Austin Tenpenny President aDoor Properties

Josh Rayls Secretary Holiday Builders

Wilma Shortall Past 2nd Vice President The First Bank

Stephen Moorhead Legal Counsel Moorhead Law Group

Heath Kelly 1st Vice President

Heath Kelly Construction

Kevin Sluder 2rd Vice President Gene’s Floor Covering

Dax Campbell Immediate Past-President CamCon

Shon Owens Tresurer Owens Custom Homes

Janson Thomas 3rd Vice President Swift Supply

Josh Peden Financial Officer Hudson, Peden & Associates

2025 Home Builders

Association of West Florida Board of Directors

Austin Tenpenny, aDoor Properties, President

Heath Kelly, Heath Kelly Construction, First Vice President / President-Elect

Shon Owens, Owens Custom Homes, Treasurer

Josh Rayls, Holiday Builders, Secretary

Kevin Sluder, Gene’s Floor Covering, 2rd Vice President

Janson Thomas, Swift Supply, 3rd Vice President

Wilma Shortall, The First Bank, Past 2nd Vice President

Dax Campbell, CamCon, Immediate Past-President

Josh Peden, Hudson, Peden & Associates, Financial Officer

Stephen Moorhead, Moorhead Law Group, Legal Counsel

Bill Batting, FBM

Keith Branch, Good Foundations, Cost and Codes Chair

Rick Byars, Florida Power & Light

Mickey Clinard, Centennial Bank

Laura Gilmore, Fairway Ind. Mortgage, Affordable Housing Liaison

Chris Graye, Graye’s Granite

Thomas Hammond, Hammond Engineering, Civil Engineering Liaison

John Hattaway, Hattaway Home Design

Lindy Hurd, First International Title, Sales & Marketing Committee Chair

Shellie Isakson-Smith, Guild Mortgage

Mary Jordan, Gulf Coast Insurance, Tradesmen/Workforce Development

Committee Chair

Daniel Monie, KJM Land Surveying

Alex Niedermayer, Underwood Anderson & Associates

Zach Noel, Clear Title of NW FL

Suzanne Pollard-Spann, Legacy Insurance Brokers, Ambassadors Committee Chair

Marty Rich, University Lending Group

John Scanlon, Pensacola Energy

Pam Smith, Real Estate Counselors, Pensacola Assn. of Realtors Liaison

Chris Thomas, Acentria Insurance

BUILDER DIRECTORS

Chad Edgar, Joe-Brad Construction

Amir Fooladi, ParsCo, Jessica Ford, FD Builds

Fred Gunther, Gunther Properties

Thomas Henry, Thomas Homes

Alton Lister, Lister Builders, Governmental Affairs Committee Chair

Kyle McGee, Sunchase Construction

Jennifer Reese, Reese Construction Services

Douglas Russell, R-Squared Construction

Anton Zaynakov, Grand Builders

EX-OFFICIO / PAST PRESIDENT BOARD MEMBERS

Edwin Henry, Henry Company Homes

Shelby Johnson, Johnson Construction, Remodeler’s Council Chair

Russ Parris, Parris Construction Company

JENNIFER MANCINI

Executive Director jennifer@hbawf.com

Publisher Malcolm Ballinger malcolm@ballingerpublishing.com

Executive Editor Kelly Oden kelly@ballingerpublishing.com

Art Director Ian Lett ian@ballingerpublishing.com

Graphic Designer/Ad Coordinator Ryan Dugger advertise@ballingerpublishing.com

Editor Morgan Cole morgan@ballingerpublishing.com

Assistant Editor Nicole Willis nicole@ballingerpublishing.com

Sales & Marketing

Paula Rode, Account Executive paula@ballingerpublishing.com

Geneva Strange, Account Executive geneva@ballingerpublishing.com

Regina Barkley, Account Executive regina@ballingerpublishing.com

Cornerstone, the monthly publication of the Home Builders Association of West Florida serving Escambia and Santa Rosa Counties, is published monthly, twelve (12x) per year. Send address changes to HBA of West Florida, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910. Cornerstone, is published in the interests of all segments of the home building industry and is distributed to its members and others associated with the HBA of West Florida. HBA of West Florida and Ballinger Publishing does not accept responsibility for, or endorse any statement or claims made by advertisers or authors of any articles. Every effort has been made to assure ac-curacy of information, but authenticity cannot be guaranteed. No part of this publication may be reproduced without the written consent of Home Builders Association of West Florida, Copyright ©, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910, 850.476.0318. Advertisers and advertorials in Cornerstone do not constitute an offer for sale in states where prohibited by law.

Dear Members,

As we move into the final stretch of summer, I’m proud to share that our Affordable Housing Project in partnership with the City of Pensacola and Habitat for Humanity is nearing completion — and what a milestone this is for our association and community.

This project has been a shining example of what we can achieve when we come together with a shared purpose. From the very beginning, the vision was simple: to create a safe, quality, and affordable home that would provide stability and opportunity for a family in need. The execution, however, has been nothing short of extraordinary, thanks to the collective effort of so many.

To our volunteer builder members: Amir Fooladi with Parsco, Kyle McGee with Sunchase Construction, and Shelby Johnson with Johnson Construction who donated time, labor, and expertise — thank you. Your willingness to step up and lead by example truly reflects the values that make our association strong.

To our generous donors, suppliers, and subcontractors — your contributions of materials, funds, and resources helped turn blueprints into reality. Without your support, this project would not have been possible.

Projects like this not only provide much needed affordable housing but also demonstrate the power of collaboration and compassion within our industry. As we look forward to a formal dedication and handing over the keys to three deserving families, I hope each of you takes pride in the role you played.

This project is a reminder of the meaningful impact we can have beyond the job site — and why our association exists.

Let’s carry this momentum into the fall and continue working together for a stronger, more connected homebuilding industry.

Thank you all for your dedication and leadership.

Warm regards,

Austin Tenpenny President, Home Builders Association of West Florida

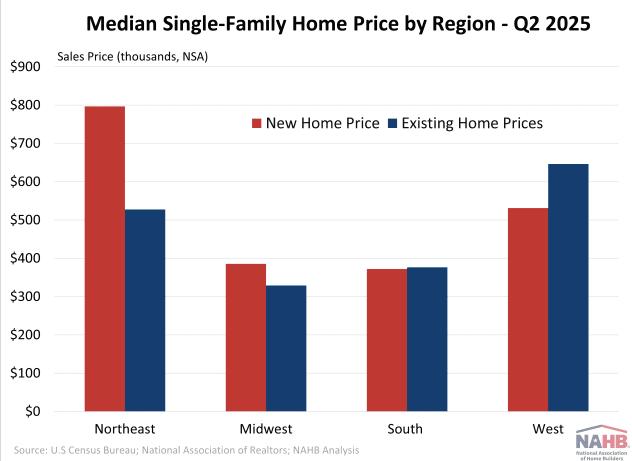

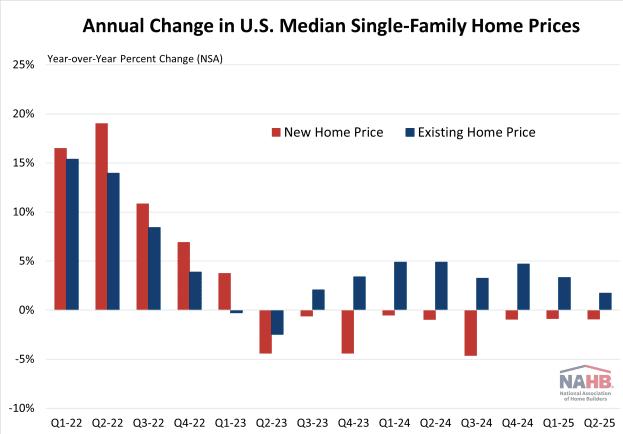

In the second quarter of 2025, the median price for a new singlefamily home was $410,800, which was $18,600 lower than the median price of existing homes, which stood at $429,400. This marks the largest historical gap where existing home prices exceeded those of new homes, according to U.S. Census Bureau and National Association of Realtors data (not seasonally adjusted – NSA)

Typically, new homes carry a price premium over existing homes. From 2010 to 2019, this pattern held steady, with an average difference of $66,000. However, over the past five years, the gap has narrowed significantly, averaging just $24,800. Notably, this trend reversed in 2024. In both the second and third quarters, the median price of existing homes surpassed that of new homes.

Both new and existing homes saw dramatic increases in prices post-pandemic due to higher construction costs and limited supply. While overall home prices remain elevated compared to historical norms, new homes prices have moderated due to tactical builder business decisions, whereas existing homes prices continue to increase because of lean supply and perhaps a lack of price discovery for existing homeowners.

Indeed, the median price for a new single-family home sold in the second quarter of 2025 decreased 0.9% from the previous year. New home prices have continued to experience year-over-year declines for nine consecutive quarters.

Meanwhile, the median price for existing single-family homes increased 1.7% from one year ago. Existing home prices have continued to experience year-over-year increases for eight consecutive quarters.

There are several factors as to why new and existing homes are selling at similar price points. Tight inventory continues to push up prices for existing homes, as many homeowners who secured low mortgage rates during the pandemic are hesitant to sell due to current high interest rates.

Meanwhile, new home pricing is more volatile – prices change due to the types and locations of homes being built. Despite various challengesfacing the industry, home builders are adapting to affordability challenges by building on smaller lots, constructing smaller homes, and offering incentives. Additionally, there has been

a shift in home building toward the South, associated with less expensive homes because of policy effects.

Moreover, the least expensive region for new homes in the first quarter was the South, with a median price of $372,100. The Midwest followed closely behind at $385,300. For existing homes, the Midwest was the most affordably region at $328,800, followed by the South at $376,300.

New homes were most expensive in the Northeast with a median price of $796,700, while the West sold at $531,100. For existing

homes, the West led as the most expensive region at $646,100 homes, followed by Northeast at $646,100.

The new home price premium was most pronounced in the Northeast, where new homes sold for $269,500 more than existing homes. The West and South followed the national trend, with existing homes priced $4,200 more than new homes in the West and $115,000 more in the South.

In a sign of NAHB’s successful efforts to make housing a top national priority, the Senate Banking Committee approved a major housing package on July 29 by a unanimous vote of 24-0.

“NAHB applauds the Senate Banking Committee for passing a bipartisan housing package to fix the housing crisis by addressing our nation’s critical lack of housing supply,” said NAHB Chairman Buddy Hughes. “Building more homes is the only way to ease America’s housing affordability crisis, and the ROAD to Housing Act includes favorable provisions aimed at zoning and land-use policies, rural housing and multifamily housing that will stimulate construction of sorely needed housing.”

The ROAD to Housing Act directs the Department of Housing and Urban Development to develop best practices with key stakeholders, such as home builders and developers, to provide state and local governments with an array of options to increase housing production. Similarly, there is a provision to reward communities that welcome housing growth with more Community Development Block Grant funding.

The legislation also provides multifamily owners an opportunity to continue participating in the rural rental assistance program after their mortgages mature. On the single-family side, income derived from accessory dwelling units can now be used to qualify for the Section 502 Guaranteed Loan Program, which also relieves the original borrower of liability when their loan is transferred and assumed by a new borrower.

For multifamily builders, the legislation calls for a study and rulemaking process that will adjust Federal Housing Administration loan limits to better reflect the true cost of construction and facilitate more apartment construction.

“We look forward to working with Congress and President Trump to enact a bicameral, bipartisan housing package that addresses supply-side and regulatory issues that are acting as barriers to build more homes,” said Hughes.

Source: NAHB

When it comes to building luxur y homes or upgrading commercial spaces along Florida’s Gulf Coast , few names are as trusted as Tradewinds Builders, LLC Based in Pensacola and ser ving the region since 2005, this fullser vice custom builder is known for its commitment to quality, innovation, and an unwavering focus on client satisfac tion.

From initial design consultations to final walk- throughs, Tradewinds Builders provides a seamless building experience tailored to each client’s unique vision

Whether you're designing your dream home f rom the ground up or transforming a tired space into something extraordinar y, their exper t team manages ever y detail permits, planning, and all the steps in between with transparency and professionalism

“ We don’t just build homes we build lasting relationships,” says Wes, founder and owner of Tradewinds Builders.

At the hear t of Tradewinds Builders is Wes, a seasoned professional whose passion for construc tion began early and has only grown stronger through decades of experience

A graduate of the University of Florida with a degree in Construc tion Management , Wes brings both technical knowledge and an eye for design to ever y projec t .

What truly sets him apar t is his wide -ranging credentials and elite recognition within the industr y. Wes holds:

A Florida State Cer tified General Contrac tor License

A Florida Cer tified Pool Contrac tor License

A Florida Real Estate License

And most notably, the distinc tion of Florida Cer tified Master Builder

This prestigious title is reser ved for a selec t group of elite builders recognized for their craftsmanship, integrity, business stability, and dedication to continuous learning. It reflec ts not just a commitment to excellence but a proven record of it

If you’re lookin g for a builder wh o listens, delivers, an d makes th e buildin g process feel effor tless, look n o fur th er than Tra dewin ds Builders, LLC

The U.S. Commerce Department has announced it is nearly tripling its anti-dumping duties on Canadian lumber importsfrom 7.66% to 20.56% following its annual review of existing tariffs.

“Commerce will now instruct U.S. Customs and Border Protection to begin collecting duties at the rates outlined in Commerce’s final results,” the U.S. International Trade Administration said in a press release.

The anti-dumping duties are in addition to current countervailing duties set at 6.74%, which would bring the total lumber duties above 27%. However, the countervailing duty rate is expected to move higher shortly, with the Commerce Department scheduled to announce its final administrative review of the countervailing order on Aug. 8. Commerce issued a preliminary determination on countervailing duties earlier this year that would raise the countervailing duty rate to 14.38%.

Moreover, President Trump in March directed the Commerce Department to launch a separate investigation under Section 232 of the Trade Expansion Act, which will examine whether lumber

imports represent a threat to national security. Such a finding could result in higher lumber tariffs above the combined antidumping and countervailing duties.

Although NAHB is disappointed by this decision to raise lumber tariffs, it is part of the regularly scheduled review process the United States employs to ensure adequate relief to American companies and industries impacted by unfair trade practices.

For years, NAHB has been leading the fight against lumber tariffs because of their detrimental effect on housing affordability. In effect, the lumber tariffs act as a tax on American builders, home buyers and consumers.

With housing affordability already near a historic low, NAHB continues to call on the Trump administration to carefully consider how placing additional tariffs on lumber and other building materials will raise housing prices and impact housing supply. We are also urging the administration to move immediately to enter into negotiations with Canada on a new softwood lumber agreement that will provide a fair and equitable solution to all parties and eliminate tariffs altogether.

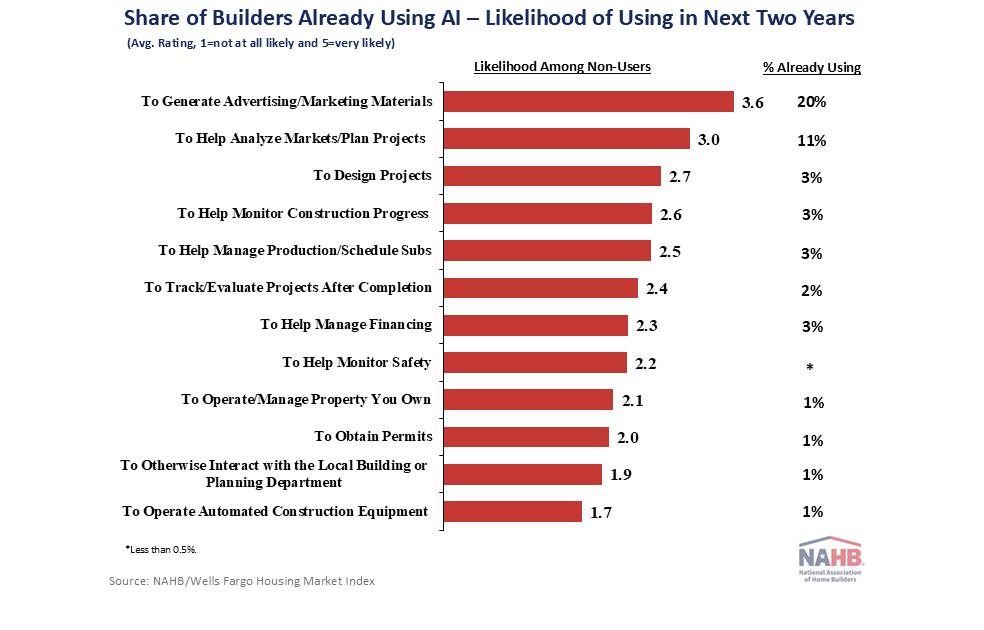

Despite the growing buzz around Artificial Intelligence (AI), most single-family home builders have yet to adopt it within their business practices.

According to survey responses in conjunction with the most recent NAHB/Wells Fargo Housing Market Index (HMI), the majority of builders are still on the sidelines when it comes to utilizing AI — but early signs suggest change might be on the horizon.

As of July 2025, AI use in single-family home building is concentrated in only a couple of business areas: About 20% of builders are using it to generate advertising and marketing materials, while 11% leverage AI to analyze markets and plan future projects.

In contrast, fewer than 5% are applying AI to any of ten other business functions — ranging from project design to operating automated construction equipment.

However, when asked how likely they are to begin using AI in the next two years, builders expressed strong interest, particularly in the areas of marketing, advertising and project planning. Nevertheless, interest in adopting AI for other business functions remains low.

Source: NAHB Eye on Housing

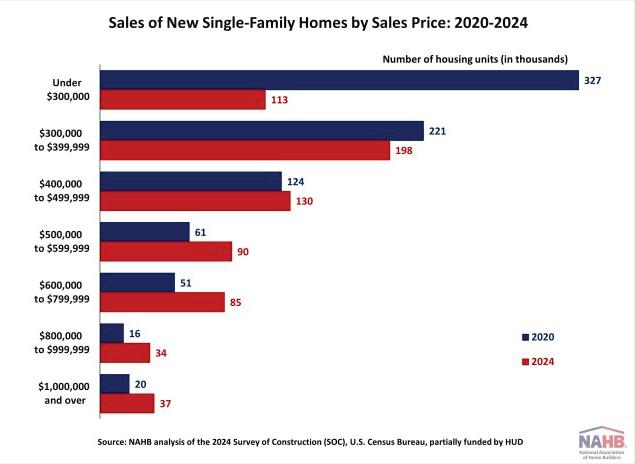

From 2020 to 2024, sales of lower-priced new homes declined significantly as the market moved toward higher-priced segments. Rising construction costs—driven by inflation, supply chain disruptions, and labor shortages—as well as higher regulatory costs, made it increasingly difficult for builders to construct affordable homes. On the other hand, low levels of inventory pushed up the price of new single-family homes, deepening the housing affordability crisis for first-time and middle-income buyers.

Data from the U.S. Census’s Survey of Construction (SOC) shows that total sales of new single-family homes declined by 17% during the 2020—2024 period. Meanwhile, the median sales price of new single-family homes increased significantly, rising from $330,900 in 2020 to $420,300 in 2024. This steep rise in sales price has placed additional pressure on prospective home buyers, particularly those seeking homes in the lower-priced segments.

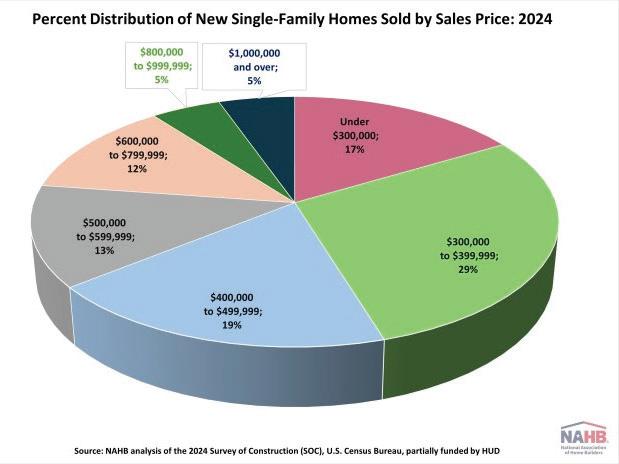

Between 2020 and 2024, the market for new single-family homes experienced significant shifts in the distribution of sales by price range. Most notably, there was a sharp decline in sales of lowerpriced homes. Homes priced under $300,000 experienced a 65% decline in sales, while sales of homes priced between $300,000 and $399,999 fell by 10%. In contrast, higher-end segments saw substantial growth, with sales of homes priced between $800,000 and $999,999 more than doubling and those priced at $1,000,000 or more increasing by 85%.

The market share of lower-priced homes declined dramatically. In 2020, homes priced under $300,000 accounted for 40% of the total new single-family home sales, making them a dominant category. By 2024, this category had dropped to the third largest, overtaken by homes in the $300,000—$399,999 and $400,000—$499,999 ranges. Meanwhile, the share of higher-priced homes expanded, reflecting a broader shift toward more expensive construction and away from affordability.

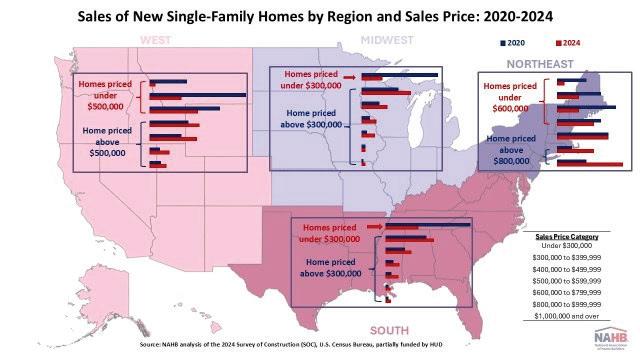

The regional picture mirrors these national trends, though the magnitude and affected price category vary by geography. Between 2020 and 2024, all four regions—the Northeast, Midwest, South, and West—saw declines in new home sales. The West experienced the steepest drop at 28%, followed by the Midwest at 14%, the South at 13%, and the Northeast at 8%. The declines mainly reflect significant declines in lower-priced home sales.

In the Midwest and South, the declines in new home sales were limited to homes priced under $300,000. In the Northeast and West, where the regions tend to have higher median home prices, sales declines occurred in multiple price categories. The Northeast saw a broader decline in new homes sold under $600,000, while new home sales in the West reported declines in three price categories under $500,000.

Furthermore, all four regions also experienced a decline in the market share of lower-priced homes. In 2020, more than half of the new homes sold in the Midwest and South were priced under $300,000. By 2024, that share had plummeted to just 16% in the Midwest and 23% in the South. The Northeast and West also saw notable shifts, with the share of homes priced between $300,000 and $499,999 dropping sharply over the same period.

The National League of Cities (NLC) welcomes several new partners to America’s Housing Comeback, an initiative of the Housing Supply Accelerator, to build federal-local and public-private partnerships to support local governments’ ongoing housing supply efforts and ignite a federal focus on policy solutions for addressing the nation’s housing shortage.

Earlier this year, NLC announced the formation of America’s Housing Comeback and is adding the American Planning Association (APA), the National Association of Home Builders (NAHB) and the National Association of Realtors® (NAR) as campaign partners. America’s Housing Comeback aims to accelerate the housing successes of local governments using the solutions, systems and partnerships approach outlined in the Housing Supply Accelerator Playbook.

“Housing attainability is a top priority for cities regardless of size, but addressing housing at scale also means upgrading or expanding public infrastructure, investing in skills training and growing the workforce, and improving systems that safeguard the health and safety of our nation’s housing stock. Local leaders are ready to build and improve the partnerships necessary to address these and other issues fundamental to housing supply,” said Clarence E. Anthony, CEO and Executive Director of the National League of Cities.

“NLC is thrilled to welcome our partners who are essential for Americas Housing Comeback. Together, local governments, community planners, home builders, realtors® can collaborate and ensure we are all aligned to solve this national housing supply challenge together.”

“Expanding housing supply and increasing affordability is a complex challenge affecting all our communities, and finding solutions requires

collaboration and partnership,” said Sue Schwartz, FAICP, President, American Planning Association.

“America’s Housing Comeback creates a powerful approach to strengthening the connections between the public and private sectors needed to make a real difference. Planners are excited to bring our expertise and insights into working with our partners at NLC, NAHB and NAR to craft the practical and powerful solutions to address the nation’s housing crisis.”

“NAHB is pleased to partner with the National League of Cities and join its America’s Housing Comeback campaign, an initiative that is focused on implementing strategies that will increase the nation’s housing supply,” said Jim Tobin, CAE, President and CEO, National Association of Home Builders. “Building more homes is the only way to solve America’s housing affordability crisis and this requires collaboration among all levels of government. We look forward to working with this coalition to build public-private partnerships that address supply-side, zoning and regulatory barriers that hinder the construction of new homes and apartments.”

“A hallmark of NAR advocacy is our ability to bring respected research and policy to the table at the state, local and the federal levels. This partnership with NLC, APA and NAHB will be another important tool in our toolbox to increase housing supply and build on the momentum for action to address affordability, said Shannon McGahn, Executive Vice President and Chief Advocacy Officer, National Association of REALTORS®. “NAR is honored to be joining the America’s Housing Comeback initiative and continuing to advocate for homeownership.”

Source: NAHB

PRESENTING SPONSOR $2,000 (1)

• Includes complimentary 4 person shooting team

• Complimentary golf cart

• Logo and company name on Banner

• Sponsor will be referred to as the Presenting Sponsor for the Clay Shoot and will appear in all promotional event materials.

• Prominent recognition with logo on Scorecards.

• Recognition on HBA Website, Cornerstone magazine and Facebook.

• Company banner will be prominently displayed during the event (company to provide banner)

PRIZE SPONSOR $1000 (1)

• Sponsor will be verbally recognized at event

• Sponsor may present awards to tournament winners

• Sponsor will have signage at event

• Recognition on HBA Website, Cornerstone and Facebook.

BREAKFAST/COFFEE SPONSOR $500(2)

• Breakfast and Coffee to be provided by HBA

• Sponsor will be verbally recognized at event

• Sponsor logo displayed on table signage

• Recognition on HBA Website, Cornerstone and Facebook

•

•

•

•

•

In construction, a spike is a steel object that is essential to making a building strong. As in construction, the HBA of West Florida sees a Spike as someone that works to keep our association strong. Spikes work on the recruitment and retention of members in addition to keeping members active with the association. Anyone is eligible for Spike status. On Spike credit is awarded for each new member recruited and an additional credit is awarded for that new member’s renewal on or before their anniversary date. If you help to retain a member, you are eligible to receive a half point for each member.

Spike Candidate 1-5 Credits

Blue Spike 6-24

Life Spike 25-49

Green Spike 50-99

Red Spike 100-149

Royal Spike 150-249

Super Spike 250-499

Statesman Spike 500-999

Grand Spike 1000-1499

All-Time Big Spike 1500+ Spike Club Members and their credits as of 03/31/2025.

Statesman Spike

Harold

Super Spike

Rod Hurston

Royal Spike

Rick Sprague

William “Billy” Moore

Charlie Rotenberry

Oliver

Green Spike

Spike Credits

Shelby

Stud-to-plate connectors

Thr eaded rod systems