State of the Industry

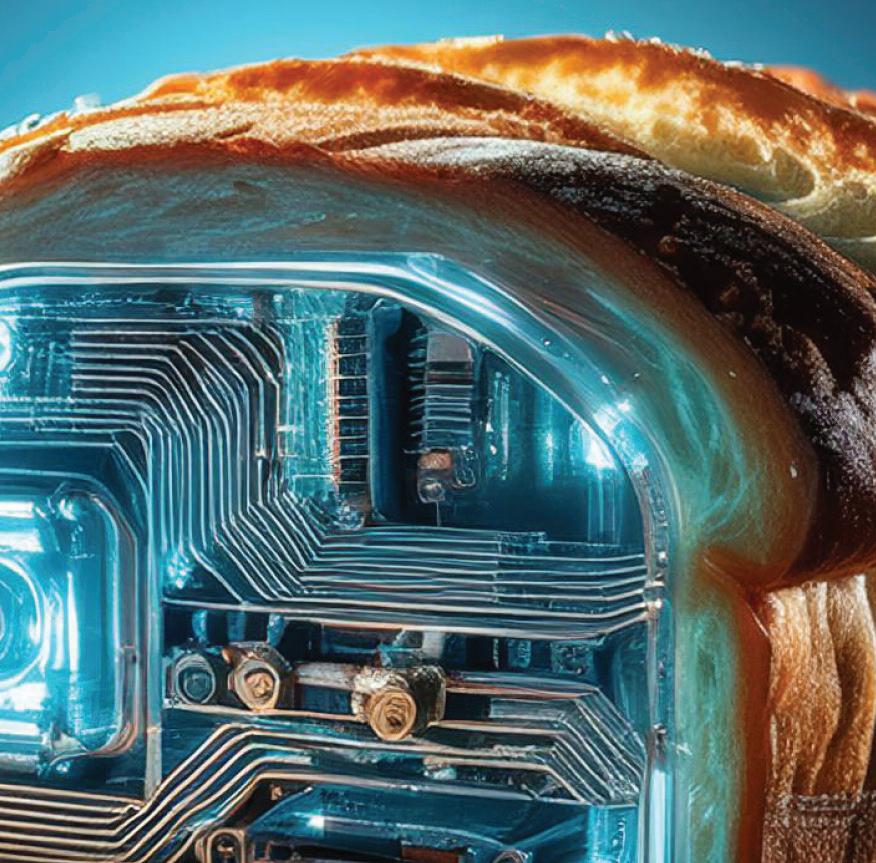

FROM TREAT CULTURE TO GLP-1 MEDS

FROM TREAT CULTURE TO GLP-1 MEDS

What is the Bred-Mate® difference?

J&K is the pioneer in natural ingredients for retaining freshness in bakery products. We are proud to introduce natural verification. Our Bred-Mate® portfolio offers our customers products which are natural verified (NV), 100% biobased and authenticated by C14 testing.

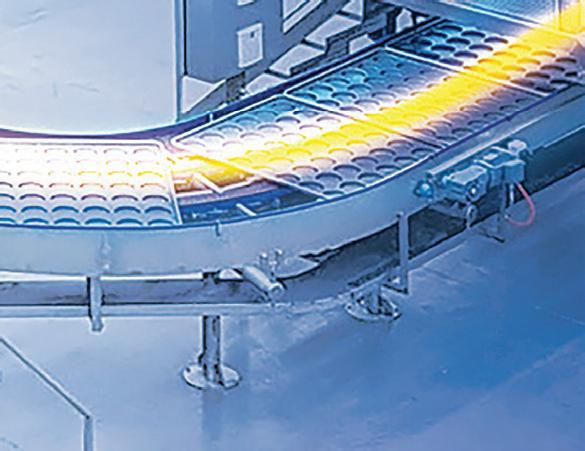

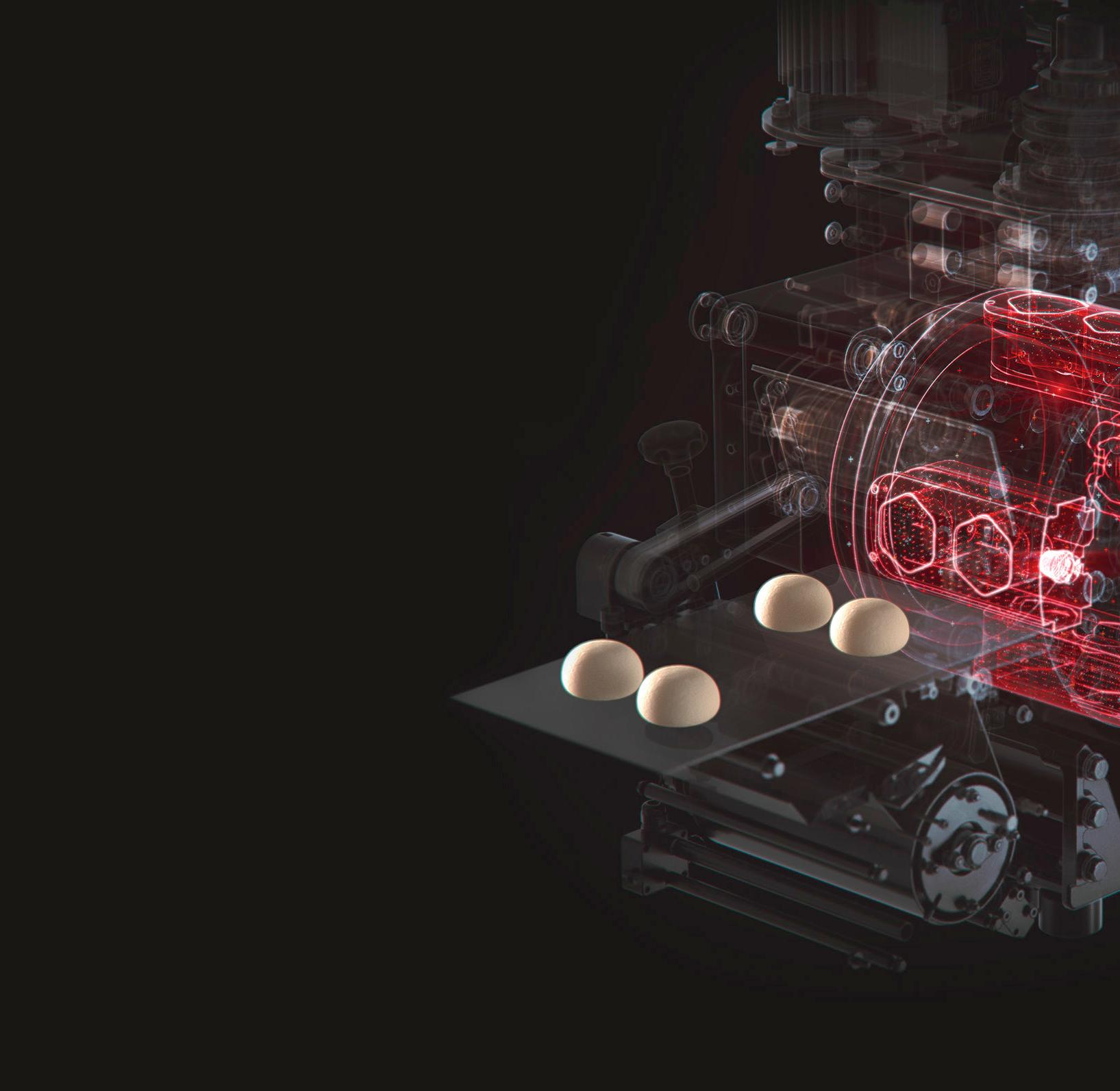

Intralox® LugDrive™ Series 8240 is a hygienic, solid thermoplastic belt built for small transfers.

Brings LugDrive belting’s operational reliability to small transfers

Able to wrap around transfer rollers as small as 1 in (25 mm) in diameter, LugDrive S8240 small transfer belting optimizes line layouts while preserving product quality and orientation—without compromising food safety.

www.intralox.com

Compatible with nose rollers as small as 1 inch in diameter

Eliminates harborage points and simplifies sanitation

Reduces transfer and drop distances

Paul Lattan

President - Principal

Steve Berne

Executive Vice President - Principal

Joanie Spencer

Vice President - Partner

Paul Lattan

Publisher | paul@avantfoodmedia.com

816.585.5030

Steve Berne

Director of Sales | steve@avantfoodmedia.com

816.605.5037

Erin Zielsdorf

Account Executive | erin@avantfoodmedia.com

937.418.5557

Joanie Spencer

Editor-in-Chief | joanie@avantfoodmedia.com

913.777.8874

Mari Rydings

Editorial Director | mari@avantfoodmedia.com

Jordan Winter

Creative Director | jordan@avantfoodmedia.com

Olivia Siddall

Multimedia Director | olivia@avantfoodmedia.com

Annie Hollon

Digital Editor | annie@avantfoodmedia.com

Maddie Lambert

Associate Editor | maddie@avantfoodmedia.com

Lily Cota

Associate Editor | lily@avantfoodmedia.com

Beth Day | Maggie Glisan

Contributors | info@commercialbaking.com

Commercial Baking is published by Avant Food Media, 1703 Wyandotte St., Suite 300, Kansas City, MO 64108. Commercial Baking considers its sources reliable and verifies as much data as possible, although reporting inaccuracies can occur. Consequently, readers using this information do so at their own risk. Commercial Baking is distributed with the understanding that the publisher is not liable for errors and omissions. Although persons and companies mentioned herein are believed to be reputable, neither Avant Food Media nor any of its employees accept any responsibility whatsoever for their activities. Commercial Baking magazine is printed in the USA and all rights are reserved.

No part of this magazine may be reproduced or transmitted in any form or by any means without written permission of the publisher. All contributed content and advertiser supplied information will be treated as unconditionally assigned for publication, copyright purposes and use in any publication or digital product and are subject to Commercial Baking ’s right to edit.

Commercial Baking ISSN 2767-5319, / USPS Publication Number: 25350 is published in February, April, June, July, August, October and December, in print and digital formats by Avant Food Media, 1703 Wyandotte St., Suite 300, Kansas City, MO 64108. Periodicals Postage Paid at Kansas City, MO, POSTMASTER: Send address changes to Commercial Baking, c/o Avant Food Media, 1703 Wyandotte St., Suite 300, Kansas City, MO 64108.

Circulation is tightly controlled, with print issues sent only to hand-verified industry decision makers and influencers. To apply for a free subscription, please visit www.commercialbaking.com/subscription

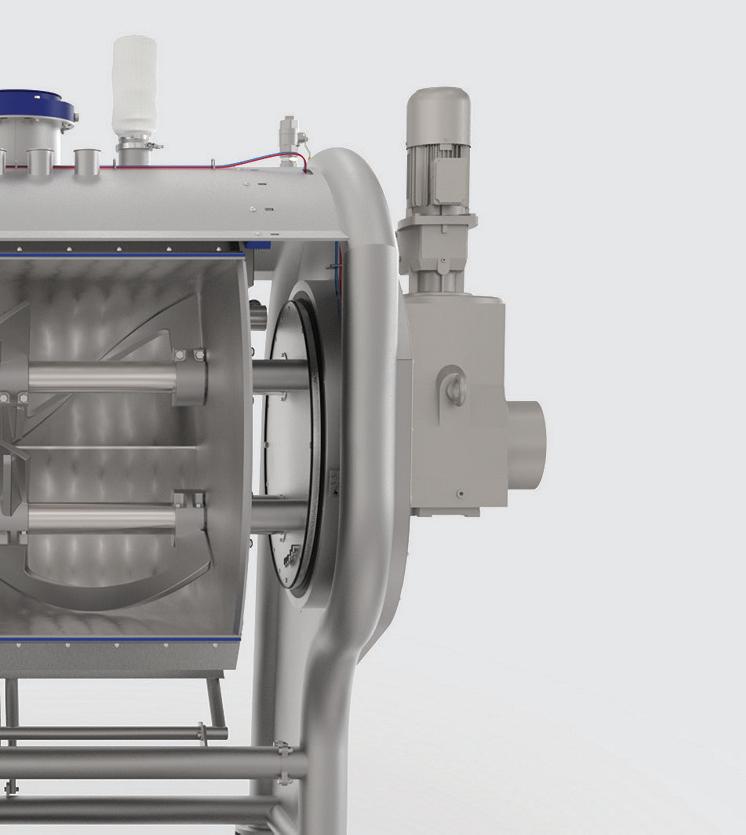

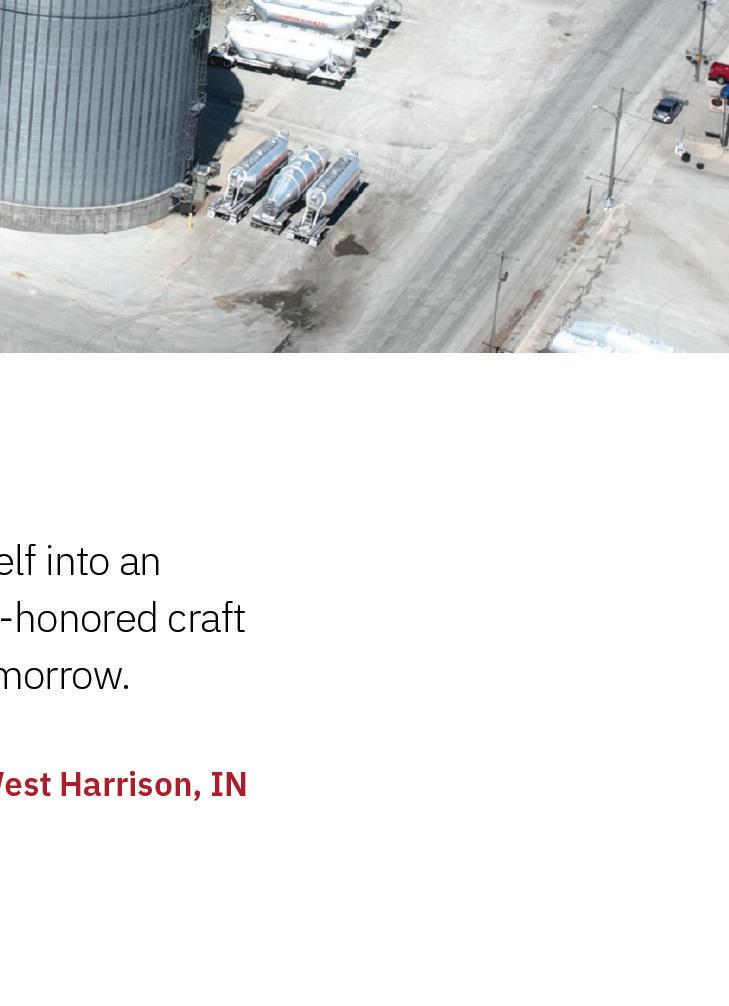

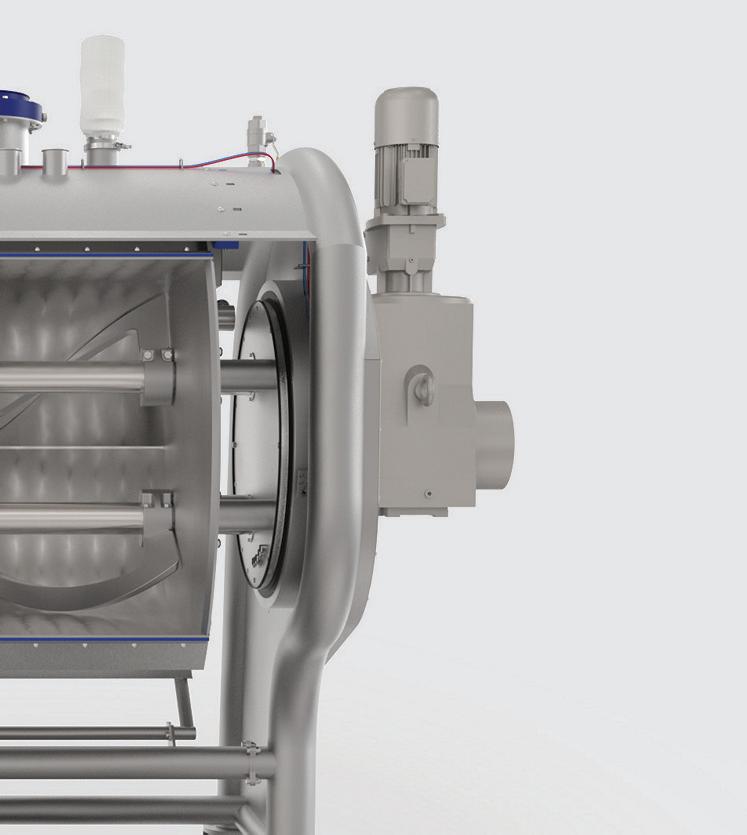

Built to fuel the future of snack production, the SNAX Double Sigma Arm Mixer by AMF Fusion combines innovative technology with decades of proven performance to deliver the ultimate solution for consistent, high-quality dough mixing. Designed with efficiency and hygiene in mind, the SNAX-DA streamlines your mixing process while helping you maintain complete control over dough quality, temperature, and consistency — batch after batch. With intelligent process monitoring and seamless integration, the SNAX-DA empowers your bakery with the data and insights to optimize every mix while reducing downtime and operational costs. Whether you’re producing cookies, granola and energy bars, pretzels, pies,orspecialtysnacks,theSNAX-DAisbuilttodeliverreliable performance today and future-ready flexibility for tomorrow.

Coperion unites the leading technology brands in food manufacturing to deliver innovative system solutions for your bakery

Technology for:

• Systems & Ingredient Automation

• Pre-Dough, Mixing, Forming & Dividing

• Depositing, Decorating & Cutting E: info@coperion.com

Meet Coperion in the West Hall

JOANIE SPENCER Editor-in-Chief | joanie@avantfoodmedia.com

WATCH NOW :

Joanie Spencer shares her thoughts on what brings joy in the baking industry. Sponsored by Bundy Baking Solutions.

My job isn’t what I call “Weight Watchers friendly.” But what it lacks in “WW points” allocation, it more than makes up for in the joy that baked goods bring. Who can’t use a bit more joy these days?

This issue gives us a moment to forget about all the uncertainty rocking our world and focus on something that makes this industry so special: new products. Our showcase is an ongoing process, and it does more than help us find our next obsession. It also helps us identify emerging trends based on what commercial bakers are bringing to market.

As a publication dedicated to fresh insights on trends and innovation, we understand the importance of discovering everything it takes — from the why to the how — to bring a new product to life.

This year’s New Product Showcase features legacy brands, new names and an homage to product development’s unsung heroes: limited-time offers (LTOs). It comes with exclusive video content, featuring our takes on some of the year’s most attentiongrabbing LTOs.

Without new ideas, innovation eventually becomes stagnation. So, to everyone who contributes to a successful product launch, from everyone here at Commercial Baking , thanks for bringing the joy. It’s worth every point.

Commercial Baking checks in on the categories covered so far this year.

Center store specialty rolls saw the largest sales change vs. a year ago, though growth is slightly lower than reported in Q1.

*Dollars rounded to the nearest hundredth

Total US Multi-Outlet+ w/ C-Store (Grocery, Drug, Mass Market, Military, Convenience and Select Club, Dollar, Beauty & Online Retailers) | Latest 52 Weeks Ending April 20, 2025

Source: Circana OmniMarket Integrated Fresh, a ChicagoBased Market Research Firm (@WeAreCircana)

Center Store Buns | Rolls Sales* HAMBURGER |

DINNER ROLLS

SANDWICH BUNS

SPECIALTY ROLLS ALL OTHER

Center Store and Perimeter Donut Holes vs. Full-Size Donuts By Dollar Sales ($ in Millions)

Total US Multi-Outlet+ w/ C-Store (Grocery, Drug, Mass Market, Military, Convenience and Select Club, Dollar, Beauty & Online Retailers) | Latest 52 Weeks Ending April 20, 2025

Source: Circana OmniMarket Integrated Fresh, a Chicago-Based Market Research Firm (@WeAreCircana)

Crackers with fillings saw the most growth vs. a year ago. Dollar sales for the remaining cracker subsegments are either flat or down.

Total US Multi-Outlet+ w/ C-Store (Grocery, Drug, Mass Market, Military, Convenience and Select Club, Dollar, Beauty & Online Retailers) | Latest 52 Weeks Ending April 20, 2025

Source: Circana OmniMarket Integrated Fresh, a Chicago-Based Market Research Firm (@WeAreCircana)

During this time of year, private label layer cakes are gangbusters in the grocery store perimeter.

Total US Multi-Outlet+ w/ C-Store (Grocery, Drug, Mass Market, Military, Convenience and Select Club, Dollar, Beauty & Online Retailers) | Latest 52 Weeks Ending April 20, 2025

Source: Circana OmniMarket Integrated Fresh, a Chicago-Based Market Research Firm (@WeAreCircana)

We’re putting the finishing touches on Capway’s latest innovation in bakery automation.

We’re putting the finishing touches on Capway’s latest innovation in bakery automation.

We’re putting the finishing touches on Capway’s latest innovation in bakery automation.

RoboStack ensures the smooth transition of pans as they leave the production line.

RoboStack ensures the smooth transition of pans as they leave the production line.

RoboStack ensures the smooth transition of pans as they leave the production line.

RoboStack is designed and built to:

RoboStack is designed and built to:

RoboStack is designed and built to:

• offer precision handling of multiple pan sizes

• offer precision handling of multiple pan sizes

• offer precision handling of multiple pan sizes

• your desired pan stack height

• your desired pan stack height

• your desired pan stack height

• work with most existing pan carts

• work with most existing pan carts

• work with most existing pan carts

• maximize uptime for your production line Custom engineered conveyor systems allow for the seamless integration of our RoboStack system into your bakery’s existing footprint or new expansion. It all stacks up to the world’s most efficient operation in daily pan logistics.

Custom engineered conveyor systems allow for the seamless integration of our RoboStack system into your bakery’s existing footprint or new expansion. It all stacks up to the world’s most efficient operation in daily pan logistics.

Call today to be the first in line to have our new RoboStack system installed in your bakery. 877.222.7929

Custom engineered conveyor systems allow for the seamless integration of our RoboStack system into your bakery’s existing footprint or new expansion. It all stacks up to the world’s most efficient operation in daily pan logistics. Call today to be the first in line to have our new RoboStack system installed in your bakery. 877.222.7929

• maximize uptime for your production line

• maximize uptime for your production line

Private label brands, treat culture and GLP-1 meds are just a few factors influencing how consumers shop.

BY MAGGIE GLISAN

If there’s one thing that’s certain right now in the bakery industry — or in any industry for that matter — it’s that nothing is certain.

Inflation remains high, tariff policies seem to shift by the hour and the possibility of a recession looms large. Amidst this backdrop of economic volatility and instability, it could be assumed that consumers are focusing on one thing and one thing only: spending less or, when they do, choosing the least expensive options. But that’s not the whole story.

“Just because there is financial pressure doesn’t mean the current environment is a constant race to the bottom,” said Anne-Marie Roerink, principal and founder of 210 Analytics. “Far from it.”

In times of uncertainty, consumers feel they lack control about the big things, but what they can control is their own behaviors and how their household buys and consumes. And what they choose to buy and how they choose to spend comes down to value.

The idea that value simply means cost vs. benefit is no longer the case. According to Hartman Group, the new value paradigm takes a subjective, consumer-driven approach to assessing the benefits of experience, quality, relevance, price and convenience. For example, 62% of consumers are willing to pay more for a

food/beverage that saves time, effort or mess, an appeal as they seek more convenience in their products. For 31% of consumers, a pleasant store environment will entice them to spend more money, proof that some shoppers value experience over price.

When assessing worth, consumers turn to their personal priorities, making the emotional dimensions of value the real game changer when it comes to choosing one product over another, especially in an environment of economic uncertainty.

“We do see consumers seeking value, but value is more complex than just the price of things,” Roerink said. “How much time do I have? What am I in the mood for? What else have I been spending my money on? How about nutrition?”

Social media mentions of single-serve baked goods are up

compared to last year.

Source: Tastewise

Sally Lyons Wyatt, global EVP and chief advisor, CPG and foodservice for Circana, said this bifurcation is happening across grocery store categories.

“People will make trade-offs,” she said. “They might opt for the private label of one item because it checks enough boxes to get the job done but then recognize where sacrifices have been made in another area and splurge on a different item.”

She noted that private brands are likely to continue growing, with the wellestablished bakery category playing a key role in that momentum. Roerink also expects more consumers to explore private brands as they become increasingly budget-conscious, adding that experimentation offers a valuable opportunity for grocers to attract new customers.

“Many consumers — low, middle and even higher income these days — are in a non-stop budgeting balancing act, and that means they are shifting dollars between foodservice and retail, between items, between brands, between categories,” Roerink said. “That has led to more trial with private brands, and if they deliver, they’ll continue buying the private brand.”

Experimenting with portion size is another way bakers can deliver value, but that doesn’t simply mean doling out value packs.

“In every category, I’m seeing manufacturers and retailers move to what I refer to as the ‘continuum of choice,’ and in a way, smaller portion sizes check off multiple boxes [for the consumer] in that they can be more affordable, they reduce waste and they’re a better fit for a smaller household,” Roerink said.

On the flip side, Roerink said she sees a lot of strength for larger family packs as well, especially for items that can be frozen and used over time, noting that the trend has everything to do with a more favorable price per pound and the ability of consumers to spend a little bit more money over the long term.

Overall, she said, consumers are hyper-focused on the price per unit. They want to know how an item fits within their total budget, and they’re particularly conscious of waste.

“People are looking to consume every dollar they are spending on food rather than throwing out a lot of items,” Roerink added, “so I think package size variety makes a ton of sense in the current environment.”

Then again, despite mounting financial pressures, people aren’t cutting back when it comes to treating themselves. According to Tastewise, searches and mentions of “premium” and “indulgent” baked goods have increased by 13% yearover-year. Items like gourmet cookies, rich pastries and specialty breads — think sourdough, focaccia or brioche — are growing in popularity, and consumers are especially drawn to elevated flavors like matcha (+18%), pistachio (+21%) and sea salt caramel (+16%), all of which add a sense of luxury.

The idea of indulgence and “treating yourself” also plays into the changing conversation about overall health, and that’s a shift from restriction and diet culture to a more balanced

“It’s still too early to tell what the long-term impacts will be, but early indicators suggest GLP-1s are impacting consumer behaviors.”

Anne-Marie Roerink | principal and founder | 210 Analytics

approach. It’s something Lyons Wyatt calls “harmonized wellbeing,” a combination of physical, mental and social wellness.

“We’ve learned a lot over the past five years in terms of what health really means,” she said. ”And that education has started to impact the food and beverage choices consumers make.”

Alon Chen, CEO and co-founder at Tastewise, also noted that the better-for-you trend in baked goods is evolving.

“Consumers are now defining wellness through emotional satisfaction, functional benefits and clean-label transparency, with a clear shift toward the first two as key priorities,” he said.

According to Tastewise, mentions of terms like “feel-good treat” and “guilt-free indulgence” have increased by 24% year-over-year, highlighting a consumer desire for enjoyment without compromise, and mentions of “stress-relieving” or “mood-boosting” baked goods are trending upward, especially on social platforms.

But it’s not always enough to enjoy a little baked treat. Consumers often want their baked goods to be good for them, too, and they’re turning to options that offer tangible wellness advantages. Per Tastewise, interest in high-protein baked goods, gut-friendly, energy-supporting snacks and immunityrelated claims are all seeing significant traction among consumers, especially in formats such as breakfast bars, functional cookies and snackable cakes.

Another factor affecting how consumers approach indulgent foods and functionality in their diets? The rise of GLP-1 medications.

It’s where we began. For the past century, Brolite has created a variety of naturally fermented cultured flavors. Designed to give bakers a handcrafted taste in no time, these flavors are a great addition to any formula.

Our sours range from strong and pungent to subtle and delicate flavors giving the baker an exact flavor profile needed. Brolite ferments various flours for specific amounts of time, then dehydrates the custom flavor before it is finally milled into a fine, easily handled, free-flowing powder.

Unique artisan flavors made easy for any baker and any baking application.

Initially approved by the FDA to control diabetes, the number of people without diabetes taking a GLP-1 medication in the US more than tripled between 2018 and 2022, according to a March report in the Annals of Internal Medicine Americans also spent an estimated $71.7 billion on GLP-1 medications in 2023, a 500% increase over a five-year period, according to research published in JAMA Network Open

“It’s still too early to tell what the longterm impacts will be,” Roerink said. “But early indicators suggest that GLP-1s are impacting consumer behaviors, specifically around the increased consumption of whole foods and a reduction in snacking.”

Smaller portion sizes, mini-indulgences and functional treats are all things bakers should consider as the impacts of GLP-1s become clearer. According to Tastewise, mentions of single-serve baked goods are up 24% compared to last year, reflecting a stronger focus on portion control, whereas small-format items such as mini croissants and bite-sized cookies, up 17% and 14%, respectively, are replacing larger, shareable formats.

But just because GLP-1s and healthrelated news are dominating headlines, Lyons Wyatt said that doesn’t mean everyone on the planet is thinking about their wellbeing 24/7.

“There are still a lot of consumers that are just eating because they’re hungry and drinking because they’re thirsty,” Lyons Wyatt said. “And they pay very little attention to all this health and wellness chatter.”

At the same time, flavor remains one of the most powerful motivators, sparking a wave of bold innovations designed

Mashups such as bite-sized Bundt cakes topped with a mini Pop-Tart exemplify the tiny treat culture trend.

to surprise and satisfy evolving taste preferences. According to Circana’s 2025 “Snack Survey,” 57.5% of consumers look for authentic and/or unique experiences in their snacks, and 10.6% look for bold and/or unexpected flavors.

Black lime and hawaij are two of the standout flavors highlighted in Tastewise’s “2025 Trend Report,” and Chen noted several other flavors worth watching, including yuzu, ube, tahini and miso.

“These emerging flavors reflect a broader shift toward globally inspired, sensory-rich baking that balances familiarity with innovation,” he said.

Cody Masters, executive chef and EVP of culinary and industrial sales for Everson Spice Co., said global flavor experimentation has entered a new phase, and bakers should take note.

“Applying globally influenced flavors to mainstream domestic analogs has become the new norm,” he said. “Certain brands or companies will gravitate to this faster than others while also leveraging their regional demographic’s buying patterns against said flavors. There is a fine line between educating a consumer versus exploiting what already works.”

Innovation around complex heat, especially “swicy,” generates interest, particularly with Gen Z.

“The data shows that legacy flavors, even ones as mainstream as ranch or pickle, do little to interest this generation’s buying power,” Masters said. “However, a simple fusion of introducing a unique heat source immediately drives attention.”

To that end, he suggested taking a more simplistic approach, such as choosing serrano instead of jalapeño, adding miso to classic caramel, or trying a new version of an apple fritter with hot honey.

Roerink said bringing flavor innovation into a category is one way to get shoppers to make an unplanned purchase.

“The consumer might try a new flavor in response to something they’re seeing on social media, or they’ll jump on a limited-time offer,” she said. ”Often you see these innovations in their shopping cart right alongside their core items, but it’s important to balance the two.”

Perhaps that’s why brand collaborations have been gaining traction and

finding considerable success in recent years. Buzzy launches such as Sour Patch OREOs or Frosted Strawberry Pop-Tarts Nothing Bundt Cakes mash one brand flavor with another, opening up a world of new possibilities for CPG brands.

“Consumers have an appetite for trying something different but are often hesitant to go all-in on an innovation and risk wasting money on something that doesn’t taste good,” Roerink said. “So, a collaboration from two trusted brands not only draws in fans of the existing products, but it also mitigates some of that risk.”

57.5% of consumers look for authentic and/or unique experiences in their snacks.

Source: Circana | 2025 Snack Survey

She foresees more innovation in this area, including pop culture collabs tied to movies and video games. It all goes back to consumers’ willingness to spend a little bit more for special occasions and celebrations.

Lyons Wyatt agreed these mashups have momentum.

“They’ve really taken off because of the co-licensing and co-branding, and I don’t think it’s going to stop in the near future,” she said. “It’s a way to take loyal customers from one brand and introduce them to another brand, and there’s a beneficial experience for both sides.”

Though today’s economic landscape might look uncertain, there’s plenty for the baking industry to be optimistic about. As the definition of value evolves, consumers are seeking more than low prices. They want products that offer quality, convenience, health benefits, unique experiences and even emotional connection. From bold new flavors and brand collaborations to right-sized portions and health innovations, bakers must find fresh ways to meet these changing needs. CB

With contract manufacturing in huge demand, relationships matter now more than ever.

BY JOANIE SPENCER

In the world of commercial baking, contract manufacturing is among the most important relationships that exist. Whether it’s a matter of geographical distribution, speedto-market or good old-fashioned capacity, companies are teaming up with contract manufacturers in ways that might not have been considered a decade or two ago.

“The need [for co-manufacturing] is higher than it’s ever been, and it’s growing at a pace faster than the industry it supports,” said Carl Melville, president and CEO of The Melville Group and founder of CoPack Connect.

“There are near-term drivers such as inflation and the long-term growth of emerging brands, as well as the continued growth in outsourcing by legacy brands, all contributing to high levels of compound growth.”

Inflationary pressures and economic fears are driving more consumers toward private label products and the perception of their lower price points. According to the Private Label Manufacturers Association

(PLMA), nearly one-fourth of US grocery products are private label or store brand items. This is well above the 17% peak that private labels saw in previous downturns, suggesting the tides are turning for this segment.

In many ways, private labels are brands themselves. Melville refers to them as “stealth brands,” and they’re gaining legitimacy in quality, especially when tied to popular retailers such as Trader Joe’s, Target or Costco. They have the consumer trust associated with brands, without the high costs traditional brands must often bear.

PLMA reported that in 2024, total sales of store brands reached a record high of $271 billion, and unit sales also hit a record 67.4 billion. While certain outlets have the resources to manufacture their own products, this increased demand for private label also creates a new need for contract manufacturing.

That need isn’t without its challenges, though — especially for manufacturers with capabilities to make both branded and private label products — when pandemic-related changes opened the door for more co- manufacturers to make a wider range of items.

One example is Legacy Bakehouse, a mid-size bakery that maintains a balance of manufacturing products ranging from large legacy brands to private labels.

“It used to be that CPGs typically wouldn’t bring branded products to those known as a private label supplier,” said Alain Vallet-Sandre, president of this Waukesha, WI-based bakery. “But I’ve seen that change significantly, especially during the pandemic, and it’s led to a more mature approach to private label business.”

Beyond a financially motivated demand for private label products, consumers

are changing their expectations around quality. To meet those expectations, store brands have stepped up their game, and they’re relying on co-mans to get the job done.

“With the increased prevalence of private brands within retailers, consumers are now demanding a national brand equivalent,” Vallet-Sandre observed. “Historically, it’s been a value play. But now, to even be considered, a private label will compare its product to the national brand and others in the private label space.”

Alain Vallet-Sandre discusses how the private label landscape has changed.

This changing landscape means that contract manufacturers are not only on the radar for what they can offer

their customers; they’re also gaining visibility for what they need. Increased demand for their services requires optimizing productivity through automation upgrades that lead to more efficiency.

In terms of capacity, it all depends on the operation. For example, an order to run one million bars could be a game-changing piece of business for one operation, but for another, it looks more like a rounding error. This becomes high stakes for emerging brands that are just breaking into the market with more orders than a commercial kitchen can handle but still small enough to be a blip on the co-man radar.

“Many new brands that start in a commercial kitchen outstrip that very soon,” Melville said. “But then again, they can’t go straight to the big guys because chances are they just don’t have the volume.”

Finding a contract manufacturer with compatible capacity is the first step, but certainly not the last. New players in the market need resources that go beyond production.

“Emerging brands also look to their co-mans to be strategic partners,” Melville said. “They can provide essential functions, including food safety, product freshness, formulation, commercialization, regulatory requirements, clean label … all the things small brands worry about but can’t build a staff for. It’s about more than just stainless steel and space.”

Meanwhile, legacy brands — which likely already have those resources readily available — often rely on contract manufacturers for completely different reasons. For starters, large brands that have been household names for years usually have access to their own manu -

facturing, oftentimes relying on co-mans for product ideation and speed-tomarket, especially for limited-time offers.

While there are literally thousands of contract manufacturers available to meet all these needs at either end of the volume spectrum, finding the right match isn’t always so easy. Just as in any relationship, matchmaking can be tricky. While the brands are the ones doing the hiring, many discover that articulating their specific needs isn’t always so simple.

Molly Blakeley, founder and CEO of Eagle River, AK-based Molly Bz Cookies, faces a particular challenge in finding the right manufacturing match for her premium “boozy” cookies that are typically infused with alcohol flavor extracts, many of which also have unique toppings.

“I’ve learned that most manufacturers prefer to do a straight wire-cut,

bake and flowwrap,” Blakeley said during Commercial Baking ’s podcast, Troubleshooting Innovation. “But mine have frosting, or Fruity Pebbles or marshmallows. They can be a nightmare to make, but my cookies are unique and visually appealing, and that’s part of what made me successful.”

Co-manufacturing doesn’t just impact grocery store shelves; it’s also part of life in the foodservice world. While global QSR chain Five Guys has its own bakery division, it relies on contract manufacturers around the globe to produce buns for its iconic hamburgers. Having the right partner is table stakes for Five Guys to ensure that eating a burger in one part of the country — or the world — is the same experience as it is anywhere else. During the American Society of Baking’s BakingTECH conference, held in Orlando, FL, earlier this year, Bill Zimmerman, bakery technologist, quality for Five Guys Bakery, shared some

Quietly Revolutionize Your Process

of the top considerations brands should think about when they’re seeking a manufacturing partner.

According to Zimmerman, a brand must focus first and foremost on its product, including the formula, specifications and key quality attributes.

“Of course, you have an idea of what you want out of your product,” Zimmerman said. “But have you clearly identified the specific attributes you need from the product?”

In addition to communicating the key product attributes and specifications that have to be executed, Zimmerman advised brands to focus on the manufacturer’s process along with its food safety and regulatory compliance. The latter is especially important for allergen-friendly products.

“A lot of bakery brands have allergen concerns,” Zimmerman said. “Think about what a big concern sesame seeds are today. What if a bakery needs to run soy, dairy or certain types of fruit? There are so many parameters a company needs to specify with the contract manufacturer, and food safety and regulatory compliance are at the heart of the brand because at the end of the day, that’s whose name is on the package.”

For Melville, who represents several contract manufacturers in food and other industries, research is the most critical homework assignment.

“Brands not only need to be clear on what their needs are, but they also must understand the needs of the co-man,” he said. “Think of this as two ‘buyers’ in the relationship. One is willing to give up capacity in return for production, and vice-versa.”

The manufacturing nature of the relationship dictates that capacity mix, bandwidth, quality and food safety are key drivers for a good match. Then again, culture is an area where alignment can become a critical component. Saying “Yes” to a contract essentially means saying “No” to the next one, so the relationship only works if the two sides are compatible.

“They don’t have to have identical goals; odds are they won’t,” Melville said. “But the cultures should be somewhat compatible because the relationship will last a duration of time, and success on both sides depends on that compatibility.”

To answer that constant refrain about seeking the right contract manufacturing partner, The Melville Group launched CoPackConnect, an AI-driven platform, in partnership with the Contract Packaging Association (CPA). The purpose is to enable brands to quickly and easily submit RFQs that can be matched with potential manufacturing partners.

“The AI agent takes a brand’s RFQ and submits it to its matching engine, which is another piece of AI technology,” Melville said. “The system is designed to match the needs of the brand with the capabilities of the co-man, giving each side enough information to connect directly while eliminating a lot of frustration, noise and added costs.”

With no shortage of uncertainty in the market, and consumer demand as fickle as ever, bakery brands of all sizes and formats have to calculate every move with the utmost scrutiny. When executed correctly, and with the right relationships, contract manufacturing can be the key to holding it all together. CB

Finding the right co-man — and maintaining a positive partnership — is an exercise in continuous learning. During the International Baking Industry Exposition (IBIE), to be held Sept. 14-17 in Las Vegas with a dedicated day for IBIEducate on Sept. 13, Carl Melville, president and CEO of The Melville Group, will host a one-hour seminar on how bakers can qualify and benchmark their contract manufacturing partners.

The session will cover key factors to consider, including sustainability, traceability and ethical sourcing. Attendees will gain high-level information as well as actionable practices that apply to legacy baking companies and emerging brands. With a deep dive into best practices for successful co-manufacturing partnerships and data from The Melville Group’s “2025 State of the Industry Report,” researched in conjunction with CPA, bakers will learn how to maximize their relationships with external manufacturers.

IBIEducate sessions are now included in the Baking Expo registration, which is now open at www.bakingexpo.com/register.

Watch live demonstrations of our industry-leading Vemag Dough Dividers

n Gently handles dough

n Unmatched scaling accuracy

n Precisely scales a wide range of dough portions

n Produces a variety of crumb structures

n Handles absorption rates from 45% to 95%

n No divider oil needed

n Fast, easy changeovers sifting and reclaim, and zig zag board

At IBIE 2025, bakers in every category will find solutions for their most pressing operational challenges.

BY ANNIE HOLLON

There’s more to the baking industry than meets the eye. From the diversity of its baked goods to the range of customers and consumers it serves, each category plays a significant role in feeding people every day. Yet, while bakers collectively face similar obstacles — including workforce shortages, ingredient costs, regulatory shifts and tariffs — each segment has its specific challenges.

The International Baking Industry Exposition (IBIE), set for Sept. 14-17 in Las Vegas, is designed for bakers to find resources and solutions to address those challenges.

Co-owned by the American Bakers Association (ABA) and BEMA and supported by the Retail Bakers of America, the triennial event offers a centralized location for professionals to network and troubleshoot common issues. Not only does it house one million square feet of innovation, but it also hosts IBIEducate, the largest baking industry education event in the Western Hemisphere, with more than 250 sessions, demos and workshops.

Taking advantage of what IBIE has to offer will help bakers and manufacturers of any specialty conduct their vital work. In addition to education, the tradeshow floor offers bakers a chance to interact with hundreds of exhibiting companies to solve their operational challenges.

Manufacturers in this space are the life force behind household staples, creating a spectrum of products for retailers, foodservice operators and in-store bakeries.

There are plenty of elements that impact the industry. On the regulatory side, FDA changes targeting artificial dyes may require reformulation. Manufacturers are also being kept on their toes through the revamp of healthy claims, sodium and sugar reduction efforts, and proposals that could impact packaging.

Consumer interest in baked goods that align with specific dietary lifestyles is prompting bakers to approach innovation through a new lens and revamp formulation. Demand for compostable or upcycled packaging offers opportunities for manufacturers to go green … though integrating these materials into existing equipment may require retooling.

Wholesale bakers are also facing workforce shortages. In a study conducted with ndp | analytics, ABA revealed findings that estimate 53,300 unfilled jobs in the commercial baking industry by 2030.

Automation alleviates some of those challenges, supporting team members by eliminating labor-intensive tasks and increasing efficiency. Incorporating tech such as AI can also provide real-time information for greater consistency.

IBIE’s Wholesale Bakers Center will offer manufacturers additional insights into sustainability, workforce development and operational efficiencies. The show feature will also serve as a networking hub, connecting bakers with peers and offering ways to elevate their businesses.

According to Circana’s “Snack Unwrap: The Insatiable Craving for Growth” report, nearly half of Americans (48.8%) snack three or more times daily. This diverse segment — which Statista projects will have $53.33 billion in revenue

in 2025 — ranges from tortilla chips to extruded snacks to pretzels.

While Americans are snacking more, they also demand more from their snacks. Flavor experience is of significant interest to consumers, which serves as an opportunity for manufacturers to develop new combinations to stand out on shelves. One challenge producers face is the speed-to-market required to meet demands while maintaining quality.

Interest is rising for natural foods and snacks that align with healthy lifestyles. According to Innova Market Insights, consumers are choosing inherently healthy snacks. In turn, snack makers are adjusting formulas and adding more functional ingredients such as fiber and protein. However, ensuring these reformulations work in their current facilities poses a different issue.

Snack manufacturers have also seen a shift toward convenience. On-the-go snacking is still important for consumers, making individually wrapped offerings more appealing. Finding the right packaging size, materials and equipment will

have manufacturers looking to IBIE for the latest innovations and solutions.

For snack food manufacturers aiming to connect with essential suppliers, the Snack Food Pavilion provides a place to dive into the latest trends, technologies and formulations.

This versatile offering is seeing a meteoric rise thanks to growing consumer interest in better-for-you goods. Paired with younger consumers’ interest in international flavors, the tortilla market — valued at $33.09 billion in 2023, according to a study from The Insight Partners — is not going anywhere.

Data from Bakery Playbook: Tortillas , part of ABA’s research study series sponsored by Dawn Foods, Lesaffre and Puratos, highlighted that the spectrum of product varieties and package sizes provides consumers with more options for various dayparts.

As seen in other factions of baking, tortilla producers are working on integrating

alternative ingredients. To meet demand for low-carb, gluten-free or lower-calorie traits, manufacturers are introducing new ingredients such as dehydrated prickly-pear cactus, buckwheat and almond flour. Sourcing and incorporating these ingredients can require reformulation to ensure the texture and structure pan out and the dough will work with existing equipment.

Consumers are also interested in more traditional varieties. For some, this requires ensuring the proper equipment is in place to execute processes such as nixtamalization. There is also interest in offerings with health-forward attributes, driving innovation through a lens of sodium, cholesterol, trans fat and carb reduction.

As with the rest of the industry, labor is vital for producing tortillas. As workforce challenges persist, producers are investing in automation to reduce repetitive tasks and drive retention.

Working with these considerations requires adapting equipment lines. To help producers adapt, IBIE exhibitors will present an array of solutions designed to ease these challenges.

Pizza, in all its many forms, remains a tried-and-true staple for American households. According to Mintel’s “US Pizza Market Report 2024,” the category had an estimated value of $9.6 billion.

Keeping up with demand requires steady relationships with vendors and ingredient suppliers. Pizza makers on the commercial scale are looking to balance incorporating automation and maintaining an artisan touch. Manufacturers of pizza crusts and pre-portioned dough balls must formulate to consistently meet foodservice operators’ needs. With an uptick in thaw-and-bake solutions, ensuring that products retain their quality is vital.

Packaging is also a major consideration, with manufacturers looking to automation to support this. Like other industry segments, there is also increased innovation with better-for-you ingredients and trendy toppings. Recent updates include crusts made from cauliflower and almond flour and unconventional flavors such as dill pickle and hot honey. Integrating ingredients poses an opportunity to find equipment that meets these needs at the show.

As a collective, baked goods manufacturers are seeing common themes on the operations side. From demand for better-for-you offerings and increased automation to specialty-specific operational challenges, bakers are searching for ways to strengthen their businesses. CB

The following sessions are tailored to the current operational needs of bakers in every segment.

• Next-Gen Baking: Integrating Industry 4.0 to Transform Your Baking Operations | Jim Vortherms, CRB

• The Power of Enrichment: Enhancing Nutrition and Leading the Past, Present and Future of Functional Foods | Erin Ball and Toby Amidor, Grain Foods Foundation

• Functional Solutions for Sodium Reduction in Bakery | Dinnie Jordan, Kudos Blends

• Advancing Healthy Snacking with Extruded Ancient Grains | Stefan Bucher, Ardent Mills

• Matching a Flavor to Your Brand | Pamela Oscarson, McCormick

• Startup to Scale: Building Personalized Success in Snack Bar Packaging at Every Stage | Josh Becker, Harpak-Ulma

• Tortilla Triumph: Navigating Shelf Life and Formulation in Tortillas | Lariza Lopez de Leon, Caldic North America

• How Consumer Trends Shape US Bakeries: Bakery Research Report | Anne-Marie Roerink, American Bakers Association

• Corn in the Modern Diet: Unlocking Health Benefits Through a Nutritional Staple | Tess Brensing, Corbion

• From Field to Flour: How AI is Revolutionizing Wheat & Baking Consistency | Lilach Aviad, Equinom

• Understanding Frozen & Refrigerated Dough Rheology and the Performance Factors to Improve Final Product Quality | Gideon Butler-Smith, Sherrill Cropper, Lesaffre

See all IBIEducate sessions at www.bakingexpo.com/education.

Communities rich with resources await early-stage brands willing to engage.

BY MARI RYDINGS

courtesy

All brands have an origin story.

Dave’s Killer Bread, now part of Flowers Foods, got its start at the Portland, OR, Farmers Market. Tate’s Bake Shop began as literally just that … a small cookie shop in the Hamptons. It’s now part of Mondelez International’s cookie portfolio. Their success didn’t happen overnight, and it didn’t happen in a bubble. To scale their businesses, these brands’ founders tapped into resources tailored toward entrepreneurs and connected with like-minded communities for support at every stage.

According to PMMI, the association for packaging and processing technologies, small brands accounted for 37% of new product introductions in 2023, a 17% gain compared with previous years.

“That’s a significant increase,” said Laura Thompson, VP of tradeshows for PMMI. “In addition to increasing market share, smaller brands are leading the way in innovative packaging and marketing, helping shift the retail landscape. Smaller manufacturers are succeeding by staying nimble, tapping into niche markets that more prominent players might miss, and reaching out to customers in new ways.”

Two factors are driving this growth, according to Circana’s “2024 U.S. CPG Growth Leaders” report: lower barriers to entry and increasing support for emerging brands. The latter addresses some of the most challenging aspects of starting a business such as creating an identity, boosting brand awareness, securing financing, finding a small-scale co-manufacturer, attracting buyers and understanding how product distribution works.

Connecting the dots among Connecticut’s food entrepreneurship ecosystem was the inspiration behind the launch

“In-person events are where the unpredictable magic happens. Brands want to be in front of buyers so we create as many in-person opportunities as possible.”

Daniel Scharff | founder and CEO | Startup CPG

of CT Food Launchpad, founded by Charles Negaro Jr. and Reed Immer, the CEO and director of sales and marketing, respectively, for New Haven, CT-based Chabaso Bakery.

“We noticed a gap in resources geared toward helping brands move from the farmers market to an in-store pilot program or the grocery store shelf,” Immer said. “Chabaso is a mid-size bakery, and we realized these brands are dealing with many of the things we were losing sleep over just a few years ago.”

Over time, CT Food Launchpad has evolved into a one-stop shop for Connecticut-based emerging brands in foodservice and CPG. It serves as a resource hub for brands and solutions providers and includes free access to two comprehensive directories: One compiles young brands by category and distribution level, and the other offers resources for essential services such as legal advice, graphic design, pricing and operations insight.

“With CT Food Launchpad, we’re trying to make it easy for the right folks to connect with the right folks,” Immer said. “It sets the stage for constructive conversations, collaborations and events, both in person and digitally.”

Startup CPG serves the early-stage brand community through digital and in-person resources on a national level. The digital platform offers free access to databases of investors, CPG financing sources, retail chains, brokers, thirdparty logistics providers and distributors; an eponymous podcast featuring conversations with buyers, brands and experts; NielsenIQ (NIQ) category data; virtual networking mixers, educational webinars; and an active Slack community with more than 25,000 users.

www.ctfoodlaunchpad.com

www.ctfoodevent.com

www.emergecpg.com

www.startupcpg.com

Summer Fancy Food Show

June 29-July 1 www.specialtyfood.com

International Baking Industry Exposition Sept. 14-17

www.bakingexpo.com

Pack Expo Las Vegas Sept. 29-Oct. 1

www.packexpolasvegas.com

events give

“When I started Startup CPG, there was no national community for early-stage brands,” said Daniel Scharff, founder and CEO. “I homed my focus on the smallest brands because it’s hard for them. Regardless of where they’re located, these brands have the same challenges, but they weren’t connected to each other.”

Buyers are attracted to brands with an engaging story, a clear growth strategy and a path to profitability. Developing a product is one thing; transforming it into a lasting brand is something else. Julie Pryor, founder and CEO of EmergeCPG, works with early-stage brands to build out these desirable traits.

“I partner with founders to shape strategy and work closely with them to put that strategy into action,” she said. “When you are clear on your brand’s purpose, mission and vision, everything benefits. You make decisions faster.”

That clarity is at the core of Emerge’s multi-track process, which supports earlystage brands with personalized strategy, direct access to leading CPG experts and peers, category insights from NIQ and SPINS, live workshops, one-on-one mentorship, and retail and distribution connections.

Pryor also introduces founders to mentors, specialists and solutions based on their specific needs, which can include funding, brokers, packaging, logistics, paid media and leadership development.

Industry associations such as PMMI have kept pace with the proliferation of small manufacturers, with many expanding to offer content for emerging brands on their digital platforms, at in-person networking events and tradeshows. Business intelligence reports on category trends and manufacturing,

a searchable directory of more than 900 packaging and processing suppliers, and the Package This video series are just a few online resources PMMI offers to young brands.

“Packaging plays a critical role in the success of emerging brands,” Thompson said. “It protects product integrity and shelf life, and it’s a powerful marketing tool that drives consumer attention and repeat purchases. With the packaging and processing industry growing, these resources help bring brands closer to the solutions they need to start their businesses or scale up.”

In-person events such as tradeshows, regional meetups and pitch competitions remain the gold standard for emerging brands because they present opportunities to meet face-to-face with buyers and investors.

“In-person events are where the unpredictable magic happens,” Scharff said. “It’s our top priority to build relationships

with buyers who want to meet early-stage brands, because that’s what brings value. Brands want to be in front of buyers, so we create as many in-person opportunities as possible.”

Tradeshows in particular have evolved to meet the needs of young brands, with many event planners adding dedicated brand exhibitor sections and targeted educational programming.

“We bring our community together at all the major retail-oriented shows, and we draw buyers to our parties and give brands the opportunity to offer samples, especially the ones that are too small to have a booth,” Scharff said.

At the upcoming Pack Expo Las Vegas, first-time buyers of packaging and processing automation can take a Discovery Tour, a curated, expertled experience that offers insights and context, with tour stops that include companies that specialize in working with brands exploring automation.

“We’ll also have more than 100 free educational sessions that emerging brands can take advantage of to learn about the latest trends and best practices in manufacturing, with topics around sustainability, innovation, processing and reusable packaging,” Thompson said.

On a more local scale, CT Food Launchpad hosted the third annual Big Connecticut Food Event earlier this year. The one-day gathering, produced in partnership with the Yale School of Management, brought CPGand wholesale-focused food and beverage brands, buyers, investors and other key stakeholders together to network, share ideas, and showcase products and services. It featured educational sessions on trending topics such as navigating the funding landscape and developing successful partnerships between brands and buyers, as well as a pitch competition and one-onone expert coaching sessions.

“We held 50 expert coaching sessions this year,” Immer said. “We helped brands connect with experts spanning law, graphic design, strategy, operations and pricing. They had several sessions within the span of an hour that otherwise would have taken them six months or more to set up if they were doing it separate from the event.”

The resources available to emerging brands are wide-ranging, but they all have a common thread connecting them: community. Early-stage entrepreneurs represent a unique network of founders and experts who are willing to exchange knowledge and experiences and support one another. Plugging into that community and taking advantage of all the networks it has to offer can propel a brand from emerging to established.

Optimizing efficiency and productivity while ensuring employee safety is always top of mind for commercial bakeries. Prolonged downtime due to equipment failure or injury can jeopardize the bottom line.

As a global process solutions leader in the bakery and baked goods market, Coperion understands the importance of keeping production lines running smoothly. Its Connect Advisor Remote Services digital platform streamlines equipment maintenance and troubleshooting to reduce downtime, improve efficiency, enhance safety and minimize training time.

The platform is designed to support customers across Coperion’s comprehensive portfolio of brands.

“Connect Advisor seamlessly integrates with all technologies across the Coperion FHN division, providing cohesive and reliable support,” said Kevin Geye, director, aftermarket sales for Coperion. “As a major supplier of multiple technologies and integrated systems — whether it’s conveying, mixing, forming, dividing, dosing or decorating, Coperion brings all that expertise under one umbrella with one thread of support through Connect Advisor.”

Connect Advisor’s remote assistance services include:

Streamlined support. A simplified experience and intuitive digital workflows ensure immediate resolution. Live audio and video links make problem-solving and decision-making faster and more efficient.

Instant access to knowledge and expertise. Collaborate with service technicians and subject matter experts in real-time by phone, tablet, laptop or hands-free interactive augmented- and virtual-reality (AR/VR) voice-controlled glasses.

Step-by-step guidance. Using AR, Coperion’s technicians can virtually inspect equipment and provide visual instructions and support as if they were standing on the production floor.

Immersive learning experiences. Working in real-time with expert technicians increases understanding of complex tasks and gives employees the training and confidence to troubleshoot problems.

Connect Advisor Remote Services gives bakers the ability to upgrade, troubleshoot, repair, replace or commission equipment in real-time, which results in:

• Improved workforce efficiency through standardized guided digital equipment workflows

• Reduced equipment downtime

• Engaging onboarding and training experiences through immersive learning

• Enhanced employee safety with hands-free AR/VR voice-controlled glasses

• Centralized access to records of previous interactions, including notes, images and video, for future reference

“Connect Advisor is the way service and internal training is headed. It’s definitely the wave of the future.”

Brian Hoover | regional account manager, aftermarket | Coperion

Consumer preferences are always shifting. From fresh takes on classic treats to all-new, lifestyle-enhancing snacks, baking companies have been innovating non-stop to keep pace, cross markets and maintain loyal buyers. In the 2025 New Product Showcase, the Commercial Baking staff sifted through the top launches of the year to divulge the trends, ingredients and R&D processes guiding the industry. These products highlight the flux of creativity seen in every category, with a special shoutout to the limited-time offers that came and went … but left a lasting impact.

Artisan Tropic, a family-owned manufacturer of plantain and cassava chips, launched three new additions to its product lineup.

The artisan crackers feature plantain flour sourced from a regenerative farm in the coffee region of Colombia and are available in three flavors: Sea Salt, Chile Lime and Tomato Herb.

“The development of our grain-free, organic, top nine allergen-free crackers was driven by consumer demand and our commitment to providing a nutritious snack option,” said Maria Agudelo, product development coordinator at Artisan Tropic.

The brand — born out of the owner’s familial connection to an autoimmune disease — is dedicated to supporting regenerative agriculture and avoiding ingredients linked to gut inflammation.

“We’ve observed a growing demand for clean-label products that address specific dietary needs,” Agudelo said. “Our R&D team invested considerable time in understanding these shifting preferences while identifying a gap in the market for a flavorful, crunchy and satisfying snack that met these requirements.”

From concept to grocery shelf, the R&D process took approximately two years. Development of the crackers began in

late 2022, and the product was finalized within 10 months, followed by recipe testing, ingredient sourcing and package designing.

“In terms of formulation, we wanted to continue using plantain and cassava — the core ingredients that have been a hallmark of our brand for over 10 years,” Agudelo said. “After several rounds of testing and optimization, we perfected

the recipe to create a cracker that meets all the essential criteria.”

Artisan Tropic’s grain-free crackers are available in 4.25-ounce boxes at an SRP of $5.49 per box. They can be found at more than 1,000 stores nationwide, including Whole Foods, Sprouts and Fresh Thyme, with plans to expand into mass markets and foodservice as well. www.artisantropic.com

Bake Me Healthy, a woman-owned allergen-free baking brand, went beyond baking mixes with the debut of Soft-Baked Dark Chocolate Chip Cookies.

Kimberle Lau, the brand’s founder, was inspired to create the cookies while holding demos at retailers. Feedback from consumers who were interested in a better-for-you sweet treat but didn’t have the time to bake motivated her to make something more quickly accessible.

“I did customer discovery interviews, polls on Instagram and TikTok, and surveys via email blasts, and what I found is that the snack of choice was cookies,” Lau said.

Through additional research, she uncovered the characteristics and flavors consumers wanted in a cookie and formulated a product with low sugar and high protein. Lau also learned shoppers were interested in smaller snack packs.

“I was planning on launching the cookies in a pouch similar to my baking mixes, and in my discovery calls, consumers said they wanted something portable and portion controlled,” she said. “So, I pivoted to a snack pack of four cookies.”

Lau spent a year developing the product, going through nearly 70 test batches and working with an intern from Cornell University’s food science program to refine the recipe. One of the challenges in creating the cookies was working with upcycled sunflower protein flour.

“People appreciate that the cookies are tasty and soft-baked,” she said. “They love the macros — being low sugar, high in protein and gluten-free.”

Bake Me Healthy Soft-Baked Dark Chocolate Chip Cookies come in a 10-count box and are available on the brand’s website and Amazon for an SRP of $29.99. Single packs are available in select retailers in New York City for an SRP of $2.99-$3.49. www.bakemehealthy.co

Bobo’s, a snack brand known for its gluten-free, oat-based bars and bites, expanded its portfolio with ‘Fig-Tastic’ Fig Bars.

“Over the past few years, figflavored products have topped the list of consumer requests, making this a natural choice for our next innovative release,” said Catherine Montgomery, assistant brand manager at Bobo’s.

The line features two flavors, Original Fig and Blueberry Fig. Crafted with 100% whole grain oats, the 1.5-ounce Fig Bars combine the natural sweetness of figs with Bobo’s classic oat bars.

“Creating Certified Gluten-Free, nonGMO products that are also dairy- and soy-free requires meticulous attention to ingredient sourcing and manufacturing,” Montgomery said. “Each standard adds complexity, but we believe the extra effort is essential to meet the dietary needs and preferences of our customers.“

Bobo’s developed the Fig Bars to deliver a nostalgic yet elevated snacking experience with the proper balance between texture and flavor. The R&D process took 12 months and involved multiple recipe iterations before the team landed on the one that imparted the desired filling flavor and texture.

“When consumers began requesting fig flavors, we knew we had to take our time to perfect these recipes, ensuring they met both our high standards

and their expectations,” Montgomery said. “Through strong partnerships with like-minded suppliers, we’ve been able to deliver snacks that align with our values and the trust our consumers place in us.”

Bobo’s Fig Bars are available in 5-count packs at Whole Foods Market, Amazon and via the brand’s website for an SRP of $5.99. www.eatbobos.com

Canyon Bakehouse, a Flowers Foods brand, pioneered a new type of gluten-free experience with the release of Sourdough-Style Bread.

“Sourdough has been a growing flavor trend across the bread category for a while now, and the gluten-free category is no different,” said Danielle Benjamin, senior director, brand management for Flowers Foods. “Consumers have been asking us for years to introduce a sourdough bread to our lineup, and we’re excited to make this item available for gluten-free consumers on a national scale, which hasn’t been done before.”

The loaf offers a tangy sourdough flavor in a 100% whole grain gluten-free format. The new product is also dairy-, soy-, sesameand nut-free. Achieving the taste consumers expect from sourdough while maintaining the product’s gluten-free status offered a unique challenge for the R&D team.

“Finding the right balance of acidity and tanginess that didn’t overload your taste buds took months to develop and test with consumers,” Benjamin said.

Taking the time to get it right paid off. Benjamin shared that the new product sold out on the brand’s website the day it launched.

“This enthusiastic reaction underscores the excitement among consumers for a gluten-free sourdough option that delivers authentic flavor without the complexity of traditional preparation,” she said. “Not only is this a beloved flavor in the bread category, but gluten-free sourdough options before this were limited geographically. We’re proud to bring this innovation to the market and look forward to expanding its reach to more consumers.”

Consumers can snag the 18-ounce Canyon Bakehouse Sourdough-Style Bread loaf in the freezer aisle of retailers including Walmart, Sprouts Farmers Market, Fresh Thyme Market and Hy-Vee as well as on the brand’s website at an SRP of $7.99. www.canyonglutenfree.com

Casa Arte Sano broke through the salty snack category with the launch of Nopalli Cactus Tortilla Chips in November 2024.

Gerardo Galván created the artisan snack alongside a team of CPG industry vets with more than 20 years of brand-building experience.

The tortilla chips are made from heritage corn, jalapeño pieces, and flour extracted from prickly pear cactus, also known as nopal. The better-for-you product is also shaped like the cactus, and topped with a final dusting of sea salt.

By using nopal, a nutrient-dense alternative ingredient, the chips meet rising demand for better-for-you products and consumer interest in snacks that balance taste and quality.

“Today’s consumers are more informed than ever about what they put into their bodies,” Galván said. “They’re reading labels and demanding transparency and quality. Nopalli offers a snack free from artificial colors and flavors while still delivering the authentic taste of our cultural heritage.”

It took the Casa Arte Sano R&D team 18 months to develop the final product. The plant-based chips are available in four flavors — Sea Salt, Jalapeño, Chile & Limón, and Lime — and are vegan, gluten-free and non-GMO. Each serving has between 130-140 calories.

Nopalli Cactus Tortilla Chips come in 4.5-ounce bags and are available nationwide at Sprouts Farmers Market and Central Market for an SRP of $4.99. www.casa-arte-sano.com

Solve your toughest secondary packaging challenges with our automated solutions

You make it. We pack it. End-of-line packaging solutions for the bakery, snack and tortilla industries. BPA loads your packaged and naked products into cases and various secondary containers including your hffs machines, wrapper chain in-feeds and indexing thermoform machines.

Cheez-It, a brand under the Kellanova umbrella, responded to consumer demand for bold-flavored snacks with a smoky twist on its classic cheesy crackers. The brand released Cheez-It Smoked Cheddar and Cheez-It Smoked Gouda varieties.

The Smoked Cheddar flavor features a 100% real cheese taste and includes hints of onion and aged cheddar with the additional elevated smoky profile of hickory and oak wood flavors.

The Smoked Gouda variety takes the nutty taste of Gouda and pairs it with hickory and maple wood smoke flavors to capture the essence of a classic cheese flavor with a novel twist.

Many CPG brands are taking cues from social media to influence not only their brand identities, but also their product innovations.

After a consumer video demonstrating how to make homemade smoked Cheez-It crackers went viral on TikTok, the brand innovated accordingly, offering consumers exactly what they wanted.

Despite the trendy nature of the request, Cheez-It decided to go all in by adding the smoked flavors to its permanent snack cracker lineup, which includes Snap’d, Puff’d, Grooves, Duoz and Snack Mix.

Cheez-It Smoked Cheddar and Smoked Gouda crackers are sold in 12.4-ounce boxes for an SRP of $3.99. Consumers can purchase the bold snacks at retailers nationwide, including Publix, Kroger, Walmart and Albertsons. www.cheezit.com

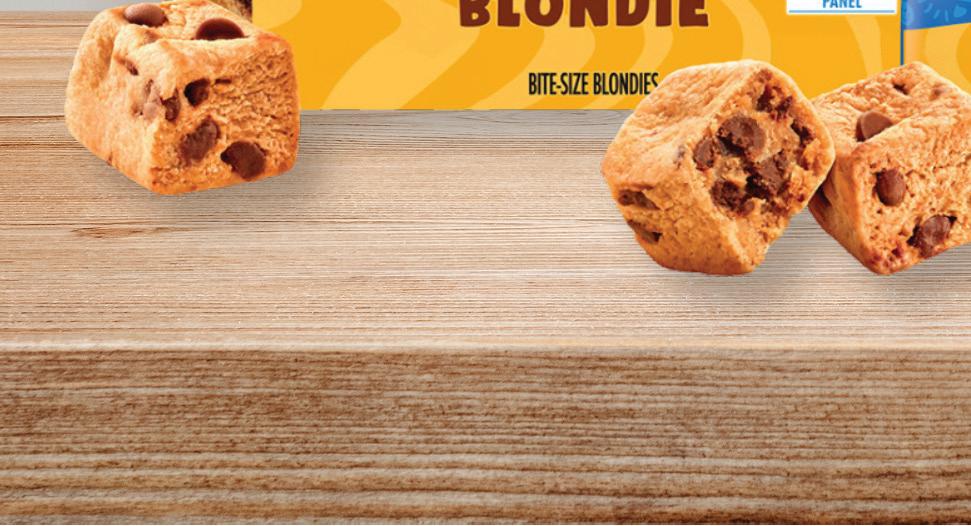

Chips Ahoy!, a Mondelez International brand, broke out of its customary cookie category into a new frontier with Baked Bites.

The soft-baked treat, made with real chocolate chips and no high fructose corn syrup, resembles a brownie in both its square shape and chewy texture, but has the flavor of the brand’s classic cookie offering.

“Our innovations at Chips Ahoy! revolve around how we can serve different consumer groups and different types of households,” said Chris Park, director of innovation for Chips Ahoy!. “The possibilities are endless in terms of new product development, and our ambition is to be a prominent sweet-snacking brand overall that isn’t just known for chocolate chip cookies.”

Shoppers are increasingly gravitating toward convenience but aren’t shying away from the desire to indulge whenever they can. By engaging consumers in the R&D process, the brand pinpointed exactly what snackers were looking for.

“We developed our new Chips Ahoy!

Baked Bites product based on consumer research that pointed to a desire for more indulgent, on-the-go snacks,” Park said. “When we went to

our focus groups with the Baked Bites concept, they resoundingly told us this was something they would buy, which gave us the confidence to move into development.”

R&D spanned more than two years and hundreds of hours in the kitchen and relied on consumer feedback to find the perfect recipe.

“We progress by showing consumers the ideas and letting them tell us what they want,” Park said. “They give us the confidence to go beyond the cookie.”

Baked Bites are available in a Blondie variety with more flavors expected soon. Five-count boxes can be found at retailers nationwide for an SRP of $3.98. www.mondelezinternational.com

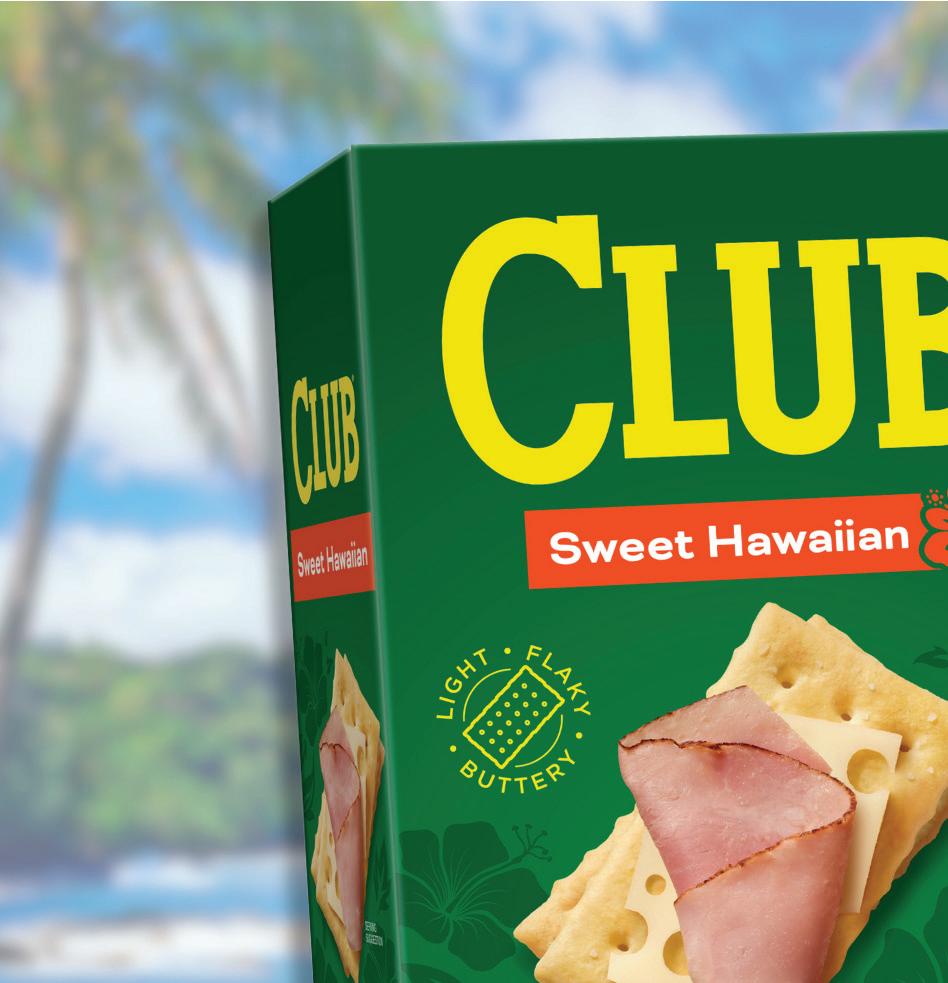

Club Crackers, a Kellanova brand, added a new flavor to the club: Sweet Hawaiian. It’s the popular flavor’s first foray into the cracker category.

“As Sweet Hawaiian rolls have grown significantly in popularity, we saw an opportunity to introduce the flavor in a totally new way with a light, flaky, buttery cracker with just the right hint of sweetness,” said Carrie Foose, director of brand marketing for Club Crackers. “Sweet Hawaiian is one of the flavors people just love. It’s versatile, slightly sweet, and works across both sweet and savory pairings. We wanted to capture that same magic in a cracker, making it easy to enjoy a whole new format.”

From concept to store shelf, the R&D process took just under a year.

“The biggest challenge was capturing the complex flavor notes of Sweet Hawaiian — typically found in freshbaked products — and translating them into a cracker with a different base flavor and texture,” Foose said. “Ultimately, the team crafted a balanced and layered profile that stayed true to both signature flavors.”

The brand celebrated the new flavor launch, which was accompanied by the debut of limited-edition Cinnamon Sugar Club minis, with an exclusive preview to guests at the Book CLUB House,

an immersive fall book club getaway experience for #BookTok followers.

“Consumers have been delighted with this new flavor of cracker,” Foose sai d.

Club Sweet Hawaiian crackers are available in 13.7-ounce packages at retailers nationwide for an SRP of $3.99. www.clubcrackers.com

Clyde’s Donuts added ready-to-finish brioche ring donuts to its portfolio to help in-store bakeries (ISBs) streamline labor, increase their margins, and refresh their bakery cases with minimal operational effort.

“With its artisanal look and elevated taste, the brioche donut is perfectly positioned to meet today’s demand for premium bakery experiences,” said Josh Bickford, president of Clyde’s Donuts. “The concept of premiumization — consumers trading up for better quality — is a significant driver of bakery growth.”

The ready-to-finish format provides ISBs several benefits: labor savings with minimal prep time, flexible flavor customization for limited-time or seasonal offerings, cross-merchandising, and daypart versatility.

“For grocery retailers facing labor challenges, the ready-to-finish brioche donut is more than just a product; it’s a strategic solution,” Bickford said. “Offered frozen, this donut requires minimal back-of-house effort. Stores can finish it in-house, glazing it fresh in the morning or customize it with premium toppings later in the day.”

To help its customers envision how ISBs can integrate the donuts into their existing menus, Clyde’s offers recipe inspiration on its website, including concepts for a Bacon & Mash Potato Sandwich and a Pimento Cheese Sandwich.

Clyde’s ready-to-finish brioche donuts are available to ISBs in 66-count cases. www.clydesdonuts.com

Cooper Street Snacks, a better-for-you snack company, expanded its Granola Bakes line with the addition of a banana bread flavor. The new snack is inspired by the traditional flavors of homemade banana bread but altered to fit a healthier, more dietary-inclusive format.

Banana Bread Granola Bakes are made without artificial ingredients or preservatives. They are also certified as whole grain, low sodium and peanut-, tree nut-, soy- and dairy-free.

Developing an alternative version of the classic baked good took about six months. The main flavor drivers in the bar are the organic banana pieces, natural banana flavoring and semi-sweet chocolate chips.

“It was a tough ratio to get the ingredients to flow correctly together,” said Max Surnow, CEO and founder of Cooper Street Snacks. “We went through 20 to 30 iterations of the formula before we found the one.”

The final product is a 1-ounce baked bar that serves as a breakfast or snacking option.

“We wanted to deliver a comfort food with the nostalgia of the classic treat,” Surnow said. “The market response has generated a lot of excitement for the flavor.”

While traditional banana bread includes nuts, Cooper Street developed a workaround that uses a proprietary ancient grain blend of quinoa, flax seed, chia seed and buckwheat, with roasted pumpkin seeds adding the expected crunch.

“To create a delicious banana bread bar that doesn’t have nuts in it but still delivers on the crunch and sweetness

while remaining healthy and staying true to the Cooper Street promise was difficult to do,” he said. “But we did it right to solidify our place in the marketplace.”

Banana Bread Granola Bakes are available online in 12- and 24-packs for an SRP of $12.99 and $24.99, respectively, with retail expansion in the works. www.cooperstreet.com

Dave’s Killer Bread, a Flowers Foods brand, grew its product portfolio with the addition of Organic Snack Bites. The portioned clusters combine whole grain crunch with bold flavors.

“After the successful introduction of Dave’s Killer Bread Organic Snack Bars and Amped-Up Protein Bars in 2023 and 2024, we set out to expand our footprint into the better-for-you snacking space with our one-of-a-kind Organic Snack Bites,” said Danielle Benjamin, senior director, brand management for Flowers Foods. “While there’s no shortage of sweet and savory snacking options in stores today, Dave’s Killer Bread Organic

Snack Bites offer a unique product format that delivers ‘killer’ taste and whole grain nutrition.”

Dave’s Killer Bread’s new product is made with a variety of nuts, seeds and whole grains such as quinoa, pumpkin seeds, chia and almonds. The snack is available in six flavors: Cinna Roll, PB & Chocolate, Honey Nut, Epic Everything, Toasted Garlic and Bold Buffalo.

The company recognized the increased consumer interest in better-for-you snacks and leveraged its reputation as a healthy bread provider to tap into a

new CPG segment. R&D for the product lasted roughly a year. It first tested the concept in several key retailers before launching the product nationally. The expansion paved the way for Dave’s Killer Bread to increase distribution. In addition to large-format grocery retailers, the new snack bite portfolio also opens the door to c-stores.

The Organic Snack Bites are currently available in two package sizes: 7.2-ounce in all six flavors and 2-ounce single serve in Honey Oat and Bold Buffalo. The products are sold at grocery stores nationwide for an SRP of $6.99. www.daveskillerbread.com

Entenmann’s, a Bimbo Bakeries USA (BBU) brand, added Big Chunk Soft Baked Cookies to its product portfolio. The new cookies are available in Chocolate, Mint Chocolate and Salted Caramel Chocolate flavors.

“We’re thrilled to introduce Entenmann’s Big Chunk Soft Baked Cookies to the cookie aisle,” said Andrea Moran Sendra, director, BBU Cookies. “Carefully crafted with bold flavors and a soft-baked texture, these cookies strike the perfect balance of indulgence and convenience. With three varieties, we’re confident they’ll become a new favorite for cookie lovers.”

The soft-baked, square cookies are crafted with real butter and semisweet chocolate and feature a soft, chewy texture. The Mint Chocolate variety features mint chocolate streusel while Salted Caramel includes real chocolate chips and bits of salted caramel.

The individually wrapped cookies balance indulgence with accessibility, providing a sweet treat in an on-the-go format. Every variety of Entenmann’s new cookies is kosher.

Entenmann’s Big Chunk Soft Baked Cookies are available in 8-count packages for an SRP of $5.29 at select grocery chains nationwide. www.entenmanns.com

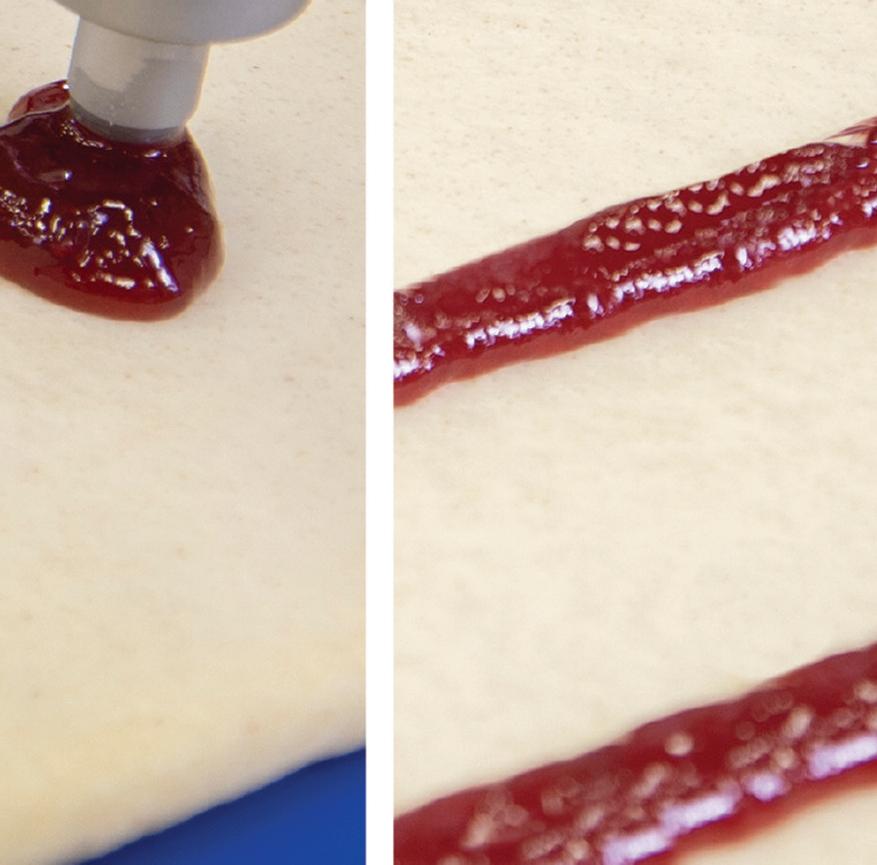

The STA Servo Topping Applicator Handles It All With Precision And Speed.

FROM SWEET TO SAVOURY

The STA Servo Topping Applicator is engineered to meet the high demands of industrial bakeries with its robust versatility, making it a standout choice for innovative and reliable topping solutions while promoting efficiency and reducing waste.

Diverse Topping Compatibility

Multi-Mode Functionality

Telescopic Height Adjustment

Servo-Driven for Precision and Speed

12” to 60” Customizable Widths

Recipe Driven with Touch Screen

Quick-Change Roller System

All Stainless Construction Easy to Clean

Available in Three Standard Models

Every Body Eat, a manufacturer of allergen-friendly snacks, released a new line of better-for-you mini treats. Cookie Bites are free from the top 14 allergens and available in three flavors: Chocolate Chip, Cranberry Vanilla and Ginger Cinnamon.

Their allergy-free status required an extended product development timeline. The R&D process for the bite-size cookies took about two years.

“Our supply chain is free from seed oils, gluten, corn and the top 14 allergens, so every product starts with unique R&D challenges,” said Trish Thomas, co-founder and CEO. “The secret is to focus on what ingredients we can use versus just trying to find a substitute for the traditional ingredients.”

The brand challenged its R&D team to create an indulgent product that elevated the cookie-eating experience. It met that goal by adding particulates.

“For example, in our Ginger Cinnamon cookies, small bits of chewy ginger evolve the eating experience with a little burst of flavor in every bite,” Thomas said .

T he brand sought feedback from Whole Foods Market during the early stages of development and also

worked with Kroger for input on flavor curation, packaging and positioning.

“Buyers and their teams have so much knowledge about ingredients and what works,” Thomas said .

Every Body Eat Cookie Bites are in Whole Foods Market stores nationwide, Kroger locations on the East Coast, and select gourmet and specialty stores in the Midwest.

In retail locations, the allergen-friendly cookies are available in 5.5-ounce resealable pouches for an SRP of $5.99 and in single-serve bags for an SRP of $2.49. The brand’s website offers 3-count packs of the 5.5-ounce pouches, including a variety pack with all three flavors, for an SRP of $17.99.

The cookies join Every Body Eat’s snack portfolio, which includes Snack Thins and Crispbread Crackers. www.everybodyeating.com

Fancypants Baking Co. introduced its line of crispy cookies featuring upcycled ingredients, such as oat flour and okara flour, and sustainable packaging.

“People are looking for indulgent, but they are also more aware of the importance of sustainability initiatives,” said Maura Duggan, founder of Fancypants Baking.

“Our cookies say that if you’re going to make a choice between brands, pick up the bag with upcycled ingredients.”