Luxury Property Report SPRING 2024

(C11)

Clair, Annex, Casa Loma (C02)

Park, Lawrence Park, Lytton Park, Forest Hill North (C04)

Moore Park (C09)

Mills (C13)

Luxury Property Report SPRING 2024

(C11)

Clair, Annex, Casa Loma (C02)

Park, Lawrence Park, Lytton Park, Forest Hill North (C04)

Moore Park (C09)

Mills (C13)

After ten interest rate hikes in just under two-years, an end to quantitative tightening by the Bank of Canada (BOC) can’t come soon enough. The downward move, predicted by the vast majority of economists, is expected to alleviate some of the uncertainty that has characterized homebuying activity in the Greater Toronto Area in recent years.

While inflation has yet to come down to the two per cent target, an upswing in the jobless rate to 6.1 per cent and slowing inflation support the likelihood of a rate cut, perhaps the first of several, anticipated in the second and/or third quarter of the year. If those predictions come to fruition, we’ll likely see a resurgence of homebuying activity across the board as the floodgates of pent-up demand are opened, somewhat like what we witnessed in the second quarter of 2023. Even if the BOC does not cut rates on June 5th, we should experience an active summer as more and more buyers are making their moves now ahead of anticipated rate cuts in the near future.

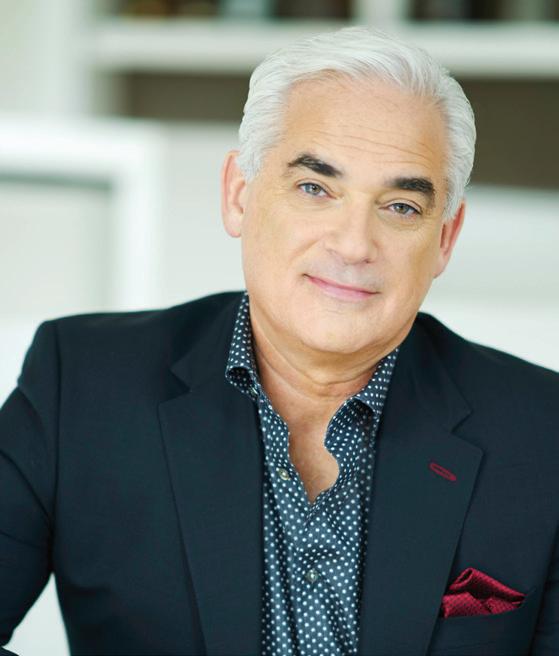

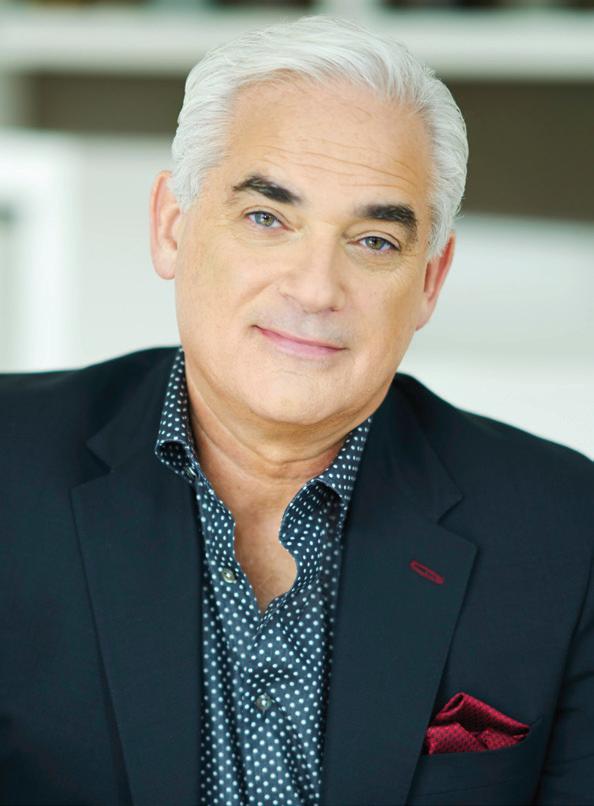

BARRY COHEN President & Broker

BARRY COHEN President & Broker

Sales of luxury homes over $2 million were up over year-ago levels in the first four months of the year, rising close to six per cent to 1,561 units. The uber-luxe market, priced over $5 million, has also experienced a serious uptick, with 85 properties changing hands between January 1 and April 30, an increase of just over 60 per cent compared to the same period in 2023. While softer demand characterized sales over the $7.5 million price point earlier in the year, the market has bounced back, with sales over $7.5 million falling just one sale short of year-ago levels.

Freehold & Condominium Sales In The Greater Toronto Area

First Quarter | January to April

2024 (Total)

Source: Barry Cohen Homes, Toronto Regional Real Estate Board (TRREB), Market Watch

Several high-end markets in the 416-area code have already shown tremendous growth:

• Freehold sales over $2 million in Leaside rose 54 per cent so far this year, with 37 sales posted between January and April of 2024, compared to 24 during the same period in 2023.

• Double-digit increases in homebuying activity over $2 million were also reported in Forest Hill South (20 per cent); Humewood-Cedarvale (10 per cent); Lawrence Park South (20.8 per cent); and Lawrence Park North (20 per cent); and Forest Hill North (12.5 per cent) in the first four months of the year.

• Substantial gains were also reported at the $3 million plus price point so far this year, including HumewoodCedarvale, where sales went from one in 2023 to three: the Annex where sales doubled from five to 11; and Lawrence Park South where sales were up 46.2 per cent to 19 units, compared to 13 one year earlier.

• Sales of uber-luxe homes over $5 million rose higher year-over-year in Yonge-St. Clair, Forest Hill South, Bedford Park-Nortown, Lawrence Park South, Rosedale Moore Park, and St. Andrew-Windfields-Hoggs Hollow.

Overall weakness in the condominium segment (apartments and townhomes) did not filter into upper price points in 2024. Demand for uber-luxe condominiums climbed 40 per cent in the first four months of the year with seven sales over $5 million, one of which sold for more than $7.5 million. Average price in the luxury segment (over $2 million) rose five per cent to just over $3 million this year, up from close to $2.9 million during the same period in 2023.

New listings have been steadily increasing this year as the industry reacts to the change in rules regarding off market listings, a trend that gained popularity during Covid. The new rules require all listings that have been marketed to on MLS within three days. Overall, this should benefit buyers as supply should continue to increase.

Domestic buyers are expected to lead the charge for real estate once again in the GTA, with promise of lower interest rates down the road sparking an uptick in variable rate mortgages. We suspect that those that have been sitting on the sidelines over the past year and half will be the first to take the plunge.

As always, our team of experts at Cohen Homes and Estates are attuned to the unique needs of distinguished and discerning clientele. We’re well-versed in the unique challenges, nuances, and opportunities that exist in exclusive high-end neighbourhoods within the Greater Toronto Area. If you’re thinking of buying, selling, or simply need a read on current market conditions, please feel free to reach out.

All the best,

Barry CohenWe are proud to be the exclusive partner of Forbes Global Properties, for the GTA & Cottage Country, an invitation only platform showcasing the world’s finest homes to a targeted audience of luxury buyers.

More earned media reach than any brand in the luxury real estate space

Cohen Homes & Estates benefits from an unmatched brand halo effect and reach through Forbes Global Properties

INDUSTRY SHARE OF VOICE

83% Forbes / Forbes Global Properties

7.2% Berkshire Hathaway / BHHS

4.2% Sotheby’s/Sotheby’s Int. Real Estate

3% Christie’s/Christie’s Int. Real Estate 1% Coldwell Banker 0.7% Savills 0.7% Knight Frank

Engel & Völkers

Overall homebuying activity in the Toronto Regional Real Estate Board’s (TRREB) C12 district consisting of Bridle Path, Sunnybrook, York Mills, St. Andrew, Windfields and Hoggs Hollow fell short of 2023 levels with just 34 homes changing hands over the $2 million threshold in the first four months of 2024, compared to 40 during the same period one year ago. Despite higher interest rates, it’s suspected that many luxury buyers entered the market in the final quarter of 2023 ahead of the municipal government’s decision to increase land transfer taxes (LTT) to 3.5 per cent on sales over $3 million, 4.5 per cent over $4 million, 5.5 per cent on sales over $5 million, 6.5 per cent on sales over $10 million, and 7.5 per cent on sales over $20 million on January 1, 2024.

Still, there was an uptick in freehold sales over $5 million, with six homes moving in the first four months of 2024, up from four during the same period one year ago in St. Andrew-Windfields-Hoggs Hollow. Values rose in tandem with the increase in sales at the top end, with the average price up two per cent to $3,854,074.

With interest rates expected to edge downward in the summer of 2024, homebuying activity in C12 is forecast to climb. Ample inventory levels, especially under the $5 million price point, are expected to draw more buyers to the area in the year ahead.

January

January

Despite tight inventory levels, young, upwardly mobile families continue to bolster home sales in the Humewood-Cedarvale communities. Eleven properties priced over $2 million were sold in the first four months of the year, up from 10 reported between January and April of 2023. Neighbouring Forest Hill South also experienced an uptick in sales over $2 million during the same period, with twelve homes selling over $2 million, including four uber-luxe properties selling for more than $5 million.

Housing values in these areas have increased in tandem, with average price in Humewood-Cedarvale now hovering at $2,652,500, up seven per cent over 2023 levels for the same period. Prices in Forest Hill South also edged upward, rising 12 per cent to $4,101,667 in the first four months of the year.

Supply shortages, especially at the lower end of luxury ranging from $2 million to $3 million, are proving challenging to buyers in the TRREB’s C03 district. Three properties are currently listed for sale in Humewood-Cedarvale, while one is available for sale in Forest Hill South. Inventory is more plentiful over the $5 million price point, with 11 properties currently listed for sale in Forest Hill South.

Greater homebuying activity will be contingent on an upswing in listing inventory in the coming months. With close to 73 per cent of properties selling for more than list price in 2024 in Humewood-Cedarvale, an influx of new listings will help to restore balance to the market. However, as pent-up demand builds, any downward movement in interest rates is likely to spark competition in these coveted communities.

January 1st - April 30th, 2024 vs. same period in 2023

Average Sold Price 2023

$2,479,704

Average

$2,652,500

January 1st - April 30th, 2024 vs. same period in 2023

Demand for homes in the Leaside community remains steadfast, with sales over $2 million up more than 50 per cent in the first four months of the year. Thirty-seven homes have changed hands year-to-date, an increase over the 24 sold during the same period in 2023. Supply issues remain front and centre in 2024, with almost half of listings in the area selling for more than list price.

The blue-chip neighbourhood, popular with young and upwardly mobile buyers, remains exceptionally sought-after despite consistently tight inventory levels, as evidenced by the single home available for sale between $2 million and $3 million at press time.

January 1st - April 30th, 2024 vs. same period in 2023

While overall homebuying activity has remained stable year-over-year at $2 million plus, an increasing number of sales are occurring over the $3 million price point in Yonge-St. Clair, Casa Loma, and the Annex this year. Eleven properties were sold over $3 million in the Annex in the first four months of the year, up from five one year ago; five properties moved over $3 million in Casa Loma, an increase of 66.7 per cent over year-ago levels; and three properties sold over $3 million in the Yonge-St. Clair neighbourhood, up from two during the same period in 2023.

Many purchasers are waiting in the wings, yet inventory levels at sought-after price points continue to impede homebuying activity. Few homes are available between $2 million to $3 million in TRREB’s C02 district at present – nine properties are located in the Annex, seven are in Casa Loma, and four are listed for sale in the Yonge-St. Clair area.

Given tight conditions in the area in 2023 – almost one in four homes sold in 2023 moved for more than list price – the market is expected to remain tight throughout 2024.

January 1st - April 30th, 2024 vs. same period in 2023

$2

$3

$7.5

January 1st - April 30th, 2024 vs. same period in 2023

$5

$7.5

January

$2

$2,959,333

Core communities north of Eglinton Ave. continued to be exceptionally popular with buyers in 2024, particularly at lower price points. Young families were drawn to neighbourhoods such as Lawrence Park and Forest Hill North throughout the first four months of the year, with sales over $2 million up by double-digits compared to year-ago levels.

S trong trade up activity was also reported in the $5 million plus category in Bedford Park-Nortown (four sales) and Lawrence Park South (three sales). Average price in Bedford Park- Nortown edged slightly ahead of yearago values at just over $3.2 million, while Lawrence Park North saw values rise eight per cent to more than $3.5 million. Forest Hill North increased four per cent year-over-year to $3.2 million.

A shortage of available homes listed for sale was in large part responsible for the uptick in values in TRREB’s C04 district. To illustrate, Lawrence Park South had two homes listed for sale at press time, while both Forest Hill North and Lawrence Park North had four homes available. A greater supply was available in Bedford Park-Nortown (11). Tight market conditions are expected to prompt competition in key C04 neighbourhoods throughout the remainder of the year. Almost 71 per cent of homes sold in Lawrence Park North in the first four months of the year moved for more than list price.

January 1st

$2

$3

Lawrence Park North

January 1st - April 30th, 2024 vs. same period in 2023

$5

$7.5

January 1st - April 30th, 2024 vs. same period in 2023

$7.5

Forest Hill North

January

$2

$3,193,248 Average

Average Sold Price 2023 $2,682,976 Average

$2,598,406

Average

$3,524,966 8% Year-over-year

Offered at $10,750,000

Homebuying activity at the top end of the market gained momentum early in the year, with buyers hoping to scoop up properties before values climb. In Rosedale-Moore Park, affluent buyers contributed to an uptick in sales, with more than 25 properties sold over $2 million between January and April, including six priced in excess of $5 million.

Year-to-date values over $2 million have risen 16 per cent to $4.1 million, up from just over $3.5 million during the same period in 2023. With interest rates expected to trend downward in late spring or early summer, upward pressure on pricing is expected to continue. This is especially true considering the scarcity of listings in the Toronto Regional Real Estate Board’s C09 district, with just four properties currently available for sale between $2 million and $3 million and six properties for sale between $5 million and $7.5 million.

Demand for properties in Rosedale-Moore Park is expected to remain high throughout 2024, with buyers at the uber-luxe levels continuing to seek out rare high-end listings.

January 1st - April 30th, 2024 vs. same period in 2023

Average Sold Price 2023

$3,548,202

Average Sold Price 2024

$4,106,881 16% Year-over-year

Offered at $7,380,000

8,700 SF OF ELEGANCE IN BANBURY Offered at $7,580,000

A shortage of available inventory has hampered homebuying activity in the Banbury-Don Mills community in the first four months of the year, with sales over $2 million down almost 45 per cent from year-ago levels. Just 16 homes sold between January and April, compared to 29 during the same period in 2023. Average price in the area softened by five per cent year-over year, now hovering at $2,938,313.

Demand remains strong for homes in the area, with close to one in two properties selling for more than list price this year. Twenty-seven properties are currently listed for sale, ranging in price from $2.198 million to almost $13 million. Eight of the properties listed for sale are priced between $2 and $3 million.

Value continues to draw homebuyers to Banbury-Don Mills. Larger detached homes on generous lot sizes have broad appeal amongst younger buyers, many of whom are driven by the value proposition of the neighbourhood. Although the landscape is changing with increased infill development, many of the older homes in the area are well-maintained and in move-in condition.

January 1st - April 30th, 2024 vs. same period in 2023

$2,938,313

5-STAR SHANGRI LA CONDO Offered at $11,500,000

ONE FOREST HILL ROAD CONDO Offered at $9,995,000

NEW LAWRENCE PARK CONDO Offered at $1,900,000

COVETED BRIDLE PATH CONDO Offered at $3,650,000

FOUR SEASONS RESIDENCE Offered at $9,995,000

Despite a 12 per cent decline in overall condominium apartment and townhome sales in the first four months of the year, the number of luxury condos changing hands over $2 million held relatively steady, falling just ten sales short of 2023 levels for the same period. The average price for condominiums firmed up year-over-year, with values climbing five per cent to just over $3 million in 2024.

Empty nesters and young professionals were once again behind the push for condominiums, with the greatest number of sales to date occurring in the city’s core including the Annex (eight), Waterfront Communities (11), and the Bay St. Corridor (9). Solid sales figures were also reported in more traditional residential neighbourhoods within Toronto, where condominiums have started to gain a foothold. Prime examples include Casa Loma (6) and Yonge-St. Clair (6).

At present, more than 200 apartments and townhomes are listed for sale over $2 million in the Greater Toronto Area. Sixty-two are currently available in the Annex, Casa Loma, Yonge-St. Clair area, ranging in price from close to $2.125 million to almost $17 million.

Average Sold Price 2023

$2,886,480

Average Sold Price 2024 $3,026,760 5% Year-over-year

January 1st - April 30th, 2024 vs. same period in 2023

When it comes to luxury listings, RE/MAX’s network, dedicated platforms, and marketing reach find exactly the right buyer – no matter where they reside.

2 nd LARGEST

Offices

3 rd LARGEST

Countries 4,000 Offices

Countries 1,200 Offices

Positioned as the only real estate company with true global reach, the Global RE/MAX portal, global.remax.net, facilitates listing marketing in nearly 100 countries and 40+ languages, from coast to coast and beyond.

RE/MAX’s online advantage, across the planet, is miles ahead of the competition, due to a marketing budget that is bigger than all other competitors combined. Additionally, Barry Cohen Homes is organically found at the top of Google for Toronto Luxury Real Estate key search words, allowing us the ability to reach the most amount of buyers for your home.

Toronto Sales Higher Than $10,000,000 (January 01, 2017 to April 30th, 2024)

Cohen Homes & Estates

Competitor A

Competitor B

Competitor C

$339,088,400 35

$113,956,668

$116,240,000 $43,200,000 5 10 5

$90,003,681 $24,550,000 $28,000,000 $203,960,349 $140,790,000 $71,200,000 $148,548,400 $487,636,800

Toronto Sales Higher Than $7,500,000 (January 01, 2017 to April 30th, 2024)

Cohen Homes & Estates

Competitor A

Competitor B

Competitor C

$555,854,900 73 $113,956,668 $150,840,000

$81,193,800 6 17 16

$99,003,681 $51,725,000 $79,994,800 $212,960,349 $202,565,000 $161,188,600 $263,104,900 $818,959,800

Toronto Sales Higher Than $5,000,000 (January 01, 2017 to April 30th, 2024)

Cohen Homes & Estates

$114,194,800 $541,001,000 $338,663,800 $310,476,488 $433,569,900 $1,525,281,198

Competitor A

Competitor B

Competitor C

$288,579,388 $223,119,000 $1,458,860,060 $785,290,388 $665,592,055 $689,970,700 $2,354,578,584

Barry’s Market Insight

Price Validation from Brand Reputation

Custom & Effective Marketing Strategies

Unparalleled Service

Multicultural Team

Forbes’ Global Reach Exclusive to Cohen

Client Concierge for Staging & Repairs

Unrivalled Negotiation Strategies

Most importantly, we represent More Sellers than any competitor which allows us to generate More Buyers, more offers, higher prices, and ultimately More Sales!