a facility.”

TIM JOHNSON, Founder and president, TJC Group

Winning public trust can pay off long after the project breaks ground.

BY SAM BARNES

Among the litany of approvals an industrial owner must pursue prior to the construction and operation of a new facility, perhaps none is as difficult to earn as public acceptance.

It’s the hardest to get and the easiest to lose, says Tim Johnson, founder and president of stakeholder engagement specialist TJC Group of Baton Rouge.

“The earning of the trust and goodwill of the stakeholders in a community is what we call the ‘public license to operate,’” Johnson says, “and there’s never been a time when it’s more important to engage and communicate with our industrial neighbors.”

Most clients are aware of the need to connect with the local community, but they often make a fatal assumption: that public acceptance,

once gained, can’t be lost.

“Many think that there is an end point,” Johnson says. “There never is. The securing of trust is not enough; you’ve got to continue to sustain and strengthen it throughout the life of a facility.”

TJC Group works with clients to build a base of knowledge and cultivate a level of understanding among stakeholders. “Then that understanding can generally lead to some level of trust,” he says. “We may not always agree, and I might not like what you tell me, but if I trust you, from that we can generate good will.”

Community advisory panels are the most common vehicle for accomplishing that goal. Johnson cut his teeth developing and running CAPs when he founded the company in 1990. Today, there are more than 400 CAPs currently operating in the U.S., 70 of which

created by TJC Group. Of those, 27 are in the industrial space.

In creating each 20- to 30-member panel, TJC Group seeks to ensure they are representative of a community’s demographics, whether it be race, age, socioeconomic bracket or occupational makeup. Some are single-plant CAPS, while others are parishwide or regional and comprised of multiple owners.

“During the meetings, we’ll talk about a variety of subjects, such as environmental performance, health, emergency preparedness, incident prevention, local hiring, support for schools, among a host of other things,” Johnson says, “with the end goal of keeping the lines of communication open.

“We want to build that trust and goodwill, but we don’t want the relationship to be so cozy that they’re not willing to say the community has a problem.”

There are numerous other ways to approach community engagement. UK-based wood pellet producer Drax Biomass has noticeably ramped up its presence in the public arena in recent months, hiring Aarika Plunkett as its first U.S. community manager and adding a cadre of community liaisons across its industrial footprint in Louisiana, Mississippi, Arkansas, Texas and Alabama.

Through the Drax Foundation and Drax Community Fund, both created in 2023, they recently awarded $50,000 to the National Audubon Society for the protection of birds and their habitats.

Another $4,000 helps the Rapides Wildlife Association power a wildlife camera that gives a bird’s eye view of an eagle’s nest in the Kisatchie National Forest.

“At any given time, there’s 500-

STRATEGIC PARTNERSHIPS CAN LEAD TO MARITIME SUCCESS. A recent report, commissioned by Louisiana’s five deep draft ports and titled “Lower Mississippi River Commodity Analysis,” provides important insights on enhancing trade along one of the world’s most important waterways.

STRATEGIC MARITIME PARTNERSHIPS, innovative initiatives, and a focus on emerging markets are key components of a plan for success in Louisiana’s maritime sector. “This report validates the direction our port has been going in,” said Jay Hardman, executive director

of the Port of Greater Baton Rouge, “and points to more opportunities that can be pursued.”

POTENTIAL GROWTH

MARKETS IDENTIFIED FOR LOUISIANA PORTS include biofuels, LNG, wood pellets, cement, fertilizers, and container shipments. Ports working together in strategic partnerships were also encouraged. Hardman pointed to the successful partnership between Baton Rouge and Port NOLA in moving container shipments from the capital city to New Orleans for export as a prime example of how that cooperation can lead to success for Louisiana ports and their customers.

“By working together,” said Hardman, “we’re not just moving cargo—we’re building Louisiana’s economic future, one shipment at a time.”

some people watching a bird’s nest in central Louisiana,” says Michelli Martin, communications manager at the company’s U.S. headquarters in Monroe. It’s not the biggest thing we’ve ever done, but it’s bringing joy to people.”

In Monroe, Drax has provided monetary donations to the Children’s Museum and the Queens of Tomorrow initiative, a mentorship program for young girls that provides them with direct access to STEM education opportunities.

In the process, Drax hopes to reinforce a sense of community among their employees. “Our employees work for us, but they live in these communities. So that’s our family; that’s our home. It would be weird if we didn’t invest in where they are.”

Drax also created its first CAP at the site of its pellet production facility in Gloster, Mississippi, and plans to form additional CAPs in Louisiana and Alabama by the end of the year.

“We have these dollars to spend in the community, but we need to know the best places for them to go,” Marti says. “While we have a community liaison who works at the plants, it’s nice to have those

boots on the ground to give us an idea of where the greatest needs are and where those dollars need to go. We’re making the community a part of the decision.We’re more successful when we involve are stakeholders such as civic leaders, religious leaders … we need all of them at the table.”

Engagement takes on even greater significance when a community’s nerves are already frayed.

In response to local concerns over Air Products’ plans to sequester carbon beneath Lake Maurepas in conjunction with its new $4.5 billion Louisiana Clean Energy Complex, the company launched a multi-pronged approach to repair its “public license to operate.”

In 2023, the company launched

the Lake Maurepas Community Fund, which will commit some $1 million annually to communities bordering Lake Maurepas.

The fund made inaugural investments to support the missions of two safety-focused organizations the Livingston Parish Fire Protection District #2 and the Manchac Volunteer Fire Department.

Each will each receive a grant of $400,000 to support their first response missions, facilitate the purchase of new patrol and emergency response boats that will bolster response times in Lake Maurepas.

“First response agencies play a critical role in the lake community, and they need to have the best equipment possible to keep our lake safe and healthy,” says Danna LeBlanc, commercial executive director for the Louisiana Clean Energy Complex, in a press release.

“It’s only fitting that the first grants from the Air Products Lake Maurepas Community Fund are directed toward their missions.”

What started as a single office in Louisiana’s capital is now the largest open-shop electrical and instrumentation contractor in the United States. With our unmatched pursuit of

We invite you to experience the

BY SAM BARNES

Quantum computing and AI are unlocking complex challenges in petrochemical and manufacturing.

It’s not scalable just yet, but quantum computing is already turning heads because of its ability to exponentially accelerate decision making in the industrial space. It’s just the latest in an increasingly diverse array of data-driven innovations that are already disrupting the market.

Quantum computing uses the principles of quantum mechanics to process information, enabling it to solve complex problems much faster and more efficiently than classical computers with the help of specialized algorithms. IBM, with offices in Baton Rouge, is particularly optimistic about its potential.

“By 2029, or perhaps sooner, we feel we’ll have a scalable modular system that can be used in solving real-world problems,” says Robert Loredo, IBM quantum ambassador worldwide lead in Miami.

Some owners have already begun to test the waters. Teams at IBM and ExxonMobil recently collaborated to model maritime inventory routing on quantum devices, analyzing the strengths and trade-offs of different strategies for vehicle and inventory routing, and laying the foundation for constructing practical solutions for their operations.

As IBM’s quantum hardware scales rapidly—from small prototype systems to more promising larger devices—researchers are excited about the possibility to one day handle previously insoluble routing problems.

“By partnering with IBM Quantum, our aim is to ultimately level-up our ability to tackle more complex optimizations,” Dr. Vijay Swarup, senior director of climate strategy and technology at ExxonMobil in Houston, said in a recent announcement. “To solve bigger problems and make bigger differences.”

For ExxonMobil, quantum’s applications will range far beyond the coordination of ships at sea. It

could provide new capabilities to simulate chemistry, leading to developments in energy sustainability and efficiency. It could also support discoveries necessary to develop large-scale carbon capture or help identify new catalysts and active materials for low energy processing.

“Even at this early stage, we’re discovering that quantum computing inspires different ways of thinking that are uniquely suited to its specific powers,” Swarup says. “We know in our bones that there are huge global challenges that we will tackle in the foreseeable future. When quantum computing scales to become utterly disruptive, we’ll be ready.”

Charles Masters, a senior partner for IBM in Baton Rouge, says quantum computing has obvious benefits for Louisiana’s petrochem ical complex. He recently discussed the promise of the technology during a keynote speech at

the Feb. 20 TEC Next Conference in Baton Rouge.

“When I think of all the businesses here in Louisiana—oil and gas, chemical, manufacturing and logistics —all of those can benefit.

“We’re currently developing the technology, hardware and framework necessary to ensure that everyone’s ready to go with the education, understanding and industry expertise,” he adds. “A lot of our industry clients are getting on board now; they’re building their skills and building their algorithms so that as quantum progresses, they’ll be ready.”

In that vein, Loredo is currently spearheading an effort to develop a pipeline of internal talent at IBM with the necessary skills and exper-

physics, who can, in turn, educate clients about the potential of the innovation. “We’re getting the word out that quantum is not just in a lab anymore,” he says.