Market Commentary by Barry Cohen Buyers returned to the GTA’s luxury markets in the second quarter and summer, sparking an uptick in sales over multiple price points including the uber-luxe segment Strong demand, lots of showings, an upswing in sales and a bit of caution. That, in a nutshell, has characterized the past several months of homebuying activity at the top end of the market. After a tepid start to the year, the luxury market came alive in April and has maintained a relatively steady pace through to the end of July. Sales over $3 million have climbed more than seven per cent since April, with more than 660 freehold and condominium properties changing hands, compared to year-ago levels for the same period. Uber-luxe sales over $7.5 million have increased similarly between April and July, with sales up more than four per cent over year-ago levels. Yes, year-to-date sales are down from 2022’s heady pace, with sales over the $2 million price point declining 36 per cent to 4,797 units. Yet, recent performance shows that there is a light at the end of tunnel. Several bright spots have emerged in our analysis of freehold sales in individual neighbourhoods, including a year-to-date increase in the number of homes sold at $2 million plus in Humewood-Cedarvale (15.8 per cent); a 6.3 per cent uptick in Forest Hill North; a close to 16 per cent jump at the $3 million price point in Bedford Park-Nortown; and a bump in homebuying activity over the $5 million and $7.5 million price points in RosedaleMoore Park between January and July, compared to year-ago levels for the same period.

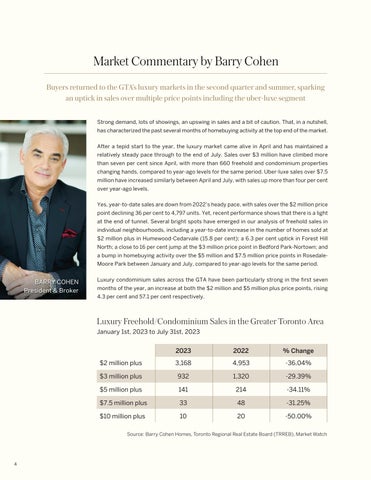

BARRY COHEN President & Broker

Luxury condominium sales across the GTA have been particularly strong in the first seven months of the year, an increase at both the $2 million and $5 million plus price points, rising 4.3 per cent and 57.1 per cent respectively.

Luxury Freehold/Condominium Sales in the Greater Toronto Area January 1st, 2023 to July 31st, 2023

2023

2022

% Change

$2 million plus

3,168

4,953

-36.04%

$3 million plus

932

1,320

-29.39%

$5 million plus

141

214

-34.11%

$7.5 million plus

33

48

-31.25%

$10 million plus

10

20

-50.00%

Source: Barry Cohen Homes, Toronto Regional Real Estate Board (TRREB), Market Watch

4