Focused on a common goal

Shaping

Shaping

With 26 sites strategically located in 9 countries, our global presence is your advantage. From the most advanced aerospace technologies, where our products have ventured into space, to the very bridges you travel on, Meridian Adhesives plays a pivotal role.

Our industry is filled with remarkable people – from those who identify future market trends to innovators who work in the lab to the CEOs who lead their company.

To recognize these outstanding individuals, ASC launched the Adhesive and Sealant Hall of Fame in 2022. Each October, at the ASC Executive Leadership Conference, we induct individuals who, through their career in the adhesive and sealant industry, have made significant contributions to the betterment of our industry. One of our feature articles in this issue highlights our Class of 2023 inductees, and we congratulate and thank them for their achievements.

Last month, I attended the European adhesive and sealant conference organized by FEICA, which represents the European industry. Like those of us in the U.S., attendees were cautiously optimistic about future economic growth.

Here in North America, slower but steady growth is anticipated for our industry over the next several years, according to ASC’s newly published North American Market Report. Inflation rates remained high in 2023 and central banks, led by the U.S. Federal Reserve, have continued to hike interest rates to try and bring them down. The resultant high rates are expected to be in place into 2024 and continue to impact economic growth. As a result, growth in adhesives and sealants is forecast to be at a lower rate than that of the last two years, when we saw the rate of volume growth at 4.5% between 2020 to 2022.

Much more detail is included in the report, which is available for purchase on ASC’s website, www.ascouncil.org. Benjamin Trent, Managing Consultant at Smithers, who produced the report, provides additional insight in a feature article in this issue.

We’re also including other future-looking articles, including Ken Alston’s piece on sustainability and Robert Fry’s economic forecasts.

As a reminder, this publication, the Adhesive and Sealant Showcase magazine, is published twice a year in partnership with Venture Business and features major issues of interest to our industry. It’s supported through advertising, so thank you to all of our contributors and advertisers this year!

Bill Allmond President, ASCThe Adhesive and Sealant Council (ASC) and its members celebrated the very first commemorative ‘International Adhesive & Sealant Day’ on September 29, 2023, in conjunction with European and Asian international associations.

The celebrations included social media posts, videos, and special websites highlighting the many items made possible by adhesives and sealants. Going forward, September 29 will be the day the global industry celebrates our industry.

“Every day, we as a society rely upon adhesives and sealants for thousands of necessities, from our homes and offices to the vehicles we drive to the packaging that protects our food to the mobile devices we use,” said Bill Allmond, ASC’s President.

“Adhesives and sealants are invisible, but they are everywhere,” he said. “International Adhesive and Sealant Day is an opportunity for all of us, around the world, to pause and celebrate the countless ways our industry’s products make daily living not

only possible but better.”

International Adhesive & Sealant Day was established at the 2022 World Adhesive and Sealant Conference (WAC 2022) in Chicago, Illinois. At the International Association Heads meeting, which took place during WAC 2022, Mr. Murakami, the

Chairman of the International Committee of the Japan Adhesive Industry Association (JAIA), introduced the idea of establishing an International Adhesive & Sealant Day on September 29. The international adhesive and sealant associations, FEICA, ARAC & ASC, unanimously approved this celebratory day.

ASC launched a website to celebrate the day at www. InternationalAdhesiveSealantDay. com. The website showcases the many uses of adhesives and sealants, the size and scope of the market, an “adhesives 101” video, how adhesives and sealants contribute to and enable sustainability benefits in countless products and industries, and resources to learn more about these innovative products.

Have you heard about the new Connected to ASC Podcast? The monthly show provides a snapshot of some of the biggest and most pressing issues affecting the adhesive and sealant industry – and it is available online for free.

In the latest episode, automotive industry veteran Kenny White, North American President of the CARES conference talks us through the innovative techniques and strategies used to facilitate sustainable automotive manufacturing. White discusses not only how manufacturers are engaging with their suppliers but the importance of communication and building relationships

along the value chain.

Recent months have also seen podcast host and ASC President, Bill Allmond, talk with Claire O’Leary, Managing Director at Venture Business, about how ASC member companies can benefit from this very publication, Adhesive & Sealant Showcase, to advertise and promote their products and services – and stay informed with expert commentary on everything from the economy to key end use markets.

Connected to ASC also reflected on some of the highlights from this year’s Annual Convention & EXPO held in New Orleans. Joined by Brian Peters, ASC’s

Director of Membership & Industry Programs, they talked through the key takeaways from the event and the importance of attending these events for the many educational and networking opportunities.

If you missed any of these episodes, or to subscribe so you do not miss future shows, visit https://www. podomatic.com/podcasts/ bill-allmond

The ASC Innovation Awards Program is designed to recognize innovation in adhesive and sealant product developments. These awards, announced at the annual ASC Convention & EXPO, identify significant impact chemistries that contribute to downstream industries unmet needs and advancements in technology. ASC is now inviting entries for next year’s prestigious award.

Last year, ASC recognized the efforts of H.B Fuller for its development of a lightweight encapsultant for battery packs. Nvirovate was announced as first runner up and Xlynx as second runner. The award is intended to foster and encourage innovation across the adhesive and sealant industry. Raw material suppliers or manufacturers of adhesives and

H.B Fuller was named as the winner of last year’s Innovation Award

or sealants as well as academia are all welcome to submit their entries for this fantastic accolade.

To be eligible, a nominated technology must meet the scope of the ASC Innovation Awards Program by meeting each of the specific five criteria.

To view the criteria and the submission requirements, download the Nomination Package document at https:// www.ascouncil.org/innovationawards. The awards are made possible with the generous support of Bostik.

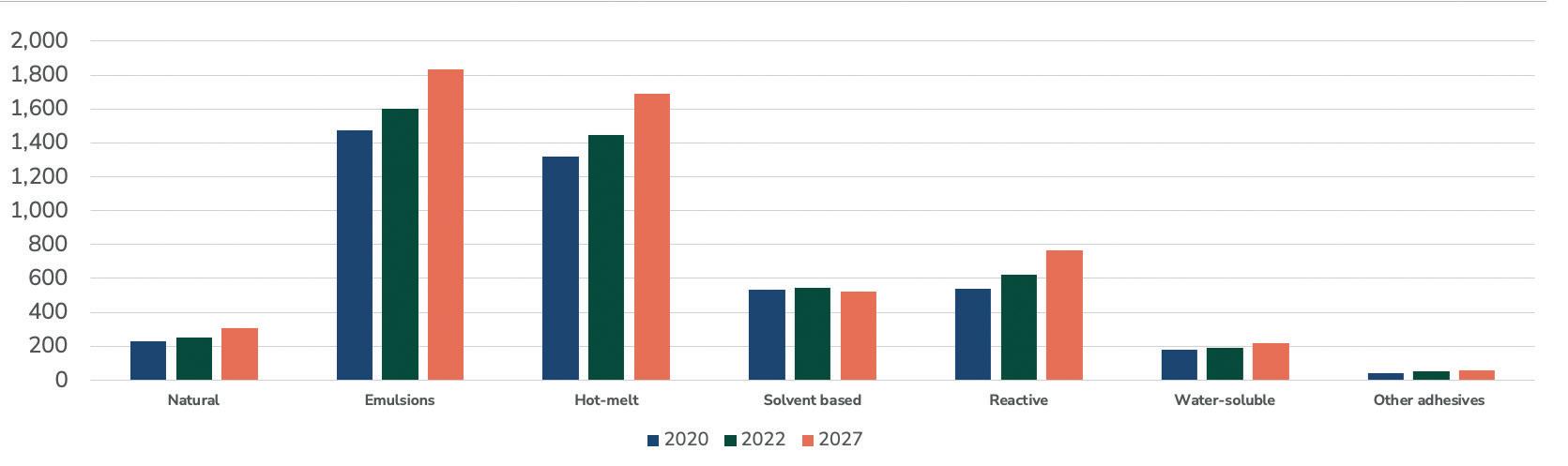

Volume demand for combined sales of adhesives and sealants in North America will grow at 2.8% CAGR to a market of 5.90 million tons in 2027, while value will grow at 3.0% CAGR to $25.79bn, according to ASC’s newly published North American Market Report (NAMR) for Adhesives and Sealants

The report’s 162 pages provide valuable statistical data for the size of the North American adhesive and sealant market by material type, end use, and country, and provides growth forecasts to 2027.

The report also analyzes the market drivers that affect the North American market, including factors influencing

market growth with forecasting and trends analysis for the United States, Canada, and Mexico.

The market report is based on extensive primary and secondary research, including 80 interviews across the adhesive and sealant value

chain – manufacturers, end users, subject matter experts, industry groups, regulators, and other industry stakeholders. Adhesive markets covered include paper, board, packaging, and related products; transportation; building and construction; consumer/

The report, published every three years, has been prepared by Smithers, renowned worldwide for its authoritative market forecasts and analyses, on behalf of ASC. You can find out more about the report and watch a free webinar by visiting the online store at ASCouncil.org or using the QR code.

DIY; footwear and leather; woodworking and joinery; assembly operations; and others. Sealant markets covered include construction, transportation, consumer/DIY, and assembly operations.

Key expert insights provided include materials supply, availability, and pricing; key market drivers; post-pandemic impacts; adhesive and sealant technology innovations; economic trends; consumer and end-user requirements; geographic shifts in industrial production; current regulatory landscape; environmental consideration and sustainability issues; and industry consolidation in the supply base.

Polyethylene Wax for YOUR:

• EVA and Metallocene based Hot Melt Adhesives (HMA)

• PVC Lubricants

• Inks & Coatings

• Plastic Masterbatches

Extending YOUR Supply Chain via CustomProcessing:

Hydrogenation

Conventional & Short Path Distillation

Synthesis

Pastillation & Flaking

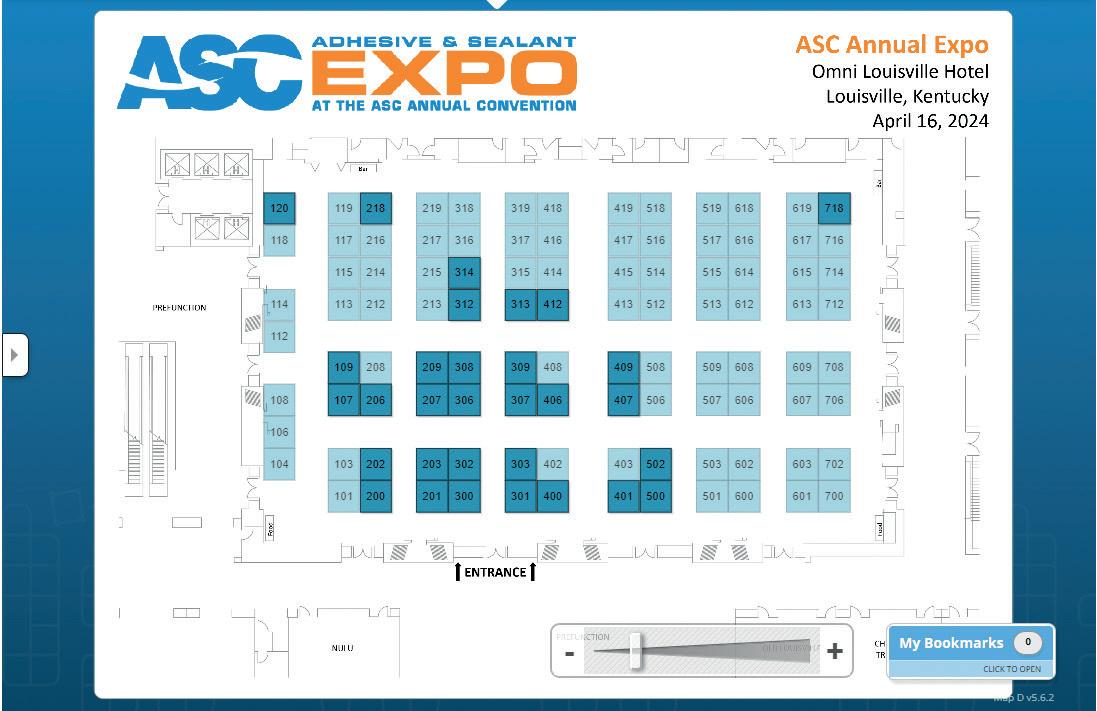

Booking your booth reservation at the ASC EXPO just became much easier and interactive. Beginning this year, exhibitors can pick their booths by visiting www.ascouncil. org/2024expobooths and viewing available and currently booked spaces.

You can upload your company logo, company and product descriptions, website links, and PDF data and sales sheets right inside the new platform. Prospects and attendees can view all your information once published. You can start generating leads to your sales team immediately and start setting up meetings at the event.

Exhibitors can now book their booth spaces and reservations are going fast.

November 14, 2023

Advanced Testing and Simulation of Bonded Structures

Mark S. Oliver, Ph.D., Principal at Veryst Engineering looks at the growing use of finite element analysis (FEA) by end users to design bonded structures. The webinar examines how the adhesives industry can better support design engineers and share methods for characterizing the mechanical behavior of adhesive materials and adhesive joints.

December 13, 2023

Cohesion Through Adhesion: Enabling Space Exploration with Adhesive Bonding

D. Malik Thompson – Aerospace Materials Engineer at NASA draws on his experiences to look at the importance of adhesive bonding for space exploration as well as the challenges and opportunities associated with working in extreme environments.

March 7-8, 2024

3rd International Conference on Industrial Applications of Adhesives 2024

Taking place in Cascais, Portugal, next March, the 3rd International Conference on Industrial Applications of Adhesives 2024 unites adhesive makers and users for a few days filled with presentations and networking.

April 15-17, 2024

2024 Annual Convention & EXPO

ASC’s 2024 Annual Convention & EXPO heads to Louisville, Kentucky and the Omni Louisville Hotel for three days of technical sessions focusing on business development and market trends, regulatory, market segments, and new/ advanced technology/ applications.

Many Americans, including many economists, have been anticipating a recession since the Federal Reserve started raising interest rates in March 2022 in an effort to get inflation back down to the Fed’s 2% target. So far, however, most of the monthly data series that the National Bureau of Economic Research uses to establish business-cycle peaks and troughs have continued to rise. A recession is simply the period between a business-cycle peak and the ensuing trough.

While industrial production has failed to grow since September 2022, employment, real (inflation-adjusted) personal income, and real consumer spending all rose to record highs in their most recent data releases. The

Robert Fry Economics LLC. is an economic consulting and forecasting firm based out of Greenville, Delaware.

Founded by former DuPont Senior Economist, Robert Fry, it guides decisionmakers at manufacturers who make and use chemicals and polymers.

An award-winning forecaster, Fry publishes a monthly newsletter on the global economy, Current Economic Conditions, and gives speeches on the economic outlook to businesses and at events and trade association meetings.

He is currently a member of the Consensus Economics, Wall Street Journal, CNBC, and National Association for Business Economics survey panels.

U.S. economy was obviously still growing through August and into September.

Despite continued growth in the economy and very low unemployment, inflation has come down this year. The 12-month change in the Consumer Price Index, which surged following passage of the American Rescue Plan in March 2021, fell from a peak of 9.1% in June 2022 to 3.0% in June 2023. Inflation was at 1.7% in February 2021.

Some economists have taken the combination of resilient growth and falling inflation as evidence that the Fed can pull off the elusive “soft landing,” getting inflation back down to 2% without pushing the economy into a recession. They think the leading indicators that have been pointing to a recession are wrong this time.

Other economists think these optimists are forgetting that monetary policy affects the economy with “long and variable lags.” The pessimists think that the 5.25 percentage point increase in short-term interest rates over the last 18 months has not had its full impact on the economy yet, and when it does, the economy will fall into a recession.

Four recent developments bolster the pessimists’ case and increase the probability that the economy falls into a recession in the fourth quarter of 2023. An autoworkers’ strike, the resumption of student loan repayments, a likely government shutdown, and renewed increases in crude oil and gasoline prices could cause the economy to shift rapidly from strong growth in the third quarter to recession in the fourth quarter.

These four developments are hitting the economy at the same time that consumers are exhausting the “excess savings” they accumulated by saving some of the pandemic relief payments they received in 2020 and 2021.

Ultimately, whether the economy falls into a recession, and the length and severity of a recession if it does occur, will depend on how quickly inflation comes down and how quickly the Fed reacts to lower inflation. Stubbornly high inflation will force the Fed to keep interest rates higher for longer, making a

Despite recent good news on economic growth and inflation, the threat of recession still looms over the U.S. economy, says Robert Fry, Chief Economist at Robert Fry Economics LLC. Can the Fed pull off a “soft landing,” and if not, how long and severe will the recession be?

recession more likely and increasing its length and severity.

But if inflation continues to decline and the Fed responds by cutting interest rates in 2024, the chance of a soft landing increases. The course the economy follows will likely determine the outcome of the 2024

Presidential election.

All these issues and more will be the subject of my keynote speech at the 2023 Executive Leadership Conference taking place at the Ponte Vedra Inn & Club, Ponte Vedra Beach, Florida, from October 23-25, 2023.

On Wednesday morning, we’ll be looking at the outlook for the global economy and markets of interest to those involved in the adhesive and sealant sector. We’ll be covering GDP, industrial production, vehicle sales, housing starts, oil prices, inflation, interest rates, and more.

“Four recent developments bolster the pessimists’ case and increase the probability that the economy falls into a recession in the fourth quarter of 2023”

Robert Fry Chief Economist, Robert Fry Economics LLC.

*99.8% delivery record in the second quarter of 2022

Ongoing energy access is essential for people, countries and economies to thrive, but unpredictable factors can disrupt the supply chain.

This challenge powered our ambition to optimize our operations through real-time visibility of the complete hydrocarbon supply chain. From our operational center, we balance demand in local and global markets with effective production planning, using the latest technologies to maximize yield, manage field operations and schedule deliveries. The relentless commitment and drive of our people allows us to achieve a best-in-class 99.8%* delivery record.

Discover how we are a reliable energy supplier to the world at aramco.com/poweredbyhow

Considering the global megatrend that sustainability has become, the adhesive industry had a bit of a head start. After all, natural materials like tree sap were used as the earliest adhesives known to man, and starches have provided renewable options for adhesive formulations in packaging applications for decades.

In addition, hot melts have long represented a significant segment of the adhesive industry; as 100% solids materials, they are inherently quite sustainable. The early shift away from solventborne formulations is another significant example.

“The adhesive industry started to transition from solventborne toward alternative sources like water and hot melt way back in the early 1980s, so we were really well ahead of the

curve compared to other industries from that perspective,” says Daniel Murad, President of ChemQuest.

Despite the early start and many successes, the adhesive and sealant industry continues to face sustainability-related challenges. The typical “reduce, reuse, recycle” mantra is deceptively simple. In reality, the massive complexity associated with sustainability can create a significant roadblock; with no single clear path forward, directives often falter.

“A major challenge for adhesive companies has been that their customers haven’t defined and decided what they want to do, as far as sustainability is concerned,” says Abe Rezai, ChemQuest Senior Vice President. “There are so many different options, adhesives go to so many different product lines, and customers, in most cases, have not really clarified the sustainability direction they have set for themselves.”

The task can seem formidable. However, adhesive and sealant companies have and will continue to support both their own sustainability efforts and those of their customers, along with the desires of end consumers.

Many adhesive and sealant manufacturers have successfully worked to make their operations more environmentally friendly, whether by reducing waste, air emissions, water usage, or other initiatives. While adhesives can also certainly positively influence a finished

product’s sustainability, the adhesive generally represents a tiny component of a much larger finished part. Recyclability offers a good example of this issue.

“Part of addressing recyclable content really is completely out of the hands of the adhesive industry,” Murad says. “Adhesives can be enablers, but they’re not the major substrate. Take a diaper, for example. If a diaper is going to be 100% recyclable or compostable, the nonwovens, the Velcro®, the core materials all have to be recyclable and/or compostable. If the adhesive is the only recyclable component, it can’t make a big difference because those other nonrecyclable materials are still there.”

One area where adhesives are having a more direct impact is in the transportation sector. Lightweighting initiatives developed in response to increasing automotive emissions regulations have prompted design engineers to increasingly turn to adhesives as replacements for traditional fasteners such as nuts and bolts.

In addition, demand for electric vehicles (EVs), which themselves represent an environmentally-friendly alternative to cars and trucks powered by traditional internal combustion engines, continues to rise. Though beset by its own challenges (for example, lack of charging-related infrastructure), this sector offers numerous exciting opportunities for adhesives.

The global market for EV adhesives was estimated to be $1.4bn last year. It is expected to see strong growth at a CAGR of

The adhesive and sealant industry has made great strides regarding sustainability and had always been ahead of the curve, says Susan Sutton, Director of Communications, The ChemQuest Group, Inc.

“A major challenge for adhesive companies has been that their customers haven’t defined and decided what they want to do, as far as sustainability is concerned”

Abe Rezai

Senior Vice President, ChemQuest

8% through 2028, according to Dr. Victoria Scarborough, ChemQuest Vice President of Collaborative Innovation at CoatingsTech Conference 2023. Primarily liquid adhesives (polyurethanes, epoxies, silicones, and acrylics) are being used throughout EVs to bond body frames, optical components, sensors, radar systems, and more.

Adhesives enable EVs to extend their driving range – the lighter the vehicle, the less battery power required to move it, and the farther it can travel without charging. They also support EV safety through heat management, helping to avoid thermal runaway and protecting the vehicle and its occupants.

Many companies – within the adhesive and sealant industry and beyond – seek to improve circularity through the replacement of traditional hydrocarbon-based materials with more renewable alternatives. The chemical sector has embraced this demand and turned to bio-based development with fervor. Globally, the value of the bio-based chemicals market is expected to reach $181bn by 2028, according to Scarborough. As a result, myriad bio-based alternatives are commercially available for adhesive manufacturers.

Incorporating these bio-based materials in adhesive formulations does not come without challenges, however. The first and biggest of these is cost.

“The problem in every aspect is scale,” Murad explains. “Over the last five, six

decades, we’ve refined the synthetic route, which involves oil and/or natural gas at hugescale crackers that are pushing out a million pounds of material per week at a very low cost. In contrast, a biomass plant is expensive, the capex is expensive, and they don’t achieve the same degree of yield. Scale-wise, they wind up being much more expensive.”

The second challenge is performance. Biobased materials often struggle to impart the same properties as their synthetic counterparts. While some are essentially equivalent to existing formulations, most bio-based materials tend to be at least somewhat inferior.

The combination of these two factors –higher cost and lower performance – has been difficult to overcome. “Consumers are not willing to pay for bio-based materials at the margins that would make that business viable long term, particularly when they don’t work as well,” says Murad.

Improving the cost efficiency and performance of bio-based materials is not

Information...

To find out more information, email Susan Sutton, Director of Communications, The ChemQuest Group, Inc. at ssutton@chemquest.com or visit https://chemquest.com.

the only avenue open for the exploration of innovative renewable raw materials for adhesives and sealants. Other efforts are focused on investigating chemical recycling processes and their possible contribution toward circularity.

For example, the pyrolysis process involves the use of heat and catalysts to break down polymers into their monomer components. The resulting monomers (for example, propylene, butylene, butadiene) can then be reused to produce new products instead of adding to the waste stream.

“Many of the large oil companies, which are all motivated to show that they have an ESG philosophy, have put together pilotscale facilities to demonstrate that this is doable,” says Rezai. “They are now working to understand how the process can be scaled up economically.”

The adhesive and sealant industry has made great strides in optimizing operations and reducing the carbon footprint, enabling recyclability efforts, expanding into environmentally friendly applications, addressing bio-based and other renewable materials. However, continuous long-term improvement remains absolutely necessary.

Some of today’s technology development efforts are focused on alternative energy sources for curing processes, such as radiation, microwave, and ultrasonic. New applications are being explored for thermoset resins (for example, two-component polyurethanes and epoxies), which are among the fastest-growing technologies in the adhesive space. As high-solids materials (often 100%), they represent an elevated level of sustainability.

Absent a clear and defined global sustainability standard, companies around the world are focusing on initiatives that align with their portfolios and capabilities. While these various efforts can seem disjointed or fragmented, it is important to keep in mind that, overall, progress is still being made every day.

“Let’s go back to the diaper example. Twenty or even 30 years ago, the industry was talking about diapers being recyclable,” Murad explains. “Are they all 100% recyclable today? Not typically. But think of it in terms of an evolution, starting with 15% of that diaper being recyclable or using recyclable material and evolving over time to 30, 40, 50, 70%. Aren’t we better off continuously improving down that path, as opposed to sticking to an all-or-none philosophy?”

Sustainability has become a critical concern for many customers and investors, and companies that fail to adequately address sustainability risks are being left behind.

While many executives understand the need for sustainability generally, many lack the knowledge and skills necessary to implement it successfully in a business. This is why CEO and executive education on sustainable business is increasingly essential. In this article, I will explore why CEOs and executives need to "go back to school" and relearn what sustainability and sustainable business REALLY is in today’s marketplace.

Most of the existing business sustainability training is completely outdated and fails to serve the current needs of the business executive. Almost all sustainability trainers and consultants start by quoting a single sentence from the 1987 report of the United Nations Commission on Environment and Development (Our Common Future) on sustainable development. Namely, “Sustainable Development is development that meets the needs of today without compromising the ability of future generations to meet their needs.”

However, most consultants have not even read the report, nor do they realize that the term ‘sustainable development is completely different from ‘sustainable business’. The 3E's of economics, environment, and equity, or its twin, the 3P's of people, planet, and profit, no longer serve the purposes of informing and driving the changes required in today's complex business environment with global supply chains.

These simple, two-dimensional models flatten and compress complex, interconnected ideas, losing valuable information in the process. It is virtually impossible to use simplistic models like these to identify, strategize, plan, and make

necessary changes in businesses. Sadly, sustainability has not moved beyond the simplistic two-dimensional concepts developed over 40 years ago. Until now.

This is where new approaches like my own proprietary, three-dimensional, Tactical Tetrahedron Framework come in handy. New frameworks can provide the necessary missing dimensions for sustainable business transformation. These help to set out an original, innovative approach that places sustainability as the base of the business model while simultaneously considering three other important dynamic variables.

New models are cyclical, not linear. They are dynamic and are based on nature’s sustainable cycle. They deal with the key sustainability issues while still giving clear guidance on

where and how to act in a business.

Old models are siloed and unable to capture the flow of a business in motion. New frameworks can provide a holistic approach to sustainable business transformation and serve as a significant improvement over the previous flat, simplistic models.

Sustainability is a complex, multifaceted concept, and business leaders who want to make a significant impact must develop a more comprehensive, up-to-date understanding. By enrolling in sustainability programs, CEOs and executives will have the opportunity to learn about new technologies available on the market, innovative sustainable, circular business strategies, and best practices in the industry.

As the world continuously evolves, so too must businesses adapt and change along with it. With the rapidly changing world and increasing demands for sustainability, those who fail to comply with sustainability are at risk of becoming irrelevant.

A lack of knowledge and skills in sustainability can hamper a company's growth, survival, and long-term success. Investing in modern sustainability education could be the smartest investment for any business leader, making it possible to transition successfully to greener, more sustainable business practices.

Sustainability is more than just an ethical or social concept; it is a strategic business imperative that (when done right) can provide companies with long-term strategic advantages. CEOs and executives who pursue additional education in sustainability demonstrate a commitment to their businesses' long-term success by understanding and addressing these emerging sustainability issues.

It is imperative that CEOs and executives go back to school and relearn what sustainability and sustainable business really is NOW – not what it was thought to be 40 years ago. Business risk reduction and new more sustainable growth opportunities await those who see what’s ahead on the business radar.

Every day new entrepreneurial ventures are spinning up to occupy these emerging sustainable business niches. Unencumbered by existing products, processes, and structures they are free to experiment with new approaches and are attracting new customers. Customers who see unsustainability in the news, who recognize the unsustainable choices they’ve been making, and who are ready to switch their purchases to more sustainable brands.

Don’t wait or hesitate, re-educate. To find out more, visit https://TripleTopLine.com

The world is changing rapidly and businesses must adapt to keep up, says sustainability strategist Kenneth Alston

The outlook is positive for the North American adhesives and sealants industry as their diverse areas of application and critical use in the construction, transportation, and packaging sectors continue to provide a solid foundation for growth. That is the conclusion from the latest research conducted for the Adhesive and Sealant Council (ASC) by market consultancy Smithers.

Following previous such reports, ASC wanted a latest market assessment that would include an analysis of the market in

both volume and value terms, looking at key drivers and trends, and forecasting growth over the coming five years.

The report focuses on the U.S., Canada, and Mexico, examining seven types of adhesives and eight types of sealants in their respective end-use markets.

As part of its research, Smithers talked to 80 market participants to gain their views and insights.

Smithers values the North American market for adhesives and sealants at $22.2bn, with the U.S. taking the vast majority – more than

80% – and Canada and Mexico accounting for 11.6% and 8.3%, respectively.

These market shares will vary only slightly over the forecast time period, says Smithers Managing Consultant, Benjamin Trent.

“In 2020, we have the U.S. at 81.5% of demand, shrinking to 81.3% in 2027. In that same time period, Canada moves from 11.1% to 11.2%, and Mexico from 7.4% to 7.5%.”

The very slight uptick in growth for Canada and Mexico reflects the maturity and size of the U.S. market, which represents a much larger base, Trent explains.

Despite the current macroeconomic challenges, adhesives and sealants are forecast to maintain steady growth to 2027, driven largely by their essential use in major end-use industries

The largest end-market share by value for adhesives is building, construction, civil engineering, and craftsmen at nearly $4.76bn, followed very closely by paper, board, and related products at $4.63bn. Transportation comes in third with a value of $3.83bn. Consumer/DIY accounts for the smallest share with $1.46bn.

As adhesives are critical elements of most building systems and structures, Smithers expects their use in this area to accelerate as the construction industry continues to adopt innovative techniques and designs, for instance the rising production of prefabs for use on building and construction sites.

In addition, the paper, board, and related products segment offers a very diverse range of applications. Smithers says that while paper products, plastic bags, and tobacco (packaging) show declining demand, others such as hygiene, flexible packaging, and (pre-adhesive/shrink/clear film) labels show continual growth – both now and within the study’s forecast period.

Sustainability is a key driver of companies’ portfolios whatever industry they are in. That remains the case for adhesives and sealants, where Smithers says sustainability will continue to have a major influence on both these sectors, as well as their underlying markets.

In particular, the consultancy expects technology advancements and product launches for hot-melt adhesives to continue their focus on recyclability. This also includes compostable hot-melt and the ability to dismantle products at end of life, as well as the potential development of ‘bio-based’ hotmelt adhesives.

Water-based adhesives have experienced high demand growth into the paper, packaging, automotive, and transportation applications. According to Trent, water-soluble adhesives grew on average by 3.8% per year for 2021 and 2022. They are predicted to see compound annual growth of 2.5% to 2027.

Unsurprisingly, solvent-based adhesives continue to have a negative image from the point of view of human health and the

environment. Consequently, they will continue to slowly decline in the years ahead. However, that decline, says Trent, is very small at 1% per year or less. This is because solventbased products have a performance record that is very hard to match. “There is a lot of push toward natural and water-based adhesives to be used in highly demanding and very technical applications, but many times they simply can’t match the performance requirements that solvent products offer,” he says.

Like adhesives, sealants are also vital components of most building systems and structures, making it by far the leading enduse by value at nearly $1.58bn. The next biggest end-use – albeit much smaller – is transportation at just $609m. Assembly/ other is the smallest use with a value of just below $238m. In the report, assembly relates to articles outside of construction and transportation applications, for example electronics, games and consumer goods. While assembly applications were hit hard by the COVID-19 pandemic, DIY had a significant boost in the beginning because people could not go out, so they stayed at home and started working on various

projects. Looking forward, assembly usage will slightly outpace the growth of DIY applications, but this sector will still remain smaller in volume through the forecast period.

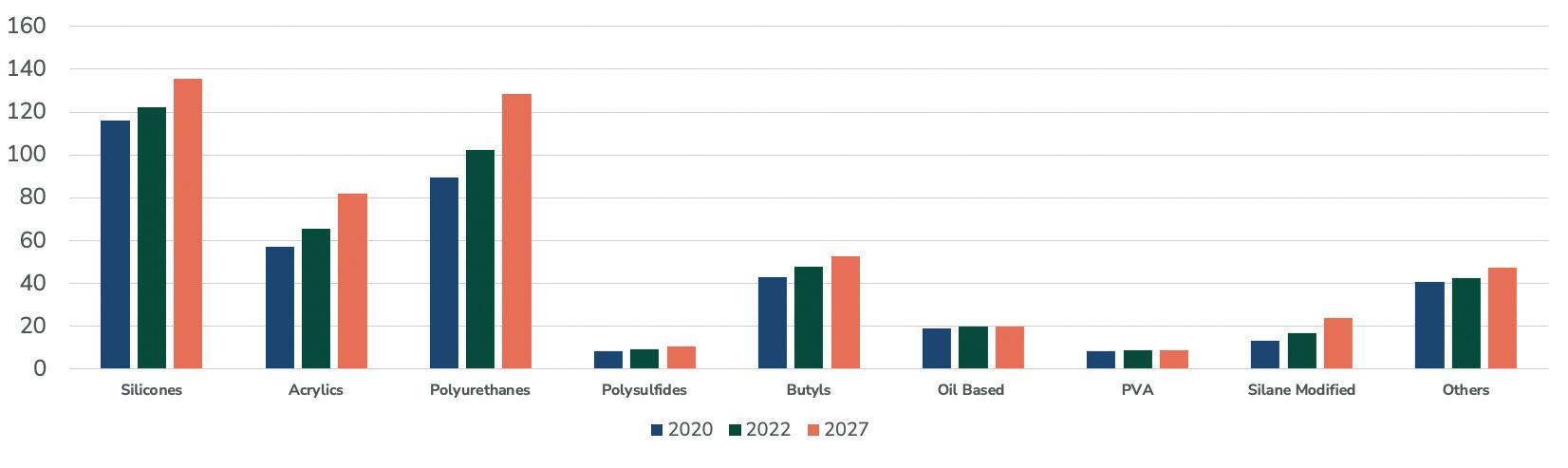

Looking at the various types of sealants, polyurethanes are forecast to grow rapidly compared with others, as they benefit from the ongoing shift from mechanical fasteners towards chemical bonding.

Silicones will also see continual growth in the next five years. Smithers explains this is because they offer very good chemical and thermal stability, while also providing energy savings that help to reduce carbon dioxide (CO2) emissions.

When asked what were important factors influencing trends and developments in the North American adhesives industry, both suppliers and end-users mentioned the leading ones as economic trends, technology innovations, and raw material availability and reliability of supply.

Suppliers also highlighted industry consolidation in the supplier base as another major factor.

When presented with the same question, sealants suppliers and end-users also cited

“The future bodes very well and looks bright”

Benjamin Trent Managing Consultant, Smithers

technology innovations and the availability and reliability of raw material supply as the major factors. For suppliers, changes in legislation and regulation were also another key influencer, while for end-users it was economic trends and environmental considerations and sustainability issues.

Interestingly, although both suppliers and end-users did make mention of raw material pricing trends as a key industry influence, it was not as important as several others. No doubt everybody is very aware just how much prices have increased in the past couple of years as industry is impacted by ongoing supply chain challenges and shipping problems that stem from the outbreak of COVID-19, but have since been exacerbated by the Russia-Ukraine war, which prompted energy and food costs to jump.

Trent notes that every company contacted during Smithers’ research talked about the issue of high prices. He is hoping that prices will tail off this year and stabilize, both for raw materials and for the adhesives and sealants themselves. He does not believe the high prices have led to any erosion of demand because of their critical use in many industries and the fact that there is no other option.

However, rising inflation has been another

Source: Smithers

Source: Smithers

challenge that industries such as construction have had to deal with. Inflation has pushed up the cost of building materials and the hire of equipment and labor, forcing project delays and reducing profit margins.

However, one of the steps end-use companies have taken to try and combat their high costs is to move from a single source of supply to multiple suppliers. Trent says when COVID-19 hit, companies realized they had a lot of single suppliers and were particularly

vulnerable to supply chain issues.

Nevertheless, despite the current challenges, Trent has a broadly positive outlook for the North American adhesives industry, especially over the next five years. “The future bodes very well and looks bright,” he says. That positivity will be very welcome during the current uncertain macroeconomic environment.

Elaine Burridge

Elaine Burridge

The Adhesive and Sealant Council (ASC) won board approval for its current threeyear Long-Range Plan (LRP) in April 2021. Scheduled to run to 2024, it was designed to create additional value for member companies and build on ASC’s many educational and business-to-business programs.

The LRP is centered on three areas of strategic importance: advocacy, end user engagement, and sustainability. While the first two have been important activities for the trade association for many years, explains ASC President Bill Allmond, adoption of sustainability as the third leg of the strategic effort was new and timely.

ASC’s board of directors believes addressing sustainability will be of increasing importance for the industry in coming years. ASC members will need to understand what it means for their products and operations, and for their customers.

A key component of the LRP, adds Allmond, is that is comes with dedicated resources to help the ASC secretariat deliver on 10 strategic objectives set out across the three key areas in the LRP. Two years in, says Allmond, and with a number of significant gains made, there is still plenty of work to be done.

Advocacy, Allmond explains, is there to give voice and representation to the industry. The LRP identifies three key tasks for ASC: to collaborate more actively with adjacent and allied industry groups to advance shared advocacy initiatives; to increase engagement with government agencies and regulatory groups to improve visibility; and to establish strategic partnerships with NGOs and consumer advocacy groups to provide access to and engage secondary audiences.

“Our biggest impact in this area,” says

Allmond, “has been collaboration with allied associations in selected U.S. states where we are seeing a lot of regulatory or legislative policy developments.” He particularly points to California and Ohio as two places where ASC has, he believes, made an impact recently.

ASC has joined with chemical industry groups in both – to leverage cooperation with them and to align ASC’s efforts with the wider industry effort. It has also met directly with state regulators and legislators and attended relevant conferences since the COVID-19 lockdown was lifted.

In southern California, for instance, ASC has helped stave off stringent air quality proposals on volatile organic compounds (VOCs) that would have affected the use of adhesives and sealants.

“The proposals were unworkable and would have imposed very low limits on VOC emissions for sealants,” he notes. “We met with the regulators preparing the rules and explained why they were unworkable and

what the impacts on California markets would be if the rules moved forward. As a result, we had a successful outcome, coming right out of our LRP initiative.”

Under End User Engagement, the LRP sets a further three strategic goals: to cultivate partnerships with advocates and players in end-use industries to advance issues of shared interest; to develop accessible resources to promote the value and impact of ASC and the industry to end users, and to identify specific opportunities for education on under-utilized adhesives.

“We have been able to accomplish things here and continue to work on all three strategic areas,” says Allmond. ASC’s effort has focused on three key end-user segments, namely packaging, construction, and transportation.

One successful strategy, he explains, has been to approach organizations in these key markets and persuade them to let ASC have a booth at their trade shows. “This helps us make connections with delegates from end user industries. Often, they come looking for advice on adhesives and we are able to point them in the right direction, even supplying a list of our members that can meet their specific needs.”

Such collaborations, he adds, also enable ASC and the end-user association to learn about each other and their issues in common.

“Our biggest impact in this area has been collaboration with allied associations in selected U.S. states where we are seeing a lot of regulatory or legislative policy developments”

Bill Allmond ASC President

And, although it is not a strategic aim, it has also enabled ASC to increase its membership, especially in the distribution sector, as companies learn what ASC can offer while visiting the ASC booth.

A second successful initiative that Allmond points to is the creation of a new publication – Adhesive and Sealant Showcase – which allows ASC to highlight activities that are important to the membership and to share this with industry customers and downstream users.

“The information covers innovation and new technology, market forecasts, and outlooks for the industry, for example. The first issue appeared in March in time for ASC’s Annual Convention in New Orleans and the second will be out in time for the Executive Leadership Conference in Florida in October,” says Allmond.

The publication is available in print and digital format and ASC members are encouraged to circulate it to their clients and customers as well as use it in-house. In addition, says Allmond, ASC is emailing it to selected circulation lists, especially to engineers in the automotive and construction sectors.

But it is the new sustainability focus that Allmond is most excited about and which is proving to be the most active of the three strategic areas. North American companies,

he points out, are behind their European counterparts on this issue and ASC has not focused on it before.

“So, the question has been, where to start and how does it fit into the North American way of doing business? We are being much more proactive now,” he says.

ASC has set itself four strategic objectives in the sustainability area: collect member and industry insights, to inform initial priority areas for attention; source member case studies of sustainability issues to promote industry wins and best practices; map the sustainability value chain for select industries to communication the value of sustainability; and empower all members with resources to expand the footprint and impact of sustainability focused education.

“We have been doing a lot of research and having conversations with our members to find a starting point,” says Allmond. “The strategic objectives have been very broadly written so as not to be too prescriptive.”

“We have found a lot of our members have been very interested in tackling the sustainability agenda and ASC has been holding a committee meeting on the topic once a month.”

In addition, ASC has very recently held its second two-day Sustainability Summit, in Louisville, Kentucky, to bring together

players along the value chain to talk about the challenges and opportunities of sustainability. Topics addressed, says Allmond, included technology, academic research, end user perspectives, case studies, and so on.

The first Summit was held in Pittsburgh in September 2022, with a hundred or so delegates – twice what ASC had been expecting, says Allmond.

“Members are most interested in what their end user customers are doing in terms of sustainability, and we find our smaller members are also most interested in what the bigger companies are doing, especially those with a European parentage. One of the biggest benefits of our activity in this strategic area is the way we are all learning from one another,” he adds.

“We are also learning what sustainability means specifically for the adhesive and sealant industry – what we ought to be targeting in terms of air, water, energy, and waste aspects of our operations and products.”

Other initiatives on sustainability, he adds, have included the development of an ASC Sustainability Awards, which will launch next year, similar to the current ASC Innovation Awards, and the production of a sustainability webinar for members’ use.

Last year, ASC mapped the adhesive and sealant value chain in its top three markets –packaging, construction, and transport – to identify all inputs and outputs and to identify the possibilities to reduce environmental impact and footprint. The aim is to provide this to all members so they can use it internally and include it on their websites for customers to see. “We decided to share it broadly with the industry,” adds Allmond.

Although much has been achieved, there is still plenty of work to do on the current LRP. Nevertheless, Allmond is already turning his mind to the 2024-2026 period. A committee of volunteers will soon be assembled to discuss ideas where best to focus resources, prior to putting a proposal to the board of directors next Spring for approval.

Its too early to say, of course, what might be included, but Allmond is reasonably confident the current three strategic areas of advocacy, end user engagement, and sustainability will be continued, with perhaps another broad area added.

“The key thing is to identify the priority areas for the members and the industry,” he says, “and make sure we have the resources and finance planned out to deliver effectively across the next three years.”

John BakerThe Adhesive & Sealant Hall of Fame was launched in 2022 to celebrate the successes and achievements of key figures in the adhesive and sealant sector.

The aim was to showcase the positive and long-lasting impact of those who had made a significant contribution to the industry, says Shamsi Gravel, Vice President of Regional Development with Evonik Corporation, ASC Board Member, and leader of the Hall of Fame Task Force.

“With the Hall of Fame, ASC wants to recognize key individuals who epitomize the adhesive and sealant industry and inspire, motivate, and innovate,” says Gravel.

“There are many different types of personalities, skills, and people who can all be seen as ‘giants’ in this industry,” she says. “Even though we're a very inclusive and social organization, there are people who often work behind the scenes and have given so much, but may not be well known to the broader industry. The bar that defines ‘giants’ is set where someone says your name and the consensus is that this person is synonymous with adhesives and sealants.”

This year, ASC is pleased to welcome three new inductees to the Hall of Fame: Ted Clark, Dr. Selim Yalvac, and Dave Nick.

Clark recently retired as Executive Vice President and Chief Operating Officer of H.B. Fuller, bringing an end to a long and successful career in the sector. His commercial nous saw him build Royal Adhesives & Sealants from the ground up

to create a $650m global enterprise. The company was eventually acquired by H.B. Fuller, where he joined the executive team. A mentor and author of two books on business strategy, Clark is well known to members having also served on the ASC Board.

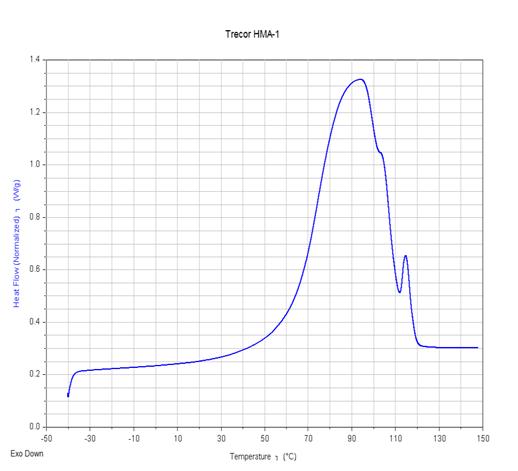

Dr. Yalvac is an innovator recognized for his development of the “Rolls-Royce” of hot melt adhesives; with 42 U.S. patents, and over 500 international patents. The recipient of countless achievement awards, his contribution to the adhesive and sealant sector includes the ADVANTRA© hot melt adhesive used in packaging. His work also led to the development of adhesives still widely used in the market today, such as AFFINITY™ GA, INFUSE™ OBC, VERSIFY™, and INTUNE Polymers for Adhesives. In 2016, he retired from Dow, marking the end of a career spanning more than 40 years.

Anyone can be nominated and considered for ASC’s Hall of Fame, no matter their age, seniority, or stage of their career. To find out more, visit https:// www.ascouncil.org/asc-hall-of-fame. If you would like to nominate someone for the Class of 2024, submissions must be received by June 1, 2024.

The third recipient, Dave Nick, forged a name for himself among ASC’s membership by producing the first-ever Global Market Study Report for adhesives and sealants for the association in 2005.

Seen by the industry as the go-to guide for economic and market trends, he extended that insight and analysis to new reports focused on North America and Asia. Nick later helped to create ASC’s World of Glue: An Investigation of Adhesives, an educational tool for elementary students.

“These awards are the people who have made a real difference, not just in their professional roles in their own organizations but to the industry as a whole,” says Gravel. “They reflect how they have contributed both upstream to the suppliers and downstream to the users, and how they are making adhesives exciting for the next generation – opening their minds to the possibilities of what adhesives and sealants can do.”

All three will be receive a commemorative plaque at a special presentation at the Chair’s Reception and Dinner taking place during October’s Executive Leadership Conference.

The Class of 2023 joins Jim Owens, former President & CEO of H.B. Fuller who was named as the first inductee into the ASC Hall of Fame last year. With a career spanning several decades, he also held leadership roles at Henkel and National Starch, and served as Board Member and Chairman of the ASC.

Andy Brice