Validation of an asset class As I write this message, we are closing the door on one of the strongest first quarters in the history of the Toronto Regional Real Estate Board for overall housing sales. Just over 33,500 homes were sold between January 1 and March 31, 69 per cent ahead of the same period in 2020, and almost 33 per cent ahead of the previous record of 25,239 units, set in the first quarter of 2017. Market drivers have been numerous, but front and centre remains the validation of real estate as an asset class. The roof over our heads is now one of our greatest wealth accelerators, especially in the Greater Toronto Area (GTA). This is of particular importance at a time when traditional savings vehicles such as GIC’s are generating tepid returns and stock market performance is increasingly volatile, setting new records one day and dipping the next. Not surprisingly, sales of luxury freehold and condominium properties have been exceptionally robust in the first quarter of 2021. Five hundred and thirty-six properties changed hands over the $3 million price point, up 225 per cent over the 165 sales reported during the first quarter of 2020. Activity is brisk in the top end of the freehold market, with the percentage increase in the number of homes sold over $3 million rising into triple-digit territory in 10 of the 14 neighbourhoods examined this quarter.

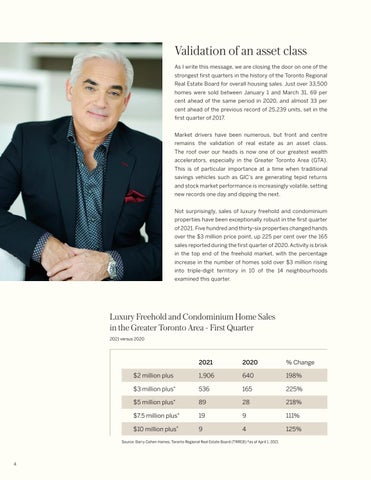

Luxury Freehold and Condominium Home Sales in the Greater Toronto Area - First Quarter 2021 versus 2020

2021

2020

% Change 198%

$2 million plus

1,906

640

$3 million plus*

536

165

$5 million plus*

89

28

$7.5 million plus*

19

9

$10 million plus*

9

4

Source: Barry Cohen Homes, Toronto Regional Real Estate Board (TRREB) *as of April 1, 2021

4

225% 218% 111% 125%