Page 5 History is Made WINTER 2023 County Lines County Lines ARORP Update Page 23 At the Capitol Page 30

Office specific extensions tailored to your day-to-day business needs. Map parcels, address points, roads, pavement issues, voters, and so much more!

Easily create, edit, and export items at anytime from anywhere. The site is mobile-friendly and backed by our unparalleled customer support team.

Real-time access to the local, state, and federal data sources you need to make informed decisions. Bringing everyone and everything together.

ASSESSOR • ADDRESSING • VOTING • LAW ROAD & BRIDGE • EMERGENCY MANAGEMENT GIS MAPPING USER FRIENDLY INTEGRATION Phillip Carper, Director of Sales & Accounts pcarper@datascoutpro.com • 501-993-0774

Little Rock Conway Jacksonville Hot Springs Springdale Bryant Memphis Responsible Attorneys:

EXPERIENCE. COMPASSION. RESULTS.

DIAL 8 888-8888

Mike Rainwater & Bob Sexton

ROADS LEAD TO STRONGER COMMUNITY.

A community’s roads connect us to jobs, healthcare, daily essentials, friends and family — and home. Ergon is proud to provide the materials and support needed to help build and maintain safe roadways across America, connecting us all to what matters most.

In This Issue

Winter 2023

Features

AG Announces Intent to Work with Cities, Counties..................25

Steel Industry Transforming Mississippi County.........................28

Scenes from the State Capitol.......................................................30

AAC Staff Profile: Karel Ortega......................................................33

AAC Staff Profile: Madison Folsom..............................................33

AAC Photo Recap: County Treasurers..........................................35

AAC Photo Recap: County Coroners.........................................36

AAC Photo Recap: Circuit Clerks....................................................37

AAC Photo Recap: Assessors.........................................................38

AAC Photo Recap: County Judges..............................................39

AAC Photo Recap: County Sheriffs...............................................40

Departments

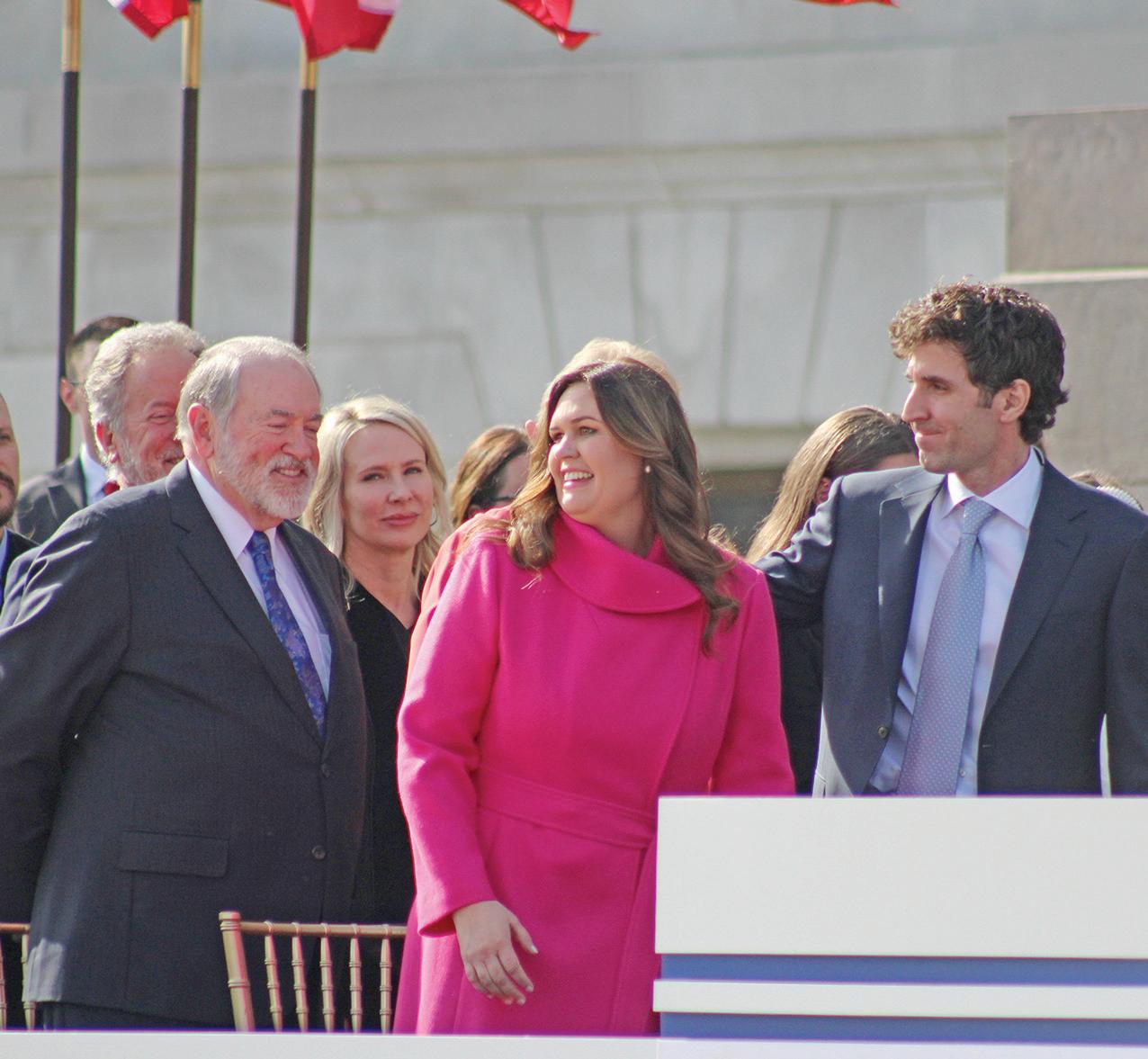

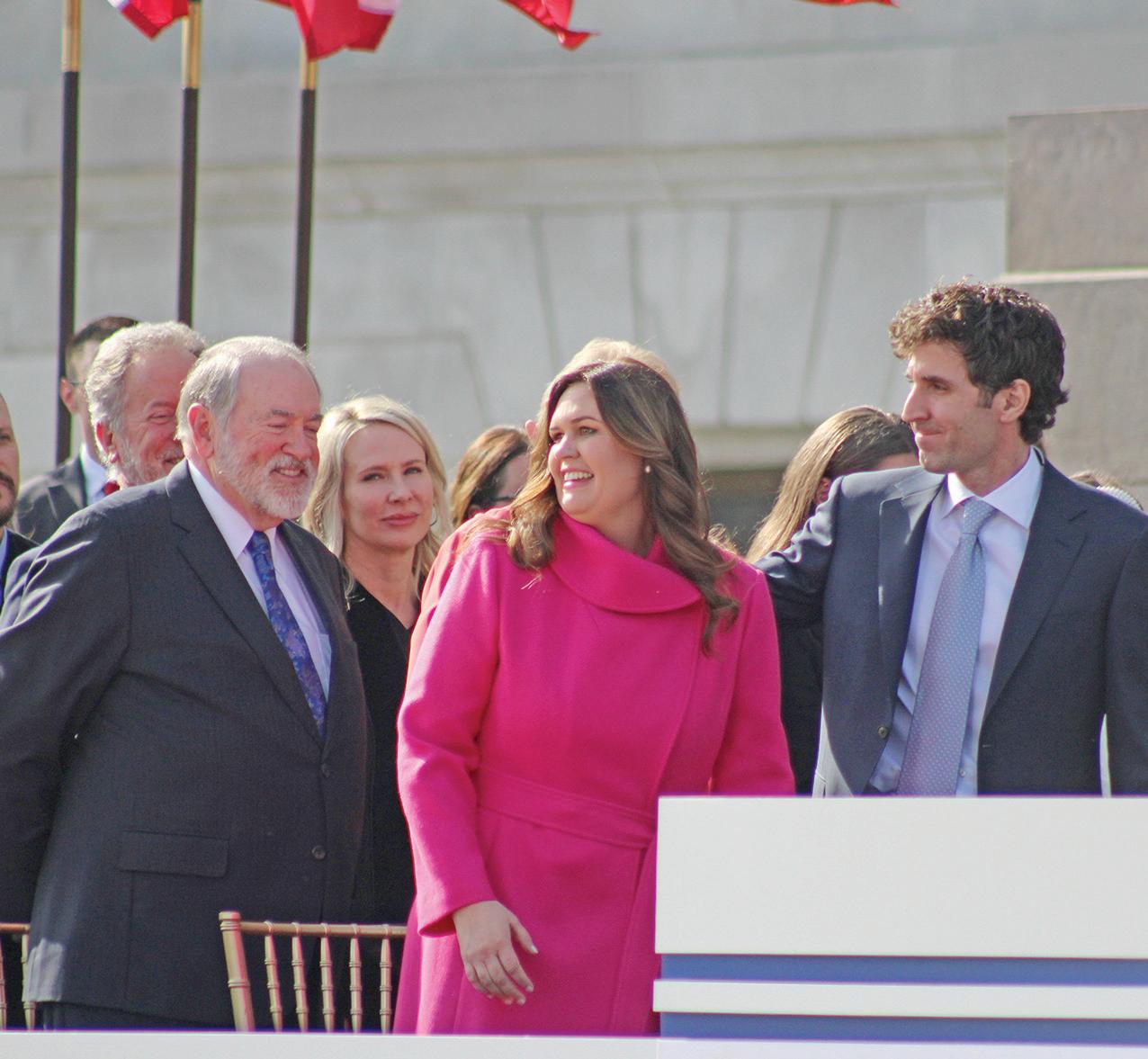

Cover Notes: History is made in the Governor’s office

History was made on Jan. 10, 2023, when Sarah Huckabee Sanders was inaugurated as the 47th — and first woman — Governor of Arkansas. She also is currently the youngest governor in the country. In addition to her husband, First Gentleman Bryan Sanders, and her children, Sanders was joined by her parents, former Arkansas Gov. Mike Huckabee and First Lady Janet Huckabee, on the special day. A large group of county officials also attended the inaugural ceremony.

the Director’s Desk...................................................................7 President’s Perspective.....................................................................9 AAC Research Corner.......................................................................14 Seems to Me.....................................................................................16

......................................................................20 Litigation Lessons............................................................................21 ARORP Update..................................................................................23

News

From

Governmental Affairs

AAC Risk Management Services...................................................26 AAC Member Benefits......................................................................27 News from NACo: SALT Deduction................................................32

from NACo: Recover Fund Contact Center.........................42

(Photos by Sarah Perry)

COUNTY LINES, WINTER 2023 5

— Photos by Sarah Perry, AAC Communications Coordinator

AAC CALENDAR

April 5-7 County Clerks

Hilton Garden Inn, Little Rock

April 13-14

Collectors

Winthrop Rockefeller Institute, Petit Jean Mountain

April 22

75-Member AAQC Meeting

AAC, Little Rock

May 9-11

Judges Road Seminar

Norfork River Resort, Norfork

May 31-June 2

Judges

Hotel Hot Springs, Hot Springs

Contact AAC

Chris Villines, Executive Director cvillines@arcounties.org

Anne Baker, Executive Assistant abaker@arcounties.org

Loretta Green, Receptionist lgreen@arcounties.org

Eddie A. Jones, Consultant e.jonesconsulting@gmail.com

Mark Whitmore, Chief Legal Counsel mwhitmore@arcounties.org

Colin Jorgensen, AAC Litigation Counsel cjorgensen@arcounties.org

Josh Curtis, Governmental Affairs Director jcurtis@arcounties.org

Lindsey French, Legal Counsel lfrench@arcounties.org

Christy L. Smith, Communications Director csmith@arcounties.org

Sarah Perry, Communications Coordinator sperry@arcounties.org

Michael Roys, ACE Program Coordinator mroys@arcounties.org

June 4-7

Sheriffs

Embassy Suites, Jonesboro

June 13-16

Circuit Clerks

Winthrop Rockefeller Institute, Petit Jean Mountain

June 20-23

County Clerks

Embassy Suites, Jonesboro

June 21-23

Collectors

Holiday Inn, Texarkana

June 27-30

Assessors

Embassy Suites, Hot Springs

AAC Mission Statement

The Association of Arkansas Counties supports and promotes the idea that all elected officials must have the opportunity to act together in order to solve mutual problems as a unified group. To further this goal, the Association of Arkansas Counties is committed to providing a single source of cooperative support and information for all counties and county and district officials.

The overall purpose of the Association of Arkansas Counties is to work for the improvement of county government in the state of Arkansas. The Association accomplishes this purpose by providing legislative representation, on-site assistance, general research, training, various publications and conferences to assist county officials in carrying out the duties and responsibilities of their office.

1415 West Third Street Little Rock, AR 72201 (501) 372-7550 phone / (501) 372-0611 fax www.arcounties.org

Cindy Posey, Accountant cposey@arcounties.org

Jenny Evans, Accounting & Program Assistant jevans@arcounties.org

Mark Harrell, IT Manager mharrell@arcounties.org

Risk Management/ Workers’ Compensation

Debbie Norman, Risk Mgmt. & Insurance Director dnorman@aacrms.com

Misty Petrus, Workers’ Comp Claims Mgr. mpetrus@arcounties.org

Cathy Perry, Program Analyst cperry@aacrms.com

Kim Nash, Workers’ Comp Claims Adjuster knash@aacrms.com

Renee Turner,Workers’ Comp Claims Adjuster rturner@aacrms.com

Jacob Trumble, Claims Analyst jtrumble@arcounties.org

Greg Hunt, Claims Analyst ghunt@aacrms.com

Kim Mitchell, Premium Analyst kmitchell@aacrms.com

Karen Bell, Program Assistant kbell@aacrms.com

Ellen Wood, Admin. Asst./Receptionist ewood@aacrms.com

Brandy McAllister, RMS Counsel bmcallister@arcounties.org

JaNan Thomas, RMS Litigation Counsel jthomas@arcounties.org

Melissa Dugger, RMS Litigation Counsel mdugger@arcounties.org

Aaron Newell, RMS Litigation Counsel anewell@arcounties.org

Mallory Floyd, RMS Employment Counsel mfloyd@arcounties.org

Fonda Fitzgerald, RMS Paralegal ffitzgerald@arcounties.org

Shantina Osborn, RMS Paralegal sosborn@arcounties.org

Samantha Wren, RMS Legal Assistant swren@arcounties.org

Karel Ortega, RMS Legal Assistant kortega@arcounties.org

James Mirus, Member Services Manager jmirus@arcounties.org

2023

6 COUNTY LINES, WINTER 2023

County Lines

County Lines [(ISSN 2576-1137 (print) and ISSN 2576-1145 (online)] is the official publication of the AAC. It is published quarterly. For advertising inquiries, subscriptions or other information, please contact

Christy L. Smith at 501.372.7550.

Executive Director/Publisher

Chris Villines Communications Director/ Managing Editor

Christy L. Smith

Communications Coordinator/ Editor

Sarah Perry

AAC Executive Board:

Debbie Wise – President

Brandon Ellison – Vice President

Jimmy Hart – Secretary-Treasurer

Tommy Young Deanna Sivley

Debra Buckner Dana Baker

Kevin Cleghorn Terry McNatt

Rebecca Talbert Doug Curtis

Gerone Hobbs Marty Boyd

John Montgomery Heather Stevens

Brenda DeShields Selena Blair

National Association of Counties

(NACo) Board Affiliations

Debbie Wise: NACo board member. She is Randolph County Circuit Clerk and president of the AAC Board of Directors.

Brandon Ellison: NACo board member. He is Polk County Judge and vice-president of the AAC Board of Directors.

Ted Harden: Finance & Intergovernmental Affairs Steering Committee. He is a member of the Jefferson County Quorum Court.

Barry Hyde: Justice and Public Safety Steering Committee. He is the Pulaski County Judge.

Rusty McMillon: Justice and Public Safety Steering Committee. He is Greene County Judge

Kevin Smith: IT Standing Committee. He is the Sebastian County Director of Information Technology Services.

Gerone Hobbs: Membership Committee. He is the Pulaski County Coroner.

Paul Elliott: Vice-Chair of Justice and Public Safety Steering Committee, vice-chair of law enforcement subcommittee. He is a member of the Pulaski County Quorum Court.

Ellen Foote: Community, Economic & Workforce Development Steering Committee. She is the Crittenden County Tax Collector.

Tawanna Brown:Telecommunications & Technology Steering Committee. She is Chief Computer Operator for Crittenden County.

AAC DIRECTOR’S DESK

Legislative rollercoaster is coming to a stop soon

As we ease from winter to spring, the biennial ritual of a legislative session is in full force here in Little Rock. We have a few weeks remaining to wrap up county work, but it has been a successful session as many of our package bills are either signed into law or well on their way to Governor Sanders’ desk.

The 94th General Assembly has accomplished a great deal already, with the LEARNS Act now finished up. But more remains, including a significant criminal justice bill that will include new prison beds to help ease our chronic jail overcrowding, passage of the Revenue Stabilization Act (the annual funding mechanism for all of state government) and likely a reduction in state income taxes as well.

Many times, you hear the phrase “watching the legislature is like watching someone make sausage.” This may be a trite comment, but it fits because it is so true. The back-and-forth machinations of creating law are something to behold. What appears to many on the outside as heated discussions between parties about the pros and cons of legislation are truly the best way for all positions to be weighed and for legislators to make policy determinations that work best for the people of Arkansas.

Those that have been doing this for a while have generally developed a thick skin to the philosophical arguing that takes place in the Capitol, but from time to time the most seasoned legislator, lobbyist or interested party can let passion get the best of them. I am proud to work with a wonderful and seasoned lobbying team at the Association of Arkansas Counties that focuses on explaining county positions with civility.

Our team consists of Eddie Jones, Mark Whitmore, Lindsey French, Josh Curtis and myself — and our days begin early and end late as we track our AAC Legislative Package while simultaneously following hundreds of bills that have an impact on what our counties do. We each are often asked at this point in a session if we are tired and ready for it to end … and just like everyone else with front row views of a session our honesty compels us to answer yes. But one constant remains that gives us all strength — our love for county government.

It is a lot easier to plod through a legislative session when you believe wholeheartedly in what you represent. And it gives everyone strength when we see your smiling faces coming through our doors on your way up the hill to convey your passion for good government. I truly believe our lobbying position is strong because we represent the best of humankind in county public servants. You are respected by your legislators, and we get to be part of that relationship.

Soon the legislature will wrap up, and we will begin assessing all the bills that have passed. The helpful bills always outnumber those that harm us, and your watchful eyes on the bills that are filed help us tremendously. Keep up that good work. Keep coming through the office as well. It truly helps.

Chris Villines AAC Executive Director

>>> COUNTY LINES, WINTER 2023 7

Once finished, we will compile a list of acts that affect county government and host you in Little Rock where we will give a recap of the session. In addition, we will take this discussion on the road to each of your continuing education meetings to dig down a little deeper into what might affect your specific office.

That brings me to one more point. Many of you are now entering your second quarter as a newly elected county official. The best thing you can do in your new role is to reach out to other officials in your same role. I discussed this during your new-elect trainings in December, but I’d like to reiterate it in this column. There is nothing more valuable for you, in your position, than getting involved in your continuing education program.

Your job is unique. Nobody in your county has your job, or one remotely similar. Nobody in business can relate to the awkward but necessary laws you must adhere to in your office. Furthermore, there is no good way to learn how to improve your office but for dialogue with your

colleagues across county lines.

Our county associations have built incredibly effective programs, and you will never regret getting involved in their (usually) three times per year meetings. It’s also a great opportunity to reconnect with our AAC staff and your liaison for our association. So, plan on attending. Mark your calendars now and save those dates this year for our meetings.

Finally, please don’t forget about a great opportunity the AAC has in place for our state’s college-bound graduates. Our scholarship program is administered by the AAC Scholarship Committee and staffed by Executive Assistant Anne Baker. If you or a co-worker have a child or grandchild about to head off to school, please encourage them to apply for an AAC Scholarship. Decisions will be made this spring and application information can be found on our website at www.arcounties.org.

Hold on tight, friends. The legislative rollercoaster should be coming to a stop soon, and I look forward to reconnecting with you all in the days that follow.

AAC DIRECTOR’S DESK DESIGN A strong corporate identity is rooted in impactful design. Our talents get noticed, and get results. Naming Logos Website Design Packaging Branding Sales Collateral Point of Sale Tradeshow Photography ADVERTISING From traditional to tomorrow’s media, we’ll strategize, plan, implement and track your next campaign. Strategic Planning Campaign Management Campaign Reporting Printed Collateral Apparel Promotional Products Outdoor Direct Mail Digital DIGITAL We’ll design and build your next site and bring you up to speed on social media and beyond. Application Development E-Commerce Solutions Business Solutions Web Development Social Media Management Content Development Search Engine Optimization Google Adwords Videography THIS IS HOW WE DO IT. M SS Arkansas’s Leading Communications Agency (888)844-MASS (6277) inthooz.com 8 COUNTY LINES, WINTER 2023

A leadership example to follow

It’s time for me to formally welcome all the new county and district officials who took office in January. By this time, you have gotten your feet wet and probably have a lot of questions. As you seek answers to those questions, I urge you to utilize all the tools available to you — this magazine, the list servs, your continuing education meetings, and your liaisons at the AAC.

I also encourage you to assess your role as a leader in your office, your association, and your community.

As a county or district official, you are automatically considered a leader in your community. And that means you must develop and work alongside others to achieve success on a larger scale.

Some of you have already taken on leadership positions in your association, and others have gotten involved in the legislative process. I applaud you for that. The more you can learn and become involved in the activities taking place outside of your office, the better. Don’t be afraid to step outside of your comfort zone.

AAC Consultant Eddie A. Jones is a prime example of someone who did just that. As a result, he has become a leader among leaders in county government. Most of you heard him speak about budgeting during your new elect seminar in December. But his expertise goes far beyond just budgeting.

Eddie is a former Randolph County treasurer and a former director of the AAC.

When he was interviewed for this magazine in 2007 after becoming director of the AAC, he said, “County government has been a passion of mine for many years. I relish the opportunity to lead AAC. I intend to work hard and work for all nine affiliate associations of AAC. I will work for every elected county official in the state. I work for you, and I plan to do my very best. I want good things to happen for

county government. I will continue to urge myself and the staff to strive for excellence.”

He did not speak of working to ensure his success. He spoke of working to ensure the success of county officials and of county government overall — and he has done just that in his various roles. Through the years he has served as a mentor and friend to many, including myself. His guidance has inspired me to be the best I can be, both personally and professionally.

Eddie writes a column for this magazine. Over the course of the years, he has written about topics such as ethics, using knowledge to act wisely, leadership, and more.

In the Fall 2022 issue of County Lines, he wrote a column entitled “Being a leader is not about you!” He spoke about how leaders must step up and help others succeed.

“The ultimate measure of leaders is their ability to help those around them become successful. It’s not about them helping you become successful; it’s about a selfless devotion to the people who work to help the county achieve its purpose and goals,” he wrote.

I encourage you to keep those words at the forefront of your mind and aspire to be the type of leader Eddie A. Jones is.

Debbie

Did an aspect of county government “make news” recently in your county? Did any of your county officials or staff get an award, appointment or pat on the back? Please let us know about it for the next edition of County Lines magazine. You can write up a couple of paragraphs about it, or if something ran in your local paper, call and ask them to forward the story to us. We encourage you or your newspaper to attach a good quality photo, too: e-mail csmith@arcounties.org.

Wise Randolph County Circuit Clerk / AAC Board President

Wise Randolph County Circuit Clerk / AAC Board President

AAC

DEBBIE WISE AAC Board President; Randolph County Circuit Clerk

PRESIDENT’S PERSPECTIVE

Debbie Wise

COUNTY LINES, WINTER 2023 9

We want your news

Tax B I L L I N G & C O L L E C T I O N S O L U T I O N S S E R V I C E S O F T W A R E S A T I S F A C T I O N E X P E C T M O R E Browser Based Full Credit Card Integration Fully Documented Multi-payment Processing Unlimited History Public Inquiry Exportable Data Multiple Annual Updates gowithtaxpro.com info@gowithtaxpro.com (501) 246-8060

The Future of

START BUYING Shop Statewide Contracts.

Arkansas’s statewide purchasing cooperative program, ARBUY, makes purchasing through statewide contracts simple. And it’s completely FREE to county governments. Contact us to start shopping today.

SAVE MONEY | SAVE TIME | ENSURE COMPLIANCE | SHOP STATEWIDE CONTRACTS Start shopping contracts Scan the QR code or visit periscopeholdings.com/countyline

AAC RESEARCH CORNER

Freedom to harass

The Arkansas Freedom of Information Act (FOIA) is paramount in ensuring democracy through governmental transparency and serves as a reminder that the government serves the people, not the other way around. Although FOIA is an incredibly useful tool in holding the government accountable, there must be a balance between the public’s right to know what agencies are doing and the agencies’ ability to perform their duties. Arkansas has failed to strike that balance.

During the 2023 general session, legislators will have two big opportunities to address some of the shortcomings in Arkansas FOIA laws. The first will be to protect coroner’s reports from being released during impending criminal investigations. The second will be to create reasonable deterrence from those weaponizing FOIA requests against city and county officials. It is up to the 94th General Assembly to bring Arkansas up to standard and provide the same protections the majority of the country already provides.

As we look toward the future, it’s important to celebrate the progress made thus far. In 2021, the state legislature passed Act 778, an amendment to Ark. Code Ann. § 2519-112. This statute concerns the production of audio and visual media by state law enforcement agencies and detention centers. The bill’s intent was to counterbalance the volume and scope of FOIA requests that law enforcement officers, dispatchers and detention personnel were receiving, and to compensate them for their time under certain circumstances.

Prior to its enactment, county employees were required to spend hours, if not days, viewing and redacting audio and visual media to fulfill these requests. Without deterrence for the requestor to do so reasonably, counties were overburdened with outlandish and overinclusive requests.

In 2019, Washington County received 32 requests that took over three hours each to fulfill. Requests included 13 hours of video media and 25 hours of media spanning over 17 separate videos. In 2020, the county received 19 requests that each took over three hours to fulfill, including requests for 14 hours, 13 hours, and 30 hours of video media. The time needed to search, redact and compile requests similar to these makes it difficult for county personnel to comply with the three-day turnaround requirement imposed by FOIA, especially without being compensated for their work.

Subsequently, Act 778 has provided agencies some relief from vexatious requests. Arkansas law now allows city, county and state personnel to be paid for their work of fulfilling time consuming requests. More specifically, employees’ work is compensable when viewing and redacting media takes longer than three hours. Additionally, it allows an agency to require

prepayment if the requested material will take longer than three hours to produce. This is a necessary deterrence and requires the requestors to be mindful and concise when submitting requests for information.

Although this is a step in the right direction for Arkansas, there is still work to be done in order to better serve state and county officials. This term, legislation is anticipated to be introduced to the General Assembly that is targeted to address some of the shortcomings in the state’s FOIA laws. There are two bills that are of particular importance to counties, one that will cover coroner reports and the other will combat the harassment of governmental officials.

Protection of Coroners Reports During Criminal Investigations and Proceedings

Rep. Dwight Tosh and Sen. Blake Johnson have filed HB1557 to address issues with coroners’ investigations and reports. Under Ark. Code Ann. § 12-12-312, the reports, records, autopsies and postmortems of the Arkansas Crime Laboratory and Medical Examiner are privileged during ongoing criminal investigations. These records are to be released only to a limited group of individuals, including next of kin, criminal defendants, legal counsel and prosecutors of a criminal case. However, coroners’ reports are subject to FOIA and only remain confidential until the time the coroner issues his or her final report, even if the materials are being used to aid in an ongoing criminal investigation.

Shockingly, this means the coroner will be unable to withhold his or her report from public inspection should the Crime Lab or Medical Examiner send them documents in due course. If the records, files and information created and compiled from the Crime Lab are protected information through the entirety of a criminal investigation, why does the law not protect the same information while in the hands of a coroner?

This loophole defies all logic and common sense and fails to preserve the overall integrity of criminal investigations. The investigating agency’s ability to limit public access to this kind of information is integral to solving criminal cases. By allowing the public access to this information before the case is closed, agencies not only face unnecessary burdens and obstacles, but deny officers the evidence and resources they need

Madison Folsom Law Clerk

12 COUNTY LINES, WINTER 2023

to complete a prompt and thorough investigation.

This term, legislators are proposing to amend Ark. Code Ann. § 14-15-304 to close this loophole. The amendment provides that the reports, records, autopsies and postmortems of the Crime Lab and Medical Examiner remain confidential even if sent to coroners, until the criminal investigation is complete in accordance with § 12-12-312. Failing to do so will ultimately delay cases from being solved, or worse, be the difference between solved and unsolved cases.

Creating Reasonable Guardrails to Curb Harassing or Vexatious FOIA Requests

Despite best efforts, the enactment of Act 778 of 2021 did not address the magnitude of harassing or vexatious FOIA requests received by counties. Arkansas currently allows requesters to file as many or as large of requests as they want, without providing the agency any assurance that it will be made in good faith. This means state and county agencies must work under the assumption that requestors will provide adequate descriptions of the information sought and that the scope of information will be somewhat reasonable.

It is critical that both parties work under this assumption to strike the balance between governmental transparency and governmental function. Most requesters, including those from news and media outlets, work with agencies to maintain this balance. Nonetheless, an inevitable imbalance is created when the minority of requesters, who refuse to work under this assumption, generate the majority of requests as a way to harass the government. For this reason, the current law is unworkable and perpetuates a lopsided dynamic, leaving governmental agencies at the mercy of the minority. These requests can only be described as unduly burdensome, harassing and “vexatious,” a term used to describe repeated or frivolous requests that are made to annoy the agency. Some factors used to determine whether the requests rise to this level include the number of requests, scope of information requested, nature or subject matter of the request, or an overall pattern of requests that impact the agency’s operations or functions. This type of request not only ties up governmental resources, but it also makes it incredibly burdensome for agencies to comply with the legal requirements imposed by FOIA. Unfortunately, these requests have become just another part of the job for most city and county employees.

To best describe this dynamic, it is important to note a few things about the current law. First, Arkansas allows state agencies three business days to respond to FOIA requests and provide the requested information, assuming it isn’t exempted by statute (Ark. Code. Ann. 25-19-105). If an agency fails to provide the information requested or wrongfully rejects the request, that employee is potentially subject

to a Class C misdemeanor under Ark. Code. Ann. 2519-105. Although a misdemeanor is technically minor in comparison to a felony, it isn’t insignificant. It is, however, a charge state employees hope to keep off their records. For this reason, they have learned it is in their best interest to not fight harassing requests.

The threat of a Class C misdemeanor looms over employees when (1) the agency is bombarded with large, frivolous requests that require hours to review and redact confidential information before they can be released; (2) the agency is unsure whether the information is subject to FOIA; or (3) the agency does not have the means or personnel to keep up with the number of requests, in addition to their ordinary duties.

Next, like all state and federal FOIA laws, Ark. Code. Ann. 25-19-105 does not allow the state to charge a requester for costs other than what is necessary to produce the information. This includes the cost of supplies, equipment, and maintenance. Federal FOIA guidelines allow states to factor employee time into the overall cost of production, which many states have already adopted. This would allow agencies to charge requesters for information that takes longer than two hours to fulfill. Arkansas, however, currently does not compensate personnel for the time searching, compiling and redacting information.

It is this combination that allows this minority of requesters free range to request as much and as often as they want. Agencies work overtime to fulfill unduly burdensome requests to comply with FOIA’s legal requirements. State, county, and city employees are facing overt harassment and work in fear of possible legal sanctions against them while having nothing to show for it. The law has incentivized requesters to abuse the system because they understand that fear leads to compliance. Legislators failed to predict, however, that state employees also have an incentive: to get out of this line of work while they still can.

This term, legislators are proposing an amendment to Ark. Code Ann. § 25-19-105, which would provide a workable parameter to deter FOIA abuse, while ensuring citizens’ right to inspect government information. First, agencies will be allowed to charge the rate of the lowest paid employee with the necessary skill and training to respond, if the time needed for personnel to retrieve, review, redact, and provide records exceeds two hours. Second, the records custodian may require a requester to pay in advance if the estimated fees exceed $10, instead of the $25 the law already provides for. Third, a custodian may refuse to fulfill any new requests made by delinquent requesters until outstanding dues from fulfilled requests are paid in full. Fourth, it would give personnel a safe harbor when requests cannot be retrieved, reviewed,

AAC RESEARCH CORNER See “FOIA” on Page 14 >>>

COUNTY LINES, WINTER 2023 13

AAC RESEARCH CORNER

redacted and provided within the three working day requirement. If necessary, the custodian would be required to send written notice of the delay and include the date and time the records will be available, the reason for delay and an estimated breakdown of the time necessary to fulfill the request.

After speaking to multiple county officials, a bill addressing these issues is long overdue. Van Buren County Judge Dale James described how the city of Fairfield Bay saw a drastic increase in FOIA requests after the Fairfield Bay Emergency Medical Services, the city’s all volunteer ambulance service, shut down in the summer of 2021. Since then, four residents have requested approximately 12,000 pages, or a stack of documents about 10-inches tall, worth of communications surrounding the shut down between Mayor Linda Duncan and the EMS department. Judge James believes these requests are “nefarious in nature.” Although not all the information requested is subject to FOIA’s protections, the Van Buren County attorney has advised the city of Fairfield Bay that it will be easier to just produce all or most of the information the requestors are seeking instead of subjecting themselves to potential liability. For this reason, requesters have learned to abuse the system because they know the city will eventually just produce the records.

The same requesters have now turned their harassing tactics against the Fairfield Bay volunteer fire department. As a result, members of the fire department recently voted on whether they wanted to shut down operations due to the magnitude of FOIA requests they have received. For now, the members have opted to keep providing services. Absent legislation directed to alleviate the constant strain to which they are subjected, it is uncertain how long they will be willing to keep their doors open.

If the department closes, they will not have been the first to succumb to the abuse. Five members of Fairfield Bay’s Office of Emergency Management Team have already quit their jobs to search for new employment over FOIA requests. A city with a population of about 2,000 cannot afford to lose the backbone of its community. Yet, if nothing changes, that is where Fairfield Bay is heading.

Unfortunately, in speaking with other state and county officials, it is clear this experience is not isolated to Van Buren County. For example, the Lonoke County Sheriff’s Office has seen a strikingly similar pattern of requests. Most notably, these requesters have taken a more menacing approach as they have learned how to use FOIA most effectively to target individual state and county officials.

Lonoke County Sheriff John Staley said the requests began

in January 2022 and are attributable to his reelection as sheriff. The majority of information sought is requested by a few self-proclaimed public servants and disgruntled former employees. Seemingly, these individuals take the information requested from several, unrelated events and use it out of context to generate content for their social media. In a poor attempt to gain relevance, they have set their sights on elected officials like Sheriff Staley by whatever means necessary. In their eyes, county employees serve one purpose — a means to an end.

Sheriff Staley’s name and character may be the intended target of these attacks and falsities, but he emphasized that he isn’t the one who ultimately suffers from the harm. Instead, it is those few people left to fulfill the mounds of requests. The Sheriff’s Office has one employee whose only job is to fulfill FOIA requests and two that have had to take on additional responsibilities to help complete them in a timely manner. Currently, the Sheriff’s Office is looking to hire an administrative assistant to provide additional relief.

If an unsophisticated scheme such as this can exploit FOIA to this capacity, another set of hands will only help elevate the strain, not solve the systemic issue. An example of this is when the office informs requesters of any delays if they have filed a single request that is too large to be reasonably fulfilled in the time allotted. The requestor will then refile for the same information over several smaller requests at the same time. Functionally, the two requests have the same implications, and the only purpose is to irritate or annoy the office. It is clear their proclamation to expose the truth is disingenuous and an unremarkable outcome of their larger scheme to retaliate against county and city officials. Since these requests have begun, the department estimates it has lost three employees. Put plainly, the kind of harassment these employees have received is not a part of their job description.

Conclusion

It is with these self-serving interests in mind, I can unequivocally say that these types of requests do not serve the general public’s interest in the pursuit of governmental transparency. So, I ask this. How many employees or volunteers must quit over FOIA requests before the legislature will provide them with the proper protections and compensation that they deserve? Ultimately, a few requests can cause devastating implications for a whole city. Now, it is time for the 94th General Assembly to step up and make the necessary changes to FOIA.

FOIA Continued From Page 13 <<< 14 COUNTY LINES, WINTER 2023

www. nancial-intel.com www.facebook.com/FISoftwareSolutions © 20 Financial Intelligence. All rights reserved.

Safeguard public deposits

Arkansas County Courthouses are brimming full of new county officials. So, we need to have a talk about safeguarding public deposits. I disagreed with many of Thomas Paine’s positions, but he said something over two centuries ago that I totally agree with.

“Public money ought to be touched with the most scrupulous consciousness of honor,” he said.

Let’s talk about safeguarding public deposits — collateralizing public funds.

What is collateral? It is a safety net for what you want protected. In the case of a deposit made by a county official of public funds, it is something pledged as security in case the bank goes into default or more properly “goes into receivership” and is taken over by the Federal Deposit Insurance Corporation (FDIC).

Walt Disney said, “Dreams offer too little collateral.”

In other words, dreams offer little collateral all by themselves. “Pie in the sky” is not good collateral. Pie in the sky is something that is pleasant to contemplate but is very unlikely to be realized.

The bank tells you, “Oh we’re good for it. Don’t you worry your little head about it. This bank has always been solvent.” That’s pie in the sky.

Before we address additional collateral let’s talk about FDIC coverage. FDIC, established on the heels of the Great Depression, has provided deposit insurance since 1933. The FDIC now insures account holders against losing money as long as they keep their balances below a certain level, even if a bank fails. Banks pay insurance premiums to the FDIC so customers don’t have to do anything to enable insurance on their accounts.

The FDIC is backed by the full faith and credit of the United States government. However, FDIC coverage is limited. That’s why county government must collateralize deposits in excess of FDIC coverage.

The standard FDIC insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.

Coverage is a little different for government accounts. The category known as government accounts (public unit accounts) includes deposit accounts owned by county government.

Insurance coverage of government accounts is unique in that the insurance coverage extends to the official custodian of the deposits belonging to the government public unit, rather than to the government unit itself.

Accounts held by an official custodian of an Arkansas county official will be insured as follows:

• Up to $250,000 for the combined amount of all time and savings accounts.

Eddie A. Jones County Consultant

• Up to $250,000 for the combined amount of all interest-bearing and noninterest bearing demand deposit accounts.

Section 330.15 of the FDIC’s regulations [12 C.F.R. 330.15] governs the insurance coverage of public unit accounts.

Under section 330.15, the “official custodian” of the funds belonging to the public unit, rather than to the public unit itself, is insured as the depositor. An official custodian is an officer of a public unit having official custody of public funds and lawfully depositing the funds in an insured institution. In order to qualify as an official custodian, a person must have control over the funds. Control of public funds includes possession as well as the authority to establish accounts in insured depository institutions and to make deposits, withdrawals, and disbursements. Each county office holder has that authority, and there is state law called county accounting law that governs banking practices for the various county offices. It is found in Title 14, Chapter 25, Subchapter 1.

So, can the county treasurer collateralize the funds of every county office holder — not only the treasurer’s funds but the funds of the collector, sheriff, county clerk, circuit clerk, etc.? I guess they can say they have the funds collateralized. But the treasurer cannot perfect the security in collateral for any office except his or her own office alone. And if the security is not perfected, the FDIC does not have to acknowledge the security.

Why? It is because the treasurer is not the official custodian of other office funds on deposit with banks. They are not the official custodian of the funds of other offices/departments until financial settlements are made by the other officials with the treasurer. When those funds are on the books of the treasurer, then he or she is the official custodian.

The bank may tell you that the county should be collateralized as a whole unit because you are all under the same Taxpayer Employer Identification Number (EIN). That is incorrect information. For public unit accounts, including county government, the official custodian rule applies.

Depending on the type of depositor, FDIC uses different terminology concerning who is covered by the FDIC insurance coverage. When talking about individual bank accounts, the coverage is per owner or per co-owner. With trust ac-

AAC SEEMS TO ME...

16 COUNTY LINES, WINTER 2023

It’s the duty of every county official — not just the treasurer

counts the terminology is insured per beneficiary. For business accounts for a corporation, partnership, or unincorporated association they use the term of coverage per entity. But for a government account the coverage is “per custodian.”

Are county officials required to collateralize public funds? The answer is yes, absolutely.

Arkansas law says, “county officials shall require security for the deposit of public funds”. This law is found in § 19-8-107(b)(c).

The amount of public deposits not insured by FDIC is the amount that must be collateralized. The first $250,000 in each banking institution is secured by FDIC insurance.

Let’s look at parts of the code I just mentioned [§ 19-8107] — a very important law for the proper execution of your duties as an elected official and the protection of public funds, the people’s money. You need to read this law in its entirety, but here are some key points:

• The treasurers or other public officials or other persons having custody of public funds shall deposit those public funds into the designated depositories.

• County officials shall make timely deposit and investment of public funds to earn optimum interest consistent with the prudent investor rule.

• County officials shall:

1. Require security for the deposit of public funds in the form of a demand deposit, a savings deposit, or a time deposit for amounts not fully insured directly by the FDIC.

2. Enter into supplemental agreements with each depository banking institution that satisfies the requirements of this subsection.

3. The forms shall include language necessary to create an enforceable perfected security interest in all collateral for deposits.

4. Depository boards and banks giving or holding collateral for deposits of public funds shall comply with federal laws and regulations so that the governmental entity depositing public funds holds a valid claim in deposits and collateral given for those deposits against, and prevent avoidance of such a claim by, the FDIC or its successor or any similar deposit insurance agency acting as receiver, conservator, or in any other capacity.

5. All security required under this subsection shall

meet the requirements of an eligible security under § 19-8-203 and § 23-47-203(c).

Do you as the county official — the depositor — have to accept the security offered by the bank? No. In fact, the law lists what may be offered by a financial institution as security but says it is “subject to the depositor’s discretion regarding the suitability of the collateral.” Eligible security for public funds is found in both § 19-8-203 and § 23-47-203(c).

If a bank pledges $1 million in security as collateral for your deposits is that pledge worth $1 million? Not necessarily. That’s why it must be marked to market on a regular basis. As the depositor you are much more interested in the market value than the book value. You want to know what the collateral is worth if you must take possession of the security to cover the loss of county funds. You want the FDIC insurance coverage and the market value of your collateral to be sufficient to cover the deposits of your office at all times.

Let’s look at the eligible security for your public deposits as outlined in § 19-8-203. This law says whenever any depository in the state of Arkansas must furnish security for the deposit of any public funds the following shall be considered as eligible security for such purposes and subject to the depositor’s discretion regarding the suitability of the collateral:

• The pledge or escrow of the assets of the bank consisting of any investment in which a state bank may invest pursuant to § 23-47-401;

• A surety bond or private deposit insurance issued by an insurance company licensed under the laws of the state of Arkansas and either rated “A” or better by any one (1) or more of the following rating agencies:

1. A.M. Best Company, Inc.;

2. Standard & Poor’s Insurance Rating Service;

3. Moody’s Investors Service, Inc.;

4. Duff & Phelps Credit Rating Co.; or

5. Listed on the then-current United States Department of Treasury Listing of Approved Sureties; or

6. An irrevocable standby letter of credit issued by a Federal Home Loan Bank.

The aggregate market value of assets pledged or escrowed

AAC SEEMS TO ME...

See “DEPOSITS” on Page 18 >>> COUNTY LINES, WINTER 2023 17

You want to know what the collateral is worth if you must take possession of the security to cover the loss of county funds.

or the face amount of the surety bond, private deposit insurance, or letter of credit securing the deposit of funds by any single depositor must be equal to or exceed the amount of the deposit to be secured.

The best collateral, in my opinion, is the “irrevocable standby letter of credit issued by a Federal Home Loan Bank. There is no monitoring needed, other than to make sure it is for a sufficient amount. You only have to look at the face amount and that’s the amount of protection you have.

However, the first item on the list of collateral that may be offered by a bank is “assets of the bank consisting of any investments in which a state bank may invest in pursuant to § 23-47-401.”

Arkansas banks have a rather extensive list of legal investments. And the market value of some of those legal investments can be volatile. If you aren’t familiar with a particular security that is offered as a pledge of collateral, ask about the market value because it is the market value you’re interested in.

You, as the public funds depositor, get to make the decision on whether to accept the security offered as collateral. You have the discretion, by law, to say yes or no regarding the suitability of the collateral.

Every county official should establish adequate and efficient administrative systems to monitor pledged collateral. Monitoring informs you of under collateralization, which may threaten the safety of your deposits.

Let’s talk about making sure your county funds are collateralized. You have $10 million in one bank with a slowly declining balance. So, you have $250,000 in FDIC coverage for that deposit and the bank pledged $10 million in market value securities — all in Treasury notes.

Are you fully and properly collateralized? Maybe and maybe not; the numbers suffice, but is the security perfected?

Your bank may tell you, “We don’t need to do all that paperwork. We will pledge XX dollars and you will be issued a Safekeeping Receipt. That’s good enough.” Be sure to tell them that is not good enough.

If a bank fails and goes into receivership, the bank loses the ability to call the shots. It is FDIC, not the bank, that makes the decision of whether the pledged security is perfected.

If FDIC takes over a failing banking institution, it may or may not honor the security pledges made by the bank to a public entity. It has no choice but to honor the pledge if the pledge has been perfected. If it has not been perfected, the FDIC might honor the pledge, but it doesn’t have to.

It is extremely important for a county official to create an enforceable perfected security interest in all collateral for their public deposits. When a banking institution fails and goes into

receivership the FDIC comes in to settle on the assets of the bank. FDIC makes the decision on what is perfected security, not the county as the depositor and not the bank that pledged the security. If everything is not in accordance with state and federal laws/regulations to create an enforceable perfected security interest, the FDIC may void any agreements and leave the county with only the right to share with other creditors in the pro rata distribution of the assets of a failed institution for the amount of deposits that exceed the FDIC coverage.

Federal law provides that a depositor’s security agreement, which diminishes or defeats the interest of the FDIC in an asset acquired by it as receiver of an insured depository, shall not be valid against the FDIC unless the agreement:

• Is in writing;

• Was approved by the board of directors of the depository or its loan committee; and

• Has been, continuously, from the time of its execution, an official record of the depository institution.

A county official should have all pledged collateral held at an independent third-party institution outside the holding company of their bank, and evidenced by a written agreement in order to satisfy the Uniform Commercial Code (UCC) requirement for control. The UCC states that the depositor does not have a perfected interest in a security unless the depositor controls it. Control means that swaps, sales, and transfers cannot occur without the depositor’s written approval.

• The value of the pledged collateral should be marked to market monthly, at a minimum, or more frequently depending on the volatility of the collateral pledged. Arkansas law requires the aggregate market value of security pledged or the face amount of the surety bond, private deposit insurance, or letter of credit securing the deposits of public funds “must be equal to or exceed the amount of the deposit to be secured.”

• Substitutions of collateral should meet the requirements of the collateral agreement, be approved by the county in writing prior to release, and the collateral should not be released until the replacement collateral has been received.

• The county should require reporting directly from the custodian of the collateral — the third-party institution. The custodian agreement should be a three-party agreement between the county [depositor], the bank, and the third-party institution.

• Reporting by the third-party institution should be, at a minimum, monthly.

AAC SEEMS TO ME...

Continued From Page 17 <<<

DEPOSITS

18 COUNTY LINES, WINTER 2023

As a reminder, here are the documents you must have in place to perfect the security pledged as collateral for your deposits: (1) Security Agreement; (2) Certificate of Corporate Resolution; and (3) a third-party Custodial Services Agreement. All pledged collateral should be held at an independent third-party institution outside the holding company of their bank and evidenced by a written agreement in order to satisfy the UCC requirement for control. The depositor does not have a perfected interest in a security unless the depositor controls it.

And one more thing; keep your eye on the fiscal condition of your bank. The very last part of § 19-8-107(b)(5) says, “Public officials may require as a condition for placing deposits or keeping funds on deposit such financial data as they need to make an informed decision, including without limitation quarterly financial statements, quarterly profit and loss statements, and tangible net worth or capital-to-assets ratios.”

The capital-to-asset ratio of a bank is a key indicator of the bank’s strength. Anything below 6 percent is considered a weak position. But how do you get that information?

Years ago it was no problem to obtain this information because the banks were required to publish a quarterly finan-

cial report in a newspaper. The publishing requirement has not been in effect for several years. But they must still compile financial reports for the banking department. You can require a copy of that report from the bank because the law allows such if the bank wants to do business with the county and you, as a county official, want that report to make an informed decision about placing or keeping funds on deposit at the bank.

The ratio is calculated easily using this formula:

(Equity + Reserve for Loan Losses) / (Total Assets + Reserve for Loan Losses)

When the Regulatory Capital Ratio of a financial institution doing business with the county falls below 6 percent the official should reduce deposits in that institution to $250,000 or less.

The next time your bank or banks try to give you skimpy collateral — collateral with very volatile market value — just tell them, “That’s not enough collateral. We’ll have to have a kidney.” They should get the point.

It is of paramount importance to collateralize correctly, making sure you have a perfected security interest. The safety of public funds is a top objective of a county official. Just remember Warren Buffett’s two most important rules. Rule No. 1 is to never lose money. Rule No. 2 is to never forget Rule No. 1.

AAC SEEMS

ME... COUNTY LINES, WINTER 2023 19

TO

AAC GOVERNMENTAL AFFAIRS

Continuing education pays dividends A

rkansas has 75 counties, each different in size, population, number of employees, and revenue. However, they all have similar visions, goals, and job duties — and they operate under the same set of laws. How they achieve their goals and follow the law could vary from county to county.

Benton County, with a population of over 220,000, is completely different from Dallas County, with a population of under 9,000. As in the private sector, one small company may offer the same product as a larger company — but does so in a different way. One way to accommodate for this is “Caucus by County Classification,” a round table discussion we have during continuing education meetings. The goal of this caucus is to get counties with similar dynamics to discuss common challenges and to reach solutions together. I believe the more our counties are alike, the easier it is to improve efficiencies and streamline services together.

Ark. Code Ann. § 14-15-811 and 14-15-1001 set up continuing education boards for county treasurers and collectors. Ark. Code Ann. § 26-60-112 sets up the continuing education boards for county clerks, circuit clerks, and coroners. The law says these boards are responsible for facilitating continuing education meetings for each respective group. This includes paying for meeting space, meals, lodging, mileage, AV equipment, educational materials, and presenter fees and expenses. The AAC works with the Auditor of State’s office to administer continuing education for county clerks, circuit clerks, treasurers, collectors, and coroners. Each county pays dues for the treasurers’ and collectors’ continuing education. The real property transfer tax funds continuing education for coroners, county clerks, and circuit clerks. This tax is levied by the state and collected by the county recorders. This is a tax on each deed, instrument, or writing by which any lands are assigned, transferred, or otherwise conveyed to, or vested in. This tax is commonly referred to as “deed stamps.”

Prices continue to increase, especially in the hospitality industry since the pandemic. These boards need an increase in their funding to keep up with the prices charged at these venues. HB1541 sponsored by Rep. Lane Jean and Sen. Kim Hammer will enhance the funds available for these boards to use. The boards have not received an increase in funding since 2013. If this bill passes, it will provide an additional $7,500 to $8,000 for each continuing education board. With the large number of newly elected officials taking office this year, we anticipate an even more robust continu-

ing education program. Our new continuing education coordinator, Michael Roys, has been meeting with these boards to find ways to improve the meetings. They also have been discussing the best ways of accommodating the new elected officials while keeping an eye on their budgets.

Josh Curtis Governmental Affairs Director

Continuing education meetings are the cornerstone for collaborating county officials. One of my first weeks working at the AAC, I was in Texarkana for the collectors’ continuing education meeting, during which multiple items were discussed. One of the leading topics regarded issues with how the state works with the counties. Specifically, how the Department of Finance and Administration (DFA) works with collectors through Department of Motor Vehicle (DMV). This topic arose from a group discussion of multiple collectors who identified questions for DFA. The following week, I set up a meeting with DFA officials, and we talked through the issues, and they answered our questions. This is a good example of officials collaborating to solve problems with the state. The more county officials who come together and work to solve issues for their counties, the better the solutions for the whole state.

Garland County Collector Rebecca Talbert told me at one of her first meetings that her staff was worried and couldn’t find her for a couple of hours. Where was she? She was walking around the venue before dinner talking to two seasoned collectors and learning things that she had never thought she would learn. She is now one of those seasoned collectors. I recently heard her say, “Just because you don’t see a topic on the agenda that you like, doesn’t mean you will not like or learn from these meetings.”

Relationships and an open line of communication make you more accountable to your colleagues. One line of communication that is always open is the list servs — an electronic form of continuing education. The list servs allow any elected official to ask questions of their counterparts in other counties. It is also great to see people highlighting the accomplishments of specific counties or seeing good news from the different offices. Some groups use the email chain very well. I encourage you to use this tool to augment what you learn during continuing education meetings. It will pay huge dividends down the road.

www.arcounties.org 20 COUNTY LINES, WINTER 2023

The Cavalry: ARORP and the administration of opioid settlement funds

In the Summer 2022 issue of County Lines, I wrote about the formation of the Arkansas Opioid Recovery Partnership (ARORP) and the hiring of Kirk Lane as ARORP director. Less than six months later, ARORP is bringing the cavalry to your communities, families, and opioid addicts. ARORP has come so far already that this edition of County Lines will also include an update from ARORP Director Lane and ARORP Deputy Director Tenesha Barnes about ARORP programs and projects already making a difference.

With this article, I will outline the important components of the process under which ARORP receives funding proposals, reviews and analyzes proposals, and approves and funds proposals, to abate the opioid epidemic in Arkansas. We have invested significant brainpower and care to create a process that is simple, evidence-driven, thorough, and efficient.

In September 2022, Arkansas cities and counties, through the directors of the Arkansas Municipal League (AML) and Association of Arkansas Counties (AAC), approved distribution agreements that are incorporated as exhibits into the Arkansas Opioids Memorandum of Understanding (MOU). The MOU, executed in July 2021 by the Governor, Attorney General, AAC director, and AML director, includes an equal split of Arkansas settlement dollars among the state, counties, and cities — 1/3 of every Arkansas dollar is allocated to the state, 1/3 is allocated to cities, and 1/3 is allocated to counties. The county and city distribution agreements govern the distribution and use of settlement funds designated for Arkansas counties and cities. Both the MOU and the distribution agreements are posted on the ARORP website along with other important legal documents: www.arorp.org/about/.

Through the county and city distribution agreements, the counties and cities created ARORP, and directed that their opioid settlement funds be disbursed by ARORP in a manner consistent with requirements and restrictions contained in opioid settlement agreements and court orders. It is important to follow these requirements; most of the settlements include payment streams across many years, and failure to follow the requirements of the settlements could jeopardize future settlement payments. This is one reason we created a Qualified Settlement Fund (QSF) through an Arkansas court — to provide court supervision of the process and ensure the proper administration of the counties’ and cities’ settlement funds and opioid abatement program. While the QSF court supervises the settlement funds and the QSF administrator manages the settlement funds, the administration of abatement funding is done by ARORP, as set forth in the county and city distribution agreements.

The distribution agreements define the ARORP mission statement: “Evaluate proposals, make recommendations, and em-

power evidence-based programs and strategies to abate the Arkansas opioid epidemic, in a manner consistent with approved purposes as defined in the Arkansas Opioids MOU, settlement agreements, and court orders approving settlements and bankruptcies.”

Consistent with the MOU, the many settlement agreements and court orders, and the ARORP mission statement, nine principles guide the work of ARORP. Each guiding principle is thoughtful and important:

1. The Partnership seeks a shared framework for disbursing opioid abatement funds. Abatement efforts will be most effective if Arkansas governments unite and work cooperatively together, as they have in opioid litigation, on behalf of the people.

2. The Partnership should seek to use limited funds to supplement and expand existing public and private abatement efforts and funding, rather than supplanting or duplicating existing abatement efforts and funding.

3. The Partnership should fund public and private evidence-based projects, and funded projects should be evaluated for effectiveness moving forward, with ongoing funding contingent on demonstrated effectiveness as appropriate.

4. The Partnership should fund public and private programs and strategies that abate the opioid epidemic at the community and family levels.

5. The Partnership should support diversion from arrest/ incarceration and should support access to peer support and treatment in correctional settings.

6. The Partnership should fund anti-stigma programs and involve communities in education and prevention efforts.

7. Priority should be given to evidence-based and evidenceinformed prevention, treatment, recovery, or harm reduction programs, services, supports, and resources.

8. The Partnership should ensure diversity of representation and funding, including racial and geographic diversity, including people with lived experience, and including less populated and geographically isolated communities.

9. The Partnership will operate with all reasonable transparency.

AAC LITIGATION LESSONS

Colin Jorgensen Risk Management Litigation Counsel

See “CAVALRY” on Page 22 >>> COUNTY LINES, WINTER 2023 21

AAC LITIGATION LESSONS

Additionally, eight guidelines inform individuals and organizations, including counties and cities, that submit proposals and seek funding to abate the opioid epidemic:

1. A proposal submitted by any person or entity other than the Partnership director shall include a letter or letters of support signed by the county judge of each county to be served by the proposal, and the mayor of each first-class city to be served by the proposal. It is the applicant’s responsibility to obtain the necessary signatures of county and city support.

2. A proposal should demonstrate evidence-based strategies to abate the opioid epidemic in Arkansas, in a manner consistent with approved purposes as defined in the Arkansas Opioids MOU, settlement agreements, and court orders approving settlements and bankruptcies.

3. A proposal should address the guiding principles of the Partnership outlined above, with honest and candid analysis of strengths and weaknesses of the proposal considering the guiding principles.

4. A proposal should be designed to treat, prevent, and reduce opioid use disorder and the misuse of opioids or otherwise abate or remediate the opioid epidemic. Each proposal should discuss and demonstrate this nexus.

5. A proposal should include suggested data and benchmarks/milestones to assist with evaluation of the effectiveness of the proposal if approved.

6. A proposal should include a sustainment plan for continuation of the proposal after proposed funding from the Partnership.

7. The Partnership may require outcome-related data from any entity that receives abatement funds.

8. The Partnership may require a proposal to achieve benchmarks/milestones as a condition of ongoing funding. Project funding is not guaranteed and may be dependent on completion of deliverables and reporting. Noncompliance with state or federal law, noncompliance with guidelines, or noncompliance with project benchmarks/ milestones, may result in funding termination.

As noted in the guidelines, applicants must obtain signatures of support from county judges and mayors in areas to be served by abatement proposals. We included this requirement for you, especially county judges and mayors, who authorized the litigation brought by all Arkansas counties and cities. We recognize, as you do, that the opioid epidemic has spawned a variety of local problems in need of local solutions. We want you to have the opportunity to study and approve (or reject) proposals designed to serve your communities — because you are on the front lines, and you know your communities best.

An applicant’s failure to obtain your signature for a project in your county will prevent funding — so you have veto power over proposals designed to serve your area. And although your signature does not guarantee funding for a project, your signature carries great weight, because we want to pursue projects that you believe in, for your communities. When a project is approved and funded in your county, ARORP will notify you so you can promote and celebrate your local abatement efforts, and so you have the knowledge to connect your citizens with resources they need. We hope you are pleased to play this part in the process, and we thank you for your input and your service.

The county and city distribution agreements call for the creation of the ARORP Advisory Board to study proposals and make recommendations to the AAC, AML, and ARORP directors, regarding programs and strategies to abate the Arkansas opioid epidemic. AAC Director Chris Villines and AML Director Mark Hayes have empaneled an advisory board with 12 members, each bringing relevant experience and perspective, and a strong desire to serve our communities, families, and addicts, in response to the opioid epidemic (www.arorp.org/our-team/).

On Nov. 4, 2022, the advisory board had its inaugural meeting. All 12 members of the board attended in-person. Each board member introduced themselves and shared the background and experience that motivates them to serve on this board.

After the board meeting, ARORP hosted a press conference to announce the formation of ARORP and the funding process described above, to introduce the ARORP Advisory Board, to unveil the ARORP website, and to explain the funding process to the public. Please read the ARORP update from Kirk Lane and Tenesha Barnes, to learn more about the many exciting programs and proposals that ARORP has studied, approved, and funded to date.

Finally, the county and city distribution agreements provide that the counties and cities “desire the state as an equal 1/3 participant in the Partnership”— just as the counties and cities desired to unite with the state from the beginning of the opioid litigation in 2018, and consistent with the unity reflected in the equal split in the Arkansas Opioids MOU. As stated plainly in the first ARORP principle, “Abatement efforts will be most effective if Arkansas governments unite and work cooperatively together, as they have in opioid litigation, on behalf of the people.”

With unity in mind, we were excited to hear from Arkansas Attorney General Tim Griffin at the Feb. 9 meeting of the County Judges Association of Arkansas. Griffin praised the work of the counties and cities and ARORP, and he committed to cooperate and unify with the counties and cities on opioid abatement in Arkansas. This is wonderful news for Arkansas, and for your communities, families, and addicts.

The cavalry has arrived and is grateful to serve.

Continued From Page 21 <<< 22 COUNTY LINES, WINTER 2023

Cavalry

Updates on the Opioid Settlement Funding Disbursement

Story by Kirk Lane & Tenesha Barnes Arkansas Opioid Recovery Partnership

In 2022, the Arkansas Municipal League (AML) and the Association of Arkansas Counties (AAC) formed the Arkansas Opioid Recovery Partnership (ARORP). ARORP will ensure that opioid settlement dollars are dispersed to vetted organizations that are using evidence-based programs and strategies to abate the opioid epidemic in Arkansas’ cities and counties. Also in 2022, the cities and counties began receiving opioid settlement funding to abate and alleviate the impact of pharmaceutical companies’ damaging role in Arkansas’ opioid epidemic.

Before receiving settlement dollars, each applicant must obtain signature approval from the county judges and mayors in their jurisdiction. The ARORP and the ARORP Advisory Board will thoroughly vet each applicant, allowing city and county leaders to provide a valuable perspective about the organization’s fit in their community.

Turning the state purple

Each time ARORP disburses settlement dollars to a project in opioid prevention, treatment, or recovery, we turn the

county where the project originated purple on the map. Our goal is to turn the entire state of Arkansas purple, meaning that every county has received opioid settlement funding to support abatement projects in your community.

As of February 2023, ARORP has put $3,792,939.44 opioid settlement dollars back into Arkansas cities and counties. Funding has supported:

• 30 new recovery beds in Johnson County

• 4,232 naloxone kits dispersed across Faulkner, Pulaski, Craighead, Independence, Pope, Saline, Izard, and Jefferson Counties

• 1 recovery community organization in Craighead County

• 2 Overdose Response Teams in Garland and Craighead Counties

• 1 statewide effort to support families who have experienced an overdose

AAC ARORP UPDATE

ARORP Director Kirk Lane (left) and ARORP Deputy Director Tenesha Barnes (second from left) present a check to the Saline Health Foundation for a Naloxone Hero Project. Also pictured is Saline County Judge Matt Brumley (center), who endorsed the project, which will bring naloxone and training on its use to the community.

See “OPIOIDS” on Page 24 >>> COUNTY LINES, WINTER 2023 23

AAC ARORP UPDATE

Opioids

•

Support for Drug Takeback

• 1 training program created for Arkansas’ mayors, county judges, and city and county officials to better protect their communities by utilizing community coalitions to abate the opioid epidemic.

Applying for funding

Applicants must fill out an online application at www. arorp.org/funding-opportunities/. There is no need to hire a grant writer; the application is designed to be userfriendly. The settlement funds are intended for the creation or expansion of opioid prevention, treatment, and recovery projects. The money is not meant to replace or supplant existing funding.

There are four categories of proposals. The general proposal allows flexibility for an organization to submit any project related to opioid prevention, treatment, and/or recovery. We want community leaders to assess their community’s needs, then submit a proposal to address existing gaps in services. There are three other proposal categories: Naloxone Community Hero, Coalition Partnership Empowerment, and Overdose Response Team.

Apply to be a naloxone community hero (HERO) to

The purple color of a county on this map, which is on the ARORP website, indicates that opioid settlement dollars have been disbursed in that county to a project focusing on opioid prevention, treatment, or recovery.

bring naloxone and training on its use to your community’s residents who need it most: people at risk of opioid overdose and their close friends and family members. (Please note that naloxone from ARORP cannot be distributed or sold to first responders or harm reduction groups.) In 2022, ARORP created the Arkansas Naloxone Bank. Naloxone Community Heroes are organizations that apply for a credit to use at the Naloxone Bank for distribution within their community. These organizations host naloxone training and equip every trainee with a free dose of naloxone.

City and county law enforcement agencies and local drug task forces can submit an Overdose Response Team (ORT) proposal. An ORT partners a law enforcement criminal investigator with a peer recovery specialist (PRS) to respond to fatal and non-fatal overdoses within their jurisdiction.

Finally, community coalitions can apply for extra training through CADCA with a coalition partnership empowerment (COPE) proposal. The COPE proposal provides coalitions with the preparation necessary to apply for a Drug Free Communities (DFC) grant.

Help us turn the state purple! Encourage organizations in your area to create new projects in opioid prevention, treatment, and recovery to abate the opioid epidemic.

Continued From Page 23 <<<

24 COUNTY LINES, WINTER 2023

Attorney General announces intent to work with counties, cities on opioid abatement

During the Winter 2023 meeting of the County Judges Association of Arkansas (CJAA), the state, cities and counties collectively announced their intent to work together to abate the opioid epidemic in Arkansas.

Attorney General Tim Griffin spoke before the CJAA, praising the work cities, counties, and the Arkansas Opioid Recovery Partnership (ARORP) have achieved thus far. He said he “greatly respects” Association of Arkansas Counties (AAC) Executive Director Chris Villines, Arkansas Municipal League (AML) Executive Director Mark Hayes and ARORP Director Kirk Lane. He said he plans to work “cooperatively, collaboratively” with the associations and the partnership.

“Some people see the cities and the counties somehow in competition with the state,” Griffin said. “The cities and counties are the state. The cities and counties make up the state. We’re not in competition. We’re on the same team. It’s the same jersey.”

Griffin said he does not plan to duplicate the efforts the AAC, AML and ARORP have already made. Specifically, he said he does not plan to create another advisory board.

“I’m not going to create another 12-member advisory

board,” he continued. “Ya’ll have great experts, and the great thing about information is we can share it. So, I can listen to your experts,” he said, noting that the partnership makes things simpler for everyone involved.

AAC Executive Director Chris Villines applauded Attorney General Griffin’s announcement.

“I am proud of the work the cities and counties have achieved thus far. The cooperation of Attorney General Griffin will only expand our outreach in communities across the state.”

Municipal League Director Mark Hayes recounted how five years ago the AAC and AML “joined in a partnership unlike anything else in the country. I don’t like the word epic, but it was truly an epic effort to eradicate a scourge in this state.”

Hayes said his perspective on the opioid litigation pursued by the cities and counties “took on an entirely new light” in April 2020 when his son died from an opioid addition and fentanyl overdose.

“I cannot tell you the joy and pride I have standing up here knowing that the state of Arkansas is now fully engaged with us because we can’t fix this problem in Arkansas unless the three entities join together hip to hip.”

AAC ARORP UPDATE

AAC Executive Director Chris Villines, Arkansas Attorney General Tim Griffin, and Arkansas Municipal League Executive Director Mark Hayes pose for a photo following the AG’s announcement that he plans to work with counties and cities to abate the opioid epidemic in Arkansas.

— Photo by Michael Morrison

COUNTY LINES, WINTER 2023 25

Factors to consider in pursuit of a suspect

Recently, I have seen a rise in claims and lawsuits pertaining to law enforcement pursuits during which a third party is injured by a fleeing suspect. While law enforcement officers have the right to pursue suspects who are fleeing, they must still exercise ordinary care for the safety of others using the roadway. There are numerous factors to consider when determining if a law enforcement officer is exercising ordinary care during a pursuit.