Copper World, a wholly-owned subsidiary of Hudbay Minerals, selected several companies in June to conduct feasibility studies and drive early-stage project development for the Copper World project. This milestone marks the continued advancement of the fully permitted mine that is one of the most significant economic development projects in Southern Arizona’s history.

The selected firms include Arizona-based Sundt Construction and M3 Engineering & Technology Corporation, each with extensive experience delivering complex infrastructure and mining projects across the state. They are joined by Ames Construction, DRA Global Limited, Knight Piésold, Mipac, and Stantec. Together, these firms bring a wealth of expertise in mine design, infrastructure development, mineral processing and environmental management.

Located 28 miles southeast of Tucson, Copper World is a fully permitted project that is expected to generate significant benefits for the community and local economy. Over the anticipated 20year life of the fully permitted mine, Hudbay expects to contribute more than $850 million in U.S. taxes, including over $420 million in state and local taxes. Copper World is also projected to create over 400 direct jobs and up to 3,000 indirect jobs in Arizona.

In July, a group of nearly 40 pre-apprentice electricians packed over 28,000 meals last week to fight global hunger. These high school students, studying in Canyon State Electric’s (CSE) summer pre-apprenticeship program, dedicated a day of the program to community service— helping international charity Feed My Starving Children.

CSE’s pre-apprenticeship program allows students to experience the electrical trade through interactive classroom sessions, hands-on education, and role-play exercises. The students, incoming juniors and seniors, are all part of the construction & technology education (CTE) program at Mesa Public Schools.

President and CEO: Michael Atkinson

Vice president and publisher: Amy Lindsey

EDITORIAL

Editor in chief: Michael Gossie

Associate editor: Kyle Backer

Staff writer: Lux Butler

Contributing writer: Jeanne Jensen

Intern: Isaac Chavez

ART

Creative services manager: Bruce Andersen

Chief photographer: Mike Mertes

Junior graphic designer: Leslie Durazo

Marketing and events director: Jacque Duhame

Director of finance: Sara Fregapane

Operations coordinator: Michelle Zesati

Database solutions manager: Amanda Bruno

AZRE | PTK

Director of sales: Ann McSherry

AZ BUSINESS MAGAZINE

Sales manager: April Rice

Account executive: Tom Allen | Maria Hansen | Lula Hunteman

AZ BUSINESS LEADERS

EXPERIENCE ARIZONA | PLAY BALL

Director of sales: David Harken

RANKING ARIZONA

Director of sales: Sheri King

AZRE: Arizona Commercial Real Estate is published bi-monthly by AZ BIG Media, 3101 N. Central Ave., Suite 1070, Phoenix, Arizona 85012, (602) 277-6045. The publisher accepts no responsibility for unsolicited manuscripts, photographs or artwork. Submissions will not be returned unless accompanied by a SASE. Single copy price $3.95. Bulk rates available. ©2025 by AZ BIG Media. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording or by any information storage and retrieval system, without permission in writing from AZ BIG Media.

Arizona real estate leaders can identify upcoming industry challenges by analyzing market trends, leveraging data, collaborating with peers and embracing innovation. Proactive planning, strategic investments and adaptive leadership will position

MOLLY CARSON, executive vice president and market leader, Ryan Companies US:

“There are several challenges our industry faces. This includes power accessibility, assurance of water and opposition to development in certain areas. We are preparing for this by staying informed, actively engaging in the communities where we serve, and being mindful of political dynamics.”

LARRY DOWNEY, vice chairman, Cushman & Wakefield:

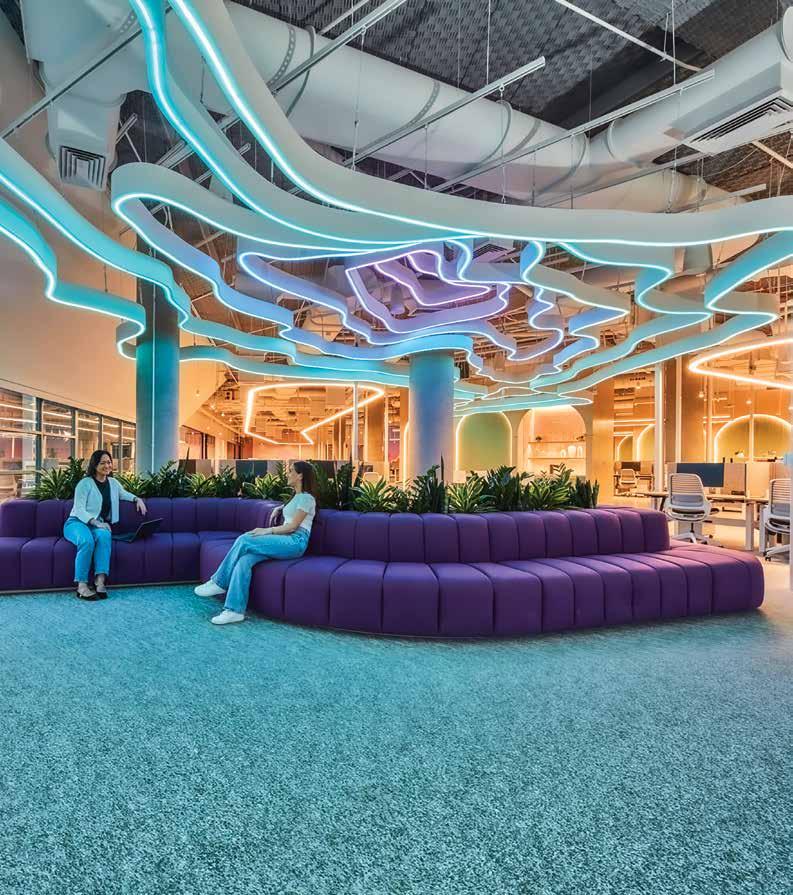

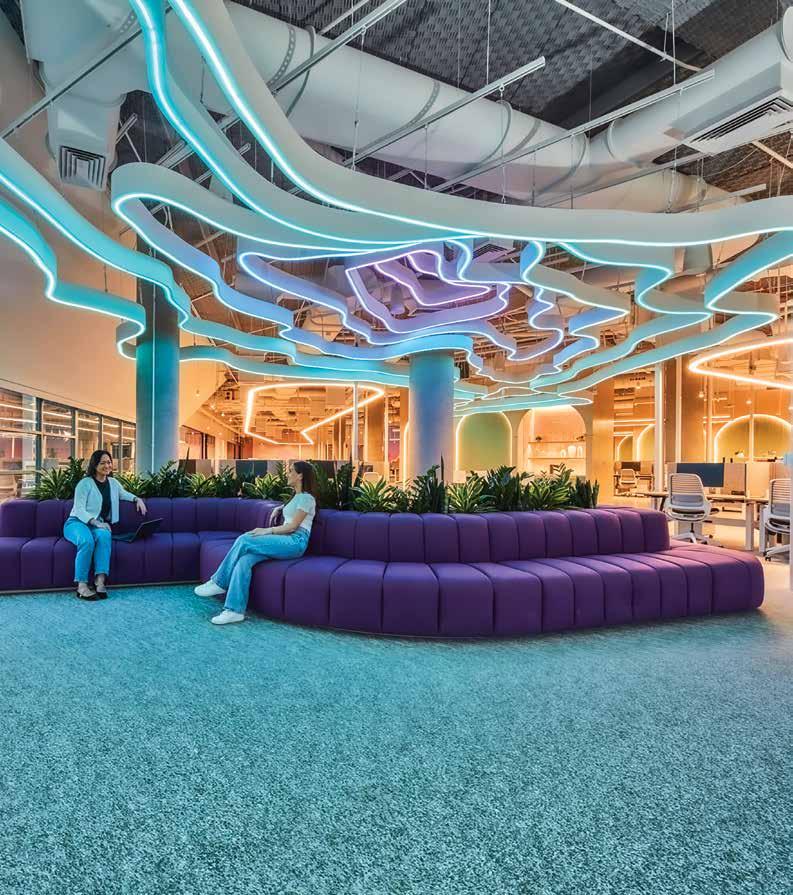

“The office sector must adapt to hybrid work models, optimizing space through right-sizing, and balanced expansion or downsizing optimizing efficiency. We proactively embrace changes with tailored solutions, relocations, and data-driven strategies, reducing costs and ensuring our clients succeed in an evolving market driven by flexibility and innovation.”

SHARON HARPER, chairman and CEO, Plaza Companies:

“In an era of uncertainty, Plaza Companies will continue to rethink and refine our approach in how we navigate change. The future for Plaza Companies is built on optimism with diligence, consistency, and persistence. Plaza Companies strives to work in a broad base of construction types and industries to ensure we are positioned for success.”

them to navigate future obstacles and capitalize on emerging opportunities. Here is what some of Arizona’s most influential business leaders say are the biggest challenges their industry will face in the next five years and how they are preparing for it.

BOB MULHERN, managing director, Transwestern:

“Arizona needs to continue to stay at the forefront of the advanced manufacturing opportunities that are considering locating within our state. We also need to recognize the role that our stellar higher education institutions play in the decision making process of these companies and provide them appropriate financial support.”

NATE NATHAN, president, Nathan & Associates:

“The biggest challenge our industry is facing is the misinformation about our water supply. Our industry has united to ultimately bring the facts to surface.”

JACKIE ORCUTT, executive vice president, CBRE:

“A lot of my work is tied to specialized manufacturing, which requires heavy power. Coupled with the robust semiconductor, electric car/battery, and data center industries, power supply will be a large focus for years to come. My team is spending time preparing our developer clients, and working with renewable energy companies to help provide long term resources for power generation.”

WORLD-CLASS CARE: Mayo Clinic is investing $1.9 billion into its Phoenix campus, which will include a new procedural building, 11 new operating rooms, 48 additional beds and more across the 1.2-million-square-foot expansion. (Rendering provided by Mayo Clinic)

Following an unprecedented streak of record setting years, Arizona economic development efforts reached still greater heights in fiscal year 2025, according to the Arizona Commerce Authority. Local

• Mayo Clinic announced a major $1.9 billion investment to significantly expand its Phoenix campus, which will increase Mayo’s clinical space and create thousands of skilled health care jobs.

• Axon will significantly expand its headquarters in Arizona, creating thousands of jobs.

• Dutch Bros. will relocate its corporate headquarters from Oregon to Tempe, supporting hundreds of jobs.

• Pure Wafer, a leading semiconductor supplier, announced plans to expand its silicon wafer reclamation facility in Prescott, supporting over 100 jobs.

• KoMiCo, a semiconductor supplier headquartered in the Republic of Korea, will establish a $50 million semiconductor equipment cleaning and coating facility in Mesa, creating over 200 jobs.

• GTI Energy will expand its manufacturing facility in Goodyear, investing a total of $53 million and creating 600 new jobs.

• Eternity Technologies will establish its North American headquarters and battery manufacturing facility in Phoenix, investing more than $20 million and creating 50 new jobs.

• Apex Power Conversion announced the establishment of its U.S. headquarters and manufacturing facility in Mesa, representing an over $60 million investment and creating up to 700 new jobs.

economic development agencies helped create a projected 24,285 new Arizona jobs with an average wage of $95,928. Here are some of the project driving the economy in 2025:

• Nucleus RadioPharma, a radiopharmaceutical manufacturer and developer, will build a new theranostics manufacturing facility in Mesa, creating 50 new jobs.

• Cognite, an industrial software company, relocated its global headquarters to Tempe from Norway, creating nearly 140 jobs.

• Komatsu broke ground on its new 210,000-square-foot mining facility in Mesa, representing an $80 million investment and creating up to 100 new jobs.

• Quantum Computing Inc. celebrated the grand opening of its quantum photonic chip manufacturing facility in Tempe, creating over 50 new jobs.

• MiiHealth, an AI-powered health tech company, relocated its headquarters to Phoenix from London, creating over 100 new jobs.

• Magna, a Canadian automotive supplier, announced a new 230,000-square-foot manufacturing facility in Mesa, creating hundreds of new jobs.

• Tricolor celebrated the grand opening of its 258,000-square-foot automotive reconditioning facility in Surprise, creating over 500 new jobs.

• Blue Polymers broke ground on its recycled plastics production facility in Buckeye, creating over 60 new jobs.

Developer: Creation, in partnership with Crescent Communities General contractor: LGE Design Build

Broker: Phoenix Commercial Advisors (PCA) Location: Gilbert Road and Juniper Avenue, Gilbert

Size: 10-acre mixed-use development Start date: May 2025

Completion: Heritage Park will open in phases, with the first openings anticipated in 2026, followed by NOVEL Heritage Park multifamily community opening in spring 2027

Developer: George Oliver, in partnership with Ascentris

General contractor: RSG Builders

Broker: JLL

Location: Scottsdale and Indian School roads, Scottsdale

Size: 360,000 square feet across three buildings and six acres

Start date: July 2025

Completion: Early 2026

Developer: HS Development Partners and the City of Sedona

General contractor: Wespac Residential

Architect: Athena Studio

Location: Sedona

Size: 24 one-bedroom units and six three-bedroom units

Start date: June 2025

Completion: May 2026

1. JW Marriott Phoenix Desert Ridge Resort & Spa

Sale price: $865,000,000

Location: 5350 E. Marriott Drive, Phoenix

Description: 950 room (81 suites) luxury resort

Buyer: Ryman Hospitality Properties

Seller: Trinity Investments

2. Scottsdale Quarter

Sale price: $645,100,000

Location: Intersection of Scottsdale Road and Greenway-Hayden Loop, Scottsdale

Description: 755,000-square-foot open-air mixed-use

destination encompassing retail, dining, and office components, complemented by nearly 600 residential units

Buyer: FalconEye Ventures

Seller: SDQ II LLC

Broker: Berkadia Real Estate Advisors

3. Sarival Logistics Center - Building A

Sale price: $128,200,000

Location: 6390 N. Sarival Ave., Glendale

Description: 1,156,860 SF mega warehouse

Buyer: Exeter Property Group / EQT Exeter

Seller: WPT Capital

Broker: Cushman & Wakefield

4. Sundance Towne Center

Sale price: $101,203,806

Location: 700 S. Watson Rd., Buckeye

Description: Site consists of six fast food restaurants with drivethrus, three discount stores, one bank, five retail buildings, two vacant developable sites and two restaurants.

Buyer: Continental Realty Corporation

Seller: Shin Yen Investments

5. Finisterra Apartments

Sale price: $96,000,000

Location: 1250 W. Grove Pkwy., Tempe

Description: 356-unit apartment complex

Buyer: Kennedy Wilson Multifamily

Seller: Blackstone

1. PUMA @ 303 Crossroads

Price: $140,200,000

Location: 8900 N. Sarival Ave., Glendale

Property: 1,023,610-square-foot Class A mega warehouse

Buyer: LaSalle Investment Management

Seller: Clarius Partners

Broker: Cushman & Wakefield

2. The Laurel Apartments

Price: $120,200,000

Location: 800 W. Willis Rd., Chandler

Property: 383-unit apartment complex

Buyer: Fairfield Residential

Seller: Sunroad Enterprises

3. Lazo Apartment Homes

Price: $100,500,000

Location: 875 W. Pecos Rd., Chandler

Property: 346-unit apartment complex

Buyer: Fairfield Residential

Seller: Sunroad Enterprises

4. Slate Scottsdale - Apartments

Price: $97,375,000

Location: 18220 N. 68th St., Phoenix

Property: 278-unit apartment complex

Buyer: Fairfield Residential

Seller: Sunroad Enterprises

5. Zone Apartments

Price: $81,750,0000

Location: 7455 N. 95th Ave., Glendale

Property: 308-unit apartment complex

Buyer: Fairfield Residential

Seller: Sunroad Enterprises

By ISAAC CHAVEZ

Long before becoming the CEO of P.B. Bell in 2025, Justin Steltenpohl dreamed of the courtroom. He became an attorney after graduating valedictorian from the University of Toledo College of Law, eventually working with Phil and Chapin Bell as outside counsel for P.B. Bell in 2007. As the company expanded, the need for in-house legal support grew, and Steltenpohl officially joined the team in 2015 as general counsel.

predecessors. The following responses have been edited for clarity and length.

AZRE: How did your career lead you to becoming CEO of P.B. Bell?

Justin Steltenpohl: If I had to describe my journey in one word, I would probably say surprising. I grew up on the wrong side of the railroad tracks, but when I read a book about lawyers and trials, I knew that’s what I wanted to be. I worked hard at making that dream come true, and I started practicing law.

In April 2015, I joined P.B. Bell full time, but I had zero inkling I was ever going to be the CEO. I knew very little about multifamily when I started — especially the back of the house side of the business, so I learned a lot in those first few years.

But I did manage to get a lateral promotion to COO, and then about a year ago, Chapin took me aside and said, “Listen buddy, I’m not gonna do this forever and I’d like to have more time away from the office, so how about you take over as CEO?”

My first reaction was, “What are you talking about?” But Chapin felt I was the right person to carry on the legacy of P.B. Bell because that is extremely important to me, and he felt comfortable that I would protect our culture moving forward.

AZRE: Now that you’re CEO, what are your goals for the business moving forward?

JS: The most important thing I can do is get the public, employees, vendors, investors, banks and the industry as a whole comfortable with the

fact that P.B. Bell is still the same P.B. Bell they know — that’s my No. 1 priority. The reason I think that’s critical is because it will set the stage for my successor, and that, to me, is crucial. I want to build a firm foundation for whoever that ends up being so they can continue growing our culture and reputation.

Moving forward, the company may not be run by a Bell, but the Bell logo everyone knows and trusts will always be on our front door. Their legacy will constantly be top of mind for anybody who runs this organization.

AZRE: Did you learn any lessons from the previous CEO that you plan to apply as the leader of P.B. Bell?

JS: More than anything, Chapin showed me that it’s okay to lead with heart in corporate America. In fact, it should be the driving force behind your decision making. The second thing he taught me is recognizing that you don’t always have to voice your opinion on every topic. As a lawyer, I’ve been trained to always state my case. That’s why people would come to me in the first place — it’s how I got paid — so turning that instinct off after 30 years is pretty hard.

But there are lots of times in meetings when it’s smart for you as the CEO to take a step back and let the discussion happen naturally without injecting your own views. That doesn’t mean you don’t care, but it lets people grow and discover why something might not be a good idea on their own. That’s how most folks are going to learn. I always say there is no such thing as failure. There’s just learning. If you’re always successful, you haven’t pushed yourself and that means you haven’t reached your potential.

...AND COUNTING Increasing the availability and certainty of environmental inspection, testing and consulting.

commercial.

By KYLE BACKER

Most people are lucky to have one job they enjoy, but Parker and Emily Ganem are in the fortunate position to have two. Parker serves as founder and CEO of Ganem Companies — a construction, architecture, development and property management firm located in Phoenix. In her role as executive vice president, Emily oversees the accounting and marketing teams, helping turn plans on paper into reallife results.

Together, the couple co-own Sky Restaurant Concepts — the group behind Squid Ink, Highball Cocktail Bar and Sparrow, which opens this fall at The Trailhead. AZRE magazine sat down with Parker and Emily to learn why the decision to enter a new sector was made and how finding success can look similar for both businesses.

The following responses have been edited for clarity and length.

AZRE: Parker, you founded Ganem Construction. Why venture into this sector?

Parker Ganem: Part of it was to diversify, but there was also the need for more restaurants in Peoria. The northern part of the city is pretty wealthy, but there aren’t many dining options beyond QSRs [quick service restaurants]. I thought Peoria needed something more sophisticated, and that’s how Squid Ink was born. People have been taking care of us ever since.

AZRE: Both Squid Ink and Sparrow are located in Peoria. Do you all have a connection to the city?

Emily Ganem: I’m born and raised in what we like to call the Upper West Side. Parker has roots in Phoenix, but we live in Peoria, and I don’t know if we’ll ever leave it. My family is there, and we’re deeply involved in the community. It’s where our hearts are.

AZRE: Construction and hospitality seem like two very different businesses. Is that the case?

With both companies, we always try to give clients the best product possible and a great customer experience, whether we’re serving food or delivering a building. But with restaurants, you’re only with them for maybe two hours, versus construction where a project could take two years. That short time span means people have a heightened sense of awareness. They’ll remember if something is off, especially because the point of leaving the house was to relax.

In construction, you might be working with someone who is making the biggest decision of their life by going forward with a project. Emotions are involved with that, just like in hospitality, but the difference is that those feelings are stretched out over many months.

EG: Like Parker said, the biggest distinction between the businesses is the time we have with the client. People go to restaurants for three things: the food, the ambiance and the experience. Delivering on those expectations in a short amount of time is our No. 1 priority.

But with both companies, having systems and processes in place is important for everything to run smoothly. We can’t do it all by ourselves, and we have incredible teams who are critical to our success.

AZRE: What should readers know about the menu at Sparrow?

PG: We call it American eclectic, because that’s what Americans are. We’re from all over the world and bring different cultures together — it’s what makes us special. Using that description also lets us change up the menu, so guests never know what we’re going to bring. But since it’s American-style food, it’ll be something people want to eat every day, as opposed to Squid Ink, which I’ve always seen more as a place people want to go on a Friday night.

EG: When I think of the word eclectic, I imagine a row of food trucks. You can grab a Korean fried chicken sandwich from one truck, then get mac and cheese from another. Is that American food? Maybe, but it’s definitely the American experience. Whether it’s food, music, language or just how people express themselves, it’s all a mix and constantly evolving — just like Sparrow will be.

After years of national positioning, the Phoenix metro area claimed the top spot among U.S. industrial markets in the first quarter of 2025 — an “overnight success” decades in the making. What didn’t make the headlines was the history of coordinated investment in infrastructure, innovation and workforce development that positioned Arizona to lead this industrial growth.

The Valley is beginning to reap the rewards. But as these missioncritical facilities like data centers and semiconductor facilities migrate to the desert in tandem, they’re straining utility grids, workforce pipelines and construction capacity. Contractors across the state are shedding outdated methods, retooling systems and tightening workflows to meet a level of industrial demand few regions have ever faced.

Growth at this scale calls for discipline, innovation and a relentless focus on people.

The drivers behind Arizona’s manufacturing momentum

Arizona’s dry climate, low natural disaster risk and robust industrial landscape have long made it an attractive base for data centers and large-scale operations. However, favorable conditions alone didn’t fuel the state’s high-tech surge.

When the push began to re-anchor advanced manufacturing on U.S. soil,

Arizona was ready. Since 2020, the state has secured more than $205 billion in semiconductor-related capital. That growth stems from coordinated efforts aligning federal policy with state-level investment.

• Federal acceleration through the CHIPS Act: The 2022 CHIPS and Science Act unlocked $52.7 billion in federal funding to expand U.S. semiconductor manufacturing and research. Arizona moved quickly to capture its share, securing multibillion-dollar commitments for high-tech infrastructure projects and establishing itself as a critical player in this chip resurgence.

• State investment in infrastructure and energy capacity: Arizona ramped up utility readiness to support fab-scale demand, with providers like Tucson Electric, Arizona Public Service and Salt River Project expanding grid capacity and resilience. Water infrastructure saw parallel attention, with reuse and recycling strategies designed to make

large-scale operations sustainable in the desert. Fast-tracked permitting also ensured manufacturers could scale quickly.

• Workforce readiness through targeted programs: Statewide programs, like the Semiconductor Technician Quick Start from Maricopa Community Colleges, deliver targeted training to meet labor demands. Meanwhile, institutions like Arizona State University built engineering pipelines, advanced manufacturing labs, and research and development (R&D) centers, feeding the ecosystem with talent ready to work.

Building this future, however, doesn’t just happen on paper. It’s now up to contractors to bear the responsibility of delivering on what this growth demands.

How contractors are scaling to build Arizona’s next industrial era

Contractors are under pressure to match the speed and scale of Arizona’s industrial wave, without burning out the teams doing the work. That reality

has sparked a shift in how projects are planned, built and staffed.

1. Planning digitally to de-risk projects

Before a single trench is dug or conduit laid, Arizona contractors are leaning more heavily on digital construction tools to map every step of the build in advance. While not new to the industry, tools like building information modeling (BIM) have become indispensable on high-speed, high-stakes projects.

BIM provides a shared, data-rich environment where all trades align on design intent. Within that model, clash detection catches system conflicts — like ductwork intersecting piping — before crews ever step on site. Pairing 3D modeling with drone-captured site data, these systems allow crews to show up knowing exactly where to cut, weld and set.

2. Balancing efficiency with long-term crew sustainability

Contractors leverage lean planning and modular prefabrication approaches to marry precision with schedule efficiency — and these tools will only become more critical. Meeting Arizona’s accelerated industrial growth will demand more than efficiency alone; it requires a sustainable pace. Lean methods that eliminate wasted labor and modular strategies that minimize jobsite chaos are being paired intentionally with crew-focused practices.

Regular team rotations, scheduled recovery days and genuine responsiveness to worker feedback ensure crews can sustain high performance, project after project. While efficiency sets the rhythm, it’s careful attention to workforce health that makes that rhythm achievable long-term.

3. Making field execution responsive by design

As timelines compress and client demands shift, agility has become a non-negotiable. Contractors are adapting on the fly, restructuring crews, rerouting specialty fabrication and realigning with local partners to achieve “drop-dead” dates. Execution feels less like a straight line and more like a coordinated dance

that adjusts to the project’s demands.

To stay responsive, field teams are working with full project visibility and the authority to pivot and problem-solve in real time. This level of trust is what’s breeding innovation, making fast-paced builds possible and repeatable.

4. Building a scalable workforce from the ground ip

Arizona is projected to need 20,000 new construction workers by 2030, according to the Arizona Office of Economic Opportunity. Contractors are responding with trade school partnerships, tech bootcamps and rigorous screening processes to match workers with roles where they’re most likely to thrive. And once hired, training kicks off immediately.

New crew members shadow veteran colleagues, rotate through job phases and gain hands-on experience with BIM coordination, drone surveying and integrated data systems. It’s a deliberate, long-term investment in people designed to build a workforce with the depth and resilience to sustain Arizona’s industrial ascent now and for years to come.

The work ahead

Arizona’s momentum is undeniable, but it’s not immune to friction. Power, water, housing, labor — all are pressure points demanding foresight. In the face of that strain, the Valley is in the thick of transformation, shedding outdated constraints to take on something bigger.

What rises from this moment will depend on the space made for bold thinking and the people equipped to carry it forward. The next few years will test contractors, owners, utilities and policymakers alike, but they’ll also reveal what Arizona does best: adapt, build and push forward.

Jeanne Jensen is director of engineering at Nox Group, a large-scale industrial construction company focused on mission-critical infrastructure across the U.S. She oversees major public and private projects, guiding the delivery of some of the nation’s most technically demanding builds. Learn more at noxgroup.us.

NAIOP Arizona’s new CEO outlines opportunities and challenges to watch in commercial real estate

CHANGING THE LANDSCAPE: ReDiscover Logistics is ViaWest Group’s transformative industrial redevelopment at I-17 and Loop 101 in Phoenix’s Deer Valley submarket. Spanning 808,448 square feet across four Class A buildings, the project reimagines a former Intel and Discover site into a state-of-the-art logistics and light manufacturing campus. (Image provided by ViaWest Group)

By KYLE BACKER

evelopment is a complicated endeavor requiring coordination across multiple disciplines, companies and governmental entities. That’s why associations like NAIOP exist to bring industries together, offering opportunities for professionals to network, learn from one another and build solidarity around legislative issues. Every organization needs a leader who can rally people together, draw on a deep well of expertise and provide a clear vision for the future — and NAIOP is no exception.

AZRE magazine sat down with Cheryl Lombard, who started her tenure as the CEO of NAIOP in September, to learn more about her thoughts on leading NAIOP, the state of development and being back in the desert. The following responses have been edited for clarity and length.

AZRE: For those who don’t know, can you tell us a bit about your background?

Cheryl Lombard: My career has been focused on how we grow, encompassing critical areas such as water, conservation, environmental protection, infrastructure and more recently, energy. I have been fortunate enough to apply this expertise across the U.S., representing both energy and real estate development sectors.

This includes a decade with The Nature Conservancy and leading Valley Partnership here in Arizona. Most recently, I spent the past two years in Washington, D.C., at a conservative clean energy think tank, where I led a cross-functional team focused on advancing power, infrastructure, and minerals policy in Congress and across various states. My work there included testifying before Congress, speaking on numerous panels, and drafting federal permitting and judicial reform legislation.

AZRE: What drew you to NAIOP as an organization you’d be interested in leading?

CL: It is incredibly meaningful for me to return to Arizona — this state has given me so much personally and professionally. I’m eager to get to work building on NAIOP’s strong foundation and helping shape what’s next.

Arizona is at a pivotal moment. The growth we’re experiencing is historic, and commercial real estate is right at the center of it. That means our industry has a major responsibility to lead with vision and purpose.

NAIOP Arizona already has a strong track record of advocacy and influence. My goal is to build on that — amplifying our voice at the Capitol, with cities and our Congressional delegation, expanding engagement across the state, and making sure we’re driving the big conversations around growth and infrastructure.

We will be focused on implementing a bold strategic plan, enhancing our events and member experience, growing our sponsorships and solidifying NAIOP as the premier voice for commercial real estate in Arizona.

AZRE: What role do partnerships play in lifting up the industry?

CL: Commercial real estate doesn’t operate in a vacuum. Every project intersects with public policy — whether it’s water, permitting, energy or transportation. That’s where I’ve spent my career, and that’s where NAIOP can have a powerful impact.

I believe in results-driven advocacy and collaborative leadership. That means listening to our members, engaging with stakeholders, and delivering on a clear vision that supports responsible growth and economic success.

Beyond metropolitan areas, significant opportunities exist for sustainable growth. NAIOP focuses on fostering connections, advocating for interests and facilitating learning. We can leverage these resources to align with the statewide opportunities for employment and economic prosperity, ensuring the flourishing of all of Arizona.

AZRE: Can you talk more about NAIOP’s advocacy efforts?

CL: First, I’m glad to be working with NAIOP’s Director of Government Relations John Baumer. Having someone with his skills in-house is a great resource for the organization. I have a background in policy, but we’re a statewide organization, and we want to be connecting with not only

our state legislature, but key cities and our federal delegation about how we can continue to grow.

There’s plenty of opportunity here in Arizona, but there are also hurdles to overcome. John and I have been talking a lot about energy demand. We’ve done a great job as a state attracting companies like TSMC, but now we need to focus on energy development. That means working with the utilities and our rural co-ops on how to provide affordable, reliable power to everyone. Water is another important topic that we want to partner with people around the state to tackle.

AZRE: You mentioned meeting with Arizona’s Congressional delegation. Does NAIOP work on federal issues?

CL: Our role at NAIOP is to represent the industry in these conversations about how legislation at all levels might affect our state. For example, the reconciliation bill in Congress reauthorized Opportunity Zones and included a lot of tax benefits to encourage economic development in rural areas. John and I are looking at how that tool can be used here and plan to sit with Sandra Watson at the Arizona Commerce Authority to learn more about their plans. There’s also brownfield legislation that needs to be reauthorized and next year Congress will start working on transportation reauthorization, which we’ll be helping with as well.

AZRE: NAIOP has a large membership base — some are competitors and others may have differing views on what the best course of action is. How do you present a unified voice on behalf of the industry?

CL: All trade associations have to grapple with this, and it can be challenging on the policy side. But that’s why the first thing I’m going to do is put together a strategic plan so we come to an agreement among our board and

members on what we stand for. That helps bring focus and alleviate some of those conflicts as members take part in those discussions.

AZRE: What is your sense regarding the health of the industry as we start wrapping up 2025?

CL: Over the past decade or so, Arizona has implemented great policies around taxes and regulations at both the state and municipal levels. The groundwork laid thanks to measures like Prop 479 will set the Valley up for the next 20 years in terms of transportation infrastructure. But we still need to take a closer look at how to build and maintain roads across the state.

Right now, we have amazing energy resources, but what’s next? We need sustainable, affordable power — how will we move it around? Building transmission infrastructure is similar to highway construction since it takes some time, but people have different reactions when they see power lines going up.

That said, coming from Washington, D.C., where businesses and residents have to deal with regulatory burdens and instability, it’s clear to me that Arizona has created an environment where economic success can continue. More can be done to ensure predictability across all layers of government, but it’s nice to be outside the Beltway and back in a place where good policy and regulations — meaning less of them — are helping foster growth and innovation.

AZRE: Any parting thoughts you’d like to share about returning to the Valley?

CL: I went to college in Washington D.C., and it’s a lovely place. I learned a lot that I will apply in this new role, but I’m so happy to be back in Arizona. I missed our beautiful sunsets, my friends and the development community as a whole. I’m privileged to be here and getting to focus on commercial development.

By KYLE BACKER

LUX BUTLER

Between the mundane requirements of life and the pressures of a demanding career, blank space on the calendar is a rare sight for those in the commercial real estate industry. Prioritizing participation in an association like NAIOP can be challenging when a lengthy task list awaits, but investing the extra effort can pay dividends over the long term.

AZRE magazine sat down with eight NAIOP members to learn more about their relationship to the association, how they’ve grown their careers from getting involved, the benefits of networking with competitors and what trends they’re seeing in the market. Responses have been edited for clarity and length.

Meet these professionals on the pages that follow:

ASHLEY HOFFMAN, Layton Construction

BRYCE TERVEEN, Colliers

CHUCK CAREFOOT, Ryan Companies US

JAMIE GODWIN, Stevens-Leinweber Construction

JIM ROLAND, Alcorn Construction

JOHN ORSAK, Lincoln Property Company

KOREY WILKES, Butler Design Group

TOM JARVIS, Willmeng Construction

Ashley Hoffman Director of business development

Layton Construction

AZRE: How long have you been a member of NAIOP?

Ashley Hoffman: I’ve been a member of NAIOP for 14 years. I started off my career in commercial furniture, and my focus was finding new business. Where do you find those people that are going to be occupying office buildings? The natural landing place was NAIOP, so I started off like most people — not knowing anyone and trying to figure out how everything works. I quickly discovered just how connected everybody is within the association and why it was so meaningful to them.

I dove right in and ended up serving on all the different events committees, then sat on the steering committee for the Developing Leaders program, which helps professionals age 35 and under grow. In 2016, I was named Developing Leader of the Year, which was so great. I’ve since aged out of Developing Leaders, but now I feel like my calling is to help the younger folks get more involved in the organization when they show an interest in it.

AZRE: Life gets busy for all of us, both in our personal and professional lives. Why invest so much time into NAIOP?

AH: My answer now might be a little different than it would’ve been 14 years ago. When I was younger, I knew I just needed to be there and the rest would follow, since I was more focused on building business relationships than anything else.

Now I show up because I want to, but I also feel like when I attend an event, I’m helping an organization that has given so much to me for so long. I can’t overstate just how deep the roots run in NAIOP. I’ve had relationships that started off with a handshake grow into lifelong friendships. I’m still doing business with some of the people I met at my first NAIOP mixer 14 years ago.

AZRE: Are there any trends in the market you’d like to share with readers?

AH: Electrical gear is still driving the schedule, which is important to know. When we start on a job, we always ask when the client wants to open their doors so we can order that equipment in time. Otherwise, construction costs continue to be more favorable. Even with all the talk around tariffs, those headlines don’t seem to be affecting prices much.

We’re also seeing more interest in million-square-foot-plus industrial in the West Valley. A lot of them are build-to-suits, meaning these businesses really want to sink their teeth into the region. The East Valley, however, is overbuilt with small bay and multitenant flex industrial in my opinion, so I expect that area will cool off for a bit, but there are still people who want to be in the West Valley.

To do more than build. To create. To innovate. And to do it with a holistic, intelligent balance of art and science that’s unmatched anywhere. We see our work through the eyes of the people who will use them every day. Through their eyes, we see places of entertainment, education, innovation, technology, healing and research. The result? Powerful structures with impacts that reach far beyond these walls.

Korey Wilkes, principal, Butler Design Group

AZRE: How long have you been a part of NAIOP?

Korey Wilkes: When I joined Butler Design Group in ’99, the company was already a member of NAIOP, so since then. The organization does a lot for the industry, like promoting legislation that creates a positive development environment. From a social standpoint, NAIOP provides a great opportunity to make connections — developers, brokers, contractors and design professionals all attend events together, so we build relationships with one another.

AZRE: How long have you been in a leadership role at NAIOP?

KW: I previously served on the Night at the Fights committee, but I was just appointed to the board of directors this last year. When that happened, I was asked to join a committee, and working on the Best of NAIOP interested me most. It has always been a great event, but I wanted to bring some fresh ideas.

We ended up transitioning from a typical ballroom to a theater, and that was a significant shift in venue. But working with the committee and putting together some skits for the event was something I really enjoyed. It all ended up becoming a bit of a side job there for a while — and there a few hiccups the night of — but I think it was received well by the majority of people. Now we have an opportunity to improve again next year.

AZRE: What industry trends should readers be following?

KW: Five years after the pandemic started, there has been a healthy shift back into brick-and-mortar retail. We’re even seeing more power centers — a term that we hadn’t used for the last five to eight years. We’re working on a handful of those, mostly on the outskirts of town, but there are few infill power centers that are chasing rooftops. Some office development is happening, but it’s niche and in specific subregions.

During the pandemic, about 75% our work was industrial, but we’re as close to having a balanced portfolio as we have been in a long time, which is good for us because we want a stable, mixed profile. Industrial has slowed a little due to some oversaturation, but there’s still a lot of infill and a good amount of speculative development going on. The TSMC effect has helped keep demand going, which has been huge for the Valley and our business.

The unfortunate thing is we have a bad rap regarding water, but the reality is that Arizona has some of the best water policies in the U.S. — if not the world. I don’t know of another place that requires a 100-year guarantee for water supplies. Overall, we’ve had some great legislation over the years, and I’d like to think NAIOP was part of that.

AZRE: How long have you been a member of NAIOP?

Chuck Carefoot: I’ve been fortunate enough to be involved with NAIOP for around 29 years. I remember the first luncheon I attended — there were about 50 of us representing the whole industry. I was only six months into my career at Ryan Companies, and I’ve been going ever since. I’ve really enjoyed my years with NAIOP, and I hope to have many more — maybe not another 29, but certainly 10 or so.

AZRE: How has NAIOP supported your professional growth?

CC: NAIOP has something to offer at all stages of your career. At the beginning, it’s a place to grow your confidence and learn from those around you. After you gain some experience, there are educational programs that expand your skills and help develop relationships with your industry peers. Once you’re a more tenured professional, you get to meet people earlier in their career through NAIOP, which is a great mentoring opportunity and a way to give back some of what you received from others. There’s also the perk of interacting with new businesses when they come to town and join the organization.

AZRE: Are there any benefits to being in an association with companies who may be your competitors in the market?

CC: Absolutely. At the end of the day, we’re all competitors to a certain extent, but NAIOP helps us all build relationships with one another. That creates a healthy alignment where there’s a willingness to learn from each other and make our collective marketplace stronger.

AZRE: What is a trend you think readers should be aware of?

CC: Since the Phoenix Metro is still a new marketplace, we don’t have the kind of real estate blight that exists in some older communities across America.

That said, we need to be diligent and not allow that to happen. The biggest thing Ryan is doing today that we weren’t as much 20 years ago is the redevelopment of our city. Instead of continuing to build further out, there’s a emphasis on redeveloping existing sites into new, vibrant properties. That helps avoid the blight that could come to a community if we let an old, non-functioning building just sit there.

Generally, jurisdictions welcome the redevelopment of difficult assets. I think we’re in a great position to improve infill sites through good, constructive redevelopment. We need to focus on that here in the Valley — if we drag our heels and don’t allow this work to happen, we could end up in a situation where blight starts to compound as it has in other cities in the U.S.

AZRE: Why do you believe industry associations like NAIOP are important for professionals and companies?

Jim Roland: Across all industries, associations are critical to the advancement and general knowledge of company staff. These groups help grow new talent, and they give an opportunity for seasoned professionals to mentor the next generation. Any parent wants their kids to be successful, so why wouldn’t you want the same for your business?

NAIOP is composed of the who’s who of deal makers in Arizona — developers, brokers, general contractors, architects and trade partners. Being involved lets you interact with these folks in both formal and informal settings, which broadens your reach and helps you make decisions on who to work with.

AZRE: What impact does NAIOP’s advocacy efforts have on commercial real estate as a whole?

JR: I think the legislation NAIOP promotes does more than just help our industry — it strengthens our community and benefits the general public. The growth that has happened across the state is because we’ve created an enticing market for companies to relocate to or start up. When these businesses come here, they need buildings to run their operations. That creates jobs and further development, which helps everyone.

AZRE: What trends are currently having the biggest effect on the market?

JR: The No. 1 thing on the forefront of people’s minds is the tariffs. Every financial institution, developer and contractor wants to protect themselves from the costs associated with those. That’s led to lots of conversations with trade partners and their suppliers when a project is getting started to figure out how to mitigate the impacts. All that has to happen up front so we can come to an understanding before promises are made.

Interest rates are another topic talked about frequently in our world. Cutting interest rates frees up money and makes deals happen — meaning we get exponentially busier. I’m pretty confident that when interest rates come down, Phoenix will be at the center of growth for the national economy because of the development that happened before rates went up.

Power is the other big concern considering all the data centers coming to town, as well as the manufacturing facilities. That has put a strain on the system, but the power authorities are working hard on that.

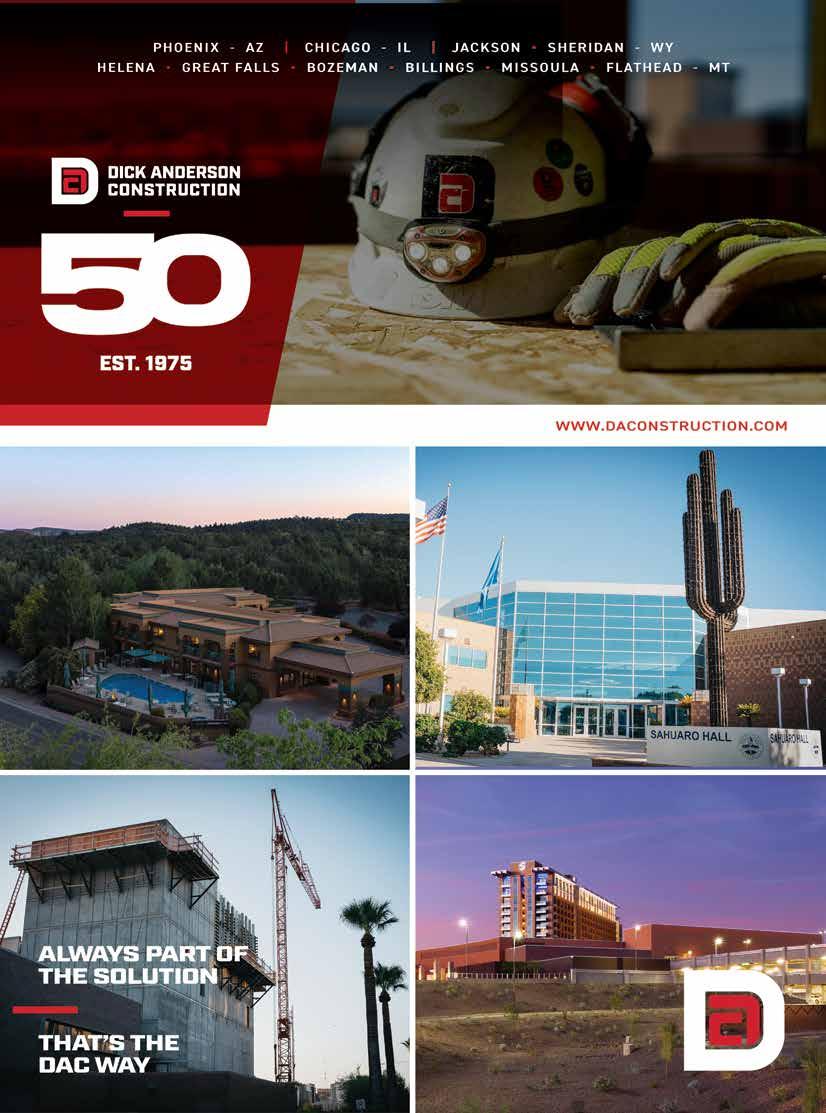

Jamie Godwin, president and CEO, Stevens-Leinweber Construction

AZRE: How did you first get involved with NAIOP?

Jamie Godwin: I moved to Arizona in 1996 and took a job with Opus, and they were already a part of NAIOP, so I’ve been participating nearly 30 years and I’m on my third year with the board of directors.

When I came to Stevens-Leinweber in 2014, the company was not engaged with the association. Changing that was a high priority for me since I knew it was a great way to get our name out there. Stevens-Leinweber has been in the market as a tenant improvement contractor for a long time, but prior to me joining, business attraction came mostly through word of mouth. Coming to the company, I saw that as a growth opportunity, and NAIOP is the best place to connect with people in the industry.

AZRE: What value does NAIOP bring to the commercial real estate industry as a whole?

JG: NAIOP is at the forefront of legislative advocacy for commercial real estate, and there has been a significant enhancement of those efforts with bringing John Baumer [NAIOP’s Director of Government Relations] on board as an inhouse lobbyist. Suzanne Kinny did a good job even prior to John, and it only got better when he started. I’m also excited to have Cheryl Lombard as the new CEO because of her background in this arena and the connections she brings with her.

All that said, NAIOP is engaged with government entities and trying to help shape what the legislative landscape looks like for our industry. There are always policy initiatives out there that will either help us or hurt us, and NAIOP truly is the organization working for the benefit of everyone in the industry — whether you’re a member or not.

AZRE: What are some trends folks should be aware of?

JG: In the last six or so months, there has been an increase in larger sized office tenant improvement projects, with clients taking full floors and larger buildings leasing upwards of 75,000 square feet to a single user. We went a long time coming out of the pandemic without that kind of movement in the market as businesses hunkered down and evaluated remote work plans.

A lot of companies have since made the decision that working from home isn’t the best structure and want people back in the office. They need the appropriate square footage to support that, so we’re seeing bigger deals happening out in the market, which is a positive change.

A look at the CRE companies that impact the community

Healthcare development trends to watch in 2026

A dive into the Arizona Association of Economic Development

An analysis of a big deal that is shaping Scottsdale’s skyline

John Orsak, executive vice president, Lincoln Property Company

AZRE: When did you start participating in NAIOP?

John Orsak: I moved to Arizona in 2006, and it was shortly after that I became involved with NAIOP. From that point on, I’ve always stayed close to the organization, even when I’ve transitioned to other firms. I’ve sat on the membership, public policy, Night at the Fights and Thursday Night Live committees, then was asked to join the executive committee.

In 2024, I served as the chairman, which was an incredible capstone achievement. This is my last year on the board before I go back to being a member at large, which is unfortunate because spending time with my fellow board members and the NAIOP staff is so special to me. But having those limits in place is a good thing. It means the association is always evolving as the composition of the board changes.

When you’re in the business for a long time, you develop a sense of the quality of these associations. Between the membership, programming, events and overall structure, NAIOP has always been second to none.

AZRE: What are some of the benefits engaging with NAIOP?

JO: That’s an easy one. I always tell people, ‘Look, you don’t have to believe me but go to one of our events and see for yourself — everyone that you want to know is there.’ Even though NAIOP is at its core a developer-focused organization, our chairman this year, Phil Breidenbach, is a broker. Other folks on the board are engineers, bankers and contractors. That’s because we want everyone within our industry to be on the same page, have the chance to network and share in the opportunity to shape public policy.

And, candidly, all your competitors are already here, so you can join the party or not. And the only reason I can say that is because NAIOP has been built into a strong, well-respected organization. There’s no arguing the facts that getting involved brings a tremendous amount of value.

AZRE: Is there anything going on in the industry you think readers should be aware of?

JO: Everyone needs to pay attention to our regulatory environment. One of the reasons why we’ve notched so many wins in Arizona is because we enjoy a very business friendly market. That has started to erode a little bit, so folks should be cognizant of what our elected officials are doing. It may seem like subtle shifts here and there, but we don’t want to wake up one day asking ourselves how we ended up with an overly burdensome regulatory framework that makes it hard for people to do business here.

Tom Jarvis Partner and vice president of pre-lease estimating Willmeng Construction

AZRE: How did you first get involved with NAIOP?

Tom Jarvis: I was hired by Willmeng in the fall of 2004, and at that time we specialized in commercial tenant improvements. We only had nine employees and a handful of really good clients, and one of them was Lincoln Property Company. The head of the firm, David Krumweide, advised myself and James Murphy that we needed to get involved with this organization called NAIOP. I remember the first event I went to because I ran into some friends from college, so it felt right from the very beginning.

AZRE: You’ve gone from attending events to serving on the board and chairing committees. What motivated you to take on that level of commitment?

TJ: If I commit to doing something, whether it’s personally or professionally, I’m going to see it through. That means investing my time and energy, but I think that’s the right approach to take in life. Not only that, but NAIOP has given me far more in my career than I could ever repay through volunteering. I’ve made friends, met like-minded people to do business with — I even met my wife during a NAIOP event many years ago, so the organization will always have a special place in my heart because of that.

From a business perspective, Willmeng has grown into one of the largest general contractors in the state, and the relationships we’ve formed through NAIOP has allowed us to open offices throughout the region. Sure, some of our competitors are members too, but there will be a day where we need to stand by each other to fight a bill being considered at the state legislature. I don’t view being in an association with my competition as a threat — I see it as an opportunity to make Willmeng and our industry stronger.

AZRE: What industry trends should readers be watching?

TJ: Artificial intelligence is changing all our lives, and these advances will make the industry safer and more efficient. We’re getting extremely accurate information in real time, allowing us to provide better service to the developers and communicate more easily across the whole project team. That said, the labor shortage will continue to be a challenge as the baby boomer generation ages out of the workforce. As they do, we lose both a worker and the institutional knowledge they have.

But overall, Arizona is in a great position. As we go through deglobalization, international companies are choosing to open their facilities in our state more than ever before. Leaders of years past did an amazing job making sure Arizona can be great hosts to the businesses that want to come here.

Bryce Terveen Executive managing director Colliers

AZRE: How does NAIOP help build relationships with all the different players involved with commercial real estate?

Bryce Terveen: It takes specialties from many different parties to make our industry work, and having those contacts is what takes projects from inception to fulfillment. At the root of it, commercial real estate is a relationship business, and NAIOP facilitates those connections really well, and that’s never going to change. As you meet people in the community, you start to develop a sense of trust with them, and that helps spur more transactions than if everyone was siloed. If you don’t have those relationships, it makes being in this business harder than it already can be.

AZRE: Can you talk more about how the relationships NAIOP fosters can help working in commercial real estate a bit easier?

BT: The Developing Leaders program is a key part of this, because mentorship is paramount in this business. Starting out as a young professional in brokerage is like drinking from a fire house. The learning curve is daunting and you’re working 12hour days and weekends — there’s a lot to learn before you start making money.

The wisdom that seasoned brokers can provide is huge, whether you’re getting that through the Developing Leaders program, going to educational events or just being involved in the association. All of those things help younger professionals find their footing.

AZRE: What recent trends are shaping the market?

BT: There’s definitely some thawing happening in the office sector. The credit market has been fairly tight with interest rates, so we’ve seen office transactions be muted for the last two years. But companies are becoming more confident in their office usage as they come to the conclusion that it’s better for productivity and culture when people are working together in the same space, even if they don’t need as much square footage as they used to.

Some parts of the Valley are seeing some tenant activity as businesses make these decisions, and we’re still seeing the flight to quality. That happens during every down market because companies can take advantage of the current conditions to trade up into better Class A buildings — that’s happening in the Camelback Corridor, Scottsdale and Tempe. That trend will continue, but some submarkets will still have some pain. New office construction may not happen for some time, but as rents go up, more capital will get deployed to rehabilitate assets that need a little love.

By KYLE BACKER

Each session, Arizona’s lawmakers consider stacks of new bills and revisions to current statutes, each one having the capacity to reshape the lives of residents and the way companies conduct business. According to statistics from the Arizona State Legislature’s website, 1,854 bills, memorials and resolutions were introduced in 2025. Of those, 439 were delivered to Gov. Katie Hobbs, with only 265 signed into law.

With less than 15% of all items surviving the crucible of lawmaking, many industries rely on associations to advocate at the Capitol on their behalf. In Arizona’s commercial real estate sector, NAIOP seeks to do just that — even if the process isn’t as simple as “Schoolhouse Rock!” made it seem.

“If you’re not in this world, it’s easy to think that all you have to do is come up with a great idea, write a bill and it gets signed into law,” explains John Baumer, NAIOP’s director of

government relations. “But the reality is that it’s not common to be successful on the first try, especially with more nuanced and technical matters.”

Enacting policy is, by design, a deliberative and thorough process. For professionals like Baumer, the journey starts with convincing one of the 90 members of the legislature to sponsor a bill. It then gets sent to a committee where it must be voted on before being presented to the wider legislative body.

“There are many hurdles to overcome just to have something make it to the governor’s desk — and even then it can be vetoed,” Baumer says. “You need to engage with stakeholders from the start, whether they support or oppose your policy. If a committee chairperson agrees to hear the bill and you tell them you haven’t talked with these other groups, they may hold the bill or just vote it down.”

Lobbying often evokes images of smoke-filled rooms and closed-door

deals, but Baumer argues that much of what he does involves education. The real-world implications of a measure can get lost when looking at statutory language, so Baumer provides the commercial real estate industry’s perspective on issues so policymakers understand the positive or negative consequences of a piece of legislation.

“At the end of the day, there are 90 elected officials who need to be wellversed on the topics that come before them. That’s a lot of information for anyone to handle,” he continues. “We want to be a resource for legislators to help them create the best policy proposals possible.”

To authentically represent the views of its members, NAIOP has two groups dedicated to the association’s advocacy efforts. The Government Affairs Advisory Committee serves as the primary group tasked with monitoring

legislative issues and engaging with elected officials.

Those with a high level of commitment and expertise may be asked to take on a larger role in positioning NAIOP as the voice of commercial real estate by joining the Public Policy Executive Committee (PPEC).

Byron Sarhangian, partner at Snell & Wilmer and co-chair of the PPEC, helped form the committee with the goal of strengthening NAIOP’s ability to shape the lawmaking process. The PPEC works closely with NAIOP’s board of directors to identify legislative priorities, as well as other organizations such as GPEC and the Arizona Chamber of Commerce & Industry to find areas of alignment.

“Historically, the commercial real estate community has been underrepresented at the legislature. That’s unfortunate considering the industry’s significant role in the state’s economy,” he explains. “But we want our elected officials to have groups they can

go to and hear what the impact of their decisions will be, because oftentimes it’s not entirely clear to them.”

Developers, contractors and attorneys all participate in the committee, each bringing their own thoughts on how to address these problems. By having a diversity of perspectives, the PPEC is better equipped to uncover what friction points exist across the whole spectrum of commercial real estate rather than fixating on a particular subsector.

That collaboration, Sarhangian says, resulted in a list of what the group believes to be the top issues facing the industry from a legislative standpoint.

“We are advocating for down-thefairway solutions and talking with lawmakers about them, so at the very least our voice is being heard,” he says.

Thanks to a series of high-profile investments from world-renown companies, Arizona’s reputation as a fruitful place to operate is spreading. Maintaining that status is crucial as more businesses consider coming to the state, and beating the competition may require action from the legislature.

“Arizona is at an inflection point,” Baumer says. “There will come a time where more assistance from the government will be needed to land the next big project. Right now, we’re fairly limited in what we can offer as incentives for any type of development.”

For example, Baumer notes that Arizona stands alone as the only state without tax increment financing, or

TIFF, after the legislature did away with it after a brief period in place. Even though Arizona has enjoyed great success in attracting businesses, the minimal economic development tools available today may throttle growth in the future.

That’s why NAIOP supported Rep. Michael Carbone’s legislation during the 2025 session that would have applied transaction privilege tax (TPT) reimbursements towards the on-site infrastructure built for projects, so long as they met statutory criteria. Allowing developers to recoup the TPT generated from creating these core facilities would help drive down overall costs and make further growth more manageable.

“This would’ve ensured no one was running afoul of the state constitution’s gift clause while understanding that water and power infrastructure have become huge expenses,” Baumer says.

Due to concerns surrounding potential impacts to the state’s general fund, the effort stalled out. Despite it failing, Baumer is encouraged to see more policymakers recognize that with all the headwinds facing the commercial real estate industry — from interest rates squeezing capital markets to uncertainty around tariffs — more robust incentives for development may be needed.

Another effort NAIOP advocated for was reforming Arizona’s construction defect statutes. Sarhangian explains that the status quo is overly harsh towards sellers of condominiums, constricting housing supply during a time of scarcity. He notes that the goal isn’t to eliminate

consumer protections but create more thoughtful mechanisms that don’t make condo construction unfeasible.

As currently written, if a construction defect issue occurs within the prescribed eight-year timeframe, there are grounds to initiate a class action lawsuit. This exposure discourages many developers and lenders from building condos, functionally removing an entire residential asset class from the market.

“Luxury condos are going up, but that’s because those projects can absorb the high insurance costs required thanks to the construction defect laws,” Baumer adds. “If we want this type of housing to be attainable for middle-income Arizonans, something has to change.”

A menu of reforms was presented to lawmakers, including having an independent third-party review claims and empowering condo associations to vote on whether to pursue a construction defect lawsuit instead of just the board, as is the case today.

“We had a number of other provisions that would’ve cleaned up the process, but unfortunately, that did not go far this session,” Baumer continues. “There was a lot of vocal opposition going into the committee hearing, so we opted to pull the bill back. We’re taking this intervening period to engage with more stakeholders and

build a broader coalition to see what we can accomplish in 2026.”

While not every item backed by NAIOP survived the gauntlet of policymaking, the 2025 legislative session did not adjourn without any wins for the commercial real estate industry. Baumer highlights a pair of bills pertaining to utilities as two achievements worthy of celebration.

“One had to do with mitigating wildfire liability, and the other dealt with utility securitization,” he continues. “We’ve grown considerably over the last few years, causing the demand for energy to spike. Those new pieces of legislation will help utilities manage their current load requirements while also enabling them to finance future developments related to power generation. That will allow our economy to continue expanding.”

The signing of House Bill 2110 was another victory, which revised statutory language around converting commercial buildings into multifamily or mixed-use properties. But in the world of policymaking, success isn’t defined solely by what becomes law.

“We opposed the [Government Property Lease Excise Tax (GPLET)] reduction bill that passed this year, and we were very appreciative of Gov. Hobbs for vetoing it for the second year in a row,”

Baumer says. “It’s a nuanced issue, but the governor and her team understood that GPLET is one of the few economic development incentives we still have in the state, and the legislation would have severely limited the ability for state and local governments to use that tool.”

Even when the passage of an imperfect law seems imminent, there is an opportunity to provide input and reduce potential downsides. This session, a push to restrict the ownership of property by foreign adversaries found a strong base of support, but Baumer notes that the original wording of the bill would’ve led to unintended consequences.

By working with coalition partners and policymakers, amendments were made to the legislation providing clarifying language and minimizing the adverse impacts on business attraction, while still maintaining the core vision of the bill’s sponsors.

“The key to public policy is being willing to have those conversations and negotiate,” Baumer concludes. “Despite the widening political divide, 2025 was an overall good year for Arizona and the commercial real estate industry, and we’ll build on those successes again next year. It was a long six months of robust debate, but it ended with a significant state budget. No one walked away entirely happy with the result — but that means the negotiation process worked.”

By KYLE BACKER

For the uninitiated, the commercial real estate sector can seem byzantine considering all the strategic planning, coordination and timelines involved with successfully delivering a project to an end user. Both rookie and seasoned industry professionals must stay abreast of trends and develop a deeper understanding of how the sector works if they want to operate at the highest levels. To ensure the industry has the opportunity to grow these skills, NAIOP provides a suite of educational programming throughout the year.

“We often have three events a month about the business,” explains Cathy Teeter, managing director at CBRE and chair of NAIOP’s Education Committee. “The association’s member base is a deep well of expertise to draw from, so we try to spread that information out to everyone.”

Considering the varying work schedules of members, Teeter says these meetings may take place during

breakfast, lunch or happy hour to have the broadest reach possible. For example, NAIOP recently hosted a lunch and learn focused on Arizona State University’s role in the state’s burgeoning semiconductor market — something Teeter says has appeal for people no matter what point they’re at in their career.

“We try to make sure our programming falls in our lane, but it’s not too hard to find topics that people need to hear about,” she continues. “Finding speakers in some places is a challenge, but people are generous with their time and knowledge here in the Valley. That’s what makes us unique — we have a welcoming and generous community that wants to make the industry better for everyone.”

Some of the learning opportunities are more technical in nature, diving deeper into cap rates or how common area charges are billed back to tenants. Others offer continuing education units so folks can keep their

certifications up to date.

For members age 35 and under, Teeter says NAIOP’s Developing Leaders program helps young professionals establish a solid foundation for their careers. Participants attend skill-building seminars, social outings to build a peer network and have the chance to be mentored by industry veterans.

“Our organization is one where competitors can come and grow together,” she continues. “The truth is that we need each other to get deals done and learning with one another strengthens those bonds. Competitors sit side by side on committees, and having differing viewpoints makes sure our programming stays relevant and meaningful.”

While NAIOP’s educational events provide valuable industry insights, they do not award credits towards an advanced degree. That said, the

association has a relationship with ASU’s Master of Real Estate Development program for folks determined to grow their careers. Enrolled students are provided a NAIOP membership so they can begin engaging with the association — if they haven’t already.

“We believe it’s important to connect our students to the industry locally, nationally and globally,” explains Mark Stapp, executive director of the MRED program. “But we don’t just buy them a membership. We engage the association in multiple ways, including the Education Committee. Each semester, we conduct case studies where people from NAIOP come into the classroom to discuss a particular project in depth, that way students have a close-up look at how the industry operates.”

Stapp was originally part of the advisory group who helped ASU create this pathway and was later asked to lead it. At first, he didn’t intend to stay for long, but found the experience so personally and professionally rewarding

that he still hasn’t left. Through his commitment to the industry, Stapp was also named a Distinguished Fellow by the national NAIOP organization — one of only 14 across the nation.

“Being recognized by one of the leading organizations in the industry means an awful lot, but it’s also an honor for ASU’s real estate programs to have a Distinguished Fellow as part of their leadership,” Stapp says. “It signifies credibility, and I’m able to network with top minds locally and nationally. That helps me identify resources we may need and get connected with them.”

The MRED coursework is targeted at mid-career professionals who want to develop a well-rounded understanding of the entire development spectrum. Students are placed into small cohorts so they progress through the degree track together, with an emphasis on experiential learning.

“All programs across the country teach essentially the same things we do, but what sets us apart is how we teach

the concepts,” Stapp notes. “There are lectures, but students also have to take that knowledge and apply it to three realworld projects. We’re working with actual property owners to solve problems, and that’s the reason our learning outcomes are so bright.”

Stapp describes the relationship with the industry as a “two-way street” since employers benefit from the connections made with these highly motivated individuals. Each project students work on includes a review where they receive feedback from faculty, NAIOP members and participating firms. That way learners receive constructive criticism, and the wider commercial real estate community sees what students are capable of.

“The industry supports us because we are their farm team and employers know the quality of our students by engaging with us,” Stapp concludes. “Our objective is to produce the best talent possible, many of whom will go on to become leaders in the sector.”

By KYLE BACKER

Each year, members of NAIOP Arizona bring some of the best commercial real estate projects to market, from monumental industrial facilities to best-inclass office spaces — and everything in between. Here are a sampling of just 50 projects that broke ground, were under construction or delivered in 2025. All photos were provided to AZRE.

Developer: 55 Resort at McCormick Ranch

General Contractor: W.E. O’Neil Construction

Architect: Synectic Design

Notable subcontractors: Cruz Concrete, Global Roofing, Spectra

Electrical Services, Grounds Control

Location: 9449 N. 90th St., Scottsdale

General contractor: Ryan Companies US

Architect: Butler Design Group

Notable subcontractors: Riggs Companies, Shambaugh & Sons, Sunland Asphalt, Integrity Electrical Services, Deer Valley Plumbing Contractors

Location: 2350 & 2525 W. Corporate Center Dr., Phoenix

Start: January 2025

Completion: Q4 2025

Details: Comprised of two Class-A industrial buildings totaling more than 186,000 square feet, 17 North Corporate Center Phase II will provide users with several onsite features and accessibility to major freeways, residential options and proximity to TSMC.

Developer: LaPour & Holualoa Companies

General contractor: WhitingTurner

Architect: RSP Architects

Notable subcontractors: Studio 11, Colwell Shelor, IMEG, PK Associates, Sustainability

Engineering Group

Location: 5550 E. Crown Place, Phoenix

Start: June 2024

Completion: Q1 2027

Details: Located near City North at Desert Ridge, the 240-key property blends sophisticated business travel and wellness focused extended stay into one elevated experience. On the west, the AC Hotel offers a clean, modern experience designed around business

Start: August 2021

Completion: March 2025

Details: 55 Resort Scottsdale Apartments is a new, three-story, 102unit, age-restricted (55+) multifamily property totaling 143,032 square feet. The property is located right on the Scottsdale Greenbelt, making parks, restaurants and shopping easily accessible to residents.

travelers. On the east, Element by Westin serves as an all-suite, extended-stay hotel with a more residential feel and wellness-focus.

General contractor: Sun State Builders

Architect: Cawley Architects

Notable subcontractors: AF Steel Fabricators, Suntec Concrete, Hawkeye Electric

Location: 3550 E. Roeser Rd., Phoenix

Start: January 2025

Completion: December 2025

Details: This project is a distribution facility for two businesses within the AF Family of companies. With rapid expansion across a national market, AFD requested that Cawley Architects provide a design

for a showplace building within their Phoenix campus.

Developer: Baker Development

Architect: SmithGroup

Location: 52nd St. and McDowell Rd., Phoenix,

Start: January 2024

Completion: Q2 2026

Details: AZUL, or Arizona Unlimited, is a 62-acre redevelopment located in the heart of the Valley. A vision in the “Silicon Desert,” this prime site will be the future home to the next redefined corporate headquarters or news-breaking data center campus.

General contractor: Layton Construction

Architects: Niles Bolton Associates, Gensler (Design Architect)

Notable subcontractors: PK Associates, Sustainability Engineering Group

Location: 217 E. 7th St., Tempe

Start: April 2025 // Completion: July 2027

Details: Astria Tempe is a 27-story residential tower near ASU, offering 380 units and standout amenities like a rooftop pool, fitness center, co-working space and retail. With bold design and prime location, it meets growing housing demand while redefining Downtown Tempe living.

General contractor: Ryan Companies US

Architect: Butler Design Group

Notable subcontractors: Riggs Companies, Next Level Steel, Progressive Services, Integrity Electrical Services, Deer Valley Plumbing Contractors

Location: 6955 W. Morelos Place, Chandler

Start: February 2025

Completion: Q4 2025

Details: Chandler Freeways Business Park involves converting a former office building on site that was originally built by Ryan in 2004 into an 87,600-square-foot single-story Class-A industrial building. A second 102,875-square-foot Class-A industrial building will also be constructed. The project is located conveniently near the I-10 and Loop 202 freeways.

Developer: Merit Partners

General contractor: Stevens-Leinweber Construction

Architect: Butler Design Group

Notable subcontractors: Suntec Concrete, Denny Clark

Masonry & Concrete, 3D Pipelines, Brown & Sons Electrical Contracting, Triad Steel Services

Location: 5101 – 5501 N. Cotton Ln., Litchfield Park

Developer: Schnitzer Properties

Architect: VLMK Engineering + Design

Notable subcontractors: High Quality Electric, B&B Concrete Contractors, Structures Group, Markade Plumbing, Graydaze Contracting

Location: 2717 E. Corona Rd., Tucson

Start: November 2024

Completion: December 2025

Details: Corona Commerce Center is directly adjacent to Tucson International Airport and three miles to the I-10, providing fully built out spec suites, air-conditioned warehouse and move-in ready suites ranging from 12,000 square feet up to 102,000 square feet.

Completion: Q2 2025