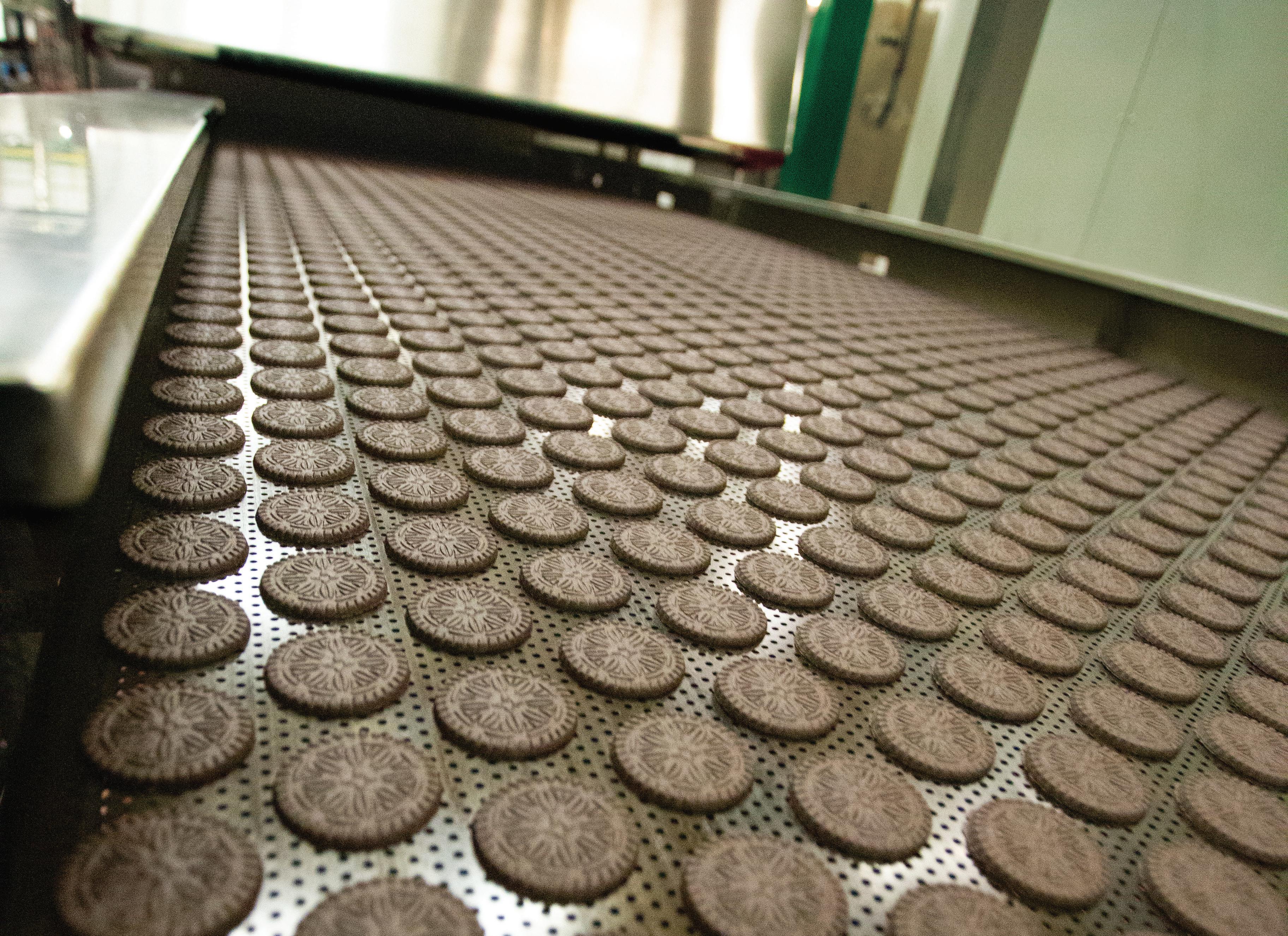

Every step of the baking process matters. From mixing to proofing to baking to decor, our brands offer cuttingedge solutions designed to make your operations more reliable, efficient, and cost-effective. Together, we push boundaries to create the next generation of deliciousness.

Top of the Line Equipment for

Bread & Buns

Sweet Goods, Cakes & Muffins

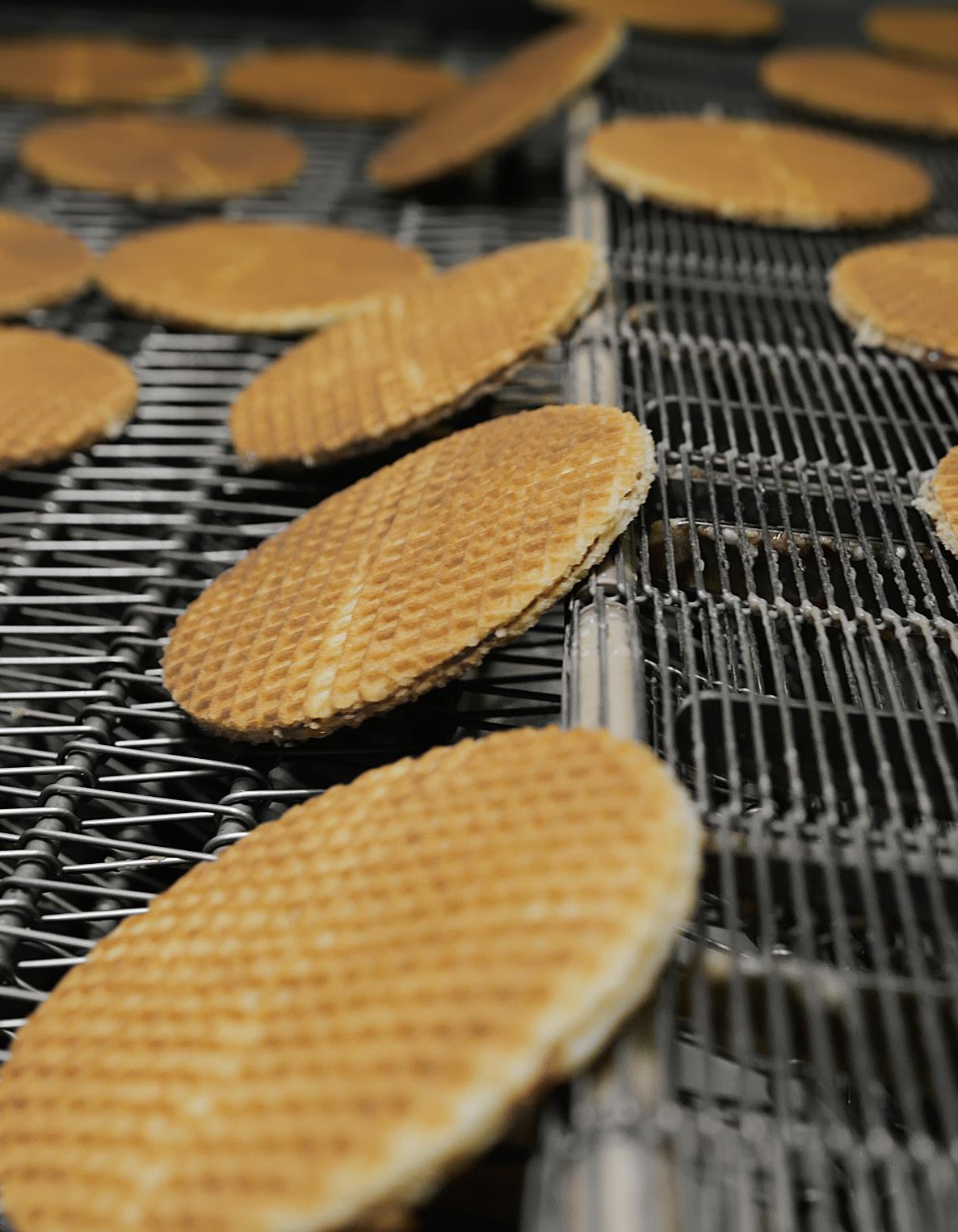

Biscuits, Crackers & Energy Bars

Artisan & Flat Bread

Pizza & Pastries

Tortillas & Snacks

We are turning up the heat at IBIE! Tour Oven Alley on Booth 1025

Removing eggs from a formula can not only remove an allergen, but also save on costs, make raw material storage easier and simplify the production process.

Brolite’s egg replacers can work as a total egg replacement in yeast raised products and up to 30% in cakes. Even with a partial replacement, a baker can have more consistent costs of ingredients and more supply stability.

Lose the eggs, keep the functionality, supply and cost savings of an egg replacer.

www.intralox.com

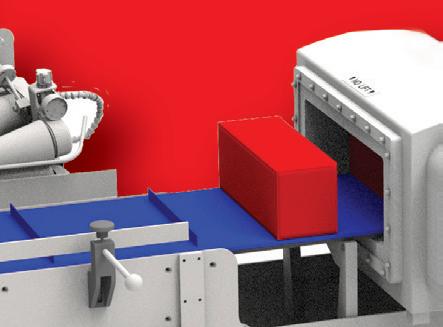

Intralox’s new Active Integrated Motion (AIM) Glide™ is a gentle, hygienic automation solution. It eliminates unscheduled downtime and jams while requiring 75% less maintenance and 50% less cleaning time than metal slat switches.

Gentle product handling while maintaining orientation

75% less maintenance

Reliable zero-jam automation

50% less cleaning time

Zero lubrication required

Paul Lattan

President - Principal

Steve Berne

Executive Vice President - Principal

Joanie Spencer

Vice President - Partner

Paul Lattan

Publisher | paul@avantfoodmedia.com

816.585.5030

Steve Berne

Director of Sales | steve@avantfoodmedia.com

816.605.5037

Erin Zielsdorf

Account Executive | erin@avantfoodmedia.com

937.418.5557

Joanie Spencer

Editor-in-Chief | joanie@avantfoodmedia.com

913.777.8874

Mari Rydings

Editorial Director | mari@avantfoodmedia.com

Jordan Winter

Creative Director | jordan@avantfoodmedia.com

Olivia Siddall

Multimedia Director | olivia@avantfoodmedia.com

Annie Hollon

Digital Editor | annie@avantfoodmedia.com

Maddie Lambert

Associate Editor | maddie@avantfoodmedia.com

Lily Cota

Associate Editor | lily@avantfoodmedia.com

Beth Day | Maggie Glisan

Contributors | info@commercialbaking.com

Commercial Baking is published by Avant Food Media, 1703 Wyandotte St., Suite 300, Kansas City, MO 64108. Commercial Baking considers its sources reliable and verifies as much data as possible, although reporting inaccuracies can occur. Consequently, readers using this information do so at their own risk. Commercial Baking is distributed with the understanding that the publisher is not liable for errors and omissions. Although persons and companies mentioned herein are believed to be reputable, neither Avant Food Media nor any of its employees accept any responsibility whatsoever for their activities. Commercial Baking magazine is printed in the USA and all rights are reserved.

No part of this magazine may be reproduced or transmitted in any form or by any means without written permission of the publisher. All contributed content and advertiser supplied information will be treated as unconditionally assigned for publication, copyright purposes and use in any publication or digital product and are subject to Commercial Baking ’s right to edit.

Commercial Baking ISSN 2767-5319, / USPS Publication Number: 25350 is published in February, April, June, July, August, October and December, in print and digital formats by Avant Food Media, 1703 Wyandotte St., Suite 300, Kansas City, MO 64108. Periodicals Postage Paid at Kansas City, MO, POSTMASTER: Send address changes to Commercial Baking, c/o Avant Food Media, 1703 Wyandotte St., Suite 300, Kansas City, MO 64108.

Circulation is tightly controlled, with print issues sent only to hand-verified industry decision makers and influencers. To apply for a free subscription, please visit www.commercialbaking.com/subscription

PLUS:

Look for QR codes that contain exclusive digital content throughout the issue.

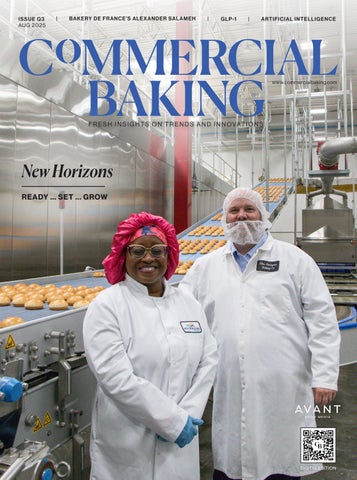

New Horizons: The Quintessential Moniker

Alexander Salameh: Running Toward the Why

Cover:

With an unconventional acquisition strategy and a bit of calculated risk, Norwalk, OH-based New Horizons Baking Co. addresses the ultimate question: “How big do you want to be?” Read more on page 22.

Critical Issues: Artificial Intelligence 47 Emerging Brand: OMG! Pretzels

Critical Issues: Sustainability

JOANIE SPENCER Editor-in-Chief | joanie@avantfoodmedia.com

WATCH NOW:

Joanie Spencer weighs in on risk vs. reward. Sponsored by Bundy Baking Solutions.

I’ve had some interesting conversations over the summer, not only in my editorial interviews but also at industry events, around the office and in my personal life. Many of them were centered around taking risks. Scary concept!

Take parasailing, an activity I’ve consistently filed under “hard pass.” Too risky. The thought of being 800 feet or more above a body of water — connected by what, to me, looks like a string — held no appeal. But someone talked me into it, and I learned it involves a harness, tow rope and winch ... not a string. I wasn’t yanked up into the air at breakneck speed; it was more like a glide. And the view from above — and the quiet that came with it — brought an unimaginable sense of peace. Parasailing, which once felt so risky, is now filed under “I’m in!”

There’s a lot of uncertainty out there. Not exactly perfect conditions for risk-taking, right? But here’s the thing: Innovation either requires or causes change, and change is not immune from risk.

These days are, indeed, unnerving. But you still have to think about where — and how big — you want to be in the future. That’s the long-game mindset that ultimately triggered historic growth for New Horizons, our featured bakery. Was it easy? No way. It took vision, trust and a solid plan. And a united commitment, even when the risk seemed terrifying.

As we head to the International Baking Industry Exposition, I recommend you go forth with an open mind. When you envision the future free from fear, you’ll be surprised how beautiful the view can be.

“The collective success of IBIE is the success of the baking industry. Every dollar that it generates is reinvested … in scholarships, safety, workforce development and more.”

Allen Wright | IBIE 2025 vice chair and president of Hansaloy Updating BEMA Convention 2025 attendees on IBIE

“Your product may change, but if your commitment to a certain type of product or quality is what built you to where you are now … that doesn’t change.”

Chimene Ross | CEO | The Killer Brownie Co.

During the Ask-A-Baker panel discussion at BEMA Convention 2025

“‘Newstalgia’ is about taking a classic and putting a little twist on it to appeal to a new customer. Nostalgic items play on emotion, and emotion is probably the strongest thing we use to make decisions.”

Karri Zwirlein | director of bakery, deli and prepared foods | Tops Markets

During a panel discussion on consumer trends at IDDBA 2025

IDDBA

“We looked for the right consumer to test [our product]. If people are passionate about cookies and can repeat-buy, then we know we can invest in more mass market conventional channels.”

Maura Duggan | founder, CEO | Fancypants Baking Co. On the Emerging Brands podcast with Kelly Bennett

Martin J. Hahn | partner | Hogan Lovells US LLP

The Provident is the latest in depanner sanitary design and compliance!

Our depanner offers a complete washdown system for the conveyor, depanner and vacuum chamber; JSD auto vacuum control; remote low profile vacuum module; and works-in-a-drawer vacuum blower/motor accessibility.

The Provident is built to meet:

•FDA, USDA and ANSI 50.2 standards!

•BRC Global Standard for Food Safety!

• Vacuum chamber and conveyor system IP69K Washdown rating! No one

“Explore different roles within the industry. Having cross-functional experiences can be challenging, but rewarding, and open up new possibilities you didn’t even realize you wanted to explore.”

Eric Lindskog | R&D principal engineer | General Mills Via General Mills’ employee spotlight on LinkedIn

“Shoppers aren’t just buying products; they’re buying relevance. Curating trendy products makes it easy for consumers to stay in the know and feel like they belong.”

Sarah Weise | CEO | BIXA During a consumer trends panel

discussion at IDDBA

2025

“Get a [packaging prototype], go to your local store and stick it on the shelf, right where you think it’s going to sell, and then step back. Does it stand out? Compared to everybody else, how is [your product] going to be different?”

Molly Blakeley | founder,

CEO |

Molly

Bz

Cookies On growing a brand, during Season 15 of Commercial Baking’s Troubleshooting Innovation podcast

“It’s

not just

about

filling positions;

it’s

about upskilling the people you have. That’s how you’re going to keep your workforce and give them those next-level skills in order to retain them and stay competitive.”

“When it comes to looking for trends, the most obvious place to start is with teenagers. Young people are the ones liking and following, and that’s what’s really driving trends.”

Katrina Robbins | R&D chef | David’s Cookies

an IDDBA 2025 session on cookie and flavor trends

“Let’s have the hard conversations. But let’s ground them in science, in nuance and in a shared desire to create better options for everyone.”

When it comes to growth for New Horizons Baking Co., the name says it all.

BY JOANIE SPENCER

Seven simple words. Strung together and punctuated, they form a question that comes with a myriad of answers, a lifetime of achievement and turning points on a path with unlimited potential.

“How big do you want to be?” That’s what Tilmon “Tim” Brown, founder and chairman of Norwalk, OH-based New Horizons Baking Co., asked his daughter Trina Bediako before she took the helm as the company’s CEO in 2020.

New Horizons was a small bun operation for McDonald’s when the Brown family purchased the business (formerly West Baking Co.) in 2014. Today, the company is home to more than 700 employees in four baking facilities that produce buns, English muffins, and, soon, pancakes for a variety of retail and foodservice customers throughout the US, as well as an ingredient blending operation, known as New Horizons Food Solutions.

“I asked that question 25 years ago,” Brown said. “I asked the question to keep people encouraged about our growth. To tell them that we could grow if we had the right vision within us.”

While the direction and speed of growth might be executed differently from how Brown did it in his day, Bediako’s vision and the operational expertise of Mike Porter, president and COO, are ushering in a new era for New Horizons. The latest milestone is a 155,000-square-foot bakery in Columbus, OH, which houses a high-speed bun line and a new pancake line set for startup in early September, as well as a 120,000-square-foot production facility, also in Columbus, dedicated to the ingredient operation.

“Trina’s doing things that make sense for the company,” Brown said. “I was more risk-averse and didn’t move the company as fast or as far as she has. It served me well at that time, but I applaud what she’s doing now. This team has come a long way, not only with the plant and equipment but also in their thinking about acquisitions and how big they truly want to be. In my mind, it’s picture perfect.”

Between strategic vision and operational execution, New Horizons has figured out how to take fundamentals into the future by turning traditional bun production into all-new possibilities. That began with getting the basics right.

Known as “the baker’s baker,” New Horizons spun off the Genesis Baking subsidiary in 2008 to handle contract manufacturing for all non-McDonald’s production, including the new pancake line. By strategically entering new markets through Genesis, New Horizons has diversified its business while maintaining McDonald’s as a longstanding, valued partner.

The past five years brought a surge of growth when the company transformed its Toledo, OH, distribution center into a bakery with a new English muffin line that launched in 2021. Then later that year, New Horizons acquired Coalescence, a manufacturer of dry ingredient blends, followed by the 2024 acquisition of Graffiti Foods, which produces liquid blends for the foodservice market.

While the ingredient side was coming together, Bediako envisioned the next chapter of growth.

“When we thought about that idea of, ‘How big do you want to be,’ we put together a plan for three to five years,” Bediako said. “We recognized there’s a lot of change in the industry. There are fewer family businesses, more private equity groups coming in, and we wanted to be sure our place in the industry was as strong as it could be.”

Oftentimes, opportunity spurs action. But sometimes, the action has to come first, and that can be risky. Intuition must

be sharp and in tune. For Bediako, the iron was heating up, and it was time to strike.

In 2024, a building became available in Columbus, originally designed for food manufacturing and equipped with an existing internal freezer, space for a high-speed bun line and capacity for additional lines. The vision was coming into focus.

“We realized we couldn’t wait for all the business to be booked before we built this next phase,” Bediako said. “If we did, we’d end up missing the opportunities when they came. So, we strategized. We assessed. We planned. We looked at where we wanted to be and what our customers’ needs were, and we decided we were ready to take some degree of risk.”

They sat with a team of 10 bankers to share the New Horizons vision and strategy for the future, and the result was the capital needed to bring both Columbus facilities to fruition. A year later, Coalescence and Graffiti merged into one operation to become New Horizons Food Solutions. With full blending capabilities, the opportunities increased exponentially, whether blending for its own bakeries or supporting customers, ingredient suppliers or even other bakers. And with the ingredient operation streamlined, the Columbus bakery is now running one of the fastest bun lines in the McDonald’s network.

“The business we’ve created from these investments has put us in an enviable financial position,” said Kurt Loeffler, New Horizons’ CFO. “The work has just begun, but the possibilities of where we go from here are endless.”

Not only will the new bakery allow New Horizons to increase its bun capacity by about 55 million dozen per year, but it will also allow the company to serve a customer base in a 250-mile radius, reaching almost as far as Washington, DC.

But the Columbus operations aren’t limited to buns and ingredient blends. The team originally planned to install an English muffin line after the bun line, but opportunity knocked from a non-McDonald’s English muffin customer on the Genesis side of the business.

“Opportunities have a way of presenting themselves,” Porter said. “We had the privilege to sit down with one of our largest customers, and we were awarded pancake business, not because of what we could do for them, but because of what we have done for the past 19 years.”

These types of opportunities come from a commitment to quality that often begins with New Horizons’ R&D team, led by Matt Bowers, director of R&D, who has been with the company for more than 34 years.

After monthsof thoughtful considerationand creative effort, we are pleased to introduce our refreshed company logoaccompanied by our newwebsite!

Our refreshed logo represents our commitment to:

✓ Innovation, growth, and evolving identity

✓ Staying current and relevant in a rapidly changing market

Our new website was designed with your convenience inmindandis:

More organized and streamlined

User-friendly experience that enables you to locate the information you need quickly.

“We pride ourselves on the fact that we don’t bake in a lab,” Bowers said. “Our R&D team is beyond brilliant, and they focus on doing samples on the line, especially when it comes to clean- l abel and high-protein products. With this strategy, we can demonstrate how we make these products day in and day out.”

With the pancake line starting up this fall, the Food Solutions facility will feed that business by blending its pancake mix, allowing New Horizons to leverage buying power for sugar and other ingredients.

What’s more, the vertical integration makes growth more tangible than ever, especially when the pancake line alone will have the capacity to produce 30,000 full-size pancakes or 72,000 minis an hour. It also provides opportunities for further expansion, should the business call for it.

“We’ve taken risks, but when we get new business opportunities, that’s how we can pay for it,” Porter said.

“What one of our other bakeries can produce in six days, we can do in four days here. We’re also using less energy and less gas, even though there’s more tonnage going through.”

Mike Porter | president and COO | New Horizons Baking Co.

As New Horizons expands bakery capabilities with a new pancake line, it’s also focused on wet and dry ingredient blending. In 2024, the company rebranded its ingredient operation as New Horizons Food Solutions, housed in a 120,000-square-foot facility in Columbus, OH.

The operation blends products such as barbecue sauce, wing sauce and smoothies, as well as salt and pepper packets, drink powders, cornmeal, pancake mixes and nutritional packs.

Dry ingredients are combined in 100-cubic-meter blending tanks. For liquid blends, two kettles heat and mix before packaging and placing in a water bath that brings the temperature up or down, depending on specifications.

As New Horizons Food Solutions grows, so do opportunities for the more than 700 workers in the New Horizons network (about 53 of which work in Food Solutions).

A unique processand blend of pre-soak..,el andpre-cook..,elgrains andseeds! Your sandwich just got healthier.

“That’s why the pancake line and the business it created have been such a blessing for us. Trina’s taking the question of, ‘How big do you want to be’ even deeper. We’re thinking inward and reminding ourselves that we have to be better than we were yesterday. When we are, the sky’s the limit.”

With new infrastructure in place, dreams are becoming reality in nearly every aspect of the business.

“Mike and I did a lot of ‘blue sky’ thinking,” Bediako said. “Now that the ingredient business is underway, we’re bringing the vision to fruition with the bun and pancake lines. It’s a beautiful thing.”

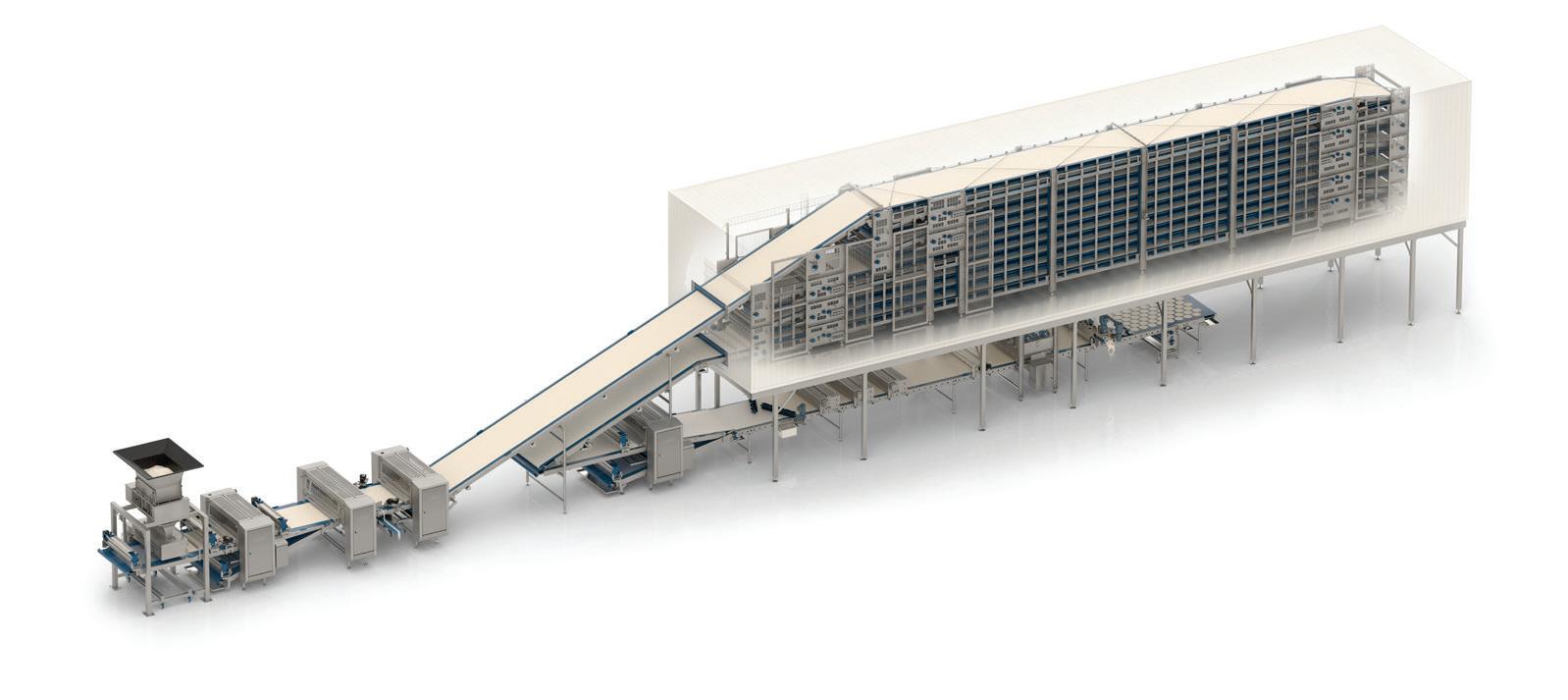

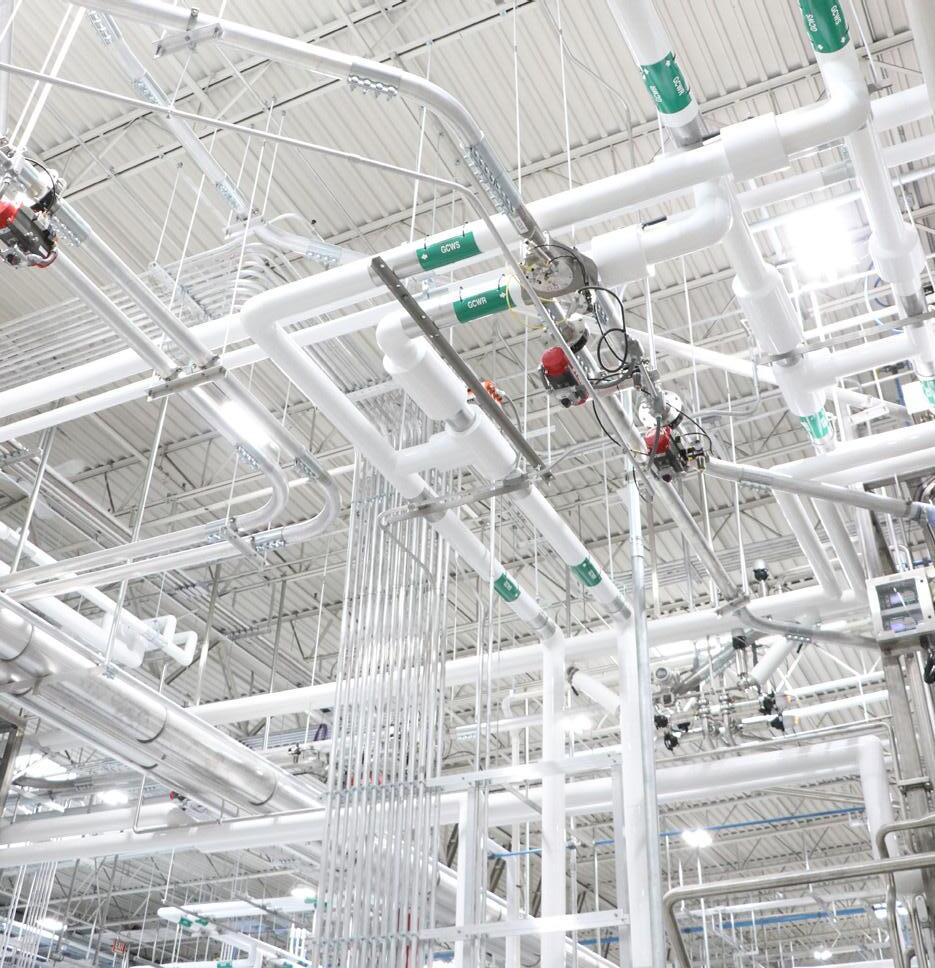

With the bakery located near the rail lines, one of the first orders of business was investing in silos, super sacks and ingredient handling systems that could receive bulk ingredients and streamline the entire process. The team chose a Fred D. Pfening Co. system that simplified a complex process into just a few steps.

“We wanted simplicity,” Porter said. “This system is three steps, and we have easy access to every one of our ingredients, including minors, and can dose to the smallest fraction to each of the mixers.”

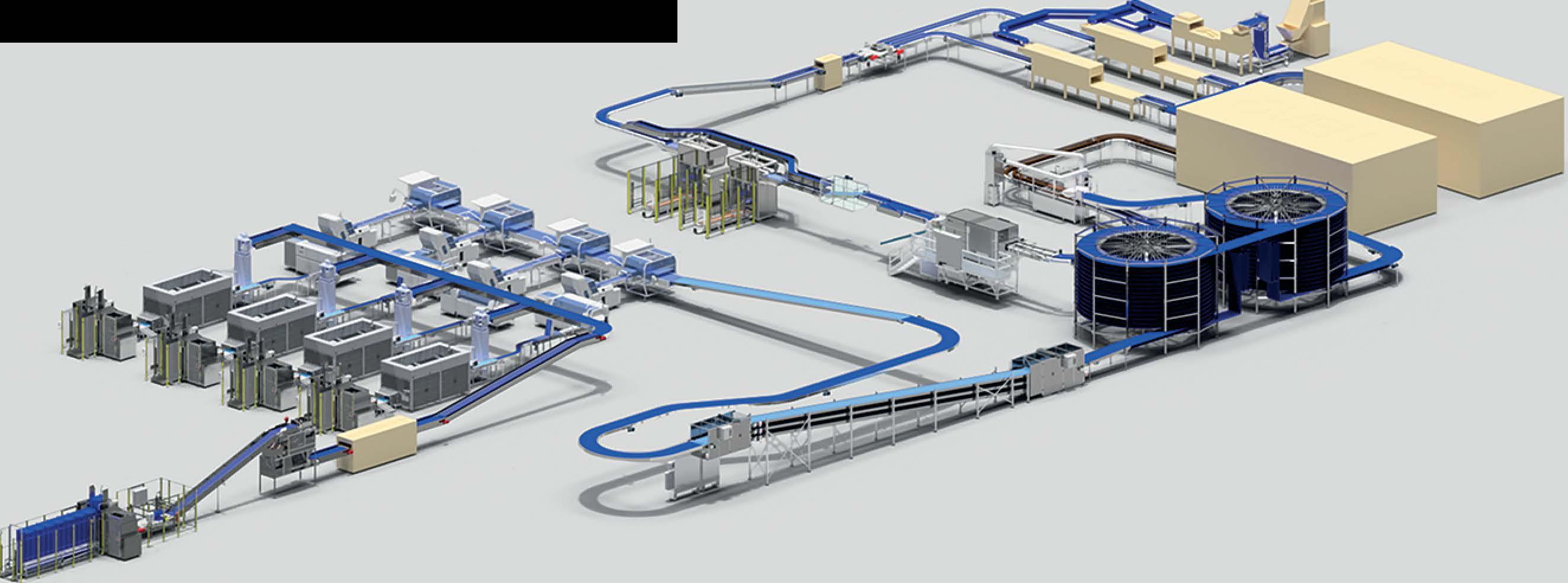

From mixing through wrapping, the bakery relied on AMF Bakery Systems as its supplier of choice, not only based on a longstanding relationship but also for AMF’s project management proficiency on a line capable of producing 8,000 dozen buns an hour.

“We worked with one AMF project manager who could oversee everything,” Porter said. “Having one point of contact for a bun line project of this magnitude was critical.”

WATCH NOW:

Mike Porter explains the benefit of working with one project manager to oversee such a big installation.

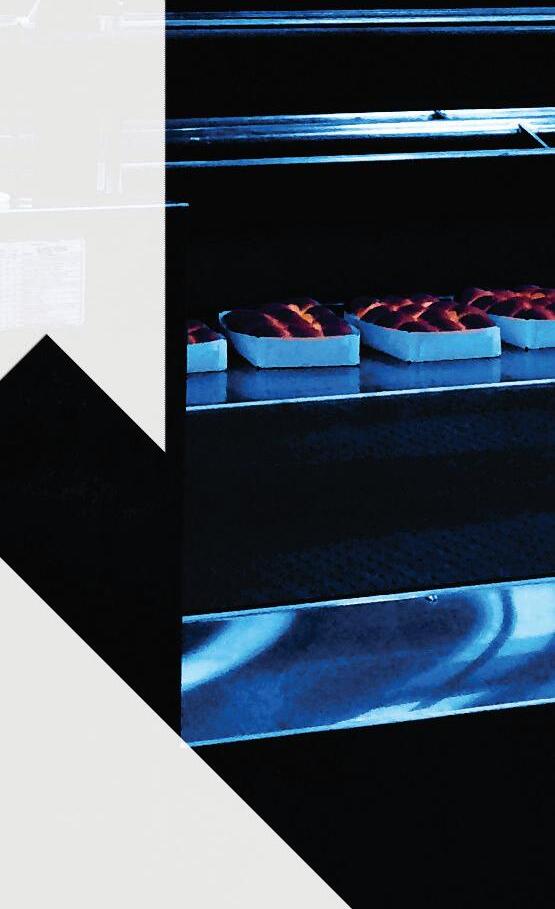

Running trays that hold 60 items at a time, the bun operation is composed of two makeup lines that feed one proofer, oven and cooler, and three packaging lines. The capacity is game-changing, not only in terms of output but also regarding workflow, sustainability and other factors.

“What one of our other bakeries can produce in six days, we can do in four days here,” Porter said. “We’re also using less energy

and less gas, even though there’s more tonnage going through.”

Ultimately, the entire system allows roughly 600 more buns per minute to go out the door, all with the same headcount as any other bakery in the network. In this facility, 90% of that headcount is stationed in the packaging area, and automation in places like the oven area reduces the need for people in those hot spots. In the uncomfortably cold spots like the freezer, where pallets wait for pickup from the distribution centers, robotic skids ensure they move first-in, first-out onto the trucks.

Taking a risk in business can be unnerving, especially when more than 700 teammates and their families are counting on the risk to pay off. Ultimately, that’s why the new bun line’s throughput is so critical. The speed can generate revenue, but perhaps more importantly, it also supports the company’s alternative work schedule: When employees fulfill three 12-hour shifts in their work week, they are paid for 40 hours, allowing for more flexibility and better work-life balance.

“When we designed this bakery, we wanted our customers and our team members to experience a facility where everything we put in is from a safety perspective and a quality perspective,” Porter said. “We wanted to create an environment where people want to be.”

The pancake line was also designed to stay on par with those expectations. With Rademaker’s Doug Hale, director of systems integration for Rademaker USA, providing system integration, commissioning is expected Sept. 1.

“Doug Hale and his group have been second to none,” Porter said. “I’ve had my team watch how they’re leading this

project so they can gain key learnings on system integration and startup. It can really help us improve our own processes down the line as well.”

Trina Bediako describes how the new pancake line will support overall growth.

It’s a point Porter took to heart when the team first saw the facility and its potential.

“We were in the plant, and there was nothing here,” he recalled. “It was completely empty. We just came together in the corner and tried to envision what the lines would look like. I went around and asked everyone on the team if they were committed to this. When we all agreed we were, we prayed over it. And we’ve been moving forward ever since.”

It’s all intertwined, capital investments and product development. But, Bediako testifies, the most important element is in relationships. Without those, the lines would simply be machines, and the building would be little more than a shell.

“The relationships are critical,” Bediako said. “My father established this business 30 years ago on a strong foundation of relationships with many stakeholders. When he handed me the baton, I had to maintain those relationships. That’s how we keep the New Horizons name a good one. It’s how we remain known as good partners who operate with integrity, keep our word and make a quality product.”

That’s how this company works: together. New Horizons is family-owned, but those ties run deeper than the Brown and Bediako names.

Whether it’s Bediako’s assistant Kelly Kromer; Jealousy Matson, who writes the company newsletter; Kevin Stevens, senior director of operational excellence; or any associate on any of the five factory floors, everyone is considered family. For the core leadership team — Brown, Bediako, Porter and Loeffler — family is who they will always see.

“Trina’s like a sister and Mike’s like a brother to me,” Loeffler said. “This

“Relationships are critical … It’s how we remain known as good partners who operate with integrity, keep our word and make a quality product.”

Trina Bediako | CEO | New Horizons Baking Co.

• Inline vacuum depanner.

• Hartmannslicerandbagger.

• SR Packbasket loader.

• Rexfabpanstacker-unstacker: electric, ultra-quiet, gentle on pans and operators

•

•

company truly is like a tight-knit family, and it’s an honor for me to serve as the CFO.”

While New Horizons is a multi-generational family business — the second generation includes not only Bediako, but also her husband Gabe, and her brother, sister, and sister-in-law, as well as her daughter and son in the third generation — the company holds more family trees than the one who owns it. Porter, who has been with New Horizons since he was 19, now has a second generation at the company, as well.

“I’ve had two mentors in my life: Russ Bundy and Tim Brown,” Porter said. “I’ve learned so much from them both, and one big lesson Tim has taught me is that all you have is your name. I’m teaching that to my kids now.”

Today, the name New Horizons is the quintessential moniker.

“With all Trina, Mike and the team have accomplished, it’s opened up a new horizon,” Brown said. “We’re starting to understand how companies can mushroom, because we’re seeing that now with capabilities we never even realized we had.”

The company began with one product, and today, New Horizons — with the leadership and executive team representing 200 collective years of baking experience — has business in 65 countries.

“We built the infrastructure, giving the sales team unlimited options to grow the business,” Porter said. “Now, we could be one phone call away from anything. If we have a pan and a product, we can make it. We really are feeding the world, and as long as we keep moving forward, every day is a new horizon.” CB

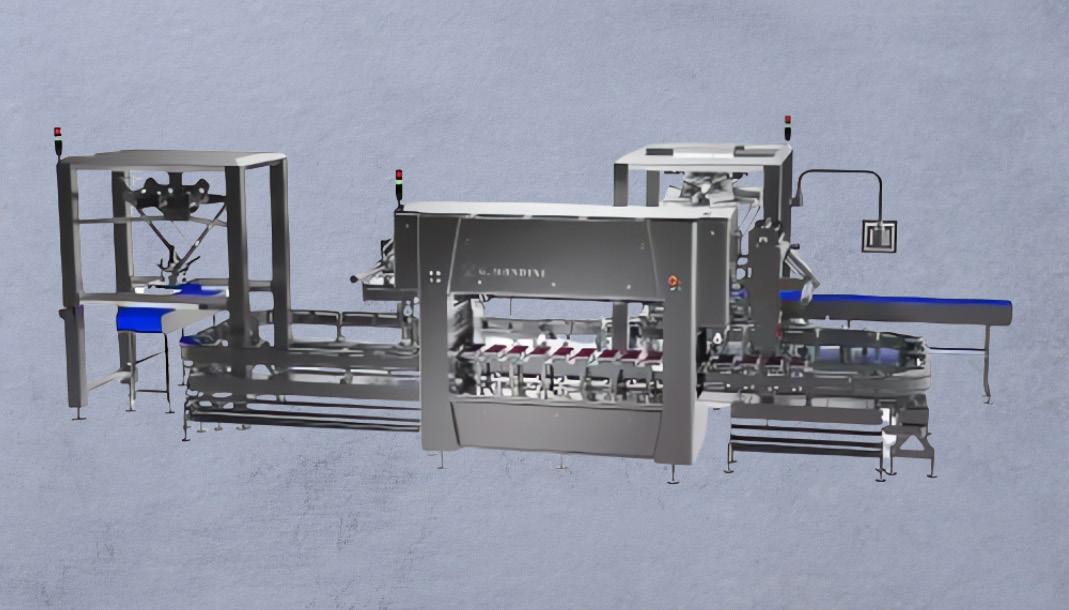

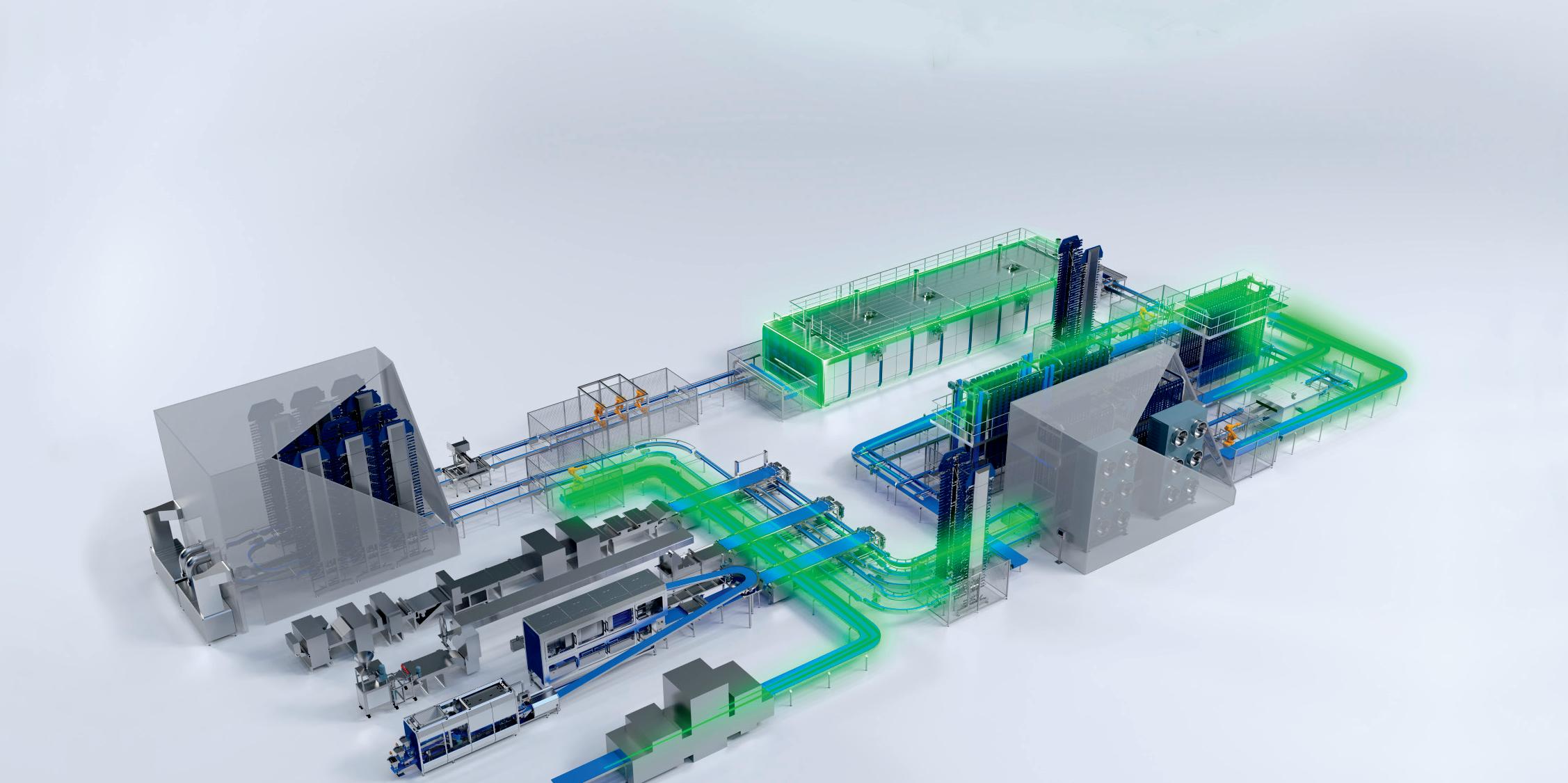

Earlier this year, New Horizons opened its fourth baking facility, located in Columbus, OH. The 155,000-squarefoot facility houses one of the fastest bun operations in the baking industry and will soon commission the company’s first pancake line. Below is a list of supplier innovations that can be found on the bakery floor.

Air Management glycol system, heat recovery

AMF Bakery Systems mixing, makeup, proofer, oven, packaging

Campbell Systems dust collection

Capway depanner

Fred D. Pfening Co. ingredient handling and silos

Newsmith pan cleaner

Spraying Systems glaze spraying

CPM griddle

FPS freezer

Pattyn case packing

Rademaker system integration

Coperion unites the leading technology brands in food manufacturing to deliver innovative system solutions for your bakery.

Technology for: Systems & Ingredient Automation

Pre-Dough, Mixing, Forming & Dividing

Depositing, Decorating & Cutting

� baker perkins b bakon rcoperion '-,,. l<-TRON

@ peerless f shaffer � shick esteve

.diosna .•• :::: kemutec l!JJ unifiller

Scan the QR code to find out more

As a second-generation baker, Alexander Salameh, Bakery de France CEO, keeps the “why” at the heart of innovation.

BY JOANIE SPENCER

Every career path is forged by choices. For Alexander Salameh, CEO of Rockville, MD-based Bakery de France, baking may be in his DNA, but the choice to be part of his family’s bakery business came straight from his heart.

As the youngest of four children born to John and Nadine Salameh, who founded Bakery de France in 1986, Salameh didn’t just see bread as part of the family business. He saw it as part of the family.

“The business was never, ‘This is what my parents do [for a living],’” Salameh said. “It was, ‘This is what my family is about.’ My parents were always lovers of good bread, and growing up, bread was part of every meal. It truly was a family affair, something we all lived and breathed.”

While the bakery didn’t mature at a time that provided career opportunities for his siblings, time was on Salameh’s side in that the organization had developed at the point when he was ready to choose his path … after a lifetime of falling in love with the business of bread making.

“Growing up, any time I wasn’t in school or studying, I was at the bakery,” Salameh

recalled. “I developed a real bond with the company and the team and with the products we make. I always seemed to run toward it.”

After graduating from The Catholic University of America with a degree in economics, he dove into the bakery field. Working for notable French baker Eric Kayser in Paris, he focused on the artisan and retail side of the industry and learning not only the French style of baking but also marketing and storefront operations.

Salameh’s time in Paris was spent learning a vastly different type of baking and business from the world of artisan at scale. It not only solidified his love for the industry and the family business, but it also opened his eyes — and mind — to how he could contribute to it.

“I realized that what we were doing in terms of wholesale baking was something I really was passionate about,” he said. “The ability to take this artisan craft and scale it to mass consumer appeal was so special to me. If we could make these artisan products at a small scale and reach more American consumers without losing what makes it great, that was an awesome challenge.”

As a second-generation baker, Salameh took the helm when Bakery de France formed a strategic partnership with Ninove, Belgium-based La Lorraine Bakery Group, a family-owned company with milling and baking expertise in Europe, Turkey and the Middle East. While the partnership has not impacted the company operationally, it does expand opportunities for Bakery de France.

It also opens new doors for collaboration and innovation, two areas Salameh is passionate about.

“You have to preserve the fundamental nature of tradition while adapting to a changing world and modern demands.”

Alexander Salameh | CEO | Bakery de France

“This partnership makes both sides better at what we do,” he said. “We gain better tools and better metrics, and La Lorraine’s ability to scale has certainly helped us as we continue expanding.”

For Salameh, a wide scope of vision is the ultimate pathway to product innovation while maintaining the brand’s standards, especially for a product that fights for loyalty in an on-again-off-again consumer relationship.

“To innovate you have to be open-minded,” he said. “And I’m proud of how openminded my company is. We’re always open to new technology and new ways of doing things. We’re not bound by tradition; we’re motivated by it. The point is that you have to preserve the fundamental nature of tradition while adapting to a changing world and modern demands.”

Having served in marketing, operations and business development for Bakery de France, Salameh is well-versed in putting customers’ needs first to provide high-quality artisan bread at scale. That’s the standard he maintains for every aspect of the company.

“We have to focus on making the best possible product while also remaining customer-centric,” he said. “To accomplish that, marketing has a specific set of needs, as does business development. When we go to market with a product, we’re focused on what’s most important about it, and every department has to be on the same page.”

As CEO, Salameh’s main goal is staying true to Bakery de France’s mission of creating quality artisan bread. For him, collaboration is the key to achieving that, especially when different areas of the business come with varying objectives for achieving the same goal.

“At the end of the day, every department’s method might be different, but the goal is always the same: to make the best product and serve customers in the best possible way,” Salameh said. “It’s important for us to maintain that, even if there might be friction sometimes. After all, good friction makes polish.”

While evolving trends have sparked some successful niches in the market, Salameh remains intentionally focused on Bakery de France’s core product.

“The right way to make sourdough has not changed for a very long time,” he said. “As long as we stay true to that, we can continue improving on how we honor the time-tested way of making our bread.”

Focusing on product integrity — while producing at scale — has been a tenet of Salameh’s career in baking and also at the heart of his leadership.

The key, he said, is investing the time and effort to ensure alignment. It’s something that can never be taken for granted, and that’s a lesson he’s learned growing up in a family of bakers. In truth, that’s inherent in any family bakery.

While his parents are still involved with the company, Salameh takes pride in the family dynamic that exists for the business and the brand. Having worked with his parents at the bakery for decades, Salameh has put the respectful, open exchange of ideas into practice. It’s a manifestation of the need to balance modern innovation with time-honored tradition, and for Bakery de France, that’s the heart of its culture.

“I have to give my parents a lot of credit,” Salameh said. “They’ve always been open-minded people and people who empower. We’ve never been afraid to do things a little differently, and that’s been a big part of our success and who we are as a company. We’ve always been able to have open dialogue without ruffled feathers or bruised egos. I want to preserve that.”

Preserving it means building trust, starting on the bakery floor. Salameh carries on his parents’ foundation by empowering — and trusting — the people in key positions at the company. It’s a leadership style that prioritizes good ideas over hierarchy or sticking to how things have always been done.

As he thinks about advancing technology, he looks at how it can benefit not only the operation but also the people. Automation is

Scan for Videos, Brochures &

seen as a tool to empower the workforce by providing opportunities to learn new skills on the line or in other areas of the bakery.

Alexander Salameh explains how automation creates opportunities for the bakery’s workforce.

“Automation can increase capabilities in different ways,” Salameh said. “It can be an opportunity for a baker’s helper to become a line operator, or for a line operator to become a technician, or for a technician to become electromechanically certified.”

It’s about engaging with innovation that makes the people — and the product — better. In terms of artisan bread, that means incremental improvements over time.

Those improvements bring a level of sophistication that can only be understood in the finished product. That’s when automation puts the bread first, rather than creating an automated process to make bread that only looks artisanal.

Whether it’s automated production lines, robotics or state-of-the-art programming, Salameh doesn’t shy away from technology … as long as it supports the core of artisan integrity.

“All of these things can be done in a way that preserves the essence of what we do,” he said. “At the end of the day, we’re bakers. We want to improve efficiency and increase throughput without sacrificing the quality of the bread.”

That’s where Salameh’s operational experience comes into play. To him, time is an

ingredient; it’s non-negotiable. Fermentation can’t be cut to run product faster, so creating efficiency requires intentionality.

“It’s possible to build an industrial, automated process and keep the requisite time in place,” he said. “What we won’t do is sacrifice quality for the sake of operational excellence. Quality is not a lever that can be pulled; we have to build the process around what the product needs to be and incorporate automation into it. We plan for the time we need and honor it without being at odds with the throughput.”

Ultimately, producing artisan at scale is a balancing act, creating a product that could be considered perfectly imperfect, while at the same time adhering to strict customer specifications. It’s a fine line that Salameh has spent his entire career carefully walking.

“When you can’t sacrifice quality for efficiency,” he said, “you learn how to produce the best quality, efficiently.”

In that regard, Salameh holds the line for living up to the reputation of true artisan bread that, while celebrating artistry through its variability, retains the same quality from generation to generation.

With a long runway still ahead of him, Salameh is building and maintaining a bridge between tradition and innovation.

“I want to always remember how we got here,” he said. “That doesn’t mean doing things the same way. It means the ‘why’ has to stay the same. I believe the ‘why’ drives what we do, not necessarily how we do it. I want us to stay open-minded about how we do things but always remember why we do it.” CB

Bringing industry-changing innovations to North American bakers for over 40 years

Some of the technologies Allied has introduced to our industry

Thermal Oil Oven technologytransforming the Artisan Bread sector

Carousel, Robot, and Continuous Systems to automate the mixing room

Large-scale, twin-tool, closed-bowl, self-scraping Planetary Mixing

Fully C.I.P. multi-piston batter depositors

Truly stress-free (no extrusion) large volume make-up lines for highly hydrated doughs

Revolutionary Vertical Dough Mixing technologies - beyond the spiral

High-speed injection equipment with an accuracy of +/- 0.25 grams

With flavors that pack a punch, OMG! Pretzels is on the cusp of a new era.

BY ANNIE HOLLON

Snacking is hot right now. Circana insights reflect that despite a wavering economy and tighter purse strings, nearly half of US consumers snack three or more times a day. Today’s shoppers are also in search of more unique and convenient offerings with stand-out flavor combos ... enter OMG! Pretzels.

A little more than a decade into business, the Plymouth Meeting, PA-based pretzel company is finding its fit in the snack aisle with authentically aged

sourdough nuggets tumbled in its proprietary seasoning blends.

The brand’s reach today is vast, with its footprint stretching coast to coast in more than 1,000 locations, including supermarkets, specialty grocers, c-stores, gift shops, airport stores and university campuses.

Along with being in hundreds of doors — and counting — across the country, the premium pretzels have made their

mark on the snack segment. The brand earned a semi-finalist placement in the SNAC Tank Pitch Competition at SNAC International’s SNX 2024, and its Lemon Pepper flavor received a finalist nod for Most Innovative New Product at the 2024 Sweets & Snacks Expo.

It took time for the family-owned, woman-run business to reach this point. Its origins trace beyond its 2014 founding to co-founder and CEO Stephanie Kriebel’s childhood home kitchen.

“My mom was very strict about the types of snacks my siblings and I could eat,” Kriebel said. “So, she started making what is now our flagship garlic-seasoned sourdough pretzel nuggets for us to eat as after-school snacks, filling the gap she saw in the snack options in the market.”

The Kriebels served the pretzels as sides and brought them to parties as gifts. When people began asking where they could purchase the snacks, a path was unlocked for a business venture.

“My parents were 70 when we started the business, and we figured it would be this local or regional brand that would help support them in retirement,” Kriebel said, noting that once the seed was planted, it took the family about a year to scale the side hustle into a full-blown operation.

Starting out, Lynn Kriebel, Stephanie’s mother and co-founder of OMG! Pretzels, made the well-seasoned snack two pans at a time in their home oven. This production model lasted a few years until growing demand necessitated a commercial kitchen. Eventually, the Kriebels decided co-packing was the way to scale.

Building the brand was always a family affair. Initially, the company was operating in separate time zones, with the mother-daughter duo living in Pennsylvania and California, respectively. Stephanie leveraged her background in packaging and marketing to design the branding, and Lynn hit the pavement to drum up customers.

That door-to-door approach paid off in the long term; about 90% of the brand’s early customers still carry the seasoned pretzels in their stores today.

OMG! Pretzels launched with five varieties: Garlic, Sweet & Salty, Cheddar

Jalapeño, Chesapeake, and Sweet & Spicy. While Lynn honed the flagship flavor early on, the Kriebels spent years formulating the other blends.

“We leaned heavily into our family roots for ideas around what flavors we wanted to bring to market,” Stephanie said.

For example, Sweet & Salty was created in honor of Stephanie’s paternal grandfather, while the Cheddar Jalapeño variety was crafted with her personal love for the spicy pepper in mind.

The production timeline varies from flavor to flavor. It takes four to six months to a year to finalize and bring a flavor to market. But it’s not enough to add SKUs to the line; each variety must hit all the right notes. As a result, perfecting the balance of each flavor is the

toughest part of the R&D process for the team.

“It’s important to get that two-note tasting experience,” Stephanie said. “One flavor hits the tongue first, the second one comes after, and it lasts throughout the whole eating experience.”

After working with a co-manufacturer to perfect the seasoning application, OMG! Pretzels took off regionally, doubling its revenue year-over-year through 2021. The brand extended its footprint nationwide in 2020 through Faire, an online

Stephanie Kriebel highlights the role flavor played in building the brand.

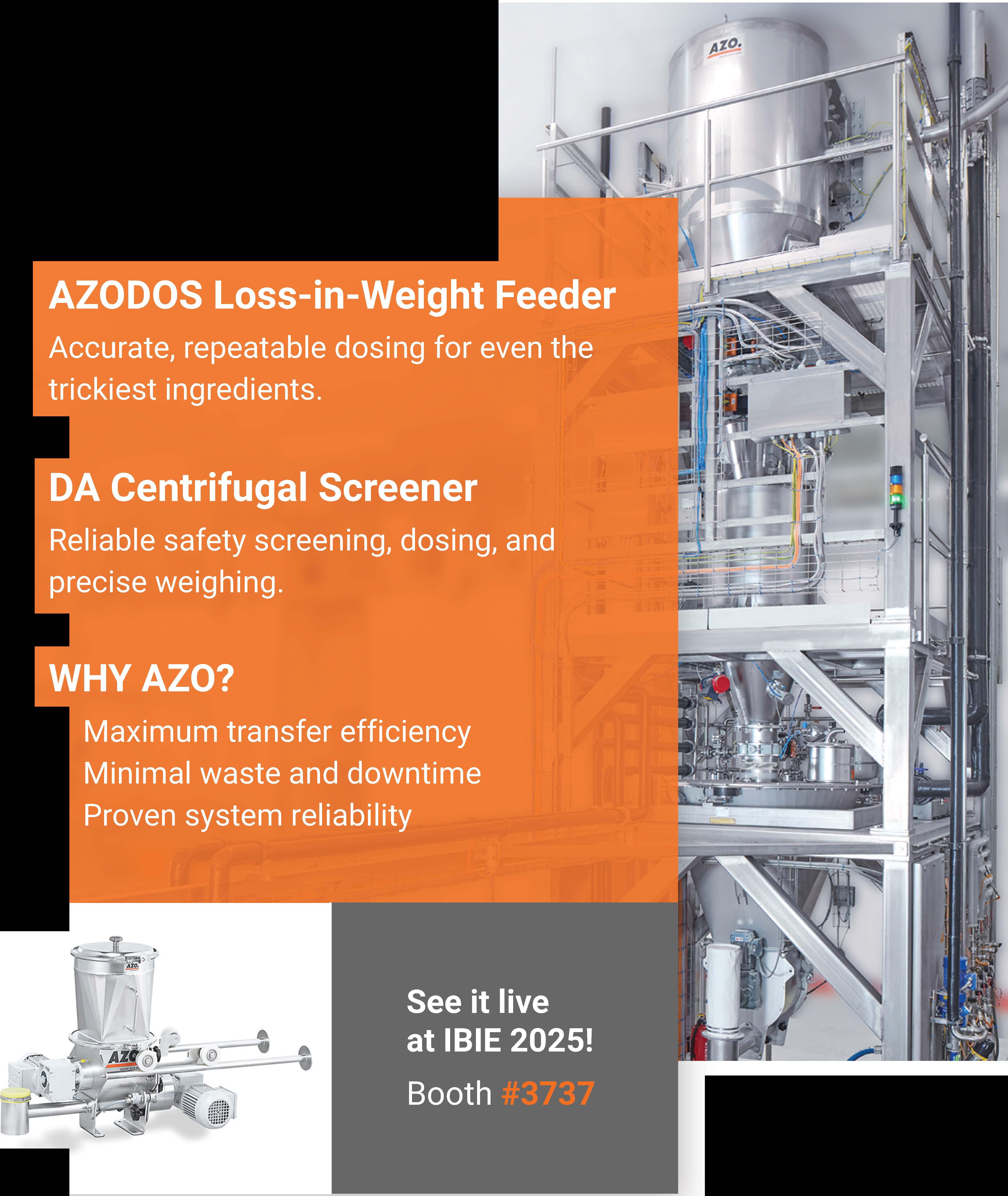

Get precision, consistency, and control with AZO's feeding and screening systems-built to perform, built to last.

marketplace. It was a move that — alongside the release of Lemon Pepper, Salty Butterscotch and Sweet Chili flavors — sustained the business during the early COVID-19 years.

After interest emerged from large box retailers in 2022, OMG! Pretzels was prompted to revamp its packaging and reformulate. The investment exhausted a lot of capital and caused a slight dip in revenue, but it was important to set the stage for the business moving forward.

Presenting the pretzels appropriately was also important. Over the past decade, the brand has worked through various visual iterations, landing on its current design — a white foil packaging with blocks of color denoting each flavor and size-accurate images of the final product — at the end of 2023. Beyond distinguishing it on store shelves, the decision also helped prospective retail buyers more easily identify the flavors. The attention to detail with the shiny, colorful packaging is costly, but a worthwhile investment to achieve the ideal look/feel for the pretzel nuggets.

Opting to use a sourdough pretzel nugget as the carrier for the seasoning mixes amplified the product’s premium status while also aligning with consumer interest. The reformulation refined the offering as clean label, non-GMO, vegan, vegetarian and kosher, as well as free from artificial ingredients or dyes, MSG, nuts, soy and sesame.

“We’ve been ahead of the curve on all these things,” Stephanie said. “There’s such a push now for removing synthetic colors and artificial ingredients in snack foods, and we’ve already done it.”

As the emerging brand looks to expand distribution, the team faces the challenge

“You can do all the marketing you want, but if your product doesn’t provide an enjoyable eating experience, you’re not going to get anywhere.”

Stephanie Kriebel | co-founder and CEO | OMG! Pretzels

of managing nine flavors in two different package sizes — the original 6.5-ounce resealable pouch and a 3-ounce graband-go bag introduced in 2024 — and a myriad of distribution avenues. OMG! Pretzels also has single-serve 1-ounce bags waiting for the right opportunity to present itself.

“We’re discussing pulling back on a few flavors, parking them in a shed and pulling them out for special occasions,” Stephanie said. “It’s a work in progress.”

Throughout the packaging changes and flavor additions the brand has had over the years, prioritizing the consumer experience has kept people coming back for more.

“Everything comes down to, ‘Does it taste good? Does it offer a great experience?’” Stephanie said. “You can do all the marketing you want, but if your product doesn’t provide an enjoyable eating experience, you’re not going to get anywhere.”

Funding the business meant bootstrapping, using credit cards and reinvesting

each year’s revenue growth. OMG! Pretzels also worked closely with TD Bank to establish a line of credit. The company financed other p rojects with a Small Business Administration loan.

“We exceeded half a million in revenue for the very first time last year,” S tephanie said. “We’re very proud; it took a lot of work and grit to get there. We’re hoping to get to $1 million this year.”

That goal is certainly achievable with the help of Michael Hoare, a decades-long member of the food and beverage industry who was recently hired as VP of sales, business development manager, advisor and consultant to support the future of the emerging brand.

With a bevy of flavor-packed pretzels, funding in the works, and a decade of slow and steady growth in its back pocket, OMG! Pretzels is well-positioned to enter its next era and bring investors along for the ride.

“We’re like plants,” Stephanie said. “We need to be watered with investments so that we can grow.” CB

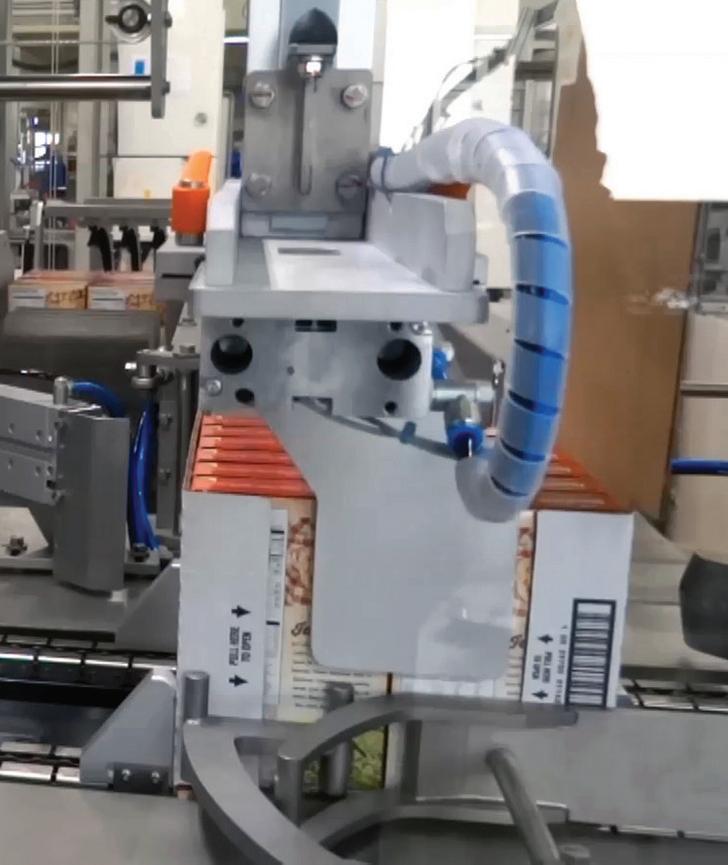

Solve your toughest secondary packaging challenges with our automated solutions

You make it. We pack it. End-of-line packaging solutions for the bakery, snack and tortilla industries. BPA loads your packaged and naked products into cases and various secondary containers including your hffs machines, wrapper chain in-feeds and indexing thermoform machines. We ASK. We LISTEN. We PARTNER.

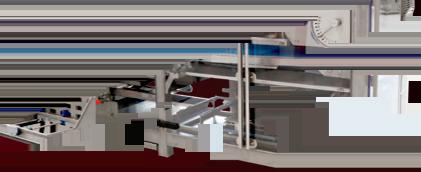

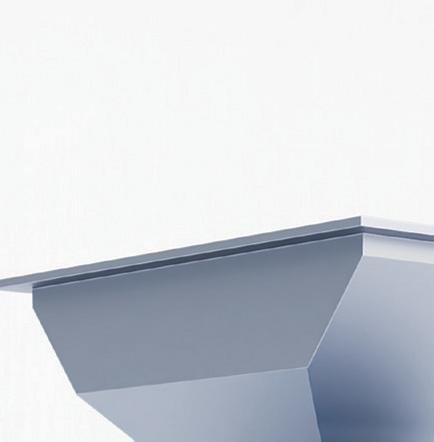

The Artisan SFE EC is a highly efficient dough sheeting line in “Easy Clean“ design. Save valuable time for cleaning processes and product changes: the innovative design ensures optimized hygiene and accessibility. With endless dough sheet generation and a capacity of up to 9,000 pieces per hour, the Artisan SFE EC is the ideal solution for your production.

With the Fortuna semi-automatic machine, the dough pieces are perfectly high and round. Thanks to its compact design, the Fortuna semi-automatic machine can easily be installed even in the smallest of spaces. The proven semi-automate is the ideal dough divider for weight ranges of 1.1 to 2.8 oz and 1.4 to 3.9 oz.

AI tools help product developers explore — and push — the boundaries of innovation.

BY MARI RYDINGS

AI is no longer the technology of the future ... it’s here. It’s also proliferating at breakneck speed and transforming how food and beverage companies do business. Embracing AI in key areas can help organizations optimize operations, boost productivity, increase profits and decrease costs.

As evidence of increasing adoption, Precedence Research predicts the global market size for AI in food and beverages will grow from $15.36 billion in 2025 to approximately $263.80 billion by 2034, a CAGR of 37.30%. In the commercial baking space, nearly 70% of the industry has adopted or plans to adopt AI in some capacity, according to “AI in the Commercial Baking Industry,” a pulse survey from the American Bakers Association (ABA), with respondents indicating marketing and sales, supply chain management and manufacturing as top AI-focused business functions.

“AI is really just taking math and applying it to something that makes the world faster,” said Chad Larson, COO for Springfield, IL-based Mel-O-Cream Donuts during a Baking Industry Forum (BIF) panel discussion at BEMA Convention 2025. “The theme behind it is always going to be, ‘What do we do, and how do we do it with less?’”

R&D is a key area where AI is thriving, specifically as it relates to new product

development (NPD), where staying ahead of trends and speed to market are competitive advantages for baking companies. Regarding R&D, the ABA survey reported that 17% of companies are currently using AI, 11% have either tested or plan to test AI pilot programs, and 24% intend to adopt AI solutions in the next 12 months.

The biggest drivers of AI adoption in NPD are speed to market, actionable

insights and consistent product qual

ity. With the right tools, bakeries can generate ideas, explore new ingredients, reduce the trial-and-error process and the risk of failure, and generate consumer-centric innovation.

“AI can find ingredient alternatives, reduce formulation cycles and cut costly bench tests, which speed up the path to market,” said Greg Heartman, VP of product management at TraceGains. “It

also allows teams to model new products and reformulations — down to ingredients, packaging and ESG criteria — before anything hits the lab. It enables product developers to explore unlimited ‘what if’ scenarios with precision, while tracking consumer trends, regulatory shifts and supplier risks in real time. From source to shelf, AI is helping food brands move faster and smarter.”

Many companies use semantic AI to track online consumer conversations across social media platforms, blogs, forums and review sites and mine them for consumer behaviors, emerging — or fading — trends, and even language that could be used in marketing campaigns.

As part of its Taste Tomorrow proprietary research program, ingredient company Puratos USA combines digital insights with extensive consumer survey results and sensory research to accelerate product ideation and recipe development

and help customers bring new products to market on a truncated timeline.

“We look at long-term, fast-evolving and seasonal trends,” said Benjamin Bado, data and digital innovation manager at Puratos. “We can gather thousands of ideas, filter them down to the most relevant ones and invest in those. AI enables us to move quickly in this kind of exploration. What used to take months can now be done in days; we can create a recipe and gauge market response almost immediately. Of course, adjustments are still needed to meet requirements for value, machinability, processes and taste, but AI accelerates the core stages that typically take the most time.”

Applying predictive modeling during formulation can also reduce some of the trial and error because it can simulate how different ingredient combinations will impact shelf life, food safety and product quality before testing even begins.

17%

of companies are currently using AI in R&D.

Source: American Bakers Association Pulse Survey

“This data-driven approach enables our customers to reduce development time; streamline innovations; and bring clean-label, sustainable solutions to market with greater confidence,” said Ashley Robertson, director of marketing and communications for Corbion. “AI empowers manufacturers to turn complex datasets into clear, actionable direction. This allows brands to innovate more efficiently and stay ahead of evolving consumer expectations.”

As a testament to the technology’s increasing use in recipe formulation, the Institute of Food Technologists (IFT) launched its AI-powered R&D platform, CoDeveloper, at this summer’s IFT FIRST event. Designed to speed up formula development and help food scientists with ingredient substitutes, texture improvement, clean-label reformulation and flavor development, the platform features a generative AI co- s cientist, advanced formulation tools for iterative development and science- o ptimized reverse engineering.

While AI tools have value in individual areas of new product development, their strength lies in cross-functional application. When Chicago-based Mondelez International decided to i nnovate on its Chips Ahoy! cookie, the company turned to AI for help. Project leaders took steps to ensure team-wide adoption of the new approach to product development.

“We encouraged people to think of it as an insights source versus a data source,” said Maria Rondon, director of brand insights, confections for Mondelez International, during a recent Industry Dive webinar. “At Mondelez, AI is truly cross-functional, especially as we think about new innovation pipeline development. With Chips Ahoy!, we

“One thing I see in the future for ingredient suppliers and equipment manufacturers is customers asking for information to be organized into individual documents for specific audiences.”

Justus Larson | VP of operations | United States Bakery

brought the entire team along on the journey: consumer insights, marketing, the innovation team, consumer science, R&D. These partners saw the value that this new process was bringing to their specific functions.”

The power of any AI tool lies in the data it receives. The more accurate information it gains, the smarter the AI becomes.

“If you want to be the best partner for your customer, you need the best tools and the most insightful data,” Bado said. “A company’s true intellectual property isn’t its machines. It’s the data and knowledge the company has accumulated over time. There must be something unique about the data you possess, because if you build the same tool with the same data source, anyone can replicate what you do. You want your own recipe, your own knowledge and your own method for creating it.”

To maximize the benefits of an AI model, companies must make sure their data is clear, concise and organized into the right model for the right position. Dissecting existing documentation into specific knowledge sections and uploading each section into the appropriate AI model will be more effective, but it can also be a very time consuming and arduous process.

“One thing I see in the future for ingredient suppliers and equipment manufacturers is customers asking for all the information inside a typical manual — operator settings, changeover procedures, maintenance tasks, sanitation tasks, troubleshooting, diagrams — to be organized into individual documents for specific audiences such as production, R&D, maintenance and food safety,” said Justus Larson, VP of operations for Portland, OR-based

More

United States Bakery during the BEMA BIF panel.

That’s where things can get tricky. According to the ABA survey, 38% of companies reported that the availability of internal data for use with AI was one of the top five challenges to implementing the technology. It’s not just a lack of data that impedes AI adoption. It’s also the increased risk exposing proprietary data, including formulas, to competitors, with 65% of survey respondents indicating cybersecurity was the primary AI-related risk most relevant to their businesses.

The growing concern of a data breach of any type has prompted many companies to construct sophisticated network firewalls that restrict communication between secure internal systems and less secure external networks, and that makes AI implementation tough, but not impossible.

“We are locked down like Fort Knox,” said Richard Ybarra, senior manager of manufacturing engineering for L akeland, FL-based Publix, during the BEMA panel. “When I started talking to my leadership about implementing AI in our facilities, the first thing they said was that we couldn’t go outside of our firewall to pull data. That was a challenge. But we went back and looked at how we could incorporate AI in various areas within this, and other, limitations.”

The use of AI in the food and beverage industry will only accelerate the pace of new product launches. Companies that recognize its value and embrace its capabilities will find new opportunities to excite consumers, a unique competitive edge and the freedom to ask, “What if?” … pushing the boundaries of taste, texture, nutrition and flavor. CB

“AI enables product developers to explore unlimited ‘what if’ scenarios ... From source to shelf, it is helping food brands move faster and smarter.”

Greg Heartman | VP of product management | TraceGains

From forming toloading andclosing all inacompact footprint

up to 120 per minute with state-of-the-art motion and wireless the 893 C Automatic Bag Machine has

Closing up to 120 bags per minute with state-of-the-art motion control, ethernet, and wireless communications, the speedy 893 C Automatic Bag Closing Machine has LEARN MORE AT KWIKLOK.COM

Come see us at IBA Hall 9, BOOTH G:11. Come Visit us at IBIE, BOOTH 2117

Sustainability and efficiency have synchronized, offering the industry a fresh perspective.

BY MADDIE LAMBERT

The word “efficiency” is tossed around like a communal frisbee, grasped by bakers, manufacturers and suppliers alike. The heightened emphasis on maximizing output and reducing costs has impacted the way businesses operate. From minimizing waste and optimizing resources to implementing advanced automation and upgrading technology, companies are revamping their processes to embrace this critical initiative.

These efforts to operate more efficiently have yielded unexpected — and radically promising — results.

The measures companies are taking to streamline operations are also enhancing sustainability beyond environmental compliance. Within multiple aspects of business, from production to packaging, a new space has formed to tackle both efficiency and conservation.

Quite simply, sustainability, in all its forms, is being seen through a new lens.

Here’s how two companies are realizing the benefits of this new era of secondary sustainability.

Thomasville, GA-based Flowers Foods focused on its water stewardship when reflecting on its baking processes and sanitation. Striving to improve water

“More than half of our bakeries use on-site meters to monitor water use, identify leaks more quickly, and verify utility invoices … which helps lower production costs and maximizes how we use our water resources.”

Margaret Ann Marsh | senior VP, safety, sustainability and environmental | Flowers Foods

metering capabilities, the company discovered that tracking water consumption per ton of product was the key to achieving this.

“More than half of our bakeries use on-site meters to monitor water use more frequently, identify leaks more quickly and verify utility invoices,” said Margaret Ann Marsh, senior VP, safety, sustainability and environmental at Flowers Foods. “We set internal goals to reduce usage, which helps lower production costs and maximizes how we use our available water resources.”

Flowers’ Bakery of the Future program provides immediate reporting of production line conditions, enabling each facility to make adjustments in real-time. By more effectively monitoring water use and incorporating data and analysis, the company improved its tracking and helped quantify water reuse.

Heat recovery is another major area that Flowers focused on. The company captures waste heat from ovens and reuses it for ingredient tanks, pipe jackets and proof boxes, which conserves energy and reduces heating costs.

Horsham, PA-based Bimbo Bakeries USA (BBU) also strives to optimize its manufacturing process to help prevent waste during development,

ultimately seeking to reduce the time and energy required to push product from concept to store shelf.

“The best way to manage waste is to not create it,” said C hristopher Wolfe, senior director of sustainability at BBU. “Eliminating and reducing waste has benefits across the value chain — fewer raw materials, energy, water, fuel and miles — and this all benefits the environment, including the carbon aspects. It also directly impacts the bottom line with associated cost savings.”

The global baking company sought to optimize its supply chain, and as commodity and utility costs increased, space for synergies emerged.

BBU reinforced fundamental programs, including steam trap maintenance, high-efficiency lighting and motors, and lowwater-flow appliances. These initiatives reduced the company’s resource consumption, minimized its environmental impact and lowered operational costs.

But it didn’t stop there.

“We’ve embraced renewables, real-time monitoring and emerging technologies like AI,” Wolfe said.

With AI, commercial bakers and equipment manufacturers can monitor energy usage across production lines, identify inefficiencies, and recommend improvements or automatically adjust processes to minimize energy consumption. For ingredient suppliers, AI can improve supply chain visibility and identify alternative, more sustainable ingredients that meet quality and taste requirements.

Transportation and logistics play a crucial role in achieving sustainability and efficiency. Through Flowers’ direct-store-delivery network, the company ships fresh goods from bakeries to depots to be picked up for delivery to retail and foodservice customers. The company consolidated its delivery service from five to four days at select warehouses and has plans to expand this initiative.

“It saves fuel, extends the life of equipment and improves our overall carbon impact,” Marsh said. “For each warehouse converted, we’ve reduced miles driven by an estimated 27,500 miles per year.”

Where there’s space for efficiency, there’s space for sustainability. By prioritizing waste elimination and optimizing resource use, commercial bakeries are primed to boost their impact ... in more ways than one. CB

Attending IBIE? The Baking Expo is offering several educational sessions on sustainability.

• Intelligent Energy Consumption Monitoring in Industrial Bakeries | Andrii Bulatov, AMF Bakery Systems

• The Future of Biscuit & Cracker Baking: New Emithermic XE Oven Design to Replace Traditional DGF Baking Technology | Tremaine Hartranft, Reading Bakery Systems

• Baking Sustainability into Your Operations: A Strategic Approach | Diana Thomas, BiologiQ, Inc.

• Adapting to Change: Navigating Sustainability in the Modern Food Industry | Abby Ceule, Corbion

• Baking for a Better Future | Olivier Hamel, KLR Systems

• How to Automate Your Admin to Build a More Sustainable and Profitable Wholesale Bakery | Luke Karl, Cybake Ltd

BROWSE MORE:

See the full IBIEducate lineup at www.bakingexpo.com/education

“The best way to manage waste is to not create it. Eliminating and reducing waste … directly impacts the bottom line with associated cost savings.”

Christopher Wolfe | senior director, sustainability | Bimbo Bakeries USA

Bettendorf Stanford

•Compatible with wire tires or any other closure device

•Built in metal detector

•Built in rejection system

•Servo driven bagger

•Centerline setup for easy repeatable setup

Our Servo 65 Bagger with built in metal detector is designed to allow metal detection after the loaf is bagged, even if you want to use a wire tie.

Don’t let food safety take a back seat, use the industry’s safest bread bagger!

Bellarise® BellaSOFT Ever Fresh bakes the best softness, resilience, and bite into all of your breads and buns.

Oh, and it's all-natural and clean label, too.

All-new Bellarise• BellaSOFT Ever Fresh:

• Maximizes value by yielding the best softness for the longest time

Protects your breads when stacked by offering top-notch resilience

Creates a perfect bite that always reveals all the best in your breads

Our master bakers put their best into Bellarise BellaSOFT Ever Fresh to help make your breads unforgettable. After all, you work hard at the bakery every single day, so we work hard to make sure all your efforts count.

Please contact us and order your sample today!

BY MAGGIE GLISAN

For more and more Americans, mealtime just isn’t the same as it used to be. They’re eating smaller portions, feeling fewer cravings and paying a lot more attention to what’s on the label — all the result of starting a GLP-1 medication. As these treatments grow in popularity, food manufacturers have to rethink how they meet new consumer habits, especially when it comes to flavor, function and nutrition.

GLP-1 (short for glucagon-like peptide-1) receptor agonists are a class of medications originally developed to help manage Type 2 diabetes by regulating blood sugar. Today, they’re increasingly prescribed for weight loss. Medications such as Ozempic, Wegovy and Trulicity mimic the GLP-1 hormone naturally released in the gut after eating. This helps stimulate insulin production, slow gastric emptying and reduce appetite.

It’s not just the physical effects of these medications that are making them so disruptive; it’s physiological as well. GLP-1 medications send satiety signals to the brain while slowing digestion, leading users to eat significantly less and feel fuller longer. Many patients report changes not just in how much they eat but also in their overall relationship with food.

As these medications become more common, the ripple effects are taking shape. The Institute of Food Technologists named GLP-1 agonists the leading driver of product innovation for 2025, and as the global GLP-1 market grows, food manufacturers are accelerating R&D efforts to meet the nutritional needs of users focusing on protein density, gut health and satiety.

“GLP-1 medications are creating one of the most significant behavioral shifts

we’ve seen in food and beverage in recent years,” said Alon Chen, CEO of Tastewise, “not by eliminating demand, but by reshaping it.”

The impact is especially pronounced in snack foods. Products such as chips, baked goods, cookies and sides saw the steepest pullbacks, with average spending declines ranging from 6.7% to 11.1% during the six-month period post-GLP-1 adoption, according to research published by Cornell University and consumer insights group Numerator. Chen said he sees traditional snacking undergoing a quiet revolution with “smart snacking” on the rise, impulse-driven snack purchases down 15% and the definition of a snack evolving from indulgence to function.

GLP-1 medications are also impacting what types of foods users gravitate toward. A 2024 Corbion proprietary survey found 43% reported increased cravings for savory foods, while interest in sweet, salty and even bitter flavors appears to be declining. Many reported a reduced craving for sweets and rich foods and more of a preference for lighter, fresher, even more savory or umami-type flavors.

Although users of GLP-1 medicines may be consuming less food overall, what they do eat is becoming far more intentional.

“We’re seeing a sharp pivot toward nutrient-dense, functional options,” Chen said. “Consumers are actively seeking foods that align with their new physiological cues, i.e. less appetite, with a heightened focus on satiety and nutrition.”

So what, exactly, are GLP-1 users looking for in food from a nutrition standpoint? There are two clear winners: protein and fiber. According to Tastewise, interest in protein-rich snacks is up 113% year-over-year, while social conversations around fiber-rich foods have surged 177%.

Protein and fiber play a critical role for people taking GLP-1 medications because they support the unique nutritional demands these medications create. As appetite decreases and overall food intake drops, every bite matters more. Protein helps preserve lean muscle mass and promotes satiety, making it easier for users to feel full with fewer calories.

Fiber, meanwhile, aids in digestion, supports gut health and helps maintain blood sugar stability, which is another key consideration for many users managing Type 2 diabetes or insulin resistance. Together, protein and fiber help people feel

satisfied longer, making them essential components of a more intentional approach to eating.

Ingredient innovations that boost protein and fiber are at the center of many emerging product formulations, but each comes with its own set of challenges.

“Fiber offers some great benefits from a nutritional perspective, but in terms of processing, it competes for water,” said Ashley Beech, bakery applications product development manager at Corbion. “When you’re using fiber, you have to be conscious of the water adjustments and how it will interfere with the gluten network, other hydrocolloids, other proteins, etc.”

Texture tends to be another big challenge when working with fiber.

“Fiber can create really tight, stiff doughs, and it can also create really sticky, wet doughs,” Beech said. “Understanding the specific fibers you’re working with and looking to your suppliers to identify the product process will help with those challenges.”

Proteins can have similar textural challenges, and that’s especially true of plant proteins.

“If you’re looking at plant proteins, they don’t form the same type of gluten network that a wheat protein will, and that can have an antagonistic effect on your baked goods structure,” Beech said. “Some proteins can give you a bit of a gritty texture and others a soft texture.”

Taste can also be affected by both fibers and proteins, imparting off notes that range from bitter to earthy. Using blends, Beech said, is one way to mitigate some of the negative impacts of adding fibers and proteins.

“Perhaps one protein gives you excellent nutritional delivery, but it comes with a bit of a gritty texture,” she said, “so finding a complementary protein to help balance that can be really helpful.”

Increasing fiber without sacrificing flavor or texture has become a particular area of focus for Bay State Milling. The company developed a high-fiber wheat flour that contains more prebiotic fiber than conventional wheat. Unlike functional fibers added during processing, this fiber is intrinsic to the grain itself, allowing manufacturers to increase nutrition without compromising the familiar taste and texture consumers expect.

“It can be quite the challenge to achieve the trifecta of taste, texture and fiber content,” said Colleen Zammer, VP of varietal solutions growth and innovation at Bay State Milling. “One of the brilliant things about flour is — because of the combination of protein and starch — it runs very well through baking equipment and can be very efficient. If you add a fiber ingredient that makes the dough sticky, you’re either slowing down your

line or having a product that doesn’t come out well or that looks different than expected.”

Ingredient innovations that boost protein and fiber are at the center of many emerging product formulations, but each comes with its own set of challenges.

High-fiber flours such as Bay State’s HealthSense are developed to address these types of challenges. For bakers looking to quietly reformulate everyday staples like sandwich breads, rolls or baked snacks, this type of ingredient offers a practical path forward in a market where fiber-rich, functional foods are gaining traction.

It’s also important in an environment where consumers scrutinize labels.

“We’ve seen that consumers on GLP-1 drugs are looking much more carefully at labels,” Zammer said. “If you can avoid a fiber additive — something that doesn’t sound like food — your ingredient label will look that much better. Balancing the whole consumer experience with the clean-label piece is really important.”

Sure, the highest quality ingredients matter. We’re pretty good at that. We’re also known for partnering with our customers to provide next-generation ingredient solutions to support their big ideas. With dedicated experts and a full innovation lab, we’d love to share our secret of success with you. Let’s get started.

Undercover Snacks is a manufacturer that’s leaning into nutrient density and GLP-1-friendly innovation. Known for its crispy quinoa-based chocolate snacks, the brand recently opened a new processing facility to meet rising demand for better-for-you indulgences that prioritize protein, fiber and clean ingredients. By combining plant-based protein with a naturally gluten-free grain, Undercover is developing snacks that offer satiety and substance.

Focusing on innovations that extend shelf life is another way bakers can capitalize on evolving eating behaviors.

“People aren’t eating foods as fast as they may have originally,” Zammer said. “A loaf of bread may be around for a lot longer in someone’s home than it might have been when they weren’t taking a GLP-1 medication. When manufacturers reformulate a product, that’s something they need to be thinking about.”

Additionally, according to Beech, adding fibers to a product can improve freshness and shelf-life stability due to their water-holding capacity.

“When you have higher water content in a product because of fibers, it can actually improve shelf life,” she said. “But you need to watch out for mold and balance that with a proper antimicrobial.”

Corbion’s data suggests that for nearly 7 in 10 GLP-1 users, the food industry isn’t meeting their expectations, particularly when it comes to fresher, more convenient options that go beyond the typical frozen and prepackaged offerings. Smaller portion sizes, longer shelf life, and even clear packaging and nutritional claims are all part of the equation bakers should be calculating.

Reformulating products to meet the needs of GLP-1 users doesn’t have to mean a complete overhaul. But small, incremental changes may be the most effective path forward, and the payoff for brands willing to invest in these adjustments could be significant. As the category grows, so does consumer demand for food products that are functional, convenient and thoughtfully designed.

The time to act is now.

“With up to 35 percent of Americans expressing interest in GLP-1s, this is a growing wave,” Chen said. “Because the current adopters tend to be affluent, health-conscious consumers, there’s a clear premium opportunity for brands that can adapt. The future of food won’t necessarily be about more, but it will absolutely be about better.” CB

Undercover Snacks is leaning into demand for better-for-you indulgences that prioritize protein and fiber.

The first bite of a croissant or donut is soft, warm and indulgent — exactly as it should be.

But behind the freshness is a process that’s anything but efficient. Most bakery items are baked, packed, frozen, shipped and stocked — all within 24 hours.

Consumers don’t notice. Producers must.

Traditional systems depend on conventional plastic packaging like clamshells, which can be bulky, fragile and manually intensive. Lids misalign, labels shift and every extra touchpoint increases the risk of waste. When packaging fails, shelf life shortens, product quality drops and margins shrink.

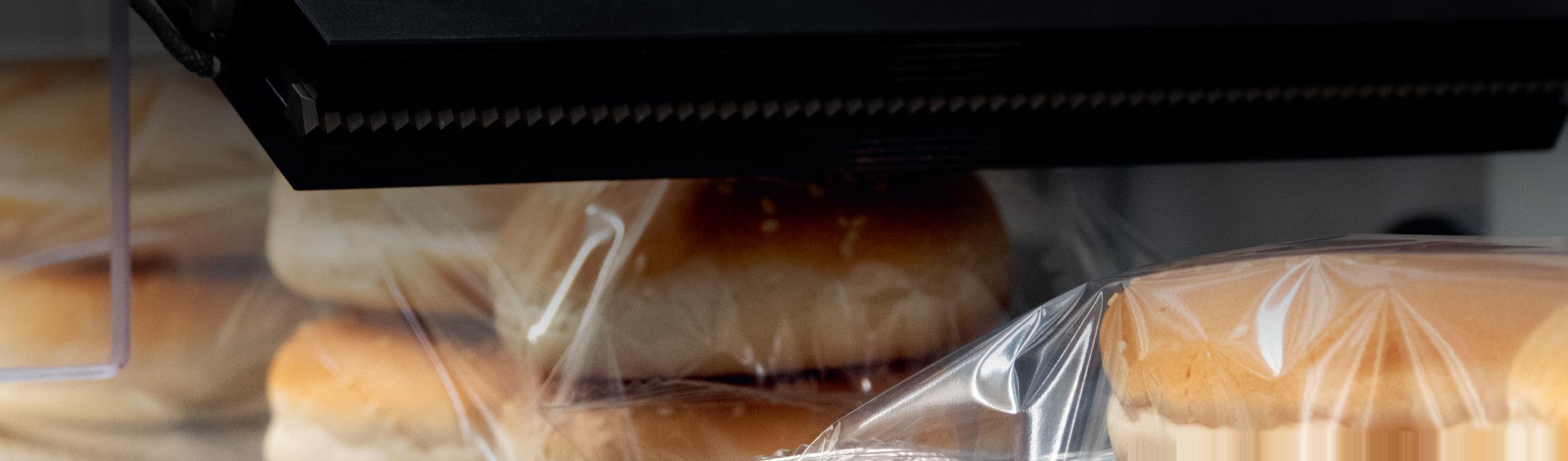

So, where can bakers turn to for a trusted alternative? Harpak-ULMA.

Tray sealing offers a more streamlined solution. It utilizes a single-tray base and a thin top film that’s sealed via heat or modified atmosphere packaging (MAP). The result is a 20%-50% (on avg.) cut in plastic use, fewer materials and a lower cost per unit.

Clamshells = $0.18 per unit

Tray + film = $0.11 per unit

Savings per 2-million-unit run: $140,000 per year

Material savings is only the start. With MAP, baked goods remain fresh without spiral freezing, which eliminates the need for freezing infrastructure, reefer trucks or cold-chain maintenance.

Bakers can save between $215,000 and $550,000 (on avg.) by removing a process or product they might not even need.

Flow wrap typically involves multiple stations: tray loading, wrapping, sealing and labeling. Tray seal condenses this into one efficient system, resulting in cost savings:

• Up to 30% less material

• $0.03 per unit (avg.)

• $83,000 (avg.) per year, per line in labor

• $40,000-$75,000 per year, per line in reduced downtime

• Up to 70% shrink reduction with better MAP integration

Tray seal adds standout shelf life that’s not just a number but also a lever for profitability. For high-turn items such as pastries or filled goods, it’s a game changer. A bakery item with a three-day shelf life sees about 10% shrink. MAP and tray seals extend that to four days and sell-through rises to 99%. One extra day can cut shrinkage by up to 90%.

Tray seal packaging also delivers on sustainability. Recyclable materials such as pressboard and fiber trays reduce packaging waste by up to 50%, allowing for a low-profile format with tighter pallet stacking and reduced truck shipments.

That means bakers can skip one weekly truckload and save 23.5 metric tons of CO₂ annually. Combine that with the energy saved by eliminating spiral freezing, and integrating tray seal is the equivalent of removing between 30 and 40 (on avg.) gas-powered cars from the road each year.

Start your day at IBIE with a pastry and hand-crafted, premium coffee at Middleby’s CommercialBaking Cafe You’ll hear from Joanie Spencer, editor-in-chief, on the latest industry trends and engage with Middleby category experts about innovations to fuel your company’s growth and efficiency.

Sunday 10am

• Bread, Buns

• Sweet Goods, Cakes, Muffins

Monday 10am

• Cookies, Crackers, Energy Bars

• Artisan, Flatbread

Tuesday 10am

• Pizza, Pastries

• Tortillas, Snacks

Catching up is never fun, but staying ahead can be.

BY LILY COTA

Keeping up isn’t always easy, especially in an industry known for its adaptability and fleet-footed evolution. Comprehensive events such as the International Baking Industry Exposition (IBIE) provide the one-stop shop needed to stay ahead of the shifting trends and budding initiatives shaking the industry.

Read on to dive into the top 10 trends guiding the 2025 Baking Expo.

Across every industry, automation is being adopted at rapid rates. Labor shortages and overall rising operational costs are driving baking companies of all sizes to make changes to their production, manufacturing and distribution methods — fast.

AI-powered ovens, robotic dough handling systems, smart sensors for moisture and texture, and predictive maintenance tech, as well as Industry 4.0 integrations, are on the rise and worth keeping an eye on at the Expo.

As a result of persisting labor woes, the industry is placing greater focus on professional development resources ... which has the potential to provide