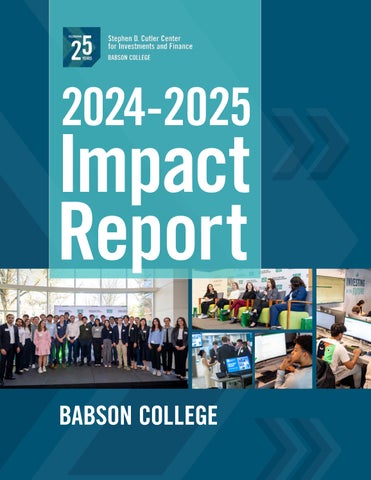

2024-2025 Impact Report

Our Mission

The Stephen D. Cutler Center for Investments and Finance is dedicated to advancing finance education and improving the marketability of Babson students. We provide programs and cutting-edge resources that enrich the student learning experience, support faculty research, and engage our alumni community. We’re committed to furthering Babson’s innovative and practical approach to finance education and enabling industry practitioners, faculty, and students to collaborate and learn from one another.

The Cutler Center

@BabsonFinance

/cutlercenter

CONNECT With Us:

/cutler-youtube

babson.edu/finance-institute/

“ The Cutler Center fosters experiential learning opportunities by providing students and professors with the leading tools and techniques used throughout the finance and investment industry. This hands-on experience, coupled with strong mentorship and a robust network of recent graduates and seasoned alumni, provides Babson finance students with a significant competitive edge to succeed in their careers and professional growth.”

Marco Gargurevich MBA’01, Head of Strategic Initiatives, Geode Capital Management Chair of Cutler Center Advisory

MESSAGE FROM THE MANAGING DIRECTOR

Celebrating 25 Years of Impact and Innovation

As we mark the 25th anniversary of the Stephen D. Cutler Center for Investments and Finance at Babson College, we reflect on the incredible journey that has shaped our mission and strengthened our commitment to experiential learning, mentorship, and industry engagement. This milestone underscores our dedication to empowering students with the knowledge, skills, and real-world experiences that prepare them for success in the evolving finance landscape.

Throughout the 2024–2025 academic year, the Cutler Center has expanded its impact by promoting hands-on learning opportunities. Our state-of-the-art finance lab, currently equipped with 42 workstations and 25 Bloomberg terminals, continues to act as a hub for students and faculty, supporting coursework, competitions, and career development. The Babson College Fund, managed by undergraduate and graduate students, has grown to $6.4 million, showcasing the power of applied investment management.

This year, we also celebrated remarkable achievements in student competitions, including Babson’s first-place finish in the local CFA Institute Research Challenge, which continues a legacy of excellence in financial analysis. Our FinTech Startup Pitch Competition awarded $4,500 in cash prizes, fostering innovation and entrepreneurship among our students.

The Cutler Center remains dedicated to bridging the gap between academia and industry through thought leadership events, panel discussions, and seminars. We welcomed over 900 attendees across 17 events, featuring distinguished professionals who shared their insights on fintech, wealth management, and value investing. Our mentor program facilitated 38 new connections between students and alumni, highlighting the significance of professional guidance in shaping careers.

None of this would be possible without the steadfast support of our advisory board, faculty, alumni, and industry partners. Their dedication ensures that the Cutler Center remains a leader in finance education, providing students with the tools and networks they need to thrive.

As we look ahead, we remain focused on innovation, collaboration, and the ongoing success of Babson finance students. Thank you for being part of this journey—we are excited about the future and the opportunities that await us.

Regards,

Patrick Gregory, CFA

Managing Director, Stephen D. Cutler Center for Investments and Finance Faculty Director, Babson College Fund (BCF) Professor of Practice, Finance Division, Babson College

25 Years of Elevating Finance and Student Opportunities at Babson

POSITIONING OUR STUDENTS AND OUR COLLEGE FOR SUCCESS

#2 COLLEGE IN THE U.S. – Wall Street Journal

» 33% of ranking criteria based on salary impact, and Babson students entering finance careers average the highest starting salaries in their class

CLASS OF 2024

» Financial Services: Top Employing Industry (32%)

» $87,295: Average Starting Salary (Highest in Class)

MSF CLASS OF 2024

» 98% Employed Within 6 Months

MBA CLASS OF 2024

» Financial Services: 2nd-Highest Employing Industry (18%)

A LOOK BACK AT THE LAST 25 YEARS:

» The Center was founded in 2000 with a generous gift from Stephen D. Cutler, MBA’61 and his wife, Alice.

» The Center was pleased to receive a gift from Carlton (Carl) F. Kilmer MBA’69 in June 2009, which allowed it to greatly increase its programs and resources.

» Through financial support from the Cutler Center Advisory Board, the finance lab expanded in the fall of 2019, moving to the newly created Babson Commons.

DEVELOPING TOMORROW’S FINANCE LEADERS, TODAY

The Stephen D. Cutler Center for Investments and Finance enhances Babson’s innovative and practical approach to finance education through programs and resources that enrich the student learning experience, support faculty research, and engage our alumni community.

» State of the Art Finance Lab: To prepare students for a career in finance, the Cutler Center provides access to state-of-the-art information resources and educational opportunities in and outside the classroom.

» Experiential Learning Programs: The Cutler Center offers Babson students unique opportunities to learn, build valuable skills, and lead outside the classroom through various experiential learning programs.

» Thought Leadership Events: The Cutler Center hosts and sponsors various conferences and events throughout the academic year. These events allow Babson students, faculty, and alumni to learn, network, and innovate collaboratively.

THE CUTLER CENTER’S FUTURE

At the Cutler Center, we continually enhance and expand our programming and resources to support and engage with more students, faculty, and alumni. Our achievements over the past 25 years have been made possible by the dedication and generosity of our donors and partners. With your support, the Cutler Center can continue to build on Babson’s innovative and practical approach to finance education and prepare students for career success for generations to come.

Cutler Center

42 WORKSTATIONS INCLUDING 25 BLOOMBERG TERMINALS

1ST PLACE FINISH IN THE LOCAL CFA INSTITUTE RESEARCH CHALLENGE, WINNING FOR THE SEVENTH TIME IN THE LAST NINE YEARS

$6.4M PORTFOLIO MANAGED BY UNDERGRADUATE AND GRADUATE STUDENTS

8 FINANCE LAB STUDENT ASSISTANTS ON STAFF TO ASSIST STUDENTS AND FACULTY WITH CLASS ASSIGNMENTS AND HOMEWORK

900+ STUDENTS, STAFF, FACULTY AND ALUMNI ATTENDED 17 PROGRAMS AND EVENTS ON OUR WELLESLEY AND BOSTON CAMPUSES

38 MATCHES WERE MADE BETWEEN STUDENTS AND ALUMNI FOR OUR CUTLER CENTER MENTOR PROGRAM

$4,500 IN CASH PRIZES WERE AWARDED TO STUDENTS AT THE THIRD ANNUAL BABSON FINTECH STARTUP PITCH COMPETITION

120 ALUMNI AND FRIENDS HAVE VOLUNTEERED

TO BE A PART OF A PROGRAM OR EVENT THAT HELPS SUPPORT OUR FINANCE STUDENTS

State-of-the-Art Finance Lab

The Cutler Center Finance Lab sits at the heart of campus and features 42 workstations with various analytical tools that industry professionals use. The facility provides Babson students with unique opportunities to learn and lead through learning experiences designed to prepare them for successful careers in financial services.

When not utilized as a classroom, the finance lab is open to all Babson students and staffed by our Cutler Center student assistants, who are trained on multiple financial research resources and can assist with research and assignments during library hours.

During the 2024-25 academic year in the finance lab:

» 6 finance and real estate faculty members taught their courses in the finance lab

» 6 student organizations hosted their events and programs in the finance lab

» 8 student assistants were on staff to assist students and faculty with class assignments and homework

» 8 Cutler Center programs for finance students were hosted in the finance lab

» 15 finance and real estate courses were taught in the finance lab

» 373 of students in those courses

OUR LAB OFFERS A WIDE ARRAY OF ANALYTICAL TOOLS: Bloomberg, Capital IQ, ESG Direct, FactSet, Morningstar, Rotman Interactive Trader, S&P Net Advantage, WRDS

Experiential Learning:

Babson College Fund (BCF)

The Babson College Fund is an accredited two-semester program that allows a select group of undergraduate and graduate students to manage $6.4 million of the Babson College endowment, gaining investment research and portfolio management skills and practical experience. Students conduct fundamental and quantitative research, pitch their ideas, and work with experienced money managers to create a diversified, long-short equity portfolio.

BCF PARTICIPANTS RECENTLY RECEIVED JOB OFFERS FROM THE FOLLOWING FIRMS:

Canaccord Genuity, Guggenheim, Lincoln International, Loop Capital, RBC Capital Markets, Rothschild & Co., Vanguard

PORTFOLIO SNAPSHOT

In the last five years, the student fund managers have consistently out-performed the S&P 500:

The Babson College Fund recruits students three times during the year: fall, spring, and summer, to participate in the two-semester course.

Complete details about the recruiting cycle, and current list of student fund managers can be be found on our website.

Experiential Learning:

Student Competitions

CFA INSTITUTE RESEARCH CHALLENGE

CFA INSTITUTE RESEARCH CHALLENGE 1ST PLACE FINISHES

The last seven out of nine years:

2025 | Babson College » Akamai

2024 | Babson College » Toast

2023 | Babson College » BJs

2022 | Babson College » Akamai

2021 | Babson College » Rapid7

2019 | Babson College » CarGurus

2017 | Babson College » Global Partners LP

Babson College extended its dominance at the CFA Society Boston’s local research challenge, winning the competition for the fifth consecutive year and the seventh time in the past nine years. The team was comprised of Arnav Doshi ’25, Danny Klatt ’25, Khadija Khan MSF ’25, Shane Kelly ’25, and Felipe Viseu ’25, who have also participated in the Babson College Fund. The CFA Institute Research Challenge is an annual global competition in which students—with hands-on mentoring and intensive training in financial analysis and professional ethics—gain real-world experience as they assume the role of research analysts. They are judged by a group of industry experts on their ability to value a stock, write a research report, and present their recommendations. Faculty advisor Patrick Gregory and industry mentor David Wellinghoff MBA’07 supported the team.

ROTMAN INTERNATIONAL TRADING COMPETITION

Babson College placed seventh out of 35 leading international universities at the 2025 Rotman International Trading Competition. The team comprised Emilio Oliva ’25, Wanrong (Sloane) Zhu ’25, Liubov Mykhailyshyn MSF’25, and Carlos Roberto Dias Neto MSF’25, supported by faculty advisor Ryan Davies. The Rotman International Trading Competition (RITC) is an annual event that brings teams of students and their faculty advisors from universities worldwide to participate in a unique two-day simulated market challenge. The competition includes teams from leading universities such as Columbia University, Cambridge University, New York University, and Carnegie Mellon.

BABSON TRADING COMPETITION

Sponsored by Fidelity Investments, the 14th annual Babson Trading Competition brought a limited number of Babson students to the Cutler Center Finance Lab for the sales and trading competition. Special thank you to the Fidelity team of Ken Martin ’95, Mettler Growney, Mahitha Valluru, Zach Haggerty who spoke with students before the competition about the trading operations at Fidelity Investments.

(Left to right) 1st : Carlos Roberto Dias Neto MSF’25, 2 nd : Napat (Oak) Kornsri ’24, MSF’25, 3 rd : ShengXun (William) Sun ’26, 4th : Liubov Mykhailyshyn MSF ’25, 5th : Emilio Oliva ’25.

Experiential Learning:

Babson FinTech Start Up Pitch Competition

In conjunction with undergraduate and graduate fintech courses, the Cutler Center hosted the third annual Babson FinTech Start Up Pitch Competition. Five teams from the course, taught by professor Linghang Zeng, presented their start-up ideas to a group of esteemed fintech professionals for the opportunity to win cash prizes.

SPECIAL THANK YOU TO THE JUDGES:

» Jason Hoch, Deputy Director, Innovation Institute

» Peter Gordon MBA’96, Founder and Managing Partner, Atlantic Fintech Advisors

» Benjamin Narasin ’87, Founder and General Partner, Tenacity Venture Capital

» John Reed Stark P’27, President, John Reed Stark Consulting

TOP 3 WINNERS & PRIZE AMOUNTS

1st PLACE: OneStream » $2000

Kunru Li ’25

2nd PLACE: Finny » $1500

Arshia Tadipatri ’26

Aryan Shanker ’26

3rd PLACE: Bondly » $1000

Valentina Schone MSF ’25

Ike Kanu MSF ’25

Seminars & Workshops Experiential Learning:

ESSENTIALS OF VALUE INVESTING SEMINAR

Select undergraduate and graduate students participated in a yearlong seminar series with Gary Mishuris, CFA, Managing Partner and CIO of Silver Ring Value Partners. Throughout the seminar, readings such as Benjamin Graham’s Security Analysis and Warren Buffett’s Partnership Letters are used to discuss the investing philosophies and processes of successful value investors. Students can use the insights from the readings to build an internally consistent value-investing framework that suits their strengths.

FINANCIAL MODELING BOOTCAMP

The Cutler Center partnered with Michael Silk of Training the Street to offer financial modeling experience. During this training session, students learned how to build a fully integrated three-statement model by forecasting the income statement, balance sheet, and cash flow statement using various assumptions. The seminar required participants to build several models of different levels of difficulty, starting with an extremely simple model and ending with a robust circular model. This teaching method ensures that building blocks and links between the forecast financial statements are fully understood.

UWIN INFO SESSION

Hosted by UWIN Founder and Credit Research Co-Director at Loomis Sayles, Shannon O’Mara, students were offered an overview of the program that offers mentorship and internship opportunities, professional development, and technical skills to undergraduate students interested in business, finance, accounting, data science, mathematics, economics, or financial markets.

Thought Leadership: PANEL DISCUSSIONS

Panel Discussions

Finance 101: An Intro to a Career in Finance

In partnership with the Undergraduate and Graduate Centers for Career Development, we hosted a panel of Babson alumni who discussed the day-to-day responsibilities of finance jobs, the skills necessary to succeed in their respective sectors, and how they entered these competitive fields. A special thank you to:

» Sarah Whitaker Clemente ’14, Director, Healthcare Investment Banking, Piper Sandler & Co.

» Alex Friedberg ’12, Co-founder, BXB Capital

» Mindy Freedman ’18, Vice President, Direct Indexing Specialist, Fidelity Investments

» Ben Simon ’14, Private Wealth Advisor, Goldman Sachs

» Kate Will ’18, Offshore Renewable Energy, Portfolio Associate, Triton Systems

Boston FinTech Week: Al and Investing: Analyzing the Current Trends and Opportunities

As part of Boston FinTech Week, a group of industry experts came together to discuss how artificial intelligence (AI) has significantly impacted the field of investing in recent years and how to make more informed decisions, optimize strategies, and manage risk more effectively. Special thank you to Sri Krishnamurthy, CFA, CAP, CEO of QuantUniversity; Kleida Martiro, Partner at Glasswing Ventures; Anish Shah, PhD, CFA, Financial Engineering at Smartleaf Asset Management; Dushyant (D) Shahrawat, Director of FinTech Investment Banking at Rosenblatt Securities, and Arun Verma, PhD and Head of Quantitative Research Solutions at Bloomberg, LP.

Exploring Careers in Wealth Management

In honor of Women’s History Month, the Cutler Center hosted a panel discussion with a group of incredible women from the wealth management sector. Our undergraduate and graduate students gained valuable insights into the world of wealth management, its significance in the financial industry, and the diverse roles available. A very special thank you to our speakers: Kathleen Kenealy ’03, CFP®, CPWA®, Founder, Katapult Financial Planning, Nancy Marchand MBA’20, Private Wealth Advisor, Goldman Sachs, Kerri McKeever ’02, MBA’09, CFA, Assistant Professor of Practice, Babson College, Leticia D. Stallworth ’99, MBA‘13, CRPCTM, Financial Advisor, Ameriprise Financial Services, LLC, Ruzanna Queenan MBA’13, CFA, President, Queenvest LLC.

CFA, CAIA & CFP®: Understanding Industry Designations and the Path to Financial Excellence

We welcomed a group of professionals for a panel discussion and networking reception focused on the Chartered Financial Analyst (CFA), Chartered Alternative Investment Analyst (CAIA), and CERTIFIED FINANCIAL PLANNER™ (CFP®) financial designations. This program was designed for students to clarify these three designations to help enhance their career prospects. Special thank you to Kenechukwu Anadu MBA’10, CFA, CAIA, VP, Unit Co-Head, Federal Reserve Bank of Boston & CFA Society Boston Board Member, Georgia Bruggeman MBA’88, CFP, Founder/CEO, Meridian Financial Advisors, LLC, Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP, Managing Director, Global Content Strategy, CAIA Association and Glenn Migliozzi, CFA, Professor of Practice, Finance Division at Babson College.

Thought Leadership: Faculty Research

The Cutler Center supports Babson faculty as they pursue vital research, develop intellectually rigorous programs, and deliver engaging lectures.

SEMINAR SPEAKER SERIES

The Cutler Center sponsors the Seminar Speaker Series, which allows faculty to build relationships in the academic community and exchange ideas with other top researchers.

Featured speakers during the 2024 -25 academic year included:

» Ran Duchin, Coughlin Family Professor, Carroll School of Management at Boston College, presented his paper, “Between Boardrooms and the Beltway.”

» Anya Mkrtchyan, Judith Wilkinson O’Connell Faculty Fellow Associate Professor of Finance, Isenberg School of Management at the University of Massachusetts, presented her paper “Creativity Without Walls, The Case of Open Innovation”

» Ishita Sen, Assistant Professor of Finance, Harvard Business School, presented her paper, “Climate Risk and the U.S. Insurance Gap: Measurement, Drivers and Implications”

» Felipe Severino, Associate Professor of Business Administration, Tuck School of Business at Dartmouth College, presented his paper “Annuities and Endogenous Longevity”

» Fabricius Somogyi, Assistant Professor of Finance, D’Amore-McKim School of Business at Northeastern University, presented his paper, “Monetary Policy Transmission through the Exchange Rate Factor Structure”

FACULTY RESEARCH

Featured research papers from the 2024-25 academic year include:

» Bowen, Donald E., Taillard Jérôme P, (2025). Revisiting board independence mandates: Evidence from director reclassifications, Review of Finance, Volume 29, Issue 3, May 2025, 747–777.

» Truong, Chi, Goldstein, Michael A., Malavasi, Matteo, (2024). Timing is (almost) Everything Real Options, Climate Adaptation, Extreme Value Theory and Flood Risk Management, Journal of Environmental Management, forthcoming.

» Abedin,Mohammad Zoynul, Goldstein, Michael A., Malhotra, Nidhi, Yadav, Miklesh Prasad, (2024). Middle East conflict and energy companies: The effect of air and drone strikes on global energy stocks, Finance Research Letters, Volume 69, Part A, November 2024, 106009, ISSN 1544-6123.

» Abedin, Mohammad Zoynul, Goldstein, Michael A., Huang, Qingcheng, Zeng, Hongjun, (2024). Forward-looking disclosure effects on stock liquidity in China: Evidence from MD&A text analysis, International Review of Financial Analysis, Volume 95, Part B, October 2024, 103484, ISSN 1057-5219.

» Ahmed, Danish, Xuhua, Hu, Goldstein, Michael A., Xie, Yuantao, (2024). Do Global Uncertainties Impede Insurance Activity? – Empirical Evidence from Two Top Economies, Finance Research Letters, Volume 67, Part A, September 2024, 105735, ISSN 1544-6123.

» Gilje, E.P., Taillard, J.P., Zeng, L., (2024). Human Capital Reallocation Across Firms: Evidence from Idiosyncratic Shocks, The Review of Corporate Finance Studies, 2024;, cfae014.

» Chava, S., Oettl, A., Manpreet, S., Zeng, L., (2024). Creative Destruction? Impact of E-Commerce on the Retail Sector, Management Science, 70(4), 2168-2187.

Commencement 2025

Babson College honors graduating Undergraduate Seniors each year with awards from Babson College divisions, departments, and notable supporters. Four of our seniors were honored, including the Carroll W. Ford Scholarship awarded to a Cutler Center Finance Lab student assistant for the fourth year.

UNDERGRADUATE AWARD WINNERS:

Khushi Chindaliya1 – Student Contribution Award

Presented to seniors for their meaningful contributions to student life and the Babson community.

Madison Roberts2 – Student Contribution Award

Presented to seniors for their meaningful contributions to student life and the Babson community.

Emilio Oliva3 – Economics Achievement Award

Presented to a senior who had taken four or more Economics courses and had outstanding scholarship, initiative, and resourcefulness, in the field of Economics.

Emilio Oliva3 – Babson College Finance Award

Presented to a senior who will have taken at least four or more Finance courses and has completed the most distinguished academic record in the field of Finance.

Nolan Card4 – Wallace P. Mors Award

Presented to a senior for outstanding performance in Finance and division activities.

Emilio Oliva3 – Carroll W. Ford Scholarship

Presented to the graduating senior who has the highest GPA in the class.

UNDERGRADUATE FACULTY OF THE YEAR:

» Ahmed Ahmed, Assistant Professor GRADUATE AWARD WINNERS:

» Fatema Rani Presswala MSF’25 – Award for Academic Excellence — MSF Program Highest GPA

» Stephen Connelly MBA’25 – Finance Division Award MBA

» Nikolaos Kritsikis MSF’25 and Duncan Robert Sutherland MSF’25

Alumni Engagement

Alumni have countless ways to stay connected with the Stephen D. Cutler Center for Investments and Finance. Here are a few highlights from the 2024-25 academic year:

» Host a company info session

Three alumni from various industries hosted info sessions about the companies they work for, including highlighting available internships and job opportunities at the time. Each info session featured a presentation from the alumni guest, followed by audience Q&A from the students in attendance. Special thank you to Craig Tessimond ’00, Houlihan Lokey (investment banking), Gregory Galimberti ’10, TotalEnergies (energy markets), and Ben Simons ’14, Goldman Sachs (private wealth management).

» Volunteer as an Executive in Residence

Our Executives in Residence are industry professionals who generously volunteer their time and energy to enhance the educational experience for students through mentorship. The Cutler Center has 19 alumni, faculty, and friends serving as Executives in Residence for the Babson College Fund and Private Equity courses.

» Join as an Advisory Board Member

The Cutler Center advisory board comprises 18 alumni, parents, and friends who offer guidance to the Managing Director of the Cutler Center on key principles that influence the center’s growth. This involves setting priorities, developing long-term plans, assisting with fundraising, and serving as ambassadors for both the Center and the finance division. All these efforts strive to enhance the profile of the Center and Babson College.

» Sign up to be a Mentor

The Cutler Center mentor program connects undergraduate and graduate students with industry professionals from the global finance sector. Mentors are paired with students majoring in finance to broaden the students’ networks, support career development, and provide advice, guidance, and feedback. We appreciate the 38 alumni and faculty mentors who participated in the program this year.

» Speak on a Panel Discussion

The Cutler Center hosts various panel discussions throughout the academic year, covering topics from fintech and wealth management to financial designations. Each panel discussion is designed to invite alumni and industry professionals to campus to share their knowledge with the Babson community. This year, the Cutler Center welcomed 20 alumni and faculty speakers across four panels on our Wellesley and Boston campuses.

Featured Partnerships

Babson College is a proud member of the CFA Institute’s University Affiliation Program and Bloomberg’s Experiential Learning Partner Program.

CFA INSTITUTE UNIVERSITY AFFILIATION PROGRAM

Through the CFA Institute University Affiliation Program, students have access to a suite of benefits as they prepare for the CFA Program, including:

» 9 annual scholarships

» Access to the CFA curriculum (Levels I, II, and III)

» Practice Exams (Levels I, II, and III)

BLOOMBERG EXPERIENTIAL LEARNING PROGRAM

Babson was the inaugural recipient of Bloomberg’s Experiential Learning Partner program. The Bloomberg ELP is designed to recognize academic institutions that are leaders in experiential learning by integrating Bloomberg terminal exercises in their curricula.

MASS FINTECH HUB

Mass Fintech Hub is a public-private partnership comprising a network of fintech leaders, financial experts, academics, public sector leaders, and venture capitalists who empower fintech startups to achieve success.

CHARTERED ALTERNATIVE INVESTMENT ANALYST (CAIA) ASSOCIATION

ACADEMIC PARTNER PROGRAM

The CAIA Academic Partnership program connects leading universities and students with the global network of alternative investment professionals. Through this collaborative relationship, institutions gain access to CAIA’s extensive resources, research, and industry connections, helping shape the next generation of investment leaders.

Leadership

PATRICK GREGORY, CFA Professor of Practice, Faculty Director, BCF, Senior Lecturer, Finance Division 781-239-3895 pgregory@babson.edu

FARRAH NARKIEWICZ

Marketing & Events Manager

781-239-4448 fnarkiewicz@babson.edu

LESLIE ROMIZA Program Manager

781-239-5115 lromiza1@babson.edu

MARK POTTER Professor Division Chair 781-239-6492 potterma@babson.edu

Advisory Board

» John Bailer ’92, CFA, Deputy Head of Equity Income, Portfolio Manager, Newton Investment Management Group

» Brian Barefoot ’66, H’09, P’01, Senior Advisor, Carl Marks Advisors

» Chris Chandor MBA’98, Senior Vice President of Development & Asset Management, The Davis Companies

» Karen Chandor MBA’74, Principal, Mercer

» Anthony Chiasson ’95, Chief Investment Officer, Aurmedis Global Investors LP

» Eric Crawley MBA’09, Director, Investment Strategist, Bank of America

» Chip Dickson ’74, MBA’76, CFA, Co-Founder, DISCERN

» Marco Gargurevich MBA’01, Head of Strategic Initiatives, Geode Capital Management

» Bruce Herring ’87, P’19, CFA, President, Strategic Advisers, Asset Management Division, Fidelity Investments

» Jeff Mortimer ’86, CFA, Director, Investment Strategy, BNY Mellon Wealth Management

» Jason Orlosky ’04, Chief Strategist & Managing Director, Bridgeway Wealth Partners LLC

» Nick Platt P’23, Partner/Chief Operating Officer/Chief Compliance Officer, Kudu Investment Management

» Annabelle Reid MBA’86, Managing Partner, FoxMoor Capital

» James Spencer ’73, CFA, Former SVP & Chief Investment Officer, Cambridge Trust Company

» Rick Spillane, CFA, Director, Eaton Vance Management

» Joseph Spinelli ’98, Trader, Millennium Management

» Jim Taylor ’86, Managing Director and Wealth Partner, J.P. Morgan Wealth Management

» Catherine Friend White MBA’86, Managing Director, Golden Seeds

Executives in Residence

Babson College Fund Executives in Residence

» Pratima Abichandani, Retired Mutual Fund Manager

» Aditya Agarwal ’22, Private Equity Associate, NexPhase Capital

» Matthew Apkarian, CFA MBA’20, Investment Manager, Strategic Advisers LLC, Fidelity Investments

» Lucas Brown ’07, MSF ’22, Entrepreneur & Investor

» Edward Ciancarelli, CFA, ’00, Principal & Senior Portfolio Manager, The Colony Group

» Richard Grasfeder, CFA, MBA’05, Managing Director, Senior Portfolio Manager, First Citizens Bank

» Patrick Gregory, CFA, Managing Director, Stephen D. Cutler Center for Investments and Finance, Faculty Director, Babson College Fund Director, Senior Lecturer

» John Hickling, CFA, Retired Hedge Fund Manager

» George Massey MBA’20, MSF’21, Managing Member, Ellisville Harbour Partners

» Edward Perkin, Former Chief Investment Officer, Morgan Stanley

» Peter Saperstone, Partner, Greycroft

» James Spencer, CFA ’73, Former CIO, Cambridge Trust Co.

» Holland Ward MBA ’98, Retired Hedge Fund Manager

Private Equity Executives in Residence

» Steve Achatz ’07, Principal, Volition Capital

» Mark Jrolf ’86, Managing Senior Partner, New Heritage Capital

» Rob Nicewicz ’07, Partner, Abry Partners

» Jessica Reed ’03, Partner, Alta Equity Partners

» David Sargent ’82, Senior Advisor, Statesman Business Advisors

“The Cutler Center is a critical component of students’ education in finance and investments, giving them the tools to hit the ground running when they enter the workforce.”

– James Spencer ’73 , CFA, Former SVP & Chief Investment Officer, Cambridge Trust Company

babson.edu/finance-institute/